Jeff Rubin: Oil Prices Caused the Current Recession

Posted by Gail the Actuary on November 5, 2008 - 9:40am

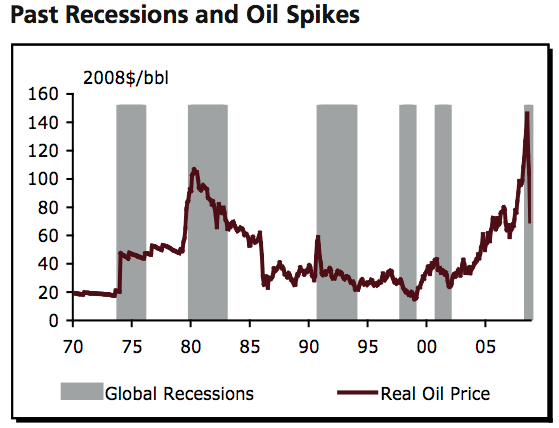

Jeff Rubin, Chief Economist at CIBC World Markets, in a recent report, is now saying that the current recession is caused by high oil prices. Defaulting mortgages are only a symptom of the high oil prices. We should be blaming the underlying cause--higher oil prices--rather than the symptom. These higher oil prices caused Japan and the Eurozone to enter into a recession even before the most recent financial problems hit. Higher oil prices started four of the last five world recessions; we shouldn't be too surprised if they started this one also.

According to Rubin:

Oil shocks create global recessions by transferring billions of dollars of income from economies where consumers spend every cent they have, and then some, to economies that sport the highest savings rates in the world.

While those petro-dollars may get recycled back to Wall Street by sovereign wealth fund investments, they don’t all get recycled back into world demand. The leakage, as income is transferred to countries with savings rates as high as 50%, is what makes this income transfer far from demand neutral.

One of the reason that Rubin doesn't feel that real estate problems are the cause of the current recession is because the geography isn't right. How could real estate prices in Cleveland cause a recession in Japan and the Eurozone? Also, the dollars involved in the oil price shock are much greater than the real estate would have on the economy. According to Rubin:

By any benchmark the economic cost of the recent rise in oil prices is nothing short of staggering. A lot more staggering than the impact of plunging housing prices on housing starts and construction jobs, which has been the most obvious brake on economic growth from the housing market crash. And those energy costs, unlike the massive asset writedowns associated with the housing market crash, were borne largely by Main Street, not Wall Street, in both America and throughout the world.

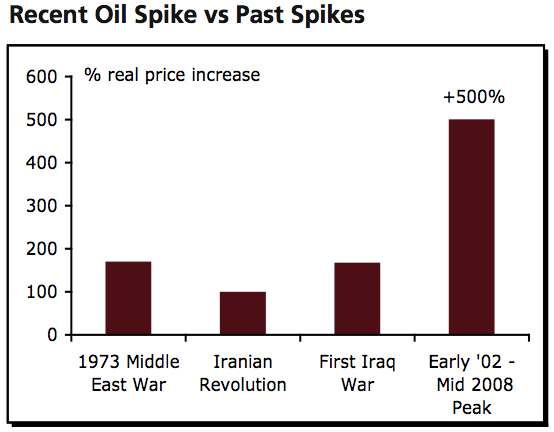

According to Jeff Rubin (and his co-author Peter Buchanan in part of the material), the recent price spike, measuring from 2002 to the $147 high in 2008 was 500%+, far greater than any of the past price spikes.

This big increase in oil prices has caused the annual fuel bill of OECD countries to increase by more than $700 billion a year, with $400 billion of this going to OPEC countries. He asks:

Transfers a fraction of today’s size caused world recessions in the past. Why shouldn’t they today?

Another issue is timing. As mentioned previously, Eurozone and Japan entered a recession in the second quarter of 2008, which was before the spike in LIBOR rates that is associated with the current financial crisis.

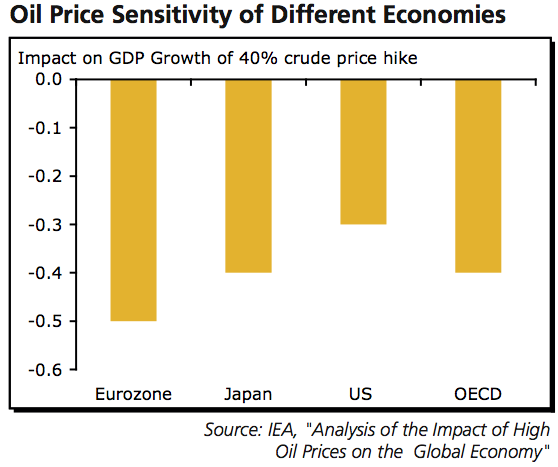

Rubin observes that it isn't surprising that Eurozone and Japan entered into recession before the United States did. The United States is less sensitive to oil price spikes because it is itself an oil producer (5 million barrels out of 19 million barrels the US consumes are produced in the US), so it receives some of the benefit of the higher prices. An IEA analysis also indicated that it should be less affected by oil price shocks.

Rubin observes that a delay in timing is expected between an oil price hike and a recession:

Some of the best research indicates that it takes about a year for an oil price shock to have its maximum impact on US GDP. Leading macro and energy economist James Hamilton notes these lags fit the experience of past shocks, including the OPEC-induced recessions of the 1970s. Among other factors, the unwinding of an involuntary buildup of autos and other durables is a key determinant of the lag structure involved. It has also been found that a similar lag structure holds for the impact of large declines in oil prices. The virtual collapse in oil prices to $12/bbl in 1986 was a key driver behind a rebound in US economic growth to a 4%-plus pace, even in the face of mounting financial costs from the Savings and Loan crisis.

Given that oil prices really took off in the third quarter of last year, after several years of more gradual increases, we should expect to see its maximum hit on the economy right about now. By the same token, however, the impact from the even larger decline in oil prices over the last two quarters should give its maximum boost to the economy moving into 2009.

Jeff Rubin then concludes:

If triple-digit oil prices are what started the recession, then $60 oil prices are what will end it.

Elsewhere he says:

Of course the bad news is, where do you think oil prices will be once the economy recovers?

Comments

Based on the last two observations quoted, I would conclude that Jeff Rubin expects the economy to zig-zag in the future, first hitting a low point, and then a new high, and then a low point again. If peak oil is part of the equation, I would expect the height of the highs to gradually decline, and the depth of the lows to get progressively lower.

The question I have is with respect to his statement, "If triple-digit oil prices are what started the recession, then $60 oil prices are what will end it." I would agree that lower oil prices are necessary to end the recession, but it is not clear to me that they are sufficient.

It seems to me that we have a different problem at this time--a barely functioning financial system that governments around the world are trying to bail out. We also have a vastly oversized financial services industry that needs to collapse to a more reasonable size. In addition, there is a problem with non-availability of credit.

It seems to me that the problem with non-availability of credit, particularly long-term debt, is ultimately tied in with peak oil. It is difficult to have more than a tiny amount of long term debt once an economy is no longer growing. Repaying long-term debt is relatively easy in an economy which is growing, since funds available to pay back debt are greater in the future than they are at the time the debt is incurred.

In a declining economy, it is likely that either there will be many defaults, or that the debt will be paid back with dollars that are worth much less than when the loan was taken out. Because of these issues, lenders will raise interest rates to such a high level that few projects will generate a high enough rate of return to justify taking out these loans. I believe that ultimately long term debt will essentially disappear--but perhaps not for several years.

Unless we can get world's financial problems worked out, it seems to me that it will be difficult for the economy to get back to business as usual. Instead, we will find more workarounds like Thailand's recent rice for oil deal or China's $25 billion loan to Russia in return for oil. Without a solution, we are likely to have a continued recession. If the financial problems suddenly take a turn for the worse--say, the US dollar is no longer the reserve currency, the US economic situation could take a sudden large step downward.

i'm having a little chicken/egg problem here.

what caused professional money guys, who most certainly must have known better, to make worthless loans, bundle them and sell them to the world?

did they have some inkling of peak oil approaching, and revert to their default mode as looters?

and nobody wants to mention the convenience of having a financial meltdown that destroys demand for oil just as peak oil becomes obvious.

and nobody, but nobody, wants to make any mention of the fact that, if peak oil is obscured, a huge motive for committing a false flag on 9/11 is also obscured.

