New Taxes for Oil and Gas Companies: Where Does this Lead Us?

Posted by Gail the Actuary on February 27, 2009 - 10:28am

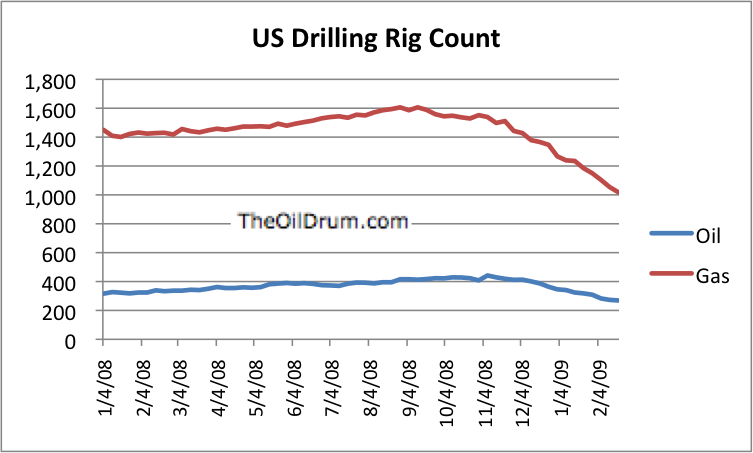

The oil and gas industry is already pulling back sharply. If one looks at drilling rig counts, the number of drilling rigs operating in the United States has dropped by close to 40% from peak levels in 2008. Now changes to the tax law which would make it more expensive for oil and gas companies to operate are being proposed by the Obama administration.

What is the likely outcome? I fear it is an even steeper drop in US produced oil and gas supplies than would otherwise be the case. This drop will come primarily because of the likely impact on small oil and gas companies that dominate the US production market, especially for natural gas.

I have read that Speaker Nancy Pelosi and Senate Majority Leader Harry Reid are asking that the Capitol Power Plant change from coal to natural gas for producing electricity. With the proposed tax policy, I am afraid that they will find themselves asking to switch back to coal within a few years, because sufficient natural gas will not be available. If the natural gas industry is to maintain or raise production levels, it will need assistance, not higher taxes.

Last September, I wrote a post saying that there was a possibility that US natural gas production could be ramped up, if quite a number of obstacles could be overcome. I included this graphic of possible future production.

The credit crisis has reduced demand, and this has reduced prices of both oil and natural gas. At current prices, it is no longer profitable to drill most unconventional natural gas wells. If taxes are higher, this will only make the situation worse, driving more marginal producers out of business.

The effect on supply won't be felt immediately, because drilling rigs are used for drilling new wells and for servicing existing wells. Wells that have been drilled continue producing for several years, but the amount of oil or gas produced each year decline, as the pressure in the well declines, and as the percentage of water produced increases. Companies need to continue drilling new wells to keep production up. Figure 1 shows that companies are already cutting back dramatically on drilling new wells. Adding new taxes will only make matters worse. Even without new taxes, a decline in natural gas production is likely within two years.

President Obama has recently released his budget proposal for 2010. I understand it has tax benefits for green energy, while also increasing taxes and adding fees on the oil and gas industry.

As I understand it, the proposed tax increases on the oil and gas industry are not huge. They are expected to produce revenues of "at least $31.5 billion" over 10 years, according to the Wall Street Journal. This would average $3.15 billion a year (or more).

According to recent testimony of Gary Luquette, President of Chevron North America Exploration and Production Company, the industry spent $152 billion on tax and royalty revenues paid to federal, state, and local governments. This averages about $25 billion a year. If the tax amounts to only $3.15 billion a year, this would amount to a 12% increase. Of course, it is not clear it will come to only $3.15 billion a year--it may be considerably more.

One of the more widely discussed changes is new tax treatment for leases in the Gulf of Mexico. According to Reuter's:

Obama's plan, which must still be approved by Congress, would levy an excise tax on Gulf of Mexico oil and natural gas, raising $5.3 billion in revenue from 2011 to 2019.

This new 13 percent tax on all oil and gas production in the Gulf would only affect those companies that are currently not paying any royalties due to a loophole, said an Interior Department official. The official said producers who already pay royalties will receive a tax credit.

The proposal would also place a $4 per acre annual fee on energy leases in the Gulf that are designated as non-producing, another Interior official said. The budget proposal expects the fee to generate $1.2 billion from 2010 to 2019.

If this is as far as the legislation went, I don't think there would be a major problem. I think the oil majors would be able to live with these provisions, but it might make them less likely to take leases in the Gulf of Mexico, and thus slightly reduce our future oil and gas supply.

The budget also calls for ending federal funding for an ultra-deepwater oil and gas research and development program. If we want our oil and gas companies to be able to maintain or expand their output, this doesn't seem like the direction to go, unless we have decided to give up on ultra-deepwater.

The legislation has provisions that will hit small producers particularly hard, if we believe the press release of the Independent Petroleum Association of America, an organization that represents small oil and gas companies. Some of the more obscure provisions it is concerned about include the following, with its descriptions:

Repeal Expensing of Intangible Drilling Costs – expensing of the some of the normal costs of business (i.e., fuel, repairs, hauling supplies).

Repeal of Percentage Depletion – as an oil or natural gas well is developed over time, it depletes the natural resource. This tax incentive allows for the “depreciation” of these wells many of which are small, barely economic wells. Without this provision, many could be shut down. ["Regular" depletion would still be allowed, though.]

Repeal Marginal Well Tax Credit – a credit that serves as a safety net for those wells that only produce small amounts of oil and gas. Most of these wells are barely economic to keep operating, but collectively they supply almost 20 percent of the nation’s oil and 12 percent of its gas.

Repeal Enhanced Oil Recovery Credit – a credit that allows industry to get more energy from wells that are “tired” and depleted, instead of drilling new wells.

Increases Geological and Geophysical Amortization Costs – allowed for some expensing of the high costs of doing seismic and other high-tech studies/surveys. Such surveys are important to locate reserves and reduce the number of dry holes and unnecessary wells (a.k.a. the industry’s footprint).

Repeal of Manufacturing Tax Deduction – a provision given to every other American manufacturer.

Smaller companies are the ones doing much of the enhanced oil recovery, and are the ones operating the many stripper wells in this country. They also are the ones drilling the majority of the unconventional natural gas supplies, which is the increasing part of the natural gas in Figure 2. According to the IPAA, the companies it its association drill 90 percent of the nation's oil and natural gas wells and produce 68 percent of American oil and 82 percent of American natural gas.

The smaller companies tend to be more dependent on debt than the "majors", so they have been hit particularly hard by the credit crisis. As one can see from the drilling rig numbers, these companies are already cutting back greatly. New taxes will only increase the degree of cutback, and will mean that more people and businesses will leave the industry. If this happens, it will be even more difficult to expand when demand picks up again.

If the Obama Administration expects natural gas to replace some of the coal currently in use, it needs to be careful in crafting its tax legislation not to penalize the many small companies that today produce natural gas and oil.

In fact, if the Obama Administration wants natural gas growth, it should really be thinking about ways it can aid the industry. One thing the industry needs help with is long term stable prices, at a levels high enough to encourage investment. Another thing it needs help with is building infrastructure, like long distance gas pipelines and underground storage tanks to go with new production, so that new gas production has a place to go, when it is completed. Also, some planning needs to be done to match up new production with new uses, so that one does not end up with a supply/demand mismatch. Without action along these lines, US natural gas supply is likely to shrink, and, in the long run, make us more dependent on coal (or leave us with gaps in fuel supply).

Copy of my post on the inventory/demand thread follows.

