Russia's Oil Production is About to Peak

Posted by Sam Foucher on April 24, 2008 - 10:00am

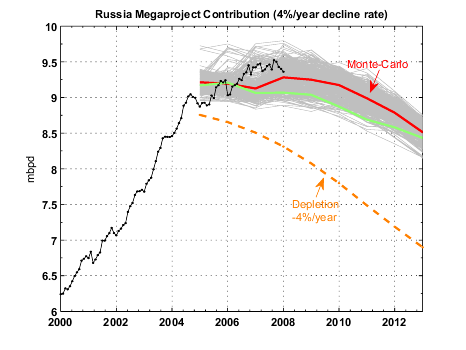

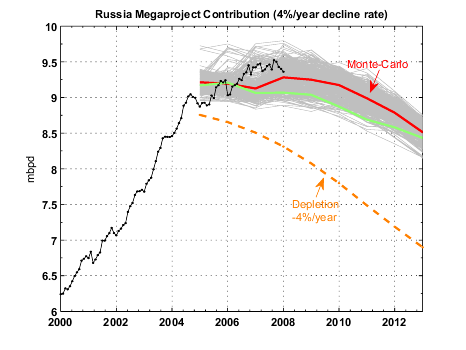

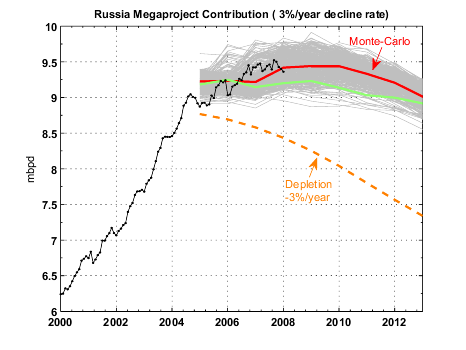

Megaproject contribution from 2005 to 2013, the decline rate is 4%/year with a linear transition period of 6 years starting in 2005. Historical crude oil + condensate production from the EIA.

When Will Russia Decline?

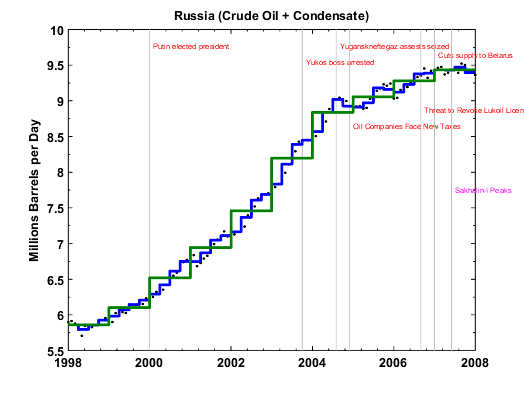

Since 2005, the Russian oil industry has been in constant turmoil. Production growth has also slow down significantly maybe as a result. The Exxon Sakhalin-I project has now reached its peak and production is experiencing a steep decline since. On the upside, many projects are expected to come online and the IEA forecasts that oil production in Russia will increase by 90,000 bbl/d in 2008 and 300,000 bbl/d in 2009, following growth of 200,000 bbl/d in 2007.

Figure 1. Monthly crude oil + condensate production (from the EIA). The blue and green lines are 12 and 3 months average respectively. Click To Enlarge.

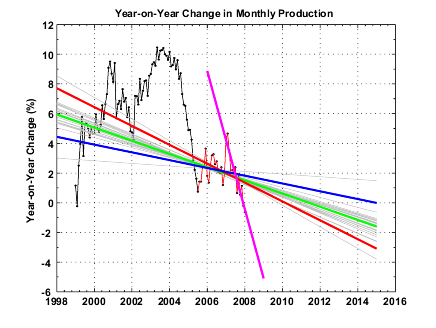

The dramatic drop down in production growth observed by Stuart is still going on and is now close to 0 (i.e. flat production). Several trend lines can be drawn, in particular the trend for 2007 in purple would imply an immediate decline in 2008. However, several decline acceleration periods have occurred in the past (similar lines could have been drawn in 2001 and 2004) so it is unlikely that the rapid decline observed in 2007 will continue in 2008.

