Looking Ahead - The Weekly Petroleum Inventory Reports

Posted by nate hagens on September 17, 2008 - 10:22am

VLCC Tanker - capable of transporting 2 million barrels

Tomorrow at 10:30 EDT we will get our first official report of crude/product inventories since Hurricane Ike and second since Hurricane Gustav. Below the fold are some brief thoughts on what has transpired in the past week, followed by an open thread.

Despite long lines and empty pumps at many gas stations across the country, and considerably high cash prices, gasoline demand likely fell week over week. This from today's Mastercard analysis (which is often more reliable than the DOE/API reports which are based on 'interpolated' demand):

U.S. Gasoline Demand Falls for 21st Week, MasterCard Says

By Barbara PowellSept. 16 (Bloomberg) -- U.S. gasoline demand dropped 3.1 percent last week, the 21st consecutive decline, as bad weather reduced driving east of the Mississippi River, a MasterCard Inc. report today showed.

Motorists bought an average 9.25 million barrels of gasoline a day in the week ended Sept. 12, down from 9.542 million a year earlier, MasterCard, the second-biggest credit-card company, said

in its weekly SpendingPulse report. Fuel consumption was 0.6 percent higher than the prior week

and was down 2.6 percent for the year, the report showed.Gasoline demand this year peaked at 9.65 million barrels a day in the week ended Aug. 1, 5.9 percent below the 2007 maximum of 10.25 million barrels in the week ended Aug. 17. The last time fuel use increased from a year earlier was the week ended April 18.

The national average pump price for regular gasoline was $3.66 a gallon, unchanged from the prior week. The price touched a record $4.10 the week ended July 18 and is up 23 percent this

year.

Below is the Bloomberg survey of analyst’s expectations for tomorrow’s DOE and API oil and product inventory reports:

Expectations

Crude oil: Down 3.4 million barrels

Motor gas: Down 3.5 million barrels

Distillates: Down 1.8 million barrels

Complex: Down 8.7 million barrels

Just as we are not weather/hurricane forecasters on theoildrum, neither are we price forecasters, other than in the context of longer term impacts on energy policy. Still, with shut-in production, and refinery shutdowns that may take a week or longer to restart due to lack of power, it is puzzling why distillate (diesel) and RBOB(reformulated gasoline) have exhibited the following chart:

Energy equities sold down sharply this morning. However, after the fed declined to spend one of its remaining bullets (by not cutting rates), the energy complex had a strong finish, outperforming most other stock sectors even with crude oil down over $3. This marks 3 days in 4 when the major energy stocks had strong positive finishes, despite the fact that oil futures were down every day and indeed 11 of the past 12 trading sessions. This divergence, at least in the past, has signalled a near-term bottom in the commodities.

Distillate (input for both diesel and heating oil) was down only 2.5 cents but RBOB (gasoline) was down 12 cents. Three things impact the price of futures: 1)supply of gasoline, 2)demand for gasoline, 3)supply/demand imbalance of futures contracts. The aggregate of these 3 forces have caused a 40% drop in gasoline futures prices since June, commensurate with the drop in crude oil.

Like many (but not all) of you, I have been struggling to understand how RBOB could be down so much with prices at the pump higher and refinery shut downs. One possibility is that we are receiving as-yet-unreported gasoline tanker shipments from overseas to compensate for our downtime. A more likely explanation however, is that gas station owners have been receiving less gas. Given a choice to buy cash gasoline at $1+ above futures and thus risk getting accused of price-gouging, it would be rational instead to buy smaller amounts of product (intentionally or otherwise) and ration/shut pumps down so as to not lose money. (the station owners would then lose money by selling fewer cupcakes and beef jerky etc. as gasoline is essentially a loss leader). So given the Mastercard report above, it is possible that gasoline stations are restricting how much they sell while at the same time showing a higher price. This dynamic would show up nationally as gas pumps being empty at sky high prices, but actually less 'demand' than the prior week or YoY comparisons. (Note this may be one example of where 'demand' exceeds 'consumption'.)

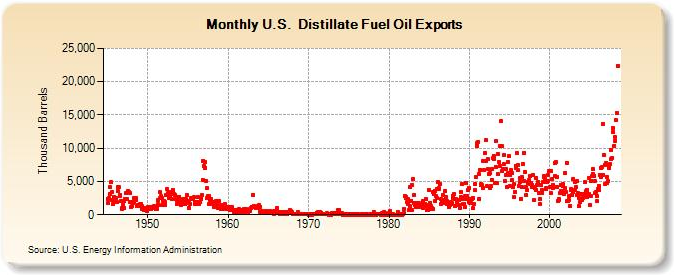

US Monthly Fuel Oil exports Source - EIA

Diesel (distillate) is another story - we are a LARGE exporter of diesel and increasingly so - One could surmise, (based on todays trading n=1), that the price elasticity of diesel is much lower than that for gasoline, and a good deal of this comes from abroad, meaning that distillate crack spreads should recover sooner than RBOB.

There also may be quite a bit of volatility following the next few weeks of DOE inventory reports depending on the timing of tanker shipments. 1 VLCC tanker can hold 2 million barrels (about 15% of our daily imports) - whether one tanker is counted this week or next is the kind of thing that has large potential to swing the weekly numbers. One thing I will note - if RBOB prices are 'correct' and gasoline demand is really going to continue to drop, then some retail and gas-station stocks are about to see less traffic, which has economic implications.

Note: This is not my area of expertise but like many of you I am looking for possible explanations for the 30-40% gap between cash gasoline and futures other than 'large hedge fund liquidations'. (Though I have been told that AIG had massive short-oil swap vs long oil futures positions and it's possible this has been being unwound throughout the past couple weeks - if true, then tonights rumoured 80% buyout by the Fed to loan AIG $85 billion might stem the fall of oil futures..) If any TODers are crude product traders at the NYMEX or gas station owners, could you please comment below on your interpretation of recent events or email me at njhagens@gmail.com if you would be willing to write a short guest post)

thanks to energy analyst Daniel Burke at Johnson Rice for some of the data in this post

update 10:35 EDT

Summary of Weekly Petroleum Data for the Week Ending September 12, 2008

U.S. crude oil refinery inputs averaged 13.2 million barrels per day during the

week ending September 12, down 246 thousand barrels per day from the previous

week's average. Refineries operated at 77.4 percent of their operable capacity

last week. Gasoline production fell last week, averaging 8.3 million barrels per

day. Distillate fuel production decreased last week, averaging 3.8 million

barrels per day.U.S. crude oil imports averaged 8.5 million barrels per day last week, down 71

thousand barrels per day from the previous week. Over the last four weeks, crude

oil imports have averaged 9.2 million barrels per day, 1.1 million barrels per

day below the same four-week period last year. Total motor gasoline imports

(including both finished gasoline and gasoline blending components) last week

averaged nearly 1.0 million barrels per day. Distillate fuel imports averaged

131 thousand barrels per day last week.U.S. commercial crude oil inventories (excluding those in the Strategic

Petroleum Reserve) decreased by 6.3 million barrels from the previous week. At

291.7 million barrels, U.S. crude oil inventories are in the lower half of the

average range for this time of year. Total motor gasoline inventories decreased

by 3.3 million barrels last week, and are below the lower boundary of the

average range. Both finished gasoline inventories and gasoline blending

components inventories decreased last week. Distillate fuel inventories

decreased by 0.9 million barrels, and are in the middle of the average range for

this time of year. Propane/propylene inventories increased by 1.0 million

barrels last week but remain below the lower limit of the average range. Total

commercial petroleum inventories decreased by 11.9 million barrels last week,

and are at the lower boundary of the average range for this time of year.Total products supplied over the last four-week period has averaged about 19.9

million barrels per day, down by 4.4 percent compared to the similar period last

year. Over the last four weeks, motor gasoline demand has averaged 9.2 million

barrels per day, down by 2.6 percent from the same period last year. Distillate

fuel demand has averaged 4.0 million barrels per day over the last four weeks,

down by 2.7 percent from the same period last year. Jet fuel demand is 7.6

percent lower over the last four weeks compared to the same four-week period

last year.

