Has Fossil Fuel Consumption Within the EU Peaked?

Posted by Rune Likvern on July 10, 2008 - 9:50am in The Oil Drum: Europe

The title will hopefully make some readers choke on their coffee and spill the remains in their cup all over their computer(s).

Click on all charts to enlarge

[Editor's note: Rune Likvern the Norwegian energy man otherwise known as nrgyman2000 or NGM2 has joined TOD E as a contributor. Welcome aboard Rune.]

One thing that caught my attention some time back was the perceived lack of interest for energy questions, usage and supplies within the European Union (EU) compared to the USA. As this post will show the likelihood that the EU’s fossil fuel consumption has peaked, back in 1979, is now very real. It will also compare the degree of net fossil fuel self-sufficiency between the EU and the USA as of 2007.

The EU has to a much larger extent (presently approximately twice that of USA) allowed its energy mixture and fossil fuel consumption to be based upon imports. The EU energy independence is not a realistic choice or goal (unless living standards are swiftly and dramatically lowered), and there are reasons to believe that the EU members will continue to find it increasingly hard to harmonize their energy policies towards energy exporters which will add to the strains within the union.

This is something Putin (Russia is presently EU’s biggest supplier of fossil fuels) seems to have been aware of while the EU occupied itself with defining goals for greenhouse gas emissions it sleepwalked into increased reliance on Russian fossil fuel imports. Former head of IEA recently urged the EU to reduce their dependence on Russian fossil fuel supplies. It looks like realpolitik again will trump wishes, which is evident to everyone who cares to have a closer look at the hard data.

On the bright side it now looks very likely that the EU will reach its agreed goals for reductions in greenhouse gas emissions by 2020, but for totally different reasons than set out in its lengthy, costly and wasted political programs.

NOTE: Some of the diagrams presented in this post may, for some readers, appear overloaded with information, but if the readers allow themselves the necessary time to interpret them I think the reward will lie in a much better understanding of the energy challenges now facing the EU.

OIL WITHIN THE EU

The diagram illustrates that the EU and Norway, which is not a formal EU member, are rapidly drawing down their oil reserves and the oil production has for some time been and will continue to be in a steep decline. The steep oil declines are possible to predict from EU’s R/P ratio of 7,8 and Norway’s R/P ratio of 8,8 at end of 2007. (The R/P ratios does not indicate any growth possibilities for oil production, generally it is hard to obtain growth with R/P numbers below 9.)

THE EU AND OIL. The above diagram shows the development in EU oil consumption (green area), (EU, (EU + Norway)) oil production (lines with circles) and EU net oil imports (red area) plotted against the secondary y-axis. Further the reported development in proven oil reserves for EU (yellow line) and (EU + Norway; black line) plotted against the primary y-axis. Diagram based upon BP Statistical Review 2008. NOTE: Scaling of secondary y-axis.

The EU will, if oil consumption is to be maintained at present levels, increasingly have to bid against other liquid bidders for declining global net oil exports (ref, diagram further down as it is now hard to envision further growth in global net oil exports in the foreseeable future). The diagram also illustrates a marginal decline in EU’s net oil imports during the recent years though it is too early to draw any firm conclusions about the reasons for this, but the continued growth in oil prices remain a prime suspect. The future declines in EU’s and Norway’s oil production will make it increasingly difficult for the EU to maintain present oil consumption levels through increasing EU’s share from declining global net oil exports.

The decline in the EU’s and Norway’s oil production also means that the EU increasingly will have to base their oil imports from more distant sources. This will be amplified with the present decline in Russian oil exports, as Russia now exports huge amounts of oil to the EU. This is now thought to aggravate the future oil supplies' security and reliability for EU.

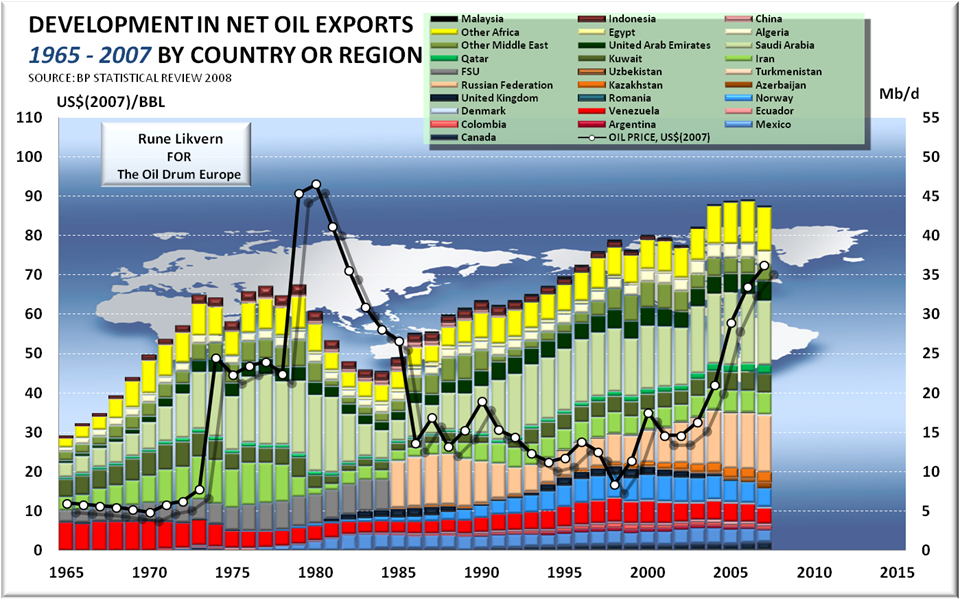

GLOBAL NET OIL EXPORTS. The diagram above shows the development in net oil exports expressed in Mb/d, against the secondary y-axis, for countries and regions that were net oil exporters between 1965 - 2007. The coloring of the stacked columns is done so it should be possible to read trends for the various regions as proposed by BP. BP data does not include agro fuels (bio fuels) and refinery gains in their statistics. The inflation adjusted oil price in US$2007 is also plotted against the primary y-axis. Diagram based upon BP Statistical Review 2008.

The diagram illustrates that global net oil exports for all practical purposes has been flat since 2004,which coincides with the run up in oil prices. It is within this reality that the EU will have to increase its imports and thus participate in the global bidding war for oil if it wants to maintain it present levels of oil consumption. At some stage the price increases for oil (and energy sources) will certainly erode economical growth and result in wealth transferral from oil importers to exporters. Presently it is hard to spot where this limit in oil prices will be drawn, but the pain will increasingly be felt by a growing number of people.

Outlook for future growth in EU oil consumption: Poor, with a decent likelihood of decline.

NATURAL GAS WITHIN THE EU

The diagram illustrates that the EU and Norway are rapidly drawing down their natural gas reserves. As of end 2007 the EU’s natural gas R/P ratio was 14,8, largely helped by the remaining reserves of the Groeningen gas field in Holland. Natural gas production within the EU peaked in 2004 and is now in terminal decline led by UK, Germany, Netherlands and Italy. Norwegian natural gas production is still growing and is now projected by the Norwegian government to reach a plateau of 125 - 140 Gcm/a (Bcm/a) (up from 90 Gcm/a in 2007) by the middle of next decade. This growth is now forecast to partially offset the declines in natural gas production within the EU. This means that if the EU is to maintain present levels of natural gas consumption it will increasingly have to rely on imports from more distant sources like Russia, North Africa and LNG. As of now it is hard to spot that growth in EU natural gas imports is growing fast enough to fill an emerging supplies gap.

EU AND NATURAL GAS. The above diagram shows the development in EU’s natural gas consumption (green area), (EU, (EU + Norway)) natural gas production (lines with circles) and EU net natural gas imports (red area) plotted against the secondary y-axis. Further the reported development in proven natural gas reserves for EU (yellow line) and (EU + Norway; black line) plotted against the primary y-axis. Diagram based upon BP Statistical Review 2008.

NOTE: Scaling of secondary y-axis.

