How Much Will Gustav and Ike Affect Gas Supplies? An Update.

Posted by Gail the Actuary on September 22, 2008 - 5:20pm

Shortly after Hurricane Ike hit, I wrote an article called Implications of a Ten-Day Refinery Outage. It is a few days later, and we know a little more. The purpose of this article is to give an update on the situation.

Based on what I am seeing now, we are likely to see significant gasoline outages in the next few weeks. These may not be as long-lasting as those with Katrina, but they may temporarily be more severe, at least in some parts of the country. Diesel may or may not be a problem. We are an exporter of diesel, so can theoretically reduce exports if need be. Also distillate (used for diesel) supplies are currently at a more adequate level than are gasoline supplies. Jet fuel stocks seem to be at a relatively adequate level, so shortages may not be a problem.

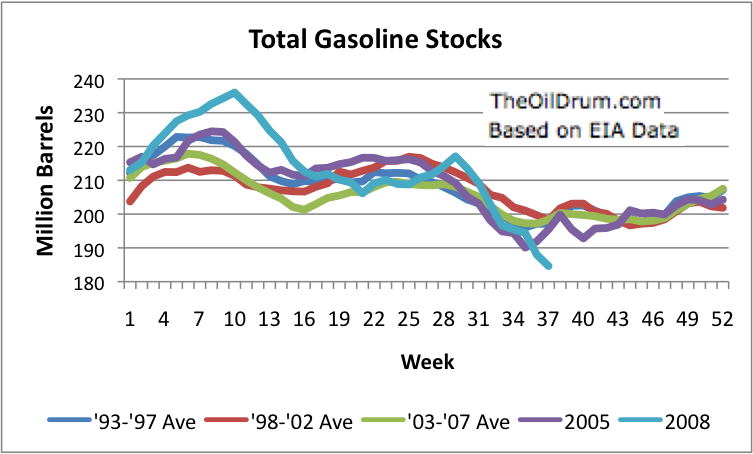

As one can see from Figure 1, EIA weekly gasoline stocks are diving, on a path to 180 million barrels of gasoline or less, in the next week. Weekly gasoline supplies when Katrina hit in 2005 declined, but not nearly to the extent we are seeing today.

Refinery Impacts

The DOE provides information with respect to refinery outages. After examining these reports more closely, I realized that there are really three categories of refinery problems we should be concerned about (I only considered two of these categories in my earlier analysis.):

(1) Shut Down = 100% off line

(2) Starting Up = This can continue for several days. I have estimated that refinery capacity listed as "starting up" is 80% off line.

(3) Reduced Runs = This can occur either after starting up or when crude inputs are not available. As in my earlier analysis, I have estimated that production is one-third off line.

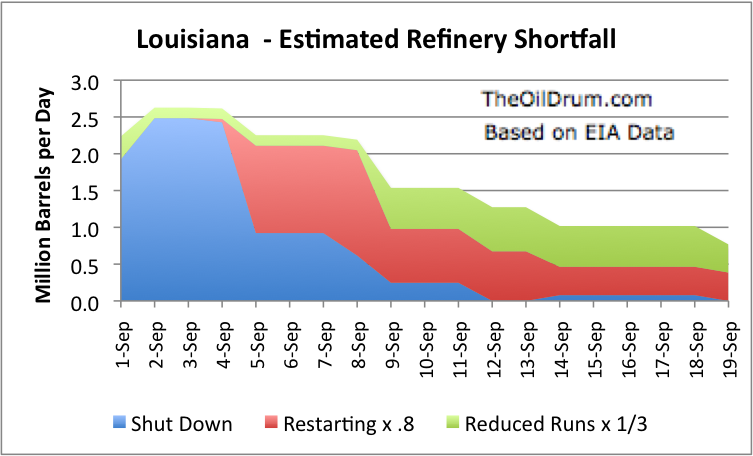

I also discovered that by adding together refineries, it is possible to look at state subtotals. This is helpful for seeing how quickly production is getting back online in Louisiana where production was primarily affected by Hurricane Gustav. A graph of refinery shortfalls shows that only now, 19 days later, is production getting back to close to normal.

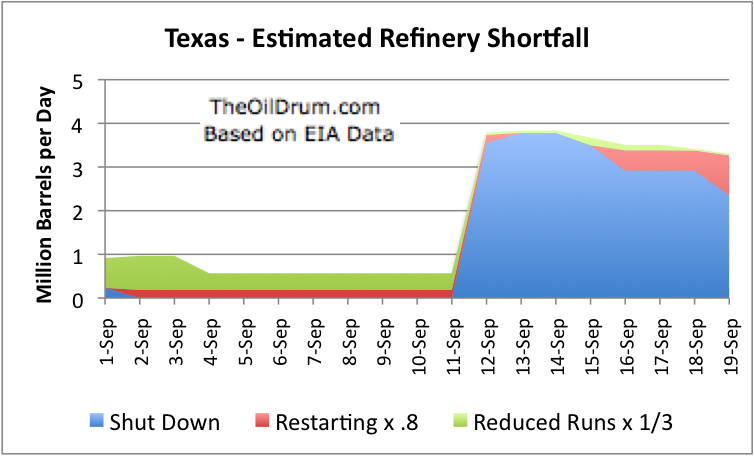

A graph of Texas refinery shortfalls shows that Hurricane Gustav (September 1) had relatively impact. Since Hurricane Ike hit, refinery availability has been reduced by more than 3 million barrels a day.

If the pattern in Louisiana holds in Texas, it may take as much as 20 days after Hurricane Ike before all of the production is back on line. It will certainly be at least 10 days. This would put full production at something between September 23 and October 3. Pipeline delays of up to 18 days could delay full distribution of petroleum products until something between the first and third week in October.

Amount of Refinery Input Shortfall

How much of a shortfall have we been seeing to date? Suppose we compare the amount of crude oil used as refinery inputs in June, July, and August, with the amount of crude oil used as inputs during the week ended September 5 and the week ended September 12 (both after Hurricane Gustav, before Hurricane Ike). The calculation would indicate a shortfall in crude processed of 1.7 million the week of September 5, and 2.0 million the week of September 12.

(This calculation is based on the following: During the months of June, July and August, crude oil used as a refinery input averaged 15.2 million barrels a day. During the weeks ended September 5 and September 12, crude oil used as a refinery input averaged 13.5 and 13.2 million barrels a day. Subtraction would suggest a shortfall of 1.7 million barrels the week of September 5, and 2.0 million barrels the week of September 12.)

In the future, as the impact of the Hurricane Ike shortfall feeds its way through they system, the shortfall of all products combined can be expected to be higher the weeks ended September 5 and 12--especially the weeks of September 19 and September 26, when the Texas refinery outages are added in. I would expect the shortfalls of crude inputs to be in the 2 to 3 million barrels a day range during these weeks, and possibly even into the beginning of October. These shortfalls will take a while to work their way through the system, so we are likely to continue to see shortages for a few weeks.

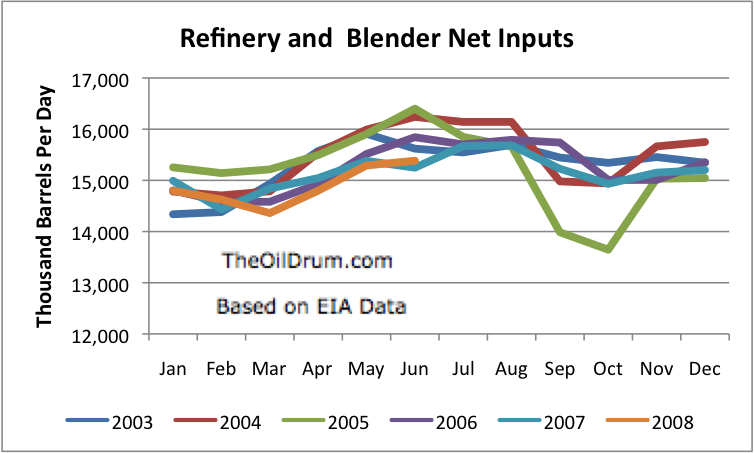

Figure 4 shows that in 2005, when Hurricane Katrina and Rita hit, refinery and blender net inputs dropped by about 1.7 million barrels as day between August and September, and then dropped another 300,000 barrels a day in October. This reflected the combination of Hurricane Katrina (August 29) and Hurricane Rita (September 24) Based on my calculations, the drop in refinery and blender inputs between August and September of 2008 is likely to be a little over 2 million barrels a day. (This assumes in the refinery capacity calculations shown in Figures 2 and 3, the refineries would not be operating at full capacity if open, and that some of the shortfall can be made up with refineries elsewhere.) This drop would be even greater than the Katrina decline, and would occur from a much lower base. Assuming there is not another major hurricane in late September or October, production should bounce back more quickly than with the Katrina-Rita combination.

