Can US Natural Gas Production Be Ramped Up?

Posted by Gail the Actuary on September 4, 2008 - 10:35am

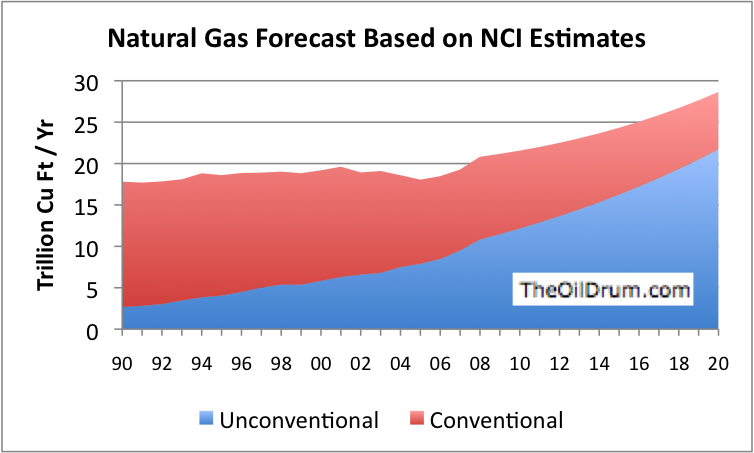

Navigant Consulting Inc (NCI) recently prepared a report called North American Natural Gas Supply Assessment on behalf of a natural gas organization called the American Clean Skies Foundation. In this report, NCI estimates the amounts shale gas and tight gas production can be increased in the next decade. These estimates suggest that US natural gas production can be ramped up by nearly 50% by 2020. How reasonable are these estimates? What obstacles are there to such a big ramp up?

My analysis indicates that NCI is correct in some respects. There is indeed a great deal of unconventional natural gas resources in the United States, and recent improvements in technology point to the possibility of significantly greater production.

There are two major problems, however. One is that short-term demand is not very flexible. It is very easy to flood the market with more natural gas than the market can absorb. The other is that there are a number of obstacles ahead for companies selling natural gas. It is likely that these obstacles, rather than a lack of natural gas, will curtail the rise in natural gas production. As a result, the full ramp up in production is not very likely.

Recent EIA Data for Natural Gas

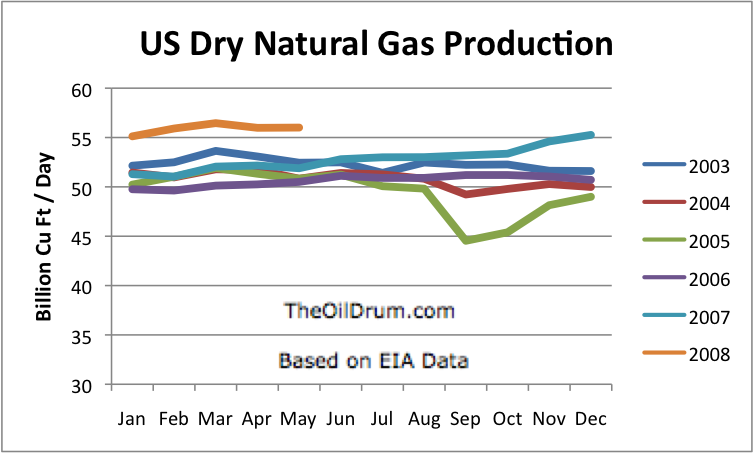

Let's start by looking at EIA natural gas data. EIA has recently reported a big increase in US natural gas production (8.8%, comparing the first five months of 2008 with the first five months of 2007). Some have suggested that the EIA numbers must be wrong. It seems to me that what we may be seeing is the effect of a recent technological breakthrough.

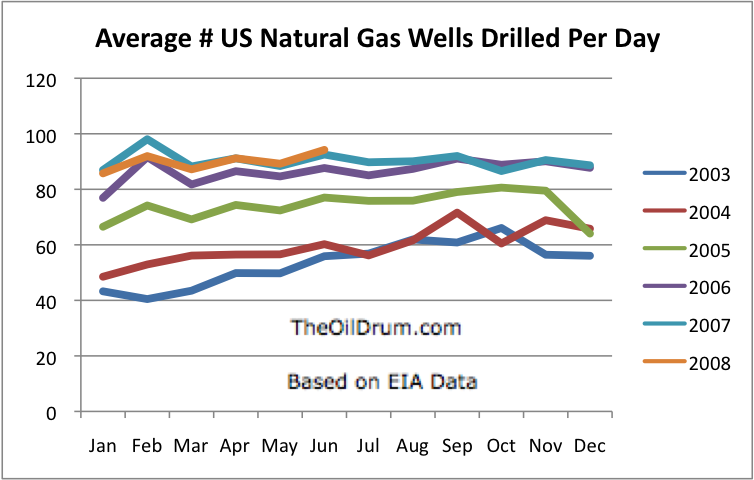

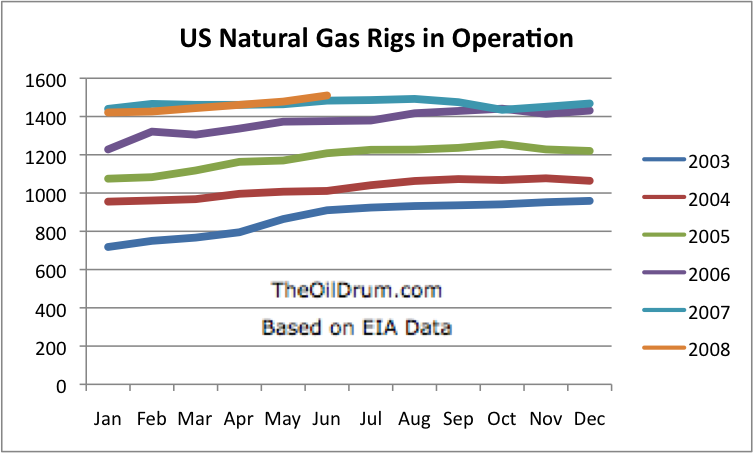

Until fairly recently, many of us had noticed a pattern of increased drilling being required to achieve the same quantity of natural gas production. Most of us interpreted this to reflect declining Energy Return on Energy Invested (EROEI).

In the last few months, there has been a sudden shift in the data. EIA data shows that recent production is rising at the same time that the drilling of new wells is leveling off. Average daily dry gas production during the first five months of 2008 is up 8.1% over the same period in 2007. (Because 2008 is a leap year, total dry gas production has increased 8.8% for the five month period.)

One can look at many other measures as well, and see a similar pattern. The number of well feet drilled per day levels off and even drops, in late 2007 and early 2008, at the same time natural gas production increases. My interpretation of what is happening is that there has been a technological breakthrough, probably in the area of shale gas production of natural gas. Because of this breakthrough, companies are able to produce more gas, with less drilling effort.

There are several reasons I believe that the data reflects a technological breakthrough, rather than, say, an error in EIA data. First, when I look at individual company reports, the ones that show drilling activity seem to show the same kind of pattern--more success with fewer wells drilled. Also, even where there is not information on the number of wells drilled, the company reports talk about increased productivity of wells, due to the increased use of horizontal drilling and better fracturing techniques. Finally, the increased natural gas in the system is having the expected impact on storage and prices, as I will discuss later in this post.

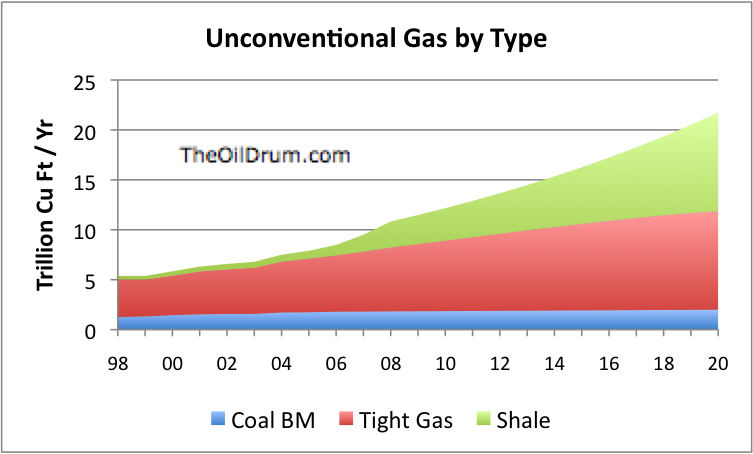

EIA does not break out recent production into unconventional vs. conventional. In fact, the most recent break out of unconventional is for 2006, given in the backup data to Figure 80 of the Annual Energy Outlook:

It is clear from looking at this figure that unconventional gas has been rising rapidly. EIA's forecast for the future looks unreasonably pessimistic alongside its production history. The other two major categories (onshore conventional and offshore conventional) are both declining rapidly (but miraculously are forecast to rise in the future).