NOTE: BP Statistical Review 2008 lists Norwegian proven natural gas reserves at end of 2007 at 2,96 Tcm while MOE (Norwegian Ministry of Oil and Energy) in their Fact sheets for 2008 lists proven natural gas reserves at 2,31 Tcm. Between these two I would bet my money on MOE’s figures.

Gazprom, which has a monopoly on Russian natural gas exports, have forecast a growth in their natural gas production of 30 - 40 Gcm/a towards 2020. It is now believed that much of this growth is for the domestic market and some for increased exports towards European and Asian customers. This suggests now that any increase in Russian natural gas exports to EU towards 2020 will be small.

Natural gas consumption within the EU had a high in 2005 of 496 Gcm/a and was close to 25 Gcm/a lower in 2007. The reason for this seems to be mostly due to milder winters in recent years. The present run up in oil prices has also affected natural gas prices and there is now reason to believe that this will affect consumption.

In a possible future post I will present a more detailed analysis on the EU’s future natural gas supplies challenges.

Outlook for future growth in EU natural gas consumption: Poor, with a decent likelihood of decline.

COAL WITHIN THE EU

The EU has through the years changed their energy mixture, where coal once was king. This has happened due to the high availability of natural gas which also helped reduce greenhouse gases and SO2 emissions and lessons learned through the previous oil shocks which also increasingly led to nuclear power was introduced into the energy mix.

EU AND COAL. The above diagram shows the development in EU’s coal consumption (green area), EU’s coal production (lines with circles) and EU net coal imports (red area) plotted against the secondary y-axis Diagram based upon BP Statistical Review 2008.

As the above diagram shows coal consumption has steadily declined within EU and has for the last 8 - 10 years remained flat. This has happened while EU’s coal production has been and still is in decline which has resulted in increased reliance on coal imports. As natural gas and nuclear mainly substituted and displaced coal, many coal mines within the EU and coal fired power plants have been decommissioned. It is believed it will take approximately ten years to reopen a closed coal mine while building a new coal fired power plant generally will take 5 years, thus it seems likely the EU increasingly will rely on growing coal imports if coal to a larger extent is reintroduced into the EU’s energy cocktail. Given that technology is available for CO2 capture and sequestration from coal fired power stations, which makes coal a more political acceptable energy source than nuclear, it seems likely that coal is in for a future growth in consumption within EU.

Outlook for future growth in EU coal consumption: Good.

SELF-SUFFICIENCY OF FOSSIL FUELS USA vs EU

The diagram clearly shows that the degree of self-sufficiency for fossil fuels is twice as high in the USA compared with the EU. It is diagrams like this one which now should raise interests for energy questions among Europeans. In addition the USA now has a higher R/P ratio for all fossil fuels. Future outlook is that dependence on fossil fuel imports will grow faster in the EU than in USA which should illustrate the urge for EU to develop long term and unified supplies strategies for fossil fuels.

The diagram above shows the degree of fossil fuel self- sufficiency (in percent) between EU and USA as of 2007. USA is presently a net exporter of coal. Diagram based upon BP Statistical Review 2008.

It now looks like EU increasingly will have to rely upon increased future fossil fuels imports from Russia or find other ways to reduce consumption and thus alter its reliance on fossil fuel imports.

EU’s future energy policy will increasingly find itself between a rock and a hard place.

HAS FOSSIL FUELS CONSUMPTION WITHIN EU REALLY PEAKED?

The diagram shows that coal consumption peaked in 1965 and it is now hard to foresee that coal consumption within the EU will grow approximately 200 MTOE to reach the same historical level.

Oil consumption within the EU peaked in 1979 and was in 2007 approximately 1 Mb/d lower. With expected oil production declines within the EU and declining global net oil exports it now seems unrealsitic to believe that oil consumption within the EU will grow in the future.

Strong evidence suggests now that natural gas consumption within the EU peaked in 2005.

EU AND FOSSIL FUEL CONSUMPTION. The above diagram shows the development in EU’s oil (green area), natural gas (red area) and coal consumption (grey area) in MTOE (Million Tons Oil Equivalent). Diagram based upon BP Statistical Review 2008.

If fossil fuel consumption within the EU is to grow this analysis suggests that coal will increasingly substitute oil and natural gas in the energy mixture. If coal can or will be introduced at a speed which covers the expected declines in oil and natural gas consumptions remains to be seen.

There is now a real possibility that fossil fuel consumption within EU peaked long ago in 1979 with a more recent secondary peak in 2005.

There seems to be a division of labor within the energy mixture, where oil is used for transport (mobility), and natural gas for cooking, heating and some electricity generation and coal mainly for electricity and some heat generation. Oil will easily substitute the other two fossil fuels, while a substitution the other way is either hard or at best negligible.

As we are at or near the apex of global liquid fuels supplies and this is a situation that is new to the world economy and therefore and as of now little is understood what will happen on the down slope of global liquid fuels supplies there are perhaps questions that needs to be asked.

How will declines in global liquid fuels supplies affect demand/consumption for energy from other sources?

Fact is there are little historical data to give any good and reliable guidance and therefore the consequences are poorly understood. Often the substitution argument is brought forward when the question is raised. However if history may be of little guidance like the early 80’s and Russia after the dismantling of Former Soviet Union, the consumption from the other energy sources (taken into account that some substitution will take place) will trend in the same direction as liquid fuels which is.......downward.

There is some logic to this; energy from other sources is consumed to build vehicles and tools that consume oil, and as oil availability declines it is to be expected that demand for oil consuming vehicles and tools also will decline. This could thus create a feedback loop reducing demand for energy from other sources.

In such a context the market will see to it that future emissions of greenhouse gases will substantially decline. And this will happen without the implemetation of any political programs.

SOURCES:

[1] MOE FACT SHEETS 2008

[2] BP STATISTICAL REVIEW OF WORLD ENERGY 2008

[3] GAZPROM in questions and answers (2007)

Other articles on EU energy on The Oil Drum

Very good analysis, with excellent graphs! Well done!

Only thing I would say is that the Global Net Oil Exports graph may be improved by the addition of the UK. I know the graph only includes those countries who were net oil exporters in 2007, but the data covers the period over which the UK exported oil, so it may improve the graph. But then again, the UK now exports a negative quantity of oil (imports it), which would be rather tricky to show on a graph!

Great analysis overall!

Thanks for the kind words.

The diagram over global net oil exporters have now been revised to include all net oil exporters (countries and regions) as proposed in BP Statistical Review of World Energy 2008 for the years 1965 - 2007.

Rune

Rune,

Great topic and great ideas for analysis.

I just updated the Energy Export Databrowser to include the Coal worksheets from the 2008 BP Statistical Review. Folks can now generate their own graphs for coal production/consumption/import/export for various nations and groupings:

Right away one sees that in Europe outside of Russia, only Poland and Greece are exporters. And it looks like Poland is well past peak coal!

-- Jon

How do you see the future timeline of oil?

Either copy the below list and add more years or create your own timeline and add major events.

2014: After several years of flat production, Saudi officials for the first time admit that they are not able to increase production and will go into a 4% decline.

2015: Electric cars now outnumber petrol driven cars in Tokyo.

2018: OPEC is dissolved as an organisation.

2020: The big tanker “war”. US and China are bidding on oil tanker in route, forcing them to change course in mid ocean.

2025: As a result in large investments in hydropower (30,000 Gwh/year) Iceland export first commercial shipment of LH2 (Liquid Hydrogen) to Europe.

2030: Canada is now the worlds second oil producer after Russia and followered by Saudi.

2040:

2050: My grandchildren run around the living room laughing and saying WROOOOOM-WROOOM, when I for the 117th time tell them I once had a 5.7 litre V8 Camaro.

Here's my interpretation of future events. Warning: All predictions should be taken with a pinch of salt, and a sense of humour.

2012: London Olympic Games hailed among Peak Oil aware community as the last great event of modern civilisation

2013: Mexican government becomes bankrupt and is overturned by a military coup. Refugees flee to the United States, but are repelled from the border.

2013: Unusually cold winter causes nearly half a billion people to die. The president of Russia is forced to step down after commenting that it would "save the rest of us money". Vladimir Putin takes over and converts the country into a dictatorship, and subsequent higher European gas and oil prices cause widespread suffering.