If you want to believe in a conspiracy, then no one will be able to convince you otherwise. See http://thearchdruidreport.blogspot.com/2008/10/arguments-from-ignorance....

They are greedy, shortsighted, and thought that they could beat the system. Just like any other bank robber.

They were running in default mode already. Shortsightedness is default.

Actually, many people have mentioned it. The problem from a conspiracy perspective is that peak oil should cause financial havoc, even if the economy wasn't already a house of cards.

Look at the chart above about the price of oil and the timing of recessions. Peak or no peak, the control of vast oil reserves provides tremendous economical power. Look at the EROEI charts for oil vs any other energy source. One doesn't need peak oil to make acquiring oil reserves a military priority.

Occam's razor is a useful surgical tool for ridding oneself of cancerous beliefs that get in the way of working towards real solutions to our problems. Please practice using it.

occam's razor dictates that people who said they wanted "a new pearl harbor" must have had a motive for making their "new pearl harbor" happen, especially in view of the fact that, shortly afterward, they were installed into positions from which they could make their "new pearl harbor" happen, and shortly after that, their "new pearl harbor" did happen.

Actually, this just goes to show that you are ignorant and havn't looked up things for yourself. You just buy whatever the conspirac loonies write.

If you've actually read the report from New American Century, you would know that the Pearl Harbour-quote is taken out of context, and is just mentioned in a passing statement.

Conspiracy theorists are "reaching", and trying to make connections that simply aren't there.

The report is available for reading at

http://www.newamericancentury.org/RebuildingAmericasDefenses.pdf

"A transformation strategy that solely

pursued capabilities for projecting force

from the United States, for example, and

sacrificed forward basing and presence,

would be at odds with larger American

policy goals and would trouble American

allies.

Further, the process of transformation,

even if it brings revolutionary change, is

likely to be a long one, absent some

catastrophic and catalyzing event – like a

new Pearl Harbor. "

From this conspiracy theories deduce a proof that the writers of this 78 page report planned and executed the 9/11 atrocities. From a single sentence, in a report that is about something completely different.

And this level of standard is typical for all conspiracy "proofs". Reaching.

ah.

so you're saying that these guys went to all the trouble to write a 78-page wish list, and didnt want to implement it as soon as possible?

want to comment on the fact that the PNAC signatories were installed into positions to make their "new pearl harbor" happen by an election recount in a state governed by the brother of the president-elect?

want to comment on the fact that that brother, jeb bush, is a PNAC signatory?

want to comment on the fact that cheney made a speech in 1999 showing he's perfectly aware of peak oil?

oded yinon in 1982 recommends balkanizing muslim states, particularly iraq.

1992, paul WOLFOWITZ and scooter LIBBY, cheney's convicted ex-chief of staff, produce a defense policy guidance paper. the paper was the first generation of what was to become PNAC and later official US foreign policy, and recommended attacking iraq. the paper was leaked to the new york times, and public outcry was such that wolfowitz's paper was disowned and revised.

1996, richard PERLE and some of the usual likud israeli american suspects write a paper for bibi NETANYAHU calling for the occupation of iraq

1997, PERLE forms PNAC with nominal founders robert KAGAN and bill KRISTOL, and all the usual likud suspects

september 2000, PNAC issues a document, "rebuilding america's defenses", calling for wars to control the oil in the middle east and central asia. the document says that these wars will be slow to materialize without a new pearl harbor to mobilize america

september 2001, PNAC's "new pearl harbor" materializes in the form of four hijacked airliners

september 2002, PNAC's "rebuilding america's defenses", the document that called for the "new pearl harbor", is adopted by the bunnypants administration as its National Security Strategy, in some cases, verbatim.

i admit that i'm uneasy with that statement... i cant recall seeing anywhere in the PNAC documents an explicit call for "wars for oil".

on the other hand, it doesnt take very good eyesight to read between the lines, especially once you look at the checkerboard and see how the pieces are being moved.

it's just too damn bad that russians play chess, and chinese play go.

This is no longer an adequate response. The US gov't and media FORCED everyone to become conspiracy theorists on 9-11. They presented a conspiracy theory to explain the events of that day, and then turned around and asked people NOT to believe in conspiracy theories! There is no one, I dare say, who believes 9-11 was a series of unfortunate accidents. It's obvious by now what happened.

Now, saying that conspiracy theories in general can't automatically discounted is not the same as buying into any particular one. Crises are endemic to capitalism, and there's no need to invoke conspiracy to explain them. And I don't think this meltdown was planned either. It doesn't seem to have benefitted politically those who might have orchestrated it.

On the other hand, the bailout plan was drafted before the meltdown, so it would seem that there was at least contingency planning. The Patriot Act, the Military Commissions Act, and several other pieces of legislation ALL point to significant amounts of contingency planning, scenario spinning. The 47 billion intelligence budget (not including the military) isn't spent entirely on video games.

Also, the collapse in energy prices has temporarily shifted some of the balance of power back to the US. I suspect that this too might have been at least foreseen.

Anyway, how much conspiracy has been an element in this whole thing is a fascinating subject, not easily fathomed.

flickervertigo-Nobody want's to live in that world, whether real or not. We much rather think we are all so smart and the people in charge are dumb, don't talk about big issues in private or plan. There is an unspoken rule that we never question motives only competence and you are breaking it. Please stop, it upsets people and we will be forced to label you unstable if you persist.

Jeff Rubin: Oil Prices Caused the Current Recession.

I say: Huge number of the exploration dry wells is a root of high Oil Prices.

Today, as it was decade years before, oil companies have drilled mostly dry exploration wells. Drilling success rate doesn’t overcome 25% on average. It means that three dry wells go to waste from four drilled. It means also that discovery occurs much slowly then if success rate significantly rise. Using Seismo-electromagnetic (SEM) phenomenon in oil deposits it is possible to triple world oil discoveries every year for same money and time-frame with 75% success rate.

Initiating of SEM phenomenon to detect of hydrocarbon deposits has the steps of simultaneously action an electromagnetic field and a seismic wave in investigated geological region so that an electromagnetic signal originates by vibrating of hydrocarbon deposit surface excited by the electromagnetic field and travels from the surface. For details see www.phenomenon-in-oil-accummulation.weebly.com

I used to debate creationists in the public forum. I have debated some of the best. Then one day a science professor said to me: "These people are idiots, they should be ignored, not argued with." And the more I thought about it, the more I saw his point. Creationism is a dogma and no logic is strong enough to penetrate dogma. I do not argue with them anymore, not even on the internet.

I feel the very same way about conspiracy theory wingnuts. They are so wrapped up in their conspiracy theory dogma that no logic can possibly penetrate their thick skulls. They should be ignored, not argued with.

I don't argue with creationists either. I consider it to be a complete waste of time. Most of those whom I've observed arguing with creationists aren't biologists, but are people who get their info from talkorigins.com. This website is pretty good but its PTB have their pet biases & misconceptions. When I hear these biases & misconceptions being parroted by those who do argue with creationists, it becomes apparent where they get their info. In the past, when I've objected to or corrected these biases & misconceptions, I've often ended up arguing with the anti-creationists, which gives the impression that I'm a creationist myself or at least sympathetic with their ideas. I've given up on trying to instruct people online and in fact have given up the landline, DSL & internet at home. Simplify, simplify.

The religious nuts are sure in their knowledge-they know the age of the universe, heaven follows life on Earth (for the chosen), etc. etc.-they aren't interested in any info that might shake their rock solid belief system-just like you.

I have often changed my most firmly held beliefs. In fact I am always looking for data that will prove me wrong. That is the only way anyone ever learns anything.

