Saudi Aramco on 60 Minutes

Posted by JoulesBurn on December 8, 2008 - 8:57pm

Part 1

Part 2

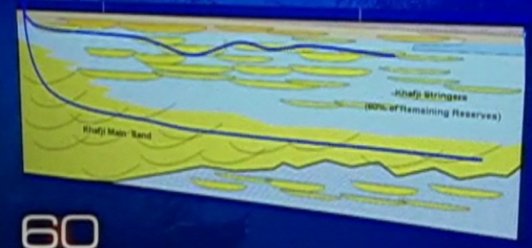

There are a lot of little things to pick apart, from misconceptions about what peak oil means to the oxymoron of Saudi Arabia developing a more fuel-efficient engine so that the world will consume more (or is it less?) oil. I will let readers do most of the deconstruction, but I found one short clip of the video somewhat intriguing. In the discussion about Shaybah (about 4:30 into the first half), an animation of horizontal drilling is shown.

The geology shown is not that of Shaybah, but rather of Zuluf, an offshore field with it's own set of problems. It is not easy to read, but the text indicates that either 60% or 80% of the remaining reserves reside in the Khafji sand stringers. This says more about the future of Saudi Arabian oil than all the steel in Khurais. While it is impressive that this oil can be retrieved using improved technology, this statement from Saudi Aramco CEO Abdallah Jum’ah has more stretch than one of his limos:

Jum'ah says that with this technology, they're able to recover ten times more oil than before.

Fear not.

Has anyone watched this on a high-res feed, and read the detail on the enormous background screens? I wonder if there's anything to learn there..

I was especially tickled by the statement that "what's good for Saudi Arabia is good for the world"!!! Shades of "Engine" Charles Wilson, CEO of GM, in the 50's! At least Chuck was humble enough to say "what's good for the US is good for GM, and vice versa", instead of this, the misquote usually attributed to him.

Nick,

I also got a kick out of the "what is good for.." comment.

This guy looked at a few HD stills:

http://benfry.com/writing/archives/210

He noted that the big screens just duplicated what was on the smaller computer monitors at the workstations. The big screen is obviously for show and not function.

One wonders how Saudi Aramco was able to churn out even more oil in the 1980's without this "nerve Center".

Big nerve centers like that are pretty much useless. From my experience, smaller curved screens display systems are actually useful as you can do 3D design and fly-throughs and perhaps even 3D graphics visualizations. But then again this whole segment was a prearranged Aramco marketing video that Stahl and company fell for.

There's an awful lot of princes to carry financially, and their large families to support. Can't let the Saudi people think the joy ride is over yet. And most of all, can't let the junkies think that their drug is going to become less available and more expensive.

Or maybe they do actually have a fair bit of oil left? People like Matt Simmons have lost a lot of credibility in recent weeks:-

http://www.youtube.com/watch?v=rkzETN8qfzw

Once again, the Cornucopians are using price as a proxy for production.

Saudi Arabia is almost certainly going to show three straight years of annual production below their 2005 annual rate (when Matt's book was published), at about the same stage of depletion at which the prior swing producer, Texas, started declining.

And the year over year increase in production in 2008 is going to result in net oil exports that will probably be about 700,000 bpd below their 2005 rate. Some time next year, the cumulative shortfall between what Saudi Arabia would have (net) exported at their 2005 rate and what they actually exported will exceed a billion barrels of oil.

Our middle case has Saudi Arabia approaching zero net oil exports in about 23 years.

Seemed to see plenty of that on the other side when prices were on their way up.

Once again, the...um... "anti" Cornucopians are using the chosen production of a swing producer as a proxy for how much they can produce.

As I previously noted, every Peak Oiler I know talked about production first, and then discussed price. Matt's mistake was that he was spent too much time talking about price, instead of production.

Regarding voluntary production cutbacks, it's a good point. In fact, the Texas Railroad Commission just released the following:

You got it right. I only talk about price as it relates tangentially.

Greed is constant, price fluctuates.

I hear a lot more of that now that prices have collapsed. :) In the past they were almost invariably linked... because assumptions about production informed their predictions of price movement and price movement validated their beliefs re: production.

Clever... but not informative. Simple question... the last time oil peaked like this, production copllapsed and took years to recover. Was it because capacity to produce had peaked?

This video discusses new projects that will begin production shortly that account for over 2million bpd. Do you really think that declines from the rest of their fields will be that intense over the next couple years? If not, you know that their capacity will be higher than it was in 2005.

the last time oil peaked like this, production copllapsed and took years to recover. Was it because capacity to produce had peaked?

Price spikes induced temporary demand destruction. Capacity to produce was not an issue then; what does that have to do with the current R/P (depending on whose numbers you use)? Yeast at point 4 on the graph might think "We can party forever!". Yeast at point 10 on the graph may think "Just like at point 4, we can party forever!".

you know that their capacity will be higher than it was in 2005.

For how many years? 2? 5? 10?

Some people thought it was... and we haven't gotten to the point where we know it is now.

Possibly even longer.

The problem with that is that almost every such graph (including coal and NatGas etc.) shows the ranmping up all the way to "today" and then beginning a decline. You could draw such a graph at any point along the climb.

Some people thought it was...

Who? References, please.

and we haven't gotten to the point where we know it is now.

Sure, but in order to be smarter than yeast, we have to make intelligent assessments of remaining supplies, and intelligent decisions about how to transition away from non-renewable sources.

Possibly even longer.

Possibly? Aren't you sure? On the other hand, possibly less, right?

You could draw such a graph at any point along the climb.

But we've hit an undulating plateau, and at a time when oil prices are high.

Sure, but in order to be smarter than yeast, we have to make intelligent assessments of remaining supplies, and intelligent decisions about how to transition away from non-renewable sources.

So your position is "let's assume I'm right" ?

Only if you believe that they don't understand anything about oil or are lying through their teeth (in a way that does them no benefit).

Which is just what happened the last time.

The point is that production can be either supply or demand-limited. You can't look at a decline in production and assume that it's because they can't pump more. In the case of the Saudis, they have decades of history of intentionally pumping less than they can.

What time was that? I hope you are not talking about the early 80's. There was never a doubt what caused that very short plateau and then a retreat of 15% of production. We had the Iranian Revolution, the Iran-Iraqi war and the subsequent "Tanker Wars". All this reduced OPEC production to about half and world production by 15%.

I get tired of people pointing to this period and saying, "Yeah, we thought oil had peaked then also." No we did not! We all knew exactly what caused that fall in production. But because non-OPEC nations could not take up the slack, some speculated that the world may be facing production restrictions. Which was also the truth.

And by the way, in 2008 non-OPEC oil production fell off it's five year plateau that began in July of 2003 and ended in July of 2008.

Ron Patterson

LoL!

So "we know", do we? You just saw the same thing happen again and interpreted it as different because you wanted to.

In the 80s, production declined because there was no demand as economies contracted. Now you see a five year plateau that just coincidentally ends just as demand is falling off the table and you somehow see it as different?

I never had any doubt about how the 80s went down (though yes, there were people who thought we were close to using up cheap energy)... you're the one stuck having to demonstrate that "this time is different".

Yes we knew! I take it you are too young to remember those days. I am not and remember very well what was going on.

That is the most absurd thing I have read on TOD in weeks. High oil prices, brought on by the decline in OPEC production, caused the recession. If what you say is true, then why did only OPEC production decline. In 1979 OPEC C+C production averaged 30.942 mb/d, according to the EIA. in 1985 their production was 16.693 mb/d, a decline of 46.05%. Over the same period non-OPEC production went from 31.732 mb/d in 1979 to 37.273 mb/d in 1985, an increase of 17.46%. So why did economic contraction cause only OPEC to cut production by almost half while non-OPEC production kept right on increasing as usual?

