Oil Megaproject Update (July 2008)

Posted by Sam Foucher on July 5, 2008 - 9:23pm in The Oil Drum: Canada

| This is an update on the Wikipedia Oil Megaproject Database maintained by the Oil Megaprojects task force (Ace, Stuart Staniford, myself and many others). The database contains now more than 425 separate entries and is growing everyday. Despite the database growth, the outcome seems to become more pessimistic with time. The derived net new capacity (i.e. once depletion from existing production is included) is around 1 mbpd until 2010 with a jump at 2 mbpd in 2008 after which depletion may dominate. | |

Possible future supply capacity scenario for crude oil and NGL based on the Wikipedia Oil Megaproject database. The resource base post-2002 decline rate is a linearly increasing rate from 0% to 4.5% between 2003 and 2008 then constant at 4.5% afterward. The decline rate for each annual addition is 4.5% after first year.

Below is the evolution of the new supply additions since the beginning of the project compiled by year of first oil:

December 2007 |

January 2008 |

February 2008 |

March 2008 |

May 2008 |

June 2008 |

We can clearly see the initial 2008 and 2009 peaks wearing out with time due mainly to delays. Now the situation does not look so good:

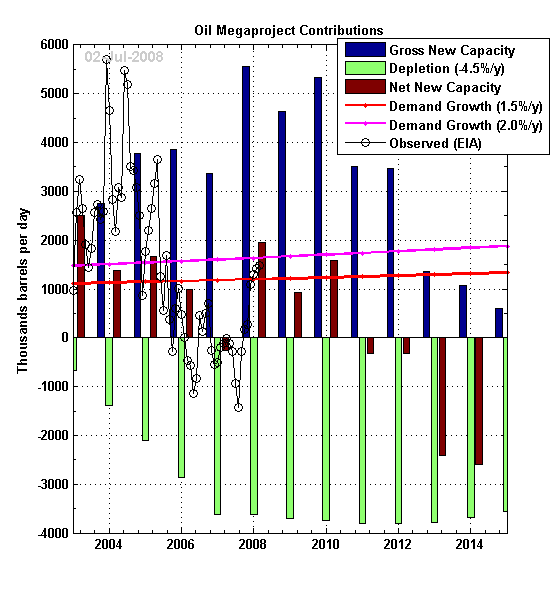

Possible new gross and net new supply additions compiled by year of first oil. Crude oil + NGL monthly production from the EIA. The resource base post-2002 decline is a linearly increasing rate from 0% to 4.5% between 2003 and 2008 then constant at 4,5% afterward. The decline rate for each annual addition is 4.5% after first year.

Below is a possible scenario for future supply assuming a 4.5% decline rate.

Possible future supply scenario for crude oil and NGL based on the Wikipedia Oil Megaproject database. The resource base post-2002 decline is a linearly increasing decline rate from 0% to 4.5% between 2003 and 2008 then constant at 4.5% afterward. The decline rate for each annual addition is 4.5% after first year.

This scenario seems to agree with this recent statement from Ray Leonard:

“By 2010, the production of the fuel that has driven the world’s economy will start to rapidly decline. This will conflict with the steadily increasing demand for oil. The collision of these two trends will lead to shortages and increased prices, providing a strong incentive to shift to alternative fuel resources…Due to unequal distribution through the world of oil and gas supply and consumption, [the upcoming] transition will result in significant shifts in global power and wealth.”Many thanks to Ace who has diligently updated the data and put more than 500 separate contributions.

Finally, maintaining this database is a lot of work and it is crucial to track delays, project final approval, etc., so I'd like to repeat our appeal: the more folks in the TOD community head over to the Wikipage and help, the faster we'll know what's really going on here.

Related stories:

Update on Megaproject Megaproject

Help us List Megaprojects

The IEA raised there estimate of the decline rate in there latest Medium Term Oil Market Report:

http://www.iea.org/Textbase/press/pressdetail.asp?PRESS_REL_ID=267

I also reacted to this info yesterday!

The gloomy part : average decline of 5.2% - up from 4% last year ..

The equivalent to "All global bio-fules gone" - in the span of one year only !

That added 1,2% DECLINE rate "wiped out" almost the entire BIO-FUEL portion of the All-liquids charts .....

When crude oil really starts to decline we will all learn really fast what bio-fuels actually are. (I've seen it already)

I never think of decline rates, only in terms of extraction rates in proportion to the current reserve value. My current Oil Shock Model uses a value of 3.8% for the extraction rate value. The decline rate will only equal the extraction rate if discoveries stop tomorrow.

http://www.theoildrum.com/node/3287

Historically, global extraction rates have been higher than 4%, but during the 1970's we started to get smart and stopped treating oil like water. If that number is going up again, the desperation measures might be starting to kick in.

Throttling back extraction be damned, turning the spigots full-on will create a plateau but then it will drop like a rock.

Here is a hypothetical example of what happens when you throttle up, the plateau can extend, but at a severe price and clearly it can't be sustained.

wht - I understand and share your concern about ramping up production at the cost of a larger future decline rate. But on your left graph, it looks like the 'choice' to scale up production using some sort of EOR circa 1995, keeping a plateau going until 2010, only crosses the 'original' trajectory after 2020. I suspect that almost all oil producers and consumers would be willing to get the upper wedge (above lower line between 1995 and 2020) at a cost of the post 2020 higher depletion....The real question (which I think is unanswerable)is when did this wedge, globally, begin and how close are we to the point where it crosses over on the downside...

Nate, I think you understand that the dates are all hypothetical as I placed them clearly in the past (just want to make sure everyone else realizes this).

And I do so agree that the real question is unanswerable. We may only see the crossover when it is upon us. When I first posted this graph a few years ago, I called it The Overshoot Point. Or TOP for short, as in TOP off the gas tank ... for the last time.

Funny my conclusion was the problem was unanswerable also.

But this does not mean its unbounded.

We have plenty of circumstantial evidence to indicate that we are in the TOP condition.

Exact some conclusion the only thing I disagree with is the drop date at 2020.

We have a host of evidence that the "easy" oil keeping us close to our current production level is exhausted.

Artsy or not the reason that production goes over a cliff is that the oil left to extract gets much harder to extract at high production rates vs remaining reserves.

A perfect extreme is the tar sands.

All you have to do to get the bounds is try and partition the oil into easy to extract group and a hard to extract group. When the easy group is gone production rates drop.

So unsolvable yes unbounded no.

When did we start turning the corner ?

November 2007.

Once you know what to look for then you know its in the past.

And this has absolutely nothing to do with the price of oil in fact

the reason we turned the corner has nothing to do with oil at all.

Since your not into artsy approaches you probably won't figure this one out.

Hi Memmel,

Thank you for taking the time to make this comment and all the other comments where you explain your scenario. Personally I appreciate it especially because I can't really fault your view. It is unfortunate that it is so bleak, I still hope you are wrong but I can't fault your logic.

I would also like to say thank you to all the other core members of theoildrum community that I feel you are at the heart of. Thanks a lot guys for all the good info.

Maybe it is just a phase but personally I am giving up hope on alternatives to oil like solar, wind, and wave (I already gave up on shale/tar awhile ago). Sure these alternatives will provide some power, but I am skeptical that they will allow us to preserve our way of life. (I'm still pro nuclear but I suspect we are running out of time/energy to build new plants).

That led me to look for more radical alternatives, which eventually led me to a device known as the Polywell, you can see a 3 minute video about the potential benefits here:

http://video.google.com/videoplay?docid=8301617273665558256

If anyone is interested I would gladly supply more links, the Polywell wikipedia page has some goods ones. (I realize even this still doesn't solve problems like running out of phosphorous).

Anyway to get to the point manufacturing net power gain products from this technology is expected to take 5-10 years. Do you think we have that long left, or do you think we would have descended into a descending spirals of energy wars by then?

Thanks again for all contributions.

Hello ICouldBeWrong,

I second your thoughts on memmel. One can only appreciate all his due diligence, his powerful insight and his willingness to share same. His contributions have helped my understanding of peak oil and its ramifications enormously.