Gasoline Shortfall

As can be seen from Figure 1, stocks of gasoline were at critically short levels by September 12, the last date shown in the gasoline stock report. Based the rate at which gasoline (and blending stocks) were dropping, gasoline supplies during the first two weeks of September were about 700,000 barrels a day short of keeping inventories at a constant level. The next two or three weeks are likely to have even higher shortfalls of gasoline -- more in the range of 1 million barrels a day. WIth the very low recent inventories, it is hard to see how there will not be shortages some places around the country.

How about Gasoline Imports

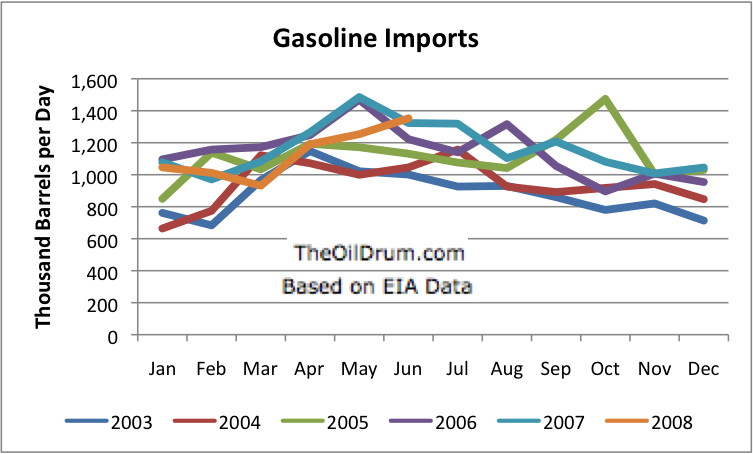

If we look at historical data, it becomes clear that we are already importing about as much gasoline as is available, and there is little room to ramp up imports.

In 2005, the US was able to increase imports by about 500,000 barrels a day in October. In 2008, we are already importing at a very high level. The reason we are able to import gasoline is because European countries tend to use diesel as fuel for their cars, and because of this, there is gasoline left over form the refining process. The amount that is left-over is not going to suddenly increase greatly, so it is unlikely that we could increase our imports of gasoline without drawing down the reserves of the exporting countries.

There was an article yesterday, US will not seek emergency supplies from IEA: DOE. The reasons given were that the rate of recovery from Hurricane Ike should be fairly good, and importing gasoline from Europe will take until October, given the time needed to transport fuel across the Atlantic. By that time, our supplies should be back up. If there really isn't likely to be much available, that adds a third (unstated) reason.

Evidence of Gasoline Shortfalls

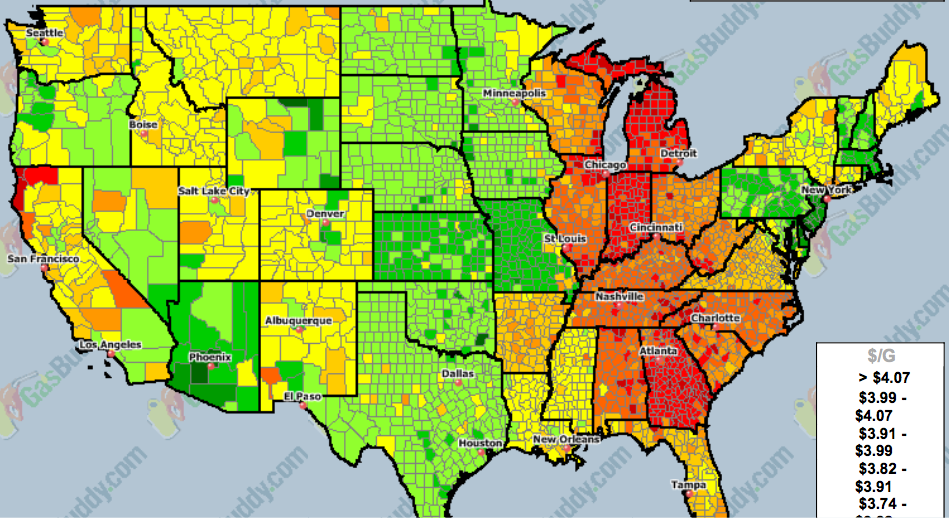

A map published by Gasbuddy shows that gasoline prices are higher in the Southeast and in the central part of the country. Both of these are areas where pipelines are operating at reduced rates, or are partly shut down, according to recent DOE reports. The reason why the pipelines are operating at reduced rates is because there is not enough refined products available, because of refinery closures.

There have been reports of $5 gallon gasoline in Connecticut. One newspaper reports that 85% of Nashville gasoline stations are without gas now.

Diesel and Jet Fuel

Both of these started with better inventories, so may have a little ways to go before shortfalls. Also, with diesel (actually distillate, from which diesel is made), we are a net exporter. If we want more diesel, the easiest way would be to reduce our exports. (If we were to ask IEA for distillate imports while we were exporting it, they would probably laugh at us.)

At ASPO-USA Conference

I am leaving for the ASPO-USA conference shortly after writing this, so will not be able to comment as much as usual. Please forgive a few extra typos. I wanted to get this posted before I left.

Edit

There are a lot of issues that I might have mentioned, but didn't. One of the more important is the possibility that the pipeline system may be near minimum operating level, and that some sections will no longer function if the level gets too low. The areas that would seem to be most at risk are the ones at the ends or lines, or on small spur pipelines. If this should happen, residents in the areas affected areas might find themselves out of all types of refined products (including diesel and jet fuel), unless they had extra supply stored in local supply tanks. Additional supply could theoretically be trucked in, but we have a limited number of trucks for transporting fuel.

Colonial pipeline is one of the pipelines that has had difficulty with adequate supply. The supply begins in Texas/Louisiana. The areas I would expect to be most at risk are on the spur pipelines and farthest north.

Thanks for the work Gail, Have a good trip.

Indeed. Great job, as usual. Thanks Gail.

Yes thanks. In the TWIP Report data is displayed that is very clear about that the a crisis is about to hit the East and Southeast by looking at the regional data. It is the extremes that kill; you can drown in a river that is on average 2 inches deep.

On the right side you can see the plunging inventories in the East and Gulf regions. Note this started before the hurricanes.

The market is responding. The Houston price last week is a regional warning. Hopefully a regional crisis will create a national awareness.

And here we have evidence of government manipulation of the price of oil as I suggested last week (and was sumarily derided for):

MSN

Did the government force down oil prices/

The United States government successfully popped the commodities bubble and brought down oil prices just in time for the election season, according to the latest rumor spreading around Wall Street trading desks.

Market strategist Donald Coxe from Canada's BMO Capital Markets discussed this idea in a note to clients last week. In his words, Ben Bernanke and Hank Paulson, trapped between commodity-fueled inflation and a tumbling financial sector, took "the pressure off the heavily-levered banks by putting pressure on the heavily-levered speculators and hedge funds that were short the banks and the dollar, and long the commodities."

