Resurgence of Risk - A Primer on the Develop(ed) Credit Crunch

Posted by nate hagens on October 10, 2008 - 10:10am

This is a post run just over a year ago, by emeritus TOD contributor Stoneleigh. It was instructive as much as it was prescient so I wanted to give its author a public hat tip. Both Stoneleigh and her writing partner Ilargi at The Automatic Earth have had a consistently, and unabashedly phenomenal call with respects to the financial and debt crisis. It is certainly not over, but we now begin to see the impacts that a financial crisis may have on future energy supplies - it's like losing the battle as well as the war. Still, the quickness of the deterioration in the economy may be a blessing in disguise - more resources left in ground for some better planned use.

Below the fold, a reprint of Stoneleigh's excellent primer on the credit crisis. Right about now is when it starts to impact the energy world.

We have been living in inflationary times, for as long as most of us can remember. The money supply keeps expanding and prices increase over time as a result. Central bankers have many tools at their disposal which they can use to tweak the economy-–they can raise or lower interest rates, can control reserve requirements for fractional reserve banking and can inject liquidity into the banking system, among other things – and we have become used to thinking that they can prevent the kind of 'economic accidents' that previous episodes of excess have led to in the past. Especially in recent years-–since the apparently successful containment of the dot com aftermath--we have acted as if risk were a thing of the past. Sliced, diced and spread around Wall Street and the rest of the global financial system, risk has seemed tamed, contained and controlled, until last week that is.

For years, industry insiders and so-called experts have proclaimed the virtues of slicing, dicing, and repackaging risk. They waxed on about how borrowers and savers, and society as a whole, could only benefit from such machinations. They suggested any sort of exposure could be disbursed and dissipated to the point where it essentially disappeared. Some even claimed that the crises of the past would no longer exist.

Yet amid the hype and assurances, few supporters spoke of the dark side of wanton and widespread risk-shifting. They didn’t seem — or want — to acknowledge that by combining complicated risks in unfamiliar and unnatural ways, the end result could be an uncontrollable monstrosity—one that eventually turned on its masters.

Nor did they heed the notion that by scattering risk into every nook and cranny of the global financial system, the vast web of overlapping linkages virtually guaranteed that serious problems in one sector, market, or country would trigger far-reaching shockwaves.

All of a sudden, markets are reeling around the world, deals are unraveling, the mainstream press is talking about a credit crunch and the world’s central bankers are injecting unprecedented amounts of liquidity to calm the markets. Risk has made a comeback, and in that environment the evident concern of the central bankers does not seem very reassuring.

The Dot Com Crash and Money Dropped From Helicopters

As the dot com boom morphed into the dot com bust (threatening to become a full-blown meltdown by the end of 2002) central bankers cut interest rates drastically and held them down for a long period of time.

In 2001, the US Federal Reserve Bank, the spigot of credit in America’s debt-based economy, drastically slashed its interest rates 84 %, from 6.5 % in 2001 down to 1 % in 2002. The Fed did so because the collapse of the dot.com bubble in 2000 had so damaged US financial markets (the NASDAQ fell by 80 %) the Fed feared a depression could result.

As Ben Bernanke was preparing to take over from Alan Greenspan at the Federal Reserve, he promised to drop money from helicopters if necessary to prevent deflation. Having spent his academic career studying the causes of the Great Depression, Bernanke understood the danger of deflation and was determined to avoid the liquidity trap by maintaining the demand for credit. As good as his word, Bernanke, and Greenspan before him, oversaw a doubling of the money supply since 2000. Adjusted for changes in the money supply (inflation), real interest rates (the nominal rate minus inflation) were negative for several years. Instead of dropping money from helicopters, Bernanke dropped free debt.

The key in all of this is not inflation, as most believe. The Fed says they are most worried about inflation risks, but the reality is that they are most worried about deflation risks. Always. Always deflation. The Fed has no choice but to always remind us that the risks are tilted toward inflation, just as the Treasury Secretary, whichever one happens to be in office at the time, must always say that the U.S. maintains a strong dollar policy, even if monetary policy and fiscal policy are conspiring to devalue the dollar.

Fractional Reserve Banking and the Expansion of the Money Supply

Fractional reserve banking allows banks to lend into existence money they do not have (on the assumption that their depositors will not all want their money back at once), provided that they keep a certain percentage of their deposit base with the Federal Reserve to cover withdrawls. Ten percent would once have been a typical figure, but since the 1990s, the Fed has deliberately shepherded reserve requirements down, essentially to zero, through dropping required reserve percentages, reducing the categories of funds needing a reserve and allowing funds to be swept from a reservable category to a non-reservable category overnight (using sweep accounts). As reserve requirements have fallen, banks have been able to expand the money supply far more rapidly than would previously have been the case, at the cost of removing the cushion they previously held as insurance against financial accidents. As with everything else, the resilience has been stripped from the system in the name of efficiency, in this case in the use of capital to generate maximum returns.

The Housing Bubble and the Debt Mountain

The combination of drastically reduced reserve requirements and negative real interest rates predictably led to a borrowing binge of epic proportions, increasing what was already a dangerous level of indebtedness. Many of those whose fingers had recently been burned in the stock market turned to real estate, and, by extension, all of the supporting industries surrounding it. People moved to larger properties, bought investment properties, renovated, upgraded and re-equipped. The surge in demand, and depreciation of the currency through rapid expansion of the money supply, led to a huge increase in property prices. This enabled owners to use their appreciating properties as ATMs, at first using the windfall for luxuries, but increasingly relying on it to fund basic living expenses through refinancing. This created both a debt mountain and a structural vulnerability to a fall in property prices.

Banks offered credit to those further and further down the credit-worthiness scale, with scant regard to the ability of those borrowers to repay their loans. Instead of holding debt on their own books as they would once have done, banks now make their money from fees and sell the loans on to investors as mortgage-backed securities. As they no longer bear the risk of default, they are unconcerned about it. They often asked for little or no information from prospective borrowers – often no proof of income, employment or even identity - leading to the label of ‘liar’s loans’.

With rates so low, borrowers were far more concerned with the level of monthly payments than with the balance outstanding. Exploiting this blinkeredness, banks offered a range of loans called neg am ARMs – adjustable rate mortgages with negative amortization. Borrowers were offered low ‘teaser’ rates for the first few years, paying less than the interest owed on their loan during that time, while the unpaid interest was added to the principle in the meantime. Often they signed the loan documents without understanding the concept of teaser rates. At the end of the teaser period, the full monthly interest payment would be due on the now larger principle at the new prevailing interest rate. As interest rates have increased recently, monthly payments on resetting ARMs are often set to more than double. In October of this year, $50 billion dollars worth of ARMs will reset, with a further $30 billion a month doing the same for over another year.

Marginal borrowers, who were often already only barely affording their existing payments, are highly unlikely to be able to afford the new ones. Their only recourse would be to sell, but falling prices have made this difficult. Some are already in negative equity – owing more on their home than its current market value. Foreclosure lies ahead for many, but mass foreclosure sales will depress property prices, exacerbating the debt problem for a wider range of borrowers. Even many quite high-income families have been enticed into a lifestyle their income could not support, and could find that falling property prices push them over the edge. As sales will be very challenging, and bankruptcy laws have been tightened, many people could be tethered to unpayable debts for a prolonged period.

Financial Engineering – Hedge Funds, Derivatives, Leverage and the Repackaging of Risk

[In December 2006], another bit of news reached us: the derivatives market , in which hedge funds tend to speculate, has reached a face value of $480 trillion…30 times the size of the U.S. economy…and 12 times the size of the entire world economy. Trading in derivatives has become not merely a huge boom or even a large bubble - but the mother of a whole tribe of bubbles…dripping little big bubbles throughout the entire financial sector.

