Hedge Funds, Hurricanes and Energy Markets

Posted by nate hagens on September 3, 2008 - 10:14am

In the past week, the energy markets have sold off steeply, even in the face of as-still-unknown damage from (a weaker than expected) Hurricane Gustav. If you were reading theoildrum.com of late, you have seen Kinetic Analysis Corp periodic updates on modeled damage/shut in production to Americas oil and gas facilities. We are also continuing to accumulate stories, data, and observations about the effects of Gustav on oil, natural gas, and gasoline production in another thread below.

Tonight another hurricane (of sorts) was announced in the financial press when CNBC reported that Ospraie, a $4 billion hedge fund partially owned by Lehman Brothers (and a major energy player), is closing it's doors after being down nearly 40% in 2008 following a -26% August. While this example is possibly unrelated to the current energy market meltdown, it serves as a good example of what may be a continued theme in natural resource markets - their small size in relation to the nominal amount of dollars seeking financial returns.

BACKGROUND:

2006 Natural Gas Futures daily prices (black arrow - announcement of Amaranth failure)

When Amaranth blew up in September of 2006, the world learned about a swashbuckling trader named Brian Hunter. In the Summer of 2006, Brian was reported to be massively short near dated NG futures, and long spring futures in NG for the following year. (I wrote about this and analyzed the crash in the winter/summer NG strips in "A Tale of Two Markets"). There is some indication that his position was so enormous, that when it went slightly against him, the information leaked out to the street, and then other funds and speculators ran in front of him. This revealed a rather Darwinian and carnivorous aspect of Hedge Funds: they all have prime brokers--i.e. access to capital from large banks--in order to put on their trades using leverage. When the trader runs into trouble, he has to call his prime broker. Having worked in this business, I can assure you that invariably, information migrates from the prime broker to other market participants (via mini tribal-cliques), who then take you out by putting on large trades against the direction of your position ala Soros vs Bank of England. If you read stories of trading in the traditonal pits, alot of this used to happen by seeing who looked scared. The other traders in the pit knew where everyone stood and were good at smelling blood (same as good poker players).

From the above chart, AFTER the Amaranth blowup was announced (the black arrow), futures made a slight new low and then continued to rally the rest of the year (even with another mild winter).

FAST FORWARD 24 MONTHS....

October 2008 Natural Gas futures - new yearly low today

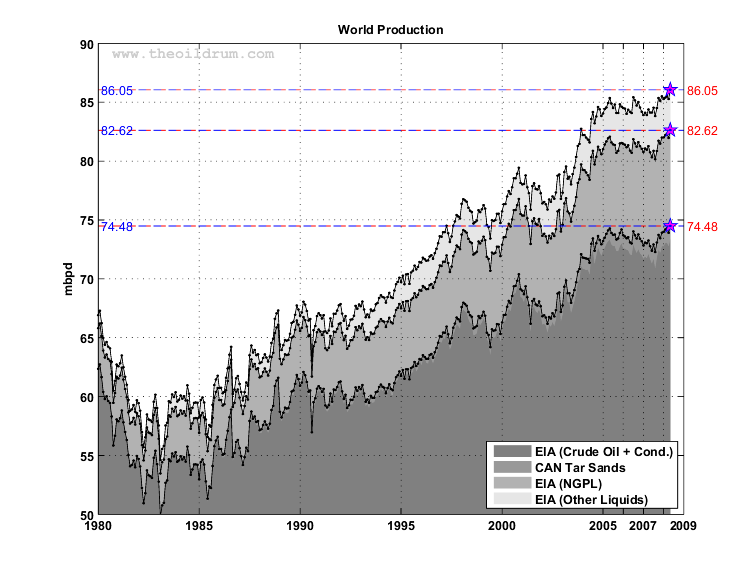

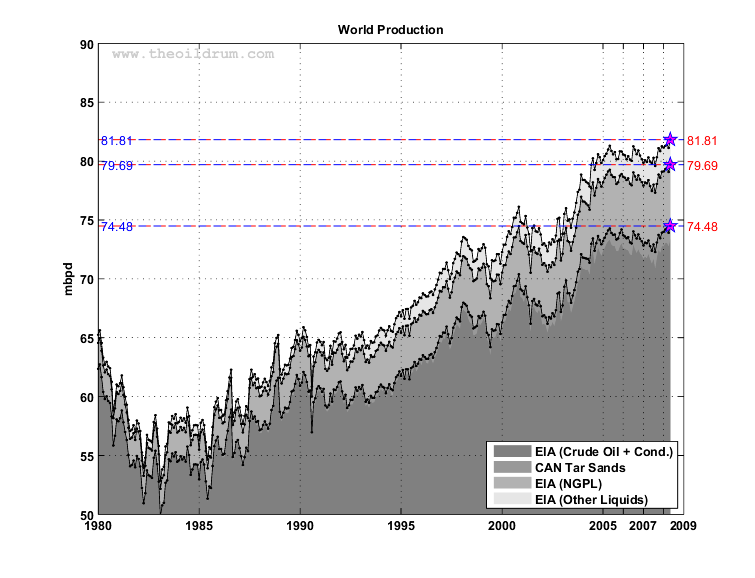

I believe that based on fundamental deterioration in oil and gas fundamentals (e.g. hard to find, costlier to procure, etc.) that we are in a long term higher high, higher low, environment for energy prices, one not caused by speculators but by more people wanting something that is less available. However, speculators have a great deal of impact in very short time horizons. (If we had more, better, smarter speculators, then volatility would probably be reduced!!**)

I have no idea what Ospraie's specific positions were other than the CNBC mention of bad bets in natural gas and copper, but in the letter to shareholders tonight, manager Dwight Anderson said this:

"The losses were primarily caused by a substantial sell-off in a number of our energy, mining and resource equity holdings during a six-week period characterized by some of the sharpest declines in these sectors in the past ten to twenty years."

Holdings in natural gas-related companies made up almost a fifth of Ospraie's investments at the end of June, before the commodity's price dropped 41 percent.

We can surmise they were doing well along with everyone else until the end of June, which means they were likely very long everything, from energy futures to energy equities. Funds like Ospraie are usually levered at least 3 to 1. Peter Thiel's Clarium Capital, one of the largest similar funds, has routinely had about 3 billion under management but is often reported to be carrying positions worth 9-12 billion. In general it's nigh impossible to measure or quantify how these funds move price around when they start liquidating. What's certain is that other players are sucked/forced into the moves, and the entire event gets magnified. (REFCO was another relevant example). Usually, it's not until weeks or sometimes months later that the people not in the know that have been scratching their heads finally get an explanation other than 'the hurricane was a Cat 3 not a Cat 5' or some such....

Bottom line: hedge funds pull alot of weight with their capital, and added leverage via credit, and when their shark brethren get a whiff of pending trouble, a positive blood-in-the-water feedback mechanism ensues, which exaggerates moves, first in one direction, then in the other. (This was discussed in Peak Oil, Reflexivity and Peak Oil)We as yet don't know how the trillions of dollars of hedge fund capital is collectively distributed, but history suggests there are often very crowded trades, so any future forced liquidations will likely be especially disruptive given the past decade of easy credit since the LTCM debacle.

OSPRAIE>GUSTAV?

Though we are told that we import 60% of our oil, the truth is somewhat less benign. The US pumps about 5,100,000 barrels of crude oil a day. The figure the US government likes to quote is total liquids, which totalled 8,457,000 barrels a day in 2007; (8,703,000 barrels per day so far in 2008). This total liquids includes a lot of stuff, including "refinery gain" on oil we import. Once we refine it, using other energy and non-energy inputs, the volume increases, and it magically transforms into higher domestic production. Total liquids also includes natural gas liquids (NGPL), which only have about 60% of the energy as WTI oil. Total liquids also includes ethanol, now amounting to about 600,000 barrels a day (also of lower energy density). So of our total annual consumption of petroleum (including ethanol) of about 20,700,000 barrels a day (2007), 8,457,000 or 40% of total liquids were 'produced' domestically, but if we look at the good stuff alone, we only produce 5,100,000 bpd, implying 15,600,000/20,700,000=75% imports. (This post points out the dangers from confusion of defining 'what is oil').