Where I live in Virginia, there are still stations without gasoline, and gas is $4 per gallon. Further south it is higher. I have heard almost nothing about this on the news, which is crazy, considering that our gas prices are higher than California's which normally has some of the most expensive gas in the country. It is amazing to me that the news organizations aren't covering the fact that a single minor hurricane was enough to shut down supplies to the southeastern united states. Clearly we do not have enough fuel to go around, and I can only imagine the dire implications of a true fuel shortage due to declining production rates in the Gulf and Middle East. If you want to see the near future of the United States, come down south.

Yeah, Gustav wasn't really all that big of a deal.

Ike, however ....

There seems to be a tacit cap on price increases, perhaps fear of being charged of gouging, or desire to not face angry customers. Higher prices would temper demand and maybe prevent dry gas pumps, but perhaps its easier to just let the customers take the gas "off the shelf" until the shelf is bare and then turn out the lights until supply returns to normal. I wonder what will happen at the last few stations still pumping gas in these regions- will they finally break, or continue selling at around $4/gallon?

As a follow-up. I just talked with the BP/AMOCO station operator next to our offices. She told me that all 20 of their stations in the Raleigh area are out of gas (well, 800 gallons left in the bottom but she does not want to plug her filters) and that the terminals are also out (Selma and Greensboro). She does not know when they are going to be supplied again, though she estimates maybe in a week or so. As she noted, the pipelines are still down

As the shortages become more apparent maybe there will be more coverage on the news, but people are going to figure out if there is no gas pretty quickly.

And that has several dynamics:

1)less gas will be sold overall which is why futures prices are declining (i.e. the imports and expected restarts of refineries will offset c rrent demand.

however,

2)we could shift from just-in-time to just-in-case behaviour and people will keep some of that 180 mill barrels of gasoline storage in their own tanks instead of government/private tanks

3)it will result in less driving to malls, Chuck-e-Cheeses, etc.

4)on top of some likely bank runs this weekend, it's gonna make for some stressed out folks. Accessing rational neo-cortex may be increasingly be trumped by our reactionary synapses. Jekyll...meet Hyde... :-o

A million fewer barrels a day of usage is great no matter what the reasoning.

I just wish California would run out for a while so that I could ride my bike in peace.

My vehicles stay above 3/4s from here on out. That's two barrels of diesel and one barrel of gasoline off the system. Ironically, prices are falling out here. I'm happy to bike and take the train, but my wife has two artificial legs and unfortunately really needs the minivan to get around town. Although the Prius also has hand controls.

Thanks Nate for all your hard work. You guys really do the world a service.

I guess it depends on the station, Exxon normally has gas no matter what, they are also the most expensive, Wilco (Hess) is also normally supplied.

We had some stations go as high as $5.49 per gallon (but they are facing possible price gouging charges if they can't back up their wholesale price increases.

It seems that the whole price issue has settled around $4.00-$4.10/gallon or the operators simply let their pumps run to "dry" to avoid getting stuck with inventory that they might have to sell at a loss.

I'm lucky, I can go another month on the tank of gas I have in my car, if I need to. Others don't have the same options I have.

Demand didn't fall. The ability to buy gasoline did. We have gas stations here in Destin Florida that haven't had gas for six days now.

Be careful how you interpret data.

I am baffled by what seems to be two conflicting realities: Google news search on "gasoline shortages" yields few actual reports of dry pumps, but the blogs have reports of stations here and there with no product (or stories like below about tank delivery drivers who are noticing major changes in the distribution system). Gas Buddy shows daily pump prices dropping Tuesday to Wednesday in markets like TN and AL, where the dry pump blog reports seem to come from. What gives? I feel like I need actual time-stamped photos of pumps without product to confirm that there is in fact a shortage of supply at the retail level. Anyone?

http://news.google.com/news?hl=en&q=gasoline%20shortages&um=1&ie=UTF-8&s...

Keep in mind that there are tens of thousands of gas stations in the US, so hundreds could have no gas even while 99% of stations are fine. Moreover, most places have multiple stations from multiple companies, so there's little impact on the public - and hence less news interest - if it's only one station or one company's stations that's having trouble, as people would just gas up at other stations.

Personally, I don't see a dichotomy here; a simple explanation is that some stations are having trouble getting product, but vast majority aren't, so almost all of the public sees little or no effect, so it's not something that makes the news.

Good points, but with empty shelves at even a small portion of stations, how can retail prices go down? What makes the stations with product, perhaps across the street from one without, so confident that the trucks will keep coming? Reports our of TX are 9-10 days of refining down at a minimum on top of already near-record low inventory, but AAA says "no worries" based on...?

Be careful how you interpret data.

Like when the newsdroids assert that "people have become discouraged and stopped looking for work", when all that has happened is they've used up their few weeks of unemployment and have been kicked off the rolls.

... define "demand"; define "supply"; define "money" ...

Update--Citgo stations are returning to normal, but Sheetz is still suffering major shortages. Gas prices still $4/gallon

Yeah, it's pretty crazy that such a bullish couple of reports are on the horizon and gasoline futures prices continue to fall. I can understand them not rising quickly due to the hurricanes, but to not fall for October while supplies are below the MOL seems a little crazy to me. If Mastercard is right about 9.25 mbd of demand and bloomberg analysts are right about a 3.5 mb drop in inventories, we would fall below the MOL at 19.9 days of supply (184.4/9.25). And that is before next week's report which will probably show a more significant drop due to the crippled refineries post-Ike...

More of my musings are at www.setenergy.org

Onwards,

Dennis

Nobody comes to a decision to loan $85 Billion overnight.... first scenario that comes to mind is that AIG was long oil and the feds forced them to sell off for the 80% stake - as a way to save jobs. Now my head is really spinning.

Regards, Sounds

And wouldn't know...tonight crude prices are rising...go figure.

as a way to save jobs ? that's absurd. The Fed just bought an insurance company, not a hedge fund.

That's what they insured - toxic debt.

They have a traditional insurance company bit, but that is not what is in trouble, but anyone who had made dodgy loans on sub-prime mortgages could lay off some or all of the risk to AIG - they were insuring it against failure to perform.

So if houseprices continue to drop, which they will as the earnings to price ration is unsustainable, particularly in the new, recessionary or depressionary environment we are entering, then the latest $85 billion has just been thrown away, to go with the money wasted on Frannie.

It's a pretty poor show that this site does not have a full article on the fact that oil prices have fallen from $147 to $90 in the last few months. Every price rise is greeted with a breathless article (or five) dissecting the intricate possible causes of the rise, but a gigantic fall is price is glossed over with talk of inventories, offshore drilling debates, hurricanes etc. So in other words any realities that run counter to the site's meme are magicked away, in much the same way this site accuses mainstream society of brushing peak oil under the carpet. Don't think your readers aren't aware of this legerdemain.

I heartily agree. The possibility of a severe deflationary depression crushing demand and prices for everything is a distinct possibility at this point that deserves more investigation.

Yes, but you guys need to keep your eyes open also. Currently, demand for physical purchases of gold is at an all time high-the paper price is going down and staying down. To simply parrot the line that a lowering NYMEX price automatically means lessening demand or increasing supply isn't valid anymore (if it ever was). Try to purchase some silver for $10. I haven't seen any credible evidence that the NYMEX market for e.g. gasoline can't be moved one way or the other (irrespective of supply and demand of the physical product) by anybody with enough capital to play with. The only argument I have heard is that the manipulation can't last forever, but the gold and silver game has been going on for a while now (granted a smaller market).

So are you implying that because you cannot buy physical silver at spot price that the same is true of oil? That would be news indeed!

C'mon, this crisis is a credit crisis and credit is the great driver of capitalism. Credit used for productive purposes is our great engine, one that is becoming much weaker as energy moves way way offshore (thanks Gail) and nukes get more complicated (thorium?) and overall EROEI drops, even if energy inputs get cheaper, much cheaper.