2014: The airline industry collapses, and one large company buys up all others, forming a global monopoly. A plane flight from London to New York now costs 6 months of the average American's wages, and flights take place fortnightly.

2014: After several years of flat or declining production, a secret Saudi Memo is leaked to the press, revealing that Saudi Arabia is now in terminal decline.

2015: Iraq suffers civil war, splitting into three separate states. The US government takes control of one third, and the other two are controlled by Big Oil and an Islamic government ruling under Sharia law. One third of Iraqi oil is nationalised, and oil exports are banned in the Sharia sector.

2016: Iran adds a $100 tariff to all oil exports to the west, in retaliation for Israeli threats.

2017: Due to a computer error, the price of oil drops to $1 overnight. Panic buying then sends the price up to twice what it was the day before.

2018: OPEC is dissolved as an organisation, although everyone knows it has held very little real power for nearly a decade.

2020: World war three begins with a stalemate between the USA and China, as both sides try to take control of 12 full oil tankers from Iran that have been idling for over 12 years in Iranian ports.

2021: The oil tankers are accidentally nuked by a trigger happy American president, causing public outcry. Both sides realise that there is no point to continuing the war, and back down.

2025: Through a combination of efficiency gains, electrification and synthetic crude manufacture, Norway becomes first country in the world to reduce Crude Oil consumption to zero.

2030: Worlds first experimental Nuclear Fusion power plant is built, a decade after the first successful fusion experiment. It provides power for a small village.

2035: My children run around the vegetable garden, laughing as I tell them of the "Golden age" of human civilisation.

2040: A reduction in oil demand, due to a massive switch to fusion power, causes the oil price to drop below $5000 a barrel for the first time in 16 years.

2060: Oil is discovered under the newly thawed out Antarctic plateau. Due to ownership disputes, it is never exploited.

2100: Recently discovered vast deposits of oil on Mars become commercially viable. Companies compete to be the first to herald in the "Second Oil Age".

I agree it's a good analysis, but contrary to Luminara's comments I have to beat up on the graphs. For good graphs see Gail's posts. They're clean, simple, and emphasize the actual data. Heading Out has used way too many graphics and even shadowing on data lines (where is the actual data point, on the line or the shadow?). Rule number one: when graphing data, don't use more dimensions than the data itself has. With shadowing you've tried to use three dimensions to display two dimensional data.

HO, I recommend a visit to www.edwardtufte.com for valuable instruction on designing data displays.

One thing I learned from consulting was that most audiences can't understand more than one variable on a graph. We may have a little more sophisticated audience here, but I still make two or three separate graphs, rather than try to put too many ideas together.

Also, when the graph is complex to begin with, a pictured background adds to the complexity. Where does the graph end and the background begin?

Another trick I learned in consulting is to always number every graph and illustration--Figure 1, Figure 2. It is embarrassing when you have a client in the room and need to say, now page back a little. It also makes graphs easier to refer to when a person writes a post, or when someone wants to ask a question in the comments.

Actually, I find Livkern's graphs VERY difficult to read. I suggest that Livkern in his future presentations remove the distracting "artwork" in the background, use solid colors for all bar graphs and area graphs, use larger fonts for the graph notations, etc. I've been staring at these graphs for the past half hour trying to extract the information that supports his arguments -- although, Livkern may be correct in his conclusions, I can't see it visually.

Frankly, if this were a paper submitted by one of my students, I'd give it a barely passing grade.

A pleasure I can guarantee you you will be spared!

Our middle case, in our (Khebab/Brown) paper on the top five net oil exporters is that Norway and Russia both approach zero net oil exports in the 2025 time frame. I've called it the 4P's--Problems with Proximal Petroleum Producers. The US is facing the same problem with Mexico and Venezuela. Mexico will approach zero net oil exports in 2-4 years. We haven't modeled Venezuela, but extrapolating the current trend suggests that Venezuela could approach zero net oil exports in about 20 years.

My take on the current situation is that the EU and the US are trying to offset the declines from their proximal producers with increased imports from the Persian Gulf and Africa, while Asia is trying to increase oil imports to meet increased demand--thus the rapid increase in oil prices in recent months, at about one percent every five days since May, 2007.

Our model, recent case histories (e.g., the UK and Indonesia) and current data suggest that net export decline rates tend to accelerate with time.

Meanwhile, back at the ranch:

“Gazprom has expressed its willingness to buy Libyan oil and any available quantities of gas,” the official, Shokri Ghanem, told Reuters, adding that it did not mean Gazprom would buy all of Libya’s oil.

Gazprom’s chief, Alexei B. Miller, met with Col. Muammar el-Qaddafi of Libya, after which the company said in a statement that it hoped to buy, at market prices, “all future volumes” of gas, oil and liquefied natural gas available for export.

A cooperation agreement signed in 2006 between Gazprom, which supplies about a quarter of Europe’s gas, and Algeria led to fears that Europe’s biggest two suppliers could work together like the OPEC group of oil exporters.

Gazprom’s latest bid to strengthen its grip on gas supplies around Europe comes as no surprise, said David Cox, the president of Poyry Energy Consulting.

Gazprom said it was also planning a joint refining venture with the National Oil Corporation of Libya, and accepted Libya’s offer to build pipelines to Europe from Libya, in North Africa.

Gazprom and the Italian energy company Eni formed a partnership in 2006 that allowed the companies to swap energy assets, including those of Eni in Libya.

Gazprom Offers to Buy All of Libya’s Gas

Source: NYTimes

URL Source:

http://www.nytimes.com/2008/07/10/business/worldbusiness/10gazprom.html? _r=1&oref=slogin

h/T Russki at Libertypost.org

And this happened while the EU was discussing biofuels.

You have to give the Russians that they are clever strategists and also is focused on long term goals (and Gazprom ceartinly knows the value of energy) while some of their counterparts (competitors) is locked into the belief that the market will solve everything including future energy supplies.

This is an illustration that the rules in a post PO world are about to change, and has anyone seen any signs that western politicians are aware of the new rules now being formed?

No, this news is proof that the Euro-politicians' starry eyed faith in "the market" to deal with energy problems is totally correct. It will.

However "The market" is now called Gazprom. And it's a monopoly.

Be careful what you wish for.

(And build more nuclear power plants.)

Did you send this to Cheney? The way I read this, it should be you Europeans that take the lead going around stomping on small oil-rich countries, not us (US). You want to hire Cheney?

Also, not only are we closer to self-sufficiency (well, ok, distant, but less distant), we also waste vastly more energy than you guys, which means we are even more superior. It's a lot easier to lose 50 lbs when you weigh 250 than it is when you weigh 150. See my point?

Stomp and waste and you'll want not.

It would be interesting to see a similar graph for Asia, I have a feeling they are even less self-sufficient than the EU.

Robert

Give me some time and i will revert later today with a similar graph for Asia.

OK?

Hello,

Below is a graph comparing degree of self-sufficiency for EU, USA and Asia and Pacific as of 2007 based upon data from BP Statistical Review of World Energy 2008.

What may come as a surprise is the high degree of self-sufficiency of natural gas of 87 % within AP (AP; Asia Pacific). The reason for this is that AP only had 15 % of global natural gas consumption in 2007. NG consumption grows strongly in AP and AP will become a strong competitor with EU and USA for NG, inclusive LNG.

BusinessWeek recently had a headline of:

Kazakhstan: Work begins on gas pipeline to China

which clearly demonstrates China willingness to increase nat gas consumption, even from areas thought to be the source of future EU supplies.

With respect to coal China produced approximately 70 % of AP coal consumption in 2007, and China was also the world’s biggest coal consumer in 2007, consuming approximately twice of the second largest consumer, USA.

Rune

Hi Rune,

Thank you for the interesting graphs. Because of NAFTA, wouldn't it be more appropriate to compare North America (Canada, Mexico, US) to the EU and Asia? And to include uranium? I think that the contrast with Asia and the EU will become stronger with these changes.

Dave

If we compared NAFTA (or North America, Canada, Mexico and USA) to EU you are right about the degree of self-sufficiency for North America would improve.

