The IEA WEO 2008: Long term prospects for coal production

Posted by Rembrandt on December 4, 2008 - 10:24am

The International Energy Agency expects coal production to nearly double by 2030 in their World Energy Outlook 2008 if no large scale governmental intervention occurs. In this post, I analyse the likelihood of this happening from the perspective of available coal reserves.

The International Energy Agency expects coal production to nearly double by 2030 in their World Energy Outlook 2008 if no large scale governmental intervention occurs. In this post, I analyse the likelihood of this happening from the perspective of available coal reserves.

My conclusions are that if we look at a global level, taking coal reserve data at face value, the global IEA reference scenario for coal production to 2030 is possible. However, when focusing on China, the country that now produces 41% of all coal, the scenario is unlikely to occur because China possesses insufficient coal reserves to sustain production to 2030 at the level expected by the IEA. Only in a highly optimistic case, if China's coal reserves are more than double those currently known, will China be able to sustain coal production as expected in the IEA reference scenario.

Based on available coal reserve data and scenarios (EWG 2007; Tao and Li 2007), it is much more likely that China will reach a plateau in coal production somewhere between 2015 and 2025. The implications of this are significant, because it will be extremely difficult, if not impossible, to substitute other energy sources for coal on the vast scale needed for Chinese growth. The quality of reserve data is poor, however. Better reserve data is needed, particularly for China, to have certainty with respect to these findings.

In a follow up post, I will take a look at the short term prospects to 2015 for coal production, imports, exports, and prices in relation to the World Energy Outlook 2008.

Introduction

According to "common wisdom", coal is an abundant energy resource. The amount of coal underground is expected by most energy experts to be sufficient to sustain coal consumption until at least the end of the 21st century. Recently, doubts have been raised about this view by two independent studies analyzing the quality of coal resource/reserve data, as well as potential for future coal production (EWG 2007; Kavalov 2007). These reports make it clear that the quality of coal data is very poor and does not support the view that coal consumption can continue to grow in the second half of the 21st century. More importantly, obtaining sufficient coal could become problematic for coal importers in the next two decades due to coal export constraints. For the details on these reports, see an earlier post by Chris Vernon published on the Oil Drum.

In this post, I take an in-depth look at the coal production scenario of the IEA's World Energy Outlook 2008, building upon the research of EWG (2007) and Kavalov (2007). I do not make a distinction among the different types of coal (Bituminous, Sub-bituminous and lignite) in most of my analysis, as this makes the analysis easier, and I think that it will not change the picture to a significant extent.

The Reference scenario for coal from the IEA WEO 2008

In order to understand a scenario, we need to know how it has been constructed. The IEA looks at future coal production from two perspectives: the availability of the resource and the price of coal in different coal producing markets. Since the formulas used in the IEA model have not been published, I cannot tell in detail how the reference scenario has been created. The following snippet is the only piece of information available:

"The coal module is a combination of a resources approach and an assessment of the development of domestic and international markets, based on the international coal price. Production, imports and exports are based on coal demand projections and historical data, on a country basis. Three markets are considered: coking coal, steam coal and brown coal. World coal trade, principally constituted of coking coal and steam coal, is separately modelled for the two markets and balanced on an annual basis." (IEA World Energy Model 2008)

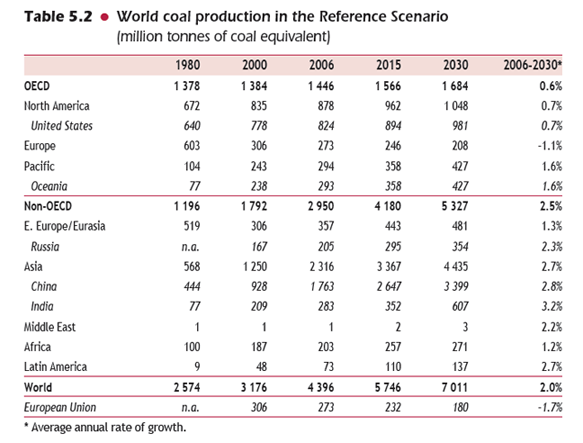

From that piece of information and some personal experience with economic models, my guess is that model uses separate coal reserves and average price levels for each coal producing country. Based on the demand model that I described in an earlier post, coal production likely occurs in the model in the location where it is most cost effective to produce. Production likely also considers constraining import/export factors, leading to an expected pattern of coal production and trade. I expressly state that I could be wrong here, since no formulas are available. In any case, the World Energy Model of the IEA leads to the following reference scenario in the World Energy Outlook 2008:

As we can see from the table, the scenario shows continuing growth in coal production until 2030 in nearly all regions of the world except Europe. Average annual coal production growth on a world-wide basis between 2006 and 2030 is expected to be 2%.

What is written in the IEA WEO 2008 about coal reserves?

The International Energy Agency (IEA) uses coal reserve data from the World Energy Council's (WEC) survey of energy resources. This is the only public source of coal reserve data in the world; other publications with coal reserve data in the public domain always use data from the WEC Survey of Energy Resources. An example is the widely used BP Statistical Review of World energy 2008*.

The IEA uses the WEC coal reserve data without questioning its validity:

"Coal is the most abundant and geographically dispersed fossil fuel. Proven reserves at the end of 2005 were 847 billion tonnes (WEC, 2007)...Current reserves are more than adequate to meet projected growth in coal demand through to 2030 in this Outlook." (IEA WEO 2008, page 127).

In my opinion, the unquestioned use of WEC data by the IEA is a core problem of the coal analysis in the World Energy Outlook 2008. Most of the data provided by WEC is of poor quality and outdated (EWG 2007). This is a result of the manner in which the WEC collects its data. It is collected by member committees of respective WEC member countries. Members of these teams are in nearly all cases not experts in the field of coal reserves/resources. They rely on asking institutes within their respective country to provide useful data, which is subsequently forwarded to the editors of the survey of energy resources. Furthermore, every individual committee uses its own definitions of reserves and resources (WEC 2007, page III, 1 and 2).

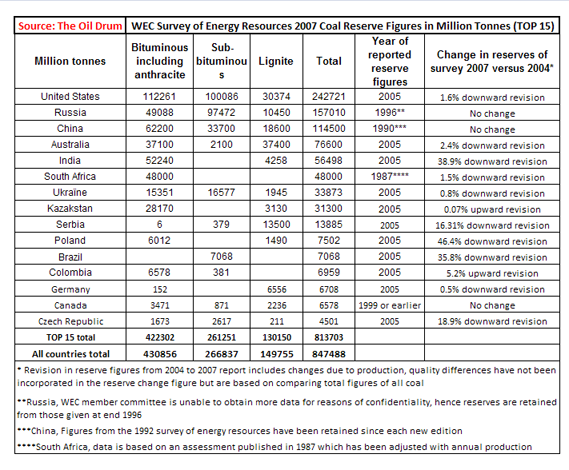

The effect on coal data can be assessed by looking at the individual WEC reports. I have compared the data on coal reserves from the WEC Survey of Energy Resources 2001, 2004 and 2007. Earlier editions are not available digitally and have thus not been included. In the Survey of Energy Resources, 68 countries are reported to have coal reserves. Of these countries, a total of 39 have had unchanged reserves since the 2001 WEC Survey of Energy Resource (which contains reserve data as of the end of 1999). In addition to these 39 countries, another 8 countries show unchanged reserve data from the 2004 to the 2007 survey. I made a table of the reserves for all 68 countries, together with each country's latest known reserve year, which can be viewed by clicking this link. The top-15 coal reserve holding countries, which account for 96% of all coal reserves, are shown below in Table 2.

The table of the top-15 has five anomalies that make it clear that the coal reserve data is of very poor quality:

1)The lack of a reserve updates from the 2nd largest coal reserve holding country, Russia. According to the WEC report this is due to confidentiality issues over Russian coal reserves. WEC has chosen to retain the latest Russian reserve figures available which date back to the end of 1996.

2)The lack of a reserve update from the 3rd largest coal reserve holding country, China. No valid reason is given as to why the figures from 1990 have been retained. One argument is given to support the original data in the WEC report, but this argument leaves a lot to be desired. It is a reference to a paper that was presented at the 11th Session of the UN committee on Sustainable Energy co-authored by Professor Huang Shengchu, vice-president of the China coal Information Institute. In this paper the same reserve figure of 114.5 billion tonnes was published as the one published by WEC in 1992, which according to WEC "indicates a degree of continuity in the official assessments of China's coal reserves and supports the retention of the level originally advised by the Chinese WEC Member committee in 1991" (WEC 2007, page 26).

