The bank panic

Posted by Jerome a Paris on September 29, 2008 - 10:10am in The Oil Drum: Europe

Banks are not to be trusted. This is not just the view of the public and policymakers, but that of the banks themselves.

And indeed, the most notable thing over the past year has been the general mistrust amongst banks, and their reluctance to lend to one another. This graph shows a direct indicator of the level of defiance between banks:

Via Mish

-- Initially posted on European Tribune, where we've had many good threads on the financial crisis and the bailout.

The TED spread can be used as an indicator of credit risk. This is because U.S. T-bills are considered risk free while the LIBOR rate reflects the credit risk of lending to commercial banks. As the TED spread increases, the risk of default (also known as counterparty risk) is considered to be increasing, and investors will have a preference for safe investments.

As the FT notes:

As someone on European Tribune noted a while ago, banks started looking at their balance sheets last August, suddenly decided they did not like what they saw, and went through the following process: "We've been wiser than others, so if our balance sheet stinks like this, we don't even want to know what those of other banks look like - but we'll stop lending to them." Interbank lending froze up then, and has never really recovered - it just gets worse at each new seizure of the markets, and the current situation can only be described as critical.

If lenders demand huge spreads for such short periods, they are either tightly constrained in their ability to lend, deeply concerned about the solvency of counterparties, or engaged in predatory behaviour. Whichever of these possibilities is true, credit to the economy will dry up.

This one shows what's happening with euro bank credit risk

Banks are hoarding all the cash they can (avoiding new deals, not renewing facilities that come to an end and would in normal times be extended, and now even trying to find legal - if not necessarily very proper - ways to sneak out of existing commitments), both because they need it for their own basic needs, and because they simply don't trust the risk represented by other banks.

And given that at any time a bank makes a loan to a customer (at least for big corporate deals), it borrows the same amount of money on the markets, the fact that the interbank market, ie where that borrowing part takes place, is frozen can makes it difficult for banks to continue with the lending.

Those that still have access to liquidity are paying an increasingly high price for it (the above represents the price the best banks have to pay - its even worse for most others). Others have to make do with ultra short central bank liquidity lending, but you cannot run your ordinary lending activities (which rely on 3-month or 6-month funds) on overnight funding at punitive rates.

Thus, credit to the economy is drying up. Corporations often had a good balance sheet, and lines of credit that were available to them at good conditions, but these are either used up or expiring as time goes by. They are no longer renewed, and the pressure is building up for companies to start scrounging for cash.

In the financial world, this is bringing about a grand de-leveraging (ie the infamous tide that supposedly lifted all boats is moving out rather brutally, and we're seeing, to mix maritime metaphors, who was naked under the water).

- The players that had low risk, low cost funding, high volume investment strategies are stuck as the low cost bit has disappeared; they have to stop their business; some have come to trouble in the process, but this is a liquidity issue and they might be saved by central bank intervention;

- those that had high risk, low cost funding, high(er) returns are quite dead as the high risks happen to have been (really) bad risks. The disappearance of low cost funding is, to a large extent, irrelevant to their situation.

The trouble is that the two cases are often hard to distinguish, because they are engaging in the same behaviour: they are trying to sell assets: in one case, to reduce their (now expensive) borrowing requirements, in the other to raise cash to plug holes in their balance sheet or to get rid of the toxic stuff.

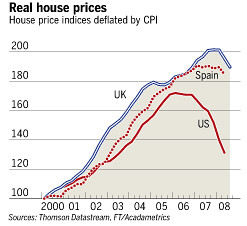

And banks have realised that, in the best case, they belong in the first category (they are highly leveraged, borrowing amounts many times their own capital to lend them again) and, it seems, in many cases they look like members of the second group - and there is no way to know which (and banks often don't even know in which category they are themselves!). rdf provides a good analogy for what financial products look like these days, and how hard it has become to truly understand what they're worth, but what is even scarier is that the underlying assets that underpin all the financial bets made about them are turning sour, as the housing markets continue to fall and the economy grinds down to a halt.

So, while banks have frozen in the fear that they no longer understand what they and their colleagues have been doing, their core assets are turning bad and, in a chain reaction, will pollute all the financial bets made on them, ensuring that the banks' current fears turn to reality.

from an earlier Martin Wolf column

Banks are paralysed because they don't know how much bad stuff they have. Can it be better when they know that they really have a lot?

Thus the Paulson plan is unlikely to help much if it does not deal with the assets at the bottom of the toxic waste pile: not even the mortgages, but the houses themselves. The only way to do this would be to actually buy the houses, to prop up their prices, but this would cost rather more than $700 billion, and would bankrupt, for real, the government.

Fundamentally, house prices are out of whack with any realistic capacity of people to pay for them, and these must converge again. Apart from falling house prices (and the ensuing collapsing house of cars built on top of it), the only way to do this is to increase incomes - not those of people that own several homes, but rather of those that are trying to own one.

The bottom for houses, and for the banks, & nbsp; which fundamentally ride on them, will be reached when incomes - for the majority, not for the few - catch up with them. Governments should work on that, with simple ideas:

- re-regulate labor markets, in particular with increases in minimum wages, and with actual enforcement of existing rules;

- launch a massive public investment plan in, for instance, public transport infrastructure, housing thermal insulation and renewable energies;

- make banking boring by limiting leverage and eliminating banks that are "too big to fail";

- and increase marginal tax rates significantly to pay for it all.

Who knows, it might save a few banks - and investors - along the way. Note: I also made a proposal elsewhere for a National Investment Bank. To those who ask why we write about the banking crisis on TOD: a response is that the good policy answers are surprisingly similar to those for the energy crisis, whereas the easy political answers to the financial crisis are likely to make good energy policy that much harder.

I would argue that there is an additional connection to the energy situation. The higher price of fuel and the resulting higher price of food are making it more difficult for individuals to pay back their debt. These individuals have less discretionary income, and this reduced discretionary income leads to more defaults on business debts.

Governments can re-regulated labor markets and launch massive public investment plans, but they will need to keep ramping up their efforts, as oil becomes more and more scarce, and people spend an increasingly large share of their incomes for smaller amounts of energy.

Gail what a lot of people don't understand is that this huge debt pyramid probably represents 70% of our world economy on a per dollar basis while the real economy i.e manufacturing food etc only represents 30% of the world flow of money either in cash or debt.

However this 30% is responsible for producing enough goods to pay the interest and some of the principal on the debt economy. Monetary inflation is used to hide this massive imbalance.

I'm sure your aware that the debt economy is leverage 10:10 - 50:1 what this really means is at best every ten dollars of debt generates 1-2 dollars of real product annually thus my generous 70-30 split.

Now where peak oil comes into play is to manage this ever growing debt pyramid the real economy has to grow enough to pay interest and at least a token payment on principal. Peak oil subverts this and the real economy becomes focused on it main purpose i.e producing goods and services to survive this year this month or this week.

The real economy i.e staying alive has become a margin account in a sense for the bankers.

It used to produce 105 dollars for every 500 dollars of debt and 100 dollars of money now it produces 99 dollars for 105 dollars of real money and 1000 dollars of debt.

What peak oil has done has shifted this 100->105 to 105->99 this small shift has eliminated the ability to pay interest on debt and the debt pyramid comes crashing down.