Figure 2. year-on-Year change in monthly production for crude oil + condensate. The magenta line is based on 2007 data only, the green line is the average trend using 2005-2007 data and the blue and red lines are the low and high case respectively (95% confidence interval for the fit).

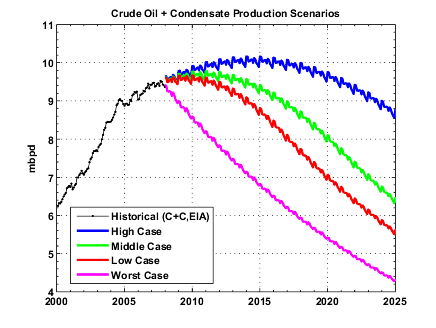

From the above linear trends, we can derive different oil production scenarios as shown on Figure 3 where peak production is seen between 2010 and 2015 with a peak production between 9.5 and 10 mbpd.

Figure 3. Oil production scenarios based on the trend lines shown on Figure 2

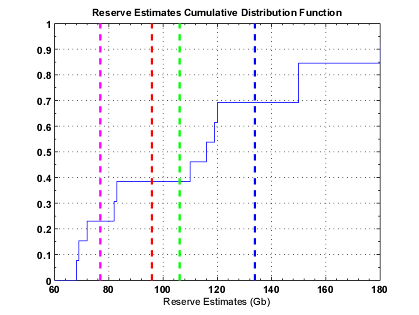

In terms of corresponding oil reserves, these scenarios are consistent with published reserve numbers. Using various reserve estimates gathered by Dave Cohen, I derived an empirical reserve cumulative distribution function (CDF). We can see that the dotted green line (Middle case) around 105 Gb is close to the median estimate at 116 Gb (F50).

Figure 4. The thin blue line represents the CDF of available reserve estimates for Russia. The vertical dotted lines indicate reserve figures corresponding to the different scenarios on Figure 3.

Impact of Future Megaprojects

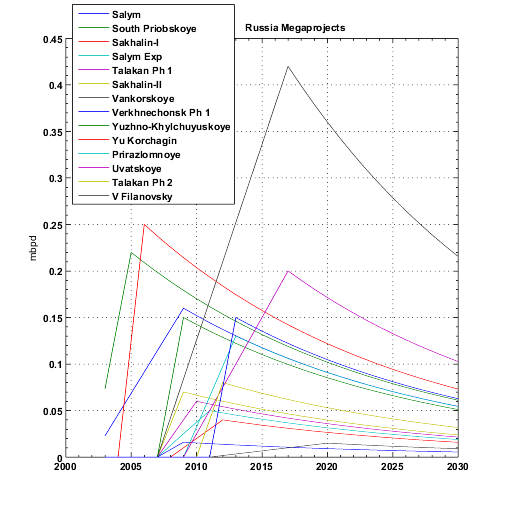

There are quite a few projects for Russia listed on the wikipedia Oil Megaproject list. I assumed an ultra-simple triangular shape for each project with a linear ramp-up until the peak year and an immediate exponential decline (decline rate at 5% on the figure below). When the peak year is not available, the year following the starting year is taken as the peak year. The most important project in terms of flow rate is the Vankorskoye that could reach between 0.4 and 0.6 mbpd in 2015-2017 and therefore will probably offset production decline in existing fields and not really contribute to maintain production growth in the near future.

Figure 5. Hypothetical megaproject contributions for Russia (source: Wikipedia Oil Megaproject project).

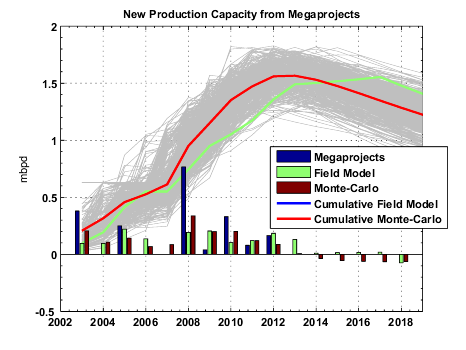

The gross new supply addition is shown as a blue bar on Figure 6, the above field model (therefore including depletion) gives an equivalent net annual supply addition shown as the the green bars. In addition, a Monte-Carlo procedure is applied on the field models shown on Figure 5. Parameters for each field model (time of the peak, post-peak decline rate and duration of the production plateau) are chosen randomly based on empirical probability density functions derived from the UK/Norway dataset (the Monte-Carlo runs are shown in gray on Figure 6).

