Mechanics of Future Oil Price Volatility (A Flubber Cobweb)

Posted by jeffvail on February 5, 2009 - 10:39am

I previously examined the interface between peaking oil supplies and oil price volatility as a predator-prey system. With the rapid drop in oil prices, it’s time to add another wrinkle to that story: widespread acceptance (psychosis?) about the stability of high oil prices acted as a damper on oil price volatility. Now that a collapse in oil prices is more than a mere theory, oil markets are poised for a long-term increase in price volatility.

The fundamental problem facing oil markets at present it this: while present supplies are sufficient to meet present weak demand, these sources of production face rapid decline. The current low oil prices are not sufficient to support the long term investment in future supplies, conservation, and consumption efficiency that will be necessary to mitigate the impact of this decline. Because of the time-lag between a sufficient price signal and oil reaching the market (or demand being reduced), and because of the impact of the recent price collapse on producer psychology, volatility will rapidly incrase as the market's price signal must make increasingly exaggerated moves to bring supply and demand into equillibrium.

Without ongoing investment to support present production levels, production decline rates will accelerate

Figure 1: This graph, from Merril Lynch, shows that reduced capital expenditure will have a sharp impact on field decline rates, but assumes this impact will diminish as our economy recovers and capital expenditure picks back up…

There are two key issues here:

1) The market’s price signals react over much shorter time-spans than new supplies or investments in conservation or efficiency can be brought to market. Depending on the specifics, it can take anywhere from 2 to 10+ years to bring a new oil-field into full production. Therefore, even when oil was at $147/barrel, oil producers couldn’t immediately realize profits from oil that would only cost $100/barrel to produce. The same is true with many efficiency and conservation measures—while the most elastic demand (e.g. Summer driving vacations) can be reduced rapidly, other conservation and efficiency efforts take much longer. Electrified rail takes years to fund and build out, and the gradual upgrade of the fuel efficiency of our vehicle fleet (or the replacement with electric vehicles) requires years of consistently high fuel prices or efficiency regulations that generally don’t take effect until several years in the future.

2) Our recent market experience—a rapid crash in prices—undermines efforts at long-term investments in supplies. At $150/barrel, oil companies were willing to invest billions in new projects that, several years in the future, would bring production on line at a cost of $50, $60, or even $80/barrel. Because of the time-value of money, and because our energy futures markets are incapable of economically hedging entire oil megaprojects a decade or more into the future, oil companies needed to leave a large price cushion. $150/barrel oil did not justify a ten-year lead time to produce oil that would cost $140/barrel, even under the assumption that oil would remain at $150/barrel. This cushion shrank some during the (relatively) steady increase in oil prices from 2001 – 2008, and oil companies’ willingness and ability to finance these projects increased. But now that the price of oil has crashed from $150 to $40/barrel, the prospect of a sudden drop in price is more than a mere possibility.

The result of this will be long-lasting: if oil prices again reach $150/barrel, there will be much greater reluctance to invest in long-range projects to produce oil at even $50 or $60/barrel. Similarly, the cost and availability of financing such projects has been dramatically reduced by the credit crunch. The result is that the more aggressive producers—those with the least cash and greatest incentive to take risks—are the least able to finance such projects. Those with the greatest ability to undertake such projects—select oil majors and many national oil companies—are also the most conservative and least willing to risk embarking on long-term, expensive production projects.

Continually Increasing Price Volatility

The principle results of this time-lag and shift in producer-psychology is that price signals must become increasingly over-exaggerated to create the desired market effect. The level of interest and willingness to invest in oil production that was spurred by 2008’s $100+ oil prices will not be regained if oil again hits $100 or $150—it may be necessary for oil prices to hit $200, $250, or more to provide an adequate incentive for oil companies to invest in oil with a $50+ cost per barrel.

And, even when the price level necessary to spur sufficient investment is reached, the resulting production will not come on line immediately. Instead, it will take several more years to reach the market. During this time-lag period between sufficient price signal and new oil reaching the market (or new demand being destroyed), prices will continue to move and push this market signal. If oil at $100/barrel is sufficient to incentivise investment in oil production to meet then-current demand, the market will continue to push the price signal past $100/barrel, especially as geological depletion continues to grind and the incentives for geopolitical disruption continue to rise.

As a result of the price rise during this time-lag, more production investment decisions will be made, and more demand will be destroyed, than was actually necessary to reach an equilibrium point. The result will be an inevitable overcorrection and price crash, restarting the price cycle. With each successive boom and crash cycle, the market psychology will become increasingly resistant to a given move in the price-signal, and the degree to which the price signal must move to create an equivalent market effect will increase. This will result in continually increasing price volatility as the market swings wildly to reconcile the ever moving targets with production and demand.

A Flubber Cobweb

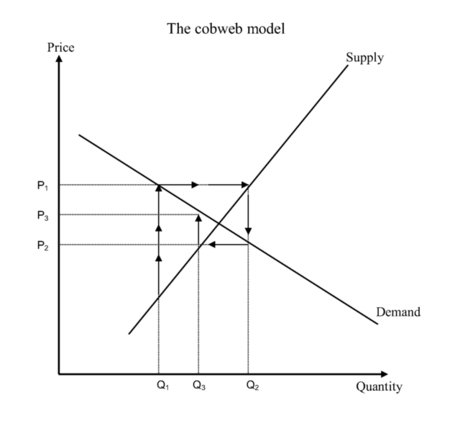

The time-lag between market and fundamentals is exacerbated by inadequate futures markets and our own psychology. On a general level, this is a common process in economics, described by the cobweb model:

Figure 2: A classical economic “Cobweb Model” of supply and demand

This model shows a supply/demand spiral characteristic of a market searching for equilibrium in a steady-state environment—it is NOT characteristic of oil prices in a post-peak environment. Rather, once oil production has peaked, the spiral will work in the opposite direction with increasingly divergent P and Q brackets.