But I digress from my main point.

The news is still trickling out about damages in the Gulf oil and gas platforms and rigs. The amount of shut-in production from Hurricane Gustav won't be fully known for a while. The latest estimates from Chuck Watson's analysis for the next 30 days is 13 million barrels (or 40% of normal GOM production lost) and 70 billion cubic feet (or 29.3% of normal GOM production lost). There are longer expected outages and damage but let's just use the 30 day numbers for a calculation.

With between $10,175 and $12,000 in margin (depending on member, or non-member), an investor, end-user or speculator can control 1,000 barrels of crude oil on the NYMEX. So, to "control" the same amount of oil shortfall expected by Gustav, ceteris paribis, one would need 13,000,000/1,000=13,000 contracts, which would require margin of $132,275,000, (a tidy sum for you and I, but for one (or several) of the behemoth hedge funds, not so much). On the natural gas side, the margin requirement for 1 mmcf contract is also about 10% - (higher than it used to be for sure), or $8,150. With 70 billion cubic feet as the latest 30 day shut-in production estimate, this equates to 70,000,000,000/10,000,000 =7,000 contracts - a notional value of $495,000,000 but requiring around $50 million in margin to control. So with $182 mil, someone could 'offset' the expected oil and natural gas production loss for the next month from this hurricane (i.e. sell via the futures market the same amount of production that users might need to buy)...Money is a powerful thing. It's like Cat 10.

This real life example shows that when energy competes with money, it is liable to get run over in the short run. As I have written about frequently during the past few years, the amount of paper currency (and related credit) circulating the planet seeking a 'return' dwarfs the amount of underlying physical resources. Here is the conclusion in my post on Amaranth, 2 years ago:

"In addition to position limits for non-users or hedgers of energy, we should create a floor price for oil and gas, so that financial market-led volatility or intermittent gluts of product do not derail the development of alternative forms of electricity and liquid fuels. The achilles heel of the big two fossil fuels in their use in our world, is the time it takes to replace them. The natural gas market, in its current price dichotomy, is a prime example of the high standard deviation potential in our current system. Heads everything is rosy. Tails there are power outages.

I have no idea whether it will be cold this winter."

DAVID (energy) VS GOLIATH (hedge funds)

The accumulation of financial capital accretes incremental social power in modern society. Everything else being equal, more money gives one more access to information, resources, flexibility, energy and leisure. As high quality fossil fuel abundance morphs into a fervent scraping for all things energy, 'money' may increasingly represent a poor proxy for the real wealth embodied in natural, built, social and human capital. Until that time, large concentrated digital accounts around the world (e.g. hedge funds) will likely continue to toss commodity futures prices around like my dog shakes a chicken - up down and all around, at least in the short run. To the chagrin and confusion of energy policymakers these same commodities form the foundation of the basic necessities used in our interconnected global economy, and volatile prices cannot send consistent long term signals to our leaders. The urgency of diverting our quality, remaining cheap fuels towards high energy surplus, long duration renewable infrastructure is lost when prices drop. Indeed, natural gas used for electricity is up 34% in the past 5 years. Each time we have price dumps influenced by financial fence-swingers closing their doors, we retreat from any momentum for action that had built up during high price regimes. Then, when prices rocket again based on fundamental supply/demand gaps, the price hikes are too steep and are not well adjusted to by consumers and businesses, who then conveniently blame speculators.

CONCLUSION

We now have 4 named storms in the US/Atlantic: Gustav, Hannah, IKE and Josephine (also a large wave off Africa which may be Kyle). I wonder between today and quarter end how many financial 'hurricanes' we will witness due to the recent, (and coming) volatility in energy. It is possible the financial markets themselves (particularly credit markets) will accelerate (or cement) the date of peak oil due to fewer approved projects and lack of funding. Furthermore, an important longer term question is how many corporate/industrial executives are adding long range natural gas electricity plans based on an (in my view) unsustainably low price per mcf....Energy fundamentals win out in the end, and the marginal costs of both oil and gas are rising rapidly. But I fear the intervening steep roller coasters in price will act as policy camouflage until our time window for change is too short. Time is a critical commodity too. (Maybe we could trade that as well, using leverage...;-)

(thanks to Gail the Actuary and Gregor for help with this post)

**Of course, if we had more, better and smarter speculators, by definition they would eventually ascertain the true nature of our energy situation- prices would rise, volatility would diminish, and the speculators would move to greener pastures.

The fundamentals for an inventory crisis remain active. The current string of storms, Mexico's field depletion, Russia's pride, etc... continue to pressure the crisis.

Forcasting the moment of crisis is similar to earthquakes; the more the tectonic plates move, you more certain you are of the crisis while remaining relatively uncertain as to when it will trigger.

There is a trigger.

Duration of efforts required to mitigate the consequences are measured in years. Crisis can trigger in moments. Self-reliance can change the lifeblood of our economy from oil to ingenuity:

Timely post Nate. When you say:

I pretty much agree with you, with a small catch: while 1 barrel of oil will always equate to something about 1.7 Mwh a green ticket has no fixed relation with any physical entity whatsoever.

Currency paper supply has been growing in excess of 10% per annum in the US, the EU and many other places; reserve paper currency has been growing around 20% per annum. There are several years of world oil supply just in the dollars and euros accumulated by central banks as reserve currency. But who guarantees them that all that paper will have the same return it has today?

There has been nothing short of a monumental flood of money bet in the oil and gas industry over the last two years, and almost all of it has been bet in one direction: LONG.

How do we know this? Simply look at the price. Oil production has indeed been a bit flat for the couple of years, but guess what? It's been flat many times before. What we saw was a 1970's style panic driven spike, but in the 1970's oil production was not flat, it was down by an amount and for a duration unseen in history. Such massive price spikes could be justified by "supply and demand". What we have seen in the last few years can in NO WAY be justified by supply and demand alone.

There is now great danger that banks and hedge funds and their investors, already weakened by the housing bubble collapse could be hit again, perhaps even harder, by the potential collapse in oil and gas prices. Those who bet long and stayed too long could be wiped out. This is a dangerous time for the heavy commodities gamblers, and many folks do not know that they may be one of those by virtue of their bank, mutual fund, 401K, etc. Betting commodities is very speculative, always has been, always will be. Many investors had come to believe that betting on ever increasing oil, gas and other commodities prices was a "done deal", no where but up.

By the way, this price decline does NOT change one thing about the potential for "peak oil" in the near future. I have made the case over and over and over here on TOD until my fingertips are sore from typing: Price is not an accurate indicator of "peak oil", never has been, and won't be until perhaps right at the very last second when peak is fully proven to have hit (perhaps not even then, for a variety of complicated reasons).

For many of the same complex reasons, declining oil price is NOT proof that peak oil in the near future is not still a real possibility. Using price as the guide is simply a fallacy. Price neither proves nor disproves near term peak oil. There are simply too many other factors than just "supply and demand" deciding price.

Crude oil prices below a floor of about $95 dollars can be viewed as bad for the world economy for a whole host of reasons. Let's hope we can hold at least that floor to encourage some of the absolutely revolutionary technical developments we have seen in the last 3 years. We simply cannot afford to give up the gains we have made and will continue to make in oil conservation technology and oil alternatives IF the price of oil holds at least a minimum sane level.

RC

So very well put. Thank you for this.

Price is most likely a necessary, but definitely not a sufficient condition by itself for declaring the arrival of peak oil.

How could you possibly know that? Your "gut" tells you?

Since at least 2005 (and actually starting before then), demand has been increasing exponentially, while net energy/net exports has been decreasing exponentially. During this time oil prices have been increasing exponentially, and yet you know that there is NOW WAY it can be justified by supply and demand alone? Nonsense.