Figure 6. The blue bar is the gross oil megaproject contribution attributed to the project starting year, the green bar is the annual supply addition from megaprojects based on the field model shown on figure 5. In gray are the Monte-Carlo runs and in red is the average production.

Below, I assumed an ultimate decline rate for the existing production post-2005 at 4%/year and 3%/year (EIA estimate). In addition, because fields online prior to 2005 won't go into decline immediately (see this post for an detailed analysis), the decline rate is set to increase linearly from 0 to 4% between 2004 and 2011. Current production seems to be well within the Monte-Carlo uncertainty interval and at best, a production plateau is seen in the near future.

Figure 5. Megaproject contribution from 2005 to 2013, the decline rate is 4%/year with a linear transition period of 6 years starting in 2005.

Figure 6. Megaproject contribution from 2005 to 2013, the decline rate is 3%/year with a linear transition period of 6 years starting in 2005.

| 2007 | 2008 | 2010 | 2012 | 2008 - 2030 Cumulative Production (Gb) | |

| Low Case | 9.44 | 9.43 | 9.57 | 9.47 | > 62 |

| Middle Case | 9.44 | 9.43 | 9.64 | 9.67 | > 67 |

| High Case | 9.44 | 9.43 | 9.73 | 9.93 | > 78 |

| Megaprojects + 3% decline rate | 9.44 | 9.42 +/- 0.17 | 9.44 +/- 0.15 | 9.21 +/- 0.12 | > 64 |

| Megaprojects + 4% decline rate | 9.44 | 9.27 +/- 0.17 | 9.17 +/- 0.15 | 8.79 +/- 0.12 | > 57 |

Production forecasts for Russia (Crude oil + condensate).

Related Stories:

Stuart Staniford, Are We missing Russian Megaprojects?

Stuart Staniford, When Will Russia (and the World) Decline?

Heading Out, A little more illustrative info on Russia

Dave Cohen, Uncertainties About Russian Reserves and Future Production

Dave Cohen, For Russia, An End To Growth is In Sight, ASPO-USA.

Dave Cohen, Has Russia's Oil Production Peaked?, ASPO-USA.

Other stories related to Russia on TOD listed here.

http://www.theoildrum.com/story/2006/1/27/14471/5832

Hubbert Linearization Analysis of the Top Three Net Oil Exporters

Posted by Prof. Goose on January 27, 2006 - 1:47pm

[ED: This is a guest post by westexas...]

It’s interesting to take a trip down memory lane, to my original post on Net Exports, in January, 2006, and to scroll down through the comments. Note that I slightly modified my Export Land Model (ELM).

In the comment thread, based on Khebab’s work I said that Russia could probably show a year or two of increasing production, with the decline probably startng in 2007.

My concluding paragraph in the post (with my consent) was slightly edited by PG. The original reads as follows:

Based on EIA data, net exports by the top five net oil exporters dropped by 800,000 bpd in 2006, from a 2005 peak of 23.5 mbpd, and I estimate that they dropped by about one mbpd in 2007. If we average these two declines, we get 0.9 mbpd. 23.5 mbpd divided by 0.9 mbpd, gives us 26 years of remaining net oil exports from the top five, which is also the middle case in our (Khebab/Brown) top five net exporters paper.

$225 oil by 2021?? http://www.cnbc.com/id/15840232?video=721421158&play=1

Of course you meant 2012. Yeah, the CNBC gang looked pretty sick as Rubin once again went over what is basically the ELM (my usual disclaimer, I was building on work by Simmons & Deffeyes, among others).

At their current rate of increase, oil prices would double about every 18 months or so.

BTW, regarding the original post on the top three net oil exporters in 2005--Saudi Arabia, Russia and Norway (accounting for about 45% of 2005 net oil exports)--all three of them are currently showing annual and/or monthly production declines, with a predictable effect on net oil exports.

More alarmingly, the clip says in 2012.

