DrumBeat: May 3, 2008

Posted by Leanan on May 3, 2008 - 9:15am

David Strahan: Oil is expensive because oil is scarce

The idea that oil companies are somehow 'to blame' for record oil prices and rising fuel costs is seductive but absurd. For all their power and profits, the international oil companies are in fact in trouble. They may still be swimming in cash, but no longer in oil. Despite vast investment in exploration and production, these days they generally fail to replace the oil they produce each year with fresh discoveries, or even to maintain current levels of output. Shell's oil production has been falling for six years, BP's seems to have peaked 2005, and this week even the mighty Exxon was forced to admit its output dropped 10% in the first quarter of the year.None of this should come as a surprise since all the evidence now suggests the world is rapidly approaching "peak oil", the point when global oil production goes into terminal decline for fundamental geological reasons. Annual discovery of oil has been falling for over forty years, and now for every barrel we find we consume three. Oil production is already shrinking in 60 of the world's 98 oil producing countries – including Britain, where output peaked in 1999 and has already plunged by more than half. When an individual country peaks it only matters for that country – Britain became a net importer of oil in 2006 – but when global supply starts to shrink the effects could be ruinous for everybody.

Former Cabinet Members Simulate Oil Crisis

BOSTON -- It's late December 2009.A simulated cable news network reports, "A brazen terrorist attack left dozens dead."

A global oil crisis is triggered in Turkey.

"Apprehension about the damage this will cause to international oil markets is rising rapidly," the news anchor reports.

Terrorists strike with an oil shockwave that sends gas prices up, and the market down.

Shell shuts more Nigerian oil after rebel attack

LAGOS (Reuters) - Royal Dutch Shell shut down more of its production in Nigeria after a fresh militant attack on Saturday on a flowstation in the restive Niger Delta, where local militants have stepped up a campaign of violence.

Big Oil's widening profit gap - Resentful public can't grasp tight refining margins

SAN FRANCISCO (MarketWatch) -- Chevron Corp. reported first-quarter earnings Friday, rounding out results from the top five oil companies operating in the United States. And the verdict is unanimous: They all posted sharply narrower refining margins as a result of skyrocketing crude-oil prices.This hurts. It means they aren't passing down the full cost of higher crude prices to the motoring public.

The Philippines: 'More oil price increases in coming months'

Expect more rounds of oil price increases in the coming weeks as crude cost in the world market has become "unpredictable" and is "rapidly" moving up, an oil giant spokesperson said Saturday."We don’t know about the amount, but it’s almost certain that there will be more increases," Virginia Ruivivar, Petron Corp. spokeswoman, told ANC television.

Bangladesh: High demand, fewer stations cause chaos

The CNG refuelling stations in the capital are struggling to cope with the ever-increasing demand for the fuel as conversion of petroleum-run vehicles continues at a very high pace.On average, about 2,000 vehicles are being converted into CNG-run ones every month, and about 92,135 vehicles were converted in 116 conversion workshops across the country until March this year.

The insufficient CNG stations, which face frequent disruption due to persisting power outage, result in long queues of vehicles, often impeding traffic flow on the surrounding roads.

POORER drivers could be forced off the roads next year as the price of filling up looks likely to cost 14 per cent of average salaries, a damning report has warned.This week the average cost of unleaded petrol hit a UK 20-year high, finally breaching the £5 per gallon mark.

But if motorists think things are bad now, they will be shocked by the gloomy forecast by independent price comparison website uSwitch.com.

With gas prices climbing, Texans fuel up at Pemex

Over the past year Pemex gas station attendant Juan Alvarado has seen a jump in the number of motorists with United States license plates crossing the border the fuel up.As of last year, he estimates that about 30 percent of his clients at the station, located on Calle Sexta in Matamoros, were from the United States. Today, he says that figure sits somewhere between 60 and 70 percent.

Qantas to strike, expect delays

"Our members feel an offer of 3 per cent isn't good enough when inflation is running at 4.2 per cent," said association federal president Paul Cousins.But Qantas CEO Geoff Dixon said: "At a time of record and escalating fuel prices and major disruptions in the industry, Qantas will not move from its stated 3 per cent pay increase and 1 per cent super."

Price of diesel hurting truckers - association

OTTAWA - Transport truck drivers in the region need relief from rising diesel costs, says the executive director of the Atlantic Provinces Trucking Association.Peter Nelson said his group is asking the provincial government to trim tax on diesel by at least a dime a litre.

Despite its limitations, the internal combustion engine won't be pushed aside so easily, but it can be made better.

The Coming War for Earth’s Resources

The subject of natural resources has been in the news for years. The media has long reported that the world’s supply of oil, minerals, fresh water, and lumber are in danger of running out. Yet few take this seriously.As earth’s resources are being depleted, nations are competing for what remains. This is leading to great conflicts. Eventually, the severity of the problem will cause nations to take drastic measures to ensure continued access. It will change the world in which we live!

Are we losing our food sovereignty? Where do we grow from here?

Following a year in which "locavore" was deemed the word of the year by the New Oxford American Dictionary and books about the 100-mile diet and local eating flooded store shelves, Puddicombe wonders if harkening back to the eating habits of old is too little, too late.

Oil Momentum Shaken as Dollar Link Questioned, Eye on Demand

"It's back to demand," said Mark Waggoner, president of Excel Futures in Huntington Beach, Calif. "One of the reasons the dollar is going up is (the belief that) the recession is limited, and if the recession is limited, then demand will stay up for reformulated gasoline."

Investors's Business Daily:

Hugo's all-too-predictable shortages

Economics: The blackout that engulfed most of Venezuela Monday was dismissed as just a technical glitch. But amid the state's takeover of the country's industries, it's not an aberration. It's a signature shortage of socialism.It happened suddenly in Caracas, and across the country at 3:59 p.m. A hydroelectric station somewhere blew out, and along with a failure of a backup system and a jungle fire, the entire electrical grid in the capital and other cities went down. It knocked out the Caracas subway, made cell phones unusable, cut traffic lights, forced hospitals to turn on emergency generators, trapped people for hours in high-rise elevators and left thousands stranded.

In Caracas, thousands waited in cars for hours. Thousands more had to trudge for hours to distant shantytowns up steep hillsides to make it home. In several cities, crime had a field day.

Americans cannot allow oil companies to continue to be fuelish with our future

Is this country ever going to find a scientific way to put efficient energy batteries in cars so we can get away from the dependence on gasoline? I simply cannot believe, given our past history, that it is not possible. History suggests we can meet almost any domestic challenge.

The Oil Conundrum - Excerpts from Gusher of Lies: The Dangerous Delusions of "Energy Independence"

From 1859, when Colonel Drake discovered oil in Pennsylvania, through 1973, the U.S. was the dominant player in the global energy business. For much of that time, America was both the dominant producer and dominant consumer of oil and gas on the planet.That dominance extended into technology, finance, transportation, and refining. When it came to developing oil reserves and getting those reserves into the marketplace, the U.S. had no serious rivals.

Gasoline-tax reprieve: an idea running on empty

The gas-tax break would do nothing about United States dependence on imported oil, or, for that matter, on a limited supply of domestic oil. Contrariwise, it would add to consumption and to global-warming emissions."We are the laughing stock of Europe because we keep [gasoline] taxes so cheap," notes Matthew Simmons, chairman of a Houston-based investment bank for the energy industry, Simmons & Co. International.

“This is something that we should be talking about a lot more,” Obama said. “We are going to be having a lot of conversations this summer about gas prices. And it is a perfect time to start talk about why we don’t’ have better rail service. We are the only advanced country in the world that doesn’t have high speed rail. We just don’t’ have it. And it works on the Northeast corridor. They would rather go from New York to Washington by train than they would by plane. It is a lot more reliable and it is a good way for us to start reducing how much gas we are using. It is a good story to tell.”

Chevron: Follow-Up Appraisal Well for Jack Later in 2008

Chevron Corp. (CVX) said Friday it plans to drill another appraisal well at its Jack and St. Malo prospects in the deepwaters of Gulf of Mexico latter in 2008."One follow-up well for Jack and St. Malo is underway right now...and another a little bit later in the year," said Steve Crowe, Chevron's vice president and chief financial officer, who was addressing analysts during a conference call. "A decision will be made following those evaluations whether or not Jack and St. Malo will be kept as separate projects or conceivably combined."