Credit for consumption or wasteful investment is a whole 'nother story. From Wall St bonuses to tripling up on mortgages to consolidate consumer debt from too many credit cards, using credit for overconsumption/spending and poor investments may have fatally narrowed our credit options as far as energy transition is concerned. We were so close...

Not too mention government deficits and unnecessary (if heroic in a Phyrric sense) and wildly expensive wars and future war spending. This is truly wasted capital. The real agenda of the cornucopians should be examined closely. It is altogether anti-democratic though cloaked in democracy. It really amounts to looting the treasury for a small minority. Anyway, savings should drive credit, not consumption/demand.

The oil market combines spikes with bubbles, two rather uncomfortable bedfellows. The feedback loop feeds cutbacks. You think companies are going to drill in areas they aren't already drilling without the guarantee of decent prices and really big returns? Heck, they don't even have the iron. Polar technology is in its infancy... Sorry folks, the lower oil goes, the higher it'll soar.

The oil market is set up for a classic economic "cobweb". This kicked the heck out of farmers as they chased the high priced bushel from year to year. High prices kick the heck out of demand and then low prices (and lack of CREDIT) kick the heck out of investment. The Saudis have actually used their oil power to crush all alternatives - and probably take positions - twice and are currently trying for a triple play.

Any country that buys into a world without limits is doomed or fatally flawed and dangerous. Maybe that's why the world has had enough of Bush and his cornucopian cronies. They claim to have repealed the basis of economics - scarcity. Who's fault? It has to be the White House and Senate, no?

George traded the cow for some magic beans. Fi fi fo fum.

Not really. Blame excessive exuberance or its author? How about the the cornucopian right wing? Their refusal to recognize basic and bleak laws of economics like "no free lunch" has perhaps ruined the US for a generation or more, at a fairly critical juncture. The only way out of this mess is tightening all our belts and making reasonable choices, on the safe side of things as my Grandma used to say.

IMO, the jester's crown among cornucopians goes to a little cabal up here in Canada: The National Post's intellectually disgraceful team of Peter Foster, Terence Corcoran, Lawrence Solomon, Lorne Gunter and a couple of other right-wing oddballs...that more or less run Canada's Conservative Party from their bully pulpit on the Post's editorial page.

You gotta give it to them. If you can buy the election, I guess you will. If there is a chance the neocons get a well-deserved tarring and feathering in DC, the incipient majority of the Far Right in Canada (the centre is split five ways...) will give them a hearty welcome.

These guys are great at getting elected but they just can't govern. Maybe the real story is that they just won't govern. Part of their agenda is to discredit government. I guess they deserve congratulations: In the USA, at least, they succeeded beyond their wildest dreams.

PS. There are left wing cornucopians. This pernicious brand of BS works is fodder for dishonest politicians of all stripes, especially during elections or populist acclamations. The left concentrates political power directly, not via concentrating wealth. If there's nothing but markets, cash is the only vote that counts.

Re: If there's nothing but markets, cash is the only vote that counts.

Welcome to American reality.

Update: Gold is up 12% in six days so maybe they can't plug all the holes all the time (maybe gasoline and oil plugging has diverted some of the resources? Who knows).

They've spent most of their hole-plugging money trying to prop up Wall St. until the election.

After election time, there be dragons :O

I'm not a metal nut, but I do buy silver maple leafs from time to time (not a lot). A few weeks ago, the coin shop raised their sell rate to $4 over spot. I thought that was silly so walked out. After seeing your note, I called some other shops nearby, one is totally out of silver with a 10 week wait for resupply. The other wants $3.50 over spot for maple leafs.

I don't really know what it means. It seems like the rise in premium charged by dealers could be because the supply is low, or it could be because they want to protect themselves from buying back at a loss with increasing silver prices -- except silver is down a third in the last few weeks. I figured they were just being greedy so I wouldn't pay that amount.

Puplava at financialsense interviews a sliver dealer on the latest broadcast-all dealers are trying to meet record demand. Today the gold and silver paper market is on fire so maybe all such market manipulation isn't that long lasting.

A leaky dam will only hold back a rushing river temporarily.

The same here in OZ. We are paying up to $5 over spot if you can get it !

Oil and gas prices tend to rise in the first half of the year and fall in the second half of the year.

I think the prices are falling because investment banks are scrambling for cash to survive. Oil and gas are fairly liquid assets. This is an artificial price drop.

The suppliers have not excercised their pricing power yet.

There is no such thing as "demand destruction." Decreases in oil demand is economic destruction that will show up over time. We can increase efficiency, but that will take time.

Price instablility is terrible for economic stability. Unstable prices, like work hardening steel, makes the system brittle.

Price instability, up or down, warns we are at Peak Oil.

Mamba, regarding legerdemain, here is some of my writing- there is content here everyday so I am sure there are many other contributors that have mentioned these issues. It is not the purpose of this site to forecast price, but I fear that due to the credit crisis, not only will the demand destruction and tight money cement the peak, but it will also cement the awareness of the peak, as we will now perpetually hear, "Well, if it weren't for the credit crisis and hurricanes, we'd be at XXX barrels by now..."

In any case, here are some quotes from prior posts:

Dec 26, 2007 (oil at $95): From the conclusion of A Poll on Oil Price Volatility for 2008

Jun 8 (Oil at $138): From the conclusion of: Peak Oil and Reflexivity and Peak Oil

Sep 3 (Oil at $111) : From the conclusion of Hedge Funds, Hurricanes and Oil Prices

July 23 (Oil at $135) : From conclusion of: CFTC Report on Oil Prices - Speculation My A$$

Yes, Nate, you have made very perspicacious comments all along, but I see the need for a full article investigating this phenomenon and teasing out all the aspects.

Mamba, you've used that word before...;-)

And you should have 20% less explaining to do given the Aussie dollar dump since oil peaked (i.e. in US dollars oil is down 50/147=32% but in AU$ it has declined far less.)

Look - you bring up a valid point -some article like that needs to be written. Would you like to write it? We have an ad hoc group of wonderfully smart contributors, who put articles into the queue when they have time or content. There is no real schedule or agenda -people write on their particular expertise or interest. I made this short post tonight because the gasoline situation is puzzling to me and I wanted to stir the TOD pot for some answers and expertise. There is no in house choreographer -we just try and keep the discussion advancing.

I have to write a speech in next few days then go to ASPO conference. I'll try and write such a post soon - but Peak Oil (at least to me) has never been about perpetually higher prices, but the mere fact that you are upset shows how important prices are...cheers

I don't have time to write a feature article, Nate, but I'll buy a beer for the person who does. :)

I suspect this topic will feature heavily at ASPO's meeting. It's robbing ASPO of oxygen, IMO. Can you imagine the press coverage the ASPO conference would glean were oil at $150 or above? I'd say there'd be mainstream press coverage, lots of it, whereas now you'll barely rate a mention in the MSM.

So this price manipulation (for that is what I suspect it is) must be upsetting not just me, but a lot of people.

I agree,

demand destruction, although the reason given for the fall in price by the MSM, is not the explanation for the dramatic fall in prices. The fall began just after the meeting called for by the Saudi King so I suspect a large amount of government manipulation is going on.

There have been some massive additions to US crude inventories in the last few months, at one point a 9 million barrel increase. But was this light sweet or heavy sour?

An artical by someone more articulate than me on this subject is needed.

It seems like a quarter of the comments I read are about prices. In fact, this thread is sort of about prices. We had a poll about prices earlier today. What exactly were you looking for that you aren't seeing? This isn't really a stock/futures trading site, though we end up talking about it a bit.

Here's an article for you: markets are wacky. At $147 the price had gotten a bit ahead of itself, the market corrected, it probably over-corrected, we may see the price bob back up. Or not. Maybe sooner, maybe later. What more is there to say? Do you think that going from $90 to $147 is an aberration, but going from $147 to $90 is of profound import? Over time the direction is likely to be up, but there is a lot of volatility.

