DrumBeat: December 30, 2008

Posted by Leanan on December 30, 2008 - 9:09am

Tempers rise over oil-heat lock-ins

Consumers and local governments that locked into long-term contracts for heating fuel and diesel this year to save money as prices soared are feeling buyer's remorse as they watch prices plummet."We've never gone through anything like this where prices rise so quickly and fall so quickly," says Dan Gilligan, president of the Petroleum Marketers Association of America.

In Connecticut, more than 500 people have called the attorney general's office in the past two months, trying to get out of the fuel contracts. The national average for home heating oil is $2.41 a gallon. Some paid more than $4 this year.

"It's a universal plea: they want us to extricate them from these contracts," says Attorney General Richard Blumenthal.

Gas falls for 11th day, nears 5-year low

NEW YORK (CNNMoney.com) -- A daily survey of gas station credit-card swipes shows that gas prices are dropping to the lowest levels in nearly five years.Regular unleaded gas fell for the 11th consecutive day Tuesday to an average of $1.616 a gallon, down 3 tenths of a cent from the previous day's price of $1.619, according to motorist group AAA. That's the lowest price since gas hit $1.6027 a gallon in January 2004.

DURING a turbulent decade in power, Venezuela’s president, Hugo Chávez, has been greatly helped by his own remarkable ability to inspire loyalty among ordinary Venezuelans on the one hand, and the sharp rise in the price of oil, the country’s only significant export, on the other. But the world price of oil has fallen from a peak of $147 last July to $40. And popular discontent with Mr Chávez’s corrupt and autocratic regime is mounting. So 2009 looks like being a difficult year for Mr Chávez and his “Bolivarian revolution”.

Saudi Arabia eyes more cuts to stop oil slide

LONDON -- Top exporter Saudi Arabia is set to cut oil supplies further in the new year, potentially taking output below its agreed OPEC target, as it strives to shore up a collapsing market, oil market sources said on Tuesday.It lowered supply to 8.2 million barrels per day (bpd) in December as the oil price dived to less than US$40, far below the US$75 a barrel named by Saudi King Abdullah as a fair price.

The kingdom had previously increased production unilaterally to about 9.7 million bpd in August to calm an oil market that shot up to a record of nearly US$150 in July.

Since then, it has reduced supplies by roughly a fifth and further "significant" output curbs are expected in February, trade sources said.

"This is because of the price. The Saudis want it higher," said a major buyer.

Ukraine Pays Russia for Gas, Says No Obstacle to Deal

(Bloomberg) -- Ukraine agreed to pay as much as $2 billion to settle arrears for natural-gas imports from Russia, potentially averting a threat by OAO Gazprom to halt supplies and clearing the way for a deal on gas shipments in 2009.Ukraine has paid in full for imports in November and has made an advance payment for December’s supplies, President Viktor Yushchenko’s office said in an e-mailed statement today.

Angola revises February oil exports downwards: traders

LONDON (Reuters) - Angola is likely to reduce its February crude oil exports by about 13 percent from January following OPEC's agreement on supply cuts to help reverse falling oil prices, traders said on Tuesday.Angola has revised its February loading programme, traders said. The revised programme, which was obtained by Reuters, showed the West African producer's exports for the month would fall to around 1.60 million barrels per day.

Russia to cut oil export duty to $119 per ton from January 1

MOSCOW (RIA Novosti) - The Russian prime minister signed a resolution on cutting oil export duty further down to $119.1 per ton from January 1 amid declining world oil prices, the government's press office said on Tuesday.

Big West Utah Refinery Is Purchasing Oil on Day-to-Day Basis

(Bloomberg) -- Big West Oil LLC said its North Salt Lake City, Utah, refinery is purchasing crude on a day-to-day basis after its parent, Flying J Inc., filed for bankruptcy earlier this month.“We are still working things out to continue to receive our crude supply,” Joel Elstein, manager of the Utah plant, said in a telephone interview. “It’s been kind of a day-to-day thing.”

Down, not out: encouraging signs for ‘09

“Americans are going to resume their normal traveling habits in 2009,” says Doug Hecox, spokesman for the Federal Highway Administration (FHWA). “We just don’t know when.” Furthermore, he suggests, the size and timing of that shift probably has less to do with the price of gas than the underlying economic situation.In a nutshell, Hecox believes we’ll adapt. “The longer the economy remains murky, the more people figure out ways to deal with it,” he says. “People start to justify little luxuries — not Godiva chocolates or trips to Paris, but maybe an overnighter or long weekend away.”

Utility's plan big on energy efficiency in Colo.

Xcel Energy's plan for providing energy through 2015 includes an aggressive energy efficiency program that could save the equivalent of a coal-fired plant.

Oil Set for Rebound as Record Drop Spurs OPEC Cuts

(Bloomberg) -- Oil futures may rebound from their worst year to average $60 a barrel next year as OPEC makes record production cuts to counter the deepest economic slump since World War II.The forecast, the median of 33 analysts compiled by Bloomberg, represents a 52 percent gain from today’s $39.48 price. A 14 percent reduction in supply, equal to 4.2 million barrels a day, pledged by the Organization of Petroleum Exporting Countries will erode U.S. crude inventories that rose 10 percent this year as the slowing economy reduced world demand for the first time since 1983.

Tight Credit Threatens Pipeline Expansion

Steady expansion for pipeline companies is grinding to a halt as tight credit makes it harder to raise construction money, potentially limiting their ability to bring new supplies of natural gas to market.U.S. gas-pipeline construction boomed in recent years as demand for natural-gas grew and production shifted to new areas, such as north Texas and the Rocky Mountains.

Pipeline demand has remained strong despite falling energy prices, but the financial crisis has made it harder and more expensive for companies such as El Paso Corp., Kinder Morgan Energy Partners LP and others to raise cash to build new conduits.

Canceled and scaled-back pipeline projects are bad news for natural-gas consumers and producers, who now could face higher fees and limitations on how much gas they can move from new production areas.

This oil man favors a gas-tax hike

NEW YORK (Fortune) -- It's not often you hear a corporate executive advocate a tax on the product he sells, particularly not in the oil business, where opposition to gasoline taxes is fervent. But Paul Foster, the chairman and CEO of El Paso-based Western Refining, is (dare we say use the word after the presidential campaign?) a maverick.Foster, 51, is a conservative Republican who has spent his entire career in the energy industry. He founded Western Refining (WNR, Fortune 500) in 1997 and in a decade built it into a $7.3 billion giant (No. 342 on the Fortune 500) that refines various fuels and also sells gasoline to consumers, mostly in the Southwest under the Giant and Mustang brand names.

Foster contends that the country needs to raise the federal gas tax significantly. He points out that, in real terms, we're paying less than we did decades ago. (At 18.4 cents per gallon, the federal tax is currently 16% lower, adjusted for inflation, than it was in 1970.)

Foster argues that the levy should be increased, in steps, to $2 per gallon or more. He's even willing to credit the Europeans with a good idea or two on this score, as he explains in an interview with Fortune.

Energy dispute over Rockies riches

A titanic battle between the West's two traditional power brokers -- Big Oil and Big Water -- has begun.At stake is one of the largest oil reserves in the world, a vast cache trapped beneath the Rocky Mountains containing an estimated 800 billion barrels -- about three times the reserves of Saudi Arabia.

Extracting oil from rocky seams of underground shale is not only expensive, but also requires massive amounts of water, a precious resource crucial to continued development in the nation's fastest-growing region.

Byron King: Whither the Oil Markets

“Global Demand for Oil to Plummet,” screams a recent Financial Times headline. Huh? No it won’t. Who are they trying to kid?Global oil demand is not going to “plummet.” And for the FT to say so is just plain silly, if not irresponsible. OK, I know. There’s an old saying that they teach in journalism schools. “You have to sell newspapers.” But this declaration by the FT highlights the perils of letting a headline-writer do your thinking for you. It’s what I call “arguing a screaming conclusion.” And a wrong conclusion at that.

