The European Gas Market

Posted by Euan Mearns on August 1, 2008 - 9:50am in The Oil Drum: Europe

[With Centrica and EDF announcing hefty retail gas price increases in the UK this week, I thought it was worth reposting this story that was first published in December 2007. The follow on story Daddy will the lights be on at Christmas?, is perhaps more pertinent this year than last.]

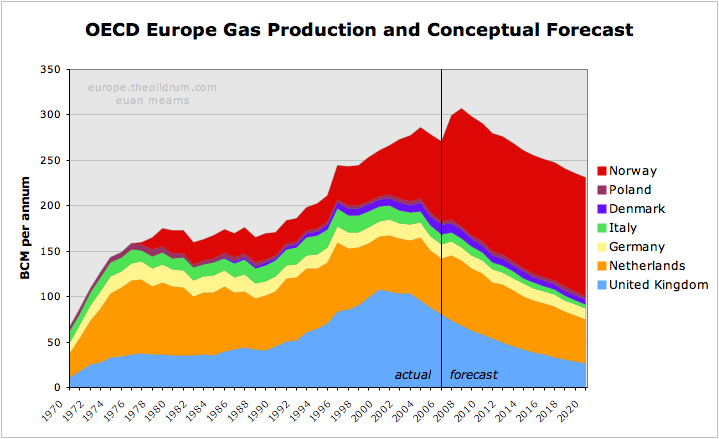

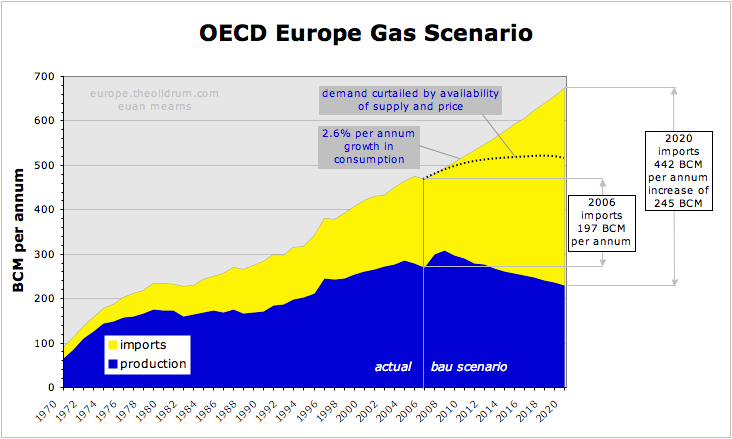

OECD European gas production looks set to peak in 2008. After that, falling production combined with rising demand will see OECD European gas imports wanting to rise from current 197 BCM per annum to 442 BCM per annum by 2020. Where will this gas come from and how will rising European imports affect N America and the rest of the world?

Figure 1 OECD Europe gas production and conceptual forecast. Click all charts to enlarge

Executive summary

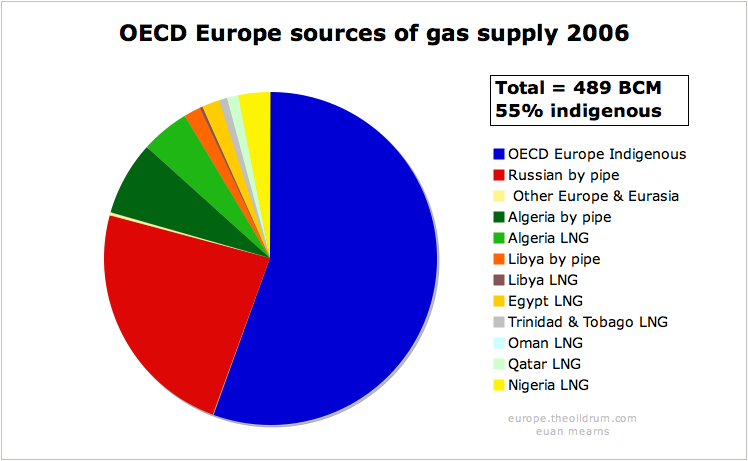

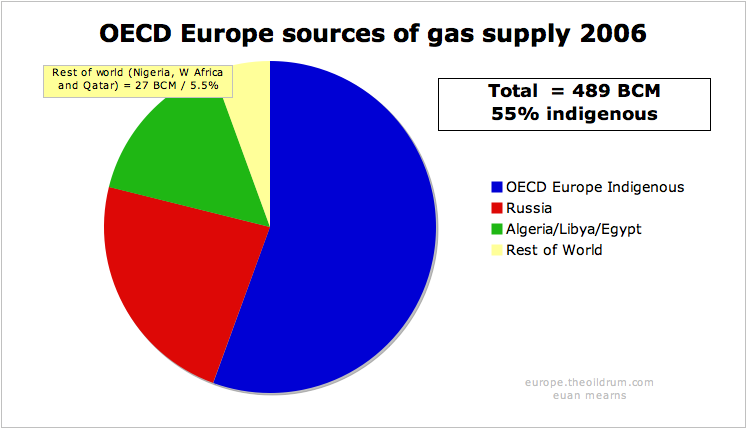

- As of 2006, OECD Europe produced 55% of its own natural gas with the majority of gas imports coming from Russia and Algeria.

- OECD Europe has three main gas producers - Norway, The UK and The Netherlands. Norwegian gas production is undergoing a major expansion, but this is forecast to halt at 130 BCM per annum next year for political resource conservation reasons. UK and Dutch gas production are in decline, and combined OECD Europe indigenous gas production looks set to peak in 2008.

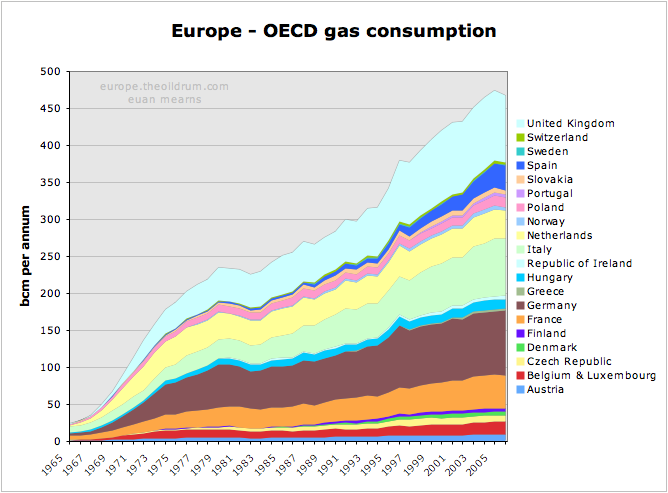

- Gas consumption has been rising at 2.6% per annum since 1980 and there are a number of reasons to suggest that rising demand for gas will continue into the future unless it is checked by high price or shortages of supply.

- It is believed that Russia will do what she can to maintain gas exports to OECD Europe. But with their three biggest gas fields - Yamburg, Urengoy and Medvezhye - in decline, maintaining supplies from second tier assets will be a major challenge. In order to maintain supplies to the OECD Europe, supplies may have to be cut to other countries.

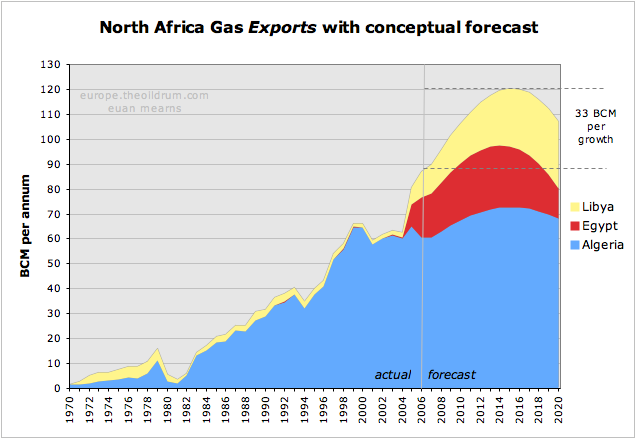

- Algeria, Egypt and Libya will all see expansion of gas production in the years ahead, but will also experience growth in indigenous consumption, especially in Egypt. Gas exports from these North African states are forecast to peak in 2015. They may provide an additional 33 BCM of exported gas to the European market.

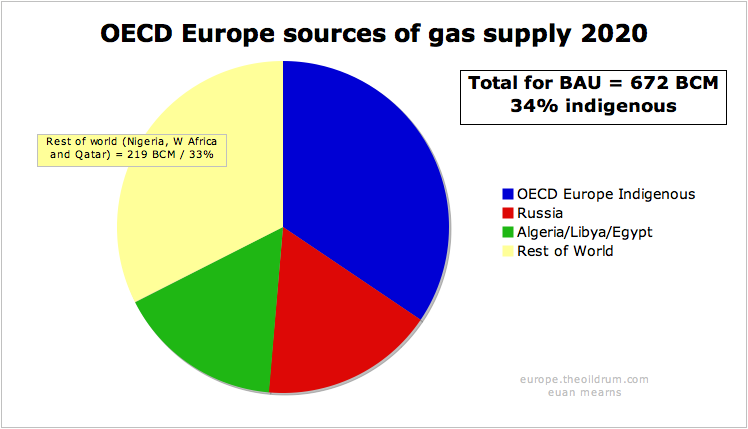

- OECD Europe gas imports are forecast to grow from current 197 BCM per annum to 442 BCM per annum by 2020 - if we see business as usual growth in demand and consumption. Where will this additional 245 BCM come from? Some may come from N Africa and some from West Africa and Qatar. It seems unlikely that an increase in imports on this scale will be possible and that high price and shortage will ration supply. This market driven outcome may hit the poorer nations hardest and one may suspect this may have a destabalising effect.

Introduction

This post will provide a production forecast for Europe's main gas producers (the UK, The Netherlands and Norway); it will examine existing import patterns in Europe's main gas consumers (Germany, Italy and France) and the ability of gas exporters to meet growing OECD European demand - Egypt, Libya, Algeria, and in particular Russia. This article was initiated as part of study of UK gas security. The UK faces rapidly falling gas production and an equally rapid expansion of imports and the key question for the UK is where will this gas come from? This will be dealt with in a separate post.

There are a number of ways to divide Europe for economic analysis. I have chosen to break out data for European states that are members of the OECD. This includes the important oil and gas producer Norway, which is not a member of the European Union (EU) but excludes the Baltic States, Romania and Bulgaria which are EU members but have not yet joined the OECD.

Figure 2 Map of the European Union.

Turkey is a member of the OECD but lies mainly outside of Europe and is not included in this study. Turkey is a major importer of gas, especially from Russia.

Data sources and gas units

Throughout this article I have used data from the 2007 BP Statistical Review of World Energy. I have also used billion cubic metres (BCM) as the standard unit for gas measurement. According to BP, 1 BCM is equivalent to:

35.3 billion cubic feet (BCF)

0.73 million tonnes of liquified natural gas (LNG)

36.0 trillion British Thermal Units (BTU)

6.29 million barrels oil equivalent (BOE)

Gas production forecast

OECD Europe gas production is dominated by three countries - the UK, The Netherlands and Norway, with lesser but significant quantities produced by Denmark, Italy, Poland and Germany.