They accomplished this in July by announcing the U.S. Treasury would extend Fannie Mae and Freddie Mac a line of credit while holding open the possibility of equity purchases -- moving the government's implicit guarantee of the GSE freak shows firmly into the explicit column. Coxe dubs it the July 13th Commodity Massacre.

By releasing the news over the weekend, when Asian markets were opening and liquidity was limited, the impact on both trader psychology and price were maximized. Moreover, the announcement was accompanied by a crackdown on short selling of financial stocks and "false rumors" by the SEC, as well as a reclassification of commodity traders by the CTFC.

The high flying hedge funds had flown straight into the G-Man's trap.

More at the link

And its seems there is some potential for a new tropical storm to form again!

Ah, interesting.

The year 1985 had a double-double whammy on the Gulf Coast:

Round One

Danny: Landed in LA on 15 Aug, Cat-1 with maximum winds of 80-kt and min pressure of 987 mb. The hurricane strengthened up to the point of landfall on the sparsely-populated central coast. Peak storm surge to the east of the hurricane rached 5-8 feet in LA and 2-3 feet in AL and MS.

Elena: Landed near Biloxi, MS, on 02 Sep with maximum winds of 110-kt and a min pressure of about 953 mb. Like Danny, this hurricane continued strengthening even as it neared the coast. The storm surge, generally 3-6 feet, reached 6-10 feet at some locations to the east of the center.

Round Two

Juan: Landed near Morgan City, LA, on 29 Oct with maximum winds of 75-kt and a min pressure of 971 mb. Then, after looping over Lafayette (the second loop on a complex path), the weakening tropical cyclone moved back into the GOM in the vicinity of Vermilion Bay. Juan, reorganizing over the warm waters, headed east toward a FL landfall on 31 Oct, with maximum winds of about 75-80 kt. Juan's slow, loopy path kept the system in the northern GOM for about five days.

Kate: Landed near Mexico Beach, FL, on 21 Nov with maximum winds of 85-kt and a min pressure of 967 mb. Mainly due to the presence of cooler waters in the northern GOM, and increasing shear from an approaching midlatitude trough, Kate was on a weakening trend before landfall. Peak intensity had been 105-kt and 955 mb on 20 Nov. An encounter with Cuba on 19 Nov, where the eye largely went over land, had only a modest impact on this hurricane's strength, and, after moving into the GOM, the hurricane intensified at nearly 1 mb/hr over the next day. Storm surge reached 11 feet at Cape San Blas, FL.

--

Given Katrina+Rita in 2005 and Gustav+Ike in 2008, it seems like one hurricane can have a significant impact on energy infrastructure, but two in close temporal association can have an incredibly bad impact. I wonder if a "one hurricane in isolation" is the typical assumption for emergency planning and the hardening of critical networks such as the electricity grid? Two hurricanes striking in a similar vicinity within a month of each other is rare on the Gulf Coast, but not incredibly so, perhaps a once-a-decade event. A triple or quadruple attack over 2-3 months is more rare, but common enough to appear in the historical record.

-best,

Wolf

Yes, 1 is looking like it's about to form - Kyle would be his name I believe.

Did we already have a Josephine? Did I miss one? :)

Josephine was born and fizzled in mid-Atlantic without doing any harm while we were busy watching Ike.

One thing I'd like to say as we figure out our real MOL is in general we have and excess of service stations. I rarely pull up to a pump and have to wait at all.

At most one car is in front of me. But this excess of pumps does not necessarily translate into a large reserve in the gasoline at the station. And of course these same stations are filled from a few local supply terminals. So on one had having 80% of the stations out of gas simply means longer lines but on the other this means to depo supplying them is incapable of filling local storage. This means for mean to get gasoline initially I go from zero wait to say 10 cars in line. But if it cuts to say 90% I may face a 100 car line.

Lots of cool exponential cascades possible.

But whats far worse is we have the pavlov's dog in effect which is a insidious version of the tragedy of the commons.

http://en.wikipedia.org/wiki/Ivan_Pavlov

http://en.wikipedia.org/wiki/Tragedy_of_the_commons

The real underlying reason that gasoline inventories are low is because of lack of oil but a short term disruption is seen is the cause. Thus the dog i.e the US Consumer has now been trained to deal with inconvience and high prices to access a common good which was before readily accessible.

They see it is simply a slightly more complex maze to be traversed to reach the end goal. And more importantly the training is not broken.

This crossing of improper responses to stimuli with access to greener pastures any minute is a powerful phenomena.

It shows how we have no problem trading time ( waiting in line ) for rewards ( fuel).

And furthermore its considered temporary by all local players. They cannot be convinced from this point on that the commons is permanetly smaller

and no amount of waiting will result in more fuel later.

This is combination results in the formation of a cargo cult.

http://en.wikipedia.org/wiki/Cargo_cult

And the people begin to believe that if they just wait in line supplies will show up.

Thus the long term effects of peak oil coupled with the assumption of short term causes results in effectively group insanity.

I.e cargo cults caused by crossing pavlov's dog with the lack of commons.

Not yet. But wait until it becomes a daily, regular time budget problem. Then behaviour may change to more premanent "solutions" like car pooling.

"Not yet." Yeah.

I am actually impressed with the orderliness of my fellow man at the moment.

Here in Asheville, NC, most gas stations are closed. The few that are open have lines up to a mile long, and people are bringing spare gas cans.

It seems they're ok waiting for hours in line at the moment, but it is looking like we will have real and major shortfalls of supply, and I'm not so confident people are going to see the world as business-as-usual then as they seem to even now with the lines and hoarding.

I'm glad they can wait in long lines and not riot, but what about when they hit empty next time?

Great analogy Memmel.

This can be applied to many other areas of society.

The big glaring example would be economics. People are, for the most part, not too troubled about increasing expenses and stagnant or declining income because soon we will "hit bottom" and then things will improve and they will prosper. That’s what they have been trained to believe.

I forget where the term came from it says a lot;

Americans believe they are all just pre-rich.

WOW! are they in for a surprise.

Great insight! It helps me understand some of the responses I am seeing in people around me... this, of course, cannot end well for everything that postpones how long it take the mainstream to begin to adapt in any meaningful way the less resources (of any sort) are available for such a transition.

I have read that some of the major brands of service stations are trying to keep some stations open in each part of town. They do this be letting some go dry for a while, and fill up others. There isn't really enough gat to keep all the stations ope, but they can try to keep a rotating group of them open.

What is so odd about this whole scenario is that there is so much disparity between regions right now. I understand there are different major pipelines servicing different regions from different origination points, but is there really no way to balance things out between regions? Is it that difficult to take resources from the Midwest to help out the SE and NE? During this whole episode, KC, MO has seen unleaded prices briefly go up, but now prices are once again descending, currently under $3.40/gallon.

This is just conjecture on my part, but if we're at or below MOL, which posters well-versed in the industry have been warning about for some time on here, then the only way to keep any flow going at all is to cut off some delivery points. There's not enough to keep the pressure up in all the pipelines, so some must be shut off or at least down to keep most of the system operating. It appears from what has been said on here that just this is happening, and that the most vulnerable points are taking turns with little or no delivery, so the rest of the nation can have BAU. The alternative is shutting down the whole system until stocks are back above MOL. Don't think that's doable politically, nor sensible logistically.

Which makes me wonder if Georgia, the Carolinas and Tennessee are being made to suffer so that the poor dears in and around the Imperial Capital won't have to suffer any inconvenience?

It is not expedient for industry to maintain excessive inventory of gasoline, nor to always increase inventory.

The current situation is unfortunate and it will be necessary to rebuild stocks after refineries are brought back online. If demand will rise due to lower prices after refineries return to full production, we might see continued pressure on supply and danger of gasoline price increases.

I read an article that the U.S. was not going to ask the IEA for emergency gasoline supplies as they did during the Katrina gasoline crisis.