There are several comparisons that is interesting like;

G-7 versus the BRIC countries (this is an interesting one because presently BRIC is a net exporter of all FF)

Eurasia (Europa and Russia with some of the FSUs) versus North America

What I expect is that new alliances is and/or will form in the near future and I will not be surprised if many of these were forged around energy supplies.

The total bars look wrong: AP is less self-sufficient for both oil and coal, and yet the total suggests that AP is more self-sufficient overall.

Nick,

Thank you for your observation.

I have been running through the calculatios from scratch again, and they come out with the same results as presented in the above graph.

The reason has to do with the composition of the energy mixture for the regions and the total is weighted numbers.

USA is slightly heavier on nat gas than coal while AP countries are very heavy on coal and very light on nat gas. AP as a region has presently a high degree of self sufficiency on coal combined with a high total usage of coal (53 % of total FF usage as of 2007).

USA coal represented 27 % of total FF usage in USA in 2007, while it was a small net exporter of coal.

It should come as some food for thought that AP presently have such a high degree of self sufficiency on FF.

Did this help to explain the seemingly distortion in the graph?

Yes, that seems to make sense.

Thanks.

Some people would have it that Cheney does in fact work for a financial oligarchy that has it's historical origins in Europe, and that as far as real US interests go, he is a traitor.

I myself am not sure about the whole oligarchy thing, but think it's a view worth considering.

I agree to some degree with what you say about Europes energy issues, we are in a bad position. But in the US you do have worse structural limits to possible energy savings, because of the greater extent of suburban sprawl.

I'm not sure about the relative amounts of energy the US and EU use for domestic heating though, that would be interesting to know.

This is an interesting and not well recognized point.

To put it another way: wasteful use of natural resources can be a contributor to a nation's energy security. If you have not implemented most conservation measures, as the US has not, and there is a real supply shortage, as the Oil Drum and others predict, then there are many measures you can implement to reduce consumption drastically. Given that the US at that time remains relatively rich, it should still be able to purchase limited supply and, because it is a wasteful consumer, be able to handle a considerable amount of the shortfall via conservation measures.

Countries which have implemented all available conservation measures will be at a disadvantage, when it comes to security of supply.

So, it may well be that the oil poor countries which have implemented all available conservation measures which will have the most interest in going around "stomping" the oil rich.

I think for the next few years there will be some ambiguity over coal. It is a substitute for oil and gas provided well maintained coal facilities are available ie recently retired power stations or multi fuel cement works. I haven't heard of coal-to-liquids in Europe. Then coal is a complement to oil and gas and may decline with them in lockstep, the negative feedback mentioned in the article. I see no evidence that geosequestration or CCS will hit prime time soon. I understand the EU carbon trading scheme will in future auction rather than hand out permits so that may make electrical generators wince over more coal. Exporters like Africa, Australia and Indonesia will be under domestic pressure to cut back and coal export prices will skyrocket continuing recent 50% annual price increases. Maybe the US could step in with some coal exports.

In short the coal option will look a winner for a couple of years then most likely turn sour.

Can you elaborate?

I understood that Germany's opening of coal-fired power plants and shutting down nuclear plants is detrimental to greenhouse gas reduction.

It's not really available yet, although considerable progress is being made. But we don't need it.

Indirect mineral sequestration will work just fine, and it's safer and cheaper than CCS with current technology, and has the benefit of increasing alkalinity in acid soils and oceans directly.

Mine a couple of square miles of olivine (a magnesium silicate), crush it to a powder (high surface area to speed up reactivity), disperse it over the coasts, seas, and agricultural land near the mines.

Put simply:

Mg2SiO4 + 4H2O + 4CO2 > 2 Mg + 4HCO3 + H4SiO4

Permanent sequestration in carbonate mineral. Simple and effective.

For more info, check out Olaf Schuiling's work, a professor of geophysics in the University of Utrecht. He's worked this out pretty well.

You wrote:

"Mg2SiO4 + 4H2O + 4CO2 > 2 Mg + 4HCO3 + H4SiO4"

no carbon sequestered there ... and apparently magnesium metal is a product.

maybe this?

Mg2SiO4 + 2H2O + 2CO2 > 2 MgCO3 + H4SiO4

we need to see sequestration in action to know how realistic it is.

no carbon sequestered there ... and apparently magnesium metal is a product.

CO2 is sequestered in carbonate mineral. Apologies for omitting the electric charge in the equasion, that creates confusion, the magnesium is of course not in metallic form (that would have been dandy for magnesium producers though!), that should be Mg with 2+ cation. The 4HCO should add sub 3- anion behind it. H4SiO4 would be neutral charge (0) then.

we need to see sequestration in action to know how realistic it is.

Alreay done. Minerals sequester far more CO2 than the biosphere does, so it's proven already. In fact, it's been going on for billions of years. Let me explain the process. Natural erosion processes are little more than neutralizing acids with minerals. CO2 is acidic. It's reaction with minerals such as magnesium silicates have helped cancel out natural CO2 emissions (eg volcanic). Mining large quantities of olivine and crushing it up very finely is essentially the same thing as the natural process. We just have to speed it up about an order of magnitude. The products created are environmentally benign - they already occur in the oceans and soils in vast quantities. In fact it would be good for acidic oceans and soils, and would add magnesium as a nutrient which is vital to life.

Right - but we need to see sequestration work on a faster-than-geologic time scale.

I saw a talk about this five or so years ago. Have any experiments been done beyond bench scale? What do they show?

The time scale for atmospheric CO2 to eat an olivine mountain is indeed "geologic", because it eats any olivine surface at a rate I don't recall -- think it was 20 microns per year or so -- but calculated here.

At the cost of five percent as much electricity was was earlier gained putting coal-derived CO2 up, olivine pulverization makes the timescale non-geological by making all parts of the olivine to be within a few tens of microns of its surface.

In that thread I also found the abstract of a report on how a large-scale experiment has been done inadvertently. Contrast this with other sequestration methods: they are talked about and not done. This is completely the other way around. Well, except for a little talk from such as me and Cyril R.

--- G.R.L. Cowan, H2 energy fan 'til ~1996

http://www.eagle.ca/~gcowan/boron_blast.html

Thanks for that link to realclimate, interesting comments, and a good link to some DOE work.

Interesting also to see how much mine tailings are sequestering already!

The DOE and others did do experimental reactivity experiments. They found several ways to increase reactivity such as high temperature, high pressure, high CO2 and H2O levels, and increasing surface area. Olivine is more suitable than serpentine, because of more favorable reactivity characteristics. Serpentine is more abundant though, so may be promising to look in to some more.

High H2O levels is easy to accomplish as you can imagine. But high CO2 may only be viable next to a CO2 emitting powerplant. Which would have to be close to the olivine mine.

High temperature and pressure are energy intensive and require rather complicated equipment.

Increasing surface area was found very useful. It's not rocket science, when you increase surface area, the reactivity area is increased. We're talking about orders of magnitude increases in surface area, which increases reactivity enough for it to sequester many billions of tons of CO2 per year.

The concept of dispersing it over the earth and oceans is simpler, cheaper (based on available tests and data at least) and less energy intensive than the other olivine proposals. And has extra benefits such as directly increasing the alkalinity of the oceans and acidic soils. Plus Mg as a useful nutrient. All of the reaction products occur in vast quantities in the oceans and soils already. The reaction speed is very slow, takes more than a year even for very finely crushed olivine, so is not aggressive.

I'll concede that the scale of the undertaking would be massive. Olivine production would have to be increased to at least several hundred times of today's levels, even more if all CO2 has to be sequestered this way (which is unlikely though).

Please no more planetary engineering on top of already failing planetary engineering. Haven't we learned anything from earlier attempts?

I remain very doubtful we can fix problems by simple causal fixes that create new problems on they often, sometimes taking a decade to be noticed.

Why not nuke the atmosphere and block the sunlight? That has been suggested as well (by a sane scientist). Because it is an insane last resort measure and we have absolutely no idea how the whole earth will react over mid-to-long term.