My question: At what stage of the production/consumption process will the proposed carbon tax be paid? Of course, prices will rise downstream from the point that the carbon tax is paid. If had my choice, I would have imposed an energy consumption tax at the retail level, offset by abolishing the (SS + Medicare) Payroll Tax.

I haven't looked at the carbon tax piece. One question is whether it just encourages coal companies to export their coal, rather than use it in this country.

Is it purely a coincidence that the Gas Drilling Rig Count peaked on exactly the same day that Sarah Palin urged us to "Drill Baby Drill!"???

;-)

You just touched the third rail.

Abolishing SS and Medicare. For if the taxes go then goes the program and then goes absolute total chaos.

This will never happen.

The US Government made a bargain. I take that bargain personally. They made up a set of rules and regulations that let them place a tax on my earnings. I had no choice in the matter. Some did but that was later changed to be universal.

They are expected to keep their part of the bargain and now payout what they promised.

Is it a ponzi scheme? Yes. Does that matter? No. They decreed it to be so and now they must uphold their end.

When I was younger I wished there was no SS taxes so I could have either saved or invested those taxes. We were not allowed a choice.

Airdale

The assumption of course is that SS & Medicare would be funded via taxes on energy consumption.

If the carbon taxes have the desired effect, the reduction of the use of fossil fuels (some are pushing for an 80% reduction) SS and Medicare will no longer have a stable source of revenue. The AARP will never allow this.

Boy, I would like that to work out!

The problem is that the ponzi scheme requires new players to pay for the previous players. Given the reality of the baby boom demographic, this simply cannot happen. That means that the only ways to pay for the existing entitlement are increased taxes or increased debt (or some combination).

So, do we opt for even more debt to be heaped on future generations? Not a terribly attractive alternative, given that the current debt load (including entitlement obligations) cannot be paid.

And that leaves increased taxes. Not exactly everybody's favorite fiscal solution.

In the end, benefits are going to be reduced (and means tested), taxes are probably going to be raised (either directly on payroll, or indirectly on some other service that cascades through the economy... oil, gas, etc.), and the debt will be increased (assuming the Chinese, Japanese and Middle Eastern oil producers are still willing to lend).

Third rail or not, we are all going to have to deal with it (or it is going to deal with us).

Brian

No problem! The Treasury will just keep rolling the debt over to the future and the future never arrives. This really works well since they have been able to reduce the cost of borrowing to zero and people still keep buying the stuff!

Please remember debt is just an agreement between two or more people, that says one owes the other something. It has nothing to do with physical wealth, but everything thing to do with human-human interactions. So if we could keep the economy working until our kids take over, they could just declare a jubilee and carry on form there?

Yes Brian, I agree with all you say.

Its not a solvable problem IMO. Not at all.

So in the past a scheme was enacted that is now imploding, or soon will or has been rising all along to the breaking point.

Yet they can do nothing about it or face unbelievable results that I think they don't even wish to consider.

Another scheme has failed, to add to all the rest and the ones that are now being devised even as we speak/type.

Its a third rail that has been spoken many times in the past, yet no one will ever grab hold of it. Never. Its instant death to anyone who does. Talk is ok. Its just talk. I speak of action.

Going to be very interesting to see what happens. It will surely occur while I am still on this earth. Perhaps before the end of Obama's term.

Airdale

Airdale

I am assuming that someday in the not too distant future - maybe somewhere between my 65th and 70th birthdays, maybe earlier - I will be receiving a letter from the Social Security Administration. It will be telling me that they are sorry, but they are no longer able to continue paying the benefits that we were promised. In their place, every one eligible for Social Security will now be receiving a flat monthly stipend. This will start out being a little less than the minimum benefit that people are receiving now. They might also warn us not to count on them being able to keep even this up, that further benefit cuts might be on their way in the future.

They might also announce some sort of food assistance program, or maybe just make social security recipients eligible for food stamps, and they might set up some sort of dormitory housing for those who cannot afford their own home. I am also going to assume that one should do everything they possibly can to avoid going into one of those places.

Boomers: We were crowded in the delivery rooms, crowded in the nurseries, crowded in the schools, crowded in the colleges, crowded in the job market, crowded on the career ladder; we'll be crowded in the rush to liquidate our 401(k) stock holdings, crowded in the rush to sell our homes, crowded at the retirement centers, crowded in the nursing homes, and crowded in the cemetaries.

I agree on Social Security.

I don't know about being crowded in retirement centers and nursing homes. I am not sure there will be any. We may need to depend on relatives.

It isn't hard to balance this one at all-simply raise the minimum age a few years, a year at a time. People don't live forever. A minimum age for eligibility of 70 does wonders to right it (cuts payouts by maybe 40%).

They have already been doing something like this for a long time.

What happens is that the later your birthdate the longer you wait before you receive full benefits.

Therefore a reduction in what they have to pay out.

http://usgovinfo.about.com/gi/dynamic/offsite.htm?site=http://www.ssa.go...

Airdale

People should remember that when SS was put into place, the retirement age was set to the life expectancy. I guess they should have indexed it, and allowed retirement age to move with the life expectancy over time.

the ss tax is the most regressive of all, so why not make it regressive for all, remove the cap on earnings subject to the tax.

Don't forget immigration, legal or otherwise. Time tested strategy...

"Repeal of Percentage Depletion "

but does this proposal repeal cost depletion ? percentage depletion applies to the 1st 1000 barrels in a calandar yr.

from irs pub 535:

"Depletable oil or natural gas quantity. Generally, your depletable oil quantity is 1,000 barrels. Your depletable natural gas quantity is 6,000 cubic feet multiplied by the number of barrels of your depletable oil quantity that you choose to apply. If you claim depletion on both oil and natural gas, you must reduce your depletable oil quantity (1,000 barrels) by the number of barrels you use to figure your depletable natural gas quantity. "

If we are talking small company impacts, I would think it is just the provision that applies to the first 1000 barrels in a calendar, and the 6,000 cubic feet of natural gas.

The larger companies wouldn't be affected much at all by such a provision.

Good. The less production the less environmental degradation. The lower the supply the higher the price. The higher the price the less oxidation & the less CO2 poisoning of the atmosphere. Tax the livin' hell out'uv 'em, I say.

Where I think that Obama has so far failed is that he continues to spread the myth that we can maintain and expand our auto centric suburban way of life--we will just power our SUV's and McMansions with cool, new green sources of alternative energy. To the extent that we suppress domestic energy production, we will be bidding for (and going to war for?) dwindling exports worldwide.

As you know, the real problem is consumption, which is why I have always favored taxing energy consumption at the retail level offset by abolishing the hugely regressive Payroll tax. But this forces us to acknowledge that we live in a finite world, with finite fossil fuel resources.

You are right--the myth that we can maintain and expand our auto centric suburban way of life is still here.

To it, the new administration is adding the myth that we can somehow just shift our electric supply to clean, less polluting natural gas. This is hardly likely, especially given the path we are currently on with respect to drilling.

Every little 'hit' to the economy and standard of living will have the blame placed directly on him. The President.

Because he made promises. And whether he did so or not...well the buck always stops at the top.

NG is only "clean, less polluting" if you don't consider CO2 to be a pollutant. To my mind, it's the worst pollutant of all.

If it is used in the traditional sense, replacing coal, then on a BTU for BTU basis it produces less CO2. If used to produce electricity, the thermodynamic efficiency of combined cycle is much greater than coal plants. Of course it doesn't solve the longterm issue, and if it merely means we only leave the coal in the ground a few years longer, then it has no lasting carbon benefit. Also a sensible medium term goal is baseline=hydro+geothermal+nuclear+tides, and variable=wind+solar+wavepower, and peaking or gap filling=NG makes a lot of sense. But that requires we begin to husband the NG usage for the gap filling and peaking role, eliminating other usage where possible.