Car-obsessed America may be hurting from record petrol prices, but one group of backwoodsmen have never had it so good.On the hillsides above Oil City, where the petroleum business was born, small independent producers who could barely survive a few years ago, are rediscovering the meaning of "black gold".

Argentina Protests Oil Exploration in Falklands

The Argentine government presented an "energetic protest" to Britain for offering concessions to explore for oil and natural gas in the waters surrounding the contested Falkland Islands, the foreign ministry said here Thursday.Argentina's attempt to seize control of the British colony in the South Atlantic spurred a brief but bloody war in 1982.

Sri Lanka: Benefit of lower gas prices passed on to consumers

Gas prices in the world market have gone down in February and March 2008 and the Government has granted this relief on the evaluation of the pricing formula agreements aiming to provide gas at lower prices for consumers in May and June, said Trade, Marketing Development, Co-operative and Consumer Services Minister Bandula Gunawardana.

California's Energy Colonialism

Politicians, business titans, academics and environmental activists proudly point to four decades of environmentally conscious public policy – while maintaining a dynamic economy, arguably the eighth-largest on the planet, with a gross state product of more than $1.6 trillion.In truth, the state's energy leadership is a mirage. Decades of environmental policies have made it heavily dependent on other states for power; generated crippling costs; and left the state vulnerable to periodic electricity shortages. Its economic growth has occurred not because of, but despite, those policies.

Brazil, which is second in the region to Venezuela in terms of oil production, now holds 11.8 billion barrels in reserves, or about 1 percent of worldwide capacity. With new finds, Brazil could catapult into the eighth spot globally and give it the political and economic respect it has long sought. It may furthermore cast a shadow over the "peak oil theory" that says such supplies will soon reach a plateau and decline thereafter.

High petrol prices see Americans ditch SUVs

America's love affair with sports utility vehicles (SUVs) and pick-up trucks is finally over.The gas-guzzlers that ply the country's freeways and clog its city streets and parking lots are falling victim to ever-rising petrol prices, rather than concern about the country's oversized carbon footprint. The fall-off in sales is dramatic however.

Fuel busts school districts' budgets

Monroe-Woodbury School District's fuel budget went from $720,000 this year to a proposed $1.2 million next year after the projected cost of fuel went up from $2.40 to $4 a gallon.

PHESBs (Plug-In Hybrid Electric School Buses)

Okay, I am a big (BIG) fan of PHESBs: Plug-in Hybrid Electric School Buses. With all the (welcome) focus on PHECs (Plug-In Hybrid Electric Cars) like the Volt, Prius, and others, the real potential for some gamechanging through fleets of large fleets seem to be falling by the wayside. In fact, school buses offer some quite serious opportunities for breakthrough benefits and merit serious attention. Happily, we are seeing some serious news advancing the possibility of actually seizing these benefits.

Logical Conclusions (review of Kunstler's World Made By Hand)

His social criticism has influenced his fiction before, but never so much as in his latest novel, World Made By Hand, an almost point-by-point fictional translation of the ideas in The Long Emergency. Moving beyond the realm of hypothesis and abstraction, Kunstler here conveys his vision of a post-oil society through a richly descriptive narrative. It’s as if he wrote World Made By Hand in response to what must surely be a question commonly asked by readers of The Long Emergency: What then?

New Zealand: Green Party MP sounds climate change warning

Humanity will enter "a new dark age" if we continue to abuse the environment, Green Party MP Nandor Tanczos told Southland students yesterday.Mr Tanczos, who spoke to students at the Southern Institute of Technology, said climate change, peak oil, drying up metal deposits and reduced food security would see the end of the world as we know it.

Ethical bank offers wind of change for green consumers

You are keen to play your part in tackling climate change and have a bit of money to invest. You are distrustful of some of the big financial institutions but would like to earn a decent return on your cash if possible.If that sounds like you, then you may be interested to hear that Tuesday sees the launch of a public share issue aimed at raising £8.5m to invest in wind farms and other renewable energy projects across the country.

Controlling crops goes against the grain

To describe it as opportunistic doesn't do justice to the Thai Prime Minister's proposal: a rice cartel as food riots erupt over West Africa and the Philippines, another Asean nation, goes begging for supplies.Still, it is nothing new. Eight years ago a similar idea was floated and came to nothing.

Plans for cartels among commodity food producers are made and abandoned with regularity.

‘Perhaps 60% of today’s oil price is pure speculation’

The price of crude oil today is not made according to any traditional relation of supply to demand. It’s controlled by an elaborate financial market system as well as by the four major Anglo-American oil companies. As much as 60% of today’s crude oil price is pure speculation driven by large trader banks and hedge funds. It has nothing to do with the convenient myths of Peak Oil. It has to do with control of oil and its price.

Why Exxon Still Denies Peak Oil

One beauty of British mystery writers like Conan Doyle and early Le Carre is their use of deductive reasoning to relate odd facts and explain reality. Matt Simmons used the same powers to help us understand why major oil companies deny Peak Oil and why they finance groups like Cambridge Energy Research Associates that go around sewing doubt in the public’s mind about Peak Oil (although, as recently reported, their scheme has failed).

The cost of keeping the economy afloat on oil

A two-day stoppage gave Scotland a flavour of what might happen when North Sea supplies run out, and the effects are grave.

Gas prices slip for first time in weeks, may be near top

NEW YORK - Retail gas prices fell slightly Friday — the first time in 18 days they haven't risen to a new record — and analysts say pump prices may be peaking for the year. Oil futures, meanwhile, soared after Turkish airstrikes on Kurdish rebel bases in Iraq injected some supply concerns into the market and the Labor Department's employment report gave investors reason to be optimistic about the economy.

Shell, Repsol aim to leave Iran gas projec

MADRID (Reuters) - Royal Dutch Shell Plc and Spain's Repsol are negotiating with the Iranian government to pull out of a $10 billion natural gas project due in part to U.S. pressure, Spanish newspaper Expansion reported on Saturday.

Nigeria drops treason charges against rebel leader

LAGOS (AFP) - Nigeria has dropped treason charges against one of two accused rebel leaders in the country's main oil producing region, but a bid to have an open trial for the remaining suspect was rejected, their lawyer said.

Oman 2007 budget surplus hits $1.13bn

Oman said on Saturday it had made a budget surplus of RO434.3 million ($1.13 billion) in 2007, wiping out a projected deficit of RO400 million, thanks to windfall oil revenues.Net oil earnings rose by 12.5 per cent to 3.63 billion rials last year while gas income increased 32 per cent to RO811 million, according to the economy ministry's monthly report.

Kidnapped oilman's wife released in Nigeria

LAGOS (AFP) - Nigerian kidnappers on Saturday released the wife of a senior oil executive who was taken hostage in its oil capital of Port Harcourt last month, a company spokesman said.

Gulf cuts some key interest rates as Qatar signals tightening

DUBAI — Gulf Arab oil producers cut some interest rates on Thursday in line with a U.S. move, to ward off currency speculation, while Qatar signalled it could raise its benchmark lending rate as the region grapples with inflation.Dollar pegs in all Gulf states bar Kuwait compel their respective central banks to track the Federal Reserve to maintain the relative value of their currencies, even though inflation is spiralling and their economies are booming.

Oil firms can weather the price storm

Higher oil prices hurt, not just when you are filling up your car. They push up an enormous range of other prices, from chemicals to consumer staples. But the oil firms themselves seem one group that is well able to weather the storm.

Chevron joins other oil companies with gushing profits

San Ramon, Calif. - Astounding profits in the oil industry are becoming as routine as the anguished looks of motorists filling up their gas tanks.Chevron Corp. put yet another exclamation point on the oil patch's long run of prosperity Friday with a first-quarter profit of $5.17 billion, or $2.48 per share. That was up 10 percent from net income of $4.72 billion, or $2.18 per share, last year.

National Express suffers as fewer fly from Stansted

Fears for the state of the UK aviation industry deepened after National Express warned that fewer people are travelling to Stansted, hitherto London's fastest growing airport.