Figure 3 OECD Europe gas production and conceptual forecast.

The UK

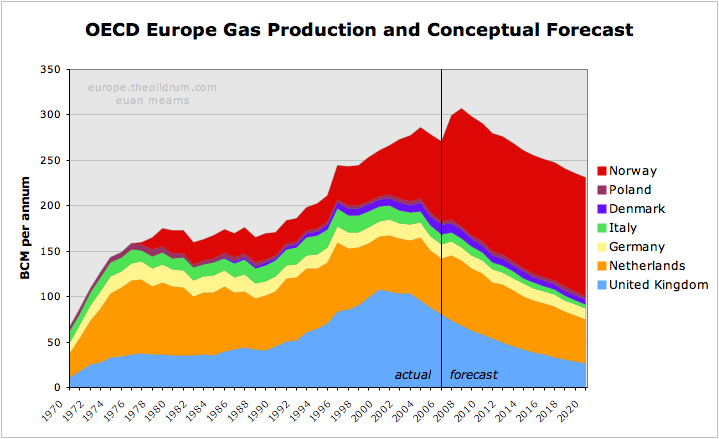

The changing face of gas production in the UK lies at the heart of Europe's emerging gas problem. In 2003, the UK was a net exporter of gas to Europe but with peak production in 2000 and production now falling at 8.7% per annum it had become a net importer by 2004. The challenge facing the UK gas industry will be the subject of a detailed post.

Figure 4 UK gas production and consumption history

The UK forecast is based simply on extrapolating the 8.7% decline to 2020 by which time production is forecast to be 26 BCM per annum. At peak in 2000, the UK produced 108 BCM per annum and in the space of 20 years the UK will have gone from net exporter to a major importer, being dependent upon imports of over 80 BCM per annum.

This view on decline of UK gas production is shared by the UK BERR (Department for Business and Enterprise Regulatory Reform - formerly the DTI). See for example Figure 5.2 in this report.

The Netherlands

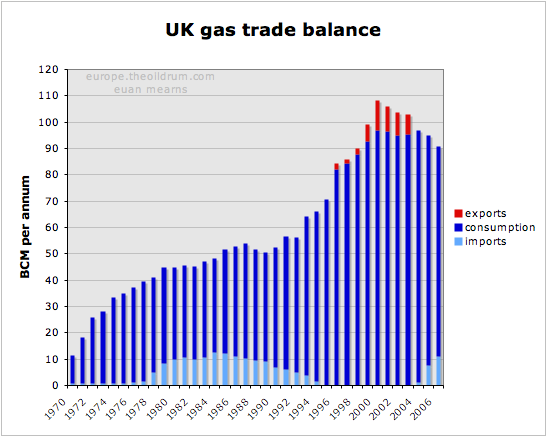

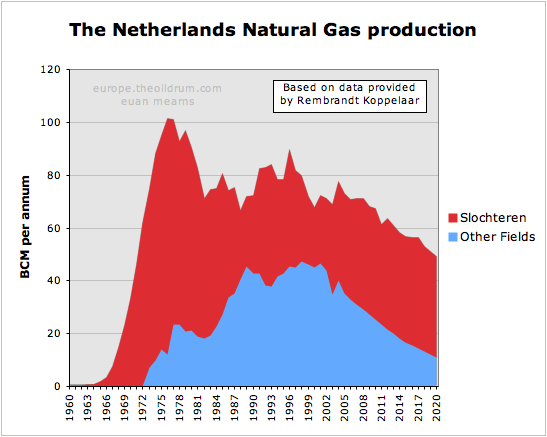

The Netherlands is home to OECD Europe's largest gas field. Discovered before WWII, the full extent of the Slochteren Field did not become apparent until the post-war years. It was the discovery of this field in the Permian Rotliegendes sandstone that sparked the exploration for gas and then oil in the North Sea.

Figure 5 Europe's largest gas fields. Data for Slochteren from Rembrandt Koppelaar. Troll and Ormen Lange from the NPD.

Slochteren lies onshore in the Groningen area of northern Holland and dwarfs the giant Norwegian gas fields of Troll and Ormen Lange. Further fields were found around Slochteren in the on-shore and off-shore areas.

Slochteren was never produced flat out and the Dutch government has laterally set a production cap on the field. In the period 2006 to 2015 this cap is set at 425 BCM over the 10 year period. NAM (the Shell - Exxon operating consortium) can optimise production over this time frame but strictly within this overall limit. The production cap on Slochteren has resulted in a long drawn out production plateau analagous to that seen in the Saudi super giant oil fileds - a very enlightened production strategy on behalf of the Dutch government.

Figure 6 Dutch gas production and forecast based on data provided by Rembrandt Koppelaar. The smaller offshore fields are showing a decline similar to the UK. Note that the volumes here are substantially larger than quoted by BP (see Figure 7). Rembrandt suggested this could be due to adjustment by BP for the energy content of the gas.

The other fields were not subject to regulation and are now in decline in similar manner to the UK gas fields. According to Rembrandt, Slochteren will also begin to decline naturally after 2015 and the bottom line is that Dutch gas production is now in an irreversible decline phase.

The forecast for the Netherlands is based on data kindly supplied by Rembrandt. This has smaller fields declining at a similar rate to the UK, while Slochteren has a somewhat lower decline rate.

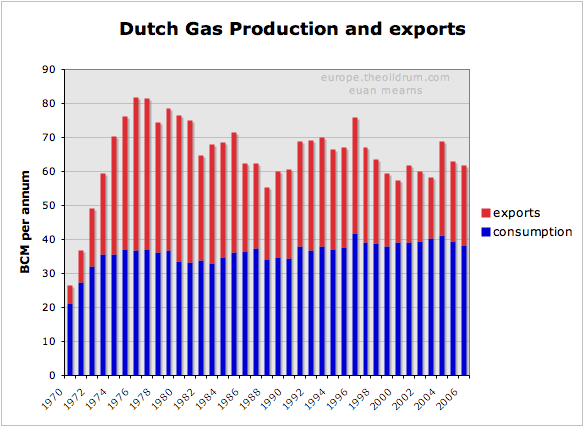

Figure 7 History of Dutch gas production and exports.

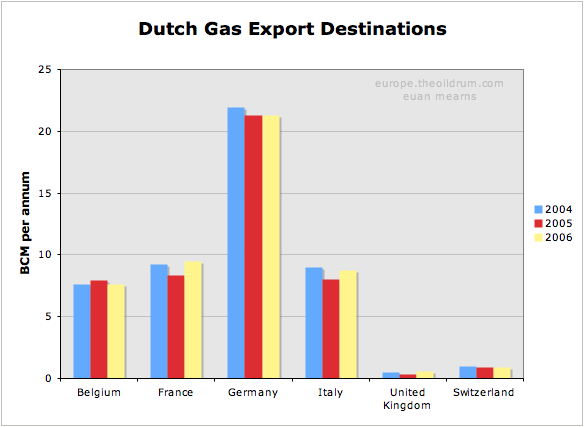

Figure 8 Destinations of Dutch gas exports. Note that the Dutch import gas from Russia and Norway for re-export.

It can be seen that Dutch gas exports have been declining irregularly since the late 1970s and that some day post 2020, the Dutch may become an importer of natural gas.

Norway

Norwegian gas production has expanded rapidly in recent years, mainly the result of the Troll Field development. This expansion is set to go on for another couple of years, but then I suspect the expansionary phase will come to a halt.

In 2006 Norway produced 87.6 BCM of gas. Since then the Langeled pipeline that connects the Ormen Lange Field to Easington in England (and also to continental Europe) has been completed. The capacity of Langeled is about 20 BCM per annum. Furthermore, the development of the Snøhvit Field in North Norway with an LNG train provides Norway with an additional 5.7 BCM capacity.

The Norwegian export pipeline system is reported to have a capacity of 120 BCM per annum. With domestic consumption running at 4.5 BCM and LNG production at 5.7 BCM, future Norwegian production is forecast to run at 130 BCM per annum.

With Europe becoming ever more thirsty for gas, there was a plan to expand production in the Troll Field by 20 BCM per annum. Most significantly, this consent was refused by the Norwegian parliament. Hence Norway is in a position of having ample reserves to sustain a short term production boost, but instead seems to be choosing the path of restrained production which will favour an extended plateau at lower than maximum possible production levels.

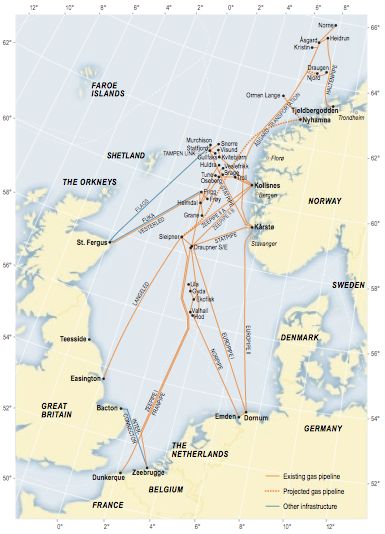

Figure 9 Norwegian gas infrastructure.

The map of the Norwegian gas pipeline export system shows where Norwegian gas enters the UK and Continental Europe. The UK imported gas from Norway during the 1970s and 1980s where gas from the Frigg Field was piped to Scotland via the Vesterled pipeline. Since then the UK has had no need for Norwegian gas - until recently where a massive expansion of import capacity has been built. The Vesterled pipeline is now connected to the Norwegian gas transmission network and has been one route into the UK for Norwegian gas in recent years. There are, however, two new pipeline systems. The already mentioned Langeled pipeline that connects the UK to Ormen Lange via the Sleipner hub. And the Tampen Link that connects Statfjord and other mature fields in the Tampen Spur area to the UK operated FLAGS pipeline system. FLAGS transports associated gas from the northern UK fields to St Fergus in Scotland and since that UK gas production is now in decline, the Tampen Link will fill that surplus capacity - for a while at least.

Five other pipelines make landfall in continental Europe at 4 import terminals. Three pipelines feed two terminals in North Germany. And one pipeline lands at Zeebrugge in Belgium and one at Dunkirk in France. These entry points are connected to a broader European gas transmission system which pipes Norwegian gas as far as Spain, Austria, the Czech Republic and Poland.