And between 1978 and 1980, oil prices increased by 150%. And oil prices stayed extremely high through 1985. That is really strange behavior for prices if the decline in production during that period was caused by falling demand! Historical Crude Oil Prices (Table)

As I said above, we all knew very well what was happening because it was on the frigging news daily! I would suggest PP, that you get your facts straight next time before you go spouting off stuff about which you are obviously totally ignorant of.

Ron Patterson

And I take it you didn't read what you responded to. And yes, I remember reasonably well... I lived in the ME around that time.

Yes... artificial tightening of supply caused economic weakness which in turn clobbered demand... that reduced demand (combined with new sources of energy) caused oil prices to collapse. Even with OPEC (again intentionally) curtailing production, prices continued to fall.

Pretty much just as is happening today.

For the same reason it's falling today. They're desperate to prop up prices but have trouble enforcing discipline on their wn producers, let alone the rest of the world.

You're kidding, right? Other nations don't allow price-fixing and cartel behavior. Nations who had discovered new supplies while prices were out-of-whack kept pumping. Then OPEC not only had to cut a bbl to prop up prices but had to cut another one for every bbl produced outside of OPEC.

This is why the Saudis (and a few others) fought against Iran/Venezuela/etc to raise quotas several months back. They were terrified that the high prices would cause another worldwide slide which would end up hurting far more than letting prices go back down.

It would be... if your characterization was accurate. It isn't. You accepted annual averages and ignored inflation (if you do remember the 80s...)

From 1975 (no idea why you selected 78) to 1980, prices were up (inflation adjusted) more like 500% and fell fairly consistently (and significantly) for over five years.

I would suggest RP, that you get your facts straight next time before you go spouting off stuff about which you are obviously totally ignorant of.

PP, you are engaging in double talk, trying to get out of the really stupid thing you said:

NO, that is dead wrong! In the 80's production declined because of the Iranian Revolution, because of the Iran-Iraqi War and because of the Tanker War that started in 1984. Prices skyrocketed. There were long lines at service stations. In some places you could only get gas on alternate days, based on whether your tag number was even or odd.

PP, to say, as you did, that "In the 80s, production declined because there was no demand as economies contracted," is just down in the dirt stupid!

Ron Patterson

PP, you are engaging in double talk, trying to get out of the really stupid thing you said:

Nope. Just pointing out that your strawman is a strawman.

NO, that is dead wrong! In the 80's production declined because of the Iranian Revolution, because of the Iran-Iraqi War and because of the Tanker War that started in 1984.

Production did decline for those reasons. It also (and primarily) declined due to economic contraction. There was the ability to export more oil... but no demand for it.

PP, to say, as you did, that "In the 80s, production declined because there was no demand as economies contracted," is just down in the dirt stupid!

"Stupid" perhaps to try to pound the truth through a thickened head... but not wrong. Sorry. What would be "stupid" would be to pretend that you remember skyrocketing prices and economic contraction but that it didn't impact demand for oil.

Note, BTW, that the embargo was in '74 and supply continued to climb. Iran was 78-79 and supply only dropped 4%. Economic weakness was well in place by that point.

A simple exercise for you. Google "oil glut" and see what you get. If prices were falling because there was too much oil on the market even though less was being produced than before... you have to know it was a demand-side problem. Right?

The price did not collapse until 1986, the year that production began to increase. Production jumped by over 2.2 million barrels per day in 1986, then prices collapsed! The proceeding seven years, 1979 thru 1985 saw deep cuts by OPEC causing prices to skyrocket. Then in 1986 they opened the spigot again and prices collapsed.

You are putting the cart before the horse. The very high oil prices, and very low oil production, caused the recession. Demand did not collapse until 1986, (or late 85) the exact same year that prices collapsed. How could you possibly have excessive production, a glut of oil, and still have extremely high prices? And remember there was no NYMEX speculators in those years to drive prices up.

Obviously there was much less oil sold during the early 80's, because there was much less oil produced. That is why prices stayed high! Then when OPEC opeaned the spigot prices collapsed. What else would one expect?

However as Will Stewart said:

Ron Patterson

You're absolutely immune to facts, aren't you? Did you not even look at the graph I provided? I can give you another one from the site you linked.

How can you expect anyone to look at that and then read you saying "price did not collapse until 1986" without laughing?

The CEO of Exxon was talking about an oil glut in 1981 (saying that the main cause was declining consumption).

Since I've now said that more than once... one must wonder what point you think you're making.

Simply (and ridiculously) wrong. So you position is that supply collapsed but people kept consuming the same amount? Was it magic pixie oil?

You can't... which is why prices declined by more than half in real terms during the period you claim there was no decline. You've entitled to your own opinion, not your own facts.

PP, The only thing that happened in the 70's and early 80's was a huge effort to make processes more energy efficient. Before that time, oil flowed like water. Afterward, it didn't. This could look like a reduction in demand, as people realized they shouldn't treat it like a sieve anymore. From this resetting of the baseline, productivity kept on increasing and demand once again started to creep upwards again.

It's happened again and we have immediate reductions in energy use, unfortunately the gains in reduction are not what we saw back then since that was an "awakening" kind of event that will never be duplicated.

The Oil Shock model is designed to handled these changes in production rates.

"the gains in reduction are not what we saw back then since that was an "awakening" kind of event that will never be duplicated."

One of the largest events was substitution of Nat Gas and nuclear for oil electrical generation. We can do the same thing, on a larger scale, with the electrification of ground (and, surprisingly, water) transportation.

This kind of large-scale substitution isn't unique to the 21st or even the 20th century - it happened in the late 19th century with the substitution of electricity for kerosene illumination. If gasoline powered ICE vehicles hadn't come along in the early 20th century, oil would have had no large markets at all.

Still waiting...

Only if you believe that they don't understand anything about oil or are lying through their teeth

You must know about the sudden OPEC reserve hikes in the 1980s, and how reserves never seem to drop. Only the naive would take something like that at face value.

Which is just what happened the last time.

Nope. On top of what was mentioned upthread, the North Sea and Alaska came online, dropping the price. More fuel efficient cars became available and common, people shifted their home heat from oil over to electric, etc. And note that demand destruction did not occur in 2005 (or 2006 or most of 2007), so this situation is clearly dissimilar from the late 70s/early 80s.

are lying. Got it.

What? You mean that non-opec energy supplies were being ramped up while energy-efficiency and conservation efforts combined with weaker economic growth to curtail demand?

Um... how is that different from today again? :)

And note that demand destruction did not occur in 2005 (or 2006 or most of 2007

It took a few years the last time as well. Living habits don't change until a pain threshold is reached... not as soon as prices rise. And new production takes years to ramp up (as does transitions to alternate fuel sources).

Again... how is that different?

What? You mean that non-opec energy supplies were being ramped up while energy-efficiency and conservation efforts combined with weaker economic growth to curtail demand?

Um... how is that different from today again? :)

A number of reasons; One, there are no major sources of new oil like there was with the North Sea and Alaska. Two, there are little in the way of massive home energy conservation efforts that have an effect on oil prices. Three, the plateau previously experienced was a direct result of demand destruction; the current plateau was not.

A number of reasons; One, there are no major sources of new oil like there was with the North Sea and Alaska.

Sorry... that begs the question, doesn't it?

Two, there are little in the way of massive home energy conservation efforts that have an effect on oil prices.

Nonsense. Never heard of hybrids? Shifting to natGas? High-efficiency washers/dryers/furnaces/AC... tankless water heaters (just got one of those) etc etc etc ???

And LOTS of the savings came well after prices spiked. Two or three years is hardly enouogh time to say nobody is making significant efforts.

Three, the plateau previously experienced was a direct result of demand destruction; the current plateau was not.

See #1. Assumes the conclusion of your argument as evidence to prove your argument.

The recent "plateau" is just noise until a substantial production decline is evident and now that we see a clear decline, it also clearly demand destruction.

You are obviously not interested in rational debate; good day...

