Analysis of Decline Rates (Part II)

Posted by Sam Foucher on May 7, 2009 - 9:40am

In the first part, we tried to estimate the implicit decline structure behind the IEA analysis of worldwide decline rates. We established that only 11.8 mbpd of a total of 69.8 mbpd were not in decline in 2007 (17.0%) and for the Super-Giants/Giants group, the IEA claims that around 20% (9.2 / 42.5) are still growing fields. I'm now trying to answer the following question: is the decline structure observed for the world and the SG/G group closer to a pre-peak or a post peak production?

Based on the only field-by-field datasets publicly available (Norway and the UK) and looking at the decline structure we came to the following conclusion: If the decline structure for the world follows the decline structure that has been observed for UK+Norway, there is an 85% chance that the world's oil production is in final decline.

Observed Decline Structure for the World

The decline rates for post-peak fields established by the IEA are shown in Table I.| Decline Phase 1 | Decline Phase 2 | Decline Phase 3 | Total | |

| Super-Giants | 0.8%

|

3.0% |

4.9% |

3.4% |

| Giants | 3.0% |

3.7% |

7.6% |

6.5% |

| Large | 5.5% |

7.2% |

11.8% |

10.4% |

| World | 1.4% | 3.6% | 6.7% | 5.1% |

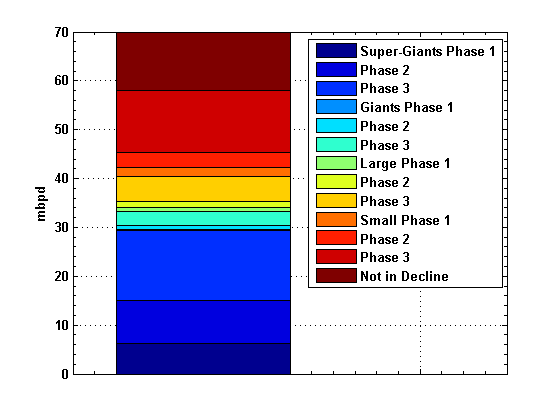

We then derived this possible decline structure for the post-peak fields.

| Decline Phase 1 | Decline Phase 2 | Decline Phase 3 | Total | |

| Super-Giants | 6.20 | 8.79 | 14.40 | 29.40 |

| Giants | 0.26 | 0.82 | 2.84 | 3.92 |

| Large | 0.73 | 1.26 | 5.21 | 7.19 |

| World | 7.19 | 10.87 | 22.44 | 40.5 |

Assuming then the repartition between the various decline phases is the same between small and large fields, we get the following:

Figure 1. Amounts of post-peak production by field category used for the global decline rate calculation.

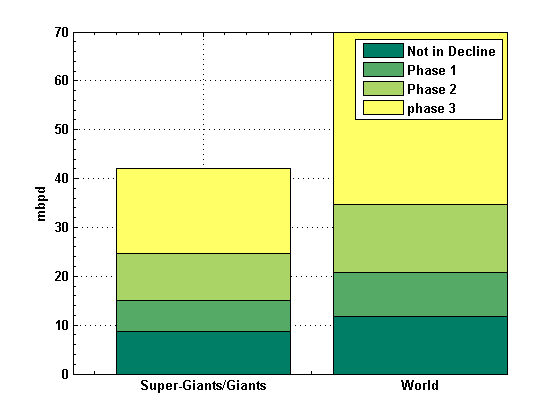

The figure below is showing what I call the decline structure for the world.

Figure 2. Decline structure of the Super-Giant/Giant fields and the world.

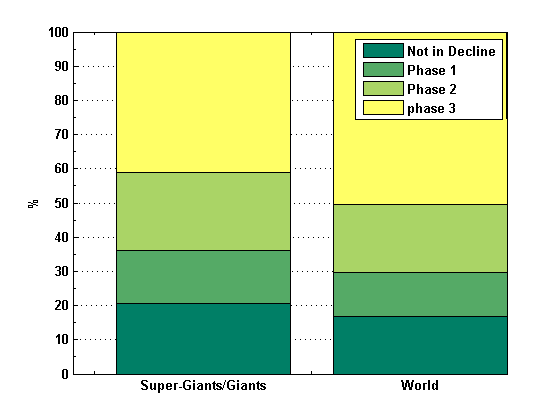

Figure 3. Same as Figure 2 but in fraction of the total.

The feature that strikes me the most is how small the fraction of field

not in decline is (between 17% and 20%).

What the North-Sea Oil Production is Telling Us

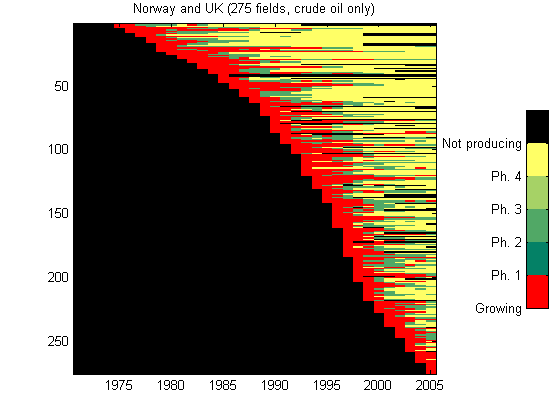

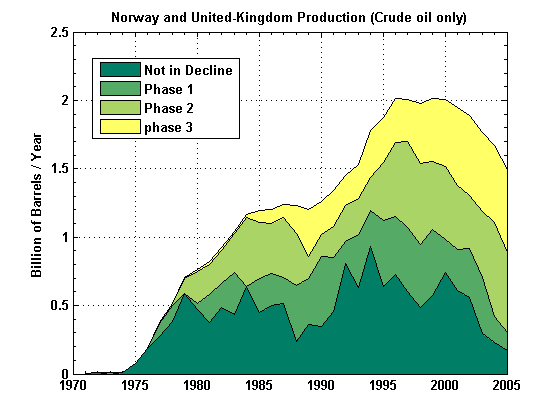

We took the available data for Norway and the UK and we classified fields according to their production status at a given time (Figure 4).

Figure 4. Oil field classification for Norway and the UK.

Peak production for the North-Sea has been reached when production from

phase 3 fields reached 30% of the total production.

Figure 5. Total crude oil production (excluding condensates).

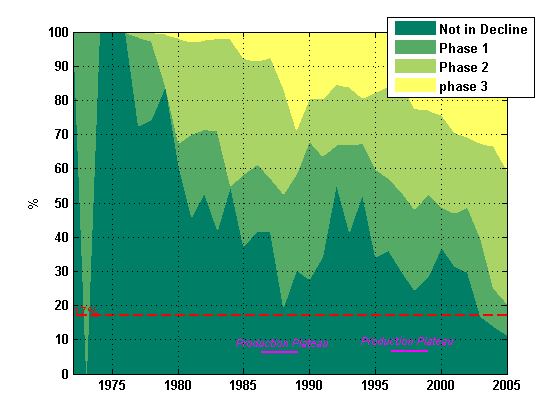

Figure 6. Same as Figure 4 but in % of total production.

On Figure 6, we can see that production plateau corresponds to fields not in decline between 20% and 30% which is higher than the value observed for the world (between 17 and 20%). Post-peak production is characterized by a fraction of fields not in decline below 30% and a fraction of fields in decline phase 3 above 25%. In addition, if we compute the correlation coefficient between the decline structure for the world (Figure 3) with the Norway+UK history, we get significant positive correlation values only for plateau and post-peak years.

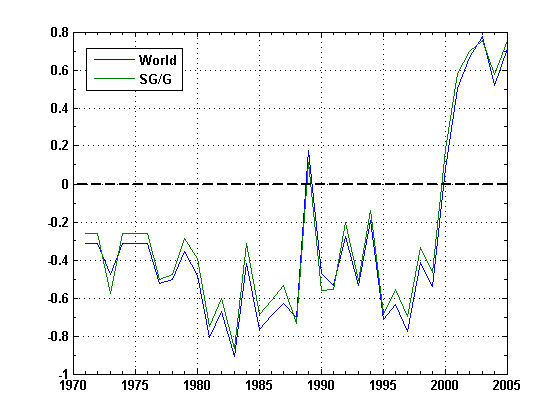

Figure 7. Correlation values between the hypothetical decline structure for the world (Figure 3) with the decline structure history of Norway+UK (Figure 6).

