A Long Term Solution to Our Financial Crisis: The Other Forms of Capital

Posted by nate hagens on October 14, 2008 - 10:09am

As the world slowly awakens to the concept that all wealth perhaps can't be measured by digits in the bank, the global economic and political elite have been meeting to potentially form a "new Bretton Woods," kick started by global guarantees of banking deposits, direct government investment in banks, and global rate cuts. Though the markets have so far reacted with glee (or short covering), pumping fiat money into the system with no biophysical linkage to the real economy has (at least) two major problems. First, it accelerates the growing gap between financial capital and real capital, and second, it tacitly acknowledges our current "ends" as acceptable, and that all forms of capital can and should continue to be directed towards the positional consumption of "stuff" that our culture currently advocates (perhaps via momentum alone). In crisis times such as these, our leaders would do well to recognize that the human economy is a subset of a larger, finite system, and is subject to the natural laws forthwith. Furthermore, a plethora of new economic, psycholgic, and neuroscience research also suggests that "more" does not equate with "better".

Below the fold is a guest commentary explaining these themes written by my thesis co-advisor, Robert Costanza, director of the Gund Institute for Ecological Economics at the University of Vermont.

The current financial meltdown is the result of under-regulated markets built on an ideology of free market capitalism and unlimited economic growth. The fundamental problem is that the underlying assumptions of this ideology are not consistent with what we now know about the real state of the world. The financial world is, in essence, a set of markers for goods, services, and risks in the real world and when those markers are allowed to deviate too far from reality, “adjustments” must ultimately follow and crisis and panic can ensue. To solve this and future financial crisis requires that we reconnect the markers with reality. What are our real assets and how valuable are they? To do this requires both a new vision of what the economy is and what it is for, proper and comprehensive accounting of real assets, and new institutions that use the market in its proper role of servant rather than master.

The mainstream vision of the economy is based on a number of assumptions that were created during a period when the world was still relatively empty of humans and their built infrastructure. In this “empty world” context, built capital was the limiting factor, while natural capital and social capital were abundant. It made sense, in that context, not to worry too much about environmental and social “externalities” since they could be assumed to be relatively small and ultimately solvable. It made sense to focus on the growth of the market economy, as measured by GDP, as a primary means to improve human welfare. It made sense, in that context, to think of the economy as only marketed goods and services and to think of the goal as increasing the amount of these goods and services produced and consumed.

But the world has changed dramatically. We now live in a world relatively full of humans and their built capital infrastructure. In this new context, we have to reconceptualize what the economy is and what it is for. We have to first remember that the goal of the economy is to sustainably improve human well-being and quality of life. We have to remember that material consumption and GDP are merely means to that end, not ends in themselves. We have to recognize, as both ancient wisdom and new psychological research tell us, that material consumption beyond real need can actually reduce our well-being. We have to better understand what really does contribute to sustainable human well-being, and recognize the substantial contributions of natural and social capital, which are now the limiting factors in many countries. We have to be able to distinguish between real poverty in terms of low quality of life, and merely low monetary income. Ultimately we have to create a new model of the economy and development that acknowledges this new full world context and vision.

This new model of development would be based clearly on the goal of sustainable human well-being. It would use measures of progress that clearly acknowledge this goal. It would acknowledge the importance of ecological sustainability, social fairness, and real economic efficiency. Ecological sustainability implies recognizing that natural and social capital are not infinitely substitutable for built and human capital, and that real biophysical limits exist to the expansion of the market economy.

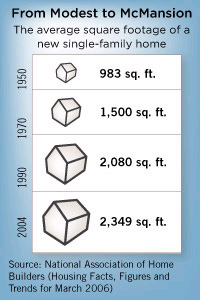

Social fairness implies recognizing that the distribution of wealth is an important determinant of social capital and quality of life. The conventional model has bought into the assumption that the best way to improve welfare is through growth in marketed consumption as measured by GDP. This focus on growth has not improved overall societal welfare and explicit attention to distribution issues is sorely needed. As Robert Frank has argued in his latest book: Falling Behind: How Rising Inequality Harms the Middle Class, economic growth beyond a certain point sets up a “positional arms race” that changes the consumption context and forces everyone to consume too much of positional goods (like houses and cars) at the expense of non-marketed, non-positional goods and services from natural and social capital. Fore example, this drive to consume more positional goods leads people to reach beyond their means to purchase ever larger and more expensive houses, fueling the housing bubble. It also fuels increasing inequality of income which actually reduces overall societal well-being, not just for the poor, but across the income spectrum.

Real economic efficiency implies including all resources that affect sustainable human well-being in the allocation system, not just marketed goods and services. Our current market allocation system excludes most non-marketed natural and social capital assets and services that are huge contributors to human well-being. The current economic model ignores this and therefore does not achieve real economic efficiency. A new, sustainable ecological economic model would measure and include the contributions of natural and social capital and could better approximate real economic efficiency.

The new model would also acknowledge that a complex range of property rights regimes are necessary to adequately manage the full range of resources that contribute to human well-being. For example, most natural and social capital assets are public goods. Making them private property does not work well. On the other hand, leaving them as open access resources (with no property rights) does not work well either. What is needed is a third way to propertize these resources without privatizing them. Several new (and old) common property rights systems have been proposed to achieve this goal, including various forms of common property trusts.

The role of government also needs to be reinvented. In addition to government’s role in regulating and policing the private market economy, it has a significant role to play in expanding the “commons sector”, that can propertize and manage non-marketed natural and social capital assets. It also has a major role to play as facilitator of societal development of a shared vision of what a sustainable and desirable future would look like. As Tom Prugh, myself, and Herman Daly have argued in our book “The Local Politics of Global Sustainability,” strong democracy based on developing a shared vision is an essential prerequisite to building a sustainable and desirable future.

CONCLUSION

The long term solution to the financial crisis is therefore to move beyond the "growth at all costs" economic model to a model that recognizes the real costs and benefits of growth. We can break our addiction to fossil fuels, over-consumption, and the current economic model and create a more sustainable and desirable future that focuses on quality of life rather than merely quantity of consumption. It will not be easy; it will require a new vision, new measures, and new institutions. It will require a redesign of our entire society. But it is not a sacrifice of quality of life to break this addiction. Quite the contrary, it is a sacrifice not to.

Dr. Robert Costanza

Gund Institute for Ecological Economics

Rubenstein School of Environment and Natural Resources

The University of Vermont

email: Robert.Costanza@uvm.edu

http://www.uvm.edu/giee

Today government protects polluters from lawsuits by those offended because government sets the levels of pollution that are acceptable and supposedly punishes those who exceed these levels. Government installed the debt based monetary system by granting banks the privilege of creating new debt money and loaning into existence; this is the root of the current economic meltdown, because debt is not money. When government intervenes in economic activity other than to punish theft and fraud, it creates advantage for some, usually the few, and disadvantage for others, usually the many resulting a skewed distribution of wealth.

Historically, the periods of greatest economic advance, technological advance, and more normal distribution of wealth have been periods of freedom, while periods of slavery have produced human suffering, skewed distribution of wealth and economic stagnation.

What we need is freedom, not slavery and things will work out as well as possible given the constraints of depleted energy. The proposal for "fairness" or further government involvement is just a proposal for slavery and the attendant greater human suffering.

Henry - Well done.

So are you saying that gov SHOULD punish polluters and SHOULD reconsider '...granting banks the privilege of creating new debt money and loaning into existence...'??

If thats what you think, I could find a lot to agree with in that - but it doesn't sound like freedom it sounds like useful regulation??