The EIA graph in Figure 5 shows that there is the potential for an increase in gas production from Alaska, once a pipeline is built. The EIA forecasts that this will happen in 2020. The amount of the increase appears to be about 10% of current US natural gas production. If this in fact takes place, on my Figure 1, there will be a small bump up in production in 2020, bringing the 2020 production total from 29 trillion cubic feet to 31 trillion cubic feet.

If there is an increase in overall natural gas production, one might reasonably assume that the increase in unconventional natural gas is finally overpowering the decline in conventional production. EIA data by state and information from company financial reports both point to success with shale gas, particularly Barnett shale in Texas. If the recent increase in production in fact relates to shale gas, this would tend to tie what is happening now to what the Navicgant Consulting, Inc.(NCI) analysis is forecasting for the years ahead.

Navigant Estimates

NCI in its report does not make an estimate of total US natural gas production. Instead, it makes estimates of shale gas and tight gas production, in very general terms. In Figure 1, I put these estimates together with some rough estimates of the remaining pieces to get an estimate of expected future natural gas production. (I used a 3% annual decline rate for conventional natural gas.)

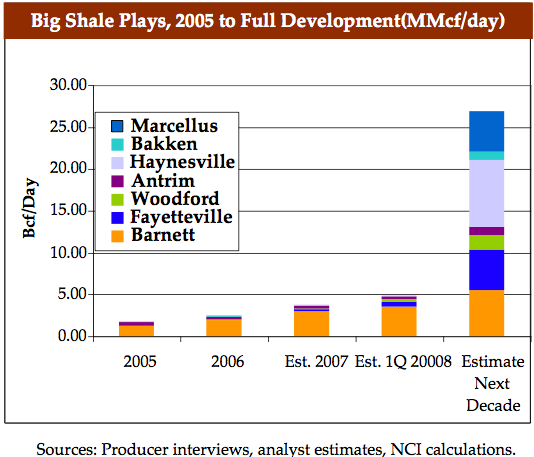

NCI's forecast of shale gas production is in terms of how much sustainable production might be expected from the various shale formations:

The timing is not given very precisely, just "next decade". In Figure 1, I assume that this higher level of production will not be reached until 2020. Because of the imprecision of the wording, a person could argue that production might reach this higher level as early as 2015.

With my interpretation of the NCI report, indications are that shale gas is now the big source of growth, and will continue to be in the future. Tight gas production will also continue to grow.

Previous unconventional gas posts

Many readers will remember that I have written previously about unconventional natural gas:

US Natural Gas: Lessons from BP's Tight Gas Facility in Wamsutter WY

In these posts, I talk about how widespread shale gas and tight gas are. I also talk about the advances BP has been making in its Wamsutter, Wyoming tight gas facility. With this as a background, it is easy for me to believe that if all of the resources are there, there is a reasonable possibility that US unconventional production can be ramped up further. I think there are obstacles that may get in the way of this, however.

Short term problem: overwhelming the system with too much gas, and causing price to drop

What happens when one increases natural gas production by 8% per day? There are a few places this can go--a little to offset a decline in imports from Canada, a little to use as exports to Canada and Mexico, and a little to meet the growing demand of electric utilities. Liquefied natural gas (LNG) imports can be reduced to their contractual minimum. On the industrial side, some factories with spare capacity can use some additional natural gas. It is difficult for these uses to absorb the 8% growth in production, however.

How could you individually increase your own natural gas use? You could turn up the thermostat to heat your house more in the winter, or you could use more electric appliances if you have electricity from natural gas. There really isn't much else you could do, without purchasing something new (for example, a clothes dryer that runs on natural gas, or a car that runs on natural gas). It is not a whole lot different for business users of natural gas.

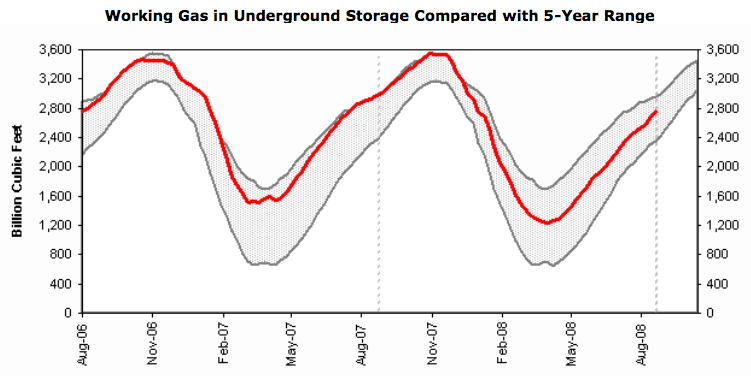

Once demand is satisfied, the remainder is added to natural gas underground storage. This past week, 102 billion cubic feet were added to storage; the week before 88 billion cubic feet were added to storage. The US is currently producing about 56 billion cubic feet of natural gas a day, so over the past two weeks we have put about 20% of production into storage.

The problem is that natural gas underground storage is not terribly large, and it hasn't been increased recently in size to accommodate the new larger natural gas production. Historical data suggests that the practical limit of working storage is 3,600 billion cubic feet. This is a bit over two months' production. As of August 22, 2008, the amount of natural gas in working storage was 2,757 billion cubic feet, leaving only 843 (= 3,600 - 2,757) billion cubic feet of "space" available.

Once storage fills up, there is no other place for the natural gas to go. To make matters worse, it is very difficult for producers to shut production in, if there is no space available for storage, so producers will mostly continue to produce, whether or not there is space available.

Once traders realize that there is a significant chance that natural gas production will exceed storage space, prices start to drop. It seems to me that this is part of what has happened with natural gas prices recently. One consideration in deciding whether the supply will exceed the storage space is the long range weather forecast. The forecast is for a warm fall, meaning that little heat will be needed. We are also in the midst of an economic slowdown, and this is also likely to reduce natural gas use.

All of this makes for a bad situation for natural gas producers--lots of supply, but not enough demand, and prices dropping disproportionately to the prices of other fuels. In another post in the next few days, I will talk various approaches that have been proposed to increase demand, so as prevent this problem. I will also talk about the quantity of gas that might be available.

Other obstacles to growth

It seems to me that the main issue is not whether there is enough natural gas in the ground. It is whether we will be able to get it out and transport it to users. It seems likely to me that one or more of the following will reduce growth to significantly below what theoretical studies would suggest:

Not enough distribution pipeline and underground storage

Every company adding new production will realize that it needs pipeline to connect its gas to an appropriate processing center. It may not be as obvious that the distribution system as a whole is likely to need to be expanded, if significantly more natural gas is produced. For example, if natural gas is to be used to replace heating oil in the Northeast, it is likely that both more underground storage and more distribution pipeline will be needed. (See this post by Heading Out.) Expanding the distribution system is likely to be expensive and take several years.

Worn out pipelines

Matt Simmons has repeatedly stated that pipeline infrastructure is nearing the end of its useful life. If this is true for natural gas, this could be a problem.

Not enough of the right kind of drilling rigs

If everyone wants new horizontal drilling rigs, this will be a bottleneck to growth, until enough new rigs of the correct type can be built.

Not enough pipe

There have been articles in the press about steel for drilling pipe and casing being in short supply.

Not enough trained manpower

This is a problem in any industry that tries to ramp up quickly.

Reduced credit availability

Banks have cut back on their lending. Natural gas companies that have depended on a lot of leverage in the past will find this business model very difficult to maintain. I expect them to either slow down their rates of growth, or partner with an oil major who is in a better position financially.

Counter-party risk

Quite a few of the natural gas companies are major participants in the derivative markets. We know that many banks are in financial difficulty. If banks in financial difficulty are counter-parties on transactions, their defaults may cause financial problems for the natural gas companies.

Issues with water re-injection or disposal

Unconventional gas production requires re-fracturing of wells from time to time. The fluid used in re-fracturing must be disposed of properly. There was recently considerable opposition to shale gas drilling in New York because of water issues.

Declining profitability

This is closely tied to EROEI. If there continue to be advances in technology, I would not expect this to be a problem. Some of the sites may prove to be more difficult to extract than the NCI forecasts, and this could be a problem. There is also the possibility of external impacts, such as higher taxes.

Peak oil

Peak oil will reduce the availability of oil for every use. It is hard to think of an allocation scheme that would fully protect the unconventional natural gas industry. The workers all need cars to get to work; food needs to be transported to the location where there workers are working; and drilling rigs often diesel powered. Any oil disruption could interfere with natural gas drilling.