You make the same analytical mistakes the talking heads on TV make. You focus on production, not net exports and net energy. You ignore demand growth, particularly in the third world. You believe that "almost all of [the money] has been bet in one direction: LONG", whereas in fact every long bet must be balanced by someone going short.

Nate has pointed out that the futures markets can swing wildly and become uncoupled from fundamentals in the short run. They do not become uncoupled in the long run, i.e. more than a few weeks or (maybe) months, but certainly not years.

This is absolutely incorrect. In natural gas, the spec money has been short.

If you're going to blame speculators for expensive oil, you have to also write speculators a thank you note for cheap natural gas.

Also, the fact that the price went up to $148 and then down to $105 doesn't mean that the high price was due to a flood of money from speculators. The real reasons for the high price were the factors that triggered the flood of money from speculators. In my opinion, there were several triggers. One important trigger was that the market is getting information about supply and demand a lot more slowly, probably due to the increase in the length of the effective pipeline to the U.S. markets, due to the decrease in exports from VenMex. The market's also missing a lot of information, or getting it later than it used to, because a lot of the new big players in these markets have no transparency whatsoever. The market is in the position of constantly guessing about China's inventory, the intentions of China's top bureaucrats, the question of whether India is ever going to deal with its power shortages, etc. It's going to take market participants some time to adjust for these factors, and prices will probably never get set as efficiently as they used to.

So, very small changes in the timing of supply and demand make for huge changes in price, and these huge changes are amplified further by the lack of transparency in the markets and the delay in getting info about supply and demand. Even if you take speculators completely out of the picture, we're still going to be seeing really scary volatility in these markets.

A couple of points about Nate's interesting article. First, why don't these hedge funds hire someone who knows how to trade? They need to read up on Kelly betting principles as well. A first-year card counter understands more about bankroll management than these guys. In.ex.cus.a.ble.

Second, although a hedge fund might have enough money to control an amount of oil equal to lost production from Gustav, they're not gonna buy it just for the thrill of owning it. They're buying it because they have some signal that others are going to bid it up, not because they think they can profit by driving up the price themselves. And you don't want the others bidding it up to be ma and pa speculators, because by the time the squares are buying, an entity as large as a hedge fund has to be getting out, otherwise they will get caught without anyone to sell to and lose all their money, a la Ospraie. This is Trading 101.

That essentially means you're buying because you think commercials will be buying. I know Nate knows this, but I want to emphasize the point. There is nothing that any sensible hedge fund manager should fear more than the possibility that money is manhandling energy, rather than following energy.

I completely understand why speculators drive everyone crazy, because they drive me crazy too (even though I'm a speculator). But I'm strongly against position limits because I think they're unenforceable and I think transparency is more important. If we really want prices to be set more efficiently, what it will take is some real diplomatic pressure on China. The last thing I want is masses of spec money running around controlling supply where I can't see it--that would be even worse than what we're dealing with now.

Also, just because the markets drove the oil price up to $148, doesn't mean society was paying $148 for oil. Society never paid anywhere near that much. If you own a royalty trust like Permian Basin Trust (PBT) for example, you frequently see months where the prices you got for your oil or natural gas were pretty far from the headline prices. The June price for Permian Basin Trust oil was $127, even though WTI futures were in the $130s. A month earlier, when the price for natural gas was below $12, Permian Basin shareholders were getting over $14.

So, there are markets and there are markets.

Moe, thanks for posting the buy signals. Speaking to your point about these funds hiring experienced traders, I was just thinking that maybe most of these funds really have a structural incentive problem more than an issue of talent. The may know how to trade well enough, but the traders don't get paid to manage their risk (unless they're one of the top guys). If they bet it all and win, they get a massive payout and if they bet it all and lose, they move on to the next fund. One the funds high water mark is breached, the incentives become even more skewed. You want to keep betting till you're back in the green cause you're not getting paid if you're not.

If they were trading with their own money, like we are, bankruptcy risk has real consequences. I don't think anyone blows up their fund deliberately, but where's their downside? Not sure if traders at Ospraie had any of their own money in the till....do you know if they did? I heard some of the newer funds require that traders drop some cash in to keep them there and keep their trading reasonable. Anyway, thanks again for the informative posts.

In every half-decent hedge fund senior traders have own money in the fund.

I doubt very much that it's enough money to make it hurt. I was referring more to the rank and file (guys running their own books but not the entire fund). The head guys usually are pretty well established and filthy rich. Putting in 1 or 5 or 10 million if you have 200 million in the bank still doesn't mean you're putting yourself on the line. One of the lessons that most of the intelligent guys at the top learned (since LTCM) was to not bet their net worths on their fund's performance. Dwight Anderson, for example, has another 3 funds that he's currently running. I'm sure he's utterly heartbroken over losing this one. I like your point about us only hearing about the bad ones, and Amaranth certainly fits that mold, but the shocking thing about this fund was the fact that it was run by a guy with a fairly clean reputation and a respectable pedigree (as far as hedge funds go anyway). He doesn't seem to be the one who would take outsized risks, so it's surprising to see a blowup there. Nobody will know for sure what really happened for months (years?), so this is all just speculation at this point. Whatever happened, I'm sure there will be tons of stories about what went wrong this time.

Then again, no investor will bet his own net worth on one hedge fund. You might have confidence in your employer, enough to buy some stock but would you really invest all your savings in it?

Imagine you're looking to invest in a high-risk-high-return fund, would trust one where everybody handling your money is in, all-or-nothing? That's not an investment vehicle, that's a sect.

Good point, but if I was the CEO or the third guy from the top, I don't think it would be unreasonable for equity holders to expect that my firm's bankruptcy should be mine as well. Only real way to align incentives. Given the size of most of the large hedge funds, I can see how your argument makes sense if you're a small fish in a big pond, but if you're running a book at a mid-sized or small fund, you're what...3-5 guys away from the top (maybe even less). If you're the head trader of a major strategy, you're probably one guy away and have an incredible amount of leeway to do whatever you like. You should be held accountable personally for the results. The fact that you're not is what leads to reckless betting and bad risk management. In any case, if I had enough to invest in these funds, I would only go in if the head guys were putting a MASSIVE amount of their own net worths into the fund. That's the only way to make sure they're properly motivated to manage the bankroll and to take measured risks. This isn't always 100% effective (see LTCM), but at least I know that they'll be obsessing over the markets the way I do when my own money is on the line. The other strategy is, as you suggested, to diversify your hedge funds and have a little in each...a blowup here or there could be offset by a star performer elsewhere.

why don't these hedge funds hire someone who knows how to trade?

They do - just ask anyone trading at a bank, refiner, producer or utility. Their best traders are invariably lured to the funds, and they don't suddenly lose their skills when they get there - they are just given more freedom to take bigger positions. You have to realise that there are many hedge funds around and the only ones you hear about are those that blow up spectacularly.

You will not gain any insight if you only study hedge fund failures - or only listen to the success stories. Hedge fund blow ups are part of the industry in any part of the cycle because their mandate is to take big positions in every possible direction. Banks blowing up, now there's cause for concern.

You point out the exaggeration present in government-issued liquids production figures which are by inference supposed to represent total US internal crude oil production. Ie. US crude oil production is in fact much lower that the figures usually quoted. This nicely points out the dilemma of developing "biofuels" based on ethanol from food grains to "replace" crude oil dependency. I suspected from the beginning that the supposed benefits in terms of EROI were probably non-existent or very small at best but did not have access to data to support my suspicions. Now it is clear that the benefits are very small indeed.

Switching to grain-produced ethanol is a great mistake similar to entering into a war based on false premises. Once you start such a war extraction from the situation is extremely difficult. Suggestions of quitting the unjustified war are met with screams of "Cut and Run" and quitting would mean that all of the war dead have "died in vain" (which they have). Those who scream loudest are often those who have vested interest in the war. In the meantime, instead of increasing security, the war creates resentment and hate in large portions of the world (especially in major crude oil portions of the world) decreasing security and increasing instability. Others who continue to support food for fuel may do so because they hold out hope that it may eventually be possible to replace grain with cellulose as feedstock for ethanol production.