There's the sign of a "true believer".

"If they don't accept my word as Gospel within five posts... they're just not interested in rational debate".

Put another way "Don't confuse me with the facts, I've already made up my mind".

More likely... you just read the Jimmy Carter quote and realized that the early 80s were far more like the current situation than you're comfortable with.

Oh well... far be it from be to hurt any sacred cows. Have a good day.

Sorry for the delay... I remembered something that works and can be cited.

Remember Jimmy Carter?

http://www.presidency.ucsb.edu/ws/index.php?pid=7372

"But early in the 1980's, even foreign oil will become increasingly scarce." - "we could use up all the proven reserves in the entire world by the end of the next decade"

That was 1977.

Please tell me the model that either you (now) or Jimmy Carter (then) was working from. If either of these is anything more than a heuristic based on empirical data, I distrust it as well. So please tell me the model that you are using now to criticize current predictions.

So, your position is that the Texas production decline is involuntary, but the Saudi production decline is voluntary?

In neither Texas nor Saudi Arabia do we stop finding oil fields post-peak. Our problem in both cases is that we can't offset the declines from the older, larger oil fields. Based on the Hubbert Linearization (HL) models, Saudi Arabia, in 2005, was at about the same stage of depletion at which Texas peaked in 1972. BTW, the semi-cornucopian speaker (Peter Wells) at ASPO-USA, who was using the IHS data base, opined that North Ghawar would be effectively watered out within two years.

In any case, when Stuart, in March, 2007, discussed the ongoing sharp decline in Saudi production, he said that the problem with the HL model was that the observed decline was exceeding what the HL model predicted. I replied that was one reason that I expected to see a future rebound in Saudi production "Albeit to a level well below their 2005 rate." In any case, the observed decline in cumulative production, relative to what they would have produced at the 2005 rate, is consistent with what the HL model suggests.

Peaks happen, even in the best of circumstances, in regions developed by private companies, using the best available technology, with virtually no restrictions on drilling:

The facts fit that, yes. When they are no longer a "swing" producer, you'll know it has ended. As long as they can say "sure, we'll pump some more" when prices get too high... you know they aren't capacity constrained.

So now finding oil fields is evidence of the peak?

Of course not.

You can't make such a model without first knowing how much oil was there to begin with. Short of that it's just stacking one curve on top of another. If they increase production by 1.5 mbpd, people will just shift the curve over until that figure lines up with the TX peak.

As noted down the thread, the Texas State Geologist, in 2005, basically claimed that Texas might be able to match its 1972 production rate. So, denial is a powerful force.

I also addressed the disclosure issue in the following article.

http://www.theoildrum.com/node/2767

Net Oil Exports and the "Iron Triangle"

July 13, 2007

The HL method is discussed in the following article (which used production data through the end of 2005). The strength of the method is that it allows us to develop a plausible estimate of URR for a region using the two numbers we have the most confidence in, annual production and cumulative to date. So, it is incorrect to say that it requires us to know URR. It is used to develop an estimate. Of course, the estimate may be wrong, but it is a relatively objective way to develop an estimate for the area under a production rate versus time curve.

http://www.energybulletin.net/16459.html

Texas and the Lower 48 as a Model for Saudi Arabia and the World (May, 2006)

That "basically" relies on emphasis that you added to "may". His actual position appears to be that TX isn't necessarily in a permanent decline.

But what about when they say "we are able to increase production and are currently doing so"? All that does is rip a hole in their back pocket.

And the weakness of it is that it is nothing more than a great big "begging the question" falacy. It assumes that you're on a curve that you've predetermined. Hardly different from assuming you know how much oil is there in the first place (which is why the assumptions behind the gives you how much is in the ground).

Let's use Alaska as an example. We know that there is oil there that we choose not to develop. You can take the historical production and come up with your estimate, but it's based on faulty assumptions.

Again, factually incorrect. The P/Q intercept and the derived estimate for URR give you the predicted shape of the curve.

Alaska helped, but it was really just a blip on the long term US decline, and I think that the same thing--new and mothballed fields-- is true of Saudi Arabia. For example, Hubbert found, in 1956, that a one-third increase in projected Lower 48 URR--from 150 Gb to 200 Gb--only postponed the projected peak by five years. 50 Gb is roughly four times the estimated reserves for ANWR.

In January, 2006, I warned, using the HL model, that Saudi Arabia was on the verge of a long term decline. In March, 2007, I suggested, based on the HL model, that we would see a future rebound in Saudi production. Also in January, 2006, I predicted that Russia would resume its production decline within one to two years and I predicted that Norway would continue to decline--again based on the HL models. I also predicted a long term decline in net oil exports, starting in 2006. The data table that Datamunger compiled showed two years of accelerating annual net export decline rates in 2006 and 2007--primarily as a result of the declines by top net oil exporters.

Regarding Texas, we have used the best available technology, and the best that we have done is periods of close to flat production, with one year of increase. So, the Texas State Geologist was argued for something that we have not yet seen, which is not to say that we are not finding new oil fields. I am developing new oil fields right now. Peak Oil means that we can't offset the declines from the older, larger fields.

It presumes that you're on a curve... which presupposes that oil is being produced at the maximum economical rate. It breaks down when there is oil that could be pumped but isn't.

Take just Gwahar. What and when was the peak for that monster? Over 25 years ago, right? Try plotting the data up until that point and ignore everything since. See what you get. I think you'll be surprised.

I'm not saying "Alaska will save us" (and Hubbert obviously didn't take it in to account). I'm saying that if you plotted historical production, your output would be wrong for Alaska because it cannot account for oil that they choose not to pump (but could economically). It also can't account for technology - which it looks like we'll address in a moment.

And since you know that they aren't producting every drop they could, you have no way of judging whether or not you were correct. Obviously if they are correct that they will be capable of 12 mbpd in the next few years, you will know that you were wrong.

Do you assume that the "best available technology" is a permanent "best"?

Shouldn't we assume that similar assumptions informed Simmons' claim just a few years ago that the US had already reached "peak natural gas"? We now know he was sadly mistaken. We weren't on the curve.

The HL method is obviously not perfect, especially for swing producers, but not perfect does not mean useless. The approach I used was to take the prior swing producer, Texas, and use it as a model for the successor swing producer, Saudi Arabia. And as we have discussed, the successor swing producer is going to show three years of lower production at about the same stage of depletion at which prior swing producer started declining. Does it prove that 2005 was the final peak for Saudi Arabia? No, but IMO it probably was.

And BTW, regarding Russia, we are principally modeling the mature basins, but I suspect that the frontier basins are to Russia as Alaska is to the US.

Two articles:

http://graphoilogy.blogspot.com/2007/06/in-defense-of-hubbert-linearizat...

In Defense of the Hubbert Linearization Method (June, 2007)

http://graphoilogy.blogspot.com/2008/01/quantitative-assessment-of-futur...

A quantitative assessment of future net oil exports by the top five net oil exporters (January, 2008)

Jeffrey J. Brown and "Khebab"

In the second paper, Khebab put in some 95% confidence intervals for (HL based) production, consumption and net exports.

Regarding shale gas versus shale oil (as in thermally mature oil in shale formations), I suggest that you look at the recovery factors in the Bakken Shale (oil) Formation versus the Barnett Shale (Gas) Formation.

Will I find something that says Simmons wasn't badly mistaken in thinking that natural gas production peaked in the US years ago?

"Not perfect" is an understatement. It can't take revolutionary technology advances into account... it assumes that whatever has been produced is the most that can be produced given existing tech... and it assumes that new discovery will always be insignificant by comparison to existing total known supply.

Basically... it presupposes what it intends to prove. It isn't hard to get what you want out of data in that case. It's the third category of dishonesty (lies, d@mn lies, statistics).

Obviously Hubbert was way off in using it to estimate total world supply. If the peak was in 2005, it was still at a far higher point then he thought could occur.