(And yes, I've read his papers)

Please no more planetary engineering on top of already failing planetary engineering.

You are confusing geo-engineering, which does have obvious risks of disturbances (and you've mentioned one of the most dangerous examples), with mineral sequestration. It's chemically harmless. We're pumping billions of tons more CO2 in the atmosphere than nature does. Cancelling it out via benign natural processes that have been proven safe for billions of years (erosion) makes sense to me. This is going on at the billion ton per year scale already. If you're going to call it dangerous, you'd better have a well structured argument. We won't learn anything with this standard unsupported quasi-ethical enviro-whacko ism that you're displaying here, which by the way is one of the reasons we haven't started a serious effort to look for solutions. It's just total nonscientific attitude.

If you've read any papers on mineral sequestration, it's not showing in your response.

I'm more worried about the oil required in mining a couple of square miles of olivine per year. It's supposed to be similar to copper mining oil requirements per ton. Any thoughts on how much diesel would be needed to pull it off?

I think SamuM's comment is a good example of condemning action on the assumption that not doing anything has no negative consequences. That is not a very good assumption. When you pump like 25 billion tons of CO2 into the atmosphere every year, that has negative consequences. Doing nothing is also action - it's a path that can be compared on the basis of it's impact with other paths. We may find that doing a lot has much lower impact than doing nothing.

Strawman. Please don't use them. They are not nice form.

Still waiting for that well structured scientific argument why olivine sequestration is supposed to carry risks of damaging the environment.

Moreover, why it could carry more risk than doing nothing or CCS or geo-engineering or whatever.

I never said it would! You are again using a strawman.

-sigh-

hopeless...

If you never said that it would, then we are in agreement and should start at least small scale mineral sequestration right now to see how it goes.

What happened here? First, I post about mineral sequestration. Then, you respond by talking about geo-engineering approaches such as nuke detonation in the atmosphere.

That's a totally different subject.

Because you did not admit your mistake, I was expecting you to oppose mineral sequestration just as well as geo-engineering, and expected a well reasoned argument from you to defend your position.

But it's no longer needed because your above post implies that we agree.

I'm not confusing with geo-engineering. These are all planetary level engineering schemes. Just like pumping CO2 is. And I never said doing nothing has no negative consequences. That is really uncalled for.

If you would have at least tried to read my argument for what it is (a basic assumption of good form in argumentation), then you might have been able to deduce the following interpretation:

How can you be sure that the non-sequestrated magnesium carbonate at the magnitudes imagined will not cause any systemic unwanted issues of big scale? Has this been tried on the mega-scale before?

I'm sure people said in the 70s that CO2 won't be a problem, because plants will just suck it up and spit out oxygen, in fact we get just more plant growth. Some people are still claiming this :/

Now, I'm all for solutions, don't get me wrong. But mega level solutions that have not be modeled for potential effects are not at the top of my personal list. That doesn't mean I flat out deny them, but I remain very very careful about advocating them, until they have at least been modeled properly! I can't find a single reference on this. If they have, can you please provide a reference and enlighten me. Schuiling's material does not provide enough understanding on this.

Also, please note that my position is probabilistic - not either or. Think about that for a while, the next time you assume something about somebody's position :)

I'm not confusing with geo-engineering. These are all planetary level engineering schemes.

Then building windmills and installing solar panels are also geo-engineering. But that's not the agreed definition of the concept. The concept relates to altering the earth's radiation balance (by albedo) to 'tailor' the climate. I agree that there are very serious risks with most of these approaches, and they are all obvious.

If you would have at least tried to read my argument for what it is (a basic assumption of good form in argumentation

I read it, and perceived your position to be a generalization which bothered me. Turns out you really were confused about the definition of geo-engineering as used in the field of climate science.

How can you be sure that the non-sequestrated magnesium carbonate at the magnitudes imagined will not cause any systemic unwanted issues of big scale? Has this been tried on the mega-scale before?

Non-sequestrated magnesium carbonate? The carbonate does not contain magnesium. Carbonate is stable and is prolific on the seabed and magnesium is already dissolved in seawater in huge quantities. It's already happening at a mega-scale - it's no different from what we call erosion - and has been happening for billions of years. The amount already accumulated by natural processes utterly dwarfs the yearly increment that we will put in even if all of antopogenic CO2 emissions need be offset this way. The process actually increases the alkalinity of the ocean. Most would agree that the ocean acidifying is a very serious issue. What will be the impact on ocean ecosystems if we let the ocean become more and more acidic?

I'm sure people said in the 70s that CO2 won't be a problem, because plants will just suck it up and spit out oxygen, in fact we get just more plant growth. Some people are still claiming this :/

Weird isn't it? When you look at the figures, the biosphere doesn't sequester as much as minerals do via natural processes. Plants do take up more CO2 if there's more in the atmosphere, but not exponentiall and the scale at which they're operating is about an order of magnitude short of what's needed to keep CO2 levels stable with the amounts we're pumping in. That means it's not nearly enough.

We need a good solution. Several actually, there are no silver bullets, but it looks like the mineral sequestration is the most proven of sequestration methods - nature has done it for us at a mega scale for mega-years - and is also potentially cost effective. Crushed olivine is cheap, mostly trading for less than 30 USD per ton and sequesters more than a ton of CO2. The process is slow and proven to be benign. It's much cheaper if done in developed countries which also provides good local development for them.

Google for more info:

http://www.google.nl/search?hl=nl&q=mineral+sequestration&meta=

And for environmental impact; everything we do has environmental impact, but most of the concerns are about the impacts of mining. This is also my concern, although it's unlikely to have global impacts it could be a local issue, along with the question how much fossil fuel, in particular oil, will be needed for operations.

One issue that has not been discussed very much by mineral sequestration proponents is the

environmental impact of large mining operations. In fact, some proponents make statements like

“mineral sequestration guarantees permanent containment and avoids adverse environmental

consequences …” (McKelvy et al., 2001). In reality, all processes have environmental

consequences, and instead of criticizing environmental concerns of other methods (i.e., they leak

and may cause environmental harm), the proponents must address the environmental

consequences of a large mining operation. The environmental issues are further exacerbated by

the fact that the volume of material increases as a result of the mineral carbonation process. In a

review by the IEA Greenhouse Gas R&D Programme, they did address these environmental

issues, concluding that “the methods for mineral sequestration of carbon dioxide present

significant potential for adverse environmental impacts, which are comparable with the issues

faced by similar sized modern quarrying/mining operations” (Newall et al., 2000).

But I'm not worried about the process itself having a more serious environmental impact than ocean acidification alone. Not to mention global warming. Even if the impacts of mineral mining are adverse, they have to be compared in relation to these issues of ocean acidification and global warming, and not as an argument in isolation. There are no perfect decisions, but there are better decisions.

More on environmental impact:

http://www.google.nl/search?hl=nl&q=mineral+sequestration+environmental+...

Please read back and show me where I said something was geo-engineering? I said planetary (mega) engineering just because that is what these things are. And while I am a layman in climate science, I read realclimate+ipcc+papers on this as well.

so, can you please stop twisting my words :)

otherwise I agree w/ almost everything you wrote (sans initially the mineral sequestration modeled systemic effects, because I didn't know of any studies on it). Thank you for the extra ref.

so let's end this storm in a tea cup, shall we :)

sorry for being terse, now on mobile phone on the train. Slow to type.

Please read back and show me where I said something was geo-engineering? I said planetary (mega) engineering just because that is what these things are.

What is the definition of 'planetary mega engineering'?. This concept could refer to anything: cities, agriculture, asphalt, windmills on the TW level, solar panels on the TW level. With almost 7 billion people, it's not something you can easily get around. And because you mentioned an example of geo-engineering - nuke the atmosphere - as your defense, I assumed we're on the subject of geo-engineering, which of course is totally different from sequestration methods. This assumption wasn't very good, but then your argument wasn't very good either. Concerns about mining are all I have left, but then they may be an environmental bargain compared to ocean acidification and the consequences of global warming.

Sorry for being so harsh and picking nits. We'd better drink that tea while there's still enough oil to transport it :)

Definition of planetary engineering.