There is strong linear relationship between the amount of field not in decline and the observed production growth/decline rate as shown on Figure 8 below. The linear fit intersects the 0% growth rate line around 27.5% which is therefore the threshold below which the observed production is likely to decline. According to this model, there is about a 85% chance that a fraction of 17% of fields not in decline is an indication of a post-peak situation.

Figure 8. Observed production growth rate versus % of fields not in decline (the colored areas from red to yellow indicate confidence intervals around the linear fit within 1.0, 2.0, 3.0 and 4.0 standard deviations). The vertical dotted red line indicates 17%.

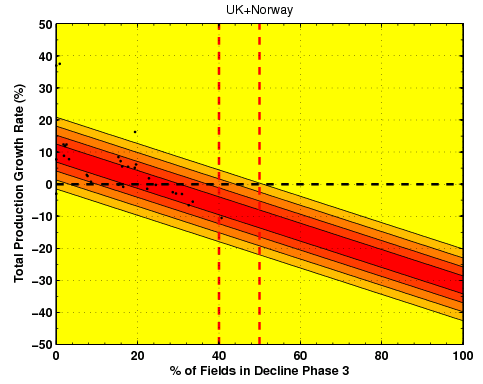

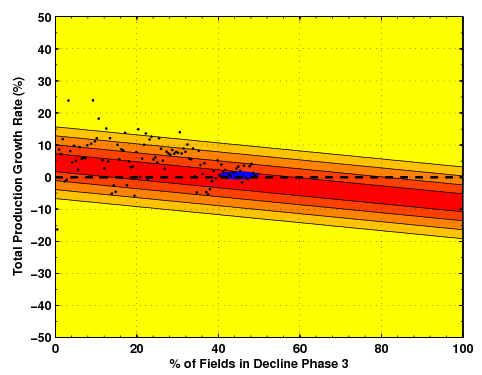

The same analysis can be done when looking at the fraction of fields in phase 3. Also, the result indicates a high probability of declining production for values above 40%.

Figure 9. Observed production growth rate versus % of fields in decline phase 3 (the colored areas from red to yellow indicates confidence areas around the linear fit at 0.5,1.0, 1.5 and 2.0 standard deviations).

It seems clear, that from a North-Sea production perspective, the apparent decline structure for the world and the Super-Giants/Giants group does not look very good and indicates that we are in fact past peak. However, these charts are based on a very small field dataset (mainly offshore fields with strong decline/growth rates) whereas the world is believed to be composed of at least 15,000 individual field contributions.

What's the Implication for the World Production

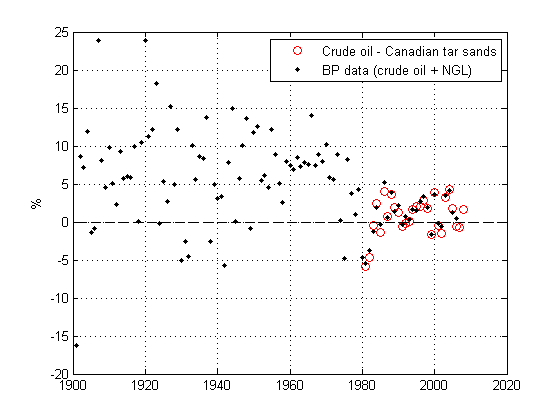

The chart below is showing the observed production growth rate for the world since 1900. Values before the 70s were very volatile and around 7% and around 2%-3% after 1980.

Figure 10. Year-on-year total production growth the rate for the world (BP data). The red circles are the growth rates without Canadian tar sands.

In order to reconstruct a similar model for the entire world, I make the following assumptions:

- if 100% of fields were in decline, the total decline rate would be equal to the one estimated by the IEA for fields in decline (-5.1%).

- if 100% of fields were in decline phase 3, according to the IEA numbers, the total decline rate would be equal to -8.0%.

- if 0% of fields were in decline phase 3,the total decline rate would be equal to -4.5%.

- The maximum growth rate (i.e. 0% of fields in decline) is equal to the maximum decline rate (i.e. 100% fields in decline phase 3) in absolute value.

Figure 11. Possible situation for the world where the blue area delinates our present situation (17-20%). The black dots are the observed growth rates (Figure 9), their horizontal coordinate is a simple linear mapping of the production date on the 17%-100% interval.

Figure 12. Year-on-year total production decline rates as a function of the fraction of fields in Phase 3 decline.

Conclusions

There are several possible conclusions:- There are mistakes in the IEA report and my calculations are therefore completely wrong.

- The table II retrieved is erroneous. This is a real possibility, however the numbers for the Super-Giant/Giant fields are directly from the report and also indicate a decline structure consistent with a production in plateau or near decline. This decline is also consistent with a logisitc fit (see part I).

- If the numbers and estimates are corrrect, then it seems very likely that the world crude oil production is in decline or about to decline. The bottom line is that there is not enough contribution coming from fields with still a growing production to support a growing global production.

Sam, great work, as usual.

I think that the initial Lower 48, overall North Sea and World (EIA, C+C) decline rates are very interesting.

The Lower 48 1970 to 1973 decline rate was -1.4%/year. The 1973-1979 decline rate was -3.9%/year.

The North Sea 1999-2002 decline rate was -0.8%/year. The 2002-2008 decline rate was -6.7%/year.

The world data show that 2008 was essentially flat with 2005, well within any reasonable margin of error, with a measurable cumulative shortfall between what we would have produced at the 2005 rate and what we actually produced.

One common connection for all three case histories is that the regions showed lower cumulative production in response to rising average annual oil prices, over the initial decline periods. Also, based on the logistic (HL) plots, the Lower 48 in 1970, the North Sea in 1999 and the World in 2005 were all about 50% depleted (conventional crude).

I think that the difference is that the world is getting a small contribution from unconventional production, but this analysis suggests that 2009 is to the World, as 2003 was to the North Sea, as 1974 was to the Lower 48, i.e., the start of the more rapid production decline. I suspect that a more rapid production decline worldwide is presently being obscured by the decline in demand.

BTW, in regard to our (Foucher & Brown) joint articles, as I told Sam a couple of days ago, I think that he deserves more credit for the superb modeling work he has done, and in regard to the actual work done, especially in regard to the modeling work, this has been more of a 90% Foucher/10% Brown effort.

--Jeffrey J. Brown

Great analysis. If world production follows the North Sea - would you expect a global decline rate of 7-8%/year? In a severe recession/depression, is domestic consumption by exporters affected such that the export-land model will not exact such a heavy toll - at least

in the near future?

The initial Lower 48 decline was slow for three years, then faster, close to 4%, and the long term decline has been about 2%/year. I suspect that the global decline might look something like the Lower 48. More thoughts down the thread.

Regarding exporters, I think that the $64 Trillion question is what happens, in aggregate, to consumption in the top exporting countries.

EIA's forecasting that in 2008 KSA shows a 164 kb/d consumption increase. You wonder if they will ever reach a ceiling, through maximum total supply for consumers of course, no way will they ever shortchange their citizenry beyond the odd batch of farmers in the east who can't get some diesel during a price spike.

Not knowing anything about the technology, I would like to suggest other factors to take into account.

- North sea fields may decline faster than on shore fields because of the difficulty of infill drilling and other possible secondary recovery methods.

- Prudhoe Bay has shown very high decline rates, in spite of extensive infill drilling.

- After major secondary (or tertiary?) recovery Cantarell has very high decline rates.

- Extensive horizontal drilling will reduce the decline rates for giant/supergiant fields quite dramatically for awhile, but will than probably lead to much faster than historic average decline rates.

I have no idea how these factors might play into your analysis, but they might be worth considering. Murray

Have the fields at the larger end of the spectrum (like the North Slope's) that have been developed more recently generally shown more rapid decline rates than similar sized fields developed farther back? If that is the case I would suspect that extraction having been relatively more efficient for a greater portion of the newer fields lifespans than it was for similar sized fields that went on line much farther back must be factored in somehow.

Sam, thanks for a very interesting article.

One question that comes to mind is what is the likely impact of all of the very small fields and the many stripper wells. If seems to me that these would likely have no effect on peak, but may fatten the tail a bit. In some ways, they may act like EOR.

Gail

I agree with you. I think we have glossed over the small fields because we have so little data on them. But IF they do comprise approx 42% of world production, as Matt Simmons suggests, they they become a huge wild card.

I think Sam's analysis is excellent to indicate trend, but we are basing this on 58% of the data we can track.

As Matt said, if Ghawar has peaked then the world has peaked. True enough.

The 42% unknown just opens up too large a margin of error to allow us to create any reasonable scenarios.