The ability to expand the money supply almost infinitely has been seized on by financial engineers interested in finding new and tempting ways to dress up leverage - seemingly eliminating risk while actually making it endemic through the financial system. The resulting derivatives have been called ‘financial weapons of mass destruction’ by Warren Buffet.

In order to sell mortgage-backed securities to investors, banks packaged them into different risk tranches of Collateralized Debt Obligations (CDOs) – investment, mezzanine and equity - concentrating the lowest risk elements in funds able to earn an investment grade rating. In order to sell the higher risk tranches, banks commonly set up hedge funds with enough seed capital to sell the securities to themselves. As housing prices rose, the securities appeared less risky, and so were able to attract outside investment and to be leveraged by being used as collateral for further loans. High performing funds, during the era of rising house prices, were tremendous engines of credit expansion.

Alternatively, equity and mezzanine tranches were often sold to large institutional investors, such as pension funds, willing to unwittingly accept illiquid securities with fictional marked-to-model valuations ultimately based on the ‘documentation’ provided with liar’s loans. These investors were chasing yield without realizing that they were chasing risk. The practice was colourfully referred to by insiders as ‘landfilling toxic waste’.

Rather than selling the risky securities, banks could also keep them, and the cash flows they generate, but insure them against default through a Credit Default Swap (CDS) – swapping the risk of default for a cash payment. The underwriting institution can then aggregate the CDS income stream into pools, themselves divided into tranches with different risk profiles. These synthetic CDOs are based, not on cash flows derived from borrowing money, but on cash flows derived from insurance premiums paid to cover the risk of mortgage default. Institutions can even insure against the risk of default on securities they do not own – creating synthetic CDOs and effectively shorting subprime mortgages or risky corporate bonds while once again hugely expanding supply of leveraged credit. Any default could therefore result in claims to underwriters many times as large as the supposed value of the underlying securities.

The danger is that underwriting institutions willing to accept huge amounts of risk in exchange for apparently being paid to do nothing, may not actually have the ability to pay out on default. The original institutions did not seem to ask too many questions of those to whom they had readily assigned the risk of default, but risk does not go away merely because one institution has paid a fee to another. The risk guarantee is only as good as the credit worthiness of the guarantor, and one commentator has described many credit default swaps as being guaranteed by Madame Merriweather’s Mud Hut in Malaysia.

International banking rules say that banks have to hold a certain level of spare funds (or reserves) to protect themselves from the danger that their loans might turn bad. However, since the banks had sold the risk of default on to somebody else, they could now argue that they did not need to hold these funds.

To anybody outside the world of finance, this might look odd (after all, the banks were still making loans); but the regulators accepted this argument, since the risk had moved, in accounting terms. And that let the banks free up funds to make even more loans. It was the financial equivalent of calorie-free chocolate: almost too good to be true.

Conflict of Interest - The Role of the Ratings Agencies

The ratings agencies that grade securities for investment purposes, and also depend on doing business with the same institutions whose bonds they rate, gave high ratings to mortgage-backed securities and did not lower them even as the housing bubble began to deflate. As the securities were not actively traded in a liquid market, the nominal marked-to-model valuations remained constant, and so did the ratings until recently. The danger is that lowering ratings below investment grade would force many institutions to sell them, potentially forcing those ‘assets’ to be marked-to-market where real bids, or the lack of them, would result in real market valuations. That would revalue a whole asset class at a stroke – revealing that the Emperor had no clothes.

It was a responsibility that ratings agencies were unwilling to take until forced by Bear Stearns’ declaration that two of its hedge funds were essentially worthless. A small percentage of mortgage-backed securities funds have since been down-rated and more have been placed on watch, but as yet there has been no real price discovery. Many investors are currently locked into hedge funds, delaying asset sales, but financial institutions can only maintain their solidarity for so long before they will have to act to extract what value they can from their collateral, even if that amounts to only pennies on the dollar. Ratings are likely to be downgraded only when they absolutely have to be. Ratings agencies have made it clear that rating securities does not mean that they do due diligence.

Moody's: "Moody's has no obligation to perform, and does not perform, due diligence."

S&P: “Any user of the information contained herein should not rely on any credit rating or other opinion contained herein in making any investment decision.”

What then is the purpose of a ratings agency?

Private Equity and Leveraged Buyouts

As the housing market was beginning to decline in late 2006, the market for private equity deals, or leveraged buyouts, was taking up the slack and feeding the credit expansion boom. Private equity was able to use a small amount to borrow huge sums of credit in order to take large companies private, with the underwriting banks able to sell the resulting securities to investors. The target companies were then often asset stripped, loaded up with debt and sold back to the public in a private equity ‘strip and flip’. In this way, private equity was able to play off the public markets, extracting real value through the use of cheap credit loaned into existence for the purpose.

Many of these huge deals are now threatened, as investors are no longer willing to purchase the securities generated, leaving the underwriting banks holding the risk. Bridging loans are becoming ‘pier loans’ as they no longer lead anywhere.

The Inverted Pyramid - Money versus Credit (or Hyperinflation versus Hyperexpansion)

Money and credit are not the same thing, although people currently use them interchangeably. Money is a physical commodity, while credit is virtual wealth borrowed into existence. Money can be subject to inflation, either by printing currency or by debasing specie (reducing the precious metal content of coins), but does not disappear. Credit, on the other hand, can expand dramatically through financial alchemy, but has no physical existence, although its effects are certainly tangible.

Because credit is used as a money substitute in the financial markets, it acts as an inflationary force in the asset markets (and this spills over into the real world as the imaginary wealth thus created leads to overconsumption and malinvestments), but it is all ephemeral - in the end, it is still credit, not money. As soon as money is needed in lieu of credit, such as has now happened in the CMO and CDO markets, it becomes clear that the money simply isn't there."

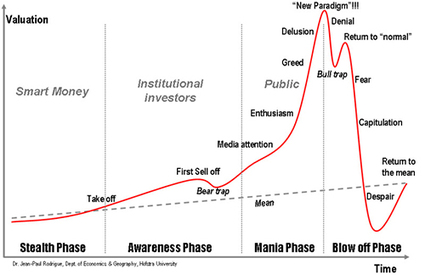

Weimar Germany or present day Zimbabwe are examples of hyperinflation, but the Roaring Twenties and our situation are instead examples of credit hyperexpansion. Inflation is a chronic scourge, but credit expansions are self-limiting – they proceed until the debt that creates them can no longer be serviced, at which point that debt implodes in a sea of margin calls.

There is actually very little real cash out there relative to credit. The "sudden demand for cash" is in fact the world's biggest margin call to date.

The value of credit is only as good as the promise that stands behind it, and when that promise cannot be kept, value abruptly disappears.

Let's suppose that a lender starts with a million dollars and the borrower starts with zero. Upon extending the loan, the borrower possesses the million dollars, yet the lender feels that he still owns the million dollars that he lent out. If anyone asks the lender what he is worth, he says, "a million dollars," and shows the note to prove it. Because of this conviction, there is, in the minds of the debtor and the creditor combined, two million dollars worth of value where before there was only one. When the lender calls in the debt and the borrower pays it, he gets back his million dollars. If the borrower can't pay it, the value of the note goes to zero. Either way, the extra value disappears. If the original lender sold his note for cash, then someone else down the line loses. In an actively traded bond market, the result of a sudden default is like a game of "hot potato": whoever holds it last loses. When the volume of credit is large, investors can perceive vast sums of money and value where in fact there are only repayment contracts, which are financial assets dependent upon consensus valuation and the ability of debtors to pay. IOUs can be issued indefinitely, but they have value only as long as their debtors can live up to them and only to the extent that people believe that they will.

