The 2008 IEA WEO - The Oil Drum Initial Review (#1 in a Series)

Posted by nate hagens on November 13, 2008 - 9:55am

Today, the world's energy 'watchdog', the International Energy Agency (IEA) published their long awaited annual World Energy Outlook (WEO) for 2008. In stark contrast to bland-to-cornucopian supply commentary in past reports, the initial language in this years Executive Summary is of an urgent nature. This report is a step in the right direction for conveying our rapidly deteriorating energy situation to world policymakers - the IEA should be commended for making the turn and finally acknowledging: costs, investment limitations, new capacity requirements, steep decline rates of existing wells, and externalities (in this case GHGs). In effect, this report shatters the global illusion that oil resources magically turn into cheap flow rates. However, at first glance, the report's details do not support the urgent tone of the beginning paragraphs. Beginning tomorrow, The Oil Drum staff will be running an ongoing daily 'analysis/review' of the new IEA outlook. Below the fold is an overview/introduction to this series.

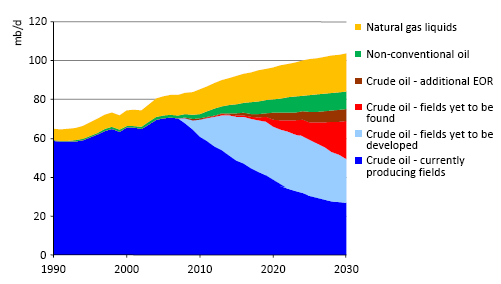

World Oil Production in IEA's Reference Scenario (IEA WEO 2008 Slide 8) Source (pdf)

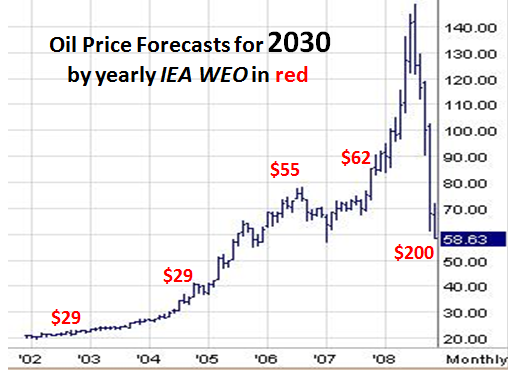

For the first time sine 1998, the IEA has forecast a higher oil price in the year 2030 than the current market price. In fact, the new price forecast for 2030 of $200 per barrel is not only higher than all previous WEO forecasts, it is higher than all previous WEO 2030 price forecasts combined. (1998-$17, 2002-$29, 2004-$29, 2006-$58, 2007-$65).

Here is the lead paragraph from the Executive Summary:

The world’s energy system is at a crossroads. Current global trends in energy supply and consumption are patently unsustainable — environmentally, economically, socially. But that can — and must — be altered; there’s still time to change the road we’re on. It is not an exaggeration to claim that the future of human prosperity depends on how successfully we tackle the two central energy challenges facing us today: securing the supply of reliable and affordable energy; and effecting a rapid transformation to a low-carbon, efficient and environmentally benign system of energy supply. What is needed is nothing short of an energy revolution. This World Energy Outlook demonstrates how that might be achieved through decisive policy action and at what cost. It also describes the consequences of failure.

WOW. Great stuff. Who wrote that? Let's sign him/her up as a The Oil Drum contributor! Basically, this is spot on, and one hopes it will be backed up with data, details, and recommendations going forward.

Second paragraph:

Oil is the world’s vital source of energy and will remain so for many years to come, even under the most optimistic of assumptions about the pace of development and deployment of alternative technology. But the sources of oil to meet rising demand, the cost of producing it and the prices that consumers will need to pay for it are extremely uncertain, perhaps more than ever. The surge in prices in recent years culminating in the price spike of 2008, coupled with much greater short-term price volatility, have highlighted just how sensitive prices are to short-term market imbalances. They have also alerted people to the ultimately finite nature of oil (and natural gas) resources. In fact, the immediate risk to supply is not one of a lack of global resources, but rather a lack of investment where it is needed. Upstream investment has been rising rapidly in nominal terms, but much of the increase is due to surging costs and the need to combat rising decline rates — especially in higher-cost provinces outside of OPEC. Today, most capital goes to exploring for and developing high-cost reserves, partly because of limitations on international oil company access to the cheapest resources. Expanding production in the lowest-cost countries will be central to meeting the world’s needs at reasonable cost in the face of dwindling resources in most parts of the world and accelerating decline rates everywhere.

Also well said - a public recognition that a) oil is finite, b) it is getting increasingly expensive and c) market prices do not predict future scarcity but rather oscillate with short term supply/demand unrelated to realizable long term flow rates.

Paragraph 3:

Preventing catastrophic and irreversible damage to the global climate ultimately requires a major decarbonisation of the world energy sources. On current trends, energy-related emissions of carbon-dioxide (CO2) and other greenhouse gases will rise inexorably, pushing up average global temperature by as much as 6°C in the long term. Strong, urgent action is needed to curb these trends. The 15th Conference of the Parties, to be held in Copenhagen in November 2009, provides a vital opportunity to negotiate a new global climate-change policy regime for beyond 2012 (the final year of coverage of the first commitment period of the Kyoto Protocol). The conference will need to put in place a framework for long-term co-operative action to bring the world onto a well-defined policy path towards a clear, quantified global goal for the stabilisation of greenhouse gases in the atmosphere. It will also need to ensure broad participation and put in place robust policy mechanisms to achieve the agreed objective.

Whoa. I am not a climate expert, but the magnitude, language and tone in this area strikes me as highly political. A further look at the executive summary shows that almost 1/3 deals with carbon emissions, climate change, and sequestration. As a card carrying ecological economist, I welcome the recognition of non-market costs (externalities), but the IEA is first and foremost an 'energy' watchdog and this segment borders on being both incomplete as well as incorrect. Firstly, there are many other non-energy environmental limitations to energy production: (most notably water, but also pollution) as well as limiting industrial inputs such as copper, steel, skilled labor etc that are not addressed at all in this report. Secondly, the focus on a 6 degree temperature rise in the reference case suggests a) they are using different climate sensitivity parameters from those that the IPCC uses - (with MAGICC Dave Rutledge reached 1.8ºC with 460 ppm) and b) the scenarios laid out to reach atmospheric CO2 concentration twice or higher those of today imply ultimate recoverable reserves for the combination of all fossil fuels to be several times higher those estimated by TOD and published by the industry. Though this website focuses on energy, not climate, the sudden attention and scale of these carbon figures in the IEA WEO will have to be analyzed and discussed. Further muddying the water is the new discovery of methane hydrates on the North Slope of Alaska which can apparently be 'safely' harvested with no runaway GHG implications.

In the end, the primary 'solutions' to resource depletion (source side) and climate change and externalities (sink side), are the same (less consumption). The area of contention will be center around how much of our remaining cheap fuel we should allocate to sequestration.

_________________________________________________________________________________________

The Full Report

At first blush, the urgency of the executive summary is not replicated in the full report. The devil, after all, is in the details. Here are some initial thoughts, which will be revised and expanded upon in a 2 week The Oil Drum review/critique of this important document.

Decline Rates

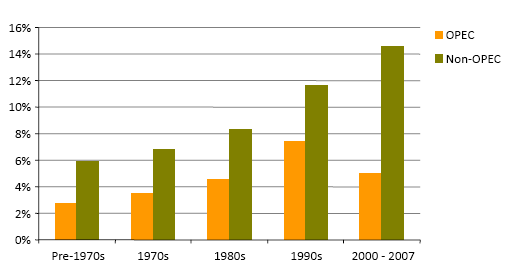

IEA WEO 2008 Slide 7 - Average observed oilfield decline rate by year of first production Source (pdf)

We know that technology and investments have perpetually been in a race with oil depletion. (first and second laws of thermodynamics assure the eventual victor, the pace and rate of change are open for debate). One area we can witness the extent by which technology is 'losing' this battle is in overall decline rates. The IEA production-weighted average decline rate worldwide is projected to rise from 6.7% in 2007 to 8.6% in 2030 as production shifts to smaller oilfields which tend to decline more quickly.