Now for people that think this means cheap oil from demand destruction I have to ask why ?

All I see for some time is that people will default on debt because the other half of the equation is that the profits from the real economy where primarily used to pay debt to the tune of 10:1 i.e for many people 90% of their net income went to debt payments. As they default they can readily pay the negative balance for energy and food.

Look around you.

Right now you see banks losing trillions of dollars yet the real economy shows unemployment up by 2-3% durable goods down by 5% etc well in line with the effects of peak oil. Certainly long term the collapse of the debt pyramid will start taking out businesses and lowering wages but until people are spending say 50% of their income on living expenses not servicing debt then the real economy will chug along. The debt economy will be blown out well before then but so what ?

Seriously its just bankers being taken out and people with long term debts like mortgages.

Big deal I mean seriously who cares ?

For the little people its only people with mortgages or expensive cars or lots of credit card debt that eventually will default but its not the end of the world. Our much smaller real economy will chug along and the will get jobs producing real goods and services and pay whatever they have to to stay alive all they won't do is take on massive amounts of debt.

And of course we don't really need that many bankers at this point. Checking accounts and simple savings accounts work just fine for everyone people and businesses.

Yes I agree with memmel. It sounds cruel, but the right thing to do is to let more banks fail and more people lose their homes. There is over capacity in both housing and the financial industry.

Where investment is needed is the energy industry. Bailing out bankers and home owners will reduce the capital available to the energy industry. Where it is needed most as we are at the beginning of a serious energy crisis.

Of course this is exactly the opposite of what the government is preparing to do. It might be a good idea to prepare for some serious hard times now.

Increasing stocks of vacant housing deteriorating while the number of homeless grows. Not a very pretty picture and to my mind not a very rational outcome.

That's not what I'm advocating.

There's a surplus of housing. Let the prices of houses collapse. Then even poorer people can afford them and there's no need for a growing number of homeless people.

It's the government that has made house prices artificially high, and is trying to keep prices high with their bailout proposals.

The gov could buy defaulted houses and rent them to the needy. In the UK there used to be a huge social housing program. It sort of worked. If it had a weakness, it was that local councils [who administered it] also had a duty to house the homeless, so bad neighbours were always housed somewhere, rather than being shipped to the colonies etc. Same problem with US 'project' housing I suppose.

Then Reaganomics arrived..

The way I see it, the problems are that the vacant houses (and houses in general) are really big - much bigger than is appropriate for an average family.

I have a two-pronged solution for this.

1: Eliminate laws on minimum lot and house sizes and gut the laws against how many people can live in a house (100 sq. ft. per person seems like a good legal limit).

2: Have the government buy up a small number of houses and convert them into apartments (perhaps half a dozen low income units can be made from a single 3,000 square foot house). Transfer a substantial amount of money to the local government to pay for the extra infrastructure needed (larger water lines, more power plants, more telephone lines, etc). Finally either rent them out directly to the public or have them go condo with the stipulation that no one can simultaneously own one of these condos and any other piece of real estate at the same time.

I think you will see better results in having a single-family own the home and rent out bedrooms - the traditional boarder model. Though rarely seen today, this model still exists to a small degree, and certainly a converted bedroom, gameroom, or such could include a kitchenette, and have a private entrance.

I know, having rental properties myself in "owned" neighborhoods, that the owner-homes are much better taken care of than rental homes by the tenant (and maintained by the owner versus the landlord). Aggressive HOAs will fight any plan to revise usage, but the bigger problem is perception. These sorts of properties would do fine in a campus-area of town, but nobody wants to be the first to try it in an upscale neighborhood.

There are still many duplexes, though, and even dividing a house in half would work for many smaller families or single people. I'm encouraging my kids to buy duplexes as their first houses, and rent out the other half at a profit to reduce their expense. It's readily possible here, at least.

"There is over capacity in both housing and the financial industry."

I find this a very strange idea with respect to housing. The best sense I can make out of it is that you mean there is over capacity to support the current price of housing. But if you consider that the cost of housing is likely to return to its historic trend line (and below by way of over-correction) as I do, then the idea that capacity should be reduced to stabilize prices at an inflated level is rather wrong-headed. I suggest there is lack of recognition of just how much of a bubble we have in housing.

I mean there has been a misallocation of resources. Too many home builders and investment bankers, not energy production, not enough hi tech companies working on break through energy production technologies.

Perhaps we are in agreement on this point.

We do agree on many of the dynamics. You're way of stating misled me. What I see from my perspective is a shortage of housing. If it were not so I could be buying a house rather than building my own. As owner-builder, I suffer greviously from govenment regulations but see them as part of the vested commercial interest's way of increasing their profits. Government is merely their servant.

For quite some time now, the household size in the US has been getting smaller. This is one of the big drivers of demand for more housing. Fewer people in larger houses, the affluent suburban dream, is not consistent with peak oil. It's hard to imaging household size getting much smaller - rather, as economic times get tougher and more people choose to live with their family or friends for longer periods of time, it will take even longer to work through the excess housing inventory that sparked the credit crisis.

Go Memmel!

Pull the plug on the crooks!

Go for the throats of the fat thieves.

(see down-south's yestyerday excellent

review of Roosevelt's second term.)

Then return to our instinctive ?

compassionate care for the

unfortunate and suffering.

best hopes for a new paradigm!

sydney

The easiest way to create compassion is to localize.

The village idiot

The town drunk

These may sound like cruel phrases to us but actually these people who are losers if you will for one reason or another are still considered part of the community. If you localize you actually know these people as people and what there problems are and you can give them the right amount of tough love. Anonymity is the biggest problem.

Jesus said the poor will always be with you but the saddest part is now in the US you don't even know their names.

Memmel

Well said, here in NZ our state agencies are scarily Orwellian, we have WINZ (Work and Income NZ) which administers unemployment, sickness, disability etc benefits) and they have 'clients', named such that even though you are living on the benefice of the state you feel no personal obligation.

Even when dealing with the IRD (Inland Revenue) we are referred to as 'clients', which I object to, I am a citizen and a taxpayer, and as part of society these are my obligations, I am not a 'client' which would imply free choice.

Neven

Look, any economic system that is based on interest-based debt is destined to fall. Its because in a pure interest-based debt that is one without bankruptcy protection for the borrower the capital never decrease it always increase regardless of increase or decrease in economy. This result in concentration of wealth in a few hands and illiquidity of money. That is what caused Great Depression.

Rosevelt, Keynes etc delayed the fall of interest-based economic system after the Great Depression by these four methods:

1) Paper currency without gold backing which allowed govts to print money on will which result in eating up people's saving that is recirculation of wealth and decreasing the speed the wealth was concentratin in a few hands.

2) A growing economy especially during and after wwii, the growth in economy ofcourse cannot happen without an increase in net energy consumption by economy.

3) A larger role of govt in economy through higher taxes and more govt expenditures especially in defense, research, space programs etc.

4) The bankruptcy law that allow borrower to default on his liabilites hence saving himself from pressures of lenders and after reaching point zero may start again.

Due to decline in net energy consumption since 2005 the 2nd method is no longer working. The net energy consumption of society is decreasing because while amount of fossil fuel used in economy is at plateau the energy cost of extraction of the fossil fuels is increasing. Imagine what will happen when the energy production itself start decreasing.