Drill baby drill — a reality check

Many Americans want to believe that the US still has unlimited oil resources within its boundaries, if only the pesky environmentalists would just get out of the way. Throughout the recent presidential campaign, the “Drill baby drill” mantra was exploited relentlessly by John McCain, his supporters and rightwing media sources.

Apache Resumes Oil Output as Australia Cyclone Eases

Apache Corp has restarted production from two oil fields with combined output of 13,200 barrels per day (bpd) off Australia's western coast after a cyclone weakened and no longer posed a danger to operations, the company said on Monday.Production at the 8,000 bpd Stag oil field was reactivated on Friday, said David Parker, a Perth-based Apache spokesman. Production at the Ocean Legendre oil field, with a rate of 5,200 bpd, will be restarted later this week.

Bakersfield Refinery Halts Production After Bankruptcy

(Bloomberg) -- Big West Oil LLC, which has two refineries in the U.S., has halted taking deliveries after parent Flying J Inc. filed for bankruptcy, the Bakersfield Californian newspaper reported, citing a crude supplier.Big West has refused shipments of oil and may be carrying out maintenance, the newspaper said, citing David Wolf, chief executive officer of Berry Petroleum Co. Big West has no plans to close or change operations, company spokesman Peter Hill told the newspaper. Flying J declined to comment, the newspaper said.

Mexico’s Fiscal Prudence Fails to Avert a Slowdown

MEXICO CITY — Twice in the last three decades, Mexico has demonstrated that one country’s profligacy and mismanagement can spell economic catastrophe beyond its borders.In 1982, the country defaulted on its foreign debt and set off a Latin American debt crisis that led to a decade of anemic growth across the region. In 1994, the peso collapsed and halted capital flows to emerging markets around the world, until the Clinton administration arranged a $50 billion Mexican bailout.

But this recession, it is the profligate United States pulling down fiscally disciplined Mexico.

Argentine government intervenes in troubled natural gas company

BUENOS AIRES, Argentina (AP) — Argentina's government is taking over a troubled gas company after it defaulted on $22.5 million in debt.

Cold turns fuel into gelatinous clump

Equipment doesn't run when the diesel inside it gels up to the consistency of clumpy wax.Severe cold weather is creating a prolonged call for higher grade diesel, and suppliers are having difficulty keeping up with demand.

Fuel scarcity crisis bogs down festive season in Rwanda

APA-Kigali (Rwanda) As Rwanda waits for dozens of fuel trucks coming from Mombasa, Kenya, as promised by the ministry of Trade, fuel shortage crisis continues to rock the country prompting long queues on almost all pumping stations by Tuesday morning, causing unexpected business paralysis.The escalating crisis which has persisted for over a week now, has led to a sudden increase in transport fares for upcountry commuters and commodity prices, restraining life especially during the festive season, APA learns.

Consumers want their SUVs; they just don't want to pay for the gasoline

When the gasoline prices dipped to about $1.50 -- I paid $1.38.9 the other day -- guess what? Trucks and sport-utility vehicles began to outsell cars. The numbers show December likely will end that way for the first time since early last year.If I'm not mistaken, the consumer was less concerned with fuel efficiency than size, luxury and performance, and fuel economy be darned.

And you know what else? This has happened several times in the past few decades, so it's no surprise.

Getting Ahead of the Data Storage Energy Crisis: The Case for MAID

There is a tremendous amount of focus on energy efficiency these days. Some think it’s a nice “green” thing. Others understand the significant financial benefits that can be gained. But for those of us in the storage and networking industry, it’s a lot more urgent than that. We are on the brink of an energy crisis that fundamentally impacts all of our professional lives.

The energy climate plan of Barack Obama

The energy-climate question is one of those areas where the policy of Barack Obama could be most radically distinguished from that of George W. Bush. Under the leadership of the new president, in fact, the United States should quickly adopt an obligatory plan of reduction of greenhouse gases, invest massively in renewable energies and play an active role in the negotiation of a new international treaty to take over from Kyoto, in 2013. The turn is undeniable. We should take note of it, but we should also measure its limits… and dangers.

Will the U.S. Move From Arab Oil Dependence to Asian Battery Dependence?

A consortium of chemical and battery manufacturers is seeking $1 billion from the U.S. federal government to build a domestic industry for electric car batteries.

Possible air hazards rarely considered in plans for schools

MIDDLETOWN, Ohio — The students at Amanda Elementary School here already breathe what appears to be some of the most polluted air in the nation.Now, a plant that makes coke — the coal-based fuel that melts iron ore for steel mills — is scheduled to be built behind the school, just past the ball fields.

"I can't believe this is possible," says Jena Manley, a college junior who attended the school and lives nearby. "How much pollution are we supposed to take?"

USA's trashed TVs, computer monitors can make toxic mess

SEATTLE — Hong Kong intercepted and returned 41 ship containers to U.S. ports this year because they carried tons of illegal electronics waste from the U.S., according to the Hong Kong Environmental Protection Department.By turning the containers away, Hong Kong thwarted attempts by U.S. companies to dump 1.4 million pounds of broken TVs or computer monitors overseas and an estimated 82,000 pounds of lead, a known toxin, in the devices.

But thousands of other shipments probably slipped through, says Jim Puckett, head of the Basel Action Network, or BAN, a three-employee environmental non-profit that over eight years has become a respected watchdog over the rapidly growing electronics recycling industry.

October oil demand down 4.07 pct from year ago: EIA

WASHINGTON (Reuters) - U.S. oil demand in October was 598,000 barrels per day more than previously estimated and down 833,000 bpd from a year earlier, the Energy Information Administration said on Monday.U.S. oil demand in October was revised up by 3.14 percent from the EIA's early estimate of 19.045 million bpd to the agency's final demand number of 19.643 million bpd, and was 4.07 percent less than demand of 20.476 million bpd a year earlier.

The final numbers, in the EIA's monthly petroleum supply report, always differ from initial estimates in the weekly petroleum report.

Oil near $40 as investors eye Gaza conflict

VIENNA, Austria – Resurfacing concerns over the world economy sent crude prices lower Tuesday, eclipsing fears that the conflict between Israel and Hamas could inflame tensions in the oil-rich Middle East.Prices have blipped upward over the past few days because of the fighting. But with the conflict in its fourth day Tuesday, the market refocused on the turmoil roiling economies internationally — and the negative fallout for oil demand.

OPEC is pumping below target: report

LONDON — Output from OPEC members bound by supply targets fell by 400,000 barrels per day (bpd) in December, consultant Petrologistics said on Tuesday, as the group more than complied with a deal to try to boost oil prices.Supply from 11 exporters was expected to average 27.1 million bpd in December, down from about 27.5 million bpd in November, said Conrad Gerber of Petrologistics, an established tracker of oil tankers.

Is Time Right To Top Off U.S. Oil Reserve?

At a time that the federal government is printing money faster than postage stamps, any dollar windfall comes as welcome news.Such is the case with the Strategic Petroleum Reserve. Last May, with oil surging toward its historic peak near $150 a barrel, Congress ordered a halt to filling the emergency reserve in a near-unanimous vote.

Timing is everything, and this is one instance where Congress got it right. Since their July peak, oil prices have dived by nearly $110 a barrel. Just in time to take advantage of this collapse, the suspension ends Dec. 31. In the New Year, the U.S. is free to resume filling the Strategic Petroleum Reserve.

Heavy crude may hit light-sweet parity on Reliance

SINGAPORE (Reuters) - Middle East sour crude could extend this year's rally to reach an unprecedented parity with gasoline-rich sweet grades in coming months, as the world's biggest new refinery in a decade fires up its furnaces.Indian Reliance's 580,000 barrels per day plant, formally commissioned on December 25 in time to meet a year-end target, enters a global oil market that has turned upside down since it was launched in mid-2005 amid a global refining capacity squeeze and as OPEC pumped every barrel it could.

Now, instead of hoovering up discounted, surplus heavy-sour crude from OPEC, Reliance may be chasing fewer barrels as the cartel cuts output by record volumes in a bid to cope with shrinking demand and put a floor under prices that have fallen more than $100 since July.