An example: Concerning the great extinctions I was once the strongest advocate of the impact theory. I debated the the concept endlessly on the internet. Then I hear a lecture Vincent Courtillot , Universite Paris 7: "Mass extinctions in the Phanerozoic: a single cause and if yes which?" found on this page: Princeton University Archived Lectures That convinced me. I turned on a dime. The second greatest extinction coincided exactly with the second greatest volcanism, the Deccan Traps and the greatest extinction of all time, the great Permian Extinction coincided exactly with the greatest volcanism of all time, the Siberian Traps.

The lecture persuaded me to buy his book Evolutionary Catastrophes. Now I know people who still cling to the impact theory simply have not heard Courtillot's argument.

I have no sacred cows, no sacred dogmas, no firmly held beliefs that cannot be changed if the facts dictate. That is because I do not have a belief system other than that I believe only what the facts support. However I do have several hypothesis which are never held very strongly. They are mostly "perhaps this might be the case". Then after thinking about such a hypothesis I usually discard them as "not bloody likely".

Ron Patterson

When you get whacked hard on the forehead the concussion occurs on the occipital lobe. At the end-Cretaceous India was an insular fragment of Gondwana south of the equator in the Indian Ocean. Chicxulub rang the Ocean Planet like a bell, rupturing the crust on the opposite side, resulting in the Deccan Traps. Similarly, the Siberian Traps resulted from a massive impact at the end-Permian. Both basaltic outpourings were the result of bolide impacts - Chicx being an Fe-Ni bolide, hence the Ir enrichment and the end-Permian object most likely was a water ice comet. Large impact craters a quarter of a billion years old exist in Antarctica and in the Indian Ocean NW of Australia. Volcanism may have contributed to the extinction events but both volcanism & mass extinction were precipitated by ET impacts. Please don't conflate correlation with causation.

Problem is Darwinsdog, that the impact happened a couple of hundred thousand years after the volcanism that caused th Deccan Traps had already started. The iridium layer thrown up by the Chicxulub impact is found smack in the middle of the Deccan Traps. A lot of volcanism before the impact and a lot of volcanism after the impact. You are making the exact same argument that I made before I saw the lecture and read the book. Watch the lecture DD, it explains it all.

The volcanism lasted several hundred thousand years.

Ir concentrations in the Cretaceous - Paleogene boundary clay varies from .1 ng g^-1 to 100 ng g^-1 worldwide. Rocchia et al. state: "A search for iridium in 47 samples from lava flows and inter-trap sediments in the Deccan yields negative results. Concentrations are not statistically different from zero, with a minimum detection level on the order of 0.1 ng.g−1 (ppb). This does not help to constrain the debate on the internal vs external origin of KTB boundary events..."

Rocchia, R., D. Boclet, V. Courtillot, and J. J. Jaeger (1988), A Search for Iridium in the Deccan Traps and Inter-Traps, Geophys. Res. Lett., 15(8), 812–815.

Your assertion that "The iridium layer thrown up by the Chicxulub impact is found smack in the middle of the Deccan Traps" doesn't appear to be supported by Courtillot and his colleague's own research.

I own Courtillot's book, btw, altho it's been several years since I read it. Several hypotheses exist that purport to explain the K - Pg mass extinction. To my mind, none are compelling save the Chicxulub impact hypothesis. In fact, I believe that all of the previous major mass extinction events have been caused by extraterrestrial bolide impacts, with the exception of the currently ongoing anthropogenic event.

In grad school I modeled Milankovitch cycles as sine waves and again as terms of a Taylor series expansion, overlaid the cycles to see if any synergisms corresponded with mass extinction events. They didn't appear to do so. This result caused me to rule out orbital forcing as a cause of major mass extinction events.

I believe the sun rises every morning at 2am. I have been proved wrong every time I set my alarm clock for 2:15 am, eager to rise and start my day at sunrise. I've had to wait for the sun until 6 or so. I have not given up my belief however because, when I sleep in to 8am, the sun is up and has been since 2am. I do not believe in intelligent design because of one simple fact; water does not run uphill. I've spent half of my life irrigating pastures, shovel in hand, trying my best to get water to flow uphill. No luck. In addition, I believe the earth was created, complete with all of it's creatures, six seconds ago. Prove me wrong. Best from the Fremont

Don't forget my favorite explanation for the dinosaurs' extinction - the Verneshot theory. It also may explain the 1908 Tunguska explosion.

The science professor who called creationists "Idiots" was speaking out of frustration, not informed thinking. I'm not saying I blame him, I don't. But I think it is very important for scientists to understand exactly what is going on in these arguments. I've seen a LOT of these confrontations. I work in evolutionary biology; paleontology to be precise.

There are two fundamentally different methods of reasoning which have been handed down to us (from the classical Greeks) that allow us to examine the world in which we live; the dialectical and the rhetorical. The dialectical line of inquiry (scientific method; question, experiment, review data, conclusion) is the language of science. The rhetorical line of inquiry (argumentation based only upon the abstract and the logical) is the language of the legal profession, the church, philosophy.

Both of these lines of questioning are very powerful analytical tools, but they operate by two entirely different rule books. For a scientist (a dialectician) to debate a creationist (a rhetorician) is akin to a boxer agreeing to fight a samurai.

Real world examples of the devastating effect of rhetoric used against the dialectic abound. My favorite was the example of how quickly and effectively Johnny Conchran destroyed the credibility of the forensic DNA evidence submitted by the prosecution in the O.J. Simpson trial. With only a few skillfully constructed logical ideas the rhetorician demolished the prosecution's argument; game, set, match, O.J. NOT guilty!

The best read on this subject is the book by the famous American philosopher, Robert Pirsig, "Zen and the Art of Motorcycle Maintenance". It is a book every scientist needs to read and understand backwards and forwards. NEVER argue with a skilled rhetorician using dialectical argumentation; you will be sliced up faster than you can say, "evolutionary and developmental biology".

You are saying there are two ways reasoning. Of course there are, but they both do not lead to truth. A skillful orator does not always argue what is right, as you admit in your post. I have often heard religionists argue that there are two ways of knowing, the scientific way and the intuitive, or spiritual, way. However intuition is not knowledge.

I have debated some very good rhetoricians and always held my own very well. In fact I made most of them look very silly. But of course none of them ever changed their minds. A belief held on faith can never be dislodged with pure rational logic. Such dogma as creationism is usually set in one's mind in childhood. It is set as if in cement, never to be dislodged. But I think you are dead wrong on one point. They never make good arguments. Everything they say is usually based on authority.

deleted post

A belief held on faith can never be dislodged with pure rational logic

How about the irrational belief that world leaders, especially those from the oil industry, don't have a working knowledge of peak oil and its implications could possibly be making plans that are not public knowledge.

Now that is IRRATIONAL and based on an even further rooted faith. A faith that our leaders actually care about the people they govern and wouldn't off some in a second if it would help there cause.

I'm happy to see that faith is quickly eroding because it surely not based on any evidence that I have seen.

I feel the very same way about conspiracy theory wingnuts.

You totally abandon logic here. You have no choice but to become a conspiracy theorist after 9-11. The gov't forces you to adopt one or another conspiracy theory. And then it tells you not to believe in conspiracy theories! It is one of the greatest insults to the public intelligence of all time.

The 9-11 hearings were held in secret to protect all Americans (from themselves).

Hey FlickerV,

Yes, there are many chickens and eggs herr, and many skunks in the woodpile too.

Rubin says that defaulting mortgages are only a symptom of the high oil prices. We should be blaming the underlying cause--higher oil prices--rather than the symptom.

Greenspan/Bush policies ramped up the U.S. construction industry and economy and accelerated the world economy, which drove oil prices very high.