When net energy available for society decrease economic activities decrease which result in contraction of economy. This means the growth that was providing the interests on debts is no longer available. Now the business have to actually cut their working capital to pay the interests. Ofcourse cut in working capital result in less goods and services produced by economy that compound the contraction of economy.

The 3rd method of larger role of govt can also no longer be effectively implemented because the govt of usa itself is technically bankrupt. Remember the technical definition of bankruptcy is when you are unable to provide for your liabilities without taking further debts.

The 4rth method is implemented and is the result of banks becoming bankrupt. This lock and reduce the amount of capital in economy. Many new business can't be started because the capital from banks is no longer available.

This leaves the america to the 1st method. The only method available for usa govt. Just print money to increase liquidity in economy. This ofcourse through inflation eat the savings and hence redistribute wealth and reduce the concentration of wealth. The issue is that this method by increasing inflation make dollar as valueable as toilet paper which enforce arabs, chinese and japanese to fire-sale their dollars and stop lending to usa govt. In addition with affects to economy this policy will bankrupt the usa govt, it would not be able to continue supporting such a hugh army and wars. That is a dangerous policy for usa when it has created so many enemies.

If you look at the bottom of this you can find that the root cause of the financial crisis is the interest-based debt. When you lend 100 dollars to someone and demand 105 dollars in return regardless of profit or loss and regardless of rate of profit you are robbing and taking what is not yours. The right way is to invest in business and share both the profit and the loss and your profit rate must be in proportion to the profit rate of the business. It means if you lend 100 dollars to someone and profit is of 2 dollars you can take 1 dollar of the profit if you and the borrower had agreed to share equally in profit. If there is a loss of say 2 dollars then your that is the lender's capital reduce along with the reduction of capital with the economy.

How will you treat a person in a community that want to share in good but not want to share in bad. When there is a party in your house he come to eat but when you are in trouble he distance himself from you. Interest-eating lenders are even worse because they would still expect party dinner at the expense of the business which is going in lost.

So, if you want to save yourself from this and all financial crisis in future you have to adopt the policy of sharing both the good and bad.

Well said, WFP.

I Second Dragonfly41's sentiment. The more postings from those in other cultures/habitats-->the better to hopefully promote Asimov's Foundations + Optimal Overshoot Decline. Seriously, Please post anytime WFP.

totneila,

Can you expand on what Asimovs Foundation has got to do with anything? I got hooked on Asimov through the Foundation series and I never really saw it as a realistic model for any sort of Earth bound political economy. I mean we don't really have a Second Foundation bunch of psycho-historians in the background manipulating us all towards some sort of pre-ordained Nirvana do we? (you may know more than me). I'm not sure how you are thinking but I am curious as to what you think the connection is?

In 1933 the M2 money supply in the US was $32.2 billion. Today it is $7,712.9 billion, a 239.5 times increase. All this money except for coins is bank debt (Federal Reserve notes, checking accounts, savings accounts, etc.). If you have doubts about this, look at the liability section of any bank's balance sheet and see what you find. Because production increased over this time frame, driven largely by available energy, prices did not increase as fast as the money supply, as these extra goods moderated prices as the supply/demand equation played itself out. Now that we are facing reduced energy supplies, production, as you say, will contract. This alone would cause prices to increase, but add on top of that continued increases in the money supply and the effect should be quite noticeable.

The majority of this money was created either by printing press or bookkeeping entry and loaned out at interest. The banks love the system because it results in a huge transfer of wealth out of the economy into their pockets. Governments love it because it provides a ready source of loans for them when they can't tax directly. The public loses because the increase in the supply of money causes prices to go up, and interest repayment requirements transfers wealth out of their pockets. I think that were we using honest money like gold which could not be easily inflated, then interest payments on loans would not be detrimental to the economy, since something of real value would have been exchanged and compensated for, but interest payments under the present system are detrimental.

This is not free market banking; there is rigged market banking, so don't blame this on the free market, as many tend to do. Some of government intervention in th economy is stupid, but well intentioned. This money system was deliberately implemented with the intent of granting privilege to the bankers, and had malevolent intent. Essentially it is just a slave system.

Where, and how, could there ever be this mythical "free market?" All markets would seem to be constrained by the will of the major participants in that market-- or is my concept of markets completely wrong?

Free markets are markets controlled by a balance between buyers and sellers acting without external force. Major participants get to become so generally because of government interference to give them advantage. There have been very limited examples in history where an industry has come to domination simply from competition, and when it has happened it has been beneficial. The domination of the aluminum industry was a classic example where the dominant force maintained its position by doing such a good job, without government granted privilege, that nobody could effectively compete.

Where you see a major participant or group dominating a market, look for the black hand of government.

"Major participants get to become so generally because of government interference to give them advantage. There have been very limited examples in history where an industry has come to domination simply from competition, and when it has happened it has been beneficial."

As I understand it, there are such things as "natural monopolies", that is, markets that are so small that more than one or a few (oligopolies) producers simply wouldn't be able to generate enough income to cover their costs. Alternatively, they may have such high barriers to entry that established companies can effectively prevent potential competitors from joining the mix. Furthermore, businesses don't want to be in competition with each other b/c it often cuts into their profit margin, so many companies routinely try to buy out or put their competitors out of business (e.g. hostile takeovers, bidding wars, consolidation, etc., often financed by easy credit). Companies *want* to be monpolies (or monopsonies, in the case of Walmart)! Please don't take it as antagonistic, but saying that all monopolies are the hand of government puts the cart before the horse (who do you think pays for the political campaigns?).

Finally, many markets have a distribution (often power-law) of players, with a very small number of very large companies, all the way through to a very large number of very small (possibly single-person) outfits. Mark Buchanan, in his book "The Social Atom", notes that this is the case for both size and duration-of-survival, so that, for example, the number of companies in a given industry of a given size/age falls off rapidly as a function of size/age. Power laws seem to be very common in both human and non-human systems. Another example is the size of rivers, streams, rivulets, etc. in a given watershed (very many small rivulets -> very few large rivers). In human systems, it would make sense that different rule-sets can alter this distribution curve, but I'm not sure to what extent as I haven't studied this enough yet. However, this is a far cry from saying that all monopolies are the product of evil government...

A free market is one in which buyers and sellers have no power to coerce each other to agree on some price(that includes sellers not colluding to fix prices and consumers not pressuring politicians to have price controls; subsidies...), allowing the price to settle towards the intersection between supply and demand.

There's nothing magical about them and they're certainly not perfect; but they are a good enough tool that people trust them with their life, every single day(e.g. most people are willing to live in a city without more than a few days secured access to food, trusting greedy profit-maximizing capitalists to keep bringing in a veritable mountain of food every single day at an affordable price).

The reason OPEC has repeatedly failed to control the oil price to its liking is that there were enough players in OPEC that any one player increasing their oil production would not have a huge impact on the price of oil; as a result the incentive to "cheat" and sell more oil became too strong(gaming the system with dodgy reserve numbers in this case) and the attempt to control the oil price eventually collapsed.

Come on. People have no choice. There is no way all the people now living in cities could live near farms, much less operate their own farms.

This is the meaning of "overshoot." We have too many people for the land to support. We have to trust the food system because it is the only way the vast majority of us can obtain food.