But Henry, debt IS money, and vice versa. When I work and get paid, the money I receive is just a symbol of debt that is owed to me. I can call in that debt by handing the money over to a merchant in exchange for goods, or in numerous other ways. Money is just a symbol of debt, and works in BOTH directions... sort of like "accounts payable" and "accounts receivable."

I do agree with your observations on the value of freedom, its superior track record, and the undue suffering caused by its absence... but freedom is a slippery word. The slave buyers, sellers and users might complain that government preventing them from buying and selling people is an undue restraint of a free market and infringes their freedom to earn a living. That was the view of many Southerners in the run-up to the American Civil War, and they were often highly educated people who considered themselves to be (and often were) of otherwise high honor and integrity.

Yes, government has frequently screwed things up, but isn't that what Nate is actually saying in his essay? ... that if we are going to make it through the coming hard times we've got to accomplish profound improvements in the way we govern?

Re: debt IS money, and vice versa

preface: I'm neither an economist nor a money expert. I'm just bothered by this phrase.

I understand that the promise of future payment is exchanged for immediate cash and that it is by this mechanism that money enters our economy. That promise to pay is not actual cash, anymore than apples growing on trees are cash -- debt and apples can be exchanged for cash, but neither is cash. In healthy markets, promises of future payments can be bought and sold with cash, but that also doesn't make the debt turn into cash.

Further, a promise that is broken leaves nothing behind. If a promise was cash, there would be some residue of its prior existence -- even vaporized in a nuclear blast, the molecules that were once cash will be floating around in one form or another. A promise is not tangible and aside from the record of its creation (the contract), there is nothing to it.

Hmmm... I suppose the same could be said for fiat money ... perhaps I'll just post anyway and read the comments rather than do the hard thinking.The problem we are having in our current market is that promises are easily broken, and the realization that many are breaking promises has made people reluctant to exchange cash for those promises.

Don't waste your breath on junkies, they cannot see that DEBT IS EVIL, and like most junkies they will go to their graves with the fit hanging out of a vein.

Speaking of junkies, 8000 on the dow was a good floor but no, they need their adrenaline fix (don't glorify them as dopamine junkies Nate, they like the rough dirty stuff).

Well I dunno about that, wouldn't going through life neither owing or being owed anything by anyone be a rather sad life. Maybe you mean that the misuse of debt is evil?

Well I dunno about that, what about going through life doing what was needed doing without discriminating between self and other as benefactor. Just eliminate debt altogether ... of course along with that we would eliminate all of the drama and comedy of life. I think God would get bored stupid and have to start chucking in snakes or something.

D.Benton_Smith wrote:

Sorry but that's simply not true.

Debt by definition must involve a debtor and a debtee. Meanwhile, when people start using cigarettes or soybeans as a medium of exchange, the result is a form of money and yet no debtors or debtees need be involved.

If debt really was money then the US would be the richest nation on the planet. I agree instead with Martenson that debt is a claim on money.

PS- All or most of what DBS writes further down is correct though.

Debt (credit) gets treated like money in good economic times. In hard economic times, credit (debt) may not be extended any longer but money you already have remains yours.

I agree with you, RobinPC. And the original poster seems confused as to the difference between credit (debt) and money.

No debt = freedom

The more debt relative to income, the more cornered people are.

Musashi I think they also become more edgy.

Hi there, anagama,

I think the word that might be hanging you up is "cash" (I didn't use it my post, but you used it in yours.)

Cash is frequently thought of as a tangible item, like a dollar bill, silver coin, or the like. Since such items have physical existence we can easily slip into the idea that they have some intrinsic value, when in fact they usually have almost none. Like all other forms of money (personal checks, electronic bank records, IOU's and Treasury Bills) 'cash' derives its value from belief, trust and agreement. We agree, believe and trust that this physical (but symbolic) item will be honored by others as a medium of exchange for REAL things.

It's so easy to exchange money for the actual things we need or want that most people slip into thinking that they want money itself... but to want money itself is of course quite psychotic. What we actually need or want are the REAL things that money enables us to acquire (food, shelter, clothing, and cooperation or dominance over the actions of others.)

That's one of the essential points of Nate's essay. Whereas money is abstract and can exist in infinitely large quantities, REAL things are finite and can exist only in limited amounts.

But that's not the only problem. One of the other problems is how we control (or fail to control) the relationship between the abstract things (various forms of money) and the real things (the things we require for life.)

Unfortunately, it is possible to have symbols of symbols and that's where the serious trouble starts. We put cash in a bank and the bank gives us a statement that we have that much money on account. That statement is a symbol for the cash. The cash itself is long gone, as a mortgaged house loan (for example) and the bank has only a signed contract (the mortgage) that the loan will be repaid with interest.

That mortgage contract is thus a symbol of a symbol of a symbol.

Well, you can see that this all gets pretty complicated pretty quickly, and if the bank sells the mortgage contract (or bunches of them) you can see that things can start to get out of hand.

By the time the ownership chain of symbols is eight or ten layers deep, electronic computers become necessary just to keep records of the mess. That records exist, however, is neither guarantee nor proof that anyone understands them.

Indeed, no one does. The symbolized money in today's financial world is so multi-layered and recursive that no human mind is capable of comprehending it.

We're all guessing.

That's an interesting answer. About halfway through my own post even I started to doubt what I was saying when I got to comparing the qualities of post-apocalyptic contracts to bank notes. Plus, I was sort of hoping that the whole "cash" thing would kinda slide through. *smirk*

Anyway --- Cash or Money, whether physical or "in the bank", is worth something because we all agree to exchange goods or services for it. A promissory note is worth something because one person has agreed to provide periodic money transfers to another entity.

One of the qualities of money is that every unit should be fungible, that is, I only care that I get a twenty if I go to the ATM and ask for 20 bucks. I'm not looking for a specific bill because any twenty dollar bill is as good as the next (aside from oddball numismatically interesting bills).

In contrast, a promissory note does not have a set value -- the amount of the loan is a fixed value set when the debt and the money were made. However, the value of the note itself can fluctuate greatly depending on how reliable the debtor is or how desirable the collateral is -- in other words, a $100k loan secured with an acre of Santa Barbara beach front as collateral, is far more valuable than a $100k loan on 79 Winnebago with a blown engine. Because the value of each $100k note might vary, every $100k note is not equivalent. If every unit of money must be equivalent, then it follows that debts are not money because the value of debt is variable.

The value of cash is variable too, on the timescales you are talking about. Extremely variable. Inflation, international trade balances and exchange rates, the cost of energy, etc. all affect it. Indeed it may be more variable than your mortgage in many ways. If the bank wasn't stupid enough to loan $300K on a $100K house, the collateral may be more stable than the money. After all, it provides housing for one family whether it costs $1 or $1000 for a loaf of bread. Thus, the human value of the house is relatively constant but the money isn't. Wiemar republic Deutsch marks had so little value that they were burned for heat. But even the house has risk of value change. A flood can wipe it out. There can be no energy to get people from the house to work. A factory can close. Etc.

The problem was, people were so enamored with the intrinsic value of a house, and worse with bogus promise of appreciation, that they let the paper value be inflated over the intrinsic value. Meanwhile, the houses themselves, even the new ones, had sustainability problems - too far from work, too energy inefficient, too large.

First of all, your money debt instrument will be 'intrinsically' valuable provided that your yield (return on accumulated money) exceeds the liability represented by its issue. Unfortunately, we are in a very low yield environment and the liability is increasing geometrically. If the liability exceeds a certain subjective threshold, the liability will rocket into meaninglessness. Your money will be worthless because nobody will accept it. Its 'implied obligation' would be infinite and would exceed any possible yield.