MOL's have been misunderstood. Gasoline pipelines were already shutdown due to lack of supply, yet other pipelines are flowing. You do not get a situation where the whole system crashes as long as some refineries are producing. If shortages will occur they are more likely to be local or regional. Trucking was used to distribute gasoline beyond the pipelines. Rails served fewer areas than trucking. If there will be shortages of rail cars and bottlenecks due to higher demand, they will try to use trucking more. Higher prices in some areas might cause more gasoline to flow to those areas. There are spare gasoline inventories in the world. If you have money people will sell to you. If you wait for a deep gasoline discount you might stand in line a long time and get nothing.

"It is not expedient for industry to maintain excessive inventory of gasoline...

It's more than just casual flippant worship of "expediency". It costs money to maintain storage tanks to hold inventories of a volatile and potentially dangerous fuel. With all the fuss about "gouging", who in their right mind is going to spend even a penny more than necessary???

The temporary shortages of gasoline can be dealt with very simply: Let the market set the price and consumers will get just the right amount of gasoline they need. If you let a market do its thing there will be no lines, no long waits, and no stations without gas to sell. It really isn't very difficult.

Retailers that do this face legal retaliation (gouging claims) as well as customer retaliation. I posit that most stations would rather leave the lights off than try to sell gas at $5 or $6 per gallon.

A consequence: those still selling at $3-4 will report gas sales "higher than normal", "double our usual sales volume" and the press will report this as a panic buying event. In truth, places like Nashville will be selling less gas overall due to the closed retailers. But, the panic meme will spread.

Prices here in the Raleigh NC area have dropped as of last night to near 3.82 a gallon. And people think its a bargain!! There are many stations just with regular, and a few are out of gasoline. I just ran by a mcdonalds and bojangles and there are 26 cars waiting at the drive thru windows!!! American drivers are just darn morons. One part of me says 5+ a gallon and then get the idiots off the roads except to go to work, but then I get real and say hey maybe we need to live differently.

By the way I am on empty and think I should get sme gasoline for work this week, gasoline line stink I remember the 70s!! Hours upon hours waiting for fuel just to get to college and work.

We as a country have learned nothing. Greedy stupid people. When I see a large SUV pull up with extra 5 gallon gas cans on the roof!! There was no hurricane here in NC this week.

I was a fuel & lubricants wholesaler during the Arab Oil Embargo and I know all about government stupidity, price controls, odd & even days and so on. Price gouging laws are the height of political nonsense. They create long lines, shortages, over consumption, and hoarding. Let the market do its job and all those things disappear. It is really not too difficult. There is a definite choice gas at the price before the storm that entails long lines, shortages, and often unavailable or business as usual at a higher price.

"Let the market do its job and all those things disappear."

great, let the market do its job and let all those sleazy mortgage holder and their insurers hold the bag, not the us treasury*.

* notice i did not say us taxpayer ? that is because this $700 billion bail out and the 100's of billions for the search for wmd are being financed by debt on top of more debt, putting the monkey on the back of our children and grandchildren. off monkey off off off, kill monkey kill kill kill monkey. time for our "leaders" to grow up and grow some b@lls.

lessee here, the debt is at over $9 trillion and if we add $700 billion to that, el'befuddleoso will probably have doubled the debt in just 8 yrs. great economy george, you are doing a heck of a job. weren't those tax cuts supposed to reduce the debt in the long run by juicing the economy ?

All that "simplicity" is utterly lost when Joe and Jane Sixpack, stumbling blindly in the far reaches of the impenetrable haze of their innate bewildered stupor, jiggle and waddle into the picture. Their time is absolutely worthless - any spare moments will be dissipated watching moronic rubbish on teevee anyhow - so they'd rather while it away in endless lines than pay a little more. Or at least that's what they've loudly, vociferously, and repeatedly told anyone who will listen, as well as everyone who won't. Naturally, politicians have pandered by enacting new foolish laws, as well as by reinvigorating enforcement of moribund old foolish laws.

The inherent irremediable problem with "democracy" is that Joe and Jane rule. It follows that if your time is worth something, there is no real solution to your problem unless you are rich enough, say, to install a reserve tank in your front lawn, as happened in the 1970s. After all, why should anyone exert extra effort, work overtime, rent extra trucks and hire drivers, etc., to work around supply issues, when their only "reward" will be to be publicly pilloried as evil greedy "gougers" by teevee airheads and addled campus Marxists presuming to bloviate on Joe and Jane's behalf - or even to be hauled into kangaroo court with their livelihood at the tender mercy of an entire jury of Joes and Janes?

And here is one of those Joes speaking for himself, comment #3 as of the time I looked (emphasis added):

Yes, indeed, thanks to those good citizens for holding the price and running out. So now you're near empty because you heeded those foolish official orders not to "panic", and something urgent has come up, maybe a family member in another town needs attention right away. Well, good luck, you've just been shafted by those good citizens who ensured that there would be no supplies to meet urgent needs. Gee, thanks again.

Idiots.

The public seems to be upset that the oil companies are profiting. Maybe the solution is a Scarcity Tax. The Scarcity Tax would be imposed when supplies were disrupted, and serve to discourage hoarding and maintain supplies for emergencies while putting money into the public coffers. The money could help deal with the emergency situation itself, and anything left over at the end of the year could be given back to taxpayers.

Of course, if folks got the idea that this was a good thing in general, the Scarcity Tax could just be made permanent.

In theory it might be a partial solution, though the country is probably too diverse for it to be enacted in a form that didn't see the funds diverted, in no time flat, into Bridges To Nowhere such as the two in Alaska. It might also be politically infeasible inasmuch as people expect free handouts during emergencies, and it might well still tend to punish efforts to bring in supplies. And alas, the problem is precisely that even with good planning (which we lack, the best we seem to manage is limited punitive planning such as requiring gas stations to purchase expensive equipment and then dumping on them furiously if they dare to recoup the cost), supplies tend to find ways to become less available at such times.

Of course maybe the real solution to this whole nexus of issues is just to nationalize the gasoline supply. Then the supply would be absurdly inadequate and of poor quality just as with the collapsing bridges, dysfunctional airways, shoddy levees, inadequate roads, uselessly unreliable mass transit, and many other things the government provides badly, but OTOH the AGW folks would be happier, and perhaps also the juvenile-minded campus Marxists and bloviating "reporters".

Bad idea-they need the taxpayers money for Wall Street-those guys have big appetites. Government screws everything up-just tax the sheeple and give the moolah directly to the club members. Damn those liberal treehuggers.

You got just such a scarcity tax with the SEC disallowing short-selling.

In the past couple weeks there have been a number of threads lamenting hoarding behavior toward gasoline. I would like to throw out an argument that hoarding gasoline by keeping ones tank full is not only reasonable personal behavior but represent the best societal outcome as well.

An argument is often made that if gas hoarding did not occur there would not be any shortages. While this may be true in many situations and perhaps even the Gustav/Ike induced events of the present, it is not a general truth. If a shortage is developing that will lead to an absence of gas for many drivers regardless of hoarding behavior, then the supposed rational behavior leaves oneself and ones family on the short end of the stick. This is your rational behavior?

Further, what is the difference between storing our supply of gasoline in gas tanks versus tanks in Texas/Oklahoma (ect.) or the local gas station. The initial answer is that storage in gas tanks creates spot shortages and drives prices up. What a tragedy, prices will be driven up and people will start conserving realizing gasoline has become more precious. This conservation will decrease the potential of a real shortage.

The alternative would seem to be continuing business as usual as if no possibility of future shortage exists. Yeah, perhaps individuals responsible enough to intentionally refrain from hoarding would also reduce consumption. I would imagine at this point in time that increased price is a more effective means of destroying demand. In my opinion, the upshot of not hoarding gasoline by topping off ones tank is limited to maintaining the illusion that everything is normal. Don’t worry, be happy.

I end by noting this does not refer to all gas hoarding situations; however, keeping ones tank full of gas seems to me personally and socially responsible.