3)The large 38.9% downward revision in the 5th coal reserve holding country, India, in the 2007 Survey of Energy Resources versus the 2004 edition. This is a result of reporting reserves on a recoverable basis instead of reporting in-situ coal resource data (WEC 2007, page 2).

4)The lack of a reserve update from the 6th largest coal reserve holding country, South Africa. In the Survey of Energy Resources it is stated that the South African Department of Minerals and Energy has initiated a comprehensive survey to re-evaluate coal reserves but that no information was available as to the progress of this study. Hence the WEC member committee had to revert to using a number from the latest report from the Department of Minerals and Energy which dates back to 1987. This figure has been adjusted by WEC for all the coal produced since then.

5)The large downward revision in the 10th largest coal reserve holding country, Poland. The revision is due to a change in the type of reserves reported. Poland now reports only the ultimately recoverable amounts in developed deposits; previously reserves from all known coal deposits were reported.

These fives anomalies in some of the largest coal reserve holders in the world make it clear that there is a need to worry about the quality of coal reserve data. Better data is needed as coal reserves could very well be much lower than currently reported. The IEA, however, does not share this concern over data quality:

"Coal is the most abundant and geographically dispersed fossil fuel. Proven reserves at the end of 2005 were 847 billion tonnes (WEC, 2007). . .Current reserves are more than adequate to meet projected growth in coal demand through to 2030 in this Outlook. However the rapid increase in demand in recent years has seen the global reserves-to-production ratio fall sharply, from 188 years in 2002 to 144 years in 2005 (WEC, 2007 and 2004). This fall can be attributed to the lack of incentives to prove up reserves, rather than a lack of coal resources. Exploration activity is typically carried out by mining companies with short planning horizons, rather than by state-funded geological surveys. With no economic need to prove long-term reserves, the ratio of proven reserve to production is likely to fall further." (IEA, WEO 2007, page 128)."

While the IEA does note that the Reserve to Production ratio is dropping sharply, mainly due to increasing demand**, this is not seen as a potential limitation to coal production. A favorable impression of future prospects is given by stating that a lot of coal is left to be explored. This is a hollow statement in the sense that these amounts left to be explored are not quantified by the IEA in any manner. Interestingly, this opinion is in stark contrast with that from the World Energy Council which states in its Survey of Energy Resources 2007, "After centuries of mineral exploration, the location, size and characteristics of most countries' coal resources are quite well known. What tends to vary much more than the assessed level of the resources (in other words, the potentially accessible coal in the ground) is the level classified as proved recoverable reserves (that is, the tonnage of coal that has been proved by drilling etc. and is economically and technically extractable). (WEC 2007, page 13)." As I am not an expert on the topic of coal exploration I cannot judge the value of either statements. I do know that some large coal fields are still being found. A large coal field of 23 billion tonnes of total resources has been uncovered in China since last year (China People Daily's Online).

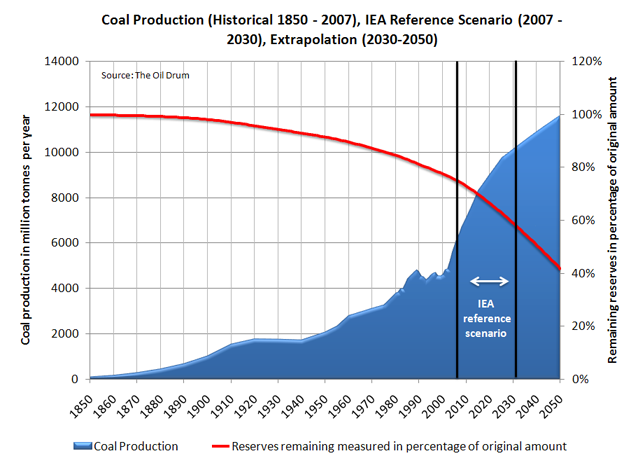

What I can say based on current (poor) WEC 2007 reserve figures is that the IEA WEO 2008 reference scenario appears to be a scenario that holds some merit. In this scenario, humanity will have used up 50% of all coal reserves by 2040, and 60% by 2050 (shown in figure 1 below). The remaining reserve percentage is calculated by adding historic coal production to current WEC reserve statistics. This is done based on the assumptions that no new coal fields will be discovered, that the current reserve figures are accurate, and that reserves will not be added due to technological improvements. While we know that all three of these assumptions are incorrect, such a scenario at least tells us that coal production will not outlast the 2nd half of the 21st century without significant increases in reserves, if coal usage continues to grow.

The shape of coal production

In order to get a better understanding of the long term production of coal, we need to study the expected production path of this resource. This is one of the the big questions that remains unanswered by the IEA. What will be the shape that coal production takes on a country level and a world level? The IEA just makes a forecast that ends in 2030 without any production shape analysis.

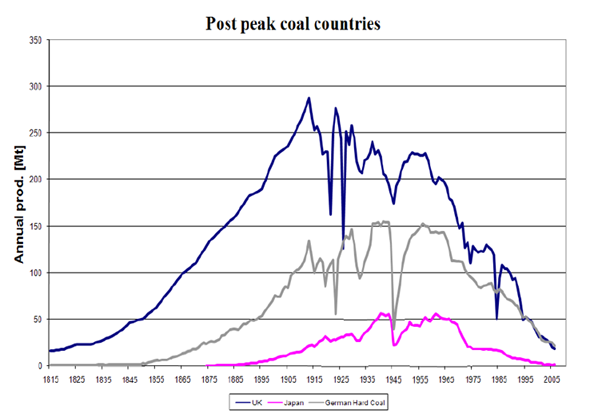

When looking at historical data from the United Kingdom, Germany and Japan, we see a very similar shape for coal production on a country level (Figure 2 below). Coal production reaches a plateau when around 30%/40% of coal reserves have been produced. The plateau lasts for several decades, after which a quite steep decline sets in. I have not studied the underlying economic and geological factors of this shape in detail. My hypothesis is that a physical limitation to coal extraction per time unit occurs due to logistics and energy/economic costs. In the beginning of extraction on a country level, more coal mines can be opened up and it makes economic sense to do so. After several decades the better coal grades in easily mineable coal seams have been depleted, and it becomes more difficult to extract more coal per unit of time out. The costs become too big to increase production; thus a plateau sets in. This is a simple hypothesis that needs to be explored further.

In case of the three examples shown above, the decline around 1960 began due to factors affecting the energy market. Between 1957 and 1960, there was an oversupply of coal as demand for coal decreased. The oversupply was caused by a combination of mild winters, several years of low economic growth, an increase of efficiency in the industrial sector, and a shift from coal to oil due to a favorable price difference (Messing 1988). The steep decline of production in Japan, Germany and the United Kingdom after 1960 continued because it became more economic to import coal than to produce it at home. Later on, after 1970, natural gas began to be substituted for coal in the electricity market.

The specific factors at play in these three examples should lead to caution in duplicating this particular shape of production to other countries and the world. In the coal studies that analyze the potential for future production, in my opinion, the duplication of a bell shaped curve with a long plateau is done too readily, without sufficient analysis.

I think that the IEA should work to develop a sound analytical framework for the expected production shape of coal, especially because the geographic spread of coal could cause several important producing countries to run out of coal long before 2050 if usage continues without interference. The first country that is most likely to reach a plateau in coal production is China. This occurs because 41% of all coal production in the world came from the country in 2007.

China - the key to knowing the long term future of coal

Relative to its current production, China appears to possess sufficient reserves. China has 13.5% of total global reserves according to WEC statistics, which implies that the country extracts 2% of its reserves each year. However, China's coal extraction is growing rapidly at 12% on average in the past five years (18% in 2003 dropping each year since then to 7% in 2007). If the 2007 growth rate of 7% continues, China will be extracting 5% of its reserves per year by 2017.