Again as Matt said, we need more and better data

We need - ideally - to get to 80% plus of the world production, so perhaps the next best step for IEA would be to do a Phase 2 world analysis where they study the next set of fields - the smaller ones (much more work)

the CERA "bumpy plateau" becomes an argument which is hard to refute without the facts

We don't track small fields because it's not conceivable to acquire individual datasets on more than 10,000 fields. We must resort to ensemble statistics.

However, a few observations about small fields:

- they decline faster (the IEA average is at least 11% decline rate for this category).

- According to oil 101: There are 500,000 producing oil wells in the U.S., 80% of which produce 10 bpd or less. Still, this accounts for 20% of U.S. production. Despite having a massive small field component (probably the highest in the world), the US production is still in decline since the 70s.

- Looking at the US, Norway and UK, they seem to have had little impact on peak production.

Sam -- I suspect that not only are you correct about limited potential of small global fields but perhaps even a tad optimistic in your pessimism. I would also add that the tail production from even the giant+ fields will fail to deliver production comparable to major US fields IMO. I’ve worked with many small operators producing stripper fields. From my perspective it’s very easy to see why the US stripper wells will always out perform (and more importantly, out live) similar foreign production: entrepreneurship. There are a few small exceptions around the globe but the fact is that small US operators survive off these marginal fields. The net revenue doesn’t flow into the corporate accounts as with the NOC's and majors. This revenue pays the mortgage, pays for the grandkids ballet lessons, pays for the deer lease, etc, etc. It’s essentially a sweat equity business for those folks.

Many (if not most) of the foreign fields are operated by NOC’s or major operators. Those operators cannot afford the manpower to operate at such marginal levels. And by manpower (sometime woman power too) I’m talking about mental expense to analyze and maintain such small operations. ExxonMobil and ARAMCO might be a couple of the largest employers of petroleum engineers/geologists in the world. But they would have to expand their staffs at least 10X to handle any stripper production they might own as efficiently as US small operators. I’ve seen these folks analyze problems for weeks or even months which might only require an expenditure of several thousands of dollars. Is XOM going to pay an engineer $140,000 a year to make decisions that might increase their net cash flow by $300 a month? An obvious answer.

I don’t have much expat experience but what I have seen is that the US is very unique not only in the entrepreneurial arena but also in the private ownership of mineral rights. I suspect there are folks at TOD who don’t realize that almost all mineral rights on the planet belong to some gov’t. And can a political system ever effectively manage such marginal operations? Not likely IMHO.

I can’t offer any quantitative guess to how much oil/NG foreign operators will recover in the future from marginal properties compared to US “mom and pop” companies, but I suspect it will be insignificant compared to the growing need.

Very good comment, thanks. I think, in general, using the US oil indsutry as a model for the world will always lead to overoptimistic forecasts either in terms of reserve growth or contribution from marginal fields.

Last I checked Alaska was in the U.S. but has government ownership of the mineral rights, interestingly from the Alaska Constitution

Section 1.2 - Source of Government.

All political power is inherent in the people. All government originates with the people, is founded upon their will only, and is instituted solely for the good of the people as a whole.

A bunch of small stripper wells on the ranch wouldn't work out too well on the slope or out in the inlet, but oil royalties paying the bulk of state operating expenses and giving each resident a check to boot is something most Lousianans or Texans couldn't imagine. It is not all so simple.

Interesting Luke. I didn't know that. But stripper wells work wherever they are. They do represent 20% of our production. But this stripper production exists primarily because of small operators and not who owns the royalty. And the citizens of Texas do get big benefit from our strippers. For one thing they represent the largest endowment of the University of Texas system. And every resident benefits from the billions of $'s of county taxes paid on all production. Both states do own 100% of the royalties under state waters which in cludes the foirst 10 miles out into the GOM. The states have collected 10's of billions of $'s from these royalities and most folks here know that. and a lot of this production falls into the stripper category.

I'll have to check on the details in Alaska. I don't think the get a check from the royalties. The state gets that money and gives SOME OF IT to the residents. Not sure but I think they recently been cut out of the gravy train.

Hi Rockman,

I understand your point about small operators doing a better job of massaging oil out of marginal fields and that is a good thing.

I was merely indicating that government ownership of mineral rights isn't necessarily all bad. But as I own mineral rights to my few acres of Alaska as do many other surface estate holders, I thought the following should be added.

In Alaska, state ownership of severed mineral interests generally arises from either the state's acquisition from the United States of a previously severed mineral interest, or a mineral reservation by the state when it conveys state lands. Severed mineral estates are common in Alaska as most contracts for the sale, lease, or grant of state lands and most deeds to state lands or interest therein (other than mineral leases or mining leases) must contain an express reservation to the state of all oil, gas, coal, minerals, and geothermal resources.AS 38.05.125(a) I pulled the above out of 1993 letter from the DNR commissioner found http://www.law.state.ak.us/pdf/opinions/opinions_1993/93-019_661930641.pdf

So my statement on government ownership may have been unintentionally misleading. Alaska is unique in that only 1% of the land in the state has private ownership. If the native corporations (odd corporate/communal affairs that were spawned by the Alaska Native Claims Settlement Act 1971, ANCSA, which was enacted to smooth the way for the Trans Alaska Pipeline System, TAPS) are considered private 10% more land is added to that. The other 89% of the land in Alaska has some government entity owning it. Alaska's private land probably would be easier to envision as islands in the sea, ownership wise, and the situation when looked at in that way would not be all that different from other states that hold the offshore mineral rights (Alaska of course has offshore rights as well, but just add those to the sea of government owned land in your mental image).

The permanent fund check all Alaska residents receive (assuming they aren't entangled in the criminal justice system in some fashion) is not a royalty distribution per se. A portion of oil royalties were/are invested in markets and the return on investments had contibuted to the bulk of the permanent fund's value. Individual distributions were not made immediately, but rather the fund was allowed to grow and compound its value for quite few years first. Until this last fall the investments had paid handsomely but the fund lost somewhere between $10-$20 billion of its value when the financial collapse dragged down the markets.

That loss added to the ire of many Alaskan's who had been pushing for the state to use its substantial permanent fund account to build a gas pipeline to the natural gas stranded on the north slope. Of course Alaskan's aren't idiots and few believe the state would be the best possible operator of a pipeline or that the intricacies of state ownership of a pipeline leased to the private sector would necessarily work out in the Alaskan citizen's best interest.

But Alaskans all know that oil royalties fund the bulk of the state operating budget and that Alaska's oil production is declining rapidly. It doesn't take too much of a crystal ball to see how that decline will affect the state's income. New gas and oil production brought on line will of course push the revenue drop out into the future. If no one else steps up to build a gas line pressure will increase for the state to act itself.

Like I said before it is not so simple.

And I haven't even mentioned things like ANWR, melting ice on polar seas and on and on. A whole lot going on up in Seward's Folly, unfortunately a big part of what is happening is the rapid depletion of Alaska's oil reserves. KSA it is not.

Thanks for all the info Luke. I hadn't had a chance to research it yet. And I didn't mean to imply gov't ownership of mineral rights was a bad thing. In the case of La. and Texas it's worked OK for everyone. Even thef feds running the OCS has worked out well. I was referring more to govn't ownership of minerals combined with NOC operations. That's where I think the inefficiency plays. And it not just gov't operations that's a hindrence IMO. If ExxonMobil operated all the production in the US we would still be producing all those stripers that account for 20% of our production.

Happy to do the little 'legwork,' ROCKMAN, better than getting to the projects I'm actually supposed to be working on (some rather banal plumbing and wiring--my house). AK is a little different so I thought I would elaborate on it a little for the few who might still be following this thread.

I thought I was following you until you wrote,

And it not just gov't operations that's a hindrence IMO. If ExxonMobil operated all the production in the US we would still be producing all those stripers that account for 20% of our production

I kinda got left at the dock there. Maybe a little density on my part but usually I pick up your whole drift. Hope you have a chance to elaborate, as your insights are valued here.

Sorry Luke. That comment was just a continuation of a point I made early. A large corporation such as XOM cannot perform profitably when dealing with small marginal fields. That has nothing to do with abilities. It's really hinges on manpower. The small stripper producers essentially pay themselves to operate these properties. XOM would have to pay their folks to do the same functions. But after they pay their staff there's essentially no profit yet. XOM could triple their staff and take on hundreds of stripper properties. But why would the board approve such a massive allocation of manpower to projects which bring no net income to the company. The same could be said for the NOC's. And that's the point I was stumbling towards earlier: the combination of small private mineral owners and small entrepreneurial operators in the US is rather unique and has given us an advantage in squeezing every little drop out of our marginal fields. From my limited view of the rest of the globe I see very few similar opportunities.