I am not talking about hoarding by keping your tank filled, I usually always would fill up when I was just below 1/2 of the tank, I was just not thinking this week about my gas tank and wow my camry with that 18.5 gallon tank is on E not smart since I do need to drive a bit over the next wekk. But when I see people bringing extra gasoline cans as I saw last weekend here in an area that had sunny skies and no chance of bad weather , they were taking/buying as much gasoline as they could get their hands on. It is a free country, but come now, how about saving some for the other guy down the line. Yes raise the price, but how bout making fuel and storing it for a HURRICANE??http://www.cnn.com/2008/US/09/19/nashville.gas/index.html

Here is the CNN article of what happened in Naseville yesterday, Thank you the INTERNET the American rumor mill is in full swing!!

Hey,

I was not actually responding to your post. It was a general comment and so I put it under a new thread. At least the people of Nashville and in parts of my home state North Carolina now have some clue gasoline is precious. Time to use less. As you suggested, also time to increase planning for future shortages. Here is an article consistent with Gail's information above, in which the former CEO of Shell oil suggests gas rationing may be necessary this month:

http://www.washtimes.com/news/2008/sep/15/gas-rationing-needed-former-oi...

Well it's a better play than putting your money in the stock market. I store 50 gals, and a bunch of propane tanks. It means I can get to work no matter what. I recall a financial advisor linked here who said, buy food, inflation makes it a better deal than any stock you can buy. The return is much higher. I do that as well.

Sta-bil is your friend.

Match my stockpile against your 401k anyday.

Cheers

Don in Maine

Rita hit at the TX/LA border and the Houston refineries were restarting (by the DOE situation reports) 3 days later. Rita was a month after Katrina and allowed some room for preparation. Gasoline (as you mentioned) inventories were much higher in 2005 when Rita.

Basically, there is no comparison to be made between Ike and Rita. Ike was a direct hit on the Houston area and most of the refineries are still completely shut-in. The ones that are restarting will take much longer to reach full capacity for a myriad of reasons (lack of industrial gases, power outages, etc...).

Also, we don't know exactly what the reduction in refinery production was outside of the hurricane affected area. For example, the nation's fourth largest refinery in Gary, Indiana is fed by the Capline pipeline originating in Houston. One Illinois refinery is completely shut-down for maintenance. Etc, etc....

I'm in Huntsville,Al and I've been taking a less direct route home the last couple of days, to scope out the gas situation.

It looks to me, like a lot of stations are out. Although some take down their prices when they run dry, about a 1/3 seem to play tricks like parking employee cars beside the pump to fool people into coming into the mini mart for food.

I put the situation as follows:

1/3 run dry, 1/3 have gas but are limiting purchase (I was only allowed to buy 5 gallon yesterday) and 1/3 park employee car's beside pump and pretend to have gas.

Note: My survey was very unscientific. For starters I wasn't going to stop at every station.

The blatantly out are easy to spot, and so are those with huge crowds waiting to fill up, its the sneaky ones that are hard to spot. They park employee cars beside the pump, but nobody is near ANY of the vehicles, the hoses are still in the pump and I couldn't spot anyone inside at the cash register.

From an african perspective, I am from Kenya. The implications of peak oil seem to be blown out of proportion (I could be very wrong of course). Kenya currently uses 70,000 barrels of oil per day to support it's needs I believe. With a population of 35-39 Million people. Yes, there is widespread poverty, lifespans are lower than the west, infrastructure is for the most part well below what anyone in the west would consider reasonable in most areas.

Yet the country still functions, people generally have a smile on their faces and are warm.The vast majority of the country works in the agricultural sector and are subsistence farmers. So if you want to look at a future scenarios, have a look towards Africa. Kenya for all it's faults and weaknesses is still a beautiful country and somehow it works! So it is possible that america as a whole could live on 5 million barrels of oil per day and still enjoy a decent standard of living.

Jambo sana rafiki! Great to hear this modest approach to ordinary resilience from the wananchi in Africa. It may well be that countries (and people!) that are accustomed to doing OK with less, especially in the way of fossil fuels, have a much better chance at bending rather than breaking as various spin-off crises take hold in a post-peak world.

One comment, though. I know something about the charcoal crisis in Kenya. We tried to introduce new stoves - jikos with a clay pipe liner in the metal Kimbo tin - but stopped after a coup attempt many years ago. Did they ever take hold? All I have heard is that charcoal is very scarce these days and the forest has not really been able to keep up, notwithstanding the efforts of Waangarai Matthai.

Yes, Kenya is a warm country, in more ways than one. It's much colder in northern latitudes, though. Driving down Route 7 through Vermont's verdant forests, it struck me that Peak Oil may soon start cutting into our temperate forests, not so much for cooking as for heating.

Many North Americans are not aware that their original old-growth forests were almost all cut down for fuel and timber until the arrival of coal and steel. Old lithographs show the Berkshires and other slopes very nearly denuded. No parks or replanting in those days. I wonder how much of a resource wood will become and if the protected forests can (or should) survive in the post-peak environment.

The parks versus people tradeoff is an old debate in Kenya and I wonder how it has turned out over time. In practice, parks in emerging countries (BTW, that's the new PC term for poor countries) are under a heck of a lot of pressure from poachers, miners, farmers and of course lumber outfits and farmers, big and small. Did I forget tourists? Now there's an irony TOD readers may appreciate!

Iko happa kazi mingi. Kwaheri bwana mkubwa.

Jambo Rafiki, It really is amazing that regardless of all the problems that Kenya faced earlier this year with the political crisis, the economy is continuing to do well. Matatus (group taxis) are still out in force and gas (petrol as we call it) is more expensive in Kenya than in the united states per litre YET life goes on. The past few years have seen quite a large change in the country towards development and modernization. I am not aware of the present situation with coal in the country, I do know there is a lot of pressure on the environment around Mt Kenya. I have not heard much of it in the newspapers of late. The wildlife parks situation is still there, with the pastoralist tribes and nomads pretty much encroaching and tussling for parkland with the wildlife park authorities trying to calm the situation and push them back.

Currently in Melbourne, Australia and I do find that the TOD arguments make sense from a Western perspective, but most parts of the world and 60-70% of humanity are not even remotely close to the lifestyle of the average european and american or their dependancy on oil. For all it's progress the vast majority in India and China are self reliant on farming and live in villages and towns and have never driven a car. Life goes on, people are highly adaptable. In developing countries and thus most of the world, it is the norm that power fluctuations occur, i've lived through chronic water shortages, lived through poor infrastructure and i've lived through political violence and strife,an economic crisis that lasted nearly a decade, unemployment at close to 40%. Big deal. Kazi Iiendele (work goes on). The country is still there and growing, the people carry on with a smile and a laugh, everyone finds a way to survive and get on with it.

Having lived in a first world country for a few years now, one thing i can say for sure is that Africa is a far more interesting and challenging place to live than Australia and there is a far greater sense of community, of people helping each other out, a close knit place. People appreciate the simple things more.

Mdio, sahib. TOD readers should note, when you use the word coal, you mean charcoal. There's no fossil coal to speak of in Kenya. My understanding is that "coal" has been replaced to some extent by various types of canned and bottled gases and parafinic (jellied) cooking fuels, as well as electricity in some areas that are served by a funky local grid.

Do you have a car or do you use matatu? How has the increase in the price of petrol in the last few years affected the matatu business?

Hey, there's a word that had slipped away into oceans of time. FYI "Matutu" is the ubiquitous shared taxi that I always thought made a lot of sense. In my days, a lot of them were VW microbuses into which we got maybe 300 people...including those on the roof and bumper.

The bubble of glass, metal and plastic that is the American private car is not the only small vehicle-based transport model out there, but man just try to crack those taxi license and intercity bus cartels! I think PO will eventually crack the private car bubble but not for a very long time in the Americas. As far as I know, the matutu has not made it to Brazil or Costa Rica and at last look Mexico.