Chapter 10 of the report provides an excellent overview of oil field decline rates based on a total of 798 super-giant, giant and large oil fields and sub-sets thereof. The data are analyzed in terms of field size, field age, reservoir lithology (sandstone / limestone), OPEC/ non-OPEC, onshore / offshore setting, geographic location, etc.

Leaving the detail for future discussion, the key number is a postulated 6.7% global average decline rate that incorporates an extrapolation to thousands of smaller fields that have not been studied directly. This figure is significantly higher than the 4.5% global average decline rate postulated by CERA last year (Peter Jackson, personal communication with Euan).

The IEA data set is based upon IHS field data (and other sources) and is likely comprised of the same data used by CERA. The very large difference in the conclusions has significant implications for future oil supplies and must at some point be debated and resolved.

CERA notes that 41% of production comes from fields that are in the build up phase or on plateau. Their 4.5% average is based on averaging higher observed decline rates for the 59% of fields that are in decline with the 41% of fields that have yet to enter the decline phase using somewhat more sophisticated methodology than may be apparent from this simple summary.

The IEA adopt a different methodology: applying a decline rate to all fields, irrespective of their stage of development. And, for example a decline rate of 0.3% is applied to Ghawar, even though the field is still on plateau and the production history of this field is dominated by political production controls.

Fields in the build up phase, brim full with reservoir energy, will not actually experience decline in the early years. It seems that the IEA apply a decline rate to this production increment which at face value seems an erroneous practice, though it is premature to draw this conclusion. This may result in over-estimation of decline rates, and this vital issue may only be resolved through dialogue with the IEA to determine how the analysis was undertaken.

The IEA provide evidence for decline rates increasing with time and, if true, this poses a serious challenge to the global oil industry going forward. Especially with current credit conditions - lower oil prices and lack of credit reduce tertiary recovery and make observed decline much closer to natural. What needs to be added to the IEA scenario spectrum, is an analysis where NO new investment takes place - what decline rates and production then?

Finally, the IEA WEO chapter on decline does not mention decommissioning of aging offshore infrastructure in areas such as the North Sea. The boom of recent years has resulted in decommissioning deferred and the slump that is now gathering pace may see an acceleration of decline rates as aging offshore platforms are sent to the brokers' yard.

Capacity Additions

IEA WEO 2008 Slide 8 World Oil Production Under IEA's Reference ScenarioSource (pdf)

Under the reference scenario, production reaches 104 mb/d in 2030, requiring 64 mb/d of gross capacity additions –(six times the current capacity of Saudi Arabia) –to meet demand growth & counter decline. Historically, the 1960's was the decade with the largest capacity addition, with about 30 Mb/d added during that 10 year period. So, the IEA Reference Scenario assumes we need to do as well as the best decade ever over the next 22 years.

Technology is clearly better now than in the 1960s - but the resource being worked is in considerably worse shape (fewer large new fields, more old and smaller fields). It's not just the case of doing as well as we did before, it's a case of doing so with a worse resource base - a losing battle. It seems the only way what the IEA is proposing is defendable is if the new resources (like deep water) and/or new technology (EOR) will somehow offset depletion of the old resource base. This has NOT been the case in the United States, where data to measure such a thing at least used to be available, which brings me to my next point.

Net Energy/ Biophysical Economics

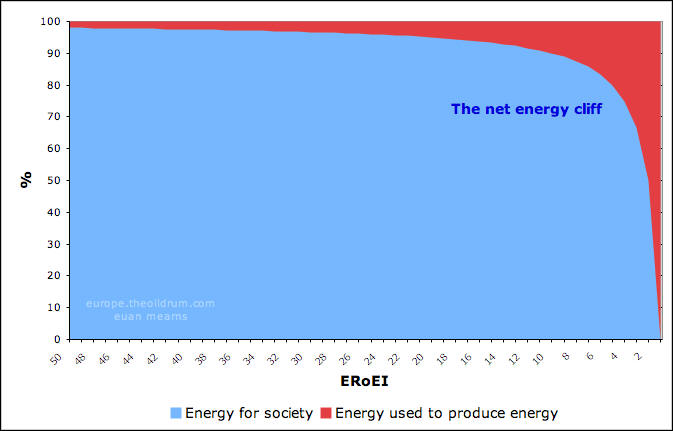

The above graph predicts that a full 20% of 'oil production' in 2030 will be comprised of Natural Gas Liquids. On average these liquids have only 70% the BTUs as crude oil, yet this handicap is not reflected in the report as IEA measures by volume, not energy. Of course much deeper than this omission of gross vs net, is the energy cost of harnessing the remaining fossil fuels. No mention of costs in anything other than dollar terms is made in the IEA WEO report. As witnessed by current global currency morass, measuring costs in dollar terms is a moving target. A huge amount of resource may be projected to be recoverable at $100 oil, but once $100 is reached, costs too have increased - this law of receding horizons does not seem to be considered in the IEA analysis. Economic activity is ultimately grounded in energy. It takes energy to procure energy. Therefore, if energy becomes as expensive and difficult to procure as the IEA suggests (requiring $24 trillion investment, etc.), more energy will be used by the energy companies themselves. The only true evidence of this we have (due to lack of data) is the work by energy analysts Hall, Cleveland, Costanza, Kaufman, Herendeen and others on US oil and gas data, showing a 100:1+ energy return in the 1930s, declining to 30:1 in the 1970s and a range of 10-17:1 in 2000. Anecdotally, it is much lower than that at present, though no one keeps data in energy terms anymore. At some point, lower and lower energy gain sends society over a net energy cliff:

As energy surplus declines, more and more of societies resources (the red) need to be allocated towards energy production

Clearly, irrespective the currency or price, if we spend more energy (of equal quality) to procure 1 unit of energy as we get out of it, this energy is no longer a source but a sink. I suspect much of the URR of global fossil fuels in the IEA report will ultimately be shown as such. The recent plunge in crude prices may be like a receding tide, laying bare those companies/projects that are close to energy breakeven. More analysis to follow on that next week.

Investments

The Reference Scenario projections call for cumulative investment of over

$26 trillion (in year-2007 dollars) in 2007-2030, over $4 trillion more than posited

in WEO-2007. The power sector accounts for $13.6 trillion, or 52% of the total.Unit capital costs, especially in the oil and gas industry, have continued to surge in the last year, leading to an upward revision in our assumed costs for the projection period. That increase outweighs the slower projected expansion of the world energy system. P 39 Exec Summary

The current financial crisis is not expected to affect longterm investment, but could lead to delays in bringing current projects to completion, particularly in the power sector.P39 Exec Summary

Ironically, the day of this IEA release calling attention to the precarious nature of future energy supply is being met with fresh 3 year lows on oil prices. Unfortunately, recent market events, only indirectly related to oil, will now likely set July 2008 in stone as the date of maximum world oil production, despite the 'best-best case' scenario portrayed in the IEA report. Up against near double digit depletion rates and higher cost (lower energy gain) prospects, the oil industry now also faces a growing lack of confidence in the international financial system where near herculean investment is needed ($26 trillion = 37 times the recent controversial $700 billion bailout package in US), and credit, especially when the price of oil is well below the marginal cost of extraction (at 86mbpd) makes approving new projects, let along continuing existing production, problematic. Though not explicitly stated, one may infer that there is now increased risk that these investments will not be made. Furthermore, the goal of OECD governments of procuring cheap energy is incompatible with these investment goals. And still further, the goal of OECD governments of having cheap energy is incompatible with their goals of reducing CO2 emissions.