Essentially, the gargantuan edifice of leveraged debt that has been accumulated during the years of credit expansion can be described as an inverted pyramid. Its point rests squarely on those at the bottom – for instance the subprime mortgage holders who’s relatively modest debts have been leveraged into trillions of dollars worth of derivatives. Each dollar of subprime mortgage debt probably underpins at least a hundred dollars of additional debt, and these loans will go into default en masse once the ARMs begin to reset in earnest. The leverage that has magnified gains on the way up, will magnify losses in a debt implosion on the way down.

Until now, his debt was an asset of the fund, and was being used as collateral against loans ten times its value. But the moment that Mr. Jones gave up on the idea of home ownership, the value of his mortgage simply disappeared. The paper asset, which derived its value from Mr. Jones’s promise, was destroyed. This had a cascading effect, since Mr. Jones’s mortgage was being used as collateral to borrow money to buy even more subprime mortgages, many of which were also defaulting. Assets purchased on borrowed money were now worthless. Only the debts remained, and suddenly there was more debt than the original amount that investors had put into the fund. These original funds would be needed repay the debts incurred by the fund. Nothing is left to return to investors.

Liquidity Traps and the Mood of the Market

Central bankers act as midwives for credit expansion – manipulating the cost of credit in order to encourage borrowing and lending. However, this cannot continue indefinitely as it does not occur in a vacuum. Central bankers have a range of options open to them, but ultimately the financial circumstances, and the mindsets, of both borrowers and lenders are important to whether or not credit expansion can be maintained.

The Fed really only can do two things. They can lower margin requirements for banks, the amount of capital they have to hold to make loans. That it has already driven to basically zero. So the Fed cannot allow banks any more “leeway” than it already has.

They can also perform open market money operations like REPOS and coupon passes. The Fed calls up big banks and buys their government bonds out of their portfolio. But they don’t buy them with real money; they buy them with credit newly created just for that purpose. The big bank can then lend that credit out in a much greater amount because the Fed only requires them to keep a small fraction of that credit to support whatever the bank wants to lend out. This is our wonderful fractional reserve system. If everyone went to the bank to get their “savings” at once they would find that they could get out less than 1%.

But here is the key. The bank must ultimately be willing to lend it and then find some investor to borrow it. This has been no problem whatsoever over the last several years. Now most investors realize that they have too much debt, that their level of income cannot support it. Banks realize this too and have increased their lending requirements. The last borrower is always the most aggressive speculator.

So most market participants are now looking for ways to pay back debt (deflation) just when the Fed is desperate to get investors to borrow more (inflation).

This conundrum is a form of liquidity trap - a shortfall in demand for credit that the policy tools of central bankers have great difficulty influencing. Keynes referred to this type of scenario as “pushing on a piece of string”. We are still in the early stages of this credit crunch and as yet, the Fed has not employed all the tools at its disposal. Most notably, it has not yet cut interest rates, likely due to recent Chinese threats to dump the dollar.

As the dollar should benefit from a flight to quality as credit spreads (the risk premium over treasuries) widen, there should be scope to cut interest rates later in the year. It is likely, however, that this will be less effective than the Fed would hope.

The theory is flawed. Central banks promising new credit to strapped banks only helps them with their current problems. It will not get new credit into a system that can't take anymore. Banks, given their situation, are reducing drastically their new commitments, as they should. Borrowers can't afford to borrow more.

The continuation of the credit expansion will remain dependent on a supply of ready, willing and able borrowers and lenders, and those already appear to be in short supply.

A trend of credit expansion has two components: the general willingness to lend and borrow and the general ability of borrowers to pay interest and principal. These components depend respectively upon (1) the trend of people's confidence, i.e., whether both creditors and debtors think that debtors will be able to pay, and (2) the trend of production, which makes it either easier or harder in actuality for debtors to pay. So as long as confidence and productivity increase, the supply of credit tends to expand. The expansion of credit ends when the desire or ability to sustain the trend can no longer be maintained. As confidence and productivity decrease, the supply of credit contracts.

A significant headwind faced by the central bankers is the dramatic change in the mood of the market in recent weeks. It is said that humans have only two modes - complacency and panic, and markets, being a human construct, are no exception. The current mood of the market is one of fear, and if fear becomes panic, it can remove liquidity from the market far faster than even a central banker can pump it in. Actual cash is in short supply, and the many investors are afraid that the game of musical chairs will end before they can grab one of the very few chairs. If they do manage to find a chair, it will be difficult to convince them to part with it, no matter what the inducement. Risk has made a definitive comeback.

Deflation and the Mother of All Margin Calls

A credit expansion cannot be sustained indefinitely. At some point the burden of debt begins to stifle the ability to produce. The debt industry can take on a parasitic life of it’s own, becoming an integral part of the culture, from the level of the individual, as documented by James Scurlock in Maxed Out, to the level of corporations and government. The attention paid to assessing credit ratings, monitoring credit activity, hounding defaulters, writing off bad debt, juggling minimum payments, thinking of creative ways to exploit leverage, and encouraging every last entity to take on more debt in order that predatory lenders might wring out every last penny of profit, is attention not paid to productive activities of the kind that build successful economies. Eventually, it requires so much energy to maintain that economic performance suffers and extracting sufficient profit to cover interest payments on ever-increasing credit balances becomes impossible. A mood of conservation eventually takes hold, replacing the expansionary fervour, and reducing the velocity of money.

When the burden becomes too great for the economy to support and the trend reverses, reductions in lending, spending and production cause debtors to earn less money with which to pay off their debts, so defaults rise. Default and fear of default exacerbate the new trend in psychology, which in turn causes creditors to reduce lending further. A downward "spiral" begins, feeding on pessimism just as the previous boom fed on optimism. The resulting cascade of debt liquidation is a deflationary crash. Debts are retired by paying them off, "restructuring" or default. In the first case, no value is lost; in the second, some value; in the third, all value. In desperately trying to raise cash to pay off loans, borrowers bring all kinds of assets to market, including stocks, bonds, commodities and real estate, causing their prices to plummet. The process ends only after the supply of credit falls to a level at which it is collateralized acceptably to the surviving creditors.

In such an environment, financial values can disappear very quickly, leaving behind only stranded debt. All it takes for an asset class to be devalued is for as few as two parties among many to agree to a new lower price. The remainder need do nothing, other than refrain from disputing the new valuation, for their net worth to fall. In this way, a few discounted house sales can bring down the value of a neighbourhood, and that lost value, which may have been underpinning a hundred times its worth in leveraged debt, is magnified through the inverted debt pyramid. The majority who do nothing end up watching the investment value of their assets plummet, while the owners of debt attempt to call in whatever value they can, from wherever they can, through margin calls.

The United States faces a severe credit crunch as mounting losses on risky forms of debt catch up with the banks and force them to curb lending and call in existing loans, according to a report by Lombard Street Research.

"Excess liquidity in the global system will be slashed," it said. "Banks' capital is about to be decimated, which will require calling in a swathe of loans. This is going to aggravate the US hard landing."

"The complexity of this era of credit liquidation," as Robert Smitley wrote of the Great Depression in '30s America , "is far too great for the mob mind to grasp. It is hardly possible for them to see the picture wherein about $700 billion dollars of physical and intangible wealth is attempting to be turned into about $5 billion dollars of money."

How much intangible debt now needs to be squeezed back into how much real money? It would be easier to find a cheap mortgage – with no ugly ARM once the teaser is finished – than guess at those numbers today.

http://online.wsj.com/article/SB122359301189021003.html?mod=todays_us_ma...