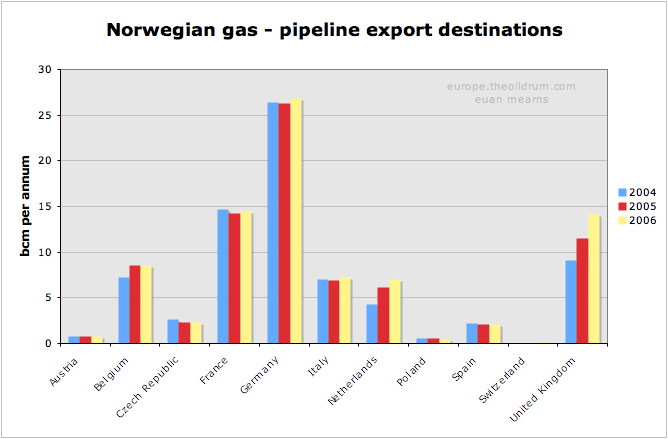

Figure 10 Export destinations for Norwegian gas. Up until 2006, all Norwegian exports were via pipelines to Europe. In 2007, Norway opened its first LNG train and it will be interesting to see where these LNG exports end up.

It can be seen that Germany is by far the largest importer of Norwegian gas, followed by France, Belgium, the UK and Italy. One curiosity in this data is that the Netherlands are shown as a net importer of Norwegian gas. I can but speculate that The Netherlands are importing Norwegian gas to meet export contracts whilst conserving their own gas reserves.

Demand and import patterns

Natural gas consumption within OECD Europe has grown on average at 2.6% per annum since 1980. Back in 1965, Europe consumed less than 25 BCM per annum and this grew to over 470 BCM per annum by 2005, fuelled by North Sea gas. Higher prices and shortage of Russian supply saw consumption fall in 2006.

Figure 11 Forty years of gas binge in OECD Europe.

Where next for European Natural gas demand? Will the past trend continue, or will high price curtail demand? This is impossible to answer, but there are a number political, demographic and resource factors consistent with demand continuing to grow unchecked.

- Growing prosperity in former Eastern European states leading to growth in energy consumption.

- Migration from East to West placing greater strain on infrastructure and energy use in the West.

- Migration from Northern to Southern Europe leading to greater prosperity in the latter and ever increasing energy needs - see for example gas consumption data for Spain.

- Climate policies which as a quick fix continues to drive gas power generation forward as a more efficient and CO2 friendly means of generating electricity.

- Pending shortages in oil supplies may lead to substitution by natural gas in automobiles.

If demand for natural gas continues to grow then source of supply and the security of that source is highly relevant. The following section shows the main sources of supply for Europe's main consumers (excluding the UK). One thing all gas import strategies have in common is diversity of supply.

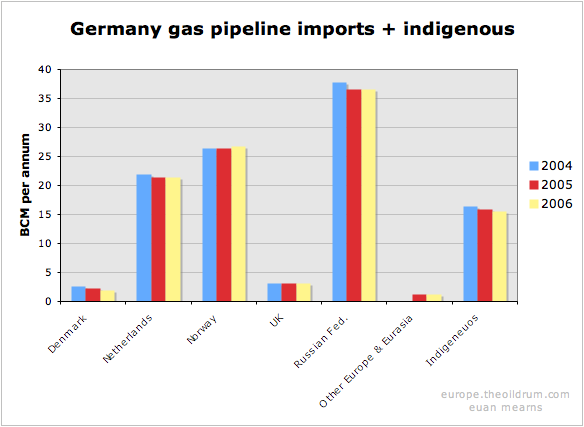

Germany

Germany has some significant and stable indigenous gas production, but is heavily dependent upon The Netherlands, Norway and Russia for pipeline imports. With Dutch gas production in decline, Germany will presumably be looking to increase supplies from elsewhere.

The cornerstone of the German strategy is the Baltic pipeline that will assure supplies of Russian gas direct to Germany that will by-pass former Soviet republics and East European states.

Without LNG, the German strategy seems constrained, since falling UK and Dutch production will place greater demand on Norwegian and Russian gas from several other states.

Figure 12 The import sources of gas to Germany.

France

France is unique among major European gas consumers with no indigenous gas production. France produces no oil and only a little coal - hence their reliance upon nuclear energy for power generation.

Like Germany, France relies heavily upon Dutch, Norwegian and Russian gas pipeline imports. France also has a mature LNG import trade with significant imports from north and west Africa.

Figures 13 & 14 The import sources of gas to France.

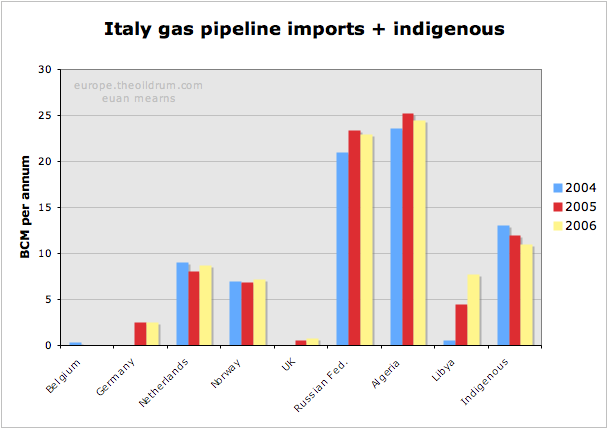

Italy

Italy has significant but falling indigenous gas production. It also has a highly diversified gas importation infrastructure born in part from its geographic location. Italy imports gas from Norway, The Netherlands and Russia but is also linked to Algeria and more recently Libya by pipeline.

Italy also imports small amounts of LNG, mainly from Algeria. Note how there were significant imports from Nigeria in 2004 - but then nothing. It seems these cargoes may have switched to France in 2005 / 06.

Figures 15 & 16 The import sources of gas to Italy.

Current and future sources of supply

The chart shows that Russia and Algeria are by far the most important sources of imported gas to OECD Europe. This raises the questions of whether or not these countries will be able to maintain or increase future supplies and if not, where will Europe's growing thirst for gas be met in the future?

Figure 17 Sources of gas in OECD Europe in 2006.

Russia

Russian gas production had an interim peak in 1991, and with the fall of the Soviet Union went into decline for a number of years. Since 1997, production has begun to rise again and a new high was reached in 2006 of over 600 BCM per annum. The $60K question is where next for Russian gas production? This question is just as important as the future direction of Saudi oil production.

Figure 18 Russian gas production, consumption and exports.

Figure 19 Destinations of Russian gas exports

Russia exports less than one third of its gas production. The majority of exports are to OECD Europe, though a significant amount still goes to former republics. But the amount going to Ukraine, Belarus and Moldova is not documented in the BP statistics, and is presumably included with Russian consumption data. The structure of Russian gas production makes exports vulnerable to any down turn in production and / or increase in domestic consumption. Russian gas exports have been essentially static since 1990, and with the largest fields in decline (see below) it seems unlikely that Russia could at this stage raise production to meet the rising import requirements of OECD Europe.

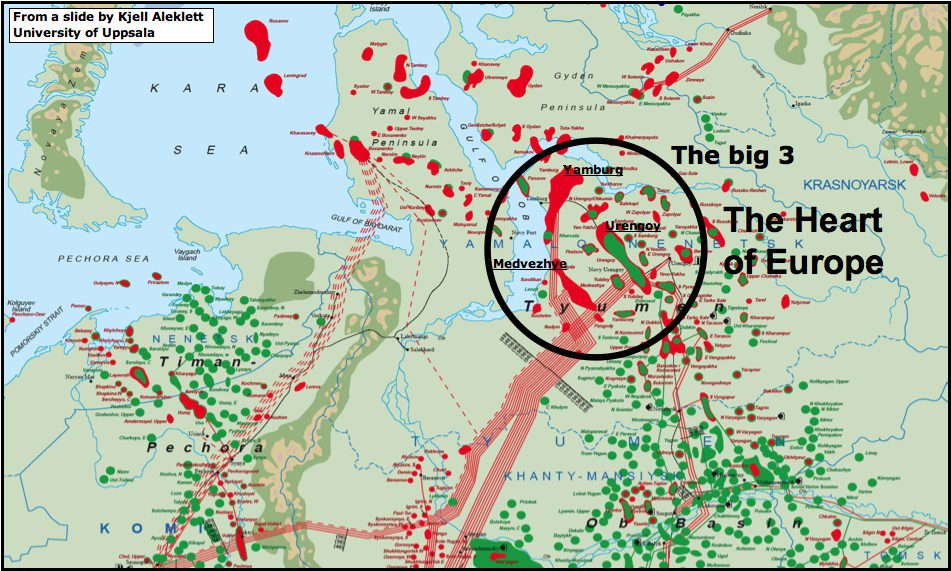

Figure 20 Map showing the west Siberian gas fields of Russia. The three giant fields of Yamburg, Urengoy and Medvezhye have historically provided the bulk of Russia's gas. All three are now in decline (see below). Much of Russia's remaining potential lies in this area, particularly on the Yamal peninsula, to the left of the circle. The map is borrowed from a presentation by Kjell Aleklett.

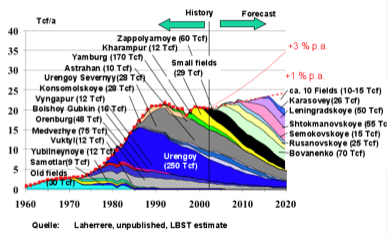

Figure 21 Russian gas production forecast by Jean Laherrere showing how second tier fields may compensate for decline in the three giants - Yamburg, Urengoy and Medvezhye.

Historically, more than 50% of Russian gas production has come from 3 giant fields - Urengoy, Yamburg and Medvezhye. This excellent chart (unpublished) from Laherrere shows that all three of these core producers are in decline. Since Russia has relied upon these three supergiants for core production they now have an inventory of second tier giant fields to develop that may compensate for the decline from The Big 3, as shown on Laherrere's chart.

The challenges for Gazprom are immense. Bovanenko lies on the Yamal peninsula below permafrost. It is at the end of proposed piplelines shown as dashed red lines on the map above. Shtockman lies out of helicopter range in the Barents Sea. Recent reports suggest that the Russians want to use a floating nuclear reactor to power the production platform.

Figure 22 Russian gas production scenarios by Jean Laherrere. WEO forecasts show rising consumption matching rising production with flat exports of around 200 BCM per annum.

This new chart from Laherrere 2007 shows a peak in Russian gas production about 8 years from now with unconstrained production which is unlikely to happen. Instead, constrained production as indicated by the slowly rising WEO 2006 forecast matched by rising consumption will give rise to relatively flat gas exports forward to 2020. So it seems likely that Russia will be able to maintain gas exports but will unlikely be able to increase exports to compensate for falling OECD Europe production.

A critical geo-political question, however, is how these exports are distributed in future? The Sakahlin projects will see East Siberian gas entering the Asian markets for the first time. Furthermore, the Baltic Gas Pipeline will witness a new prioritisation of gas energy security in Germany and western Europe.