Prices are what 21st century human agents respond to. If oil was $15 dollars, could I convince you to change your consumption habits and build more wind turbines?

Strangely, when oil was 15 dollars a barrel is pretty much the time the Greens were starting to become a real political force in Germany.

Actually, price is not the only thing humans respond to - but it certainly has become an article of faith in the U.S. that all human activities can be reduced to economic decisions.

The poverty of such a narrow perspective is now on full display.

But admittedly, the Greens could be considered 20th century humans.

On an INDIVIDUAL level I would argue that price IS the only thing that people respond to. Peoples' actions (for the majority of people, that is) are based on what affects them directly. Price does affect them directly, but climate change or what may be going to happen in the future as far as energy supply is concerned do not.

The only way in which actions get taken by the majority of people on a longer term basis is when they act collectively, when there has been a process of rationalisation of the prospects by the society involved.

In 1995, by national referendum, the Swiss people voted for a detailed study and plan to massively upgrade their rail system, to be submitted for another national referendum for approval.

In 1998, they voted for a 20 year, 31 billion Swiss franc program to improve Swiss Rail (SBB). Half for two rail lines under the Swiss Alps, one a flat, straight line from Zurich to Milan. 1 billion CHf for quieter rail cars, some for semi-HSR links to Germany, etc.

Many goals, but #1 was to shift freight from trucks to electrified rail. Improved passenger service was another goal.

Adjust for currency & population, and the Swiss vote would be like the USA voting $1 trillion to improve our railroad system.

And the price of oil in 1995 and 1998 ?

Best Hopes for Vision, and acting on it,

Alan

Answer:

In calendar year 1995, the average closing price for the WTI benchmark spot market oil was: $18.40/barrel.

In calendar year 1998, the average closing price for the WTI benchmark spot market oil was: $14.50/barrel.

So far, for 2008, the running cost of WTI benchmark spot market oil is running just under $114/barrel ($114.02 as of last Friday). The running NYMEX front-month futures closing price for WTI was $114.04 as of yesterday.

This site is really more of an "open" forum with some direction by the editors and contributors. Subjects start in one place and may take off in other directions. There has been plenty of talk about markets, stocks, trading, futures, spot prices, etc. All is interesting and adds to the main idea about "energy and the future" as the title says.

Well Mamba, I don't know if you regularly read this site, but there have been two full articles on the downward price movement since August 5, and several other which address this topic at least tangentially. Just today, the new price survey was posted. This is the fifth price survey since prices began heading lower; comments on those surveys revolve around the present price movements. In addition, virtually every Drumbeat is host to substantial threads which discuss this very topic.

Perhaps you need to read more closely?

Are you hoping for an article "Peak Oil Cancelled" or something?

I'm a complete believer in peak oil theory, Bryant. But this enormous downward move in prices has made me look like a fool to friends and family, and I believe it needs to be dealt with directly, as a feature article, not tangentially in articles about other subjects or camouflaged by an article title that does not directly address the issue. How about an article with the title: "Oil Price Collapse: Causes and Implications. Where to now with Peak Oil?"

Fair enough Mamba.

But if that article gets written, I can ghostwrite all the posts by memmel, gregor, etc. as we all have traveled this road for two months now. I think I know by heart the various explanations, from tightly reasoned delevering to wild conspiracy and most everything in between.

Yeah, I've been there. Now I just say "I don't know" and that the plateau is likely to have "volatile oil prices". I'm just regurgitating something Nate said...or maybe it was memmel or... ;-)

I avoided that fate by explaining the economic conditions caused demand to fall. It doesn't matter that supply is capped by geological constraints when demand is below the cap. My family and friends are clever enough to understand that. They also noticed the price is still way higher than in 2002.

Now we get to the heart of the matter - the price decrease has made Mamba look foolish. Well, you know if you had read Stuart and Dave and many others who are long since gone from here over the last few years, you would have understood that volatility is the real price problem in a supply constrained environment.

Second, I suggest you stop your whining. If you want the article written, then write it and submit it to Nate or PG. Otherwise, stop demanding more freebies.

I think that one of the hallmarks of a serious, mature blog site is that it's bloggers show respect even to those who post some thing that they do not agree with and who perhaps have stated their opinions in a manner that gets under the skin. On the whole TOD has done a very good job of this and I hope it continues to do so.

I'm with Mamba - I do think an article like this would be of great value at this juncture. Surely the raison d'etre of TOD is to examine objectively all aspects of oil supply, whichever way things are heading. An analytical article of such a significant change in the situation seems to me to be of great value, if not obligatory in the circumstances. We get many (invaluable) articles analysing (some might say justifying) the upward movements in price - why not when the price is coming down, particularly in such a dramatic way? It seems highly inconsistent, unobjective and irrational that an article on this subject has not been written by one of the esteemed contributors.

And it's not good enough to simply way "well, you do it then", as the roster of contributors have previously been very forthright in justifying articles they have written on the basis that they are necessary given what is happening - not that they just happened to want to write an article and this was the first subject that came to mind.

Energy is volatile. In other news, the sun will rise tomorrow morning.

I'd point out to them that a year ago $90 /bbl would have been viewed as expensive. Two or three years ago people would have dismissed $90 oil as ridiculous.

The price just balances supply and demand - nothing more.

The price does not tell you anything about overall flow rates.

Peak Oil is about flow rates, anybody that says falling prices means there is no peak oil doesn't fully understand peak oil.

As evidence that flows and price aren't closely linked - supply has been essentially flat for around 4 years now and the price has gone from ~$30 to ~$140 over that time.

Peak Oil is not about price, it is about affordability - some people can afford to pay the price some can't. Over time oil becomes less and less affordable, we will go from collectively affording a bit more each year, to no more each year, to less each year. Even when we have passed peak some people will be able to afford the price.

Also, Peak Oil has nothing to do with reserves, there are still at least a trillion barrels of oil in the world, anybody that argues against peak oil by quoting reseves either doesn't understand peak oil at all, or is deliberately attempting to deceive.

The evidence as to whether the world oil flow rates are up or down are only found in historical oil supply statistics - at present these seem to be being manipulated, ask yourself why this might be happening.

Then you probably made predictions you shouldn't have.

The key ideas here are:

Based on your audience, you could also add:

The result is that oil will tend to rise in price over time. Accordingly, it is in our best interests - individually and nationally - to use less of it.

Note that this doesn't say prices will only ever go up. It doesn't say the economy will collapse. It doesn't predict an apocalypse. It just says that there are good reasons to use less oil.

You can't make a horse drink, but if you lead it to water, you've made it a lot more likely. Giving people the plain, unembellished, uncontroversial facts of the matter and then leaving them to come to their own conclusions can be one of the most persuasive arguments of all.

Mamba:

I don't have time to write an article either, but I'll repeat here a post that I have made many times:

Oil prices will have their ups and downs, but there will be more ups than downs, and the ups will be up more than the downs will be down.

To elaborate briefly:

Oil is a commodity. Like all commodities, its price is volatile in the short term. Because oil is a finite commodity, and because we know we are at, or maybe already past, or at least very soon will be at peak, we can confidently predict that in the long term supply will lag behind demand (true economic demand, not demand = purchases as appears to be the common usage in the oil industry), prices will trend up.

One cannot infer long term price trends only from a single short term price movement. Long term fundamental shifts in supply or demand curves are much more decisive and reliable guides to long term price changes.

Hello WNC Observer,

Well said. I would suggest Mamba and other TODers keep an eye on I-NPK flowrates and prices: much less volativity; a more consistent upward trend as peoples' desire to keep eating is quite obviously universal. Remember, there are No Substitutes to I/O-NPK, yet there are lots of weak substitutes to FFs, including much more manual exertion.

I-NPK is basically nothing more than transformed FFs. Recall my earlier posting on the amount of FF-energy embedded in a high power bag of potent I-NPK. The Nitrogen component alone: to Haber-Bosch manufacture 1 ton of anhydrous ammonia fertilizer requires 33,500 cubic feet of natural gas. Then, add much more FFs to add the sulfur beneficiated P & K rock to get a completed bag of I-NPK, then the final energy addition of global transport to the final acre for application.