I think peaking or gap filling with waste incineration makes even more sense. Better to use waste constructively and thoroughly recycle the materials present than leaving it to decompose and release potent GHGs, possibly breaching it's liners in time, all while we continue to use NG when we don't have to.

So if the plant runs an average of 4 hrs per day it must have a capacity 6 times larger than a conventional plant. Employees will expect a full paycheck.

What about emissions, waste energy and mechanical stress during heat up and cool down?

Waste incineration is a potent source for dioxin, since so much plastic is the waste stream. Reducing(eliminating is impossible) dioxin/furans emissions requires very careful control of combustion conditions. While natural gas combined cycle is ideal for peak-filling modulation, waste incineration is not suited for load-following.

My guess is that load management/shedding, pumped storage, biofuels(not as liquids but simply combusted in thermal power plants) will be the cheapest quickest gap fillers.

Waste incineration has other advantages; It gets rid of waste! Is it better to use energy from waste and pollute the atmosphere or just bury the waste and pollute the land? I don't know the answer, and as it would appear neither does anyone else. As with everything in life, the motivation is profit, not necessarily because its the best option for the environment.

If NG is used to produce electricity, it releases roughly 2 to 4 times less CO2 than coal, for the same amount of electricity produced. So it is in fact "less polluting" when you do consider the CO2 a pollutant. If we could move the bulk of our electricity production away from coal to NG (unfortunately, we can't, but that's another question), we could in fact reduce CO2 emissions massively.

Any carbon tax type policy would have the effect of making NG more competitive compared to coal. If your goal is to reduce CO2 emissions, it helps to know (politically) that NG is the last fossil fuel on the list you want to target. Coal and petroleum come first, in that order.

The problem w/ NG in terms of GHG emissions is that every particle of methane that escapes has a GWP of 70+ over twenty years, so a 1+% rate of NG leakage will double it's GHG emissions in the short run.

There is a vent over here on a small coal mine in Southern Illinois. The "air" coming up that vent shaft is 4% CH4. I know because it was measured for illinois basin coalbed methane project evaluation. It was conservatively estimated at 4 MMCFPD.

FF

NG emits less CO2 per BTU than coal. Not "clean", but "less dirty".

"it's (CO2) the worst pollutant of all." Really? How did you come by that educated opinion? Let's see what the IPCC has to say about CO2's Global Warming Potential (GWP). Here you go:

http://www.grida.no/publications/other/ipcc_tar/?src=/climate/ipcc_tar/w...

What people might find here, should they actually read the IPCC reports rather than the summaries put out by western political commissars, is that CO2's GWP is insignificant when compared to most global warming gases. You won't find water vapor in the list because it really blows CO2 out of the water as a significant global warming gas, both by potential and by volume.

When all is said and done, and read and understood, nothing has done more to "GREEN" the planet over the last century than moderate sun-driven warming together with elevated levels of CO2, ONE OF THE MOST CRITICAL COMPONENTS in photosynthesis, the process which FEEDS you on a daily basis. As a matter of fact, doubling atmospheric CO2 levels increases plant growth by 33 percent. It is no accident that commercial grenhouse operators invest heavily to elevate CO2 levels in their greenhouses to increase productivity, product, revenues and (Xxx forbid) profits. Guess what elevated levels of CO2 in our atmosphere are doing for crop and forest production? Oh yes, CO2 is an infinitesimally small trace gas, constituting .04 percent of our atmosphere. Photosynthesis stops at .02 percent and is optimized at .1 percent, two and a half times its current atmospheric concentration. It's warming effects are "in the noise" when compared to solar (I amd M) variations and the effects of other global warming gases, particularly water vapor. Clearly, you and many others here, have no "earthly" idea either what or who butters your daily bread.

Just take the cap off the income level taxed by SS. That quick 15% tax bite should pull the exburbs in and prop up the SS system for a couple of decades. It is a well connected small minority of citizens who benefit from the cap so the screaming will be loud.

While I support your idea that we should heavily tax oil and natural gas, this should not simply be focused on domestic producers since the resulting CO2 is a global problem. Taxes also need to be applied to imports unless exporting countries impose an equivalent carbon tax. There is no point in punishing domestic producers, especially small ones, if there are no taxes or restrictions on imports. Besides, it is just flat out unfair and counterproductive.

Agreed, if we are concerned with near term (up to a decade) energy. If we are concerned with how we handle the backside of Hubbert's curve, then putting obstacles in the place of near future production could leave more available for the backside. If the Democrats are really intent on making domestic production of oil/gas less attractive, that is a political time bomb, which will blow up in their faces, once supplies become tight again. The populist anti oil sentiment assumes the industry is making obscene profit levels, that may have been true six months ago, but today is a totally different story. Taxes should be designed to smooth out the boom-bust cycles. That means during times of low prices like today, they should be very low. Giving in to the punitive desires of a sector of the electorate is not good policy.

If I could just up arrow you I wouldn't have to waste space saying that I totally agree.

If it could only work that way dog. It's very simple IMO: any decrease in energy sources such as oil and NG will lead to increased coal burning. We can say what they want about alternatives but the economy is in shambles and the cheapest energy source, regardless of environmental degradation, will be utilized to restore us. Unfortunately I feel any expectation that society will suddenly take up the mantle of good stewardship is pure fantasy.

According to naturalgas.org, most of the heating in the U.S. is provided by natural gas. The focus should be on extensive insulation rehab of existing housing and zero or near zero fossil fuel use for new homes from the use of best practices for passive heating and active solar heating of homes and water. Part of the savings from natural gas can be applied to required increases in the power industry.

We simply cannot be talking about increased growth of fossil fuels, even those which are relatively low carbon compared to coal. Natural gas is hardly benign as can we understood by looking at what has happened to the air of Wyoming over the last several years. I went back packing in the wilds of Wyoming a couple of years ago; the vista looked like I was in L.A.

I am also for keeping up the price of natural gas, if that is an option, if only because that would encourage the use and production of alternatives to natural gas, especially for heating of homes and water.

You call for long term stable prices. The final price to the consumer can be kept high with taxes. But how do you maintain long term stable prices that are going to the natural gas producer? One way would be to restrict supply? But that isn't what you are trying to accomplish. Therefore, am I correct to conclude that you advocate subsidies to keep prices high to the producer? That sounds like a misallocation of resources to me. To the extent that we provide subsidies, they should be focused on getting us off fossil fuels, even natural gas.

What I am talking about is a long term minimum price that is high enough to encourage production. In some ways, it might behave similarly to agricultural price supports. Ideally, it would result in higher prices to consumers all along, so that efficiency would be encouraged.

It would not be a maximum price. Price will have to go up, as EROEI goes down.

Please Gail, don't ask me to quantify this (because I can't and I'm too tired to try) but in the 'Niewe American Paradigm' price increases - by taxation of otherwise - will simply collar demand. Instead of allowing an investment pool to form as a byproduct of consumption, demand management - by consumers - is shrinking margins thinner and thinner.

Higher prices put producers into bankruptcy; their customers won't buy the product. The production dynamic is inelastic - your rig count figures bear that out.

I'm guessing maintainence cost of stripper/marginal well production includes legacy costs from the $140 a barrel period. In today's economy, even winning is losing. High prices were supposed to encourage new production but instead have throttled it.

The 'inelastic demand' model is wrong; business is getting schooled the hard way how elastic demand can be. When prices shrink, demand shrinks along with it, much different from the 'lower price, increase sales volume' model. Consumers have redefined demand into the 'discretionary' category. Because so much energy use is wasted ... btu's out- the- window ... cutting consumption of energy is 'painless' compared to putting the kids on a diet.

The cycle isn't self- reinforcing ... yet. But it is getting there very quickly. Good behavior has adverse consequences. Call it 'The Paradox of Conservation'.