As has been written here often, the world's fiat currency reserves and financial assets, which works as a system of exchange and store of value because everyone agrees that it does, nominally dwarfs the amount of real commodities. Leverage, and leverage upon leverage provided by easy credit not checked by biophysical realities unleased a massive speculative bubble in financial asset classes in recent years. Though some claim this was an oil bubble, the facts suggest it has been a bubble in all paper assets, the unwinding of which, though largely over, has spilled over into the real economy. Earlier today Russia, the world's second largest oil producer, lifted their short term interest rates to 12% to defend the ruble. The currency traders, out of defense, are playing increasingly serious games of hot potato. Hedge funds and money managers, part of a global derivatives market measuring north of $700 trillion dollar earlier this year (in perspective that was 10 times the value of a 1 trillion barrel yet-to-be-recovered oil resource at $70 a barrel)

Bloomberg graph of oil, euroyen cross and SP500 daily closes

Those who rationalize the recent crash in oil prices as evidence of an oil bubble are only partially correct, and miss the greater point entirely. We are in the midst of a global deleveraging of an enormous bubble in financial assets, of which oil futures contracts, is just one. Oil futures peaked on July 14, 2008 (somewhat ironic in that the IEA is headquartered in Paris). In the nearly 4 months since, the daily price moves of oil have an R^2 of .97 with the SP500 - the prior 2 years the correlation was -.29. Similarly, just about all the major asset classes have had a .85+ correlation with the unwind of the carry trade (investments in all sorts of things using borrowed dollars and yen). As the unwind took out banks, insurance companies, countries? (Iceland+), wealthy natural gas entrepreneurs, etc. it had an unseen but far more tragic casualty - energy market disruption and misleading signals of future scarcity of oil (and gas).

The (Initial) Bottom Line of the IEA WEO 2008 Report

Though it is clear there were many different factions and authors writing this report, about 1/2 in the urgent and 1/2 in the complacent camps, the general sea change in opinion, analysis and outlook is long overdue. The certainty of future oil supply painlessly matching demand for decades to come has been replaced with something closer to reality. However, as long time readers of this website are aware, the world energy situation is even worse than the 'best-best case' scenario this IEA report has portrayed - more analysis to follow after we have read the actual details.

In sum, recent events in the real economy have put us in the liminal space where drops in demand will temporarily exceed drops in supply. Our energy future is a battle being fought between depletion and investment/technology in a world that is not only interconnected and complex but increasingly fragile. Counterintuitively to most, the lower oil prices go and the longer they stay below $80-$100 per barrel, the steeper the fall off of the crude oil plateau will be, and the dimmer our energy future. In sum, this Jekyll and Hyde IEA WEO 2008 report was needed 10 years ago. Uncertainty, error bands, black swans and the precautionary principle need to be terms injected into international energy discussions. Governments and decisionmakers should assume what is presented here is a 'best-best case', and start making urgent, difficult decisions with respect to social priorities. As many know, without cheap and consistent energy availability, nearly all other social objectives cannot be met. Energy is everything.

In the coming weeks, we will provide analysis and commentary on the details of this IEA report on the following topics:

- Decline Rates

- Saudi Arabia/Ghawar

- Natural Gas (in particular, Europe)

- Net energy and EROI

- Demand

- Coal

- Biophysical economics

- Human belief systems and paradigm shifts

- Reserves

- Renewables (hardly given much attention in the article)

- Energy and Climate Change

- Wikipedia Megaprojects

- and others..

Essays and analysis will be from The Oil Drum contributors as well as guest posts from James Buckee of Talisman Energy and Professor Charles Hall. We will probably raise many more questions than we will have answers. But that is perhaps as it should be.

Stay tuned!

Comparison of the IEA and CERA decline rates:

The IEA chapter on decline is clearly written by an expert. However, so is Peter Jackson of CERA an expert. Considering the three main stages of oil field life:

Build up

Plateau

Decline

There is a genuine conceptual problem in getting to grips with how build up is handled in modeling a global average decline rate. My gut feel is that the real number most likely lies somewhere between 4.5 and 6.7% - but we will need the IEA to engage if closure is to be reached on this vitally important issue.

I developed a model earlier this year (presented at TOD several times) that had decline rates (with EOR) at 5.7% in 2008 and 4.95% in 2007. My projection was 6.0% for 2009 and 6.4% for 2010.

This is in line with the 5.1% the IEA measuerments say, because the data was collected in early 2008, and the result (5.1%) is between 4.95% and 5.7%, closer to 4.95% (as expected, 2008 Q1 being closer to 2007 than 2008 as a whole).

The most important thing in my opinion is: In case prices remain low, some EOR projects will be abandoned, effectively increasing the decline rate very close to 9%. That should result in a loss of 3 mbpd (as that's 4% of 75 mbpd, and 4% = 9.1% - 5.1%)

All in all: any EOR projects abandoned NOW wil lresult in a loss that can never be overcome, because there isn't enough in the pipeline for the years to come.

In other words: we have already seen peak production and it is all downhill from here on.

The IEA do a good job of differentiating between Natural Decline (9%) and Observed Decline (6.7%), the difference being attributed to field interventions such as in fill drilling, work overs and EOR. I've not read the whole report yet, but the slice of additional EOR in the chart Nate posted up top, is I believe CO2 injection - what chance at $60 / bbl?

The question I'm posing here is how to handle decline in fields that are in build up phase. -ve decline rate, zero or +ve decline rate?

I will write the IEA to ask them how they have handled this and to discuss.

euan

this is another example of feedback. the lower we go in oil price

a)the fewer new projects

b)the smaller the difference between natural decline and observed decline due to pricing out of EOR (though I believe Denbury Resources is profitable above $25/bbl)

So, as oil prices drop we have the double whammy of both larger natural decline and less EOR leading to larger observed decline.

If you email IEA - ask them how much oil out of 106 mbpd is profitable at $55 per barrel. I suspect they won' know the answer (because no one does), but my guess it's a good bit less than 106 mbpd

Re-phrasing that:

"What oil price is required to reach 106 mmbpd and what will the % be of global GDP?"

It looks like the markets don't have a f*ng clue about the implications of all this and we are now bound to an energy suicide pact:-(

Its actually much worse than that the consumer is already fairly certain high oil prices are a con game by the oil companies the recent price drops will make it almost impossible to get consumers to believe in peak oil.

You can ponder if this was intentional or not.

We are not going to see support for mitigation of oil until every single producers admits they are well past peak

physical evidence alone does no good.

To be fair even perma-PO-Bull Matt Simmons said something along the lines of "we won't be able to judge Peak until it's in the rear view mirror..."

(But by having a damn good informed guess I hope -and probably so do many who come here- to be positioned well in order to benefit, cope OK or simply survive)

Nick.

On the menu tonight is MEAT AND POTATOES! Yummy!

There is a strong element of belief in all this. Unfortunately, as Memmel and so many others here point out ... the beliefs are ALL WRONG!

IEA sez:

I'd suggest the IEA hire an economist ... unfortunately, most of these are servants of the status (or stasis) quo. Things really ARE different this time. The "current financial crisis" is a long- term shift in the economic ground rules even if one leaves the micro- economics that surround petroleum production untouched. There will simply be less (or no) credit available to anyone in a few years and this will become a permanent state of affairs.

As a 'financial lifeboat', a locally distributed hard- currency regime could be built from scratch but the available credit from such a system would be hard pressed to meet the needs pressed upon it.

The likelihood of a hard- currency regime happening in the current political environment is almost non- existent.

Nate sez:

The market is wicked; it is inherently unstable. The idea that markets can faithfully serve the financial needs of investors is being unmasked as a fantasy. In all instances, the stable market is a manipulated market; the breaking of the hedge funds is giving all a view of the 'Free Market' at work. Markets are inherently and destructively unstable. This is my own personal opinion and is not shared by 'legitimate' economists.

Nate sez more:

The unwinding of paper assets is just beginning; there is a lot of paper out there and the belief holds that the market will 'turn around some day (tomorrow would be nice.) Most 'investors' don't mean to day- trade, they hold until retirement ... or until the doomsday market hits and stop loss orders (or margin calls) eject them. What is happening (starting in credit- landia) is a market clearing event; all speculators will be broken before the bottom is reached. Real estate will be valued as unimproved land, stocks @ pawn- shop valuation and bonds will tell us the future was ... in Paul McCartney's famous lament ... "Yesterday, all my troubles seemed so far away ... "

Solutions:

- An Oil Drum solution would be an 'Alternative Economic Convention' that would sharpen the focus of non- establishment thinking and press to change public policy. I can think of several very smart persons who would have something useful to say; Nouriel Roubini, Michael Shedlock, Doug Noland, Umair Haque, Greg Mankiw, Nassim Taleb, Herman Daly ... the people here could certainly add more names.