Under peak oil theory, Q must gerally decline, even if there is significant noise present. From a civilizational-perspective, I think there will be a great deal of information carried by what happens to P as Q approaches zero: If P1 and P3 diverge or generally trend higher as Q approaches zero, this may show a sign of fundamental economic strength in the face of peak oil—perhaps indicating that the realized EROEI of alternative energy supplies is sufficient to maintain a global-industrial economy. However, if P1 and P3 converge or generally trend lower as Q approaches zero, then I see this as the dimming of global-industrial system.

One important note: I don’t think that these values carry meaning when measured simply in absolute dollar values—inflation, deflation, and other currency games introduce too much distortion. Rather, I think a measure of the dollar price of oil as a percentage of median national and global incomes (in dollars) will carry much more meaning when measuring the divergence or convergence of P1 and P3 going forward.

Add in declining supply due to geological and geopolitical peak oil and increasing global population and oil price volatility will rapidly accelerate over the next decade.

Discussion Questions:

1. How will this system interact with the global economy (itself a key driver of demand and cyclic in nature)?

2. Will oil price volatility be primarily characterized by increasing spread between price highs and lows, by a shortening of the period between highs and lows, or by some combination of the two?

3. This article suggests that oil price volatility will continually increase. At the same time, I generally criticize other theories that argue for perpetual increase (in population, GDP, resource consumption, etc.). Clearly, at some point volatility must either (1) slow or decrease, or (2) reach a functional maximum at which point market signals are reduced to meaningless “trading noise” and the market function ceases to provide utility. Which result, and why? In the spirit of Kurzweil (link) or Moore’s Law (link), does this process lead inevitably to the end of markets? Half in jest, what if the causal mechanism of the Maya 2012 hypothesis (or insert your favorite apocalypse meme here) is simply global markets grinding to a halt as prices cease to carry meaning and we can’t find a way to reverse the complexification that caused this?

**In light of these three concluding questions, I hope that it is clear that I am not intending to argue some fundamental “truth” with regard to ever-increasing price volatility, but rather that I’m using that argument to set up the three concluding questions (which I consider much more interesting and important in the long-run).

The dynamics your are describing can be captured by making your equillibrium supply-demand graph a dynamic graph.

First of all, the demand curve is extremely convex, even L-shaped. This creates very exciting dynamics when you are near the up-leg as we typically are.

Depletion means that the supply curve is drifting upwards to higher price levels. THE DRIFT RATE IS A FUNCTION OF CURRENT PRICE LEVELS. Similarly, our economic over-leverage means that the demand curve is drifting leftward to lower consumption levels. THE DRIFT RATE IS A FUNCTION OF CURRENT PRICE LEVELS.

When prices are high the SUPPLY drift rate is low, and equillibrium can form, and volatility is relatively low. A few decades ago the drift could even go negative (creating gluts) but that doesn't seem likely any more.

But high prices acclerate the DEMAND drift, destroy the equillibrium, drop prices and rapidly restart the supply drift. This spikes prices and starts the whole cycle over again.

Unless the economic situation stabilizes or significant new supply becomes available, we are locked in a downward spiral.

duplicate deleted

Remember this one? Whalebone price volatility after peak whalebone

PRICE TRENDS OVER A COMPLETE HUBBERT CYCLE: THE CASE OF

THE AMERICAN WHALING INDUSTRY IN 19th CENTURY.

http://www.oilcrisis.com/History/whaleOil20040913.pdf

Of interest, the price increase of sperm whale oil was less extreme than baleen whalebone. Kerosene became a substitute for sperm whale oil, so the sperm whale exploitation became less lucrative. Thus, sperm whales were not eradicated, they remain numerous in all oceans.

There was no substitute for baleen whalebone, only demand destruction, so prices increased exponentially (with great volatility). Also right whales could be exploited to commercial extinction because it was profitable. (Right whales are still critically endangered in both the North Atlantic and North Pacific and may never recover)

Oil is more like baleen whalebone. There is no cheap alternative, so it will be exploited to exhaustion, probably all the way down to EROEI <1. (It might be economical to pump oil for chemical feed stocks)

Well, you learn something everyday.

I've take the graphic from the .pdf and added a bit of annotation to spice things up -the question is: "Are we there yet?"...

With Whalebone, after the initial 'decline' (which was much less % wise than we have seen with oil btw.) the price recovered and never really fell back to its lowest lows after peak production. Roughly the price doubled again within 10 years.

Nick.

Very interesting! I do think, however, that oil may exhibit even more extreme movement as, at least in my opinion, we have no acceptable alternative to oil use at presetn. I don't know the value of whalebone precisely relative to its replacements, but my impression is that it was replaced (at least eventually) by superior products made of spring steel and plastics--at least for now, we don't have any "superior" replacements to oil...

your right, we don't have superior substitutes at the current price "oil is it" (if this where not the case then the substitute would already have been substituted I guess!)

The question then becomes: at some higher price point is there a substitute -e.g. ammonia or hydrogen for transport. Of course we then get into issues like timescales for the substitution due to current built stock, etc.

Perhaps we are just heading for a world where we are just using a much greater fraction of our wealth to do a lot less. Alternatively if we can become much more efficient in how we do 'what we do', we might be able to maintain some sense of normalcy in the decades ahead.

Nick.

P.S. Just seen the oil price -dips below $40 seem to be triggering buys...

The difference is that the world economy did not run on whalebone. A whalebone price spkie did not tank the global economy. There was money available from a functioning economy to pay these progressively higher price spikes. Each time oil hits >$90/b the economy tanks, so can real oil prices keep repeating the above pattern for long before a market of $'s for oil ceases to exist?