On the other hand, the increase in yield relative to a stable liability will mean (borrowed/loaned) money will be harder and harder to obtain. This is where we are now. Banks can get 7% lending to other banks overnight. That's a pretty good yield! Lending to you is risky compared to lending to a bank since your chance of default is theoretically higher than the insured bank.

"Further, a promise that is broken leaves nothing behind."

Depends ... who makes the promise.

If you make the promise (to a bank) and walk away, the bank will go to court and obtain a judgement against you. Your wages will be garnisheed or your car reposessed or ... your house forclosed upon and you put onto the street.

Alternatively, you can petition the bankruptcy court to discharge all your debts. In that case, the debts are forgiven. These hassles involved keep people from simply walking away. That, and the appearance that some are clever and hard- working enough to claim a small part of success ... a 'win' in the gambling casino called the US economy. Some people have to be allowed to win, otherwise nobody would gamble.

Nobody is winning so nobody is playing.

It is also besides the point of the inherent liability of lent money, since the obligation is yours individually as the borrower of the money, not of the money itself.

YOUR bankruptcy would not increase the liability inherent in the money ... but millions of bankruptcies would. This is also where we are, now.

As to the promises ... again. The Federal Reserve is doing the best it can to borrow for all of us citizens. Unfortunately, there is no 'bankruptcy' for the world's largest deadbeat. The government is required to keep its promises. Unlike a hedgee fund or investment bank or commercial business, it can't cheat or 'bend' the rules. It has to always 'play it straight', even if it is doing something completely idiotic. As a result of both sets of circumstances, the Fed has become the 'fool in the market', who buys high and sells low, who buys at the top and sells at the bottom, who winds up holding all the 'bad bets' the other casino gamblers want to unload.

Since the Fed (and the Treasury) are well- known fools, any organization that anything to do with them is either another fool or a churlish knave, taking advantage of the handicapped. The more the Fed 'tries to help' by lending, the more damage it causes.

You mean, like this?

http://online.wsj.com/article/SB122394360912831019.html?mod=todays_us_op...

Reading what are the chairman's priorities is enlightening. He is interested in, "repairing and reforming our financial system, and thereby restoring prosperity to our economy ... to encourage private capital to further support the reinvigoration of financial markets."

Not a word about the people, it's all process, for the chairman.

"As in all past crises, at the root of the problem is a loss of confidence by investors and the public in the strength of key financial institutions and markets. "

Throwing money at our financial institutions will magically solve everything, eh?

This is where we are here and now. The captain of the Titanic now has all the administrative tools in place to right the ship, so to speak. Doncha feel confident, already?

The real problem is how to we get from the boat deck to where we need to go ... without hitting the bottom of the Atlantic, first? Yowza, that's a problem. Rapid economic transitions have historically required revolutions or conquests and even so, there is little relevant 'economic history' to serve as a guide. The Soviet Union emerged from a crony- capitalist autocracy but required Imperial Germany as a midwife. Socialism snuck up on France, Germany and England for political, rather than economic reasons, as all were dependent on the US for capital in the ten years post WWII.

Japan maintained its centralized banking and finance structure even though Douglas McArthur completely re-wrote the Japanese constitution (and outlawed military expenditures at great economic benefit to the Japanese). In the post-war, post- modern NOW, the changes have tended toward the 'born-again US-style capitalism' that has transformed the Indian and Chinese economies and is making headway in Africa. The countries that have made the most progress toward a more reasonable relationship to natural resources have been Denmark and ... ??? Denmark follows a social - democratic semi-welfare state approach that is similar to Germany's. Their economy has been experiencing some turmoil as they are in the Eurozone and their banks undoubtedly issued and bought bad loans. Unlike Iceland, they did not over-leverage their reserves nor did they have a housing bubble.

The question is whether Denmark's approach is a model at all, other than the manifestation of a form national conservatism and caution that inherent to Denmark. Adjusting the knobs on our economy will not be enough to pay off or settle all debts, reduce to small level consumption, build a level of savings, and invest in a resource- sensitive (capital-conserving) infrastructure ... all roughly simultaneously.

The most important message that Mr Bernanke has to offer us is this, "Americans can be confident that every resource is being brought to bear: historical understanding, technical expertise, economic analysis and political leadership."

The Fed and its contemporaries have shot their wad. Let the games begin!

I do not agree that debt is money. Debt is a claim against someone who has issued the debt. The debtor is a counter party and you rely upon his ability to pay to give value to the debt. You will find this out when your bank does not honor your checking account, or if it does you can buy very little with the depreciated value of what is denominated in. Circulating the debt instruments does not make it money, but does make it circulating evidence of debt. It is a second rate medium of exchange subject to depreciation and default.

Gold and silver have intrinsic value, and do not require a counter party to ultimately be called upon to pay. History has shown that gold and silver are superior money for these reasons, and for other traits like durability, easy divisibility, high value per quantity, and difficulty in expanding the supply.

When you work and accept something in exchange, you are using a medium of exchange. It is only of value because you recognizes it as having value in exchange. It is not a symbol of a debt owed to you for you work. Rather, under our monetary system, you have accepted a third party's debt as a settlement of the debt owed to you for your work by your employer, and only accept it because you think you can use it in exchange with others. You don't call in the debt when you exchange the money to a merchant, but rather you pass on the medium of exchange to him; you cannot call the debt of the third party, the bank, other than by accepting debt of a different form, perhaps as you cash a check at your bank and get debt of the Federal Reserve bank in exchange (Federal Reserve Notes). If you really called in the debt by passing it on to a merchant, then the debt would be canceled instead of being further passed on by the merchant to other. So in effect we just circulate hot potatoes and the rate at which we circulate them, the velocity has an effect on the value we can exchange them for, as does the total volume of the hot potatoes in circulation.

My point is that debt is not money but debt; there is no money, only circulating debt. If banks can issue their own debts as money and loan them out to you as interest, you do not have money circulating, but you have bank debt circulating. It can be expanded as easily as banks can make loans. It depreciates in value as the supply increases. It can be defaulted upon. The loans made to the population can be defaulted upon. The interest on the loaned debt money enriches banks at the expense of the population.

Money (i.e. the right to print money) is at the moment monopolized on a national level. Meaning the garantee for your "promisory notes" in your pocket comes from the govnt and not from a bank. Yes, every bank "could" print (digitalize, etc..) money. Nat. govnt would then have to crack down on it, because according to not only the US constitution, the nat. govnt has the sole right to print money.

But you are right. Money is not directly debt - just almost. As a promisory note (read your dollar, please) it is "backed". It is a securitized value. Way back when, the value behind it was theoretically gold. Factually it is a securitization of next year's (or that in 20 years?) tax income. That is, btw, the reason all governments want "growth". Then they have more future earnings which can be securitized and therefore more money can be printed..

Right now, now that the layers of debt based on this securitization have become somewhat surreal - expecially in regards to the global expectations of growth and therefore the ability to cover the compound debt - trust in the security behind the promisory note is failing. The securitized "junk mortgages" have busted and the reason they are threatening to bring the system down is that our national currencies (not only the USDollar!) reflect the "junk" security factually behind it. There are real reasons that trust is seriously being strained.

Now back to growth, the subject of the essay. Everything Nate and Robert wrote are right in a sense.

My objection is only that they are tackling the problem (as is the case on any sustainability site) much too deep. For as long as the right to print money remains on the national level, any deeper issues can hardly be addressed. We need to wrest those rights away from the nations in order to create a more objective sort of money. A money which does not depend on growth...