Something needs to be done to move the situation from 'top dead center'. Have this convention and ask Obama Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben Bernanke to attend.

:)

In a general way, the ultimate solution is obvious: since underground resources are being depleted (hydrocarbons) or will become inaccessible (metals and minerals) because the those being depleted, the only solution is to move to reliance on above ground resources -- soil, water, forests, oceans, etc. all of which have been seriously damaged. This means radical retrenchment of course. The hope is that science will allow us to rejuvenate the soil, the forests, etc. There is just no other place to go -- simple logic.

But getting there, the transition, that's the toughie. I am tending to think we need two economies: ONE is the global and national market economies; TWO is the the new non-or-local-market economy.

TWO is what needs to grow, and it needs to be where people can go if there is no longer room for them in the ONE economy or they are willing to be pioneers or early adapters. It needs to be an economy based in small dense towns surrounded by agriculture and light industry. It needs to be mostly and as much as possible self-sufficient in basics. Their claim on underground resources need to be, say 5 or 10 pct of that of those in the ONE economy. The gov't(s) need to fund and encourage and protect these TWO economies. They are the future.

The ONE economies cannot and will not disappear overnight. But shrink they must. They are the ones consuming the finite underground resources. It's a tricky matter distinguishing between necessary interim industries and totally parasitic ones (which have been getting the bailouts). The guidance of traditional economists, or at least the more radical of them, will be needed to avoid prematurely crashing the whole system.

Over the next 20-30-40 years the transition needs to be made from ONE to TWO. At that point ONE will be small relative to ONE, and subservient to it, literally. But TWO will be important, because that is the world link, the fiber that hold humanity, science, culture together as one -- otherwise we become disconnected tribes, and we will not have the advantage of science in restoring a badly damaged natural enviornment.

On the one hand, I know this is sounds utterly unreal, even ludicrous. And of course it will not be readily adopted. On the other, what choice is there? What other possible route is there to survival?

Well said.

We need to "Grow" a new economy. One not based on oil and fossil fuels. The monetary system, money and investment if you will, needs to be linked to this new economy.

By default fossil fuels, and the economy tied to them, must shrink and eventually perish just like an individual business that has outlived it's usefulness, say making rotary phones, perishes over time.

We are in the very beginning of the transition between the two and it will get worse before it gets better. The money doesn't know where to go yet.

"The likelihood of a hard- currency regime happening in the current political environment is almost non- existent."

Not related to a hard-currency regime but I heard that 1.2 million copies of a spoof New York Times were handed out. The headlines were "Iraq War Ends" & "Nation Sets its Sites on Building a Sane Economy".

Shame it's just a spoof but maybe it will help remind the politicians why they are there. Oh, i forgot with over a million lawyers who are vastly over represented in government there's little chance.

It's also online.

http://www.nytimes-se.com/

This is very insightful. I'm a PO believer. Most people here are too. But the fact of the matter is that we are tiny percentage. My business partner thinks oil company profits are totally obscene. The "Photo of the Day" in my local paper is a picture of a gas station sign advertising the first sub $2/gal price here in town for about as long as anyone can remember. Nowhere is this IEA report mentioned.

My totally unscientific survey suggests to me that 90% of the country thinks that oil problems are over -- afterall, gas is only $2 now. 8% don't really care because they either don't drive or are so rich that price is irrelevant. 1% are one or both of perpetually stoned/psychotic and are simply not capable of caring. Of the remaining 1%, a few are POers concerned for the future, a few are POers hoping hoping for calamity due to religious beliefs, environmental notions, and/or a form of self-directed hatred (where self=nation) or anger toward the "rich bastard oil moguls who deserve to be taken down a few notches." A few simply defy categorization.

Anyway, in my not so humble, but not so valuable or nationally voluble opinion, we won't see any recognition of PO till gas approaches $4/gal again, or it isn't available in sufficient quantities. Even for me, with gas this cheap, I've stopped hypermiling, ride my motorcycle far less, and think very little about running out for an errand. This of course, does not bode well for the future as my behaviors are certainly compounded by millions.

I'm not of the opinion as inferred in one of the comments above that its all down hill from here and think we will have one last surge before the 'Big Event'.

My reason is simply this -and reflects your comment- the vast majority of people DO NOT BELIEVE IN PO.

Only when there is a 'mass recognition event' will it be game over IMO.

So my advice to you would be wait around 12 months and buy as many PO-related downbeaten stocks as you can afford and sit back and wait till 2014 at which point you will probably be glad that you where one of that tiny % of believers way back in 2008...

Nick.

I have been buying energy and energy shipping stocks, but I fear that it might not work out as I intend. There is so much anger directed toward energy companies by such a large portion of the public, that I wonder if we won't see nationalization either directly, or through onerous tax burdens that destroy any profitability. For an example, look at how Canada has treated its canroys in the last couple years. Two years ago it arbitrarily changed the tax structure after explicitly promising not to, which caused the value of canroys to drop about a third. This year, Alberta decided it wants more royalties, again causing damage to share prices. Nobody sees these things as issues however, because, in the minds of many, oil companies are evil and deserve punishment.

Anyway, I keep buying in, but without the same conviction I used to have that I will see a good payoff in 5-10 years. I used to worry about flow rates and reserves and such, but I'm coming to realize that the largest risk energy companies face is government and public sentiment -- something perhaps even more fickle than mother nature's underground world.

Natural decline in oil fields is defined as the decline taking place without any improvements. So that decline is there irrespective of oil price. If the oil price is lower and these improvements are scaled down the "observed decline" will go towards the natural decline rate, that is the difference is actually getting smaller

ya - sorry i was tired

i meant the bigger the overall decline rate and the smaller the difference. thanks

And what does the 5.1% figure stand for then? My understanding of the FT article mentioning that number last week was that fields undergoing secondery and tertiary recovery tend to show a decline rate (weighted average) of 5.1%

Is this interpretaion of mine false?

On observed decline rates:

5.1% for 580 fields post-peak

5.8% for 479 fields post-plateau

Adjusted up to 6.7% global average to take account of higher decline in 1000s of smaller fields not included in their data set

Thx.

Euan, how does these figures - 6.7% average decline rate for all fields today, rising to 8.6% by 2030 - square with the projected 64 mbpd additional oil by 2030?

How about a joint list of questions from the oil drum personnel?

Otherwise they might get crazy by the bombardment of emails with questions from each oildrummer.

Obviously, the single biggest flaw is in the projected capacity additions. One is left with the impression that these numbers were pretty much just made up to fill the gap between supply and demand, rather than being built on the basis of anything truly realistic.

In detail:

Crude oil fields yet to be developed: The Megaprojects database does not support a projection anything close to this. If this projection is to be realized, there need to be a lot more megaprojects already far along in the planning stage than we have seen to date.

Crude oil fields yet to be found: Where? Is there ANY evidence that the level of present discovery effort, and the results of past discovery effort, can produce these types of results in the future? This is certainly the most purely wishful of all these projections.

Crude Oil additional EOR: This is the one thing on this graph I might actually be able to believe. Of course, this is also very expensive oil, both in terms of dollars and energy inputs.

Non conventional oil: Mostly tar sands, I presume. Well, maybe, but it is also going to come at a very high price.

NGLs: The world is straining to maintain present levels NG production, so where is this going to come from? Are they assuming that NGLs that are presently not being separated out, captured, and transported into the global inventory stream will be brought on line? Fine, but need I point out that once again we are looking at massive infrastructure investments to make that happen. Once again, where will all the money be coming from?

I continue to assume that something in the range of 50-60 mbpd by 2030 is much more realistic.

WNC - PO.com member OilFinder2 maintains a Catalog of recent oil discoveries. 25 pages long, started in January. Lots of 50 million bbl bits of course, but he isn't fazed by all my arguments about flow rates/costs.