I found this on another blog:

Yes, we can re-open all the European coal mines and use the stuff but should we?

-Lets hope we choose wisely...

Nick.

That's very interesting if it's true.

Depends on what one opts to call truth.

Atoms come in 'flavors' - the bio-sequestered heavy metal U found in coal has radioactive and non radioactive versions. Fission plants use the radioactive version. So on a pound per pound comparison, the pounds of fissionable U would be less than pounds of mixed fissionable and non fissionable U found in coal.

The re-introduction of heavy metals from coal burning have already effected fresh water fishing in the form of mercury. The U from coal will have an effect over time.

Aren't all isotopes of uranium unstable? U238 isn't very dangerous in terms of radiation, although I wouldn't make jewellery out of it. It does have considerable chemical toxicity. But U235 is quite dangerous radiologically as well as chemically.

238-U half-life 4468 million years, 235-U 703.8 million years, 6.35 times quicker.

A factor of 6.35 is not enough to make the difference between "isn't very dangerous" and "quite dangerous".

--- G.R.L. Cowan, H2 energy fan 'til ~1996

http://www.eagle.ca/~gcowan/boron_blast.html

difference between "isn't very dangerous" and "quite dangerous".

And neither changes that U is a heavy metal. Heavy metal toxicity is well known.

It's not just about the decay of either uranium isotopes. Alpha decay can't even penetrate the human skin so as long as you don't breathe it you'll be fine (some soldiers learned this the hard way with DU ammo). It's also the decay of their daughter isotopes that is somewhat damaging to life. U235 decays into Th231 6.35 times quicker than U238 into Th234 but Th231 also decays much quicker than Th234 and also has a bit higher decay energy (although they are both relatively small). Still you have a good point. Both U238 and U235 can be quite nasty so it's a good thing we have relatively effective storage methods. The Russians sometimes make a mess out of it though, and the Chinese have some suspicious cases as well. I'm hoping this will improve greatly with their economies growing decently.

On Americans' behalf, the American nuclear power system -- enrichment plants plus reactors -- takes 4.5 mL of UO2 per person-year from mine to storage cache annually, although strictly speaking, much of the cached stuff is UF6 that never gets to a reactor.

That's a lot more than the U that goes through American coal burners, but the amount that is actually fissioned is 0.05 mL, and that, the coal plants' throughput does exceed. Since UO2 is very refractory and involatile, ash precipitators get it, and it is likely to end up in a coal ash heap or as concrete filler. At low temperatures in a coal ash heap it may oxidize. Try this search.

The possibility that the ~99 percent of the uranium that gets stored, having undergone no nuclear change, can someday be made to do so is one of the arguments that prevents the caches from just being buried, or in the case of the fields of drums of UF6, dumped in the ocean. The idea is that it hasn't yet been used, and may yet be.

--- G.R.L. Cowan, H2 energy fan 'til ~1996

http://www.eagle.ca/~gcowan/boron_blast.html

Noutram

Some more words of wisdom;

"More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly."

- Woody Allen -

"The Earth is not dying - she is being killed. And those who are killing her have names and addresses."

- Utah Phillips –

I've heard the Woody Allen one before, it's a classic!

I also rememberi n one of his films he starts to worry on learning that the Universe is expanding and I think it's his mother that shuts him up by saying something like "Brooklyns not expanding..." :o)

The next chance I get to play devils advocate here I'm going to ask why high oil prices mean doom -I would have thought that only inneficient users would be penalized and that bringing efficiency and alternatives to bear can be a highly positive stimulus... As an example Europe could have been said to have been on an energy plataue for 30 years and it hasn't killed us...

Nick.

Man: "We are on a path to total extinction."

Earth: "Who is "we" kemosabe?"

The bad news is that we are on a path to total extinction. The good news is that the earth will do quite nicely without us. We suppose that we are at the center of the universe. Taint necessarily so.

It took 50-60 million years of silicate weathering to cool the Earth after the Paleocene-Eocene thermal maximum. Is there enough easily available rock to expose to the atmosphere?

I find it hard to believe that the current European stance on global warming remains unchanged in a few years when energy cost has moved from annoyance to serious grief for most of the voting public.

I would expect that the cost of heating mid and northern Europe will make most people welcome any warming in the winter, and not mind somewhat warmer summers (except maybe spain/greece/portugal/italy). I would expect public opinion to turn 180 degrees and consider pushing CO2 into the atmosphere a rather good thing.

Admittedly I have nothing to back my assumption up other than those 20 people that I have spoken to about the subject of GW and the energy crunch, but they all had the same opinion ...

And yes, I still believe that public opinion can change politics, so call me a dreamer :-)

Great article. Do you have any thoughts on how much of the fossil fuel consumption in Europe could be 'easily' removed by consumers?

As I see it, there are lots of little things that people will start to do when the cost gets sufficiently high; drive less, drive more efficient cars, turn the thermostat down, turn the air conditioning off, buy local food etc.

The real problem comes when all these, relatively painless, measures have been taken, and we need to still cut further.

If the figure for 'easy' removal is 10-20% then we're probably in a lot of trouble, but if it's 50% then we could have 20 years of gradual belt tightening but nothing too serious before the real crisis hits - which gives us 20 years of planning on nuclear and renewables to take some of the hit. The latter of these is the best 'soft landing' I can see, just wondered if you thought it was feasible?

Thanks!

I think that with the recent run up in energy prices many consumers are taking some steps to conserve energy. That is driving less, being more conscious about using electricity and natural gas etc..

As was mentioned by someone further up this thread American consumers probably wastes more energy than consumers within the EU, in other words the easy part is to reduce waste before it gets hard.

As of yet I don’t have any numbers on how much the relatively easy energy conservation amounts to, could be there are some data within IEA or within some EU department dealing with energy.

For the EU my wild guess as of now is that “easy” removal is somewhere in the span of 10 - 20 %.

In other words I think even small reductions will require efforts and campaigns to give any meaningful results.

Rune this is a great post, well thought and well organized.

I have two questions for you:

I hope this post helps EU leaders and folk representatives of every kind to objectively address the challenges ahead with a proper Energy Policy, once and for all leaving CO2 behind as the main driver behind their strategies.

Hello Luis and thanks,

At the bottom of the spreadsheets version of BP Statistical Review 2008 (and earlier versions)some groups of countries are listed like European Union, OECD, FSU etc., for oil also OPEC, OPEC 10 and others.

The present trend is growth in coal imports for Europe (or the EU if you like). Europe has closed down many of its coal mines (mainly as a result of substituting coal with natural gas) and it could take up to 10 years to reopen these and put them back into regular operation, therefore evidence suggests continued growth in European coal imports for some years ahead. If coal mines will be reopened and decisions reversed to delay planned close downs remains to be seen.

Let us hope that politicians, consumers, businesses, everyone focus gets adjusted towards the importance of a challenge Matt Simmons once on a scale from 1 to 10 gave a.......12.

Great post!

When you see this you also understand why the EU is the main CO2-reduction-policy driver. It is not because we Europeans are such nice chaps, it is because we do not want to give anybody else a competitive advantage for free.

If the EU hade the fossil fuel resources of the US, and vice versa. How do you think things would have played out?

Olle thanks!

Hypothetical if the roles of EU and USA had been reversed with respect to self-sufficiency and reserves of FF, chances are good that USA could have been the driving force to reduce emissions of greenhouse gases.

I hate to bring up the subject, but what about nuclear? It is a small component of the total energy mix, but it is the primary source of electricity in France, although a declining (for now) source in the UK. Only one or two plants are being built at present, but more are on the drawing board. I recognise that this is difficult to fit into a fossil fuel model that is looking at supply and demand, but if we can see the supply trend for nuclear power it will give some indication of how much new nuclear build could realistically offset the coal supply decline.

Yes, as I remember, that data is available in the BP review - might be wrong there though.

Good work already though.

Very thought provoking article, thanks!