Thank you. Now allow me to translate. You took a prior example where you knew the producer had long-ago peaked and assumed that you could use the model on a producer that may have peaked. Should we be surprised that the results point in a given direction? Is it really fair to tie them together by simply saying both were "swing producers"?

Again... wasn't the peak in gwahar over 25 years ago? How did TX production compare to peak 25 years later?

Better yet... take Iraq. You can look up or reasonably guess at their historical production figures. They clearly produce far less then their most recent peak. Can you rely on those numbers? Or is it possible that they could be producing 2-3 times as much ten years down the road?

BTW... I hope I don't come across as too strident. I enjoy the debate but don't mean to be insulting. Thanks!

BTW... I hope I don't come across as too strident.

Other than implying "Everything I say is right, and I'll repeat it until everyone agrees with me", I'd say no. Having a rough day, or too much coffee?

Positive_Phototaxis, I suggest you look at the derivation of the Logistic model as it forms the basis of HL.

http://www.theoildrum.com/node/4171

Please criticize in the context of a real model not in terms of a heuristic.

Again, factually incorrect. The estimate for the area under the curve, i.e, estimated URR, is derived from the plot. The estimate may be wrong, but it's just a tool, and as I have outlined above, many producing areas are showing a reasonable approximation to what the HL models predicted. Regarding Saudi Arabia specifically, we will have to wait and see if they ever again exceed their annual 2005 production rate, but we do know that it appears that they will show three straight years of annual production below their 2005 annual rate, which is what the HL based historical analogue model suggested we would see.

Did you watch the clip? Simmons makes some very specific and very bold predictions, and all of them have been completely wrong. He very confidently asserted a future that has been the opposite of what reality gave us.

The simple fact is that what happened this summer does not support the "peak is now" hypothesis. Oil supply was rising as the price rose, hitting new all-time highs, and didn't stop rising until the price crashed. That's relatively strong evidence that we had not hit a peak in extraction rate.

We may have hit a peak now, thanks to price-related supply destruction, but that's just speculation.

Maybe they do.

Analyses here have raised very relevant questions regarding the claimed reserves in Saudi Arabia, but it sometimes seems as if those questions are mistaken for conclusions. Nobody here knows how much oil Saudi Arabia has left - we simply don't have access to enough data to know - and it's a mistake to delude ourselves otherwise. Go re-read the comments on the "Nosedive Towards the Desert" series and compare to the last year of Saudi production to see how much this kind of self-delusion can lead groups astray.

Such predictions also miss the point. The core argument of peak oil is simple one of risk management:

Predictions for the future are useful as examples of possible scenarios, but there is not enough publicly-available data to determine how probable those scenarios are, and it helps no-one to forget that.

Making false predictions gives people reason to dismiss the entire question; making a simple, bullet-proof risk management argument doesn't let them off the hook so easily.

I heard a good deal of price discussion, but I didn't watch the whole clip.

Crude oil production, the stuff that accounts for 98% of the input into refineries and the stuff that we use as the index price, was down slightly in 2006 and 2007 and up slightly in 2008, through August (by about one-half of one percent, year to date average, relative to 2005, EIA). Note that the 2008 data are preliminary, subject to revision, frequently downward. Total Liquids is up more than crude oil, which Simmons partly attributes to the dying gasps of some large oil fields, as their gas caps are blown down.

Subtracting out unconventional crude production, which we really can't model at this point, it's a pretty good bet that we will see three years of declining conventional crude oil production worldwide, relative to the 2005 rate.

I stopped laying bets on KSA's decline after listening to Strahan's interview with Henry Groppe, who's been in the business forever and is well known in Saudi Arabia. In the interview he went over in great detail how talented and resourceful Saudi Aramco's people are, how solid their plans are, how they have decades of steady production ahead of them. Well, file this guy under "bullish," I thought. Then Strahan asked Groppe when he thought the world would peak. "2008."

For US citizens KSA is, I feel, somewhat of a red herring, aside from being, in Khebab's words, a black box. Mexico is incontestably declining, is next door, couldn't be more dependent on sales of crude for its government to function. Why isn't that more of an issue and topic?

As I have previously noted, three top 10 net oil exporters are in long term or terminal decline--Venezuela, Norway & Mexico. Russia, IMO, has now joined the long term/terminal decline list. And even Saudi Arabia, showing a year over year increase in net exports in 2008, will probably be down by about 700,000 bpd versus their 2005 rate.

The main thing I gather from these endless debates about peak oil is that no one really knows whether we have peak oil or not. We will know when we know. Meanwhile. We continue to become more dependent upon foreign oil and there is very little dispute about whether oil has peaked in the U.S. notwithstanding the drill, baby drill crowd.

Peak oil or not, Saudi Arabia is devoted to the proposition and will do anything necessary to convince us to be complacent and convince us that we should continue to be dependent. The typical drug pusher.

Debate about peak oil is a distraction. We need to get off oil regardless.

Agreed on the last bit but the way things are unfolding right now does not fit the radical back to nature agenda of some of the people here, who actually want modern industrial societies to collapse. If the peak isn't imminent there may well be time to make a relatively painless transition away from oil and it may be OPEC that actually have major problems over the next decade if the western world does actually make a concerted effort to move over to lithium ion batteries in transportation terms and loses its post-Chernobyl phobia over nuclear power. Removing a large portion of the demand could collapse the price of oil on a sustained basis to the point that many of the dictatorial regimes in OPEC countries collapse like the Soviet Union did in the late 80s. The posture of Iran and Venezuela over the last couple of years makes the switch to Li ion batteries more likely because the world got a wake-up call as to what regimes like that will do when they have the leverage in economic terms. Longer term although Daniel Nocera's research was ridiculed on here, the ability to use solar panels to carry out the electrolysis of water under mild conditions with Earth abundant materials is a major breakthrough and then even longer term than that there is the whole question of nuclear fusion powered by 3He from lunar regolith based on tokamak reactors.

"Matt Simmons have lost a lot of credibility in recent weeks:-"

how could that be ? i doubt cornucopians ever gave him much credibility. who do you claim to be a spokesman for ?

You should maybe watch the youtube clip before commenting. His predictions were totally at odds with what subsequently unfolded. I think Pitt the Elder has summed things up quite nicely above. All I'll add is that I never claimed to be the spokesman for anybody other than myself.

the utube claims that conucopians gave simmons credibility and now dont ?

you should read the post.

Looks like these guys have played it pretty smart. They have managed to get most of it themselves and spend the profits. Saddam played it stupid and the world took it away from him. My guess is they are projecting to the world their intent to extract it all an share it with the highest bidder. Now that the resource wars are about to begin again in ernest I bet they are still a little nervous.

"Looks like these guys have played it pretty smart."

I have made friends of mine mad by asking the question: Point to one example where the Saudi's have been stupid or lied to us in the last, say, 10 years?

I trust the Saudi's to do exactly what is good for them. We would do the same thing. So all we have to do is keep clearly in mind what is good for them. The good news is that we have many mutual interests.

KSA says that if the price collapses it cuts capital and oil production stalls or drops. What we have to keep in mind is lead time. Iraq went to war in the first gulf war and blamed the collapsed price of oil as part of the motive, claiming that they were being bled to death in the early 1990's. Sure enough, factor in about 10 years lead time and oil production stalled. Does that mean the oil was not out there to be drilled? There is at this moment no proof that is the case. What was not easily obtained was the capital to keep development and new projects moving.

Now, we see another super-spike in price, and the danger is the same. The "60 Minutes" program aired on this last Sunday could have aired in 1978 with virtually no changes! If the price of oil goes down more from here we will see a slowdown of capital, development will stall, and we will be building the price emergency to come some 5 to 10 years from now, peak or no peak.