One of the industry journals he linked to has a page dedicated to recent finds - forget which one. Rigzone seems to have a discovery piece every other day. They're out there, but the pickings are slim, or really fat but buried underneath thousands of feet of molten salt. ROCKMAN commented once about how much easier it is to find fields now, but they're much dinkier - albatross vs. passenger pigeon.

It would have been nice if they gave equal weight to the pessimistic.

Maybe a best, middle, worst case scenario.

Makes me wonder if there is another version for World Leader(s)?

Seconded. It's pie in the sky speculation without discussion of what can actually be done, is likely to be done, and could happen if it wasn't done. Doesn't sound to me so far like they fulfilled the last sentence of their first paragraph, specifically the part about consequences of failure. But maybe that will come up in a later portion of the review?

The lightblue and red additions are each half as big (due to overstated reserves), there is a line labelled 'total exports' which goes from about 40Mb/d in 2008 to around 10 Mb/d in 2030 out of total production of around 60 Mb/d.

Can someone convert the figures into energy rather than barrels? If you assume NGL's are equivalent to about 0.75 barrels of crude and non-conventional oil is about 0.5, Are these figures approximate? What effect does this have on the graph. IMO its very misleading to display total production in volume when energy content and EROEI is so different.

"Non conventional oil: Mostly tar sands, I presume. Well, maybe, but it is also going to come at a very high price."

Too true! So far there is no panic in Calgary, but all the petes are cutting back both conventional and non-conventional projects. The existing oilsands projects will continue to operate, I dare say as low as $20/barrel, because the capital costs are done. New projects are being postponed, officially because of high costs. I'm invested in conventional infill freehold drilling but you can't convince the drilling rig operators there is any crisis and they won't lower their rates. There are none so blind as they who have eyes yet will not see.

Calgary housing prices have declined about 10% because of overbuilding, not because of the Panic of 2008. Other than that, there are as many SUVs on the road as ever, and the malls are still packed. The economic indicator I use is 7-Eleven; they are still advertising here for clerks at $11/hr plus benefits plus retention bonus.

There are vast deposits of heavy and extra heavy oil that fall in the unconventional category. Much of this heavy oil is very high in sulfur and vanadium. It is typically produced by steam injection and tight well spacing and requires it upgrading, all adding up to low EROI. The other big problem is the low output per well. This is the stuff we'll still be using 50 years from now.

Well below that level. Based on my model we will have C&C production at 60 mbpd by 2015, and my model proved to be way too optimistic, as I assumed a smaller decline rate now (5.7%) and I didn't take the financial crisis into account.

We should put progressive price tags on this image and calculate the assumed minimum price floor based on where the demand curve falls (the following is just a dummy exercise, not reflecting real marginal production costs):

Now, that's just a quick idea sketch on top of the latest WEO08 graph.

We'd need a production flow time series graph like that, but more based on cost of production (as a function of time).

Then dropping a demand curve on top of that would give a rough idea of where the price might fall.

Of course, this would assume maximum theoretical production at each level of production that was surpassed by demand - using that price figure. So it would be a rigid model and not dynamic, like the cost function is in the real world.

However, the point of this exercise would be to make it simple for decision makers and ordinary people to understand that the marginal production cost is not fixed and that the more they use, the more the price is going to rise.

I wish I had the time to wade through the WEO2008 data myself in detail and build even a crude approximation of above.

But I don't, so I'll just pass this on.

On a last note, one could also use some other production profile time series (ASPO, etc), because some of those wedges in the WEO08 graph are whacked.

Excellent idea, SamuM!

That's exactly what I thought recently: In uranium mining it is common practice to classify the reserves by $50 Uranium, $70 Uranium etc. (or whatever numbers) but not so in oil, natural gas and coal, although this informations should be even more important.

I hope that we'll find more accurate data for this.

Great work as always, Nate.

The original summary (which is unavailable from ASPO-Australia as of today) had this to say about the fields analysis:

From this do we infer that IHS has access to KSA production figures? I'm puzzled by this, given Matt Simmons's call for data transparency.

Nate

I've been sprinkling questions on the little data that is publically available on this report on different threads. If you have access to the full report, can you answer:

1) do they define what is included and what is excluded from the base decline data on old fields? No precise reading actually seems to fit, but I think they include all reworking on old fields (which makes the decline rates very high)

2) do they give decent info on the year by year decline rates on old fields? Because from the data in that graph, they seem to accelerate and then slow down again.

3) Take a look at the graph from the top of your article. Look on the blue boundary around 2020. See this?

It looks like they edited the data by hand in a vector package before turning it into a PDF. Given that this is the point the decline levels out, is there any better data elsewhere in the report? A tabulated set of data maybe?

This?

Year on year would be nicer, but that table screams out problems itself. Supergiant OPEC decline rates of 2-3% say its after all infill and extension work is added (given previous Saudi statements of gross and net decline).

The more I look at this, the more I don't think they have done an 800 field bottom up analysis, but fudged something from average data. Whether they actually did it and didn't like the results is a question - but its smelling like a back-of-the-envelope calcs at the moment.

Oh, and where is Cantarell in that above table?

Perhaps we should also have a closer look to the various types of decline they describe (natural decline, observed decline...).

In the text sometimes they use one type, sometimes the other, which makes it difficult to compare them.

The Second WEO Report.

It is hard to believe that any leading organization with access to prime data could be far off track in its projections. Hence, there may be some reasons that could explain, let’s say, the still exaggerated optimism in this report: What I am talking about is the possible economic impact of a WEO report based upon “the truth, the full truth and noting than the truth” under the current conditions of a global recession already on its way. IEA analysts are most certainly not stupid to believe in their own “fairy dust discoveries” of new fields that suddenly seem to appear with deus ex macina just as they become required by demand projections.

Garip’s remark of possibly hand edited graphs made me even more suspicious about the existence of a second 2008 WEO report - classified top secret and strictly denied to exist. Rambling, just rambling, but what’s published may be just an estimate of the maximum level of gloom & doom that present market hysteria is able to digest without an immediate cardiac arrest.

http://www.guardian.co.uk/business/2008/nov/12/oil-gas-companies-credit-...

3 Saudi's by 2015?

The tooth fairy must be really good to the IEA

LOL! A much needed bit of levity--thanks Dude.

If you can't get it up after 4 years of trying hard, you've Peaked, unless you are the IEA, and they must use lots of Viagra :)

00ps, that's vhat Yiagr@ can d0 8-)

Hi Nate,

Thanks for the summary - good stuff.

I have a nit regarding your comments on paragraph 3 in the intro - I didn't see anything particularly wrong with their discussion of potential temperature rise due to CO2 emissions. First off, they hedge by saying temperatures could rise by "as much as" 6 degrees "in the long term." They are not necessarily predicting that amount of temperature rise, only saying it's within the realm of possibility at some (unspecified) future date (unless this prediction is made in another part of the report which you did not reference in your summary). And secondly, while an atmospheric CO2 concentration of 460 ppm might lead to ~2 degrees of warming assuming all other things being equal, of course all things are not equal. Ice caps will melt, the ocean may stop absorbing as much CO2 from the air, etc. Who knows what feedback mechanisms will kick in? This kind of uncertainty explains the possibility of such a large rise in global temperatures for the reference case.

I agree re feedback mechanisms - you are right - we don't know.

My main problems were:

1)focus on GHG without any mention of other environmental impact

2)1/3 of report seemed to be about climate change which is not IEA wheelhouse - but perhaps there IS no agency that can tackle the intersection of the two?

3)their FF numbers are exceedingly high, making climate seem more dangerous than more realistic fossil flow rates. (on the other hand, if they are high on oil and low on coal estimates, then it could be worse

"I don't know" should be an acceptable answer for anyone. unfortunately, it is not in our political nature to say those words. I find it difficult myself...;-)

I agree wholeheartedly with 1)

I agree that 2) is a bit odd, although to be honest I don't view it as a problem. Energy and climate issues are closely linked, so I'm glad to see the IEA is recognizing this.

In fact, it seems odd to say (in point 1) that they should mention environmental impacts besides climate change, then (point 2) say it's a problem for devoting so much time to the one environmental impact then do mention.