Dow Chemical Plummets as Kuwait Cancels Investment

(Bloomberg) -- Dow Chemical Co. plunged the most in at least 28 years and Rohm & Haas Co. tumbled after their $15.4 billion merger was threatened by the collapse of a deal between Dow and Kuwait that would have provided some of the funding.

Drillers eye oil reserves off California coast

The federal government is taking steps that may open California's fabled coast to oil drilling in as few as three years, an action that could place dozens of platforms off the Sonoma, Mendocino and Humboldt coasts, and raises the specter of spills, air pollution and increased ship traffic into San Francisco Bay.

Texaco Toxic Past Haunts Chevron as $27 Billion Judgment Looms

The ruined land around Cevallos’s home is part of one of the worst environmental and human health disasters in the Amazon basin, which stretches across nine countries and, at 1.9 billion acres (800 million hectares), is about the size of Australia.And depending on how an Ecuadorean judge rules in a lawsuit over the pollution, it may become the costliest corporate ecological catastrophe in world history.

If the judge follows the recommendation of a court-appointed panel of experts, he could order Chevron Corp., which now owns Texaco, to pay as much as $27 billion in damages.

The case, which has languished for 15 years in U.S. and Ecuadorean courts, highlights the growing human and environmental toll of the global quest for oil.

Dollar Falls on Concern Israel-Hamas Conflict May Choke Off Oil

(Bloomberg) -- The dollar declined against the euro as Israel’s assault on the Hamas-controlled Gaza Strip in response to rocket attacks raised concern exports of crude oil to the U.S. may be reduced.

Profiting from Oil's Inevitable Rebound

The price of oil is down, way down. Last June's $142/bl has recently been below $35/bl. Now may be a very good time to invest in oil stocks. On the other hand, prices still seem to be heading south. You have the "falling knife" risk.Yet, how low can it go? Unlike derivatives, we are talking real assets here. At a certain point, pumping won't pay. And, of course, low prices stoke demand. It is not a matter of if oil prices will rebound, it is a matter of when and to what extent. There is also the geopolitical risk and the "Peak Oil" scenario. Events in the Middle East can flare oil prices up on a moment's notice.

Seeing the bottom and strength of investments

Well, I do agree with the peak oil theory, and there’s evidence that it’s happening. The reason we got to $140 oil is the supply and demand numbers were coming together. There wasn’t a lot of excess supply. Let’s say there was an extra 1.5 to 2 million barrels between OPEC nations, but that isn’t necessarily easily brought on stream. It would be there, but it might require some capital, and there is some question whether those estimates are even valid as to how much extra there is. But the point is that you are getting to a level that it’s hard to replace natural declines.As a result of this low price, a lot of large projects are either outright cancelled or deferred. And we have seen a lot of that in the oil sands; probably, when all is said and done, we might see the deferral of between half a million and a million barrels of production. The world is producing 86 million barrels a day now; the decline rate in that production is 6% to 7%. So, just to keep production flat, you have to add 5 to 5.5 million barrels of production a day per year.

Libya orders further oil cuts of 20K bpd

TRIPOLI, Libya (AP) -- Libya's oil chief says his country will cut production - starting in January - by almost 20,000 barrels per day more than Libya's OPEC quota.National Oil Corporation head Shukri Ghanem says the latest cuts would bring Libya's total output reduction to 270,000 barrels per day from September levels. That is about 20,000 barrels more than the country is required to cut under its OPEC quota.

Gazprom renews Ukraine gas threat

Russia's Gazprom has reiterated it will cut gas supplies to Ukraine on 1 January if no new contract is signed."The last round of talks with Ukraine is beginning. We are counting hours," the firm's head Alexei Miller said.

Gazprom Offers to Prepay Ukraine for Gas Transit

(Bloomberg) -- OAO Gazprom, Russia’s natural-gas export monopoly, offered to prepay fees for shipping gas to Europe via Ukraine to help the country pay its debt and avoid a cutoff.The proposal is “under discussion,” Sergei Kupriyanov, a spokesman for Gazprom, told reporters in Moscow today.

Gazprom sets up action group to start gas cuts to Ukraine

MOSCOW (RIA Novosti) - Gazprom has set up a special action group to begin preparations to halt gas supplies to Ukraine if the former Soviet state fails to repay its outstanding debt, the Russian energy giant's CEO said on Tuesday.

Indonesia’s Oil, Gas Revenue Rises 63% in 2008 on Higher Prices

(Bloomberg) -- Indonesia’s revenue from oil and gas production climbed 63 percent this year as crude prices reached a record in July.Income from petroleum surged to 303 trillion rupiah ($27.4 billion) this year from 186 trillion last year, Energy Minister Purnomo Yusgiantoro said in Jakarta today. The country’s mining industry, including coal, brought in 42 trillion rupiah this year, 13 percent higher than a year earlier, he said.

Getting renewable power to the people

The Southern California desert could produce a gusher of renewable energy.Strong sunlight bathes its open plains, even in winter. Powerful winds stream through its mountain passes. Fractures in the earth along the San Andreas Fault heat pools of underground water - the perfect fuel for geothermal power plants.

There is, however, a problem. Most Californians don't live there.

Hydro power shows signs of comeback

America's search for cleaner electricity has developers studying dozens of government flood-control dams from North Carolina to Oregon to see if it makes financial sense to retrofit them with hydroelectric turbines.The studies are part of a broader trend that has developers looking at everything from millpond dams in New England to locks and dams on navigable waterways such as the Mississippi and Ohio rivers.

NZ airline flies jetliner partly run on veggie oil

WELLINGTON, New Zealand – A passenger jet powered in part by vegetable oil successfully completed a two-hour flight Tuesday to test a biofuel that could lower airplane emissions and cut costs, Air New Zealand said.One engine of a Boeing 747-400 airplane was powered by a 50-50 blend of oil from jatropha plants and standard A1 jet fuel.

Answers To Huge Wind-Farm Problems Are Blowin' In The Wind

While harnessing more energy from the wind could help satisfy growing demands for electricity and reduce emissions of global-warming gases, turbulence from proposed wind farms could adversely affect the growth of crops in the surrounding countryside.Solutions to this, and other problems presented by wind farms - containing huge wind turbines, each standing taller than a 60-story building and having blades more than 300 feet long - can be found blowin' in the wind, a University of Illinois researcher says.

"By identifying better siting criteria, determining the optimum spacing between turbines, and designing more efficient rotors, we can minimize the harmful impacts of large wind farms," said Somnath Baidya Roy, a professor of atmospheric sciences at the U. of I.

How the split between creation care's leaders and its grassroots activists is dictating the future of the green evangelical movement.

"CURRENT global trends in energy supply and consumption are patently unsustainable — environmentally, economically, socially … What is needed is nothing short of an energy revolution." I have said similar things myself, but this quote is from a new "World Energy Outlook" by the International Energy Agency.The change is as amazing as if the Pope were to support contraception or the Business Council to call for stabilising the population. Until last year, the energy agency was still deep in denial about the problems of climate change and peak oil, and was talking about world energy use doubling and an increasing use of coal.

Food lessons from the Great Depression

When she was a kid, for a treat Pat Box and her seven siblings got "water cocoa," which is pretty much what it sounds like and nothing special today. But that was in the 1930s, when her father's business was reselling bakers' barrels to coopers, and the family would get first crack at them, scraping the wood for any traces of sugar or cocoa left behind.

Adapting to climate change and decreasing agriculture’s environmental impact, while substantially increasing its productivity, are among the key challenges confronting us in the twenty-first century. Despite the bad rap they’ve gotten, the GM crops in use today have already contributed to meeting both challenges.

How does a 4.07 reduction in demand result in a price drop to a quarter of its former value? I don't understand that. Does anyone have any theories about the precipitous price decline?

Kevin Walsh

Chicago Peak Oil

october's price (wti monthly) was down by a factor of 1.75 from july's peak.

kevin,

There was a lot of debate back when prices peaked as to the effect of speculators in the futures market. In particular was the supposed effect of the credit crunch forcing many of those players to liquidate their positions in a rather rushed manner and thus crushed the price support. The price swings we've seen seem to support that theory IMO. Following that the thought, the futures market should swing back to a more reality based flow. Add the potential OPEC production cuts and we could see a significant rise in prices in 2 or 3 months. I've seen it speculated eslewhere that such an expectatioin is being seen in longer term future contracts.