Microhydro:

Is is credible that there will still be a chemical industry pumping anything if(when) we are down to oil EROEI<1? Pumps powered by what exactly? (I don't presume the answer is no, but I wouldn't rule it out.)

Pumps powered by wind would do nicely. There are plenty of pumpjacks in Texas up through Kansas with plenty of wind, and excess might even be fed to the grid.

Your predator/prey model reminds me of the old Wa-Tor game, from Scientific American, IIRC. Here's an applet modeling that predator/prey dynamic:

http://www.leinweb.com/snackbar/wator/

The features include -

No equilibrium. It's chaotic, irrespective of initial conditions.

Vulnerable to extinction - particularly when the "world" is small

Stabilized by addition of more dynamic variables.

A friend of mine coded up the equivalent three-phase game, something like plants/fish/sharks, and found that it's much more stable in all respects. That stability couldn't be had by merely tweaking the lifespan, response time, or other features of the simple two-element predator/prey relationship. But the more separate, interwoven dynamic elements were present, the smaller the excursion magnitudes in population became.

I think it's a worthwhile paradigm for the energy markets, if for no other reason because it does away with the whole notion of equilibrium - complexity theory seems more applicable.

I found some of the explanation of the cobweb model from Wikipedia helpful.

Oil prices would seem to be the divergent case.

It seems to me though that the world's economy is in a sufficiently weak state that the very first bounce up will cause massive bankruptcies, and possible collapse of financial systems around the world. I am not sure that we will have to wait for multiple iterations to happen.

I agree that, depending on the resiliency of the global economy, we may not sustain very many wild swings in the dollar-price of oil. I do, however, think that we need to also measure volatility in the ratio of $/barrel:$/year median income.

In theory, oil could hold steady at exactly $40/barrel, but this could represent massive price volatility if there are wild swings in household income, inflation leading to deflation or vice-versa, etc...

As useful as it is for a snapshot, IMO the Cobweb Model cannot account for the system dynamics. Take a look at almost any real-world system's time history and you'll see the same quasiperiodic but unpredictable behavior that oil (or pork bellies) prices display.

With the elasticity of demand so low, and our diminished future ability to compensate for changes in demand by adjusting supply, I predict the seasonal variation in gasoline and crude demand will have a larger influence on prices than even three years ago. The normal seasonal varition in gasoline demand in the US is about 9 to 10 percent between its low in mid January and its high, usually in June. With an elasticity of demand around -0.1, we can expect January to June price increases of about 150%, or conversely June to January price drops of 60%.

These wild swings will be layered on top of the predator prey swings. Also, by mid summer 2008 it was obvious that the typical 9-10% seasonal demand swings may become more muted going forward. Thus actual price swings due to seasonality may be more on the order of 100% Jan to Jun and -50% Jun to Jan.

How does the model represent the moment when dollars (or ultimately any currencies) are left out of the picture completely and countries just start trading oil for other tangibles?

Wheat has already been mentioned as something the US might be trading for oil with SA. Doesn't "price" become irrelevant then? Or is a bushel the new currency at that point?

How close are we to that scenrio? I've heard that some countries are starting to directly trade commodities for commodities already, but I haven't heard that this is being done with oil yet.

I think you're exactly right: if it comes to trading wheat for oil, then the ratio of wheat:oil becomes the new price. I'd imagine this would initially be much less volatile because it would be much less fluid--rather than minute-by-minute trading between thousands of independent parties, these ratios would be the results of protracted negotiations between governments. However, I don't think this cause of lower volatility would be a good thing, as some degree of volatility in a market is necessary to effectively bring supply and demand into some form of equillibrium...

I don't think we're very close to that scenario, as nation-states everywhere simply have too much invested in the currency-model. However, precisely because that system is brittle, it could break down very, very quickly... I just don't think this will happen in the next few years. I think we have the ability to keep up the smoke and mirrors for some time still, though at the expense of exacerbating the eventual reconciliation with reality.

Jeff, I think you're mistaken in thinking that protracted barter negotiations would produce more volatility than minute-by-minute trading. Earlier you rightly reckoned that delayed responses are a cause of volatility. Surely the cumbersome barter would be a similar delayed response adding to volatility. Curiously I've been noticing erratic price movements of canned fish which were of very stable price for many years. I think the retailers are now struggling to work out what the price "should" be (with oil being a major cost for fishing fleets). And fish cans with sunflower oil now have a 2p premium presumably reflecting the value of the oil.

As for maintaining the smoke and mirrors - just about everyone desperately wants to believe we can continue without a disastrous crash. But it's already becoming very hard to maintain that faith. Even the uk prime criminal oops minister recently committed the ultimate taboo --told the truth!-- saying we are in uncharted waters without historical precedent.

What will cause the next rise? There doesn't look to be an end of contraction in the coming year or years. But there will presumably be an ongoing supply decline leading to at first a gradual price increase. But when the consequences of the present underinvestment hit home, the resulting price hike could easily wipe out all confidence and terminally shatter the global system in my reckoning. Assuming that hasn't happened already for other reasons.

Nice post. Pretty much the concept I've been thinking of.

However I think we may have another factor thats entering the equation as this system follows a model similar to what your describing. This is that the overall system efficiency will decline and it gets disrupted. Its almost a law of thermodynamics that a complex system disrupted from its normal pathways becomes less efficient. We are seeing this situation unfold right now. A example is for shipping as profits fall it becomes more profitable to make as many trips as possible. I think this is intrinsic in declining EROEI or very closely related as your marginal profit declines you attempt to grow by doing more marginally profitable transactions leading to higher and higher energy usage. Disruption of the system can be seen as and artificial lowering of the overall EROEI. I.e as the system gets disrupted it tends to become less efficient lowering the EROEI and thus driving it to try and expand the marginally useful transactions making it overall even less efficient.