Cheers, Dom

If we listen to economist currency, checking accounts, savings accounts, certificates of deposit, and the like are included in their M2 measure of money. All of these are circulating debts of banks.

Back in 1933 the M2 "money" supply was $32.2 billion in the USA. It is now $7,712.9 billion, an increase of 239.5 times. The currency component (federal reserve notes which are the things we carry around in our pockets, wallets and purses) did not go up 239.5 times, however.

Checking accounts are created by bookkeeping entry out of thin air by local banks and loaned out at interest. You simply sign a note payable to the bank for a loan and they create a checking account for you in an equal amount. The bank's assets and liabilities increase as a result in equal amounts. The checking account may circulated from bank to bank, clearing against the reserves banks keep for such clearing, or it may be converted to currency as when you cash a check, but the money supply stays at the increased amount until you repay the loan and interest thereon, at which time the loan is canceled along with the checking account balance as you write a check to pay the loan. So banks do create debt based "money" out of thin air.

Likewise, the federal reserve notes are liabilities carried on the books of the federal reserve bank. They may be printed by the US treasury, but they are issued by the federal reserve bank by loaning them out, frequently to member banks to put into their vaults to cover check cashing. So again banks do create debt based "money" out of thin air.

Notice that all this "money" is debt of banks. It can be expanded as easily as making a new loan. It is predatory because the borrower pays interest to the banks on something created out of nothing. It is a privilege granted to banks by the government which transfers wealth out of the hands of the many into the hands of the few; however, were you printed up your own bills of credit and loaned them into existence you could go to jail for counterfeiting.

Because this "money" is debt, it is subject to counter party (the bank) default such as when banks become insolvent or get a bank holiday.

If we want money that does not have counter party default risk, then we should use gold and silver. It is a stable money that does not depend on growth. It can be carried in coin form or placed in warehouses against which receipts (paper or electronic) can be issued for convenience in transactions, so long as each receipt is 100% backed with the proper amount of actual metal in the warehouse. This takes away the risk of default such as is being experienced in the current panic. This makes inflation of the money supply extremely difficult so price fluctuations in the economy would depend on supply of goods and services, and the velocity of circulation (psychological attitudes).

Debt is not money. Money is:

1. A medium of exchange.

2. A store of value.

#2 is not valid for the current paper debt pieces. It is NOT money.

"What we need is freedom, not slavery"

+1 for that.

Freedom is an ambiguous yet highly romanticized term (one of the reason political hacks like Bush love it). What freedom(s) are you calling for?

We have the freedom to give mortgages to people who can't afford them as well as the freedom to label instruments that contain these "sub-prime" mortgages as AAA rated, and the freedom to claim that in the case of default they will be covered by insurance. We have the freedom to amplify the inherent risk in reserve based banking with leverage via exotic financial products (derivatives and the like). Should we continue these freedoms? Did you call for Paulsen and his ilk to let the free market play out with regard to AIG and the rest?

We had the freedom to dump toxic waste into streams and all the other things that business people will do if left unchecked. Should we return to the freedom of no environmental regulations and just rely on trust and the good will of our CEOs and their minions?

We had the freedom to give massive bribes (aka campaign contributions) to our politicians but now we have limited those bribes. Should we return to the freedom of unlimited bribery?

Should we have the freedom to own whatever firepower we want? Should we be free to carry bazookas and machine guns to the grocery store in case of a traffic dispute?

We have the freedom to zone commercial in one area and let residential areas sprawl ever outwards from that. People are free to buy a V8 truck and commute 50 miles each way to their job as a shipping and receiving clerk. People are even free to commute over 100 miles to their jobs in the vehicle of their choosing despite the fact that they use far far more oil than the average person on earth. Would it be slavery to tax (and therefore discourage) these outlandish uses of an exhaustible resource?

In terms of of income disparity nothing distorts it more than the freedom to pay CEOs whatever their friends on the board (in many cases fellow CEOs looking for higher comparables) think sounds good and the freedom to hire workers from among the millions upon never ending millions of immigrants coming into the labor force surpressing wages and creating a perpetual "buyers market" for labor.

If your use of "slavery" implies that you are concerned with the common worker, an end to immigration and world population growth would be the greatest thing that ever happened to workers. If by slavery you mean "having to take orders from the government" or "having things run by the government" then I hope you are a Libertarian. Because as much as the Republicans preach "limited government" they currently increase it more than Democrats since they finance it with the initially less painful borrowing rather than taxes. Case in point is the 4 or 5 trillion in debt that Bush has amassed. And, despite spouting phrases that include "states rights" during their campaigns, they are quick to overturn/outlaw any state law (as in take away that state's freedom) that doesn't meet their approval like assisted suicide or medical marijuana.

One of the icons of the "freedom-loving" financial community is Microsoft. The financial media was standing and cheering as the government repeatedly gave them only a slap on the wrist after finding them guilty of using their their monopoly position to surpress competition in other software areas. Is that part of the freedom you are advocating - freedom to use monopoly power to dominate and create disparity in the marketplace?

You have freedom when you're easy in your harness. - Robert Frost

There are two freedoms - the false, where a man is free to do what he likes; the true, where he is free to do what he ought. - Charles Kingsley

It is good to have the freedom to conduct this discourse. Thanks to TOD.

The liberty of speaking and writing guards our other liberties - Thomas Jefferson

Seems to me you mock the idea of freedom.

Freedom is self ownership and the attendant rights. The opposite is ownership by others, slavery, and the attendant burdens. Of course freedom is not license to do anything, but it is license to do anything that does not involve an act of aggression against another. A free person can enter or leave a market place as he chooses, but he cannot pass on his costs to others by dumping pollution into the commons. When you own yourself, you can dispose of yourself as you see fit, including doing things that might be bad for your health, like eating sugar, smoking tobacco or other substances, and gaining assistance in suicide. When you own yourself you keep the fruits of your labor if you so choose, so rigged markets are destructive of this right of yours and you have the right to defend yourself against this destructiveness either individually via lawsuits or as a group via laws to punish monopoly collusion and fraud in market transactions.

As an owner of yourself, you have a natural right to protect yourself, which includes the right to own and use the best means for doing so, i.e., arms. Government does not grant this natural right, but often attempts to infringe upon it. So yes you do have a right to carry a gun, but you only have a right to use it to defend yourself, not to attack another in road rage.

So much of what government does today is destructive of freedom, and the majority suffer as a consequence. The black hand of government and collusion with corporate and other special interests is the cause of much of our economic ill. The solution is not to blame freedom and free markets. The solution is to eliminate most government involvement. A good place to start would to eliminate the creation of these artificial entities we call corporations, which could not exist without the government grant of incorporation. Another would be to eliminate government licensing of professions and businesses. Another would be to eliminate the grant of privilege to banks to create money out of thin air and loan it into existence (interestingly the US Constitution prohibits states from making anything but gold and silver coins legal tender in commerce, but this is ignored as bills of credit issued by the Federal Reserve circulate with the illegal designation "legal tender for all debts public or private").

I suppose that after decades of indoctrination in government owned or government controlled private schools that the concept of freedom has become cloudy in some minds, but in reality it is not difficult to grasp. It is just that those who want to be taken care of in life and lack the drive for independence wish to impose upon others the burden of their own existence. Somehow the right to life, liberty and the pursuit of happiness has been distorted into the right to a good life provided free of charge by big daddy in Washington DC.

Your definition of freedom is narrow. You have confused freedom for a reasonable amount of freedom balanced with other's freedom. I.E. you defined about the right amount of freedom but not what freedom is.