Remember the rock is free, but it takes much energy to move potash up from 3300 ft underground, process it, then move it to the high altitude Himalayan farmlands, innermost Africa, or far flung Argentina. Same dynamics apply to sulfur and phosphate.

http://www.reuters.com/article/rbssIndustryMaterialsUtilitiesNews/idUSN1...

------------------

WRAPUP 1-Canada fertilizer producers say demand stays strong

...Potash prices more than tripled to levels above $1,000 a tonne this year as producers struggled to keep up with orders.

At one point last week, there were only 75,000 tonnes of potash in North American producers' warehouses at a time when there should have been 1 million tonnes, Brownlee said.

Potash producers will be unable to supply 8 to 10 percent of world demand this year, or a total of 3 million to 4 million tonnes, mainly in China, Brownlee said.

"We think there's actually a chance that you're going to see potash be short for the next five years," he said.

---------------------------------------

Have you hugged your bag of NPK today? Borlaug: No I-NPK-->Game Over!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

People knowledgeable about Peak Oil have been forecasting this price volatility due to cyclic fluctuations in the supply/demand balance for a long time now; in fact, I think it's fair to say that it is an integral element of the standard Peak Oil view of the world. I even recall an article from the www.fromthewilderness.com website a couple of years ago that directly predicted that the low points in these fluctuating cycles might well be EXTREMELY low - they even threw out a specific figure of $15 a barrel, if I remember correctly.

Does anyone remember the article I am talking about? I believe it was either by Dale Allen Pfeiffer or Stan Goff.

Here is a different one:

http://www.financialsense.com/fsu/editorials/lalani/2007/1028.html

POST-PEAK PRICES $1,000 a Barrel Oil / $20,000 a Pound Uranium

by Saif Lalani October 28, 2007

In 2008 dollars there is NO WAY we will ever see $1000 oil. Social inequity would disrupt the economic system long before that. Oil might trade hands on some market someday at that price, but not on any organized exchange. Bombs would fall first.

The question is the number of people that might be paying $1,000 per barrel--and for what volume. The trend that started in 2006 was for a smaller number of consumers to pay a higher unit price for a smaller volume of exported oil. Having said that I think that Saif is talking about nominal, not CPI adjusted, dollars.

As Matt Simmons has noted, the retail price for refined product in Europe has been as high as $350 or so per barrel.

This would depend on how long oil will keep playing the same central role in the economy. If the answer is 'all along until the MadMax scenario' then I am afraid you are right. But if we succeed in reducing its role, then oil may become a luxury good without unbearable social inequity as a consequence.

But many in this country, myself included, would have very little problem paying $18.00 per gallon of gas....and continue on their merry way. $18.00 x 55 = $1000.00

No?

$1,000 per barrel oil would probably translate to about $25 per gallon gasoline.

$25 gallon gas wouldn't be much of a problem for most Americans, were we to adapt our lives to it, quite honestly. The problem is not our individual responses, but the response of the overall economy - that is, the ability of the economy to support enough people who could pay $25 a gallon to do so more than once in a great while.

I personally don't find a lot of people saying "oh, you crazy loon, obviously peak oil is over." Why? Because gas is still quite close to $4 gallon, no matter what the price per barrel of oil is. And people in my region are still flat-out terrified of freezing this winter, even if heating oil has come down. Why? Because they think their ability to buy $4.25 heating oil without a job, and while buying increasingly expensive groceries is probably not going to be better (and probably much worse) than their ability to buy 5.50 heating oil was this summer, when they were still employed.

Sure, the price of oil has come down - and a combination of factors is probably at work - some sell offs, some manipulation, some depression, some dollar, some end of the stimulus checks and end of Beijing buying oil like water. But the reality - that gas and food are now frighteningly expensive luxuries that people don't expect to be able to keep coming into their lives - that hasn't changed, and isn't going to as we descend hard into a depression.

Sharon

In 2007 the US was consuming about 5.5 billions barrels per year. At $1000 per barrel this is $5.5 trillions.

The US GDP is about $13.8 trillions.

Nope. You can't get this fraction of the GDP on crude oil alone. It doesn't matter how many wealthy people can afford it. Something will break before we reach this price.

I don't think anyone is claiming that the same number of barrels will be sold for $1000 as are sold for $125. Also, the number of barrels available for sale will decrease over time (that whole Peak Oil thing, you know).

Selling one eighth the number of barrels at eight times the price would keep the fraction of GDP the same (in some hypothetical universe where GDP was not affected). What I expect that we will see is an increase of the percentage of GDP devoted to energy (also food), while other aspects of the economy shrink as a percentage (perhaps big screen TVs and plastic surgery). Say a quarter of the barrels sold, at eight times the price, doubling the percentage of GDP devoted to energy. Something like that.

It looks like my point wasn't clear enough. I didn't argue the number of barrels had to remain constant. I made a point about a ratio.

There is a maximum to the share of the GDP that can be devoted to energy without harming the rest of the economy. As long as oil remains a primary source, this fraction depends on the price per barrel times the number of barrels consumed. This brings an implicit ceiling threshold to the price of crude. If this ceiling threshold is crossed, something in the economy will break. Then reduced activity will reduce oil consumption which in turn will bring the price down under the threshold.

The implicit corollary is that peak oil will not necessarily raise the price of oil. Instead I expect it to bring economic activity down while keeping the price in a trading range. The economy will be in a permanent recession until we move off oil.

this is my view as well.

Reduced plastic surgeries and big screen TV purchases may in fact reduce oil usage, but since supplies of oil will be decreasing that may not, and in the long term will not, be enough to reduce the price.

The economy will eventually evolve to the point where there are four groups of people:

* those who can only afford food

* those who can afford food and energy

* those who can afford food, energy, and some health care

* a tiny fraction that can afford anything else

So the prices of "anything else" can be expected to drop.

I agree about the permanent recession, I just think it will be an inflationary recession, our old friend stagflation.

I think you will find that 'anything else' is actually currently the largest part of the economy and is largely financed by debt.

We only experience price inflation or deflation when we buy or sell something.

If population continues to increase exponentially then daily purchases of food and energy will inflate as a proportion of income since they are limited in supply, implying the prices of 'everything else', the largest part of wealth, must deflate.

I.E. When you try and convert your house or pension/savings to money you will get less and less as time goes by - you will have to destroy wealth at an exponentially increasing rate to maintain your standard of living.

Eventually almost all wealth/savings will have been destroyed to provide for food, drink, shelter and heat and you will survive (or not)depending on what you can extract from the locality on a daily basis.

That's how most of the world lives already, most people have little wealth and live a subsistence lifestyle.

I wonder how long the economic decline will take, it looks like it may already have started? - nobody knows the future in detail, but wealth falling exponentially while expenditures rise exponentially isn't a good scenario, a kind of economic ELM.

Something break hmmm.

Expensive suburban housing.

Check.

SUV's

Check.

Financial economy from planet bizarro paying people billions to do nothing and not related to living.

Check.

Things will break and will continue to break its when we get to the point we can't sustain at least a much smaller high tech civilization my enclaves.

However these can readily run on 1000 a barrel oil or the renewable equivalent.

The maximum is when maximum demand for oil fits into the amount we can produce reasonably plus what ever we are still extracting. Price best guess is 800-1000 a barrel.

I was expecting to read:

"Prices falling back to more sustainable levels in reaction to slower economy - Check"

But on the longer term, there is a limit to how much we break thing without having a total collapse.

I have trouble envisioning a high tech enclaves without low and middle classes to do the hard work. You can't spend one third of GDP on crude and still have a functioning economy for these classes. How does you $800 to $1000 figure translate in terms of GDP? I think I don't understand your concept of enclave.