Economically this is seen as the statement we will sell at a loss and make it up in volume.

Even though this is a nonsense statement its true. Whats happening is the original system was designed to be efficient at a certain volume i.e economies of scale as the volume falls then the survival of the overall system is just as dependent on maintaining volume even it it results in a loss vs outright profitability. This attempt to maintain the volume component or economies of scale at all costs results in a significant drop in overall system efficiency.

I think if you add this one concept to your model then you will see that the system is certain to collapse if it embarks on the path of attempting the maintain the current status quo as it vainly tries to keep system tuned to profit marginally from economies of scale.

This can already be seen at the large scale as we move away from a market economy to a socialist then probably command economy whit the government taking over more and more sectors resulting in massive waste in and attempt to avoid having sectors fail as economies of scale no longer work. We are playing the game of selling at a loss and making it up in volume.

First, do not measure the price of oil against median income. In the future, "median income" measured in dollars becomes just as meaningless as oil measured in dollars, because you don't know if $300K will buy you an island, a house, or a cup of coffee.

Instead, measure it against the relative prices of various inputs (human labor, other energy sources, infrastructure), and relative prices of various outputs (pesticides, gasoline, asphalt). The system contains feedback as pesticides contribute to labor (through food), gasoline contributes to energy sources, asphalt contributes to infrastructure.

Second, now that we are approaching a dynamical systems perspective (including periodic, complex, and chaotic effects), "Chaos: Making a New Science", by James Gleick, is an excellent primer. The 24-part "Chaos" lecture series by The Teaching Company is also very good.

To answer question #3, the system we are living in will go through two phase- or state-space changes. The system we are in right now is a complex system, meaning it has some amount of differential feedback, functional cohesion, and regularity.

Biologically, this type of complex system encompasses nearly all of normal living functions, like eating, breathing, drinking, playing, screwing, etc.

The system we pass into at the first change is a chaotic system, which has dysfunction, disintegration, and irregularity. This is what we are beginning now, increasing volatility of the parameters we measure. Feedback mechanisms are also strained with unexpected or mistimed inputs.

In a living system, this chaos would be represented by fatal onset of cardiac arrhythmia, respiratory failure, or severe blood loss.

The system we pass into at the second change is the steady-state system. This is when the system as we know it stops permanently. Only the pieces are left over at this point. This is when a living thing dies.

Now, within the bounds of organic tolerance on Earth and with positive (solar) energy flow, the pieces can re-assemble into a different complex system. This would technically be the third state-space change, the world engendered by the survivors post-collapse.

In a chaotic system, asking questions #1 and #2 are like proposing that we will head straight for the hurricane in our fishing trawler, and we want to predict which parts of the boat get ripped apart, and in what order people drown.

The question to be asking is, "is it a good idea to go out on the water?"

"Yes, but if I don't fish, I can't eat!"

"If you go out in the storm, it will kill you today. If you don't go, you'll starve to death in three to five weeks. You can use that time to figure out where else to get food."

I agree with you that measuring median income, in isolation, in dollars is meaningless going forward. That wasn't my suggestion. What I did suggest (though it's probably my fault for not being clear), the measure of oil price (in dollars) as a percentage of median income (in dollars) is not meaningless, because it uses a common denominator to establish how much oil an average person can buy. This will be a highly meaningful ratio in our economy going forward, regardless of whether $300k will buy you a house, an island, or a cup of coffee, precisely because it communicates relative buying power of energy, which represents the fundamental ability to do work. As such, it will effectively represent whether our development of alternative sources of energy is increasing or decreasing our individual ability to do work.

I agree with you that chaos theory provides some insight into oil markets, but I'm not sure there's any value in asking "is it a good idea to go out on the water?" What is the practical equivalent of this question? "Is it a good idea to continue to use oil?" The answer to that question is meaningless in the sense that it does not produce a realistic, implementable course of action. It's more akin to realizing that we're already in the middle of the hurricane, and asking "would it have been wiser to never have left shore last week in the first place?"

I think the real lesson for us from chaos theory is that, given the incredible complexity and non-linearity of our civilziational system, and the extreme dependence of any such system on initial conditions, we have no realistic hope of understanding the long-term outcome of present inputs. It's like asking the Venetians to correctly recognize the long-term impacts of the corporation (which, in a manner of speaking, they invented), and to then decide whether it is a wise course of action. Our time-frame from action to result has shrunk from centuries to years, but we're no more capable of guessing the correct outcome. I do think, however, that by recognizing our inability we can arrive at a rational course of action: consciously reduce the size and complexity of our societal and economic networks. That, however, is a discussion for another time...

Ahh, I get it about the price of oil as a percentage of median income. I don't think I was reading carefully enough.

Is it a good idea to remain attached to a failing system, was the direction in which I was headed. You don't want to be on the boat during the hurricane. Find something else to do while the storm passes.

No, technically, there is no value in asking the question whether to go out on the water, because only idiots, sheep, and lemmings would head toward certain death.

I think when you say we have no hope of understanding the long-term results, you and I are on the same page with not being able to predict the future with pinpoint accuracy. True, and aside from it being impossible, we don't need to predict the future with accuracy. Prediction is only a map, and the map is never the territory.

As far as reducing the complexity, that's not possible for us where we stand now. It would be like you trying to excise your existing appendix without anesthesia. Your body will let you know in no uncertain way that it doesn't want this, as you are interrupting and breaking myriad existing support systems to remove your appendix.

In the same way, reducing our societal complexity in situ would cut off many people who currently rely on those high levels of complexity for their systems of support. It's their lifestyles and very lives which would be cut off, and they will fight as much as your body would.

What we actually seek to do is evolve a new generation without an appendix. After the collapse, build a different infrastructure of support which learns from the mistakes of the old.