The Saudi's have to look at least a decade ahead given the lead times that are needed to plan and fund future projects and developments. Oil Minister Ali Al-Naimi says that they will be producing oil and lots of it for decades. Does anyone here doubt that? Despite the current hysteria, peak oil does not mean running out of oil. Al-Naimi says that there is no real alternative to oil. Right now he is absolutely correct. Isn't it here on TOD that we read that no alternative is "scalable" at this time, and the time needed and costs of transitioning away from oil on a large scale will be huge?

The Saudi's want to sell oil to the world? Duh! What the hell else are they going to do with it? The idea that undeveloped oil sitting in the ground is some kind of national asset makes no sense whatsoever and is one of the most idiotic myths in the world. So what's a nation going to do, sit on the oil and then one day realize that they need money and bad and fast...so they say "quick, spend a half trillion dollars and get that oil out of the ground and oh by the way we need the money by the end of this year." (!!!!) to which their finance minister says "if we could get a half trillion bucks we wouldn't need the oil would we?"

But look down the road a few years, and I am not talking next week, but a few years to a decade...here is the way it will happen:

The new product cycle for cars is due in about 2010 through 2012. No major car manufacturer can be caught without hybrid and plug hybrid technology, and due to the concern that oil could again super-spike to $150 plus, the hybrids will be designed with easy "phase 2" adaptability to plug hybrid capability. With the combined battery demands of the Chevy Volt, Chrysler's new generation of electric and plug hybrid cars and the coming impact of Volkswagen and other Euro manufacturers, but most importantly the Chinese and Japanese manufacturers, advanced lithium ion battery costs will begin to decline, and as the Chinese move into truly mass production, costs could drop VERY fast.

At first the plug hybrid option will be rare, but as costs come down, and as governments around the world begin to give incentives for plug hybrid vehicles in the interest of carbon reduction, we are looking at an expansion of grid powered transportation throughout the modern world.

The Americans will not determine the price or the consumption patterns of oil directly. We are already declining as a percent of world oil consumption, a trend that will continue as Chinese, Indian, Russian and East European consumption continues to grow in the next decade or so. In other words, and the Americans really need to understand this, what the Americans drive will matter less and less to peak oil, oil price or carbon footprint of the world combined. We in the U.S. are becoming marginal in our fuel consumption compared to the world, and this is a trend that will accelerate rapidly in the future.

But this next point is SO VERY IMPORTANT: We will lead the world by example. This is what the Saudi's know. This is why they concern themselves with trying to keep the U.S. tightly bound to oil and hope to slow the acceptance of alternatives in the world. It is the U.S., the Germans and the Japanese auto culture that the developing world model themselves after. It is ironic that all three of these nations are now becoming marginal in thier oil consumption as a percent of world oil consumption, but at the same time are the technical and aesthetic trend sitters in the world of automobile development.

Just as the world aped the U.S., Germans and Japanese in their adoption of the sports car, the luxury seden and the Sport Utility Vehicle, they will ape us in their adoption of the plug hybrid automobile, as these vehicles are viewed increasingly as the "cutting edge" of modernism. Cars such as the Lexus Hybrids are already viewed as trendsitters, stylish and chic while being viewed as "green".

In the second phase of development, plug hybrid electric will be combined with fuels other than oil as the confluence of technology moves forward. Since the liquid onboard fuel will be used in ever smaller amounts only as performance and range enhancement, other fuels such as natural gas, propane, ethanol, methanol, and even recaptured methane can be used. It is possible that this fuel can be sold in returnable and rechargable cartridges in the future, altering the way in which fuel is sold.

Let us assume that this occurs over the next 20 to 30 years (if oil prices spike again which is very possible, the pace of change will be much faster)the Saudi's know that they are already in the last stages of the expansion of oil sales worldwide. They have been delivering oil to the world for 70 years. There is virtually no possibility that oil will expand in use for 70 more years, and most likely will not expand in use for even half that much longer. They are in the closing innings of this game, and they know it. They know that even if they have the oil, this is no longer a growing market over the long term, and to repeat, volatility and price spikes will only accelerate the move away from oil. This is why the Kingdom of Saudi Arabia was so discomforted by the recent price spikes, which they knew were not caused by any real shortage of oil in the world, but was caused by what Ali Al-Naimi calls "the fear factor" and by rabid speculation on the part of hedge funds and banks, now freed up to speculate on oil in a way they have not been allowed to do since before 1933 when the Glass Steagall Act was passed, but free once again after 1999 when it was repealed.

The combination of price spikes and the increasing concern about climate change has put the world on a path of research and development leading away from oil as the primary transportation fuel. The Saudi's have seen what Western research and development can do once it reaches the stage of technical confluence. And just as every young upwardly mobile citizen in the developing world now wants a laptop and a flat screen TV, they will soon want their very own plug hybrid clone of a Toyota PHEV, a Chevy Volt, or a Mercedes plug hybrid class car. And the Chinese and Indian production system will provide it.

In decades to come, it will be seen that the rabid speculation that drove the price of oil through the roof was the best thing that ever happened to the Western world, and spelled the end of the expansion of oil as the fuel of choice. It will also have been seen as the end of the road for Saudi and OPEC influence in the world, even though oil will still be produced and burned by the millions of barrels per day for years to come. But the days of oil as the driving fuel that drives change and development in the world will be over.

Ali Al-Naimi began as a teenage office boy at Aramco, and has spent his life in a growing company and industry. A young office boy at Aramco today will almost certainly live too long to spend the rest of his career at a growing oil company and industry. Whether the oil is still out there in the desert in the projected amounts is a moot point. "Peak" in so many other ways, is already here. Oil was never, NEVER intended to be, nor was it going to be the final stage in human technical development. Only those whose whole life was built around the oil industry ever believed such a thing.

RC

Japan is the most energy efficient and technically advanced country in the the world. I have several times posted that I believe it is leading us into the Post Peak Oil Era. If we want to see what is ahead for us, look at what is happening in Japan.

http://www.bloomberg.com/apps/news?pid=20601068&sid=a8w0BcHxjlf4&refer=home

Japan has the largest debt of any country in the world despite all the talk about American debt. It is 1.7 times their GDP.

Despite near zero interest rates and huge deficits, deflation is the problem and a stagnant to declining economy is the result. This fits neatly into the need to reduce oil consumption.

It looks to me that is what is ahead for the U.S. for years to come if we follow in Japan's footsteps as we are doing currently.

I don't know, though. Their economy has a lot of differences from ours. Their population has peaked and is starting to drop (which means that a 0% growth can still be an increasing per capita GDP), and more notably they're very export-dependent. They had started to recover until the destinations of their exports (the US for consumer goods, and China for durable goods, to make consumer goods for the US, basically) fell apart.

You can't compare the solvency of nations just by looking at the official National debt figures.

For a start, they are fiddled in all sorts of ways, with a lot of the deficits left off the books, but to varying degrees in different countries.

Then of course you have to add in local Government liabilities, and corporate assets and liabilities, and, very importantly, banks.

Personal savings are also very high in Japan, just as it is in Italy, another high National debt country, which contrasts with massive personal debts in the US and UK.

Then of course you have to factor in an estimate of how much of Japan's savings you think may have been lost by being placed in bad assets in the US - a default there or hyperinflation would wipe out much of Japan's savings.

Germany probably has the strongest position overall of any major economy, but precise calculations are difficult.

They're not, actually. EIA figures on per capita energy consumption (Mbtu/yr):

Japan's energy consumption level is actually relatively typical for a wealthy nation, suggesting there's not much reason to look to them rather than to European nations for hints on what a lower-energy USA might look like.

"Point to one example where the Saudi's have........ lied to us,..."

we dont have proof that the saudi's have lied, we dont have disproof either. we just dont know.

a good candidate for a lie is that unchanging 260 Gb reserves, but again, we dont have proof or disproof. we dont know for sure how they even define the terms. does it include only oil that can reasonably be expected to be produced based upon current economics and technologies ? we dont know because we dont have the data. do we know if it has even been discovered ?