Maybe sooner.

Hopefully sooner...

The sooner oil is expensive, the sooner alternatives will be proliferated...

So what do you say to the people that are advocating the Russian don't have western technology that would allow then to search and drill for more oil in the vast region's of Siberia that haven't been thoroughly explored??

Khebab probably has his own opinion, but IMO (for what it's worth--I have never claimed to an expert on Russia) the frontier basins in Russia are to Russia as Alaska is to the US. Alaska helped, but it was pretty much a blip on the long term US decline.

As I have noted several times, Hubbert found that a one third increase in estimated Lower 48 URR, from 150 Gb to 200 Gb (four Prudhoe Bays) only postponed the projected Lower 48 peak by five years.

I don't think it's a fair argument, the Russians are extremely capable and willing in expanding their own resources. Anyway, even if a flurry of new discoveries are occurring, projects are getting more and more complex and costly. It's not easy oil anymore and timing is of the essence in sustaining good production growth rates.

Could you post our Texas/North Sea graph?

These two regions were developed by private companies, using the best available technology, with virtually no restrictions on drilling. The initial Texas decline corresponded to a 1,000% increase in oil prices, and Brent crude, from 1999 to 2007, increased four-fold.

Well, I would reply to those people that actually western technology would not be as advanced as it is if the Russians hadn't been contributing to that advancement. The Russians have hired some of the best engineers from the west as they have also sent out some of their own best engineers to the rest of the world.

My wife has some family working over there and they work with Schlumberger, Maurel&Prom, and such. Some areas are really very extreme and I have a lot of respect for them : they are not only very skilled but also very tough and adventurous people.

What the Russian peaking means for the global crude oil plateau can be seen here (bright green area):

The graph shows incremental crude oil production only as explained in our article here:

http://www.theoildrum.com/node/3793

It contributes to the 2nd underlying peak (of hitherto growing countries) marking what can be considered the end of Bakhtiari's transition phase T1.

According to the late L. F. Ivanhoe, peak production was 12.6 million B/D in 1987.

http://hubbert.mines.edu Issue 98-3

Russia is using Western Technology, they are not stupid. Schlumberger was doing intensive in house training in YUKOS and the same model was then pushed to other Russian oil firms.

Western software, hardware etc. is there and if they lacked the expertise they would buy the consultants in the Market.

So if production is dropping it is dropping because they don't have anything at the moment to stop it from dropping. Fields with sufficient production to do it.

Some of the megaprojects are kind of iffy. TNK-BP's Uvat will be producing around 28,000 b/d in 2009. Expansion beyond that will be slow.

Gazprom's Prirazlomnoye oil field (Barents Sea offshore) is still in the discussion phase. I am doubtful it will produce 130,000 b/d in 2013. This field was discovered in 1989.

Lukoil's Yu. Korchagin (2009) is small -- 40,000 b/d.

Lukoil will be fortunate indeed to get Filanovsky off the ground in 2011 (peak at 210 in 2015?). Right now they simply can't finance development. They are hoping for some tax breaks that would allow them to start development after 2010.

Surgutneftegaz is taking Talakan (Sakha, Yakutia) to 60,000 b/d in 2009 from 20,000 b/d now. They will start production at Alenskoye in 2010. Together, they see these two fields having a potential of 80,000 b/d altogether, but no date can be assigned to that production peak.

Who knows what Vankor will eventually produce? Peak production is many years away. There are difficult financing issues i.e. where's the cash going to come from for longer term large scale development?

So, you see, what we know beyond the next few years (up to about 2011) is not much.

-- Dave

Dave ..

Nice names from those Russian Projects ..

Filanovsky = Fil-a-my-tank-anovsky

Suregutneftegaz = Sure-we-got-no-gas-lefty

Can't wait for them to develop the

No-more-fuel-at-allsky project !!

Triff ..

I actually did some work on Prira - zlom - noye in the mid 1990s. A big carbonate field being appraised then by Hamilton Brothers. Probably not an issue getting it to produce 130,000 bpd by whenever. The telling thing is that the Russians are now developing these deep water off shore fields like this one and Shtockman. I dare say if they had a cupboard full of nice on shore fields they wouldn't bother with this stuff far off shore in the Barents Sea.