Being able to mow people down with an AK-47 is freedom. So is being able to go about your business without someone mowing you down with an AK-47. Ultimately, one persons "freedom from" requires reasonable limitations on another's "freedom to" and vice versa. By defining freedom as narrowly as you have, one cannot discuss the freedoms that people have to give up in order for others to also be free.

You are redefining freedom to mean something other than what it actually is. What you are defining should be called something else, like "just freedom" (as in justice, not as in mere). Because it mixes justice and freedom as well as balancing freedoms. Or balanced freedom.

This sort of freedomist fundamentalism is just as warped an ideology as any other and is a peculiarly US response to all that ails you.

If you wnat freedom then just quit your job, abandon your family and community, live in the moment and help yourself to whatever you too can also withdraw from the natural capital.

Historically, the greatest periods of economic advance, technologial advance and more "normal??" distributions of wealth have been in times of abundnat energy supplies, which have transfered the role of slave to the coal, oil, gas or ox and horse, freeing up the humans to concentrate on other pursuits. The energy however came well before the freedom that you speak of.

I believe there are more instances of the abridgment of the freedom of the people by gradual and silent encroachments of those in power than by violent and sudden usurpations. ~James Madison, speech, Virginia Convention, 1788

The very few in this world, want freedom. Or truly know what it is. What the Human longs for, is safety. ~C_A

We anarchists do not want to emancipate the people; we want the people to emancipate themselves. ~Errico Malatesta, l'Agitazione, 18 June 1897

"In crisis times such as these, our leaders would do well to recognize..."

I think it's amusing that when one wishes the government was more righteous, they refer to them as "leaders", as if they were stately elders of our clan who were out for our best interest. The truth is that they are "politicians", and they can't get rich on a complex system if they fundamentally change it.

In modern society, politician=leader, for better or worse.

Just my own take on sematics Nate: leaders = those followed. Politicians = controllers. How many of the current political system would use choose to follow? I doubt your list is any longer than mine. I may be forced to follow the rule of law as designed by our politicians but that doesn't make me a follower or them leaders.

Being a minority almost always sucks. As you say: for better or worse we're stuck with the choices of the majority.

I have to say that for all it's flaws, America and most of the OECD countries have excellent systems of Government, Judiciary, Organization and Infrastructure when compared with the rest of the world e.g. Africa, China, India. From an outsider who now lives in Australia, the West has allowed their citizens to prosper and even the poorest Australian or American can expect a higher standard of living than the poorest of Africans, Chinese, Indians etc.

There are a lot of things that people here take for granted that I first find astonishing, things such as well paved roads, traffic lights that work, pavements on all roads, the level of cleanliness, Ambulance services, Fire brigades, running electricity and water through out the year, the quality of University education. These are luxuries back in Africa even for the richest amongst us.

Please send your politicians and bankers to Africa, we'd be glad to have them, today the average OECD citizen worries about his/ her pension, 401k, social security(super annuation), healthcare while there are many countries in the world where the avg. citizen is worried where there next meal will come from!!

OECD govt's for all their flaws have created, instilled and institutionalized the tools for such a prosperous society. Although peak oil will hamper the OECD and development in other countries, I still believe that America will lead the world out of the darkness of peak oil.

VK; Those political leaders and institutions you applaud and invite to come to Africa, are by and large, responsible for the conditions you find such a burden to carry.

Those political leaders send ambasadors in the form of corporations to Africa, and these ambasadors loot, pillage, rape, Africa of its wealth. They are hosted and fawned over by African political leaders, who accept tokens of gratitude, in return for their corrupt allegiance, the tokens of gratitude are sometimes as great as equipment for an entire army or as miniscule as a gold watch.

Nephilim, I used to believe what you say and to some extent it is partially true. But Africans are a victim of their own mentality and their inability to choose better leaders. Earlier this year I watched in horror as my country exploded with ethnic rage resulting from fraudulent elections, tribe against tribe, neighbor against neighbor. The simmering tension that lay underneath was exposed and ignited for the world to see. Did any western leader incite it? Did any western corporation incite it? NO, it was us, our own fault, our own stupidity,folly and hatred.

If one looks at any disaster, any crisis across the world, any sort of calamity, which countries extend their hand of friendship first? Do you see Arab nations? NO do you see Asian nations? No Do you see South American nations? Nope. It's first and foremost America followed by Europe and the UN. For all their flaws, at times of world crisis, who steps up to the plate? In 1963 Kenya and South Korea had the same GDP per capita, we are both countries with poor natural resources. But with good systems of governance and intelligent leadership and support from America they are now a First world country, where did Kenya go?

Singapore and Hong Kong are today world class cities but 70 years ago?

As an African I am tired of seeing my continent beg, I am tired of our same old leadership, the big Man mentality of Africa, shocking to see that south africa has taken the big man path with Zuma as well. The grand corruption and litany of ills, where there is no accountability.

And most of all I am tired of blaming the West for all our ills. It is our own bad choices that have led us down this path. Western nations have long showed the path to prosperity through free markets, rule of law, investing in people and technology, we are just to divided along ethnic and tribal lines to see it effectively though, I do see promising signs of change for the future but only time will tell.

Wow. Thanks, VK. I'm not sure I agree but your comments are very thought-provoking.

VK -

although your comments are theoretically right, I think it boils down to a completely different problem:

Africa (as well as other "poorer" regions of the world) is a *power* sink. It does not help that it is on the perifery of the world's (i.e. Western) economic system. Therefore it has little chance to establish an effective bottoms-up organization or a top-down one that for instance Russia, China, Brasil (and partially India) are doing. The base does not work while Western capital is sent to extract resources. This capital tends to corrupt the top layer instead of helping it become prudent...

It seems to me entirely the opposite. The poorer regions of the world are power sources, "empower" sources to use Odum's terms. That is why they are poor, because the richer nations suck low entropy resources from them and return very little of wealth. (Dollars not being real wealth and what they can purchase with dollars often being worth far, far, far less than the natural resources they export for those dollars. Remember, nature never gets paid, only the humans cutting the trees or pumping the oil, not nature itself for all the work creating the resource.) All of our technology (social, legal, machine) acts to devalue their natural wealth; we partner with their ruling elite, ship them military hardware in return for their natural wealth, etc... as you point out.

cfm in Gray, ME

ehh, right.

No, not right.

What was stripped from Kenia, so that it became poor?? Nothing!!

There was nothing to strip. (Nor in S. Korea) And the West was not the stripper. And Kenia was not "raped" by the West. So why doesn't Kenia "work" like S. Korea works?!?! Sorry, but I agree partially with VK. He just leaves out a systems component (just like yourself) that has nothing to do with perpetrator/victim. He thinks it's mentality. I think mentality plays a very secondary role.

Cheers, Dom

I think mentality is everything. If all you can worry about is how rich you and/or your cousins can get off any particular deal, it's hard to do the right thing for your country. And that's still how sub-saharan African runs.

Of course a couple of hundred years of getting screwed over by everyone else plays a big part too. At some point, though, you have to take responsibility for your own future.

Do you really think that the developed world operates any differently than this? I see absolutely no evidence that the people of US or Europe are trying to do the 'right thing' for our collective future. We are just trying to get personally rich in the present.

Actually, sometimes nature does get paid (to use your distorted terminology). Thousands of years ago, humans domesticated plants. Or was it the other way around? Did (some) plant's domesticate us? We provide seed distribution, tillage to improve seed yields, fertilization, soil conservation, and irrigation. Better on some farms than others.