Depletion Marches On

Speaking of OPEC, Indonesia (a founding member of OPEC) is a good example of net export rate versus cumulative remaining net oil exports. I put the final production peak for Indonesia in 1996. The following percentages are net oil exports as a percentage of the 1996 net oil export rate (left) and cumulative remaining post-1996 net oil exports as a percentage of the 1996 number (right), for Indonesia (EIA).

1996: 100% & 100%

1997: 85% & 78%

1998: 91% & 56%

1999: 78% & 37%

2000: 63% & 21%

2001: 46% & 10%

2002: 27% & 3%

2003: 13% & 0%

2004: Net Oil Importer

In 1998, note that the net export rate was only down by about 10% from the 1996 rate, but the cumulative remaining net oil exports were down by close to half.

By the time that net exports were down by about half, in 2001, cumulative remaining net oil exports were down by 90%.

Mexico is following the same trajectory as Indonesia (both consumed about half of production at final production peaks). The top five will follow the same pattern; it will just take a little longer for them to approach zero.

There have been comments that the ELM model doesn't properly capture internal demand changes relative to cost shifts as oil depletes.

I wonder if cost and price for oil are in reality moot (no graphs, whether ELM or Hubbert, include price in the model)? If prices are high, exporting countries have money to spend and use more internally, but they also have money to spend on production technology and drilling. If prices are low, then exporting countries have less money to spend and may use less internally, but they also have less to invest in production, and presumably production will drop.

If the effect is roughly linear, then I think the end of exports will happen at the same date regardless of price, only the amount of oil left for subsequent internal use would increase. The curve would be lower and flatter, in essence, but cross the ELM zero point at about the same date.

I know this is a bit more pessimistic than the original discussions, but I guess we can watch Mexico this year and see how production and exports fare with low prices and a slow internal economy.

Regarding oil prices, US annual oil prices didn't cross the $40 mark until 2004, when Indonesia became a net importer. The 1997 to 2003 decline corresponded to annual oil prices in the $14 to $31 range.

As I've been saying since the summer, there doesn't have to be a good reason for a price decline if it follows a run-up that also wasn't supportable on simple supply/demand changes.

The current price is below what I think it "should" be at this level of supply/demand (which doesn't mean that it can't/won't go lower - it very possibly will), but it isn't unusual to overshoot to the downside if prices previously overshot to the upside.

Let's just hope that the gas price stays low for another two months , so that all the bone_heads around have time enough to buy a brand new SUV .... (before the hikes start all over again)

It's important to remember that oil is traded on the world market. What happens in the U.S. does not determine the world price since it's relatively easy to ship oil from one market to another. Given that the U.S. has been a wealthy nation lately, we have been able to pay the higher prices to purchase the oil we want. Other nations are not so fortunate, so one must consider the change in total world demand. Also, the production of oil can not be rapidly decreased (or increased), as the wells are drilled and the borrowing to do so must be repaid. The producers continue to pump and the last barrels pumped can't be sold when supply exceeds demand, so the price drops. The reverse happens when demand exceeds supply, as may have happened during last summer's price spike.

E. Swanson

There are as many theories as there are analysts. I am not convinced that anyone really knows and have given up worrying about it. There was an article in energy bulletin the other day that made a pretty convincing case that no one really understands what is going on. If someone really does understand and I were convinced they did, I would pay close attention to them and make a ton of money in the process. In the mean time, I am sticking to the theory that prices will rebound; I just don't know when. Buy and hold.

It's not just a 4% reduction in demand. The decline in oil prices represents an "unknown" future decline in demand in addition to the 4%.

6 months ago, it was assumed the demand would be higher in 2009. Now we know it is not going to be as high. No matter what happens, that is a certainty. Much industrial capacity is already scheduled to be taken offline, so we know for sure that we wont need as much oil. The degree of certainty that there will be oversupply is what drives the price down.

Go back in time 10 years and look at oil supply and demand. It was a similar situation, except now the potential demand destruction is greater. $5 a barrel isnt out of the question. That probably wont happen until after the next round of destructive "economic stimulus", Obama style. (Note it was the last stimulus that drove oil to $147.)

excuse me, but where do you get such ideas from .... 5 dollars / barrel ? It's less than a Big Mac in my country slightly more than a bottle of water ..... Man,

Many producers would close the spigots looooong befor that scenario could theoretically happen.

"No matter what happens,..."

unless demand is higher.

Kevin,

The theory is the amount of excess supply determines the price. If there is not enough oil to go around, suddenly the price takes huge leaps upwards, but with just a small decrease in demand (i.e. enough for everyone again) the price drops precipitously.

I am not an economist but supposedly this is well known. Can anyone out there explain it better?

1)we are looking at Feb 09 contract right now - I suspect that when Feb numbers are released there will be a much greater drop YoY than 4%.

2)The concept of price elasticity only works to a point on a non-storable commodity like oil (i.e. storable but with small limits). If storage is full, and even for a few weeks/months time demand is lower than supply, then price has to drop beyond where it would be in a 'normally' functioning economy. Lots of people think oil is cheap, but lots of people also think its going to $10. Watch distillate demand and the shipping indexes (which have really crashed). If those perk up, then oil prices will too- if not then it could be a long wait for demand drop to outpace decline rates, though the recent cuts may start to bite in a month or two.

3)While all commodities have plunged since July (not Gold but the rest), I suspect grains and NG will bounce before oil. Reduction in capital investments in oil and it's substitutes take years to be felt, whereas drops in rig rates will have impact in same year for Nat Gas (though rig plunge is still ahead of us - we are as yet only down about 350 rigs from 1600+ peak). For grains, drops in purchases of seeds or fertilizer will be felt within 6 months, as the entire crop comes to market each year. All of these commodities (except for gold, which is a perceived inflationary/crisis hedge), have built in negative feedback loops - its just a question of how fast the negative feedback occurs. With oil, it will likely be on the slow side - e.g. we might have a 10% YoY drop in crude supply and still have low prices.

All this volatility is like a sonic shock wave with differing amplitude each iteration- low prices inhibit production meaning less product next time around. As events progress, the timing intervals between lows and high prices are going to get shorter and shorter. There is a (meaningful) chance that the July 2008 all time peak in production may also prove to be the all time high in price. I would roughly guess that there is a 30% chance of NO new higher high/energy investment cycles and this is start of permanent great depression - e.g. when fundamentals again support $148 oil, no economic social democracy in the world will be able to afford it and nationalization, stoppage of futures trading, etc. will have occurred along the way. I think a 60% chance that there is one more 'energy bull market' run, where the economy partially reloads, and oil demand outstrips supply and we have significantly higher world prices, for a time. Finally, I put at 10% chance there are TWO more of these cycles left, albeit shorter in length both within and between. In any case, as the amplitude gets narrower each time, there will be fewer (public and national) energy companies making money, as receding horizons on energy costs loom closer.

What to do? Depends if you are an individual or a government.

If you think about it, ALL of us spend our lives trying to get enough abstract wealth to turn it into real wealth when we retire (land, vacation home, books, time with friends, nature hikes, garden, etc.) This energy crisis will just accelerate the timing of this mass 'investment re-allocation' from financial to real capital. My 30/60/10 distribution is just suggestive that though there are still a great deal of variables in play, there is a non-zero chance you may not have years ahead to capitalize on energy investments and transfer dollars into real capital.

From policy perspective, big, bold, and painful decisions need to be made now, to emphasize energy and basic goods over throwing good money (and resources) after dead-end endeavors.

Nicely put.

My observation is that the market is a teacher who gives a continuous seminar, and the speed by which participants learn is much slower, as a group, than the speed by which the clever kids learn. (like yourself). So, while you have moved on to the likely price action in a post-peak era, with a model for increasing amplitude of price along with shorter durations between the waves, much of the world remains decidedly unclear about such things, and is very likely still crowded into the Mean Reversion room. I do think global participants are learning. But, from the vantage point of someone going faster, they may appear stuck.

