Last Week's EIA Conference

Posted by Gail the Actuary on April 18, 2008 - 10:00am

Last week, the EIA held a special conference, celebrating the 30th anniversary of their founding. They have held smaller one-day conferences in the past, but this was an expanded conference for the occasion.

I decided to attend because we use a lot of EIA data, and I thought I might learn more about the behind the scenes process. I also thought I might learn something from the presentations, and meet a few new people.

The conference was held in the Washington Conference Center in Washington DC. We were told that there were 1,600 registrants. The conference was free, so it was "sold out" shortly after registration opened.

The website for the conference can be found here. It now includes links to presentations from quite a few presenters. Below the fold are a few of my take-aways, including some graphs from the session on peak oil and a session on electrical issues.

EIA Itself

Some of the sessions were about EIA itself. I also learned some things at other sessions. These are a few things I learned:

1. Funding for the EIA has been declining in real terms over the years, and is getting to be a concern. The frequency of surveys has had to be cut back, because of inadequate funds. It is not possible to do as much work on investigating how data collection should be changed, to adapt to the way the industry is changing. EIA would like it if its customers would put in a plug for them, to get funds to do the job the way they feel it needs to be done.

2. The EIA prides itself on its independence. In the early days, the EIA had problems with other governmental agencies (like the IRS and those investigating price fixing) wanting to look over its shoulder. It took steps to make certain this could not happen, since this would compromise the integrity of the data. Even with forecasts, I got the impression that the agency is fairly separate from outside influence.

3. A disproportionate share of the staff is approaching retirement age. With the gradual cutback in funding over the years, there has not been a great need to hire new staff. Now, after thirty years of operation, quite a few of the staff are approaching retirement age, and some have retired. One of the purposes of the conference was to try to find people who might be interested in working for the EIA. This is a list of current staff openings.

Presentations

There were presentations on a variety of topics:

Peak Oil. Although not the main focus of the conference, there was one session on peak oil. Presenters included Matt Simmons, who is well-known for his peak oil talks; Peter Jackson of CERA, and Glen Sweetnam of EIA.

Matt Simmons talk was pretty similar to others he has given recently.

The main graph in Peter Jackson's (of Cambridge Energy Research Associates) presentation was this one:

This graph seems to show decline in conventional oil beginning around 2035 or 2040, and decline in total liquids beginning not much later. Total all year production is shown as 1.92 trillion for peak oil forecasts; 2.93 trillion barrels for what appears to be CERA's forecast of conventional oil; and 3.61 trillion barrels for conventional plus unconventional. ( I have seen higher CERA amounts quoted in the press. This article claims the CERA's amounts are 3.74 trillion barrels remaining for conventional, and 4.82 trillion barrels remaining on a combined basis.)

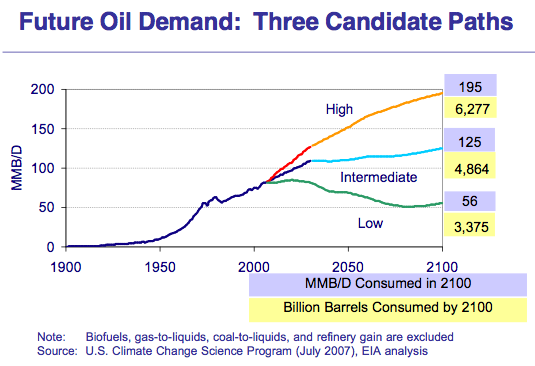

The third presentation was by Glen Sweetnam of EIA. He presented a forecast that went out beyond 2030. The forecast was characterized as “preliminary”, so probably has not at this point been used for official purposes. The model uses three candidate paths for demand:

It might be noted that all of these three demand curves use far more oil than the peak oil estimates would suggest is available. The amount of oil required until 2100 is shown in the boxes to the right, in billions of barrels. Peak oil estimates would suggest something like 1,900 to 2,200 billion barrels of oil are available for all years, not just to 2100 (see Figure 1 above). All of these demand curves require considerably more oil than that - as much as 6,277 billion barrels, for the high demand curve. The low demand curve is more or less in line with CERA's supply forecast shown in Figure 1, if the timing is right.

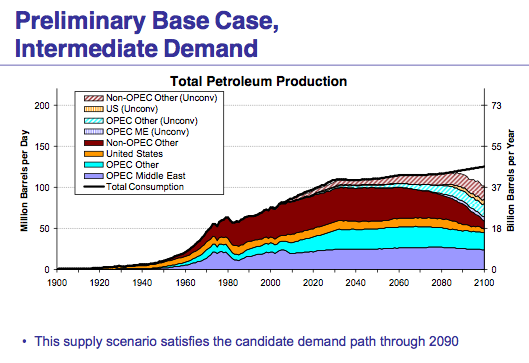

EIA then put together various forecasts for supply. There are four supply forecasts for the intermediate demand case:

In Figure 3, the amount shown as "IIP" is oil initially in place. In the scenarios used, these range from 16 trillion to 21 trillion, and the recovery factors are as shown. The oil IIP estimates are very high; Nansen Saleri, a former officer of Saudi Aramco, only assumes a base of 12 to 16 trillion barrels, in his Wall Street Journal Editorial, The World Has Plenty of Oil, and he was clearly looking for as high a number as he could justify. The discussion indicated the recovery percentages applied to the oil IIP are based on the assumption that technology would be improving, and lead to higher recoveries.

When one sees the results of the simulations, it becomes clear the supply models generate a lot of expected future oil. When supply in the base case is matched up with intermediate demand, the model indicates that there will be enough oil to last until 2190, before demand outstrips supply:

It would be nice if the world were really like this! If you want to learn more, the full presentation is at this link. Fortunately, the EIA forecast is still at a preliminary stage, and there is at least some possibility that it will be revised before the final version is developed.

Electrical Supply. Quite a few of the conference participants were from the electrical industry. I would characterize the electrical supply folks as being very concerned about the future of electricity -- more so than the people from the oil side of things, who often thought speculators were the main source of problems. This is one presentation that summarizes some of the electrical supply issues.

One graph from that presentation shows the projected year when margins are expected to fall below minimum target levels:

From this map, It does not look good for RFC (MISO) which I believe is Michgan and Indiana and the Rocky Mountain Region. New England, California, the great plains, and Texas are not much farther away in time when electrical capacity is expected to be bumping up against limits.

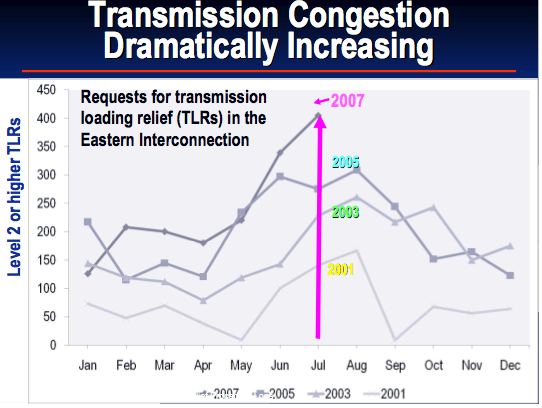

Another graph shows trends in electrical transmission congestion:

If you expect that plug in cars will save the day, you may want to check out what the electricity people are saying about the current state of electrical supply.

Climate Change Legislation. The major session the second day was devoted to climate change legislation. It was pretty clear from the discussion that nothing is likely to pass this year. It was also clear from electrical discussions that no utility would be able to get funding for coal fired power plants, until it was clear what type of carbon legislation would be passed in the future. Thus, it looks like coal is off the table as on option until climate change legislation is passed.

There is not a lot on the internet about the content of this session. This is a link to the remarks by John Dingell.