But ... this isn't the consumers problem, producers are responsible for their own cost structure ... inelastic production is a money cost- dependent phenomenon. Producers bet that demand would support ever- increasing prices and invested accordingly. Just like the real estate industry, the energy business suffers from a 'cost overhang'.

Cost hangover?

The only way forward is the cost structure to change which means somebody will have to pick up piecss from the bankrupts. The cost of producing energy has to fall into step with demand.

Is this possible? The sixty- four thousand dollar question ...

:)

On the API call this morning, Gary Luquette, President of Chevron North America Exploration and Production Company, was talking about getting costs back in line with 2006 prices (where we are now). That would involve a fair amount of cost deflation. Also, oil / gas now is coming from sources where extraction is more difficult than it was in 2006. That by itself adds inflation to the equation. All of the debt and interest on debt is a big overhead expense for many producers. It can only be reduced by defaulting.

Not only that:

- US GDP is declining ... dramatically.

- US Money supply has expanded geometrically since 2007.

- The US is fighting TWO expensive wars simultaneously. All the above with borrowed/printed currency.

- The developed world's economies GDP is declining and central banks are pumping up money supplies as fast as possible.

- BRIC (Brazil, Russia, India and China) are dumping hard (relatively) currency reserves into their economies as fast as possible.

All this would indicate inflation, in fact the classic Irving Fisher money supply - money velocity model (along with other models) suggests hyperinflation.

It's not happening.

Mr. Luquette clearly understands the new conditions but probably doesn't want to follow the implications to their conclusion. One outcome would have production following demand downward to an equilibrium point of much lower prices and much lower production with that being adequate to service utilization (demand), which would also be very low.

I personally think that would be the most beneficial outcome. It would probably be transitory, but low utilization of energy sources would 'stretch out' the decline phase of peak fossil fuel for many years. In other words, during the transition period investment in alternatives such as metal salt reactors for electric production could be made with a more conservative financing structure. This would arise out of a condition of relative price stability.

Another outcome would have prices declining until all producers are bankrupt. This would be the investment cycle equivalent of what happened on the NY Stock Exchange in 1987. An arbitrage condition linked the NYSE to the Commodity Futures trading market in Chicago. Stocks would have declined to zero if communications been New York and Chicago had been able to cope with information load.

Yet another outcome is a long period of deflation followed by hyperinflation. Inflation is obviously in the background; very much the same way as in gold- backed monetary regimes. When the inflation finally emerges it would probably be explosive. Treasuries and central bankers are playing with fire. If there is an inflation episode it would be at a much lower GDP and would not be investment- friendly. In fact, there would be no investment at all.

:)

It seems like at some point, one has to start over with a new currency that does not permit debt, except perhaps for short term, to facilitate delivery of goods.

In reply to: But ... this isn't the consumers problem, producers are responsible for their own cost structure ... inelastic production is a money cost- dependent phenomenon. Producers bet that demand would support ever- increasing prices and invested accordingly. Just like the real estate industry, the energy business suffers from a 'cost overhang'.

Inelastic production is the reality of the natural gas industry as traditional reservoirs become less productive we become more dependent on unconventional reservoirs, tight gas sands, shale gas, CBM, these require a lot of drilling and infrastructure to be constructed, in order to produce gas. I am not an economist so bear with me and my lack of economic terminology. I believe there will come a time when the market fluctuations will exceed the lead time required to ramp up production sufficiently that it will have a real hampering effect on the economy. We may see this on a small scale in the next 4 years, as the Obama administration attempts to shoe-horn a struggling economy into green energy. If the demands of the market increase the demand for energy to a degree that it cannot be met by the increases in renewable sources created under the Obama administration, the consumer will suffer. He has made a lot of promises, but can he deliver? I feel the high capital expenditure of these green energy sources will rise even more as demand for their components as a function of expansion drives their price up. This increase will be passed on to consumers in a painful fashion as overall energy demand and the economy rise, and the lack of continued development of UNG leads to a market scarcity of NG. I feel demand will catch up with production quicker than we may think. Hence the next oil and gas boom, that will leave a struggling green industry to live down its broken promises of clean affordable energy. I feel that renewables are vital to the future demands for energy; however in a time of economic struggle, to try to level the playing field through taxation is only going to hurt the public in the long run.

Take the example of the oil and gas service sector that has shrunk exponentially over the last few months as reflected by the drop in rig count. Every rig accounts for ~50-100 jobs excluding completion, and that figure is shot from the hip and may vary depending on the density of development, thousands are out of work in the Rockies now as a function of oversupply driven decreases in demand. Adding more taxes to the process of drilling only provides a greater incentive for operators to shut down development and marginal production, and sit and wait for better governmental conditions to continue development. During which time the labor force that had been employed is out in the cold. Many of these workers will be lost to other industries and when demand rises again we will be stuck with the same growing pains as in the beginning of every other boom. Roughnecks on prison work release, inexperienced service personnel, lack material supply infrastructure, a fleet of rigs with high R&M from being left in the weeds, all these costs will ultimately be split between the producer and the consumer as in the NG market there is not the vertical integration from wellhead to consumer that exists in the Oil market. For example even though gas was trading over $8 though much of 2008 producers in my area were receiving $4-5 with pipeline companies getting the rest as infrastructure created a bottleneck to the market, I don’t even want to think about what operators in Utah are getting for gas with it being at $4. Add in additional development taxes there is little incentive to apply for drilling permits at all. Oil and Gas companies only make money at the sale of the product not while drilling.

Once demand rises replacement costs associated with regard the labor force will keep prices higher for longer, in 1982 when the last bust occurred thousands lost their jobs, and as late as last December the industry was in the process of replacing that experience and knowledge. Now the latest downturn has occurred, setting the industry up for a “brain drain” as this industry is divided between the aging boomers and the younger guys, well guess what, the younger guys are the ones out on the street as in a market of decreasing demand for services, those with the greatest amount of experience have jobs. Once demand rises will there be enough experienced personnel to meet it? I have seen tool pushers with 6 months total experience, I have seen company men with 2 years experience, if green energy cannot fill the gap of declines in production of NG what will happen then? That could be peak production, not driven by scarcity of resources, but by scarcity of the knowledge and ability to produce them all the while consumers suffering to keep their homes warm in the winter. Placing taxes that decrease the incentive to drill for resources decreases the knowledge base and experience base, and rate of technological development. The same factors that someday could yield cost effective utilization of geothermal as a non-variable sustainable resource. A major stumbling block to geothermal is the cost of drilling in hard high temperature environments. Placing taxes that decrease the incentive to drill will lead in my opinion only to a greater dependence on nuclear power in the future and energy imports in the near future. As wind only generates electricity when the wind is blowing, solar only when the sun is shining, hydroelectric only where/when the environmentalists will let you build dams, and tidal only where/when environmentalists will let you build installations. NIMBY California people, will have to brace themselves for the reality that one of the hot spots for the generation of wind power lies along their coastline where daily fluctuation of sea breezes provides excellent potential, however in a political climate where their backyard extends to all land potentially within sight of Arches and Dinosaur national park these people will have a field day when someone proposes building windmills in their backyard. Our current department of the interior appears to be more than willing to bend to popular special interests, which I personally feel will be reflected in higher energy costs for American consumers further hindering economic recovery down the road.

Just curious does anyone know how much of Obama’s, Gore’s and Salazar’s personal investment portfolios are made up of green tech stocks? Only curious. To me it feels that the Obama administration is taking every opportunity to kick oil and gas in the family jewels they can, in the interest of making green energy more viable.

Sorry for the bitterness of this post I lost my job in the Rockies in January and it hit me today as this: B.S. Geology yielding 4.5 years experience servicing happy costumers in the rocky mountain oil and gas industry -20K, the fact that this resume experience won’t get me a minimum wage job flipping burgers at McDonald’s - priceless.

