Hurricane Gustav, Energy Infrastructure & Production Impacts/Models (Updated!--Thread 2)

Posted by nate hagens on August 29, 2008 - 10:36am

(Welcome: we are now on a later and more updated thread, which can be found here: http://www.theoildrum.com/node/4478 NB: you may want to just go the front page (it will be post #1 or #2) to get to the most recent thread: http://theoildrum.com ...)

Hurricane Gustav is on its way. Damage to oil and gas infrastructure from this event is looking more and more likely on current track. Here are the latest damage graphs and updates from KAC/UCF. Update from Chuck Watson 9:24 EST (Next update Saturday 8/30)

Continuing westward shift: this based on the BAMD model, which is doing as well as the more sophisticated runs and is a lot faster (this run based the 8pm position and intensity estimates, so it's almost real time as opposed to waiting 3-4 hrs for GFDL or HWRF).

(Welcome: we are now on a later and more updated thread, which can be found here: http://www.theoildrum.com/node/4478 NB: you may want to just go the front page (it will be post #1 or #2) to get to the most recent thread: http://theoildrum.com ...)

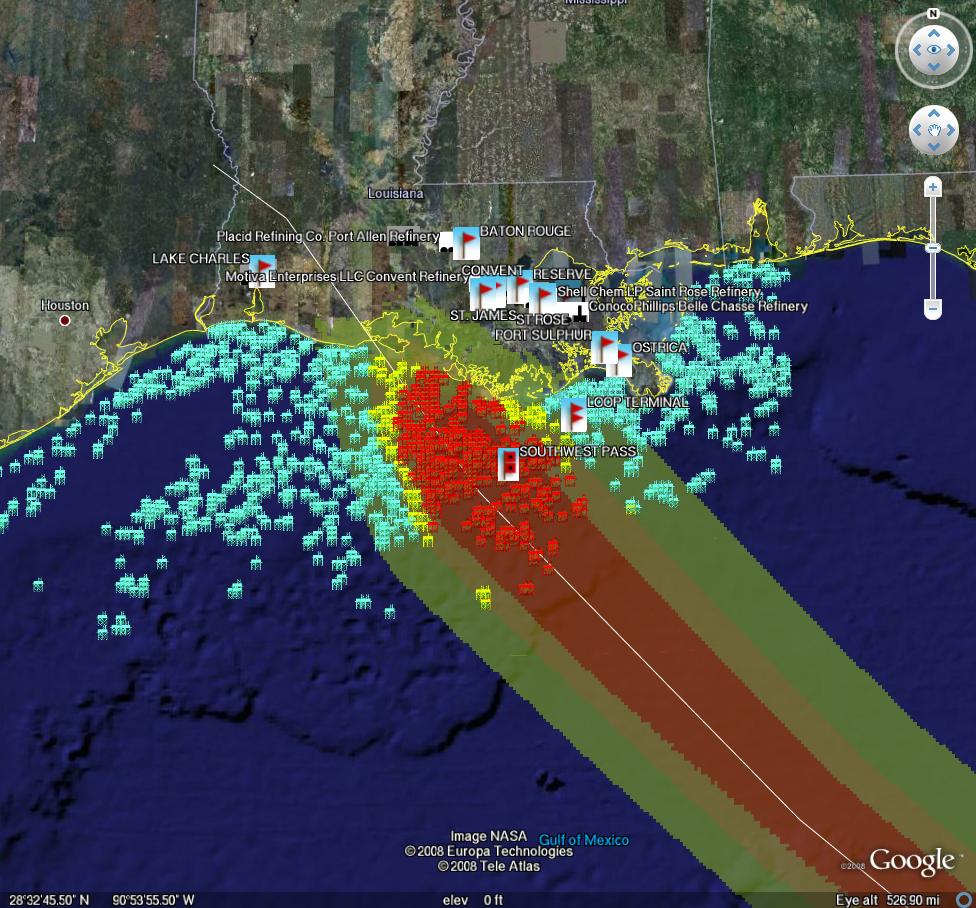

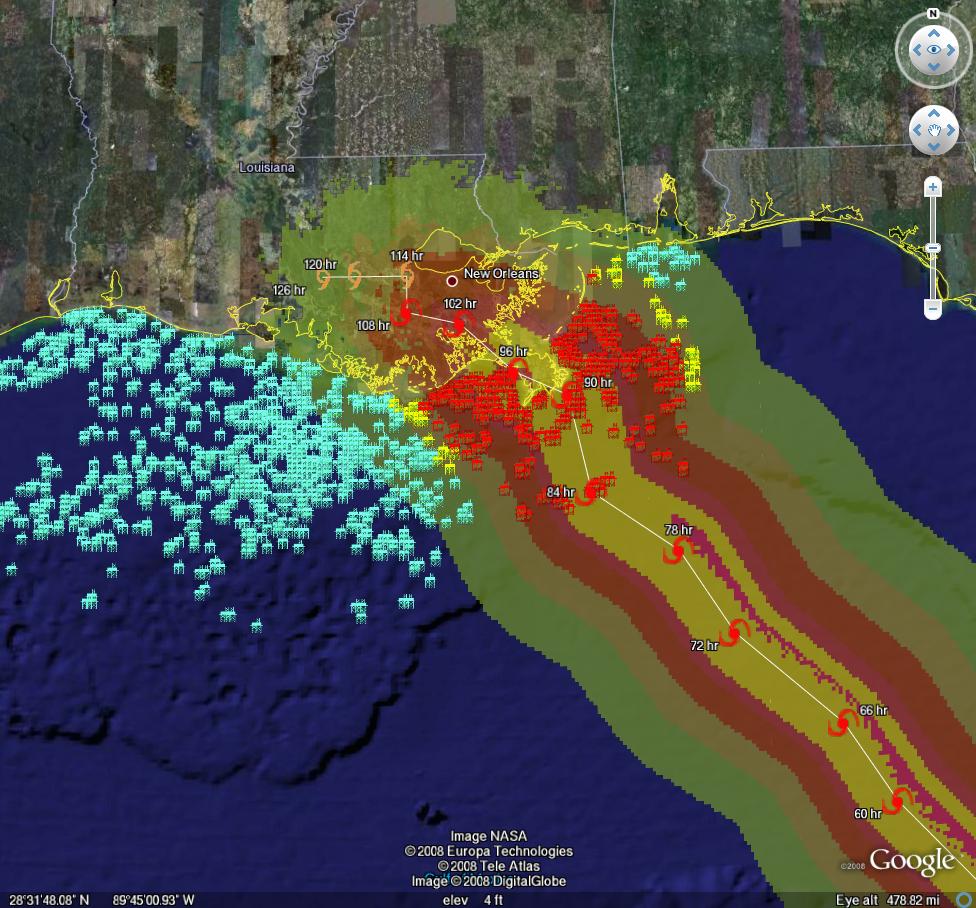

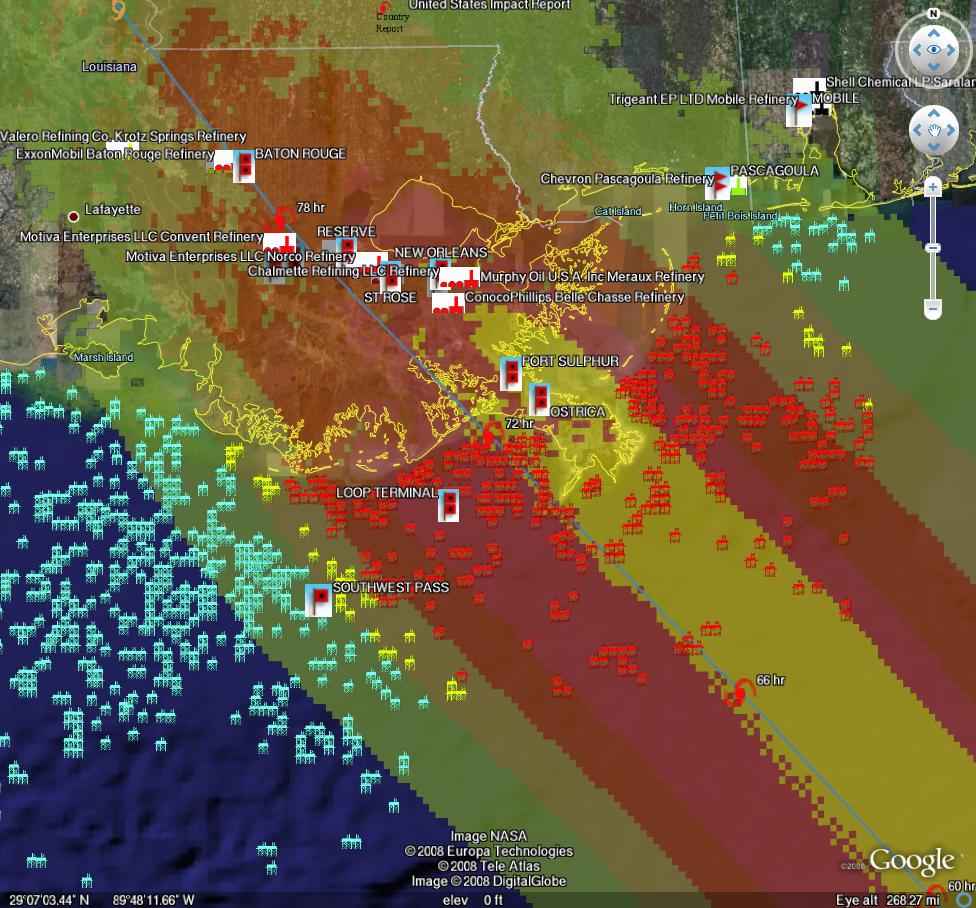

Latest damage run based on BAMD

Chuck Watson update 3:44 pm 8/29:

"This from the latest damage run based on the HWRF model. Note how the storm stalls out after landfall as a tropical storm. Bad news for recovery, especially if wet. This scenarios results in a loss of nearly 50% of the GOM production/processing capacity for the rest of the year. Ouch." (Note: this analysis on oil/gas damage is based on HWRF run verifying)

Rig damage run based on latest HWRF

From KAC/UCF google earth link

Port damage run based on latest HWRF

Refinery damage run based on latest HWRF

Though the Methaz runs based on HWRF model are among the most eastward of the ensemble models,(Chuck has been east of consensus since storm begain) the damage using the current official 5 pm NHC path is just as bad. It shows a bit more production loss (about 60% of the rest of the year), plus about a month down time for the LOOP and inland pipeline damage.

