DrumBeat: December 20, 2008

Posted by Leanan on December 20, 2008 - 10:25am

'Drill, baby, drill' process has begun

WASHINGTON (CNN) -- Remember "drill, baby drill"? In its last weeks in office, the Bush administration is starting to make it happen by quietly starting the process of exploration and drilling off the coast of Virginia.The move means that President-elect Barack Obama and brand new interior secretary nominee Ken Salazar -- a Democratic senator from Colorado -- will have to jump feet-first into the decades-old debate over offshore oil drilling. It's an issue where the two disagreed at one point.

Wait. Virginia?

The state is ground zero for the drilling debate because of possible reserves off the coast and what energy experts see as a friendlier government than elsewhere.

Peak Oil, Falling Oil Prices, and the Global Economic Crisis

Now is anyone surprised that oil prices have collapsed in the past few months? Demand for oil is way down, since people can no longer afford to consume.Far from contradicting the peak oil theory, falling oil prices are an expected result of the super-spikes caused by demand trying to grow against a flat rate of production.

Recession likely to fuel another roller-coaster ride for oil in 2009

It was the year that broke the banks and the back of the global economy. For oil prices, it was the year of the superspike.And for governments and companies making plans for the year ahead, it was a year that bequeathed them a massive dilemma: whether to count on oil prices staying near their current level of below US$40 barrel – roughly a four-and-a-half year low – or to brace for further wild price swings.

Oil prices will start rebounding in Jan. '09 - Algeria

ALGIERS (KUNA) -- Oil prices will start rebounding as of next month when OPEC's fresh cuts of 2.2 million barrels per day (bpd) take effect in the first month of 2009, Algerian energy minister Chekib Khalil said Saturday.

Robert Bryce: Obama buys the biofuel hype

The senator from Big Corn is now the president-elect. And he's buying the hype on biofuels. On Tuesday, Stephen Power of the Wall Street Journal reported that Barack Obama's transition team has been talking to the Renewable Fuels Association (RFA) – the trade group funded by the corn ethanol producers – about a bail-out for the ethanol industry. And on Wednesday, Obama announced that the former governor of Iowa, Tom Vilsack, would be the next secretary of agriculture. Announcing the selection, Obama said Vilsack would be part of the "team we need" to strengthen rural America, create "green jobs" and "to free our nation from its dependence on oil".According to Power's story, the RFA provided Obama's team "with some ideas on how to craft the language" on an economic recovery package. Those suggestions include the creation of up to $1bn in short-term credit facilities that could allow ethanol producers to finance their operations" and "a $50bn federal loan guarantee programme to finance investment in new renewable fuel production capacity and supporting infrastructure." The RFA also wants the feds to require that any automaker getting federal bail-out money must begin producing fleets that are "flex-fuel" – thus, able burn fuels containing up to 85% ethanol – no later than 2010.

NEW YORK (CNNMoney.com) -- Gasoline prices dropped Saturday after four straight days of increases, according to a daily survey of gas station credit card swipes.

Don’t Panic! Asia May Yet Stabilize Demand

Countries such as India and China may well fend off recession and continue their growth patterns. If this happens, not only will demand remain at current levels, it may increase according to the IEA’s Chief economist, Fatih Birol.“If those countries continue to consume oil as much as over the last couple of years they may easily make up losses coming from OECD countries,” Birol told Reuters in an interview on the sidelines of the World Eocomic Forum.

Australia: Bowsers run dry but `no shortage'

QUEENSLAND Premier Anna Bligh has tried to allay fears of a fuel shortage over the Christmas-New Year break -- but a local service station has already run dry.A servo at Banora Point was one of the first affected by the shutdown of Caltex Lytton refinery in Brisbane which has sent jitters through the tourism industry.

Nepal: Power cut to lead to job loss

Nabin Rijal, owner of a plastic factory in Khanar, said that the energy crisis had made it difficult for industries to pay their workers.Many factories have changed their working hours because of load-shedding. They have also asked part-time workers to stay on leave. Reliance has slashed production by almost half.

Nepal - Nation will collapse sans thermal plants: PM

KATHMANDU - Prime Minister Pushpa Kamal Dahal on Friday said that load shedding hours would be extended up to 18 hours in March and April if the government did not bring thermal power generation."If a situation arises where there has to be 18 hours of load shedding a day, the country will collapse," he said. "Political speeches will be of no use then."

Catholic High in Niagara Falls will go to four-day school week

Niagara Catholic students will have three-day weekends throughout next school year, with Mondays off, after the school’s board of trustees unanimously decided to give the idea a try in 2009-10.They hope the move will boost falling enrollment, create more educational and part-time job opportunities for students, and save a few thousand dollars on utility bills.

Duck and Cover: Climate News Reporting

Routinely Draws Big, Loud Pushback

Publish a climate change-related news story, and be ready for pointed attacks, long knives, and brutal dismissals. And expect accusations of political bias and conspiracy.That’s still the rule for the nation’s veteran environmental and science reporters, despite changing attitudes on climate change from the public at large.

A word about Easter Island and other calamitous feedback loops

Deep ecologists tell us the wealth of nations is founded on drawing down deposits of natural energy placed in this earth by the sun over billions of years. In this, “the last syllable of recorded time,” to quote Shakespeare, we’re drawing those deposits down, turning them into money and ruinous greenhouse gases.England stripped her landscape of most primordial forests in a couple of centuries and then turned to coal, mostly in the 19th century. Then, along with America, Germany and many other countries, she discovered the power of oil, bestowing prosperity on millions, yet contributing to wars around the world. It’s been little noted that Japan bombed Pearl Harbor in part because of our oil embargo against that country.

Glut of oil creates short-term storage problems

Traders locking up storage space for crude created a huge rift in prices Friday between oil that must be delivered in several weeks and oil that can be taken in February.The January contract for crude expired Friday and with stockpiles rising at the key storage facility in Cushing, Okla., the price dropped close to a five-year low as brokers and traders attempted to unload supply for whatever price they could get.

"If you could find storage for it, it's a way to get rich real quickly," said Peter Beutel, an analyst with Cameron Hanover.

Does Matt Simmons still expect $200 oil in two years?

The price for a barrel of oil has fallen from $145 in July to less than $40.So you might think investment banker Matthew Simmons is worried about his wager that oil will be worth five times that amount two years from now. Convinced that oil production can’t keep up with global growth, Simmons bet New York Times columnist and blogger John Tierney $10,000 that the average daily crude price in 2010 will be more than $200.

Is he having second thoughts?

“God no,” he said on the phone the other day. “We bet on the average price in 2010. That’s an eternity from now.”

Tropical Cyclone Billy Rampages on Australian Coast

Australia’s northwest, the site of most of the nation’s oil and gas output, may have more tropical cyclones than average this season, potentially threatening operations, the bureau said in October. The region may have five to seven cyclones from Nov. 1 to April 30, up from four last year, it said then.Woodside Petroleum Ltd. and Royal Dutch Shell Plc were among oil companies that suspended drilling exploration or appraisal wells in the Browse Basin on Dec. 16 and evacuated workers because of the possibility of a cyclone forming.

Kuwait urges compliance with OPEC cut

Kuwait's oil minister urged fellow OPEC producers to comply with a record oil supply cut agreed by the group to shore up oil prices, the official KUNA news agency late on Friday."There is commitment in general to agreed [production] levels but there is a need to enhance it," Mohammad al-Olaim told KUNA. "Kuwait will be committed to its quota."

The Arab Gulf states will take a double hit from the collapse in oil prices and deep crude output cuts, economists said yesterday.Omani government has drawn up alternative plans in case oil prices continue their slide, Ahmed bin Abdulnabi Macki, minister of national economy and deputy chairman of the Financial Affairs and Energy Resources Council, said on Wednesday.

Kazakhstan increases wheat and fuel oil shipments to Tajikistan this winter

DUSHANBE, Asia-Plus -- Practical implementation of bilateral agreements was a major topic of bilateral talks of Tajik President Tajik President Emomali Rahmon with his Kazakh counterpart, President Nurusultan. They agreed to expand and strengthen integration processes to mitigate effects of the global financial crisis, according to Tajik presidential press service.