Credit Crunch and Sinking Prices Threaten Chesapeake Energy's Growth

WT, Chesapeake is but one of many. Basically ANY entity that needs to borrow money is having a hard time at present regardless of what collateral they have. I have advised those with credit lines to draw on them while they can. Stories are coming in of banks refusing to acccept Letters Of Credit from other banks, and these banks are amongst the most reputable (world top 20 not Icelandic:-)- banks just don't want to lend more than one day to anybody.

"Letters Of Credit" I hear people say aren't those just another funny derivative? Well no they are the basis for international trade, a Chinese exporter wants to know his goods will be paid for before he ships them to Americaville. So no LOC then no goods! Oh, OK then something to do with oil, say refiners find it more difficult to obtain LOCs then it could lead to refiners cutting output for financial reasons, despite demand for products. Which well known country do we know that imports lots of oil? Again it comes down to counterparty risk, everybody is less trusting and so wants the highest guarantee of payment.

CHK's annoucement perhaps sheds some light on a recent acqusition. In early Sept they paid International paper $264 million for 13,000 net mineral acres in the Haynesville Shale trend in N La. Difficult to tell for sure but that appeared to be a good deal for CHK. They may have the clock ticking against their leased acreage but the mineral right don't expire.

CHK, our largest Nat gas producer, is being raided, just like LEH, AIG etc. by financial players.

people are shorting the stock and buying the credit default swaps

a large % of their hedges are at Morgan Stanley - if MS goes under, so does CHK. NO WAY does govt allow that to happen, but what to do?

I think XOM spends some of their war chest of 40 bil to buy some of these failing nat gas companies

CHK is now trading at $1.70 per mcf, a level last seen in the late 1990s.

heres another example of the disconnect between financial and natural capital. hedge funds trying to put CHK out of business to make money, yet when they get home they'll have no heat or diapers..

"but what to do?" Hey Nate, I thought you were in favour of being able to short? How about preventing all shorts?

It all depends on the context.

We need regulation and a major paradigm shift in the direction of our institutions. But we need SMART regulation. Stupid regulation is worse than no regulation at all. And we cannot change the rules overnight lest there are unintended consequences. Changing the short-selling rules caused 10s of billions to leave our markets via closed/closing hedge funds. I know this for a fact. Its possibly much more. It adds to volatility and sends overvalued stocks higher and cheap stocks cheaper which then begets more panic and confusion.

We need less leverage. Short selling is a minor but integral part of the markets ebb and flow. If they are to remove it thats fine by me - but announce that shorts will no longer be allowed starting 1/1/2010 or something, so people have time to adjust.

I cringe to hear what will be announced tonight or over the weekend. I'm quite certain there is an abstract rabbit in the hat that I haven't conceived of that is being given the gift of rabbit life as we speak.

Nate, when I hear the words paradigm change then I usually try to listen hard and do the opposite:-) In this case I would completely agree with you, we need less leverage and financial institutions to be far more responsible.

The problem is being SMART and avoiding the unintended consequences especially when we can't sit back and wait months. A small example, how about preventing foreclosures and not throwing people out on the street? sounds good like apple pie but could it lead to more people giving up on their mortgages? if i had a mortgage and was struggling then i would be tempted as i understand that in the US you can walk away from a mortgage.

As to rabbits, yes no end to what can be dreamt up.

I don't know if people saw this yesterday. (Cook county is more or less equal to the city of Chicago.)

Chicago's Cook County won't evict in foreclosures

Lehman collapse puts hedge fund in dire straits: Short-seller Copper River should be in its glory in a market like this. Instead, it's fighting for its life.

I agree Nate. The folks I know with cash reserves are starting to morph into sharks. All the specualtion about CHK is just like bood in the water. A number of the smart players have been waiting for cracks in the leverage suit of armor. That day may quickly be upon us.

Nate,

You know I love you, something that doesn't go for all the drips you run with.

That said, I'd say it's quite clear how bang on Stoneleigh and me were from day one. And you, Wall Street affficionado, were not. Are we clear on that?

So today you re-run a year-old Stoneleigh piece, without even asking her for an opinion or update.

¿Que pasa, contigo?

She's all tickled and all, but I am not.

Is it so hard to pay dues where they are due? Yes, the Oil Drum has been wrong, consistently, and all along. Hey, just admit it and move on.

Nate, Stoneleigh just tells me to tell you I'm a retard.

Wrong about what amigo? Look at my last 20 posts - I've been as right as rain. Look at my predictions in the oil volatility post in December, look at in 2005 and 2006 I said we were seeing the end of growth forever, and last summer that credit crisis would swamp peak oil in near term, etc etc...

And 'theoildrum' has also been way ahead of the curve. We just haven't focused on finance, because it's not a finance site.

In any case, you've had a great call, and I have no idea how you find time to put up a post everyday as well as links, (and in your second language).

We are all on the same team - trying to steer this societal ship thats going over Niagara Falls. I think TOD is taking the longer shot - trying to change the social and political paradigm for everyone at its most central tenet - energy. TAE is more ground-up - trying to save individuals money from avoiding financial morass. Hopefully, we've both made a difference. One will likely never really know, so its the path that matters.

I was very pleased to see this post run today, and to have a chance to discuss its message again.

I certainly can't speak for Ilargi, but I do think that many people coming at this from a technical perspective, including some folks at TOD, have dramatically underestimated the degree to which we will be able to invest in major projects in the longer term - that is, there has been an undercurrent narrative of assuming that we would have the wealth to make major, innovative changes when the time came. That narrative, for example, was an undercurrent of the discussion of relocalization I participated in sometime back - the assumption was that those who advocated primarily low energy, low cost, low input solutions were primarily doing so because of an agenda, not because such solutions were necessary.

I get the sense from many people on this site and at others that while on one level folks knew the end of growth was coming, at the same time they assumed that there would be just enough growth for their pet projects and solutions. This, of course, is not universal, but the sheer sense of shock that the odds are against it is quite vast - again, I'm not speaking of anyone in particular, but I do think that quite a few people have suddenly got the "doomer" religion ;-), over this way, when they suddenly grasped that oops, maybe we weren't going to be doing whatever mitigation project they'd most like to see.

Sharon

There was no guarantee the U.S. government (corporate oligarchy) would make all the wrong decisions. I certainly did not expect the Republicans to resort to corporate welfare for the Wall Street titans which likely crushed our financial ability to transition our economy away from crude oil. When arguing against the $700 billion bailout to my congressmen, I advocated spending the money on converting infrastructure to stimulate the economy. There is still a chance for a peak oil aware infrastructure project similar to the New Deal, but given the poor performance from the presidential candidates and congress, the odds seem decidedly against it.

Then again, the worst part of the subprime crisis is now, fourth quarter of 2008, which means the defaults and credit crunch will lessen next year. No one knows if the present financial crisis will be severe enough to plunge the world into a sustained depression. Some of the poorly managed companies that rely heavily on debt for day to day operations will be eliminated. I think it depends on how severely unemployment rises during the next 3 months. If it rises enough to cause widespread defaults on mortgages, including prime ones, then the world will be in a depression will little hope of anything other than low energy, low cost solutions.

The subprime crisis is small beer compared to what's in store for Alt-A, and prime, lending. The resets on pay option ARMs in those much larger areas have hardly begun and won't end until about 2012. The credit crunch is set to get worse, not better, as the default rate on underlying assets steadily increases, or perhaps climbs in leaps and bounds as unemployment shoots up.

The new year should see the Wall Street crisis spill over on to Main Street with a vengeance, and not just in the US either. Much of Europe is teetering on the brink, suffering from far worse housing bubbles than the US (Germany being a notable exception), and Asia has been crashing as well. The financial system is too integrated to avoid contagion.