Union highlights aviation job loses

Unite, the biggest union for the UK's aviation industry representing over 70,000 staff, has warned that a significant number of jobs are at risk following a spate of redundancy consultations with airlines. The union said the cutbacks were a clear indication of widespread problems facing the industry.A spokesman for Unite said the recently implemented EU - US 'Open Skies' agreement, consolidation within the sector, competition from low-cost airlines and increasing fuel costs are just some of the factors that are currently putting aviation jobs at risk.

Japan, China to Use CO2 in Oil Extraction Project, Nikkei Says

(Bloomberg) -- Japan and China will cooperate on technology to extract crude oil by injecting carbon dioxide into wells, the Nikkei newspaper reported today.

European rainfall could decline by 20 per cent

Summer rainfall in northern Europe is likely to decline by between 5 and 20 per cent by the end of this century, scientists have said.The prediction by the Meteorological Office's Hadley Centre is the first to give a precise range of predicted rainfall which is expected to be used by insurance companies and flood defence experts.

Because The AntiDoomer has not posted this solution to all our problems - Fly Maggots!

http://www.thebiopod.com/index.html

34% fat for bio-diesel! (and 40% protein for bug burgers!)

Sounds good (and oh so tasty!), but what's the EROEI? :-)

The bug burgers need the fat--otherwise they won't taste as good as the beef burgers they replace.

Yes - a lack of fat is why bug burgers won't be popular. Guess road kill eating bugs won't solve the Peak Oil problem - but a road killed kritter source of motor fuel does close the loop.

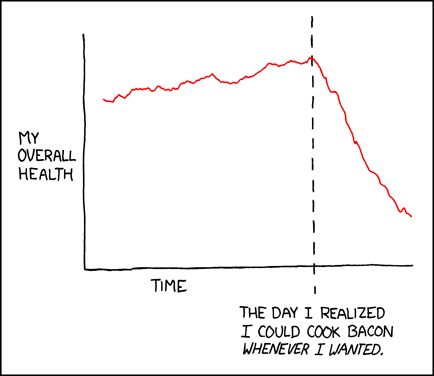

35% fat isn't enough? Good god, man, what is it that you do eat, bacon drippings?

http://imgs.xkcd.com/comics/stove_ownership.png

(and this is what I had planned as as a response)

The impact on prices of oil speculators remains a mystery to me, but why, if these speculators have all this power, do they let the oil prices go down? Conspiracy theory logic would say that they let the prices go down to confuse us.

Speculators don't care whether oil prices go up or down. They can make money going both ways. In fact, they would make the most money by driving it up, and then driving it down. That way they could make money on the way up and then again on the way down.

The key thing to remember about speculators is that they don't buy oil. They buy oil futures. The last thing any speculator wants is to be the proud owner of 1,000 barrels of oil sitting in a tank in Cushing, OK. Somebody has to be willing to buy the actual oil at the actual price. If a speculator pays $120 for oil, and real consumers are only willing to pay $90, the speculator is going to lose a lot of money. This puts a limit on the effect speculators can have. In effect, their contracts get "marked to market" on expiration day. In addition, the "commercial interests" (i.e. non-speculators) dwarf the speculative interests in the number of outstanding oil futures contracts, further limiting the speculative effect.

Prices are ultimately set by supply & demand. Speculators have a limited effect on supply & demand, and what effect they have is opposite to the direction of their speculation (e.g. pushing prices down will tend to increase demand & reduce supply, which limits the downward movement of prices). If speculators could just push up prices at will, the Hunt brothers wouldn't have tried to corner the market in silver back in the 70s, they just would have "speculated" it up. They didn't, because cornering the market directly affects supply, which directly affects price. Speculation doesn't.

Speculation actually serves a number of useful purposes. Besides providing liquidity for commodities markets, it also helps contribute to a sort of cumulative wisdom effect. Everyone, both producers and consumers, needs to know what the future price of a commodity will be.

When a speculator thinks the current price is low relative to where it will be in the future, he goes long (e.g. he speculates that the price is going up). When he thinks the price is too high, he goes short. Each speculator makes that judgement himself, and the cumulative ratio of longs to shorts represents the cumulative wisdom of speculators.

The net effect of the speculation is to push in the direction they are already headed, but to get them there sooner rather than later. This sends an earlier price signal to both producers and consumers and allows them to plan accordingly. This early price signal helps prevent future supply problems. Of course, if the cumulative wisdom is wrong, the majority of speculators are going to get crushed.

Right now, anyone who is not drinking the government/MSM Cool-Aide knows oil prices are too low and should be "speculating" that they are going up. If enough people did this, it would signal to the world that we have a future supply problem, and that would perhaps force us to address it before it was too late. Speculators are a convenient scapegoat for people who don't believe in supply & demand or who are in denial about peak oil.

The key thing to remember about speculators is that they don't buy oil. They buy oil futures. The last thing any speculator wants is to be the proud owner of 1,000 barrels of oil sitting in a tank in Cushing, OK. Somebody has to be willing to buy the actual oil at the actual price.

A few speculators do take the physical delivery. The WSJ had an article a few months ago about Cushing - some traders and financial firms lease oil tanks or tankers.

http://online.wsj.com/article/SB119162309507450611.html?mod=googlenews_wsj

Moe Gamble wrote on tnis topic if speculators influence on price of oil...http://www.theoildrum.com/node/3909#comment-335695

Bottomline or conclusion was:

there is no correlation between numbers of speculator contracts or speculator "herding" or net spec longs and commodity prices

F. William Engdahl is scientific quack, who believes in abiogenic petroleum. He has also revealed his kook leanings in other writings. However, he serves a useful function--which is to provide cover for those who remain totally uninvested in legacy energy, and new energy. Thus, giving us who do invest more time. As always, I want to thank Mr. Engdahl and others like him.

Gregor

The odd thing is that he used to be a peak oiler.

Yes he once was a peak oil believer but that was before he figured out that the earth has a creamy nougat center of oil:

Obviously the man is a complete nut.

Ron Patterson

The abiotic oil theory is irrelevent anyway, since even if it is right the oil produced will not be relaced on a human timescale.

I am actually friendly to abiotic hypotheses. It has been noted, for example, that petroleum-like substances have been produced spontaneously upon the combination of volcanic emissions and oxygen in the air. It is fairly clear that coal comes from biotic material, plant matter, because you can see the imprints of fossilized leaves and so forth in the coal. However, his computations are not irrelevant, since if you compute the amount of plant matter it would take to make, for example, a 17ft coal seam, the conclusions are rather daunting.

There are hypotheses, for example, that some oil deposits have been created during catastrophic events, in which there are huge volcanic eruptions. In some cases, the volcanic gases combine with the air and petroleum falls from the sky, and perhaps sinks into the earth. Normally, this would evaporate or degrade quickly, but during these cataclysmic events, tidal waves wash over the area, putting down a layer of sediment and, ultimately, a layer of dried salt.

As for the coal deposits, there are cataclysmic explanations for these as well. Velikovsky (try Earth in Upheaval) did similar calculations regarding what would be necessary to deposit a sufficient number of tree or plant matter to generate observed coal seams, and then cover it with sediment so that it wouldn't decay by the usual processes. Basically, you need a tidal wave of huge proportions to do it. Although you can burn peat, or just downed wood for that matter, it is difficult to identify a single place in the world today where coal is being created.

Ultimately, however, the question of where it comes from is somewhat irrelevant.

Got any references for this fantasy?

It is certainly possible to make oil abiotically. The question is whether abiotic oil exists naturally in "economically interesting accumulations." The answer to that is no, at least on this planet.

A geologist explains how they know oil is biotic here.

I believe in abiotic helium. And could easily be convinced that comparable quantities of abiotic methane might be found in analogous situations -- which is to say, an extremely tiny fraction of our otherwise biotic reservoirs.

DIYer, all helium is abiotic! Helium is an element therefore there is no such thing as biotic helium. And of course there is abiotic methane. There are oceans of it on Titan and other moons and planets. Most methane on earth however is of biotic origin. Farts are methane and are definitely of biotic origin.