The production of grain-based ethanol creates many of the same undesired side-effects spinning off from an unjustified war.

Firstly, when political proponents of food for ethanol finally realize that it is inefficient (energy-wise) they find it difficult to back off of their positions. Why - because we are drifting from crude oil dependency to energy from grain dependency. Backing off and stopping this use for grain would cause further energy problems and expose the governments misleading domestic "crude oil production" for what it really is. That is the US is far more dependent on imported crude oil than suggested by government figures. As with an unjustified war, many of the strongest advocates of food for fuel have vested interests in the "war against foreign oil dependency". These include connections to companies and States that produce the grain. Also, an infrastructure has build up around processing of the grain and conversion into ethanol which helps the economy?

Secondly like the other war, this war against foriegn oil dependency, using grain to replace oil, generates massive insecurity and destabilization in the world. Hungry people will do desperate things. Poor people are not stupid or totally uninformed. They know about food for fuel and if they do not there are always folks who will point it out to them for political or religious gain. These poor people only have to look at pictures or films showing the West driving over-sized, gas guzzling cars to make the connection that rising food prices are connected to food being used to fill the fuel tanks of the cars of the rich nations.

The use of food for fuel is one more example of a path being taken that narrows even more the window of opportunity for taking needed measures in conservation and changes in infrastructure to prepare for the crunch that is coming.

Talk about a false analogy, comparing ethanol to war takes the cake!

Total silly nonsense. They are not at all alike and can not be compared.

Things that are different can not be compared, added, subtracted, multiplied or divided. I have railed against comparing apples and oranges many times but it continues unabated.

Part of the problem is that the government and esteemed universities do it and no one calls bullshit. It is especially discouraging to see respected posters at TOD doing it.

The total liquids figure that Nate points out is really an apples and oranges false comparison by adding different things to come up with total liquids. Can't do that! Things that are different can not be added.

If they are anyway, the figures are silly nonsense. This is the same problem that is the root fallacy of EROEI when applied across different forms of energy. While the numbers add up as in total liquids, they are meaningless because the forms of energy in total liquids are no all the same. Each has a different price, different characteristics and differing utility.

When this kind of thing permeates the discussion of Peak Oil, there is no end to the confusion. And there is no possibility of a arriving at a consensus mitigation solution.

The discussion gets bogged down in minutia arguments because the slight of hand of comparing apples and oranges befuddles clear thinking.

I will rail against this silly nonsense when ever I see it, so be forewarned.

While the numbers add up as in total liquids, they are meaningless because the forms of energy in total liquids are no all the same. Each has a different price, different characteristics and differing utility.

But your glaring, perpetual blind spot is being unable to see that when the various forms can be used in the same service - as is the case with natural gas and ethanol as transportation fuels - then you are comparing apples to apples.

It is a perfectly legitimate question to ask: If I use natural gas to produce a very small energy return in the form of ethanol - why wouldn't I be better off just using the natural gas directly? Why must we create these negative externalities by going through a convoluted conversion process? Why are we indirectly subsidizing the usage of natural gas by subsidizing ethanol?

R^2,

Your objection that natural gas in cars is more efficient than dry milled ethanol in cars has been debunked before.

A gallon of ethanol(including coproduct) takes 45802 Btus of energy

(including fertilizers) which is roughly 46 SCF.

http://www.ethanol-gec.org/netenergy/NEYShapouri.htm

A 127.77 SCF of natural gas is 1 GGE. So 36% of a GGE(45.802/127.77=35.8%).

1.53 gallons of ethanol is equal to 1 GGE or 1 gallon of ethanol is .65 GGE.

So if you put in .36 GGE and get out .65GGE, that is the same as putting in 1 GGE of NG and getting out 1.8 GGE of ethanol, whereas with a CNG car you just use 1 GGE of natural gas.

http://en.wikipedia.org/wiki/GGE

Even forgetting the co-product you get 72052 BTU or 72 SCF or .56%

or .65/.56=1.16GGE.

So you put in 1 GGE of natural gas and get 1.16 GGE which is superior to burning 1GGE of natural gas in a CNG car.

Robert I agree 100% the world has two primary sources of energy that are easily converted to transportation fuels Natural Gas and Light sweet crude. A distant third is biodiesel below that sugar cane ethanol.

The last two are viable and will work in a world where they are used in places that liquid fuel cannot be replaced. This is my viewpoint.

From a completely different direction if you have ample electricity from renewable resources or fission/fusion in my opinion hydrogen + carbon => liquid fuel is also probably viable.

But this and the biofuel approach only mean that we probably can reasonably generate a supply of liquid fuels with a volume like 5% of todays usage. Add in direct Natural gas and you have say 15-20% of todays energy levels available for fuel cell or internal combustion. Air transport would probably be the primary use case representing like 50% of the total liquid fuels usage in a post peak world. Farm machinery would also represent a big share but probably using internally produced fuels.

The point is we probably will have enough liquid fuels for critical use cases even if the EROI is negative as long as liquid fuels are themselves not a primary input.

The above is doable and fairly easy for most people to agree on if we cut our fuel usage by 85% then we can live in a low energy world. Widespread use of electric rail would ensure that ability to transport people and goods would be cut a lot less than the total energy. I'd say that going to electric rail we would lose and this is debatable about 50% of our mobility if you will. But the important routes would continue to have 100% service so its better to view it as different. The way I define mobility is the ability to move basically anywhere in a region. Cars have high mobility and planes coupled with cars gives us tremendous mobility.

Basically today you can be anywhere in the world within 2 days. In a electric train world this would probably extend to more like 4 days so thats why I say you have lost 50% of mobility. The greatest use of mobility is in the suburbs and this is where you would have the greatest losses. But once you remove suburbia then you get pretty much exactly this 85% reduction in usage.

So long range trips may take twice as long and anything like suburbia today would exist only for the upper middle class or higher.

Certainly you could have higher mobility in the future but with constrained energy supplies what people are missing is past the core transport requirements converting energy to mobility is negative for GDP your better off using that energy to create products not driving a SUV to the McMansion.

At its core the problem is that as energy gets expensive the EROEI for Suburbia drops to 1:1 i.e the typical suburbanite cannot produce more than they consume and are not productive. You get this huge divide between the overall productivity of someone living in town using electric transport to do a job vs someone living in the burbs with a SUV driving to work. I'd not be surprised if the suburbanite is not a net drain and has been for some time cheap energy hid this situation since it did not matter. Balance of trade indicates we have consumed more than we have produced for a long time. When the pie is finite and getting smaller you see this EROEI cliff develop rapidly. We can no longer afford to have used house sales people do marginal productive transaction work and use kWh's of electricity and thousands of gallons of gasoline just to facilitate a transaction. The job they do is just not worth it in the energy they consume. Same for suburban houses themselves the additional costs of supporting expensive homes that use a lot of energy and the transport to and from those homes simply is not a net gain from most jobs descriptions.

memmel, I don't think that you can make your case through an EROI POV.

From such a viewpoint the EROI of electric vehicles is just fine, and electric bikes, scooters and delivery vans even more so.

If combined with railways they could do the job with relatively small loss of mobility.

It is also a lot cheaper to knock down a few houses and build some shops locally, and distribute more of the offices and industry than it is to abandon vast swathes of excellent housing, as it is to insulate them to an acceptable degree rather than move.

I don't know if we will have the time to make such a transition, particularly with the dire financial position we have, and I take Gail's prognosis in this respect very seriously, but as far as the technology and EROI is concerned there would seem no good reason why a very substantial degree of mobility should not be retained.

The amortised costs of an EV or hybrid with petrol at $4 gal would actually be less than a petrol driven car, and if that could not be afforded an electric scooter still cheaper. Most would put up with the inconvenience of two wheeled transport to work rather than abandon their house and live in a hovel in the city centre.

Dave your missing the real point. We have limits and choices if your job does not cause you to earn enough money to justify the energy usage level implied by suburban living EV or no EV then you will not be able to live in suburbia.