Damage run based on latest official forecast

Click to go to WUnderground

Latest updates from Chuck Watson:

(3:34 pm 8/29)

Unfortunately it seems the favorable options for this storm are dropping off one by one. I think we're seeing a trend in the dynamic models towards the central LA coast and into a "target rich" environment with respect to oil production, as a strong enough storm to cause significant damage. Our in-house models are now showing a 50% chance of long term (more than 10% production loss for more than 30 days) damage from this storm. The GFDL scenario, for example, whacks the LOOP pretty hard.

Keep in mind that this storm is still not a hurricane (although it may well be any time now)(*Ed note, it is now a hurricane), and while the track models have been fairly consistent, intensity forecasts are a very tricky business. There are still some big unknowns with respect to shear the day or so before landfall. A small change in wind speed (10 knots) can make a big difference in damage since damage is proportional to the cube of the wind speed. So a 110 knot storm might cause 10% damage, but a 120 knots storm would cause 15% to the same structure.

(8:35 am 8/29)

Gustav is a bit better organized this morning, and continuing to slowly drift westward, but there are signs the turn to the northwest has started. But the track across the GOM oil/gas lease sites and potential impact on refineries is still very much an open question. We're pretty

sure it will turn north-northwest, and move across western Cuba or the Yucatan straits. The key question is the timing of the interaction with a high pressure system that could cause a sharp left (west) turn is unknown. That will also increase shear and weaken the storm, so it could well be the difference between this being a major disruption and a no-big-deal event depending on when the shear and turn kick in. To repeat myself, we'll know more when Gustav clears the Yucatan straits, which is looking like tomorrow evening.

Chuck has put together a dynamically updating page that will reflect the latest damage models/forecasts at this link: KAC/UCF models.

On current track, which the weather geeks (and I use the term "geek" in kinship...) at http://easternuswx.com and Jeff Masters at WU say is too early to say for sure, but this could do a lot of damage.

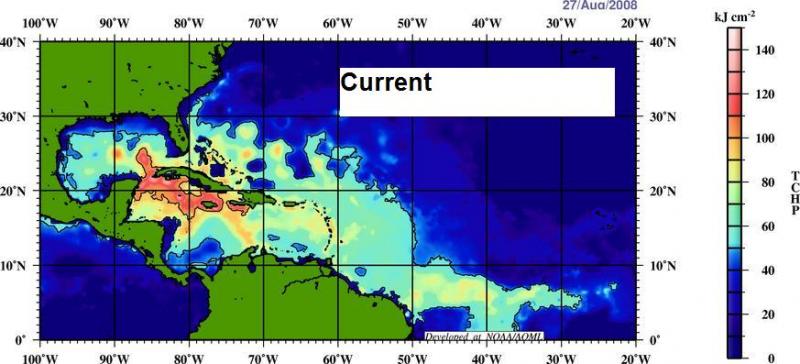

Very high SSTs in Caribbean:

UPDATED

PRODUCTION/INFRASTRUCTURE MAPS AND REFINERY INFORMATION

Here's a link to a really good map of oil refining/SPR storage facilities in respect to the path of Katrina (NB: OLD TRACK MAP!) and here is a listing of production and refining capability for the state of LA.

Just to give you a rough idea of where things are, the map above is a probability swath for Katrina (OLD TRACK MAP!) with the Thunder Horse platform as the red dot, and the other purple dot represents the Mad Dog development (100,000 bd); the Holstein development that produces at peak, around 100,000 bd of oil; and the Atlantis field that may have ramped up to around 200,000 bd in all. Put together these projects have the potential of around 650,000 bd, but as can be seen, they were sitting in an uncomfortable spot relative to the track of the Katrina.The white dot is where Port Fourchon is. This is where the Louisiana Offshore Oil Port, or LOOP, is located. Rigzone pointed out that this is where the foreign tankers offload, Google and Terraserve maps you can see that the area is very low-lying. One of the big concerns is that there will be sub-sea landslides or other ground movement that might affect the LOOP. Were this to be disrupted, then foreign tankers would need to be diverted elsewhere, with the likely port being Houston.

We have accumulated resources from previous hurricans below, but we'd like to find updated materials if you know of them. Recent refinery maps, recent rig maps in the gulf, recent gas fields, SPR facilities, the Intercoastal Canal, pipeline stations and transfer points, etc., etc. Leave links in the comments please.

Also, here's the EIA's Alabama, Louisiana, Mississippi, and Texas Resources pages. They will also likely come in handy. Also, here's a link to the national page.

Here's another good resource for infrastructure maps and such. (scroll down a bit)

Here's a map from CNN with large and small refineries laid out. (though it is an old storm track)

Very detailed piece by RIGZONE on rigs and other infrastructure in the area. (thanks mw)

Here's a flash graphic of the oil refineries and rig maps from Hurricane Rita, it emphasizes Beaumont and Galveston's importance. Click on oil production in the tab. Note the many rigs on the east side of the storm that will get the brunt of the damage from the NE quad of the storm...hence the high long-term GOMEX oil production damage estimates below.

You want a detailed map? Well here's the probably the best MMS map I could find. Very detailed and lots of interesting stuff. (VERY big .pdf warning)

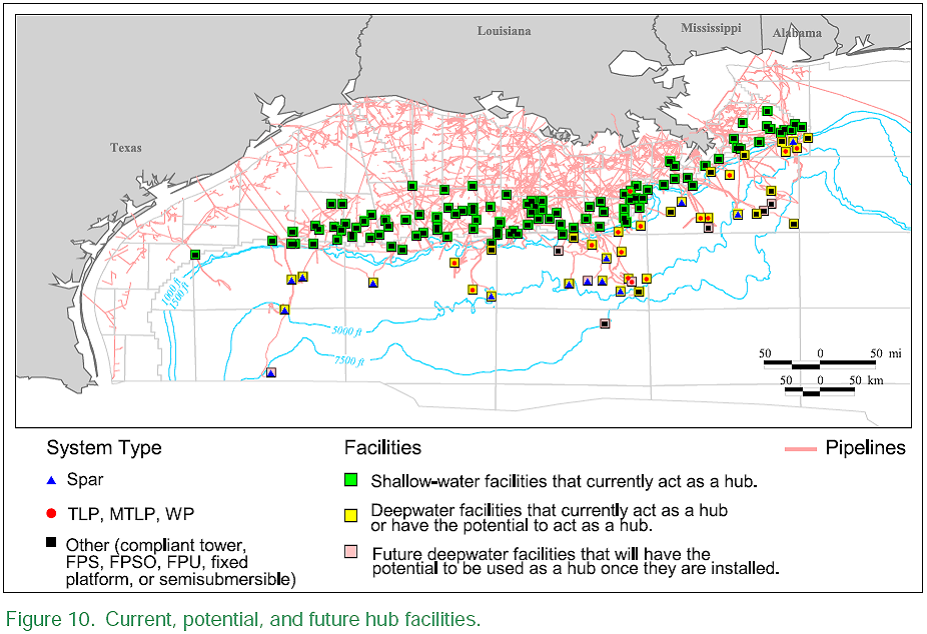

Also, Scott Wilmoth at Simmons & Co was kind enough to send us this map. The map below captures only deepwater infrastructure. For a complete list of deepwater development systems (includes operator, depth, location): http://www.gomr.mms.gov/homepg/offshore/deepwatr/dpstruct.html

(Please deposit new relevant links, graphs, and comments in this new thread...we have updated the resources part of this post with new maps and some more old maps and articles from Katrina on the LOOP and Port Fourchon--important parts of the infrastructure, as we learned about three years ago. We will start a third thread when we get new info or Sat am)

If I were bowling, this looks to be a perfect stike in the making.

Water temperatures in the gulf are favorable for this storm to intensify. I don't know how to post the map but here's a link.

http://marine.rutgers.edu/mrs/show/?file=../regions/gulfmexico/sst/noaa/...

There is a 5% chance of hurricane force winds in New Orleans, according to NHC.

I was referring to oil infrastructure.

As far as New Orleans, due to the counterclockwise rotation of the storm, as the storm approaches land, (under the current model) the wind will come from the east, straight into the mouth of the river.

It's not the wind, it's the rain.

Gustav will impact oil infrastructure and production levels.

For the 2008 hurricane season, the EIA estimates that mean shut in production will be 20 million barrels. However, the EIA believes that the median shut in production of 11 million barrels is a better representation.

http://tonto.eia.doe.gov/FTPROOT/forecasting/2008_sp_03.pdf

Below is an updated oil production forecast for the USA Gulf of Mexico showing recent hurricane outages.

click to enlarge

Excellent

Today, it looks like cooler air will keep Gustav away from the New Orleans area. I wouldn't be surprised if Gustav winds up in Mexico.