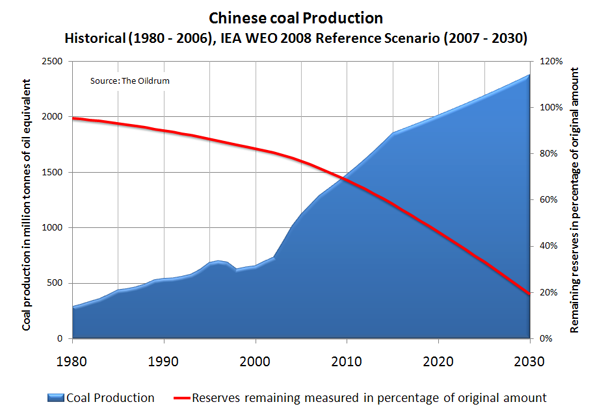

According to the IEA World Energy Outlook 2008, this will not become a problem. The growth in Chinese coal production is expected to slow significantly, averaging 2.8% between 2006 and 2030, with growth continuing until 2030. If current WEC reserve figures are accepted at face value, it becomes clear that this scenario is not possible, as shown in Figure 3 below. The red line in the figure shows the percentage of reserves remaining based on adding historic production to the WEC reserve figure, and subtracting the reserves produced in the WEO coal production reference scenario for China from this number each year. As can be seen, China will have used up around 50% of its reserves by 2020, and 80% by 2030, in the IEA reference scenario for Chinese coal production.

Based upon empirical data from Germany, UK and Japan as shown above, it is much more likely that China will reach a plateau in coal production somewhere between 2010 and 2020. Again, I have to state as earlier, this is based on the assumptions that no new coal fields will be discovered, that the current reserve figures are accurate, and that reserves will not be added due to technological improvements. While we know that all three of these assumptions are incorrect, it at least becomes clear that the IEA Reference scenario for China is not possible without a very large increase in Chinese reserves.

In the WEO 2008, the IEA does not state what assumptions were made in arriving at their scenario for Chinese coal production. However, some information is given in an earlier report, the World Energy Outlook of 2007. In the 2007 edition a more detailed look was taken on China and India, including Chinese coal production and consumption. Regarding Chinese coal resources and reserves the following is stated:

"China’s remaining coal resources are second only to Russia’s, totalling 1003 billion tonnes (General Geological Bureau, 1999). These resources have been defined by exploration and mapping, but only 115 billion tonnes can be regarded as proven reserves, yielding a reserve-to-production ratio of around 50 years at current production levels. More recent assessments conclude that proven reserves could be as high as 192 billion tonnes (Barlow Jonker, 2007). A prospecting programme is currently under way to prove up more resources, using revenues from the competitive tendering of mining rights."(IEA WEO 2007, page 334)

The reference to Barlow Jonker in the piece above quoting 192 billion tonnes, as a potential figure for proven reserves, is the only piece of information that the IEA gives to support their Chinese coal outlook. Barlow Jonker is a daughter company of Wood Mackenzie. The report the IEA refers to is Barlow Jonker's China Coal Fourth Edition report from 2007 which is available at an unknown price (probably more than $10,000 dollars) through Wood Mackenzie's China coal market service.

From Barlow Jonker's statement of capability we learn the following about this report:

"Barlow Jonker’s ‘China Coal 4th Edition 2007’ is the most complete review of China’s coal industry available on the market. The 3 Volume Study covers China’s coal geology, coal production, transport, consumption and trade. Containing over 500 pages of information and 60 maps it is THE essential reference guide to all involved in and impacted by China’s 2.3 billion tonne coal market.

Vol I ‘Industry Overview’ provides over 250 pages of information on China’s entire coal chain from detailed reviews of each province’s coal geology, to government policy, coal transport, consumption, and trade. It contains Barlow Jonker’s own expert opinion and analysis of a range of drivers shaping the industry and forward outlooks.

Vol II ‘Key Producers’ has been expanded and contains detailed mine data sheets (including cost estimates) on 66 of China’s largest coal producing companies that collectively control over 500 mines together producing over 1,000Mtpa. Also included are data on 230 new coalmine projects with combined new production capacity of over 800Mt. The level of detail, presentation, and analysis of this data exists nowhere else.

Vol III ‘Coastal Consumers’ is a new addition to the Study examining coal demand in China’s coastal provinces – the key region impacting on the international seaborne market. It contains data and analysis of each province’s coal demand, including power stations and coke producers. It is essential information for exporters to China, as well as all those impacted by China’s involvement in the international seaborne market." (Barlow Jonker 2007)

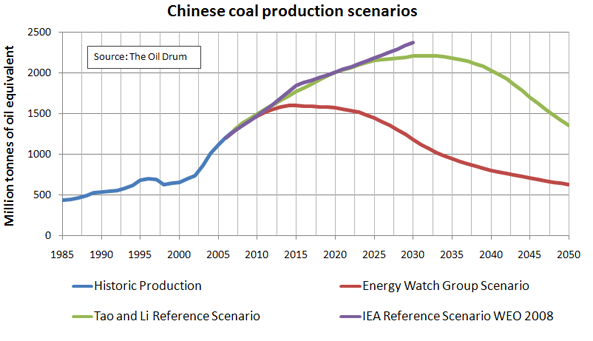

The report sounds like a worthwhile piece of information, but it is inaccessible due to high costs. Since we cannot read the report, no judgment can be made regarding the validity of the 192 billion tonnes coal reserves figure. However, what is possible is modeling Chinese coal production with a figure of 192 billion tonnes. Even better, to make my life easier, there already is a study in which Chinese coal production is modeled using a similar coal reserve figure. This analysis has been conducted by Tao and Li (2007) from China Northeastern University. In this study a coal reserve figure of 186.6 billion tonnes is taken that comes from the Chinese Ministry of Land and Natural Resources as of 2002. This figure is inserted in a bell shaped production formula after Laherrere (2000) by means of Stella modeling software. Their results show that Chinese production will begin to plateau around 2025, and the eventual decline sets in around 2035 (green curve in Figure 3 below).

A similar study to that of Tao and Li, based on much lower reserves, has been conducted by the Energy Watch Group (2007). This study concludes that China could reach a plateau in coal production already around 2015, if reserve figures are lower then WEC suggests (blue curve in figure 3 below). The EWG uses a coal reserve figure for China of 95.5 billion tonnes, which is the result of subtracting production since 1992*** from the WEC reserve figure.

The International Energy Agency reference scenario for Chinese coal production almost exactly matches the Tao and Li (2007) scenario until 2025. After that, the two forecasts diverge, with the IEA expecting continued increasing coal production in China until 2030 (purple curve in figure 3 below), while Tau and Li forecast a Chinese coal production plateau.

The difference between the scenarios caused by doubling the reserve estimate is striking. If the Energy Watch Group scenario plays out, the world will be in significant additional trouble soon (on top of the current problems), since it is unlikely that China's growth boom can continue when Chinese coal production plateaus at the beginning of the next century. There are no energy sources that can grow quickly enough to substitute for China's appetite for more energy in such a short period of time, including the import of more coal. (I will come back to this in the third part of this series.) On the other hand, if Tao and Li's scenario plays out, there probably still is sufficient time for China to prepare for substitution of coal by other energy sources around 2030. In any case, the IEA scenario appears to be unfounded even if we look at a very optimistic coal reserve figure for China.

One of the first issues that needs to be sorted out to get a better grasp at future coal production is the actual state of Chinese coal reserves. As I was writing this post, I investigated whether there are other sources of data for Chinese coal reserves outside of the public domain that are not as expensive as Barlow Jonker's coal assessments. The only source that I found was China Coal Resource. This company gathers coal data based on an extensive resource/reserves classification assessment including grade quality, production location, and coal seam depth and thickness. The details could be found earlier here, but this section has been put into the subscriber part as of last week unfortunately. Subscriptions for one year to this data cost $700, which is a very affordable price. Furthermore I am informed by the company after inquiring that the reserves data has just been updated to reflect the latest data as of September of this year. All in all it looks like quite a promising source of data that could shed a great deal of light on China's coal production, and with China the entire world.

Conclusions

In this post I analyzed the likelihood that the IEA WEO 2008 reference scenario for coal production can happen from a coal reserves perspective. My conclusions are that if we look at a global level and take the coal reserve data at face value, the data is supportive of the global IEA reference scenario for coal production to 2030 which shows on average coal production growth of 2% per year between 2006 and 2030. Beyond this scenario, further growth of coal production into the 2nd half of the 21st century is unlikely to happen without a significant increase in reserves.