Gail,

My congratulations on your excellent study of the natural gas situation. What I find confusing is that just a few months ago, gas prices were extremely high and North America has been in the "Red Queen" dilemma of running harder and harder just to stay in the same place. Now suddenly, many people are going into the cornucopia mode.

Do you have any idea how large unconventional gas reserves are or how quickly they will deplete compared to conventional gas fields. Does tight gas or Barnett shale hold reserves comparable to the elephant gas fields we have relied on?

There is an incredible amount of resource out there. This is a map I posted earlier regarding tight gas.

Shale gas resources are just as widespread. Even coal bed methane is theoretically very widespread, since veins that are too deep to mine can possibly be used.

These resources will certainly vary in quality from one part of the county to another. Originally, none of it could be extracted profitably. Companies have chosen what appear to be promising sites, and gradually made incremental progress on being able to extract the natural gas profitably and in reasonable quantity. It is yet clear how much of this gas can be extracted profitably, since this will depend on how much technology can be adapted to extract gas in different formations. In some formations, the gas may be so "dilute" or bound so tightly that nothing can be done to profitably extract it.

One of the issues in determining gas reserves is how closely wells can be spaced. The original spacing (I believe) was one well to 80 acres. This is now coming down to one well to 40 acres in some places, and even one well to 20 acres a few places.

In my visit to BP's Wamasutter WY location, BP said that it has produced about 3 trillion cubic feet of natural gas since 1977. This represents less than 20% of the resource available in BP's portion of Wamsutter field. We were told that gas wells from the 1970s are still flowing.

If we had unlimited resources (including no peak oil), I can imagine a scenario where unconventional gas could keep producing at a high level for 20 or 30 years, because rigs could be moved on to new locations, as old locations became exhausted. In the real world, I doubt that this is will happen.

Cheers Gail and thanks for the excellent article. Just a few thoughts:

1. Doesn't this put a little wrinkle in the 'peak oil' situation? Can we use Nat Gas to release some of the burden on Coal and potentially, oil?

2. As for excess gas, doesn't this play well to the Pickens plan? If we could run 10% of our transport on Nat Gas, wouldn't that help ease any glut while providing a more steady demand? Added benefit -- less foreign oil imports (10% Nat gas + 10% biofuels + 20% efficiency gain +10% all electric might just destroy our imports and achieve the dream of energy independence -- I know, you guys will all cry cornucopia. Just a thought).

3. How much of the gas could we liquefy and export? Europe needs gas bad. Russia is a geopolitical problem. A few bargaining chips other than the navy in the Black Sea would be nice.

4. Can you 'crack' gas into traditional petroleum products? If so, at what cost/EROI?

5. With demand curtailed for oil and new supply of nat gas is the energy market headed for a mini bust?

6. Chemicals/plastics/fertilizer. Bring more industry back to the states. Am I wrong???

7. This looks like one giant opportunity in need of a few good capitalists.

8. Or would it be best just to pace production so we can make the best use of our resource over the longest period?

As for 4: Yes, I think this should be possible. Methane has even advantages to longer hydrocarbon chains as it has a better hydrogen/carbon ratio. So a plethora of natural gas would be a great fix to bridge the gaps opened by peak oil. But I'm still not sure how far the UNG resources provide is a sustainable solution or are only a temporary straw fire (see the comments below).

The Independence Hub and its 0.9 Bcf/day started July 2007. That is one reason that early 2008 is so far ahead of early 2007.

Well worth the wait Gail. An excellent picture of today’s unconventional NG plays. I can back up some of your assertions from the front lines. The technology improvements have been THE key along with supporting NG prices. As an example, 5 years ago a vertical UNG well might be drilled on a 40 acre unit. A year or two later, one horizontal well 1000’ long might be drilled on 80 acres thus replacing 2 vertical wells. This well might be fractured in 3 or 4 spots thus allowing even better results then the 2 vertical wells it replaced. Today, a horizontal well drilled with a lateral length of 4000’ might be drilled on a 320 acre unit. This well may also have 10 or 12 intervals fractured. This latest effort would replace 8 vertical wells drilled just 5 or 6 years ago. The initial production rate might easily exceed that of the combined 8 wells also. Thus there would be a big disconnect between the number of wells drilled and expected results if these advances were not taken into account. It’s difficult to estimate future expectations of advancing technology but I’ll guess we’re getting close to the point of diminishing returns on that front. Some improvements for sure but nothing like we’ve seen in the last 5 or 6 years. On the other hand, new UNG plays are now being explored which have never been considered viable targets in the history of resource development in the USA. With that in mind, any effort to offer a maximum/minimum detailed expectation of future recoveries would be almost pointless at this time IMHO.

With respect to increasing gas storage, this has been one of the most sought after opportunities in the last 5+ years. But there have been significant road blocks. Only certain reservoirs are suitable for NG storage. And this number is limited. Complicating the effort even further is that many such sites are in the Gulf coast region. Adding storage here does little to alleviate demand out side the region due to the transportation bottle neck. Even where potential storage reservoirs are close to the end users it isn’t a sure thing. If the sites are distant to the pipeline system it adds a huge cost factor to make the connection. Additionally, building the new pipeline connections take a considerable amount of time. This adds considerably to the risk of predicting future demand/pricing. And even when conditions are favorable, NG storage is an expensive proposition to initiate. A certain volume of “bunker gas” is needed. This is the volume of gas that will never be produced as long as the facility is operating. A NG storage of significant size night require 10 bcf of such gas or more. At $10/mcf this would tie up $100 million of capital indefinitely.

A significant amount of tite NG sand production is still locked up in the western states due to lack of regional transportation lines. But advances on this front have been made over the last 5 + years.

But, as to the question of these plays being similar to the giant conventional gas plays of old, the simple answer is no…not even close. I’ve worked in some of those old fields where an individual well might produce 30 or 40 bcf over its life time. Cumulative production from some of the best UNG wells might approach this level but the vast majority will produced just several bcf of NG. The production profile of the typical UNG well is very different: a high initial rate with production dropping as much as 70% to 90% in just several years. This is why you’re seeing such an acceleration in new completions. (and given current NG prices these wells do generate a very acceptable, if short, rate of return). As wells drilled just 2 or 3 years ago start their steep decline rates the companies (especially the public one) must drill more wells to replace them. But as these newer wells begin their decline even more wells are needed to replace. Almost all the big UNG players are public companies. As outlined here earlier, these companies must show consistent y-o-y growth in reserve volume. This is how their stock is valued by most on Wall Street. This fact actually adds to the potential recoverable NG values. Even if NG prices were to drop to a level that a public company could only expect to just recover their capital cost they would have no choice but to continue drill as fast as their cash flow would allow. We may actually reach a point where NG prices won’t support continued development of UNG due to over supply conditions. But these periods will be relatively short lived as production rapidly declines.

Many thanks for your comments. Your on-the-ground comments are always helpful.

I was looking at your statement, "The vast majority [of UNG wells} will produce just several over its life time." This fits in with what I was seeing at BP's Wamsutter. They were talking about production of 1 or 2 bcf over a well's lifetime. I hadn't realized that old conventional natural gas wells might produce 30 or 40 bcf over their lifetimes.

I suppose that we could be seeing a "U" in productivity. There is a huge drop down from conventional to unconventional, but now the unconventional could be coming up a bit. With the huge resource there, it is theoretically possible to extract quite a large amount at a low, but acceptable, EROEI.

If my fading memory is correct the highest recovery I've seen from a single well was around 120 bcf from an offshore TX field drilled by Chevron decades ago. It was a one well field...I suspect Chevron didn't realize how big the reservoir was and thus didn't drill additional wells to accelerate recovery.

I also meant to point out something important about the spike from the Independece Hub. The various Deep Water wells tied into it will also have a relatively short life compared to old conventional fields. Don't know the details but I'll guess 5 or 6 years. They may eventually be replaced by new wells down the road but only time will tell. Having the Hub inplace might bring more drilling back to this rather NG prone area.

The natural gas through the Independence Hub would actually be conventional natural gas, rather than unconventional natural gas. It would be good to have a breakdown on conventional vs unconventional in real time, rather than years later. Does anyone have a source that breaks out the amount of this flow separately? Perhaps some of the MMS offshore data, perhaps?

If the new offshore wells are much more productive than the unconventional wells, this could also be skewing the well productivity somewhat also.

In my Figure 1, I made a guesstimate of the 2007 and 2008 conventional / unconventional split. It is possible this split is skewed too much toward unconventional.

Gail,

I think in your previous post you said that the production per well of shale/tight gas was MUCH lower than a conventional gas well.