Re: Dr Bussard. You probably know this but he passed away last October. I'm not sure if his "team" will be able to go forward without him or not.

Dr. Bussard

Hard to get a break these days isn't it?

Thanks for the article Khebab. You and Westexas have done great work.

Don

Thanks.

And on one hand I'm sorry I've not been able to come up with some cool graphs. But the collapse of civilizations is a hard problem that the smartest people around at the time of collapse have been unable to solve time after time after time.

The first mistake they make is that its a solvable problem. I.e collapse can be prevented this is wrong.

It cannot be prevented but once you recognize this it can be controlled.

Collectively we are all going to get a lot poorer as the leverage provided by cheap oil disappears.

Like it or not McMansions and monster SUV's are tangible wealth given cheap oil and in a expensive oil

regime their value goes to zero. This wealth will be lost period it won't be spent on electric rail or on

a fuel efficient car etc.

As you expand this to include other assets who's value is upheld by cheap oil you realize that the US alone will lose trillion and trillions of dollars in paper wealth it makes the underlying cost of oil a small part of the problem. The reason its small is we have leveraged oil deleveraging regardless of if its a planned move to rail a panic move etc will result in a write down of the value of the far flung suburbs strip malls , road and parking lots that cannot be resurfaced etc. Next its a major contraction in the consumer economy as people become more focused on necessities. The world economy will naturally move over time to one driven by its yearly solar energy allotment this economy is only a fraction of our current one.

Thats the big picture problem and no reasonable alternative to oil can solve this problem.

And of course even knowing the right answer if you will that we need to undertake a controlled collapse

of our economy is not really all that useful since people refuse to believe that our only two choices are

controlled collapse or chaotic collapse. This refusal is in effect a vote for chaotic collapse.

If you still don't believe me let me put it this way. Peak oil theorist focusing on production completely missed the concept of export land and its implications we discovered this problem fairly late in the game.

How many other serious situations do we face that are not directly related to oil supply but have a significant impact on oil production and utilization ? How many other "export land" type problems are

lurking ? These are the types of problems which drive the solution chaotic and thus into collapse and

they are almost impossible to predict but require insight to recognize.

We know about a lot of them EROI, fiat currencies, growth economy etc etc.

And I believe I found another one that has a impact just as large as exportland.

Just enumerating the number of external factors that are causing problems as oil supplies decline is impossible and it seems that they are growing exponentially but this is exactly the conclusion I came

too and why you can't solve the problem.

I still have a academic or probably more correct forensic interest in peak oil and its effects.

I'd like to know what actually killed the victim. Are we dead yet ? yep.

Thanks for your reply Memmel!

I fully accept peak oil, Hubbert's 1953 'Nuclear energy and the fossil fuels' paper by itself convinced me. I also accept the export land model that shows exports to the oil consuming nations will peak before production does. Furthermore I find your hypothesis that improved technology that has allowed us to extract fossil fuels at an increased rate means that rather than oil production resembling a normal curve, it could instead resemble a drop off a cliff.

There are other problems too, e.g. with the global financial system. It's not in good shape for reasons discussed by luminaries like Jim Rogers, and Peter Schiff. Basically the financial system was due to collapse and a greater depression begin even without peak oil. Peak oil is simply the 1 ton boulder that has broken the camels back.

So I agree things look extremely bad, and agree we are rapidly running out of time. Maybe we no longer have time to build more nuclear reactors, let alone solar/wind/wave machinery.

Having said that I haven't given up all hope. We need a revolutionary energy production technology, and I've been searching for one. What I've found is the Polywell IEC fusion reactor. This technology is not 'reasonable', Farnsworth and Bussard were not reasonable people, they fought the odds and on Dec 17 2003 they appear to have hit pay dirt achieving fusion.

This technology has the promise of producing energy at 1/1000 the cost of anything we have today. It can run on boron which is the 10th most common element in seawater. So it can run on seawater producing fresh water and virtually free electricity as output. Potentially you can put one on a barge take it to a country like Brazil and produce ethanol from sugar at a cost of less than 35 cents a gallon.

(See around 1 hr 3 minutes into this long video for more info

http://video.google.com/videoplay?docid=1996321846673788606&ei=&hl=en )

Now obviously this is a speculative technology, maybe it won't work. And producing a working (net energy gain) product will take 5-8 years. I'm just wondering, that is my question to you is, do we have that long left or will civilization as we know it have fallen apart be then?

1observer: Thanks for your reply, yes I realize that Bussard has moved on, I'm also aware he got funding and a team together to continue his work before that. Obviously more money and more good people would be a great help.

Sorry I meant to say Hubbert's 1956 'Nuclear energy and the fossil fuels' paper.

Also Farnsworth, the inventor of electronic television, died before Bussard led the Polywell team to achieve fusion on Dec 17 2003. Bussard based his work on Farnsworth and some other people I'm vague on Hirsch, Elmore, Tuck, Watson. There was a publishing embargo for I think 11 years, due to the work being done for the Navy. So heaps of info has come out quickly. Current team is being led by Nebel I think.

I wish them good luck.

Actually fusion is not all that hard to create.

http://www.physorg.com/news10806.html

This one that uses crystals to create the intense electric fields needed is probably a better approach then the fusor. I used to work on the theoretical side of penning-paul traps and given a deep enough of a electric field you probably could generate fusion even with weak magnetic trapping.

I believe that some of the so called cold fusion experiments are actually seeing something similar to the piezo/pyro electric fusors. My best guess is that they might be forming platinum nitrides.

http://www.sciencemag.org/cgi/content/abstract/311/5765/1275?rss=1

Or some other nitrides that then produce intense electric fields. Who knows for sure.

But at least with my work on traps you get a sort of intrinsic understanding of these fields and the energy it takes to make a strong electric field is pretty high and the amount of fusion possible in the small region

is pretty low. The net outcome is chances of break even generation simply because of physical constraints and volume issues is very low in my opinion.

Fission of course occurs naturally and room temperature and we already have nuclear batteries.

http://en.wikipedia.org/wiki/Atomic_battery

With some really neat new ones that use ionization and are much more efficient then the thermonic ones.

http://en.wikipedia.org/wiki/Radioisotope_piezoelectric_generator

With most fusion routs you have to deal with a build up of radioactivity so long term fusion or fission is not as big a gap as most people think. Fusion is not "clean" cleaner than traditional reactors yes but not clean.

Nuclear reactors can be used to generate large quantities of isotopes and indeed we did this with plutonium.

The point is we already have nuclear batteries that can last basically forever. And of course we obviously have nuclear reactors and we can say use induction roadways to power cars. Very small nuclear reactors certainly small enough for a bus or truck and maybe even a car are possible. But fission also suffers from this volume constraint issue. I was once asked why we could not have nuclear bombs the size of a regular stick of dynamite a reasonable question but the answer is really the same as with break even fusion devices.

You need a certain amount of material to get a chain reaction and its actually fairly large.

You probably could generate fission using methods not all that different from a fusor but I can see you reaching break even. Its a cross-section thing and probability thing. Neither fission or fusion scale down it seems past a certain energy threshold thats actually fairly large. I won't say its not impossible but the problem of break even gets very hard past a certain size just like a "dynamite" size fission bomb is almost impossible to create. Your making a really hard problem we have not yet solved orders of magnitude harder with plasmas that small in some cases a few hundred atoms at the high energy state.

Now with all that said I've always felt that we could create much smaller fusion reactors then what we have attempted to create to date. For some reason we tried to go strait to one big enough to power a city. While smaller ones say capable of powering a submarine could have been prototyped much faster.

We kinda looked into this here.

http://www.space.com/missionlaunches/launches/fusion_rockets_000719.html

And doh hmm maybe smaller is better.

http://adsabs.harvard.edu/abs/1985epfr.sympQ....P

More here.

http://fti.neep.wisc.edu/studies?rm=MINIMARS&s=1

Long run they are better and probably will eventually be commercially built but they really don't offer any advantage over using small nuclear reactors which we could build quickly if needed.