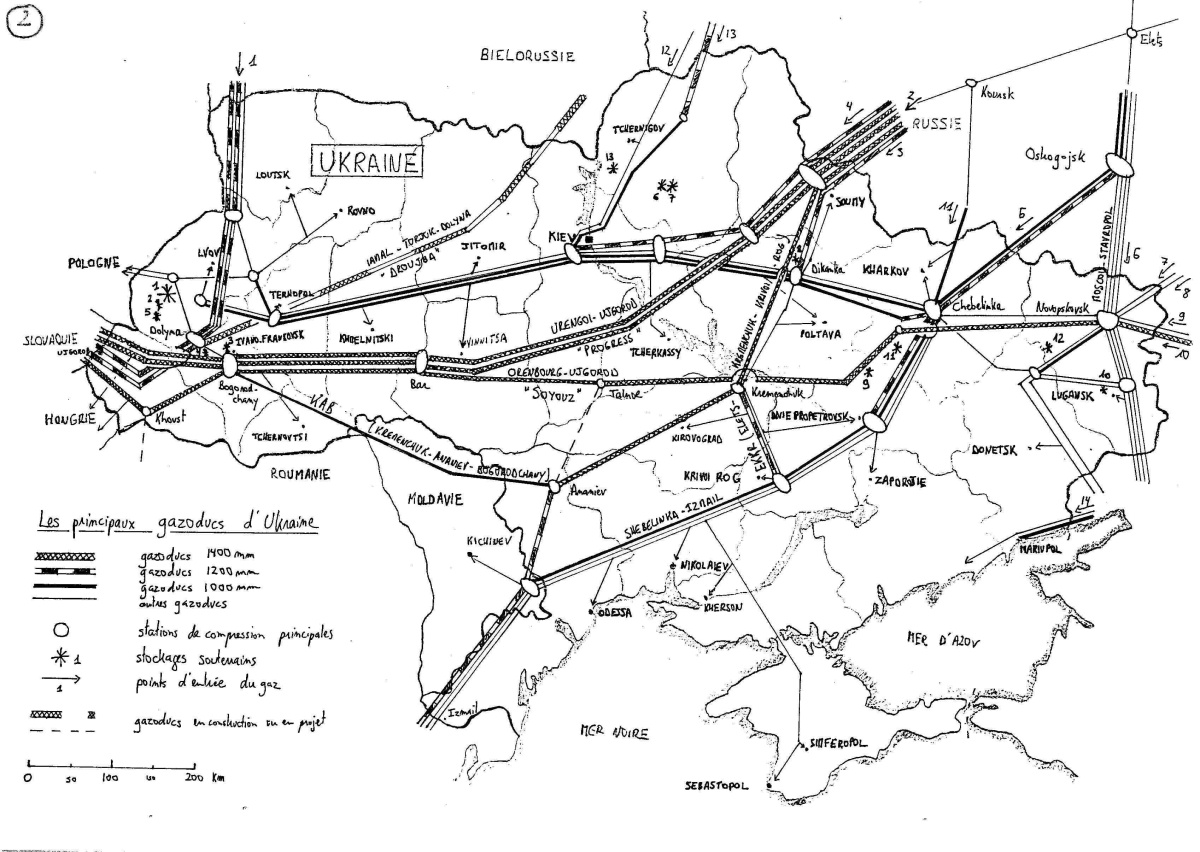

The Baltic Gas Pipeline, which is under construction under a joint venture between Gazprom and German companies BASF and E.ON, will deliver 27.5 BCM per annum direct to Germany in the first instance with the option to rise to 55 BCM. All of OECD Europe's gas from Russia currently has to cross The Ukraine and then either Slovakia or Poland in order to reach the main destinations of Germany, Italy and France. As we saw in the winter of 2005 / 6, Russia struggled to meet all commitments given extreme cold weather at home and cut gas supplies to some unfavoured former Soviet enclaves. The spat with Ukraine at that time highlighted how dependent OECD Europe was on the goodwill of the Ukrainians and the Baltic Pipeline circumvents that problem, providing gas security to Germany at least.

Figure 23 Map of pipelines in Ukraine that carry Russian gas to western Europe via Poland and Slovakia. From Ukraine vs Russia: Tales of pipelines and dependence by Jerome a Paris

The Baltic pipeline will be fed primarly by gas from a new field. The Yuzhno-Russkoye field, which recently started production, is located in the same area as Urengoy, is included in Laherrere's chart and is one of the new fields that will offset decline from The Big 3. This new export capacity, therefore, does not necessarily represent new productive capacity but merely a more secure route for Russian gas into the OECD.

OECD Europe currently receives 115 BCM per annum from Russia, so the Baltic pipeline may eventually secure almost half of those deliveries. However, should OECD Europe face gas shortages, it is those countries at the end of the pipeline that will still be most vulnerable. Some interesting negotiations may lie ahead.

In summary, it is exceedingly difficult to predict how reliable Russian gas exports to OECD Europe will be in future. It seems most likely that Russia will maintain current production levels of 600 BCM per annum until 2020. However, increasing domestic consumption, and exports to East Asia may see gas exports to the west declining. Germany will be in the strongest position to secure supplies. If the remaining supplies are rationed by ability to pay then some of the poorer eastern European states may suffer.

Algeria

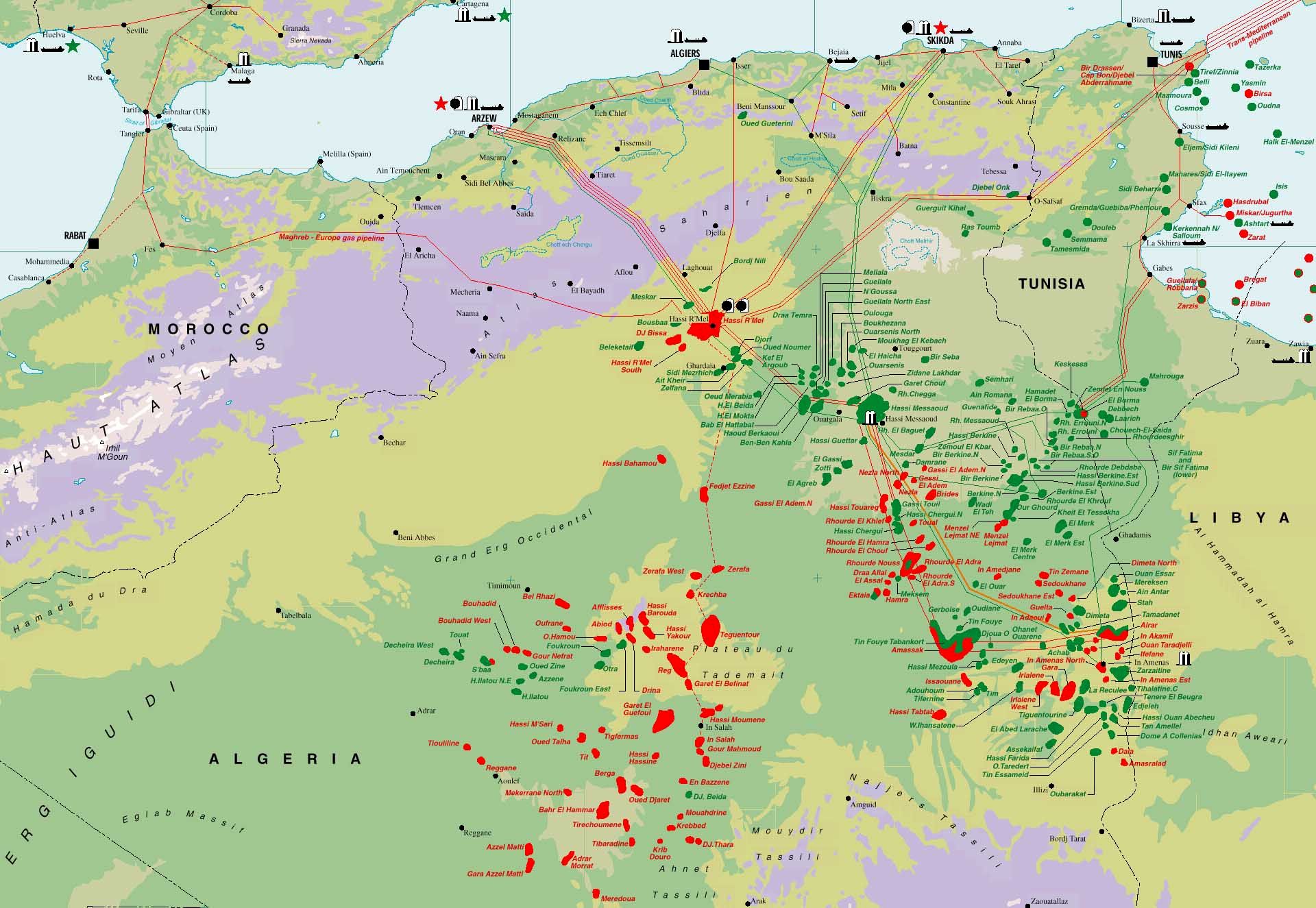

Figure 24 Map of oil and gas infrastructure in Algeria. Europe is fortunate to have gas rich North Africa lying off its southern shores.

According to the BP Statistical Review, Algeria has 4.5 TCM remaining gas reserves placing it number 8 in the world. Accordng to the analysis of Jean Laherrere, Algeria has 4TCM gas reserves remaining, which is in fair agreement with the BP figure. It is fortunate for Europe that Algeria lies close to the southern border of the continent allowing Algerian gas to be piped into Italy and Spain. There is also a significant trade in LNG between Algeria and Europe.

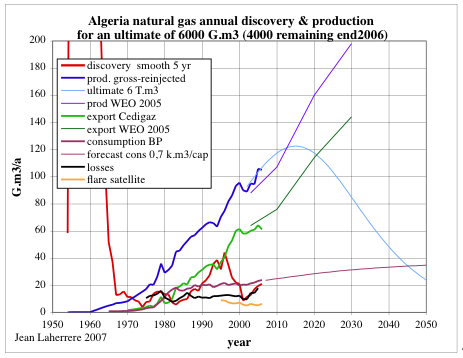

Figure 25 Discovery and production gas models for Algeria by Jean Laherrere.

Laherrere provides a more detailed picture of gas production than can be compiled from the BP data. The main difference is production reported gross of re-injected gas. An unconstrained production peak some 17 BCM per annum higher than today's production is shown around 2015.

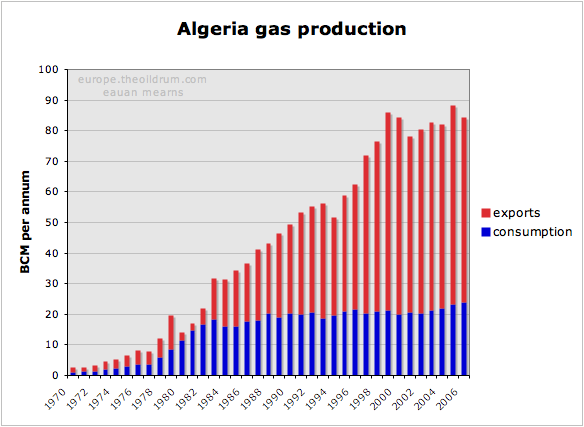

Figure 26 Algeria gas production, consumption and exports. Production and exports have not risen since 1999.