However, inasmuch as 41% of coal production is now located in China, looking at whether coal production can match up with global reserves no longer makes sense. When looking at Chinese reserve data, it is not likely that the IEA reference scenario for Chinese coal production can occur, because the coal is simply not there based on current reserve figures. Only in a highly optimistic case, assuming China's coal reserves are more then double those currently known, will China be able to produce the amount of coal that the IEA expects in their scenario. Based on the available coal reserve data and scenarios (EWG 2007; Tao and Li 2007), it is quite likely that China will reach a plateau in coal production somewhere between 2015 and 2025. The implications of this are significant because it will be extremely difficult, if not impossible, to substitute other energy sources for coal in the quantities needed to maintain China's growth in consumption.

In order to be able to better assess the likelihood of a Chinese coal production plateau occurring and to study the effects of this on coal production on a global scale, better data and analysis of coal reserves in general, and for China specifically, is a necessity.

References

Barlow Jonker 2007, Statement of Capability, Barlow Jonker, Sydney

EWG 2007, Coal: resources and future production, Energy Watch Group, Ottobrun

IEA WEO 2007, World Energy Outlook 2007, IEA Publications, Paris, ISBN 978 92 64 02730-5

IEA WEO 2008, World Energy Outlook 2008, IEA Publications, Paris, ISBN 978 92 64 04560-6

Kavalov 2007, Coal of the future: supply prospects for thermal coal by 2030-2050, JRC Institute for Energy, Luxembourg, ISSN 1018-5593

Laherrere 2000, The Hubbert curve: its strengths and weaknesses, Oil and Gas Journal

Messing 1988, Geschiedenis van de mijnsluiting van Limburg, Martinus Nijhoff, Leiden, ISBN 90 6890 213

Tao and Li 2007, What is the limit of Chinese coal supplies - a stella model of Hubbert Peak, Energy Policy 35, pages 3145-3154

WEC 2001, 2001 Survey of Energy Resources, 19th edition, World Energy Council, London

WEC 2004, 2004 Survey of Energy Resources, 20th edition, World Energy Council, London

WEC 2007, 2007 Survey of Energy Resources, 21st edition, World Energy Council, London

Notes

*In the BP Statistical Review of World Energy 2008 it is stated that the coal reserve data shows proved reserves at end 2007. This is incorrect as the data is until end of 2005, as stated in the original source of the data, the Survey of Energy Resources 2007 by the World Energy Council.

**While the IEA states that the drop in the reserves to production ratio from 188 years in 2002 to 144 years in 2005 is solely due to demand, this is not the case. Coal reserves dropped from 909 billion tonnes in 2002 to 847 billion tonnes in 2005 (WEC 2007; WEC 2004), a difference of 62 billion tonnes. In the same time period 16.6 billion tonnes of coal have been produced (BP 2008). If coal reserves would not have been revised downwards due to other factors than the amount of coal produced, then reserves would have been 892 billion tonnes instead of 847, and the R/P ratio in 2005 would have been 151 instead of 144 years.

***The Energy Watch Group subtracts Chinese production since 1992 from the WEC coal reserve figure for China, as this was the year in which the last Survey of Energy Resources by the WEC was published that contained new data on Chinese coal reserves. However, WEC normally publishes in their report data that is two years old (the 2007 report showed end 2005 data, the 2004 report end 2002 data etc.). I think it is likely that the 1992 report published end 1990 data. Since I have not been able to find the 1992 report I cannot confirm that this is the case. The Energy Watch Group has assumed that the 1992 report published 1992 data.

I'm a little wary of applying a Peak Oil style analysis to coal production. Yes, it is a useful thing to do. My problem is with the idea that few new fields remain to be discovered, and most of the coal in known fields will not be recoverable.

My misgivings centre around your use of reserves rather than resources. It is true, at least in Australia, that miners do not bother to prove up reserves until they are a few years away from commercial extraction. This is because to a large degree they take the process of converting resources in to reserves for granted - because there is still so much of the stuff left here. I think you need to assume that a sizable proportion of estimated resources will be successfully converted to reserves, at least in countries like China and Australia where production is still increasing.

Also, while the majority of reserves may turn out to not be recoverable by conventional methods, it may well be recoverable through in situ gasification, which is attracting more interest now the coal and oil prices are higher.Potentially there are several trillions tonnes of "unrecoverable" coal which could be converted to syngas, which is useful for power plants, "town gas" and GTL plants.

Gasification may become quite popular after the low hanging fruit is extracted. If China hits a coal production plateau in 2015 or 2025, which I agree is plausible, they are likely to turn to gasification in order to extract coal that is not recoverable by conventional means. Or, more likely, they will start building gas fed power plants in parallel to conventional coal plants as they see the plateau approaching.

Perhaps this was outside the scope of your initial article, but as we are literally talking about trillions of tonnes of non-conventional coal extraction it deserves a mention.

Isn't that pretty costly in dollar terms, though? I've only read about coal seam gas in a "carbon sequestration" context. Cost could keep production down, and the cost could restrict consumption - which in practical terms is the same as physical factors, and gives us a peak.

It costs more than digging up a thick seam with little overburden, definitely. You wouldn't bother if you had cheap alternatives. But when "conventional coal" hits a plateau, rising prices will make "unconventional coal" a more attractive proposition. Gasification potentially allows a country like China to increase its total energy use while coal production stagnates.

I've seen CTL projects claim they can be profitable at $30 per barrel. Gasification is cheaper because you skip the liquification step and just burn the syngas in a power plant.

This is 19th century technology, by the way, been done many times before. It isn't common because oil and conventional coal is cheaper and in abundant supply - for now.

Coal seam gas is a very different thing to gasification (UCG - Underground Coal Gasification).

I agree with the reservations above about total coal resources (probably because I'm Australian as well and am very aware that our coal reserves can jump pretty quickly whenever anyone feels like going out and drilling a few more holes - which they only do when they want to start a new mine up).

One day coal production will peak - but I'm very wary that we'll see a lot more coal produced in Australia, China, Pakistan, South Africa and the US than some people imagine.

For more on the Oz context, check out these posts on coal to liquids and coal seam gas in Australia (note that since these were written the Monash CTL plant has been shelved and the UCG industry has been pushed out of Queensland by the CSG boys and is trying again in South Australia) :

http://anz.theoildrum.com/node/3817

http://anz.theoildrum.com/node/4618

http://peakenergy.blogspot.com/2008/08/csm-vs-ucg-in-queensland.html

http://peakenergy.blogspot.com/2008/11/triumph-of-csm-over-ucg-linc-flee...

http://peakenergy.blogspot.com/2008/12/monash-ctl-project-put-on-hold.html

I feel I need to make a pre-emptive comment in regard to CO2 and climate change: Just because something is is a bad idea does not mean it is "not an option".

Often when CTL or gasification comes up somebody says "oh, we can't do that, think of all the CO2 it will release" and then dismisses the topic as if it will never happen (because it shouldn't happen). This is a rather strange kind of wilful blindness - if human beings refrained from doing something whenever there were harmful side effects, most of the industrial revolution would never have occurred in the first place.

Do you think a country that currently digs up a billion tonnes of coal a year will be squeamish about creating gas from coal in situ?

Have to agree.

Here's the fun bit, though..

If we add up all conventional oil, conventional gas and easily-mined coal, get the total CO2 emitted and assume half is absorbed (empirical observation), I believe that final atmospheric CO2 hits circa 450-500ppm, which is at the outer limit of 'manageable' climate change. Probably.

If you start adding in tar sands, assorted non-con gas and especially gasified coal seams.. well, just don't bother with property lass than 12m above sea level.

"12m above sea level"?

Sounds optimistic. But may be true if you only think about people like you and me (as most people do, sadly).

But our children and grandchildren (as far as they survive) should move quite a bit more up the hills: If the 25,4 million km³ of Antarctic ice melt away (e.g. due to feedback mechanisms) this would lead to a sea level rise of 57 meters (187ft). At that stage you can be sure the Greenland's ice sheet will also be gone, adding further 7,3 metres (23ft) to the sea level. (As far as I remember the sea level of the ice-free periods of earth history was even close to 100m above the current level, but I don't find the data right now.)

Roughly speaking: In the end phase of this coal-economy greenhouse scenario all the (dark) green areas of a present day world map will be "blue" then - supposed that the remaining population will still have things like world maps.

For my part, obviously I am not keen on having a big chunk more CO2 pumped out, whatever the source.

My query was only about the cost and technical difficulties involved in coal seam gas, because we're talking about its peaking. I mean, in oil we've got good old Saudi light sweet crude circa 1950, whack a pipe in the ground and out it spurts, and then we've got Alberta tarsands, a real mess to get the stuff out. If more of our oil comes from tarsands than easy reservoirs, then we're at peak.