Energy and the Macroeconomy Model. We got to hear from Steven Brown of the Federal Reserve Bank of Dallas talk about their oil shock model. Oil shocks are modeled as temporary events in a model of the economy. Lucia Guerrieri of the Federal Reserve Board observed that Steven Brown's model likely overstated the impact of oil shocks, because we now have experience with oil price spikes, and know how to deal with the situation better. High oil prices wouldn't cause a recession this time.

I'm afraid I couldn't agree with these folks. I thought it was sad that the people in the Federal Reserve are this far removed from what is really going on in the world - haven't considered the fact that oil price shocks might be more than temporary and that learning from experience isn't really sufficient.

Summer Transportation Fuels. If you are interested in the summer fuel situation, there were several presentations on this subject.

This list is not exhaustive. There are a number of other topics covered by the presentations given. Check out the EIA Conference Website!

After the Titanic hit the iceberg, the first person to realize that the ship would sink was Thomas Andrews, whose company built the ship. Within a couple of hours or so, everyone realized that the ship would sink (some realized it as they were drowning, or dying from hypothermia). So, it was a continuum from one person to everyone.

In a sense, when we started consuming fossil fuels, especially at an exponential rate of increase, we "hit the iceberg," and King Hubbert was one of the first to realize what was happening. We are basically on the continuum from virtually one person, Hubbert, to everyone.

My current opinion is that one should generally refrain from arguing with Yerginites, and instead offer to sell them your rapidly depreciating suburban home.

LOL! There were a few peak oil believers at the conference, but not a huge number. I ran into about six that identified themselves as TOD readers.

A lot of EIA people I talked to (often working in areas having nothing to do with oil) were interested when I mentioned the TOD site, and wanted my business card. Quite a lot of the people there were from EIA.

Sell it to them in Yergins.

< / Chuckles off>

Jeff, some of your ELM predictions are for pretty severe declines which will very shortly be undeniable. In fact, if your plausible model is correct, within the next 5 years or so there will be a "Black Swan" event (The 2013 'UN Nations Energy Crisis Report' perhaps?) which will be the equivalant of The Titanics Captain broadcasting Mr Andrews realisation over the ships tannoy...

Assuming that most TOD readers consider themselves as the equivalent of the small clique crowded around the table as Mr Andrews unscrolls his architecture charts and declares the ship has "but a few hours" what are we to do?

Any breakaway from that small group would either not be believed -"The Titanic is unsinkable"- or perhaps save just a few... The majority still drowned after all...

Nick.

Noutram, we can at least try to save ourselves. Buy gold and silver, bicycles, some arable land, solar panels, literature on organic farming and poultry farming, and anything else you can think may be useful when the 18-wheelers stop rolling and the container ships thin out. Even small things, for example a straight razor, sharpening stone and strop so you can shave when the plastic razors become too expensive or rare.

Gail,

I think you want trillion not billion when you first introduce estimates of remaining reserves.

Thanks for reporting on the conference.

Chris

fixed. thanks.

The total all year production appears to be the production until 2070. At least thats what I estimate from the area under the curve.

Good information to have. Then my comparison of EIA to CERA is not right, if omits the numbers past 2070. The CERA graph is not well labeled.

The USGS 2000 estimate for conventional oil are given in this Table.

The P50 number they give is 2,659 oil + 324 NGL billion barrels = 2,983 billion barrels of ultimately recoverable conventional oil and natural gas liquids.

They do not give totals for P5 and P95. It is not quite theoretically correct to sum up the various amounts in the table, but it is fairly close. Summing the amounts, we get

P5 = 3,536 oil + 524 NGL = 4,060 billion barrels

P95 = 1,924 oil + 183 NGL = 2,107 billion barrels

If CERA expects a lot more beyond 2070, they would be up in the P5 range or higher, relative to USGS 2000.

Gail,

Is there a trend in historical USGS ultimate yield estimates? Are they revising down over time? I am thinking of Dave Rutledge's graph of U.K. recoverable coal. The estimates began to converge with real production several decades ago, but prior to that had been orders of magnitude high.

The USGS has a long history of producing inflated estimates of available oil. This is an article by David Strahan about this problem.

My impression is that their view of what is available is generally trending higher. At one point, I had a link to some data showing the figures over time - I don't see it right now.

Gail and I had an intersting conversation (if not surreal) after the "Conversation with the EIA Administrators."

In his view, all resources (and used the word "resources") including those not yet discovered (they are "out there, like the X-files, we just don't know when they'll show up) about 8 TRILLION barrels of oil and we've only used about 1.1 trillion barrels of that so far.

He also tried to make an argument as to why there is still so much oil left in the KSA. Basically, he was saying We've seen the data and have been doing this longer than anyone else.

I don't know whether he was surprised when I could recite, chapter and verse, the production numbers from Prudhoe Bay and the North Slope, but he was trying to prove that recovery numbers (as percentages were getting better and better) were going to provide more oil. I reminded him that initial (wild) estimates were on the order of 100 billion barrels and that there was talk of a second pipeline because the volume was thought to be so large.

And I think he was decidely taken back when I pointed out that peak oil was not about the size of the reserves, it was about the rate at which the oil can be supplied. It apparent that a number of people think in terms of resources (if only we could get to them) and not flow rates.

Hi Star,

I wish I could have been there when you and Gail were conversing.

What does "he" imagine would happen to other resources were the 8 trillion to really exist? (and come online at approximately current flow rates, as you so correctly point out - ?)

Have they not heard about water scarcity, collapsing fisheries, lack of arable land, overcrowding, etc.? A rhetorical question, I realize.

Well, I was quite stunned by this statement. Earlier we had seen similar numbers in a different presentation that would have no problem and continuing growth out to nearly the 22nd century.

I can't account for why this is so. As an engineer, I tend to ask a simple question: "and you are going to accomplish that how?"

Now, I would point out that this is exactly the same thinking that got the EIA into trouble with the IEO documents. If you want an example (and there are quite a few) go back and read the International Energy Outlook on oil production. Pick the North Sea in particular. Now in the earliest version I think you can find online it seems like they correctly projected the peaking in 1999-2000 (might be a previous version hardcopy). Then notice that all of a sudden they are pushing the peak date well into the first decade of the 21st century.

It wasn't until the IEO 2006 that they finally got around to admitting that the North Sea might be in decline. The UK peaked in 1999 (the second peak with ~110 fields in service compared to the first peak with ~30 in service) and Norway peaked in 2000.

Nor do they seem to get that an "undulating plateau" is death to a system that is entorely dependent upon growth for it's own self-defined "health."

I'll be looking at my notes this weekend and putting some thoughts together for a Forum I manage. I place some additional thought here, as well. I recorded some of the presentations (audio and video) for accuracy.

Hi Star,

Thanks for responding and for the example. I hope you can write this up as an article for TOD, perhaps.

Your point about future oil supply not being about reserves and being mostly about flow rate is the thing most people can't seem to grasp about peak oil. The beauty of Hubbert's analysis method is that it cuts straight through the bull and confusion about politicized reserve estimates and how oil should flow out of rock and gets to the heart of the matter, which is the real life flows produced considering all the complex factors. By doing this, it solves the riddle of who's lying about reserves and how certain rocks will behave.

In an earlier post of mine, this is the way I define peak oil:

I have never in my life witnessed a greater disparity between two sides of a story than this one. Global warming is close, but the magnitude of differing opinions on a topic that is going to impact the very near future is so vast that its obvious one camp has to be missing something enormous. I think the cornucopians (16-21 trillion OIP, 75% recovery factor, etc.) are completely ignoring costs and flow rates. What is the cost in energy, water, ecosystem, and dollar terms to get 75% recovery on 16+trillion barrels? Its as if these oil analyses are done in isolation and ignore all other aspects of the system we live in.