Because of this phenomenon, I think the world may have several more learning stages to go through with oil, which would mean that there may be a few more price-phases up ahead. Oh, I do think your Amplitude model will punch through and assert itself quite strongly. However, it strikes me that for a good length of time before the world admits defeat and accepts the narrow corner created by growth vs. affordability of oil, we may need to go through three more distinct price phases that I see as follows: 1. The "classical" Peak Oil price phase, characterized by a new understanding and acceptance of limitation on flows. In this phase, participants are optimistic that the world can live within the newly accepted production ceiling. Conservation is accepted, and fluctuations in Days Supply upward are still seen as confirmation that we can cope. Oil is still not priced based on finite reserves. 2. The geo-political price phase, characterized by a new understanding that those who have oil have much more power than previously accepted and those who don't have much less. (Again, this framing may already be obvious to some, considered by more--but is still not close to any kind of widespread understanding). In this price phase, anxiety rises strongly and other hydrocarbons such as NG and coal start to get priced for their strategic value especially in countries like the US which have a lot more coal and NG than oil. 3. The Reserves or Wealth value price stage, characterized by a final breaking-free from value-in-use pricing of Oil. In this stage, oil is priced like money. It's not necessarily used as money (though I could see an oil certificate currency come in to play). In this phase, the Peak Oil value and the geo-political value are fully incorporated into the price. Also, there is still alot of work to be performed on the planet, and even if oil has been priced too high for most users, oil still performs labor. So the value-in-use price still exists, but becomes subordinate the new money valuation of oil.

Ultimately, it's oil's chemical properties that will drive these phases. There appears to be no escape from the pull exerted by oil's concentrated energy, in liquid form. Even in an era of pressured EROI.

For the investor who still intends to do further Alchemy of Capital work in the years ahead, I would position between your Amplitude Model on price (and impending structural change in the global economy)--and--the phenomenon whereby the herd is an ongoing learning phase, and because they are slow and because they hold the capital, they do determine price.

;-)

I agree, that explains it all.

The NYMEX is where two people exchange bet. One bets it goes up and the other bets it goes down. When the contract is up, one wins and one looses.

My experience is that I am more likely to be the jumpee rather than the jumper.

Through September YTD marketable natural gas production in Canada is down 6.4%. Through November, well completions are down 18% to 9,684. In the 1990's less than half this number of well completions brought increasing natural gas production.

Regarding the price of 'oil', folks want to remember that the marginal barrel sets the price. The ~86th million barrel is a very expensive barrel to bring to market each morning and therefore a rare and pricey barrel.

" All this volatility is like a sonic shock wave......"

maybe it will develope into a tsunami and when the wave hits shallower water(whatever that means*), the acceleration will be converted to amplitude and swamp everything.

* probably the dreaded collapse. i'm feeling doomerish already.

Reduction in new investment does have a substantial lag, but opec cuts will be felt quicker than, say, new crops. As I noted above, oil is the only commodity that has a relatively effective cartel... even 50% compliance is far more effective than no cartel at all. IMO compliance is growing, we will likely see at least 3mb/d cuts implemented by jan, and this will affect stock levels everywhere in a few months. Meanwhile, demand is growing on account of low price, suv's are selling relatively briskly.

As far as gold goes, look at any jewelry store in any mall - they were all dead just before xmas, imagine jan. And, this lack of buying is duplicated in asia, much more important than here. In fact, people are selling their old jewelry, which is becoming a new highly productive mine. Industrial uses are down, though not so much, too. THe only demand is fear... we are in a deflationary economy, the only thing supporting gold is that short-term treasuries pay nothing. Eventually fear will dissipate, treasuries will pay some yield, and gold will crash.

I agree with all that except for the 'fear will dissipate' part.

And notice of physical deliveries of gold and silver are going to make for some interesting dilemmas for COMEX and ETF admin in 09. Look at trend of deliveries vs stock %s.

I think that people will lose confidence in the transparency and credibility of financial markets in general and the US stock exchanges in particular and turn to hard assets. This will be supportive of gold bullion prices which already have a higher than typical premiums over the contract spot price.

Gold has outperformed the Dow for the past 3 years and will continue to do so. IMHO

I think the graph of Icelandic Cod Fish Biomass, posted in Drumbeat for December 27, might be a good model for future oil production:

The big question is which oil price a recessionary or even deflationary world economy can afford. What if that oil price is so low that parts of the expensive oil supply system start to collapse?

As is well documented here at TOD, world (C+C) oil production is peaked at ~80 million barrels/day and declining at ~5-10%/year. Gold is real money. Gold's world production is peaked at ~80 million troy ounces (2500 metric tonnes) per YEAR and probably declining. The oil to gold yearly production ratio is ~365 barrels of oil to 1 troy ounce of gold. This is a relatively inelastic ratio. The US dollar is being debased through exponential money printing and is rapidly becoming irrelevant as a store a value. Therefore, it is more useful to discuss the price of oil in real money (gold) than to price it in the dollar. It is the flaw of the dollar and the debt based money system that allowed the credit bubble ($147/barrel) and collapse ($40/barrel). After the dollar gets done dying, the world will still need oil.

The oil producers are not just selling the oil that they produced today but are also selling the oil they pumped yesterday and didn't sell.

And once their storage is full they have to shut down wells and lay off people, which means they sell less oil etc........

So the price goes lower, and lower

Ed

I have several written articles on the subject of the big oil-price drop relative to the drop in demand. The current financial issues (including collapse of credit) seem to be playing a significant role in the situation. Those making comments to my articles also have some interesting insights.

See:

Why are Gasoline (and Oil) Prices So Low, and Where Are They Headed Dec. 8, 2008

Impact of the Credit Crisis on the Energy Industry - Where Are We Now? Dec. 1, 2008

Oil Prices, a Little More of the Story Oct. 27, 2008

Why Are Oil and Gasoline Prices So Low Oct. 22, 2008

US is 'only' 1/4 of world market, so 4% US decline is 1% world decline. However, china also sharply cut oil imports just as the olympics began having previously stocked a substantial amount to assure no shortages during their coming out party. Perhaps world demand declined 2%, mostly on account of high prices.

However, opec has been producing all they could since 2004, resulting in a production increase this year of around 1.5%, boosting world production to a record this summer. So the combination of new supplies plus declining demand was around 3-4%.

This is a very large and relatively sudden change in direction of the supply/demand tug of war, reversing the 2003-2008 environment. Western stocks rebounded, refiners had to curtail deliveries. Then a one-time event occurred - hedge funds, facing redemptions, had to cut their commodity holdings. However, this effect is either over or nearly so.

IMO we are now moving into a new era, one where opec is once again in control, surprising many at tod, including me. I thought opec was a spent force, unable to pump enough to maintain prices under three figures... however, their announced cuts are nearly 5% of all liquids, an amount that is more than sufficient to raise prices back to 100, except that cheating has, so far, prevented about half the cuts from being implemented. However, the various countries seem to be becoming more serious, more are announcing compliance daily. Meanwhile, low prices are stoking demand, suv's are once again selling well as of this month and overall driving is rising. IMO opec will cut enough to bring prices at least to saudi desired 75/b level by mid-year, maybe sooner.

Those who think that oil usage must be curtailed will naturally cheer opec cuts and the higher prices they bring. Better, of course, to tax ourselves, but we don't have the political will or popular support for such a policy. OPEC is also useful for investors, note that oil is the only commodity with a relatively effective cartel. Oil price has occasionally dipped during this century's runup in price, and each time was an extremely good entry point for investors. And we are coming closer to the permanent decline, indeed we might never really recover from the opec cuts.

And that tax should be used for infrastructure to make us less dependent on oil. Oil price volatility and Gail's above graph of gyrating production is a guarantee that there will be no smooth transition to electric or other "green" cars.

OPEC has become a negative swing producer.

Kevin, I've had the same thoughts, but think of it this way. When there is no extra capacity in the system, people bid up the price and there really is no limit to the upside. But as soon as there's extra capacity, and quite a bit of it, the price will drop to soak that extra capacity up. We have tons of extra capacity now, and that's the reason the price is low.