Algerian production grew steadily until 1999 but has since stagnated. There was a new discovery cycle during the 1990s and it is this that may provide impetus for some new production growth. Algerian consumptin is growing slowly and this will consume a portion of new production. New gas export capacity is estimated roughly to be 12 BCM per annum by 2012.

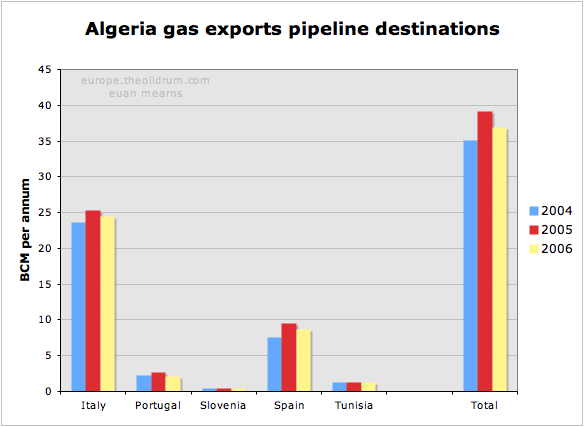

Figure 27 Destinations for Algerian pipeline gas exports.

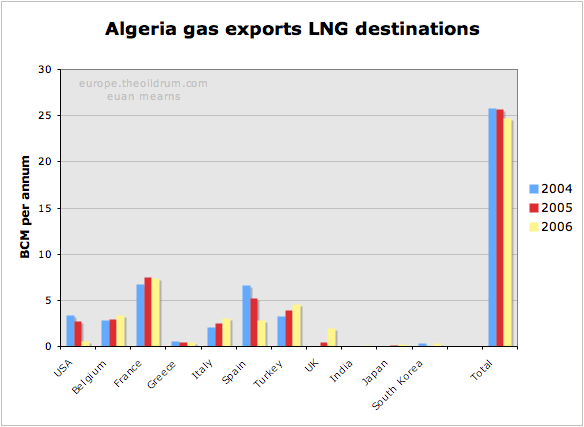

Algeria exports about 37 BCM per annum by pipeline but is also active in LNG production with LNG exports of 25BCM in 2006. Most of the LNG was exported to Europe (and Turkey) with only small quantities going further afield. Europe is a short trip for an LNG tanker from North Africa, and in terms of tanker utilisation I suspect it will continue to be more profitable to deliver N African LNG to Europe than further afield.

Figure 28 Destinations for Algerian LNG gas exports.

The IEA 2005 energy outlook had this to say:

Algeria is the third-largest exporter of natural gas in the world. Exports are expected to increase as pipeline and LNG projects are brought on line. Gas exports were 64 bcm in 2003 and are expected to climb to 76 bcm in 2010 and reach 144 bcm by 2030.

The IEA target for 2010 looks marginally optimistic and their target for 2030 is a reserves busting feat as indicated on Laherrere's chart (Figure 25).

Libya and Egypt

Both Libya and Egypt have seen rapid expansion of their gas production and exports in recent years. This is set to continue at a slower pace for a number of years according to these forecast models from Jean Laherrere. Growing population and domestic gas consumption in Egypt looks set to outstrip production growth and Egypt may cease to be a gas exporter beyond 2025.

Figure 29 Gas discovery and production models for Libya by Jean Laherrere.

Figure 30 Gas discovery and production models for Egypt by Jean Laherrere. In the export model (Figure 31) I have used the "slow" production model for Egypt.

Combining the three production models of Laherrere from Algeria, Egypt and Libya provides this picture of gas exports from N Africa peaking at around 120 BCM per annum in 2015. That represents a 33 BCM per annum growth from current export levels.

Figure 31 Gas export model for N Africa showing expansion of production and exports in the years ahead but with a conceptual export peak around 2015.

OECD Europe gas security

With OECD Europe indigenous gas production set to decline and good reasons for believing that demand for natural gas will continue to expand in the future, OECD Europe faces the prospect of importing ever larger amounts of gas (LNG) from ever more remote parts of the world. Current imports are running at 197 BCM per annum and the BAU scenario shown below shows imports burgeoning to 442 BCM by 2020. Where will this additional 245 BCM come from?

Figure 32 Gas scenarios for OECD Europe summarising the indigenous supply forecasts and demand forecasts from the preceding sections. With the BAU demand scenario, imports will need to grow from current 197 BCM per annum to projected 442 BCM per annum by 2020 - an increase of 245 BCM per annum. It is doubtful that this quantity of gas may be sourced from African and Middle East markets. It is therefore considered more likely that high price and supply shortages will curtail demand for gas. It is conceivable that conservation, more efficient energy use and substitution with alternative sources of electricity may fill the gap left by declining gas supplies.

This is near impossible to answer with certainty. My feeling is that Russia will strive to meet current commitments which will result in their gas exports neither increasing nor decreasing in the 2020 time frame. N Africa will see strong growth in production that will be offset by strong growth in their domestic consumption. Up to 33 BCM of new supply may come from N Africa and it seems reasonable to assume that the majority of that gas will come to Europe. That leaves 212 BCM to source from else where and will inevitably entail a massive expansion of LNG export and import infrastructure beyond that which already exists. In the period 2010 to 2020 Europe will face fierce competition for LNG supplies from the mature markets of Japan, South Korea and Taiwan and growing competition from new markets for LNG in the USA and most likely also in China.

In 2006, the total global LNG trade was 211 BCM and so we are talking about doubling that by 2020 to satisfy OECD European needs alone. The main sources of new supply will be West Africa (Nigeria), Qatar and Iran. Since Qatar has declared a moratorium on new LNG projects forward to 2011 it is a major challenge for these three countries alone to meet global demand growth.

Figures 33 & 34 The changing face of gas security in OECD Europe. With a BAU demand scenario, OECD Europe will face importing ever growing quantities of LNG from remote sources around the globe.

The crux of this whole issue is how growing demand for gas is managed. The UK, and other OECD governments seem intent on allowing market forces to determine the outcome. I would be the first to admit that the dynamics of supply and demand in the European gas trade has so many dimensions that trying to regulate and plan this trade is not simple. But on the other hand, allowing market forces, national economic strength, and price to determine who gets and who doesn't get the available energy may have disasterous and unforeseen outcomes. A scenario where the former Soviet Republics and then the east European states and perhaps Turkey are left in the cold whilst western Europe uses historic strengths to secure itself energy supplies may have unpleasant outcomes flowing from a newly destabilised former Soviet bloc. Energy poverty throughout the poorer parts of Western Europe may also have undesirable consequences for the warm middle and upper classes.

The main message of this post, therefore, is to call upon the politicians of the OECD in Europe to show some rare leadership, and to recognise that massive energy conservation, and expansion of sensible alternative energy schemes, offer a better alternative to the polarisation that is likely to result from allowing market forces to determine the outcome of energy decline.

Acknowledgement I am indebted to Jean Laherrere who upon my request sent his most recent work on gas resources in countries relevant to the European market. Many of the charts come from a paper titled "Etat des reserves de gaz des pays exportateurs vers l’Europe" presented at Club de Nice Energie et geopolitique 29 nov. - 1er dec. 2007.

The Free Market Old New Labour Style

With retail gas price rises of over 30% now on their way in the UK, my feeling is that the lower third of income groups will likely be insolvent with the combined effects of higher gas, electricity, fuel, food and mortgages.

Unemployment is rising and I think things are about to get a whole lot worse as public sector workers discover they can no longer afford to live let alone afford a holiday in Spain.

This is beginning to hit the news. And since the UK government follows and does not lead, we begin to get a sense of what the reactions might be to this crisis.

Winter fuel allowance

Its clear that the winter fuel allowance for pensioners will be increased. This will barely scratch the surface of the problem though.

The basic problem we have is demand in excess of supply and increasing the fuel allowance merely bolsters demand - the exact opposite of what needs to happen. UK government money will get transferred straight into the pockets of the Norwegians - that's ultra smart.

To be fair, Malcolm Wicks and Centrica's boss were both promoting fuel efficiency yesterday - just a decade too late. The UK government is guilty of dereliction of duty. When thousands of pensioners die from cold this winter those responsible should be lined up and held to account. I'd start with the idiots who in the past and who continue to provide ridiculous optimistic forecasts for UK oil and gas production.

Windfall taxes

The calls for more windfall taxes on the energy producers and utilities are already being made. Again, this would be the exact opposite of what is required. We need to maximise energy production and provide all incentives to companies engaged in that area.

So my message to the politicians - and those reporting this story in the MSM. Think supply and demand. Policies must do everything to promote supply and to reduce demand for energy.

Speed limits

Engine size

Insulation, insulation, insulation

Expansion of alternative energies

Politicians that got us into this terrible mess are unlikely to be able to solve the problem. Trouble is none of them seem to have a f*g clue.

Hi Euan,

Another great post clearly showing the problems we face, thank you. Why is this not so totally obvious to our so-called leaders and media?

Maybe Sarkozy knows this and that's why they are trying to include North Africa in the EU? and i thought it was just to get more Frech speakers.

We have just heard that the deal for a French company EDF to take over our nuclear power stations (existing sites that would be easiest to build new plants) has been blocked by two shareholders - Investec and Prudential. They obviously realise that coal and gas fired generation will become increasingly expensive over the next few years. Again this is yet another example of how bad the UK government is at managing finances since they sold off these shares last year for a quick cash fix when they were worth much less than today, just like the sales of gold and Westinghouse Electric Company (nuclear reactors). So whatever happens we are almost certainly faced with a lengthy delay in getting anything started:-(

I would agree with Euan in trying to drastically reduce demand and would also suggest as a first step that all "social" housing be heavily insulated at no cost to the occupants (this rented housing is generally occupied by the lowest section of income groups). To pay for this there should be an "efficiency tax" that only begins above a certain number of units.

One good note, i heard Spain is going to impose a 90kmh speed limit.

"Politicians that got us into this terrible mess are unlikely to be able to solve the problem. Trouble is none of them seem to have a f*g clue."

I know for a fact that some politicians do understand the issues but unfortunately we have the problem that us sheeple don't like hearing bad news and would be reluctant to vote for anybody who asks us to cut back - think Carter and his cardigan:-( I'm having enough trouble convincing my wife.

We must still keep pressing for better thinking from the politicians.

By the way what have you been doing with UK day ahead prices while I was on holiday? I'm away two weeks and the prices go mad:-)

I think we need also to invite Russia to join the EU. Day ahead gas is 54p / therm - up 15%.