And the other camp thinks we see mandatory rationing, resource wars, starvation, etc in under 10 years, and maybe considerably sooner

Cognitive biases seem to be at the root of these opinion disparities. Otherwise, people would just differ at the margins. But here the margins are monumental. Here is another list of our cognitive biases - #25 - the Plank Problem of particular relevance here...where intelligent people are more likely to be able to debate their point of views and also less likely to consider alternative viewpoints to their own.

I really believe that people will believe what they feel comfortable believing - new facts rarely change the corpus of their fundamental beliefs. Given such disparate opinions of generally smart people, the discrepancy has to be rooted in how we (humans) process and believe in information, how its presented, how it impacts our own future trajectory (threatening or helpful) and who is presenting it (someone respected in our 'tribe' or someone fringe.) At least thats my belief...'-)

Yes. I am new to this whole PO thing. After reading

a book or 2 on it, my entire world view / life view changed.

But I still don't understand how there can be 2 hugely

different outlooks on the amount of oil the world can

produce over the next 20-30 years. I mean, we're not

talking "religious faith stuff" here - this is supposed

to be science, and it's not rocket science. Is there

any idea of what it would take to get EIA people to

change their view and "adopt" PO (i.e. 5-yr peak)?

And what would it take to get POilers to change theirs ?

I think in general the economists have had a big influence on thinking. (I don't know of this is true at the EIA, but it is in general.) The view is that if the economic stimulus is there, suddenly the oil will appear. Technology can fix anything. Scientific American and other science publications have encouraged this thinking as well. The apparent unanimity in the press has lead a lot of people astray.

With respect to the EIA changing their minds, we are talking about a relatively small number of people - I would guess less than 10 - making the decision. I am not sure what would change their thinking. My impression is that they honestly want to be correct, and might be more open to reviewing additional information than most people expect. It might be that they would change their forecasts gradually - a step down in the 2009 forecasts, and another step in 2010 forecasts. If the IEA made a big change in their forecast, this might affect the EIA.

Gail the problem with this view point and one I will soon make a key post on is that technology itself is not created via magic. It takes time persistence and money to develop. The technical cornucopian's base their faith on past technical advances. But these same past achievements have enhanced our ability to extract oil for decades. This the argument has a fatal flaw in that its own premise destroys its conclusion by making some simple assumptions like technology works with the physical limits of the system thats being refined. No amount of technical advances will make water boil at a different temperature than 100 C at atmospheric pressure.

The fallacy of the techno magic argument is thus twofold you ignore the benefits and effects of past technical advances and you ignore simple physical constraints. This is the difference between technology and magic. Of course the techno-magicians call it economics.

Hi, memmel.

Everything you say is true. So where does the techno-magic line of thinking come from, then?

Perhaps it is part of a very long-lived conversation that started long before you and I arrived. When we were born into the world, there were many conversations already being spoken in the human network of conversations. Some conversations extended over the entire network, some were local to where we lived. Some already had very long lives, some were spoken only for a brief time. The techno-magic thinking seems to be a conversation that started several centuries ago.

The following is from a previous post in response to the adverse reaction the authors of the Limits to Growth received when it was published:

It is clear to me that we are about to transition to the next episteme.

-André

Hinson, I think much of the huge disparity between future production views is simply the difference between those who understand Hubbert and those who don't. The Hubbert model has been proven to be remarkably accurate in the past in a variety of large producing areas. But I would guess few in the EIA or CERA have a good understanding of the model; and if they do, they think that technology will make it different in the future. However, in the U.S. peak case, the decline transpired while one of the greatest tech revolutions of all time was raging - the computer age. And it did nothing to do away with the Hubbert model U.S. peak calculated in the stone age of 1956!

Gail is right, economists are responsible for a LOT of this mess. Their belief system is at the root of this whole problem and it is a discussion that has been going on for 300 years. Galileo irritated the Roman Catholic church for having the audacity to suggest that the earth went around the sun. The church only eventually conceded Galileo was right in the 20th century. This episode marked the beginning of a debate about God, Man and nature and who was supreme. It was carried out by people such as Descartes and Francis Bacon. The upshot of the discussion was that they decided that Man ruled supreme over nature and that nature was unbounded, there simply to serve man, as man saw fit.

This view, fundamental to classical economics, and eargerly endorsd by all modern economics inlcuding both marxist and neo-classical economics, holds that the resources of the earth, including oil, are for all intents and purposes infinite. It is this fundamental article of faith that lies behind the 8 trillion barrels of oil "resources". All of a sudden, as if by magic, all of the unconventional "sources" of oil (tar, shale etc) suddently become oil, "because technology will make it so". Note that it is an article of faith. It is deeply embedded in their belief systems; and it represents an inability to consider any other opinion. As with faith generally, such beliefs are hard to change. One economist actually told me that geologists such as Colin Campbell do not understand the situation (oil production)!

The view that resources are unbounded may have been effectively true in the time of Francis Bacon when the worlds population was less that 1bn people. It is no longer true now, but that invites a discussion about limits, economic growth and population control. And this is all in an area that is uncertain and hard to define. Also, until the sub-prime mess, the worlds economy was in great shape, even with high oil prices. Because this drama is playing out over several years, various psychological mechanisms, such as the recency effect (today is like yesterday; and tomorrow will be much the same) act to limit the acceptance of paradigm shifting information.

Most people cannot absorb new information, however uncomfortable in makes them. Passengers on the Estonia sat, waiting for crew to instruct them, even as the ship went down. The thought that the ship would sink was outside their terms of reference, so they were frozen, unable to act to save themselves. If people are listening to anybody, it is to the people who are saying what they want to hear, the ones who are reinforcing their existing belief systems.

And that is that resources are infinite, including oil. This is perhaps my favourite quote:

Thanks for the quote. There are a lot of people that really believe this stuff.

The impression I got during the EIA presentation was that all we needed to do is figure out how much oil we would need, make the appropriate (presumably not too large) investments, and the oil would appear.

Paradigms,

Paradigm Paralysis,

&

Groupthink

http://en.wikipedia.org/wiki/Paradigm

hinson,

2 world views? There are more like 20!

After much study and ready over the last 3 years, I have decided that there is no useful information to work with.

The needed information to make projections is slanted by the source of said information, everyone has an agenda, and even those who believe they are in the know are most certainly NOT.

The only possible option is to attempt to case harden your energy consumption and economic situation to be as prepared as possible for any turn, but to do so without destroying your current lifestyle (accepting that you like your current lifestyle!) You want to avoid the risk of selling a home you like, giving up retirement investments you have, or destroying your children's educational possibilities, but at the same time, look for ways to reduce outstanding risk, debt and energy consumption to as low a level as possible.

Whatever you do, TAKE EVERY SCENARIO, CATASTROPHIST OR CORNUCOPIAN WITH A HUGE GRAIN OF SALT. Most of them are nothing but nightmare projections or wishful thinking, depending on the source.

RC

Is there any idea of what it would take to get EIA people to

change their view and "adopt" PO (i.e. 5-yr peak)?

And what would it take to get POilers to change theirs ?

M. King Hubbert predicted a US peak in something like 1965 to 1971. Some US agency (USGS I think) was predicting it would peak in the early 1990's (still soon enough that the government should hvae been taking steps in preparation). After oil peaked in 1970, it only took two years - - 1972 - till Morris Udall issued the public an apology on behalf of the government on how they had gotten the oil peak wrong.

The EIA, CERA, oil company suits, etc., can only go so long after a peak before having to admit it. "Market speculation", "lack of investment", "lack of REFINING capacity", and "political instability" have a limited shelf life.

I would change my view on Peak Oil if oil discoveries started increasing and in significant amounts. A decade of discoveries like the 1960's would make it look like Peak Oil was not emminent. Or if all the countries in decline (the majority) started plateauing or increasing in production I would change my view on Peak Oil being emminent.

While I agree this is not rocket science, it is more difficult. Regardless of how you cut it, the damn problem is that all this black stuff is under ground.

That is a perceived problem. It is only hard if people think it is hard.