3 foreign workers fall victim to Nigeria attacks

LAGOS, Nigeria – A private security official says a Filipino ship captain was killed and two Russians were kidnapped in attacks in Nigeria's troubled oil-producing region.The two Russians were seized by gunmen in speedboats during a pre-dawn raid Saturday in the southern state of Akwa Ibom. The captain of an oil services supply vessel was shot dead during a similar attack in the same state late Friday.

A Crude Reality: Canada's Oil Sands and Pollution

Because the oil in the sands is low grade crude, extracting and refining one barrel of it requires three times as much energy as producing a barrel of conventional oil, and releases three times as much carbon dioxide into the atmosphere. At the same time, side effects of increasing oil extraction, including vast deforestation, also contribute to ever-growing emissions. The area is now the most rapidly increasing source of greenhouse gas emissions in Canada. Furthermore, washing the bitumen to separate the oil and sand wastes over 12.7 billion cubic feet of water per year. This results in both a lack of local water resources and a large amount of water pollution. Reports have also surfaced of deformed fish in the toxic lakes surrounding the extraction area.

Oil sands spell energy security

Any serious approach to national security and energy policies must include a significant reduction on the dependence of oil from hostile countries such as Venezuela and Iran. It should include maximum use of a vast energy resource: Canada’s 174 billion barrels of oil sands. This oil can be recovered with existing technology, but Congress has been too preoccupied with global warming and the emission of greenhouse gases to recognize that it is essential to our national security.

China to support 9 crisis-stricken industries

China plans to initiate a policy package in the coming new year to revive nine industries heavily hurt by the unfolding global financial crisis, the Ministry of Industry and Information Technology (MIIT) vowed at the meeting.The nine industries to receive national support include light industry, textile, steel, non-ferrous metal, automobile, petrochemical, ship-making, electronics and telecommunications.

Kunstler: Change You Won’t Believe

The peak oil story has not been nullified by the scramble to unload every asset for cash — including whomping gobs of oil contracts — during this desperate season of bank liquidation. The main implication of the peak oil story is that we won’t be able to generate the kind of economic growth that defined our way of life for decades because the primary energy resources needed for it will be contracting.

Among the results of the 1873 Panic & Long Depression (lasting until 1896) were the labor movement and religious fundamentalism in the US, modern anti-semitism in Europe, and (according to Hannah Arendt) the origins of totalitarianism.As for transportation networks and pandemic, they were actually connected issues. In 1872, equine influenza took hold in the US, infecting close to 100% of all horses, with a mortality rate ranging from 1-2% to 10%. The ”Great Epizootic of 1872” froze horse-drawn transportation (even leaving the US cavalry on foot), which in turn stalled trains because of the lack of coal transport.

As a preview of peak oil it’s admittedly shallow, but the similarities are there. The damage to transportation and industry in 1872 was a significant multiplier to the financial crisis; a modern collapse of transportation—even if equally temporary—would be potentially even more devastating.

As global markets weather a new period of turmoil and instability, Sachs’ ultimate confidence in the world economy’s abundance will fail to comfort many. Whereas Sachs dismisses concerns about peak oil on the grounds that “[w]e might run out of conventional petroleum in a few decades, but we have centuries left of coal and other nonconventional fossil fuels, such as tar sands and oil shale”—which new technology, of course, will allow us to effectively exploit—there is no shortage of analysis suggesting that limits on natural resources are real and that the consequences are dire. Likewise, there are ample observers of capitalism’s recurrent downturns who will note that the unfettered market is not just limited in its ability to do good, as Sachs would have it. It can also do ill, creating crises—financial and environmental—virulent enough to raise serious doubt about neoliberalism’s sustainability.

Suddenly, a bright light in the bathroom caught my eye. Something was flaring in there. I ran in just in time to see the votive candle forming a column of flame, involved in a chemical reaction with the plastic toothbrush hanging well above it....It was the first, and the worst, of several little candle incidents over the next few days, as we struggled to make sure splattered wax and wayward flames didn’t get the upper hand in our quest for safe light. We weren’t alone in discovering that there’s more to keeping multiple candles going safely for hours at a time than there is to burning a couple for mood lighting. I mentioned our “learning curve” on this to a friend who was also without power, and she replied, “Yes, my son caught his hair on fire leaning over a candle!”

The flaming toothbrush haunts me because of the questions it raises about learning curves.

Saudis biggest donors to Clinton foundation

The foundation promotes efforts to fight disease, poverty and climate change around the world.The disclosures on Thursday include the Kingdom of Saudi Arabia giving 41-million-dollars in donations, and other Middle Eastern governments giving multi-million-dollar contributions.

Methane Leaking Into Arctic Ocean

The carbon pool beneath the Arctic Ocean is leaking. A study on the East Siberian Arctic Shelf found an increase in methane bubbles rising from chimneys on the seafloor in 2008. In fact more than 1,000 measurements registered the highest dissolved methane concentrations ever seen in the summer Arctic Ocean. Methane is a greenhouse gas 20 times more powerful than carbon dioxide.

Global warming 'causing more tropical storms'

Los Angeles - Global warming is increasing the frequency of extremely high clouds in the Earth's tropics that cause severe storms and rainfall, according to a Nasa study released on Friday.The space agency's Jet Propulsion Laboratory (JPL) said a study by its scientists "found a strong correlation between the frequency of these clouds and seasonal variations in the average sea surface temperature of the tropical oceans."

Environment Ohio Warns State Economy Vulnerable to Climate Change

"It's not just about the polar bears and Arctic ice-caps anymore," said Amy Gomberg, Environment Ohio's program director. "Climate change poses threats to Ohio's environment that could have a negative impact on our economy, as well.""Not only could climate change lower the water level in Lake Erie, damaging Ohio's fishing, shipping and tourism industries, but it also could harm Ohio's agriculture and timber industries," she warned.

Advocates for Action on Global Warming Chosen as Obama's Top Science Advisers

President-elect Barack Obama has selected two of the nation's most prominent scientific advocates for a vigorous response to climate change to serve in his administration's top ranks, according to sources, sending the strongest signal yet that he will reverse Bush administration policies on energy and global warming.

"If you could find storage for it, it's a way to get rich real quickly,"

What's the deal here? If I live close to a delivery point (Cushing, OK?). Then can I buy a Jan contract for $33.87 and at the same time sell a Feb Contract for $42.78. Store the crude for a month, then deliver it and make a $8.91 profit per barrel, 26% in a month!?

Right. Take delivery. Store the oil. Deliver the oil you stored. Pay the storage people and the interest on any money you may have borrowed to finance the whole thing. The rest is your profits.

If I had the money and brains: I would rather hoard sulfur to profit wildly the next time its price increases Twentyfold or more in less than a year [see USGS website for details].

Recall that potash in 1914 sold for an inflation-adjusted $15,000/ton. A dire phosphate shortage due to wildly insufficient sulfur and energy for the beneficiation process plus other critical industrial usage--the sky is the limit. My feeble two cents.

The difference is that the oil profit is guaranteed and easy to lock in, assuming you've got the money and can arrange for the storage.

I guess the Jan contract closed on Friday, so too late this time. But for future reference I wonder what the practical considerations are for arranging storage and delivery. For instance for a gold contract I believe if you take delivery of bullion it has to be re-assayed before it is allowed back into the system.

Maybe someone has already gone through this process and can relate their experience of it. At current prices taking delivery of a full contract (1,000 barrels = $33,870) is not prohibitively expensive so long as the storage and transport costs are reasonable. How much does it cost to hire a small oil tanker for a month? Dry shipping rates have dropped through the floor but I don't know about liquid shipping rates.

http://www.nymex.com/CL_spec.aspx:

"Delivery

F.O.B. seller's facility, Cushing, Oklahoma, at any pipeline or storage facility with pipeline access to TEPPCO, Cushing storage, or Equilon Pipeline Co., by in-tank transfer, in-line transfer, book-out, or inter-facility transfer (pumpover).

Complete delivery rules and provisions are detailed in Chapter 200 of the Exchange Rulebook."