If people start to have small gardens, the situation will be improved, but not by very much.

One bright spot is that right now Americans eat way too much. On average, we can reduce our daily calories and wind up healthier than we are now.

That's not the issue here. Farms have all the labour they need to produce enough food for everyone using less land than 50 years ago in both the US and Europe even though people are eating way more grainfed meat and we have all this food-to-biofuel sillyness(a result of subsidies which distort the market).

It incurs almost no cost to keep a few weeks of dry food like pasta, baked beans, dried rice, frozen meat or potatoes just in case. This is food you'll eat anyway; you're just letting it sit on a shelf or in a freezer for a few more months before eating it, reducing it's nutritional value by a tiny amount. Very few people bother even with such a simple precaution, which to me is a strong indication that they're not concerned about food security.

People could say hey, free markets are fine for television sets and other toys, but this is life and death and I want the means of food production to be publically owned in a soviet style command economy.

A few thousand people could easily get toghether and share the cost of buying farmland, machinery, fertilizer, labour and share the resulting produce to have an ensured supply of food; but they don't.

People could call for the government to keep an emergency store of rice or grains in each city. They could call for far-reaching price-controls or other distortions in the free market.

Land isn't the limiting resource here at all. We can easily support the number of people we have with the land available; billions more if we stop wasting so much land on meat production and turning food into fuel.

The limiting resource is energy. Even in the case of phosphorus or other mineral resources; as long as you have the energy and technology to do so you can keep mining ever more marginal phosphorus ores and keep recycling phosphorus with ever greater efficiency.

If you have less energy available you're forced to economize on energy to the detriment of land and labour.

Well, it would cost you as much to transport 15 MJ of rice energy as it would to transport 1 MJ or cabbage energy. For price sensitive people that will mean cabbage(and carrots, lettuce, cucumber, tomatoes, broccoli, turnips...) are off the table unless you grow them.

People in cities have better access to railroads and ports.

This is very persuasive, WFP. Are you describing a "Koranic" financial system, in which interest is prohibited?

If so, it would seem like any lender would, in effect, become a "partner" in any business enterprise he lent money to. Under at least U.S. rules governing partnerships, the partners bear equal liability up to the limit of their entire assets, no matter how small their investment.

That would seem to be a major inhibitor to business in a non-corporate, non-interest financial system.

Yes I am describing the quranic (not koranic) financial system in which interest is strictly prohibited. Infact its warned in quran that if you still take interest on your debts get ready to have a war with God and his prophet. Since everything belongs to God when you fight with God you fight with everything including yourself. All interest based economic systems are characterized by continuous warfare and new, complex diseases (fighting with yourself).

If you give money to someone to start a business there are only two rightful ways in this matter. First ways is to not share in profit and loss and set some time when you want your money and all of your money back without any addition or subtraction, means you neither takes any interest nor share in loss. Second way is to become a partner in business in which case you are no more a lender but a sharer in both profit and loss, you may increase or decrease your money depending on business getting a profit or getting a loss.

Western (european and american) financial system do support the borrower in case of a huge loss when he is unable to pay back the debt and interest due to complete loss of business through bankruptcy law. If business has a loss and borrower is unable to submit installment of interest and debt the best strategy for lender is to give the borrower sometime to recover and then get the debt, the interest and the interest on the delayed interest back in this financial system.

Without going into much debt one can still see the drawbacks of the interest-based debt. The lender is only sharing in the good, the profit and shielding himself totally from the bad, the loss. The business is pressurized to not declare itself bankrupt because if it do so in addition of embarrassment it also get bad credit rating which eliminate any chance of borrowing further. Thats why all businesses try their hardest to not declare themselves bankrupt hence kept on feeding the vaults of the lender.

I've also read about this and actually this style of financial system was commong in Western Europe where interest was forbidden. Its one of the reasons that Jews engaged heavily in the banking system since it circumvented the Catholic Church. The Sultans in the east played a similar game.

The real power was of course the kings and merchants who could then use debt to expand by trade or conquest and when the house of cards came tumbling down as it must the wicked jewish bankers where driven out their gold confiscated and the process started anew.

Now that religion is not such a factor the names change but the process stays the same now instead of jews we have the wicked short sellers and energy speculators to blame for all our troubles and of course those dirty immigrants taking the high paying jobs cleaning toilets in McDonalds from the God fearing Americans.

I'm not writing this to be racist but to point out the parallels with today and the pompgrams of the past.

But yes the answer is of course for lending money to become part of the business cycle and you share in the upside and the downside. Then everything tends to work out. Certainly money can and has been injected if real growth is happening.

Thanks Pakistan--

Personanlly, I can only agree with the system you describe, but of course, it is not adapted very well to taking over an entire continent, eradicating the native population, and turning the rivers, the forests and the land itself into money. To do that in any kind of human timescale you need to use the leverage of compound interest.

The proof of that is fairly obvious -- Native Americans lived here for 25,000 years or more, and the Columbia River was teeming with fish and the forests were majestic. Two hundred years later, the place is becoming a slum.

Quranic law would seem to create partnerships to do business deals. There are, of course, partership business models in the U.S., but the serious problem problem of liability

No one, even in Pakistan, lends money for free. They may not receive 'monetary' interest, but do get repaid via social contracts, reciprocal altruism, status etc. It is a cultural phenomenon, and probably one much better suited to finite energy than the fiat monetary interest system we have in the West, but don't kid yourself into thinking the money-lenders provide others with loans out of the goodness of their hearts...

The discussion here is not about lending for nothing or in some mere hope of some altruistic return. It's just the difference between raising money by taking out a loan or by selling stock. Loans are generally at fixed interest - the lender doesn't usually share in the risk. Whereas the return to stockholders is not at all fixed - the stockholders share in the risk of the enterprise.

It's really not embarrassing, especially if it's as a result of a failed business rather than going bankrupt as an individual due to profligate personal spending, and the credit rating effects are also quite minor. This is because banks recognise that businesses often fail and are working on the basis that some proportion will fail. A much bigger problem is if a person's history suggests they're a useless businessman rather than a technical credit score.

To my mind there's advantages and disadvantages to interest bearing loans vs "having partners". If I have an interest bearing loan that represents essentially the time-value of money plus profit, then I just have to pay back the money on time, I don't have to give someone a percentage of a business or let some capital providing idiot partner interfere with the running of the business. The disadvantage is, as you say, the loan requires repaying regardless of if the businesses underperforms.

I think the bigger issue with monetary interest is that there's no inherent limit in the financial system to the amount of "expected future money/productivity" I can "move" into the present, but resource depletion suggests there'll probably be a tightly limited amount of future productivity.

Good stuff, Wis. Keep posting. The idea of debt-forgiveness jubilees and Islamic-style interest-free lending are beginning to get some notice in the West now, as the current financial-plus-resources disaster screws up Western-style BAU, probably for good. These wiser ways of handling debt have proved workable in many places in the past. Probably the old railings against lending at interest, when that began to take over, were right, from the start.

A balance in the karma of all things, including lending money, brilliant.

I recognize the proposed method of financing as that used by the merchants in the Middle Ages, and earlier, when undertaking risky and distant journeys by land or sea. the Prophet Mohammad incorporated it into the Koran holy book, I am given to understand. His wife was a very rich and successful trader and so he must have known all about this method of financing risky ventures.