Some here seem to be ignoring the fact that Peak Gas will be governed by the 'size of the trap' not the size of the resource(which seems to be growing by the second).

But let's look at the 'natural gas fairy' for a sec.

It takes 127.77 SCF to equal 1 GGE. The US uses 150 billion GGE per year so that works out to 19.165 trillion cubic feet of natural gas. Current US consumption is around 24 Tcf of natural gas so adding domestic production of natural gas just for CNG cars will increase by 80%. We still would use at least 3.65 billion barrels of oil per year and we produce 1.9 billion barrels per year. We would still have to get about 900 million barrels a year from Canada and 600 million barrels a year from Mexico (will Canada's tar sands grow as fast as Mexico depletes?). So we still import 250 million barrels of oil.

How long will our new NG 'potential' last? The USGS says that unconventional gas is around 544 Tcf of gas. Conventional is around

400 Tcf and then there is the ever popular undiscovered potential of something like 300 Tcf. Total ~1200 Tcf. Divided. By. 44 Tcf. Equals. 28 years. (Assuming unconventional gas flows like conventional gas, which it doesn't).

And what do you know... Boone says other technologies will take over in 30 years(probably hydrogen from much more abundant coal)!

'Fool me once...I won't get fooled again', right?

I am happy we have found some more natural gas but I'm not deleriously so.

Could somebody please tell the agents of the natural gas companies that the party is over?

Get off fossil fuels.

You are right. Anything is temporary.

Also, it is not clear that continuing our motoring ways is the best use of resources.

Hi Majorian,

I'm working on a post about T. Boon's idea for CNG powered cars, and you are correct. If you power all 134 million passenger vehicles with CNG, it would overwhelm our current production. But if you use plug-in hybrid CNG cars (CNGPIH - bad acronyms strike again!), then you only need about 10% to 15% more gas after 20 to 25 years, which is not too bad (time required to replace 134 M cars at current scrapping rate of 5.8 million cars/year).

I see at least two potential problems with a only CNG-auto approach:

1) If you invest lots of $$ in a CNG vehicle infrastructure, then you've got to live with it for awhile, otherwise, you'll have to pay in $$ AND energy to build a different one. So that implies that the car of the future would be either a CNG/biofuel dual fuel model, or you go in the direction bio-CNG as a replacement for oil/gasoline. I'm not sure CNGPIH only is the way to go.

2) Natural gas is now the lifeboat of choice for many, power plant folks included. Using the EIA’s data for proposed power plants, I calculate that between now and 2015, about 6.3 TCF additional will be needed to power them plants (see my response to Gail below). When you start to add all of this on to CNG's back, it makes me nervous, especially if we don't have a clear picture of what future gas supplies will be.

However, if CNGPIH’s are part of a balanced solution and/or peak oil strikes with a vengeance before we are ready, then CNGPIH’s would be a easy way to handle part of the loss until we can find and produce bio-fuels in sufficient quantities. - SMH

I've got some stock in a little oil company that's planning on drilling two or three exploratory sub-salt wells in the later half of this year and the first part of next year in Southern Lousiana.

These wells are deep and they're extremely expensive--they're talking between $25 and $30 million each. But the reserve figures they're throwing out are jaw-dropping, something like 50 to 100 BCF per well.

Have you heard much about these plays, ROCKMAN?

Is the geophyisics used to locate these prospects new?

Is the technology used to drill through the salt new?

Isn't drilling the subsalt the same thing Petrobras has done with such stunning results?

What kind of potential could this unlock for U.S. natural gas producers?

I've heard a lot about these shale and other resource plays, but almost nothing about the sub-salt.

DS,

I'm not too knowledgeable about sub salt plays in S La. My work has been in the Deep Water GOM. But there are similar aspects. To answer your specific questions:

It's 100% seismic exploration. Even when there are a lot of offset wells (and there are very few in your play) most deep targets are confirmed seismically. Advances in seismic over the last 10 years have led these plays.

No...drilling through salt is old hat...been doing it for 30+ years. But there are still significant mechanical risks. The weight of the drilling mud is varied to deal with high reservoir pressures in all deep wells. Too heavy a MW and you'll collapse the hole. Too light a MW and you risk a blow out...makes for a very bad day. This is actually my job these days: monitor the drilling situation and make MW recommendations. The one caution: a $25 million hole can turn into a $50 million one in a blink of an eye. Drilling deep is always a risky proposition. Make sure your guys have deep enough pockets to handle such a cost overruns. My last Deep Water $100 million hole cost $148 million by the time we were done. And it was a dry hole.

Same type of animal Petrobras is chasing but otherwise no relationship.

I know Exxon and others have been chasing ultra deep targets in S La but haven’t heard of any great successes. There isn’t a potential for the cookie cutter type plays in the unconventional shale gas plays. The deep exploration programs are chasing very specific types of structural traps similar to the old conventional NG fields. There may be a number of fields to find out there but nothing like the 10’s of thousands of unconventional gas well that will be drilled. Huge payday for a company that finds one but the play won’t ever add up in aggregate like the UNG plays.

And this is why you don’t hear much about sub salt: just a few players with new discoveries coming just a few times a year at best.

Thanks for the heads up, ROCKMAN.

From what you're saying, it sounds like these are highly speculative ventures, not only from a gelogical perspective, but from an operatonal one as well.

It makes one wonder whether the potential rewards justify the risks.

These domestic oil and gas producers face some pretty tough choices. Despite all the technological advances in seismic, drilling and completion technology, a panacea of quick riches doesn't seem to be in the cards: they can either opt for the low risk-low return that the resource plays offer, or they can go for the high risk-high return projects like the subsalt.

It's a hard business.

Joe Stiglitz has a new column out today. Even though I disagree with his conclusions, I nevertheless think his division of the economy into two parts--manufacturing vs. service--is insightful:

Guys like yourself are out there doing the heavy lifting in the manufacturing sector. Meanwhile, the so-called "whiz kids" reap the huge monetary rewards in service sector endeavors like banking and finance.

Where I think Stiglitz gets it wrong is his characterization of the service economy as the "knowledge" economy, the "information" economy, the "innovation" economy. His blind spot is in thinking that guys like yourself, dedicated to the manufacturing sector, don't deploy as much knowledge, information and innovation as his fair haired boys in the service sector. The reality is that you probably deploy about 1000 times as much.

As much as I admire Stiglitz--his strident condemnations of the Iraq war and Bush's profligate and disastrous fiscal policies--I nevertheless think the time is rapidly approaching when we will see that he lives in a world of illusions, a dream world of smoke and mirrors.

I think Stiglits is right here, but only in times of great surplus.

Surplus energy, food, water, basically all resources.

However we are entering or in a period of huge forced constraints on all of the above.

So he is DEAD wrong. IMO

"His blind spot is in thinking that guys like yourself, dedicated to the manufacturing sector, don't deploy as much knowledge, information and innovation as his fair haired boys in the service sector. "

No, when someone like Stiglitz refers to the "knowledge" economy, he's including people like Rockman. Rockman is a knowledge worker, not a manual worker. That's Stiglitz's whole point - Rockman may not drag wellcasings around, but his services are essential to drilling.

Thanks for information on spacing. I was wondering how they were doing that. I had heard they were drilling laterals up to 4000 or 5000 feet. And I had heard they were drilling on 40-acre spacing. And I figured if you drill wells on 40 acre spacing with 4620 foot laterals, then the laterals are only going to be a few hundred feet apart, because a 40-acre parcel 5280 ft. long would only be 330 ft. wide. So I was intrigued, since that would mean they were figuring these wells could only drain 165 ft. from the wellbore.

I had also heard they were drilling numerous wells from a single location, like a fan, and I was also curious as to how that works.

It's all very interesting, and certainly a big change from the days when I was in the business.

It is a whole new world from when I started in 1975. Maersk is drilling hundreds of 25,000'+ laterals in the Persian Gulf developing a tite chalk gas reservoir. That was their chopper that just hit the platform and killed 7. I think one of my cohorts was killed but still waiting on confirmation.

Right now, in many of the UNG plays, operators are targeting a certain direction for the laterals based upon assumed orientation of natural fractures. Thus you might just see two wells at most drilled from a single location.

And you're right: the more we drill the more we learn. The wells probably aren't draining much more than 100' or 200' from the lateral. That's why you're starting to see 10 or 12 fracs per hole becoming more common. Essentially, only those portions of the reservoirs in direct contact will the frac will produce. That's one big reason why folks throwing around those big "in place" gas reserve numbers are misleading. That NG may be there but an whole lot will be left behind when the wells are depleted.

Gail,

Excellent and thorough analysis.

It's good to see some positive results for a change.

Even if gasoline prices continue to trend higher at least we'll get a break from heating bills and potentially from rising electricity bills for a short period.