As for 3), I don't necessarily disagree, but I'd like to see their predictions for coal. Do you have that information? If so, I'd appreciate it if you would put it in a reply or in one of your future posts on the IEA report.

It's been 2.5 years since our Peak Oil and the Environment conference in Wash DC. Most environmental organizations who were given free entry tickets were no shows. Truly sad that 2.5 years have passed, we've burned more cheap oil, scaled more corn-ethanol, oil prices are lower than at our conference, and about all we have accomplished is a general acknolwedgement that oil is finite. At this pace of action, the cliff will arrive well before any meaningful, forward planning.

Coal-to-liquids on massive scale was our biggest fear then, but I am now more concerned about water.

This was a quick intro post - yes we will have both a coal analysis and an analysis on total fossil fuels-maximum c02 ppm - likely next week.

Nate,

Some positive developments in last 2 years; US has added 12GW wind power capacity, and has doubled wind capacity additions, most major car companies are now in early stages of testing BEV or PHEV for production in 2010. Legislation has been passed to encourage PHEV vehicles and further renewable energy. The SUV owners have seen $4 gasoline prices, and may be more reluctant to replace current vehicle with another gas guzzler.

The biggest development is that you now have a president elect who appears to understand the situation and is not owned by oil companies.

Nate wrote:

2)1/3 of report seemed to be about climate change which is not IEA wheelhouse - but perhaps there IS no agency that can tackle the intersection of the two?

The intersection is so strong that findings supported by the vast majority of scientific organizations should be recognized and given due weight.

Don't forget that GHG doesn't just mean CO2; methane is potentially more serious;

DoE's Office of Environmental and Biological Research

Earlier this summer...

The methane time bomb starts to go off

And then...

Hundreds of methane 'plumes' discovered

Nate also said;

"I don't know" should be an acceptable answer for anyone

Science Academies Call for International Action on Climate Change, Global Health

I don't have a problem with that. As I've said before, few people are joining these two problems of fossil fuel depletion and human-caused climate change. Those most concerned about climate change just assume "there are more than enough fossil fuels to burn to destroy us" and those more concerned with peak oil either think peak oil will screw us within a few years while climate change will take generations to harm us, and are often actually climate change deniers.

And the thing is that in both cases the simplest and single largest though not only solution to the problem - burn less fossil fuels, and eventually none - is the same. So people need to be joining these problems.

Really we need more of that in our society. While putting everything into little specialist boxes lets us have a good understanding of those particular things, if we stay in our box then we often miss out on great benefits from bringing the different fields together. Sometimes one solution solves several problems.

The agency which is meant to tackle the intersection of different problems is democratic government. That is imperfect and rather muddling, which is what we have freedom of speech for - to wake 'em up. And that includes freedom of speech for the IEA, to bring up whatever they think is related to their main concern.

I don't think it's a big leap to go from "how much energy will we have?" to "what are the effects of using it?"

I'm relatively new to this forum having been a lurker for several days and this being my first post

However, I have an extensive background in much that is being discussed in what I would characterize as apparently quite analytical and in general quite well reasoned fashion.

Unfortunately, the above has to be subject to a major "But" -- not when Climate Change is being discussed

On this topic -- the usual suspects seem to be dominant -- believing the "Al Gore Hype" -- "Hook Line and Sinker" -- where is the analysis and natural skepticism that should be present

When I read people uncritically accepting professionally ignorant press releases masquerading as science -- and in particular "settled science" -- I feel like the character in "Network" -- go to the window -- open it and shout "Its the Sun you Morons!"

in short -- Anthropomorphic Global Climate Change is a Monstrous triumph of pseudo-science over reason and true science -- the obvious natural variability of weather and climate on all time and geographic scales should be a given from thousands of generations of human vicarious observation and adaptation -- to whit:

1) we didn't make it cold -- e.g. Little Ice Age

2) we didn't make it warm -- e.g. Medieval Optimum, 20th Century Optimum

3) we lived through both -- adjusting as necessary

4) we won't make it cool -- although it will certainly get cooler sooner rather than later

5) we wont make it COLD -- although it is inevitable

Our real concern -- should be 5) -- as a real cold period (colder than the 1600's in Europe) -- would be a major human catastrope

In general while we can argue about the details we must remember the basics:

1) It's the Sun that makes this place not an unimaginably cold iceball -- the sun has not always and will not always behave as benignly as it has for the past few thousands of years

2) CO2 is Life itself and within a factor of orders of magnitude -- More CO2 means richer and more productive life

3) Warmer is almost always better than colder -- certainly when we are talking a few degrees C average

4) Humans have adapted to changing temperature, changing rainfall patterns and changing sea levels and will continue to do so

Finally for today -- Let's worry about providing adequate energy to keep the planet productive -- that means for the next few decades at least we depend on petroleum, natural gas, coal and most importantly nuclear with minor contributions from wind and solar and the rest of the "non traditional" sources

Westy

If you wish for a full, frank, and vigorous discussion of human-caused climate change, feel free to come to my blog, search for relevant articles and comment, I get an alert when someone does so I can respond however old the article.

The nature of this particular place does not allow me to give you the full and frank response you deserve.

This is not the thread for climate change discussions, we have been over that say at Euan's thread the other week... we do peak oil here.

Have a look at realclimate.org, there you can discuss on a forum dedicated to your postulations.

Here we want you to back up arguments with data and figures.

You said "in short -- Anthropomorphic Global Climate Change is a Monstrous triumph of pseudo-science over reason and true science --"

1) you mean anthropoGENIC, I assume.

2) I work as a researcher in that field - I consider my research quality to be of perfectly normal standard, compared to history and other fields. Not very nice of you to call my professional life "monstrous pseudo-science"....

Get me data mate.

OK -- here's a brief summary of how I learned to be a skeptic of anthropogenic or – perhaps it should be anthropomorphic as in AlGore’s Global Hot Air (sorry I meant to say Climate Change)

I started as an experimental Plasma Physicist studying "Hot Fusion" in Tokamaks using arrays of x-ray, pyroelectric radiometer and magnetic sensors to image the magnetic mode structures of the "instabilities" that limit the confinement of the hydrogen plasma. This research taught me several things beyond the detailed plasma behavior:

1) the sun also has a magnetic mode structure that is quite similar (except in geometry) -- in fact the events that we called "Disruptive Instabilities" that terminated the plasma confinement -- appear to be very similar to Solar Flares

2) Most computer predictions of the behavior of complex physical systems are subject to GIGO (Garbage In -- Garbage Out) and are not worth the paper that the plots are printed upon

3)Most systems in the real world are highly nonlinear in their behavior and even measuring the behavior -- let alone predicting it is difficult at best

4) I also learned a lot about processing and extracting frequency domain data from non-stationary processes

The next climate/energy relevant step in my professional career involved serving as the "engineering seat holder" on a citizen commission that served as the policy adviser to a quite-large municipally-owned electric utility -- here I learned what kinds of energy supply systems were realistic and what kind were of academic interest only. At the same time we introduced a pioneer appliance efficiency incentive program

The next step in my professional career involved looking at a lot of the National Climatological Data Base in order to analyze the propagation of radio waves through the atmosphere -- I found that the database was highly unreliable in terms of ocean-based measurements of ocean surface and near to surface water and air temperatures -- I identified several sources of error embedded in the data base some of which was due to a systematic change in measurement of seawater temperature and some of which was due to a combination of systematic and random errors in the most up-to-date (at the time) measurements of air temperature (particularly the diurnal variability and the effect of direct solar heating of the sensors)

Most of the rest is just my analysis combined with a natural distrust of theorists pronouncements and computer models that don't include all of the necessary physics combined with adequate initial or boundary value data and then "kinda fudge things" to make it up -- i.e. GIGO

Since the 1970's scare of an immanent new Ice Age -- I've been skeptical of Climate Scares that have later been shown to be Hype without substance -- as I'm quite convinced that the latest mild warming of the past few decades is of a similar nature and utterly undeserving of ALGore Armegadonism

Specifically recent climate change seems to be well described by being:

1) solar activity driven -- several potential mechanisms -- none proven as yet although the flux of galactic cosmic rays is apparently 180 degrees out of phase and strongly correlated with solar magnetic activity

2) apparently over -- using the admittedly flawed surface temperature record -- there has not been any significant change in global temperature over the past decade since the Highly Hyped Warmest year of the (..... fill in the blank) of 1998. -- in fact while a year doesn't make much of trend -- the earth seems to be cooling -- certainly it is not catastrophically warming over the past decade (its almost 11 years now since 1998)

3) the Sun seems to be (a) unusually active or (b) unusually quiet or (c) both

The answer is apparently (c) -- it was unusually active for the past few decades (perhaps since about 1830 although long term trends are still hard to extract from the combination of direct observations and measurements of radio nuclides produced by Galactic Cosmic Rays and deposited in trees and ice) and it now is kind making up for it by being very very late in starting Sun Spot Cycle 24

By the way -- much of the same pseudo-scare-based-analysis is being applied to "Peak Oil" or "Peak Hydrocarbons" , etc as has been applied to AlGore-based Climate Catastrophism.