But backing up a little bit coal fired plants could be constructed even faster if we really needed the electricity.

Nuclear powered cars with either a fission or fusion plant thats cheap is probably not possible in the short term. Other solutions can produce stationary power and grid electricity. With the nuclear option any grid issues could be rectified easily within a fairly short period of time not to mention expansion of renewable or coal fired plants etc.

The only problem thats solved by desktop fusion is the potential for a "car" power plant.

Unless we have a break through very soon I don't think they will make it in time even if they are feasible.

I went through my own Farnsworth fusor phase myself I think its something everyone goes through that looks at the problem. But if you step back and think a bit about cross-section collision probabilities and energy densities you become a advocate for electric rail and renewable sources of electricity.

Assuming even todays PV cells and Wind energy and a bit of hydro electric generation of enough electricity to power a high tech civilization is readily feasible. Whats missing is good storage systems and thats what I'm actually working on.

I've chosen liquid nitrogen as a storage medium its not got the energy density to really power a car but its perfect for a diffuse network of renewable energy sources.

http://en.wikipedia.org/wiki/Liquid_nitrogen_economy

If your considering load leveling of a electric grid its a really good fit.

CO2 is another possibility either compressed to a liguid or in the form of dry ice.

http://en.wikipedia.org/wiki/Energy_storage

This is the problem we need to solve along with better cheaper PV systems.

Hydroelectric or concentrated solar in the desert can be used for the small amount of high energy sources you need in a well planned electric/ low energy/ high information not high tech economy.

I'd say leave fusion for space rockets we don't actually need it on earth if we design our societies correctly. I'm not agianst it but its really not needed. We are better off living as peers with the rest of the ecology making use of our alloted photons like every other living organism in a sense as energy equals to other dumber forms of life. If we live this way we can be pretty certain we won't overstep our ecological niche and destroy the environment. Remember energy is but one resource we need and all the others are also effectively non-renewable. Coming up with a good small high energy source just means we will hit peak something else in the future. Given our population growth I'd guess it would be peak food.

Energy equality with the ecosystem forces us to solve our population problem which is the real problem we face peak oil is a symptom. So treat the real disease and start living within our means.

Wow what a great reply, I'm impressed.

You write "Actually fusion is not all that hard to create.", I concede not only are you correct, but this is an important point. The Dec 17 2003 fusion was the first fusion by a Polywell system, that's all.

You also write "I'd say leave fusion for space rockets we don't actually need it on earth if we design our societies correctly... We are better off living as peers with the rest of the ecology making use of our alloted photons like every other living organism in a sense as energy equals to other dumber forms of life. If we live this way we can be pretty certain we won't overstep our ecological niche and destroy the environment.... Coming up with a good small high energy source just means we will hit peak something else in the future. Given our population growth I'd guess it would be peak food."

I agree we don't need advanced technology to become happy, I suspect it doesn't even help. Also I agree 'good small high energy sources' could result in unparalleled environmental destruction, loss of life and suffering. Nevertheless, if such devices are built and work they will be used. Those who adapt most quickly will have an advantage over those who are slower to adapt. The genie can't be put back in the bottle.

Regarding the physics, unfortunately I'm no expert but I thank you for the links you have provided and will attempt to respond intelligently to the points your have raised.

You wrote: 'With most fusion routs you have to deal with a build up of radioactivity so long term fusion or fission is not as big a gap as most people think. Fusion is not "clean" cleaner than traditional reactors yes but not clean.'

Bussard designed Polywell devices to run on Boron11 fuel. According to Bussard reactions using this fuel produce only harmless Helium, that's it. The reactions are completely aneutronic, the reactions are radiation free. There can be no 3 mile islands or Chernobyls. This is covered in minutes 5-6 of the long video I linked to above. Or you can read page 3 of this paper http://askmar.com/ConferenceNotes/Should%20Google%20Go%20Nuclear.pdf

Memmel wrote "You probably could generate fission using methods not all that different from a fusor but I can [not] see you reaching break even. Its a cross-section thing and probability thing... I went through my own Farnsworth fusor phase myself I think its something everyone goes through that looks at the problem. But if you step back and think a bit about cross-section collision probabilities and energy densities you become a advocate for electric rail and renewable sources of electricity."

As I understand it cross-section probabilities are mainly a problem for Maxwellian systems like the Tokamak. The Fusor and Polywell systems solve this problem by mimicking fusion in stars. In a star gravitational forces cause particles to combine. In Fusor/Polywell systems a spherical electric field is used to combine fuel particles. Both gravity and electric fields have 1/(r^2) convergence. So rather than a Maxwellian distribution fuel particles are concentrated at the core. See page 5 of the above document.

The main problem with Fusor/Polywell systems is electron containment. In a Polywell magnets are used to contain electrons to create the spherical electric field. I believe that's the problem Bussard spent most time working on.

Memmel wrote: 'The only problem thats solved by desktop fusion is the potential for a "car" power plant.'

Unfortunately currently designed Boron11 fueled Polywell machines are too large to fit in cars. They are about 2.5 meters in diameter, hence the need to produce ethanol from sugar. Given the extreme cost it would seem desirable to avoid migrating the worlds transportation fleet from hydrocarbon based engines to something else (like liquid hydrogen) if we can avoid it.

The current Polywell machines are small in size because they are cheaper to build than full scale (net power gain) machines. Because they were large enough to solve the known physics problems. And I think because even small machines can be used to confirm that power gain scales with the fifth power of the radius of the device.

"backing up a little bit coal fired plants could be constructed even faster if we really needed the electricity...

Both Farnsworth and Bussard suffered from underestimating the work required to build commercially viable machines. Maybe 5-8 years and 250 million will not be enough. Possibly coal fired plants can be used in the interim.

Memmel wrote: "Energy equality with the ecosystem forces us to solve our population problem which is the real problem we face peak oil is a symptom. So treat the real disease and start living within our means."

I'm not willing to agree with you on this point. I'm not convinced that we have reach the carrying capacity of planet earth let alone the universe.

Thanks again for your great comments, and all your time.

No problem I like your responses also. And as you say you can't put the genie back in the bottle.

But I'd respond that if we are not careful we will smash the bottle and shoot the genie.

As far as crossections etc all I can say as showme :)

Like I said I actually worked on Penning Paul traps.

http://en.wikipedia.org/wiki/Penning_trap

A number of variants exist.

I worked on this. In fact this link is too my professor.

http://www.ncbi.nlm.nih.gov/pubmed/9920628

In any case consider mechanically spinning both the electrodes and magnets with the electrodes

and magnets designed to produce a non-linear field say a double well.

This sets up all kinds of secondary fields and compression of the magnetic field lines.

I've never seen anyone spin the piss out of there 10 million dollar traps but its something

I'd love to see done.

So in short yes you can beat thermal cross sections. And I really supect if I'm alive when we

finally develop fusion that at least part of the machine will have a mechanically spinning magnet

or electrode that generates a non-homogeneous rotating field causing plasma oscillations.

Right now these are considered the problem but I think they are the solution the ions are

allowed to "escape" but if you can spin fast enough you capture them with the time varying field.

This paper off the first page is going in that direction.

http://www.ncbi.nlm.nih.gov/pubmed/15446986?ordinalpos=1&itool=EntrezSystem2.PEntrez.Pubmed.Pubmed_ResultsPanel.Pubmed_DiscoveryPanel.Pubmed_Discovery_RA&linkpos=2&log$=relatedarticles&logdbfrom=pubmed

Enough on that I'll get sucked in again :)

The only point I disagree on is carrying capacity of the earth. Here I think we are in overshoot.

Just flying over the US and China shows that we have developed all the best places and a good bit of the marginal lands. Flood plain ecosystems have been destroyed for so long people don't realize it.

Natural rivers in the south used to have huge natural dams called snags that built up along the rivers the riparian environment has been destroyed etc.