I agree with insulating social housing - though I think there needs to be some element of cost to retain some link with individual responsibility. Problem is I suspect vast amounts of poor quality housing is likely beyond the pale. But if you hand out £200 / year for a decade, that's £2000 that could be spent on conserving energy as opposed to helping folks burn it.

Seriously, inviting Russia to EU is a great idea. Better do that now, otherwise it might be that in 10 years time Russia will be inviting EU to join the CIS (half-kidding).

After all EU made the compromise of adjoining Romania and Bulgaria, why not Russia too? No matter how much I love my home country (BG), it was and still is light years away from EU states and in many respects well behind Russia. I realize the distaste in EU with Putin's policies, but incorporating Russia may be the best way to keep him under check. The problem would be that Russia will be too big of a challenge for the EU political and financial resources, but IMO it would be worth it.

either that or Russia inviting europe into the Russian federation.

Boris

London

Great piece Euarn. Makes one go mmmm. When disaster strikes in the UK in the near future maybe other countries will wake up. That's the only possitive thing I can filter out.

Euan,

I think you are right focus on this subject needs to be maintained.

:::::::::::::::::::::::::::::::

The hunt for scapegoats and guilty ones for the emerging energy mess made recently a vital breakthrough.

The picture above, just released by the International Anti Depletion Task Force, shows members of the force rounding up THE prime suspect.

The suspect clearly has GUILT written all over itself,…………what a monster!

I say pull the trigger. He is fully aware of his misdeeds as he has selfishly insulated only himself from freezing in the dark.

Edit: not to mention this handy tool to see in the dark.

I can't decide to call the pussy Alex, Peter or Tom:-)

What about Gordon?:)

He looks more like an Alex to me.

Actual and forecast nat gas supplies and demand for EU towards 2020.

The figure above shows actual (from BP Statistical Review 2008) and forecast supplies (by me) of nat gas split on production within EU + Norway, nat gas imports by pipeline (North Africa and Russia) and LNG.

Further a forecast on supplies towards 2020 from EU + Norway, North Africa and Russia and LNG (yellow area). LNG supplies are presently the most uncertain so if any readers have good references for growth in global LNG supplies I would appreciate it.

Supplies for EU + Norway is based on still some growth from Norway and declines In production within other EU producers as proposed by authoritative studies recently made public.

The black line shows expected growth in consumption as suggested by EIA in their recent International Energy Outlook.

Russians supplies are based upon allocation of some of its future growth towards EU as published by Gazprom (which presently produces 85 - 90 % of all Russian nat gas).

For North Africa some growth as indicated by their governments.

The diagram shows a potential supplies gap opening up in the near future which will grow towards the end of the next decade.

The article Russia 'exceeds targets' for gas supplies via Ukraine to Europe suggests that the increase in Russian nat gas exports towards Europe reflects tightening of nat gas from other sources.

Further The coming gas supply shock in the Gulf suggests that there could be limits to growth in LNG supplies from the Gulf due to increased demand in the region and…………….sour gas.

The high level of Norwegian nat gas exports to UK through this summer and lowered exports (so far this summer) from UK to Belgium through the Interconnector further strengthens the impression of a European nat gas market becoming increasingly tighter.

The recent drop in prices at NBP is as of now thought to be highly seasonal.

The coming heating season seems to become increasingly interesting.

Rune - we look forward to a full post on this.

One thing I've decided is that we will not see rising gas consumption in the EU to 2020. The flat supply trend you show would likely not be too bad. But this is heavily dependent on Russia maintaining supplies.

Let's imagine a series of very cold winters in the N hemisphere - what would happen then with Russia struggling to keep production going, using much more gas at home, and increased demand throughout N Europe. We'd be totally f*d.

Look forward to the debate with Vladimir Feigin at Sparks and Flames:

http://europe.theoildrum.com/node/4363

I feel confident about the forecast on pipeline supplies from what is known today.

I tend to believe that the LNG supplies forecast is a bit on the optimistic side.

Yes, I will continue work on this post (the graph is from the work on a larger post on European nat gas supplies) and hopefully it will soon be ready for TOD E.

The thing is do we really know how consumers will behave if a nat gas supply deficit should materialize?

Will a critical mass substitute some nat gas usage with electricity? And what then?

I think we're finding this out right now. A supply deficit = prices that consumers cannot afford. It felled Labour in Glasgow East. So the morons that produced the problem are about to be replaced by a batch of new morons who don't even understand what a problem is let alone what the problem is. Hence no chance at all of solving said problem.

Right now it looks like nat gas will be replaced with tax payer's money. We still have £1 notes in Scotland. 1 billion £1 notes make create more energy than a single billion £ note - but I've not worked out the eroei yet.

An $A13.6 bn takeover offer by the UK's BG Group for liquified Australian coal seam methane was rejected as too low.

http://business.smh.com.au/business/origin-says-no-to-136b-takeover-bid-...

It was not made clear whether the CSM-LNG would be heading to the UK as preferred destination.

The gas situation is compounded by the demand for combined heat and power, CNG as a diesel replacement in buses and trucks, combined cycle electrical generation to balance wind power and Haber processes for nitrogen compounds. I don't believe this can be supplied anywhere near enough by biogas. I suggest a partial solution is to prioritise uses for gas whereby baseload electrical generation is supplied by other means (let's say hamsters on treadmills to avoid argument) and the more critical uses take up the slack. Maybe that could help for a decade or two.

Yes, this is looking quite scary now.

I was wondering how the rationing of gas might work, whether this is actually practical in the UK. If prices continue to rise, I think there will be enormous pressure not to leave the allocation to the price mechanism.

What made me think about this, was actually the letter I received from E.ON Energy Services yesterday asking me to contact them immediately:

Assuming this letter is genuine...

Do you think this is in any way connected to the gas situation, or am I just being paranoid?

Hi

I think it's paranoia, I had my letter from them in June. The meter man came yesterday and said he'd noticed there were lots more people working from home to reduce travel costs

But I'm noticing another problem - the increased amount of time needed to manage with less energy, and the corresponding reduction in time available to do anything useful about it.

I used to have time to read Oildrum, work on campaigns etc, but now I seem to spend most of my time walking to shops, walking to the allotment, drying clothes in the open air, growing vegetables in the garden etc - and also working longer hours in the hope of keeping income going.

I console myself that the best way is maybe showing by example - but sometimes I think of how much more effective I might be if I used more fuel & energy !

I mostly work from home myself, but have done for a while now. Are they implying that people are starting to use more energy because of working from home? If so, that's a down side to telecommuting that I hadn't really thought about - the need to heat more premises during the day (rather than fewer, bigger workplaces).

I know what you mean about the time/money/ecological balance though.

My girlfriend and I have purchased a small amount of land to start growing some food and firewood on. Now we're faced with the dilemma of whether to hire agricultural machinary for helping to make the raised beds and prepare the heavy clay soil, or do this by hand, which I'd prefer if time permitted, but I'm not sure it does.

Yes, once you start to do it for real, it all gets more complicated.

We live in a converted 1840s public house - built just by the station when the railways were getting started. Originally it had lots of chimneys and fireplaces - but the developers took them all out, in mid-90s fashion. Now we cannot install a wood-burning stove although we've got lots of firewood because there is no chimney - and I'd guess it would cost a lot to have one put in as it is a 3-storey listed building. So we're stuck with standard fuel at present.

Also, more recycling means more refuse stored in the cellar, and as there was a strike that means more flies, or else walking to the allotment more often with smelly bags - can't put it in the car because I don't have it today as three of us in the family are sharing the car.

And then our allotments are overrun with rabbits, so actually if we tried seriously to feed ourselves from an allotment we'd need to be there every day, and then what would happen to our jobs?

Sometimes it feels like going back to the middle ages, life as a peasant.

The blackberries and rhubarb are great though, much better than anything shop-bought.

Dear Andy,

We need to replace your gas meter with a sealed cap. Since you will no longer have a gas supply, I hope you realise you will no longer need a gas meter that has been reallocated to someone more needy.

The £500 charge will be withdrawn directly from you account.

Yours truly,

British Gas

Sorry for the sarcasm here Andy - but it is time to ensure an alternative means of heating should electricity and or gas be off a while. I am in process of getting new energy efficient boiler and wood burner installed - but it costs a lot. And I've been trying to gather fire wood. That's a sobering experience - a lot of work for not much return.

My conservation efforts are getting obsessive.

Im now down to 9000 kwh for gas plus 3500 for electricity for a 4 bed house with 3 occupants

Currently have a 20 tube solar water heater. I have decided to purchase another 20 tubes to double size. Added complication is a heat dump (£1 ebay radiator!) and diverter valve.

Other options under consideration inlude:

Secondary glazing - to effectively upgrade to triple. Not sure o cost effectiveness but this is about the last practical measure to get house near passivhaus standard. Already have cavity wall and 500mm in the loft.

Less practical is adding 40-50mm of insulation to the floor.

Wood burning stove. Main draw back here is cost. DIY contemporary 5kw stove plus twin wall flue (i have no chimney) £2800. I wonder about stoves as an investment as I don't have much land and when tshtf wood will become very scarce too. I suppose I can burn junk mail if its still dilivered. Also in the event of extensive power cuts I am not sure that I would want to be seen with a pufing chimney - could make ones self a target - thats why I like the passivehaus approach.

Also looking into small PV system with battery back up.Basically enough to power solar water heating, a couple of lights and keep refrigerator going for 48 hours.

Beyond that its the emergency box - kelly kettle, solar tubes to heat water and 25 litres of methanol for meths burner.

Have you considered 25 l of ethanol instead?

We could do with a post on the ins and outs of DIY conservation and other practical tips on keeping warm this winter.

I'm keen to install solar hot water. But find it hard to find a supplier. And need advice on plumbing etc. We currently have a pressurised hot water tank etc. And with new boiler will also have pressurised central heating system.

Hi Euan

Yes ethanol would be better - more energy and less toxic. Methanol does seem to be cheap though - you can pick up 25 litres for £20-£25 on ebay.

As for solar - I avoided a pressurised system to make solar intallation easier. I plumb in my own systems and get them signed off by a Corgi Engineer. However pressurising the solar circuit does help improve the efficiency as the circulating water can be at 120-130 degrees (and melt your insulation).

As for DIY stuff I would be keen to contribute as this is my forte. Over the past 13 years I have rennovated 5 houses achieving energy consumption reductions of 25,25,58,41 & 44%. Cumulatively this works upto about 60,000kwh of gas and 10,000 kwh electricity savings annually.

In contrast technicial analysis of Saudi oil fields is beyond me and my control - although interesting to read.

Regards

Nick

If you would like to send something really simple to start with like "How to install a solar water heater" - how to, what it costs, what you save?

I'm off on holiday for a week.

Best to keep these things short - 1000 words - and if there are unanswered questions - there's always the Q&A session.

Euan

Hi Ewan,

great post covering the bases - it does seem that people/politoes might be waking up - but have no idea what do do about the predicament.