Wouldn't it be great for everyone to have the option to pick up paying customers, and not just through ride-sharing websites? You'd think there would be a card and ID system that could be designed. Or is the private car too personal? And government and the many carriage business interests too patronizing about our safety?

I don't know about Costa Rica or Mexcico but in Brazil they are called "Lotação" , though our VW Micro buses only hold about a hundred passengers. ;-)

Americans will turn the entire planet into a radioactive dead zone before they will become subsistence farmers. You must never have been here or you wouldn't make such a silly statement.

Maybe a little overstated, but point taken. There's a larger point about choice. If you've never had a car, it's just not in your thought processes. All three of my kids show no inclination to get themselves licensed to Zoom Zoom. The oldest is 23 and all are doing fine. Urban folks, of course.

Then, when you go to a restaurant is a menu as thick as a phone book better than a short one? Too much choice is confusing and counterproductive and leads to confusion and duplication, including double orders!

From an intellectual perspective, jostling ideas can indeed distract and dethrone important material and stop essential actions, which requires a modicum of agreement or certainty. This seems to be the case in the Americas with respect to peak oil, global warming and other major policy issues.

Fortunately for the military industrial complex, no such doubt about vaulting defence budgets. Nuclear space frisbees must enhance our security. That's what they're for, after all. The rest of the world watches and wonders if we are all actually enemies, despite claims to the contrary.

Folks, I am about to go off the grid too. Help us spread this crucial information around please? Send it to the media...I still don't think they get it. Linkfarms, other sites, name it.

It just so happens that Sept 30 is that date I have chosen to experimentally abandon my car and cope with the Canadian winter in Montreal. Just until April or May.

The clincher was the Quebec government's new law that mandates snow tires. Talk about ecomomic decisions made at the margin... Next spring I want to hear about personal transport alternatives and, yes, I have a bike.

Maybe some kind of TOD ridesharing links or even a TOD stencil in big letters that can be applied to the standard piece of recycled cardboard as signage would help with my transition.

I wish I could make more suggestions, but I need to hop into my car and head out to pick up a litre of 2% and a half dozen donuts. Oh, and a Sunday Times (just to make the trip worthwhile).

Best of luck for your experiment.

I live in Winnipeg and voluntarily parked my truck (yup - all 8 cyl gas guzzling 4 wheel drive 7 seats of it). It has been over a year now - and I am managing. Sometimes it is a chore - grocery shopping is never ending but somehow not so disruptive and tiring as the bi-weekly stockup used to be. Overall though I believe I have come out ahead. Economically there is much more money hanging around - even if I occasionally have to use a taxi or pay to have items delivered. The largest difficulty was persuading my children (teenaged boys) that not driving could work.

Canadian winters are a bit of a challenge (tongue tucked firmly into cheek) I discovered that I had to adapt my wardrobe somewhat - and revise my expectations about what is reasonable travel - but we do that anyway with any blizzard warning - this is just an extended approach to bad-weather awareness - lol.

Interestingly - I parked the behemoth out of concern for the environment - I have only recently become peak oil aware. Looks like it was a good idea from several perspectives. This year I didn't renew my plates.

Al

Well done, sir.

I have a friend who also lives in Winterpeg, Manifroza (and visited there over New Year's a while back - now THAT was an experience!) and she's never owned a car. The bus service is good enough for her. Maybe that's what we should aspire to; if Winnipeg can make it work, it will probably work in most cities of its size or larger.

That's the ticket!!!! Make it work, adapt to the local environment, or just stop whining and move....and don't go on whining about how hard it is to move. We truly have become a nation of whiners, where every problemm is someone els's fault.

I used to live in downtown Montreal and I survived very well without a car.

Montreal

Montreal's Underground City

Calgary has an elevated system of enclosed walkways called "+15" which connect much of the downtown. The other day, I stumbled across a beautiful indoor botanical garden connected to the system.

Devonian Gardens (Calgary)

Calgary's +15 Network (PDF)

Minneapolis has the "Minneapolis Skyway System" which is very similar.

Minneapolis Skyway System

You *don't* need a car to lead a civilized life. In fact, not having a car can be a blessing if you live in a city designed for people.

Viva Montreal and all other cities designed for people!!

Montreal will be making pubicly owned bikes available following a model used in Paris. Apparently these are free for short term use.

You can cycle in winter. Studded tires are available and work very well. The real problem is avoiding heat build up and sweat which is deadly once you stop exertions and obtaining separation from vehicle traffic to avoid unpleasant suprises.

Kudos to the car free Canucks! I'm trying to join you. :-)

On pipeline MOL.

I note the following from reports of shortages and prices: it's worse along the intermediate portions of the Colonial (Georgia, NC, Alabama) than it is at the end (MD, DE). This could be the result of either (1) extra supply in the mid-Atlantic arriving at ports of Baltimore, Philadelphia, NY or (2) a pipeline effect.

This pipeline effect consists in the fact that as operating levels fall, it is the intermediate spigots that must be cut back first in order to maintain any pressure at the end of the line. In other words, as the operating level falls, the cutbacks are NOT evenly distributed along the entire pipeline. SE is starved to keep mid-Atlantic fed.

Not something anyone wants to talk about as the regional implications are painful. Further, it may be counteracted to some extent by pumping.

There are refineries up in the northeast, Linden/ Elizabeth NJ, Down in PA so yes there is more supply. It is just darn stupid with a dumb car culture and little mass transit in the southeast that there are no refineries in NORTH CAROLINA!

We wouldn't be having this discussion if our governmnet had intervened in the auto and energy markets (pre-mediated, smart intervention to achieve a goal, not this willy-nilly clown show going on right now that structurally fixes nada).

Whatever do I mean?

WHy, for example, aren't we able to buy this and other products like it?

http://www.businessweek.com/magazine/content/08_37/b4099060491065.htm?ch...

Allegedly our US CAFE is 24.6 MPG, which allegedly is a mixture of cars and light trucks, apparently with an exemption for SUVs and mid-to-large consumer trucks. I'm not sure if this figure is highway or combined...if it is combined, I don't find the 24.6 number credible.

http://www.autoindustry.co.uk/news/08-10-07_3

And whatever happened to the Partnership for a New Generation of Vehicles? Canceled in 2001 after Uncle Sugar spent billions of dollars feeding tech to the Big 3.

http://en.wikipedia.org/wiki/Partnership_for_a_New_Generation_of_Vehicles

Now apparently we have the Freedom car initiative...anyone heard of that? Apparently one person (Pickens) can do a much better advertising job than the USG and the Big 3!

Here is the point: With government leadership and smart manipulation of the auto fuels markets and picking some winners with industrial policy, we could have a car fleet with at least double the CAFE of the present fleet, and a fleet with a CAFE of ~60 MPH would be feasible with more effort.

Government has many control options: set a $5/gallon (2008 dollars) floor on gasoline and diesel (2008 dollars means the price is inflation-adjusted every year). Raise that in real dollars by 50 cents per year for the next 10 years. Impose significant tax penalties on both the consumer and the manufacturer for any vehicles that do not meet new CAFE minus 10 MPG. Provide a sliding scale of tax credits for vehicles that meet CAFE + 5MPG, +10 MPG, and CAFE 15MPG and beyond.

We have the ability to cut our auto fuel use in half, and with great effort by two-thirds. We don't have the will. People could have their cake (personal cars) and eat it too (vastly reduce or eliminate our money going to hostile oil kingdoms and reduce greenhouse gases and re-invigorate US auto makers) but we are too stupid. I'm sorry, that was too direct...we have too many 'low information voters.'

And the Big 3 have the gaul to ask the government for $50B in cash to play catch-up with auto technology...first it was $25B before the financial debacle, then $50B at the beginning of the debacle...any bets that it wont end up being $100B+ now that the precedent has been set for Uncle Sugar to bail out everything (a precedent being set by the Republican Party!)