I think of the competition for declining net oil exports as more of a continuum, with forced energy conservation moving up the food chain. If we divide all consumers in all importing countries into five groups, ranked by income, we have a poor Third World consumer at the bottom of the bottom quintile and Bill Gates at the top of the top quintile. As forced energy conservation moves up, each successive quintile has far greater capacity to shift discretionary spending to non-discretionary food & energy spending.

Let me put it this way. Why didn't forced energy conservation among poor consumers in Africa in 2006 and 2007 bring the price down?

The trend which began in 2006, and which I expect to see continuing, is for a smaller group of consumers to pay a higher unit price for a declining volume of exported oil. I am of course arguing that the world economy as we know it is dying, but most people don't know it and/or they refuse to accept it.

I don't think this model is accurate because pricing people out of the market does not give, to use a computer science term, a graceful degradation of performance as you price out of the market more and more people up the food chain.

At the extreme, when you pass certain thresholds there will be discontinuities in how society operates. For example if there are no workers willing to operate the rigs, refineries and pipelines, there will be no gas for Bill Gates. This could happen if there are riots because what used to be the middle class don't have access to food anymore. Another example, the oil industry cannot operate without supplies such as food for the workers, communication services, financial services etc. What happens if the industries providing the supplies have to stop because they are too low on the food chain?

But well before you reach these discontinuities other factors will come into play. Consider the distribution of people across the food chain. The bulk of the buyers are in the low and middle classes of the western economies. There is not such a big spread in buying power between the bottom and the top of these classes. Small variation of price will exclude a disproportionate number of buyers. There is not enough room remove people out of the market in a progressive fashion. I this phenomenon is a feed back loop that prevents the price from raising without bound.

http://online.wsj.com/article/SB122161720455746373.html?mod=testMod

As Oil Speculators Lose Backing, Market Exodus Could Ripple

Colin Campbell has been clear about this in his writings, for example:

Hubbert Center Newsletter # 2001/2-1, M. King Hubbert Center For Petroleum Supply Studies, Colorado School Of Mines

"The reality is that there is no real reprieve. Gradually the market – and not just the oil market - will come to realize that OPEC can no longer single-handedly manage depletion. It will be a dreadful realization because it means that there is no ceiling to oil price other than from falling demand. That in turn spells economic recession and a crumbling stock market, the first signs of which are already being felt."

And also: http://www.oilcrisis.com/Campbell/TheHeartOfTheMatter.pdf

"The scenario assumes that the demand and production of Regular Oil are on average

flat to 2010 because of recurring recessions caused by price shocks that arise when

capacity limits are successively breached."

The same disconnect is occurring in other speculative futures markets between the price on paper and the price of the real physical asset on the pavement. Precious metals ETF and paper spot prices are very low, while the real physical asset is either unavailable or is priced with a significant surcharge over spot.

I think that the dynamic here has to do with the fundamental difference between debt/credit and power money. Debt is an IOU on future work in a growth economy. We have accumulated debt in the global economy that is about 900% of the world's GDP, and is 87% of the world's liquidity. At this point, with a contracting world economy, exponential debt growth becomes inoperable and debt becomes worthless. What we are seeing is the top two layers of the liquidity pyramid below blowing up. Those top two layers consist of what I like to call The Casino, with over 10x the world GDP in bets in terms of derivatives and securitized assets. The futures markets is inextricably linked to the casino. The real economy that is still linked to power money (and to broad money to some extent) still operates, but it is starting to delink from the casino layers above. Real economy meet FIRE Casino (financials, insurance, real estate).

These reactions seem to be highly localized. My wife ran into a minor gasoline panic in Orlando Friday evening, and the evening news showed gas prices in the $4.50 range at several stations. Here on the coast - 50 miles east - I saw no prices above $3.8x, and only a little congestion at the gas stations.

So, LOOP has been offline or at reduced capacity for two weeks, gasoline sales are only down a tiny bit, refineries have been shut down, nearly all the Gulf production has been shut-in for two weeks, and the complex is only going to be down 8.7 million barrels? In last week's report it was down 15.2 million. Seems like this one would be significantly worse. 20 million seems more likely? The Port of Houston must be offline now, but maybe that doesn't factor into this report. Did anyone hear whether Mexico suspended shipments due to the weather?

My surprise will be zero if BOTH Oil and Gasoline drop 10M+ barrels in this weeks report.

And if they don't, expect a shocker in next weeks TWIP.

The reporting period ends on Friday. Ike hit Saturday morning. Most of the refining that was off-line was ramping back up by Friday 9/5.

Next week's report will be the killer.

Also, I think the turn-around in prices between 8/18 and 8/25 was the likely curve of the graph above. After that, banks started blowing up which distorted the price. It seems reasonable that oil popped 3.50 right after the AIG bailout was annouce this evening. Plus, the 10year bounced from 3.29 to 3.60 in a little more than a day.

As for Mexico, I heard 60+ ships are parked outside Port of Houston waiting for the gates to open. I assume they are in line as well.

Here's the Port of Houston status. Not good.

DATE: Tuesday, September 16, 2008 6:03 p.m. (CST)

PHA MESSAGE TO THE TRUCKING INDUSTRY

Port of Houston Remains Closed due to Power Outage http://www.phastatus.com/go/site/1175/

A range of serious complications due to the lack of electricity prohbits the Port of Houston Authority (PHA) from opening for business operations Wednesday, September 17th.

PHA is continuing to work with CenterPoint Energy to establish power.

The welfare and safety of PHA's employees, customers and neighbors is always its first priority.

PHA will update its status regarding business operations on the PHA Hotline 713-670-2870 and on its Web sites www.portofhouston.com and www.phastatus.com after daily.DATE: Monday, September 16, 2008 6:05 p.m. (CST)

Looks like everyone is back to work as of tomorrow (Thursday).

http://www.phastatus.com/go/site/1175/

But no word on actual commodity movement through the port.

Re tomorrow's inventory report- would anyone here be surprised by a combo of gasoline stocks down e.g 9 million and the NYMEX price down 4.5% in response (along with a MSM blurb about weak demand)? I am not predicting it, just saying that this occurrence would not surprise me at all (it would have a few weeks ago).

I'm sure that no matter what the numbers, it will be "good news" that we "dodged a bullet" becaues "demand fell".

It's crazy, but this too shall pass.

Yeah, this is what is driving me crazy. I'm fed up with the cheap oil, dropping gold and silver prices, and happy days talk. It's all over the place. Example: the local free realty magazine has an editorial this week entitled "Stage set for market rebound" (I'm in Australia BTW). It's a form of mass delusion, and these oil prices are behind it.

This article is one I found on Platts a few days ago, as the gas pricing crisis started:

Cash market soaring as Ike approaches

When I try to look at the EIA spot market website for price quotes for that period, they have not been posted. The only ones available are through September 9, and the pricing problem at the pumps started September 12.

I am wondering if/when we get the East Coast spot prices, they will be much higher than the corresponding futures prices. Is there another source for spot prices?

This suggests that we will see a force majeure declared soon for NYMEX futures contracts like we have seen for NG. I'm a bit surprised we have not seen it yet I'd assume we probably effectively have one now.

Thus the contracts are not moving since they no longer assure delivery.

http://www.nymex.com/notice_to_member.aspx?id=ntm458&archive=2008

Whats important is that this was backdated on the NG contracts I expect that the same will happen for gasoline contracts with the force majeur backdated till now.

Now life gets really interesting if we attack Iran like I suspect and force majuere is declared for oil contracts.

Welcome to American style free markets in any case if your wondering why the futures markets are wacko this is probably the reason for gasoline and I suspect potentially the reason for oil.

Memmel: It is funny-a couple of hours ago I had the idea that maybe they are driving the prices down hard pre bombing of Iran-yours sounds more likely. I watched a film on Youtube-AMERICAN ZEITGEIST recently-anyway it details the history of the USA and the repeated attempts by the connected at gutting the country-it followed the theme of some of your posts.

Thanks.