What I mean by living within our means is only using a small portion of the best lands say less then 10% so that all the natural ecosystems remain intact and this means leaving many rivers untouched by man all along there route. I don't know exactly the density that we need to be at to support keeping large parts of the worlds ecosystems untouched but its a lot lower than today.

Now since we must always have some high energy sources if we are going to have a technical civilization done correctly fusion could replace the use of hydroelectric altogether and we could rip out all or dams.

But it has to be done at the right time and place and for the right reasons and the right level. We are not ready for another endless power source we screwed up big time with our first one (oil).

So I hope that if we do achieve fusion it won't be for a long time and it will be in a society that wants it to rip out dams.

As far as space goes the more the merrier plenty of room to expand and a society that lives within its means would only lightly touch the planets it settles before moving on to others.

If we had star flight now we would basically be a scourge on the universe. We make locust swarms look benign.

Who knows if aliens exist but if they did I'm sure they would not want use "escaping" :)

Memmel: "As far as crossections etc all I can say as showme :)"

Here is WB6 in a vacuum machine,

In page 14 of the should google go nuclear PDF linked to above, Bussard reports

"On November 9 and 10, 2005 they obtained DD fusion

at about 10 KV, with B fields of 1300 Gauss, in a 30 cm

diameter device. It produced a pulse of DD fusions at

109 fusions/second that was 200,000 times higher then

anything that Hirsch and Farnsworth had ever achieved

in any experiment they had ever done for similar well

depths and drive conditions."

According to emc2fusion.org this "agreed with rate predicted by theory" and "confined electrons as the computer models said it should".

When the funding was cut to the lab they decided to run WB6 with as much power as it could handle, that's how they got the above results. (On the last test run it was broken perhaps a magnet short circuited, they didn't get the results until they were computed a month later).

Now WB7 an improved version of and the same size as WB6 has been built to reproduce and verify the results obtained from WB6. Here it is achieving first plasma in January (a larger image is on emc2fusion.org):

Richard Nebel who is leading this project said "The initial analysis showed that Bussard's data on energy yields were consistent with expectations", according to a report here http://www.dailykos.com/story/2008/1/13/224458/454/929/436375

But I'm not sure that info is accurate, because they were reporting on first plasma, at the time of the report first fusion may not have yet been achieved.

Next they may build WB8 another device similar in scale to WB6 and WB7, but with an alternative (truncated icosahedron) topology which may more efficiently trap electrons. After that if the results are ok if funding can be obtained the plan is to build WB1000. The full scale net power gain model, that is if Bussard's prediction that power gain scales with the 5 power of the radius is correct.

Hopefully Nebel reports more results. But he may have to go under embargo publishing like Bussard.

Maybe fusion will help or maybe it will accelerate peak food and other problems as you suggest. Anyway thanks for the discussion about it, it has helped improve my understanding.

Regarding Penning Paul traps, I will look at the links you have provided. Your suggestion to consider mechanically spinning both the electrodes and magnets sounds interesting, thanks, I will think about it.

Regarding the carrying capacity of the earth, well you could be right. I hope for the best but I can see the logic in planning for the worst.

Memmel: "What I mean by living within our means is only using a small portion of the best lands say less then 10% so that all the natural ecosystems remain intact". This sounds nice but I don't know how it can be achieved in practice it's difficult to get people to practice population control. I could see the planet getting more crowded with cheap power. We might irrigate the deserts and colonize them and also build colonies in the oceans.

Thanks again for the discussion.

I don't know if you have mentioned it in any of your links, but the next reactor is likely to be 100MW:

http://nextbigfuture.com/2008/07/next-bussard-iec-fusion-reactor-could.html

Next Big Future: The next Bussard IEC fusion reactor could be 100MW size producing net energy

Hi Dave!,

I'm not sure if that blog is correct. Perhaps it is a misinterpretation of something Nebel said. I think he said 'We might as well go ahead and build the next one'. Which I would have thought meant WB8. The author of the blog may have jumped the gun thinking it meant the 100MW machine.

If they are going to start work on the 100MW version that would be great. I'm interested in a link to a direct quote by Nebel making that clear.

Another gee whiz technology that will be forgotten in ten years as a curiousity in plasma physics when they finally realize they aren't getting useful energy out of it. Maybe in 100 years something similar will be used for caulatron refining.

So far I've seen no conclusive data from these guys, just press releases to get more grant funding. I'm sure they're not being dishonest and believe in the concept, but I just don't see them overcoming braking radiation losses.

If you accept that global warming is occurring, then by definition we have exceeded the carrying capacity of the Earth.

Refer to our article

The Disconnect Between Oil Reserves and Production

http://www.theoildrum.com/node/3664

I have just updated the graphs there with the new BP data. The group "reserves and production declining" (Fig 6) has now an extraction rate of 9% pa, but a low decline rate year on year of 1.7%. It is important to understand what's going on in this group with a global production share of around 30%

That chart seems to jive with my extraction rate plot, if OPEC is a significant fraction of the overall output. Opec only started to drop around 1980.

Nate said:

I suspect that almost all oil producers and consumers would be willing to get the upper wedge (above lower line between 1995 and 2020) at a cost of the post 2020 higher depletion

Really? Do you not think such a rapid decline rate would ultimately have worse effects, at that cutover point, than the original likely decline? There'd be a larger world population at the time the cliff hits and some economies may be starting to use energy more efficiently, in that longer plateau. They may be starting to switch, a little, to alternatives, only to be hit by that calamitous decline rate. Then gas and coal peaks would follow more quickly than they would otherwise.

Tony

I don't know about Nate, but I do. Without a blatantly obvious signal to TPTB, nothing will change. Maintaining a production plateau for ten years won't encourage them to invest in alternatives etc.

While an extended plateau would buy us time to make a rapid transition (with all the attendent disruptions), no transition will be attempted until final decline sets in (and with a 'cliff' rather than a 'slope', any belated mitigation efforts would be for naught).

My 2.2c (inc GST).

Alan, fyi, "there" in the sentence

means in a non nearby position; the word you want is spelt "their".

Alan must be reading to many of my comments :)

Sometimes I wonder if I'm responsible for the destruction of the English language.

Your stream of conciousness posts are really cool, almost like listening to a Dylan song. Well intuited, if a little hard to follow sometimes. You seem to be trying harder with the grammar and punctuation recently. Don't let that get in the way of your intuition.

BTW--that's "too many" ;-)

Absolutely, if you want to go the arty way, this S.O.C. is OK. But I won't respond any more to his comments on mathematics modeling. I spend far too much time disentangling and discerning the meaning, and not enough getting insight. So don't get upset if I don't respond any longer. I already said I would shut up; this time I mean it.

'Taint destruction, Memm!

I'm a native English speaker (one of the several distinctive Brit flavours), and I revel in the proliferation of hundreds, if not thousands of different flavours of English.

Many are being created right now, as much by fairly fluent speakers for whom English is a foreign language, or a second language learned after the acquisition of their first language, as by the native speakers.

It's a world language. It's got away from its original owners. Anyway, all living languages change constantly, in unpredictable ways, under the constant inventive pressuir of all their current speakers. Great. isn't it! Don't apologise. Go at it with gusto! I love it!

Word.

No no no! If they want our English, they must give us their oil in return. If they don't have oil to give us, they should please stick with another language.

'Taint destruction, Memm!

I'm a native English speaker (one of the several distinctive Brit flavours), and I revel in the proliferation of hundreds, if not thousands of different flavours of English.

Many are being created right now, as much by fairly fluent speakers for whom English is a foreign language, or a second language learned after the acquisition of their first language, as by the native speakers.

It's a world language. It's got away from its original owners. Anyway, all living languages change constantly, in unpredictable ways, under the constant inventive pressuir of all their current speakers. Great. isn't it! Don't apologise. Go at it with gusto! I love it!

Don't mind him. Anyone who would use "spelt" instead of "spelled" has no room to talk! Those Brits, they have a little trouble updatin the language! "At" the weekend... criminy...