I can't argument this numerically right now (gotta dash), but I want to offer some counterarguments quickly if not for other reasons, then just in order to stimulate debate. That is, I don't necessarily disagree with you - I'm just interested in various hypothesis:

First of all, I'd divide energy need/want of a society (nation, set of nations, whole EU) from energy consumption. Why? Because if we look through this fuel by fuel - then we'll quickly find that a need or want of a society for a particular fuel may be much higher than available supply, often resulting in substitution in the actual consumption of another fuel.

Case in point UK

Everybody knows their natgas situation. Once Norway drops off natgas cliff, there is nothing that can come close to providing UK with the natgas they need as their own production is dropping. Their nuclear industry is in the shambles, but they still have coal (burning) history. It's the cheapest and it's among the fastest to offer base power. So to coal they will go:

Natgas -1

Coal +1

GHG emissions +1

Germany

Gas need/want will continue to grow at the expense of coal, until supply situation changes the balance. At this point coal will stop dropping (in fact it already has, the base power level for GER seems to be at c. 80 Mtoe p.a. level) and may start rising again. This situation is more uncertain than that of UK for both natgas situation and nuclear.

Natgas: 0/(-1)

Coal: 0/(+1)

GHG emissions: 0/(+1)

France

While coal consumption has dropped steadily in France for the past 40 years, natural gas consumption has gone up roughly the same in terms of MtOE. Fortunately for France, their nuke capacity has grown about 450 fold. Drop in natgas supply might increase coal need as well, but for me this is harder to tell - I haven't studied enough country specifics. As with others, oil remains an Achilles heel for them.

Now one could ask why did I only list these three countries as they are not the whole of Europe or EU. Well, other than time constraints, it remains obvious that these three are the trend setters in EU. What they do, others must try and follow. They are the ones who can largely set the pace for a major changes in energy consumption mix. Of course there are the lucky countries like Norway (not part of the EU) who can just say 'screw you guys, we've still got plenty of oil & gas', but they are in the minority.

The three big countries have already shown what they want: less coal, no nukes, more natgas (nordstream, LNG, etc). However, this want may turn not to be feasible based on supply number forecasts beyond 2010/2015.

Basic backround assumptions (may or may not turn out to be true)

+ If oil supply drops precipitously, there'll be a quick scramble for natgas and coal (in power generation and to some extent in synfuels). As natgas supply will likely not be enough, most of this demand will try to spill over to coal. This will mean more GHG emissions and possibly some stupid/hasty decisions done under pressure.

+ electricity consumption will increase steadily 1.0-1.6% p.a. in mature EU countries and even faster in new entrants. When oil decline starts, electricity consumption will go much faster (in the order of perhaps 2-5% p.a. or depending on available capacity and grid tolerances).

- not enough natgas supply will be available to fill the full EU need/want beyond 2010-2015

- not enough political interest (or necessarily time) to built huge amounts of new nuclear capacity

+/- EU electricity network deregulation will do very little to alleviate the situation, if it happens at all, although it will definitely increase electricity bills in Scandinavian countries and in Finland.

- increasing global average temps may somewhat reduce heating requirements in the long term

- Political speech about negawatts will mostly NOT turn into effective and long-lasting conservation, until there is shortages/rationing

+ wind and even solar will be built rapidly, but not enough to supplant the capacity drop in natgas use, not to mention if we had to remove all the coal plants from use (in the next 10-20 years). In the long term I hope substitution is possible.

In summary I think coal consumption will grow, as it can in some cases take place of fuel oil and esp. natgas in power generation. Amongst fossil fuels, it is cheap, plentiful and fairly fungible. Sure this will be dirty and CCS is not guaranteed, but I'm afraid that when it comes down to saving the economy or saving the climate, people will choose the economy over the climate.

Now, where will this coal come from? Barring no resource grab and a working worldwide market, a lot of places incl. Russia, Americas and even potentially Asia. The rest of the remaining EU production potential may not be economically very viable and certainly not of high energy quality while 'flow' volumes remain fairly small compared to potential elsewhere.

My growth assumption appears to be in line with the EIA estimate of worldwide coal consumption growing 1.7% pa until 2050. most of this growth will come from Asia, but as the trend for the past 8 years or so for Europe+Eurasia seems to be on the rise in the face of a warmer weather cycle, and considering supply problems above for other fossils, I see the potential for coal growth as fairly probable even in Europe. I don't like it and I hope it's avoidable, but this is how I see it: growth probable - at the very least stays on the same level for a long time.

As for the total fossil fuel consumption, I think that roughly I have to agree that Europe is near peaking or that is has peaked. This based on forward looking supply numbers alone, not just consumption trend forecasts. Even if we wanted to burn much more oil, gas and coal, it remains somewhat unlikely that a lot of oil and gas will be available for extra consumption growth.

Now, if this assumption were to be true, it remains an order of magnitude more difficult to guess what this means and whether GHG emissions will actually drop or how this will affect the economies in the near-to-long term.

However, I do remain skeptical about assumptions that automatically assume GHG emissions from fossil fuel burning in Europe have peaked and will go down in the next 30 years. I hope and in my minor way continue work that they will, but there are potential kinks in the road going forward.

My apologies for the primary energy mix images being so old. Didn't have time to make new ones, but the mix hasn't changed that much, even though imports for some countries (like UK) have.

PS Now that I think back, I didn't offer really any counterarguments as I have agreed on almost everything, with the possible exception of a small difference on the GHG emission position. Ah well :)

SamuM, thanks

and as always some interesting thoughts and perspectives.

One thing I have observed is that when oil supplies declines are brought up the common response is that there will be substitution to continue BAU.

Do we know that it will be BAU on the down slope?

This is one of the reasons why I think we need to really understand what Peak Oil is about. By training and experience we are so locked into the expectations of continued growth that when PO is brought up the most common response is substitution.

If energy consumption fell in lockstep with oil consumption then it would be a wrong allocation of resources to replace oil with other energy sources either this is coal or nuclear (within the EU I think they soon will find out that nat gas is not a viable or sustainable substitution alternative to oil).

I think many of the renewables are great, but again are we here falling victim to the dogma of future growth where renewables to some extent will allow BAU?

I don’t have the answers, but recognizes that PO introduces a discontinuity which as of now is poorly understood and hopefully discussion groups like TOD will help advance the debate and thus the understanding.

I'm totally with you 100% on all your further points.

My position was that which I consider to be 'political realism' in the current climate.

I don't advocate for it, I don't hope for it, I don't like it, but I accept it.

Until it changes. And I agree that PO might be the discontinuity that changes this completely.

Samu: great charts-thanks. Re coal consumption, some who have looked at this one closely feel 2050 for a peak is far too optimistic (I think some have predicted 2015-2017)-looking at the track record the EIA has of always missing on the optimistic side makes me think they might be right. Obviously that would change everything.

Yes, the WEG coal report from 2007 remains crucial and if correct would put a hard(ish) ceiling on max coal use growth and probably lead to geographical diverging in coal markets, even more rapid coal price rise than so far and possibly to supply disruptions or at the very least coal-quality demand-supply mismatch in mid-to-long term.

Still, coal has afaik more volume flow growth potential before peaking and starts with the lowest price. Thus it is a likely substitute candidate.

Of course positive breakthroughs in the hydrates development could change the gas scenario after 2020 or so (see yesterdays gas TOD piece for a ref on this).

All this of course very IMHO, and I retain the right to change my opinion as new data surfaces.

SamuM,

I hope i haven't stated that GHG will automatically decline if FF consumption declines. This of course depends on what will substitute oil and natural gas, which most probably will be coal.

What I also try to challenge with my post is; will growth in energy consumption happen post PO?

Are we being fooled by randomness; in other words do we extrapolate to much of our sucessful past into the future also post PO?

The three big countries have shown that they want no more nukes?

France is building one, and ordering another.

The UK is trying, as ever inefficiently, to revive the nuclear industry.

Only Germany is still committed to a phase out, and many voices there are urging a re-think.

Agree on france. Not sure abou UK, singnals mixed. Ger is the laggard (or spearhead on renewables, depending on POV).

Are planned increases enough to substitute for declining oil & gas combined? Likely no, not without serious consumption cuts & long infra transition.