Philip Arnason

oil demand revised up to 4% down. as gomer might have said surprise surprise surprise.

and if the 4% figure is correct, then their previous demand reduction estimate was off by 100% (actual - estimate)/actual.

october ng demand is essentially flat with '07 and ytd through october is up slightly. heating degree days may be a factor.

so have the forecasters of $10 oil overforecasted reduced demand ?

This had better change quickly or OPEC will start to splinter again.

Iran is really in a bind at these prices.

Taking other than a short term perspective, might it be in the interests of the low costs producers to let these low prices play out in order to destroy investment and the high cost producers? Then,after this has all washed out, the low cost producers could make relatively massive profits. Under this theory, perhaps Saudi Arabia, by cutting production, is actually operating against its long term interests. Anyway, the cartel does not seem to be very good at being a cartel.

It would... if you assume that the losers will "play nice" and just accept it. Using one label ("OPEC") for what are really very different nations gets people in to trouble.

Iran is certainly one of the ones that would suffer in that scenario. You could even expect their governing regime to collapse. Would they just sit by and watch it happen? Or might they make a few threats? "Threats" that then begin to look like one tanker each from Qatar, UAE, Saudi, and Kuwait sunk as they pass the straights?

Tankers are cheap and replaceable, plus a moving target. I would go for the Oil ports, Oil-water seperator plants, that kind of stuff.

Sinking just a few tankers only adds a few days to the movement of oil, taking out the source will take months to years to rebuild.

Ed

Almost all true, but not something that you can back down from when your opponent comes to the table. Tankers may be "moving targets", but they have to funnel through an incredibly tight bottleneck and missiles are far cheaper and move much faster.

They can shut in far more than a "few days" of production cheaply and easily (until it became war with the US again). Then they can "fix" the problem almost instantaneously when the rest of OPEC relents. Actually taking out facilities that take years to replace would require retaliation and Iran isn't in a position to stand against the West if the Arab world opposes them as well.

"This had better change quickly or OPEC will start to splinter again."

reports of opec's splintering are, imo, greatly exagerated.

IMO, that's almost exactly backwards. Reports that they ever really got along have been greatly exagerated. They were only able to "sell" the act while they didn't need it (that is, for the few years where capacity was so close to demand that nobody had to retrict their production and quotas were irrelevant.

could you be a little more specific ? i dont see a new north sea coming on production anytime soon, do you ?

I don't rule out the possibility (thought certainly not "soon"), but it hardly matters. All that counts is whether their ability to produce exceeds demand and they therefore must enforce production discipline. Falling demand does that every bit as effectively as rising production can.

"All that counts is whether their ability to produce exceeds demand....."

it is not. non opec producers have an ability to produce as well.

Home prices post record 18% drop

Airlines 'shrinking by all measures' - report

Chinese workers leaving cities in droves

Student loans turn into crushing burden for unwary borrowers

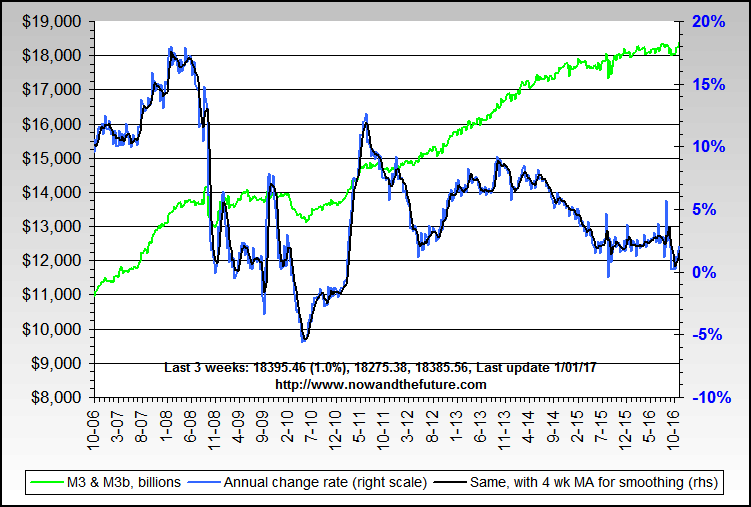

Denninger posted an interesting graph:

![]() http://market-ticker.org/uploads/MULT_Max_630_378.png

http://market-ticker.org/uploads/MULT_Max_630_378.png

His take is that we're hitting the point of diminishing debt returns going negative -- where each new dollar added is doing more harm than good.

From what I observe, this singularity in the graph is a new dollar phenomenon never seen before, and I wonder what it portends in the short term.

Anybody with a better grasp of economic theory willing to take a crack at it? Is our economy about to grind to a complete halt?

Edit: sorry for the obtuse link. I guess I don't see how to post the image.

That's okay. The image is probably too wide for a lot of people to see if you posted it here anyway.

And it's best seen with the rest of Denninger's post.

Which is a good explanation of why printing money isn't as powerful as some think it is. Printing money isn't enough. You have to get people to spend it, too.

Consumer sentiment hit a new low, too:

Down to 38, from an expect bump up to 45 from 44 or so last month.

But hey, the market is up! Party on!

I've just read today's Denninger, and I strongly recommend that EVERYONE read it.

Welcome to the "Oh $hit!!!" moment.

For anyone who thinks that "recovery is soon around the corner", take a very good, long, hard look at his 2nd chart, "Diminishing Returns From Each $1 of New Debt In The US Economy."

The bottom line: The Party's Over, folks. We are past "Peak Economy", and are already starting the sled ride downhill. There is NO POSSIBLE WAY left for Bernake or Paulson or any financial or economic guru or messiah of your choice to turn things around at this point.

Welcome to 2009: The year when we ALL start to figure out how to live in a permanently, and increasingly, poorer US economy.

I wouldn't make too much of that... he's intentionally ignoring other impacts and assuming that the graph tells you all you need to know. In reality, that "1" line is manufactured.

A couple problems I see.

1) He's using M1, which doesn't tell you nearly enough about what is happening to the money supply. It wasn't that long ago that such analysys (almost certainly including Denninger) were griping (with good reason) that the Fed had ceased reporting M3. Now he wants to restrict the conversation to M1?

2) The graph doesn't exist in a vacuum. The problem right now is attempting to avoid crippling deflation. The velocity of money is important, but if the overall supply of money (by a wider measure) is collapsing, then you can add new dollars at below that magic "1" level.

Put simpler, if you're pumping in less-effictive M1, it doesn't "make things worse" if higher measures of money supply aren't rocketing out of control. Put even simpler than that... Denninger is looking at a symptom that would make you afraid of rapid inflation when it's actual a symptom of an attempt to fight deflation.

It's like trying to cure cancer with a drug that causes a high fever and having another doctor tell you that the fever is the problem.

The St Louis Fed doesn't track M2 multipliers in its Monetary data.

That doesn't mean that it doesn't exist.

M1 simply isn't a good measure of how "effective" new injections of supply are. I have no doubt that more inclusive measures of money supply multiples are also falling... but not to anything approaching "1".

It does somewhere:

Somebody else put back together M3 as well:

I certainly don't believe that recovery is soon around the corner. In fact, I'm not sure there will ever be a recovery.

But I do think there are things the government can do. Printing money may not help, but printing money and giving it to people who will spend it might. And our new more Democratic government is likely to be willing to do that. Increase welfare and/or social security. Offer national health care. Increase food stamps and WIC. Allow people to collect unemployment longer. Build infrastructure to provide jobs. Etc.

No, I don't think it will "turn it around." But it could be enough to make the Greater Depression look like a normal recession, at least for awhile.

I think there is some chance your first point may 'work' for awhile. The current bailouts are going into black holes (money velocity = zero?) of bad debt. Maybe this is one form of "debt collapse"? Giving dollars to people who would spend them at least once would have some velocity at least. I think many people are their own mini-black-hole though, and those who would be most likely to spend are the ones least likely to get hand-outs.