Weird that the asshats at the fed reserve swiped my 'oil shock model' name and likely replaced a simple model with some demand driven monstrosity.

If you have the same person or group of people working on the issue for 30 years, you will tend to get some perpetuation of whatever was believed to be true in the past. This is even true if it is different people are working on the project.

I have done enough consulting work to know that the bias is always toward making this year's analysis look not look too different from last year's. For one thing, the model you use this year is likely to be similar to the one used last year. For another, you don't want to look like you got it wrong last year. I think studies have shown that forecasters often miss turning points.

I'm not sure about the Federal Reserve folks. I suspect they went to school in Economics, and skipped the science courses.

'I'm not sure about the Federal Reserve folks. I suspect they went to school in Economics, and skipped the science courses.'

Actually, they all go to Hogwart's. They take courses such as 'Advanced Muggle Bamboozelment' and 'How to Make your Hand Invisible' in preparation for their careers at the Ministry of Central Banking Magic

There have been at least some Fed discussions recently about resource scarcity due to its impact on global inflationary factors that cannot be directly addressed by any one nation's monetary policy. I believe that the Fed is becoming more peak lots-of-things aware. A little oil demand destruction is not perceived as such a bad thing, but prices going parabolic without demand destruction is a policy dead end - they would have to let it go if the economy in general is weak.

For one thing, the model you use this year is likely to be similar to the one used last year. For another, you don't want to look like you got it wrong last year. I think studies have shown that forecasters often miss turning points.

This is the type of thinking and behavior that doomed the USSR.

And after reading Nate above - I'm having another one of those moments, when I consider how widely people were prepared to believe in fairies, or a flat earth, or even today that the Apollo missions were faked, etc etc... Pick your 'conspiracy' - And I have a moment where I just need to recheck that I'm really NOT one of those people... Am I? Are we? Ummm... moment over... oil at over $116 a few minutes ago <sarconal>bad speculators - must call my broker...</sarconal>

I posted a link to an article yesterday that predicted that Middle Eastern oil exports would double by 2030. Our (Khebab/Brown) middle case is that the top Middle Eastern oil exporters will be approaching zero net oil exports in the same time frame.

In a WSJ article on cognitive dissonance a couple of years ago, the writer described the research on space alien cults. When the aliens failed to arrive at the predicted time, frequently the cultists tried even harder to convince people that they were right.

Of course, Peak Oilers--who believe that a finite world has finite limits--are the ones who are generally considered to be the equivalent of space alien cultists, while people like Peter Huber--who believes that the sum of the output of a group of depleting energy sources will show increasing energy production forever--are considered mainstream.

So, as noted above, I am leaning toward the "Let natural selection take its course" option, and let's encourage the Yerginites to buy up all of the SUV's, McMansions and stocks of financial companies.

For once, the people that think that "the sum of the output of a group of depleting energy sources will show increasing energy production forever" ARE mainstream.

If only they weren't...

You are exactly right to think:

Only the school of hard knocks will wake people from the dream. I figure the dream will die around $5/gallon oil. At that point Congresscritters will start holding hearings where they parade various Panglossian predictors from USGS, EIA, Exxon, etc before committees and ask them how they can be such fools. We are within a year or two of the end of the denial period.

Hi Future,

Well...a little bit different slant on

re: "Only the school of hard knocks will wake people from the dream."

A lot of people are in the hard school right now.

Many in prison.

Many in foster care or just out of same.

Many with substandard education. Or addictions (and I include kids hooked on TV/Games, etc.) Or mental illness. Or under-employed. Or...

The hard knocks do not awaken people.

Emotional support, education and open conversation are the liberating factors. (That's my VHO.)

I would just say:

Remember that when people are awoken to bad news that's been ignored, they have a tendency to shoot the messenger.

Now where was that tax on oil companies bill I had in my hand ...

I was at a closed door workshop on the outlook of world oil supplies a few weeks ago, and one session put EIA up against a very well-known oil consultancy presenting their outlooks for future supply. EIA was as shown here, and the consultancy was very pessimistic, with our current plateau ending within years. After the two talks, the two guys got into an argument with each other while the rest of us sat and watched. The upshot? They both use the same data sources for reserve volumes and yet come to diametrically opposite conclusions. EIA's "trick" is to pump up recovery factors, and they argued it strongly despite not being able to point to any technology or physical reason why it should be so.

My other takeaway is that most so-called "energy experts" are really just "energy market experts" who really don't understand energy. And yet these are the folks that are called to these government workshops for their "expert" opinions. I was rather appalled.

One person I talked to said he had been doing this for 30 years; he was an expert. Some of the things he claimed to know seemed really strange. He couldn't possibly have been talking to people in the real world for 30 years.

Hi Spraxis,

This is interesting. I'm curious...

1) How did it end? (if it did.) Did the parties - I mean, esp. the EIA - realize the exact nature of the disagreement? The way you describe it here, for eg. Did anyone say "OK, here is exactly where we differ." (Question mark?)

2) What did everyone do then?

3) I'm also curious...if one grants, for the sake of argument...any recovery factors the other side wishes to use, and then applies "ELM", doesn't that move the date of peak panic forward by a considerable amount?

4) Also, how can anyone apply "pumped up" recovery factors to existing fields already in decline? Or, do they not look at this?

Aniya,

It ended where it started, and no minds were changed. The "official" position that crude supply will keep growing stays on the books and there was plenty of grumbling about how unrealistic EIA is. One very well known peak oil person just threw up his hands and bemoaned how our energy policy is hostage to such enormous uncertainty in the data, yet government action is assuming only the possibility that EIA is correct. I brought up the importance of looking at exportable volumes and not gross world production, and what surprised me is that only one other person there had even considered that. So ELM is not even on their radar screen as an issue right now. I spent some time offsetting the presented outlook for alternative liquids, using a thermodynamics perspective, and they all looked at me like I was from outer space. When one "energy expert" noted that the reason the 20th century led to such wealth was because of contract law and the free market, and that oil "just happened to be the cheapest thing around", that's when I knew that we have a serious education and communications gap...

Agreed. And that chart of Peter Jackson's is a collector's item. What will CERA's story be in 2010 assuming production is essentially flat for the next two years (I'm trying to be optimistic)? Will they move their red line?

If they are only modeling capacity, I think they still have an out. The countries had the capacity, but chose to save the oil for their grandchildren. They are good at making up stories. They will think up something.

I am like hinson and am new to PO. Learning mostly from TOD about it and other internet sources and Matt Simmons youtube videos and presentations. And I search for the denier viewpoints as well. And anything in between. I can even discount abiotic oil now! What seems clear...is that my kids will live in an very different world than the one I grew up in. So this revelation (for me) about the facts of the energy world has changed my viewpoint in signficant ways. I feel almost imbalanced and dizzy from it.

Nansen Saleri seemed to buoy me with some optimism. Then Nate's reaction brought me back the other way somewhat. My question for Nate is...as it seems that Nansen Saleri view is that techonology will help with the recovery factor..and even if it is modest..will make a significant difference. Are you saying that the EROEI (another important study I am trying to grasp) will invalidate that claim?

The main problem is that no one speaks the same language or uses the same boundaries. For example, on this site, we realize that the peak in available energy (oil and gas) is of central importance as opposed to the CERA/EIA camp that focus on the amount of total resource and if pressed, the date of peak liquids. So we will never agree because we differ on what the central terms are - and on the thing we do agree on - that a 'peak' in oil production will occur - we care about the net and they report the gross (and a moving target to boot, continually adding things that are not oil, into the definition of oil).