Undoubtedly this method of finance has a lot to be said for it - especially because of its simplicity. Indeed, venture capital is often quite similar in structure.

However, the various Italian merchants/bankers (Genovese, Venetian and Florentine) of the Middle Ages went ahead with more advanced forms of financing trade and that is partly why they did so well - until the Portuguese managed to bypass the Middle East and circumnavigate Africa.

In the same way that physical capital can accumulate - the number or ships, camels, bridges, factories etc. - interest on loans can also accumulate. I have no problem with that. You can even borrow gold and repay it with interest (in gold). It has always been so. Obviously, the interest rate in this case is much lower than would be the case with paper money. Mines that have yet to produce gold frequently borrow gold from banks on the understanding that the gold will be repaid with interest once the project is producing gold. These mines sell the gold to buy machinery and labour.

There is no uniquely correct way of financing investments - all of them can coexist. Obviously, gearing your capital by 30-60 times as so many prominent banks have been doing (and are still doing) is not a smart way of doing things.

European banking on borrowed time

Just a week or two ago, I got my hands in a piece of research that says that the 70-30 split you talk about is in reallity near 90-10. It was printed, but on a widely circulated brazilian magazine (Veja).

If by cheap they mean "low nominal price", than yes. But that doesn't make it affordable. So, while I agree with you, the people who say that oil'll get cheap will be able to say that they are right...

Exactly in line with the efects of peak oil, but it may not even have happened yet! We seem to be in a bigest economical overshot than I was thinking (or peak oil already hitted because of EROEI and we don't know it?).

I think that's correct. We are on a plateau of oil production, but we know EROEI is declining. I'm convinced net energy peaked in 2005, or maybe even a bit before. Some of it is being masked by "stealing" energy from natural gas, but some of it is hitting home. All the while, people are looking at raw production numbers and saying, "Look! We pumped 52 barrels more than in 2005, so we're not at peak!"

Per capita we probably peaked on net energy way back in 1980 the inflation of fiat currencies has succesfully hidden this for almost 30 years which is very impressive in and of itself.

Technical advances also helped hide this. But I forgot where I read it but not one Airline has ever been profitable long term not one in 100 years of flight. Zero zip nada.

And believe it or not even high tech companies such as Microsoft look to fall into the same fate eventually becoming unprofitable and failing even as the original founders of the company are still alive. Its not clear that any software company or compute hardware company will actually survive longer then the people that created them.

This may sound crazy and people my object but lets see how the next ten years plays out I suspect you will find out I'm right. I'd be really surprised to see Microsoft post a profit in ten years.

So overall a lot of our high tech has not really accomplished a whole lot and has yet to find its stable point if you will.

I'm not saying it does not exist but I think people will be surprised in twenty years at the role that technology plays in our future in a lot of ways it will be less than today but also in some ways more I suspect its use will be focused on where it adds real value and not the reckless investment in technology that we have seen to date that offers no sustainable gains.

So probably once the US became a net importer of oil this vast flow of energy in to a fiat based misallocation of resource resulted in decling global per capita energy usage and wealth concentration. I think Nates posted some of these graphs.

http://www.futurescenarios.org/content/view/51/73/

What happened in 2005 is that the total decline in net energy finally reached the point that it effected the wealthy nations who simply started paying more for energy. Physical peak of the underlying natural resources dramatically aggravated the decline and made it visible to the rich.

Look, any economic system that is based on interest-based debt is destined to fall. Its because in a pure interest-based debt that is one without bankruptcy protection for the borrower the capital never decrease it always increase regardless of increase or decrease in economy. This result in concentration of wealth in a few hands and illiquidity of money. That is what caused Great Depression.

Rosevelt, Keynes etc delayed the fall of interest-based economic system after the Great Depression by these four methods:

1) Paper currency without gold backing which allowed govts to print money on will which result in eating up people's saving that is recirculation of wealth and decreasing the speed the wealth was concentratin in a few hands.

2) A growing economy especially during and after wwii, the growth in economy ofcourse cannot happen without an increase in net energy consumption by economy.

3) A larger role of govt in economy through higher taxes and more govt expenditures especially in defense, research, space programs etc.

4) The bankruptcy law that allow borrower to default on his liabilites hence saving himself from pressures of lenders and after reaching point zero may start again.

Due to decline in net energy consumption since 2005 the 2nd method is no longer working. The net energy consumption of society is decreasing because while amount of fossil fuel used in economy is at plateau the energy cost of extraction of the fossil fuels is increasing. Imagine what will happen when the energy production itself start decreasing.

When net energy available for society decrease economic activities decrease which result in contraction of economy. This means the growth that was providing the interests on debts is no longer available. Now the business have to actually cut their working capital to pay the interests. Ofcourse cut in working capital result in less goods and services produced by economy that compound the contraction of economy.

The 3rd method of larger role of govt can also no longer be effectively implemented because the govt of usa itself is technically bankrupt. Remember the technical definition of bankruptcy is when you are unable to provide for your liabilities without taking further debts.

The 4rth method is implemented and is the result of banks becoming bankrupt. This lock and reduce the amount of capital in economy. Many new business can't be started because the capital from banks is no longer available.

This leaves the america to the 1st method. The only method available for usa govt. Just print money to increase liquidity in economy. This ofcourse through inflation eat the savings and hence redistribute wealth and reduce the concentration of wealth. The issue is that this method by increasing inflation make dollar as valueable as toilet paper which enforce arabs, chinese and japanese to fire-sale their dollars and stop lending to usa govt. In addition with affects to economy this policy will bankrupt the usa govt, it would not be able to continue supporting such a hugh army and wars. That is a dangerous policy for usa when it has created so many enemies.

If you look at the bottom of this you can find that the root cause of the financial crisis is the interest-based debt. When you lend 100 dollars to someone and demand 105 dollars in return regardless of profit or loss and regardless of rate of profit you are robbing and taking what is not yours. The right way is to invest in business and share both the profit and the loss and your profit rate must be in proportion to the profit rate of the business. It means if you lend 100 dollars to someone and profit is of 2 dollars you can take 1 dollar of the profit if you and the borrower had agreed to share equally in profit. If there is a loss of say 2 dollars then your that is the lender's capital reduce along with the reduction of capital with the economy.

How will you treat a person in a community that want to share in good but not want to share in bad. When there is a party in your house he come to eat but when you are in trouble he distance himself from you. Interest-eating lenders are even worse because they would still expect party dinner at the expense of the business which is going in lost.

So, if you want to save yourself from this and all financial crisis in future you have to adopt the policy of sharing both the good and bad.

"When you lend 100 dollars to someone and demand 105 dollars in return regardless of profit or loss and regardless of rate of profit you are robbing and taking what is not yours".

I say bullshit.........

Is there any interest on your money placed in a bank?

Are there any stock markets?

Who finances research and development?

Where does charity go in your ideal world?

Are all forms of gambling disallowed?

Could I lend money to a person requiring an urgent medical procedure, or do people in urgent need, beg for charity?

If you think that financiers do not participate in risk, why are they now going bankrupt?

You have so much wisdom, I wish you were around to design the financial system which took us into the twentieth century.

So do I.

Why should there be? Why should you get money for nothing? Even so, if there were, why can't the interest be paid by the money being invested in companies or stock rather than fractional lending?