The long term outlook for the NG industry still looks good to me, however for the young it’s going to be a few miserable years before we can get back into jobs that are interesting and we feel passionate about.

4-8 more years: and don’t forget: Vernal, Rock Springs, Casper, Wamsutter, Grand Junction, Rifle, Silt, DeBeque, Dinosaur, Roosevelt, Myton, Duchesne, and many other Rocky Mountain gas boom towns, last one out needs to turn the lights out, see you again in 4 or 8 years.

Wildcat,

So very interesting details. Were I you I would place this post in todays (28th) DrumBeat...it needs more eyeballs.

Sad about your job loss. I expect you will be sharing that pain with many others who are not posting about it.

Back in the rather good 60s,70s and 80s I never feared for my job.

I was working for a 5 Star Corporation whose main business belief was "Respect for the Individual"...still got my awards and Attaboy's hanging on my den wall.

Yet later all that changed and the belief was thrown in the dirt. Thousands upon thousands were 'let go'...defined as YOUR OUTA HERE.

Whole offices in many cities were shut down and many I knew drove home that night with tears streaming down their faces and wondering what comes next.

The world changed overnight for many folks. Abruptly. I was gone before all this started. I was lucky that I started and ended when times were still good.

Yeah,,4 or 8 years,

Airdale

Found on a Russian blog:

America has begun the initial steps to final outsourcing of it's last dominant industry. As before, a recession is the key to making the move. Even as we speak, the oil/gas and oil/gas services industries, always a US dominated industry, has begun mass layoffs. From Schlumberger to Baker to Halliburton and dozens of smaller firms, tens of thousands of jobs are either already gone on being shoved into the guillotine.

America has always been the dominant player in the oil/gas services field as it had led the way, back in the late 1800s, in oil and later gas exploration and exploitation. Oil services companies do everything that it takes to deliver the product to their clients, the major private and national oil companies. This includes everything from locating deposits, up to 10km under the ground, to drilling to them, to developing the wells and managing production, to transferring the product to refineries and storage facilities. As such, these companies employ an immense amount of technology and industry.

As oil/gas exploration moved to the far corners of the world, it made more sense to move at least some of the manufacturing closer to the international customers. However, the business units, engineering departments and quality personnel were almost all exclusively employed in America. This will be no more.

As with other formerly dominant industries, such as light manufacturing, IT, textiles, etc, a recession was used as the knife to finally do in the workers. IT is a prime example. While outsourcing was a force that was picking up steam throughout the 1990s, it was not until 2003, the year after the tech bubble bust of 2002 (and a short recession) that IT outsourcing finally took off. The companies involved, used the bust to lay off hundreds of thousands of tech workers around the US and Britain, sighting low profits or debt. The public as a whole accepted this, as part of the economic landscape and protest were few, especially with a prospect of the situation turning around. However, shortly after the turn around in the economy, it became very clear that there would be no turn around in the IT employment industry. Not only were companies outsourcing everything they could, under the cover of the recession, they had shipped in tens of thousands of work visaed workers who were paid on the cheap.

A similar process had already begun in the oil/gas services and oil/gas industries and has now begun it's initial acceleration into a full removal of the American worker from those positions. Regardless of the layoffs, work still has to be done, so new hires will be done in cheaper countries, where much of the manufacturing is already located. Once a subsection of a team or a new office is set up, it will become much easier to rationalize the movement of whole departments.

Worst of all, this is not a process that takes long to complete. In truth, the IT landscaped went through its total metamorphoses in less than 3 years and the recession, and thus excuse, were tiny compared to this one. America/British IT went from begging locals to work, due to the high demand for employees to having 700+ resumes on a single job opening with in a mere 24 hours. The situation has never changed.

So what is in store for America's energy industry future? For the owners, higher profits, when demand goes back up. For the workers? The same hell of unemployment that the rest of the US/UK now enjoys.

In reply to: "According to naturalgas.org, most of the heating in the U.S. is provided by natural gas. The focus should be on extensive insulation rehab of existing housing and zero or near zero fossil fuel use for new homes from the use of best practices for passive heating and active solar heating of homes and water. Part of the savings from natural gas can be applied to required increases in the power industry."

In a time of a severely depressed housing market, and skyrocketing unemployment, and little new housing construction, how many people are going to invest thousands of dollars into properties that are already worth less than what they purchased them for, especially if they may need to relocate for work and may be trying to sell their property in a market of other cheaper homes?

I like your idea but I don't see it happening until the economy and credit markets have stabilized, and even then not until gas prices are quite high to drive the investment by homeowners.

It seems to me that the problem is one of balancing supply and demand and not the cost of producing natural gas exactly - either by tax or just the rising cost of drilling.

The issue is that drilling companies over spend when prices peak, they over produce, then they drive prices down, then they cut back too far, then they under produce, then prices peak again.

During price peaks, you could charge any amount of tax you wanted, they could afford it. During price dips, no amount of tax is affordable because the price has fallen below the cost of production.

The problem is inherent in the slow development times of natural gas production, the low elasticity of demand which sends prices flying up and down. And also the tragedy of the commons situation where if one company slows drilling for fear of over production, the company next over hires the rig and drills and extra well. No one company can throttle back enough to keep the overproduction from happening.

I don't know what others feel about this idea but I think we should allow a nation wide gas cartel. They would have the power to demand that flow rates be cut on wells. This would greatly reduce the incentive to over drill (because all wells would pay back more slowly) but it makes the situation of over production far less damaging to all players in the industry.

The investment environment would be much less dangerous because over production would not bring risk of dropping prices to half. Instead it might mean a 5-10% reduction in flow rates. Much more manageable.

The nation would get steady predictable prices. And possibly a carbon tax added to the price. If the same was done with coal, then wind would be the lowest cost electricity generation and the market would increase investment.

I would think the companies most reluctant would be the majors, who are using these dips to buy up companies without the cash flow to survive.

Jon,

In general terms I agree with you. But I really don't know of any realistic way the gov't could act, but I can guarantee that the energy industry would be glad to gain a stable price market even if it prevented price spikes in the commodities. The high price periods are helpful but don't begin to compensate for the damage caused by low price periods. The risk from price forecasting is weighed much more heavily then geologic or engineering factors. In 33 years I've never seen an inefficient company prosper to any great degree during price spikes. But I have seen many competent and well managed operations destroyed by pricing slumps.

Folks may love to hate the energy companies but the relationship is simple and absolute: an unstable energy sector harms the economy in the long run. Just as low pricing periods harm the sector in the long term so goes the quality of life for most Americans. It might be viewed as a selfish and wasteful life but it’s one folks have so far demanded. We’ve just been hammered by volatility in the financial markets which was unimaginable just a year ago. Now it appears volatility in the energy sector could hammer our economy again just as we begin recovery.

Yes, the market as an allocation system "works" but in the cases of low elasticity goods with long supply lead times, it does not work very well. Sometimes you have to set down the hammer and pick up another tool.

Maybe someone who knows how the Texas Rail Road commission set oil well flow rates could chime in with a bit of history. Somehow they managed it with 1930's technology. Natural Gas might have complicating technical factors that prevent a similar mechanism.

I think an environment of slow but certain price increases would be helpful in convincing people to invest in higher efficiency. It is hard to talk anyone into putting $20k - $50k into super insulation and a furnace upgrade with prices falling.

If the increased taxes were put into a revolving fund that loaned money for insulation work (no down payment, and low interest rates) it would make a big difference in lowering long term residential demand.

It seems the coal industry went through same sort of price related expansion contraction for an extended period (centuries). Eventually the big players got control of the railroads (or was it the railroads that got control of the coal, a bit of both I seem to recall) and snuffed the little guys (oversimplified but not ridiculously so).