Stoneleigh you are a calm eye of reason in a hurricane of self justification and recrimination. Good for you.

The thing that I didn't foresee, but which you guys did, was how widespread the collateral damage from the mortgage and overall financial meltdown would be--to the point that it is affecting food & energy production.

I have thought for a long time that the auto, housing, finance, etc. industries were toast, but I didn't think that food & energy would be collateral damage. To be precise regarding energy, I thought that the global decline in net oil exports would outpace the global decline in demand, which I still think will happen longer term, especially with the difficulty in getting energy projects funded.

In a nutshell: We're f!@#ed!

I've read blogs as early as 2005 about the credit bubble, it was foreseen by many people and they are not Nobel price winners. It's just common sense.

I think the worst case scenario is actually happening. Price of oil is going down but don't kid yourself, depletion will bite our ass even faster as we will not be able to make the necessary investments in new oil production or energy alternatives.

And the implication of this is that the value of the commodity will increase relative to other goods and services. This higher price will stall and delay the recovery of those nations seeking to recover from the credit collapse and will reward those nations that 1) have made efforts to improve the ratio between energy inputs to the economy and productive output; 2) have maintained a high domestic savings rate.

I have said repeatedly that we have not yet seen the greatest event in our lives.

Every watershed in oil has been marked by a shadow watershed

in socio/political/economics.

There is a book titled -Selected Essays on Political Economy,

Frederic Bastia.

"That the right to property is prior to the law." We're about

to find out out, just as Robespierre did, whether property is

a social institution.

The Watershed of the debacle, creating debt thru ever increasing amounts of energy flow, is upon us.

BTW-remember just a few months ago when folks thought that the idea

of a Plunge Protection Team intervenng in financial markets was tin foil?

How does the DAX, CAC, FTSE drop 8%+ and the DJIA is only down 3.5%.

With GE up. Please.

Your comment is ridiculous. Think.

Fine argument Nate, that will bring much enlightenment to us - the great unwashed.

This is "the" point. And how critical it is can be seen in one of the "Urgent and immediate necessary actions" advocated by Nouriel Roubini in his latest diagnostic and recommendations piece (please remember that this is the economist - and AFAIK the only economist - who in February predicted this meltdown, so his thinking now weighs a real lot with the establishment):

Since this recommendation will most likely be heeded, it is evident for us all Peak Oilers that the world is facing a most critical and urgent issue: how smart or dumb, from a Hubbert's Peak-aware perspective, the forthcoming massive public works, infrastructure spending, tax rebates, etc. will be. E.g., are governments going to:

- spend on airports or railways?

- build new roads or electrified urban rail networks?

- offer tax rebates for SUVs or efficient PHEVs?

- finance building in Las Vegas or wind farms?

In a word, using the Easter Island model, are they going to start a massive moai construction program or a massive reforestation program?

So, this is "the" point, and this is "the" time for all good Peak Oilers to come to the aid of their country (actually planet because this is global), by speaking out as loudly as possible to influence public thinking to ensure that the forthcoming stimulus packages will be conducive to helping society withstand the oncoming descent from Hubbert's Peak and not to accelerating its collapse, this time due to shortages of physical "liquidity" that no Central Bank can provide.

Yes! I am both enthused and terrified by the turn of events.

For years now I have been seeking a sane allocation of funds towards assets that are productive. It has been a mixed bag. I came down hard on a freeway project and have been a villain in the eyes of many in the establishment ever since. It is almost as if they seek revenge for arguing against their pet projects, and are further incensed that I may have been correct. But I have generally been calm and polite and data driven so if cooler heads prevail public input at this juncture may have some influence. We shall see, huh.

Hi Khebab,

It certainly isn't all coming up roses, that's for sure, but on the other hand there are worse things than being "f!@#ed!" . Being actually out of oil, for example.

In the words of some anonymous pilot, "Any landing you can walk away from is a good landing." Which is to say, this economic meltdown is about to rough us up pretty seriously but it IS a landing of sorts, and perhaps not quite as lethal as the one we seemed to be headed for before (i.e. the one where the economy kept running at full tilt until the crash was caused by running out of energy VERY suddenly.)

I don't think any significant number of people (and certainly none of our governments) were going to slow down the 'oil burn' voluntarily, so perhaps it is a blessing in disguise that Great Depression II will now do that for us. If we burn half as much it will last twice as long... and penny pinching paupers will be a lot less wasteful of it, too.

True, there will be less money around, and allocating for alternative energy infrastructure and new wells will be drawing from a smaller pot, but eventually running out of petroleum was preordained anyway, and alternatives did not lag from lack of money... they lagged from lack of will. We did not, demonstrably, want them badly enough. (We had mountains of money but chose to spend it on funner stuff.) Well, now we're going to NEED those alternatives, and my bet is that people will consider getting their electric lights turned on as a lot more desirable than a new ski boat or wider TV set.

Moreover, a little 'Taste of the Lash' is a good lesson for humankind to learn at this juncture in history. Nothing like a little objective reality to get people to pay attention to their lessons.

Of course at the moment everyone is morbidly fixated on losing their money, but they will adapt to the far leaner reality that settles out of the current mess... and when they do they will be more amenable to the Peak Oil situation so admirably documented here on the Oil Drum.

From Heinberg--

The great turning has begun.

I seem to recall that The Oil Drum essentially told Stoneleigh to get lost not so long ago. Maybe she didn't do enough Laplace Transforms.

Rehabilitated, is she?

I wonder why.

Yeah! Where is Stoneleigh? Get her back Nate!

She and I have been friends before there ever was a TOD. We met on Jay Hansons listserv. She was never told to get lost btw. She, like many of us, has many priorities and fits in many different tribes, and wouldn't be able to have a job, write with Ilargi and be an oildrum editor all at once.

Those who have read theautomaticearth AND theoildrum probably have a very good sense of what is happening to our modern economics based civilization.

What's next is the discussion of the 4 capitals (a core precept in ecological economics). Financial capital is abstract, and is a social construct that is/was created to represent a marker for natural, built, social and human capital. But the marker went beyond the notional value of the worlds real capital (or close). $700 trillion in derivatives is 7 times the total endowment of remaining recoverable oil at $100 per barrel, etc. How we choose to 'mark' our remaining (and abundant) real capital, and what social rules will be laid on top of it is the next great question.

We may write in different places, but friends we remain :)

And Nate is right - I wasn't asked to leave. I had to choose between writing on finance with Ilargi and writing here. I wanted to write on finance as the timeframe is shorter than for other crises, hence financial upheaval will set the stage for the way other crises, such as peak oil, play out. And Ilargi and I both live and work together, so continuing the partnership made sense.

Rather than dwelling on the past, I would rather concentrate on the future. There's more than enough there to worry about unfortunately.

I've been reading about hyperinflation. Some say because of all the money that is being fed into the system that hyperinflation is inevitable. But the article says it's hyperexpansion of credit. Is hyperinflation a possibility?

The money that is being fed into the system is disappearing into a black hole of credit destruction. It's a drop in the bucket compared to the deleveraging that is well underway. The analogy I've used before is Ben Bernanke standing on the Gulf cost ordering a Cat 5 hurricane not to make landfall. The storm we are seeing is a similar force of nature (human nature in this case), and no institution, or group of institutions, has comparable power.

IMO we could well see hyperinflation (as opposed to the hyper-expansion we have recently lived through) once the deflationary force is spent. By then the international debt financing model will be well and truly broken, and the power of the bond market to limit freedom of action - by punishing 'printing' with much higher interest rates - will be much diminished. At the moment, debt-junkie economies ignore the bond market at their peril.