Meanwhile I hear on the TV that Alan Greenspan says he thought the financial institutions would regulate themselves. He must have had a different college education than most, or maybe he lives on a different plant. This is even worse that the Savings and Loan scandal of the Reagan administration, crisis of 1985,

http://en.wikipedia.org/wiki/Savings_and_Loan_crisis

which I used an example of government corruption/stupidity in teaching policy evaluation for 20 years. In both cases lax government regulation allowing a few to rip off the public and then the nation suffers horrendously in paying for this nonsense, and in both cases many saw it coming and put out warnings to change government policy. And the Enron scandal was just a few years ago.

As a history major, I know that the only thing we learn from history is that we don't learn. Nevertheless,to see this same type of nonsense occur in less than a quarter century is just ridiculous. A lot of people are now out of jobs and will be homeless as a result. And a lot of people lost wealth rapidly, with no time to figure out how to adjust their investments. And just like the S & L crisis, many suffer, and the guilty will mostly put money in the bank, instead of going to jail where they belong. They are just as bad as those who evade taxes and are sentenced to years in federal prison. Obviously if I knew about the S&L Crisis/Scandal, then Alan Greenspan did too.

We should be blaming Bush, Greenspan, Congress, and the corrupt banking and financial institutions. Business ethics is an oxymoron. Blaming high oil prices is like blaming the bullet that killed someone, instead of the assassin.

Ilargi wrote about the possible creation of financial chaos for averting peak oil in the October 9 Debt Rattle, in a much more articulate fashion than Deffeyes's recent venture.

Rubin says that defaulting mortgages are only a symptom of the high oil prices. We should be blaming the underlying cause--higher oil prices--rather than the symptom.

Conversely there would not be nearly as many defaults if people weren't coerced into precarious positions which was caused by the housing bubble mania. High oil prices surely did assist but there would still be massive defaults without just because of the dynamics of a massive asset bubble. Turns out people are not to keen on keeping property that is worth half as much when they bought it and did not put money down. Who would've known?

Jeff Rubin, as a representative of CIBC World Markets (a firm that has been burned very badly during this financial fiasco) is not at liberty to be making the most forthright statements on this subject-he is smart enough to be aware that with low oil prices the housing bubble could have lasted longer, blown up even bigger and higher, and then crashed with even more spectacular destruction. A light breeze will knock over a house of cards piled high enough.

But Colin Campbell is, and he said it three years ago.

http://www.youtube.com/watch?v=lDNMjV6sumQ&feature=related

Cheers

The whole fantasy that something as complex as a nation of 300 million people can be successfully regulated by a small group of ordinary mortals is amazing. Now imagine orwellian task of centrally managing the whole globe. Economy just happens to be a substantial yet very small part of that complexity. There are no supermen in D.C, they happen only in comic books.

Here is a short article on the real effects of most regulations...

I don't think regulation is inherently good or bad. Unfortunately all regulation is geared towards the upward distribution of wealth.

Contrary to MSM myth, financial fraud is not a necessary and integral part of a free society.

Fraud is part of any society. More regulated and controlled a society is, the more it tends to exhibit corruption and nepotism.

Yes, but any profit driven system is inhumane. This is the old people are not wise or moral enough to regulate markets and our regulators are so eager to prove it. I don't buy it. The regulation-deregulation meme is used as a political tool to achieve a goal. I'm sure they were spewing some bs when the repealed glass-segal about the need to deregulate. Take the profit out and deregulate all you want otherwise you are looking for trouble.

As far as I am concerned there is no freaking way you can have an unregulated market in the face of peak oil with out mass famine. Paradigms are shifting old rules and ideologies do not apply.

Glass-Steagal was signed into Law by a so called "Laissez-Faire" President - Herbert Hoover. It's repeal was signed into law by a darling of the control mongers - Bill Clinton.

151 democrats in the house voted in favor of the Gramm-Leach-Bliley that repealed Glass-Steagal. In fact, the only politician in legislature that I agree more than 90% of the time voted against it - Ron Paul. Not because deregulation is bad, but Gramm-Leach-Bliley was not deregulation.

here is the excepts of his speech from 1999

http://www.govtrack.us/congress/vote.xpd?vote=h1999-570

http://www.govtrack.us/congress/vote.xpd?vote=s1999-354

You have total misunderstanding of profit. Without profit, a civilized society is not possible. If nothing is left at the end of a day's work, we all die.

Your assumption that a centrally managed economy, where an omnicient planner allocates resources to everyone is rather silly. After he has given everything to his cronies, there will be nothing left.

The whole assumption that private enterprise is bad, but government bureaucrats and politicians exist not to serve themselves but the people is equally misguided.

People always act in their self interest, even Mother Theresa and Mahatma Gandhi was acting in their self interest. If there was no joy for them in their work, they would have been hardly motivated to do what they did. People serve their self interest in different ways.

In a libertarian society, if a few people want to voluntarily pool their resources together and create some sort of socialist subsociety, it will be possible. But in a coercive socialism, freedom will not exist.

maybe we need to redefine "profit"... for instance, food, shelter and clothing could be defined as profit.

maybe we need to redefine "civilized", seeing as how our "civilization" seems to be best known for its ability to oppress and kill masses of people.

maybe we need to refine our understanding of "work"... if our work contributes to the growth of the above "civilization", a "civilization" that oppresses and murders millions of people, maybe our "work" is not work, but something worse.

.

the simple fact remains: "profit", no matter what system, seems to accumulate in the hands of people who use that profit to maintain their position as predators... and this situation has prevailed since... when? ...since the invention of agriculture?

what do you think the legend of adam, eve, the snake and the apple is about?

Simple one: Great big bonuses and comissions, and zero comeback. Let's fact it, if you found that you could sell gold-plated turds as if they were solid gold and no one could come back and complain, you'd have a pretty massive incentive to sell as many gold-plated turds as you could..

aha!

so the whole financial system of america was based on tactics that were sure to kill the goose that shat the golden turds...

that smacks to me of foreknowledge of something that was gonna kill the goose that shat the golden turds, anyhow.

flicker

I'm with you and the story goes like this:

The controlling powers know all to well what peak oil means and they set up a series of events to deal with it. One, go get some oil to have more leverage on the world stage. Two, blow up the economy because that is what would happen anyway and transition to something more capable of handling PO while keeping control of their vast amounts of wealth and power. Everything inbetween is noise. Now the story continues with Obama, whether he is aware or not. His job is crowd control while we transition to a post peak system of economic governance.

Occams Razor indeed.

I think the myth that needs abolishing is not creationism, but, that of people in power do not have a working knowledge of peak oil and its implications, plan ahead, conspire and care about the people the rule over. Little do we know they are trying to achieve sustainability. Sustainability of control, which in the end will inevitably fail.

agreed.

There are two distinct types of professional money guys. The sell-side, who have engineers build complex financial products so the salesforce can sell them for big commissions, and the buy-side, who have portfolio managers invest people's money in the lots of things including the afore mentioned goldishturds. The buy-side guys are competing with each other for client investment dollars based on their performance with those dollars. The real culprits are on the buy-side.

I have been on the buy-side of the money biz for twenty plus years and I have seen this play out over and over. If the sell-side makes something complicated and tells the buy-side that it is so difficult to understand that few players on the buy-side can handle the complexity, buy-siders will buy it with every penny they have.

A good part of the recent epidemic of insanity has to do with the engineering metrics that buy-siders use to evaluate risk. Asset risk has been quantified in investment science as volatility: how much price moves around. According to volatility measures, assets like junk bonds have a lower risk than treasury bonds. That sounds kind of silly, but mathmatically it is usually true. "Usually" being somewhat of an important word here. A junk bond like XYZ Steel Co might normally trade at a yield of 8% or 4% higher than a corresponding 4% yield treasury bond. When the economy is booming and XYZ is doing well, their bonds might trade at 3% higher than a treasury instrument, but since the economy is booming, the treasury trades at 5% due to inflation fears. Since my CFA training tells me that 5+3=8, I know that the treasury has been volatile, but the junk bond hasn't moved an inch. If the economy slides into a mild recession, the inflation risk declines and the treasury yield dips to 3%, while the XYZ junk bond needs a yield 5% over the treasury to cover the extra risk. Once again, the treasury has been whipsawed, but the lovely little junk bond is still priced to yield 8%. And there you have it: under Modern Portfolio Theory government issued bonds are too risky to own.