So the question is whether coal seam gas is more like easy oil reservoirs, or more like tarsands.

I mean, I don't want another gramme of the stuff burned, oil, coal or gas. But that's not likely to happen, so the question then becomes, when are economic and technical factors going to give us the peaks, so that we end up burning less whether we like it or not.

Perhaps better to let billions die and not destroy the planet so that at least some will survive.

Sounds harsh? Well all the destruction up til now has in the end been pretty harsh for nature wouldn't one say?

Ohh but not to US! We deserve better,like that new Hummer etc.

While plants and animals continue to die off to make more rooms for more fat asses. A shame but then the fat asses surely don't care.

So harshness? Whose perspective. The planet or some fat asses?

There is lots of coal in Kentucky. It has not really been kind to Ky all this strip mining. Take a ride out Hwy 62 to Greenville. Notice the land or the lack of it. Notice the creeks still flowing with runoff that looks and likely is toxic.

And the small towns nearby? No better off than any others. So strip mining seemed to profit no one.

Now what I really get mad about is the huge pulp/paper mills who are hell bent on cutting every single piece of timber they can find. Their woodyards cover hundreds of acres of dead trees hauled there. All so someone can wipe their fat asses with paper.

Yes I tend to go a bit overboard but the folken in the cities do not get to see it daily. The huge losses to habitat all to feed the maw of 'a better life'? Fahhhhh...

Airdale

We have shown virtually no concern thus far in this age of extinction, even for the future of mankind, not even mentioning non human species. How dare you point out the truth. Don't you know we are in the midst of a global economic crisis? Just let us get through this crisis and then we will go back to doing something about the ecological health of the planet. Oh wait!!! We did nothing while we were in a state of prosperity.

On an intellectual level, I think Obama gets it that we cannot put off doing something about energy and global warming in the face of what we call the crisis. I am not sure, however, that he really gets it in his gut. To confront these problems will take passion. But I could be pleasantly surprised. So at least I should wait until he actually gets in office.

Don't you know Jesus is going to provide a couple trillion tons more coal for us to burn? It's underground, after all ... and we can't see underground. We can't watch Jesus making coal.

Making all this new coal right under our noses is a miracle.

Jesus is going to make some more 'abiotic' oil while he's at it. It's another miracle. For someone who can turn water into wine, turning garden variety rocks into coal and oil is a piece of cake!

We need to pray the US auto industry gets a government bailout, so they can get back to building more automobiles. How hard can that be? Jesus doesn't care about rain forests or weird species of amphibians or fishes or birds. Jesus is on OUR side, on the side of subdivisions and developers. He wants life to be comfortable, convenient and for us to run up enormous debts in the process.

Jesus will keep us from going bankrupt. If Jesus can raise up dead people, he can certainly raise up dead investment banks.

All you need is hope ... baby!

Yeah, but Jesus can't put the tops back on the WV/KY mountains. They're way too gone for even JC.

He can't pull the overburden out of the 700 miles of creeks already filled and the ??? miles yet to be filled that are not covererd any more under the clean water act.

No, Jesus can't do that.

God or Buddah or the Invisible Pink Unicorn can't do that either.

I wish JC could tell me when the oil price slide will end. Too scared to short USO, too scared to buy :-O

It is not clear why billions need die. The Olduvai doomers have yet to explain the causative relationship between fossil fuel consumption and being able to maintain a particular population level.

Given the misanthropy in the rest of your post, I assume it's just wishful thinking.

Generally because of a simple logic error:

(1) Food production requires fossil fuel (Fairly true statement)

(2) A reduction in the amount of fossil fuel will automatically cause a reduction in agricultural production because of (1). (False - this would only happen if 100% of fossil fuel was used for food production).

Misanthropy? Misanthropy?

Try living where you have to see it often. Huge huge piles of dead trees. Not used for fuel.Used to simply create paper for printing on.

What happened I ask to the PaperLess Office? Was it just bullshit or is the paper used to print stock certificates or just more dollars then?

It sickens me to see the landscape virtually stripped of growth, ignorant deadly agriculture practices and you dismiss it as 'misanthropy'. I call it the 'steps to hell'.

The log trucks never stop rolling. Coming from the ozarks of Missouri , the lands of western Tennessee,even parts of southern Illinois and finally most of reachable Kentucky.

I talked to a log cutter last summer. He was proud of his job,well previous job for he was not assisting me in some work, I said to him that he was denuding the land for future generations and us as well.

His reply which I have made part of my post was simply" Why don't you try wiping your ass with plastic then?"..I told him he needed a corncob shoved up his.

He didn't last on the ag job so now back to cutting timber.

Now the folken running these enterprises have decided to make them a bit obvious by hiding some. Yet in mountaintop removal you can see it for many many miles away and you wonder then about the ignorance and utter depravity of this people who inhabit what was once very beautiful and extremely fertile lands not to mention the beauty of the Smoky Mtns.

Yet they could care less. We could care less. We are eating our seed corn and now the price is coming due. Very much due and its not

"Misanthropy" to me. Its killing us.

Airdale..course you may not see it and have to watch it...eyes wide shut....We will need it but like gas its not renewable either.

And I hear that recyclers are not able to find a market for their product. There should be a major tax on the use of virgin material. It is a crime that we have so much unrecycled paper while we continue to denude the landscape. Misanthropy indeed!!!!

Trees are renewable. If it takes more money/energy to recycle post-consumer paper (which contains stuff like ink, toner, glossy coatings, adhesives, etc.) than to use virgin pulp, maybe it makes more sense to turn the paper into biogas or ethanol or something else that displaces a non-renewable resource.

While a lot of countries would be interested in doing in situ gasification, I don't believe the technique has been perfected yet. It seems like it is all too easy to just get run-away burning of underground coal.

I think that this is one of the big question marks on the availability of energy from coal long term. If someone can figure out how to do the in situ gasification, there is at least the possibility of keeping the CO2 underground--but I wouldn't make bets that that it will actually happen, if not doing so is a lot cheaper.

@Gail

There is more than just an interest in doing in situ gasification. Worldwide there are around 30 to 50 small pilot projects going on or planned in this field in 10+ different countries (including Australia, India, South Africa, China, U.S., United Kingdom, Canada)

I remember from my youth that in Pennsylvania there have been underground fires in coal mines. Somehow they get started and there appears to be no way of putting them out. So they just burn and burn, until the coal is consumed. And this burning provides no economic benefit.

I wonder what plans are for keeping the underground gasification under control. Is the technology of gasification CONTROL understood? or is it just wishful thinking?

If you're talking about Centralia and the like, those seams are quite close to the surface and can get air to burn. If the seams are deep enough there won't be any air except what's pumped in to drive the process; turn off the air and groundwater will quickly snuff the fires.

One way to kill the fires in Centralia would be to dam the valley and let it fill with water.

A very interesting article, Rembrandt, thankyou. All too often we focus on peak oil, while forgetting coal and gas. My feeling is that their peaking is more deadly to us and our comfortable lifestyles, since we use coal to power us, natural gas to grow and cook our food, but oil just to transport stuff and make plastic junk. If the oil halved in production tomorrow life would be difficult but we'd live; if the coal and gas halved overnight many of us might freeze to death in the dark hungry. So it's good to see a look at coal.

It's a pity there isn't more open data. Things of public concern ought to be public domain.

I'd be interested in seeing more scenarios giving us global peak coal and natural gas dates. While the reserves are uncertain, what we've seen in the peak oil scenarios is that a bit more or less in reserves doesn't make a big difference to the peak date, just a few years here or there.

@Kiashu

Thank you for your kind words. I do think that the reserves matter quite a bit with coal and its respective plateau date (a peak is not an appropriate term for coal I think) as there is a much bigger uncertainty in the coal data as in the oil data.

Hello Rembrandt,

Outstanding work as usual! I recall reading sometime back about the new formation of a ASPO/China branch with Colin Campbell and/or Kjell attending their jumpstart ceremony. It would be interesting to solicit the Chinese ASPOites to comment on your China coal posting segments, plus any other energy news relating to the IEA WEO 2008 Report. Is this possible, or is the language barrier [or China Govt. political censoring?] too much at the moment? Thxs for any reply.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

@Totoneila

I have e-mailed Feng Lianyong from ASPO China to comment on this post and chip in on the Chinese situation, after you made this comment. If I hear from him Ill post it here.