Very true! I just got back from a trip to asia. You should see all of the new suburbs that are sprouting up around Beijing. Each house is cookie-cutter with Italianate-style columns at the front door and a one-car garage. The houses were kind of small but otherwise it could be from any suburb found anywhere. It was very jarring to see this in the middle of an Asian country.

A point I've been making for several years now. Welcome to the club!

I think they're fricken marketing geniuses, really. It's almost like the all trained at Philip Morris.

Just like Robert Rubin, "Of course we support a strong dollar".

"...to the oxymoron of Saudi Arabia developing a more fuel-efficient engine so that the world will consume more (or is it less?) oil."

A better engine based on oil-products increases the utility of oil relative to other fuels which makes oil more competitive in the long term. If there are no serious competitors efficiency also allows people to pay just as much for a smaller quantity of oil without adding any more burden.

Either one is a benefit to fossil fuel pushers(e.g. Lovins) and they know it.

Pushing for wind power is another useful ploy if you have a lot of natural gas to sell or if you want to keep your sleazily acquired eminent domain for building a water pipeline with which to unsustainably mine large quantities of ground water and sell it to the highest bidder(see Pickens).

About the solar thing:

Saudi Arabia would be an ideal place for large scale solar power, however, who will they export electricity to? Most of its neighbours are also ideal places for solar power.

I suppose that by using solar for their electricity, it allows them to export more oil and gas, since they get their electricity from gas now. Solar is not very efficient in high latitudes, so northern Europe will happily pay for the gas.

It's not just solar, in May of this year Bush penned an agreement with Saudi Arabia to support their development of a civilian nuclear programme for electricity and other industrial uses(desalination, medicine?). They've also been in talks with the french about nuclear technology.

Given Boone Pickens is 80 years old and won't be able to take a sleazily acquired pipeline with him when he goes he maybe deserves the benefit of the doubt on his motivation.

Except for maybe the airlines, where weight is a factor, utility of oil is mostly a function of price. Price is determined by supply vs. demand. If demand goes down because cars get much better mileage, then so does price. Not only that, but an improved ICE could burn biofuels as well.

The whole "greening" of petroleum discussion was ridiculous. You can make it less brown, perhaps, but the only way to "green" it would be to capture the CO2 as it is produced.

This story is #11 hit on Google for 'Saudi Aramco.' Khurais Me A River is #2 for that term. Hey, random curious citizen! Check this out:

Hey, random curious citizen! Check this out:

From The Oil Drum | Further Saudi Arabia Discussions. Details therein.

Good catch on those stringers, Joules. Khurais going up to 1.2 mb/d when the previous peak was 144 kb/d will be quite a feat, and the Hanifa reservoir only has permeability of 1-2.

"permeability of 1-2."

1 -2 md ?

Yep, just a step up from suitcase rock. Joules shows a table in Abqaiq and Eat It Too with figures for Arab-D and Hanifa. Dunno if the Hanifa at Khurais has better perm than Abqaiq, perhaps JB will step in and elucidate.

Watching the 2nd half of the interview, the Saudis know that no way is the World kicking its oil addiction. The way he said, "alternatives? well come show them to me, bring them" (I think).

30 years from now we'll still be dependent on oil, infact more so as it will be scarce and used very conservatively and standards of living will be much lower.

The Khafji main sands at Zuluf are 200-300 feet thick, the Khafji stringers were above the main sands. A stringer is a narrow sand channel. According to Simmon's summary of SPE reports a gas cap was forming above the oil in the main sands. The Zuluf field was one of the five largest in Saudi Arabia has since entered a more mature profile.

I could guess a single horizontal well might be ten times more productive than a vertical well. The Omanis and Shell made the mistake of overestimating the productivity of some of their wells. Shell was sued by the SEC for its mistake. I would not guess that they have increased their reserves ten times with the use of horizontal directional drilling. After horizontal drilling was introduced to Texas there was some flurry of activity and new production, yet the technology did not return Texas to its glorious days of peak production.

No worries for Texas. According to the Texas State Geologist, all we have to do is apply the right technology. In 2005, in response to a question from me (questioning his "Undulating Plateau" presentation for world oil production), he stated that "While Texas may not be able to match its 1972 peak rate, it could, with the use of better technology, significantly increase its production."

While we are still finding new (smaller) oil fields, so far we haven't found the magic elixir that will bring fields like The East Texas Field back to life.

It's almost certain that you're misreading and misrepresenting his intention.

The use of the word "may" doesn't imply that he thinks it's possible to surpass the 1972 peak; it's just a turn of phrase. Do a Google search for "While I may not", and you'll turn up plenty of examples:

All of those use "while I may not..." but have little or no ambiguity. Fixating on the word "may" in the phrase is as misleading as fixating on the word "run" in "will my pen run out of ink".

Geez, I wonder which one of us was in the audience?

He basically presented the CERA "Undulating Plateau" theory for world oil production. In the Q&A, I pointed out that we had not seen "Undulating Plateaus" for Texas and the overall Lower 48. He responded with the quote I used, stating that while Texas may not be able to match its 1972 peak, it could, with the use of improved technology, significantly increase its production. In other words, he promised that a counterfactual miracle would occur which would make the Texas production case history better fit his narrative.

Texas has, at best, seen periods of flat production, and one year of increase, in the past 36 years, despite the use of the best available technology, with an overall long term decline rate of about -4%/year. And again, we continue to find smaller fields. It's just that many giant fields like East Texas are becoming history.

And the other example of private companies, best available technology and virtually no restrictions on drilling--the North Sea--has declined at about -4.5%/year since peaking in 1999.

Can you apply the same analysis to "best available" technology and TX natural gas production?

Has it been all downhill since Hubbert's 1970 peak? Nothing can be done to do any more than flatten out the decline?

Read up about the East Texas field, it's had the book of secondary/tertiary recovery methods thrown at it, and currently still delivers 12 kb/d of production - out of a 99% water cut. When fields start going down there's no returning, barring geologic intervention (Wilmington, Ekofisk, Eugene Island). Sometimes production in a waning field gets an kick up from EOR, as in the case of Samotlor in Russia, which has been slightly revitalized in recent years - but to nothing like what its peak output was. Cantarell is in a similar process of irreversible decline, after a few exceptional years. This is why all the talk of reserve growth from Lynch et al is utterly irrelevant once a field goes into decline. It's somewhat pertinent on the upside for determining URR. Lynch claims there are scores of examples of fields coming back from the dead to surpass previous peaks - graphs of which he never provides, and I've rarely seen myself in years of looking at the things.

Don't know why you're bringing up unconventional NG. Someone may have drilled some horizontals or MRCs in TX oil fields - Jeffery? If it's economic someone might give it a shot, but until we switch to a command economy in the US or begin heavily subsidizing IOCs to Drill Now it's not going to happen widescale with old sluggish fields. Hirsch covered EOR as one of his supply side "wedges" in his paper, along with CTL, GTL, heavy oil.

As I have previously said, take a look at the recovery factors in shale formations for oil versus natural gas. Also, with very high decline rates--average Barnett Shale wells reportedly will produce about 80% of total reserves in the first two years--there is a real question of whether the industry could keep the gas production rate increasing for much longer, even without the credit meltdown.

Joules and the editors,

Thanks for doing this.

You can register and post comments at the 60 Minutes site for this piece as I did below.

===========================================================

Ms. Stahl,

I watched your piece on Saudi Aramco with great interest. As a near year-long member of The Oil Drum, but sill very much learning the ins-outs of the oil and energy arenas I invite you to review and participate in the discussion that is taking place on your piece right now at: http://www.theoildrum.com/node/4850#comments_top

I believe 60 Minutes and you owe it to your viewers to offer a counterpoint to this piece and you could do no better than contacting the staff at The Oil Drum at editors at theoildrum dot com (note: I used the proper format) for that counterpoint.