We have reasonable understanding opf the processes that lead to Oil depletion in a field --- mostly due to local geology and locally economically supported extraction technology combined with the effects of economic demand determined price

On the other hand -- Planetary Oil or hydrocarbon resources is mostly guessing game on a moving playing field -- with some factors that include aggregate demand determined price combined with all of the technology involved with finding and extracting the hydrocarbons, global and local politics -- not a nice simple system that can easily be modeled -- mostly GiGO

You also mentioned history -- I presume in a disparaging fashion -- to boost the prestige of your chosen profession versus that of what you might consider to be less important or "brainy" ones

Well I like to consider myself to be an amateur historian when it comes to the influence of Climate on Human Life -- I'm a great believer in taking from the non-mathematical record what we can as well -- thus I'm perfectly willing to take advantage of pre-Galilean and certainly pre-Wolf (method of counting sunspot numbers since 1750) observations of sunspots and other anecdotal information to conclude that there was a "Little Ice Age" and it happens to have correlated pretty well with the absence of solar activity during the Maunder Minimum

Should we study what has happened in the past (through proxies, anecdotal observations and direct measurements) and try to understand what are truly at this time mathematically intractable complex systems -- Yes!!

Do we now know enough of how these systems behave to confidently predict the future of Global Climate or Global Energy will be -- No!

I'm sorry -- but anything else is SOPHISTRY

Westy

PS: if my spelling is not up to your standards I apologize -- sometimes my typing has trouble keeping-up with my thinking and I don't always notice the miscues

Well, since there was no Ice Age scare in the scientific press, you can let this one be the first "climate scare" you're sceptical of. [source]

Cosmic "rays" are actually about 90% protons, 9% helium nuclei, and 1% electrons. These have no "phase" measured in degrees or the like. What are you talking about?

You have a contradiction here. First you say that the data is no good, then you say that the data shows no warming.

You can say the data is no good, or you can say that the data shows something. Which is it?

Or could it be that your assessment of the reliability data depends on whether it agrees with your preconceptions? That is a very common though not admirable trait among many scientists.

Those notoriously sloppy scientists over at NASA give us the following,

Figure above shows:- Annual surface temperature anomaly relative to 1951-1980 mean, based on surface air measurements at meteorological stations and ship and satellite measurements of sea surface temperature; the 2007 point is the 11-month anomaly. [Green error bar is estimated 2σ uncertainty….]

They tell us,

"Through the first 11 months, 2007 is the second warmest year in the period of instrumental data, behind the record warmth of 2005, in the Goddard Institute for Space Studies (GISS) analysis. The unusual warmth in 2007 is noteworthy because it occurs at a time when solar irradiance is at a minimum and the equatorial Pacific Ocean has entered the cool phase of its natural El Nino – La Nina cycle."

So 1998 the warmest ever, not quite.

Uncertainty goes both ways; things could be more resilient than we think, or less.

Thus, if we're unsure about how the system works, then that means we need to be more careful about what we put into or take out of the system, not less.

If it is true that we don't at all understand climate and resources and our interactions with them, then things could be worse than even the most hysterical greenie says.

Think back to your lab days. If you have to move a piece of lab equipment you don't recognise, you ask how delicate it is.

"I don't know," says the boss.

"Oh okay I'll just kick it over here, then."

No.

This is all pejorative and useless except to illustrate you are acting to fulfill an agenda, not from a perspective of objective inquiry. You are not a sceptic, you are a denier.

By using insult as your primary argument, you show you have no real argument.

You are implying some scientist somewhere has "confidently predicted" the future. This is, of course, false. If you so poorly understand what modeling is intended to do, how can you bother commenting? You are being hypocritical when you speak of sophistry.

As to your background, there is nothing there that makes you a climate scientist, so you get no more points for that than our proverbial Joe Sixpack.

Then you toss out discredited point after discredited point and use logical fallacies to underpin your positions:

1. The supposed Great Ice Age Scare was wrong, so current climate science is wrong.

2. The data has errors, so it is useless.

3. There were sunspots and warm periods, this is cause and effect. If you know anything at all about climate science you know the sun's output has been completely deconstructed by better science and peer review of "research" in the area.

4. Al Gore is the Climate Devil! Strangely, you wish to be taken seriously when you post here acting as if Al Gore actually has anything at all to with climate science? Do you not realize he's not a climate scientist? He's a politician doing what politicians do, nothing more. Invoking his name does nothing but show *you* to be the propagandist, using the Appeal to Authority in order to discredit scientific endeavor.

Sadly, what damns your position more than anything else is your own writing. You are asking us to believe a person with the education and experience you claim would not know the difference between anthropogenic and anthropomorphic? Sorry, but I'm not buying. You prove the mistake was one of knowledge by then claiming it was a spelling error. No, sorry, it was a usage error, and one that would be nigh impossible for you to make if you are what you claim.

Also, it seems someone of a similar background was here posting not long ago, just as you are now?

I feel confident in labeling you both a troll and a sock.

Jeers

Westhighlander wrote;

I have an extensive background in much that is being discussed

Perhaps you can share your educational and research background with us, so that we have an understanding of said background. So far, all I see is a regurgitation of denialist propaganda.

Will Stewert said,

"So far, all I see is a regurgitation of denialist propaganda."

Will, I know you have been coming here long enough to know this, but really, I would try to use a different insult than "denialist".

I may not agree with everything or anything that Westhighlander said, but calling someone a "denialist" here has kind of lost it's sting. It is the term used to refer to anyone and everyone who does not agree with everything claimed and said by the inner circle.

RC

Rather than "denialist", I have many other words which I think aptly describe the people who deny or downplay humanity's part in climate change. However, as I said before, that sort of full and frank description and discussion does not have a place on TOD, which is why I invite such people to come to my blog.

So far, none have come: one or both of courage or interest have been lacking. They prefer places where they are not seriously challenged.

ThatsItImOut said;

calling someone a "denialist" here has kind of lost it's sting. It is the term used to refer to anyone and everyone who does not agree with everything claimed and said by the inner circle.

"Inner circle"? Read the scientific consensus by over 30 scientific organizations and then get back to us. I don't consider Rush Limbaugh and James Inhofe to be on the same level...

If the term "denialist" has "lost it's sting" (and note that I used it as an adjective), then what are you complaining about?

Troll, what was your former sock?

As with all denialist trolls, provide even one peer-reviewed paper that has withstood critique.

Actually, don't. You're wasting bandwidth with faerie tales.

Jeers

Nate I agree with all three points. 2) raises an important concern as peak oil and climate change are very much related given that CO2 emissions are a significant factor in global warming, a hypothesis still requiring much more investigation. "I don't know" is really, really the best response. If AGW turns out to be true AND early peak oil also turns out to be true, we could use an agency to examine the intersection of the two hypotheses. TOD might be a logical place to start.

In many countries global warming is more accepted than peak oil so the hidden message is: the oil may be there but we cannot continue on a growing oil path because of CO2 limitations. Because of lack of integration of the different chapters this has not found its way into the final oil production graph.