The difference between gross liquids reported by EIA has to be reduced by: a)increasing amounts of energy used by energy sector, b)lower BTU (and therefore less ability to do work) of many of the 'other liquids' components such as ethanol, NGPL, etc. c)the higher costs of getting out the marginal barrel, d)the higher usage by exporting countries, e)the depletion rate is causing more exporters to become importers (Indonesia is a member of OPEC but is now an oil importer - 60% of Mexicos oil comes from Cantarell which has just entered 15%+ decline stage, meaning Mexico will soon not be exporting oil but importing, f)environmental, non-energy limitations to production, g)maximum power principle suggesting that technology is borrowing from second half of oil at cost of higher future decline rates, rather than continually increasing the flow rate with promise of more to come.

So we are talking about net flow rates and CERA/EIA are talking about something else. What amazes me is after what we have been writing for 3+ years and what CERA/EIA have been projecting, why more people haven't woken up to the facts that are really impacting the oil situation - productive capacity is not one of them.

Declining net energy will first be seen as higher prices, as non-energy sector has to bid for more of the BTUs in oil and gas to do economic work, as was detailed in this post. At some point there is a 'cliff' where accelerated drilling/alt energy, etc. uses more and more of our surplus energy squeezing out the other sectors completely. But once this happens it will be too late to impact it in anything less than a command economy, likely without the economy.

Actually, Nate, there isn't any clear cliff, it's more like a gradual decline. And I'm indebted to Jon Friese for making suggestions that led to that conclusion. To satisfy yourself of this, work a numerical example, taking into consideration that for every high quality concentration of a resource there is usually equal or greater amounts of lower quality concentrations. i.e. There is a gradient.

Generally as net energy available declines, prices rise and quantity demanded decreases. There is no drilling frenzy unless society can afford it. And it can't unless it is bringing other unrelated energy resources on stream that are not declining EROI-wise or utilizing dramatically better technology in order to 'subsidize' the frenzy.

Anyhow, I'd love to see this famous energy cliff modeled. I strongly expect that the attempt would tease out assumptions that are very different from what make sense in our world.

Nate said:

"Its as if these oil analyses are done in isolation and ignore all other aspects of the system we live in."

This has been my experience over and over again...people exist in their silos. Shocking recent example. My wife was doing some research for the Teach In Dan Bednarz helped organize and came across a report about mitigation for climate change in the state of California from a Public Health perspective.

Big worry...if it gets hotter people will suffer from heat stress.

Big solution...make sure everyone has an air conditioner.

Results...10% more electricity usage in the state FOR AIR CONDITIONING ALONE than is currently used for EVERYTHING TODAY.

Unbelievable! The laws of unintended consquences are going to start springing up all over the place...

I really think the climate folks are well behind the curve on the energy situation.

We evolved to be warriors, shaman, and storytellers, not systems thinkers...;-(

"Its as if these oil analyses are done in isolation and ignore all other aspects of the system we live in."

I got to wondering the same thing about Global Warming the other night. I got my set of DVDs on the Peak Oil Conference in Houston and have been watching them every night.

Two nights ago I watched the presentation by Pushker Kharecha of NASA on Global Warming and it go me to wondering a couple of things.

First, the only sources of CO2 that are being considered and listed are fossil fuels. Yet, each of us sucks in oxygen and exhales CO2 24 hours a day, 365 days a year until we die. Individually it doesn't amount to much, but multiplied by 6.6 billion people it must be a considerable amount. And that annual total times the 40 and 90 year time frame in the presentation (2050 and 2100) would surely be a lot of CO2 (and therefore a lot of carbon). And then all of our domestic animals are exhaling CO2 and that total would - as a guess - be 3 to 4 times the total for people. And then there are all the wild animals (???). Every living thing on the land, in the air and in the water is taking in oxygen and expelling CO2. Then there is all the vegetative matter on the planet. As an average guess I would think the total turnover rate must be around 50 years and what percent of that total turn around mass is given off as CO2 from decomposition??????

I know Global Warming is taking place (I live in Minnesota and have seen the changes in animal life - we never used to have o'possums living here and are now overrun with the darn things - I used to have to plow snow every two weeks at least in winter and now plow only once or twice a year - and we used to have 6 foot drifts and now only get maybe a foot at most), but I am wondering if maybe Homo Sapiens is causing the problem not just by burning fossil fuels but by the simple act of breathing and raising breathing animals for food? And going from 6.6 billion people to 9 billion even if we stopped burning coal might still cause the effect of signifact CO2 Global Warming problems?

Second, In the above referenced talk one slide stated that of the CO2 put into the atmosphere over 50% stays in the atmosphere for over 1000 years? If that is true I have to wonder if 1/2 or more of all the CO2 produced by Homo Sapiens and his domestic animals stays in the atmosphere for 1000 years at our current and projected populations would not our species be doomed to extinction from excess CO2 in the atmosphere even if all fossil fuel burning were to be completely banned tomorrow? CO2 exhaling Homo Sapiens numbers have risen just as fast or faster than the burning of fossil fuels.

Are WE the direct problem?

I regret that my scientific knowledge is not sufficient to figure out the exact numbers for the above questions but hope that perhaps someone here can supply them. Even if they turn out to not be too dramatic or significant in the big picture, they should be included in presentations on Global Warming so people don't get the suspicion that people might be cooking the numbers when they are not included?

Jon Kutz

There's no question that animal husbandry for meat consumption is a major source of methane, which is something like 23 times as powerful(as a green house gas) as CO2 - I have the vague memory of it being 25% of AGW. Further, meat takes something like 7 times as much agricultural production as does direct consumption (beef more, poultry less).

We could probably reduce our agricultural impact by 50% (or feed twice as many people), and our GHG emissions substantially, by going vegetarian.

All of a sudden, I just had a really really crazy idea!

If you took a thousand people of all ages and put them all in a big sealed room and gave them all the food and water they wanted or needed but they couldn't leave the room, what would be the die off scenario?

Would they die off all together or spaced over a period of time from excess CO2 over decades, years, months, weeks or days?

So let's go back to the age of Dinosaurs. They were all in a sealed room (the planet). They had plenty of water and food and their numbers grew and grew. One half or more of their exhaled CO2 stayed in the atmosphere for 1000's of years. Could the CO2 concentration of the atmosphere have reached a tipping point where 80%-90% of all life would die off over a short period of time due to suffocation? Maybe it was not an astroid hit that wiped them out, but their own exhaled CO2 building up in the atmosphere?

Like I said, it's a crazy crazy idea - But then that is about the only thing I have ever been really good at is coming up with crazy ideas - If only I could have found someone who would have paid me a good wage to do that - Sigh -------

Jon Kutz

Very crazy idea. Atmospheric CO2 concentrations are in the range of 385 parts per million today. Large increases in the CO2 concentration will kill off species through climate change long before anything comes anywhere near suffocation.

In your scenario, people would soon be wallowing in their wastes and at some point die of suffocation. Think of the recent coal mine collapses. For your other idea, James Lovelock of Gaia Theory put together a simple model called Daisy World to show how a planet's biota would respond to changes in its environment to maintain itself. (This is a very simplified explanation; please read his work to get the full implications. Also along this line, I would suggest reading Catton's Overshoot and the 30 year update to Limits to Growth.) Also, there's zero evidence that dinosaurs overshot their ecosystem the way humans have, which is why I suggested the latter two books. Another work I tout highly is Lynn Margulis's Microcosmos as it provides a wealth of knowledge of how life and its ecosystem have evolved over time.

Are we the problem?

Heh Heh

Black Death Caused Little Ice Age...discuss....

Researchers from Utrecht University, Netherlands were trying to tie the black death into the cooling period known as the little ice age. They said with the depleted human population that a lot of cleared farm land reverted back to forests. With the sudden increase in forested land the carbon dioxide levels dropped causing the cooling period.

Full article is here http://news.bbc.co.uk/1/hi/sci/tech/4755328.stm

Bill Ruddiman makes a fairly good case for plagues -> lower CO2 -> cooling in his well-written 2005 book Plows, Plagues, and Petroleum. Still an early hypothesis, but makes reasonable sense.