Good news.

Gail:

Thanks for this. However I am not sure that we can be this optimistic. The evidence from wells producing gas from shale is that their production runs are very short. I followed up on DownSouth's comments on the Texas Railroad Commission reports, and typically you're seeing less than three years of production from a well (and this goes along with the World Oil report I quoted some time back). Production thus becomes a year-to-year thing with much greater difficulty in making longer term predictions since tapped reservoirs, and thus known production doesn't last that long.

i.e. better technology equals faster treadmill....now if we could combine better technology with a market system that pays for FUTURE earnings, as opposed to extrapolating CURRENT earnings into future, then maybe some of this natural gas would be marshalled...

Any change in trend needs to be studied and so thank you Gail for reviewing NCI's study and starting a discussion on whether the trend is sustainable. As a nat gas developer by trade, the increase in production has surprised me and many industry peers.

First, in reply to Heading Out, these wells will not have short lives - they just will have rapid declines to a low rate that can be sustained for decades.

Second, what is making shale plays work is the merging of two old technologies - Horizontal drilling in combination with hydraulic fracturing.

The entire natural gas industry is grappling with how profitable and wide-spread the application will be. It's a difficult call at this stage.

Tom

There exists one key piece of information that belies your conviction that "there has been a technological breakthrough." And that is that the production cost of natural gas continues to go steadily upwards. Let me ask you, if there is some technological breakthrough that allows one to produce wee-jees with greater efficiency, does it make sense that the production cost would go up? Quite to the contrary, the production cost should go down. But with natual gas, that hasn't happened. Here are the figures for Chesapeake Energy, whose chairman, Aubrey McClendon, by the way, is also head of the American Clean Skies Foundation:

Operating Costs* Investment in Fiscal Qtr ($/MCF) Property & Eqmt.** Q2-2003 $2.27 $ 58.86 Q2-2004 $2.60 $ 63.54 Q2-2005 $3.11 $120.80 Q2-2006 $3.90 $116.52 Q2-2007 $4.50 $154.01 Q2-2008 $4.73 $142.71 *Operating costs include production expenses, production taxes, G&A and DD&A **Investment is expressed in the value of total property and equipment as reported on the balance sheet at the end of the quarter divided by the total number of MCF produced during that quarterOf course these are all trailing costs, and maybe forward-looking costs will be much lower because of the much touted "technological breakthroughs." I might add, however, that if the stock prices of these companies heavily involved in the exploitation of resource plays are any indication, Wall Street is far from convinced.

DS,

Good points as usual. Drilling and completion cost have been escalating wildly. Operational costs not so much except for compression. Compression is the crazy aunt in the basement we don’t talk about much. Not only do the wells decline quickly, their flowing pressures drop to low to get into the transmission lines. I suspect a big chunk of their increase in ops cost is coming from compression. At that point some rather expensive (to acquire and operate) compressors are brought into the picture. Thus at the phase where production is the lowest operating expenses are the highest.

Even though technology advances are improving recovery efforts they do come at a cost. The cost of steel casing alone has more than doubled in the last year. At the moment, the UNG plays do offer an acceptable rate of return but not big (and more importantly sustainable) profits. As I mentioned elsewhere, the UNG plays have turned into something like a McDonald’s operation: you’re just making a few pennies per burger but if you sell billions of them they do add up. But the good news for the consumer is that, regardless of the relatively low profitability, they still benefit from increased supplies.

A small bit of the operating cost increase is due to higher amounts of production taxes collected. They are relatively small (3% to 5%) and if NG runs up $5 then that adds about $.20 to the cost side. As far as the other factors they offer it’s a mystery to me as most SEC defined numbers are.

As you say, it would be nice to see the forward looking cost vs. return numbers of well drilled 4 years ago compared to expectations for wells drilled today but that won’t happen. Closely guarded secrets well above my pay grade. I also noticed the Chesapeake presence in the ACSF. As usual, I’m always skeptical of numbers coming from the corporate cheer leading squad. I’ve seen first hand how my technical analysis has been massaged by TPTB. And don’t tell Aubrey I told you, but I would bet he would keep slamming UNG wells down even if he were loosing a few pennies on every dollar invested. At least for a while anyway.

Good points as usual. Drilling and completion cost have been escalating wildly. Operational costs not so much except for compression. Compression is the crazy aunt in the basement we don’t talk about much. Not only do the wells decline quickly, their flowing pressures drop to low to get into the transmission lines. I suspect a big chunk of their increase in ops cost is coming from compression. At that point some rather expensive (to acquire and operate) compressors are brought into the picture. Thus at the phase where production is the lowest operating expenses are the highest.

You're not kidding. Getting compression in unconventional plays is like chasing your tail. Its very easy to overspend on compression as you are trying to increase production because you're getting all these gangbuster wells and management is screaming "We're losing production, we need more capacity", but then the wells' decline is so steep that within weeks of not hitting another giant producer, you're way over capacity on compression and management is screaming "OMG, why did we place orders for 3 compressors" (because leadtime is such that when you want the compressors, they're 6 months to a year out). Then, before you know it, drilling has moved on and you've got the albatross of oversized overheating compressors and they're draining your bank. Tight gas is horrible on facilities planning.

Never a dull moment in the oil & gas patch.

In support of some of your comments, it seems to me that UNG operators are going to keep drilling almost no matter what the price is, primarily because of lease situation. If you have a large block that you paid a few hundred dollars for, but that might cost you tens of thousands of dollars to renew (although this could change), you are probably going to drill. And if you have a short term lease that cost you tens of thousands of dollars, you are probably going to drill.

All in all, it could make for some interesting times price wise. I have concluded that I am glad that most of my production is oil.

Growth is going to be a big issue in stock company valuations. Highly leveraged companies like Chesapeake Energy are going to have a hard time keeping up their growth, with the problems in the credit markets. The low current valuation of natural gas isn't doing them any good either.

The reason I am not as worried as I might be about the operating costs going up is that oil and gas are closely connected, and oil prices have been rising rapidly over the last several years. As the price of oil goes up, so does the price that consumers are willing to pay for natural gas (Especially if the American Clean Skies Foundation is successful in getting people to use natural gas powered cars. More on that in my next post.)

Are operating costs usually the same per field /well? If the average cost is approaching $5 there may be some wells below that and others above that #. I could see some well with operating costs of $6.50 or more that would be shut in if prices go below that level for an expected period of time, not just a day or two.

From various notes from brokerage firms, the marginal MCF in US is between $6.5-$7.00. That means the last few hundred BCF that are produced (out of over 21TCF) cost around $7. This will likely continue to escalate at a higher rate than in the past, due to the quick depletion using horizontal technology. So there WILL be a burst of new gas in 09-10, but how long it lasts will be another question.

Average cost per MCF on high quality Haynesville shale property is about $1 per mcf (almost all up front in the drilling). Coal bed methane in Rockies might be closer to $5 per mcf. All of this is usually reflected in companies share prices that are represented in various areas.

In sum, as the marginal MCF cost increases, only the cheapest to produce areas are going to be very profitable. From this point forward, I expect the commodity itself to outperform the majority of NG companies (there will be a few that crush it however...)

titan,

It will tend to vary more by "field" then by well. But even the term field is misleading. It's really more representative to say each well is a field unto itself. Unless you drill too close each well will be producing its own unique portion of the reservoir. The producing areas, from an operating cost stand point, are defined by lease ownership and not geology. Chesapeake, for example, owns 100’s of thousand of acres in E TX and N La. But those acres may be broken up into something like 300 different contiguous parcels. Each parcel, containing many wells each, would function as a separate “field” from an operating cost stand point. An older parcel, with big compressors on it, would have a much higher operating cost then a newly drilled parcel. Some parcels with the same number of wells may have total rates significantly different than others. Individual wells on a parcel may vary significantly in production rate. In those cases operating cost are usually assigned on a pro rated basis. This is actually a very complicated accounting problem as royalty ownership typically varies from well to well.

The best non-engineering analogy I can offer is to imagine an apple orchard covering half of Texas. Each tree represents one unconventional NG well. There will be some trees with lots of nice apples and some with almost none. And you might find your best tree next to one eaten up by bugs. But you know you can drive 500 miles north and still be in the middle of an apple orchard. But is that section full of good trees or bad trees? Don’t know till you get there and start picking (or drill a well). This is why I think it’s a little misleading to start predicting recovery numbers from areas where, although they may contain the same UNG reservoirs producing elsewhere, little or no drilling has occurred yet. Just like everything else in life, there are sweet spots out there amongst the sour ones.