Rembrandt

Right now we need more Planned Parenthood branches more than we need more ASPO branches. ASPO identifies and discusses problems. Much like the Sierra Club or Al Gore. Planned Parenthood is extraordinary in that it is an organization that is implementing a critical part of the solution.

Good comment, that's probably why conservatives find PP so dangerous. They actually make progress :)

Thanks for reminding us again of this very serious issue. There are many more questions around coal reserves and how they are produced.

(1) The article starts with a picture of coal trucks. That is a very inefficient way of transporting coal. With peak oil (crude) just behind us, this will not continue for very long. How many % of the coal is transported by truck and over which distances. If coal to liquids is used to substitute for diesel from oil, that will be even more expensive. With increasing urban population, transport of food to cities will be more important and more immediate a problem when the crunch time comes

(2) We don't know how many % of the reserves are in underground mines or in open cut mines. How much overburden would have to be removed in those mines to get at the coal? What are the energy requirements there?

(3) What is the size structure of those coal mines? Which technologies can be used in different mines? If there are many small mines, they will be more labor intensive and as salaries go up, more costly to produce.

(4) We also need to know how much of that coal is thermal coal and coking coal. If it is not available in the ratio needed in the economy that would be a limiting factor. How about the sulfur content? China will get an acid rain problem like Europe in the 60s and 70s.

(5) We read China needs 7% pa economic growth to avoid social unrest. By how many % must coal production grow to underpin this development? If we take the rule of thumb it has to be 3.5% pa. (=50% of economic growth). Anything under 3% may cause problems in the society and coal production is disturbed.

Of course there is the CO2 problem, but I understand this is not the topic in this article. Still, it has to be said that one of the most important impacts of global warming on China will be the melting of glaciers in the Himalayas. Water supplies and food production will be in danger.

China: Melting glacier leaves world's worst polluter with no room for doubt

http://www.guardian.co.uk/environment/2008/jul/25/glaciers.climatechange

No doubt, like the rest of the world, Chinese leaders will be confronted with terrible choices.

Hi Matt,

Good comments, on your point # (1) -- coal trains in the U.S. are maxed out (and prolly elsewhere too), and so there are transportation limits for trains, and there will be even more future demand for using trains to haul food.

Cheers,

CJ

@Matt

I don't have data to answer any of your questions at the moment. Perhaps China Coal resource has some data for China specifically to answer your questions. However, it might take a while before I can get to that data due to a paywall.

Matt,

a few quick remarks:

@3) Of course there are reports about this. For example you find some information here:

http://energy-edge.net/EUR%2022644%20EN%20Coal%20of%20the%20Future.pdf

and here

http://ie.jrc.ec.europa.eu/publications/scientific_publications/2007/EUR...

I think it is also one of these reports that state that coal transport by truck (@1) is probably one of the bottlenecks of the sluggish performance of Venezuela's coal exports.

Since one thing we can agree on at TOD is that oil and natural gas supplies will peak before coal, and between them they represent over 90% of the primary energy used by man, that peak coal must also mean peak energy (in the unlikely event that total net energy does not peak first).

The much lower energy return on investment of other energy sources makes their expansion to replace all fossil sources as fast as they 'deplete' highly implausible

In that context we are by definition looking at a global fall in GDP, because it is also very unlikely that we could improve energy efficiency in the economy to make up the shortfall (although the US in particular could do a lot in that respect).

So the bottom line is that peak coal MUST mean a declining global economy. That is to say the global energy production level that the economy will support must fall. So any expanasion of coal (or over energy) reserves based on more expensive (ie lower energy return) methods of extraction cannot be economic at that point. In any case, by that stage renewable energy sources will almost certainly have a better energy return on investment, in which case coal and all fossil fuels should ( in a free market - ha!) suffer in favour of renewables (and possibly nuclear, if the technology has advanced, and we can sustain such a high tech industry in a declining economy).

From an environmental point of view, peak coal is about the best news possible for humanity.

By definiton, net energy will peak first. Even without considering energy costs, the BTU content of our energy mis is declining on a gross basis. (NGL and ethanol are increasing % of total liquids, coal BTUs (in usa) peaked about 10 years ago - I don't have chart on this computer - perhaps someone has it)

Here you make some pretty big assumptions. The default route if we are out of ancient sunlight (coal) will be to go for old sunlight (trees). That will undoubtedly occur unless we have infrastructure in place to harness modern sunlight. (and has already occurred in Africa and elsewhere where people walk for miles to scrounge firewood)

Ralph,

Sorry. Not with you on that one. I think the best estimate that I have seen for coal peaking was done by Dave Rutledge at CatTech by doing Hubbert Linearization for world production and comes up with a coal production peak around 2023. Natural gas seems likely to peak around 2029 and who knows what will happen with all the shale gas and methal hydrates, which could extend it out well beyond then?

Rutledge is DaveR on TOD and has a few posts down thread. He also helped Euan and Luis on the global warming article earlier this week.

Not with you on that one, either. The supplies of fission fuel are at least in the millions of years, fusion fuel in the billions. Wind will be there as long as there is an atmosphere and solar until the end of the earth. The problem is not the supply of energy. It is converting from the declining sources to the plentiful sources fast enough to not go through some huge die-off and collapse of civilization.

Sterling

I have just been listening to a BBC radio 4 programme on the history of the science of thermodynamics http://www.bbc.co.uk/radio4/history/inourtime/inourtime.shtml

A key point in the evolution of theory was the notion that in a Carnot heat engine the work derived from heat was needed to drive the process (if I understood correctly?).

If our industrial world(s) is considered by analogy as a heat engine, then the useful work (rate) derived from heat is needed to drive the engine, and this would include the work of mining and using coal. Perhaps the descriptive 'work', rather than 'energy' is a more useful practical parameter that links 'economics' (i.e. the choice of activity) to reserves of chemical or other sources of heat? Otherwise it might be a bit puzzling why coal can be so effective in China's economic growth, (and in supplying 'us' with cheap Chinese products), when as a source, coal needed to be in part superseded and increasingly supplemented in earlier advancing economies of Germany, UK, France and Japan, and I guess USA? There maybe coal resource available, but not of the sufficient kind that can be 'worked' to maintain outputs of the more advanced world engine?

Notwithstanding their own climate woes it is clear that neither China nor India will make voluntary emissions cuts. Therefore we could be saved by the bell, as in bell shaped curve. As I posted on Drumbeat India needs to import a lot of metallurgical grade coking coal to run its steel industry. I believe that China has been leaning heavily on Vietnam to take much of its coal production with the promise of a nuke down the track.

Chinese interests are behind some UCG experiments in Australia. I understand that some of the likely sites have proved unsuitable due to issues with water and porosity. Thus UCG may not open up the many coal deposits inaccessible to man and machine in China or anywhere else. That leaves the possibility of opening up large remote lignite deposits such as the one in Mongolia. However the net energy after trucking (due to inadequate rail) that lignite to southern China must be low. Mongolia apparently also lacks water I presume for coal washing.

I recall a stockbroking report that said within a few years China will want a billion tonnes a year of coal imports, some four times Australia's exports. I also read that China wants to get into assembly line nukes that are prefabricated in factories and assembled at the customer's premises. Thus China's looming coal shortage looks very real.

Since the MAGICC software has been dissed perhaps IPCC could be asked to run an alternative coal output time path through their preferred model.

No need, as anyone who looks at this data can plainly see, we can all breathe a huge collective sigh of release and stop worrying about the consequences of rising CO2 concentration in the atmosphere caused by the combustion of coal and other fossil fuels. We won't need no more stinkin climate scientists to keep scaring the beejeepers out of us with their doomsday scenarios.

Cheers and Good luck all!

LOL! a negative four. Is parody not allowed around here or have I offended some who have either have no sense of humor or truly can't tell the difference?

When there are human-caused climate change deniers on the actual editorial staff, it can be hard to tell the difference between parody and a serious comment.

As opposed to the climate change deniers that were caused by what? Abiogenesis?