The real question mark is Hanna. It is hard to see Hanna avoiding Florida.

Remember, it is 26.5C that is the important temp.

Above 26.5C and hurricanes grow. Below, and they decrease in size.

From that SST picture, the temperature seems to be between 29C and 32C.

I think this is the key:

http://www.weather.gov/sat_loop.php?image=ir&hours=24

If the cooler air (which is north and west of the big T-storms in the midwest) gets to the gulf coast before Gustav (which is off the map @ the lower right-hand corner), then that hurricane will likely drift to the west. The gulf energy platforms will be in Gustav's powerful North-East quadrant, but the shear would limit Gustav's intensity.

Hanna could turn more directly westward toward Florida. If there is an infill of cooler air, then the storm tracks would diverge, with Gustav tracking toward Texas then turning north over the plains and Hanna tracking west then turning north, perhaps moving out to sea without making landfall.

Official NHC has this:

http://www.nhc.noaa.gov/gtwo_atl.shtml

http://www.nhc.noaa.gov/refresh/graphics_at2+shtml/144513.shtml?5day#con...

http://www.nhc.noaa.gov/refresh/graphics_at3+shtml/144212.shtml?5day#con...

If the cooler air doesn't fill in, then Gustav will steer more towards New Orleans/Mississippi but will create shear that will limit Hanna's intensity.

Florida could get hit by Hanna, or it could get hit by Gustav. If Florida manages to avoid a hurricane hit within the next 5-7 days, they will have "dodged a bullet."

TD8 is TS HANNA.

This is getting interesting fast.

Quoting SavannahStorm:

"I've just realized that Hanna Montana is gonna be a BIG storm. All that convection right now is just half of the system. The whole western half of Hanna is being sheared off by that ULL. By determining her circulation on visible sat, once the ULL dissipates, we could be looking at a storm that spans 9 degrees of longitude. That's over 520 miles across! Not Tip-sized huge, but still a big girl."

Tip was as big as Brazil.

Check this out:

http://www.ecmwf.int/products/forecasts/d/animate/catalog/products/forecasts/medium/deterministic/msl_uv850_z500!Wind%20850%20and%20mslp!72!North%20America!pop!od!oper!public_plots!2008082712!!!relative_archive_date!step/

Cool, look at all those slashes, %'s, _'s and !'s.

:-)

Marco---

Point well taken )

Try http://tinyurl.com

http://tinyurl.com/6c7seb

Watch out, its Java.

But it shows Gustav hitting LA, then Hanna sweeping in right behind him even bigger!

If that ends up being the case.. Oh man. :(

Gustav 'Likely to Explode into Major Hurricane,' Target GOM

I don't remember such a 1-2 punch as this combo-Hanna is quite a big bigger size wise.

Currently, the NOAA track has most likely landfall (am I stating that correctly?) just west of Port Fourchon. Bad news for them, and us? How much crude comes through there?

Answered my own question: 15-18%

http://www.cnbc.com/id/26437866

"We play a critical role in 15 to 18 percent of the entire nation's oil supply," Falgout said. "If the Lafourche corridor takes a severe hit, everyone in this country will feel the impact."

ooooooh no 3. brewing:

http://www.nhc.noaa.gov/gtwo_atl.shtml

best hopes for nutter surf dudes.

IEA Ready to Release Oil Stocks if Gustav Hits GOM

Shell Evacuates 400 Personnel in GOM, Plans to Remove Over 800 More

ConocoPhillips Removes Personnel from Magnolia Platform

The IEA doesn't own any oil inventory itself. It's just an advisor to nations that do have such. All the IEA can do is advise, not actually release.

This is incorrect. IEA is an implementing arm of a treaty to which the US is a signatory. Every member nation pledged their Strategic Petroleum Reserve to IEA management of 7-12% shortfall. Measured by Net Oil Exports, we current have a 5.3% shortfall from the 2005 peak.

When Gustav hits we are likely to see an inventory crisis that exceeds the trigger (watch the TWIP report). The IEA committed treaty resources in response to Katrina. Following is a graphic shows what will happen if a Katrina level inventory event happens to current depressed Gulf imports.

Thanks Bill.

That graph is good, but not exactly accurate, because this week should fall exactly under the 2005 drop from Katrina. So what this says is that refineries were out and we couldn't process the crude AND prices went up and met with demand destruction? If we receive IEA 'oil', would that count as an import?

I agree it is not accurate, just an approximate illustration. I have no idea what will actually happen. But an inventory shortfall of a million barrels a day will drop inventories below historical operating levels (blue band).

If inventories drop very far then, my guess is pricing will increase substantially and there will be outages. I believe IEA will help. But shipments of oil from the US Gulf takes a great deal less time and ships than shipments directed by the IEA.

IEA commitments will help. More and more events are adding stress to the system. Russians in Georgia, hurricanes, field depletions, etc... are mounting. Systems under enough stress shred.

I also did not mean to imply that the IEA 'owns' oil. It does command the national reserve of members by force of treaty. I have been doing a lot of studying about contingency plans and will send you a summary soon. As examples Utah's, California's and Ireland's plans were written to be in compliance with the IEA treaty obligations.

Yes

please send that - it might be a good guest post

If i recall, the US opted out of the IEA shortfall contract, saying that our economy was 'too sensitive' and that our SPR had double what most countries do. But the other member countries, in case of a 5% shortfall (IIRC), have mandatory 10pm curfews, odd even liscence plate driving days, etc....(guess my next vehicle should have an 'even' end number...;-)

cheers bill

I will send it. The web site www.EconomicLifeboat.com is being tailored to contingency plans.

Everyone is welcome to come make changes to the site. It is still just roughed in.

Also, please make a guest post for Chris Martenson and his very clear thinking Crash Course. The Peak Oil section is excellent.

IEA still does not own any oil. It can only advise signatories to the treaty to release. But treaty members may or may not choose to abide.

New Zealand does not have any reserve, AFAIK our commitment to the IEA is met via insurance. The contracts require release of reserves in Japan and the UK, of course if defaulting is more profitable than honoring contracts we are screwed

Neven

And with all this potential damage to the oil & gas sector in the GOM, Crude Oil and Natural Gas go... DOWN. The risk is to the upside. Who's selling at a time like this?

I'd guess that revised GDP numbers seem more important to investors in the medium term than Oil. Optimism moving out of hedges. Don't see wide swings either way until after the election. Volitility yes.

Amazing, at 11:45 ET in 1 minute CLV08 dropped $2.16.

It's the IEA announcement, but I don't think most of the market was much surprised by that. Open interest has been steadily falling--meaning people have been getting out of positions both ways. In other words, nobody's been going long because of this hurricane--shorts have been closing out positions, but longs have been using the price rise to get out of longs as well.

What the market is really doing is slowly assessing the chances of long-term effects on supply.

It's interesting that natural gas is tanking, down nearly 10%. IEA doesn't have any strategic reserve of natural gas, does it?

U.S. natural-gas supply up 102 bln cubic feet: Energy Dept.

By Myra P. Saefong

Last update: 10:39 a.m. EDT Aug. 28, 2008

10:30 am natural gas weekly injection number VERY bearish (meaning lots of gas)

It seems that the news of the IEA ready to release strategic oil stocks brought the price of oil down.

http://uk.news.yahoo.com/rtrs/20080828/tbs-uk-markets-oil-9c49c44.html

Truly amazing over the last 45 minutes. Mass psychology in action. Lemmings however aren't very effective at long range planning. :-)

It's also probably a reaction to the coming long holiday weekend in the States. Most of Wall Street is heading to the beaches today (if they aren't already there). The next two days will probably have very low volume (which can lead to large swings in prices).

As someone else stated, many traders have probably exited their positions for the weekend.

What a joke, it's the shorts that should be covering like crazy not so much the longs, such a large drop in a few minutes show that the PPT is bashing the price big time while at the same time shoring up the Dow and other indices, what a joke, so much for free markets in this country..

Energy, Metals, and Grains are getting hit today, but the financial stocks are going up. That must mean hurricanes are headed towards the GOM and many banks are set to fail...

Nobody wants to bet against the stock market going into the elections. Normal seasonal kind of thing.

I think there might also be an element of funds and prop desks closing out winning bets on financial stocks (shorts) and locking in gains before month-end in addition to what Moe just mentioned. As stated before, there's gonna be no volume tomorrow since it's a half day and most people are out anyway, so get your trades in today. Headline numbers for GDP also look (depectively) good and remittance information on home loans and consumer credit (released on the 25th) have shown some signs of stability (still bad, but not getting worse or better).

Moe, was wondering if you had a mid-term outlook for oil. Do you think we're gonna drop lower or do you see more signs of a bottom here? What are you expecting after the OPEC meeting? Been reading your stuff for many months now and really appreciate all your ideas. Thx.

csguy, let's put it this way. I'm comfortable holding on to my long-term positions in oil, which are long. Still no buy signal since a week or so ago that I felt worthy of posting for Macduff, but I didn't see any need to post any warnings to sell either.

I don't see how you can get an edge betting on what OPEC will or won't do, and I don't even see how you can bet on the hurricane until we have more information, other than to take off any short positions.

People with long-term oil investments they're worried about should probably resign themselves to being kept in agony through the elections, unless we get a big effect from the hurricanes.

Thanks a lot moe. Your advice is always appreciated.

csguy, it's the elections vs. the hurricane. The hurricane is already having some impact on oil production. And there are already shortages of gasoline in Fargo, Sioux Falls and upper Minnesota. (No surprise to anyone here, after recent inventory reports.)