Do they require fractional lending? No. They can be run as simple exchanges where stocks are bought and sold, period.

Why does that require usury?

See above. Why can't charity be giving work? Providing a meal? Like it used to...

To repeat...

Why does lending require interest?

Cheers

You are one dumb turkey.

Memmel said - "The debt economy will be blown out well before then but so what?"

The problem as I see it is that the "debt economy" and those loosely affiliated with it employs a vast amount of people. A huge percent of computer tech, soft and hard, only exists in support of the debt economy.

Indeed the surplus energy that is dwindling away supports huge numbers of relatively useless jobs.

I suspect that massive unemployment is going to be a much bigger problem that anyone is accounting for.

Unemployed people can't pay a mortgage so you get a jump in forclosures.

And around and around it swirls around the bowl

around the bowl!

Hey Soup. Yep. Overlap into the 'real' world is a biggie. I believe our fearless leaders just got a short course from Hank and the Fed. on just what that implies for our prospects going forward. Interesting that when asked about voting for the rescue plan even Johnny Mac gave a crisp "sure" last night in the debate.

The prospect of an impending 'sovereign downgrade' for all financing US in the not too distant future means , I think, a case of when you have them by the short hairs their hearts and minds will follow even it it means political suicide.

W/o the debt economy the taxes fail and Washington is left w/o a hell of a lot to administer. Somebody maybe informed the presidential prospects just what 'winning' an election under those conditions might be like.

Whether the Chinese lend more to our banks or buy more Federal debt may not matter much in prolonging the swirling action's eventual outcome. But it may get it passed Nov. 4. I think Congress is pushing hard now to get a 'hanshake agreement' before the Asian markets open tomorrow to forestall that downgrade and all it entails.

Ah ha...now I know why Obama and McCain were giving such wimpy answers last night. They want the other guy to win. Neither one can just quit outright and save any face, so they are both trying to look incompetent so the other wins. Ingenious plan, except they both know what the other is doing and will require sequentially more insanely stupid moves and statements. Good luck and may the best man lose.

LOL! Recall the Matt Simmons interview where he said, "I would start crying if I found out that I was President in 2009."

hmmm,

so that's why Palin was selected as VP candidate?

Best of luck,

Seppo

"I believe our fearless leaders just got a short course from Hank and the Fed. on just what that implies for our prospects going forward."

I wonder if the expression "Going Backward" will ever come to be applied with regard to our future prospects?

I think the problem is that there are a lot of tie-ins between the real world and the financial world.

For example, the some of the oil industry uses debt to finance payroll. If they lose this ability to obtain additional debt, they cannot hire the oil workers. This is probably not the oil majors--it is more like the many servicing companies that are involved in the process. But the problem is that even taking out some of the servicing contractors could mess up oil production. On the API call yesterday, this problem with debt was one of the issues Red Cavaney highlighted.

Another example is in the electricity. Most electric utilities buy at least some of their electricity from other countries using the grid. If these electric utilities do not have adequate credit, they will have to depend on what they can generate themselves. I would expect that some of them also use credit to buy fuel such as natural gas and coal. If their credit lines get cut off, they may not be able to purchase fuel.

"I think the problem is that there are a lot of tie-ins between the real world and the financial world."

It's everywhere!

See Totonielas post on food production and finance.

McDonalds getting cut off. Corporate America comes to a screamming halt without rolling over debt.

How did we get to the point where nothing functions without debt?

I have been involved in dozens of startups, many were killed by the finance element or VC's, many were able to succeed only because they stuck with friends and family funding. Yes it means a slower build but the fun stayed in the project much longer and everybody involved profits.

What none of the articles and editorials about interbank lending mention is how the interbank lending mechanism actually works. Consequently, people can't formulate any idea about solutions ... to what are basically three problems.

Let's look at the easiest, first:

When banks lend to each other it is not a 'plain vanilla' transaction, where 'Bank A' lends $50 (million) dollars to 'Bank B' for six days or six months. Instead, the cash flows of banks - as well as those of large corporations - are sliced and diced and recombined. Parts of commercial paper, floating rates of deposits in checking accounts, fixed returns from corporate bonds ... etc. etc. are de- constructed then reformed into Frankenstein securities. These are then exchanged. These transactions can be all lumped together under the rubric of 'interest rate swaps'.

Banks and companies use these swaps for many reasons; to gain some cumulative yield in a poor environment for returns on money, to manage risk by 'innoculating' swaps by including bits and pieces of government guaranteed instruments, such as FDIC insured bank deposits, hedging currency fluctuations, as well as to avoid the taxman or national capital controls.

There is an immediate similarity to the same kinds of derivatives of mortgages, with the same kinds of problems, with a twist. Many swaps have fixed rate components while the counterparty swap may have a Libor component. The floating rate these days doesn't float so much as plunge up and down; a good swap today could turn into a disastrous nightmare overnight. The 'spread risk' itself is reflected in the spreads as they widen, which reinforces the likelihood of more swaps going bad ... all this in a vicious, self- reinforcing cycle. It is not surprising that there is no interbank lending, even if the banks themselves are good banks with excellent capitalization and prudent management, the interbank market ITSELF is broken and nobody will trust it.

The second problem is related to the first; the market is driving the participants rather than the other way 'round. Part of this problem revolves around the issue of risk management by banks; the idea is to get the Federal Government to stand behind all participants, thereby managing the risk component. Since risk is an expense against yield, managing risk by any means can add some yield to a transaction. The slicing and dicing machine works hard to make sure all interbank lending includes bits and pieces of Federally guaranteed deposits. This is one reason the Treasury is in Congress with hat in hand. The exposure to the 'bad' parts of interbank lending have enmeshed the 'good' parts. As the systemic 'furball' continues, more banks will fail ... and the Federal Government will have to come up with more and more money. The $700 billion dollars can be paid through the 'front door' by the Treasury or through the back door by the FDIC. As part of the 'Creeping Sovietization of the US Banking System' the government is up to its neck in this mess and has been for quite awhile. Consequently, the market isn't managing investment, but wagering on what the government will do next.

Instead of being the 'lender of last resort' the central bank is becoming the lender of first resort. The creeping giganitsm and concentration of economic power in fewer and fewer hands has its own set of dangers that themselves can take the place of any of the problems being discussed here ...

The third and greatest problem that underlies all the economic problems of today ... is the long term decline of yields - the poor on non- existant return on investment. People think of the interest costs of loans to borrowers without thinking for a second about the hidden - and not so hidden - costs of a low return on money to lenders. The biggest cost of low yield is the disincentive to save. The other cost is that low yields make otherwise sane money managers into risk- taking riverboat gamblers. They must embrace risk, otherwise, there is no return on money. Gambling has become the substitute for investment.

Solutions: First is to get rid of the current interbank lending system and return to 'plain vanilla' lending. The current system is broken, the Fed can declare a holiday and unwind existing positions. Congress can do something useful and draft a 'Simplicity and Transparecy in Interbank Lending Act'. This would not cost the taxpayer a dime and would calm the money markets, that depend on interbank lending.

Second is for the government to erect some firewalls between the various markets so the meltdown in one won't destroy all. One connecting thread is the 'implied backing' of all kinds of securities that contain some bit or piece of government- backed security. The Treasury should announce that its guarantee only exists to a security as a whole, to the institute or individual that originated it.