Damn -- I just realized why that statement was so confusing. I meant to type that "we WOULDN'T still be producing....." Sorry about that chief.

I think the big problem with small fields is if the total number is increasing or decreasing. My opinion is that the growth of small field development in the 80-90s as the Majors where cut off from the large ME fields played a large role in keeping the total production up. Polytropos mentions 42% of the production base.

However small fields unlike large fields have another factor at play which is the rate at which new small fields are brought online. One can look at UNG shale plays as a perfect example of this a swarm of rapidly declining UNG shale wells where brought into production leading to a large boost in production rate. Howevr to maintain and expand requires a treadmill of new wells. The small field production follows similar behavior as long as new fields are brought online at a high enough rate then production is maintained or increased.

Once the rate of field addition slows then the decline rate goes to the average of the individual existing fields with little contribution from new fields. Given that we know that peak discovery is well in the past. And given that most evidence points to the majority of the worlds oil basins as being well developed we can expect that the contribution from new smaller fields to either have already declined or to start to decline.

Globally this suggests that the decline rate for the world would be greater than the decline rate for individual basins as the effect of having all the worlds basins fully developed kicks in and additions slow esp for the small field case where new additions play a big role in the actual average decline rate.

And just as important given the long time spans for these sorts of analysis is changing technology. Most of the technical changes have been towards better ability to find oil and reach a higher maximum extraction rate sooner at the expense of a steeper final decline rate.

Better exploration technology tends to ensure that once you can no longer find oil worth producing you probably have done a good job of finding the oil in a region the search is done.

Better extraction technology would tend to ensure once new fields are no longer added the final decline rate will steepen.

And last but not least the same extraction technologies have been applied in reworks of existing fields of all sizes especially ever more advanced horizontal drilling.

Given that world production is at least on a plateau one can readily argue that expansion in the rate of addition of small fields is probably no longer possible or at least can no longer overcome the worlds decline rate. Given the nature of small field development one would expect this to actually be the stronger constraint that new field addition not only has slowed but slowed rapidly. Given the technical advances argument one can then argue that the rate of decline from the 42% of production will increase rapidly. Lets assume it goes from 11% to say 14-15% as the limits of growth are reached in addition of new small fields.

Using the 69.8 production number rounded to 70 ( is this low ?) you get about 30mbd from small fields.

A additional decline rate of 4% would be 1.2mbd on top of a base decline of 3.3 mbd for a total of 4.4mbd. Interestingly enough this sort of decline can account for a lot of the 4mbd of new production estimated to be needed to maintain the overall production rate.

Next we have no reason to not believe that the advances in technology won't cause sharp increases in the decline rates of even large fields once they pass peak production. Canterell is the poster child.

I'd say at least a 2% increase in decline rates for larger older fields is quite reasonable from the technical effect. So for the large fields 70mbd * 0.58 = 40mbd 40*.02 = 0.8mbd of potentially faster decline rates.

And last but not least the smaller fields suffer from much higher depletion rates than the larger fields.

Depletion rates of 10-20% are not uncommon this means the overall field life is generally in the range of

5-10 years before the field is abandoned. If you agree that new field addition has slowed rapidly and that small field production is effectively a square wave from advanced extraction methods then basically withing 5 years of peak your not really talking about a decline rate but production falling off a cliff as the existing small fields go into steep decline without replacement.

This depletion rate approach suggests a 50% decline in production from small fields about five years after new field addition drops rapidly. So if I'm correct that new field additions from small fields actually slowed rapidly in conjunction with the 2005 peak ignoring the questionable and unsustained increase in 2008 then five years later production would be cut in half. All things considered the year before it would probably fall 25%.

This approach suggests that from depletion effects we would see and additional decline rate in 2009 of 25% from the depletion rate of small fields without replacement or assuming production is 30mbd a absolute decline of 7.5 mbd. This dropout effect is in addition to the accelerated decline rate of existing fields for a total decline rate of 7.5+4.2 = 11.7 mbd

Next back to the large fields assume a 5% decline rate plus my technology factor

40*.05 = 2 + 0.8 mpd = 2.8 mbpd.

This gives a total decline in 2009 of 14.5 mbd. Now assuming new projects captured in the megaprojects lists are still able to add the normal average of 4mbd we get 14.5 mbd - 4 = 10.5 mbd of decline.

For export land this is offset by growing consumption in the producing countries lets say its 1mbd increase in consumption. This bumps it up to 11.5 mbd.

Now the export land model also implies that any loss in production will primarily go to exports not internal consumption i.e declining production does not change internal demand.

Overall this approach suggest the contribution of small fields will drop rapidly effectively resulting in the loss of Saudi Arabia and then some from available world export.

It is extreme and certainly its probably a overstatement time variation will serve to spread this out into a more gentle curve. However unless I've made and obvious mistake even cutting the amount by more than half to 5mbd you still get a sharp drop in total world exports. In the case of countries that are net importers and also produce from a large number of small fields this is seen as a effective demand increase in imports.

This scenario also works in reverse before you hit the limit and can no longer bring small fields online.

It suggests that until that limit is reached as long as small fields are profitable swarms can be brought online for several decades leading to a steady growth in production dropouts prevent it from growing to rapidly. I'd suggest that geometric doubling is effectively possible thus even with the high depletion rates you get overall growth for at least two decades. Assuming that vigorous small field development started with the nationalization of oil assets in the late 70's-80's you can readily see you get 20 years of growth out of expanded small field development before it begins to reach the point that dropouts start making it impossible to increase the rate or you reach the limits of growth or probably both about the same time.

1980+20 = 2000.

Bottom line even if I'm wrong in some of my numbers the contribution from small fields to future production should be negative and can be distinctly negative. Just the fairly solid knowledge of the average lifetimes of these fields and knowledge about the discovery curve is sufficient to question any further substantial contribution from small fields. They are not going to help and indeed they probably will result in a very steep decline rate within five years of peak with the decline rate stabilizing when large fields make up about 70% or more of remaining production about 5-10 years further out.

Basically you should see peak production lets put this in the more realistic 2005 peak which showed sustained declines afterwards despite increasing oil prices while the 2008 peak happened as prices increased dramatically then fell off sharply giving no indication it was sustainable.

You have 2005->2008 with a steady decline rate. 2008-2015 with the decline rate basically increasing at 50% per annum from a base of about 5-8% with 2015 production down about 30-50% but decline rate then slows to say 5-8% per annum steadily slowing from then on as it becomes capped by production rates from watered out fields.

Also as it becomes obvious that the world has peaked as long as oil prices remain elevated extreme methods will be used to produce more oil this will work to again arrest the decline rate to some extent.

But this is against a base production with the contribution of small fields well in the past.

I just don't feel that I've made enough mistakes to not conclude that we will see accelerated declines starting last year.

Memmel and Rockman,

I guess there are a number of issues that need to be understood wrt small fields

- geology & global dispersion

- technology

- economics

- politics & laws re mineral rights

- country infrastructure

- personal attitude and entrepreneurship

lets say oil is at $200

is it possible for an individual to go to a field that has been abandoned by a major firm as unproductive, and using sweat equity extract a living from it? would he be allowed to do it? would he have the technology to do it?

or are there fields that the majors can't or won't develop today because of the economics?

my point here is we know there is still a lot of oil out there, and that it is becoming uneconomic to extract it. (the intersection of economic / uneconomic is a moving target)

but I would say the Third World (what a quaint term!) may come up with some new ideas, as they have in many other areas, based on cheaper labor, and not having the legacy infrastructure we have in the West

I agree that these fields decline much faster. Just as they do with gas. so you have to find more and more of them. but how many are there?

I think we at TOD are "stuck" in a mindset of traditional technology & big company & mass production.

this may change

Probably true -- how economical is for people living by finding recycling stuffs in garbage dumps. It's all a matter of relative.

Well, if we can move 1/2 of Indians to TX then maybe maybe -- or we can turn part of US into India kind of poverty -- when TSHTF, it's probably where we are heading.

Well I think it depends. The absolutely biggest problem with oil is the shear volume of oil produced.

That may sound strange but its not. Nothing can compete not even your example of low volume oil wells.

This is mainstream big money oil. What your really talking about is a sort of localization of the oil industry and probably associated with it a tendency for the product to be refined and used locally.