You might also want to think about the value of the rising dollar as you ride this out. Your investment may be diddling around in a trading range in nominal terms, but if the value of the dollar is rising, the real value of your investment is rising as well, assuming you bought in dollars.

And on gasoline supplies as well.

A local newscasters' Dad lives in Ocean City, MS.

She reported he told her that a lot of gas stations are already out, he had to drive many miles inland to get gas and inland hotel rooms are also gone.

Yeah, everyone will be filling up tanks.

So much for the poker tournaments at Beau Rivage over the next week.

Even here (middle of Texas), prices are starting to go up. People here are filling up to try and get one last tank of "cheap" gas, before the inevitable "gee, there's a hurricane, so prices will go up five times today" event.

Why is gas $3.19 in Houston today, and $3.69 here, 100 miles further inland?

A poster from the Florida Panhandle (at the Weather Underground weather blog) said folks are cancelling Labor Day vacation plans in a big hurry, due to the uncertainty, which is putting a damper on the local economy.

I don't know about gas being $3.19 here in Houston. I bought premium tonight for $3.59, I think the regular was $3.39. Across the street, regular was $3.49.

Sorry, I was going by this site. I know they sort it and this may not be widespread, but there are quite a few stations at a low price. I can't afford to drive down to Houston and check first hand :)

Here's closer to my home. Even our lowest cost wouldn't make the first page of the Houston list.

Go figure, I'm pretty sure we get our gas from the same companies.

Is this where I can put "your mileage may vary" and a smily face? :)

Consider yourself fortunate. Many of us have yet to see 4.00 yet.

Of course, the shortages are not a surprise, but I need more info. What is your source? Thanks

Found it here: http://www.kdlt.com/news/0827n2.html

so how do we deal with this. It should be getting national media attention and it is not.

96L has emerged in the Gulf of Campeche. It's track is North East. This could add additional complications to size and direction of Gus,

As of this afternoon, all of the models showed 96 passing over Mexico en route to the Pacific. Has it changed that much in a few hours?

IIRC its the Met Office model that was predicting a kink to the south a few days ago. Therefore although its the GFDL model that tends to be taken most seriously, may the Met model prediction should get the nod for this one?

Hello Beaumont

In other news oil drops three dollars on news of three hurricanes hitting the GOM in quick succession resulting in at the minimum production shutdown for 1-3 weeks and delays in offloading imports.

Fox and Bunny figures out whats up:

Now that all the speculators have been scared out of the market the price of oil is going down because no one is buying since they are scared they might not even have a refinery after this. So the good news is the price of gasoline should moderate so keep driving that SUV. Plus Bush promised he would release oil from the SPR we have not determined where we would refine it but Saudi Arabia said it would be ok to return it for a full refund.

LOL!! The even funnier thing is the fact that traders and public alike buy this tortured logic!!

Marco.

Here is the real hurricane:

Mexican Net Oil Exports (EIA data & my estimate for 2008):

2004: 1.8 mbpd

2005: 1.7

2006: 1.7

2007: 1.5

2008: 1.0 (est.)

Westexas,

this is a thread about the weather. ;-)

Hi Rune,

Yes the weather is so much more interesting, all those wonderful dynamic graphs and charts and it is going to happen over the next few days unlike that pesky PO thing - so it doesn't tax our concentration too much. We can panic about hurricanes and be complacent about PO.

Fortunately it is happening in a strange land far far away where I have heard tales of fairies and unicorns and where they build cities below the water level.

That looks like "hurricane alley." Here's Hanna:

And the combined wind forecast

Is this very normal, for a TS to turn south? I thought storms started off Africa and moved across the Atlantic. If they started far enough north, then they would turn north and head straight up the Atlantic toward Greenland. If they started far enough south, then they made a line toward the Gulf. In the three years since I started watching the storms via the charts, I haven't seen one turn south like this.

http://www.wunderground.com/blog/JeffMasters/comment.html?entrynum=1048&...

Not totally unprecedented but highly unusual especially for the forecasted time and distance to be traveled.

Jeff Masters says:

I think in many spheres of the future, we must rethink what is "normal". Climate is just one aspect.

Chuck's forecast (landfall in Mobile, AL) is east of where most others are. Everyone else is drifting west.

The new path has led some to upgrade the intensity, even as high as Cat. 5.

I have trees to cut down and stack, (new)chickens, goats and horses to feed, papers to write, basement to clean all on the weekend docket. Knowing my neural penchant for 'unexpected reward', there may be unfortuntately be a new post next week "Dammit - You Forgot to Feed the Chickens"...;-)

We still have a week to go!

Did you understand a word of that? I dunno, but before I went to skool I couldn't spell enginear, and now I are one. Really, who writes these things? Is plain English an aesthetic abstraction, or are we made to suffer government double-speak?

And why do they insist on using caps!!? Hello, its the 21st century!

Nate, I really appreciate the work you and Chuck are doing. It gives credit to the Internet - this is what it was built for. But that weather description defies gravity!

Hi everyone. Here's the past three days of Gustav's performance, based on information from the National Hurricane Center:

The storm appears to be on a strength-gain over the past half-day or so.

-best,

Wolf in YVR BC

Jeff Masters latest;

"It's time to get familiar with the names Hanna, Josephine, Ike, and Kyle, because the tropical Atlantic is about to put on a rare burst of very high activity in the coming weeks."

http://www.wunderground.com/blog/JeffMasters/comment.html?entrynum=1046&...

(Hola Wulfy)

Hi Soup,

Thanks for the link to Jeff Masters' blog:

A good example of how the complex interactions of various transient atmospheric features can lead to surprises with these storms. Gustav will probably have many more surprises in store... Some may be beneficial (e.g. a perturbation that would help New Orleans stay alive), some may not.

-best,

Wolf in YVR BC

As the lay observer living in the region for the past 10 years and now back to living in BC like Wolf, I came up with some very simple rules to predict hurricanes:

1) 3+ days out they were a best guess.

2) Once a storm hits land, throw out the track projections.

3) You can never be too prepared. (Our house is in NE Florida and we do stock up come hurricane season).

4) Hope for the best and plan for the worst.

I've been through some minor hurricanes, however my wife and family went through Andrew and they went through some of the worst. They live in the South Miami area (yes, South Miami is a separate city BTW). You don't want to go through that.

So please keep in mind as we academically analyze the potential damage that there will people living with a freight train going over their heads and possibly having everything they own and dreamed for strewn between the Gulf and Baton Rouge.

As someone has noted, God is clearly not pleased that fundamentalists were praying for Obama's speech to be rained out.

Just take a look at this forecast by one of the computer models:

http://www.ecmwf.int/products/forecasts/d/animate/catalog/products/forecasts/medium/deterministic/msl_uv850_z500!Wind%20850%20and%20mslp!72!North%20America!pop!od!oper!public_plots!2008082812!!!step/

2 hurricanes hitting New Orleans in about a 4 day period... A doomers wet dream.

edit: not sure how to create the hyperlink.

Here you go:

Linky

I don't fancy myself a doomer, but if even half of that comes to pass... things could get interesting.

If I am counting correctly, the model shows four storms hitting the NO area by Sept. 7th.

Evacuations in Gulf of Mexico Accelerate as Gustav Strengthens

Hurricane Gustav has put Republicans in a bind, since it appears it will strike as they start their convention in St. Paul.

If they carry on with the convention and ignore Gustav, they will appear callous and re-enforce the perception that grew after Bush's mishandling of Katrina. Also the convention will become second page news and a filler item on MSM as Gustav's devastation will dominate. Not only that, all eyes will be on the Republican governor of Louisiana to see how he handles himself and the situation.

If McCain cancels or postpones the convention, the carefully choreographed shindig will be thrown off stride compared to the Democrat's crowning of Obama-Biden.

They are in a no win situation if Gustav hits as forecast. Scheduling the convention on about the 3rd anniversary of Katrina looks to be a mistake that will test McCain's leadership.

Democrats can sit back and watch the fun as they all squirm.

"...all eyes will be on the Republican governor of Louisiana ..."

lol, good one.

Maybe Jindal can exorcise Gustav.

It sounds like you're licking your chops already.

Why not? For 40 years Republicans have been barraging us with the idea that the 19th Century, when the government did nothing about natural (or business-made) disasters, was Utopia. That the market would solve everything, fix everything, and give everybody what they deserved. Katrina showed us all what that actually meant for our forefathers. A sneak preview for the barbarization that is slowly crawling over our country, bankruptcy by bankruptcy, foreclosure by foreclosure, ruined sewer by ruined highway.

super-

It sounds like paradise--- Maybe a monopoly of water? Thirsty people will beg and give away everything. Sounds like the ideal ownership society. The divine right to prosperity- so what if

a few people and trees are in the way. you've sen one redwood, you've sen them all (Ron Raygun).

Surely you're not under the delusion that Democrats had nothing to do with this. The financial rules were relaxed under Clinton's watch. We haven't seen real GDP or Inflation numbers since. No signals = no action (no matter who's in charge).

X - that is a very good point. Gonna be hard to be rah-rah if a city is being destroyed (not that that is the most likely scenario but certainly possible) I wonder if they would postpone it???

PG?

GOP could delay convention if Gustav hits

If we get really lucky we'll have hurricanes in the gulf every week until November.

Good thing Hurricane season ends Oct 31!

But, do they really need a convention?

After the treatment Palin's selection as VP is getting I would think the Republicans might want to relocate their convention somewhere less embarrassing than the United States. I don't know who that was intended to please but it looks like they're making this the Worst. Ticket. Ever. so they can demonstrate improvement in 2012.

Everyone seems to love it. Which is rather strange. Democrats are celebrating McCain handing them the election on a platter. While Republicans think this puts a stake in the heart of the Obama campaign.