If the big gas producers somehow vertically integrate and end up owning substantial power generation and grid (or if big electric power players gain control of significant gas) they could manage the same sort of market monopoly and gain price stability. It is a proven market strategy.

Rockman,

If the volatility is such a killer for energy companies, why don't more of them engage in hedging? I would think any company thinking long term would hedge most of it's production. I know some natural gas producers do, but think many don't.

I know some have hedged, and gotten hurt on the hedges.

Just a guess fozzy but I suspect most of the larger producers do hedge. If fact, many are required to do so by their finance source. But there are limts. An operator can suffer a loss of refvenue from a hedge if they bet to heavily in one direction. And hedges aren't free. Under most structures companies are paying a price up front. and hedges can only carry you so long....longer term hedges carry even more revenue loss risks.

I agree that we need some system that keeps prices stable and high enough and does some planning. It could be a cartel. I suppose it could be a government takeover, but I don't see the government as sufficiently adept at running anything that they could do it correctly.

There are so many small natural gas producers that it would be difficult to do. It seems like I once calculated that Chesapeake Energy only amounted to 3.5% of the natural gas market, and it is big relative to other natural gas firms (other than the majors).

Apply the carbon tax as it comes out of the ground. Have an escalator based on barrels/ tonnes/ cubic metres produced so that, for once, the little guy has it a bit easier than the mega-corps. I like the idea of cap and dividend. But I know I'm naive.

Reduced production encourages efficient use. At least, it did in the 1970s.

Use the tax revenues to invest in something cleaner like windmills, or electrification and expansion of public transport. Maybe subsidise purchases of more efficient fridges, freezers and so on.

Anything that slows the use of US reserves should be looked at from a perspective of 20 years down the road. If we need fossil fuels (we do) we should be burning those from sources that may not be available to us much longer. Obviously we need to do everything possible to wean ourselves from this energy source as quickly as possible, but our oil and gas will become increasinly valuable so we should keep them in the ground as much as the economic situation allows. Tax imports high, and tax domestic stuff even higher. (Although maybe one could/does? cleverly favor stripper type wells that won't come back if they are allowed to go belly up)

-dr

I think imports need to be more expensive than domestic, unless the plan is to use other people's resources before our own. From a balance of payments perspective, cheap imports doesn't work.

Thanks for the disappointing news Gail.

We should be extracting domestic oil and gas as fast as possible to reduce our trade deficit and develop a healthy economy to pay for the R&D to develop new technologies as fast as possible and implement the new solutions.

I believe that 100 years from now energy will be clean cheap and abundant. People will be able to make cheap hydrocarbons from energy air and sea water. Our fossil fuel reserves will be worth less than they are now.

It is unfortunate that the U.S. is not leading this transition.

U.S. energy policy should be designed in such a way that failure is not an option. But this administration is fabricating a policy focused on ineffective technology for which success is not an option, except for the remote possibility of a breakthrough like cold fusion. But with our tiny directed R&D budget that is improbable.

Recommendation;

1...Implement a $100 billion / year R&D budget that pushes all technologies as hard and fast as possible. $100 billion / year is not much to solve the two biggest problems faced by 6.5 billion people, energy and climate change. The economic return for getting it right will be many orders of magnitude larger.

2...Build demonstration plants of every technology as it becomes possible. If the first one fails, build improved models until the technology is proven to be useful or not.

3...Publish all the data.

4...Eliminate all subsidies. Note that R&D and subsidies are two completely different things. With R&D there is always the potential for a dramatic breakthrough that will change everything. Not so with subsidies.

5...Include all external costs for all technologies.

6...Allow the cost of energy to rise or fall to its real value on a totally level field.

7...Allow a well informed private sector of individuals and corporations to select the best technology for mass production.

This process will produce the best possible solution in the shortest time.

Recommendation 8...Assemble a well informed private sector of individuals and corporations to begin to dismantle the commercial aviation fleet as we all know that in 100 years pigs will be our major form of air transport...

;-)

Tell Obama to give me $100 billion & I'll design an artificial chloroplast the size of Texas. Notice that I didn't say I'd build it, just design it. That way failure won't be an option.

Watch out for pig poop falling out or the sky!

Thank you Gail for telling us about oil subsidies I didn't know about. I knew about percentage depletion but not the rest.

Now in addition I know of 3 new de fact subsides for oil:

1. Expencing Intangible Drilling Costs

2. Marginal Well Tax Credit

3. Enhanced Oil Recovery Credit

How anyone can expect ethanol to compete against heavily subsidized oil without also getting subsidies is beyond me.

And the above oil subsidies still leave out wars for oil security, PIK payment in kind royalties, and the Strategic Oil Reserve which removes oil from the market thereby acting as a price support.

We hear little of all this. We only hear complaints that ethanol with only about 10 percent of the market gets the outrageous blenders credit which goes mostly to oil companies (of course).

Increasing taxes on oil at any level is long, long overdue.

How anyone can expect ethanol to compete against heavily subsidized oil without also getting subsidies is beyond me.

This is over the top - even for you. Do you want to get into a debate of the relative contribution to the tax coffers of oil companies versus ethanol companies? Do you really want to go there? Do you think, per gallon of ethanol, that the government nets out on the positive side? How about a gallon of gasoline? Give me a break!

We only hear complaints that ethanol with only about 10 percent of the market gets the outrageous blenders credit which goes mostly to oil companies (of course).

Then I say let's eliminate the blender's credit! Don't you agree? No, the funny thing is that the ethanol industry lobbies to keep this credit, which oddly "goes mostly to the oil companies." Funny thing, don't you think? Ethanol companies lobbying on behalf of the oil companies? Unless of course it really benefits the ethanol companies (and by default, corn farmers like X).

First, in a free market economy these taxes will most likely just be passed on to the consumer in the form of higher energy costs. Unless this tax increases the cost of gas significantly (more than 10 or 20% of unit cost), I doubt it would have much effect on demand, and only demand drop would lower the gas price and thus profits. These taxes would have little or no impact on profits.

Second, the tax changes for exploration that allow expensing of exploration costs would equalize industry depreciation schedules. When our company upgrades a railroad car, all costs are put in the depreciable catagory, and not expensed. Why should the energy industry get special treatment? Make them subject to the same accounting rules as other industries! If it lowers their profit, too bad!

I vividly remember the late '70s, when NG supplies were very tight and the winters were extremely cold. They were pretty worrying times, those who knew what was going on (and a lot of people were well informed, it was pretty well covered in the news) really were concerned that supplies would run out and some people freeze.

I'm not looking forward to seeing a return to those days, but I am sure that not only that, but much worse, is on the horizon.

This has probably been said already, but isn't shrinking the extraction of fossil fuels (gently, gradually) the entire point, the major positive goal? 'Gaps in fuel supply' sound exactly like what is needed, for less-unsustainable energy sources to move in and fill those gaps. As for shifting to coal, this would simply mean that increased regulation of oil/gas must be matched with increased regulation of coal, so that both shrink together.

But... a steeper drop is exactly what we need, presuming we can muster the political will to do it. That's the only way to drive the reduction in consumption. Or, perhaps there something I don't understand.

In computer systems/chips/software design, people often have fierce arguments about the features/policies for the next release, and sometimes those have unintended consequences later on. A useful feature of that domain is that bad consequences came to light relatively quickly [a few years], forcing some of the original designers to deal with their own problems.

The best designers always thought as many iterations forward as they could, then worked backwards to make sure that the next steps were at least heading in the right direction. Sometimes this meant actually ripping something out of a near-complete design, because you realized it would cause trouble later.