On the rest, I'm not so sure. I think that "created money" does no more good than "busy work" -- it's another round in a zero-sum, resource-constrained game. The money created or work created needs to be spent efficiently on long-term durable assets, in order to increase the relative wealth of the individuals. Created work needs to create durable goods (and services) for individuals in the "real" world, rather than virtual assets in a broken virtual world.

I guess make-work that created something today that will be thrown away tomorrow would be one way to kick the can down the road one more time, at the expense of wasted resources. It would be better to efficiently focus work on assets of durable value, though, for long-term good.

As previously pointed out, the velocity of money can only increase if it gets into the hands of those willing and able to spend it. Right now the Fed is pumping enormous amounts of money into the system. In fact, they're close to doubling the total money supply. This money is not helping the economy because it's being eaten up by toxic assets just so that balance sheets can recover. Only after the balance sheets are brought back in line can there be any hope that additional money will get into the hands of those that will spend.

I find one exception with Denninger's write up. He leads us to the conclusion that each additional dollar is actually slowing the velocity. IMO there may be correlation, but not causation. The new money is going to rebuild the financial foundation, the velocity of money is dropping because banks aren't lending. The more insolvencies/bankruptcies the country endures, the more our money deflates, leaving the system short on money which lowers the velocity. This new money isn't even being introduced to the economy so it has no impact on the velocity. The debt implosion/deflation is what's driving the decreasing velocity, not the additional money the Fed is creating.

I do agree that this un-earths a very interesting revelation. Just how BAD are the collective balance sheets REALLY. After reading many books and articles, I've come to the conclusion that the derivatives are really what's dragging the financial system down. According to Ellen Brown the total value of all outstanding derivatives is in the neighborhood of $1 quadrillion (as she puts it, or $1,000 Trillion). Derivatives can be veiwed as bets. The problem is that each side of the bet is booking the bet as an asset. Knowing that all bets have two sides, a winner and a loser, it's easy to see how the collective balance sheets became overvalued. Anyways, you bring in the housing slump, which started the credit crisis and it became apparent that the balance sheets had to be written down. Well, this brought many banks down low enough to where they couldn't legally lend money because of reserve requirements. So before the masses see any of this newly created money, the banks have to get their balance sheets fixed. It's a pretty revealing bit of data that shows that the money supply was effectively doubled and yet the velocity is still tanking. It shows just how large the holes in the balance sheets are. So the question is, are the masses going to go bankrupt while the banks are trying to print their way out of insolvency? Or are the banks going to get things fixed and then we'll experience Hyperinflation and lose the value of our money? And just when, in all of this, will countries like China totally lose faith in our financial system.

TS

Denninger states that mathematics is the only true science. He does not understand that things can be mathematically true and logically false. This is the trap that so many fall into.

It may be mathematically true that 1 apple + 1 orange equals 2 fruit. But fruit is an abstraction that does not exist in the real world. Fruit is undefined except as a broad intellectual concept. Fruit can not be measured, bought or sold. Only the forms of fruit exist in the real world. Fruit could be plums, cherries or pineapples. If we solve for the value of an apple, we find that it is 2 fruit minus 1 orange which is nonsense since a real orange can not be subtracted from and abstract concept.

This is the same trap EROEI leads us into and is the reason EROEI is fallacious nonsense.

Things can be mathematically true and logically false. Logic is the boss of mathematics. Logic is the true science not mathematics. Mathematics is merely the servant of logic and must do its bidding or the result is silly nonsense.

It is disappointing that Denninger does not understand this. But he has a lot of company at TOD.

You know, just repeating endlessly your false claims doesn't make them any more true than before.

You really expect people to believe that the energy invested to get energy is "fallacious nonsense"? I have never seen anything from you that supports this - and I have seen very detailed information that contradicts your statements on EROEI.

But since you are involved in ethanol directly, I should not be surprised that you would continue to loudly declaim that EROEI is unimportant or false.

Must bring back rating system. Just not worth the trouble to respond to some people. Not talking about you, btw.

Is there a version of TODban that will work with the new version of the site on the new Drupal? It's getting to where it would be quite useful again.

What about fruit cake? Or fruit baskets? Or fruit loops? Anyway, apples can be compared to oranges if one converts them to their sales prices or nutritional values first.

I would actually agree with X if 'Fruit Loops' were the fruit in question.. I mean, I would be in trouble if I were to try comparing Apple Jacks with Orange Whips.. but even with these, as with Fruit Juice, Smoothies, Fruit Salad or Ambrosia (Even Including their HFCS ethanol gogo syrups), one could certainly gauge one 'fruit-food product' against another by their basic caloric-content.. allowing of course that you deduct the number of calories invested in the growing, processing, storage and transportation (packaging and advertising) of each entrant.

That might be referred to as the 'Fruit Net'.. or FroFroi of these foodstuffs?? ('Fructose returned on Fruit Originally Invested')

Bob

I suppose by mathematics you really mean just "arithmetic + elementary" algebra? I'm guessing that you've also never taken a course in Clifford algebra (or any of it's disguised forms like spinor calculus)? Regarding your "equation", the real question a mathematician would ask is what precisely you mean by "equals", and indeed whether a different concept (say, equivalence wrt some criteria or some other variety of morphism) is more appropriate. What you do is something semantically very strange: you are attempting to "solve" for a non-variable in a relationship and then complaining you end up with a restatement of the relationship. Finally, I suspect like most people who aren't experts in the area (and I'm not a logician), you have the idea that there is just ONE logic (some variety of syllogisms/predicate calculus) when there are various varieties of logic, and the issues they deal with make it unclear whether they are can truly be said to be more foundational than many other parts of mathematics.

That's a pedantic answer to your post. The real irritation I have with your posts is that you keep harping on about how various things are nonsense simply because you call them nonsense rather than actually showing a contradiction they generate. If you've got some analysis rather than rhetoric then it'd be more convincing to post that.

The math in the EROEI calculations is the representation of the laws of thermodynamics. Don't debate them. Learn them.

"Denninger states that mathematics is the only true science."

if denninger states that, then he doesnt understand mathematics or science, imo.

mathmatics is an invention of man, so how is it science ? did man invent god ? or did god invent man ?

this denninger (guy) is ignoring observation as science. did darwin derive the theory of evolution matmatically or by observation ?

First off, Denninger appears to be fairly accurate in his observations, (with my limited knowledge of economics and finance). I like what he writes, but he should stay in his own playpen because his analogies suck.

"In science there is physics, everything else is stamp collecting."

Sir Ernest Rutherford

Mathematics is not a science, it is a language created to attempt to describe certain phenomena, which were discovered by direct observation, (data) and later by inference of data about phenomena related to an event that could not be directly observed. As such, it has many flaws, i.e dialects, like any other evolved, and evolving, language. Another example is the nomenclature and equations of chemistry, and perhaps better established. The notation describes the science, it does not define it.

One might argue that linguistics is a science, but I would consider it a study that is esoteric, not fundamental. People speak to each other without higher learning,in my experience.

Observation is the fundamental core of science. If observation counters the math, then the math is wrong. This is evidenced by climate change. In this case it is not wrong, just incomplete or insufficiently expansive.

All that said, his meanderings do not falsify his on-topic rants, it just shows his limitations.

Oh, and BTW, man invented god (lower case intentional).

after further thought, i can think of an area where math may be considered science, theoretical physics.

for example, bose-einstien condensation was derived mathmatecally a long time before scientists were able to create it. man has yet to find a practical use for it.

so maybe this denninger guy is not operating in the "real" physical world.

time travel is (mathmatically) theoretically possible, but i doubt currently living earthlings will experience it unless a benevolent space man or woman drops in to explain it to us.

the quest for the not so holy grail continues, viva the theoretical physics alchemists.

Not quite, theoretical physics is a science but the B-E condensates theory was expressed mathematically. For non-mathematicians, the idea could also be expressed verbally, albeit with some difficulty.

For example, consider philosophy, at the other end of the spectrum. Ideas exist in the mind and then those ideas can be expressed in the form of words, in any language. The words can then be manipulated to better convey or refine the idea but the words did not create the idea.