I will add that even if a well is only making $1 profit PER MONTH, most operators will keep it producing regardless of how poor the operating cost to net income appears. It costs thousand of $'s to abandon a well. Additionally, the operator continues ownership of the lease. Abandon the well and the lease usually expires in 30 days. Many of the UNG wells being drilled today are on leases that have been maintained in just this manner for many, many years. There are leases being drilled that would cost $20,000 per acre today that companies paid $30/acre 20 years ago. Many lease contracts even allow an operator to pay a “minimum shut-in royalty” for wells that are producing nothing just so they can maintain ownership.

Is this due to unavoidable technical limits (underground flow dynamics?) or "only" to above-ground reasons (legal and financial transactions etc.)?

In the latter case it might be possible to streamline such processes in order to allow more flexibility.

I was very interested to read that in Utah they cannot keep up with demand to convert cars from gasoline to NG. The reason is that the NG to gasoline equiv is 87 cents per gallon, where gasoline is selling for 3.75

So if you drive 20,000 miles a year the conversion cost payback is about one year. after that you are paying 87 cents a gallon

Honda is the only company selling a true NG powered car - the GX - and the backlog is 8 months

If the excess NG supply Gail discusses continues, the gasoline/NG price ratio will only improve

people will vote with their wallets

poly,

I don't know for sure about Utah but I recall last summer an engineer working the rockies told me NG fell to less than $1/mcf at the well head. The NG transport lines had hit capaity and you either sold at the low price or you shut your well in and made no income. New lines are being built to markets back east as well as the west coast. I'm guessing that future NG prices for you will hang on this transportation issue.

I can verify that. I saw a production nomination price at $0.10/mcf during the worst period.

And I bet the gas buyer made the producer pay for lunch too.

I take that back, it was a spot price. Unfortunately with no capacity in the transport lines, it was the best that could be gotten in the local market.

some cbm gas in the wyoming powder river basin sold for $0.12/mmbtu in nov '07. rockies gas has historically been a step child due to distance from markets and lack of pipeline capacity.

in '07 there was a fire at a major compressor station near cheyenne, wyo that handicapped the market even more. since then that facility is back in operation and additional pipeline capacity has been added, rockies express i think it is called.

the same wyoming cbm gas sold for over $9/mmbtu in june '08.

I looked at cngprices.com, and most filling stations in California are $2.50-$3.00/gge with a few closer to $2.00. It's really shocking how cheap it is in Utah and how much it varies by state. TX is $3.00/gge; OK is $1.00/gge. If you fill up at home, the utility rates for gas are much cheaper than the filling stations, but when you consider the cost and service life of a home refueling unit, you'll pay just as much.

Since "peak" storage is only needed about two months of the year, there is little incentive to develop new storage until a larger peak storage is needed.

Thanks for a great article, Gail - but then that is no more than we are accustomed to from you.

In the context of the discussions here it might also be worth mentioning underground coal gasification, as by that means a lot of what would otherwise be inaccessible deposits may be used.

The links I have are for Europe, but resources are also very large in America, one would imagine:

http://ergobalance.blogspot.com/2007/10/underground-coal-gasification.html

Energy Balance: Underground Coal Gasification.

I have read about this also, particularly in reference to China, since they have such a need for more energy resources. One report that talks about this is "Coal of the Future", a study by B. Kavalov of the Institute for Energy (IFE), prepared for European Commission Joint Research Centre. I haven't been able to find a working link for the study. This is a quote I copied from the report, when it was on line:

Here is a link to a brief article on China's progress in simplifying underground gasification:

http://www.newscientisttech.com/article/dn12290-china-simplifies-method-...

China simplifies method for turning coal to gas - tech - 18 July 2007 - New Scientist Tech

And here is a link to another gasification company:

http://www.ergoexergy.com/eucg.htm

.:: ERGO EXERGY TECHNOLOGIES, INC. - The only source for Underground Coal Gasification ::.

And here is a coal gas to liquid fuel project:

http://www.lincenergy.com.au/process.php

Gas to Liquids GTL - Underground Coal Gasification UCG - Linc Energy - Fueling Our Future

The major reasons I could see to add more storage:

1. Trying to bring more folks to NG residential heat, particularly in NE.

2. Problem with year to year maximum heat need, if unusually cold winters.

The problem of exceeding storage capacity would only be a reason for building storage more if it could be cost-justified, based on evening out the price variability. I am not sure it would help much--storing more would probably just delay the problem of too much supply for a few months.

Gail,

There is actually some salt dome NG storage outside of Houston that handles just the DAILY float of NG gas and not for seasonal demand swings. Between the power plants and residential users there is a big swing in daily demand…enough to justify this sort of operation. Your comments made me wonder about the prospect for similar complications should other major metropolitan areas start a significant switch to NG. Even if there were sufficient seasonal NG storage could NG suppliers to NYC handle daily swing volumes without a local storage system? New potential solutions also bring new potential problems with them.

I just don’t understand why things are getting so complicated just because we’re getting closer to PO.

I worry that we someone will start converting cars to natural gas use on a big scale in someplace where natural gas resources are stretched to begin with, like Boston. It seems like this could play havoc with supplies. If the cars are mostly used for commuting, use could be very different on M-F than weekends.

Some of these technology improvements seem to have some analog in the oil extraction area - I'm thinking specifically of the THAI process for extracting tar sands oil. Does it not seem possible, even likely, that in the next 10 years or so, improvements in our ability to extract oil from poor quality areas (like tar sands) that have huge quantities of oil will improve to the point where we can sustain production levels at 50, 60 or more million barrels/day worldwide for the next 50 years or so?

This is a process which is supposed to increase oil production:

'Modified Seawater as EOR Fluid Could Boost Oil Recovery From Limestone Reservoirs Up to 60%'

http://www.greencarcongress.com/2008/09/modified-seawat.html#more

I have no idea how realistic this is, or if people like west texas have taken it into account in their projections.

Dave,

I can't give details because I'm bound by a confidentiality agreement. But this is real. Statoil in Norway has more.

www.norwaypost.no is a good starting point.

Thanks for the info.

I don't know if you can comment on this, or perhaps others could given your assurance that it works - how much difference is this going to make to projections given here for oil production?

Is this a major difference, or is it already accounted for as technical progress which was held to be probable?

What does this do for peak oil, and decline rates?

Enquiring minds want to know! ;-)

The next time Fractional Flow or one of the other engineers stops by, you might ask them, but in general terms I think that incremental increases in oil recovery factors won't have a material impact on the big picture, but as I said, see what some of the engineers have to say.

Just on a naive reading of the link I gave, they state that around 50% of reserves are chalk or limestone, that recovery in chalk could be up to 40-60% higher, and that chalk has a more reactive surface than limestone, but that they have got around a 15% improvement from the limestone.

On the assumption that the split between chalk and limestone reserves is 50-50, then you might be looking at an average of 30% better recovery form 50% of fields, so it would come out to something like 15% of total reserves.

Not enough to delay peak forever, but not to be sneezed at either, especially coming at this stage in the game, and if that is in the ball-park could do a lot to cushion the decline.

the process of imbibition of water into the pore space, especially small pores , is an important component of any water displacement process. this occurs at a low rate (not suitable for pw economic forecasts). imbibition is very efficient , water enters the pore space, displaces the oil and doesn't increase water relative permeability, because of the rocks affinity for water. imbibition is limited to a few % of pore volume.

alkaline flooding and its cousin alkaline surfactant polymer flooding has been used in the us and canada since at least 1986 that i know of personally.

displacement by imbibition is not new in the north sea either particularly in chalk reservoirs, going back to about the same era.

arps discussed this in some of his work done in the '50's and this along with gravity segregation is long forgotten oil field lore.

in short, i dont think it will sell in this pw economic, maximum production, next quarterly report enviromnent we are in.

I can't find any relevant news there. But there's the story titled "Free ferry trips for el-powered cars" - maybe this is a good hint to the real solution ;-)

I can't find any relevant news there. But there's the story titled "Free ferry trips for el-powered cars" - maybe this is a good hint to the real solution ;-)

Probably the statement "Upcoming experiments will verify" is the key message in this article. I can't help to find that "Modified Seawater" sounds a bit esotheric to me: It would be a huge surprise if after decades of expensive and extensive R&D such a simple method would boost the recovery rate.

Using sulfuric acid in the underground is already a standard leach&pump method at uranium mining (and the precipitation of BaSO4 a possible means to clog the porespace).

I think that there is some possibility there. We even have some very heavy oil deposits in the US. (I have heard Texas and California mentioned.)

I think that there is probably a long list of obstacles for these sources as well, perhaps somewhat analogous to my list of obstacles at the end of this article for unconventional gas.