From the big picture whats important is that the argument has been made on the oildrum by many that we will never see the smooth geologic peak predicted from oil production estimates alone. Various feedback loops will overwhelm the base signal if you will. I daresay that evidence that peak oil will not unfold smoothly is mounting.

With all this only Alan has proposed a solution electric rail and trolleys that can be implemented by a bankrupt United States with its internal resources and the will to accomplish the task. I hope at least other people proposing solutions will finally start looking at how the proposed solution is executed in the midst of the greatest depression ever known.

As long as our technical civilization does not fall into chaos its possible to create a very reasonable low energy standard of living in many ways different from todays but not even close to living in mud huts.

However we are going to have to become very realistic about where we are who we are and what we should be doing.

Mucking about in the middle east playing the worlds only superpower is not the future for America its time to suck it up and focus on rebuilding a new robust low energy economy and more important debt free economy.

So mud huts it may well be.

So you're saying that hopefully the light at the end of the tunnel is indeed a train, and an electric one at that?

Maybe "Snail Shells".

http://www.n55.dk/MANUALS/SNAIL_SHELL_SYSTEM/SSS.html

or

Micro Dwellings, the anti McMansion.

http://www.n55.dk/MANUALS/MICRO_DWELLINGS/micro_dwellings.html

Some other possible pieces to the "solution puzzle":

Build out as much wind and PV as we are able. Develop geothermal and microhydro where we are able. Connect the US grid to HydroQuebec and cooperate to develop as much hydroelectric as we can. Continue R&D on various oceanic renewables - tidal, wave, current, thermal gradient.

Direct all urban sewage and agricultural waste streams into anaerobic digesters (which could even be done on a small scale homebrew basis using salvaged materials) to capture biogas (methane) to at least partially cover natural gas depletion.

Forget about biofuels - EXCEPT grow just enough oilseeds to produce just enough biodiesel to keep public safety, agricultural, and other essential equipment running.

Remodel urban houses & garages to add accessory apartments, convert single family homes into duplexes or multiplex units, convert large houses into bording houses, and some people just rent out rooms, take in borders or roomates (in some cases A.K.A. "relatives"). This increases density and thus makes walking, bicycling, and urban mass transit more viable propositions. Implied as the flip side of this is the permanent abandonment and dismantling-salvaging of non-viable housing in places like low-density suburbs or settlements vulnerable to global climate change impacts such as extreme drought (e.g. Las Vegas) or seawater inundation (e.g. Galveston).

Equip as many homes as possible with solar water and space heating systems, if necessary building homebrew collectors using salvaged materials from aforementioned dismantled housing. Even if said houses are not situated in a manner that allows sufficient insolation to provide 100% of their water and space heating needs, most houses can at least cover a major portion of their needs.

Insulate, caulk, and weatherstrip like crazy. Fit all windows with insulating shutters & shades (which could be made out of all manner of scrap materials, including even cardboard, if necessary). Make all housing and other buildings as energy-efficient as possible.

Two words: fans (in the summer), and sweaters (in the winter). We can all live with less cooling and heating if our lives depend upon it. Price residential energy in a manner that results in consumers paying a heavy premium if they use more than a minimal per-capita baseline amount for their locality.

Encourage industry to re-engineer to batch processing utilizing CSP wherever possible.

Yes, build out Alan's EOT as quickly as possible. But in the interim, also expand mass transit ASAP using buses, vans, or whatever, powered by electricity, biodiesel, or CNG - whatever works to make mass transit as available to as many people as possible as quickly as possible. Equip all public transit with bike racks.

Don't worry so much about maintaining or extending AMTRAK's cross-continental routes. Instead, forge federal/state/local/private sector partnerships to develop inter-urban passenger rail service between nearby cities, with the immediate goal being to replace short-haul airline travel and most non-local automobile travel. As these city-to-city passenger rail links develop, a more robust and extensive national passenger rail network will develop naturally.

Set up short-term bicycle and NEV rental systems in all towns and cities, especially at mass transit nodes. Mandate that all public and employer parking lots be equipped with metered recharging stations for NEVs and PHEVs. Supply these recharging stations with power from PV arrays erected over parking lots ASAP.

Facilitate carpooling and ride-sharing whenever and wherever possible. Implement emergency ride home programs in each community to address concerns of those at work without their own car.

Don't bother keeping more than one lane up and running on Interstate highways. Focus limited infrastructure repair funds on keeping critical bridges and keeping the local street and road networks functioning. One result of this will be a de-facto decrease in traffic speeds, regardless of what the offical speed limit is. Another result will be to drive most long-haul freight traffic back to the railroads.

The above is by no means a compete list. I haven't even gotten into localization of production of food and other necessities, and there are a lot more radical lifestyle changes that might be required in the future.

The U.S. is attacking western Pakistan less dramatically, perhaps as a substitute for Iran.

Bush OK'd Secret U.S. Strikes In Pakistan, CBS News, Sept. 11, 2008.

NPR says it this way: Pakistan Raid Start Of Concerted Bid To Hit Al-Qaida, Sept. 12, 2008.

Will this destabilize Pakistan allowing al Qaeda and the Teliban to gain control of the country and a nuclear arsenal?

The Pakistan affair is starting just like it did in Laos and Cambodia at the time of the Vietnam war. Most air raids in the two countries were carried out covertly and was rarely reported in the US press. Anyone who has traveled through Laos will be shocked at the number of bomblet and massive bomb craters that still exist along every road and around every village and bridge.

Are we going to see a massive escalation of bombing again - now in Pakistan?

Gates defends Afghan border raids: http://news.bbc.co.uk/2/hi/south_asia/7623332.stm

Looks like it is starting.

Interesting comment !

In the event of an attack on Iran, do you think there would be any basis for a force majeur in the deferred contracts? Say 2010-2015 crude expirations?

All I can tell you is my personal approach to this.

I expect the futures markets to be eliminated at some point after 2010. Before 2010 it makes sense for the most part for them to be allowed to operate outside of extraordinary events like and attack on Iran.

We still need to run our military-industrial complex at full tilt for the next several years and in general a functional oil market is required at least for a while longer.

Given this I don't have any stake in oil or energy for that matter past 2010. But this is just my opinion and at least at the moment the Government seems to be doing things that I did not expect for several years so even this super doomer is a bit surprised at the moves being made now since I expected them much later.

For example I did not expect the bank/government to start sweeping up assets this early but this is the intrinsic problem with our problems it easy to figure out what will happen but when is very difficult.

Gas shortages? Or Last Contango in Houston?

Retailers hope to get more gas; price gougers targeted

Times-News Staff Reports

Published: Tuesday, September 16, 2008 at 4:30 a.m.

Last Modified: Tuesday, September 16, 2008 at 4:44 p.m.

Gasoline should be on its way to Western North Carolina in the next few days but a stable supply — and lower prices — may be seven to 10 days away.

http://www.blueridgenow.com/article/20080916/NEWS/809150225/1008/sports&...

------------===============-----------------

source: NIST

source: gasbuddy.com

------------===============-----------------

September 15, 2008

Plantation [pipeline] is currently delivering about 60 percent of its typical volumes, although 100 percent capacity is available. Several of KMP's Southeast Terminals in North Carolina, South Carolina, Mississippi, Georgia, Tennessee and Virginia are experiencing tight gasoline supplies as a result of reduced refinery supplies. Diesel and jet fuel inventory levels generally have not been impacted. Plantation does not own refineries or refined products.

http://www.oilandgasonline.com/article.mvc/Kinder-Morgan-Assets-Not-Sign...

------------===============-----------------

"Lines are back up and running at reduced rates," said Steve Baker, spokesman for Colonial Pipeline in suburban Atlanta, which normally supplies 100 million gallons of petroleum products a day to the South and East Coast. "We've got power and staff at virtually every facility of ours. We're just ready and taking advantage of the supplies we can get on line."