-> http://www.nymex.com/rule_main.aspx?pg=63

Oil stocks are at the top of the 5 year range, so it's a no brainer that storage facilities are full:

http://tonto.eia.doe.gov/oog/info/twip/twip.asp

It's the guaranteed profit that is attractive to me, but I guess I would be exposed to margin call risk by shorting the Feb contract. So there's a catch there too.

Moe have you heard of Robert Prechter ? What do you think of his predictions (Grand Super Cycle)?

OK TODers what's up with this?

(they got it very confused in last nite's report and elicited very hot Holdren comments both pro & con )

http://news.yahoo.com/s/ap/20081220/ap_on_el_pr/obama

Please watch Dr. Jane Lubchenkos presentation to House Select Co;

"OCEANS & CLIMATE CHANGE: Dr. Jane Lubchenko"

http://www.youtube.com/watch?v=LG5M-ziD_Q0

What a superb presentation! A real scientist outlining a real scientific description of important aspects of global climate change, and also outlining sensible recommendations for how to address these changes.

Even though the information is disturbingly grim, the willingness to look at reality and then to respond intelligently is encouraging.

We need the education element of the response badly.

Science has been misconstrued as "research to make new and better toys" for too long. People need to understand that science -- and our lives -- will be about conserving enough habitat for us to survive for a few more years or decades, and maybe beyond if we get lucky and blessed along the way.

Methane Leaking Into Arctic Ocean

MSM is not likely to pay much attention to this but it may turn out to be a real harbinger of things to come. It could just be the most important news of the decade. Of the century?

It's the most ominous news since the report of arctic ice melting 30 years ahead of schedule. Looks like even us old farts will live to see AGW predictions realized. (and then some)

That ancient seabed methane is the real old fart. Our contributions (personally and via cattle) may pale in comparison.

Agreed that methane releases from the tundra and seabed may turn out to be the Black Swan that trumps our other concerns.

IMO, we are just marking time until the next repeat of a Storegga or Unimak event:

http://www.semparpac.org/tsunami.jpg

EDIT: Won't be much fun for a city where the tsunami throws/break ups a giant LNG tanker against the docks or rocks.

it's happened before. Though the last time it happened was in the Permian era and is known as the great dieing. Looks like we are playing the remake here, just like the original except that instead of the formation of the Siberian traps dumping carbon into the air as the first part of the ball rolling it's us.

It's Gaia saying "pull my finger".

But, but, but.. I was told that we have nothing to worry about - it's snowing in the Himalaya's for Pete's sake!

But in all seriousness. It's only a matter of time before the the remaining deniers are forced to sing a different, and unfortunately accurate, tune: "Climate change is real, but it's far too late to do anything."

What a disgrace.

Thank god for Leanan's inclusive drumbeats.

Right, and the temperature on Neptune is rising, or some dumb crap like that.

I have no idea where the denialists get this nonsense when 1) there are so few actual data points on the outer planets; 2) they can't understand the spectrum of CO2 nor explain why other planets' weather is predictive of the terrestrial climate.

Neptune has a more eccentric orbit than Earth. In terms of it's solar year of 164.79 years, it is approaching it's perihelion in 2045. In terms of it's solar year, it is now in spring (about April 1st). Solar radiation in > "black body" radiation out, so Neptune is warming up.

The solar radiation is concentrated on the South Pole (Neptune has a severe orbital tilt and "presents" just that end towards the sun near perihelion).

http://www.universetoday.com/2007/09/18/neptunes-south-pole-is-the-warme...

Simple orbital mechanics,

Alan

In reality, we don't know if this is dangerous or not. In absence of certain knowledge though this is like driving along a cliff with the wheels just at the edge.

We often read stories about old people who grew up in the horse and buggy age and now have witnessed space flight, computers, flat screen TVs and such. I often think about how I was born into a world that was still safe and now we have driven the climate to the edge with CO2 emissions, forest clearings, pollution and such.

Words can't express how much this story affects me.

If our species was sane by any reasonable criteria, this story would trump all others.

Gavin and company at realclimate are NOT panicing about this subject. They think the methane releases will not be that large or rapid to be a major threat. That doesn't mean that it isn't yet another incremental increase in greenhouse gases, just that they don't think a runaway process is at all likely.

James Hansen and other scientists have been stressing the probability of tipping points for some time.The methane release in the Arctic could be a tipping point.We don't know but by the time we do it will be too late.

Meanwhile the naysayers relish their moment in the spotlight.The Yale Forum article linked by Leanan has some interesting comments on this phenomenen.

Any idea how much? If it's a small amount it will dissolve in the sea before reaching the atmosphere.

We need a measure of quantity -- I suggest MCE (Million Cow Equivalents).

Well, it's been another cruel week for us investors in the energy

markets. This after hearing Simmons and Hirsch on Financial Sense

last week talk about how dire things will be in the future and how the

current oil price is out of all proportion to the reality out

there. But maybe they really are missing the demand destruction. They

claim it's small but I'm becoming less convinced of that.

I've been invested in energy and precious metals every since

discovering peal oil in 2005 after picking up the Long Emergency in an

a book store quite by chance. Things went well until this fall. I

never expected to make a fortune but I did sign on to the notion that

energy was more likely to hold its value that fiat money. Right now

that's not the way its working out. I own a variety of oil and gas

trusts which pay good dividends and mutual funds such as Fidelity

Select Energy. So how am I feeling now? Not so great; basically I'm

down about 70% since the summer and maybe down 40-50% from my original

purchase prices. Thankfully I have some gold (but I also have a lot of

gold stocks that have been beaten up)

I'm not ready to retire yet, but this is basically my retirement

fund. It's not the first time I've made the mistake of not protecting

capital - did it in the dot.com crash - but you know how it goes. At

first it looks like a correction and they happen, so you don't sell.

Then it drops some more but now you can't sell because you are sure

it's a bottom and so on. Maybe we are close to done now but I wouldn't

be suprised to see oil hit $10 the way things seem to be going.

The sick thing is just how much money you could have made if you had

made the right calls. We are not talking a few percent here, we are

talking major multiples. I realised this after reading the comment a

few weeks ago about how the double-short oil fund DTO was up 270%. It

was at around $100 at that point. I checked just now and it's up to

$140, so I guess it's over 300% total gain now. I'll admit that until

then I didn't even know such a vehicle existed.

Think about it. You cashed out somewhere close to the peak (and, yes, I did

briefly consider selling my USO partly because I know it's fundamentally

flawed by contango) and then went short via DTO. Instead of having your assets

reduced to 1/3, you multiplied them by 3 so, rounding up, you just got a

ten-bagger. I'm guessing some of the savvy people posting here have made a

killing in the past few months doing just that.

Oh, and now you can cash out and buy all those solid assets back for a

song and maybe double or triple your money again.

Maybe I'll get it right next time. Oh, I forgot, we're so screwed

there won't be a next time.

Go to the energybulletin.net today and read the article about oil pricing. No one has a clue; so even if some people got it right I think they just got lucky. After all, this is basically just a binary decision.

Regardless, I wouldn't bet the farm and certainly wouldn't have all my bags in any one basket, including oil. But if you have the time, I have to believe this oil market will recover within the next few years and, when it does, it will be with a vengeance. We were in an upward mania before and now it has reversed. Mania is a feature of this market and it will return on the upside.

Dibs for despair! (It beats the alternative)

I think oil will get cheaper and cheaper until the gas stations and KSA etc have to pay people to take it away. That's what I'm waiting for. That's when I step into the oil market (no initial investment needed) and get paid big bucks to carry off some unneeded oil. But until that wonderful day comes I'm not getting involved in oil markets---too volatile and probably will become more so.

At about $5.00 there isn't much risk on the downside and a lot of potential on the upside. Of course $0.00 is better but not likely.

Pricing theories assume Calculating Buyer/Calculating Seller.