I grew up on a farm that had been in the family for 120 years, and a large pasture had been in place since ~1940. 20 years after Dad stopped farming, it was covered with dense woods.

Things are a bit more complicated than that. We eat plants (or animals that eat plants, or animals that eat animals that eat plants...), and plants get CO2 out of the air. Every atom of carbon that we eat was sequestrated from the air recently.

The problem really lies with fossil fuels, deflorestation and other nonciclic fenomena.

Funny you should ask that question because before the EIA Conference I had been asked a similar question and did a set of calculations using standard human activity factors. It's really straight forward math and material balances. It's the same numbers we use for risk assessment.

The answer is this: humans (all 6.6 billion of them) just doing nothing but living and breathing would produce the equivalent CO2 as the consumption of 19.8 million barrels of oil equivalent per day. Note that humans are using the equivalent of more than 85 million barrels per day (oil equivalent) of petroleum products to maintain the ability to release that personal level of CO2. Add to that the use of gas, coal and the removal of land area from productive, though temporary, sequestration for things like food production, etc., and you get a very large number that dwarfs human exhalation, but the aggregate number is a nonzero value.

In a 70 year lifetime, for a personal perspective, you turn out the same CO2 quantity as the consumption of 3000 GALLONS of crude oil (in round numbers) or just under 3700 gallons of gasoline, 600 cubic feet of natural gas, 14.6 tons of bituminous coal, or 19.4 tons of subbituminous coal.

As for the persistence of CO2...about half of the CO2 emitted today would be taken up in about 25 years, two-thirds by about 100 years and 80-90 percent by 1000 years. It is a highly nonlinear uptake but plotted on log-log scale looks linear. I have the formula for the estimated uptake somewhere in addition to the breakout from seawater, plants, etc.

It is startling how much people are willing to believe and defer to authority. Before the Iraq invasion there was a team of WMD inspectors in Iraq. They inspected hundreds of sites and found nothing. The US couldn't point them to a single location anywhere in the country where they could find WMDs, and yet the world didn't raise a single objection (to the claim) when Collin Powell told the UN there was no question that they had them and even showing pictures of buildings where they had "from 5 to 100 tons" of them. To this day virtually no one sees how ludicrous it was to have US politicians telling the world there was no doubt Iraq had WMDs while inspection teams could find nothing. Nothing. The US politicians should be on trial at The Hague as the former Yugoslavian premier was. But instead, they were reelected.

Now we have a situation where a government agency can actually make a presentation showing oil production increasing for another 20 years or so and then holding steady for another 50 or 60. And yet, oil discoveries peaked in the decade of the 1960s and have declined every decade since. How can they be so confident there is all this oil out there when no one is finding it???? With most countries in decline, how can they be optimistic??? I wouldn't try these guys at The Hague, but whoever is responsible for the EIA presentation should see some jail time.

The optimism of people is also quite astonishing. If I mention peak oil to people, most will quickly and *emphatically* dismiss it by saying

a) we still have used only a small amount of the oil out there, we just have to drill for it. Like off the coast, in Alaska, reopen old wells...

b) big deal, we will just transition to (liqified coal, hydrogen, ethanol)

c) People have been saying for years that we would "run out of" oil. "They" were wrong then, therefore, they are wrong now.

Finite: The majority of the first world population outside the USA didn't buy all that crap for two seconds, so your history lesson isn't even close to being accurate. The "world" didn't raise a single objection but giant crowds of demonstrators worldwide did.

Were they objecting to the claims of the US government about WMDs - or objecting to the invasion? I don't remember anyone saying anything like "If they have them why can't anyone find them?". Although they no doubt could have been saying it, as I would only have heard about it if the US media reported it, and they were closely following the government story on the issue.

The US also had demonstrations against the invasion, but I believe it was based on the carnage that would result to the Iraqi people, and not on the fact that the government was delivering a pack of lies about WMDs.

That is exactly what "everyone" was saying. At the time, IMO most Canadians were shocked that anyone could believe such nonsense-I would assume the feeling was the same in Europe.

We, the marchers, objected to everything being said by BushCo. Indeed, many of us objected to Bush being installed illegally as president by the USSC.

I was literally wide-eyed at your first post above... Just want to back up the other responders - in London, this question or variant of it seemed to be talked about constantly. People were objecting for many reasons, but the lack of ANY WMD evidence, and stuff around that including the 'handling' of the inspectors was perhaps the most talked about.

It doesn't seem like all of London could have shared those views, as Tony Blair and company were fully on board with the Bush Regime and their lies. The UK was in the #2 position in the Coalition of the Willing, so they had to have some support from the people.

In the USA I don't think there was a single TV spokesman, newspaper reporter/columnist, or radio personality who made note of the fact that there were no WMDs being found by the inspectors - who were told to leave by the Bush Regime so they could begin raining bombs. If any did they did it in passing. The one exception may have been Phil Donahue who had some negative discussions about the coming invasion. MSNBC canceled his show despite what was said to have been very good ratings for that network.

As far as discussions among peers, I remember less people in the USA being upset at the coming invasion than are worried now about peak oil. If someone was against the invasion, my recollection was that it was because Iraq was not a threat, not because the Bush Regime was delivering a pack of lies. But I do think that if someone was alert and informed enough to realize the goverment was lying about WMDs, they also now are aware of peak oil.

Hi Finite,

From an example of one - even though it seemed unlikely on the surface (to me), I looked into the WMD claim (when literally no one I knew was doing so). On the part of many people, I noticed a distinct desire to either 1)believe authority or 2) to believe that "we cannot know the truth", which is another version of (1). And some who were opposed and afraid to let others know.

No - not everyone - just most people - polls established that. Remember, feelings were high enough that somewhere around one in every thirty people in the entire country turned up to march in London on one day. The feelings were strong, loud, and dominante, and ineffective and utterly irrelevant to Blair and co.

The core of the UK government was #2 in coalition with the Bush Regime - it's an accident of politics that the UK is seen as more willing that say some of the small Eastern European countries - I remain utterly flabbagasted to this day that the will of the people couldn't stop the UK involvement from proceeding - but for a long time we were convinced that without an authorising UN resolution there was no way Blair would go... Suffice to say my perspective on the value of democracy has been __severely__ dented as a result - I have no better alternatives though - can see no way to prevent the progression of power to the tight executive core... Not without, hmm, bad things.

Anyway, off topic for TOD...

But damn it, we are running out of money. Even if all the oil producing countries could increase production,how would we pay for it? Oh yeh, the Chinese do that. Thanks. And how much leverage do we have over those countries that fund terrorism? None.

The argument that we should become independent made sense 35 years ago. And it makes sense now except for the fact that it is now virtually impossible. And the EIA is not helping.

Well, the cornocupians are not alone while ignoring reality. Doomers also have plenty of unconvincing arguments.

For one thing you are right, cornocupians tend to ignore fact about how much oil is there. Doomers tend to ignore other kind of things (like several moments of history, what technology is already doing, etc).

Doomers tend to ignore other kind of things (like several moments of history, what technology is already doing, etc).

Can you elaborate on what you are referring to?

yes, I am curious what "moments of history" and "what technology is already doing" are going to do about declines in finite resources, coupled with rising demand and growing populations...

"Doomers tend to ignore other kind of things (like several moments of history, what technology is already doing, etc).

FiniteQuantity asked, "Can you elaborate on what you are referring to?"

Since Marcosdumay did not come back and snap at the bait I can't guess what he was referring to, but let me give a thought or two on what I am referring to...

Many "doomer" scenarios are based around a core set of assumptions that set the framework for any debate concerning the human races ability to cope with upcoming changes involving energy. We are accepting for the sake of this discussion that changes will indeed be needed, pushed forward by the twin drivers of (a)climate change or the risk of it and (b)declining energy resources, in particular the non renewable fossil fuel oil, natural gas and eventually coal. We accept that these fuels are by definition non-renewable and therefore depletable.