If you or others are interested in practical insulation, renewables, etc, with a UK slant, the forum at http://www.navitron.org.uk/forum/index.php is loaded with good discussion and pratical advice - often hard earned. Indeed, I see a couple of regular contributers to that forum moonlighting under different aliases on this thread !

I've been actively looking to reduce my gas reliance for the past five years. No silver Bullets. Insulate. Insulate some more. Stop air leaks. Turn down thermostats. 17deg is enough with the legendary woolly jumper. Turn down hot water temperatures. Reduce boiler-on time. Install a woodstove and use it for at least evenings. Get any bad-actor windows changed to DG units. Get a laser thermometer so you can see what is going on.

Quite a lot of activity (esp the gathering, processing, and drying of wood) .... but no major discomforts involved.

And - well there is a payoff, and it is big. The amount of gas used in our four bed London house has reduced year on year, steadily, from 2900 units in 2003/4, to 830 units in 2007/8. That is a reduction of around 70%. (The woodstove doesn't actually save that much gas itself, but it makes for a very cosy living room).

The UK needs a crash programme of insulation, part funded by the gas companies, to get awareness up, consumption down and keep some of these constuction people employed.

Doubt that it will happen of course.

regards

Bill

Well done Bill a reduction from 2900 to 830 is great:-)

I installed a chimney in my house and currently have an open fire but think in the event of fuel shortages there will be very little spare wood. England was pretty much out of forest by the middle ages. Today just five per cent of England is covered in native woods-making the country one of the least-wooded in Europe:-(

I would agree with you the UK needs a crash programme of insulation and think it should also be linked to stamp duty (i.e. that tax paid when a property is sold) a reduction in stamp duty equal to the cost of the insulation should be allowed.

Tony, Bill,

I also agree that we need a national programme of home insulation.

Britain has very poor housing stock compared to the other parts of Europe.

The availability of relatively cheap north sea oil and gas has lulled us into a false sense of energy security. This attitude has to change rapidly - and there are now signs that people are starting to take heed.

I also have invested in a woodburning stove with backboiler, but I estimate that I will need 5 tonnes of firewood per year to replace my gas usage entirely.

Not everyone will be able to make use of wood as a heating fuel, either for lack of chimney or lack of effort required in preparing wood. Hopefully this will keep the demand down.

When wood fuel becomes scarce, we will really know that we are doomed.

2020

Yes, difficult for us as we're currently renting. I don't suppose our landlady would take kindly to us suggesting she provides us with an additional means of heating (just in case) - especially since she's only recently got a new boiler fitted ;) More woolly jumpers it is then!

So long as they are organic sheep.

First, thank you for this is an outstanding and exhaustive post.

Second, natural gas is presently a continental market dominated by pipelines with small quantities of LNG. The price is set in the region and different regions have different prices. At present a 30% rise or fall in the price of gas in the USA doesn't effect the EU. But if significant quantities of a continental market are supplied by LNG then can we expect the market to globalize? To restate somewhat, if the USA and the EU both import significant quantities of LNG does that force ALL gas prices to converge, the imported LNG and the domestic or imported piped gas?

I suspect that it does, but I would really like to hear some expert opinions.

Thanks in advance,

Tim

Hello Team10tim,

First: Big Kudos to Euan for this keypost!

In answer to your question on global natgas pricing convergence:

IMO, it is hard to accurately gauge the total global effect, but Haber-Bosch natgas Nitrogen products [ammonia, urea, etc] are probably the best indicator of pricing convergence.

It takes approx. 33,500 cubic feet of natgas to make one ton of anhydrous ammonia. If one doesn't consider the additional energy cost of transport, then this ammonia is Highly Fungible; farmers worldwide are desperate to get this into their topsoil.

http://www.icis.com/Articles/2008/07/31/9144627/mideast-ammonia-prices-r...

-----------------------------------------

LONDON (ICIS news)--Against a backdrop of tight supply Middle East ammonia prices have jumped $150/tonne (€96/tonne) this week following a spot sale out of Kuwait, market sources said on Thursday.

..The hike in prices comes at a time when the global ammonia market is extremely tight.

Middle East suppliers said any new business would take place above the $800/tonne FOB mark.

-----------------------------

In my feeble opinion: Crude oil is just as fungible as Haber-Bosch products. But for comparison:

One barrel of oil equivalent [boe] = 5,487 cubic feet of gas

One ton of ammonia = 33,500 cubic feet of gas

33,500/5,487 = 6.11 boe in one ton of ammonia

6.11 X $130/barrel of crude = $794.30

Natgas Ammonia is therefore selling on the spot market for roughly the same price as spot market crude. Since many countries are net importers of natgas-made Nitrogen--> this indicates to me some degree of global natgas-pricing convergence, just as we see in crude oil markets.

Expanding upon Westexas' theme: if a country is a net energy importer, plus a net I-NPK importer, plus a net food importer--> bad postPeak news ahead.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Tim,

I am no expert.

My thinking for LNG would be that once a supplier has spare gas after taking out existing contractual commitments then they will sell that gas to the current highest bidder - why not?? For example in Japan the nuclear outages have caused them to import more gas, in Spain imports increased by 2/3rds to counter low hydro levels.... Distance will matter because of the "boil off" (.15%/day??) and higher transport costs. So for LNG a global price should generally apply. Note, complications regarding availability of ships and where they are allowed are omitted:-)

For piped gas then assuming completely free options the question is what can you do with it? how much can you sell it for?? I cannot see a reason why it should be cheaper than any imported LNG, can you? So for markets importing LNG then the LNG price should apply.

For a market with no LNG import capability then a "local" price should apply. Of course if you build an LNG terminal then you could export it, so the price shouldn't differ by more than the cost of building and running the terminal.

Conclusion, gas prices should become global(ish).

Tim, this is a complex market that I don't fully understand. Its notable that there are now cries within the UK that the market isn't functioning properly and that is blamed on there being only 6 companies supplying gas. This of course is nonsense. 6 companies is more than enough to ensure competition.

The UK authorities have deluded themselves into thinking that a free market will deliver low prices. Where in fact a free market may deliver lowest possible prices - which may still be very high.

In the past gas was delivered at a contract price that was often higher than the "spot" price at a time when supply was way in excess of demand. And this is where the gigantic error of judgement appears. Now that demand is way higher than supply, spot prices are now way higher than contract prices. The UK has opted to buy gas on the spot market and is now finding it has to pay a very, very high price. This can be blamed directly on the economists at BERR and the EU who have failed to understand how this energy market works - during the transition from surplus supply to deficit.

I believe that many continental buyers of gas are still doing so on contract - so those supplies are tied up, and the UK is left to fight for what is left and must bid up price to ensure supply. Worse still, we used to buy most gas on contract but these contracts are now unwinding and so every year we have to buy more and more gas at ever higher price. End point we'll be paying 200p / therm for all our gas by 2010. And at that point or economy is stone dead.

To answer you question. The grown LNG market will likely lead to harmonisation of spot prices. But most of the world is still running on contract for LNG. Whenever there is a shortfall, like last winter that was very cold in E Asia, the Japanese and S Koreans were bidding up the marginal bbl of LNG. They're OK - cos they're buying most of their gas on contract. But the UK has decided to buy most of its gas on the open market and will be destroyed by this. This will likely be a catastrophic failure for the UK - that can be blamed directly of the Government's free market dogma. I hope Rune writes a post on this soon.

I have a post in the pipeline about UK nat gas supplies for the upcoming heating season, presenting a simulation on how storage gas is used to take the swing in demand during cold spells. This post is scheduled for the end of August/early September here at TOD E.

Hint, pray for a mild winter. If not,... things could easily become bad,.....very bad.

Oil is infinite. Hydrogen is the most common chemical element in the universe and carbon is the fourth most common chemical element in the universe.

Yes, but the supply of rocket fuel is even more infinite. Oxygen is the third most abundant element in the universe. Even better: oxygen is the most abundant element in the earth's crust. The government knows this, but they make sure only the military gets adequate supplies, so they can carry out their Illuminatist plan for World Domination.

The linked site above promotes the abiotic oil scam.

Delusion is infinite.

If you take a large enough time scale, possibly.

Abiotic oil or not, it's not helping us very much is it? If you think it is, why are so many post peak oil fields not refilling?

Besides, population growth IS finite.

Obligatory Public Health Warning.

Burning oil endangers the health of the planet.

For more info, visit http://www.ipcc.ch/ and read Scientific Assessment Report 4.

Phil, getting rather tired of reminding the blinkered ones of the obvious

Euan,

As always excellent analysis.

Re Russia - there is an increasingly cogent theory emanating from inside Gazprom itself that the cost of the new pipeline capacity that they will have to build out of the Yamal peninsula is currently not economic. Thus they will work on smaller (non-giant) fields which can make use of the pipeline capacity that is freed-up by the significant declines in the major fields, maybe even provide some capacity to independents.

Gas imported from Central Asia is now priced 30% above the theoretical free-market price in the areas through which it transits - go figure.

The long and short of it is that domestic producers from both associated gas as well as independent producers are expected to meet the domestic demand gap - whilst at the same time not running foul of the Canutian attempts to manage inflation.

Net result - there will continue to be (note the use of the present tense) a shortage of gas in Russia and very little ability to increase export demand.

The PR fudge is to emphasize that Gazprom has more than enough gas to meet both European and domestic demand both in the short and medium-term. As a statement of fact this is correct. What it may not have enough of is pipeline capacity to transport that gas to where it is needed. The direct result of diverting cash to buy television stations and real estate in the south of France - though to be fair that is called stealing.

Euan, if you stand for election you can count on my vote!

To pick up on Andybts's 'Meter replacement' thread above:

I live in a block of flats. No gas !. A couple of months ago a number of the flats were put on

pay as you go meters. When these were installed a padlock was put on the storage space that

contains everyones meters.

I complained that I had not been given a key and was therefore unable to:

a) read my own meter for the purposes of billing

b) keep any kind of check on actual daily/weekly power usage

I was informed that I could have a key if I too had my meter changed to a pay as you go system.

I pointed out that I didn't want the hassle + the higher tariff rate that this incurred but was

told this was my only option if i wanted to become a key holder.

What incentive is there for people to accurately keep track of personal power consumption and

contribute effectively to the need to downsize consumption when we are effectively being

branded as, and treated as, potential meter coin thieves by the suppliers ?

How is it possible for companies to apply pressure to convert people to pay as you go in order

to shirk any responsibility to supply power to those who are in arrears ?

There's a useful article on the useless regulation of the UK power industry by Ofgem in the Guardian

which can be found here:

http://www.guardian.co.uk/commentisfree/2008/jul/31/gas.energy?gusrc=rss...

On another note - I was working on a public event last week in Leeds and a group of guys drove

a 7 ton truck onto the site and calmly stole 8,000 pounds worth of electric cable in plain

view !