But there's really a quadrant of pricing situations, and a different equilibrium price will be reached in each case:

1. Calculating Buyer/Calculating Seller.

2. Calculating Buyer/Desperate Seller.

3. Desperate Buyer/Calculating Seller.

4. Desperate Buyer/Desperate Seller.

With oil at $150, we were in the Desperate Buyer/Calculating Seller quadrant. Currently we are in the Calculating Buyer/Desperate Seller quadrant. At the end times, "when the Vikings are at the gate" as my economics professor used to phrase it, it'll be Desperate Buyer/Desperate Seller, i.e. totally unpredictable Mad Max territory.

Yes, I've done worse than you for the same reasons. Trying to time a system this complex, even to work out the sequence of events in advance, is tough if not impossible.

Far as guessing goes, then, my guess is that things will be volatile, not stable. Holding some funds in cash, while also putting 5-10% of assets into long out-of-the-money crude and gold calls, appeals to me.

I know this site is NOT for investment purposes; it's so much more useful than that. But...I wonder if it means anything that the DTO (double short)10 day average volume is only 300k shares per day and the DXO (double long) average volume is 20 million. Just seems like a huge difference. Might explain some of the volitility at least in these specific etf's.

Guess it makes no nevermind. I am going to get back to what I was doing...hording the sweet god send that are candy canes by the truckload in the attic in case this is the last year I can get them.

Learn trading signals. They're very easy to use--the only difficulty is in having the discipline to use them. You can get by with a single book: Timing Techniques for Commodities Futures Markets, by Colin Alexander. Open an account at Optionsxpress.com and use the Flexcharts. If you want to get really expert at trading, I can recommend some more books.

We did get a glimmer of a possible trend reversal on Friday. It could peter out, we'll see. It's not a buy signal in and of itself.

If this is for your retirement, and you've been hanging on since much higher prices, I would not sell now.

If you've just bought, be sure you know how to set stops, or are prepared to ride out significant fluctuations.

There is no big mystery to trading. I personally know some real idiots who are very successful at it. I'd estimate it takes about 1/10th the skill of poker. Again, the difficulty for most people is that it requires you to overcome risk aversion tendencies that are hard-wired in your brain.

Moe_Gamble:

re Timing Techniques for Commodities Futures Markets, by Colin Alexander

A fool and his money are easily parted. There are hundreds, if not thousands, of books on 'timing techniques', all offering mutually incompatible tips and tricks on how to get rich quick.

If their authors had been smart enough to work out these techniques, they wouldn't have had to write books about them.

sounds like you are my long lost twin

i had very similar reasoning and took similar actions - except i bought gold and silver only

(not the companies, just the metal ETFs) as oil was too expensive (i thought) back in 2005. I still have the glod, but i have cut down significantly on the silver. I realized the silver bugs are eternally waiting for another Hunt bros incident.

and they will wait forever

however, not to be outdone, as i also listened to Simmons and Hirsch (becuase i like to invest till it hurts) i discovered the oil 200% up ETF UCO and bought in in the mid 40's. bought in a lot

so now i am hurting, and waiting, and saying "never again"

i guess i am just a typical small investor - i think i am smart, well informed, rational. which means i am the perfect lemming

While out hiking toady I was listening, as I usually do, to Financial Sense Online. The guest expert session with Danielle Park was very interesting, although eerily familiar to Irrational Exuberance in 2000, in the sense that I wished I had read the book or heard the talk before the crash. Danielle basically doesn't believe in buy and hold. Essentially, in her view, if you don't have a rule as to when to sell, you make no progress because you lose all the gains you made on the upside on the downside.

It is certainly impossible to time the market but there are clear enough signals that it's time to sell. Part of this is not being greedy and I think that's my problem. I don't sell because I'm hoping for more. Related to this, it's the case that whenever I have put in stops they have always hit, usually due to some local volatility and I ended up selling at a local minimum, when I didn't really want to. I think options to sell at a given price are a better idea. Sure, you pay the insurance whether you win or lose, but it's a small price for peace of mind to lock in gains. This year everyone should have sold USO at $115. It was clearly parabolic and the probability was much closer to 1 than 0 that it would fall from there. Ditto my favorite US oil trust, SBR, which hit $70, after trading in the $35-$45 range for as long as I have owned it. I didn't of course.

As many posters have said, most of these stocks will probably rebound, that is if we have an industrial economy going forward. But as Danielle said, I've now probably got a several year wait to get back to where I was, and retirement (and possible job loss) is getting closer all the time. Ironically I could have made enough on DTO this quarter to retire next year!

The hike, buy the way, was from Sunol Regional Park in the SF Bay Area to Mount Rose, 3800', 10 miles each way. Snow still lying above 3500' from this week's unusually cold storm. Such a trip always puts things in perspective. The natural world is a beautiful place.

I always wondered how it would feel to find my Doppelgänger - maybe it proves that misery loves company! Our stock investing experience is identical.

I'm down over 50% on commodities and alternate energy. However, right or wrong, I'm not going to sell at this time. My guess is that there will be a general economy recovery of sorts that will restore prices in these sectors to a fair degree. However, it also seems likely that our collective failure to make fundamental changes in energy and climate policies-behavior will keep this recovery short lived and ultimately result in another crash - maybe worse than this one.

Then the big question is how to recognize a reasonable point to gracefully exit some of our more vunerable positions. And further, what to do with any cash we raise? Holding cash may be just as dumb as hanging onto oil stocks that were taking a nose dive. Buying cases of pork and beans only makes sense if we eat them before the expiration date. And, I don't really like pork and beans.

The old concept of ‘stored value’ lent out at very low or reasonable interest, expected to return steady revenue, is dead.

Instead security is sought by playing the markets and the players get peeled, the whole ‘market’ is designed, in a way, just for that purpose. To pull in the punters. Even Madoff comes to a bad end.

The slickest and smartest and most pointedly the well-connected can continue to reap the last drops of the squeezed-out lemon.

Speculation, betting in the casino, Ponzi schemes and other frauds of the most primitive type, are part of the actions that led to the present problems in the first place. We now see that speculation in commodities was a reaction to a downturn of a massive type.

No moral point, or condemnation, one has to be pragmatic.

But on a grander scale - for the good of all. ;)

I love the two articles about canadian oil sands back to back, the first pointing out its obvious harmful environmental effects and the second fabricating it's virtue as a means to "security."

I listened to Matt Simmons and Bob Hirsch on Puplava last week. Simmons was nothing if not obnoxiously defensive. Hirsch was calm and reasonable. Simmons has lost it. He has become something of a laughing stock and I think he knows his credibility is gone. The previous depression was not caused by a lack of cheap energy. Oil was plentiful and inexpensive. While lower energy cost will help everyone but the oil producers save money, it's a reach to think that the stimulus is great enough to compensate for the credit bubble unwind we're presently enduring.

Simmons didn't have enough sense to hedge his predictions with a caveat that a crashing financial system could reduce demand enough to cause prices to fall dramatically. He's always seemed to me the kind of fellow who's not going to let facts get in the way of his opinions. So here he is in a basket with the likes of Jim Kunstler. Two peas in a pod.

All we really know right now is that we emphatically don't know how long this current financial mess will play out. If it does resolve and economic growth resumes it's really hard to see the financial authorities pulling the punch bowl away just as some semblance of economic trust is restored. The energy price volatility will make oil companies very nervous about investment. Economic growth will be accompanied by increased energy use and we'll soon enough run right into the inelastic brick wall of supply. Looks like a roller coaster ride.

In the meantime we have not dealt with a primary issue. The alchemy that turned "uncertainty" into "risk" and then allowed a rather simple Gaussian derived probability curve to substitute for mark to market pricing is still very much alive and well. The failure of LTCM should have brought with it SEC rules to eliminate this particular Ponzi scheme. Instead we have the sequel ten years on. And it looks, like Godfather II, to be a doozy. Comes down to computers. Computers model risk with facility. The incentive to treat uncertainty as risk is just too great, I fear.

The primary problem is that a financial system is comprised of the collective actions of individuals who use their knowledge of how the system is modelled to make financial decisions. This induces feedback and dramatically "unmodels" the system behavior. This changes risk right back to uncertainty. Panic ensues, faith is lost and everything goes bonkers. Computers have allowed us to gloss over this uncertainty with the arcane ministrations of quants straight out of physics grad school. These are wet behind the ears kids who don't know diddle about human psychology and would laugh in derision if someone suggested that we are a herd animal subject to fits of greed and panic.