Obviously needs some touching up, don't you think?

Ouch. Now the gamblers are appropriating science and technology terminology. Too cute.

Don't get me wrong, KjC, an excellent post with valuable input (though I find it very difficult to believe anyone sane would buy into your proposition regarding relative risk of Junk and TBills).

I agree. The theories are goofy.

Too many assume that bond failures are "independent". There is no way that they are independent. If peak oil reduces resource availability, there will be a lot of failures.

Life insurance companies made guarantees on their variable annuities. People were guaranteed a certain minimum return--say 6%, on a mixed stock portfolio. Now the assumptions are coming back to bite the companies.

Conspiracy or fate?

It is easy to invent conspiracy theories around the issue of peak oil, theories of how “Big Oil” and “The Military-Industrial Complex” are conspiring with corrupt politicians and overbearing governments.

The Internet is awash with such ideas. The truth is probably much more mundane.

As C Wright Mills the noted sociologist wrote sometime in the 60s:

“Only sometimes and in some places do men make history; in other times and places, the minutiae of everyday life can add up to mere "fate".

He gave us an unusually clear definition of this important word. Infinitesimal actions, if they are numerous and cumulative, can become enormously consequential. Fate, he explained,

“…….is shaping history when what happens to us was intended by no one and was the summary outcome of innumerable small decisions about other matters by innumerable people………….”

“Using the ecological paradigm to think about human history, we can see that the end of the age of exuberance was the summary result of all our separate and innocent decisions to have a baby, to trade a horse for a tractor, to avoid illness by getting vaccinated, to move from a farm to a city, to live in a heated home, to buy a family automobile and not depend on public transit, to specialize, exchange, and thereby prosper.” (C Wright Mills, website).

We don't need any conspiracy theories.

"need" is a funny word, isnt it?

if we're willing to accept being manipulated by predators, who conspire with each other to maintain their power over us, well, then, we dont "need" to know that those predators are conspiring.

Gail, thanks for another excellent post.

I am curious about the differences in the global economy between now and the early 80's. It appears from the chart above that we got out of a recession while oil prices were still as high as they are now.

In other words, what are the necessary conditions to get out of a recession? Are the conditions dependent on the causes of the recession, so that we have to agree that it was oil and not a property bubble before we can agree on a solution?

I don't have any answers myself and I agree with the general idea that we're in for more than just a recession.

Yeah, and if markets, traders, businesspeople and bankers understand the dynamic, then they know there is no "recovery" along the lines of business-as-usual. My suspicion is that they do understand that, hence the credit freeze and the global margin call on planetary resources. They will take the 8 cents on the dollar assets of a company itself worth only 8 cents on the dollar because they understand the end of business as usual - or enough of them do. Hell, even the hardware store down the street does. They won't sell me the damaged pallet of NPK by their front door at this years price. They are taping up the broken bags and putting it away for next spring.

If getting out of a recession means we return to business grinding up the planet, that's not success. Leaving aside that the fungibility of every other resource is determined by the price of energy, we've already overshot the grindability of the planet. As a species, we need to start putting our effort into rebuilding the planet. Humans are the best soil builders - where they put their minds to it. In a sense, our new economic paradigm has to be the most massive global savings program conceivable.

Virtually everything that suggests "more" in the human context or share makes matters worse. Economic justice isn't between humans anymore either; it is now necessary to consider economic justice across species and biospheres. No, I'm not proposing how or even thinking we animals might be able to make that switch until it is forced on us, merely suggesting an analysis of the economic predicament. CELDF and Tom Linzey have been working on this sort of thing: local ordinances and enforceable rights of nature and the environment.

virtually everything that suggests "more" in the human context or share makes matters worse. It's as if enough large players in the business community understand that at some fundamental level, hence the global economic crash.

This isn't a recession because we cannot regain. It's a turning. [s/t how one measures, YMMV]

cfm in Gray, ME

There's a disconnect between posters on TOD who are anthropocentrist technocopians & those who are ecocentrist agrarians of one sort or another. These two contingents often talk past one another. The former just can't understand why the latter can't get all excited over visions of electric trains & thorium reactors & peddle wheelbarrows, etc. The latter can't understand why the former don't realize that that kind of thinking is what got us in this mess in the first place. So it goes...

Planners and dreamers.

Many people may be ignoring the elephant in the room here. Peak oil may mark the death of capitalism, or at least capitalism as we know it today.

Robert Heilbroner makes the following observations about the nature of capitalism:

I think many non-economists can see that capitalism is in crisis. As we have seen recently with the price of oil, capitalism's underlying mechanism--free markets--are not at all rational, but vulnerable to emotional buying and selling. When it comes to peering into the future, or evaluating risk, they do an even worse job. If we define economics as the process by which society marshalls and coordinates the activities required for its provisioning, I think most non-economists can see that capitalism has become dysfunctional.

What direction will history take now? Will we replace the market (capitalist) economy with a command (centrally planned) economy? Will we end up with a mixture of the two? Will we revert to a traditional (primarily agriculturally-based, perhaps subsistence) economy? Or will some brilliant thinker conceptualize some entrely new economic regime?

Whatever happens, it would be a mistake to think the capitalist ideologues will go away without a fight. They are now being forced to confront the same bleak truth that the Marxist ideologues were forced to confront only a few decades ago. Their theories join the wreckage of other passing scientisms, dashed to pieces on the rocky shores of history and human nature.

Reinhold Niebuhr warned over half a century ago that the "powers of human self-deception are seemingly endless." We have "dreamed of a 'scientific' approach to all human problems," clinging to "the pretension that a community, governed by prudence, using covert rather than overt forms of power, and attaining a certain harmony of balanced competitive forces, has achieved an ideal social harmony. A society in which the power factors are obscured is assumed to be a 'rational' rather than coercive one."

As Niebuhr goes on to explain:

Capitalism thus suffered the same fatal flaw as Marxism: it was "incapable of recognizing all the corruptions of ambition and power which would creep inevitably into its paradise of innocency."

The loss of innocence is now clarion to all except the most committed of capitalist ideologues, which includes almost all economists indoctrinated in American universities as well as businessmen and financiers who benefit from the existing economic regime. But outside of these insular enclaves, rank and file Americans are rapidly awakening to the fact that something is terribly dysfunctional with their capitalistic economy. As Niebuhr tells us: "The force and danger of self-interest in human affairs are too obvious to remain long obscure to those who are not too blinded by either theory or interest to see the obvious."

You make good points. We tend to take too much for granted.

Everything that we have come to consider as 'normality' is merely an artifact of the age of cheap and plentiful energy -make your list...

Nick.

Excellent post Down South-Whether planned or not I think it's pretty obvious that the "crisis" is leading to an inevitable transformation of our current economic paradigm being that it is on the door step of peak oil. Looks like a command economy is coming to me. Still the question remains: Do our financial leaders know a little more about peak oil the they lead on to and could this "crisis" be peak oil preparation. If we answer yes to this we are shuffled off to the ranks of the babbling paranoid. 2009 surely will be a year of *Change* much to the dismay of capitalist ideologues.

"The Economy" is a complex system. It doesn't make sense to me to try to pin "the problem" on any one thing -- but if Rubin is correct (or is being quoted correctly, since I didn't read any of the original material), then what was it that made the price of oil go up so fast? Prices don't just "go up"-- in the passive voice. Some agent makes it happen. Peak Oil? Credit meltdown?

This is like an alcoholic finally dying of heart failure -- no one could understand it, because they thought his problem was a bad liver.

Oh those bones, oh those bones,

oh those skeleton bones.

Oh those bones, oh those bones,

oh those skeleton bones.

Oh those bones, oh those bones,

oh those skeleton bones.