The core set of assumptions that indicate a coming catastrophic failure of human designed systems are human beings (a)lack of ability or willingness to change at the systems level fast enough to scale possible alternatives in time to avoid catastrophe (b)the "finiteness of the Earth and (c)growing population.

Two of these assumptions are not new, and in fact should have been able to have been read from any actuarial table and science textbook, these being population growth and the "finiteness" of the Earth. These could not have been a major surprise to any educated person. However, it is very easy to make false assumptions based on past trends and on too narrow of a definition.

The population curve has indeed been up, and worldwide it is still climbing. But in the most developed, i.e. energy consumptive nations it is flattening surprisingly fast. Future population trends seem to have as much to do with economics, sociology and education as they do with biology. Despite the question of Bob Shaw, humans are not yeast. When yeast invent a birth control pill, then I will accept his question as valid. (for you newbies, that's an inside TOD argument! :-)

The other issue that seems to be a given is that the Earth is finite. And indeed it is. It's weight and volume is relatively easily measured. The absolute fixation with the word "finite" is noticable here as you will usually see that word used more often in a day on TOD than you will hear the word "fries" at a local McDonalds in that same day.

But while the Earth is indeed finite, it is NOT a closed system. Billions of BTU's are poured on to the Earth every single day. And billions of biological processes occur on Earth every day, driven by those billions of BTU's. Billions more inorganic chemical processes are driven by this energy, and at least millions of weather events are driven by it (wind, lightning, tides and waves, etc.) The Earth is ANYTHING BUT a closed system. When it comes to energy (as opposed to the narrow discussion of fossil fuels) the Earth is finite only insofar as the Sun is finite, which for our purposes, it is infinite.

Some dismiss Solar energy as having no possibility, and seem to feel that the amount of power that can be extracted from it is tiny and a fringe amount. But the potential is staggering:

http://upload.wikimedia.org/wikipedia/commons/3/35/Available_Energy-2.jpg

So if we properly use the energy available to us, a case can be made that we suffer no energy crisis, but a crisis of liquid fuel, that is to say, transportation fuel. Energy we should have the ability to produce vast amounts of. And indeed, there are already systems in the world producing power with PV solar panels, and other systems producing power with Concentrating Mirror Solar systems.

It will take materials to build solar collecting systems. But the world is using millions of tons of steel, aluminum, glass, copper and other materials everyday to build cars, trucks, motorcycles, powerboats and luxury airplanes, all of which consume oil, and produce no energy. There seems to be huge amounts of materials to build huge skyscrapers.

It seems like it might be a good idea to get underway building renewable energy facilities while the material is still easily available. Many solar systems that were built in the energy crisis days of the 1970's are still producing power today, a third of a century later!

So we have accepted that the human population may continue to grow, but almost certainly not as fast as many had predicted. The population growth rate can be slowed IF we can continue prosperity and educational growth around the world. {we will call that a moment in history that breaks all historical pattern}

We have accepted that while the Earth is finite, it is not closed, and for purposes of energy, it is not finite at all. {call that a great conceptual breakthrough}

We have accepted that we already have technology that can take advantage of the infinitie sea of energy, but that we are still facing a problem with liquid transportation fuel. The goal then would seem to be a transition away from liquid fuel for transportation and to a more diverse energy platform {we will call that our action step}

This leaves us the most unpredictable factor:

(a)lack of ability or willingness to change at the systems level fast enough to scale possible alternatives in time to avoid catastrophe.

We know that physics is on our side. We know that science is on our side. We know that population growth can be withstrained with education and technology.

But, we do not know that humans are willing or able to change. We have allowed our educational systems to decay horribly in the last 30 years or so. We were warned again and again that we would pay a price for our laziness and lack of will. With the need to completely alter our energy system, we may now be paying the bill for our long years of complacency. "Peak oil" is not a crisis of physics or science or geology. It is a crisis of will and intellectual ability. We have allowed ourselves to be convinced by the lowest element that we are yeast or screaming monkeys. Thus we have educated our young to be no more than screaming monkeys, no more than yeast with only biological processes and no sense of mission or destiny. We are paying the price for our nihlist philosophy and it may be a very heavy one.

We can only hope and pray that there are still a few of those who choose will, action and life over slavery, decline and cultural suicide. THIS DEBATE IS NOT ABOUT SCIENCE. It is about choices. This is an aesthetic, philosophical debate between those who want to slither back into the caves, and those who want to stand up tall, as humans are designed to do, and to reach upward into space rather than downward into the hole. The effort to succeed as real beings of destiny, beings with a future is being mocked daily. It is now hip to give up and accept defeat.

But the reward will be so great for those who reach upward, the sounds of the mocking losers slithering down in the dirt will soon be inaudible.

At least some percentage of the human race are preparing to enter an age filled with glory, a moment in time which will be celebrated in books, film and song in years to come. This is what is meant by "a moment in history." It will be worth being alive at this time in history just to watch the age unfolding. But if you are wise, you will teach your children not to simply watch this great age, but to participate in it. Your children should not be slithering backward into serfdom at such a moment in history. They should be learning to be ready to take part, to lead it. Could you really face yourself in your old age if you caused them to miss this opportunity, the birth of a new age, because you taught them the nightmare ramblings of a dying age, the histrionic occultism of a cult of declining oil worshippers?

Would you drag them down to that level?

THAT, FiniteQuantity, is what I am referring to.

RC

This might go down as the post of the year. "Antidoomer stands claps, tears in his eyes"

Hi Nate,

Thanks. Of course,

re: "And the other camp thinks we see mandatory rationing, resource wars, starvation, etc in under 10 years, and maybe considerably sooner"

These things are already happening. It's a matter of looking up the references. The "starvation" and what we might call "starvation's malnutrition equivalents" are perhaps easier to document than what actually constitutes a "resource war" (as opposed to a war by greedy people, say).

Rationing is mandatory if food and energy are allocated by price and one has no money with which to pay.

Many thanks for the very useful post.

Totally frightening in terms of the light it shines on the disconnect from reality by some very influential players.

What I find so stunning, is the way that economic theory of 'market forces'is so selectively applied - allowing for a moment the hypothesis that the world could eventually find ways of recovering lots more oil from known places and new oil from difficult places, if the price remained in the $100-$300 per barrel range indefinitely, this hypothesis ignores comptely that 'market forces' would ensure that eventually (well wthin the time frames of their forecasts) expensive oil would be replaced by much cheaper electricity.

Mike

Homo semi-sapiens

I don't think it would be replaced by electricity, if what the people are saying about electricity is true. The electricity system is in terrible shape, thanks to deregulation, lack of grid upkeep, and a whole host of other problems. The same economists who chose to ignore oil problems came up with approaches to handling electricity that make it much less stable than it would have been if it had been left alone.

Our grid system was set up with the idea of transmission being mostly local. Now it is being used in a way that it was never intended to be used. We sit and look at oil problems, but if we sat down and looked at electric problems, I think they would be close to tied in severity to the oil problems.

Gail,

I know that where I live, there is an application for a natural gas plant to be completed within the time frame where there are anticipated shortages. But, at the same time, Maryland just declared conservation the first fuel and one expects moderated demand if California's model can be emulated. I think that the grid: generation and transmision and distribution are always facing a crisis that is about as far off as the amount of time it takes to build whatever component is thought to be lacking. If there isn't a crisis, it is hard to get the regulators motivated.

On the other hand, I think it would be possible for oil prices to get people to switch to electricity for heating pretty quickly, and if there are weak elements of the grid that have not been thought through, we could see some surprises. But, I think that will be the crisis that you don't hear about at such a conference rather than the type of constant crisis the grid always has that you did hear about.