All this has nothing to do with long strings of hydrocarbons. Hydrocarbon strings are of biotic origin unless you can explain how they could be created deep in the earth. Heat breaks down long hydrocarbon strings, it does not build them.

Methane is not a "string" as it has only one carbon atom and four hydrogen atoms. Ethane is a string of two carbon atoms and six hydrogen atoms. The term "string" implies strings of carbon atoms.

Ron Patterson

Like I said, it would be plausible for abiotic methane to exist. In quantities comparable to helium, which is to say a microscopic fraction of otherwise organically grown natural gas.

I didn't recall mentioning polymers.

There are two relevant projections from Abiotic oil. One, is it sounds like we should wait for cataclysmic events to help replenish our our oil inventory. A massive volcano eruption anyone?

The second more germain point is it looks like the volumes produced and our ability to extract those deposits are minuscule in comparison to our exploitation of biotic oil. Abiotic may not even be the little sprinkles on the donut.

Therefore, whether one is right or not is immaterial in the face of the problem, and hence crisis. Thank God for time to edit - here's the long and short of it; Abiotic is a non-sequitur. That's it, move on.

If you find yourself in some remote area with a freakish easy access to some Abiotic oil reserve, more power to you. Now, is this what paid for Jed's "cement pond"??

Bullshit.

".....it is difficult to identify a single place in the world today where coal is being created."

you are mistaken, coal is being "created" in northwest wyoming, along the teton mntn range. and, i might add on an extremely long time scale, subsidence works that way.

now that wasnt so hard, was it ?

oh your behalf, i hope your post was tonge in cheek. otherwise, my recommendation is to keep your postings in a comic book fantacy world where all is cataclismic and conflagurations.

you dont happen to have a geologic theory about the big flood, now do you ?

Gee .. it's the first time I've seen Velikovsky being cited with a straight face for perhaps 30 years. Nice flashback!

Ron,

Anyhow one can 'black box' Engdahl's hypothesis by putting the American Question:

If his idea is so smart, how come he hasn't managed to convince Big Oil, or Small Oil, or Middle-Sized Oil, to invest in it?

For all we know, perhaps they are out there, drilling away ....

10 trillion barrels of oil discovered 10 000 000 leagues under the sea, BP claims ...

Until the enormity of it hit him.

On a similar note I find myself reading jr wakefields posts that contradict GW, praying there's some truth in them.

As devastating as PO will be it truly is nothing compared to Lovelocks assertions.

Lovelock's assertions are just that--assertions. You can try to predict climate change with models, intuition, or ESP--and the models aren't saying what Lovelock is saying. Furthermore, I don't think any period in the paleo record corresponds with the conditions Lovelock describes--even the Carboniferous.

And the data is not saying what the models are saying either. The data is uniformly worse than the IPCC's models. This has happened to every single IPCC report - the data within a year or two obsoletes the entire report.

There was an article in this weeks New Scientist warning against apocolyptic predictions of climate change, since they could damage the credability of the idea. They did say also that all predictions, including the IPCC's are basically guesswork. Far from the data bieng uniformly worse for the last decade the warming has been less than predicted. Infact since the millenium temperitures have been fairly stable.

From the NASA GISS temperature set:

Global Land+Ocean Surface Temperature Anomaly (C) (Base 1951-1980)

End of millenium

1999 0.33

2000 0.33

Most recent annual temperature

2007 0.57

Looks like quite a rapid rate of warming, and on this data is even more rapid than the trend of 0.2C per decade - unless you want to complain about cherry picking data points that is.

Jeremy

Really?

Some more on Global Warming / Cooling / Warming /Cooling /whatever.

http://www.telegraph.co.uk/opinion/main.jhtml?xml=/opinion/2008/05/04/do...

‘’A notable stories of recent months should have been the evidence pouring in from all sides to cast doubts on the idea that the world is inexorably heating up. The proponents of man-made global warming have become so rattled by how the forecasts of their computer models are being contradicted by the data that some are rushing to modify the thesis’’.

‘’The most dramatic evidence, however, emerged last week with an announcement by Nasa's Jet Propulsion Laboratory that an immense slow-cycling movement of water in the Pacific, known as the Pacific Decadal Oscillation (PDO), had unexpectedly shifted into its cool phase, something which only happens every 30 years or so, ultimately affecting climate all over the globe.

Discussion of this on the invaluable Watts Up With That website, run by the US meteorologist Anthony Watts, shows how the alternations of the PDO between warm and cool coincided with each of the major temperature shifts of the 20th century - warming after 1905, cooling after 1946, warming again after 1977 - and how the new shift to a cool phase could have repercussions for decades to come.

It is notable that the German computer predictions published last week by Nature forecast a decade of cooling due to deep-ocean movements in the Atlantic, without taking account of how this may now be reinforced by a similar, even greater movement in the Pacific.

Mr Watts points out that the West coast of the USA might already be experiencing these effects in the recent freezing temperatures that have devastated orchards and vineyards in California, prompting an appeal for disaster relief for growers who fear they may have lost this year's crops’’.

What is not said in your post is that these are regional variations that do not reduce the overall amount of energy being taken in by the planet. Not only that, but these variations are typically balanced. For example, when you have a La Nina (the cold pulse) there is warming in the Western Pacific in the areas of the coasts of China, Korea and Japan.

These shifts may mask the increasing heat for a time, but, just as we often see with oil production curves, a big disruption is usually balanced by a rapid re-balancing later as the "hidden" energy taken into the system presents in ways more obvious to us.

Attenuating all of this may well be the warming of the Arctic. With an 80% mass loss over recent decades and so much of the ice so thin, low minimums in the summer are almost a guarantee. A few winters of exceptional snowfall, a change in wind patterns, etc., may allow the ice to regrow, but it is not looking likely now. If there is another 10 or 20% loss this summer - predicted - it will likely ensure the trend of rapid loss continues to a point where the ice melts every summer. Long-term, the energy absorbed in the Arctic waters will put that energy into the overall system and make a "rebound" in global temps a virtual certainty.

Cheers

PS. Someone else was right above: overall, climate change is more dangerous than PO. I've no doubt we can create sustainable energy systems if properly motivated and with enough time. We have precious little chance of slowing climate change once a key tipping point occurs. (I hope to hell we haven't already...) And, climate change *can* happen in a single decade.

I dont agree.

I think PO can get us a lot harder and faster than GW - Man made or not. (we are still living in an Interglacial. Temperatures and Ice cover will vary)

You seem to have missed my saying, "Overall,..."

My post is accurate. The end of the oil age is not going to end humanity, but Climate Change might. The long-term risk of the latter is far and away greater than that of PO. I generally agree that PO is **probably** the greater short-term risk, but that assumption is a dangerous one. As I sated, and the geological record plainly shows, climate flips of 5C can occur over the period of a decade. Now, over the time span of relatively modern humans - say, 20,000 years - these have all been drops in temperature. The Older and Younger Dryases for example. What we are facing now is the possibility of rises in temperature of 5 or 6 degrees. (For us Americans, this is a LOT of F.) Now, 5 degrees doesn't sound like much, but that's an avg. The highs become some multiple or fraction of a multiple higher than that 5 degrees. (Think temperature tsunami.)

We are not currently designed to live well in temps of 110, 120, etc., degrees F. More importantly, our food plants aren't.

Cheers

Michael Tobis nicely summed this up the other day in his blog:

http://initforthegold.blogspot.com/2008/05/falsifiability-question.html

Thanks, that's a great link. Gotta bookmark that one.

Here is an interesting argue...which argues that even if there is abiotic oil...it doesn't matter.

http://www.fromthewilderness.com/free/ww3/100404_abiotic_oil.shtml

Driven to the Brink

Download the full study here.

That's interesting! Pretty much what one would expect.

While all of the goofy lending practices set the stage, what really upset the apple cart was the rise in gasoline prices and food prices. The cost increases were greatest for those with the longest commutes.

Doesn't the story go...

Rising oil prices cause mortgage defaults for those with the longest commuting distances.

Banks realise they shouldn't have lent these people money in the first place but have all ready sold on the debt as Structured Investment Vehicles (SIVs)on subprime mortgages.

Banks exposed to dodgy SIVs go bust forcing bailouts by the Fed and the UK Treasury.