;)

But, seriously, chastising a non-native speaker for errors/mistakes in a perfectly understandable sample of text is a little silly. Communication is the object, not accuracy. To wit:

I love cats. Oil is very expensive. The cat, however, is cheap, so cats are obviously better than oil. Also, you can't eat oil in an emergency, but a banana is surely edible.

I rest my case.

Carry on, memmel.

Cheers

PS. I'd say a majority of Americans are dropping the -ly adverb endings. "Come here quick!"

Languages change. C'est la vie!

Thanks my wife is from Taiwan and I'm immersed often in the Chinese language which does not have tenses.

Nothing like a dyslexic American picking up chinglish writing patterns :)

Being dyslexic writing English and falling into Chinese speech patterns is not a good thing.

You get the picture :)

Be glad it's not German so we'd have to wait to the end of any dependent claus for the verb. :)

LOL I must tell a story.

I was in Kuala Lumpur meeting with the guy that bought the Malaysian stock exchange after it crashed.

The guys name was Mohamed something I can't remember he owns most of the banks in South East Asia.

Anyway after the meeting we go to a ultra high class party where yours truly gets a wee bit drunk.

So anyway in this condition I start hitting on this super hot German lady who is the wife of some CEO high muckty muck.

The problem was as I get drunker my southern accent becomes very strong so the lady finally says "Look I speak English I do not know what language your speaking".

Immediately my dream of getting laid evaporates and worse since the only language I know is English or at least I thought I knew I could not even respond.

My friends who where there still remember the event it was funny as hell she was all pissed off and I was doing my best to respond in a drunken southern accent.

The moto of the story is never try to pick up a German women in Malaysia if your from the South and drunk.

memmel :

As someone who is familer with Chinese dialects you will appreciate this. I was learning Cantoneese and at one time tried to tell a Cantoneese speaking women that she was very pretty, she looked at me and walked off in a huff, later a mutual friend spoke to me and asked me why I had insulted her, I said I thought that she "was very pretty" LeY Ho Laan; my friend told me I said "LeY Ho Lan", which means "you are very lazy",

Another motto, be careful when trying to speak Cantoneese especially when saddeled with a wicked severe non-rhotic rural New Hampshire dialect.

LOL

When I was living in Shanghai I asked my wife how to ask our maid if it was raining outside.

My wife is busy so she won't help me remember the mistake but in Mandrian.

I actually asked here exactly the same thing are you very lazy ?

Funny as hell.

Chinese languages have tones of these play on words and they can go one forever they have some very funny comedies based on making mistakes like this esp using people learning Chinese.

You can really get yourself in a lot of trouble :)

I stick to pi-jio which means beer :)

When I was in Vietnam one of the fist things I ask is how you say thank you and beer in the local language.

So I ask my friends how to say beer in Vietnamese.

They say umm beer.

Fell in love with the country right there :)

I know but estimations on the global decline rate have been all around the place for a long time so I have to check what are the new data behind this new estimate.

I've I'm reading MOTMR 2008 presentation right, the revision downwards in incremental supply for 2012 is 2.6 Mbpd, that's c. -28% revision downwards. No wonder they are pushing the alarm button.

Also, it remains worthwhile to notice that even in this scenario, IEA is assuming

As for reasons for decline changes, they said in 2007 the following:

It'll be interesting to see if they have adjusted this position in WEO 2008 or whether they still think it's mostly due to above ground factors.

PS Great work on the Megaprojects work!

I think the IEA will adjust their position in WEO 2008 if they can get third party audited production and reserves data from all of the OPEC countries. However, I doubt that countries like Saudi Arabia, Kuwait, UAE and Iran will provide this data.

If you want a more realistic position by the IEA, chapter 7 of their WEO 1998 is worth reading.

http://www.iea.org/Textbase/publications/free_new_Desc.asp?PUBS_ID=1244

The 1998 WEO is significant because it was published prior to the IEA becoming heavily influenced by the USGS 2000 Petroleum Assessment study which stated that there were huge amounts of oil yet to be discovered.

http://www.oilcrisis.com/laherrere/usgs2000/

A realistic scenario in the WEO 1998 was shown by the chart below. It forecast about 90 mbd total liquids in 2008. There was one part of the chart which was overly optimistic: demand of 130 mbd in 2030 would be satisfied mainly by 90 mbd of unconventional oil and NGLs.

A few modifications to the chart above produces a more realistic chart below. The dashed blue line shows forecast total liquids production. Forecast unconventional oil and NGLs have been reduced and a demand supply gap added. I'm hoping that the IEA will show a chart, similar to the one below, in their WEO 2008, but I remain doubtful.

My total liquids forecast below is similar to the dashed blue line in the modified IEA total liquids forecast above.

click to enlarge

Today on the spot market some crudes were already trading consistently above $150. How does that affect your estimates?

I think right now there are way too many tea leaves to read, and we will just have to hold our breath and see what happens. Hopefully it will turn out that the continual price rises over the past several weeks have been anomalous. If this pace continues, I am not sure how the developed world is going to cope gracefully.

Consider air travel, not an insignificant part of our current way of life. The cost of a jetliner fillup has gone from around $12,000 to something like $22,000 just in the past year. If you are running an airline and you pass that increased cost through to the public, your volume goes down so much that you have to lay off thousands of people, and then you go broke anyway. Or you can just absorb the increased price of fuel and go broke around the same time.

I guess the airlines will have to merge, and cut down on flights, and mothball a lot of equipment. What alternative do they have?

Run your airplanes at higher capacity rates.

Charge higher prices to your passengers.

Lower the prices you pay for the airfield gates.

Lower the salaries of your employees.

Lower the salaries of your executives.

Lower the bonuses of the Board of Directors.

About in that order.

What do you think Reagan did when he broke the Air Controllers Union, also known as PATCO? He had to have fewer flights in the air to offset 1980's higher jet fuel prices with increased passenger capacity factors. He broke the union and spaced airplanes out in the flying patterns using untrained air traffic controllers as an excuse. Cut peak gate capacity in half and enabled the airlines to increase prices by reducing the supply of seats out of airports at peak times used by business travellers.

What else could he do?

The price used in the chart above is "All Countries Spot Price FOB Weighted by Estimated Export Volume (Dollars per Barrel)" which was $131.41/barrel on June 27, 2008.

http://tonto.eia.doe.gov/dnav/pet/xls/pet_pri_wco_k_w.xls

The long run oil price estimates are likely to be in an upward trend. However, in the short term prices may be rangebound.

If there are any serious supply shortages during the next few months, prices of some of the light sweet crudes, Tapis and Minas, could temporarily reach $200/barrel.

The price chart above shows a problematic forecast 4Q2008 supply demand gap of 1.5 mbd. Supply could struggle to meet the increased demand starting in October 2008, driving oil inventories down and pushing prices up.

Nevertheless, at oil prices of $150/barrel, demand destruction is continuing. From the latest June 2008 IEA OMR, OECD demand has been falling since 2005 at 49.7 mbd, 49.3 mbd in 2006, 49.1 mbd in 2007 and is estimated to be 48.6 mbd in 2008. On the other hand, the IEA forecast non-OECD demand to increase from 36.9 mbd in 2007 to 38.1 mbd in 2008.

http://www.oilmarketreport.org/

My recent ‘top-down’ aggregated HL models(unlimited growth unconventional crude oil production model and capacity limited conventional crude oil production model, median URR estimate of 1979 Gb and upper URR estimate at 95% confidence of 2325 Gb) gave me a production plateau within 82-97 mb/d. My estimate of peak liquid production date is within 2nd quarter of 2009 and 3rd quarter of 2011 very close to the prediction of the 'bottom-up' model by Ace.

Khebab,

have you found out the alleged upgrades to the BP Azerbi projects? Steve Levine wrote about it in his blog:

http://oilandglory.com/2008/06/more-on-baku-bluff.html

It is a minor addition and may not increase flow rates, but perhaps worth checking if people have access to full Platt's archive:

https://www.platts.com/Oil/News/8780394.xml?p=Oil/News&sub=Oil&query=BP+...