All of the obstacles you mention seem solvable or are obstacles from the market-based economy, which means that when we get to the bottom line, there is gas that can be produced. This gives me hope. It makes me think that Ilargi is right - that what we are facing is economic collapse, maybe societal collapse, but not civilizational collapse. Hopefully the difference is clear without me having to define these terms :-)

I admit to being pretty dense, so maybe you can help me. At least to the individual, a societal collapse would look a lot like a civilizational collapse, I believe.

Do you, or Illargi, mean that the "civilization" the Ancient Greeks started (more or less) has remained intact for 3000 years, despite the short term collapses of the Roman society, the Holy Roman Empire, medieval Europe, etc.?

In the end, what are we trying to preserve? What is the basis for your hope? Many of us would be happy to give up those parts of the current society that we feel are harmful or useless in exchange for those parts which are worth preserving-- especially if we didn't personally perish in the process. And in truth, it probably wouldn't take a lot of oil or gas to accomplish that. But we are all so fearful of change that we will hang on to our familiar unsustainability as long as possible. Me included, no doubt.

I probably shouldn't speak for Illargi - I was just saying that I think he's right when he says our problem is primarily financial and not a matter of demand wildly outstripping a dwindling supply, and that the price of oil will go lower, but you still won't have the money to pay for it. Neither of us have any argument with the peak oil theories other than how it's going to play out in terms of price.

Beyond that, I would say:

economic collapse = Great Depression

Societal Collapse = End of Soviet Union

Civilizational Collapse = Olduvai Gorge

If you combine economic collapse and societal collapse, you get what I am expecting. There will be a lot of pain, a lot of violence and crime, some war, famine. But, our knowledge we have gained in science in technology will mostly survive, and there will be means available for the survivors to pick up the pieces and start over again at a pretty decent standard of living. And the death toll will be in the millions rather than billions.

I'm such an optimist, don't you think ;-) ?

I don't know anything about optimism, and couldn't judge your depth of feeling.

I'm more of the Walter Miller line of thought

Today, I feel like Illargi is practically a stand-up comic.

Speaking to the demand side of the equation, and also framing it in a larger political context, here's what Pickens and McClendon are up to:

http://ballotpedia.org/wiki/index.php/California_Proposition_10_(2008)

http://www.nytimes.com/2008/08/30/business/30gascars.html?hp=&adxnnl=1&a...

(There was another excellent story linked from the Drumbeat the other day on this same subject, but I can't find it.)

They want natural gas transitioned as a transport fuel, and they want tax-payer subsidies to pay for that transition.

I'm 100% in favor of the use of natural gas as a transport fuel. On a heat content basis, it's a real bargain in comparison to oil, and also much cleaner burning.

But I question the need for tax-payer subsidies. I have some problems with that, especially when they're being promoted by these right-wing, so-called free market fundamentalists (the hypocrisy is mind boggling), and also question whether they should be necessary if everything is as they claim it is.

I think transportation use of natural gas will be very difficult to control. It is very difficult to see a need for tax-payer subsidies. I will write more about that in the next few days.

I agree with you DS. The tax payers will be supporting NG vehicle fuel enough just by having to pay for conversions/new vehicles. But T. Boone is great at this game. I'm sure you know about his wind farms in W TX. Do you know that there is no market for his product out there? That's why it was so cheap and easy: no competition. But unprofitable too. No problem: a couple of months ago the TX PUC approved a $2.4 BILLION transmission line, at rate payers expense of course, to connect his wind farms to Dallas. Easy to guess that his wind farm is now worth many, many times its value of just a few months ago. It's great to have powerful friends in Austin....makes you look like a real savvy business man.

Don't forget his purchase of the water rights from the Ogewalla reservior to sell to Dallasians also

No, ROCKMAN, I hadn't heard that. From what I had read here on TOD the plan was to get power of eminent domain from the state for his power transmission and then use the same right-of-way to build a pipeline to move his water to market.

Like I've said before, he's one ruthless SOB. But to be honest with you I don't find that all that objectionable. What bothers me is the layer upon layer upon layer of hypocrysy.

Gail,

I feel that the profit margins for the production of these unconventional sources will be squeezed from both the top and bottom. Enhanced horizontal drilling will decrease EROI thereby increasing production costs, while increasing supply (production levels) above and outside the market elasticity (nearly inelastic market) of NG will lower prices, therefore decreasing further the profit from these developments. Although i am not sure this squeeze will be enough to thwart production....Anyway - Good post

I think that is why folks are really interested in ways to ramp up demand quickly, and get the price up. More on that in my next post.

Nice overview of the situation, and helpful to have the charts. I'm not sure that we have to choose however, in our current analysis, between technological breakthroughs in drilling, and, data errors, or the persistent sense that EROEI decline is underway. My view is that we have both. The technological breakthroughs in drilling for Shale NG are real. They are real in the sense that we can both tap the resource that was previously uneconomic, and, that the drilling techniques themselves are being perfected over time. Producers learned how to do it, and now they are getting good at doing it. However, any declines or efficiencies in the new drilling techniques are coming off of much higher levels. They are coming off of the original step-change higher, in the costs to drill via the new method. Eventually, the new method will no longer be seen as new. It will be perfected to the degree that drillers new to the game will be able to uptake the skills. However, the new method remains very energy intensive. The water required is intense. The diesel required to run these rigs is notable. And the specialized metals/pipe to do this are expensive. I can't, offer up more quantitative data on that however, as I only understand the situation thematically, at this point. I think we are still in the early stages of analysis where we are rooting around between Rig Count data, actual reported cost figures from the Producers, and some hype and even strong disagreement on these issues within the industry itself.

What's an easier lay up, however, is that while the continental US has indeed found a way to increase NG production (again, at a higher price, imo), what's pretty clear is that Canada is not there yet. And the import/export data from both EIA Washington and Statistics Canada , on Canada's growing needs and reduced ability to produce NG are notable. For the moment, it looks to me like the lower 48 will be able to offer NG to both Mexico and Canada, via the expanded pipeline export capacity built out, over the past decade.

Between 1990 and 2007, import pipeline capacity from Canada increased by 169 percent (to 17.3 Bcf per day) and from Mexico by 147 percent (to 0.9 Bcf per day). During the same period, export capacity to Canada more than tripled (to 4.3 Bcf per day) while export capacity to Mexico quadrupled (to 3.6 Bcf per day).

http://www.eia.doe.gov/pub/oil_gas/natural_gas/analysis_publications/ngp...

I do agree that the US needs to increase storage capacity. Significantly. Especially if we are to move to CNG, say, for government and state vehicles. But it does seem to me that, even though we have no LNG export capacity in the lower 48 (we do have Alaska LNG run by Marathon Oil) that Mexico and especially Canada will need our NG. Based on current trends.

G

Here's some more info from the Canadian Assn. of Petroleum Producers:

http://www.capp.ca/raw.asp?x=1&dt=NTV&e=PDF&dn=112818

In addition to natural gas and oil production it also gives some data on drilling activity and costs going all the way back to FY2000.

I agree that reduced imports from Canada and increased exports to Canada/Mexico are likely. These may reduce the amount of additional gas that is available to US consumer by 40% (or even more), depending on the assumptions made.

I started to try to write about these issues in this post as as, but decided I couldn't cover everything at once.

Gail,

I can see export potential to Canada especially if you throw ramped up tar sand production into the mix. But with regards to Mexico how would you project their ability to pay for it? As their oil production continues to drop their imports demand will certainly increase but at the same time their falling oil income will make it that much more difficult to pay the rate. This is why I see the potential of the worst case doomer views of the future for Mexico.

I could see someone opening up a fertilizer factory in factory, or something similar, and using the sales price of the output to pay for the NG input. But you have a good point--poorer people will find it more difficult to purchase anything. That goes in the US as well as Mexico.

Gail, I always enjoy the excellent quality of your posts and this one is no exception.

I do, however, have a very different perspective on the interpretation of import/export numbers. Decreased exports of Canadian NG to the US have most likely been caused by competition from increased American production. There are no projected NG supply problems here that I am aware of.

A couple of months ago the CEO of Encana was interviewed on local TV. He was talking about potentially 100 Tcf from their first Horn River development with another 100 Tcf from a second development nearby. Some estimates are even higher:

Horn River

NG developers in BC and Alberta see the following conditions:

It's not at all certain that increased UNG production from BC and Alberta can be sold at an acceptable profit. Which is a very different situation from not being able to increase production.

One additional point that I would like to make.

There is a legitimate argument to be made that oilsands production (using current methods) will be limited by availability of NG. In one of your posts, you seem to believe that UNG production will be limited by the availablity of oil. However, IMHO, if the NG is available, then there should be no difficulty in oilsands production for the forseeable future.