Along with mom and pop extractors you can get a return to mom and pop refineries probably with lower efficiency than our modern ones. You don't want to run a 100,000 barrel a day refinery based on collecting barrels of oil from stripper wells. It works now by leveraging the infrastructure left over from US peak production and as a addition to other oil inputs. Its like collecting aluminum cans out of the Alcoa parking lot.

Will it happen ? Sure to some extent but is it important ?

I'd say once the usage volume drops low enough that crops can replace oil then most people will probably choose to focus on oil bearing crops and or solar wind. The obvious reason is that both the cash and technology requirements are a lot lower. Once oil usage is down to the point that this sort of mom and pop type operation is viable I'd suggest oil bearing crops are probably cheaper and you can always sell most of the oil types as food.

One has to figure that eventually the market for hydrocarbons either fossil or from plants has to reduce to the point that you can reasonably supply it with true renewable agricultural sources. The use cases that I can see continuing for some time would be secondary power sources, airplanes and chemicals. Natural Gas from known deposits can supply a lot of these use cases leaving a even smaller fraction for liquid hydrocarbons. I think that for a long time dwindling current sources are more than sufficient if you make the assumption that per capita oil usage will converge on a low number. By the time the use case your talking about is viable I just can't see it being cost competitive with plant sources.

For me at least once oil is no longer viable as a feed stock for general transportation use although it almost certainly will remain valuable the desire to produce it at high cost is low and alternatives actually work. So basically once the infrastructure dies most importantly the refineries we will stop extracting oil. Once refineries become uncommon then you have no use for oil and hydrocarbons for fuel will become a byproduct of the remaining chemical synthesis plants that use NG and plant feedstocks.

Methanol from NG would probably become a primary fuel for example. Assuming that solid oxide fuel cells or similar robust fuel cells become common on the small scale you probably will see fuel become a mix of liquid products up through butane or propane and even methane with pressurized tanks capable of handling a witches brew from pure vegetable oil to pure methane including alcohols and amines. Basically junk leftover from other petrochemical processes.

http://www.ecogeek.org/content/view/684/74/

Whats neat is once this becomes the norm you might see a sort of rebirth in mom and pop extraction.

From a ecological standpoint as long as the extraction rates are low I don't see that the environmental damage is worse than that caused by agriculture its probably a wash.

However all of this depends on future markets how much technology we retain how much we continue to rely on petrochemicals. Certainly we have use cases where natural products are probably not a good choice the best example to date are various glues and certain plastics Teflon for example. But one could readily argue that the real need for synthetics is very low and aggressive searches for replacements that work or need small synthetic modifications to work are doable. A return to using local materials and durable goods also eliminates vast swaths of use cases for synthetics. A return to slower transportation modes say wind powered and my favorite solar powered zeppelins eliminates even more. And of course assuming our society maintains its technology and information networks we have yet to really adapt to using them efficiently we don't really need to travel much except for pleasure and for the ritual smelling of arses.

I mean face to face meetings :)

Sorry for the long reply but thats my specialty :)

You can see that as you change the culture then demand tends to go along different routes many take us back in time using technologies more common with the period before the industrial revolution.

Think autonomous intelligent robots building roman style aqueducts and bridges with the engineer overseeing on a horse communicating via an implanted total communications device and you get the sort of future I hope will unfold. You can see that total amount of synthetics are low and used in high value items.

I'll never forget riding my mountain bike past a girl riding a horse texting on her mobile phone and realizing that this was probably the future.

poly -- Actually most of the stripper production operated by very small companies originated as discoveries by big independents and the majors. Just a Wag but I would say at least 80%. At the moment I can't think of one worn out old oil field that didn't originate this way. The bigger companies sell the fields to progressively smaller companies. Also, much of the stripper production in the US today is not from originally small fields but from some of the largest ever discovered here.

Cheap labor and lack of legacy cost isn't going to be of much benefit to the rest of the globe IMO. The oil patch isn't the US auto industry. I would say 99% of the effort that goes into maintaining a stripper field is mental/financial. Small operators avoid paying third party contractors with a passion. I've once sweated like a stuck pig on a hot August afternoon in S Texas helping one such operator hang a lease road gate because he didn't want to pay a contractor $300 to do it. I didn't get paid but I did a couple of free turkey hunts out of it so I was a happy camper.

The technology for maintaining stripper production is very mature also. It has to be. The small cash flow from such operations can’t fund expensive technology. The one big new technology that can improve some of these old fields is horizontal drilling. But the very nature of stripper operators is such that they don't have the capital to do it. To drill one horizontal well might take 10+ years of an operator’s net income. That's were folks like me and WestTexas come in. I've got a project to use horizontal tech to recover another few hundred million BO from some old Texas fields. First I get a capital source to fund the idea. Then I find a small stripper operator to sublease some of his acreage to us to drill the wells. Eventually, as the new wells peters out we would likely sell them back to the old stripper operator of the field. Of course, I put that file back in the cabinet when oil prices fell. Maybe bring it back out in early 2010…we’ll see.

That’s why I’m of the opinion we’ll see very little additional recover from foreign fields when they reach marginal levels. The entrepreneurial structure just isn’t there.

Polytropos,

you think:

"the Third World (what a quaint term!) may come up with some new ideas"

In theory I'd agree with you. But in practice there are loads of good ideas which would be perfectly applicable in the third world. But sadly they arent as the political and economical circumstances are too bad there. Some of these "failed states" even fail to boost production that would be already profitable now (e.g. Iraq, Iran or Nigeria).

And as soon as peak oil (+ climate change) really hits we should expect even more of these "failed states", some of them not far from the OPEC countries.

Sorry for the delayed answer poly...spent the weekend on a well.

Yes: once a field has been abandoned by who ever was operating it, another operator can lease the mineral rights and attempt additional recovery. More commonly, the big company will sell the field to another company (ususally a smaller one but not always). even marginal fields have some value and the origina owner doesn't have to spend $'s abandoning the wells (not always a cheap process).

In fact, this aspect has been a key compnent of expaqnsion in the oil patch for almost 20 years. As I've mentioned before "PO" was recognized long ago in the oil patch. But we've called it the "reserve replacement problem". Exploration in the US has been on a downward track for about 30 years. Most new companies could drill enought successful exploration wells to sustain growth. So it's been an "acquire and redevelopment" business plan for the great majority of small and even medium sized companies.

The "Third World" has new real advanatge with cheap physical labor. Nothing will happen with their fields as they move towards marginal production levels without someone supplying mental labor and capital. The free market isn't always the best way to go in many areas but with respect to maintaining marginal o&g production (which can cumulatively be very significant) it's the only process I've seen that works.

This (deliberate) constrained production could mean that ME production can remain at least on plateau for many years to come. The ME is incomparable with Texas and the North Sea, assuming the latter had unconstrained production. Could someone clarify this maybe wrong conclusion ?

memmel,

This couldn't be emphasised enough. A one third increase of URR seems to shift PO only 5 years. Tertiairy recovery (CO2-EOR) can increase URR much more, however I suppose that CO2-EOR doesn't affect the year that the world goes in terminal decline. It can only make the decline less steeper.

The graph of the growing gap in discoveries and production is one reason why I a priori don't believe CERA.

This is why, IMO, that we can compare these various regions using the HL method. We are, in effect, basically plotting the rise and fall of the large oil fields. The smaller fields that we find post-peak and enhanced recovery efforts help, but smaller fields + incremental increases in recovery factors can't restore production back to peak levels.

I wonder if we might have offsetting penalties with world production, to-wit, we won't see the same drilling density worldwide that we see in the US, but worldwide we do have a larger contribution from unconventional.

Taking these two factors together, perhaps the net result will be a low single digit decline rate worldwide, much like the Lower 48, where in round numbers we saw about a -1%/year decline rate for three years, a -4%/year decline rate for the next six years, and then a long term decline rate of about -2%/year. Of course, keep in mind that a -4%/year decline rate for six years would drop production by about 20%.

Lets see how US production goes over the next few years even with the deep water fields coming online.

We have every indication that even with the latest drilling effort the US has really drilled a well in just about every place possible.

The combination of a lot of existing infrastructure developed up to the 1980's and the Texas oil bust in effect subsiding future production for several decades afterwards plays a big role in my opinion in US oil production since the 1990's. If you take into account the money lost during the oil bust I'd be surprised if the US has even broken even on oil production since the 1980's. Next of course technical improvements play a large role. So in effect you have the combination of being to pick up known producing fields for pennies on the dollar and reworking them using more advanced technology.

Here is one link on the bust.

http://money.cnn.com/magazines/fortune/fortune_archive/1985/07/08/66121/...