Are we better off building trains or personal EV's and who gets the personal EV's ?

I'm a pretty talented person in my domain and have a broad educational background and I'm in the top 15% income level. I think assuming I manage to keep something close to the same income level I have now I'd barely be able to afford and electric suburban lifestyle. And I'm pretty conservative so I'd have to have a LOT of faith in my future earning power to commit to the debt load that would entail.

Bottom line if you don't have a very secure position earning over 100k your probably not going to be able to join this fantasy land of electric suburbia.

I get the feeling your fairly well off financially so you don't realize how few people will have their own EV. I've never said we probably won't have these sorts of suburban enclaves but they will be for the wealthy.

I just don't see them as important on any time scale or productive for that matter.

Also as with my EROEI argument approach the overall productivity of supporting workers with that lifestyle stinks. Its effectively exactly the same as having your entire economy based on constructing houses and stores does not take long for it to implode.

I could really care less what the wealthiest people in America can or will do its has little relevance in the big picture. Sure a lot of them will hole up in guarded walled estates and drive electric SUV's to the companies they own but so what ?

Btw I'm assuming that post peak my own earning power would drop to 30k a year which is a LOT lower then I make now. And thats doing the same job I do today. Earning that I'm riding a bicycle to the train not driving a EV. And I fear I'm overestimating what I could make but thats very competitive with wages in India and China today so not a bad bet I could make Indian/Chinese wages in the future. My bottom estimate is 15k a year as a professional. I'm assuming that some belated protectionism could help limit the number of people with my skill set.

Can I afford a 200k suburban house and a 30k EV on 30k a year ?

Nope. Even if I'm wrong about my personal future plenty of other people with lesser skill sets will see steep drops in wages as unemployment rises so if I do better than I've outlined I assure I'll realize I'm lucky. And no way in hell would I go into debt even if I did decide I could and wanted to live the Suburban/EV lifestyle I'll pay cash.

Thats just me but I'd love to see how the hell all these middle class people that do incredibly useless jobs are going to maintain their income levels in the future and who can afford them and what they nominally produce. So before we ever get to this concept of EV's and abandoning suburbia lets figure out how all these people are going to make all this money effectively doing nothing.

My point was the narrower one that it does not look as though EROI is the reason why personal transport should cease, or the suburbs be totally depopulated.

You seem to be going with the top case of people switching seamlessly to EV cars, which seems unlikely to me anyway, but I can't really see why most of them shouldn't use some sort of electric scooter, or why they should be unable to finance it, and given that they would probably prefer to hang on in their houses.

The situation in the States may be a bit confused by non-recourse mortgages, but when a really large number of people get hit, the alleged price of their house is likely to be inflated away to a realistic level.

The biggest stock of available houses for rent for those who don't hang on would be in the suburbs anyway, so whoever owns them they are more profitable rented than empty.

Sure there will be contraction and some abandonment of suburbia, particularly the most far-flung, but overall, especially if times are hard, it makes sense to continue using the housing you have.

In most areas of the world, the issue does not even arise, as mortgages are non-recourse, so you hang on as long as you possibly can, and for instance in the UK the local authority has an obligation to re-house families, and often do so in regions which are inconveniently far from the city centre, so ownership may change but most of the houses would still be lived in.

The point is, a Prius is cheaper to buy than the average light vehicle, and a plug-in Prius won't be more expensive, so why should the economics of driving from the suburbs change?

Actually, the overall cost per mile will go down substantially from current costs, given the electricity is much cheaper per mile.

Nick this get completely wrapped up in the financial mess we are in throughout the world.

My contention is that most people will be unable to finance long term debts and those that are able will be unwilling. You cannot make assumptions that the future availability of consumer debt will be like it is today.

I won't use Brazil but I will use Mexico as a better example of conservative lending when defaults increase.

Understand that at its heart Housing/New Cars or WT Iron triangle is a ponzi scheme built on expectation of future earnings these expectations rest on assumptions of a cheap oil supply. Once the directions of these vectors change course you start spiraling downwards. In your post your making the assumption that most people can afford to finance a new car. I'm not making this assumption.

In my opinion you have to assume that from now on out we will be in a deep recession to depression that should be your basic economic assumption. Any "solutions" would have to be workable in this context implicitly assuming that a large number of people are willing and able to take on 20k of long term debt much less more is in my opinion a mistake.

For the most part the vast majority of white collar jobs in the US are irrelevant and not needed once discretionary spending collapses walk around your neighborhood and ask people what they do for a living and think about the viability of the hair stylists and insurance analysts positions in the near future.

At best and feel free to show me different as near as I can figure only about 30% of the work force in the US is involved in reasonably needed work 70% is fluff that could be massively cut. Think about EV's under these conditions and at least you can see why I'm saying they will be the toys of the wealthy and are not important. Just look at home and car sales through the last great depression to understand. This is all well known and its also well known how our economy differs from the 1930's.

I'll repeat I make over 100k now I'm hopeful to make 30k a year in 2011 I'm confident I'll earn 15k.

I have zero plans to buy a EV and will only buy a house if I can pay cash. If I do get a good deal on a suburban house I can pay cash for then I'll be riding a 150 cc motor bike or bicycle to work or to the train till I get enough cash to buy a used EV in a few years and I'll consider myself very lucky. And to be honest I probably won't buy th EV but save to send my kids to college.

" most people will be unable to finance long term debts and those that are able will be unwilling"..."from now on out we will be in a deep recession to depression that should be your basic economic assumption"..."once discretionary spending collapses "..."70% is fluff that could be massively cut"

But why do you think this will happen? On what basis? World GDP has grown 40% in the last 5 years on flat oil consumption. US GDP grew about 20%, with flat oil consumption. US oil consumption fell almost 20% from 78-82, while GDP grew a little. Why do you believe oil is magically essential to our economy? Heck, we could reduce consumption by 25% in 6 months just by wartime type requirements for carpooling, and lose no jobs at all.

"expectation of future earnings these expectations rest on assumptions of a cheap oil supply"

ah, no, they don't. We didn't need oil 100 years ago to run an industrial economy, and we won't 50 years from now.

Nick I'll let someone else respond to this one or you can educate yourself on our situation.

I'd suggest starting with Mish Shedlock.

http://globaleconomicanalysis.blogspot.com/

He has some really good links off of his page. For a more direct on the street type viewpoint I'd suggest

http://www.thehousingbubbleblog.com/index.html

You really should educate yourself if you want to come up with realistic post peak solutions.

Your certainly free to not do anything but I'm very interested in real solutions post peak.

I fully and 100% endorse Alans electric rail proposals and WT ELP concepts. I agree 100% with Roberts views on ethanol etc.

You should also look at the wedge concepts that have presented here on the TOD and consider trying to execute a wedge under depression like conditions.

http://www.theoildrum.com/story/2006/12/17/1377/0132

If you do read and understand the problem then I suspect you will come to the same conclusion I have the only viable solution is a rapid expansion of electric rail service nothing else will work.

People simply won't have the cash to finance the transition it will have to be done via public works.

All you've said here is "if you don't agree with me you must not understand the problem", which is both patronizing and reflective of a very closed mind. You haven't actually provided any information; all you've done is dodge answering his questions.

As a general rule of thumb, if somebody asks a question you can't answer, that probably means you've got a flaw in your own understanding somewhere. If it was a basic question that anyone who understood the situation could answer, then you'd be able to quickly and definitively answer it, rather than having to wave your hands and mutter "you just don't understand..."

Check down the page, the general discussion continues there. Memmel was quite forthcoming with the reasoning behind his opinions as he has been in previous threads.

Back to the topic of the value of houses, here's a place in Detroit selling for a buck if anyone's interested:

$1 house

"Memmel was quite forthcoming with the reasoning behind his opinions"

I don't see any evidence for a depression there, either. Do you see any?

Well, I reviewed Mish's blog, but I didn't really see something that supports the idea that we're facing a deep depression. Could you point me to a particular article of his?