Not all of our actions are purely exploitative of the environment. In some cases, it is synergistic. When we do things in a sustainable manner, we do pay. An animal eats fruit, which a plant has evolved to entice animals, and deposits the seed somewhere else where it doesn't compete with the parent plant along with a dollop of fertilizer. If we practice sustainable agriculture, we play a similar role. Perhaps better than some species such as the more virulent locusts.

Also, nature is pretty flexible and may have different ideas of what constitutes payment. We could pollute the world enormously and new species would evolve that see that pollution as a resource. Long ago, anerobic organisms polluted the planet so badly that they could not thrive or in many cases even survive. The deadly toxin was oxygen, now used by large numbers of species, and this is called the "oxygen catastrophe". If we pollute the planet with mercury, lead, antimony, arsenic, etc. who is to say future species might not thrive on that?

We upset the balance of nature but nature finds a new equilibrium - one that may not include us. "Extinction, though, is usually a natural phenomenon; it is estimated that 99.9% of all species that have ever lived are now extinct". The earth has had mass extinctions before; there have been 5 mass extinctions that wiped out over 50% of all species in just the last 540 million years.

It really isn't about paying nature - it is about preserving the future value to us. If we cut down all the trees, nature isn't the one that goes bankrupt for lack of "payment" - we are. We are effectively "eating the seed corn" or spending our future, today. The grasses will be happy to see the light hogging trees gone, and they will make short work of our asphalt and concrete within a few decades.

Totally agree, at some point you have to take responsibility and too few African governments have done enough to help themselves. Often it is regulations, paperwork and bribes that can stifle an economy. Slash the paperwork to set up a business and the economy could be set free in many counries. At the moment there is very little in the way of manufactured goods that the rest of the World wants from Africa, they have to trade amongst themselves to build a base to grow on.

Yes western corporations want resources and they will try to get them as cheaply as possible. The Chinese are doing the same while dumping their textiles putting Africans out of work.

As for corrupt leaders, shame them, publishing their Swiss bank account balances would be a good start.

In addition, it may be caused by simply living too close to the equator.

Has not caused Singapore a problem!

http://en.wikipedia.org/wiki/Hans_R._Herren

Incidentally, my co-author of a paper under peer review ATM.

Best Hopes,

Alan

Excellent.

I will read your paper with great interest.

Please keep us informed.

I was reading and quoting Dr Herren and his work at ICIPE in a paper I wrote 1998.

best hopes indeed

phil

Send me an eMail (in my profile, but not in yours) and I will send you a copy for "professional review".

The paper is strongly suggestive that the best energy policy is the best environmental policy and best economic policy.

Best Hopes,

Alan

Yes, and we intend to keep them that way. That's why we're vigilant, want accountability and are always seeking ways to improve them.

I am with Nate on this one. Leaders need not be good leaders and those that are followed can be followed for a variety of reasons, including not letting the followers any choice but to follow.

I once attended a seminar on leadership. One of the exercises was to define the characteristics of a good leader vs a bad leader. Over reliance on control and lack of care for the followers opinions and well-being were part of bad leadership while good leaders had characteristics that made them easy to follow willfully. But both good and bad leaders were undoubtedly leaders.

We do not have rights, we have owners.

Politicians and media are the voice of the owners.

And the biggest owners are trying to juggle things so they can run off with what is left of the loot.

You know, Eastex, I saw that quote and asked myself how could Nate Hagens write such a thing?

To Nate: I'm betting that Jay would have something to say about that sort of wishful thinking. ;)

Actually, Jay would recommend to first define precisely what the terms meant, so that people weren't talking past eachother.

All I meant was that you and I are not leading the show right now. If we make a 'decision' it cannot be implemented. A politician CAN make a decision and help it to be implemented.

We are all leaders in our own way, but the current socio-political system is about power - and the politicians, lobbyists and corporations have the majority of it, so other erstwhile leaders get quashed - perhaps 'drowned-out' is more fitting, as the media harp on our 'leaders' and few outside conventional thinking get a voice.

And as you know, Jay thinks I'm wasting my time here, but as I've told you in the past - a 1% chance of change is infinitely more than 0%.

After eight leadership programs during eight years as an elected official, my favorite definition of leadership is the ability to "create a compelling vision and make it happen." None of us can make anything happen alone. If you want change then you have to support change. You cannot expect someone to go out on thin ice with unconventional views, turn around, and see everyone else standing on shore to see if the "leader" falls through the ice. Support good people. They ARE out there.

Hear hear!!

Excellent definition, thanks.

Permit me to add. Most folks can sit around in a group and together come up with compelling ideas. The leader in the room is the one who has the courage, skill and will to motivate, to stimulate action and see it through. And the action may be risky. If it isn't, then the cause is a small one. Leaders do not have to be elected, rich or powerful but they do have to have a cause, build a consensus and act. Lincoln, Crazy Horse, Ghandi, MLK, Al Gore (like him or not he has balls), Mandala, on and on. When the going gets tough, and it is not tough yet here in western capitalism land, the leaders will rise with the tide. Hopefully before.

What ever happened to the term "Public servant"?

Is that only used when a politician is running for office, never to be mentioned again, after being elected?

I personally have had several occasions to remind realtors or lawyers or others I employed, that they work for me, not I for them. I was abrupt and stated clearly "In legal terms of master / servant, I am the master in this relationship." Not one enjoyed the reprimand, none ever quit my employ.

I suspect not one politician would enjoy the reprimand and none would quit either.

I skimmed through and probably will fully read & ponder this some more this afternoon, but can you provide some examples? To me, it seems that institutions such as public libraries would fall under the "common property" of this type of new system.

Would this be fair to say?

No. -1

Public libraries are an excellent example of common property, that helps build social capital. Public parks, community gardens, the grand public buildings and open spaces all help define the common good and help direct socail capital in ways that produce a set of common values of respect and care for that sense of belonging.

Our built environemnt has been trashed in the pursuit of financial capital to such an extent that we now have littel in the physical public realm to bind us in the esoteric social realm. Until we understand this deeper human need, we will keep electing bozo's whose only focus is to increase the financial at the exepense of the natural, human and socail capital.

This is a good piece, and I agree with a good bit of it. I do think, however, that the title is a bit misleading - I'm not sure there is a long term solution to our financial crisis, in the sense that I think our financial crisis is something we have to go through to find any other alternative. If the financial crisis is, at this point, a necessary price of adaptation, I don't think it can be said to be solved by any particular approach - eventually, it will probably burn itself out, and with luck, some of us may have some power to put something better into place.

Sharon

We must remove the fear factor.

As long as people understand that money is the determinant for who lives and who dies we can expect them to act in their self interest in order to survive.

Even a wealthy man feels he could loose it all and die a horrible death, cold and alone so there is never enough (greed?)

If our social structure guaranteed none will suffer we would solve many of societies ills, even the biggie – population.

We must remove the profit element from the basics of life.

I know, I know, its all just KUMBAYA but I can dream.

I'm curious, how would a social structure that minimizes suffering also minimize population?

Are you thinking in 3d world terms where people need enough kids to help on the farm ('not tonight ma, I just got a new tractor today'). That much I can see -- but how would that work in the first world?

I suppose I am talking about more than minimizing suffering. I an talking about eliminating fear. Fear of hunger, cold, health, education, that kind a thing.

So population in 1st world? I guess thats where education kicks in.

Do that and 25% of the population will never work again. They'll just smoke and drink and have babies and bankrupt everyone else. It's been tried. Doesn't work. A lot of people are just plain lazy and stupid.