Whats not really talked about is this left a huge amount of known resources many drilled with producing wells available for nothing along with rigs galore. The people that made it through eventually did pretty well. Free oil for someone with enough money to actually extract it.

One has to figure that these huge write offs allowed the remaining oil industry to book profitability for a decade or more. I'm suggesting twenty years is certainly reasonable.

Looking at Kebab's detailed graph.

http://www.theoildrum.com/node/5180#comment-499782

One can see using my scenario about the time that slumming off your ill gotten gains from the bust was starting to run dry oil prices started increasing and new investment started flowing in.

And Westexas you have already admitted that you made some smart calls that eventually allowed you to take advantage of the bust :)

In anycase if my model is right then I expect US oil production to fall to 3.5-4.0 mbd I think it already started down but was masked by the deep water which is similar to the effect Alaska had. So this would be lower 48 minus deep water. Maybe 4.2 or so if you include deep water. Even with deepwater we can expect it to continue downward closer to 3mbd or so over the next year or two. So by running off curve so to speak by about 1mbd or so we are going to now run below HL by about the same amount eventually getting back on curve at about 2.5 mbd in 2018. This is assuming that the last burst of drilling activity really finished off most prospects in the US there is nothing left. Widespread use of horizontal drilling simply caused faster extraction.

Also if I'm right then once can deduce that technology advances have probably contributed to a 25% boost or so in extraction rate at the expense of a similar increase in depletion rate.

For example in the case of Ghawar if the depletion rate in 1990 of remaining URR was 10% and technology boosted it to 12.5% then Ghawar would have been fully depleted by 1998. If it was 5% then it got boosted to 6.25% reaching full depletion by 2006. Ghawar probably actually had three increases so it went from say 5% of remaining URR to 6.25 in the 1990's with additional advanced wells added in say 2000 to raise its depletion rate to vs 1990 to say close to 8%-20% vs 1990 rate against remaining reserves.

Notice that this depletion rate is not quite the standard one which is based on total reserves but more like compound interest with the time to depletion shortening to maintain flow rates.

I think the same thing happened in the US and by 2003 we where depleting at 15-20% of remaining URR.

If so the US has to see a production crash. And it could well be happening its just at the moment masked by the deepwater projects that happened to come online which I consider a external province like Alaska their relationship to shallow GOM production and land production is tenuous at best its safe to classify deep water GOM as a newly explored and developed province.

This seems to show what I'm saying.

http://tonto.eia.doe.gov/dnav/pet/hist/rcrr72r3fm_1a.htm

More data here.

http://tonto.eia.doe.gov/dnav/pet/pet_crd_crpdn_adc_mbbl_m.htm

Maybe also Colorado ?

http://tonto.eia.doe.gov/dnav/pet/hist/mcrfpco1m.htm

Maybe PAD1, PAD2, PAD3, PAD4 and PAD5 in aggregate.

http://tonto.eia.doe.gov/dnav/pet/hist/mcrfpp11m.htm

http://tonto.eia.doe.gov/dnav/pet/hist/mcrfpp21m.htm

http://tonto.eia.doe.gov/dnav/pet/hist/mcrfpp41m.htm

http://tonto.eia.doe.gov/dnav/pet/hist/mcrfpp31m.htm

It looks like if I'm right then my timing was slightly off but certainly you see

hints of a sharp drop off in production starting generally in Feb 2009 we will

have to see how it continues. My best guess estimate continues to be Mid 2008.

If it turns out I'm off by 7-8 months well given the nature of the problem I consider

that close enough. If production does not fall of rapidly in 2009 even as oil prices rise

then I'm wrong.

polytropus - here is a graph that will illustrate the percentage of wells in each production rate bracket for the US:

As you can see as a percentage of the total wells the most productive don't even register here. As a percentage of total US production <=15 bbls/day = 19.9%. Can cook that graph up for you as well if you'd like. Some of the wells in Western PA dating from the dawn of the petroleum industry were dusted off during the price run up last year; we're talking like a barrel a month, but at $147/bbl they were worth it, for a while.

As ROCKMAN says the US is an anomaly on the world scene; viva free enterprise. I've been told the majors look down their noses on anything <20kb/d. Perhaps the NOCs should open up their citizenry to this literal wildcatting; I remember a very informed poster here, Bob Ebersole (RIP), saying that a lot of onshore Mexico has never been properly explored, which might be more productive for them than waiting 4 years for a semisub to run up $100 million bills in the GOM; but in all likelihood it's too late for them.

Very interesting. My untutored eye cannot find much to quibble about, and that is a problem; the problem being my untutored eye, and the untutored eye of reviewers when you quote stuff like this. While it is nice to see this stuff on TOD, I think it would be much better for all concerned if it got into the peer-reviewed literature somewhere. It is much more likely to be cited if it was in something like Energy Policy (or whatever), and the reader would know that it had been reviewed by other experts (no implied criticism of many of the TOD commentators, but it is a whole lot harder to get something published if you use Web based references rather than peer-reviewed papers.) I also know, from bitter experience, that it is hard to get published, and I don't want to wish this on Khebab.

Don

I agree and I also think its obvious that the warnings about tobacco are suspect I think that you really need to consider the opinion of experts on the subject from the tobacco industry to get a clear peer reviewed answer to the question of the safety of tobacco.

I'm not sure just what you are getting at here, unless you are being sarcastic, which is unwarranted. I am stating that Web-based stuff, even if it is 'world class' is not viewed that way by many researchers and scientists. A few years ago I tried to get material published about the role of peak oil in health care. AT the time, virtually nothing was in the published literature about this and a major criticism of the reviewers of the paper was that my references were suspect. Now, there is a bit more out there and it is a bit, (a little bit) easier to get something printed. But, to go to a Dean, or a University President, and say, "look, we are facing a problem and maybe we should start to think about how our faculty or university will fare in the future because of what I read on the web"; just how far do you think I would get? I might not get too far under any circumstance but I would get farther if I had some papers from credible journals.

You seem to think that the experts who would review a paper by Sam would all discount what he is saying; they are all on the 'dark side'. Would Kjell Aleklett? He can't be the only one. You have to start somewhere. It is relatively easy to get something on TOD (or some other blog), much harder to get it into print, but it is essential to do so. Mentioning it on TOD is like going to a conference and presenting a paper. Nice, but unless there is follow up with known critical review, it is harder to get accepted.

Don

All you are saying is that it is very important to cater to ignorant or biased authority. That is a waste of time. Should Doug Noland have spent more energy getting the respected "experts" to acknowledge the inherent danger of the financial economy bubble? It would have been pointless.

So, you don't try to educate ignorant or biased authority. Just leave them that way, let BAU carry on as it is doing, let political decisions be made by the loudest voices, or the richest ones. Ultimately, economic theory and political or theological ideology and loud, well reimbursed voices will be trumped by biological and physical reality. But the knowledge about that biological and physical reality will be spread better, and to more fertile minds, by getting it published where it can be read with the confidence that it is likely to have some validity. Process does play a role in education: of the public, of politicians, of grad students, even of you. If you considered only what you read on the Web, or heard on TV, presented by someone or some organization with an axe to grind, you could end up with lots of information, but no mechanism of weighing its usefulness; full of 'information', but ignorant. Writing a paper is bloody hard work. I don't like doing it any more than the next person. I would rather do my research, such as it is, post it, and get along to the next bit. Easy, but ineffective.

I've had my say. That's it.

Don

You are convinced that the "mechanism" to weigh the usefulness of information is by having an authority figure approve it-that is your individual view probably reinforced by an academic background. Not everybody thinks that way-this latest financial fiasco has opened a few eyes to the weaknesses of such an intellectual approach, but your view is still surprisingly widespread nonetheless.

I think you have a fundamental misunderstanding of what "peer review" entails. It is not, and should never be an appeal to any kind of "authority figure" and in fact a large proportion of reviewing is carried out by relatively junior researchers. Anonymity is a crucial feature of the system in that it allows young post-docs to harshly criticise papers written by the giants of their field without any fear (justified or otherwise) of retribution. As researchers become older and more established they tend to gain the confidence to sign their name to reviews but in my experience they also tend to do less reviewing (and in general become more forgiving).

"Peer review" is exactly that - review by your peers (even if that peer happens to have been in the field for twenty years more or less than you have) and in principal is not a lot different to some of the more careful and considered comments that you see here in response to articles on this website.

God that was funny.

I assure you it did not work that way in theoretical chemistry.