Can you show me the link for those observed EIA data points?

http://www.eia.doe.gov/ipm/supply.html

Khebab,

For some reason I am perhaps missing, the graph looks a bit off with those observed EIA data points. The plateau looks like its at 81 mbpd yet the data shows the plateau at around 84 mbpd, whats the deal here? Is the Y axis messed up or am I just missing something simple.

Thanks,

Crews

You must add two spreadsheets:

Crude only: http://www.eia.doe.gov/emeu/ipsr/t11d.xls

NGL: http://www.eia.doe.gov/emeu/ipsr/t13.xls

I see,

I was looking at the world data from this.

http://www.eia.doe.gov/emeu/ipsr/t44.xls

I figured it was something like that, I believe this data contains Tar sands and bio-fuels and other stuff that shouldn't be called oil?

Thanks,

Crews

Tar sands are already in t11 as well as condensate.

I was wondering if you had seen this slide, from a recent IEA presentation.

It talks about average delays of 12 to 15 months and 1 mb/d loss due to slippage. Do you have any idea what kind of impact such delays would have on the model? I also notice they are using 5% decline, going forward.

Yeah, Kashagan is the real killer. I saw an MSM report the other day that said they'd be lucky to get 500kb/d by 2011

OTOH Brazil Petrobras was making big noises again today about rolling in oil. Their prez, Gabrelli, seems pretty level-headed tho. He gave several interviews in which he fell just short of saying peak oil. Then, again, they may just be looking for investment $$$.

Reuters today on Kashagan

Scaroni added that he was more optimistic of first oil in 2013 after a deal with the government.

(receding horizons, a work in progress)

It may be even after that, if they don't get pipeline work done. A recent article says:

Taleb would probably say that this is actually Extremistan and not Mediocristan - a single Black Swan like Kashagan can throw a monkey wrench in all sorts of models and projections.

This is a kind of positive feedback that is hard to predict but that could make things worst really quick, I think the rush to drill all over the globe is straining the industry capacity (both human and material). Also commodities are becoming more costly across the board and costs are rising fast potentially scaring investors away, some tar sand projects have been delayed because of that.

I saw that back 3 years ago, wanting to drill in the depleted fields of Ohio: most of the infrastructure was retired and the stuff you could get was much too expensive. Drilling just wasn't worth it like it was in the 70s.

Cheers, Dom

I'm not surprised to see increased cost overruns and time slippage. Nor will I be surprised to see this only worsen in the future. We've already picked all the low hanging fruit, the going only gets tougher from here on out.

Thanks for your work in keeping the megaprojects database up to date. I have two questions:

1. The "New Supply Additions" graphs show new supplies dropping off significantly around 2012. It seems to me that would be expected because of the time horizon for planning projects. For example, no one today is planning projects that will start producing in 2030, but that doesn't mean that no new fields will start producing then. Hence, could we not expect that as we get closer to 2012 and beyond, we'll see an increase in the expected new supply for those years?

2. To me, one of the most convincing (in terms of proving that peak oil is real and imminent) graphs I've seen shows historical oil discoveries over time as a bar graph. How would the recent announced discoveries in Brazil and elsewhere effect that graph? Or are the reserves estimates of recent discoveries too uncertain?

Thanks.

Yes thedean- agreed quite convincing : It's a "killer graph".

It's ugly and disturbing at the same time, going straight down in Bakhtiari land by 2020.

... and NO countries are planning for this graph ! That is the interesting part!

Adding to the excitement : IF the IEA is correct with their NEW underlying decline-rate at -5.2% per year, the whole thing will look even worse.In that case we all must start to pray to Thor and Odin for relieve.

Thanks are hereby directed to : The Oil Megaprojects task force, keep up this important work

Just a note on the increasing decline rate from 4% to 5.2%.

The although most of the large fields are in decline its reasonable to expect most of them to have a fairly stable decline rate for some time. As far as I know the status of most of the large fields has not changed substantially.

Therefore if we continue to see the global decline rate increase I suspect the culprit is that since we have not had replacement of reserves for some time the rapid decline of small fields 10%+ without replacement is starting to effect the total decline rate. We can expect that it will only increase overtime at first until enough of the small fields are no longer making a contribution.

They contribute about 14% or the worlds oil or about 11mbd so we can expect if this is the cause for the decline rate to steadily increase until we are down say 10-15 mbd before moderating and finally reducing. It will keep going up as the smaller fields get further past peak and decline faster and larger fields also begin to decline etc.

Time will tell of course but I don't see increases in global decline rate of this magnitude coming from the worlds large oil fields but from the small ones going in decline without replacement.

Regarding decline rates, I'm hoping most comments on being "surprised" are a bit of hyperbole for those posting them. There has been a lot of discussion about decline rates here and it was my impression that most thought as I did: 4.5% was a minimum, and highly unlikely, number. (After all, it's CERA's!) I'm doubting that even 5.2 is accurate given Russia falling down the other side of the hill.

Color me amazed...

Cheers

All I care about is the first 5-10mpd drop after that I'm 100% post peak lifestyle or more likely during this initial drop.

This first drop is the most important one economically socially etc etc. The rest of the decline really does not matter.

I don't care about pretty curves that tail off in 2030. They are not relevant to me nor or they probably important to most of us.

By the time we are 15mbd down we will be living in a much different world with the chance of it being peaceful minimal.

What we lack is a good short term prediction thats real and fits the past data.

The flood of oil from the megaprojects trumpeted last year turned out to not happen. Decline rates are increasing and oil prices are much higher then I've seen predicted by any model.

Think about it this way over the next 2-3 years a major Hurricane in the Gulf of Mexico is pretty much a given and with the way the situation has unfolded it will have major repercussions. We are right now and for the foreseeable future one major event away from a serious oil crisis.

On the economic side its a train wreck any chance of spending serious money on alternatives such as electric rail are probably gone except for very local projects.

So for me at least its really about making the right decisions over the next year or two more realistic short term models would help.

Bingo!

Lorenzo

What sort of preparations can you make given just a year or two??

Nick (One foot in the Pre-Peak Spend spend spend debt suburban sprawl World of today, one foot in the Chicken sh*t world of tomorrow...)

> eliminate your debt.

> plant a food garden.

> get to know your neighbors. Find common ground and avoid proselytizing about peak oil or doom.

> buy a shotgun and learn to use it. Best is short barrel with a pistol grip.

> get a job or retool for a new job on the non-discretionary side of the economy.

> if you can do it, move to a place where it's not too crowded, there's a good growing season, farmland nearby, a major railroad cloe by, access to green energy, and plenty of good water.

On the "eliminate your debt" entry. How?

I assume you mean run up your debt buying solar panels and disposable razors and then filing BK on the same day your bank fails?

If the end is within 5 years, one would be crazy to accelerate debt repayments. That's like having a death wish but still wearing a bicycle helmet. Better off paying your neighbor 5 cents for each aluminum can. Recycling rates are rising faster than inflation.

Bottom line. I think hiding assets by converting electronic assets into physical assets is the way to go. I mention disposable razors as I see a good barter potential in stuff like that.

I could be wrong, but if the banks collapse, having a high FICO won't be of much value.

I sold my home in California and bought a much less expensive one in Oregon. Not only retired my mortage but all my outstanding credit card debt as well.

Another easy way to eliminate debate is to not run it up in the first place, like charging away on the old credit card. Or, pay off the balance IN TOTAL every month, which is what we do.

Stop buying anything you don't absolutely need. Instead get stuff freecycle. We have an amazing amount of furniture acquired from the streets of Sacramento, absolutely free. It is astonishing just how much stuff is available for free if you just ask and haul it away.

Spend less.

Work more and harder.

Invest with a lot more research work behind the choices.