Maybe he just wanted to take the attention away from the Democratic convention. If so, he succeeded. Nowhere near this buzz over Biden.

Not gonna help, though, if the RNC has to compete with the big swirly thing for media attention...

Sarah Palin is a Dominionist. A zero in the eyes of most voters but sweet candy delight to the disloyal Christian Right. Oh, but she knows nothing, so if McCain drops dead she panders and the existing powers that be still call the shots. Just lovely ...

http://www.dailykos.com/story/2008/8/29/163234/559

Palin's selection just highlights the inexperience of Obama.

Palin's selection stole the news cycle from the Obama spectacle.

I haven't seen so many scared liberals looking for the exits in a long time. It's kind of funny.

Gulf oil braces for Gustav

Uneasy Big Easy

"Many have attributed the tipping points in the US economic and political scene to the aftermath of 2005's Katrina weather event. Questions have already emerged about the ability of the US economy to sustain a second such strike while in its currently fragile condition, albeit GDP numbers expected this morning might show a higher than 1.9% growth rate for the second quarter."

http://www.kitco.com/ind/nadler/aug282008A.html

A director of Transocean was just on CNN.

He indicated that the number of anchors on many rigs had been increased from the 8 usual at the time of Katrina and Rita to 12.

He made no exaggerated claims for 100% effectiveness, but indicated that drifting should be less likely.

5:00 PM EDT advisory:

Found via the Dot Earth blog:

Tropical Atlantic Headquarters

The wide Atlantic shots are spectacular, you can see a whole string of 'canes on the march.

Is that a nasty little tropical wave parked over Cantarell right now? Looks like a bad week shaping up for the GOM.

Cheers,

Jerry

This is definately the best oil related hurricane coverage on the web. And the posting crew here is sharp and generous. But I'm amazed at the way you guys buy into and offer fundamental explanations for the oil price sell off in the onslaught of Gustav and Hannah.

Look back at the 3 days before Katrina. We had oil prices drop over $4/barrel! Knowing what we know now, was that logical or a freely operating legitimate market.

Do you think the Open Market Commitee (Plunge Protection Crew) only operates in stock futures? Do you think gold markets are legit? Heck no. We are supposed to be a system of checks and balances but thats long gone. And if you give secret committees the power to operate with impunity, do you think they are going to be self limiting? Heck no.

They have nearly limitless funding and they can pump this liquidity into the system by a myriad of ways- not just by buying TBills. They are active in all commodity markets. And their game plan is always to pound down precious metals and pound down oil when the situation looks damaging. They did it on Katrina and they're doing it on Gustav. You watch, oil will be off more on Friday. They know that if they scortch speculators on events like Katrina or Gustav or Mideast calamities, then those evil speculators won't be bidding things up on these inflationary events. They are doing exactly what their name says they are supposed to do- Protect us from stock market plunges.

Poster's Prediction: Gustav is trouble. It'll spin into the Gulf and obtain Cat 4 status but the oil markets will sell off in advance of it making landfall just like they did b4 Katrina. It'll make no sense, but we here should all know by now that we don't have logical, freely operating markets. Once again, it'll be OMC intervention.

Quote link: http://downstreamventures.yuku.com/topic/2133

Notice the above post was made Wed morning at 7:30AM. Its getting way too predictable. We dont have free and open markets anymore.

what you write seems so.....plausible.

I have never really believed in the PPT, but I guess in some ways it does make sense - but there still is a decent chance (e.g 50%) that gulf infrastructure is not affected other than the shut-ins, so the oil market may be acting rationally. For the oil market....

But eventually the people with the fundamentals on their side would sop up that PPT liquidity like Soros vs the BOE. E.g. if these hurricanes do produce damage, especially to the uninsured shallow shelf rigs or the refineries, natural gas and refined products prices are going up 10-20%+. Therefore I just can't believe such a plot exists. People are dumb enough in their own right to make bad investment choices in short run.

The market is up--it's been rising into a strong dollar, even with utterly demoralized bulls. And the squeezeable shorts have already been squeezed out--look at a chart for last Thursday.

The IEA took the rewards off the table for a short-term storm bet. So, we're back to fundamentals, and how the storm affects fundamentals.

Besides, a PPT couldn't work in a market like oil, because if the price were manipulated too far or too long, you'd have gas lines. The powers that be want cheap gas, but they don't want to see gas lines going into the elections.

nat.gas storage # way over mkt expectations after a week of buying on tropics risk = stop loss, no PPT here. That fcst of shut-in's should be compared to katrina...

dr's fcst is right on, the gfs has picked it up, but it needs to track just left of 90,25 to not strengthen over the potential.

Helpful, tuj.

moe - shoot me an email if you have a chance - njhagens@gmail.com

I will, but Nate, have you fed your chickens?

Please cc: me Alan_Drake at Juno dot conn

Thanks

Next thing you will tell me is...the 1919 World Series

was fixed!

http://en.wikipedia.org/wiki/1919_World_Series

Or the Hunt brothers cornered the silver market

http://en.wikipedia.org/wiki/Nelson_Bunker_Hunt

The eldest Hunt was an oil barron. He made billions $

on the silver scam and was fined a mere $10 million

Thats a cool cash profit of more than $3.9 billion.

Who says crime dont pay?

The eldest Hunt was H. L. Hunt. He was not involved with silver. It is true that he wrote about the dangers of inflation as far back as the 60's. His son Bunker Hunt and others purchased silver futures legally. Arguably they were cheated by the commodity exchange in collusion with the government. Were those who failed to deliver silver that they had been legally sold - criminals?

It is a time honored tradition of those in power that if anyone is ever clever enough to figure out the rules and especially to use the rules to their own advantage, to change the rules.

It happens all the time and should be expected in any system where its managers are threatened.

The first rule of power is to maintain itself. If it can not, power is lost.

11:00 PM EDT public advisory:

11 pm advisory:

NHC realizes the POTENTIAL of this storm: from the 11 pm discussion

"HOWEVER...IT WOULD BE NO SURPRISE IF RAPID

INTENSIFICATION OCCURRED AND GUSTAV BECAME A CATEGORY 4 OR 5

HURRICANE BY 72 HR."

And at 72 hr the fcst point is? CENTRAL GOM.

I think they know this is now likely. They just won't show it on their maps until theyve confirmed it.

Check out the headline on the Drumbeat thread about Russia cutting off oil supplies.

Just Propaganda from England..

Maybe you're right, but who's interest does it serve? What is the purpose of it?

Well, it sure is helping the dear old dollar.

To show the world who is the bad guy, in case it didn't understand yet.

Not to wish ill effects upon anyone BUT, if you read the Houston Chronicle online comments re: Katrina victims and media 'hype' regarding storms, the politically backwards denziens of the greater Houston area are due for a major smackdown. The free market can save them, just like utility deregulation worked out so well. Just sayin.

Oh, they're just repeating what Fox News has told them: the Katrina disaster was caused by corrupt Dem LA politicians, and it was "those people's" own fault for not leaving immediately. GWB had nothing to do with it. (I get my Fox News from my weekend bicycle riding partner...).

That is what my son was taught in school. It was all the fault of the state and local pols and the people who wouldn't evacuate. He had to write a paper about failure to send the school buses using facts supplied by teacher. She didn't realize she was pushing an urban myth.

cfm in Gray, ME

Don't forget the storm was caused because there was a gay convention in town. The Wrath of God always makes for an interesting school report.

Since both Gustave and Hannah are heading to Cuba for a one-two punch, does this mean God is having a last word on all those nasty Godless communists?

Or is God making a comment on Raoul's switch to market economics?

There are more things in heaven and earth, Horatio...

He heard about those Chinese oil rigs off of Cuba :) ... It's gonna be a one-two on Cuban oil rigs, then Lake Charles/Beaumont/Houston/Galveston.

do huricanes hook, or slice more often ?

Depends on God's grip and whether he swings outside-in or inside-out. Of course, if he is coming out of his swing, He is going to slice.

Joke

One day a twosome met up with another twosome on a par 4. "Mind if we join you?", they asked.

The other twosome was Jesus out golfing with St. Peter caddying. "Jesus, it's 250 yds across water and there is a lay up to the right at 150, hit the 7 iron." "No", says Jesus, "Give me the driver." He hits the ball and ka-plunk! in it goes into the water.

He is all pissed off and walks out across the water to play his ball not wanting to give up a stroke. One of the other twosome asks, "Who does he think he is, Jesus Christ?" St. Peter answers, "No, Arnold Palmer".

O.k., now back to you Bill with the storm coverage...

From the NHC:

From Hurricane Jim (in the inbox):

Assisted evacuations will start later today. For St. Bernard Parish, the cut-off for requests for assisted evacuation was midnight last night.

Requests for more volunteers with CDL to drive buses.

Prisoners being moved as are animal shelters.

Unlike Katrina, plenty of time to plan and execute in Sequence (due to a sudden and dramatic change in direction, Katrina started at 40 and not 72 hours before landfall).

Contraflow from both SE and SW Louisiana appears likely on Sunday. This will take every state trooper. Mutual aid, including exchanging state troopers depending upon path of the storm, with Mississippi & Texas.

Alan

I just heard that those famlies still displaced from Katrina are getting $17,000 per year per family member from FEMA. Is that true? And, that they are in no hurry to rebuild?

No, more "blame the victim" BS that Republicans excel at.

The only on-going assistance is those in poisoned FEMA trailers that were moved into rentals units after the FEMA cover-up failed (due to Sen. Landrieu bringing in the CDC to deal with epidemic of illness in FEMA trailer inhabitants). From uncertain memory, 6 months rental assistance for those forced out of FEMA trailers (I meet two homeless people that left FEMA trailers because it was making them sick, this was before FEMA cover-up was exposed).