Baker would not disclose the level of flow since the disruption, nor speculate Monday night when conditions would return to normal. He said Louisiana refineries are just now recovering from Gustav, "but Texas refineries are still a ways from giving us new barrels."

http://www.wsbtv.com/news/17488997/detail.html

------------===============-----------------

COMMENTARY:

What is happening in gold, silver, and gasoline futures is BACKWARDATION. (cash price above near future). This is also termed , according to Dr. Antal Fekete, as a widening 'basis' -- the opposite of contango. The futures markets are indeed a casino controlled by JP Morgan, HSBC, and other money center banks, which is done not so much through a 'concentrated short' position, but rather through complex systems of OTC derivatives traded through dark liquidity exchanges such as Baikal and Turquoise. In a recent article Rob Kirby noted JP Morgan traded $7.6trillion of these sorts of derivatives in a single quarter.

We are about to watch what happens in a central-banker controlled casino/command economy. It will produce shortages.

Backwardation and deleveraging in the futures (read: paper) market coupled with reduced supply from the Texas and Louisiana refineries is why we are seeing shortages. We also see every attorney general across the country making gasoline stations (especially the independent ones) fearful of being accused of 'price gouging', idiocy will do nothing except make shortages worse and gas lines longer, because gas station owners will be afraid to raise prices. Furthermore, the price divergence on the futures exchanges predicts imminent retail delivery defaults and delays, particularly for gasoline. I think within a week the shortages will worsen significantly unless the NYMEX price is allowed to rise.

The continuing divergence between the cash price and the NYMEX price in the face of dramatically reduced refinery output is a national security threat. I cannot help but think this event has been engineered, but I will of course leave that up to your own discernment. Here are the facts as of this evening:

1) Colonial pipeline is operating at 75% capacity

2) Plantation pipeline is operating at 60% capacity.

3) I talked face to face with TWO gasoline truckers, both of which confirmed there are gasoline shortages due to the dramatically reduced supply in the Mid-Atlantic pipelines ultimately fed from Texas, which suffered the wrath of Hurricane Ike. One of the truckers was driving to pick up gas in Baltimore, MD instead of Manassas, VA due to limited availability.

4) The idiotic media keeps repeating, 'The refineries are not damaged badly' -- but the media fails to mention many of these refineries are not yet operational due to debris in roads, lack of electricity, lack of workers, etc etc. Thus, there is dramatically reduced supply going into the critical pipelines (Colonial and Plantation). This, the media also fails to mention.

There seems to be some question as to whether demand destruction outweigh the reduced supply. Perhaps someone more qualified can answer this question. Personally I doubt it. Unless retail gasoline demand drops by 25-40% within the next two weeks I think we are going to have some serious problems on our hands.

thanks for the info and links.

quibble: i always understood backwardation to be near futures higher than long dated futures. I have never heard it referred to it a differential between cash and futures.

Hey no problem ; I'm not an economist. Just goin' off the wikipedia definition and what I've lately learned reading Dr. Antal Fekete....

'Backwardation is a futures market term: the situation in which, and the amount by which, the price of a commodity for future delivery is lower than the spot price, or a far future delivery price lower than a nearer future delivery. One says that the forward curve is "in backwardation" (or sometimes: "backwardated"). "Backwardization" is an incorrect variant of the term. Backwardation is a situation where the cash price of a commodity is pregnant with a premium a buyer is willing to pay for the immediate delivery of the commodity.'

http://en.wikipedia.org/wiki/Backwardation

I guess we'll find out what the deal is by this time next week... hopefully there will not be significant gasoline supply disruptions, that's the last thing we need considering the economic crisis...

Cheers and Thanks for the great board!

The price of oil is above $94. As of yesterday (9/16) the MMS reported that 97.2% of the GOM oil production was shut in. The day before 99.9% of the GOM oil was shut in. OPEC was exploring options to try to keep oil prices from rapidly sinking.

After Katrina the U.S. was able to import fuel products from European stockpiles. Gustav related refinery and oil production was being shut in on Sept 1 and now it is Sept 17 without power to some refineries.

Maybe a good idea to curtail non-essential driving untill after the hurricane damage is repaired.

Hi, this is unrelated to the content of the article, but the big picture of an oil tanker reminded me of a funny video i saw a while ago, that i have since found on YouTube:

Link: http://au.youtube.com/watch?v=WcU4t6zRAKg

Embed (not sure if this will work, but here goes)

Enjoy :)

Edit:

For those of you that do not have the luxury of fast internet, i have created a transcript for you, though you should be warned, watching the video will be much funnier than reading the transcript :)

1: Senator Collins, thanks for coming in

2: its a great pleasure, thank you.

1: This ship that was involved in the incident off western Australia this week

2: yeah the one the front fell off?

1: yep

2: Yeah thats not very typical i would like to make that point

1: well how is it un-typical

2: well there are a lot of these ships going around the world all the time, and very

seldom does anything like this happen, i just don't want people thinking that tankers

arn't safe

1: was this tanker safe?

2: well i was thinking about more about the other ones

1: the ones that are safe

2: yeah, the ones that the front doesn't fall off

1: well if this wasn't safe, why did it have 80,000 tonnes of oil on it

2: i'm not saying it wasn't safe, just perhaps not quite as safe as the other ones

1: why?

2: well some of them are built so that the front doesn't fall of at all

1: well wasn't this built so that the front would not fall off?

2: well obviously not

1: how do you know?

2: well cos the front fell off and 20,000 tonnes of oil spilt into the sea caught fire, its a bit of a give away, i would just like to make the point that that is not normal

1: well what sort of standards are these oil tankers built to?

2: oh, very rigorous maritime engineering standards

1: what sort of things?

2: well the fronts not supposed to fall off for a start

1: what other things?

2: well there are regulations governing the materials that they can be made of

1: what materials?

2: well cardboards out

1: and?

2: no cardboard derivatives

1: like paper?

2: no paper, no string, no cello tape

1: rubber?

2: no, rubbers out, umm, they have to have a steering wheel, theres a minimum crew requirement

1: whats the minimum crew?

2: oh, 1 i suppose

1: so the allegations that they are just designed to carry as much oil as possible

2: ludicrous

1: despite the consequences i mean thats ludicrous is it?

2: absolutely ludicrous, these are very strong vessels

1: so what happened in this case?

2: well the front fell of in this case by all means, but its very unusual

1: but senator Collins, why did the front fall off?

2: well a wave hit it

1: a wave hit it?

2: a wave hit the ship

1: is that unusual?

2: oh yeah, at sea? chance in a million

1: so what do you do to protect the environment in cases like this?

2: well the ship was towed outside of the environment

1: into another environment?

2: no no no, its been towed beyond the environment, its not in the environment

1: no but from one environment into another environment?

2: no, its beyond the environment, its not in an environment, its been towed beyond the

environment

1: well it must be somewhere, well whats out there?

2: nothings out there

1: well there must be something out there

2: theres nothing out there, all there is is sea, and birds, and fish

1: and?

2: and 20,000 tonnes of crude oil

1: and what else?

2: and a fire

1: and anything else?

2: and part of the ship that the front fell off, but theres nothing else out there

its a complete void, the environments perfectly safe.

Where is this amazing fall in the price of fuel available to the retail customer? I haven't seen it. Currently the price I am paying is above $3.50. THIS IS A PEAK OIL PRICE. This is a price that is damaging the economy. It is an inflationary price. Maybe it will drop. I doubt it. We had a brief spike that went above $4/gallon. That lasted maybe 2.5 weeks. This, the $3.50 price, is a damaging price. I can only guess that the refiners are trying to recover some of their costs lost when the spread was greater.

I hear that $4/gallon was the "breaking point." I disagree - I think it was $3/gallon. We just didn't stay there long enough to find out.

I am proceeding with my peak oil planning.

PS: I don't mean to imply that this price is the final one that peak oil will produce. I mean that it is a price that is along the Peak Oil Road. The price will go higher, much higher.

Current gas price in the UK is about £1.14 a litre (what I paid last friday). At current exchange rates I work this out to be about $7.20/gallon. I can't remember the last time it was below 80p/litre ($5/gallon). This is the norm in Europe.