Then isn't it all the more important to have a good guess on the true decline rate? If we're to mitigate, it's at the beginning that any actions taken will have the greatest effectiveness, no? If serious demand destruction and conservation occurs a la the 80's, that first 5 mb/d could be an extension of plateau and delay of the worst consequences, eh? A decline rate of 6 - 8% virtually guarantees the beginning strong declines within the next 24 months or so, so knowing that rate would be helpful in determining if an individual must take emergency steps or can still risk working towards setting up the ideal situation.

Of course, the cascading failures and feedbacks of oil, financial meltdown, political instability, warmongering and AGW probably make it unlikely that we will avoid serious consequences for much longer.

Cheers

I like your reflections Memmel, you are prolly spot on. The initial plunge will be the mover and shaker, beyond that is planning stage "the what now?"-stage .... A delayed and ad hoc Hirsch-report-phase if you will.

I honestly don't know. My only recommendation is to not hold long term debts. Think like house have little value if the situation becomes unstable. How many loans where taken out for homes in Germany in 1944 ?

Your not going to be able to do things like this.

http://en.wikipedia.org/wiki/Mefo_bills

If mefo bills bear any resemblance to Federal Treasury Notes and T Bills I assure you its a pure coincidence.

Interstates are not the only thing we learned from WWII.

http://www.caribbean360.com/News/Caribbean/Stories/2008/07/03/NEWS000000...

Ehhh?

I think the question is when the financial impact will cause a US credit implosion and major drop in the dollar. I expect that the US will get substantially cut off from buying oil imports. Then the US will have a big drop-off in available oil, whether or not the world does. Some countries may be winners in this process.

When this happens doesn't really depend on a decline in production as much as it does other things--demand outstripping supply; oversight of US financial system; rest of world pulling back from holding dollars.

"I expect that the US will get substantially cut off from buying oil imports."

Thats when we simply move from buying to takeing.

First GREAT JOB AGAIN, Khebab and Ace

Thats when we simply move from buying to takeing.

The amount coming online after 2010... How easy would it have been to drill, pump, and distribute oil in 1942???

If we are considering that the ease of traveling to and working in remote countries will be the same in 2012-2015 as it is now, Well, I just think that is a optimistic assumption.

As Kunstler said "Many glasses on the table will be spilled by people reaching/fighting to get the last ones"

And you thought we were maintaining all these ICBMs because we're afraid of the Russians? Boots on the ground just gets your guys shot up. Sending over a tanker with a note about how they'd better fill it or else - priceless.

Iran stopped working on their nuke in 2003. Word is that they bought some of the suitcase nukes wandering around since 1991 and modified them into basement bombs in our cities.

Basement bombs have no size limits. One per metropolitan area.

They'd since us back a bulk freighter and tell us to fill it with wheat or else. Maybe nuke a metropolitan district or two so we'd know they were serious.

Want to bet Milwaukee?

The one thing that we're not taking into account is the world food market. KSA needs to import their food and while the US retains capacity for exporting food and world markets remain tight, the US will be able to purchase some oil (or perhaps barter for oil). What is going to be interesting is whether KSA or other sovereign-nation funds begin to use their oil profits to purchase US or Brazilian farmland. And if not farmland then companies that directly support agricultural production.

It need not be Brazil or the US. Currently a few middle eastern nations are looking at investing in The Sudan to grow wheat and other crops.

Plenty of farmers available in Egypt if skilled labour required; Egypt has also threatened to bomb Ethiopia if the Nile is dammed at the source. The arab nations have plenty of weapons, men, money and oil to carry such schemes out.

The US will have to export a lot more and consume a lot less. But we still do have productive capacity and farm capacity.

Seems like interest rates will have to skyrocket as Asian cash inflows stop.

Seems also like retirement ages will need to be raised in an emergency fashion.

What I wonder: How adaptive will the political response be? Will President Obama and the Democrats in control of Congress be able to bring themselves to cut back on the welfare state and force people to work longer hours and more years and at more productive work? We need to cut way back on the parasite jobs.

I suspect that the year the world only produces 80 Mbpd is the year the developed world panics. Up to that point, most of the price-induced "demand destruction" will have likely been absorbed by the poor economies of Africa, parts of Asia, the Caribbean, etc. Countries like Nigeria will be coming under intense regional pressure to stop exporting to the developed world in order to provide oil for their regional neighbors. The export-land model becomes even more extreme if it becomes regionalized -- that is, if producing countries satisfy domestic and regional demand first, and export only what remains after that. I'm in a small minority, but I believe that that situation also leads to the beginning of regionalization within the US -- areas with energy resources in excess of their local needs begin to have second thoughts about "exporting" energy to the energy-poor areas. Eg, Wyoming begins to think that perhaps it is in their long-term best interests to use that Powder River coal to keep the lights on in Denver, as opposed to Cleveland.

The countries around Nigeria have not got the economic or military clout to apply any pressure, and even dearer oil will weaken them further.

I suspect that in the coming economic crunch the states like Wyoming which have coal reserves will not worry about anything other than employment.

Hmmm... people here may not be keeping up on their military strategy reading, what with all the energy statistics, and the analysis by Khebab and team (thanks, people!). Try Rupert Smith, "The Utility of Force".

The sound-bite summary (of the part relevant here) is, "Economic and military power is so, like, nineteenth- and twentieth-century."

Small groups operating independently can disrupt static facilities (oil pipes, refineries, wells) for sustained periods of time. They don't need to co-operate, or even to have the same aims.

Gen. Smith describes one historical example of an insurgency being stopped successfully (i.e., with the outcome being a stable, semi-open, West-friendly society.) -- Malaya/Malaysia.

The method? Redistribute property (i.e a permanent source of food and income), and provide education and health-care so the lives of the people are improved to the point where they have a future. That cuts recruitment into "freedom fighter" ideologies.

Not an option for Nigeria, even if its leaders wanted to try. When the decline is well-established, various groups in and around Nigeria may take up the pastime of attacking oil facilities, just to deny others the use of the oil.

Mr. Kunstler (quoted in a post above) put it too weakly. Much "water" will be spilt in order to deny others the use of it, let alone by clumsy attempts to grab it first.

Re Wyoming: agreed. Doing their bit for global warming...

Coal- we got. Oil- we've got some but not much ( 6 mb/month), Uranium we got, Nat gas- we got. Good soil and adequate precipitation to raise food - We don't got. We in Wyoming could just as easily be the energy colony to a much larger region. Most of our soils are too alkaline to do much large scale agriculture owing to being sea bed until the late Cretaceous and low rainfall to leach to garbage out. Not nearly enough river water to irrigate much except right near the Nebraska border. We fight constantly with neighboring states about water allocations (North Platte, Bighorn, Snake and Green). We are the headwaters of three of the four mentioned above but we became a state so late the other states had claim to most of the water before irrigated agriculture could even begin here. We'd better hook up with some region that can produce more than their own share of foods if we in WY are going to keep "sending it (coal-oil-natgas,etc.) on down the line" to the rest of the neighbors.

Could the revised IEA underlying decline-rate at -5.2% per year be influenced by techniques such as the nitrogen injection in the Cantrell field and the horizontal drilling in Saudi. While these boost production for a time the evidence seems to be that sudden unexpected declines eventually set in. Could the effect of these techniques worldwide be one of the reasons for the revised decline rate?

This small fields etc etc. The averaging approaches taken by most of the data modelers on the oildrum and indeed pretty much most of the peak oil community suffer from a syndrome which I don't know the formal name for but have a graphic representation.

On the average all humans have one nut and one tit. This is not a useful average.

You get away with it in modeling oil depletion because 80% plus of the oil is coming from larger fields which have a fairly slow decline rate and initially a slow depletion rate.

However about 20% of our oil production is comming from 5% or less of our stated reserves and thus is being produced at a much higher depletion rate than the averaging approaches can show. This is the deadly if you will failure of these approaches as we hit the peak date. This noise at say a 5% level of production is really critical to our society and is completley missed by traditional approaches.

The short term success of almost all the peak oil models has been dismal at best.

The continued publishing of curves showing peak in 2010-2011 that are continually wrong is of increasingly limited usefulness as details of our oil production over the next 5-10 years become important.