Can policies chang? Yes.

Will it come in time to avoid serious nrg system disruptions? Perhaps, hard to be sure, but does not look very promising currently in terms of known scale & assumed time available.

I agree the nukes won't be built in time to prevent major disruption.

Just to float an idea though, perhaps imaginative financing could leverage France's nuclear production.

Suppose Germany, for example, which has extensive grid connections with France wanted to take advantage of France's nuclear build in the ten years or so it would take to build their own.

France is currently installing 50,000 air source heat pumps a year.

Including the upgrade of radiators needed it might cost Euros 5,000 to upgrade a house.

On an existing build this would increase the efficiency of heating by around 2.5.

If Germany paid to increase the installation rate then every home they installed in would mean that they could heat from the nuclear energy made surplus 2.5 homes - over 10 years that is Euros 200/year per house, plus the cost of also installing heat pumps in the German homes to reach this level of efficiency, so the total cost over 10 years might be Euros 700pa- not bad!

Total cost for the French side of things is around Euros 60bn - the reactors are already there so don't need re-costing.

12 million or so French homes should just about take care of the German household heating market - and if a few more reactors were needed to provide this, the French could build them quickly and cheaply - I don't have exact figures for the number of French homes using electric heating, but around 12 million seems reasonable.

Can anyone put some better figures on this?

Good idea. Quick search finds this:

Sales of electric heaters in France this year increased by 8.6 percent, official figures released last week showed. Total turnover in the sector reached 235 million Euro. Wall mounted electric heating remained the main segment with 82.5 percent value and 53 percent units.

For the last four seasons these heaters broke the sales record in October 2007 with more than 241 000 sales units. In the meantime, sales of free-standing heaters strongly increased (11.2 percent units).

http://www.neurope.eu/articles/87400.php

They're installing loads of electrical heaters, suppose these are all resistance heaters that's pretty dismal.

The French can do much better. Tax electrical resistance, natural gas and especially oil heaters big time and use the money for rebates on efficient air and geothermal heat pump systems. Or maybe deep sea water pumping to air conditioning as well which is also very efficient, 4x to 12x less than conventional ACs I've read. But requires considerable investments in plumbing so probably more interesting for utility/commercial scale cooling:

http://www.makai.com/p-swac.htm

Lots of useful policy improvements can be made. Building insulation standards are mostly not too good in France. All new builds should be passive solar and superinsulated in a few years. Denmark has about a one cent tax per kWh for incentives for cogeneration. All European countries can do that. If a carbon tax can finally get off the ground then there's a lot more money avaible for incentives.

What do you think of the basic argument? Since it has difficulty building the nuclear plants, Germany could invest in paying for some of these measures in France, in return for guaranteed supplies, this creating 'virtual' energy generating capacity?

I would agree that France can and should do more on it's own, but there may be an opportunity for other European countries to capitalise on the fact that it hasn't.

EDIT: Btw, Hi, Cyril!

Hi yourself. A very good idea I'd say.

Two potential problems come to mind though.

First, the air heat pump would have to have a buffer thermal store because it must be mostly continuous load, if it's peak load then more fossil will be used even in France. The heating system must be 'baseload' to get the highest correlation with the nukes output for optimal effect. This looks like a manageable issue but does require attention.

Perhaps more serious is that the efficiency of air heat pumps varies quite a bit over the year with the outside air temperature. With that, energy use also swings seasonally. In the winter, when heating needs are biggest in both France and Germany, the air heat pumps would actually be least efficient and so use the most energy. Average summer temperatures look very favorable for small amounts of efficient cooling/heating, but that also means the difference between winter and summer draw is going to be really big much of the time.

Even in winter, air heat pumps are more efficient than resistance heaters, but still I'd say a geo exchange system would be better. They are more expensive, but, for large systems the overhead to create the geo exchange plumbing is much smaller and big systems can be even more efficient. Big buildings, appartments, even complete city blocks could share one system, with the per household costs kept low. That also opens up new possibilities for community involvement and participation.

Good point about the buffer, but even if at some points in the day the nuclear capacity were exceeded, then the extra FF burn would still be less than it would be without the efficiency of heat pumps.

It's the overall burn which counts within the (nearly) European grid.

I dunno how closely you have been following heat pump technology, Cyril, but it has come a long way.

The expert on this forum is 'Here in Halifax', who likes the Fujitsu units, and the new Eco-cute units which use carbon dioxide are good for very low temperatures where previously you would have needed ground source, and have a much better profile for efficiency right down to around -15C:

http://www.worldofrenewables.com/index.php?do=viewarticle&artid=953&titl...

Paying for insulation and solar thermal would also free up 'virtual' generating capacity.

Water thermal storage (or integrated into the house if it's a new building) is relatively cheap and there's economical benefits to be had from buffering the heat at cheap off-peak rates (which would be mostly nuclear). And of course, with loads of thermal storage, the systems's kW capacity can go down which saves nicely on investment costs. I suppose the technology can be tailored to be extra efficient under bigger delta Ts while being less efficient for lower delta Ts in order to level out or plateau the COP curve. Which would be great for your France plan and great for heat pump economics in general. Is that what these air CO2 heat pumps do?

Er, dunno Cyril! - and since an engineer I ain't, any fiddling around trying to sort out too precisely how they are doing the job is probably a waste of time, but AFAIK they are simply better in their basic efficiency than the older types - but take that with several shovel fulls of salt!

Hopefully you can be persuaded to poke around and give me a better run-down of how the air-=heat pumps do the job now.

It should also be pointed out that France already intends to install 5 million residential solar thermal heaters in the next few years, as well as substantial wind capacity.

I wasn't sure how those CO2 heat pumps work, but found a good reference that explains the benefits:

http://www.r744.com/papers/pdf/pdf_379.pdf

Also mentions the EcoCute design. CO2 has really good thermodynamic properties for heat transfer and compression, and it looks like perhaps more of the expansion energy can be recovered. Which could definately make heat pumps more efficient. They use a different cycle which has some pretty weird characteristics for a heat pump! Like, being more efficient for higher temperatures required for domestic hot water. The idea is that in a passive solar house with superinsulation there's not much need for space heating but there is still need for domestic hot water. And the CO2 system could be more efficient in that case. But for low temperature space heating it appears they are actually less efficient. See the reference for more technical details.

CO2 is also cheap and environmentally friendly. Except when you release billions of tons of it in the atmosphere, Al Gore would say.

Poking around on the Fujitsu website, I couldn't find the CO2 pumps, which are mostly in the development phase it seems. Some specs on a small system with COP of 3.61 for 20 degrees C inside and 7 degrees C outside. Which is pretty good. I don't know if that's a CO2 system. Other modern systems can also get three or four COP with these conditions. The theoretical limit is much higher than that, 4.9 shouldn't be impossible.

http://www.fujitsugeneral.co.nz/includes/builtins/new-compact-floor-cons...

Another one says COP of 3.7 for a bigger commercial system, but they don't say under what temperatures, probably the same as above. And there's no curves! Which is supicious.

http://www.fujitsugeneral.co.nz/includes/builtins/vrf-v-series.pdf

Another company is working on air heat pumps with a COP of 5 to 9:

http://www.kobelco.co.jp/english/environment/2007/1179137_5838.html

They mention water spraying to lower the temperature difference to improve the (cooling) COP under very hot outside temperatures.

You're absolutely right, there is much going on in heat pump development.

AFAIK most Eco-cute pumps are not designed to work in Passivhaus houses, and so may be optimised differently.

The Fujitsu models Here in Halifax was referring to were not CO2models - but just the same do a pretty good job of dealing with Canadian cold:

http://www.theoildrum.com/node/2943#comment-234567

If you search here under 'halifax' and heat pump' or 'Fujitsu' there is a lot more good technical information which you will be able to evaluate far better than I.

On new builds where heat pumps are combined with underfloor heating rather than 20% larger radiators as is normal with a retrofit you will get much better efficiencies - the rough figures I saw from some time ago were 2.5 vs 4.0, but times are moving on.

Thanks, will be looking into it some more later on.