Sorry, I couldn't resist ;-)

The Oil Drum is a truly great resource, however the editors (most especially the editors) despite the fact, that they are actually human, have to be held to a higher standard than the general public. When they post material that falls outside the bounds of their fields of specialty their conclusions must be able to withstand scrutiny by peer reviewed scientists of said specialty. Having said that, their expertise can and should contribute significantly to the ongoing scientific discourse. Our very survival as a species depends on a deeper understanding of the many multifaceted, complex and chaotically interacting systems of both our social and natural environments. This is no time for narrow minded uncritical thinking and should not be tolerated.

Excellent article on Coal.

I wonder if the same Export Land Model explanation of declining oil exports can be used with coal.

Here's one graph of Polish coal production from the Energy Export Databrowser:

Looking at similar graphs for the nations listed in Table 2. leads one to wonder whether coal importing nations (e.g. India) will soon be paying a substantial premium for imported coal as producing nations consume a higher and higher proportion of their own production.

@Jonathan

The export land model doesn't apply to coal as such because of the much larger substitutability of coal with other energy sources. The economic variable in imports/exports thus plays a larger role.

I will look into imports/exports in my next post.

At the risk of incurring the wrath of the statistically enamored, I find the reserves estimate for Canada - seven billion tons - versus the US at 242 billion somewhere between fatuous and laughable. I suppose it's a matter of what you call reserves and what is defined as resources.

The cordillera so far has been exploited right beside the railway passes and maybe some short spurs. This upthrust region which starts in Tierra del Fuego and goes all the way to Alaska- you betcha - just rears up an entry into a seam of coal that would otherwise be 'uneconomic' to mine. I seem to recall estimates of 300 billion tons recoverable from Alberta alone and no reason to believe that the same geology doesn't go all the way to Alaska. It may not be 'proven reserves' but anyone who has spent time in the area can figure it out. Any idea that the US has forty times more viable coal than Canada is out to lunch.

And Exxon did negotiate rights to a huge mess of northern Alberta tar suitable for toe heel air injection. Plus the possibilities for in situ gasification of that non upthrusted coal that you drill through to get to the oil and gas. It is quite possible, indeed probable, okay inevitable, that the volume of not so easy tar and coal vastly exceeds the easy stuff we're now coming to the end of. The largest volume isn't necessarily on the low hanging branches.

It's amazing what becomes economic when you're starving or freezing.

@Petrosaurus

The reserve estimate on Canada trace back to at least 1999 (probably much earlier but I cannot tell without having access to all the survey of energy resource reports). This would explain the huge difference.

Good point to keep in mind when hunting for coal data. There must be a better estimate for Canadian reserves out there somewhere.

Rembrandt,

Thanks for your article, I thought it was excellent.

But I think a lot of the individual country reserve figures will turn out to be a joke on closer inspection. That's my concern.

If coal is very widely distributed, does it make sense for one of the worlds largest countries, Canada, to have 7 billion tonnes, while Australia, India, China, Russia and the USA all have about 10 times this amount?

Likewise, is it credible that another large country, Brazil, also has only 7 billion tonnes?

Is there a geological reason to explain this - or is the explanation that both countries have a low population density and have not yet been fully surveyed?

In the case of such an obvious anomaly, I don't think we can accept these figures at face value. It would be necessary to talk to industry sources to find out how thoroughly the country has been explored. You may find that the feeling in the industry is that there are many large basins which have remain unexplored and are not counted in resource or reserve estimates because they are geographically remote and there are plentiful deposits closer to markets. Thus "not economically recoverable". At current prices. Because there is no rail line. But if prices increased and you then opened up a new region by building a rail line, they would be recoverable.

For example, you will note that all the coal mines in Australia are close to the coast. Is this because coal is only found in coastal areas? No, it's because the cities are on the coast. We are exploiting the resources near the ports. There may be other basins 500km or 1000km or 2000km inland, but we'll get to those later.

Another little example of data doubtfulness. Argentina has oil and gas, but apparently less than 700 million tonnes of coal, despite being a large country. A little Googling reveals they have ONE working coal mine at Santa Cruz, which accounts for 80% of the country's known reserves, at 500 million tonnes.

Is it plausible that a country of 2.7 million square kilometres has one sizable, economic deposit, but only ONE?

@TenThousandMileMargin

The point you make makes sense, do you have any ideas for books/written resources to study on this topic?

Rembrandt

I think it was at www.chrismartenson.com that I read that coal had already peaked if one looked at it from the energy output point of view. I.e., the various grades of coal have different energy densities, and the high density grades had already been used up, and although there's plenty left volume-wise, it's of ever lower quality, etc.

What do the coal people here have to say about that argument (if I've presented it correctly)?

All the coal mines I've seen seem to have a railway track beside them. They have coal trucks in China but in the NA west it's all rail hopper. I don't know whether coal deposits have an affinity for railways or the other way around.

I'm sure you are making a point, but in a way that's far too clever for me to understand.

I typed in a sarconal warning but had second thoughts. I just mean that when the railways hit the Rockies they exploited the visible coal seams that were beside the right of way. When these played out or it became simpler to find another seam they just ran a spur line. Before the big coal boom of the last few years a ton was going for under $50. That's the thermal equivalent of maybe six barrels or so.

I was just joking that the reserves figures don't seem to think that the stuff might not just be where the railways went. In BC they built a long spur line, which I think might be electric, to Tumbler Ridge for coal to export. When I see the whole cordillera area a jumble of spur lines I'll start getting worried about depletion. You can't send it through a pipeline so the carrier of choice is truck or rail, and at the equivalent of maybe $8 a barrel you're not going to haul it with $50 oil if you can help it. When you get the coal wholesale you think thermal electric, hence rail.

I can understand why coal is dirty little secret, but I have yet to find reason to believe we have really begun to exploit the resource significantly in most of the cordillera region, and in the East it is maybe a matter of how many mountains you want to level. If this is what you're going to plug your Chevy Volt into, I'm revolted.

Ahem. Coal pipeline.

I think transportation is a major issue. As far as I remember one of the reports I mentioned above said that the coking coal of western Canada, which is carried by railway to the coast, is the most expensive coal in the world (at the time of the report). And I remember that the cost to carry the coal from the mines in Mid West America to the coast is much higher than the mining itself - and all railways are fuelled by oil.

The transport issue may considerably reduce the possibilities of converting resources to reserves - and also downgrade new discoveries. For example the USGS made a new assessment of Alaska in 2004, which seem to have boosted US resources considerably. However production costs were not assessed. A big part of the coal seems to be lignite, which cannot be exported but only used near the mine.

If at least a bit of climate protection is taken seriously then underground carbon capture and storage (CSS) has to be possible there or not too far away - otherwise the entire project won't be possible economically (which is challenged anyway by CSS).

Maybe I'll write more on the topic later on.

The association of railways with coal goes back to the very beginning of the industrial revolution. Railways, drawn by horses, were invented to haul coal out of mines. As coal accumulated at the mine head, railways with steam engine motive power were invented to haul the coal to market in cities. The association is absolutely not accidental ;-)

About the coal trucks in China: What will they do to move the coal when diesel fuel is very scarce? Being late to the party can be very difficult.

Perhaps they are planning on building rail lines, and the trucks are a temporary measure.

He refers to US coal production, which is producing more tons but less total energy content. This is in line e.g. with BP statistics.

Hi Rembrant,

I think you are referring to the energy content of the different types of coal. Am I correct that coal is a bit like wood with Oak, having a higher BTU density than Birch which has a higher BTU density than Pine?

If so, is the need not to be concerned with the different coal types due to the reason that the worldwide ratio of each remains relatively stable over the next 40 years? But in China's unique case, would the ratios change enough over time to further add to their inability to replace the coal gap in time?

@PriorityX

I am referring on one hand to the energy content, but also to the way in which the different types of coal are used (lignite isn't transported over the seas because it is too costly, from bituminous coal one can make coking coal and steam coal (depending on the quality etc.).

Your reasoning on wood as an example is correct. In answering your question, it would make sense to differ between qualities when talking about coking coal that is needed to make steel. However, since we are talking about electricity production here mainly, and one can produce electricity from all coal grades, I decided it wasn't worth the trouble to make things more complicated than they need to be at the moment. Especially because of the poor data quality, if there is sufficient data available it would become worthwhile to do a net energy analysis on coal.

In my next post I will look at the difference between coal usage/qualities by the way as this is very important from an import/export perspective.

Coal varies considerably in its energy value.

Anthracite is the best at about 14580 BTU/lb.

Then you have various grades of bituminous (13,900 BTU/lb), through sub-bituminous and finally down to lignite or brown coal that is approximately 8750 BTU/lb.