LOL ! Derision can be evoked many ways.

I recently graduated from a community college trade program. I am as old/older than the instructors - who had much derision heaped on them by the majority, which were 20-somethings. The herd dynamics was also evident is other ways specific to the learning environment.

Careful,RBM.These are the cohort who will,in the not too distant future,be wandering around the countryside trying to scare up a feed.Then they will have a really big chip on their shoulders about the older generations.

Two choices for us oldies - get knee pads to relieve the discomfort of adopting the kneeling position or get rifle for some urgent population control.

"Simmons has lost it. He has become something of a laughing stock and I think he knows his credibility is gone."

well, if you feel that way, you should probably short crude oil and all the oil companies from xom to tag oil inc.

The show isn't over, LJR, Simmons could still be correct on many of his calls. And if he is sounding less calm than Hirsch, I for one can't really fault him. He gives speech after speech pointing out that we have a real problem and yet...nothing happens. Mostly he probably hears, "Why that's very interesting. Did you like the lunch that was served today?" which is one response I got at a Rotary Club meeting.

From personal experience, it is no fun at all being the bearer of this particular news. It mostly just bounces off of people and that can be really frustrating after a while.

I'm pretty sure, this unprecedented plunge in oil prices from a 145$ level to a mere 33$ WITHIN 4 MONTHS has been initiated/managed by Government bodies. They knew, that a crude price over 100$ would be the last nail in the coffin of the economy, besides the financial crisis anyway.

They started the manipulation with the "bubble" stories, which one could read repeatedly in practical all medias.

Remember: The US is going the way towards socialism.

Tuesday President George W. Bush made a remarkable admission. He told CNN television, “I’ve abandoned free market principles to save the free market system.”

Then the FED refuses to disclose the recipients of this 2 Trillion $ transfers.

This manipulated plunge in the price of crude was a requirement in order to initiate all those bailouts, and stimulous programs, at the end of the day it is printing money out of thin air anyway. Without the plunge in oil prices and commodities i.g., this mission had been impossible because of immidiate threat of Hyperinflation. Now, they have bought some time.

If the above thesis should be wrong, then I would expect in 2009:

- an completely imploding economy worldwide

- world trade comes to a absolut standstill

- we can expect a tsunami wiping out the prosperity of the world

Well, these are my 2 "explanations" reg. the oil price collapse.

If you are not an oil trader, it helps to take a longer term view. US annual spot prices through 2007 are shown below. The 2008 average will be right around $100, and the futures market is currently forecasting an average price of about $50 for 2009.

One thing, westexas. Futures markets aren't really designed to predict future prices. They're designed to distribute price risk.

IMO you are partly correct, but the collapse in demand has been huge-their manipulations wouldn't have succeeded without the global slowdown.

"Collapse in Demand has been huge"---That is very likely. Anecdotally I offer an article from Asahi Shinbun two days ago: "No More Construction Noise in Tokyo". Many projects (condos, office space) have been stopped without being completed, because demand for space collapsed, companies won't put in more money. "Like a NIGHTMARE" says the article. The implications are HUGE: unemployment (lots of single men now sleeping in parks), taxes (big cities can't generate revenue from new buildings), banks seeing bad loans, etc.

I get the feeling that the end of the bubble era (1990) was nothing like this here. Toyota and Honda will report a loss this quarter. Domestic and national car sales are forecast to plunge again in 2009. People are looking at the Big 3 over in the US and shuddering.

Ther is a sense of fear here like I've never seen. The things people thought they could count on (building condos, making cars) are going away and what is left?

The collapse in demand is smoke and mirrors.

Look at your own energy consumption.

Even after I lost my job, I didn't stop needing heat, gas, products made from oil.

I may have lost the means to replenish how I pay for it all and I'm now running on my savings but my energy foot print has not stopped in its tracks.

Look at the difference between the fall in demand in the U.S. for gasoline over the past few months (a little over a percent) and the fall in demand in the U.S. for diesel over the past few months (something like 6%).

You're correct that there hasn't been that much of a drop in consumer demand for gasoline and heating oil, but there's been a sharp drop in demand for shipping plastic stuff from China, making plastic dashboard components for automobiles, etc.

Rather, look at this file from the Energy Information Administration

http://www.eia.doe.gov/emeu/ipsr/t17.xls

OECD demand dropped a whopping 4 million barrels/day between November 2007 (start of US recession) and August 2008, out of which 1.2 mb/d from July 2008 to August 2008. That's why oil prices did not go up when the BTC pipeline was attacked and the war in Georgia broke out.

What you are describing is subsistence. You are spending just enough to get by. That is quite different from optimistic investment where people think they can make money by erecting a new office building, condo, shopping mall, etc.

The way the credit freeze has stopped so much construction and other economic activity is beyond breathtaking.

It seems to me that the Rotarians, the Kiwanis Club-ians, and so forth are organizations for BAU folks to hob-nob and conduct business networking...pressing the flesh, greasing the skids of (again) BAU.

The mental orientation of these herds does not seem conducive at all to messages beyond the bubble/fence line of BAU/conventional 'wisdom'.

I have had the ill fortune to be regaled with stories from my superiors of 'laying the foundation for deals' in these kinds of gatherings...anything to grease some contract bucks from federal, state, and local politicians, as well as from small businesses fronting to gain small business contracts by partnering with huge, front-line defense contractors.

9-11 has been an unconstrained boon for defense contractors...anything they have to shuck in the name of 'Homeland Defense' (or any other defense) gets the bucks, few questions asked.

Question: How many defense contractors are in the news asking for bailouts? Answer: None, they have perfected the art of being on the government dole for decades.

It is really sad when America doesn't make anything anymore, except for defense 'goods'. Then again, a huge part of defense contracts are for 'services', which means that Uncle Sam pays a crap load of money for retied military officers to write reports and make PowerPoint briefings that get read a few times then consigned to the trash heap of history. Joe taxpayer doesn't ever even get to read 99% of this drivel because it is not for open distribution. So much for transparent government.

The mega-churches are another 'Cheyenne Social Club' for these deals to get greased. Same with the Chambers of Commerce.

It seems to me that the tribes roaming these preserves are highly resistant to any messages of scientific reality...owners of Priuses are mocked as 'fags'...people who espouse conservation are 'socialists', and anyone questioning any aspect of our war machine is branded as a 'terrorist'.

I think we need a no-kidding depression to wake these people up.

Except that these folks tend to be heavily armed and have big chips on their shoulders.

Wonder what it would be like for massive layoffs in the defense industry?

See the movie 'Falling Down'.

I wish I could offer a brighter outlook during this holiday season.

I don't buy the "demand is falling" bull.

Oil's price manipulation has nothing to do with supply and demand.

My condo furnace is still heating my condo the same as it has since the late forties. (I like living in buildings older than I am. [But the insulation is definitely not 'state-of-the-art"])

My need for heat is not decreasing in the least, (The but bill for it has been going up and down and is giving the entire board the extreme jitters. [Fuel is our biggest cost by a large margin.])

Jersey City is saturated as far as car traffic goes. Every parking spot for blocks around is filled. (The financial meltdown has not altered the commuting patterns in the least. If you have a job you still go to it. [But its now costing less than last summer{, for now.}])

The alleged percentages in consumption reduction are vanishingly small.

BUT the alleged feeling that we had been manipulated (read "had our wallets raped by the terminally greedy") is making far more of an impression on us than the vertiginous price drops.

I think that we have reached a watershed moment in the history of energy consumption.

We will push forward with alternative energy as a safety measure (a salve for our battered pockets) to get us the hell off the oil treadmill.

That it is good for the environment, for the species, for our energy independence as a nation, is fine and dandy but merely incidental.

People who have never even heard of "peak oil" (and that's the majority of the population [despite our years of screaming in the wilderness,]) are wanting to get off any energy treadmill and most every grid because "they just don't feel right."