Best Hopes for Just Karma for FEMA officials,

Alan

I believe that many of the volunteers putting out the e-mail hate against Katrina victims are currently preoccupied with proving Obama is a Moslem. Another hurricane in New Orleans might cause their heads to twist off.

Hey, if they're willing to spend as much time using the Internet for that purpose as we spend at The Oil Drum trying to salvage the future... and they're more successful than we are... maybe the future isn't salvageable.

And what shall they do if Gustav veers towards Republican Texas ? And another 40 are killed in the contraflow evac ?

Alan

Hear... see... speak...

Cheers

Gustav Path Includes More, Bigger Oil, Gas Gulf Platforms

And those are all floating production systems Leanan. I've heared many, if not all, have had their anchoring system design beefed up since K. Same goes for the mobile drilling rigs. Maybe we'll see just how good those new designs will work. I'm sure they looked good on paper.

From later in the article:

Leanan,

Is it my old eyes or the stop motion effect of that loop: Hanna looks like it's tryING to rotate CLOCKWISE?????

Rockman,

On the satellite photo, what you're seeing is the high-level cloud shield over the hurricane, also known as the central dense overcast (CDO). This veil of cirrus and cirrostratus tends to hide the low-level circulation of the storm from the "eyes" above. With air rising quickly in the strong convection of the storm, higher pressure (relatively speaking) tends to develop in the upper atmosphere right over the storm, while strong low pressure (relative to the surroundings) develops at the surface. With a developing upper-air "anticyclone", there might be some counter-clockwise circulation in the upper outflow.

-best,

Wolf in YVR BC

Rockman,

Greywulffe is telling you true - what you see is the upper-level anti-cyclone clouds. Development of an anti-cyclone in the upper layers is an important aspect of storm intensification, as the convection at the lower levels needs to "breathe" well at the upper layers -- this is termed upper level outflow. Sometimes you'll hear tropical forecasters remarking on "good outflow in all quadrants", or "outflow in the NW quadrant affected by a ULL". A ULL -- upper layer low -- tends to rotate counter-clockwise like the storm itself and general has the opposing effect to an anti-cyclone, shearing off its precious convection.

Like geology, the storm models are improving but there is still a lot to be learned, and timeliness of results hampers the complexity of computation that can be managed. Gustav is a good example of the problems the computers face. A few days ago it was well formed and growing, and was forecast to stay that way, but interaction with Haiti and an unexpected north-south ridge hampered its development and motion, and rather than strengthening it almost died. Today it has reformed larger and a new set of model tracks are being generated, but there is a LOT of room for track and intensity error. By Sunday we could easily have a small Cat 5 or a large Cat 3 heading for NO, or we could have a large cat 5 headed for Texas or a small Cat 3 going for the Floriday panhandle.

I doubt we'll see anything much less than a Cat 3 by Sunday, though, and I wouldn't be surprised to see a rapid intensification to Cat 4 prior to Cuba followed by some eyewall replacement cycles (natural restructuring processes of a hurricane) with increasing size overall.

Spend some time at Weather Underground in Dr. Master's blog if you want to learn the basics. They know tropical weather just like you folks here know oil, and you can pretty quickly pick out the "smart ones" and filter out the wannabees and trolls just like here. If you have family on the coast you'll get continuous data on the blogs there as the storms landfall.

I've never seen the oil infrastructure maps on the WU blogs though -- these are superb.

There is a good chance that a Cat 3 or greater will slow or stall over the oil fields on Monday. That would be good for the coastal population, as the cooler water will sap the storms strength, but I wonder what a prolonged lower-intensity storm (say, coming it toward Dauphin Island as a Cat 4 or 5, then curving west just off the coast as a Cat 3 and ending up in Texas as a Cat 2) would do to the rigs?

Excellent info guys ...thanks. Regarding water temps I did see a report this morning showing that GOM temps were several degrees warmer than at Gustav’s current location. That would seem to offer a greater possibly of intensity increases. Also, granted my mind's eye isn't as sophisticated as any of the models, but just looking at the WS satellite loop image it appears that the high coming in from the north will get to the Fl panhandle before G makes landfall. Likewise, the Pacific system sitting over Mexico also looks like it might offer a barrier to westward movement. Thus it seems we may see an "alley" for G to roll right into the middle TX coast....right down the road from me. The front moving south also makes me wonder if Hanna could get pushed farther west than north. Might be a long shot but that makes it look like both G and H could hit the GOM.

Interesting times.

A scary but potential scenario is for Gustav to head north off of Mobile AL, then hang a left and cross directly through the ENTIRE GOM OCS as a cat3 for Texas. Basically a Katrina and Rita level damage all at once. But this is low odds of happening (but each discrete scenario also is low odds too, so this has to be considered - we will have much better sense by tomorrow night)

Actually I guess the WORST case scenario would be tornadoes, flooding, etc that damages grid infrastructure and the pumping stations that send fuel to the East coast. We came close to major fuel shortages after Katrina due to this. I don't know if these pumping stations have since installed backup generators, etc. Anyone?

Platform design isn't my thing but there are some insights. Modeling short term stress is fairly old sciences. Prolong and repeated stress is a different matter. The structures are designed to handle very high winds for a relatively short time. As you might expect, flexing a relatively stiff structure over an extended number of cycles is a whole different ball game. It could be an even bigger factor for subsea pipeline damage. Prolonged strong winds could generate currents near shore which could cause a lot of damage. It wasn’t covered much in the MSM but Katrina caused a lot of pipeline/flow line damage. Didn't make for dramatic pics like a toppled drilling rig.

So you're saying those stiff structures could fail in a fatigue condition, rather than in overstress?

What does that imply about the lifespan of a rig in hurricane country?

I suppose so. And I've never heard engineers talking about life span in terms of being stressed by X number of incidemts.

Fatigue due to cyclic loading is a well understood failure mechanism in structural engineering. Certainly seems like this would be a common design parameter for these structures.

Fatigue is a major concern with MODUs. On the Grand Banks we would ride out 70 footers without problem. The constant beat of 35 footers was more of a concern. I do not know what inspection regime applies in GOM but we were pretty stringent about structural inspections. Each vessel represents a floating capital asset worth around half a billion $ and it won't earn much of day rate sitting with the fishes.

There was a prior comment/quote about adding anchors so each unit had 12 instead of 8. I don't quite understand this as the real holding power is developed from the catenary weight of the anchor rode. Adding cable reduces variable deck load so there is a big trade off there. Just adding another hook does not do much for holding power.

Ok you got me :)

Can you translate that into english.

I'm guessing that you mean rope not rode and what your talking about is like a kite at the end of a long string the weight of the string itself is whats holding the kite not the anchor (you). As with a kite new string of similar length don't make a lot of difference however a new much longer anchor rope would probably help ?

So thats my guess am I right ??? :)

Yup. You're right

No I mean rode. The links are steel maybe 8" by 14." No rope would have the required tensile strength.

That is it exactly. When the sea pushes against the hull, the retreating hull attempts to lift the kite string off the ocean bottom. The catenary curve absorbs the horizontal translation and creates a restoring force that returns the hull to its prior position. Very little of the "pull" should actually make it to the hook.

Talk of anchors and string: I was once on a hovercraft that broke down at night in a major shipping lane. I went looking for the anchor to secure us and damn if the anchor rode was nothing more than string. The anchor itself was this lightweight tinfoil thing. You don't want to carry excess weight on a hovercraft and nobody ever expects to use the safety gear :-(

Okay, but the cyclic load is presumably planned to be within the elastic range of the members.

Long-term exposure to regular loading beyond the elastic limit will lead to fatigue failure, right? So if the weather extremes are ramping up, it's not just the levees that will be taxed beyond their design parameters.

I tend to agree even though I barely understand. Basically adding more anchors does not really do a hell of a lot of good. You have a fairly strict limit to how much force you can withstand with this sort of arrangement. Its like adding multiple shock absorbers two is better than one but three gains little.

At the end of the day its a tensile issue. Your right its planned to be within range but when its out of range thats it does not matter really how many your have if your over your over.

Certainly exposure would be and issue but I think it comes down to a design limit issue.

I got caught once in a 27 foot boat in hurricane force winds off of Florida I know for a fact how much power is in the wave action. Think perfect wave but cut the boat size by 60%. Its simply out of this world. I have a sympathetic understanding of what the old Spanish sailors went through. I think that few people really know the power of hurricanes. You can think of it like and atomic bomb or the worst explosion you have ever thought of going off then damned if it does not happen again and again.

The waves where so large we could see them coming at us on our radar, And they knocked down our antennas. Two shrimp boats sank during the wind Tampa has seven foot waves the next day. What it was was a hurricane trying to form in the gulf. I heard the wave reached 25 feet but from the bottom of our boat to the top of the conning tower was at least 20 feet and we had waves in the middle of the ocean like surf breaking over us.

The big boys had to be at least 30-40 feet high if not more for us to pick them up on radar. I don't know how high they were but they where huge waves the front of the trough at least 3-4 times the length of the boat. These monsters where actually not near as bad as the ones that where breaking like surf and about 20 feet hight they where the real killers and we could not see them coming.

Slightly off topic but it gives you just a hint at what it means to ride out hurricane force winds with and anchor. Probably a bit off topic but I assure you most people really really don't understand the power it took me a long time after that to even get back out on the ocean.

Good description.

I read the AGW deniers and I shake my head. They hear of a 6 degree rise and think so what.