Yeah, I don't see a new age dawning, either. But I don't have many unrealistic fantasies, so I allow myself this vice.

Another issue is whether supply and demand curves are kinked because of large sunk costs. This is an image from a presentation by Daniel Ahn.

Us computer folk can see that we need a buffer. Let's rename the SPR the "Tactical Petroleum Reserve" and create a real Strategic Petroleum Reserve that is 10 times bigger and that the government does actually fill when the price is low and empty when it is high. By printing money to buy the oil, then unprinting money when it is sold the government will also act against deflation/inflation respectively.

Hi Robert,

In a highly retrospective way, your idea makes a lot of sense. The general train of thought as commodities get into a meteoric rise or precipitous fall, is that it will always be that way. SO FAR, that has not happened. It seems easy, in hindsight, to see that oil was low, or was high. As an example, however, just what is it right now? I have friends who feel that the price range will fall to $20-25/BBL, and others who think that it will shoot back up to $80 and beyond before we know it. Perhaps all of them are wrong, but someone(s ?) will have to make a determination of that price point if we are to have a buffering reserve. Temper that with the ELM "theory" and you might think that someday, it will not fall as we might have expected, or may not rebound as we had thought.

I do think that rational folks will someday agree that the oil market has overreacted in both directions, and did that overreacting within one twelve month period, but that is just my thought. Time will certainly tell.

If (big if) we are going to ever come out of this slump then the price of oil will have to go higher, because at current levels there is no investment and oil production is being turned off. It is logical for Government to act on this assumption. It is like a Bridge hand were declarer needs the opposition cards to be a certain way to have any chance, so he can assume that, and make further deductions from it.

[duplicate post deleted]

The great thing about oil depletion is that you don't even have to turn anything off to get lower supply -decline IS BAU. So 'Peak Oil' is the point at which (on average) new supply fails to overcome depletion. Oil will not stay this low for long as far less supply will be created at these prices and that's pretty much the same for a host of commodities that are -on average- now undervalued if civilisation is to continue its merry path...

I don't get your Bridge analogy as I am not a player...

Nick.

Hi Jeff,

Short term, I think volatility must decrease because the credit supply has been reduced.

Here is the mechanism:

A company, say airline, has a profit margin.

If the price of oil rises high enough, the profit margin is consumed.

A. Without credit, the airline would need to reduce purchases of fuel because it is focusing on a smaller customer base that can afford the higher price to keep the company in the black. The company's elasticity of demand has just changed from a very low oil based elasticity of demand to a much higher airline customer based elasticity of demand.

B. With credit, the airline borrows money and maintains market share while operating in the red. In this case the company's elasticity of demand is clearly much higher than in the first case. It continues to pay ever higher prices while taking on more debt.

Companies have a strong incentive to take on debt because any that survive the oil price spike will have reduced competition on the far side and hope to make up the earlier losses. This is the same issue as a close stand of trees growing too tall for their root systems as they race upwards competing for sunlight. They don't want to become top heavy, but the other choice is stay short and starve.

Eventually, credit is exhausted. When that happens, the oil price debt driven bubble bursts and all strategy B companies will be forced to become strategy A companies. (Notice that no speculation was needed to drive up a price bubble. It would appear as all commercial traders which was what we were seeing last fall.)

I feel credit acts as a volatility amplifier, but not in the speculative fashion most assume. So I think that until there is a lot more credit available or a lot of debt is retired, that we are unlikely to see such levels of volatility.

Does anyone else feel this mechanism has merit?

I think the mechanism you describe has merit, especially over the short-term. However, the more and longer that credit issues impact exploration, capital expenditure on maintaining/expanding production, etc., the more violent the eventual correction will be. To take an extreme case, if there is zero exploration and drilling for the next 5 years, production will begin to very rapidly fall off a cliff, and the relative value of oil will rapidly increase. It may well be that there are such serious economic problems that the dollar value of oil doesn't increase much (or at all), but our relative ability to afford oil (and the economic work it permits) will fall very quickly under such a scenario.

I think there are parallels here to a general theme: we can push back the date of our accounting with reality, but every time we push the date back, we make the eventual accounting more extreme... quite likely true for oil, housing prices, population growth, etc.

Yes, it makes sense to me. Also, just a perception of future price movement is IMHO enough to change elasticity. If you believe the price will fall soon, it's more likely you will extend credit or postpone some other purchase in favor of filling the tank. If you believe prices are going to stay high, you have to cut consumption. I think demand destruction kicked in when people realize the prices are not going to fall next week.

Jeff:

This is a fascinating post. Not being an economics wonk, I see this from a control systems perspective, specifically a badly tuned PID controller.

At first, when I discovered PO, I assumed that mitigation efforts would proceed apace, with significant volatility but prices always on a positive slope. Naive, I know.

As a rank econ novice, I now see the possibility that an increase in the volatility could have a much bigger effect on mitigation than the price increase itself.

Aggressive markets may have an interest in volatility as that environment offers the greatest opportunities for profit (and loss), but we often confuse markets and the economy. The economy, consisting of the actual suppliers and consumers, doing actual work have a large interest in some sort of stability. The theory of hedging, IMO is a dangerous approach when the volatility is divergent, rather than convergent, as has been shown with various airlines being caught seriously long.

So, it comes down to the question of whether companies will:

- use foresight to mitigate now, or just enjoy present low prices and pray.

- have the resources to mitigate

and will government establish a buffer, as was suggested above, or a price floor?.

From what I have seen so far, volatility and instability will likely continue and increase. As for ending markets, I think they are doing that to themselves. I would hope that a new system would emerge where traders would have to present a clear justification for being on the floor, with no margins on futures, but I am likely delusional.

Again, thanks for the post.