The dollar (and the pound) slump in value. So the oil price goes up some more...

So there are more mortgage defaults by the people who were not quite as bad as 'subprime' and no doubt whose mortgages have also been parcelled up into 'not quite subprime, but certainly not prime' SIVs whose dodginess has not yet been exposed.

Will we see another wave of banks going down the pan?

I only read the executive summary. Sorry..

Gas prices (and food prices) may have been a contributing factor but the mortgage scams have been brewing since 2005 at least. In any case the upper 10% or more is not affected. The bubble was created/encouraged by some who could make money out of it, short term. Many did, if only for a while. Incorrectly rated debt, sold on, the new bonanza... It is generally accepted that the house owners were ‘pigeons’ (marks or dupes in English), though many made a profit too, the flippers, the savvy, some investors, etc.

Rising prices of property fed the debt bubble, ppl borrowed on the equity, the whole circuit - a kind of Ponzi scheme - went over the top and is slowly crashing in finger-nail biting waves, a sluggish tsunami. Now people look back and find causes here and there, neglecting the allowed corrupt financial practices, not much about that, and taking price of x or y commodity as a sort of ‘reason’. Families became strapped, by ARMs, as everyone knew they would, and who cared, nobody.. and that is it. The price paid for Mexican maids, Iphones, dentistry, operations, new cars (!), cable TV, Barbie dolls, gas, school books, cleaning products, corn meal and rice etc. sank or rose ...of course gas represents some consequent part of the budget.

"Gas prices (and food prices) may have been a contributing factor but the mortgage scams have been brewing since 2005 at least."

Again, PO happened May 05.

And we haven't even seen the first wave of bank failures yet.

Fannie/Freddie bailed out ($1.5 trillion) before Hannukah.

Fannie knowingly took liar loans from CFC.

I thought this observation from the report was intriguing:

In other words, house price declines happened before delinquencies and defaults among subprime borrowers began to shoot up. Here's a speech by Janet L. Yellen, president of the Federal Reserve Bank of San Francisco, in which she makes this point.

There were many factors leading to the decline of housing values -- notably a vastly overbuilt supply. But part of the problem was the location of that supply: In many parts of the country, it was extremely inconvenient distant exurbs that were most susceptible to rising gasoline prices.

yes

As Laurence notes below, the article wasn't about the cause, but about the collapse. The pattern of the problem spreading from the suburbs out to other areas of the industry supports this contention. So, no, PO didn't create the bubble, it helped pop it.

Cheers

The lumber mills were the precursor_

"Stimson Lumber has been on a long slow downhill path since at least 2005 – a steady stream of lay-offs, with excuses offered up by mill representatives that have been accepted de facto by the local media, without any apparent follow-up (or Journalism 101) questions. I see many unanswered questions, I see even more questions that haven’t even been asked, and I can’t understand how it isn’t getting done."

The future is here now. We're just not paying attention to it.

"

$395000 LESS THAN 1/2 PRICE - LUXURY SCOTTSDALE, AZ CONDO

A FORECLOSURE STEAL!!! $455,000 PRICE REDUCTION FROM ORIGINAL PURCHASE PRICE OF $850,000 IN 2006 FOR QUICK SALE! QUALITY UPSCALE, MODERN, 1 BEDROOM (1072 TSF) EXECUTIVE LOFT WITH 24-HOUR SECURITY, FULL-SERVICE CONCIERGE, UNDERGROUND/GATED PARKING AND MANY FINE AMENITIES

http://housingpanic.blogspot.com/

Laurence,

Thanks -- though you've spoilt my plans for the afternoon, since this engrossing study is worth reading from start to finish, twice over. Great graphics too -- the 'visual display of quantitative information' at its best. The maps are also of 'award-winning' design quality. A link like this is worth a thousand comments.

This sounds like South East Florida, South West Florida, perhaps most of FLorida. I believe the tri-county area of Miami-Dade, Broward, and Palm beach are number two by a hair in housing price declien percent (behind Las Vegas).

With the possible exception of Jacksonville and Tampa - mebbe Orlando - there isn't a proper central city to be found althogh even for them the publci transporation is abysmal.

I used to put 100-200 miles A DAY in a car as a technical computer sales support person in South East Florida. We coudl easly do call from South Miami to Boca Raton in the same day.

Now I tele-commute for at a different job.

Pete

there isn't a proper central city to be found

There is in Miami.

And a decent "Subway in the Sky" is under expansion.

http://www.miamidade.gov/citt//RailMap.htm

Blue open. Red under construction. Orange in advanced planning (delayed by GWB, could have started construction), and Green in preliminary planning. Light brown was going to be after 2014. Now after 2017 (see GWB). 90% of Dade County population within 2 miles of a station.

Alan

I suppose you are correct. Good thing the MetroRail is elevated for when the rising sea comes.

Personally I avoid Miami as much as possible.

FYI - here's a bit more recent on the light rail in Ft. Lauderdale.

http://www.sun-sentinel.com/news/columnists/sfl-flbmayocol0501sbmay01,0,...

On a somewhat unrelated note lots of fuel will be "saved" this weekend as the 13 year running Ft. Lauderdale Air and Sea Show sill NOT be held. It had been held during Fleet Week, this week, with the USN in at Port Everglades. McDonald's backed out after last year and no one else wanted to pony up $3.5M+ to play.

Pete

Personally, I would suggest (with limited local knowledge), extending the "Orange Line" north into Broward County on University (perhaps swing over to SW 72nd & SW 64th @ North Perry Airport) and then turning it East just south of I-595 (on Griffen, last major surface street before I-595) to the Ft. Lauderdale Airport, FEC RR ROW and the sea.

There loop south on FEC RR ROW to downtown Miami.

Then either feed this "U" with more Elevated Rapid Rail (North on FEC RR ROW near sea ?, East on Griffen ?), Light Rail, Streetcars and/or buses.

Stage I - just extend Miami MetroRail 2.x miles north on University to North Perry General Aviation airport. Shut down airport and redevelop as TOD. Ground floor shopping, upper floors residential or office.

Racehorse course at end of line in Dade County will be slammed by Ft. Lauderdale commuters (IMHO). Move that focal point 2.x miles into Broward County and use the traffic counts to justify further extension.

Urban Rail works best as systems, not isolated lines. Miami is well along to creating a system. It makes much more sense for Broward County to plug into a viable system than to re-invent the wheel and start from scratch just north of what can become a first class Urban Rail System.

Development will follow access to Non-Oil Transportation post-Peak Oil (it already does).

Best Hopes for Regional Co-operation,

Alan

As I mentioned in a response the other day...you know the area almost and in some ways better than I do - me being a REAL NATIVE (58 years old) of Miami but living about 50 miles NW in NW Broward County - not quite the exburbs, but close.

Here's the REAL rub: -> "Regional Co-operation,"

Thanks,

Pete

Yes, regional co-operation is a MAJOR issue. Miami has a 3/4 mile head start and they are "different" than Ft. Lauderdale/ Broward County. With Tri-Rail (commuter train) all three counties were more or less equal, but not with Metro-Rail.

None the less, IMHO, any independent start of Urban Rail in Broward will take an extremely long time to get up and running and it will never be more than Light Rail (slower, lower capacity, surface running).

OTOH, attaching an upside down "U" to the Miami system will add ridership both ways (Broward > Dade & Dade > Broward) as well as travel within Broward. And create a high speed, high capacity spine to which lower volume feeders can be added. And the volumes might justify (post-Peak Oil) further expansion of elevated Rapid Rail (say north along the coast on the FEC RR ROW).

IMHO, Stage 1 is a no-brainer. Even if all Broward builds after that 2.x mile Metro-Rail spur is Light Rail, it is better to have the northern terminus inside Broward County and, post-Peak Oil, there will be less need for general aviation airports. A 536 acre TOD development @ North Perry Airport, right next to Broward Community College.

BTW, I expect terrible traffic jams at the currently planned northern terminus at the racehorse track. Florida Turnpike exits plus University traffic plus ...

It is bad today without adding 4,000 or so Park & Riders (maybe 10,000 with gas @ $7/gallon).