Hello Nate,

Thanks for the write-up. We poor slobs without access to the report appreciate it. As you essentially said, the only real surprises in this report are that they did it at all, and that they appear to have been relatively truthful about decline rates, even if not completely candid about future scenarios and net energy. A big step forward, at least.

I must question your comments on Climate Change, however.

One would certainly hope so! The IPCC report was behind the curve before it was even presented to the public. It was released almost two years ago. That makes the science behind it anywhere from 3 to 6 years old. I am certain you know this, so don't understand why you would use it as your reference point.

This is especially true with regard to climate sensitivity, which were based in the long-standing use of the range set in 1979 by Charney using research from Hansen and Manabe.

The IPCC paper was primarily useful as a wake-up call to the general public, not as an up-to-date scientific treatise. How could it be with observable changes coming so fast that all of our models are hopelessly behind the curve, too?

Can you please justify your use of Rutledge as your touchstone here given the work of Hansen, et al., is the Gold Standard with regard to climate sensitivity? With all the discussion of this topic on these forums, I find your surprise at the 6C number - commonly and often stated here and in the media - a bit strange.

Just to be clear: the 6C comes from Hansen, et al. Given the hydrates are melting a century ahead of schedule and potentially store more carbon than all other fossil fuels, I'd say 6C is a bare minimum, wouldn't you?

Cheers

The tables and graphics for IPCC emissions (SRES) scenarios can be found by browsing here:

http://www.ipcc.ch/

What these may mean for projected temperatures are here:

http://www.ipcc.ch/graphics/graphics/syr/fig3-2.jpg

I notice that only some parts of one scenario group, A, goes up near 1000 ppm, and that the upper end of these scenarios get towards 6 C.

It appears that the IEA is presenting a "worse case" from that perspective.

However, I would caution that while the IPCC scenarios have way overblown fossil fuel reserves, they clearly underplay positive and delayed feedbacks in the climate system. This is key: the climate system is dominated by positive feedback loops. While the climate models play out the physics of the planet's heat balance, they don't incorporate long-term albedo changes from ice loss and vegetation shifts. Neither do emissions scenarios include liberation of stored carbon from soils and peat, vegetation death, bubbling methane hydrates, etc.

So, it is quite possible for fossil fuels to push the planet to 2C above 1990 levels, and then the system takes off on its own without anymore burning of coal, oil, natural gas, etc. In my view, 6C is NOT a worse case scenario given the existing fossil fuel reserves with peak everything fully acknowledged.

Thanks Jason. Iw a ponering this lat night that Peak Oil might just be the only thing standing between us and catastrophic climate change. Thanks for the wake up call as I was begining to feel a lttle hope that global warming may not be inevitbale. I still think that there needs to be a lot more work done to explore how FF decline rates will impact climate change. However the risk is that vested interests may use such research to push for short term BAU rather than investing in mitiagtion strategies that will extend the oil age and allow for safe and ordered population decline. If I have to choose, I'll take the world with no oil, gas or coal, over the world with no rain, acidified oceans, depleted soils and coastlines that march rapidly inland.

For an academic paper evaluating the link between global warming and peak oil you may want to have a look at,

Implications of "peak oil" for atmospheric CO2 and climate, http://arxiv.org/abs/0704.2782

P.A. Kharecha, J.E. Hansen (NASA GISS and Columbia Univ. Earth Institute). Although they are rather optimistic about peak oil dates, relying on the usual official data for reserves and future production (a year ago)

"6C is NOT a worse case scenario..."

That's why James Hansen claims the stop should be at 350ppm, not 450ppm or higher, and that a way to accomplish this is to sequester coal by leaving it in the ground.

This caught my attention:

"Expanding production in the lowest-cost countries will be central to meeting the world’s needs at reasonable cost in the face of dwindling resources in most parts of the world and accelerating decline rates everywhere."

Talk about political! They are looking at OPEC and national oil companies and saying, "Please let the International Oil Companies extract your resources."

Now, take a look at slide 7. Who is doing the job of keeping decline rates low? The nationals!

Another issue I have, which you bring up Nate but I want to highlight. If they are so worried about climate change (and that's nice), then why aren't they applauding the demise of easy and cheap oil. Why don't they give us models on the potential build out of alternative energy systems and conservation? That would be an actually useful service. Instead, they are pleading for the money to permit the planet to go to 6C...huh? (Not that I believe any amount of money would get those reserves.)

My completely non-insider suspicion is that the answer to both my questions is the same: The IEA is basically a sanctioned political tool of the international oil corporations.

Based on your summary at least, this report is a load of inconsistencies and should be easy pickings for TOD.

Ya think? What could ever have given you that idea?

"The IEA is basically a sanctioned political tool of the international oil corporations."

Good observation for starters. Did you hear the story of the three bears? One of them (govts of importing countries) married a giraffe (the IEA) and the other two (the IOCs) put him up to it (conjure up visual image here).

Who funds the IEA? Isn't it the govts? Maybe the IOCs lobbied for it to be set up, but I recall its inception during the '70s oil crises as basically a reaction by govts motivated mainly by energy security issues.

Question: Did the IOCs lobby the IEA to suddenly become aggressively proactive on climate issues, even though they are not so aggresive themselves? Was the IEA's new view on climate at the behest of the govts or the IOCs? From the govts' perspective, the IEA is just jumping on the bandwagon, but the potential benefit for the IOCs is that they can now just borrow the IEA's views when they address climate issues. ("We're not wing-nut advocates, just repeating this, you see.")

Well written stuff Nate on the IEA changing their models to reflect economic variables better. As written in the report.

"The oil and gas production and trade models were expanded tot take better account of economic variables and to reflect the recent surge in cost inflation and the fall in the value of the US dollar against most other currencies." (IEA World Energy Outlook 2008, page 61)

Is there a hint of understanding in the report of the problems arising in the world oil markets when exporters increases consumption?

[Edit: Looks great!]

My Question is this: for how will the black line flow to the left if what goes the other way is increasingly worthless? (or perhaps just 'worth less')

Nick.

I expect a shinking of the available oil on the world market to push the price up since it is so vital for economic activity... There are limits to how much less oil the importers can use without catastrophic results, so the willingness to pay up should be there.

Also increasing world oil prices might convince exporterts that it might be in their economic interest to tune down internal consumption... But as long as prices are just modereately high and export surpluses for exporters remains strong this pushes in the direction of more internal consumption.

Have you any eperience with 'Systems Dynamics' modeling? I think you have the start of a nice model there, need some equations to model the flows now. At its most simple you can use Excel...

One v.important thing you don't show though is 'Petrodollar Recycling' -a lot of the money that goes to the Exporter bubble gets fed back as purchase of goods, bonds (debt) and other financial assets from 'Importer'. If America ever loses its global Dollar Hegomony or defaults on its debt then this pipeline is cut and "VERY SERIOUS THINGS" would happen... Watch this space?!

Nick.

I don't have experience with pure "System Dynamics" in a theoretical sense but I have done a lot of programming and made a couple of quite dynamic systems that way.

What I fealt as the biggest ommision from this illustration was that it didn't represent depletion and reserves... I was thinking about adding som graphics to show that too...

Then one could program a system, plug in reserves, production rate, decline rates, export share, internal consumption share, demand growt in both imporing countries and in exporting countries, price level where export is favoured over internal consumption.

I guess if you run such a system simulation then pretty fast you will end up with a scary picture of available oil on the global market.

I thought this slide from Ken Verosub's ASPO 2008 presentation did a good job of summarizing the different viewpoints on when oil production would peak:

Clearly the IEA believe in the larger values for conventional reserves. Here is a main point from their summary:

The USGS is a tool of the energy industry. For U.S. citizens, you can see your tax dollars at work: to bamboozle the American public while the fat cats take your dough to the bank, ha.

Meanwhile back at the ranch, the U.S. Army Corps of Engineers said Peak Oil is now.

Venezuela has certified more than 400 billion barrels of heavy oil. It is less expensive than Alberta tar to extract. How long will they sit on their position without exporting? They might be able to get a quota like Saudi Arabia but more, certainly not less.

There could just as well be 3.5 gazillion barrels, if the money isn't there to recover it, then it stays in the ground and might as well not even exist.