I would note that he has a serious conflict of interest in that he's a salesman for commodity investments with a strong "goldbug" emphasis, there's no sign of energy or economics related training or experience (the only background given is photography), and he's building a home in a far suburb of Chicago that fits the profile of the kind of exurban community that you've suggested is going to be a terrible place to live in coming years.

I would echo Pitt's comments on the tone of your comment. I've reviewed all of the other sources you mentioned (Alan Drake, Jeffrey Brown, Robert Hirsch) in great detail, and there's really nothing there to support the notion of a great depression. Oil is simply not a magical elixir for economic growth (though applied energy certainly is), and it's decline is not a disaster.

You might want to look at www.econbrowser.com for authoritative analysis by a PO-aware economist. You could also look at my analysis on my blog ( www.energyfaq.blogspot.com ), especially the section on Robert Hirsch's recent prognostications.

Read my reply to Chris if your solution is not viable in a depression then its not viable and probably not a solution. The only reason I even care is we are not doing electric rail but stupid stuff like EV's and trying to save suburbia.

Well, I still see no evidence for a coming depression.

Sure, SUV and pickup sales have crashed, but isn't that what we would want? Car sales are stable, and manufacturers can't make enough fuel-efficient vehicles to satisfy demand at the moment.

PHEVs and EVs won't cost any more to buy than the average vehicle (a Prius costs rather less) and will have much lower operating costs, so unless we have a major depression PHEV/EVs will naturally replace ICE's.

Re suburbia: unless the housing market picks up, the housing stock we have now is pretty much going to be the housing stock we'll live with. Why is Mish (the blog you referred me to) planning his future in the suburbs?

Have you looked at www.econbrowser.com ?

"My contention is that most people will be unable to finance long term debts and those that are able will be unwilling."

Memmel, I see what you're driving at (and yes I've read Mish and the rest) but I still say 'taint necessarily so.

For example were I live there is a small operation with three principals who are wealthy enough to invest their money in hedge funds or what have you (and for all I know, they do). They have started a third-party financing company that's making it possible for any small commercial operation to install solar without being one dollar out of pocket on the deal. It's a no-brainer for the customer, a good deal for the financiers, and they're doing some good sized systems. They just financed a deal worth over $500K for a school district.

The same thing could be done in next-gen vehicles, in doing "green ups" on homes, etc.

With all that hedge fund money at risk and in flight mode right now, such a business model starts to look pretty attractive. There is very little risk in it and if you subscribe to the peak oil/energy thesis, it's a virtually guaranteed gain. It wouldn't surprise me at all to see hundreds of billions in private equity exit the hedge fund world and move into the energy/efficiency world.

Chris this is a completely different sort of way to move money around. Actually its the way the US got rich in the first place the Banker was local and the rich guy was local and they invested locally.

From the super big picture the problem is wealth concentration at the top with no way to reinject the money back into the bottom if you will globaliization and even nationalization warps the cycling of money locally.

What your describing is the right way to do things.

Next time the conversation drifts this way on the drumbeat I'll bring up concepts like what your saying.

I think this thread is buried. I'm by all means not a doomer actually I just think that we have to face the facts that some approaches will work post peak and some won't ELP which is what your describing more from the financial side and Alans electric rail pass with flying colors and work even if the financial system deteriorates.

I'm intrested in solutions which work when a lot of people are flat broke I could care less about people opinion of if we are going are not going to be flat broke or suffer financial crises. The base of our new economy should be something that works well without a lot of money or assumptions. And its not just for us which almost no one recognizes but also for the third world.

Every night when the cars are being charged has anyone guessed at the huge extra demand on the power grid ?

Yep. Extensive studies have been done.

http://www.pnl.gov/news/release.asp?id=204

PNNL: Newsroom - Mileage from megawatts: Study finds enough electric capacity to �fill up� plug-in vehicles across much of the nation

http://www.chiefengineer.org/content/content_display.cfm/seqnumber_conte...

Grid Will Handle Rechargeable Cars

Some main points to bear in mind:

We won't instantly be producing as many electric cars as ICE cars at present.

Electric cars are far more efficient and use a fraction of the energy of petrol cars - check out the comment that charging one overnight would use a quarter of the energy a plasma screen uses.

Only part of the capacity of the grid is used most of the time, so the Californian system of charging different rates for different times would mean that the grid was not under too much strain.

Thanks DaveMart,

Here in Australia there has been a lot of talk on the subject without true facts.

Hello Davemart,

I wonder if it has occurred to anybody that PHEVs will be essentially useless in an regional emergency? A vehicle with only a thirty mile range won't get you very far from an incoming hurricane, or if a big quake hits Cali, a PHEV won't get you across the desert to Phoenix or Vegas to recharge the batteries. :(

Just another reason we need to expand the RRs. Even if your PHEV can be recharged periodically along your chosen escape route by evacuating extra early, your overall progress will be slow. Then, you won't be able to get back to your house till the grid is essentially fully restored.

My 'Wild & Crazy' idea to help restore a Hurricane failed grid more quickly by proactive unloading of high voltage wiring:

http://www.theoildrum.com/node/4487/402885

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

I hadn't thought about it - it's a long time since we have had a hurricane in Bristol!

More seriously, we seem to have two problems with the EV and PHEV alternative - either they are discounted because everyone will be destitute and not able to afford an electric bicycle, or because they may not provide 100% of the performance of an ICC car for a few years.

You are also confounding two technologies, Bob - the GM Volt PHEV will do around 40 miles on electric before needing recharging, but will carry on just fine if you put some petrol (gas!) in, whereas a pure EV will likely do around 80 miles or so before they need recharging, which should be good enough.

In any case, there is a world of difference between a situation where people can't get to work or the shops from their current homes, and so have to abandon their homes, and one where they don't have a perfect emergency escape vehicle - if they are that worried, they could keep an old ICC, 4 wheel drive of course, and some cans of petrol in the garage!

Hello Davemart,

Oops! Thxs for correcting my wrong info on PHEVs vs pure EVs--so many acronyms and differing tech ideas nowadays, it is easy for me to get them mixed up & confused.

Memmel, I see no reason why the fact that we are at some slight variance on this particular issue should preclude me from picking your brain, so perhaps you would use your mathematical talents on my behalf to substantiate that many of the suburbs should be perfectly inhabitable even if people do not continue to run private cars! :-)

Have a look at this:

http://www.taxibus.org.uk/

That does not seem to be working on my computer - here is the Google cache of it:

http://64.233.183.104/search?q=cache:gHPOoJkl0-EJ:www.taxibus.org.uk/+taxibus&hl=en&ct=clnk&cd=3&gl=uk&lr=lang_en|lang_fr&client=firefox-a

Anyway, if this doesn't get through the basic idea is that you give a bell on a mobile, and 3 minutes later a 8-10 seater vehicle picks you up, which has other passengers who are going in the same general direction.

To work to those specs for London you need around 50 taxibuses per square mile.

It should be cheaper than buses as the smaller size gives more flexibility, and so it doesn't spend so much time running around half empty.

Capital costs and fuel costs are also far lower, in spite of the door to door swift service.

So if you used a hub and spoke system, perhaps dropping most who were going a longer distance off at a bus or rail terminal, at what population density does it become unviable?

Would this be sufficient for most American suburbs?

Superficially it would seem that if instead of a 3 minute delay you accepted a 30 minute delay, then you might be able to run it at 100 times less density than London, but I am sure I have dropped some of those pesky decimal places or something somewhere.

This certainly has the potential to be a powerful mobility tool, at least.

Well your leaving out the delay for a train so 30 min commuting from the suburb to a rail coupled with train travel times probably puts you at the 2 hour limit for travel thats pretty constant.

I'd think that bringing back trolley cars is probably going to have a bigger impact. Also believe it or not simply walking a few blocks to a mile or riding a bike a mile helps transportation issues a lot.