Oh mercy how they scare!

http://kids.niehs.nih.gov/lyrics/bones.htm

He really doesn't talk about why oil prices went up in the first place, at least in this article. I haven't read many of his other articles.

I do know he is "peak oil" aware. I also know that he, or someone on his staff, is reading TOD. Some of the graphs in a natural gas article in the same PDF are from a TOD post I wrote (with proper attribution)!

The very best lecture at ASPO Ireland was given by Jeff Rubin. However the lecture was given well before most of the demand destruction we are experiencing today had taken place.

The Rubin video is the fourth one down on "Session Two: Demand Side".

Thanks. I enjoyed the presentation. He talks about how much oil demand is increasing in oil producing countries. For OPEC, he says demand is increasing by 1 million barrels a day per year, if I understood correctly. As a result, OPEC exports can be expected to decline.

He also talks somewhat about the Canadian oil sands, and the fact that they are quickly becoming the only game in town or IOCs to invest in. He says that Hugo Chavez, by kicking out US oil companies from the Orinoco heavy oil, has added to the Canadian oil sands value, since they are now the "only game in town".

erichacker,

I think this recession is different from previous recessions, both in terms of where we are relative to peak oil and in terms of what it is doing to the financial system (and these two differences are in fact related).

We had ways of getting out of previous recessions, but I am having a hard time seeing them work now. To get out of recession, we will need to use more resources. There are really two constraints on these--(1) the absolute amount available for a given amount of effort, which is getting to be less and (2) lack of credit to expand the use of resource. The lower resource prices and lack of credit will discourage investors from developing resources, holding back growth.

I'm playing Devil's Advocate here because I see this as a weak point in getting people to recognize peak as the issue.

This isn't necessarily true as efficiency could help, we could gain productivity from negawatts for instance. However, Rubin's top chart shows recessions vs oil price, and from Gail's statement we at least need to consider overall energy consumption. Ideally we'd have the major energy source's use (oil, gas, coal, nuke) and their costs compared to the recession data. After that then maybe we can figure out (WAG) some value for the efficiency variable or it might not be big enough to matter.

Oil peaked, but the overall energy vs economy picture needs to be put together to get a better understanding of the impact. Economists will claim substitution so we need to show how that there is really not enough to substitute.

I thought the Rubin was arguing that the transfer of wealth to the oil exporters was a problem because they were saving it. It seems that there might be an argument for them to be more proactive in propping up the bubble with easy credit, so to speak. :)

Oh, and since I've gotten silly, don't forget to project the development of a miracle energy source sometime before 2020 on any forward looking total energy chart. We can't forget the technology will save the day. ;)

A recession represents negative growth (economists cannot use words like reduction, decline, etc., so we get "negative growth", which can also be applied to haircuts, weight loss, and, possibly, lost airline baggage :).

The solution to a recession is therefore the return of growth (an obviously unsustainable condition, but that is a subject for another time). Something must drive that growth. In the US, the driver for growth is consumer spending. Has been for a long time. Consumer spending currently represents something like 70% of GDP. If you don't get strong consumer spending, you don't get growth. For consumers to spend freely, they must at least perceive that they have wealth to spend, and that that wealth is likely to grow rather than shrink. The source of the consumer's perceived wealth/wealth growth has changed over time. Historically, it was rising wages, but the most recent economic growth spurts were not due to rising wages, but to bubbles in technology, housing, credit, etc.

The major asset class within most Americans' net wealth is real-estate, specifically, their homes. With home values dropping, credit essentially unavailable, financial markets down and volatile to the point of being chaotic, and real wages stagnant (or down, depending on your preferred metric), what is going to provide the wealth (or perceived wealth) that will allow the US consumer to return to spending and restore growth?

Credit? The US debt is now over $10T and 2009 will add another trillion+ to that number. At what point do the Chinese start to wonder whether we can actually pay off that debt? Consumer debt is at record levels as well. Credit-card companies are seeing substantial increases in defaults and are, correspondingly, getting increasingly squeamish about offering more credit. It will be a long while before lenders are going to allow people to borrow our way out of this.

Real wage growth? From what source? Perhaps an Obama administration can pass a New New Deal type plan, rebuilding crumbling infrastructure and creating a new green/clean infrastructure. A plan of that size would, by necessity, require millions of workers and would probably drive up wages just through supply and demand. Of course, it would have a shatteringly high price tag, which would require higher taxes, or increased borrowing, or both. Taxes at that level tend not too be terribly stimulating to the economy and credit, as noted above, has its own problems.

Efficiency? Not sure I can see efficiency alone generating sufficient resources to allow consumers to return to spending. At the consumer level, a conserving/efficient mindset is not a spending mindset, it is a saving mindset. While there are many benefits to an increased savings rate, growth stimulus isn't one of them. Corporate/manufacturing efficiency could provide some excess capital/power that might make growth more likely, but American business is not built on using its own capital. It's built on using available credit to fund growth, and only if that growth represents expected increase in value. Most companies will not be interested in using any efficiency savings for growth until the consumer shows signs of spending again. Instead, those savings would simply be applied to the bottom line to make the financials look better.

Peak oil, when it arrives, will mean that oil prices will, over time, march higher and higher, affecting all of the above negatively. Higher oil prices drive inflation higher, reducing money available for consumers to spend on anything. Higher costs negatively affect long-term profits and, fundamentally, stock prices and the financial markets. Huge public works projects designed to help the economy will necessarily be dependent on fossil fuels, driving up their costs to the country in taxes, debt or both. Credit in a peak oil world is an iffy proposition. Credit is based on the assumption of growth. It requires it in order to pay interest. Given the various peak oil constraints on growth, it is hard to envision an expansive long-term debt market.

I'm just working through these off the top of my head, so I could easily miss lots, but I'm having a hard time seeing where a return to growth comes from. Long term growth requires consumer spending. Some source of wealth (real or perceived) has to backstop that spending. Where is it coming from, especially if peak oil is upon or nearly upon us? Beats the heck out of me. Any ideas?

Great post !

You forgot one that I believe is very important and thats rising food prices. The psychological impact of budgeting in the grocery store is huge. I'm normally blissfully unaware of prices for food but about six months ago they reached the point that even I suddenly realized that stuff was getting expensive. My realization in the store spread to other spending rapidly. Since I have children all it took was one whiff of concern about buying food to change my spending habits.

This is part of a general refocus of the consumer on ensuring they can afford the basics esp as they run out of credit.

I don't remember a recession during the late 90's; that is the fifth out of five, and the one that wasn't correlated with oil prices. Perhaps that is because it didn't occur? Or is this a "world-wide" table, that focuses on the Asian problems of the late 90's that didn't spill over to the US or the Eurozone?

My understanding is that this analysis is on a world-wide basis, so I would think it would include the Asian problems of the late 90s.

RE: Figure 2

The most recent percentage price rise is charted over a 6-year span (2002 to 2008). Is that reasonable? What are the time-spans of the other price increases charted there?

Thanks Gail, great post. I agree with Rubin that the price of oil has been the driving force of the recession. I have stated such in several posts on TOD. However I think Rubin, and just about everyone else overlooks one very important factor: The increase in oil prices is itself a symptom of another and more fundamental cause. And that cause is the plateauing of the world's oil supply.

A recession is loosely defined as two consecutive quarters of negative growth (or contraction) of gross domestic product, All the developed world’s economies are based on growth. Growth in goods and services is impossible without growth in the energy supply. So it really doesn’t matter how low the price of oil gets, economies cannot recover unless the supply of oil begins to grow again. Oh if oil prices stay low, the economy will feint recovery but it will never recover because the supply of oil is not likely to rise above the plateau it has been sitting on for four years.

I doubt we will ever see even $150 oil. People with no money cannot buy oil now matter what the price. It will be the energy supply, or the lack of it, that drives the recession deeper and deeper, not the price of oil.

Ron Patterson

"People with no money cannot buy oil no matter what the price."