The meltdown in the financial sector is just adding to the perceived malaise.

Since Joe Public can't run a bank, he can change his buying pattern and his consumption pattern. (Look for opportunities in localization and energy efficiency, in both products and services.)

What we have to do is exactly what we've been doing (creating an infrastructure for alternate energy,) and hope the public's malaise at living in "Hummer World" lasts long enough for them to "buy a Prius." (Sadly, the bankrupt American car makers may not have woken up in time.)

Once they have "bought the Prius", (Once they are left with a durable good which is a major expense but which doesn't require major expenditure to keep it operating,) we may look forward to breathing a sigh of relief(, and not coughing up a lungfull of phlegm when we do.)

Personally I think Simmons is very brilliant, which is why he's made many millions over decades doing investment banking for the energy biz.

And I think anyone laughing at Simmons right now is either in high school or has a low IQ.

In addition, the markets sure don't share the view that Simmons is a laughing stock. The premiums speculators are getting for shorting future months are incredibly high--which means producers think Simmons is right. The market is saying that the people who know the most about energy market fundamentals don't want the price risk of selling future months at these prices. In fact, they are largely passing up the chance to lock in profits of over 11%. That's a strong bet on Simmons.

Matt Simmons' slide shows are here:

http://www.simmonsco-intl.com/research.aspx?Type=msspeeches

The latest presentation:

Houston Energy Institute, December 10, 2008

The Risk Of Misjudging Peak Oil: A Real Physical Crisis

http://www.simmonsco-intl.com/files/Houston%20Energy%20Institute.pdf

This is one the great ironies. I work for a computer company that sold a lot of hardware to Wall St (and is now suffering as that market has tanked). It's clear to me that Wall St wouldn't be in the mess it is without high-speed computers to run all these crazy derivative algorithms.

For that reason, those of you who were planning to post gaudy Christmas photos should do it this weekend. Post them today or tomorrow, not Christmas Eve as originally planned.

Thanks for the reminder "public service announcement," Leanan.

Pretty color, too!

You're making him work on Christmas day?

That's it. You will be visited by three oil drum postings. Expect the first one at 01:00:00.0000+local_variation GMT.

The rest of you enjoy a hearty plum pudding and an extra lump of clean coal technology generated electricity.

Just log on all the earlier the next morning.

:>

Jon.

Although I am unimpressed with Obama's selection of (spineless) Sen. Ken Salazar (D-Colo.)for Interior Secretary, who was welcomed by industry groups reassured by his support for expanded offshore drilling, Obama's appointment of Dr. Jane Lubchenco for NOAA is a sea change. Her predecessor under Bush, retired Navy Vice Admiral Conrad C. Lautenbacher, served as the administrator for NOAA until his resignation on October 31, 2008. He was noted for denying the impact of Climate Change in 2002 and blocking any substantive action within NOAA...

Dr. Lubchenco's Aldo Leopold Leadership program (in operation for eight years) supports and encourages scientists taking an advocacy role in public debate regarding climate change and environmental issues. Attached is a speech given last year which lays out her philosophy:

http://osulibrary.oregonstate.edu/specialcollections/events/2007paulingc...

Dr. Jane's observation:

Current reality: "Obama buys the biofuel hype" (from today's links above).

Next year:

"Last Gasps of Federal Dinosaurs Crush, Kill, Destroy Profoundly Local Microfauna - Newz @ 11:00:"

Severed cable disrupts net access - AGAIN!

The WEB protocol TCP/IP is designed to be resilient, but it seems only if it is relatively lightly used. Being 'efficient' and running the system close to capacity can result in some economically serious failure modes.

http://news.bbc.co.uk/1/hi/technology/7792688.stm

That sounds very bad. Don't think you can really criticise the resilience though if you've lost 75% of your cables normally carrying 90% of traffic and Internet connectivity is still available - if degraded.

Anyone seen the USS Jimmy Carter recently? ;-)

Perhaps the CS Mao Zedong has not been seen near home waters.

that last line will break, you can bet on it. question then becomes what will happen during the blackout in the middle east as those communication lines are down.

The lack of resiliency can arguably be attributed to business practices. The underlying internet protocol (IP) is astoundingly resilient if the network lacks centralized choke-points. As in many complex systems, redundancy leads to robustness. Failure of single cable ought not to seriously affect the system. Ask your self, how many redundant, high capacity links exist between Europe an India? Is the traffic free to flow over those other links or is it constrained by business practices?

Now, consider what will happen if you reduce the redundancy in financial markets, or in the oil industry, or in an ecosystem. Everything looks fine until the predictably unpredictable happens (in a statistical sense) and the system collapses.

Sadly, redundancy in artificial systems is expensive and there is a financial incentive to eliminate it. Few pay attention to the increased risk of system collapse that arises from such optimizations.

I figure you Peak Oil types would like this essay, called Life Without Cars.

http://www.newworldeconomics.com/archives/2008/122108.html

I liked the photos in the essay and also the lighthearted fun style. However, Harajuku in Tokyo has a few popular narrow streets (Yamashita Dori is the most famous)but it borders on a huge boulevard packed with cars and Tokyo itself is generally a "hypertrophic city" filled with "supergigantic buildings" and there are even some ugly expressways, although OK they're not as big as the ones in the US.

A lot of the picturesque villages here are just for tourists. People would never think of living in one. Everyone likes to live with driveways and parking garages. So convenient! Until it's NOT!

"Everyone likes to live with driveways and parking garages."

Ah, yes indeed. And in residential areas where there's room for individual driveways you find parking lifts for stuffing two cars into one cramped driveway. (Car lifts are not limited to parking structures.)

I saw quite a few residential lifts in Chibaminato. And IIRC, in some areas, to register a car, you must prove you have a place to park it.

Japan is one of those places, like England or Holland, that, despite having rural areas, seems as if it's at risk of sinking into the sea from the sheer weight of population...

Tokyo is tending toward a hypertrophic city but it is mostly a traditional city for now. There are many, many small streets in Harajuku. Takeshita Dori is the most famous.

I think the only small villages you have been to are the ones that are popular with tourists. There are many, many small villages in Japan.

It's nice to find someone out there who hates cars as much as I do. Thank you.

An invasion from outer space couldn't be as destructive as automobiles and hamburgers.

Imagine if California had led a round of offshore lease sales before oil fell in price, in preparation for extensive offshore drilling? The problem that now faces the country is that we have lost, imo, the right to our ideals. We're going broke, and printing the money to pay for the next round of investment is going to become a serious problem and not in the distant future.

US states need to monetize oil and gas. Full stop. As I have written previously, California could devote nearly all of its royalties from new offshore drilling to build out commuter rail, light rail, and then high speed rail--in that order.

Let's examine California's framing of current problems: refuses to monetize offshore oil and gas while at the same time repeatedly monetizes the future labor of California residents and future children via expansion of its debt. Continues like the rest of the country to invest in automobile infrastructure. Places a ridiculous plan for ultra-expensive high-speed rail on the ballot, instead of first going to the highest impact transport solutions of commuter rail and light rail. Never revisits its property tax laws from decades ago. Has few to none Toll Roads, and subsidizes car drivers every which way.

California reflects where the country is. Still in denial about the car, and offshore drilling, and "where the money comes from."

I want to see the major US environmental groups advocate for offshore drilling as a way of raising the revenue needed to build out transport to devalue the car. Will never happen. But I would ask, why not?

Fact: there is no way the US can ever pay off its aggregate public and private debt now without further monetization of natural resources. Our GDP is not high enough. We are already monetizing the debt through printing. I am a huge advocate of a collapse in Defense Spending. But even a collapse of Defense Spending combined with our GDP from BAU will no longer be enough to even service our debt let along pay it down. The "things" we need, like the truly effective infrastructure that will reduce energy consumption will cost money. Printing it into existence while refusing to monetize natural resources is crazy. I don't wish to succumb to and either/or framing in this regard, but I don't see any way out.

Meanwhile, Obama leans towards the cement and asphalt weighted plans that surround a "roads and bridges" fiscal stimulus plan, and introduces his new Aggie Secty pick as a "guy who understands that energy solutions for the country come from the farmlands." Oy vey.