Lets look at it a completely different way your main contention is to maintain the value of the suburban housing however its trivial to look at cities such as Detroit or any rustbelt city in the US to see that housing value can readily drop to zero they have no intrinsic worth. You have no a priori reason to assume housing values cannot decline to zero. Next construction of higher density housing and condo's or even English style row houses is well understood and provides a nice density vs lifestyle pattern. The terrace house if you will is a really good solution.

http://en.wikipedia.org/wiki/Terraced_house

Certainly higher density living is possible but these row houses result in very reasonable walkability with balanced density.

We have no intrinsic reason to not move to them also they make great rental or owned homes while your typical suburban home is a poor rental prospect.

So now back to the current housing stock in the US the obvious probable result is that houses resonably close to a main street for trolley or bust access will probably either be converted to apts or replaced with apts or row houses. Also some will be converted to businesses such as walkable grocery stores. As the potential for rentals climbs in parts of the suburbs these will become new small town centers.

Best guess is that at least 20% of the current suburban land/houses will be refocused to this suburban converted to small town. Outside of this I honestly don't know as far as the other homes go I'd guess many will be torn down some will become slums etc. Basically every single scenario you could think of will probably come to play and it will be dependent on the details of the conversion. The amount of suburban housing that goes to your electric suburban scenario is probably small say 10% and only probable in the top suburban neighborhoods say areas with current incomes over 100k as I've said.

So just like with what I said about overall economics being depression like the basic assumption is suburban housing values go to zero unless they can be re-purposed or its high end houses. I suspect a lot will be knocked down and scavenged for the creation of row houses.

Surely this does not address the substantial comments I have made?

Both new technology such as Taxibus making a more retail public transport available and the possibility of using relatively cheap electric bikes and scooters should mean that for many they are better off staying put.

Your comments on the devaluation of many suburbs happened in the very different context of an expanding economy and relatively small areas of decline.

It seems to be something of a Strawman to assume electric transport merely means the continuance of present patterns, when what we are probably looking at is a fairly messy process of a lot of inconvenience being traded for some reasonable standard of accomodation.

A trolly bus system costs many times what a taxibus system does to install, so why in a cash strapped environment that should be preferred outside of the main routes I can't understand.

Dave their are no strawmans here I already stated that I'll only talk about solutions in the context of economic conditions I expect to occur if you don't agree with that then it makes no sense to talk about solutions.

Your correct about trolleys only on the main routes and I said I expect the only housing that will retain value to be on the main routes or in walkable distance of the main routes. This is effectively your trolley car suburb of the past.

Even with the dire economic conditions I envision public socialistic style programs can and do work and can be used to build out a public rail network and furthermore they can be used to build out apt flats if needed. Look at postwar USSR for and example or postwar Asia. Even with limited energy supplies we can do this.

We end up in the same point we do on all our conversations other means of transport are secondary.

The addition here is that you believe that homes have some sort of intrinsic value yet we have ample historical evidence and even contemporary evidence that without a robust economy and jobs the values of homes goes to zero.

http://www.trulia.com/for_sale/Detroit,MI/price;a_sort/#for_sale/Detroit...

http://www.trulia.com/foreclosure/2002309048--Spencer-St-Detroit-MI-48234

http://www.trulia.com/OH/Cleveland/#for_sale/Cleveland,OH/price;a_sort/2_p/

And example for California.

http://www.trulia.com/CA/Manteca/#for_sale/Manteca,CA/price;a_sort/12_p/

I'm sorry your making basic assumptions of some intrinsic value in suburban real estate thats simply not true.

These are cities in the US that have experience economic contraction today.

So your basic argument that somehow there is something to "save" in Suburbia is false. The fate of suburbia itself has nothing to do directly with oil and everything to do with the economy.

The future economy will be negatively influenced by high oil prices.

The electric rail proposals are the only solutions that are robust agianst economic dislocation.

Every single other solution I've seen makes assumptions about some sort of Business As Usual.

In your case its the assumption that building in places that have no local economy have some sort

of intrinsic significant worth. Why on earth does a house 20 miles from the town center have any intrinsic value ? A whole huge pyramid of assumptions underlie this and they are not robust against stress.

Feel free to look at links like I've posted your assumptions are already failing dramatically.

And we have not even started to have serious problems. I'd actually be surprised to see suburbia even

make it much past peak oil right now much less be worth saving. The way things are going suburbia will be dead before we even get worldwide acceptance of peak oil.

Dave you don't have to believe me.

http://globaleconomicanalysis.blogspot.com/2008/09/gm-ford-chrysler-sale...

So I'll happily wait till these same people snap up your EV's.

Good luck.

Or the problem is obsolete automobile manufactures producing overpriced vehicles loaded with unnecessary options. All the extra junk, such as computer controls, navigation systems, antilock breaks, air bags and crash safety designs, will be discarded if a large portion of the U.S. population can not afford automobiles. Look at Tata's vehicles to see what can be done on the cheap. Last I read, GM's Volt will be loaded with options making it pricey and perhaps dooming it to failure. Ford and GM need to go bankrupt to sweep away those dinosauric corporations clearing the way for new, innovative ones. They had their chance with California's zero emissions mandate but instead of complying, joined a lawsuit.

Memmel, when it comes to buying a used PHEV, the longevity of the expensive batteries will be of prime importance. The seller will try to sell just before the batteries fail dumping the expense of replacement onto the buyer. Without a decade of experience, their longevity will be a huge unknown. In this respect compressed air or hydraulic drive trains have an advantage because they should be durable.

I agree the major car manufacturers will have to go bankrupt before the paradigm shift can happen. In Europe too.

They have been adding technology and gadgets to keep the price and profits up, but faced with a new economic setup where people can perhaps afford a 5000 euro car, but certainly not a 15000 euro car, I suspect they will die rather than give in to what the market actually demands (the US auto makers certainly are!)

An interesting example : Renault bought the Rumanian auto maker, Dacia, and makes cheapish family cars for Eastern Europe there, with a level of equipment equivalent to those of Western europe 20 years ago.

People started parallel-importing them back to France... it's EU after all... so now Renault sells them in France, but rations them. There are long waiting lists. And they are not even especially cheap!

In the electrical era, will a bunch of start-ups fill the void / accelerate the implosion of the big makers?

Most business models lease the batteries, not sell them.

Costs for the purchase of an EV and leasing the batteries look lower than running an ICE car if you assume petrol at $4/gal.

How much money will be available to buy cars though is the big issue, as we have managed to drive the economy into a wall just as we need to radically alter the technological base.

The last time automobile manufacturers leased electric vehicles, they refused to renew the leases and destroyed the vehicles. I do not want to be in a situation where they refuse to continue the lease on the batteries leaving me with a inoperable vehicle and a shipping bill for the return of the batteries. If I can not own it, I would not buy it.

I think the cost of purchasing an EV and leasing the batteries would assume high annual mileage. I have had the same compact pickup for 20 years and have drove it 50,000 miles for an average of 2,500 mi/yr. The vehicle is absolutely necessary because I must go to town for supplies. It can not be replaced with an electric bike or electric car because they can not transport enough cargo. I need a pair of horses and a wagon :) I have spent a total of under $20,000 on this vehicle, including the purchase price, fuel, maintenance, insurance... and, in short, everything. Unless the batteries are much more durable or inexpensive than I suspect, a PHEV will not achieve this level of economy. My analysis makes me conclude that a compressed air or hydraulic drive train, even though less efficient than a battery, would be superior for my application and anyone trying to minimize costs by driving infrequently. A lease creates a constant cost per unit time, not a cost based on usage.

I do not think start-ups have a chance until Ford and GM are gone because they protect their turf religiously. I also suspect the U.S. government will bail them out preserving their decay and suppressing the needed innovation. Toyota is on the right track with the Prius and may thrive. Congress must change laws to allow vehicles to be manufactured more economically. Will the right decisions be made in time?

Since I have already stated many times that I feel that there will be no instant change-over to electric vehicles, but this will initially be mainly in things like delivery vehicles, and most people will use electric scooters, assisted bikes and trikes and so on, I have no idea who you imagine you are rebutting.

Considerable personal mobility seems likely to remain though.

A range of options are surely possible, although obviously there are deep problems in both finance and technology.