Kindest regards,

Pete

I don't see any comments there yet. Pete, maybe your comment was deleted as the way you put it it looks too much like PR for the Oildrum?

The comment was posted on the first of many pages.

-----------------------------------------------

"Ms. Stahl,

I watched your piece on Suadi Aramco with great interest. As a near year-long member of The Oil Drum, but sill very much learning the ins-outs of the oil and energy arenas I invite you to review and participate in the discussion that is taking place on your piece right now at: http://www.theoildrum.com/node/4850#comm

ents_top

I believe 60 Minutes and you owe it to your viewers to offer a counterpoint to this piece and you could do no better than contacting the staff at The Oil Drum at editors@theoildrum.com for that counterpoint.

Kindest regards,

Pete

Posted by ptoemmes at 09:09 AM : Dec 09, 2008"

Aramco will be pushing 2 million barrels of salt water into Khurais per day. Some of this water will go in other directions but most of it will be pushing almost 2 million barrels of something back up. Aramco is betting that about 1.2 mb/d of this will be oil. In 1980 Saudi embarked on a massive gas injection plan for Khurais. They managed to get production up to 144 thousand barrels per day in 1981 before production fell off dramatically in 1982.

Of course all this happened before Saudi had such very high pressure water pumps. Water injection in the early 80's was not nearly as efficient and as it is today.

The point I wish to make is this is exactly what is happening with Ghawar and every other Saudi reservoir. They are pushing harder, a lot harder, in order to get the oil out a lot faster. They are managing to cap wells that are producing too much water and still keep production up. Their new MRC wells are pulling only from the very tops of their reservoirs.

Now I hope I don't have to explain to people that pushing a lot harder and extracting oil from the crown of the reservoir will indeed keep production up and the water cut down. Saudi reports that through their "reservoir maintenance program, they have managed to keep decline rates of their major fields at 2% or less and that the water cut has actually decreased. This means that they are able to keep production level or even increasing by bringing back on line older fields like Khurais. But while decline rates are dramatically decreased, depletion rates will be dramatically increased. Sooner or later this these "superstraws" will have devastating effects on production, and it could be sooner rather than later.

Ron Patterson

I understand that until a well suffers water or gas breakthrough production can be increased by opening the choke wider. This will decrease the Ultimate Oil Recovery from the reservoir.

The question I have is do the ultimate decision makers in Saudi Arabia understand this. I am sure that Aramco has people on staff who understand this. My understanding is that ultimately Saudi Arabia is run by a council of elders made up of sons of Ibn Saud headed by King Abdullah. Most of these men are in their 80s and came to adulthood before the oil business was really important. I suspect the palace school curiculum was light on Math, Science, and engineering. Do they listen to "experts" from outside the house of Saud?

Another way to phrase my question is "Are production decisions being made for political reasons by people who do not understand the technical issues and will not listen to people who do?"

No, that is a vast oversimplification. Every oil reservoir is different. Some, like Khurais, have no natural pressure almost from day one. Others maintain pressure for decades. In most the pressure drops off after only a few years where some artificial pressure injection is required. Most of Saudi's reservoirs have had water injection for decades. Only a tiny few can be controlled by simply opening the choke wider, without water or gas injection, and those only in the first very few years of production.

All that being said, I think ARAMCO is getting sound advice on production decisions. I doubt seriously that the King or Princes are going against the advice of ARAMCO engineers.

Ron Patterson

There's more on ARAMCO's PR offensive in Forbes recent article penned by Christopher Helman called "The Octopus". It's distinctly a puff piece, by one of the leading cornucopians, but it provides some field claims and even discrete bits of choke and water data that may be of use in this detailed debate. The article is dated Nov 24. I was surprised not to see it critiqued in TOD.

Three points: The KSA enjoys flooding the oil market. Just like old times. The Royal Family is not only run by old guys, they have good friends in the GOP and a certain corporation that is mobilized to take advantage of KSA decisions. Its kind of a money machine. Destroy the energy competition and buy out anything that still moves. Then cut back production and raise prices again.

It's just a straight-up state monopoly with little regard for the welfare of the people and long term consequences. As such, why not let it serve both the GOP and the KSA? With $1/gallon gasoline, surely it's time to reintroduce the Hummer, a bigger and better version, now with more tax deductions attached so the free market can save Detroit again. So much for the free market...

Second, if you add Iran to the list of exporters that need higher prices, only the GCC and KSA are enjoying this crisis. Don't underestimate the fear factor as Russia and the other exporters remind KSA that US military power ain't what it used to be.

Third; What happens when the IDF finally hits Iran's centrifuges? Now's the time for such a move, non? Just before the next President takes office and while the oil prices are in the tank.

The information there was similar to a puff piece on the Saudi Aramco site, and there was brief comment on that in the DromBeat.

Stay tuned, though, because I have a post on this coming out soon. As usual, their numbers don't add up.

JB

Great movie (also the 3rd is worth a look)!

Now I am wondering how far the numbers -taken at face value- are realistic - or if they provide any usable information:

According to 60' the Saudis say:

- The Khurais facilities will provide 27 billion barrels of oil, and it will take more than 50 years to deplete the field.

- Shaybah has 18 billion barrels

- These two mega projects, plus three others cost $60 billion over five years.

- the cost to produce one barrel is less than $2.

If we simply assume that Khurais + Shaybah + 3 others = 60 billion barrels this would result in a cost per barrel of US$1. But in fact we have only the cost information of the first 5 years, so with every further investments in the remaining "45 years" the cost per barrel has to rise. And if much more is needed to keep oil running oil may well cost more than $2.

And still, all the other above statements may be wrong anyway.

Part of the Saudi Aramco PR strategy is to aggregate varying projects (both past and present) with varying degrees of accuracy to come up with a big number -- their own version of "Shock and Awe". Letting Ms. Stahl climb down into the giant tank ("do be careful...") was a brilliant move because it took up several minutes of air time yet provided no information whatsoever.

27 billion is not an unreasonable number from what is known about the field, and it would last 50 years or so at 1.2MM/yr. The Shaybah number is also reasonable. It would take more than these to get up to 12 mb/d, however. They need Manifa to do that sustainably, and I don't see that happening within the original timeframe.

Compared to anywhere else, KSA has a lot of oil remaining in the ground, plus it is relatively cheap to extract. But Saudi Aramco has to maintain the fantasy that they are still on the upswing. Hence, reserves never decline and there is somehow even a lot more oil available if they really wanted to find it. There are lots of holes in their story, but 60 Minutes won't find these by talking to the head cheeses. Just a lot of Shock and Awe.

Joules,

thanks for your comment. But I was mainly wondering about the production costs of 2 dollars. This looks a bit strange compared with the marginal costs in the range of US$ 70...100 reported by Goldman Sachs and many others (there was a report at FTD recently) as well as OPEC countries stating that an oil price of $ 60 (or so) is needed.

So I wonder what to make of these 2 dollars.

RC:

But this next point is SO VERY IMPORTANT: We [Americans] will lead the world by example. This is what the Saudi's know. This is why they concern themselves with trying to keep the U.S. tightly bound to oil and hope to slow the acceptance of alternatives in the world.

No you wont. America has done nothing serious in automobile innovation in the last 60 years. In fact in that time it has TAILED developments elsewhere, esp Japan (unless you count the fashion for stupid and bizzare tailfins).

I have come to the conclusion that there are two types of Americans:

a) Loud mouthed, "Were better than every other country," chest thumping arrogant types.

b) The rest - who are actually embarrassed by group a).

Now you could well ask, "Isn't that the case with every country?" Well yes it is. The difference is that in the United States is that group a) is louder, more obnoxious and proportionally in greater number than is the case with other countries.

"America has done nothing serious in automobile innovation in the last 60 years. In fact in that time it has TAILED developments elsewhere, esp Japan "

Could you expand on that? I would note that the US started development of hybrids first, with the PNGV program, and is developing the first production serial hybrid.