Some countries have already exhausted their anthracite, and are working their way through the bituminous grades. This means that the tonnage needed to meet a nation's energy demands, will naturally increase as the mean calorific value of the fuel decreases.

Germany and parts of eastern Europe have only lignite - but have devised ways of burning it efficiently for power generation.

A coal gasification plant in North Dakota, converts brown coal to natural gas, which is used for heating and power generation. The gasification process also releases useful byproducts, and almost pure CO2 which is used for oil well pressurisation in Saskachewan, 200 miles to the north.

Coal will continue to be a valuable fuel in the future despite its relatively dirty image and the quantity of CO2 emitted when it is combusted. It is likely that it will be even more in demand as other fossil fuels such as natural gas and oil become less available.

It will be difficult to persuade coal burning nations to reduce their coal consumption on the grounds of climate change if no other viable options for power generation and iron/steel production exist.

2020

Very good post.

Is there a coal reserve classification system similar to the one for oil (3P)?

It seems that "unconventional" coal reserves that could be tapped using gasification techniques appear to be huge:

http://www.theoildrum.com/story/2006/1/6/181130/4446

My concern is that we are maybe too conservative in our estimates by looking only at conventional extraction methods in the same we were too conservative with Natural Gas production that has benefited from unconventional NG sources.

Also, is there any YTF amount for coal?

Hi Khebab,

"Is there a coal reserve classification system similar to the one for oil (3P?"

As Rembrandt says, at the world level, the only data that make much sense are the WEC survey responses. These are for "proved, recoverable reserves." In earlier WECsurveys, coal-in-place was reported rather than recoverable coal, and some countries are just now making the transition, like India and Brazil. This contributes to the downward trend in world coal reserves.

"Also, is there any YTF amount for coal?"

This goes in the other direction than for oil. Coal is a rock, and most of the major fields were identified at outcrops more than a century ago. In the process of proving the coal fields by drilling, it was often found that the fields were not as extensive as one might guess from the outcrops. This contributed to the 10:1 reduction in US coal reserves over the 20th century.

Dave

I am still working out the significance of the 3P classification scheme, as I didn't want to be tainted by what seems to me a subjective categorization. IMHO, for a given model, the most important result is the most probable outcome, and then a spread of results with different levels of confidence on either side of the most probable. Especially the possible outcome seems awfully arbitrary as it usually means possible on the optimistic side, yet there is also an equally possible outcome on the pessimistic side, if you believe in probabilities.

The provable amount seems to be a case of a model-independent accounting that offers little in the way of projecting outcomes. Or is this just the""pessimistic" balance to the "possible" projection?

@khebab

Here you can find an article on the reserve classification used by the USGS on coal:

http://pubs.usgs.gov/bul/b1450b/b1450.htm

Rembrandt,

Thank you for the excellent analysis. I have a particular interest in coal as I live where "coal is king." I vote YES for MTR-VF (mountain top removal and valley fill) and SO2 and CO2 every time I turn on a light.

I'm following allenfrombigeasy's lead and shooting for 3000 kwh per anum. At this time we're at 4200 ttm (trailing 12 months.) We feel it's doable with more conservation only.

I'm also working with local tree huggers and will suggest city wide 3000 kwh initiative and major city lighting reduction to reduce coal consumption and much needed cost reduction at a meeting next week.

My houshold is also participating in this excellent clean energy program:

http://www.eon-us.com/green/ge_motherannlee.asp

Yours in transition...

@Sterling925

Has centralized electricity use in your area gone up or down in the last few years?

Usage has been flat to slightly down.

all GWh:

2002 - 33,172

2003 - 33,492

2004 - 34,429

2005 - 35,624

2006 - 35,192

2007 - 34,663

14 e.on u.s. plants serving about a million people (25% of total) in KY USA.

8,401 MW capacity(based on published plant info)

87% coal

11% gas/oil

2% hydro

Edit: Why do you ask? Futility check?

@Sterling925

Out of interest to get a better grip on what is going on in the USA. I know too little about the electricity situation in the US.

Rembrandt,

Hope this was helpful to you. What we have in this region is relatively cheap and abundant coal. This may be an incorrect assumption but it appears from my brief investigation that in spite of calls for conservation no significant reduction of use per capita has occurred. We have only remained flat usage wise, perhaps slightly down if 1-1.5% growth is considered. Also, IMO there is no way in the world that coal could be phased out in this area and contiguous states by 2030 as Hanson (NASA) calls for.

It also appears that we used a higher proportion of combustion (gas/oil) to coal than capacity. 70%/28% coal/gas-oil use vs 87%/11% capacity. I'm wondering if they're doing this to meet Clean Air standards?

I'll be taking a closer look..Thanks

@Sterling925

I think the crucial question to phasing out coal usage in the US as Hanson calls for is the rapid deployment of a massive HVDC (High Voltage Direct Current) Grid so that states without a lot of natural capital for alternative energy can import electricity from states that do have that capital. Such a grid would have to be built in a 15-20 years time period along with scaling up alternatives.

Would be extremely costly, but perhaps worth it depending on how urgent the question of climate is (I'm not an expert just follow the discussion on the sidelines and don't have a position).

Please tell them to put some damn wind turbines on top of those mountains.

Good idea. I'll check and see what's in the pipe and get back in another thread. One rationale to date for MTR-VF has been that more flat land is needed in Appalachia for airports, hospitals and big box stores.

Jobs...

Note - I heard a report on NPR yesterday that Bank of America will no longer lend to companies engaging in MTR. A small blow for sanity.

You should always check if "green" is really green.

With e.on I have my doubts. Look yourself:

sourcewatch

greenwashguerrillas

prwatch

corporatewatch

etc.

Just saw a TV commercial that comes down hard on "clean coal." Real hard.

http://action.thisisreality.org/

Would anyone like to look at the detail portion of the site, http://action.thisisreality.org/content/details and help me understand just how accurate they are? Are they leaving anything out that would diminish their argument?

They seem to have their facts right, but they contradict themselves in their commentary. One paragraph they are saying coal w/CCS can be part of clean energy, and the next paragraph they are saying that it can't because of MTR and other enviro concerns.

Personally, I think clean coal as a solution is a complete waste of time and will never happen (it's just a PR stunt by the coal industry).

Hi Rembrandt,

Thank you for an interesting post. It is an excellent idea to focus on the relation between China's production and its reserves. However, it is not clear to me that China's own reserves will limit it. The world's top coal exporter, Australia, would have little difficulty greatly increasing exports to China over the next two decades, if the Chinese choose to buy the coal. In the longer run, it is easy to imagine major exports to China from Siberian coal fields that are not even producing yet.

"3)The large 38.9% downward revision in the 5th coal reserve holding country, India, in the 2007 Survey of Energy Resources versus the 2004 edition. No reason is given for this large downward revision in the WEC report."

The WEC says this on page 2, "In Asia a significant change(down 41 billion tonnes) was largely due to improved data for India, where the WEC Member Committee was able to report reserves on a recoverable basis, rather than the in-situ data emanating from the Ministry of Coal." I interpret the downward revisions as indicating that the national authorities are taking a more critical view of their coal resources, and that the WEC reserves are improving in quality.

"However, WEC normally publishes in their report data that is two years old (the 2007 report showed end 2005 data, the 2004 report end 2002 data etc.) Since I have not been able to find the 1992 report I cannot confirm that this is the case."

Yes, the 1992 report gives reserves for year-end 1990. Scanned versions of the WEC coal reports are here (50MB pdf).

"In the coal studies that analyze the potential for future production, in my opinion, the duplication of a bell shaped curve with a long plateau is done too readily, without sufficient analysis."

Could you please explain what you mean by this sentence? Was there supposed to be a link?

Thanks,

Dave

Dave,

Your coal HL is getting some traction but it seems so incredible to many. I have posted links to it many times on TOD, including above. I think you have made the strongest argument for why resource depletion is a more critical issue than global warming, but it still will take years to gain common acceptance. Maybe Obama will change that.

Keep up the fight.

Sterling

Hi Sterling,

Thank you,

Dave

@DaveR

Thank you for your very useful reply and critique. I missed the part on page 2 in the WEC 2007 report on India. In my hunting for data I looked at all the individual country notes (the one for India is on page 30). The country notes for India do not mention the reason, which is why I stated in my post that no reason is included in the WEC report.

I have now included this explanation in the post above.