I'll keep it short:

There is a book: "Road to Reality" by Penrose

In opening chapters he explains how math is attempt by our limited minds to model a much more complex world. Note the part about geometries other than Euclidean. The Universe appears to be non-Euclidean and yet we stick to Euclidean model because our minds can't easily grasp the other geometries.

"Mathematics is an invention of man"

As Robinson Jeffers said it so eloquently

"Or as mathematics, a human invention

That parallels but never touches reality, gives the astronomer

Metaphors through which he may comprehend

The powers and the flow of things..."

The Inhumanist (Part II of The Double Axe)

Just to put a little poetry into TOD

Don

You might be right, but I am old enough to remember when Pelosi and gang were swept into power on a promise to get the boys out of Iraq (it seems like a lifetime ago). Their rhetoric doesn`t seem to match their actions very well.

Given another year, liberals may become as disenfranchised with their electors as conservatives have become with theirs.

Denninger is a very smart guy, but he is not mentioning the whole story on this one. 8.5 trillion dollars is a very large sum of money, more than large enough to provoke dramatic temporary surges in the USA economy (if that was ever the intention). Obviously you cannot shift 8.5 trillion dollars from the overall economy (adding a liability) and funnel it into relatively few pockets and expect a surge in the overall economy-rather than efforts failing as Denninger states, the reality is that no efforts at all have been made. Everybody know the numbers-the USA is being looted big time, as surprising and psychologically threatening as the reality is to most observers.

"His take is that we're hitting the point of diminishing debt returns going negative -- where each new dollar added is doing more harm than good."

Sounds like something from the Herman Daly post the other day;

"Marginal costs of growth now likely exceed marginal benefits, so that real physical growth makes us poorer, not richer."

WOW exactly what I though was happening now we have proof.

What this means is the economy has effectively reduced to close to a steady state or no growth economy. With the velocity effectively flat monetary stimulus no longer works I think it eventually results in inflation when is anyones guess simply out of devaluation of the currency aka the next step is a currency collapse. This is a different sort of inflation from a debt inflation aka stagflation of the 1970's since wages and goods purchased with debt esp long term debt fall as goods that or needed in a steady state economy i.e food, oil etc rise in price as the currency itself is devalued.

However whats important is that whatever oil demand is right now given the velocity of money has flattened is probably fairly close to what we need to run a steady state economy without changes. Thus given say a range of 1-2% and including increases from simply population growth this velocity results say that US oil demand is approaching close to its natural bottom level.

On the reverse side if velocity stays this low which I actually expect it will on a oil/GDP basis any attempts to grow the GDP will be far more oil intensive then in the past when we had high velocity. I.e energy/GDP ratio is effectively the same as the velocity of money. Any further reduction in oil usage would require a major economic collapse as we are effectively now in a day to day living economy.

As far as oil prices go given that demand has probably stabilized the question is what will the supply be going forward.

Why does someone else thinking the same thing that you've been thinking mean that it's now proven?

Also... as I said above... M1 is a lousy tool if this is what you're trying to identify. Why would money in a checking account really be that different from money in a savings account at the same bank?

Because great minds think alike?

"Because great minds think alike?"

:-)

Seriously though... unless something has changed since I last looked... even your checking account may not be in M1 if no checks cleared last night. Do you really think that the effectiveness of a supply injection should be judged by whether you wrote a check last week or not?

Is this related to my theory/conceipt that the economy as a whole is has passed diminishing marginal returns to negative absolute returns on activity? My intuition tells me it's a parallel expression.

If more money means more activity that would mean more destruction of our "natural wealth".

cfm in Gray, ME

Or spend it yourself. I think that is Obama's plan.

Hmmmm ...

Denninger isn't a pilot. What he's talking about is a stall. Too high of an angle of attack, you lose airspeed and drop straight down. Hard landing if you are close to the ground. A flat spin is where your aircraft spins on its vertical axis. G forces will make you black out before you can do anything about it. Apparently the space shuttle Columbia was subject to a flat spin:

http://www.nytimes.com/2008/12/31/science/space/31NASA.html?hp

As for money velocity or lack of same, Denninger is basically on the money.

Ironically, instead of taxing power the asset that Bernanke and Paulson are printing against is the willingness of the Fed to borrow more and more cash from itself.

Nice job if you can get it ...

Speaking of accidents, I heard a pro- nuclear advocate speaking on C-Span this morning mention that there are approximately 1.2 million ('MILLION') auto crash fatalities every year! I thought he was blowing some smoke up my ying- yang ...

http://www.car-accidents.com/

The American Way of Life, what is there not to LOVE!!!

I read the article related to the graph and this sounds like the liquidity trap that Krugman (see http://krugman.blogs.nytimes.com/2008/12/29/optimal-fiscal-policy-in-a-l... ) has been talking about on his blog at the New York Times site. Krugman also says that the Fed has done everything it can do regarding interest rates and the money supply and any further attempts to use monetary policy will be fruitless. Accordingly, the only tool left with any chance of success is fiscal policy,i.e., government spending approaching a trillion dollars or until we reach full employment, whichever is comes first.

Those who resist government spending for ideological or other reasons, if successful, may guarantee that we continue the downward spiral. Others, of the doomer persuasion, think that there is no way out of this mess regardless of what we do.

Krugman, bless his soul, ignores any resource constraints in his analysis. Others may think this is a fatal flaw.

Thank you. What he seems to not address is a potential inability of the gov't to spend more -- what if a liquidity trap bumps up against a negative debt/GDP correlation and/or an unwilling debt financier?

Will his model of "have the gov't buy more stuff" work with printed dollars, or does it still end up reducing the utility (velocity?) of existing money?

Taken to extremes, you could say the gov't could pay people to do work and throw it all away, and gain benefits of full employment and fiscal growth. This seems absurd -- if long-term growth is restricted by resources, and long-term debt is restricted by that lack of growth, then only the most valuable items should be produced, and optimally at that. But that means decline, not growth.

I think Denninger has one part right -- debt collapse is the only way out. This may require bond collapse as well. The interesting question is whether the drop in the money ratio says there is no more latitude to kick the can down the road again.

Ilargi over at TAE seems to echo the "debt collapse" as well.

Debt Rattle, December 30 2008: The End of Credit

He does not comment on the M1 - N relationship and I'd be cursious on his and/or Steoneight's comment on that.

Pete

Anyone with kids or who has been one themselves (most of you I hope) know the sound you get when you blow into a burst balloon. Think whoopie cushion.

Thats the best description of what they are trying to do that I can come up with.

LOL!!!

That's the best explanation that I've heard!

You would make a good economist...

You've got to wonder if some of those kids with huge student loan debts might start viewing emigration as their best bet. I wonder what countries they could move to that are out of reach of the debt collectors? They are young enough to start with a clean slate and build themselves a better life than they are likely to get in the US.

You've also got to wonder how many people will decide that emigration is not an option, but will nevertheless figure out that they are better off to just drop out of the formal economy and live incognito, not unlike illegal aliens?

I think you may be on to something when you talk about those who will "drop out" of the formal economy. I'm not so much sure that it will be like being an illegal alien, but I do see possibilities for living in two economies at once. As the formal or "official" economy weakens, the grip of central authority on economic activity will weaken.

How many of my official economy obligations can be allowed to slide while I move increasingly large parts of my day to day life into the informal or "unofficial" economy? (And it strikes me that the "unofficial" will not be singular and will be local.)

If I want electricity I'll need to stay connected (unless I go off-grid), but most anything else could be moved to the informal (food, clothing, any actual material good or personal service). Does this mean the end of things that are only possible with a single economy? like the internet? cable and satellite TV?

And the trillion dollar question is mortgages. Will a failed banking system continue to be able to foreclose on delinquencies? At what point does it become safe to stop paying your mortgage because the bank can no longer enforce its contractual rights?

(And an aside - does it really make sense for a society to allow a large portion of its housing stock to sit empty when there are many who need housing? At what point to local govt's take over the empty housing stock and distribute on some local created value basis rather than allow them to be squatted?

Hmmm - lot of possibilities here in the great unwind.

I would bet that many famalies who double or triple up will have a head of household in the formal economy and the remainder of the members will choose to drop out.