I wasn't really looking much at the Canadian end of things in this post. Long-term, I was expecting Canadian exports to the US would decrease because of greater use of NG for producing oil from the oil sands. I believe there may also be some royalty issues also. If our production is cheaper, that may make a difference as well.

AFIK, longer term (> 10 years) energy for oilsands extraction will mainly come from geothermal and nuclear. NG is projected to be too expensive.

I thought both of them were quite location dependent. You put your nuclear reactor in one location, and do your mining around it. If 20 years out, you have moved too far away from the reactor, it doesn't work any more, and you have an expensive, no longer necessary reactor. Or do you convert the energy to electricity, run wires to where you need it, and use electricity to heat the oil sands?

The nuclear reactors would be used for electricity, not for heating. Geothermal is location-dependent in the sense that different locations will require different well depths - so it is a cost issue.

My company estimates about a decade before widespread use of next generation energy sources. There is a lot of work to be done to get reliable cost estimates for different configurations.

One of the big drivers is the expectation of increasingly stringent limits on CO2 emissions.

Although this excellent study focuses on supply I would be interested in the demand side analysis as well. Of course much harder to predict and forecast. But with the PickensPlan and others pushing for NG as the bridge for transportation until we come up with the next great idea for some sort of renewable transportation. I would be interested to see how this all plays out...how long could NG be a bridge before we suck it all up for our transportation needs. I think I have heard Pickens throw out the 2030 date for the bridge window.

I started to try to put both supply and demand discussion into one post, but the post got totally unwieldy and too long to read in one sitting. I will try to attack the demand issue in another post.

Natgas demand is actually fairly flexible in the mid-term. I don't think the scenario of strong increase in natgas demand is that unlikely - NW-Europe went through the exact same experience, four decades earlier: the unexpected discovery of lots of local natgas. A fine mesh of pipelines has delivered natgas to retail customers, which has almost completely eliminated heating oil usage outside of remote/mountainous areas. This transition started in the 60s and was completed in the early 80s, with heavy industry (steel mills, power plants) the last to give up burning fuel oil. If that transition could be done with 1960s technology, it can certainly be done today.

With the North Sea fields in decline, this will probably lead to a shift for LNG: the major flows will divert to Europe rather than the US.

I think the heavily populated NorthEast is the only part of the US that didn't get converted to NG years ago. Pipeline capacity there seems to be low. I suspect with the dense population (making upgrades to piping more difficult), and being the most remote from the source, it got left until last.

Since Sarah Palin has made her debut I, and the entire nation I suppose, have become intrigued by the proposed natural gas pipeline from Alaska to the Lower 48.

To me this is a potentially much better recipient of tax-payer funds than the Pickens/McClendon Proposition 10 being considered in California. Wouldn't the benefits be much more evenly distributed to all Americans instead of the handful who would benefit by buying a CNG vehicle?

I don't see why the federal government can't build that pipeline. In Texas we have all these farm-to-market roads that originally were built so farmers could get their produce to market. Wouldn't that pipeline be in that same spirit? One difference is that the government could charge a transportation fee.

Drumbeat had a link the other day with some of the details:

http://www.nationalpost.com/todays_paper/story.html?id=756796

According to the article, Alaska has 35 TCF of proven natural gas reserves and an additonal 250 TCF economically recoverable. I think someone needs to verify these numbers, as Palin, not unlike most of those who inhabit the Beltway these days, has pretty well squandered her credibility with rash statements like her 11-billion-barrels-of-oil-and-9-TCF-of-natural-gas-under-2000-acres claim.

My concerns with the pipeline are two-fold:

► I don't see how it can be economically feasible without some sort of government subsidy. It is projected to cost $30 billion and will carry 4 BCFPD. Figuring straight-line depreciation over 20 years and 10% annual ROI you're already looking at over $3.00 for each MCF that you put down the thing, and that doesn't even include direct operating expenses. I am cluesless as to what operating costs might be, but let's make a wild guess of $0.50 per MCF. So at today's Henry Hub natural gas price of only $7.00/MCF, that means the Alaskan producers of natural gas net only $3.50 per MCF they deliver to the intake of the pipeline.

► Whoever builds the pipeline will have a de facto monopoly on buying and transporting natural gas produced in Alaska to market. If government subsidies, eminent domain and other quasi-governmental concessions are awarded, then it only makes sense that the pipeline should be treated like a public utility, accessible to all current and future natural gas producers on the same prices and terms, those prices and terms governed by a state or federal agency. If the deal Palin has cut with TransCanada does not do this, then she is awarding it a liscense to steal. My question is this: Wouldn't it be easier just to have the federal government be the owner?

Once the pipeline is in place, open up to the state to competitive oil and natural gas leasing and let a thousand flowers bloom. And if her claims that the incumbent producers are sitting on and refusing to develop all these potentially prolific leases are true (claims, by the way, that I find highly dubious), then I see nothing wrong with her proposal to use the full extent of the law to force those producers to either drill them or relenquish them to other operators who will.

I would go along with the gov't ownership of the pipeline but only if Down South were appointed the Pipeline Czar. I can think of many major energy projects that would, theoretically, be better managed by such a central control. Unfortunately, I just can't see our current political structure being up to the task. I really am ashamed to say it, but I would rather see Petrobras pay for and manage the PL then see the US gov't get involved. Honestly.

Ha! Ha!

I can just create my own little country 1600 miles long and 100 ft wide, apply for a foreign aid package from the U.S. to build my pipeline, appoint myself dictator and rake in the bucks.

I could name it DownSouthistan, and every time the President of the United States made me mad I could threaten to cut off the gas.

Once you start getting into subsidies, I think you run a real danger disguising a situation where you are converting 1.5 million Btus of oil energy to 1.0 million Btus of natural gas energy. If a project doesn't make sense on an unsubsidized basis, there is a good chance it doesn't make sense period.

You will notice I commented on EIA's forecast of 2 trillion cubic feet of natural gas from the Alaska pipeline, starting in 2020, up near Figure 5. The pipeline would need to carry about 5.5 billion cubic feet per day to meet this target. If the US resources are as good as NCI seems to think they are, the amount this 5.5 billion cubic feet a day adds to our projected supply at 2020 is only on the order of 7%. If the pipeline is smaller, then we are talking adding 5%. How much should we be willing to spend on this incremental supply?

Appears Shell Oil has bought into the potential way up north. Just saw the press release: they paid $2.4 billion for around 275 offshore North Slope tracks. That's a bit of change for one company in one lease sale...even for Shell.

I see from a link on today's (Sept 5) Drumbeat that Palin has upped the ante to build the pipeline:

So does that make the cost $4.00 per MCF plus operating costs, just to pipe the NG to the US? If NG is selling for $25 per MCF, this might work, but I suspect other costs would be higher then also.

I don't know Gail, I'm not an accountant nor a pipeline financier, so I don't know exactly how returns are calculated on pipeline projects nor what sort of return on capital the people who invest in these projects look for. Likewise I'm clueless as to what direct operating costs might be.

Certainly, many factors could affect the "cost." For instance, if the builders of the pipeline are able to finance the project with tax-free bonds that would bring the cost way down. Likewise, if the loans are guaranteed by the government that would bring the cost down. There are many ways to subsidize a project like this, passing costs and risks onto the tax-payers without appearing to do so.

But the wild guestimates I made were to demonstrate that bringing that gas down to the Lower 48 will be an expensive proposition. And as this discussion has highlighted, there are a lot of new developments on the natural gas front that make predicting natural gas prices just a little bit dicey at this point. I just don't see how, given everything that's going on right now, and until the dust settles a little, that this pipeline could possilbly be built without some government subsidies and/or guarantees to at least ameliorate some of the downside risk.

There's another article in this morning's Dallas Morning News about the pipelie:

http://www.dallasnews.com/sharedcontent/dws/dn/latestnews/stories/090608...

It says its projected to carry 5 BCFPD.

Here's an interesting quote from the story which serves to strengthen my contention that, whether the pipeline costs $30 billion or $40 billion or whether it carries 4 BCFPD or 5 BCFPD, it won't be built without significant tax-payer subisides:

It looks like there's a lot of smoke and mirrors going on here. I'm not sure this is the chiliastic showdown between big oil and the people of Alaska that Palin is portraying it to be. Maybe it's more of a battle between powerful interests within the oil and gas industry.

There are also some links from the Dallas Morning News story to some web pages that discuss some of the issues which I have already raised.

Gail's excellent item prompts me to ask how much of this resource exists globally and what is its distribution?

I haven't looked into this. If I were in Europe, and depending on Russia for my gas supply, I certainly would start looking at whether there was any local gas production I could ramp up.