I think we will see in the next few years too many irrational responses to this problem. One thing I'd be particularly worried about are dwellings that lack chimneys and thus allow for alternative forms of heating. So many flats and modern houses are 100% dependent on gas for electricity for heating.

We are now 1-4 years away from the system breaking down due to limits on natural resources. But which resource will it be?

http://www.financialsense.com/fsu/editorials/lalani/2008/0331.html

Resource failure may vary from region to region. Nat gas in the UK. OIl and water in the USA. Food in Africa, and so on.

Broad Beans are the first to go!

http://www.telegraph.co.uk/earth/main.jhtml?xml=/earth/2008/08/01/eabean...

More on near future UK nat gas supplies from Forbes;

FOCUS National Grid uncertain of UK winter gas supplies

and nat gas storage from TIMESONLINE;

Threat from lack of gas capacity, expert says

Hi Euan,

I am your greatest fan, that was a very predictive post.

When a PhD speaks we are obliged to listen, or ignore at our peril.

Way back when Demographics and predictive graphs were starting to be taken seriously, many of my MBA buddies became millionaires because they understood the power of a good graphical prediction.

Why are we all still in denial. More precisely why are those leaders who are supposed to be foreward looking, and whom we have hired specifically to take care of our future, not seeing what is being foretold.

Is there any chance that yet again Chicken Little is running around saying the sky is falling. Is the Doomsday cult heading to the hills again, only to slink back home frustrated.

OR is this really for real, and even in my lifetime, will I experience a disruption of my middle class "comfort zone"

If these things are really, really going to come about, would not even ONE leader in the world stand up and say, "Houston We Have a Problem"

Not one single leader, and least of all, the two turkeys hoping to replace Bush, and certainly not, one candle power Brown, have ever said we have a "Problem" looming, which we must address now or it can destroy our way of life.

Where have we, the supposed intelligentsia, failed? Why is nobody (other than the already converted)taking it seriously. Can we be wrong?

Graham

Where was this, do you have a link (in case it's online)?

Thanks in advance.

Was discussed in this thread http://europe.theoildrum.com/node/4103

There's an MP3 audio of Wilson/Strahan at http://www.savefile.com/files/1592999

And part 1 with Euan Mearns/Skrebowski at

http://www.savefile.com/files/1592532

Curious, I always thought Wilson was labour. But he is in fact a Conservative.

http://en.wikipedia.org/wiki/Brian_Wilson_(politician)

He is one of the few politcians we have who understands energy. Cameron needs to get him on board ASAP if we are to have any chance at all.

He was a director at Airtricity and is non exec Director at Amec - that has nuclear ambitions. (I assume the CIA are tuned in tonight):-

The same Brian Wilson ... ?

Graham,

"Where have we, the supposed intelligentsia, failed?"

Maybe because you/we think the answer is subject to clear reasoning and that everyone else will do what is best for society as a whole rather than their own short term goals? Do you think the politicians, MSM ask themselves if the future of all human civilisation depended on me, what would I do, how would I be? Do you, do any of us?

Do we vote for the best person? Our very own Tony Blair was allegedly paid USD 500,000 by a property developer for a three hour trip to a Chinese housing estate to spout off clichés, does Bill Clinton charge for his talks, is it the best use of their time? Wikipedia tells me that Berlusconi is a politician, entrepreneur, real estate and insurance tycoon, bank and media proprietor, sports team owner and songwriter. Does he sleep? Back in 2003 he pushed through legal immunity to the five most senior people in Italian politics benefiting himself more than anyone else. In June this year senators from Berlusconi's party made last-minute amendments to a crime fighting decree that would suspend for a year all trials for crimes committed before mid-2002. Bush - humanitarian and wise beyond years. A truly wondrous human being with messiah-like judgments.

.

.

By the way how do you know you are Euan's greatest fan??? There may be people out in TODland who are even more enamoured than you :-)

IMO your leaders do not feel at this point that they have a problem-they think it is you who has a big problem. There is a major difference.

Graham - I hear what you are saying. I used to post here using the tag Cry Wolf - and still have a bit of a reputation as an optimist. Just focussing on what we know for sure:

• UK gas production is declining at about 8% per annum. Where once we exported gas we now import about 40% - according to Centrica

• UK oil production is declining at about 9% per annum. Wher eonce we exported a lot of oil we now import.

• Points 1 and 2 combined means our balance of trade is all to shit - some economists think this doesn't matter - hahahhaha

• Our housing stock is crap quality - and costs a fortune, and we have far too much of it. Single occupancy dwellings are a waste of energy and capital - a point the market does not yet understand.

• Oil and gas prices are rising very rapidly in response to scarcity - and we are more scarce oil and gas than most owing to our indigenous declines.

• Most of our politicians haven't a f*g clue what is going on. Same applies to the media. Hence the "we'll save you by giving you money" attitude.

• Proper measures to tackle this are now being discussed, but about 15 years tooooooo late.

I asked BERR about rabbits and hats - there aren't any.

The UK are The Canary Islands - you can all watch us going tits up with some satisfaction - but you gotta realise the H2S is heading your way. Tits up will appear on p3 - no doubt.

Nothing like a fast bike and some girls to keep your mind off this - eh? So what's your Rhodesian farm worth now? Up another several trillion%?:-(

So why is it that the Dutch government is capable of making reasonable long term plans, yet meanwhile in the US, the government is so far beyond corrupt that they couldnt plan for tomorrow's lunch?

You'd need to look at the Dutch system in detail.

It has its' problems but overall it offers rigid

tram lines negotiated over a period of years to

meet the requirements of an essentially humanist/socialist

group of people.

Centralised policies resulting from something very close to proportional

representation !!! (and that includes the Media)

Euan,

Another informative post.

Very interesting to compare Fig. 4 (UK) and Fig 7. (Dutch) gas consumption.

Whilst the Dutch have kept their consumption fairly constant since 1990, and had a lot of surplus gas to export, the UK decided to use their surplus gas for power generation. The "Dash for Gas" can clearly be seen in the UK chart, and this is probably one of the reasons that our North Sea gas fields were quickly depleted, and we are now buying on the open market.

You can see that UK consumption has peaked - and this is probably because the power generators have partially switched back to coal, as the gas became increasingly expensive.

Why did we choose to waste this gas, in 45% efficient power stations, when it could have been used with almost double that efficiency for domestic heating, and last at least another decade?

Enjoy your holiday.

2020

I agree, the Dutch are looking pretty smart today.

The most interesting takeaway I have from this piece is that at least one government in the world is enlightened enough to implement a production cap on a limited natural resource. If other countries shared a similar enlightenment we could take big steps toward to a sustainable, lower carbon future.

It also struck me how the common UK political dogma "leave it to market forces" proved to be so unwise. The inevitable bubble as the market rushes to squeeze out every drop of gas as fast as possible, followed by precipitous decline. (As we also going to see with the housing market.)

Drawing down production toward sensible caps, sustainable for the longer term sounds pretty damn good to me. Sure there's short term pain and a lot of social/political resistance. Especially to suck up the initial cost impact, but I think it can be done. I see a big advantage as giving planners and the market a fixed target to aim for. Having fixed and clear targets galvanizes human action.

As I'm a newbie, I'll step back now and see if any experts care to tell me where I'm right, wrong or delusional.

Disclosure: I am concerned about climate change, population growth, resource depletion and environmental degradation. I am an advocate of immediate reduction in worldwide fossil fuel use. I have no interest in perpetuating resource depletion through CO2 sequestration. I believe the solution to climate change only begins when LESS oil, gas and coal is produced world wide. I want the world to start planning TODAY for our limited natural resources to last for at least 10,000 years

A point inspired by BrianT and Gregor.

We have already seen what happens when a country (UK) uses one valuable energy resource, natural gas, to produce electricity - at a typical 45% efficiency for a UK CCGT.

What then happens when another country uses much of its NG to exploit tar sands, at an even lower efficiency?

I suspect that it would be more prudent to conserve the NG for domestic heating and fertiliser production, rather than burning it up trying to get oil out of sand.

2020

Coal bed methane exploration in UK is just getting started. Drilling is now underway in Scotland and South Wales. Hopefully this will lead to some extra gas supplies becoming available - every little bit will help.

Thank you Euan, very interesting and comprehensive. Colin Campbell speaks of Ireland being at the end of the supply chain in terms of natural gas; any thoughts on what this means for the Emerald Isle? It sounds potentially grim to me...

Thanks to Euan, Laherrere et al for work done.

Crystal clear.

TOD at it's best.

Maybe the post will be forwarded to Commissioner Piebalgs ?

Kind Regards

And1

Not sure if TOD-ers are aware of this, but there is a huge meme developing right now in the analytical community that an NG glut is coming in 2009, in the US. Not only from new, North American Shale NG plays, but also from the global LNG market. Alot of this analysis is being driven by the success of new drilling techniques, which unlock NG from shale deposits. There is separate analysis that "too many" new LNG trains will be starting up next year globally.

What's interesting is that prior to these drilling successes here in the US, there was agreement that the economics of Shale NG meant a significantly higher structural price. Others at TOD have written on this issue. The EROEI of shale NG, in particular. One of the largest plays, or deposits, known as the Haynesville on the TX/LA border has no pipeline infrastructure, as yet. So it's fascinating to see the analytical community, which on one hand is aware that the price of incremental NG is closer now to 9.00/MMBtu, is suddenly talking about gluts and "Gas on Gas" competition.

TOD-ers are probably also aware that an intersection is taking place, between the NG producing industry, and policy makers. Boone Pickens is more than aware of these NG shale plays and is invested accordingly in several of them. You are also seeing alot of promotion of "plentiful NG" from Chesapeake Energy's Aubrey McClendon. He's been on the Hill this week, and on TV, talking up CNG for vehicles, and the clean nature of NG.

The bottom line is that we are at an intriguing inflection point in North American NG. The last of the hydrocarbons to remain trapped by geography, we have on one hand a Glut vs. Weather/Oil Price dynamic in N.A. NG, that perpetually sends the NG price each year into orbit, and then collapse. On the other hand, a persistently high oil price that continues to blow out the BTU ratio of NG/Oil from an equality of 6-1 to a massive 13-1 does its best to drag NG higher. In other words, there is no Liquefaction/Export facility in the Lower 48 to immediately remove the spread between N.A. NG and the price from global NG. And yet, the oil price is in part acting as a lever, to conduct the same arbitrage. But it's not successful, so far.

Finally, I have been tracking the switching story here in the Northeast, in which town and city governments, universities, apartment building owners, and homeowners are stranding their legacy Heating Oil heating-systems, for NG systems. With the price of Heating Oil to NG blown out even higher, the economics of this switch are easy. Very easy.

Gregor

Gregor: It was my understanding that the tar sands would run into NG availability issues within a few years-it sounds like the situation has improved dramatically. Is this correct?