A short northward extension would spread that Park & Ride load out considerably, and attract more riders. An 80 to 120 acre office park at North Perry Airport could attract commuters and businesses from Miami, so it would work both ways.

I have an "eye" for such things, and was looking closely when I visited the areas in 2004 to speak at APTA.

Best Hopes for Common Sense over Parochial Considerations,

Alan Drake

Related. Sorta. The other side.

Here is a map (the only one afaik) of all streets (roads) in the US. 26 million of them.

http://benfry.com/allstreets/

explanations about creation here:

http://benfry.com/writing/archives/54

I commuted from South Miami up Dixie Highway (U.S. 1) to work in North Miami in the early 70's. Traffic was hell even then.

I also live in the land of the Blue Hairs and Red Hats....So what's the problem? 25% of Fl will be under water within 20 years, the spread of the Chinese Hoof and Mouth Virus will get a great many, and the rest will be swept away from the Cat5 H that is rolling in. Housing will be back in a few short years so just wait and jump back in then..

I telecommute to Mars for work....Remember to always wear the Tin Foil.

BZ

Seems To Me,

That this study only affirms what James Kunstler and Westexas having been saying steadily for several years.

That being that the outlying suburbs will decline in popularity and eventually whither as the economic worth of mis-allocated resources approaches scrap value.

The days of the "Happy Motoring Lifestyle" do indeed appear numbered.

Airlines slow down in the skies to save millions

What I would like to know is how far airlines can extend this principle. One to two minutes is nothing, after all. Suppose they altered their schedules so as to slow their speeds down to two-thirds of what they are now, let's say (so that e.g. a flight that takes four hours now takes six instead). Is such a drastic speed reduction technically feasible? And if so, how much fuel would it save them?

I would certainly be thinking along these sorts of lines if I were an airline executive.

The wings are the determining factor. They are designed to operate efficiently within a a certain range.

Winglets are saving 3+% (despite extra weight). 6% in some cases.

Southwest would be well advised to start ordering larger 737-800s and reduce frequencies on busy routes. 737-800s h

ave better fuel economy per seat-mile than SW 737-700s. Also retire existing old 737-300s and -500s from fleet "ahead of schedule". Not as efficient as modern 737-700s (or 737-800s).

$42 million is a triviality in SW's multi-billion fuel bill. Good that they are taking that small step.

One little known fact is that Boeing wings are optimized for cruise (and fly faster & higher than Airbus wings) but pay a penalty in climb. Airbus has a hybrid wing, optimized for nothing, but with less of a climb penalty.

Going high (thin air) is more important that going slow in most cases. High, straight and slow is best. Improved Air Traffic Control could certainly help fuel economy. Allow aircraft to fly straight and high (and slow).

Alan

You beat me to it. It's in the wings mostly, and of course parasitic drag as well. Angle of attack is airspeed. At slow airspeeds, high angles of attack, the vast majority of your drag is going to be induced drag...that is, drag created by the creation of lift. At slow airspeeds the parasitic drag (what you normally consider drag) is going to be lower. At high airspeeds (cruise), you'll be at a lower angle of attack and the drag will shift from predominantly induced, to a majority coming from parasitic drag.

At the extreme end, there's something called "flying behind the power curve" whereby if you slow down enough (and it's usually not much), you wind up having to put in MORE power to maintain level flight than if you were flying FASTER. You wind up going slower AND burning more fuel.

So, there's a certain point where Induced Drag and Parasitic Drag intersect and that's where you'll find the most efficient cruise.

Wing aspect ratio (span/chord), loading, NACA profile, and planform come into play to determine the size and speed range of the drag bucket.

A number of years ago Boeing, along with Ilan Kroo came up with the concept of the Boeing C-wing, based upon a non-planar spanwise constrained efficiency model. It's been called the "Klingon Battlecruiser" because of it's strange look and the canard on the front. The C-wing is stable by itself, though, without the canard (the rear winglet-lets are downpush like the regular tail) so it doesn't need to use a reflexed airfoil like a normal flying wing (large induced drag penalty at high AoA) and approximates the spanwise efficiency of a box-plane.

Uh, your first paragraph is not correct, IMHO.

For level flight, Lift (L) is a constant, that is, L equals the total weight of the plane with passengers, fuel and baggage. The faster the plane is traveling, the less angle of attack is required to maintain the required lift at a particular altitude. The idea is to hit a "sweet spot" where the aircraft is operating with minimum drag, thus it's desirable to optimize the L/D curve for some specific cruise speed. That will minimize the induced drag. The parasitic drag for the entire craft is a function of density and airspeed, thus, flying higher at low density reduces that component. Flying much slower may shift the L/D away from the best value, but would also reduce that parasitic drag.

Another aspect is that the engines are also optimized for a specific cruise speed and altitude. Moving away from that design point would also result in less efficient engine operation.

E. Swanson

It's right, but admittedly poorly worded. I tried to stay away from the term "L/D" because it's a bit odd to people. Anywho, the best way of putting it I suppose is thinking of it in terms of a teeter-totter...on one side is the induced drag from the wings (higher during climb, slow speed (high AoA)) and on the other is parasitic drag which increases with speed. So considering the whole of the plane you're left wanting to increase the speed to reduce the induced drag, and decrease the speed to minimize parasitic drag. Somewhere in the middle is a sweet spot where reducing speed will increase fuel consumption, and increasing speed will increase fuel consumption.

Substrate, you seem to understand the issues. I had thought from my earlier days (I once took a fluid dynamics class) that there was some sort of absolute limit of lift/drag. Assuming you are at that limit, and you need enough lift to counteract gravity, your drag is then fixed, and baring headwind/tailwind drag implies needed power per mile. But modern airliners are in a flow regime that is referred to as "transonic", which doesn't mean that the plane is supersonic -but the airflow which is speeded up in some portions of the air surrounding the plane is effectively supersonic -and can presumably lose extra energy due to that. Is that correct? Perhaps that provides some scope for cutting drag via slowing down. How big an effect, if they try to reach optimum fuel consumption?

Later on, if the plane was redesigned for passenger miles per gallon, the plane wouldn't need be as strong, since it is designed for lower speeds, and the engine could be smaller as well. So the question is how much savings is possible?

There's pretty much a practical limit to L/D and I think that's exemplified by a sailplane called the "eta". It has a 101 foot wingspan, aspect ratio of 51, and a glide ratio (L/D) of 70 to 1. If you saw a picture of it, you'd realize how rediculous it was. A lot of glass sailplanes are in the 40:1 and something like the old Schweizer metal planes (non-laminar airfoils) can be from low 20's to low 30's. IIRC, the Gimli Glider, a 767-200 showed a glide ratio of about 12-15:1 (glide ratio and L/D are equivalent).

You're right about operating in transonic conditions, but unfortunately I haven't much of a clue about it. Because the freestream velocity is so near the speed of sound the flow over the wings can exceed the speed of sound and cause something called shock drag or wave drag and there are airfoils designed for those conditions and Reynolds numbers called "supercritical." It's probably also why most of those airliners use a Delta planform, or swept back wings. Most of these fancy foils are usually lower Clmax and climb performance can suffer - I'm not sure about the supercriticals. Most of what I know I gathered while working on designing an ultralight sailplane, so I kind of bypassed all of the high-speed hijinks and concentrated more on slow-speed, low min-sink, high L/D design specifics.

For some examples of interesting and efficient aircraft you should take a look at Strojnik's "Laminar Magic" and Rutan's original Quickie.

Which pretty much means that trans-continental or inter-continental flights are about the only ones that really make much sense and that we're likely to continue to have available for very much longer.

Perhaps. What sort of airline and infrastructure would that support? For anything less than continental, one needs to spend much time getting to the airline. And if the systems are good for that, then the airline is less and less necessary. Intercontinental might be a different story. I can imagine a whole pile of flag carriers eating the expenses to keep the tourist industries happy. For a while.

cfm in Gray, ME

Today, rail gets a small modal share for trips over 500 miles (800 km) even with the best high speed rail lines.

Overnight trains (with sleepers, lounge cars and diners) are less efficient than day trip trains.