G

Great post as always, gregor. But, since I don't expect the government to get it right, I think it's better to print the money than not print it at this point, and build the roads and bridges, etc. even though I agree the things they are monetizing are wrong.

At this point, I'd vote to pay people to dig ditches and then fill them in again (which is about the equivalent of making ethanol). At least then you have a prayer of bottom-up solutions to the whole mess.

Rarely have I seen an expression of opinions on a host of subjects that is so close to my own. I didn't know I had a long last clone! So I'm sure Gregor has discovered how unpopular someone who opposes, highspeed rail, and supports more drilling, funds to be used for the transition to the postoil era. It's kind of like the viscious attacks from climate skeptics remarked about in one of Leeann's other Drumbeat stories today.

California has some structural problems. Actually just a few words on a piece of paper, but the unwriting of them is verboten. The first of these is the whole election proposition process. This leads towards government by the lowest common denominator, with many voters not even knowing about many propositions until they enter the voting both. Sexy sounding things, like high speed rail, which require numeracy to recognize as having costs far in excess of benefits can sail right through. Secondly, the state constitution requires a 66% majority to raise taxes of any sort, which means it is a long term near impossibility to raise taxes ever, leaving the state with a longstanding, and increasingly dire budget situation.

California already has very high taxes and a particularly wasteful and venal government. It is not clear that raising tax rates in the state would result in higher long term revenues. The people who earn high incomes and provide jobs and tax revenues are fleeing the state, while welfare clients and illegal aliens that use lots of health, eduction and welfare services are moving in. Welcome to the doomed state. No future/ only a past.

Most taxes in California are not that high. Marginal tax rates are somewhat high. The thing about taxes is that they are invested in the commons which are used by everyone and contribute to economic activity. Sure, some taxes are spent inefficiently. Other taxes have built the freeway system, BART, a huge system of world class universities, and on and on.

There was an article in the Chronicle last week which said that due to low taxes someplace like North Dakota was the friendliest state in the US to small businesses. I almost fell out of my chair laughing. Businesses want the benefits of society without paying for them. No slam on North Dakota but if it were such a wonderful nurturer of small businesses we'd see a huge blossoming of businesses there instead of the reality which is a dwindling population. Something like 90% of VC money is spent in Silicon Valley. I guess they somehow manage to look past the "high taxes".

Businesses profited hugely with property tax cuts under Prop 13. These tax cuts should be rolled back. Businesses should pay their fair share to support the commons.

Hello TODers,

We have had weekend weblinks detailing banks going broke. Will we soon have lots of weblinks pronouncing countries going belly-up?

http://news.yahoo.com/s/nm/20081220/bs_nm/us_financial

---------------------

Japan stumps up more cash, Belgian govt falls

-----------------------

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Well, the Belgian govt falls on a regular basis, as the Italian one does. No really news actually.

Maybe a website along the lines of f***ed-company.com, the Y2K era site documenting the end of the tech bubble. Or ml-implode.com now.

country-fu.cx

Some like "Zimbabwe" should fall.

Mugabe should be taken out the back and shown his people's high regard in the same way that Nicolae Ceauşescu was shown.

As some of you may recall, one week ago, we installed a second ductless heat pump to heat and cool our basement level and I wanted to share our initial impressions. As previously mentioned, it's amazingly quiet, even on its highest fan settings and in "quiet mode", the only way you can tell it's working is by sticking your hand in front of the grill. Secondly, this past week has been fairly chilly, with temperatures running between -5C and -15C (5F to 23F) and it has had no problem keeping this lower level at a steady 21C.

I have this unit plugged into a watt meter and it's interesting to see how power usage rises and falls in response to changes in set and outdoor temperature. For example, when it's -3C outside, it typically draws 400 to 500-watts; at -10C, power requirements creep into the range of 800-watts and at -15C they climb to 1,100-watts as the compressor ramps up in response to the increased heating load (peak draw appears to be about 1,450-watts). Over the past six days, it has used just under 85 kWh or an average of 14 kWh/day. To put this into context, this lower level is roughly 900 sq. ft. in size and the concrete floor is un-insulated and partly slab on grade construction so, consequently, our heat loss is a little higher than normal. There's also 80 sq. ft. of north facing glass and an open stairwell that allows a fair amount of heat to escape to the main floor (the latter is not unwelcome).

In terms of operating costs, we're currently running in the range of $1.50 per day (i.e., 14.1 kWh/day x $0.1067/kWh). In rough terms, we're likely displacing about 4.0 litres of fuel oil per day which, based on the cost of our last fill-up, represents a net savings of $2.40/day. Although the dollar savings are not insignificant, this wasn't our primary motivation. When we heated this lower level with oil, I was reluctant to raise the thermostat beyond 13C/55F unless we had company and, now, we keep this space at a constant 21C/70F. We're a whole lot more comfortable and we're still saving some $70.00 a month on our home heating costs.

Cheers,

Paul

I too love my ductless heat pump. I wish I had sized it larger, but that's my fault and not the fault of the manufacturer or the technology.

Hi André,

This Sanyo has a nominal heating capacity of 4.2 kW / 14,300 BTU/hr so, technically speaking, it's also undersized for our local climate and sq. footage, but you would be hard pressed to tell that from its performance thus far. Over the past 24 hours, our outdoor temperature has averaged -12.6C/9F and whereas my older Friedrich has been at times rather sluggish, this little guy shows no signs of slowing down. I really couldn't be more pleased.

BTW, the following chart shows our annual fuel oil consumption, in litres, since we bought this home in 2002 (the '01/02 numbers are for the previous owners). The initial drop in '02/03 is related to the work we did to improve the thermal performance of the outer shell, as well as the installation of the new boiler, indirect water heater and Tekmar control. The second major drop in '05/06 corresponds to the addition of our first ductless heat pump.

Now, with the small 1.5 kW water heater pre-heating our DHW and this second ductless unit, I'm hoping we can get our fuel oil consumption under the 500L mark, which would put it at less than one-tenth our initial baseline.

Cheers,

Paul

Paul,

Do you have any experience with heat pump water heaters ?

I just stumbled on them and I know it wasn't covered in my program.

Hi Robert,

I don't have any first hand experience, but I've been following this market for sometime now. There are currently few products in North America suitable for residential use; however, this GE drop in replacement, scheduled for release Q4-09 looks promising:

http://www.geconsumerproducts.com/pressroom/press_releases/appliances/en...

Cheers,

Paul

Thanks for the link ! Promising for sure !

Heat pump water heaters underwent a large pilot program here in California by the military, I believe, but they failed miserably because they kept breaking down. I suspect that there was nothing wrong that high-quality manufacturers wouldn't have eventually sorted out. But the interest was lost by the sponsors of the program and they didn't stick with it.

Meanwhile, one manufacturer claims to have sold 35,000 heat pump water heaters despite the rocky start for this segment of the industry:

http://www.aers.com/etech_residential_water_heating.html

Hallowell told me a year ago that they were coming up with a residential water heater and it seems to be available now:

http://www.gotohallowell.com/waterheater.html

Here is the page describing heat pump water heaters at the Dept. of Energy:

http://apps1.eere.energy.gov/consumer/your_home/water_heating/index.cfm/...

And here is a comparison of life cycle costs for various ways to heat water; heat pump water heaters are the least expensive in this table:

http://www.aceee.org/consumerguide/waterheating.htm

Thanks aangel !

I went straight to the life cycle page and it's a real eye opener. I can believe there's a tremendous amount of lost energy in old systems.

As much as I would like to recommend HPWHs, I don't consider the current NA offerings to be commercially viable; until we have someone like GE throw in their hat, it's just too risky.

For additional background, see:

http://www.cee1.org/eval/db_pdf/277.pdf

http://www.swinter.com/services/documents/1_4_1_CLP_HPWH.pdf

http://www.ornl.gov/~webworks/cppr/y2001/rpt/120429.pdf

Cheers,

Paul

The data in the last paper looks promising...quite possibly they got the bugs worked out by now since that was back in 2004. Higher reliability than I expected, actually. And the problems were mostly with the electronics and temperature sensors; the compressors etc. were quite robust.

that was in the 2001 units and QA progress seem to be evident.