It sounds like the Nashville pipeline problem is a power outage,

Panic Grips Area During Gas Shortage

OFF TOPIC MODERATORS PLEASE CONSIDER STARTING A NEW POST / THREAD ON THIS:

RAILROAD EFFICIENCY --- There was a rather hot discussion about the efficiency of railroads vs. truck freight on this site a while back.

Here is an article that every rail advocate need to read and see how we get around these issues:

My point:

Rail may be theoretically efficient, but much of the rail system are dominated by 19th century industrial rules, norms, and behavior that makes them one of the least efficiently run industries despite the theoretically efficient system.

It is nearly as bad as dockyard workers at Los Angelos's port.

http://www.nytimes.com/2008/09/21/nyregion/21lirr.html?hp

September 21, 2008

A Disability Epidemic Among a Railroad’s Retirees

By WALT BOGDANICH

Edited by Gail Sorry, we can't quote whole articles, because of copyright rules.

You are comparing a public commuter railroad like LIRR to the 7 major private freight railroads and making naive generalizations.

The market speaks. If freight railroads were that inefficient the truckers would eat their lunch.

Francois.

http://www.thetowntalk.com/apps/pbcs.dll/article?AID=/20080920/NEWS01/80...

Edited by Gail Quote too long

Found on Twitter, a map of who has gas in Nashville.

Where's the gas?

oh God. Scary.

Mostly people seem to be feeling one or more of the following:

1. Confusion/borderline panic. 'WTF is going on!?'

2. Anger at their local news media for lack of reporting.

3. Anger at the avaricious oil companies and gouging gas stations.

4. Anger at Congress for not drill, drill, drilling.

5. Anger at their fellow citizens for panicking.

Looks as if the local press has finally decided, after monitoring their feedback, that keeping their audience in the dark is far worse than covering the story.

Hunting for a fill-up in metro Atlanta

Didn't Deffeyes suggest, in Beyond Oil, that there'd probably be gas lines by the end of the decade? Looks like he was right. Sensitivity to hurricane-induced production and refinery disruptions seems to me just one more sign of escalating oil scarcity.

-best,

Wolf

From a 2007 Colonial Pipeline press release:

http://www.colpipe.com/press_release/pr_90.asp

So, how are things out at the airport?

I'm flying back Wednesday to Atlanta. I hope things are OK. Recent countrywide stocks seem to be pretty good:

Hi Gail. I'm a big fan or yours. But your pipeline delay argument always has me scratching my head about what you may be thinking.

Above you list an 18 day delay for getting the pipelines going after production is restored on the understanding that that is how long it takes a drop of product to travel it's length. However, I can absolutely guarantee you two things. One, the pipeline is not "empty". It is filled to the brim, only the pumps are turned off. And two, the minute you try to squeeze a single drop in at Point A, a drop necessarily has to come out of Point B, otherwise the pipeline will rupture. You can substitute "drop" for gallon, barrel, day's worth or whatever.

Compressors are started approximately simultaneously and flow from Point B is approximately immediate, and certainly not in any case 18 days.

Am I missing something? I would appreciate a respectful discussion on the topic if I'm not understanding correctly but I feel this point is very important to understand, and your conclusion and mine differ dramatically.

Thank you very much for your hard word.

Respectfully,

jteehan

Good question. Given that vapours are the most dangerous part of fossil fuels, I always assumed lines were kept full. It also prevents oxidization (rust corrosion).

The full lines are part of what is misleadingly termed "inventory". The qualifier. "minimum operating inventory" is a better term, but these are quite literally goods in process, mainly in transport (tankers, lines, even refinery units), with a tiny component in the good old stock tanks in OK and other delivery points. The real (accessible) inventory stock is much lower.

Just how low is it, really? Does anybody know? What are the implications? My guess is that any panic buying immediately drains real buffer stocks straight into car gas tanks and other consumer storage points. They disappear. Poof!

This happened in 1980 and (as I recall) after Katrina/Tita and happens a lot in countries at the margin, though they tend not to have as many cars to act as sponges in times of crisis. It means near-instant vulnerability and implies a greater need for priorities and SPR-like buffer stocks.

jteehan,

I think it has to do with the pipelines not being entirely full. I know I am not the only one say it. For example, a part I edited out of one of the long quotes above said:

I've been reading through the Peakoil.com thread titled, North American Fuel Shortage Reports. I'm not qualified enough to testify to the accuracy of the analysis, but the user 'shortonoil' has some interesting thoughts:

Ok,

I guess I always made the mathematical connection that Minimum Operating Levels explicitly states that the system is operating. Since somethings are clearly not operating, we must be below MOL. Your explanation is as good as any. I wish we could be more sure. It is a rare opportunity to determine, at least regionally, exactly what the MOL is.

Thank you and the others for your replies.

We are definitely below MOL for the Manassas VA terminal of Plantation Pipeline.

Is anyone in Nashville that can give us a report as to the gas shortages there?

i will be flying into nashville tomorrow morning, and i will try to give an update of the gas shortages. i did see many gas stations with no gas last tuesday, and that down around Brentwood and franklin, south of nashville. at that time gas was selling anywhere from $4.15 to $4.35 for regular. i did see last thursday gas for $4.09 at a shell station. so that was only 3 to 4 days ago.

i'll take a look!

Not in Nashville, but North Atlanta is having problems. Local RaceTrak station a huge multipump operation with around 16 pumping stations (4 pumps per station) is out completely of all grades. Monday should be interesting, CNN is reporting gas shortages as of Sunday night - using I-reporter cam footage. Saw a line that reminded me of the 70's - it snaked out of the station and half a block to the traffic light, couldn't see if they were lined up around the corner from the light. A Shell station was shown next to the freeway, it was completely out, and the prices were pulled from the signs.

I saw a couple like that friday afternoon in North Atlanta, but I managed to fill up ( I was below 1/2 tank - with an intank pump - I like to refill to make sure it stays cool and functioning, it has 210,000 miles on it)

As always, great work Gail. Reading the comments reminds me that even the most educated people really don't get it. There could be unlimited crude oil supplies underground and there is still so many obstacles to be reached between where the crude exist and our fuel tanks. Makes reform of whatever kind it is going to be even more important.

http://thealternativeenergyinvestor.blogspot.com

Great article Gail. Thanks

----

I want to ask this: Why is the NYMEX price dropping when there is an inventory drawdown of 1.0million - 1.5million barrels per day??

Let me reiterate what I wrote last week:

----

------------===============-----------------

COMMENTARY:

What is happening in gold, silver, and gasoline futures is BACKWARDATION. (cash price above near future). This is also termed , according to Dr. Antal Fekete, as a widening 'basis' -- the opposite of contango. The futures markets are indeed a casino controlled by JP Morgan, HSBC, and other money center banks, which is done not so much through a 'concentrated short' position, but rather through complex systems of OTC derivatives traded through dark liquidity exchanges such as Baikal and Turquoise. In a recent article Rob Kirby noted JP Morgan traded $7.6trillion of these sorts of derivatives in a single quarter.

We are about to watch what happens in a central-banker controlled casino/command economy. It will produce shortages.

Backwardation and deleveraging in the futures (read: paper) market coupled with reduced supply from the Texas and Louisiana refineries is why we are seeing shortages. We also see every attorney general across the country making gasoline stations (especially the independent ones) fearful of being accused of 'price gouging', idiocy will do nothing except make shortages worse and gas lines longer, because gas station owners will be afraid to raise prices. Furthermore, the price divergence on the futures exchanges predicts imminent retail delivery defaults and delays, particularly for gasoline. I think within a week the shortages will worsen significantly unless the NYMEX price is allowed to rise.

The continuing divergence between the cash price and the NYMEX price in the face of dramatically reduced refinery output is a national security threat. I cannot help but think this event has been engineered, but I will of course leave that up to your own discernment. Here are the facts as of this evening:

1) Colonial pipeline is operating at 75% capacity

2) Plantation pipeline is operating at 60% capacity.