I meant nothing serious in affordable mass produced cars. Projects that target people who can afford to spend something like Aus $75,000 (US $50,000) on a motor vehicle, do not count as serious innovation, IMO.

In any case my main point was that I think the citizens of that country which has just dragged the rest of world into its quagmire of endless unwinnable war AND a global severe recession (or is it depression?) could do with exhibiting a little more humility. Anyone got a problem with that?

http://tryckle.com/

http://daytona.craigslist.org/mcy/927592379.html

The Volt is likely to cost no more than the average new vehicle in just 5 years (depending on the balance of supply and demand). Consider the Prius: it costs $4k less than the average new light vehicle, and it won't cost more than $4K to add a large battery (the current price estimates for the Volt are inflated to capture early-adopter premia, and a $7,500 tax credit). PHEV's like the Chevy Volt will allow the average driver to eliminate 90% of their fuel consumption at no loss of convenience.

There's no arrogance in stating that other countries will follow the US's example - that's just an observation, and IMO correct. It does lend urgency to the US getting things right.

The volt will not be affordable for enough people as is the Prius currently.

cbs has been running a story about a tinkerer in wichita ks who has the answer. one segment shows niel young's ev conversion 1959 continental. makes the claim that it can go 160 mph and without blinking an eye then says it can go 100 miles on a charge.

ya think they left part of the story out ?

You mean the part where Dorothy wakes up from her dream and everything is in black and white again?

There's no reason it couldn't do that. It'll just cost about US$20,000 in LiFePO4 batteries (a lighter car would get by with less batteries, maybe as little as US$10k, because it wouldn't be accelerating so much mass).

Tangentially, my 1976 Holden (Isuzu) Gemini (Opel Kadett) can do 160kmh, but it doesn't mean it's stable at that speed, or that it can get there with a short run-up. ;)

Could you expand on that? Why would a serial hybrid, a simpler architecture, be more expensive than a Prius plug-in?

GM's Lutz has stated that the Volt will likely cost $48k. A bill was recently passed to provide a $7500 subsidy for buyers of such vehicles (and the Prius looks to qualify for a $2500 subsidy). I personally don't consider a $40k car to be affordable to many.

"GM's Lutz has stated that the Volt will likely cost $48k."

I'm not sure if that was a misquote, or they just caught Lutz on a bad day. In any case, it's old (at one point they were indeed talking about a price of $40K) and misleading (if you read the article very closely, you'll see that Lutz was talking hypothetically about pricing to make a point about GM forgoing profit in the beginning).

The latest estimates are for an initial price in the high $30's, which with the $7,500 tax credit would make the effective price close to $30K.

Keep in mind, GM's price estimates for the Volt were inflated precisely to capture that tax credit, as well as the early-adopter premium (that may seem cynical on their part, but isn't it clear they need to scratch for any income they can? You can't really blame them...). For public consumption they've said that they're pricing in an OEM and and a warranty replacement battery (see http://blogs.cars.com/kickingtires/2008/09/gm-exec-volt-ba.html )into the price at current price assumptions - both 100% replacement (this chemistry is very durable, and they've reduced depth of discharge range to only 50%) and current pricing (prices will drop sharply in 5 years) are clearly unrealistic. Also, they're clearly pricing in a very fast amortization of R&D in order to justify that early-adopter price.

The Volt is likely to cost no more than the average new vehicle ($28K)in just 5 years (depending on the balance of supply and demand). Consider the Prius, which has a more complex, costly parallel design: it costs $4k less than the average new light vehicle, and it won't cost more than $4K to add a large battery at that time.

The latest estimates are for an initial price in the high $30's,

Whose estimates are these? Link to something substantive, please (i.e., news article vs. blog)?

The Volt is likely to cost no more than the average new vehicle ($28K)in just 5 years

I can appreciate your enthusiasm, but cannot blindly assume your speculation is grounded in a sufficient manufacturing background. No offense, of course. I purchased our 2005 Prius for $21k (they were not making just the top of the line packages then), and the addition of a large battery per your estimate would take it to $25k. The $2250 subsidy would then drop it to around $23,500.

What do you estimate the cost differential is between the Prius parallel design and the Volt serial design? What criteria and BOM knowledge are you using to make that assessment?

"Whose estimates are these? "

They're from GM, as relayed to the author of gm-volt.com (which is as authoritative as it gets, at least as far as info about GM's plans go, as articulated by it's top managers and engineers). They were a few posts back, but I'll try to find them.

"What do you estimate the cost differential is between the Prius parallel design and the Volt serial design? "

Well, the Prius design is pretty elegant, considering, so the differential won't be enormous. Of course, I'm assuming all else is equal - sadly, Toyota has a lower basic cost, due to their later entry to non-union manufacturing in the US, the lack of GM's overhead due to the US's odd ways of handling health-care, GM's legacy pension costs, and Japanese direct and indirect subsidies. Those advantages will likely soak up pretty much all of the difference in practice. And, of course, that's before the increase in capacity from the Prius 1.3KWH battery.

The Prius parallel design requires an ICE (and all of the supporting equipment, such as transmission (depending on design - an electric motor has a much wider RPM range, so the trans can be either eliminated or simpler in an EV), fuel pumping, carburetion, liquid cooling, oil, air handling, catlytic conversion, muffling, etc, etc) sufficient to power the vehicle and provide any and all desired acceleration at high speeds. The electric motor is redundant, and used at low speeds to improve efficiency. A serial hybrid design has a larger electric motor, but you eliminate the complex drivetrain that integrates ICE and electric power, and you can reduce the size of the ICE (and all of the supporting equipment) greatly (more than the increase in electric motor size) due to it's decoupling from the wheel. The cost reduction is much larger than the increase in electric motor components, in part because electric motors are much less complex (only one moving part!), and don't require all of the supporting equipment.

Further, an all-electric design is accompanied by the elimination of hydraulic and mechanical systems for braking, steering, etc (drive by wire).

Maintenance costs will also be much lower, due to the elimination of moving parts. Of course, Prius costs are already low, due to Toyota's quality, and the partial capture of the benefits of the electric drivetrain (regenerative braking greatly reduces brake wear, for instance), but a vehicle which is primarily electric will be cheaper still.

I regret that I can't provide quantification of this, but I think the elements of the analysis are clear. The important thing is, it's clear that a serial hybrid would be no more expensive than a parallel design like that of the Prius, which allows us to use the cost of a plug-in Prius as a benchmark. Does that help?

Now, the larger topic is that a plugin hybrid (whether it's a Volt or a Prius)can be as cheap or cheaper than the average vehicle, at around $28K (or a $7K premium over your Prius). Tesla says that conventional, small format batteries cost only $400/KWH a year ago - large formats, with cheaper chemistries, should be substantially cheaper - $300/KWH, looks extremely likely in 2-4 years. The Volt's 16KWH battery would only cost about $5K, for a total of about $26K. Does that make sense to you?

I'll wait for estimates from a more tried and true source.

The 1 liter Volt motor needs pretty much the same equipment as the 1.5 liter Prius motor; the Volt needs a generator, and it's not clear if it also needs a reduction gear like the Prius. In addition, the power brakes, steering, etc need electric motors. I don't see much, if any, difference in maintenance costs.

As you said, many different economic factors between Toyota and Ford make a simple comparison of manufacturing costs difficult.

I'll just wait and see what the true cost is when it finally shows up in production quantities.

hmmm. Let me try again.

Toyota is planning a plug-in Prius with a relatively small battery and electric range, perhaps 10 miles. That's likely to get it in the range of 100 MPG.

Would you agree that it's reasonable to project that a plug-in Prius would be priced at or below roughly $28K (assuming, of course, the same kind of reasonable pricing you faced when you bought a Prius), and that there's no particular reason to say that it would cost significantly more than that?