Chris

I think you hit on one part of the problem. If we suddenly have a downturn in natural gas availability, we will have some interesting times - I am not sure which buyers don't get what they want. If there is a drought, and some big plants have to be taken off-line during the summer months, this could trigger a different kind of crisis.

I am not sure how California limits demand. I thought part of their low utilization was due to mild climate.

"I am not sure how California limits demand. I thought part of their low utilization was due to mild climate."

CA has limited demand growth tightly in the last 30 years. I believe this is primarily through pricing: residential prices are tiered, and go higher than $.35/KWH.

I believe California has also been very innovative in their pricing structures, so that it is to the advantage of the utilities to reduce use, not provide ever-increasing amounts of power.

For this reason they have done things like provide high-efficiency light bulbs to customers FOC.

A full article on what measures they have taken and what lessons that can provide for other States in the US would be a fine resource.

1) CA per-capita electricity use has stayed flat for 30 years, whereas US average has gone up ~40%, but it isn't just climate. if you look at the lowest energy/person states, many are further North. Some is climate, some is industry differences. A big chunk is just paying attention and putting policies in place, knowing that changing installed base takes a long time.

2) The CA PUC incents *efficiency* at utilities, resulting in oddities like giveaways of CFLs, since they understand that negawatts are the cheapest megawatts. The local utility is PG&E, whose website shows what they're thinking about.

I heard their (impressive) CEO Peter Darbee talk a few months ago.

he said that no one should expect utilities to push efficiency unless the rules changed. Also, he said that utilities tend to be pretty conservative in their thinking. Finally, he said that replacing 28 of 35 senior executives helped a lot.

" The electricity system is in terrible shape, thanks to deregulation, lack of grid upkeep, and a whole host of other problems."

This exaggerates the problem. The US grid certainly needs substantial investment, particularly for transmission, but it's much more reliable than that would suggest. Keep in mind that the need for new generation is exaggerated by utilities, whose regulatory model demands new generation for profit growth.

"The same economists who chose to ignore oil problems came up with approaches to handling electricity"

This is simplistic and unrealistic. It wasn't economists, it was utilities and investors, who saw a profit opportunity (at the expense of the public).

"that make it much less stable than it would have been if it had been left alone."

I agree.

"We sit and look at oil problems, but if we sat down and looked at electric problems, I think they would be close to tied in severity to the oil problems."

Please, let's encourage someone to do this analysis, and stop relying on anecdote and impressions.

Nick, Alan from Big Easy posted recently giving a cost for DC power transmission lines.

Stupidly, I can't find where I bookmarked it, but the costs were surprisingly modest, of the order of a couple of million dollars a mile if my memory serves me.

If that figure is in the right ball-park even in a very cash-constrained environment building a bigger and hence more stable grid would not seem to present insuperable obstacles.

Under those circumstances a rapid build of wind-power would seem to be a good option, as intermittency is it's main shortcoming in the States with it's excellent wind resources.

"cost for DC power transmission lines....the costs were surprisingly modest"

Yes, recent CA and TX long-distance wind transmission projects are being planned on the basis of about $.25/watt, which is very, very roughly 12-15% of the wind farm costs. I don't think they are DC, either.

Gail,

I agree entirely about the shape of the electricity system, particularly in the US, for the next ten to twenty years or so. But the issue is a global one, and I think the imminent possibility of Peak Gas is already mobilising government thinking in some countries - In the UK the government has decided to try and have new nuclear power stations built flat out. Once the lights start going out as in South Africa, the pressure to build more nukes, or concentrated solar thermal, or whatever, will be overwhelming, and will eventually deliver. So in 20 years or so, I can see no reason that expensive oil and gas will have much of a future, for transportation and heating or electricity generation. As we get to that point, hugely expensive investment in oil development will itself be inhibited by the emerging visibility of electricity much cheaper than oil. What happens in some parts of the world will change the views in other parts. By 2050 it looks to me as if electricity will dominate.

Mike

The EIA would piss on your leg and tell you it is raining, if they thought you were stupid enough to believe it.

"If you expect that plug in cars will save the day, you may want to check out what the electricity people are saying about the current state of electrical supply."

When they refer to margin, they're discussing peak periods (and using utility projections that are sales presentations for more generation, and therefore ignore the effect of alternatives such as time-of-day pricing).

Plug-in cars (PHEVs) will be primarily charged off-peak.

Further, utilities (such as PG&E, as well as related entities such as EPRI, Comverge, GM, etc) are aggressively pursuing two-way integration of PHEVs into the grid, such that they will increase grid stability. Utilities can't wait to see PHEVs - the more the better.

I live in the green MRO area of the electricity map with a 2009 date on it. This is a cold region of North America.

I'm currently in the process of replacing my LPG heater backup for my corn stoves with electric space heaters. Eventually I think I will have to replace my gas clothes dryer and tank-less gas water heater also. When I bought them the local rate was about 13 cents/kWh. It is now 9.2 cents/kWh after a rate adjustment that gave the local company a higher monthly set fee. At the time I was on a kick to save electricity because of the high rate and LP was much cheaper.

I have to pay the $30/month fee regardless of how little I use. I originally switched to LP before I knew about Peak Oil. But LP has gotten so expensive that electricity is about the same cost and doesn't have the fuss and expense of buying tankfuls that can cost close to $1000 per.

If I have figured this out, no doubt many others are coming to the same conclusion. It seems to me this as implications for electricity production in this area. While we are slowly adding wind farms, I doubt they are being put up fast enough. The switch to electricity from LP could be rather fast since it is easy to do especially with space heaters. The nice thing about them is you can spot them around the house and only turn on the one near you.

I think what you are talking about is a problem. I have heard about it before with people replacing some form of gas with electric. I know here in Georgia, when I went to replace my gas clothes dryer, the sales person pointed out that electric was cheaper both initially and for annual operating costs.

We haven't been adding electric capacity to any significant extent in recent years, so this higher utilization bumps us up against the capacity of the system. This is especially a problem when it is very hot or very cold. If there are outages, or limitations on the amount of electricity people can use, are most likely when heating or cooling needs are greatest.

"We haven't been adding electric capacity to any significant extent in recent years, so this higher utilization bumps us up against the capacity of the system. "

Again, capacity problems are for peak. Total US generating capacity is about 1,000MW, and average consumption is about 450GW, for an average capacity factor of about 45%. The US has very substantial unused capacity at night.

Peak problems would be relatively easily solved by time-of-day metering, but utilities resist this, as it doesn't fit their regulatory profit structure. This regulatory obstacle could, of course, be easily and quickly fixed.

You might want to actually analyze this, in quantitative terms.

There is a whole learning curve on electricity similar to the learning curve on oil.

It would seem like unused capacity on nuclear would present a real opportunity. Unused natural gas capacity would be of limited benefit, especially if we are bumping up against limits of how much natural gas we actually have to burn. Coal is probably more like nuclear. One would have to look at the detail, to understand the situation.

"There is a whole learning curve on electricity similar to the learning curve on oil."

Yes.

"It would seem like unused capacity on nuclear would present a real opportunity."

Yes, although one wouldn't use that terminology. In the US, nuclear (like wind and solar power) always runs at 100% of available, due to very low marginal costs, and displaces other things. In part due to this (and partly due to excess coal generation) night time electricity is very, very cheap. Significant electricity is wasted at night.

"Unused natural gas capacity would be of limited benefit, especially if we are bumping up against limits of how much natural gas we actually have to burn."

Even if limited, it's extremely useful for load following and balancing (especially at peak), because it's relatively agile. It's terrible for baseload, and not so good for mid-load.

"Coal is probably more like nuclear."

Coal is the base-load swing producer. It's not ideal for load-following (not nearly as good as gas), but nevertheless average coal utilization is about 73%, due to load following.

"One would have to look at the detail, to understand the situation."

Yes. It would be nice to see a good treatment on TOD.