===

So, a meta-question (or a suggestion for a future article) for Gail & co: this is focussed on the immediate future. My questions are:

a) Given the constraints of realistic geology and economics, what would we *want* the supply profile of oil & gas to look like over the next 100 years? I can think of looking at several scenarios (for oil&gas), ranging from:

- Drill as fast as possible to avoid bad short-term effects, but knowing that the backside of the curve will be steeper.

to

- Push efficiency really hard, and stretch oil&gas as long as makes sense, and keeps a right-shaped petroleum industry as long as there is one.

b) Some climate folks, like Kharecha & Hansen expect us to burn all the conventional oil & gas we can get, and also don't seem to think it matters that much exactly when it will get burnt. [Coal, tar sands, etc seem the big worry). Anyway, one could then simply say: we'll use most of the oil&gas by 2100, what do we want that curve to look like?

If somebody already has done it in TOD, just point me at it. Anyway, I just wish for a set of reality-based longer-term scenarios as inputs to decisions.

Thanks for the ideas!

The most likely current scenarios I can envision are three.

1. Actual demand drops as fast or faster than supply, keeping prices suppressed unless or until economic growth tries to get going again. I regard this as the most probable scenario.

2. Potential demand rises while supply remains flat or continues to drop, resulting in price increases which yields a new (reduced) level of demand.

3. Potential demand continues to drop but more slowly than supply drops, resulting in higher prices which yields a new (reduced) level of demand.

Part of the problem here is that the current economic situation is definitely harming energy investments right now, but the global political situation remains as problematic as ever. We're even looking at scenarios where one oil producing state may become motivated to damage another oil producing state's ability to produce, to lower supply even further. I see very little on the immediate horizon that portends large increases in energy availability but I do see many potential problems that could easily result in drastic reductions. So while my immediate expectation is for continuing low or declining prices, any event that could raise prices is likely to be an event that would raise prices drastically even in a largely deflationary environment.

Obama's policies will be directly responsible for any energy shortages in the United States in the next four years. He won't be able to blame George Bush, just as he cannot blame the last 1200 points lost on the DOW on George Bush. Obama's insistence on playing political games with everything rather than facing the truth, from energy to finance, will lead to a tomorrow much worse than many now expect. I could hope that some of you would be wise enough to see that and prepare accordingly but most will not. And Obama supporters will have every excuse, just as Bush supporters did, for why their man's actions are necessary. Let that be your consolation if you end up cold, hungry, on the street, or worse because you're not likely to get much sympathy from those of us who saw this coming.

Actually the DOW looks to be ready to shed somewhere near 2000 more points if the past is any kind of guide. You have to just discount most of the the post 1990 runnups and downs as noise. Plenty of people to blame but none have been on the scene only one month. There will be plenty to blame Obama for but the DOW has considerable down room to run before he gets credit/blame for it.

Seems facing the truth wasn't too popular when Carter tried it so I don't expect to see that done again, of course he made a few colossal blunders that didn't help his case any (boycotting the Olympics just didn't get votes and bringing the Shah in certainly showed an over devoloped sense of honor married to an undeveloped survival instinct).

I believe the Reagan/Bush crowd took credit for most of the economy's runnup in the early Clinton years so Ws legacy costs can't be shed that instantly this time around. Come summer of 2010 though Obama better be ready to accept all the blame/credit from that time forward, regardless of the real causes. That is just the way it will be.

I disagree and believe you are mistaken. The DOW was holding well above 8000 awaiting the inauguration of Obama on the belief that Obama and his team would do better than Bush had at providing transparency and prosecuting the lies in the market. However, as the investment community has seen, Obama has done nothing of the sort, instead speaking in campaign populist stumping speeches without one shred of substance. He claimed Geithner would unveil details of the banking plan and the next day Geithner made a fool of himself and Obama in basically admitting he didn't yet have a plan.

Yesterday 3 banks all gave upbeat press releases about their financial health. Those banks were Citibank, Bank of America, and Wells Fargo. Then, as soon as the market closed, they amended their 10K quarterly reports to reflect the reality of their current situation - a staggering $80 billion in write downs between the three of them. That's fraud, pure and simple. They and others played off the false press releases, profited from the short term run up in stock prices of equities, then cashed out while some sucker is going to be left holding the bag while they "amend" their 10Ks to be correct after the market closes.

Obama had a choice, as Ralph Nader said. He could decide to look out for the rest of us or he could be Uncle Tom for the Wall Street boys. It is now obvious that Barack Obama is an Uncle Tom and the blame for the last month's loss of 1300 points lays squarely at his feet.

You may be right, but you are also contradicting yourself.

If Obama was in service of the investment class, wouldn't he be doing everything he could to make the stock market go up? Are you saying he is just a really bad Uncle Tom for Wall Street?

Anyway, I don't see why the Pres. should be in any way held responsible for what happens with the stock market, essentially a bunch of drunken gamblers.

As for taxing oil and coal, one good approach would be to tax all imported oil to pay for all current and former resource wars and other direct and indirect subsidies that prop up dictators in US friendly oil rich nations (have someone like Michael Klare, author of _Resource Wars_, do the cost estimates here).

For domestic oil, tax it at a rate that will allow for its replacement based on its estimated value in fifty years (have Gail or any other of our luminaries here do that estimate).

Tax coal on the estimated cost to the earth and to current and future generations based on its immediate destruction of landscapes (mountain-top removal...) and on its longer term effects on global warming (have James Hansen do these estimates). Similar approaches could be taken for tar sands.

Tying the taxes to tangible costs associated with these resources would make them less arbitrary and more palatable to all but the most blinkered (oops, that would include most American politicians).

OK, at the risk of starting a flame war, I'll also say that nukes should be taxed based on all the gov. research money that has been spent on this technology over the decades, and on the estimated expense of keeping waste safe for tens of thousands of years (have current--not former--researchers at Greenpeace do these estimates).

My point is that he is doing everything he can to try to help the market rise when there is no fundamental reason for it to rise. He's allowing lies like those I mentioned (and many many more) to go unchallenged by his administration. He's pouring taxpayer money into undocumented black holes without any serious oversight in an effort to reinflate the market bubble. I think the evidence is amazingly clear from the events of the first full month in office, especially considering the actions of Geithner, Bernanke, and even Obama himself.

You appear self contradictory again as you blame Obama for a 1300 point drop in a market that you say has no fundamental reason to rise. If it has no reason to rise and the percentage of Americans in the market only matched the pre 1929 numbers in the last seven or eight years, it does have a very fundamental reason to fall as the rest of this increased percentage of market players pull what chips they have left now that they too finally see the market has no reason to rise. The mislaid hope of there even being the possibility of a saviour is all that held the DOW up the couple months ahead of the innauguration.

If Obama manages to do everything wrong, as it appears Hoover did, watch out. The 1929 DOW bottomed at 198.60 on November 13, but it was back up to almost 300 by the end of April 1930 (higher than it had been before the famous two day October 1929 drop) then the real slide started. On July 8, 1932 it bottomed at 41.22, an 89% drop from its peak. Even the extremely pessimisstic don't think the DOW will get down under 1600 points by 2011, that is what it will take to match Hoover's numbers. I guess we will know soon enough, 28 months goes by pretty fast.

Magically created wealth can disappear without a trace.

double post sorry

I wanted to pass along some information I received from my son, who is a CPA specializing in oil and gas taxation, regarding the pending Federal budget initiatives currently being undertaken by the Obama administration that will negatively impact every oil & gas royalty owner’s tax positions.