What is wrong the a national testing lab has it's test loops malfunction ? (low water pressure)

A larger issue, much more that nitpicking IMVHO, concerns unit 2.

Original symptom was HPCO tripping. Workaround was remove 3 oz from system. Hypothesis was malfunction due to blockage. After tests "Destructive

examination" revealed no blockages.

Conclusion:

Implicit in that conclusion is an ASSUMPTION ---- actual factory charge of 18 oz was installed.

In the program I just finished it was drummed into our heads, sometimes multiple times in an hour, sometimes by more than one instructor in a single day -

NEVER, EVER, ASSUME.

Then, there was the second instance with the qualifier 'likely' used regarding the overload.

My education prepared me for field work and the bar was set accordingly.

This is National Testing agency ?

One other possibility exists - the short comings are all in the written report and the actual testing was of the utmost rigorousness.

Even then ... SHEESH !

Hi Robert,

Your point regarding assumptions is well taken, but I think the larger problem is that this technology hasn't fully matured as yet. Builders and professional contractors can install just about any conventional electric or gas water heater and be assured of predictable, trouble-free service, with few or no customer call backs; we simply haven't reached that point with HPWHs, although I'm hoping this forthcoming GE product might take us there.

Afterall, operating costs half that of a standard electric unit and air conditioning and dehumidification thrown in at no charge -- what's not to love?

Cheers,

Paul

I agree with the 'not there yet' opinion. So how do we accomplish that ? With ineffective testing/reporting on the products. Leave it to the manufacturer's QA department ?

Yup, it is crucial to understand most companies will not tempt callbacks and unhappy customers. More true, the higher the cost of energy.

Paul,

I would think that in equilibrium (i.e. if your basement had been at the same temperature for a long time) that the uninsulated floor would be neither a source nor sink of heat. Unless of course, there is a crawl spce underneath, which might be done for access to plumbing or whatever. Since you used to have the basement cooloer, you are probably still heating up the ground immediately beneath your feet, but this transient should decay to zero over time.

Hi EoS,

Unfortunately, there’s a good amount of heat lost through this basement floor, in particular, along the north face which is basically slab on grade.

When we renovated this space back in the fall of 2002, there was no cost effective way to insulate this floor, so we opted for a DRIcore sub-floor instead (see: http://www.dricore.com/en/eIndex.aspx). It helps, but its far from a perfect (the primary benefit is that it helps protect flooring materials from potential mould and mildew and/or water damage).

I’m guessing the heat loss through this basement floor is in the range of 2,000-kWh/year or more, but I wouldn’t be surprised if it’s much higher than that.

Bonus Points: For those who are mathematically inclined, see: http://www.energy-based.nrct.go.th/Article/Ts-3%20steady-state%20compone...

Cheers,

Paul

Paul, I suspect that the new mechanism these new cold-weather units use mean that even a relatively small unit like yours continues to deliver heat even as the temperature outside drops.

I know that when the outside temperature drops to around freezing the air from my unit is barely warm to my hand. It's definitely warmer than the air outside, but not warm enough to make enough of a difference to the house temperature.

My unit is just 12,500 btu and uses the earlier (non-cold weather) design with just one stage. I think the size would have been just perfect if it was the newer three stage design.

This bit is about the Hallowell design:

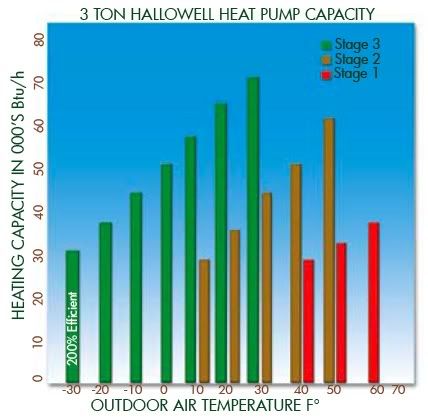

I think the new Sanyos use a similar system with more stages (i.e. compressors). Here is the efficiency curve from Hallowell:

Hi André,

In effect, these new DC inverter drive units have an infinite number of stages -- they seamlessly ramp up and down in relation to the heating or cooling load. Last week, when I first turned it on, the outside temperature was -3C/27F and the outlet temperature from the indoor air handler was a toasty 42.8C/109F, so no issues with "cold blow" whatsoever.

Cheers,

Paul

I'll have to check out how that works, sounds intriguing.

FWIW, it's -15C/5F outside and I re-measured the temperature of the air coming out of the Sanyo's air handler at 43.1C/110F. I did the same with the Friedrich immediately after it completed a defrost cycle and it peaked at 38.7/102F then, after several minutes of operation, started to gradually trail off. The key difference is that when outdoor temperatures fall below -10C, the Friedrich defrosts itself about every ten to fifteen minutes whereas this Sanyo continues to soldier on for an extended period of time. The other major difference is that you can easily tell when the Friedrich switches between heat and defrost modes (there's a sort of a "bang", "crash", "whoosh" to the whole affair) whereas you have no way of knowing with the Sanyo unless you happen to glance up at the indicator light.

Before the start of the next heating season, I'll likely donate this Friedrich to a local NPO and replace with another inverter model.

Cheers,

Paul

LOL ! just another sensory input !

The HP test set that the school had was quite noisy going into defrost ! Then again, it's probably an antique in test set timelines.

Let's hope this is just bluffing:

http://www.presstv.ir/detail.aspx?id=79031§ionid=351020402

---------------------

Report: India may attack Pakistan

Sat, 20 Dec 2008 15:27:30 GMT

Indian military has prepared operations against targets in Pakistan and awaits the signal to go forward, a US intelligence report says.

"These most likely would take the form of unilateral precision strikes inside Pakistan-administered Kashmir, along with special forces action on the ground in Pakistan proper," Global Intelligence Service, Stratfor said in its latest report.

--------------------

I wonder if Obama has finally decided that he has got a really lousy four years ahead when he got this briefing by the CIA/Pentagon.

As Tom Brokaw said, the winner of the presidential election should have demanded a recount.

Or, as The Onion put it: "Black man gets Americas worst job"

Stock up on powdered milk and potassium iodide tablets.

Re: Robert Bryce's anti ethanol rant up top.

If Obama is buying the ethanol hype, Bryce is buying the anti ethanol hype. The anti ethanol position is based on fallacious logic, lies about the effect on food prices and straw man arguments like it will not solve America's energy problem.

Of course it won't solve the energy problem, who but a few over zealous supporters said it would. Reasonable people know that the most it will ever be is perhaps 10% of liquid fuel supply. But it is the marginal 10% that puts price pressure on gasoline. The dramatic fall in gasoline prices is not all from the economy collapsing, some of it is pressure from ethanol. Sadly ethanol feels the effects the same as gasoline, and some producers will have to shut down until prices improve, but that's competition.

Bryce attacks the appointment of Vilsack as ag secretary. Obama could not have made a better choice. It was Vilsack who led Iowa to try to become a center for the production of alternative energy. He succeeded by almost any measure. Iowa's ethanol production leads the nation. Its wind electricity production per capita also leads. Albeit, in absolute terms Texas and California lead. And bio diesel was also started under Vilsack.

The result has been large energy savings as less corn and soybeans are shipped out of the state. Instead value added products ethanol and bio diesel provide jobs and an market for corn and soybeans.

The Clipper wind turbine factory located in Cedar Rapids is currently supplying about half of the 180 wind turbines for the Crystal Lake wind nearing completion around our place. Those are Iowa manufacturing jobs and income for farmers who have turbines on their land. Some of the wind electricity is used in state too.

Some have speculated that Obama would ditch his ethanol and alternative energy positions once in office. I am glad to see that he is not buying the anti ethanol lies. His choice of Gov. Vilsack was a stroke of genius.

vile sack ? he didnt do anything of note as governor and maybe we will be lucky and he won't do anything now either.

i have no idea why he thought he could be president. wooden al was a fricken human dynamo in comparison.

More distortion from X.