I can see trips from New Orleans to Chicago (825 miles by air) having some taking a 110 mph train (figure 10 hours with stops and not straight-line) but most flying, even if the cost is greater. Many fewer traveling though.

Best Hopes for Efficiency,

'

Alan

What we're probably talking about here are a number of regional air hubs, but with rail constituting the spokes. Air travel would be from hub to hub only. It would also be possible to travel longer distances by rail, through a series of hops from hub to spoke to spoke to hub and so on; much slower, but maybe a bit less expensive and thus the option for those with more time than money.

Yes, that is what is developing in Europe and what I predicted in USA 2034.

However, large population centers will continue to get some air service, even if they are close to other hubs.

Philadelphia is close to NYC & DC, but will get some air service regardless.

Best Hopes for Regional Rail,

Alan

One-world offers an interactive map of world flights.

It's a little hard to use.

Note how the main departure + destination points are in a narrow ‘west’ world band, those who dominate and have constructed the infrastructure and can maintain it, and can afford to buy /make planes, buy jet fuel, because their customers will stump up.

http://www.oneworld.com/ow/flight-info/where-we-fly

Exactly. The initial climb is a small proportion of the total flight time on long-haul flights. And if short-haul traffic drops, long-haul flights won't have to spend much time circling at their destination either.

What I can see in the near term is some airlines changing to turbo-prop or even piston engines for regional trips. I've heard one airline here in Canada is already doing that. Buy stock in Bombardier!

Pretty far... Arguably, if Southwest had just held onto its oil hedges and kept its planes parked on the ground, it would have made a better profit.

(I may be wrong about this - does someone have the actual numbers to refute or confirm? Still, I recall wondering whether Southwest is, at this point, an airline which hedges fuel or a hedge fund with some airplanes.)

Simplistic calculations compare the fuel hedge profit vs. reported profits and if hedges are greater make such claims.

Untrue.

Reported profits are after income taxes. If there were no fuel hedges, lower profits would have reduced income taxes paid as well as after tax income.

AFAIK, SW would have been close to breaking even without fuel hedges. But since planes continue to depreciate regardless, gate rentals are due, etc., not flying would have meant massive losses.

SW has pricing power, and they can adjust fares (within reasonable ranges) to generate the profit level that they want.

Best Hopes for SouthWest,

Alan

More from the same article:

That meant flying at an average speed of 532 miles per hour, down from the usual 542 m.p.h.

Northwest normally uses huge planes for those flights, so let's guess 500 passengers, a 15% error wouldn't matter much. At 8 minutes each, they spent an extra 4000 minutes, or 67 hours, between them, "enjoying" the miserable conditions that prevail on that sort of flight. The airline "saved" $535, so by dividing we can estimate that the airline valued the passengers' time at $8 per hour. And that's a serious overestimate because I didn't deduct what the airline paid the flight crew and accrued in aircraft flight time and wear-and-tear for those 8 minutes. Had I done so, the "saving" may well have been zero or negative.

Not that it matters. In any case, now we know why air travel has become so miserable. The airlines have such awesome market power that they can charge you north of $150/hour for even the most cramped, awful seat, and yet they can get away with valuing your time at essentially zero. With all that market power in their hands, you've gotta wonder why they can't raise fares instead of constantly yammering for subsidies...

I have a question. I've been following TOD for a while, and so am pretty familiar with the PO issues and enjoy dealing with the various challenges that come up when discussing it. But one argument I don't have a quick reply for is the old story about the supposed patented designs that were bought up and/or locked up by the oil/auto company consortia. Everyone seems to know someone who had an uncle who drove a Chevy for a while that got fantastic mileage because it accidentally escaped into the wild with a special patented carburetor. Or some such thing. So the theory goes that if/when either internal financial or external government pressures forced these solutions into the marketplace, they would/will greatly alleviate our problem. The whole issue to me is a dead end anyway, but I would like some numbers or data to use in dismissing it, the same way that one can dismiss the ANWR reserves by showing how quickly they would be used up if we actually did access them.

I read here recently that a contemporary ICE is 20-30% efficient, and presumably most of the waste is in the form of heat. Any figures on what the efficiency would be with a theoretically perfect carburetor (or fuel injection)? Modern engines are better aspirated (more valves), but with theoretically perfect combustion, what would the efficiency be? Isn't the combustion itself already close to perfect? What about internal friction? And losses inherent to the reciprocating mass? How much loss due to unrecoverable combustion heat alone? Presumably the only practical way to release energy from oil is via combustion, and so the challenge is to burn completely and then completely harness the heat energy thus released.

But even with an ideal power plant (oil to mechanical energy converter) it looks like we would “only” quadruple our mileage and still run out of oil eventually. My own vision is for a combination of electric rail, electric cars and bikes, and old-fashioned biking and walking, with the electricity coming from renewables (hydro, wind, solar). I know; good luck ramping up with all that. But it's a direction to go in, and I do believe our energy solutions will of necessity trend toward smaller scale, more localized, and more optimized for specific needs and applications. Along with greater conservation and efficiency. Thanks in advance for any feedback, and special thanks to Leanan and to all the staff and regular contributors who make this an excellent forum.

Walt

Efficicency in an ic is related more to the temperature of the burnt gases at the beginning of the power stroke and the temperature at the end of that stroke. That is related more to the expansion or compression ratio than anything else.Hence diesels get better efficiencies than gasoline engines. The carnot cycle sets the theoretical upper limit. To be more "efficient" the waste heat needs to be used for something.

Back in the piston engine era of the US military services, the ultimate radial engine was the turbo compound Wright R-3360. It powered the Navy's old Douglas AD Skyraider. For efficiency it used exhaust gas turbines which were mechanically linked to the crankshaft thru a gearbox. I wonder why that hasn't been done in the automotive field?

I wonder why that hasn't been done in the automotive field?

1) You tax dollars do not pay for your car. Warbirds are cost +.

2) Cars do not have limited fuel then fall from sky. Anything that could expand warbirds capacity would be added.

3) Gas has been cheap, so why improve?

Walt, Randy is correct, the waste energy is lost in the form of heat. If gasoline is burned then you get heat and no carburetor can alter that fact no matter how good. The carburetor just mixes gas and air and the optimum mixture will only give you the best mileage, it can do nothing about the energy lost as heat.

But basically people who make these claims about carburetors who will get 100 mpg or cars that run on water instead of gasoline are idiots. These people should be ignored, not argued with.

Ron Patterson

But basically people who make these claims about carburetors who will get 100 mpg or cars that run on water instead of gasoline are idiots. These people should be ignored, not argued with.

So idiot postions should be allowed to stand VS challenged?

I'd much rather see the challenge. Management may, however, not agree.

Eric,

Sorry, but Darwinian is correct. Life is too short to waste on the tinfoil hat brigade -- the flat-earthers and perpetual motion wackos. The silent treatment is only effective method of dealing with them.

Of course there is a 'grey area' (ideas that sound wacko but just might contain some nugget of truth) , but the combustion engine conspiracy theorists certainly don't belong there.

And yet you were posting on Abiotic oil.

If you want to get more out of the fuel burned in an IC, you have to use the heat in the exhaust gas to produce more work. There's actually a lot there and the temperature is fairly high (like 600 C or more at the catalytic converter), so it's theoretically possible to convert most of it to work, but it could be expensive. Maybe a counter-flow heat exchanger and a steam turbine add-on to a make a 60% efficient combined-cycle car?

Maybe a counter-flow heat exchanger and a steam turbine add-on to a make a 60% efficient combined-cycle car?

Thus adding to the weight - a water tank for the steam.

The stirling engine or Thermocouple Power would seem to make more sense and has been suggested.

There have supposedly been some materials science breakthroughs that will allow better thermoelectric generators. You might be acquainted with thermoelectric generators (run in reverse for cooling) if you have one of those plug in car drink coolers. They claim these would be useful for just that application -generating electric power from automotive exhaust. I have never seen any numbers for what sort of efficiency they might be, but they could certainly give a good efficiency boost for most hybrid vehicles.