In a nutshell, it appears that the Administration, and Democratic Congressional leaders, are moving forward with the elimination of $32 billion worth of certain critical tax preferences and credits traditionally afforded to E&P companies and royalty owners as follows:

• Levy tax on Gulf of Mexico oil and gas (limits excess royalty relief)

• Repeal enhanced oil recovery credit

• Repeal expensing of IDC

• Repeal deduction for tertiary injectants

• Repeal passive loss exception for working interests in O&G properties

• Repeal Sect. 199 manufacturing deduction for E&P companies

• Increase geological and geophysical amortization period for independent producers

• Repeal percentage depletion for oil and natural gas

(see line items on pages 122 and 123 of 2010 Budget: http://www.whitehouse.gov/omb/assets/fy2010_new_era/A_New_Era_of_Respons...)

While the first 7 of the 8 above tax increases do not affect the individual royalty owner, the last item (repealing percentage depletion) will impact each of us!

Why? Well, if we cannot deduct the 15% depletion against our oil & gas royalty revenues as currently allowed under percentage depletion rules, we will be forced to use “Cost Depletion”. Cost depletion rules require that you capitalize all of your costs related to the mineral deposit – unfortunately for royalty owners these costs typically only include costs associated with purchasing the mineral interest, and developing the well or field (usually paid by oil and gas companies). Under the current tax code, as royalty owners do not typically pay for the development of the well or field, and determining their basis in the actual deposit is extremely difficult (value paid for land that can be allocated to surface rights vs. value paid for land allocated to mineral rights) then they will take the automatic percentage depletion deduction (excludes 15% of oil & gas revenues from taxation) - this is the standard way that royalty owners appropriately reduce their tax burden (if you are not doing this now, please talk with your CPA!).

Under Obama’s budget, your only oil and gas tax deduction just went up in smoke! The good news: this tax increase is not slated to take effect until 2011 – if the Republicans win a majority in Congress in 2010, then this will be one of the first things they will correct.

However, if you like the idea paying tax on an additional 15% of your income and paying $4 or more per gallon for gasoline (yes, the oil companies will immediately pass these punitive taxes on to all consumers), then vote for a Democrat in 2010.

Your future (and bank account) is in your hands – Carpe Diem!

Very nice summery IP. I would also add that some the first 7 changes (such as increasing the net cost of any secondary recovery operation) may well affect many royalty owners. Any additional burdens on operators on near-margin wells will cause those wells to be abandoned. As you probably know (though many outsiders don't) once such operations are abandoned it's unlikely they'll be restarted when economics improve. Many will think this won't have an impact since these wells each produce so little (5 or 10 bopd). But collectively these wells are the backbone of US oil production. There are over 250,000 wells producing in this country. Abandon 25,000 wells average 5 bopd means importing $1.8 billion of additional oil each year. In addition to adding to our trade imbalance it may also mean a loss of several hundred million of $’s in royalty to US citizens and the loss of taxes they would have paid on that income.

This is a comment my son ran on the www.gohaynesvilleshale.com blog site.While it mentions "Haynesville Shale", the message is applicable to all Oil & Gas U.S. exploration operations.

by exbig4acct

As an O&G tax professional (and also as a Haynseville shale royalty owner myself) I would like to let everyone know what I have been hearing from my contacts in the industry as possible responses to Obama's budget proposal (and yes, it is only at the proposal level now - it can be stopped if enough citizens speak-up and the House Democrats become scared of losing seats).

First some facts:

1) Inbedded in the budget are provisions that force companies with foreign operations to bring earnings that would be used to fund foreign ops back to US to be taxed (companies, such as Coca Cola, Exxon, etc., currently can exclude certain foreign earnings from US tax in order to fund foreign operations - leaves more actual profits global company books so that true net profits can be used to strengthen US headquarters). Why is this important to the royalty owner?? (answer below)

2) The 8 major punitive taxes (see original conversation above) impact smaller, independent E&P companies and royalty owners more than it does the larger integrated E&P (who for years have not been allowed to take certain deductions (i.e. percentage depletion, etc.)). Why is this important to the royalty owner?? (answer below)

Answers:

1) Besides having the highest corporate tax rates in the developed world, the US is one of the few countries that punish successful companies by making them pay US taxes on foreign earnings (unless they claim the currently-allowed APB#23 exception). If companies who have the means to conduct foreign operations (i.e. Exxon, Shell, EOG, etc.) cannot shield funds to pay for foreign ops, and are forced to pay more taxes by being a US-headquarted company, they will do as so many others have (i.e. Haliburton, Baker Hughes, Cameron, Tyco, etc.) and perform an "outbounding" maneuver. Outbounding is when a company ceases to be a US corporate citizen and moves its management and citizenship to another country whose political and tax environment is pro-business (Bermuda has already taken a number of our big companies from us). The net result is that large E&P companies can legally avoid paying US taxes on non-US earnings (like companies in more intelligent developed countries can do). The reality is that many of those companies that have already "outbounded" end up drastically reducing their operations in the US because paying our punitive taxes does not make economic sense when you can make more $$$$ somewhere else.

As such, we can expect to see a substantial drop in development and production of fields here in the US as our major oil companies migrate away from the US. Can't blame them, we are the ones that will make doing business here unprofitable. If you are a Haynesville royalty owner and have a deal with a major E&P company, that has not yet been developed, there is a very good chance that it will NEVER be developed (especially when the US can get LNG from Yemen for next to nothing). The Democrat Party platform is adversarial to energy companies and are moving forward to drive them out of business (or atleast out of the US) in order to appease their "Green" constituency. The royalty owner's land will be valuable for farming or timber and little else under this scenario.

2) For those E&P companies that are smaller and are unable to "outbound", then they will have a very small window to economically drill wells (before Obama's anti-fossil fuel tax increases take effect in 2011). From experience, it is the current tax preferences on drilling wells (which were originally enacted to encourage US domestic energy production) that can mean the difference in being profitable in any given year - easy to understand when $.35 of every dollar they make already goes to Washington (while other material parts of that same dollar go to the state in income and severence taxes). If independent E&P (exploration & production) companies are punished for "exploring" by over-taxing drilling, then they will shift to a business model whereby they become primarily "production" companies - producing only what they drilled before Obama's tax increases (pre-2011) and when it dries-up, then they will wrap-up their operations and the owners will retire.

The reality is that as a royalty owner signed with a smaller E&P company, you had better pray that they develop your land before 2011... or you may NEVER see a royalty payment at all. My advice - if you have not been drilled yet, then don't count on making money - it may not happen!

I agree that this whole situation can be reversed, but ONLY if the Republicans can regain control and put an end to the "Class Warfare" that Obama, Pelosi and Reid are determined to wage.

To all you Democrats (personally I am a conservative independent): please keep in mind that because you have potential royalty income that hopefully will add-up to a material amount of money for your families and communities, your Democratic Party has just declared war on you as well. Nice payback for you loyalty to them!!!!!

Seems to me that it is time for us "rich" (sarcasm intended) little-guys to take back our country and bring logic back to Washington

Obama may be on the wrong track, but the class warfare didn't start with him and Nancy. Try to make a living at minimum wage, or better, looking across a border at the 'nirvana' (all inherent contradictions intended) of actually getting a U.S. minimum wage. Class warfare is only acknowledged when those controlling the most feel they are no longer increasing their percentage of control. Class warfare is always around in our system it just gets more intense when the pot is contracting.

Communist Party USA (CPUSA) Emdores Obama's Agenda

Communist: Obama working to nationalize U.S. economy

Claims 'people advocate president' pushing through radical agenda

--------------------------------------------------------------------------------

Posted: February 08, 2009

7:30 pm Eastern

By Aaron Klein

© 2009 WorldNetDaily

Communist Party USA leader Sam Webb

President Obama is "considering" a radical agenda to nationalize the U.S. financial system, the Federal Reserve Bank, and private industries such as energy and other sectors whose future is "problematic" in private hands, claims the leader of the Communist Party USA (CPUSA).