Most people in the U.S. have incomes, and they have shown themselves willing to buy a lot of gasoline and home heating oil and diesel when oil was at $147 a barrel. Of course they buy more oil products when prices drop to $70 per barrel. Falling supplies of oil--even in a depression--will eventually drive oil prices up to and beyond $150 per barrel, and if Saudi Arabia makes major cuts in production then the oil price could spike up rapidly.

Before people cut back very much on their consuption of gasoline (and other oil products) they quit buying houses, quit buying cars, cut way back on eating in restaurants, cut back on charitable donations, cut back on Christmas spending, even cut back on visits to the dentist.

In other words, I think there will be a double whammy of falling oil exports and rising oil prices. In combination, these two factors will tend toward stagflation and eventually (within three years) a Greater Depression.

...that will last until somebody makes a breakthrough in fusion, or some complete white swan pops up... or possibly, furever'n'ever.

I'm in 100% agreement Don this was my own take on the matter.

Stopping expansion is very different from reducing consumption. As you point out and I have on the reduction side money itself is fungible so cutting costs cross a wide spectrum of activities. And also as you point out you can cut costs in a lot of areas before you see significant declines in oil consumption.

Understand this is different from the decline in consumption from the death of growth industries such as housing.

I'm sure we will see further real declines in oil usage as various industries falter if this will result in demand pulling back enough to cause low prices is open for debate but at best its temporary.

In the really be picture what Don is talking about is a move from a Debt based society to one based on cash. What I really believe will happen over the next several years is that the consumer will repudiate debt.

This will happen first with large long term debts such as housing and cars thence to credit card debt. Most of these people will do it by defaulting and more important they will not re-enter the debt markets.

Some of course will do this by paying off debts. The next step will be that more and more people will be forced to save some money to act as a cushion as debt cannot be used.

Companies will follow a similar process with some failing some saving etc across the regular or daily economy we are and will continue to see debt being repudiated.

However the system cannot handle this and the defaults would have destroyed it plus the above situation results in a stagnant economy. To counter this we will continue to see more and more debt that should have been defaulted on taken over by our governments. They will issue ever more debt to attempt to restart the economy.

So the very last debt junkie the governments will refuse to change repudiate the use of debt.

So whats probably really happening is as borrowers either become unable to borrow or refuse to borrow the governments simply attempt to borrow for everyone in essence.

We are not getting true debt deflation but concentration of debt most of no or little value on the open market.

Right now we have raging arguments over the internet as to which way our economy will crumble and the choices are deflation or hyper-inflation.

My opinion is neither instead I think our world economy will simply stop the real economy if you will is unable to take on any debt and the governments will eventually become insolvent and finally be cut off from being able to issue more debt. So in a sense it just stops the governments become unable to pump the economy they are setting on a huge pile of debt and the normal economy has reduced itself to a sort of cash/daily economy thats stagnant.

Thus the Greater Depression is probably going to be the result of a financial system thats incapable of operating its stuck if you will having suffered from several years debt concentration.

If you start looking at our financial system as a grid similar to the electric grid and we think about the spectacular failures that have happened to our grids I think we will see a similar event take out our financial system.

Its really just a information network and one day it will suffer from a cascading failure scenario as some transfer fails to happen and initiates a cascade of failed transactions. Nothing can go forward because know one understands the current state of the financial system. People don't pay a lot of attention to the vast amounts of money that move on short duration time scales. In fact our current financial crisis can be seen to be rooted in this sort of network failure. The flow of money stopped.

The reason I think it ends this way is simply because the underlying cause is the creation of a moral hazard.

Peak Oil results in a declining economy regardless of what people say about efficiency we are still dealing with a world that is poorer every year in a critical basic resource. Since efficiency gains suffer from declining returns the more you save the harder it is to save you are forced to actually reduce. Maintaining our fiat currencies requires endless growth. The moral hazard is that the governments have taken on the role of debtor and lender of last resort to prop up our economies agianst this relentless truth. The worlds population is happy to play this game and engage in it in hopes that the ever growing mountain of debt will result in short term personal gains.

Eventually some player becomes unwilling our unable to play the game the Moral Hazard explodes and people are forced to account for the debts.

http://en.wikipedia.org/wiki/Moral_hazard

Again if you look at our current situation the Moral Hazards that have been created are immense so it makes sense that moral hazard will probably be our undoing.

My best guess is that over the next few years people will be increasingly faced with decisions that have no positive outcome i.e every action results in a loss. This is because the underlying moral hazard has effectively removed the chance of making choices that are positive over the short term or long term. Once we reach the stage that effectively every move is negative the system has no choice but to not make any move thus it simply stops.

Now I've actually not been able to find and example of a systematic crash created by taking the option of choosing moral hazard as a solution. We certainly have Japan as and example however I can't see that this applies to the case of choosing the moral hazard solution globally. Just like peak oil in the US is probably not a perfect model for world peak.

We can guess that the fall of the Roman Empire can readily be modeled as the rise of moral hazard but the time scales for the fall of Rome and our own economy are radically different making it difficult to use them as a model.

Maybe a better example is the repeated looting of the treasury by the Kings of the Middle Ages esp England.

This is a good example that attempts to discuss it.

http://distributism.blogspot.com/2008/03/bear-steans-and-moral-hazard.html

Also I think that rise of moral hazard is tightly linked to the key failure of capitalism which is concentration of wealth. They are effectively the same problem. The moral hazard comes from the failure of concentrated capitol to be effectively redeployed i.e socialization of losses. This is coupled with socialistic programs to subdue the masses creating all sorts of miss allocation. The perfect example is the immense amount of interference by the government in the housing markets ever since the last depression. The real welfare program in the US was the subsidizing of the home owner. Social programs don't hold a candle to the tax monies spent on supporting WT's iron triangle. And of course on top of this we added the military-industrial complex.

Thus although our current fiat currency regime is capable of preventing direct deflation or hyper-inflation as a failure mode it does so by embracing the most insidious and final failure mode which is a moral failure induced stopping of the world economy as it can no longer operate without recognizing large losses.

If you look back on history this situation has been building since the end of the Roman Empire only new avenues of growth from the discovery of the America's and opening of trade with Asia have allowed us to dodge the bullet. In fact this suggests that instead of looking at the collapse of western civilizations as a guide we should look at India, Japan and Chinese histories since these economies routinely collapsed and in general at least from my understanding they may be the perfect examples of economic collapse from the final triumph of Moral Hazard over capitalism.

Fantastic pdf covering a wide array of societies.

http://www.bwl.uni-kiel.de/ifs/lehre/pdf/ss07/sem_economic%20systems/SEM...

Whats clear to me is that in all cases the theme is introduction of a snowballing moral hazard situation that eventually results in money no longer functioning in its most primitive role which is as and way to smooth barter. Thus the assertion that we fail by simply not performing needed transactions as moral hazard's make it impossible to ascertain the value of the money used in the exchange.

Deflation and hyperinflation are not the only two possibilities. I think a stagflation with real GDP growth declining at about 5% per year and the Consumer Price Index increasing about 10% per year is perhaps the likeliest scenario of the next fifteen years. Were this to happen, the dollar loses 75% of its value--and so does the national debt and the value of mortgages and other long-term debt. A declining GDP could cause low interest rates even in an environment of 10% inflation. In other words, real interest rates can go negative.

Gail is right to be concerned about the lack of capital investment for energy alternatives to oil. Where I think the capital will come from is the U.S. government printing of money with multitrillion dollar deficits year after year: $1 Trillion in 2008, $2 Trillion in 2009, and more than $2 trillion a year thereafter.

Eventually the Fed will have to "print money" to finance the deficits, because nobody else will want to buy Treasury securities in an environment of increasing inflation.

Thus I see the biggest moral hazard as being in our trust of the Federal Reserve System to maintain the value of the dollar. Just as the Fed pumped up the money supply in the nineteen seventies, I think it is going to happen again--but for longer and in a more extreme way.