Not that I did not actually do the reviews for my boss looking for obvious errors but that was more clerical review. The bulk of the paper is often written by students and post docs and contains errors not caught by the primary researcher.

In general it only takes a small amount of time to recognize the writer of a review by their style regardless of if they sign the review or not.

What I do find interesting is how often I see academics post these positive posts on the scientific process. My experience was that scientist are passionate and often arrogant people who believed deeply in their ability to see the truth from their own world view. This leads to clashes that are very very human.

In general in the end the truth triumphs unlike a court of law you can go back and add to the body of evidence as often as required until the opposition is overwhelmed as long as your funded.

Not the nirvana your describing closer to criminal court.

My biggest beef with science today is developing and exploring valid areas outside the realm thats currently receiving funding is impossible you don't get any discretionary funding and stealing money from other grants to peruse unfunded research only goes so far. God only knows whats not been done because of the funding policies.

And it does not pay well I would have never paid off my student loans if I had continued into Academia a poor person that self funds their college with work and student loans through the PhD level has no hope of ever making a decent living. Took me a while to finally accept that I simply could not afford to continue.

In any case thanks for the laugh I've seen fist fights almost break out at conferences over reviews that tends to counter your view and plenty of other crap get thrown around during the review process.

What area do you work in to have formed such and opinion ? Sounds like I was in the wrong field.

I suppose it might depend on whether you've been exposed to the "post-doc as lab slave/ghost writer for a dictatorial group leader" model, which I have heard of in other disciplines (chemistry, medicine), predominantly in the United States but is completely outside my own experience as an earth scientist in Europe and Oceania. I have heard that some post-docs are not well-paid in the US which might be part of the problem - in Australia post-docs start at ~A$65,000 compared with a national average wage of ~A$57,000, so if you want someone to do your bidding in the lab you employ a tech instead as they are a lot cheaper. Post-docs should be expected to initiate their own research projects and write their own papers (which in most disciplines outside chemistry means their name is first in the author list and they are credited as lead author).

And absolutely no-one treats PhD students like dirt around here. They are almost impossible to attract and they command substantial scholarships. Irritate them enough then they leave and your faculty gets hit with a financial penalty.

Sounds like you might have been. That's quite a substantial chip on your shoulder. And a fist fight a conference? I'm almost inclined to call BS on that. When? Where? Who? FFS, I know researchers who've had bitter ongoing disputes in the literature but they're still capable of sitting down and discussing it over a beer or two.

Oh, and I stand by my comments regarding the review process, but maybe there are discipline-specific elements to it. If you like, I can give concrete examples in paleoclimatology where a paper mounts a strong attack on previous work of another author and then credits that author as a reviewer in its acknowledgements. Accept/Reject decisions are made by editors, not reviewers, and editors get pretty good at spotting a reviewer who is having a bad day -especially true for the higher-impact journals.

In the US if you complain they bring in a post doc from China sort of the in sourcing variant of outsourcing nothing wrong with these guys as people but it collapsed wage scales. Its been over ten years since I was in school but I made between 8-12k with a teaching assistantship and variable on grants in the summer if we had a grant my tuition was 12k a year and could not be paid via grants.

Post docs made 15-28k again depending on the grant.

As far as the almost fist fight it was at a conference and there is a bit more to the story having to do with grant request being blocked by the same person. It was a sad incident and I don't think more information is warranted on a public forum the people involved let emotions take over. My main point is it can get stressful to the point that people almost snap. Funding was/is the root cause more on that below. And yes its normally does not come to even a hint of physical blows. But I remember the incident vividly because it woke me up and made me take a hard look at what on earth would drive scientists to such a point.

And yes the editor makes the decision to publish that universal about the only pull a reviewer has is deciding to boycott a journal or publishing a counter paper as far as the publish decision.

Big question how is research in paleoclimatology generally supported ? Do you receive general funds ?

I know when I was in school European schools seemed to have a saner more general support for research.

In my particular area at the time I was in school research was concentrated in Europe and the US.

I think it all depends on how research is funded in the US it is nerve racking.

Here is article you can read the press release here.

http://www.brokenpipeline.org/materials.htm

More complaints.

http://collegeaffordability.blogspot.com/2006/09/our-broken-system-of-fe...

And here is how its done in the US.

http://www.utsystem.edu/News/Clips/DailyClips/2003/1102-1108/HigherEd-WS...

Certainly my views could be colored by having to depend on NIH funding but I'm not the only person that realized the system was badly broken.

In the US at least the majority of the funding is monopolized by the superstars who can pay the post docs to write more papers and get more grants.

I don't mind one bit sharing my personal experience.

I wanted to teach and work on a small number of hard problems and try and publish a few papers a year. I really wanted to focus on numerical exploration of complexity.

Basically mixing AI methods with chaotic systems as input. Sort of a cross discipline CS/Physics area.

I found that people doing research in computational physics did not explore alternative methods in CS and vice versa. Looks like 15 years later it has a name :)

http://www.cs.vu.nl/ci/

Crap :)

Given the links I provided about the NIH can you not be surprised I was shot out of the water ?

I switched to CS to try it from that side then was offered a very nice job working the new WWW and never looked back. Looking back I'm happy with my decision I'd never have experienced the life I had if I had gotten my wish but the real point is science can be broken its not always as you describe it.

I did what I could th change my situation and was allowed to transfer out of Chemistry right into a graduate CS program but how long can you stay in school trying to do science ?

And before this I did three years of a PhD in Biochem I switched to theoretical when I discovered a novel anti-cancer drug based on water stable tetra alkyalammonium borate esters of riboflavin and a whole branch of potential drugs based on these novel borate esters. We filed for a patent and US Borax gave me 5000 dollars for rights to the patent that was personally which was wicked cool. They validated the novel chemistry and decided they did not want to enter the drug business shortly thereafter my patent application was shelved because of the fiasco at UofA with the supercondutors. With the patent application "in process" we could not easily publish. We tried a company but no go I went to Utah state to work with one of the few Boron chemist in the world when I showed up she left to become provost of Washington state. At that point I gave up and went into theory than as you read that eventually blew up.

Slowly I'm starting to see my idea that chaos was a dead end by itself and you had to take a information theory approach become more prevalent in the literature. Any chemist willing to whip up some tetremethly borate ester shoot me a email its free to look at. The riboflavin complex acted like a anti-vitamin starving the cells and of course boron is perfect for radiation therapy it still makes me sad seeing this idea dead. We tested on chickens with virally induced tumors and got over a 50% cure rate and immuno response stayed high so it was not immuno supressive. In fact it seemed the mode of action was to simply stop or slow cell division until the natural immune response flagged it as cancer. Mammalian cell cultures showed viable cells but very slow cell growth we never established a LD50 level with injections of up to 20 grams into the abdominal cavity of chickens. The chemical structure was new and could not be established NMR,IR,Raman spectra where novel and did not fit known bonding types. the NMR indicated that it might be a partially aromatic system between the amine boron and oxygen atoms this would explain the water stability of the borate ester.

Ab Inito calculations and xray diffraction would be required to determine the real bonding.

And this is what really pisses me off I pretty sure I've been sitting on a new type of chemical bond all these years ! US Borax confirmed it was a novel branch of boron chemistry and I get stuffed ?

Every chance I get I beg people just to look at the system again.

Eight years of grad school three branches of knowledge 45k in loans and after two really good ideas were wrecked I said f@#$ it.

Depends on the institution. In my case I rely on research grants from about five different countries at the moment, and also dabble in archaeometry and mineral exploration among other things as required to help pay the bills.

Maybe that is true. But the flip side of that is that for the most part things are nothing like as bad as you describe, and the majority of scientists are in fact people of integrity. I am truly sorry that you had such a tough time.

Well thats the breaks as they say.

To be fair my current research work has received ample funding from a EU grant via Spain.

I'm of course working as a private company now. At the moment the economic crisis in Spain

has left the whole project in limbo.

Given this experience I can say its the American system thats become increasingly broken in

particular NIH. I was of course in school during Reagan's all out attack on non military research.

It was probably the worst time to be a researcher and from what I've read American research never

really recovered. I don't think people realize the damage Reagan did to US research.

Even funnier is I ended up doing some work on the launch detection sensors later on at this institution.

http://www.sdl.usu.edu/about/

However I had the best equipped senior physical chemistry lab on the planet filled with equipment on

"loan" from SDL :) Several hundred budding doctors that chose a undergrad in chemistry received a top of the line introduction to experimental physical chemistry.

But overall my point is science is not always done the way it should be and I'm not a isolated example.