It makes no sense to me to be too deterministic about what the outcome 'will' be.

Some contraction of the suburbs is already taking place, and further contraction will surely take place.

It makes a difference though if the contraction ends up as being 80% or 20%, and it is not realistically possible to fully determine that.

In arguing your case for massive contraction you basically ignore options which might reduce this, by re-writing critiques, and refer to arguments for considerable personal mobility remaining as BAU, when so far as I know no-one is arguing that.

However, you do not substantially address why electric scooters, more clever taxis etc are not possible, at least to some extent, or simply some re-location of offices and other work places.

Where you get the idea that 'my assumptions are failing dramatically' I really don't know, as I hold no deterministic position on how successful outcomes will be, and that is the sort of Strawman I was referring to - I simply have no attempted to make some of the arguments you seek to rebut.

As for 'houses having no intrinsic value', sure they have - they give you somewhere to live, at a far higher standard than some of the slums you suggest, and it is surely reasonable that instead of throwing away all that sunk effort, whatever it's nominal current market value, many will put up with considerable inconvenience to stay there.

How it plays out depends on a lot of decisions which have not yet been taken, and any result is possible, at least in the US, from the suburbs being virtually abandoned to their being substantially intact, although doubtless gradually being re-zoned and infilled.

Your models do not appear to be robust, as they depend heavily on a series of assumptions, and flatly ignore any forces which might mitigate the results you project.

Maybe everyone will make very silly decisions, and maybe no attempts will be made to alter the financial and legal framework to address them , for instance much of the abandonment which occurs in America is due to a peculiarity of the legal system, non-recourse mortgages, and seemingly small differences, say a relaxation of zoning so that work and home can be closer together, can make real differences to the outcome.

My EV will be an electric bike. But mostly I figure on using pedal power or just not going places as often. Besides, if the roads fall into more and more unmaintained conditions and I start breaking wheels, that will only work so long. Road conditions - not traffic - turns out to be the most difficult aspect of biking at night.

I was at my son's soccer game yesterday and had to listen to other parents talk about how they were hanging on and busy enough that they never ate at home. Some sort of finance/insurance work. Pretty soon the talk changed to how big the police department was. Useless jobs supporting bloated suburban cops - probably most of them stricken to have missed playing at the RNC.

cfm in Gray, ME

I think there are two answers to that, infrastructure and vehicle cost. Ethanol can be pushed through the same infrastructure used for gasoline and can be burned in the same vehicles.

For natural gas there is not much fueling infrastructure, although maybe this should be government subsidized. A NG powered Civic costs about $7000 more than the gasoline model. That might come down with higher volumes but a high pressure tank is always going to be more expensive.

I like natural gas as an alternative fuel but I'm not sure wether it should be used for cars replacing gasoline or for trucks replacing diesel.

Your point is well taken. One possible way around it is to use a like quantity of natural gas prsently used to produce ethanol for fleets powered by natural gas.

This way the distribution of the fuel is concentrated to a much smaller number of locations. The specialized maintenance of the vehicles is also concentrated. Another silver bullet for the time being (life of the fleet).

David

x,

you can rail all you want, but I personally think it would do your position more good, if you tried:

- give us a title of a book, paper or anything that properly and scientifically explains how it should be done. I promise to get it on my hands and read it.

- when attacking a proposition: attack the real weaknesses point by point. Don't throw the baby out with the bathwater. Quality adjusted EROEI comparisons have many sane uses, if one is aware of the limitations. Trying to deny that is not going to get you anywhere.

I don't mind you posting, but if you can, please provide more references and be as specific as you can be.

This way the discussion can move forward from the typical children's sandbox shouting match of "it's good! no it's not! yes it is!" etc.

I wonder why:

Per the EIA June ethanol production was down 13 thousand barrels per day compared to May, or 1 million Brl's for the month, or 42 millon gallons.

The largest monthly drop ever. Is the market saturated, or is the margin to small.

If the July numbers don't exceed the May numbers it can't be blamed on the floods.

MIght have to do with $10 Nat gas and $8 corn in May-Jun. Some ethanol producers went out of business (very low energy gain could have predicted this (and did). Nat gas and corn prices have since dropped quite a bit, so with the 50 cent subsidy from Uncle Sam, ethanol producers should be cranking it up. There still IS an ethanol mandate, and a growing one at that...

SamuM,

It's difficult.

Nobody in the realworld seems to be interested in EROEI. We can't even get reliable figures here at 'the home or EROEI' on ethanol for example.

The fact that a BTU of gasoline is twice as expensive as a BTU of natural gas and 6 times as expensive as a BTU of coal doesn't seem to register (out in the real world), because EROEI folks KNOW that a BTU is a BTU is a BTU.

IOW, the whole thing just don't add up, son.

Other than this part,

I disagree with the rest. MOST people who understand EROEI know that quality plays a huge role. I wrote about that in my first post here on Sasquatches and have mentioned it in every post since. We basically have two 'essential' forms of energy in modern society - electricity and liquid fuels. Electricity (currently) costs more because it is more versatile. But the extreme dependence on liquid fuels for transport can only very slowly be diminished - minimum 10 years - probably much longer. So energy QUALITY of liquid fuels is going to be very important, perhaps trumping EROEI of higher, non-liquid sources.

But all that is a red herring. The biggest issue we face is not whether this or that has a higher or lower EROEI, but that global commerce has been built on a significantly higher aggregate energy gain (or surplus) than we are going to be able to produce in the future. Even oil now, at the margin, costs in the neighborhood of $100 per barrel. Nat gas between $6 and $7 per mcf. So a great deal of the liquid fuels that we are using right now to run our daily lives (as well as experiment, succeed, fail, etc. on alternative energy schemes) is stuff we found decades ago - the largest costs associated with it have long ago been spent, but we are still reaping the benefits of its cheapness. As the % of new oil overtakes the % of old high energy gain oil, that is when we will see that things like corn ethanol are for all intents and purposes, energy sinks. We need high energy gain sources that match up to our uses OR offset the difference with conservation/efficiency OR we are in deep deep trouble

And no one in the real world seems too concerned about population, biodiversity, habituation to higher energy use, species extinction, etc. either....so EROEI is in good company

Nate,

A small quibble. When you say "global commerce has been built on a significantly higher aggregate energy gain (or surplus) than we are going to be able to produce in the future." I think you are referring to oil and gas.

I think we agree that renewable electricity has a high energy gain. Also, for better or worse, it should be noted that we have plenty of coal available at fairly high E-ROI, and that nuclear is reasonably high as well.

So, your comments really refer to liquid fuels.

Yes. But we need high EROI liquid fuels in order for the high EROI electrical fuels to be important (and it is also easier to define boundaries of an EROI analysis on liquid fuels - because with wind and other renewables resulting in electricity we need to include the transmission lines, storage etc. something than many of the e.g. wind life cycle analyses don't include.

Fyi - it looks like most everything from Gustav is reasonably OK with the exception that 13 of the 14 transmission lines into the area are down - this may take quite some time to repair (and lots of vehicles, helicopters, extraneous trips around the area are gonna be using gasoline and diesel)

"we need high EROI liquid fuels in order for the high EROI electrical fuels to be important "

I'm not sure what you mean. Certainly we'll need some liquid fuel as long as we have infrastructure that uses it, but in the long-term there's very little transportation that really needs liquid fuels beyond aviation.

"with wind and other renewables resulting in electricity we need to include the transmission lines, storage "

Transmission only adds about 15% to the cost of wind, even with very long distances. That's not going to significantly change E-ROI. Storage is a long discussion, but let me note that in the short term it isn't needed, and in the long-term I don't see it as a dominating cost - I'd estimate that a 100% renewable grid might cost 10%-40% more than a FF grid (due to transmission, storage, overbuilding of generation), which in the larger picture really isn't much. Keep in mind that most storage and balancing is likely to be provided by PHEVs and EVs, which will grow in parallel with renewable power.

"transmission lines ...may take quite some time to repair ...using gasoline and diesel"