Third, the Fed should raise the discount snd funds rate a lousy- stinking, single, measly point. (One) This would do several things; help rationalize real estate prices (lower and lower still, but that the way it will go anyway); it will diminish moral hazard, it will also demonstrate the Fed has a longer and broader conceptual horizon than the immediate. Raising the rates a point would give the Fed some credibility ... which it lost about this time last year. Slighly higher rates with a slightly stronger dollar would give the Fed more ammunition than would the Paulson Treasury plan, which just prints some more cheap money and throws it at the problem ... willy nilly.

Raising rates a point would also begin the process by which the gamblers and speculators are driven from the markets.

For those who would say that doing so would trigger another Great(er) Depression, I would point out that this is not 1930; our country relies on foreign investors and foreign fuel, it has no savings (the savings rate during the Depression was 12-15%) and many of our productive enterprises have decamped for China and Mexico.

I generally agree with your description of the complexity of the transactions we see these days in the financial markets. The problem is that the vanilla transactions themselves are no longer happening right now. And they are still needed.

One aspect of this situation is the 'regulators' - a concept that is ezpanded to include the financial press - only looks at what it wants to look at. The Libor and the 'Ted spread' only show what they show ... current interbank lending that takes place within a certain ambit.

There would be much non- derivative lending if only that between corresponding banks. There would have to be since without it, the interbanking spreads would be off the charts. Part of the problem is the assumption of an 'ideal' spread, which might have existed before this crisis for a short period, but it may be that a higher interbank lending rate than has been seen over the past ten years is 'normal'.

As for anecdotes from 'persons with interests' (Such as from the Wall Street Journal and the FT) about the lack of lending ... consider the source and what they want; they are the mouthpieces of the markets and the large players.

I agree that the regulators have been asleep while all this nonsense has grown. Part has been ideology and part is that an innovation such as that represented by these securities cannot be put into any context, it's too new. The 'derivatives concept' as it has developed has never really been tested under market conditions before this crisis althought the Long Term Capital Management collapse was a foretaste of the effect of derivatives on both the market participants and the markets themselves.

There have been two recent articles about the derivatives:

http://www.nytimes.com/2008/09/27/business/27charts.html?partner=MOREOVE...

http://www.nytimes.com/2008/09/28/business/28melt.html?hp

I think the hardest recent blow was the collapse of Lehman. It's lending schemes' failure disrupted the short term commercial paper and money markets terribly and caused a run on money funds. This gave Bernanke and Paulson nightmares about everyone that could rushing to close their retirement and money market accounts. If the panic spread from there, the exposure to the losses would be trillions and trillions ... plus all the more derivatives losses.

(BTW, the people are closing their accounts and using the cash to buy gas and pay debts ... :)

One aspect of this crisis that greatly exacerbates the problem is the delay in addressing it. That a crisis lay in the future was apparent several years ago to anyone observing the housing market, the nature of the transactions taking place, and the lack of due diligence on the part of all players - especially on the part of the regulators who should have stepped in long, long ago.

I agree with what you have written and would add that the next stage of this crisis will come when foreign lenders seek a higher risk premium due to a lack of confidence in the US economy. The one point rise would help prevent a transition to this second stage crisis but I don't think there will be such a rise, or any realistic attempt to address and resolve the underlying factors.

Bush has repeatedly spoken of the arab world by way of analogy to the Munich Crisis of 1938. I think he is incorrect in his interpretation and use of the analogy in that framework. But I think it would not be incorrect to say that in regard to the current economic crisis all of the US leaders are trying hard to play the role of Chamberlain. The outcome will not be pretty.

Steve,

Interesting analysis.

Is it necessary that the Fed and Congress intervene in the over night lending process? As the pain from a shut down complex over night market increases, wouldn't banks themselves seek straight vanilla deals from one another out of necessity? Perhaps freezing in the headlights is just an initial reaction, to be followed by self corrected behavior.

Memmel, is this what you are talking about?

Yes its real goods in services I'm not sure what your index is but I suspect its the same as what I'm talking about.

A simple example is producing and selling tomatoes is creating a real good. As you can see real goods have a lot to do with energy quality concepts sunlight and oil are converted to food.

Selling insurance to the farmer in case of a bad crop is not the real economy and as you can see it exists on the surplus of the real economy. The insurance salesman depends on the farmer having more good years than bad. And worse he substitutes for the farmer simply having prudent savings and planning ahead to weather the bad years. Generally this is because he does not have the extra income to save because he borrowed money to buy land to maximize profits.

This of course leads to the ready availability of debt. It does two things it siphons off the real profits and makes people leverage themselves and it as you see creates a large number of jobs that serve no actual useful function.

If the farm had simply saved money then we do not need the insurances sales guy or the banker or the accountant to manager the debt etc etc.

You could go on and on with these type of scenario the key point is that managing money or more correctly debt does not create anything. It looks like it does because it looks at first that the farmer and the banker and the insurance sales guys all have a lot of money on the surface instead what has really happened is a lot of debt has been created and managed. Instead of having a simple savings account.

In nature there is no debt. You can't borrow from future. You can only use what you saved in past. You can't eat the crops not grown yet. You can't slaughter the goats not borned yet. Therefore an economic system based on debt where majority of business is done on debt money is not natural even if the debt is interest free.

If you free the debt from interest there would not be any considerable number of lenders available. The businesses would be done with the businessmen's own money, not the borrowed money. This enable the marginal businesses to keep running too that are making only enough income to keep working and not generating any profit because the load of paying interest would no longer be there. Therefore in times of trouble you would not have that many businesses shutting down. Another benefit is that when a profit is made it would be invested in increasing the business unlike an interest-based debt system where a huge part of business profit go to the vault of lenders who may or may not lend it to business again and may use it in non-productive game of speculation in commodities and precious metals bringing the whole system down.

The core economy is the goods producers, the farms and the factories. We need trade to increase productivity of farms and factories through work specialization but the amount of trade needed is little. In my opinion in any sustainable economic system the trade part would be less than or equal to 20% of the economy.

We need another kind of services too, the public jobs. We need an army and its related weapon building factories and research laboratories but it not need be very large. A 5% economy diverted here is enough unless you are fighting at your borders. We also need services in form of health care and education which should ideally be provided by government. This also not need to be large. A 5% of economy diverted here should be enough. Altogether the govt intervention in a sustainable economy should be like 10% to 12.5%.

With a reduced and natural number of traders and a reduced and more affordable number of govt jobs about two third or more of the economic efforts should be in actually producing something, some good not service, some tangible solid material thing.

If you think about it closely you can find out that to have a good living standard you need more goods and less services, not the other way round. You really don't need that much of marketing stuff going around to convince you to buy a good if the good itself has some quality. You not need people who make a living trying to convince you to buy insurance. You not need that much of lawyers, doctors, nurses etc. You certainly not need bankers in any case.

The sustainable economy should have atleast 70% goods production and atmost 30% services production, not the other way round.

You are certainly correct that the elimination of interest is not a sufficient condition for creating a sustainable economy. In fact one can make a good argument that a properly designed economic system without interest would grow even faster that one that employs interest. If the price of innovation includes paying for rich people's yachts and ski condos then innovation is less likely to occur than if this price were not exacted. The only path to sustainable economic production lies through voluntary simplicity and mutual support. Monetary policy alone cannot fix the problems of our society.