Producing 11mbpd from 3% of your reserves ad a depletion rate close to 20% gives you 5 years before your screwed.

Thats one of the short term problems we face and others exist having nothing to do with oil production that make future production doubtful. Export land shows how world exports are in danger. I've found other issues of similar magnitude starting to happen which make it doubtful we will use a lot of the remaining oil.

I'm hoping that others knowning that we have at least one other problem we are facing now that just as bad as export land will wake up and figure it out.

I'm not going to explain what the problem is unless someone else on the oildrum hits it. Several have gotten amazingly close.

But once you figure it out you realize that in 1980 we not only shot our selves in the head but used a double barreled shot gun and pulled both triggers.

I bring enough doom and gloom to the discussion there are a lot of bright people out there if you can't figure out what we have done then eventually I'll relent and explain after it becomes obvious.

Given all we know now if your not making post peak prep then that your problem knowing that we are certainly toast does not change the issue. And its way way to late to fix.

Hint Please Memmel??

I know a few, but want to really know which one you're thinking of.

John

Try

In the 1980's OPEC's reserves doubled without finding any oil

Ed

edit:http://www.theoildrum.com/node/1586

Back in 2006

See throw something out to the collective and you get things you never thought about.

First wrong answer buut..

I never bought into this OPEC quota thing as the reason for the increases. OPEC is at best a loose federation which has never worked well.

However the right answer explains your answer something in 1980 scared the piss out of OPEC and caused them to claim gobs of oil more then they could ever pump in decades if not 100 years.

The same thing that scared the piss out of them is why we are 100% screwed today.

I don't want to give away the answer because insights like this show I don't think of everything.

Right now for me the site is running very slow and I'm sure what I have said will be lost in the thread.

Email me if you think you have the answer and we can post relavant bits on the board.

As a hint read the above and its Economics 101.

mike.emmel@gmail.com

Arab oil embargo: Oct. 73 - March 74

1980, Iraq Iran conflict

early 80s OPEC reduces output

....> considerable demand destruction,

.....> > decrease in OPEC share or world market, sinks from about 50% to 30% in mid decade (rough)

1990 Gulf War I

Wiki give a timeline from 1980 I see: link

memmel wrote: caused them to claim gobs of oil more then they could ever pump in decades if not 100 years.

In many situations ppl, groups, and nations judge it advantageous to claim they have ‘more’, in store, in reserve, in the bank, in hidden locations, in potential leverage, in future brilliant actions, etc. than they actually do.

The stuff or projected actions in reserve - which only implies it will be available for use in the future - may be physical, monetary, or entirely intangible, such as favors owed, or projected novelty; potential threats; influencing predictions or manipulations of future behavior, possible forward developments, in one way or another.

“We” have money, ppl say, “we” can pay for future bills .., we have goods to sell, we have kudos and contacts, we have control, we will change the future with our X (biofuels, new rock star, better plants, groovy cars, etc.)

Ppl, and groups, position their status, their assets, in the present, with a view to setting the future, by affecting the calcs. made by other parties.. Duh.

I always took the OPEC jump in reserves as being in that line, with the ‘quotas’ in effect being detached from the ‘reserves’, as well as ostensibly justified by them, book keeping tricks to fiddle the numbers and keep everyone temporarily and dubiously happy.

I’m off the mark here, as memmel is referring to something very specific. (?)

No your spot on they are making the claim of more oil as you say because they fear something and they want people to think they have a LOT of oil gobs of oil.

Generally people make these claims because they are afraid of not being able to continue doing some sort of business transaction. Qualify for a debt etc. They don't do it because of fear of some quota from a loose knit cartel with no military power. That was not in your list.

But this is all a result of what happened not a cause.

To expand a bit maybe the situation really started in the 1980's and continued to this day its not one event

but a economic change and its a decision that has ruined our chances for a smooth ending for the oil era.

And its just a stupid simple Econ 101 problem so obvious in hind site that we have missed it.

I did not think about the quota stuff or other things you have mentioned when I realized what we had done

its simpler than that.

The hint is again its Econ 101 and its not oil. Oil is not our problem and running out of oil will not take out our civilization we face a bigger problem that we created.

ok

.

See throw something out to the collective and you get things you never thought about.

First wrong answer buut..

I never bought into this OPEC quota thing as the reason for the increases. OPEC is at best a loose federation which has never worked well.

However the right answer explains your answer something in 1980 scared the piss out of OPEC and caused them to claim gobs of oil more then they could ever pump in decades if not 100 years.

The same thing that scared the piss out of them is why we are 100% screwed today.

I don't want to give away the answer because insights like this show I don't think of everything.

Right now for me the site is running very slow and I'm sure what I have said will be lost in the thread.

Email me if you think you have the answer and we can post relavant bits on the board.

As a hint read the above and its Economics 101.

mike.emmel@gmail.com

Not sure what you are driving at but a couple of things come to mind:

1) Future production of drilling rigs in already committed years in advance, and it will take years just to build the factories to produce drill rigs at an increased rate. So as declines in offshore fields set in and an accelerating number of wells are required for infill drilling to reduce decline rates, we simply will not have the rigs available, or the capacity to produce extra rigs. We will struggle just to replace equipment nearing end of life.

So we will be effectively powerless to slow down decline rates once declines really set in. We won't have the rigs to do anything about it.

I can't really back this up, except to refer to Simmons. I suppose this is a consequence of under-investment during the 80s as we believed oil was super-abundant.

2) Discount rates. When interest rates are high - for example, 20% back in 1980 under Volker - investors will demand a risk-adjusted return on investment of at least 20%. This means that the value of all current income streams is marked down until you get a 20% return on investment. It means that the FUTURE is discounted at a rate of 20% - hardly any projects with a 5-10 year lead time are worth undertaking under those circumstances, because a risky project needs a COMPOUNDED risk-adjusted return of 20-30% to get off the ground.

If you announce that oil is in short supply, and prices are about to rise dramatically, this implies that growth in the world economy is about to stop or go into reverse. It implies that economies based on consumption and cheap energy such as the US and UK will see a drop in consumption, and reduced profits , and unemployment, etc. So it is negative for the stoock market and housing market. And it is negative for credit risk. And the for safe return of funds lent to the US goverment.

So once the end of cheap oil, and the fact of a declining supply, is publicly know, investors should demand a much higher return for lending funds - somewhere north of 15% - to compensate them for the risk of lending in an economy that is likely to be flat or declining in the long term.

Once a 15% return becomes the norm, all stocks, bnds, houses, projects etc must be discounted until returns match or exceed 15%. This implies a catastrophic revaluation of the stock market - down to DIVIDEND Yields of 15% and P/Es of about 7.

It also means that all future infrastructure projects must make sense even when funding costs are 15% or higher. And it means that the future is discounted at 15% or higher.

A project with a 5 year lead time, which then returns income for about 15 years before ending, must produce returns of better than 15% compounded over 20 years including the 5 year dead time.

So if the project costs $1 billion, it must return $16 billion by the time the well runs dry in 20 years just to break even. At least $20 billion to get funding.

So unless the value of the oil produced over the lifetime of the well is 20 times the initial cost of the project, it is never going to happen.

If interests rates go to 20%, the project must return 50 times the initial cost over 20 years in order to break even.

In other words, once you start discounting the future at 20%, there are , for all practical purposes, no long-term projects that make economic sense. None. Zero. Nada. We've already done everything with a 50 to 1 pay-off in the easy oil days.

So there will be no commercial funding for oil projects.

Why would rates go to 15-20%? Because investors realise that the party is over, they have to re-evaluate their understanding of risk and demand returns of that rate of loans because they are lending in a very dangerous economic environment.

Maybe memmel is insuating that the Saudi's saw what 20% interest rates did under Volker and figured that in a situation of permanent shortage those rates would be normal, which would kill the world economy. So they way out was to make oil abundant by opening the taps, and keep people from ever realising that shortgages would one day inevitably return.