I expect a deflationary depression to unwind over several years, as deflation supports depression and depression supports deflation in a positive feedback loop. Cash will be king during that time, but as deleveraging proceeds, converting to hard assets will become advisable at some point. The idea is to be fully liquid at tops and fully invested (whether in stocks, gold, oil, firewood, real estate etc) at bottoms, which is the exact opposite of what most people do. We are still much, much closer to a top than to a bottom (although there will be many false bottoms and sucker rallies along the way).

So for a practical guy with limited skills and time to invest, how do you know what to do when?

I've got some cash, some gold, some property, and some mortgages. No stocks to speak of.

In a deflation, I figure my gold may lose value, but as long as I'm employed that's fine -- and if the banks take a vacation or something nasty happens overseas I've got some money of some sort at least.

But when should I shift cash to gold, paying of mortgages, or something else? Obviously just before inflation really takes hold, but how will I know when that is?

Cash and gold are fine, although of the two cash will be more important initially. Gold should fall initially relative to cash and may be difficult to trade for essentials, especially if ownership is outlawed again as it was during the Depression. Property will become illiquid and mortgages (even relatively small ones) are a risk under those circumstances. Property prices have much further to fall than almost anyone thinks, so a large percentage of owners will find themselves in negative equity.

It would be better to consolidate so that what property you own you own outright. That way you don't have to worry about what it's worth as you hold no debt on it, and you'll have less need to continue earning as much as you do now. Considering that a lot of jobs are going to disappear, it's reasonable to assume that earning power will diminish greatly, so being less dependent on a given wage would be a very good thing.

I don't think you'll have to worry about inflation for a long time, but eventually you will need to convert from cash to hard assets. My guess is that cash will be king for at least a few years.

Thanks for your superb insight and perspective. I just read TAE for the first time as well. With another blog to track, now I'll get even less work done going forward. :)

I think I will not worry about my modest holding in gold and a bit more in cash, and look hard at the real estate.

The tough part is convincing the family to bail on the biggest, nicest house while we still can, and squeezing into a smaller one. It makes perfect sense to me -- lower bills, lower mortgage (plus if I'm lucky some equity from the current house to push into it), less energy consumption, no HOA, no expectation of a yard-man, and so forth. And the ground actually will grow a garden.

Here's the last question I'll nag you experts with: given a choice between sitting on $x in cash or putting it on the mortgage (twice that), which is better? Does outright ownership of your house trump all else?

Why don't you follow Stoneleigh's advice?

"Property prices have much further to fall than almost anyone thinks"

You could make 'crazy' low ball offers now, half of the offered price. And try to buy with 100% cash if you can.

Trying to win over a family that's used to the good life is difficult, as they often don't understand the vulnerability that comes with doing it on borrowed money. I'd say your idea of living in the smaller property with much less debt is highly advisable. Of course selling the larger one will be challenging at this point, and you'll have to be realistic about the price you ask for and be prepared to bargain. The important thing is to get out from under the debt and pay off as much as you can on the other property.

As for the cash versus paying off the mortgage question, I'd say everyone should have cash on hand in case they suddenly lose access to savings and credit, as is entirely possible. That's what happened in Argentina in 2001 when they had their financial crisis. People were just cut off with no way to pay their living expanses and debts. There were riots in the streets and the country went through about five presidents in a matter of weeks. As their crisis was isolated, while this one is global, it's likely to be both worse and longer this time.

I'd try to pay off the mortgage as soon as you can by living as frugally as you can manage though, even though your family won't like it. They'll thank you later.

I imagine I'll lose some equity in the sale (bought in 2001, so I have some room), after the necessary carpet and paint, but I think I can still come out with a few bucks if I sell quickly.

I'll pay cold hard cash if you'll call my wife and convince her. :) There's a cottage industry with potential for you!

Money in a fractional-reserve, fiat currency system IS credit. They are one and the same (with some relatively minor exceptions). So the hyperexpansion of money is also a hyperexpansion of credit.

Lending creates money. Paying back a loan destroys it. So does defaulting on your loan. At any point in time, the amount of money in circulation is equal to the amount of credit. However, the amount owed on the loan includes interest. So, at any point in time, there is not enough money in existence to pay back the outstanding loans and the interest on the loans. The interest can only be paid back out of future credit expansion.

And therein lies the apparent contradiction: expanding money/credit too fast can lead to hyperinflation, however if anything interrupts the expansion, the entire system is prone to quickly collapse in a black hole of deflation. This is why central banks fear deflation like the plague and will always choose inflation ... assuming they get the choice.

Inflation and deflation aren't really opposites, they are more the Yin & Yang of the same thing.

Exactly, this is the fundamental flaw with our financial system.

To pay the interest on previous debt, we require a never ending expansion of new debt. This requires an infinitely expanding economy.

But our economy can't expand infinitely due to finite natural resources so our fiat debt-based currency system is not compatible with a sustainable steady-state economy.

It must inevitably fail now that we are facing peak oil and ecological destruction.

That assertion has developed into a mantra, but it's not true. If the real growth of the economy exceeds the amount of debt, then the interest can be repaid.

It's only when the amount of debt massively exceeds the real growth, you have a problem, as in our current situation.

Even if you made debt illegal, the real economy cannot grow infinitely, such growth is obviously unsustainable.

Therefore debt is a red herring. It's like a fever, it's a symptom not the cause of the illness.

"Even if you made debt illegal, the real economy cannot grow infinitely, such growth is obviously unsustainable."

This is what I was saying in the first place, so I find your reply nonsensical.

Our debt based financial system was created under a paradigm of infinitely expanding growth (i.e. increasingly rapid rate of resource consumption). To prevent the debt based system from imploding, it requires an infinitely expanding economy (or in the short-term it can be propped up by blowing debt bubbles).

So our current financial system requires a non-finite resource base which is clearly impossible on a finite planet. I never said that the debt system was the cause of our woes, but simply that it was incompatible with reality. It is the first system that must collapse as global resource extraction reaches a peak.

TAE and TOD give me sanity and clarity in this insane world. Thanks for hanging in there and keeping us informed.

The fact that the derivative market is several times the size of the whole world's GDP shows how much gambling has been going on. To me, it also indicates that these derivatves are not wholly necessary, i.e. the same risk has been "insured" many times over by people who have no direct involvement with the original risk or trade. What would happen if all derivative were cancelled, who would actually really lose other than potential profits??

Count me as one of those who read both. These are my 'morning newspapers' and I'm so much more informed than if I'd had to rely on MSM. Thanks to all who make these sites possible.

My view is that we are seeing the first of several market cascades as global deleveraging proceeds over the next few years. However, no market moves in only one direction, and cascades are likely to be followed by very sharp rallies. Extreme volatility, the risk of rule changes midstream (such as the ban on short selling), and the risk that exchanges may be overwhelmed by volume make trading a dangerous prospect. Most people would be better off on the sidelines in cash or cash equivalents (short term treasuries), provided they don't place their trust in the banking system or the FDIC.

We are still near the beginning of a deflationary spiral, as the credit hyper-expansion of the last couple of decades morphs into contraction. Whereas currency inflation divides the underlying real wealth pie into ever smaller pieces in a form of forced loss-sharing, credit hyper-expansion creates multiple and mutually exclusive claims to the same pieces of pie. The appearance of great wealth is created, but it is illusory. As expansion comes to an end, the excess claims are rapidly and messily extinguished in real wealth grab. The dynamic is Enron-esque and the result will be a long and extremely painful economic depression.