With any right or privilege if you don't defend it you lose it. My opinion is that the US lost a lot of its ability to do risky creative research with Reagan and its not come back. The EU has certainly filled a gap created but the US losing its way but all is not well in the science world and you can look deeper at our student loan fiasco etc and you will see that higher education in the US has developed serious problems. I think they are hidden to some extent because the superstars receive ample funding so the absolute best and brightest keep America competitive. The problem lies right below that level with the average researcher or one that wants to chase a risky project. All is not well below our gaggle of bought and paid for Nobel Laureates. And sorry to go off on this tangent but its important introducing a politically sensitive subject such as peak oil into the scientific literature is not going to be treated as you describe but dealt with by a corrupted politicized US science system.

I'm sure a paper on peak oil will eventually make it into Nature and we will force the vested interests into debate in a peer reviewed arena. Given my experience I maintain the chances of it being a level and honest scientific debate are slim. Maybe I'm unlucky as you say but there certainly are very powerful forces in modern science that are not interested in determining some truths your wrong to dismiss them out of hand. The stem cell research debacle in the US for example. Peak oil obviously has a explosive political component so consider this when it finally reaches the front pages of the scientific journals.

Obviously on the oildrum we have shown it makes a mockery of our financial system and a good bit of our lifestyle is called into question. You can bet that the scientific community once they look at the problem will come to similar conclusions.

And it will its just a matter of when.

I think you're fixating on the peer rather than the review. Clearly a review by someone who knows nothing at all about the subject under discussion isn't any use, but in most cases someone who roughly knows the area is as good as an expert; the key is to actually review stuff.

You seem to be assuming that a review is a simple yes/no affair. A good review will attempt to express how the work is viewed: comprehensive and understandable, probably right but not completely understandable, probably right but case not supported strongly enough by experiments, ets, down to the occasionally completely incorrect or incomprehensible, and provide information as to which points are at issue. The authors may get a chance to submit rebuttals and changes to the same venue, or they may have to submit a modified version to a new venue. But in either case criticism (in the sense of analysis, not necessarily negative) has been presented to the authors and they have to deal with it, even if it's in a rebuttal letter. So there's a strong probability (I won't say guarantee because it isn't) that the authors have been forced to consider other viewpoints and this is in their opinion still the correct analysis and viewpoint after a reasonable level of thought. (It's a bit like the difference between saying 'I'll kill him' when you're drunk in a bar and sending a death threat note when you've gone home and sober up.)

The problem I have with webpages is that quite frequently they get put up in the rush of enthusiasm by the writer, and you have no idea about their status. When the author received criticism by email, did they: (1) think about it and analyse it, and maybe even modify their web-page based on their response; (2) decide that anyone who doesn't agree with them is an idiot to be ignored; (3) maybe they don't even believe the work to be correct anymore, but just haven't bothered to take it down. Peer review isn't perfect and isn't the be-all-and-end-all but knowing a paper was refereed provides a basic level of pre-filtering that you know the author is in category 1.

Incidentally, when I did reviewing I only considered my job to be finding factual errors, deciding if assertions were sufficiently supported by experiment and whether the viewpoint selected by the writers was made clear and coherent. Importance, beyond a very trivial "this is much too simple", wasn't something I tried to rate, although maybe conference/journal editors do have to apply that.

Tobacco is a great example of the dislocation between 'evidenced common sense' and political/market reality !

http://www.epha.org/a/1078

http://www.conservativeeurope.com/news/730/hypocritical-eu-vote-for-toba...

.... yes - that's opposition from the Conservative Party of the U.K.

.. I wonder if it's the product or the fact that alot of it's grown in France ?

Couldn't disagree more. There are plenty of knowledgeable people reading and commenting at TOD (though I'm not one on this issue). It's extremely interesting and educational to see these issues debated here, and challenging to try to understand as much as one can. I hate to even imagine all the great (and some not so great) stuff I've read here over the last few years being hidden in some so-called peer-reviewed closet.

Here an author is challenged not only to be accurate, but also interesting and as comprehensible as possible. It's a very good model for other areas.

Hello DavebyGolly,

I second the motion that critical, top-level eyeballs follow TOD and ASPO.

Dspady,

I have no proof [maybe SuperGoose does, but obviously can't disclose it], but I very strongly feel the DOE, CERA, API, EIA, IEA, CIA, NIA, MI-6, KGB, MOSSAD, USGS, XOM, ARAMCO, CINOOC, et al, plus lots of oil journals, and much more orgs & govts, keenly follow the detailed math and graphical work by Sam & Jeff, ACE, Euan, Rune, SS earlier, the ASPO experts [Rembrandt, Dave Cohen, Kjell, Colin, Matt, Udall, et al].

Don't forget that many years ago now, an officer from US Naval Intelligence spent some time with Colin, and many TopTODers such as Gail & R-squared have been forum guests at Red Cavaney's API.

totoneila

I think you are quite right. I do not want to give anyone the impression that I think that what is presented here is garbage. I think it is pretty good stuff, and I use it when I give talks on peak oil, and I read the comments and weigh whether or not I think they are valid. As an aside, I always enjoy your comments. In an earlier life I obtained a degree in Human Nutrition, so your insights on food production are appreciated very much. They appear to be very knowledgeable and very human. You would be someone I would love to have a coffee with.

Someone else (I think below) said I came from an academic background. I confess. I am a physician in the Faculty of Medicine & Dentistry at the Univ. of Alberta. It is because of that that I think one needs to also 'get the message out' in academic journals. If I give a talk and refer to (no aspersions here) 'totoniella' or 'westtexas' or 'khebab' or 'Prof Goose', or 'x' people might think I'm referring to characters from Damon Runyon (I guess that dates me a bit). Talking with academics about what will be a change in our paradigm of living and practicing medicine requires a certain level of face validity.

Down the road maybe not too far, we are going to have to have some very serious discussions about how to provide health care to people, how to train physicians for a new kind of life, how to convince populations that their expectations for health care are going to have to drop and it is going to be a lot easier if I can quote Nature, or JAMA, or Science, or Energy Policy, or Global Environmental Change or some other peer-reviewed journal, rather than Life After the Oil Crash, or TOD, or DieOff, or Casaubon's Book or Clusterfuck Nation. So, this is not just an academic exercise, it is a plea.

I know I'm not the only academic that reads TOD. I ask you, am I totally out to lunch on this?

Again, totoneila, a pleasure to meet you. Along with many others, I wish you would write a post on the implications of Peak Oil on I-NPK, and at the same time, publish it.

Don

I know you addressed this to T, but I can't resist answering: no, not totally, but to some considerable extent, yes. The academic model is deeply flawed, too insular, too remote. The whole model for handing out PhD's is ridiculous as are the publishing pressures for academics.

I know that in physics the publishing model has partially broken down although I don't know the details. But what I do know is that climate, peak oil, and some related subjects need to be propounded, explained, and debated in a way and in a venue that is available and somewhat comprehensible to outsiders who take an active interest. The academic journals don't do it. I don't say never publish in a peer-reviewed journal, but if your work has great relevance for the public, then a forum such as TOD is the far better place to put one's efforts, especially if you're not in an academic environment and subject to its constraints and demands.

I'd far rather read something that is relevant and wrong here than right and irrelevant in a journal.

I don't say never publish in a peer-reviewed journal, but if your work has great relevance for the public, then a forum such as TOD is the far better place to put one's efforts, especially if you're not in an academic environment and subject to its constraints and demands.

As ever, we end up back at the trough of the Almighty Dollar. Publications make their money from advertising and subscriptions. To boost subscriptions, they keep their content private. If it gets out to the mainstream, there is less incentive for anyone to buy the 'zine.

I posit things are getting too serious to continue this modus operandi. The closer we get to crisis, the more it is an issue of the commons. Perhaps research should be treated that way? Also, as someone pointed out recently, any research that is paid for by the government is public property, and should be treated as such.

Cheers

Where are the experts ? Oil extraction is primarily a engineering problem in the domain of companies.

I used to do research on chickens funded by Tyson I did a lot of work on trace mineral toxicology from water contamination but I assure you not one bit of work on the growing conditions or genetic defects in their breeding lines. The obvious question of using less genetically warped lines and less stressful conditions to handle variations in water quality was not addressed and rarely talked about.

I have a hard time believing your in Academia and did not do corporate sponsored research unless your field is to far removed.

M King Hubbert started this work and his papers and predictions worked out well the academic groundwork has be in place for decades why has it been allowed to gather dust ? Why on earth was this line of research left to a motley collection of people on the internet ?