How about regulating a high enough price for oil to accomplish the following:

A. Reduce volatility in transport costs.

B. Encourage production of renewable energy.

C. Provide a clear signal for increases in oil production.

D. Encourage conservation.

E. Encourage production and purchase of high mileage vehicles.

F. Helps support overall economic stability.

In other words, if you let the market dictate price then instability swings defeat incentive for long term investments. Set a price by quarter and only allow minor changes in price, like interest rates are regulated, and it should work well to accomplish the above outlined goals.

You have the problem of allocating the oil to the end users. If you fix the price, you'll going to have shortages or surplus. If you change the price to reflect new situation, you'll end up with exactly the same price as the market price. Just in less efficient way.

This is a flawed model because is assumes inaction by the participants. If it was modeling a system where the participants were not cognizant of their behavior, it might be applicable. However, it would be incorrect to assume that governments would not understand the price swings and take action to mitigate its effects. To some extent, European countries are already insulated to these extremes due to the high fuel taxes. Government action could take the form of rationing or minimum floor prices.

All models are flawed. Some are more useful than others. I think this model may at least be more useful than the coin-flip or dartboard model.

You are welcome to propose a dynamic model of human emotional response, cognition, and behavior. It could then be integrated with this one, time permitting.

"All models are flawed."

This is an incorrect statement and the scientific/engineering/economics/medical profession lets people outside of their specialty make these statements without calling them out.

Models are flawed when there is a fundamental error which makes them inappropriate to answer the question which they were intended to answer. You will note that my comment to Jeff Vail mentions a specific reason why the model is flawed. I did not make a generalized statement that implied that since it was a model it was by its very nature incorrect.

The model proposed may in the short run be correct. But to extend the model to conclude the entire collapse of the financial system is a stretch primarily due the flaw which I mention. In fact, as a policy maker, I would welcome such an oscillatory swing in prices/supply because it would provide the political cover to take meaningful action.

I concur with the general consensus on this site that it is possible and perhaps likely that we could have a near term runup in prices which will result in demand destruction. However, I also believe that policymakers (and you could extend that statement to oil company execs) aren't as dumb as we think they are. Many are aware of how alternative energy was undercut in the 1980s by the Saudis. And certainly the Saudis realize that they have responsibility as the swing producer to moderate these price/supply oscillations. It is likely that the Saudis were just as surprised as the rest of the world at the rapidity of the onset of the current economic crisis.

I'm not sure that alternate energy was the target of the Saudis (and the Reagan administration). The main victim was the Soviet Union, which collapsed when its major exports (mostly oil) could no longer support it; alternate energy was collateral damage.

Is it better to use a model which patently gives bad information or better to admit that there is no adequate model? I would argue the latter, as at least we will realise there is a great deal of uncertainty in projections, and will widen our contingency planning.

Bad information is not better than no information.

"...it would be incorrect to assume that governments would not understand the price swings and take action to mitigate its effects."

I think, when we're looking back on this as history, it will be clear that we didn't do anything substantial until it was far too late.

I also think (as noted above) that the system is far too complex for us to actually understand the outcome of a given government input, so even though we may do something drastic, we have no way of knowing whether it will help or just exacerbate things.

That said, I agree with you that a price floor created by taxes, with those taxes gong to alternative energy and increasing elasticity by focusing efficiency measures on the most inelastic portions of our consumption would help. The chance of that happening, though, I think is effectively zero.

So, if I thought it was possible to actually understand the outcome of our actions (i.e. be cognizant), and to further assume that our governments would actually do so, then I would agree that the model is flawed. As it is, I think a model assuming no such cognizance is much more realistic, but I'd love for history to prove me wrong...

Jeffvail,

Simpler solution: OPEC sets fixed prices! KSA seemed to think $100 a barrel for light sweet has a nice ring to it. Perhaps allow heavy oil which is more difficult to sell to have a floating price, but if you step back from the last 6months; OPEC has the big stick, they are being polite in not hitting us while we are down.

Jeff - Nice post.

I would agree that history, especially the price the run-up in oil over the past 7 years, has not shown that governments understand how oil prices work. Prices are too high - increase production, prices too low - decrease production etc etc etc. And then this past summer, when oil prices were at a max - what were the political suggestions - a "gas-tax holiday". Come on!

Furthermore - as you [jeff] briefly mentioned in your post, the impact of declining EROI of almost every single major fuel, including oil, is now a sleeping dog that should not be allowed to rest. The double-wammy impact of declining resource quantity and QUALITY will, in my opinion, create large price oscillations as the world attempts to replace millions of barrels of light-sweet with heavy-sour.

-Dave

Jeff:

Indeed, the myth of competent governments of "brilliant" people dies very hard.

Matt Simmons said 8 months ago to put a floor under the oil price. His wise advice was ignored. The supposedly "brilliant" "leaders" not only don't have sound ideas, they don't even understand sound ideas when shown them.

No the system is not far too complex. The controlling 'leaders' are far too mentally rigid but that's another matter. And how to replace the incompetents with any number of the more competents is far too impossible a task!

Twas written:

Now that a collapse in oil prices is more than a mere theory,

WTF? Are you f**king high? Or what?

Let's introduce a little reality into the situation.

In 1998 oil was $10 bbl.

As of end of 2008 it stabilised around $40 bbl.

$10 -> $40 = 400% increase in 10 years, OR, in a more interesting analysis, sustained an average of 35% inflation for four consecutive years. Now, if you can believe that 4 years of 35% inflation resulting in an increase of 400% is some kind of collapse in oil price... well... YOU'RE HIGH. Been sniffing gasoline or something?

Sure it's DOWN from $150 a barrel, but the top prices are never as interesting as marginal (low) prices or sustained average prices.

When people tell me oil prices have collapsed, I just have to laugh at their amnesia and historical myopia.