As credit (ie excess claims) represents probably 99% of the effective money supply, the removal of credit causes the money supply to crash. This is deflation by definition, as deflation is the reduction of the money supply relative to available goods and services. 'Printing money' (monetizing debt) will not help under these circumstances as injections of liquidity disappear into a black hole once a cash-hoarding mentality has taken hold. Watching the TED spread reveals how little trust there is in the banking system. We are headed directly into the liquidity trap, where a dramatic slowdown in the velocity of money aggravates deflationary debt defaults.

The effect on energy will be significant. We have already seen the effect of speculative expectations shifting into reverse, combined with some demand destruction. As the economic fallout of the on-going financial implosion proceeds, demand destruction will become much more significant. Prices are likely to fall, but as purchasing power will be falling even faster, thanks to the loss of access to credit, lower prices will be less affordable than the current high ones.

However, economic upheaval affects supply as well as demand, albeit more slowly. In a capital constrained world, many energy projects will become uneconomic at lower energy prices, or will not proceed due to high risk (both financial and physical). We are also very unlikely to see the construction of the renewable energy infrastructure that we so badly need if we are to reduce dependency on oil. The effect will be to reduce supply as drastically as demand over time, which will place an upper limit on recovery.

We are likely to see an end to the fungibility of oil, as supply becomes tied up in bilateral contracts or fought over in a global resource grab, with much consequent destruction of vital infrastructure. The result is very likely to be wild fluctuations in energy prices for a period of time, with enormous variations in both price and availability in different places. Oil is a strategic commodity that confers hegemonic power, and as such will become even more important as the fall in supply predicted by Hubbert's curve is substantially aggravated by 'above ground factors'.

Whoa! Stoneleigh is back!

"...lower prices will be less affordable than the current high ones."

Watch the cities begin demanding grain from the countryside/farmers/elevators.

http://futures.tradingcharts.com/marketquotes/index.php3?market=W

CBOT wheat down 38 cents.

I completely agree there will be huge volatility. An example in the UK is the bank Royal Bank of Scotland (RBS) until one year ago it was the second largest bank in Europe and tenth worldwide. Since then its shares have dropped from about 550p to 80p about one eighth. During this week the range has been between about 70p and 180p, almost doubling and falling on one day.

This weekend the G7 are meeting in Washington so let's keep our fingers crossed they finally come up with something sufficient to steady the markets. Unfortunately Bush thinks the current TARP plan is sufficient.

Your potential end to the fungibility of oil may be proven very soon. While there will be significant demand destruction due to the current global economic woes, OPEC is in a different position now then they found themselves in 1986. At that time the 15% DD from the prior oil price spike and uncontrollable competition among the OPEC members eventually led to $10 oil. Now, nearly all exporters are admitting being at or close to their own PO. It would seem the KSA will have absolute power to control oil supplies to degree. Should they decide to cut production to provide price support there will be no other exporter capable of replacing the deficit. The political/military consequences of such a policy can offer seeming unimaginable results.

China’s aggressive acquisition of bilateral production agreements as well as direct ownership of overseas oil fields over the last 10+ may prove to be a very brilliant strategy. It also adds another layer to the prospect of severe political/military confrontation between the major oil consuming nations. Perhaps it’s only a coincidence, but several weeks ago I saw just one unconfirmed report of a low level US diplomat opening a discussion with the Brazilian gov’t regarding the US helping to fund there new Deep Water oil play. If true it may mean that our gov’t hasn’t been completely ignoring PO and is looking to establish its own bilateral agreement with Brazil. One can hope, at least.

Exactly. Others are now having to play catch-up, but coming from behind is far more difficult. IMO the developed world, and the anglo-saxon countries in particular, have been blinded by their faith that the market would always provide, and the arrogant assumption that they would always be able to outbid others.

A story was related at the ASPO-USA conference re. China...China is apparently generously offering foreign aid to very small countries. The example give was Western Samoa, which received something like $200 million in aid from China. This was suggested by a W. Samoan diplomat as an obvious inducement to follow China's lead when casting votes in the United Nations.

You must have faith. Ben is on the job. He'll print like never before and before you know it all will be well with the world.

Damn, I wish I'd read that three weeks ago! You see, at the beginning of this crisis, I set out to try to understand what the hell was (fundamentally) going on. It took me two weeks of lost sleep and angst (and the discovery of Irving Fisher) to pound into my head essentially the same understanding you ably summarize above.

I started to catch up on my sleep. Then today, I saw this thread, and wished I had seen it earlier. Oh well, without the hard work I probably wouldn't have understood the significance. Thank you, Stoneleigh, for making so much clear over the last few years.

Here is my 6 word gloss on the above summary, for what it's worth:

Money is debt.

Resources are finite.

From this, I think, all else follows.

The end of American capitalism?

Wow, it's top story on MSNBC. Only a day late and a quadrillion dollars short. Like the tag on the story about Iceland's defunct bank: banked and tanked.

and at the same time on bloomberg comes a story saying "...Investors should buy the dollar while selling the euro and the pound because interest rates in Europe and the U.K. will fall faster than in the U.S..."

Of course it's from my old friend the Royal Bank of Scotland who are in such fine form that they will be the first to blink and accept government money in exchange for their soul or at least excessive pay! They go on to say "...Dollar bets will pay off as the currency stops being used to pay for higher-yielding assets globally, in the so-called carry trade, amid the worldwide economic slowdown. It will benefit longer term as the U.S. enters a recession, which will help narrow the current-account deficit..."

So there you have it, the US is going in to a recession - I'll bet you didn't know that.

One does wonder if the market is pricing in the end of growth... (which has been written about here extensively as byproduct of peaking surplus energy)

But I seriously doubt it - old beliefs die hard. This continues to be super heavy money manager elephants on leveraged steroids heading for a human sized exit door...

Pricing in the end of growth? Isn't that functionally what is happening with this unwinding? And it's not only the end of growth but the financial recognition of overgrowth. The resources are not there.

cfm in Gray, ME

It gets better...

Berlusconi Says Leaders May Close World's Markets

This should cause another "interesting" final hour of trading today. CNBC is confirming that several heads of state are meeting this Sunday.

From Reuters

The White House on Friday dismissed suggestions that U.S. markets would be suspended so international financial rules could be rewritten amid the turmoil that has gripped markets for weeks.

"There are absolutely no plans or discussions to interfere with the functioning of markets in the United States," White House spokesman Tony Fratto said in response to a question about the idea raised by Italian Prime Minister Silvio Berlusconi.

The Italian leader, who is set to meet U.S. President George W. Bush on Monday, later played down the idea.

When did the White House hire the Iraqi Information Minister as a spokesman?

That almost made me laugh out loud until I considered it contained a kernel of truth (maybe a whole cob).

Apparently, it's the Finance ministers getting together this weekend.

WT they are now called Information Ministers :)

Maybe they will decide to all move the decimal place to the right, so 8,000 becomes 80,000.

They wouldn't be so wise as to use Hubbert or the Technocrats idea of pegging currency to energy?

Boy I hope there are some ecologists and natural scientists in those meetings. If it's all economists the new Bretton Woods is going to be more spiked punch.

I think it would be good now to talk up alternative forms of currency backing. One that I recall backed by energy has been proposed by Richard Douthwaite and is termed the "ebcu" as in Emissions Backed Currency Unit. It could also be considered a depletion backed currency unit.

In Ecology of Money he also lays out the different functions of money and how different forms should be used for those different functions.

Read here: http://www.feasta.org/documents/moneyecology/chapterfour.htm

I kept looking for something to indicate this was from the Onion. Sometimes imagination gets mosh-pitted by reality.

Stoneleigh,

This is excellent stuff. What I want to know is what will happen to investment perspectives for future energy projects. After all those who still have some 'real' money will want to invest it but will be terrified of risk.

Most renewable energy and nuclear projects have high capital costs and require long project lifetimes to pay back the money (40 years or so for nuclear or big hydro).