Where has it been tried? Certainly not in the Soviet Union or communist China which were both ruled by terror and extreme fear.

Also freeing people from fear does not mean freeing them from the obligation to work. It means guaranteeing that they will have useful work to do independent of whether some private investment banker decides to extend credit to manufacturers of electronic toys. And it mean guaranteeing that the reward for useful work is a decent quality of life now and in the future.

Pretty good cartoon about the "rescue plan" here:

Sinfest

Thats interesting because by direct implication the bail out will only work if we starting gorging on more debt and finance ie. start spending more money we don't have!! I think I just had a Eureka moment (I don't profess to be an econo-guru!)

Marco.

You got it!

I think the fed and Treasury have given Americans the template for how this should work.

Just use your credit card to pay your mortgage then borrow somey money to pay your CC bill. Got it! Good.

I have to say I am gald I did not do my study of economics at University of Vermont!

Dr Costanza is so wrong headed it is hard to know where to begin.

In the first paragraph he talks about under regulated markets. As any student of economics knows markets fail and there is a role for regulation - but it has to be well thought out. The current credit crisis is a consequence of poorly thought out regulation not under regulation. Just look at the response to those who tried for years to bring better regulation to FRE and FNM. His new visions smells like the old marxist crap that has failed everywhere its has been tried.

So what assumptions is he talking about in paragraph 2. I bet those underlying the theory of perfect competition. For people like Dr Costanza, they never get beyond the most simple case. Anyone who knows economics realizes the immense amount of work that has been done to understand imperfect information, assymmmetric information, etc, etc, ect. It is like a critic of physics pointing to the problems on newtonian physics without ever understanding how far the profession has come since then.

Create a new model. What is he talking about. Economic theory was built up from observing the real world and how people interact in it. Economics theory is an effort to explain what we observe. Notice how Prof. Costanza wants to impose his view of what is right. Do I smell a hint of fascism here? The progressive left has always been about telling people what to do and how to behave.

In paragraph 4 the professor claims he knows the right social wealth function and hence lays claim to knowing whats fair. Typical. I would bet the prof has no idea the complexities behind trying to create a socuila welfare function. It is a classic indexing problem.

Real vs unreal economic efficiency! What a hoot. Of course many "goods" are non-marketable, which is why there are no markets for them. Wow what an insight. At least he touches on the notion of property rights! I suggest those who are interested read Coase's "Theory of Social Costs" to get a little background.

Of course there are public goods and thee is a role for government to bring about a "better" allocation of resources when markets fail. Market failure comes in 3 general categories - externalities, public goods, and monopoly power. Actually I would argue the assigning property rights goes a long way to bringing about "efficiency" The prof is totally out to lunch here. Again, read Coase or any other entry level public finance text.

Look at his conclusion! Move beyond "growth at all cost." What does that mean? Since markets do not produce "growth at all costs" Markets produce goods that individuals desire the most and do it in a way that minimizes the use scarce resources. What the prof wants to do is reinvent the wheel and make it square. Given his total confusioon about the most simple economic concepts he is about the last person i would want trying to "redesign" our society. Anyone who think his commentary makes any sense should spend a bit of time understanding basic economics.

I disagree with Bob about many things, but we agree on about 90% of first principles. However, I disagree with EVERYTHING you wrote.

Thats the core of the problem. There are no biophysical laws underpinning economics. Economic growth has been an observable correlation with energy. With surplus energy, division of labor and capital has been effective in promoting efficiency and everyone in the system 'believes' he/she can get to the top of the pyramid. The entire foundations of economics will crumble without energy surplus, except perhaps comparative advantage, which will still work, but with less distance.

Wow. I suggest you are the one that is out to lunch. There is NO such thing as financial capital. Period. It is just a marker for the 4 real capitals (built, natural, social and human). The only reason fiat money has value is because it is convenient and we agree to use it as a form of exchange - other than that it is just an abstract social construct. I have an MBA from the University of Chicago, and with exception of some of international economics (comparative advantage) and all my statistics, regression classes, the rest of the curriculum will soon be subsumed by biology and ecology (especially thermodynamics and population dynamics). Finance, in the conventional sense, is passe. Energy is what we have to spend. Money is just who has the energy.

I think I'll stop and let others step in here and comment - there is a great deal of research and reference on this site if you dig.

I leave you with one question. You have stated you are a hedge fund manager. Isn't it your objective to make tons of money and eventually retire? I.e. turn the financial 'capital' into real stuff (like vacation home, yacht, free time, beautiful woods, solar powered home, parties with friends, playing with dogs in a field, going kayaking on a lake, learning new skills like beer-making or archery, etc.) All of us are on a trajectory to turn fake capital into real capital - most do it (or plan to) near the end of their lives. Resource depletion in general, and peak oil in particular, are going to accelerate the timing.

By the way, Bob is an ecologist, not an economist.

Thanks for this extra comparative advantage.

PO aware hegdefund managers for christ sake!

But money has always served as a means to exchange energy.

I feel the comment above Nate's was a caricature instead of someone's true thoughts, but it was effective nonetheless in illustrating the very problems we are seeking to ameliorate.

Well said Nate.

And yet

A new, sustainable ecological economic model would measure and include the contributions of natural and social capital and could better approximate real economic efficiency.

still seems no less quixotic. Whoever gets to assign the coefficients by which these intangible, disparate, subjective apples and oranges are weighted against each other to measure, i.e. judge, "fairness" and "real" efficiency - IOW whoever gets to define operationally such vague concepts as "fair" and "real" ex cathedra - gets to Boss The World.

Of course, for Marxists this is very attractive, since they know that they and they alone, having been ordained since before time began to Boss The World, know best how to assign the coefficients. For others, who might see things differently and might resent being bossed around, the conundrum of who decides may be more than just a caricature.

Fairness can be measured, and there have been quite a few studies on this. See, for example, this one which suggests a genetic basis (and, of course, that it's not unique to humans).

You're right that having a group of humans as "fairness deciders" would be problematic, but it's neither suggested nor necessary. Fundamentally, our concept of fairness is wired into our brains via cultural and genetic factors. Objectively measure and understand those factors, and you objectively measure and understand fairness.

I think this is your key mistake. "Judge" is most certainly not a synonym for "measure" in any remotely scientific context. You don't "judge" the mass of an electron, you measure it.

Accordingly, when the article says we should "measure and include the contributions of natural and social capital", it's not unreasonable to suppose that it means actual measurement, rather than the straw man of "The Commies" that you immediately leapt to.

The article is vague, certainly, but that's no reason to pretend it says things it doesn't.

There are also those things we can't know and measure well that can come back to haunt us. For example, who knew that the ozone could be destroyed by chlorofluorocarbons when they were invented? Much of the same problem exists with climate change.

Instead of seeing these uncertainties as "caution" signs, meaning we should slow down, our society just plows through because of short term interests and the structural need for growth. In "fairness" to future generations (hell, even my children) I'd personally be willing to sacrifice a whole heap of present day comfort and titillation to feel more secure about the viability of the planet going forward.

Still waiting for leadership and institutions to take the long view and not keep propping up all this phoniness, this miserably hollow, vapid, mirage-like, hyper-consumptive "way of life."

Way of death, more like it.

Well, yes, and we could just paralyze ourselves with a hyperabundance of caution and precaution, frightened of our own shadows to the point where we wreck the prospects of future generations by plunging everyone into dire poverty. Where is it written that life is absolutely 100% free of risk?