So how to you see wages moving. In my opinion this printing is simply going to slow layoffs as the economy contracts so we don't see traditional wage inflation but more people employed for longer than they should via government handouts. Given your scenario in my opinion both real wages will be declining and probably the nominal amount so people stay at work but face both pay cuts and rapid decreases in purchasing power. This of course leads to continued mal-investment and overproduction of unneeded goods and services. CPI in terms of needed goods and services will probably explode while luxury items drop dramatically. As far as the movement of the overall CPI I don't know whats more important is that it seems to me discretionary income falls off a cliff.

So I don't see long term debts being retired via a successful inflation of wages.

Thus what I'm saying is we will see more of what we have seen the Government directly assuming debts and directly printing to monetize them. The money is not making it out into the general economy.

I think this is what your saying but at least for most people the key is if we see real wage inflation.

So what do you see is the chance we can actually cause a inflationary spiral in wages ?

So to finish although I agree we will attempt a repeat of 1970's stagflation I just can't see it as possible.

If both real and nominal incomes are falling its impossible for the CPI to increase across the board instead we will simply see the precentage of income devoted to basics increase.

And of course tightly coupled with this is peak oil. In my opinion the underlying scarcity of real resources prevents us from escaping if you will via the moral hazard you have outlined.

Financial games cannot change the basic situation that we no longer have enough basic inputs to continue to expand and we have a tremendous amount of debt that simply cannot be paid off. Attempts to inflate it away simply cause the contraction of the real economy.

Just to finish all of this rests on the belief that wage inflation is probably not possible if its possible then we could well play this game for quite some time. Look at Zimbabwe they have now been on the verge of collapse for years. If we can inflate wages then people can retire debts and the impact of rising commodities prices will not be so bad and your correct the overall CPI will increase.

What I see when I peer into my foggy crystal ball is:

Real GDP declines at 5% per year, roughly in accordance with declining oil production.

Inflation increases at 10% per year.

Nominal GDP and disposable nominal income and wages all increase at 5% per year. Real purchasing power diminishes therefore at 5% per year, but note that the real burden of old debt diminishes at 10% per year due to inflation. In not too many years of 10% inflation houses will be worth more than the old mortgages against them, and also the real burden of fixed mortgage payments diminishes 10% per year.

Note that it is much easier to cut Social Security and Medicare benefits if you have 10% inflation. All you'd have to do is to maintain nominal increases of 5% per year along with a real 5% annual cut in benefits. Also you can finance these benefits with humongous national deficits that are promptly monetized by the Fed.

One way or another, our standard of living (as conventionally measured) is going to decline along with declining production of oil and declining net exports of oil to the U.S. Politically, it is much easier to adapt to this decline if nominal wages are going up. Deflation is much more painful--both for business and for government. Deflation would benefit foreign countries who hold U.S. Treasuries; who wants to do that?

Note that I do not advocate the policies and results above, but I do think they are likely to happen. 10% and 5% are taken merely for purposes of illustration; obviously the actual numbers will fluctuate.

Hmm I'm unconvinced that wage inflation is possible. Look at our recent bout with attempted inflation.

All it lead to was a housing bubble wages remained flat in both real terms and nominal terms. We did get price inflation esp in housing.

Attempts at wage inflation really have not worked since the 1990's. The dot.com bubble being a brief period for a few people just like the housing bubble caused wage inflation for a small segment of workers in the financial and housing industries. General wage inflation did not happen.

Recently the cash injections are basically not making it out of the top rungs of the financial ladder.

At some point some of it will spill over but its practically trickle down economics. Or in our current case a few drips.

I have to suspect that Obama's approaches will only result in maintaining wages at nominal levels as any excess would rapidly get sucked overseas via the globalization infrastructure thats been developed.

One can look at minimum wage to see this.

http://www.cbpp.org/6-20-06mw.htm

This is old but its even worse now.

More complete results for Oregon here.

http://www.qualityinfo.org/olmisj/ArticleReader?itemid=00003899

Since Oregon shares in the High Tech industry along the west cost the results for Oregon map well with the rise and bursting of the .com bubble.

Thus we see that the recent bubbles since the 1980's even have not resulted in generalized wage inflation.

We have been unable to repeat the 1970's despite repeated attempts. As each area bubbles the duration and sustainability of the wage increases has dropped. I work in the high tech industry and I've seen no increase in my wages for over ten years outside of some fairly small ones attributed to my increased skill level.

I agree with you that the massive infusions of cash will eventually result in a bubble somewhere it literally has to happen however I see no evidence for any significant increase in wages and given the amount of debt or monetization or monetary inflation needed to incite the next bubble the chances are slim we will see any real wage inflation.

I happen to think that the EROEI/ peak energy and esp US peak oil are responsible for this situation attempts at monetary inflation fail because we simply don't have the underlying energy to cause real economic expansion

instead we end up with a brief bubble a large increase in the debt load and steadily decreasing purchasing power for our basically stagnant wages.

Also finally we have a basic problem that the financial world will be loath to give up money until they regain the profits that they where making at the height of the last bubble so we have a very powerful greed factor that will ensure that using our existing financial conduits will result in the drip down situation I mentioned earlier.

Certainly the housing bubble resulted in the broadest distribution of wealth and was arguably the most successful bubble but it destroyed one of the last local industries in the US. The price we payed was effectively almost destroying the worlds economy.

In my opinion we will see the same results but worse over the next few years this time around wage inflation will be nil. The influx of cash will cause two things commodities inflation and ever more inefficient companies on the public dole with flat to declining wages except at the very top this will keep consumption fairly flat and more importantly energy consumption fairly flat but taking a increasing amount of a workers pay.

Thus I call it the flat bubble in the sense that the public debt will grow to immense proportions but rising basic living costs and falling real purchasing power and flat wages will result in a fairly rapid impoverishment of most Americans. We care going to the the worst aspects of both deflation and inflation. This is why I'm saying that the eventual outcome is the economy will effectively halt as people simply become unable to execute transactions.

So the last bubble is really not a bubble in the true sense but one that prevents collapse when it fails we collapse.

Regardless of what happens to wages, consumption will have to fall as real disposable income decreases due to declining oil production.

BTW, your chart of the minimum wage shows a large nominal increase over the years--but with little or no real increase in the minimum wage.

Nominal wages have risen over the past five or ten years, roughly in step with inflation; real wages have gone up little or not at all, but the inflation rate has increased from about one percent to about five percent. (My cost-of-living increase in Social Security Benefits for this year, based on the Consumer Price Index, is 5.8 percent; nominal wages did not increase this much, but they did increase some.)

Along with you, I expect a quick runup in oil prices that will tend to keep inflation rates up--or at least prevent them from declining.

Suppose we have no increase in nominal wages, but inflation continues at five percent per year. That would mean that real disposable income would decline at five percent a year and real GDP would also decline at five percent annually, while nominal GDP stayed the same.

If prices and wages start to spiral up, I expect the Obama administration to impose wage and price controls. In any case, price controls plus rationing of oil products seems likely as oil goes over $200 per barrel, which I expect to see in the next couple of years. Even a decline in real GDP of 5% per year is not going to stop rising oil prices based on production declining faster than demand goes down. Thus there can be rising oil prices while consumption declines, so long as production declines faster than production does.

I see an iron linkage between declining oil production and declining real GDP--possibly not an equal percentage amount, but in a fixed relationship. For example, oil production might decrease 6% per year to cause a 4% per year decline in real GDP.

In the light of an inevitable decline in oil production and an even more rapid decline in net oil exports, real GDP all over the world will decline (despite continuing population growth). I think the poorest countries will be hit the hardest, because there is little non-essential consumption of oil in these countries. But the U.S. will be hit very very hard, with real GDP declining somewhere around 4% or 5% per year for the next fifteen years. I think we got on a plateau of oil production around 2005, and the first year of decline from this plateau will be either 2009 or 2010. The first year's decline likely will be mild, maybe only two or three percent. But I expect the second and subsequent years decline in oil production to be more rapid, probably in the 5% to 6% range as depletion races ahead of new production.