The central banks are winding down interest rates which would favour these. But I suspect that investment time horizons will shrink and that nobody, banks or equity finance, will want to invest in anything that doesn't pay back in under ten years.

This leaves us in an investment world of low energy light bulbs, woolly jumpers and loft insulation on the demand side. On the supply side it will favour burning expensive oil and gas in cheap to build CCGT power plants rather than investing in capital intensive nukes and renewables.

Unless of course, these can be classified as 'public works' and 'job creation' for unemployed bank clerks.

Thoughts please,

BobE

High capital, long term investments are likely to go right out the window, unless they are undertaken by the state sector in a Keynesian attempt to generate employment, but even then the likelihood is relatively low. States will have their hand full dealing with claims for assistance, social unrest and protectionist trade wars (as a global economy based on comparative advantage breaks down), while trying to cope with plummeting tax revenues.

Almost nothing gets built by the private sector in a depression, as the few who still have money become very reluctant to part with it in an atmosphere of risk and uncertainty. We are already seeing cash hoarding by banks, and they won't be the only ones. Low interest rates won't help, as only the nominal rate will be low. Against a backdrop of a collapsing money supply (as credit loses 'moneyness'), the real rate (the nominal rate minus negative inflation) will be high even if the nominal rate goes to zero. Prying money out of anyone's hands for anything less than a punitive interest rate is going to be very difficult.

Adaptation to a low energy future is going to be very unpleasant, as we have a tremendous structural dependency on cheap energy. Even though demand destruction should lower prices further, that doesn't mean energy will be cheap. Without access to credit, which will be the case for most people in the not too distant future, purchasing power will be extremely limited, and may well not cover even the bare necessities. Adaptation therefore means coping with deprivation in whatever way one can. Woolly sweaters are certainly going to make a comeback.

The USA has become the top SOCIALIST country in the world and that will make it's failure the largest.

I thought socialism was income redistribution for the general public welfare; however John Q Public gets nothing good from this series of bailout deals.

Since a few corporate fat cat crooks at the top are banditoing the treasury and imperiling the general welfare by bankrupting what is left of the social safety net [pensions, FDIC, Social Security, Medicare], what you are witnessing is not socialism at all but rather FASCISM. Look it up in the dictionary.

McCain: No mandatory retirement fund sales

Wall St. giants buried in global stock market panic

I wonder how many of the following currencies will still exist 1 year from now?

B Pound, Euro, NZ dollar, Mex Peso, Auss dollar, Can dollar....

The dollar rally against this basket has been staggering. And the yen has been even stronger (amazing considering Japan imports all their energy and has a 180% debt to GDP ratio)

Note: Gold has sold off over $100 in past 3 hours.....I wait with bated breath smelling of freeze dried food for the weekend press...

Gold down, silver down, oil down.

Looking deflationary out there...

But the Dow just turned positive again so we're all saved - at least for the next few minutes.

Up 100 points.

Up 300 points!

down 50! wheres the lithium?!

What's going on? Why that sudden spike at the end?

a)Lehman CDS auction went better than people thought

countered by

b)lots of mutual funds got phone calls to redeem and they start that at 3pm EST

Hmmm. All in all, pretty good for mutual fund holders who sold today, then.

It's telling that a 128 point loss on the day is considered not that bad.

I can already envision CNBC next spin: Dow finishes with 75% less losses than expected!

Short squeeze? Do they have those any more?

Have a look at

http://www.kitco.com/charts/livegold.html

http://www.kitco.com/charts/livesilver.html

COMEX (paper metal) prices started to plunge at 12:00 NY time, which happens to coincide with the close of the London (physical metal) market (where BTW today's Fix prices were 900 for gold and 11.74 for silver).

Moreover, the final half of today's plunge occurred after 13:30 NY time, the close of COMEX floor trading, after which the market becomes extremely illiquid and can be moved by a very low number of contracts, particularly today, a Friday before a long weekend in the US, with more traders leaving early. But stop orders never sleep, so by initiating such a "cheap" price plunge, the sellers (which have big short positions) could have harvested maybe thousands of stop orders at bottom prices not seen in more than two years in silver.

So the big shorts (big name banks BTW) have spared none of their whole gamut of tricks to engineer this sell off. Viewed in conjunction with the rise in metal lease rates and the soaring worldwide demand and rampant worldwide shortage of retail gold and silver, my personal conclusion is to agree with this view:

"The one thing he (Ted Butler) always told me for the past eight years was that before the big upward explosion took place, the price would be crushed. He said the big shorts would be among the first to notice a shortage in silver. They would then do everything in their power to extricate themselves from their short position. They would manipulate a big sell-off so that when those who held silver on margin were forced to sell, they would buy back their silver and thereby reduce their short position."

This was an excellent article, Stoneleigh's comments are excellent.

About gold.

Personally I started shorting gold today at US$917.3 and finished covering at US$832. Nothing personal. I'm a contributor to the wikipedia gold as an investment page. In the long term I'm bullish on gold, and own physical. Partly I was just hedging my physical against a drop.

But gold is a market I've had consistent success trading in, and it was due for a drop. As this article explains the system is deleveraging. That applies to all commodities including gold. Maybe gold won't drop as fast as oil but I think it will drop too. This week I put my money where my mouth/keyboard is and profited from that.

I wish this had occurred to me before I tried to pick the bottom in oil last week. I lost money on that trade before I turned bearish/deflationary on oil.

Look at the USD strength. I think Jim Rogers is the best, but Bernanke says he is not monetizing the debt. He says he is not printing money (yet) and I see no reason to think he is lying. So gold had to come down too.

Now for some contrarian thoughts.

I'm actually turning optimistic. This deleveraging might not be such a bad thing. It's just a transfer of wealth from weak hands to strong, and the dispelling of dreams of wealth that were always illusionary. It's not like there has been a war of something, no productive capital has been destroyed.

This might be similar to the rich man's panic of 1907. Life might proceed as normal now for a few years. Airlines might even make a profit again.

Unfortunately, financial panics tend to lead into serious consequences that affect everyone, especially when people so far down the financial food chain have bought into the preceding boom lock, stock and barrel. When 'widows and orphans' are buying, you have an all-consuming financial mania, the inevitable collapse of which triggers a great deal of socio-economic upheaval. Typically, the middle class is ruined.

I would argue that the events of 1907 were a contributing factor to WWI, as 1929/1937 and the Great Depression were to WWII. I could easily imagine a similar chain of events this time, especially considering that peak oil could prompt a much more active resource grab than we've seen so far. Even if demand destruction results in a temporary glut (given that demand is what one is ready willing and able to pay for and that purchasing power will be very limited), the nations set to compete for hegemonic power know that oil is finite and that oil IS power.

Thanks for your reply Stoneleigh!

Well I can't disagree with your fundamental analysis, it's simply flawless. Good bye middle class America.

But I can find bright spots. Namely Japan. If we can come out of this mess I think Japan will lead the way. Cheaper commodities are good for Japan, and their banking system seems to be in relatively good health.

Also there's always the possibility of a technological breakthrough in energy production, e.g. fusion. Japan could lead the way here. You can't rule out this possibility, there is some hope.

With the Nikkei in the 7000's good quality domestic Japanese equities look cheap to me (not exporters like Toyota, but other stocks I don't want to name as I haven't been able to get completely filled yet).

On the other hand if the S&P500 slices through the 2002 low at 775 then, we could see equity indices trade at 1970's prices. This would suggest to me that you are right about resource shortages and WWIII is coming soon.

(Warning religious aside follows)

I pray the good lord will have mercy on our souls. I believe he watches us even now and I hope we have not been so sinful that he is about to destroy us all.