However, it seems to me that claiming that debt has no role to play in a sustainable system of economic production is incorrect. Any time production resources are invested for which the payback time is longer than the time period of the investment, debt is being incurred. If I live in a hunting society and I spend a substantial period of time training a horse I am incurring a debt for which the future productivity of the horse will pay. In complex economies our economic support is provided not only by the output of the current year but also by the output of past years in the form of lasting infrastructure. Unless any new debt (i.e. investments of production resources with long payoff times) assumed in the current year is balanced out by economic services provided by old investments, then the new debt will make us relatively poorer in the current year. However, this true statement is not the same thing as saying that the economic concept of debt has no physical counterpart. The problem that our current economic system is faced with is not the concept of debt, but the belief in everlasting increases in total productivity. It is true that without composite growth private, interest based private lending will not work, and the total amount of debt that society can afford to incur in a given year will be far less than in a growing economy. Debt will shrink as a fraction of the total volume of economic transactions. Nevertheless the concept of debt as investments of production resources with long term payback times will continue to exist in any economic system which whose technology rises above that of neolithic villages.

When the lender is getting only his money back after some time duration, not any addition in it then most of the lenders would stop lending. Therefore very tiny part of business money would be coming from debt. Almost all of the business money would be coming from partners.

If you are living in a hunting society and you are training a horse to use for future hunting you are saving. Once the horse is trained you are using this saving that you had accumulated in past. In no way in nature you can borrow from future. If you could have borrow from future then you would be able to use a horse now and give back a trained horse later in return to your lender once you finish training your pony. Very little number of lenders would be able to lend you a trained horse now to get a similar horse in future, not two or three horses. The lenders would think "what do we get from this?, why not we use our trained horse now ourselves or become partner with a hunter who have the skills of hunting but lack a horse, this way some agreed parts of the increased numbers of hunts can be taken from the hunter".

In a sustainable economic system the capital should decrease with the same rate the economy is decreasing. In a debt-based no-interest economic system the debt remains the system while the economy contracts, this decrease the working capital available to business as they pay back the debt, the decrease in working capital of business further decrease the economy. This feed back loop result in disaster. In a debt-based economic system that do take interest on debt the debt and interest increase while economy contracts, this result in far more decrease in working capital available to business than in a non-interest debt system, since the decrease in working capital of business is higher in a interest-based economic system therefore decrease in economy due to decrease in amount of goods and services produced is also higher.

Problem with interest-based economy is not only that you need perpetual everlasting growth impossible on a finite possible but also that the govt has to increase inflation regularly to decrease wealth concentration in a few hands and illiquidity. Therefore, even if economy is growing and growing fast you still need inflation, this inflation which is simply currency printing give enormous power in govt hand which encourage govt to destroy wealth in non-productive expenditures such as warfare, space programs etc, there is no guarantee that govt will redistribute the wealth it get in its hands by inflation at the right place, that is the businesses. Even if govt is redistributing wealth it get through inflation at right place it only reduce wealth concentration, not stop it, the difference between rich and poor keep on increasing, after every few years you get a financial crisis even before peak net energy.

You do not seem to have understood anything that I said. I agreed in my previous post that private, interest based lending will not work without growth, so why are you explaining this to me again? You are using standard economics jargon and not paying attention the actual content of what I wrote. Personally, I have never been able to make any progress in understanding economics by means of monetary theory. What little understanding that I have of economics comes from thinking in terms of actual material modes of production. Debt has an actual physical meaning which has nothing to do with borrowing from the future (a physical impossibility). Debt means borrowing economic output from the present in return for future economic productivity. Anytime long term infrastructure is created, debt of this physical type is also created. Anytime a factory gets built economic output in the present is consumed and somebody is expecting a future return from this investment. My feeling is that it should be the community who finances large scale investments. Partnerships could easily turn into wealth concentrating mechanisms just as much private lending.

Maybe we are arguing about semantics and I am calling something debt which you do not call debt. Think up a different name for it then, but I assure that some form of borrowing from the present in return for future productivity will survive the fossil fuel age.

Both debt and investment is borrowing from past, that is savings.

Non-interest debt would be scarce because of absence of increase of capital of the lender. This leaves investment as the only practical and sustainable source of capital.

Ofcourse there would be wealth concentration in investment too but this would not continue forever because the investors would be sharing the loss too.

Roger,

I was following Pakistan's line of reasoning and did not get a sense he is not reading what you wrote.

In fact I found his reasoning quite lucid and insightful.

Even with your example, obviously there is a difference between "borrowing" from assets you have right now (like investing labor and energy into training a horse), as opposed to borrowing from future assets (getting a fully trained horse without making any kind of investement, except for a promise to return the horse with interest added in the future).

So, we could say that what you describe as debt, could more accurately be called "saving" or "investing".

When you invest or save, you are using assets you already own in the hopes of future benefits.

When you borrow, you are not using any current assets. You get something for free in the present, only because you promised to pay it back with interest in the future.

The difference between investing / borrowing is when do you pay.

Investing: payment now and benefit in the future.

Debt: benefit now and payment in the future.

Clearly there is a difference here.

With debt, there is no natural limit, except for the amount of risk lenders and borrowers are willing to take. The current credit crisis is clearly a result of debt (or leverage) going beyond reasonable limits.

With investing there is a natural limit, when your net-value equals 0 you can't go any deeper.

I am not sure what distinction you are trying to make. I regard the building of a house as an investment in physical and psychological comfort. The minute it is built and I move in I get benefit from it right way. But if two weeks later a tornado destroys the house, the full value of the production resources invested in the house will never be recovered. A real physical default on a real physical debt has occurred. Even if I had managed to save up enough money to pay for the house in cold cash, someone is going to pay for this debt (probably the insurance company/policy holders). Of course, buying a house that is much larger than I really need and which requires long distance commuting, under the assumption that our current economic productivity and our current transportation are going to last into the indefinite future is probably a foolish choice and greatly increases the risk of default. But even building a small house in a walkable neighborhood involves the creation of a physical debt.

Admittedly consumer credit card debt assumed for the purpose of buying toys is an incredibly frivolous form of borrowing (as is the building of toy factories in an era of increasing human pressure on natural resources). However, if this is the only form of debt that you recognize, then you are using an economics terminology that is very strange to me.

No one ever borrows from the future. Such borrowing is a physical impossibility. All that we can do is invest production resources in the present. You are making a distinction between investment and borrowing, but I think that this is a false distinction. Suppose that a new solar panel factory is built. No matter how this factory is financed, whether in cold cash by a partnership, by state tax money, by a bank loan, or by selling shares of common stock, the real physical cost of the factory is the production resources consumed. If, for some reason, the factory never performs its intended function and never produces anything of value, a real physical default on a real physical debt has occurred.

You might say that we can avoid this situation by using only savings to build new factories, but this another distinction without a difference. Real physical savings are simply economic output that is not used immediately. Somebody has to produce the bricks, the steel, the copper, the concrete, etc which make up the components of a factory. Merely letting these outputs sit around in warehouses for a few years before the factory is built does not change the fact that if the factory burns down before it can be used somebody’s labor goes unrewarded.