3) I talked face to face with TWO gasoline truckers (EDIT: As of 09/19, THREE gasoline truckers have confirmed shortages), which confirmed there are gasoline shortages due to the dramatically reduced supply in the Mid-Atlantic pipelines ultimately fed from Texas, which suffered the wrath of Hurricane Ike. One of the truckers was driving to pick up gas in Baltimore, MD instead of Manassas, VA due to limited availability.

4) The idiotic media keeps repeating, 'The refineries are not damaged badly' -- but the media fails to mention many of these refineries are not yet operational due to debris in roads, lack of electricity, lack of workers, etc etc. Thus, there is dramatically reduced supply going into the critical pipelines (Colonial and Plantation). This, the media also fails to mention.

There seems to be some question as to whether demand destruction outweigh the reduced supply. Perhaps someone more qualified can answer this question. Personally I doubt it. Unless retail gasoline demand drops by 25-40% within the next two weeks I think we are going to have some serious problems on our hands.

-Anonymous Poster 'Goldman Sachs', September 17, 2008

http://www.theoildrum.com/node/4544

I have to believe that after the panic driven gasoline run from Ike, people will again get their bills from the credit card companies and say oh $hit, and again stop driving except to work. Seriously 4 dollars a gallon and above is the big tipping point when Americans say screw you oil companies and cut way back. Prices are falling because of this factor, we will drive less and use much less gasoline. Plus if the oil companies and refiners cannot get product to consumers well heck we do not buy the stuff

That's not what I'm observing here in central NC, one of the places where there are ongoing minor spot shortages. Fleets of teenagers are still driving themselves to school, while fleets of buses make their rounds half empty. Weekends find the malls full (so I'm told by others - having not been in a mall myself in months), and the state park to which I walk still crowded with folks who drove there. And on and on. I see zero sign that $4 gas is any kind of tipping point. I wish it were, but the pedal is still to the metal, no matter how much closer the cliff might be...

We are about to watch what happens in a central-banker controlled casino/command economy. It will produce shortages.

Second the motion. But I'd omit the word "casino". If possible, there won't be an element of chance about it.

Monday Crude oil is up near 110 which is almost 20 dollars higher than last week when it got to near 90 a barrel. Gang crude is going up and never gonna be cheap again, gasoline heck lets get to 5 and 6 bucks a gallon and get Nascar Johnny out of his dumb pickup and suv and maybe just maybe rebuild the railroads.

What we are watching is a complete failure of the business model that the Republicans have been yelling about for years. Big business does it better than government. Look if you do not have transportation fuels for movement around the country this country is finished. It is the responsiblity of both govmint and business to get their $hit together and make the greatest country on earth work!!

But alas we have incompetent leaders and real greedy business that could care less if you can get to work.

What is surprising is that the Gasoline inventory levels have been dipping even before Gustav, since April, despite the fact that Gasoline demand had also been declining. Is it only on account of exiting of speculators from spot Gasoline market or any other factor?

I think some of it is "normal". In summer, people tend to drive more. Production does not really ramp up to the higher demand. Instead, the amount of gasoline in inventory is drawn down.

By September, supplies should start to build again. This hasn't happened. I think part of what happened is that discretionary gasoline demand dropped in summer. There is less discretionary demand in fall, so so there was less fuel use drop off than in most summers. Inventories started to drop drastically, because demand stayed at close to summer levels in the fall, after Gustav hit. Once the impact of Ike hits the pipelines, we will be even worse off.

Yes gasoline prices dropped to the mid 3 dollar a gallon range and people actually thought it was a bargain again!! Please we have dumb people here in the states. The oil companies saw demand destruction at 4+ a gallon this year next summer it will be 5 dollars a gallon and then will drop in september of 09 to head toward 6 in 2010. Now the attack on Iran at some point will really spike the price, I gotta get a bike soon.

Gail if I'm right about most of the demand destruction coming from the end of the housing boom we would expect demand to be lower in the summer when constructions at its peak and return closer to seasonal norms as you enter the winter. Certainly some conservation happened but we will see how much as we enter this winter and next year without a booming housing industry. I suspect we will find US demand surprisingly strong past five dollars a gallon with real demand destruction in the sense that people start changing their life styles only when gasoline gets into the 5-7 dollar a gallon range.

Great post, Memmel!

I purely love testable hypotheses!

Don't forget to come back and report how your idea holds up.

With the pace that things are happening now though, I would really expect that other influences will kick in to make your data fuzzy - a crashing dollar, or stockmarket, or something.

What demand destruction. YOY gasoline consumption is only down about 2.7%.

I live in Nashville--here's the situation. A week ago Sunday, the stations started running out of regular unleaded. By the middle of the week, the only stations that had any gas at all were Shell, Exxon, etc., but there were no lines. But by Friday, everyone realized that the weekend was here and and there was no gasoline. That's when the so-called panic started. By Saturday morning there seemed to be only two stations on the west or south side of town that had any gas at all, and there was about an hour wait, with cars backed up for a quarter of a mile. (The stations take down the prices when the gas runs out, so it's pretty easy to find out who doesn't have gas.) You can still buy gas here and there (and good luck!), but most of the new shipments appear to be going to the big truck stops on the interstate.

Anyway, the long and the short of it is that the news reports of "unfounded rumors" are not true. The "85% of stations without gas" was the start of the panic, not the result.

http://www.businessweek.com/ap/financialnews/D93BUCMO0.htm

Here's a link to a video story on WSB in Atlanta:

http://www.wsbtv.com/video/17524574/index.html

The field reporter is standing in a gas station with empty pumps in Alpharetta which, coincidentally, happens to be where the headquarters of Colonial Pipeline is located.

The reporter did not mention this fact.

Perhaps just as well.

http://www.cnn.com/2008/LIVING/wayoflife/09/22/atlanta.gas.crunch/

Fuel Shortages Grip Southeast

http://www.trafficworld.com/newssection/trucking.asp?id=47931

It will be interesting to see how the numbers add up when the dust settles. Here in Houston we had long lines at the stations for 3 or 4 days. Then poof: no lines at all even with many stations still closed for lack of electricity. I’m sure we had lost some delivery volumes but I suspect it wasn’t a huge amount. Throughout it all, I did not see nor have anyone tell me of someone running out of gas or even lacking the gas they needed at the moment. Back in the late 70’s, during the embargo, there was a sudden lose of gas reserves in the system. All kinds of accusations about refiners hiding gas. Long after the apparent shortage ended the numbers were studied and did show a real loss of gas inventory. And they determined exactly where it was “hidden”. It was in the gas tanks of every American vehicle. When they estimated how much additional gas folks were carrying (filling up at half a tank instead of when nearer to empty as they would do usually) it was spooky just how close the numbers matched.

Just like in Houston last week: a 4 - 8 hour wait to get gas because every one was in line at the same time. And many stations ran dry because the inventory was transferred to all those mobile storage facilities (cars). And then just one day later no lines at the stations. Why? Because everyone in Houston had a nearly full tank of gas and didn’t need anymore. This is when I pulled into a gas station right up to an empty pump and filled up. I don’t know if this a portion of the explanation for the long lines/empty gas pumps in other areas. But keep an eye on the situation and report any sudden changes in availability like we saw here in Houston. That could go a long way to explaining the situation.

County sees fuel shortage, rising costs

Officials say prices may last two weeks

http://www.tennessean.com/apps/pbcs.dll/article?AID=/20080916/MICRO06010...

State Energy office releases info on shortage

John Boyle • JBoyle@CITIZEN-TIMES.com • published September 23, 2008 3:10 pm

http://www.citizen-times.com/apps/pbcs.dll/article?AID=200880923054

Handy way of driving the independents out of business.

Should be good for profits down the line.

But things are improving.

MMS reports today:

That's like 8% better than yesterday, so another week and the gulf could be back to full production. Looks like mother nature is cooperating, for the time being.

The refineries are still only at around 72% right? I guess we find out the exact numbers tomorrow...