Problem is that most modern urban people have never had experience of the raw power of nature. Without that experience they are not able to fully judge what they see on TV news, or to grasp the full implications of 100 knot winds, or what a 6 degree temperature rise truly may mean.

In another life I was on SAR patrol for the BC herring fishery. It was lumpy out so we holed up in an anchorage. Off the bows there was a 100 foot rock pile and on top of that was a crown of jack pine another 100 foot high. Beating on the other side of all that was the Pacific and the spray was coming in solid white sheets flying over the tops of those trees. That was heavy weather but not a hurricane. They should rename them heat storms as that is what they are.

With regard to design limits, it is not just the number of hooks or the anchor pattern. It is the age of the design (Is Mr Charlie still out there?), the quality of the build, the materials spec (lotta bad steel in the 1980s), the classification society, the maintenance and inspection schedule, the quality of the folk performing all the various roles. Gustav or Hanna or Vladimir is going to test all of that. Matt Simmons is 100% right when he speaks of aged infrastructure. There will be leases where they cannot provide economic justification for the rebuild. But moosehunting and snowmobile races are what capture the attention of the public and then they wonder why the quality of leadership is so poor.

I did my best to explain what I went through I think you explain it better.

Think about surf breaking over the trees and then you have at least the basis of a hurricane.

Whats missing is the monster waves every ten or so waves. A three meter storm surge does not capture the fact than ever tenth wave or so is actually six or more meters at least and it that are a few monster waves of unknown size every few super waves.

Yes these monster waves are also known as rogue waves which are caused by two or more large waves intersecting from different storm systems. And since we have a bunch of storms brewing in the GOM one would expect a few of these. To get an idea of their power and their proclivity to come out of nowhere you may want to watch this video.

100' fishing boat struck by rogue wave on youtube

Don

12 anchors v 8.

What 12 anchors does is allow a 30 degree spread instead of the 45 degree spread you get with 8. With more anchors, aligned at better angles to the weather, the strain is shared, and the peak loads which cause line failure and / or dragging are reduced.

Another advantage is that in the event of failure of one line, it can be possible to obtain classification society approval to continue operations with the remaining 11.

Downside - as you mention, reduced deckload capacity, increased initial costs and ongoin maintenance, additional time / costs during rigmoves.

BTW - not uncommon now to use 10" fibre lines where additional elasticity is required, or where the chains cross pipelines. These have breaking loads in excess of 600 tons, similar to 3" K4 chain.

I dunno see my long comment above once your over your over. The load sharing adds little basically it means you get to say a few extra prayers between the first few lines snapping and the last one snapping. I've been in this crap and no way extra lines amount to much if its strong enough to start snapping them.

The second sentence about breaking loads makes a lot more sense knowing the little I do about the ocean whatever level of energy its riled up to it does in abundance. But if its strong enough to snap one it can and probably will snap them all.

Typically the vessel will drag rather than snap the lines. In the GOM where you have significant sub sea infrastructure this may create a lot of problems as the ground tackle will damage whatever it drags through.

Please introduce me to the people you know that have dragged lines or been on a platform that has. I'm not saying it does not happened but the difference between dragging and breaking is probably nothing.

Well, there's me.

I think we will agree that any system will exhibit failure at its weakest point. So the question we have to answer is: The weakest point of any system of ground tackle is where?

In the majority of cases (and we are speaking of commercial vls here. What pleasure boaters sometimes do is utterly beyond belief and comprehension) the weakest point in the system will be the holding ground itself. For the most part this will be unconsolidated sediments ie: mud. So you have several thousand tons of vl deadweight, you have an engineered anchor system with a 2x or 3x safety margin, you have some high dynamic loads and all of this ends up in the mud. What gives first? The mud.

You can piggyback your hooks. You can put out additional lines. You can use your DP system to take some of the load. Heck, you can put yourself under tow. But bottom line is you are hanging onto mud. And the guy who engineered the mud, I'm not sure if he did a great job or not.

Cheers!

Best laid plans of mice and men comes to mind.

Can someone pinpoint BP's Thunder Horse on a map in GOM? I know we've done this awhile ago, but forgot where it's at. Just wondering if it's in the target zone.

TH is pretty much in the middle of all the storm models. About 100 miles south of the mouth of the Miss. River. Somewhat ironic since they almost ready to start production after the long delay caused by K.

Ya...that was my thinking. They just started ramping up again and whack. Better sell some more of my BP stock pretty soon.

I think they will be really embarrassed if they are unable to find Thunderhorse after one of these canes on the way.

Lost one multi-billion dollar oil platform if found please return to BP 123 -444 -567.

Last seen floating on the top of the ocean but could have decided to go adrift or sink.

Goes by the name horsie.

Tristan da Cunha (most remote inhabited island) awoke one morning to find a semi-submersible drilling rig beached on their coast.

http://www.tristandc.com/newsofPXXI.php

Best Hopes for Salvage Rights,

Alan

Ha...finders keepers I guess. Might be a good business salvaging junk in the Gulf after Gustav.

LOL thanks for that one Alan.

Once hurricane season is over I'd like to invite you to the west coast to enjoy and earthquake. We had one the other day and my five year old son was pooping when it started. Given the situation he actually did not shit his pants but finished rapidly and left the bathroom.

Personally being older being caught in and earthquake while your taking a dump brings on a certain interpretation which we don't even have a word for to the phrase

oh shit.

So, we have discussed the higher cost of drilling offshore petroleum than onshore. Does an event like this, if it tracks as modelled, increase the cost of offshore drilling worldwide? I would think it could with insurance, replacement of rigs/parts, etc.

Experts? What ya think?

Yes.

Understand that these may not be the storm that cause the problem but a perturbation like what we are seeing right now will occur every few year think about these storm occurring say two years from now. The point of the fast collapse scenario is we cannot predict when it will occur but we can say with almost 100% certainty given the periodicity of events that our current civilization will be in collapse within five gears.

I'm willing to bet everything I have that we will be under within five years of today and on the same hand I cannot bet a penny on within this range we will go under. Such is the nature of the problem.

You are looking at the same supply / demand curve as impacts the cost of the product.

We are already in a constrained environment with tight supplies of rigs, steel, qualified people. If you need to replace some percentage of the existing infrastructure therefore adding additional demand to the current environment it seems reasonable to expect the costs of all inputs to increase.

I cannot tell if memmel is just typing fast, or if he is trying to type while balancing a bottle of hootch on his nose, but if I read him correctly what he is saying is that the yearly recurrence of this pattern will result in disinvestment as capital will flow to regions of lower cost. That sounds reasonable to me.

Weird. Oil hovers around $117, apparently unaffected by the forecasts. If it won't spike today, we'll probably see it monday or tuesday. And if it won't spike at all, i'll never predict oilprices again. ;)

I agree...go figure.

No Trading Monday (holiday) at least I don't think there is (anyone know for sure?)

So Tuesday is next trading day - and GUSTAV will likely be making landfall on the unfortunate target of the final track.

BTW, WRT Houston comments above - NGFDL model shows a direct hit on Houston.

NGFDL is a the new replacement of the GFDL model for NHS...and should NOT be discounted.

Although, it is likely a NOLA strike would be much more devastating due to the intensification in that path and the sheer number of oil platforms in the way.

My thoughts and prayers are for Alan and NOLA(my brother is there as I write)...

As Alan would say "Best Hopes" for COLD WATER and WIND SHEAR.

On possible plus for the informed - is if the track resolves...we have time to fill up tanks over the long weekend BEFORE the prices spike.

AFAIK, I have never seen a major gasoline price change over a weekend...but there always could a first time.

You gotta be kidding. I've seen huge price swings over holiday weekends. Which this is.

On the weekend itself...or before? Not too argue...but never noticed myself if they did.

I certainly have noticed the spike on the Friday before as SOP.

Either way, without a crude move I doubt we will see a major price movement outside of the affected area(s) until the next trading day.

Just as with Katrina - market was closed Monday but futures trade sunday night and in europe monday am. (I remember that weekend specifically because its when I first met Stuart and Richard Heinberg at Community Solutions conference in Ohio)

Yes, on the weekend itself.

I figured out how to stop these massive storms!!

Stop Labor Day weekends. All the major storms have hit on, or around Labor Day weekends. No more holiday, no more storms - brilliant!!

Post-Katrina gasoline price spikes were partly driven and sustained by disruption of the Colonial Pipeline caused by power outages. (The Colonial carries products from the Gulf region to the East Coast over land.)

Frankly, the lack of reaction in oil prices to the hurricanes and to Russia's invasion of Georgia should put to rest all notions that the price is driven by speculation. Rather, the price is driven by very short term supply and demand forces - ie those who have the oil and those who burn it almost immediately upon buying it are in control of the price of oil.

So, when oil spiked to $147/barrel, that indicated a very tight supply and bidding situation. Because of decreases in demand (probably from China due to Olympics) and increases in supply from Saudi Arabia, the price has come down. The price won't go back up due to a hurricane or from Russia's threats to cut off oil until supply is actually disrupted and the buyers suddently can't find the oil to buy.

That is how I view it anyway.

I totally agree with this!

The only thing I would add is that sometimes there is a temporary disruption in the supply of futures contracts, so that there is a spike or dorp in mkt - this clears out people on other side of trade which results in larger than normal retracement in other direction.

But in some futures markets represent best info on ABOVE ground resources (but they do crappy job on below ground..)

Look at the volume. Nobody's trading today. The boys are already out on their yachts for the long weekend, sipping margaritas. I'm about to make a margarita myself.

General rule in the markets: Everything happens long long long after the absolute latest you thought it could possibly happen.