<$40 down from $147+ is a collapse, the current trading range in the $40s is also well below the sustained $60-80+ range the few years prior. I think it's important to be able to place events in history, but equally myopic to think that they have no relevance because similar such things have, at one point, happened before. The current price collapse, especially so close to the timing of global peak oil, may well be the single most important price collapse (when viewed on any time frame) in the history of human civilization--not historical myopia I would recommend laughing at, but I could be wrong :)

It's probably better to consider annual oil prices. For example, many salesmen on commission might make (or used to make) $20,000 some months, but have an average annual income of $120,000. Which is the more important metric, a monthly peak of $20,000 or an annual average of $120,000? Which number better reflects what consumers paid for oil in 2008 and what producers received in 2008, the monthly peak or the annual average?

From 1998 to 2008, average annual oil prices increased from $14 to about $100, an average rate of increase of about +20%/year. Oil prices were up nine years and down one year. 2008 was not the largest annual rate of increase:

I suspect that 2009 will be to the Greater Depression as 1930 was to the Great Depression. It appears that world oil consumption in the Thirties only fell one year, in 1930, and rose thereafter. After Texas succeeded in controlling the output from the East Texas Field, oil prices rose from 1931 to 1937. BP apparently puts the constant dollar rate of increase at +11%/year from 1931 to 1937. The big difference, IMO, is that we saw an expanding supply of exported oil in the Thirties, whereas I expect to see a long term accelerating net export decline in the Greater Depression.

Here is my 2¢ worth, regarding oil prices. This article has a plot of annual oil prices from 1992 to 2008 versus actual and estimated combined net oil exports from the 2005 top five net oil exporters.

http://www.energybulletin.net/node/47541

Jeff,

You may want to look a book titled The Great Wave : Price Revolutions and the Rhythm of History by David Hackett Fischer. The book combines data, theory and speculation.

The data is presented largely in chart format with well documented sources. Fischer identifies price revolutions for 1180-1350, 1470-1660, and 1760-1830 in which price levels rose rapidly with the largest increases being in food and energy and least being in labor. Food and energy prices fluctuated with increasing magnitudes and amplitudes of change with a steady, underlying (averaged) exponential rate of change until the revolution broke. Period of oscillation does not appear change much in the later part of the period.

If we are in similar price revolution, volatility will increase, something will stop it (war, famine, plagues, discovery of a new continent, technological breakthrough). Without doubt volatility with play havoc with the world economy.

Paul in Nevada

For all:

A very interesting discussion on oil price volatility especially on efforts, however imperfect, to model such a complex system. While the oil price spike and collapse has been center stage for a while, we may be on the verge of a similar volatility cycle for NG. While the time spans of these cycles won’t likely be as short as they have been for oil, the low price periods while probably have a significant negative effect on NG supplies in the US. Efforts to mitigate such shortages will also take a considerable amount of time IMO.

Most are aware of the decline in drilling rig utilization in the US. Many don’t realize that the bulk of this scale back has been, and will continue, in the unconventional NG plays. My client is one of the big UNG players. They decided in late November to significantly cut their 2009 budget in these plays. But it takes time to modify the actual operations. In December ’08 they had 18 rigs drilling in the UNG plays. On 1 February first they had the same 18 rigs drilling. On 30 March they will have only 3 rigs drilling with no current plans to increase that number for the balance of the year. This will be an 80 % reduction of the number of wells they drilled in 2008. I don’t have specific data on the other UNG players but they are clearly cutting back activity also.

Since 1/1/07 there has been a dramatic rise in US NG rates with new records being set almost every month. This was the result of the ever increasing drill rate in the UNG plays with a smaller contribution from Deep Water GOM NG. Most are already aware of the rapid decline rates of these UNG wells -- 40% to 70% per year is not uncommon. But some are not aware that there is virtually no “flush” production period for such reservoirs. Literally the first month such a well come on production it begins its decline. Wells drilled 12 months ago may be nearly 50% declined at this time. It was the ever increasing rig count which produced the record levels. By mid summer I suspect we’ll be seeing the beginning of a potentially shocking decline rate in US NG rates. I expect the rate of decline in drilling activity will be significantly greater then the increased rate over the last two years. It takes many months to build and deploy a new rig. It takes only one day to stack it in the yard and watch the rust start to form.

It’s difficult to model how quickly the drop might manifest itself. We’ll still be producing the older conventional fields that have much shallower decline rates. We’ll likely see a continuation of demand destruction also. Again, another model of a complex system. Should there be a sudden and dramatic increase in oil demand it would be a simple matter for producers to once again open the valves. But not so for US NG. There is no great reserve of NG being held back by the operators. In fact, it is typical during low pricing periods for operators to do all they can to increase rates. The oil patch is a cash flow business start to finish. The operators, the capital sources, the drilling contractors and the oil field service industry won’t respond very quickly when prices do rise again IMO. There is a rather quiet and relatively unreported meltdown occurring in the oil patch right now. I’ve witnessed such events before in my 33 years but not at the rate and severity I see today. It’s difficult to imagine drilling activity regaining that momentum even if prices quickly rebound to previous levels. Originally I felt given the demand destruction we seen so far (especially with industrial NG users) that supply/price issues with NG wouldn’t reach a head for another 18 to 24 months. But with the ever increasing cut backs in drilling those problems might become significant as early as next winter. Unfortunately, the only factor that might alter such a possibility is a worsening economy. But that scenario would only increase the possibility of even greater NG supply problems in 2010-11.

Years ago, a NG guy told me that the supply difference between a glut and a shortage in North American NG markets was 2%.

If there is very little storage and demand is essentially fixed, the 2% remark makes sense!

Thanks Rockman. That was a very informative post. The cratering rig count factored with the precipitous decline rates of UNG wells certainly sounds like it could be one of the bigger stories going into next winter. Talk about your slow motion train wrecks.