Walt - If there ever were any such "patented" inventions that then got bought up and put on the shelf: (1)patents are generally public and can be viewed; and (2) patent lives I believe are only for 17 years. So, unless the uncle with the Chevy just had it happen, the patent is now in the public domain. And, if the item was never patented, well then "anyone" who can come up with any such item would become overnight the richest person in the world (or richest corporation) by licensing the product for royalties. But, unfortunately, facts never sell, but patently stupid conspiracy theories thrive. Which tells you a lot about the human race as a whole.

Please can somebody explain to me, in simple layman's terms, how speculation can cause 60% of today's oil price?

http://www.globalresearch.ca/index.php?context=va&aid=8878

I don't understand this at all.

Surely, futures trading is pure gambling? Just because I back a horse to win doesn't mean it will win. Or is the speculation they talk about not futures trading?

In order for speculation to affect the price actually paid wouldn't the oil have to be delivered and the oil have to be stored above ground forever? ... and wouldn't this amount have to increase month after month and be a large percent of consumption?

What am I missing?

Xeroid, the man is either a fool or a liar, perhaps both because he states:

This is simply not true. According to the EIA's This Week in Petroleum US inventories are in the lower half of their five year range and about 15 million barrels below where they were at this date last year.

OECD inventories, according to IEA's Oil Market Report fell 48.9 million barrels in February but stand at about the same point as last December. Checking back through the archives I found that OECD inventory levels, though fluctuating up and down, have remained pretty steady for over a year, though dropping slightly.

To say that inventories are now higher than any time in the last eight years is just a flat out lie.

Ron Patterson

Thanks Ron,

We both know how to analyse the oil data, and I agree with you.

But are my basic assumptions correct with regards to rising oil prices and speculation?

Is it me (who thinks it is a 'free market' operating with limited supply) who doesn't understand or all these commentators saying the cause is speculation - or are we both wrong to some extent?

Xeroid, your basic assumptions are correct the rising price of oil was caused by an imbalance between supply and demand. This story about "speculators" and "hedge funds" have been around since 2004. Michale Lynch was one of the first to make this claim. He has been wrong with every oil price prediction he has made since then. He has been wrong because his predictions have been made on wrong assumptions.

But at least Jim Cramer gets it: Oil's Spike Starts in the Ground, Not in the Dollar

The rest of the article is behind a pay wall so no need to go there. But I can probably finish it. ...but they do not buy crude oil futures. Cramer is saying that even the Wall Street Journal has it wrong, speculators or hedge funds cannot possibly be the reason oil prices have been rising for over four years now.

Ron Patterson

What exactly are these speculators supposedly speculating about?

Should not the market price this in if "everyone knows" that speculators are hoarding oil and intend to sell it off. In which case all this should come into the market in some time and prices should fall and futures a couple of years out should reflect that. Do they?

Or they might be speculating that peak oil is here and oil prices might hit $200 in the next 2 years and it might be well worth holding on to $120 oil even if it means storing it somewhere.

My understanding is that futures have to be settled physically. I read a report of 2006 saying that hedge funds have about $100B invested in oil (in 2006) - at those prices that would be 1.6GB or more than twice the US SPR? where is all this stuff being stored? And there is the forex risk of the USD going down in that period as well.

Could someone here answer this? I am genuinely puzzled.

From CNBC

Oil goes up one day (supposedly) because the dollar goes down, then it goes down because inventory has gone up. 2 days later both oil and the USD go up because jobless claims are lower than expected. How are they able to find such accurate correlations so quickly? Or do they just indulge in verbal diarrhoea?

Srivathsa

Guys - Futures do not HAVE to be settled physically. However, if you buy a long position and hold it until contract expiration, then the corresponding "short" HAS to make physical delivery as per the contract terms, which are a standardized part of the contract. Normally, people just sell their positions prior to expiration. Howver (get a book), it is common for market participants to do Exchange of Futures for Physical (EFT's), which are also regulated, and allows for physical delivery as agreed between the long and short. Oil, by contract, is deliverable in Cushing Oklahoma (and the grade is specified by the contract). But, an EFT would allow parties to exchange, e.g., in Houston with a different grade, if they both agreed. Generally there would be an agreed upon $ difference for a grade differential and a location differential for the EFT.

Do speculators drive up the price a huge amount? Well that is like attributing to them the mentality of the tulip bulb traders, and assuming that they are all willing to risk their entire wealth against the chance that the music stops when they are long oil. Strangely, for 30 years, farmers wanted the agricultural commodity markets shut down on the theory that speculators were driving the price of their products down.

We are a capitalistic country and virtually no one understands supply and demand. If we were talking about a cartel of speculators trying to drive up the price of Picasso paintings - well that might be possible. But, a market trading hundreds of millions of barrels of oil daily worldwide. It would take a group of 1000 billionaires to illegally get together and decide to do it. And, even they would be at risk of a country like SA doubling its output - if anyone cares to believe that that is possible.

This is a myth. Holders of long or short positions at expiration are not required to either make or take delivery. Contracts can still be settled in cash even though the contract was not closed before expiration. This happens all the time and the open contracts are simply settled at the settling price unless the buyer specifically request delivery or the seller specifically request that delivery be made. Even then, if there are not enough buyers requesting to receive delivery as sellers wishing to make delivery, or vise versa, then those unmatched contracts are still settled in cash.

Think about it, your margin requirement for one contract of NYMEX crude is $9,788, less than ten percent the cost of the actual oil. It would be impossible to collect $115,000 for the actual oil from a speculator who has only put up a fraction of that to trade, or require him to take delivery if he has no tanks. And you sure as hell cannot require him to make delivery if he has no oil at all.

The same goes for pork bellies, live hogs, live cattle, wheat or whatever. By the way, I was a stock and commodities broker, for all of six months back in 86.

Ron Patterson

Wrong! Only a very tiny fraction of all contracts are ever settled for actual. On the NYMEX approximately half a million contracts are traded daily. Each contract is for one thousand barrels of oil. that means that each day, contracts are traded that equals 6 to 7 times all the oil produced in the world for that day. And that figure gets even more absurd when you consider that far less than 1% of all oil produced is actually traded out of the Cushing, Oklahoma Hub, the benchmark for the NYMEX contract.

Some exchanges, like the Tokyo Commodities Exchange (TOCOM) only settles in cash. That is, there is no such thing as actually making delivery or taking delivery for a TOCOM crude contract.

Ron Patterson

Thanks Ron.

OK, Peak Oil it is, panic over - and I am now very concerned, 'cos like Memmel I think we are more likey than not way past 50% depleted, implying a steep post peak decline - implying very steep post peak 'net export' decline.

The flows will slow because of the extraction techniques used since around 1980 and the fact that much of the 'new' oil being added to reserves is restatement of old finds (the new oil can't be produced until the original oil has been produced since it is below it) and the oil is increasingly worth more left in the ground than being produced now.

IMO, this means that the world's economy has no option but to continue to shrink (otherwise known as deflation!)- judging by the Japanese experience that means falling house prices (which means you can't borrow a high percentage of the house price long term) and zero interest rates for savers. Zero interest rates means savings don't grow, which means pensions don't work, and on and on!

I suspect that speculation (buying/selling for a hoped for short term trading gain) has a dominant effect on the shortest time scales -say hours and days, but probably has very little effect over times spans of a year or more. In Gold speculation can have a long term effect, because the commodity can be stored at very low cost. To physically hoard oil for later usage, you need a tank to store it in. I doubt that tanks can be built cheap enough to make this a viable means to make money.

The black Market will tell you.

a black market will deliver all you want at the world's

highest prevailing price.

If NYMEX was the world's black market price, NYMEX would

be flooded with oil.

Ex. You pay enough you can get Disney World in Baghdad.

Given that global prices are set at the margin in commodities markets -- markets that can only exist because there ARE speculators -- a case could be made that 100% of the price of oil is established by speculators -- and always has been.

Back in the commodities run of the 1970's, my 80 year old grandfather was delighted to showoff his cabinets full of 5 lb bags of sugar. He purchased 20 bags when the price was very cheap and just starting to rise. By the time the price had doubled, he was confident and correct that the price would double again, he bought 20 more bags. He kept buying more all the way up. I was amazed when he showed me several hundred bags in his cabinets. I knew him to be a man of wisdom, common sense and frugality, but I witnessed a man smitten by a "gold bug".