Thats always been my problem - I've always been 3 steps ahead - so only time I'm right is if I wait a real long time, or the brief periods when 1 step ahead matches 3 steps ahead..;-)

Remember how it was in school, when you knew the answer to the teacher's question immediately, and the rest of the class sat there forever looking blank?

Basically the speculators won't get their signals until the commercials start to move. The commercials can't start to move until they know what's happened. Imagine buying oil for your refinery, only to have your refinery severely damaged by the storm. Plus, why pay storm prices when you know a gov't nervous about elections will release supply from strategic reserves if the damage is severe?

Those big abrupt moves up that everyone's looking for would normally come from shorts having to get out of their positions. Longs know the shorts are vulnerable, and wait for higher prices to make deals. But people have been closing out shorts on dip after dip after dip, and we even already had a short squeeze, so that lemon's pretty dry.

Hi all. Here's a chart of the wind and pressure (altimeter setting) at Kingston, Jamaica, during the passage of tropical storm Gustav:

Note that the time axis is column-scaled, and special observations outside of the usual hourly reports distort the depiction (somewhat).

Gustav was no hurricane Gilbert, which devastated the island in 1988, but was still a serious storm. Based on the sustained wind readings at Kingston, gusts were possibly approaching 70-75 mph (roughly 110-120 km/h) at times. Such wind speeds can cause serious disruption, especially if there are plenty of trees to be knocked over (forced amplifiers).

-best,

Wolf in YVR BC

Two Trends Locally.

*ALL* of the local weather casters are downplaying the certainty of a hit by Gustav. A possibility, yes, be prepared, but "too early to tell".

Do NOT evacuate to elsewhere on GOM.

And Nagin is spending a lot of time on mental health issues, asking people to reach out to friends, family, neighbors that seem withdrawn, cannot make a decision. And providing some advice on dealing with children (talk to them, reassure them, strictly ration TV watching/internet time).

Nagin also warned West Bank residents, who missed severe damage from Katrina, that this could be their time.

I am closely watching rates of evac. 2 AM Monday is my tentative "final decision" time.

Best Hopes,

Alan

Hi Alan,

Are the yellow school (aka evacuation) buses still parked below the water level?

Why all the oil focus on Gustav around here? The market just told us that there wont be any oil production shut in, refineries are aok, there won't be any gasoline hoarding and Russia is all bluster. Ha!

CLICK HERE

I'll stick by my earlier contention. It wasnt a free and open market when oil prices sold off $4 bl on the advent of Katrina and it wasn't legit this week either.

Moe's quote:

"Besides, a PPT couldn't work in a market like oil, because if the price were manipulated too far or too long, you'd have gas lines. The powers that be want cheap gas, but they don't want to see gas lines going into the elections."

I think you're mostly correct here on longer term ramifications. The intent is shorter term- burn the specs, take the wind out of the scramble for barrels and deflate the panic mode. It worked today, didnt it?

But we do have serious gasoline shortages on the pipeline level thru the upper Midwest including Minn, Iowa and the Dakotas. We have oil shortages thru the Southern Hemisphere, in China and South America. And we will see this get worse in the aftermath of this hurricane season, so I'm not sure if your rebuttal fully stands.

We do?

For Nate:

http://www.startribune.com/business/27639274.html?elr=KArks:DCiU1OiP:Dii...

BISMARCK, N.D. - Industry officials are mystified by fuel shortages at terminals in the Upper Midwest this week, but they expect enough supplies for the Labor Day holiday weekend.

Terminals have run out of fuel in West Fargo and Grand Forks in North Dakota; Alexandria, Minn., and Sioux Falls, S.D. Dozens of tanker trucks lined up in West Fargo on Wednesday after a new batch of fuel was delivered.

Hello Downstreamer,

These shortages could be mighty embarrassing for McCain & Palin at the upcoming Republican National Convention in the Twin Cities if the delegates can't get gasoline for their rental cars.

Wow. I think that must be due to local 'hoarding'. According to EIA website market is well supplied:

(EDIT: I posted wrong data but it is relevant to nat gas so I'll leave it here. Thanks for your insight below Leanan - you are likely correct)

I've been following this story for awhile. They've been having sporadic fuel shortages for over a year now. (It's gasoline and diesel, not natural gas that's the problem.)

The problem seems to be that they are at the end of the pipeline, and sometimes, there's "nothing left but crumbs."

I think this may be a sign of MOL. There may be enough fuel in the country, but it's not evenly distributed, and there's no easy to re-distribute it.

sorry, MOL?

And i care cuz this is where I now live...;-)

MOL = Minimum Operating Level.

The most commonly used number for MOL for gasoline is about 170 mb, so we have about 60 hours or so of supply in excess of MOL nationwide. As Leanan noted, some areas have more than 60 hours, some have less--especially at the ends of the distribution system.

As others have noted, the most likely petroleum related problem resulting from the hurricane(s) will be shortages of refined product.

If we do get a whole series of hurricanes--or one like the 1900 Galveston hurricane--massive cumulative damage to powerlines along the storm path(s) is going to be a problem, which of course causes problems for gasoline stations.

I don't buy this.

http://www.eia.doe.gov/oil_gas/natural_gas/ngs/ngs.html

I agree we have reasonable amounts of natural gas but give that in the previous years when supply was increasing we topped out of the average range and this year we have had repeated injections that seem to only keep us in the average 5 year range.

I simply don't buy that we have had a huge increase in NG production.

I don't have the link but the Texas Railroad commission report is inline with what we are seeing in storage.

Stocks in the Producing Region were 8 Bcf below the 5-year average of 785 Bcf a net injection of 25 Bcf.

And.

http://tonto.eia.doe.gov/oog/info/ngw/ngupdate.asp

Of course its always a supply and demand equation but if you look at the previous years we had indication that supply was ample and storage was at the top of the 5 year range. Continued above normal injections with working storage staying in the middle of the five year range means supply and demand are balanced.

With NG shortages can come on quickly but we don't see evidence of extensive growth in production its either small growth < 5% flat or declining production.

And further more we are seeing some of our largest injections in a declining price market the hurricane not withstanding. Overall NG prices are favorable and in general producers should be injecting into storage close to the maximum rate.

The real natural gas production situation can probably change very rapidly given our dependence on shale production with its steep decline rates.

My opinion is that not only have we not seen the supposed increases but that we may be seeing shale production declining fairly rapidly over the next few months as new production fails to keep up with the initial boost from the first 5 years of development. A lot of this early production is now in rapid decline pretty much for the first time. I think we will see soon that the new production is unable to prevent and overall decline and the only issue is how steep it will be.

Certainly this seems to also be balanced by what looks like increased demand this year despite the high prices but I don't see the current situation is simply the result of higher demand.

Yeah, but Downstreamer, it's so easy to burn specs, you don't need a PPT to do it. All you have to do is give Bloomberg a headline.

Alan, I would NOT wait until Monday pm. The GFDL model is much faster than the other models and has been the most consistent and has it arriving before that (or concurrently). The GFDL, if verified, puts the city underwater, and the HWRF comes close with an even stronger storm. I think the decision for an evacuation needs to be made tomorrow am, and I would leave sunday at latest if these models look anywhere close to being right.

Mandatory evacuation for St. Bernard, St. Charles, Placquemines and LaFourche Parishes Saturday (noon for all but St. Charles, 5 PM for them). I think Terrebonne was included in list.

These are the most exposed Parishes and first of three layers of planned evacs.

I am waiting till 2 AM Monday (not 2 PM) for a decision of whether to evac or not. About the last one out is my strategy ATM. But subject to change. Go to Hammond (I-55 & I-12) listen to radio, eat a meal or two and be first one to drive back in Monday PM.

Alan

Lower Parishes are reporting "bumper to bumper" traffic on two lane roads out.

Voluntary evacuation of lower (coastal) West Jefferson Parish (our suburban neighbor). Nursing homes being evacuated in an orderly manner, hospitals tomorrow morning (helo in extreme cases). Terrebonne Parish mandatory evac @ 4 PM Saturday (they are ground zero with latest NHC track).

Starting 8 AM public buses that want to evac and do not have funds will start picking up those that want evac.

Total mobilization of Louisiana National Guard (those not in Iraq). Units from Arkansas and Tennessee are "in transit" to replace LA Guard helo assets deployed in Iraq. Assets that were included in emergency plans.

Alan

Bob Breck, my favorite meteorologist, has an interesting theory. Hanna will help pull a blocking high down south faster and this will force Gustav towards Texas. He was VERY non-alarmist. BTW, said that Gustav is NOT another Katrina.

Separate contraflow plans fro both SE & SW Louisiana will be activated early Sunday morning.

LA has asked EPA for permission to use winter blend gasoline (in storage @ refineries) during the evacuation, in order to expand supply.

Thanks for the "on-the-spot" reporting, Alan. Just don't be like those fools on the Weather Channel that wear parkas and stand outside as sheet metal siding goes flying by...

...stay safe!

Other than one experience (when I was younger & dumber) of driving out in 100 mph winds, I am typically "out of here" by 40 mph.

Best Hopes,

Alan

Jeff Masters is advising you to leave now, tomorrow at the latest:

http://www.wunderground.com/blog/JeffMasters/comment.html?entrynum=1049&...

My plan is to leave a couple of hours before they close the roads out. Wait a half day at the closest safe place and then come back in (or continue out).

Or not evacuate at all if, at the last minute, it is simply not required. Odds >50%

Alan

I assume you're the well-prepared sort? A stray tornado can be worse then a hurricane hit......

I also assume you're traveling alone, and have no family to deal with last minute? Much better to be early-out than late with kids, I'd think.