Thanks Jeff, this goes in line with a comment about the pork cycle feedback loops I made in December. Interestingly, there even seems to be widespread consensus about the future oil price volatility. Even the IEA forecasted this in their latest WEO (with the nice side-effect that their price outlooks can't be wrong any more as they are all covered by the wide volatility range).

Another side effect may be that the oil price roller coaster will be intertwined with a volatile world economy: High oil prices lead to economic downturns, which again reduce oil demand, which reduce the oil price etc.

This may be fostered if governments refrain from regulating the markets proactively but restrict their activities by hectical emergency reactions as they are doing now. For example by pumping paper money into unsustainable economy branches that will provide the next bubble to burst as soon as people find out about their implosion risks.

These activities are like the oversteering of an aeroplane pilot: If he tries to move the plane up excessively the the plane may slow down to stall speed and suddenly flip to a rapid downturn.

So far the bad news. The good news (or at least hope) is that these dramatic feedback loops might be dampened if there is a political will to anticipate and remediate excessive up and downs.

This might be by adding some "friction" into the oscillatory system, which regulate and slow down hectic market activities (working like the Tobin tax

Or like charges / supports that bridge the valleys and tunnel the tops of the oscillation (like e.g. variating fuel taxes).

The main obstacle is probably that a strong political will is needed for installing such regulations as they may be sometimes unpopular and may find strong opposition from the established corporate lobbies.

Maybe this won't happen before most people have become aware of the mess they have blundered into.

If I understand correctly that oil is the prey and humans are the predators then there are some sticking points with the ecological analogy. Firstly as pointed out the intersecting curves may not be short term near-linear but have wobbles or kinks near the crossing point. Secondly time lags are continually changing. I give as evidence for that people are unsure whether to spend or save their stimulus money.

Another difficulty is that the rabbit and fox model assumes constant external energy flux. The sun makes the rain and then the grass grows. Rabbits eat grass and foxes eat rabbits, sometimes too quickly. So energy supply is a constant (assumed to be large) in the rabbit and fox model but is a variable in the oil and human model. Oil is not replenished so the model must have a negative feedback loop for depletion or declining net energy.

A test of such a model is that it should show that the last ever barrel of oil should sell for around $0. The reason is that either the system has collapsed or evolved out of the need for oil.

Regarding social consequences of oil pricing fluctuations some speculations backed up by some data can be found at:

http://ideas.wikia.com/wiki/Volatility_in_the_Price_of_Oil_since_Hubbert...

This wiki develops ideas on how the "bad behavior" of Wall Street may be causally downstream of fluctuations in oil price.

I'll post again and maybe I can make this more understandable.

The real problem is probably one we cannot solve. As the system gets stressed and starts to break down its overall efficiency declines. This means for example for oil usage we have the highest efficiency we will ever achieve right now. We will never use oil more efficiently then we do today from a overall system perspective. Think of Matt Simmons alert about infrastructure in the oil industry.

From a predator prey perspective the predator fearing a lack of prey will consume more energy hunting for food then is absolutely required to the point it often burns more than it consumes.

Another example think of a person driving around looking for a gas station and burning say three gallons of gasoline then only to find a station with two gallons left.

For shipping as profit margins have collapsed they have done away with slow sailing.

For manufacturing you may decide to burn more energy to make less overall profit.

In general from the economic view point it makes sense that people will often trade increased energy use to overcome lower profit margins.

And example from construction a builder is reduced to doing odd jobs and burns twice as much fuel for half the income he made building a home on a single job site.

This is why historically we see fuel use first decline during recessions and depressions then start increasing again. Energy is what drove the economic expansion in the first place and expanding and often less efficient energy use is how we get out of depressions and recessions. War can be viewed as the least efficient use of energy but its a perfect example of massively expanding energy/resource usage to create wealth and drive a country out of a depression recession.

If the system is now constrained like we think it is by and overall geologic peak then we won't get out. And finally I question if alternative energy programs will be able to compete with strained and breaking existing technology that chases a ever more marginal return. The main concern is that energy costs would be increasingly passed through even as profit margins decline ensuring that the ability to invest in alternatives remains marginal. We will see but it seems to me at least that alternatives will suffer the receding horizons problem that afflicts the entire system since they have to bootstrap off of existing technologies. I'm not saying we won't invest in them but that the investment will not be sufficient to migrate the system. The problem is of course existing technology will compete ever more desperately for investment dollars using current cash flow arguments and current profit margins. Thus they will win investment over the short term that will default in the longer term as profit margins continue to fall.

Government support and bailouts will generally allow malinvestment to continue in the name of retaining jobs and stifle longer term investments in alternatives.

And finally of course flux in energy prices will work to cloud the longer term future of alternatives in general.

In closing we are going to literally try and burn our way out of this and only when this finally fails will we seek alternatives en masse. I question if we can then succeed.

Jeff, you write:

"From a civilizational-perspective, I think there will be a great deal of information carried by what happens to P as Q approaches zero: If P1 and P3 diverge or generally trend higher as Q approaches zero, this may show a sign of fundamental economic strength in the face of peak oil—perhaps indicating that the realized EROEI of alternative energy supplies is sufficient to maintain a global-industrial economy. However, if P1 and P3 converge or generally trend lower as Q approaches zero, then I see this as the dimming of global-industrial system."

Can you elaborate a little more on this, to clarify the point you're making and why you believe it is true? In the real world, how can you tell whether P1 and P3 are diverging or converging? How do you measure them? And why do you think their relationship carries a lot of information?

Thank you in advance.

Interesting article but could you pleEease correct this gross spelling and grammar mistake:

which presumably should say:

And this real whopper here:

Should surely say INsufficient.!

Plus a mistype here:

(enough nitpicking for one night (hopefully).)