Ah, now we get down to brass tacks. As seems usual with this sort of discussion, the real issue isn't so much chloroflourocarbons as it is an idiosyncratic personal judgment call about a "way of life". Perhaps there are many others who don't feel hollow at all. So when you call for "leadership", are you really calling for anything more than "the use of governmental force to impose my personal judgment calls upon others"? And with all the wonders available to you that were unavailable even to kings a century ago, how is one to make any kind of sense of your judgment call in the first place?

I'm just seeking some sort of balance. I am radically moderate.

Fairness doesn't need to be totally defined operationally. It's the sort of thing that can be hashed out in town hall among peers - not by a handful of fat-cats acting on behalf of us mice.

Measure, judgement, justice and fairness are all tied together:

From Easton's 1897 Bible Dictionary [easton]: Measure Several words are so rendered in the Authorized Version. (1.) Those which are indefinite. (a) Hok, Isa. 5:14, elsewhere "statute." (b) Mad, Job 11:9; Jer. 13:25, elsewhere "garment." (c) Middah, the word most frequently thus translated, Ex. 26:2, 8, etc. (d) Mesurah, Lev. 19:35; 1 Chr. 23:29. (e) Mishpat, Jer. 30:11, elsewhere "judgment." (f) Mithkoneth and token, Ezek. 45:11. (g) In New Testament metron, the usual Greek word thus rendered (Matt. 7:2; 23:32; Mark 4:24). Measure \Meas"ure\, v. t. [imp. & p. p. {Measured}; p. pr. & vb. n. {Measuring}.] [F. mesurer, L. mensurare. See {Measure}, n.] 1. To ascertain by use of a measuring instrument; to compute or ascertain the extent, quantity, dimensions, or capacity of, by a certain rule or standard; to take the dimensions of; hence, to estimate; to judge of; to value; to appraise. [1913 Webster] Great are thy works, Jehovah, infinite Thy power! what thought can measure thee? --Milton. [1913 Webster]cfm in Gray, ME

It's still mumbo jumbo and pseudo science, and you sir are fractally wrong and it doesn't take a Phd in economics to see that the system has failed. Just walk outside and look around.

I posted this link the other day I think it is even more appropriate in response to your post.

http://www.sciam.com/article.cfm?id=the-economist-has-no-clothes

You beat me to it. Anyone who says this:

has already failed as a student. The only usefulness of economics that I can divine is in describing what has happened. Even then it doesn't do well with the why of things. The important issues in economics are known to any ten year old:

If you spend your allowance each week on candy and a movie, you will have no money for that shiny new bike you want. If you save most of your money, you can buy that bike. Then you can get a paper route so you can someday buy a car. The car can help you get a job. The job, if you keep saving, can help you save for retirement... when you can finally rest.

Or you can buy the candy and go see the movie and end up a fat tub of lard with no car, no job, no home of your own, and eating cat food when you are old. Or can end up deeply in debt and never able to retire.

What more do you need to know?

(Yes, this is very over-simplified, but it's essentially accurate.)

Cheers

I'm glad I'm not "any student of economics" who "knows" all the things that most students of economics "know" because their bankrupt discipline teaches that their assumptions are absolute truths.

The truth is that part of our problem stems from the attempts of economists to make the world conform to what they "know" to be true that isn't.

Sharon

jewishfarmer -

I agree.

I have long ago come to the conclusion that economics (at least the theoretical macro side of it), is one of those fields heavily based on what I'd describe as 'reverse empiricism.' By that I mean a process whereby one starts out with a particular ideology and/or agenda of one's chosing, and then collects data and constructs models in support of that ideology or agenda. That partly explains why you have different 'schools' of economics (e.g. U of Chicago, Austrian, Keynsian, etc.) Forget about a successful academic career in economics if your own views run counter to those of your academic institution's 'school'.

And perhaps that is why whenever I hear people arguing about economics, to me it tends to sound more like a theological rather than a scientific debate. Theological arguments are bad enough, but when they're disguised as science, they become insufferable.

I've never liked engineering all that much, but at least it's comforting to know that the science of say heat transfer or fluid dynamics is pretty much the same whether you are at the University of Chicago or in Austria, or anywhere else for that matter.

Institutional economics in an obscure little subfield of econ that most people ignore, but it highlights how the "rules" of markets- their creation, maintenance, and occasional destruction- are highly important for anyone who wants to say something meaningful about a market. I took a class with Dan Bromley and highly recommend his book on the subject:

http://www.amazon.com/gp/product/0691124191/qid=1142185482/sr=2-1/

Austrians reject empiricism. According to Mises, economics is the science of Human Action -

http://en.wikipedia.org/wiki/Praxeology

Well said, joule.

Have economists taken the place at the policy table that used to be filled by clergymen?

Don't get me wrong. I don't want to live a life without spirituality, or without spiritual leaders. Nor do I want to live a life without some economic philsophy, or economic guidance. But as you point out, economics and religion do seem to suffer from a common vulnerability.

Because both lack a test of truth, entirely too often we see them both used in the service of power. The quest for truth is supplanted by a political ambition.

'Because both lack a test of truth,'

Good Point..

It kind of makes the 'In God we Trust' printed on our currency seem a bit like a wink and a nudge, eh?

Markets produce goods that individuals desire the most and do it in a way that minimizes the use of scarce resources

you must be kidding right? mass production of goods at low cost which is the norm now is incredibly wasteful.

>>Markets produce goods that individuals desire the most and do it in a way that minimizes the use of scarce resources

>you must be kidding right? mass production of goods at low cost which is the norm now is incredibly wasteful.

I think it means "minimizes the use of scarce resources (per item so produced)," which is true.

However it also maximizes the number of items so produced, which has the effect of using more total scarce resources.

But "scarcity" is defined on the margin, today!

Therefore, you can have products that weight 2 grams packaged in reams of paper and plastic so it looks good on the shelf.

Hardly efficient from the perspective of someone who thinks about next year even.

Yeah, that's true. My comment was in response to a claim that industrialization can leverage economy of scale to consume less resources per item. Sure it can, but it increasingly doesn't. And since it makes more total items, more resources are wasted.

I'd also point out that goods can be produced, then desire spurred by advertising.

Adults don't really desire the ubiquitous small plastic toys that we see everywhere. They are produced because the production costs are lowest, and they are sold for as much as the marketers can persuade people to part with.

With no institutionalised advertising, consumption, wealth and hapiness would be very different.

Riskyvalue,

I think you're being rather harsh on the prof. Your comments seem arrogant and you bascially call him a fool, compared to you, who apparently have studied economics and have a profound and far highly understanding of this field than the prof. This kind of attitude, is, usually, an indication of the exact opposite.

You seem mostly to be criticizing him on the micro-economic level, whereas his criticisms of the current economic paradigm, are aimed at the macro-economic level. So, in way, your talking across each other.

Economics isn't primarily about observing what one sees in the world and developing theories based on observable facts, that's the bourgeois, propaganda version of economics. It works fine, as long as one accepts a vast number of assumptions about power relationships in society which have developed over centuries.

I don't believe 'free markets' exist, never have, never will. Markets are controlled and managed, and in their very essence profoundly unjust, not just unfair. Capitalist economics is a psuedo-science designed to 'explain' and justify, and disguise, a system which is fundamentally based on creating inequality and transfering wealth from the majority to the controlling minority. In way it's like a technological version of fuedalism.

You lash out at poor, old, dead, Marx; yet his theories probably saved capitalism from itself, if anyone saw clearly how capitalism really functioned, without ideological blinkers, it was him. If bourgeois economists hadn't read Marx and applied his ideas to the United States during the Great Depression, I imagine we'd still be mired in it today.