Khebab,

What would the model look produce if the megaprojects produced only 50% of their supposed ultimate output?

Something like that (with a 3% decline rate):

I'm still working on that Monte-Carlo simulation, it's pretty much a work in progress.

Thanks! So even with a three percent decline rate, 2008 is peak. With a 4% decline rate, it would be worse.

Duplicate.

5% extraction rate on previous discovery-driven shock model, circa 2005

http://mobjectivist.blogspot.com/2005/11/fsu-oil-shock-model.html

I tend to look at the larger macro-historical sense and when I photoshop my graphs onto the micro-analyzed year-to-year data, I hope you can see what kind of apertures we have available to us.

Interesting, I didn't get good results with the HSM so far. In particular, the 1998 rebound is hard to replicate.

The rebound is basically a stabilization in extraction rate. The notch lines up with the collapse of the FSU. It seems logical that the social and financial chaos that existed during this time had a lot to do with the retrenchment and ultimate recovery in production.

"Russia is a riddle wrapped in a mystery inside an enigma." -Winston Churchill

Khebab's analysis is probably as good as any. But it is a vast, and still somewhat chaotic, land.

Huh. Thought that was from Oliver Stone.

Think they'll just wait for their wells to fill up again?

True about the size. Once I saw a map of Siberia with a scale map of Texas superimposed on it. Texas looked insignificant. I bet if they properly prospected Siberia they would find a lot more oil.

If Western oil companies were able to develop the Russian basins, perhaps they could duplicate the long term success that we have seen in Texas and the North Sea.

The analogy to Texas and the north Sea is invalid. Their production has declined but Texas was throughly prospected for oil in the first place. Much more than Siberia has been. When Texas peaked it's production was the most that could be hoped for. The same is probably not true of Siberia.The North Sea is an undersea formation and they tend to deplete very quickly for some reason.

As noted down the thread, actually Russia peaked back in the Eighties at about the same stage of depletion as the North Sea, based on the logistic HL models. Because of high operating costs, offshore regions are produced at high rates.

The rebound in Russian production in recent years was largely making up for what was not produced following the collapse of the Soviet Union, and as also noted down the thread Russia is now showing declining production.

The question is how the frontier basins, which were not in production in the Eighties, will perform. My guess is that they are to Russia as Alaska is to the US--some help, but no substantial difference.

What the Texas and North Sea declines do show is that regions peak and decline when oil companies can't offset the declines from the older, larger fields. These two regions had essentially zero impediments to drilling. Perhaps if major oil companies were in charge of all production worldwide, they could hold the world decline down to the Texas range, about -4%/year.

This is why I think a global decline rate of -8% and even my concept of accelerated depletion is probably more valid post peak then -4%. What a lot of people don't realize is a good bit of the oil glut that caused cheap prices in the 80's and 90's is related to offshore oil production. I believe its 40% but I'm not finding a good link for the exact number. In any case offshore production has in general much higher depletion rates and thus in general steep 10-30% decline rates after about 80% depletion. On land modern horizontal drilling also has this square wave like depletion/production decline pattern.

So assuming -4% production declines for the world is probably not a good bet. Given the historical production pattern with the long large easy fields on land drilled and depleted first followed by fields generally offshore or smaller with increasingly higher depletion rates one would expect us to see the worlds depletion level to climb fairly quickly on average followed by a steep production decline once the old large mature basins are in production declines. Its the tortoise vs the hare race and in our case both are going to lose about the same time.

I think this is what really driving the fact that technology simply can't stave off production declines post peak the simple dynamics just don't add up.

This is a graph on onshore / offshore shallow / offshore deep production that Matt Mushalik sent me. It was prepared by Energyfiles Ltd.

The graph is of separate layers of world oil production. They are not stacked, which is why the top amount is not equal to world oil production. From this graph, it appears that something over a third of world oil production is currently offshore. The graph includes some forecasts by these folks.

I remember a comedy bit on TV, a parody of USSR television, where a guy would take an outline of a country and place it inside Russia, then cackle madly. "What Fits Into Mother Russia." Everything to scale.

The catch is that in figuring out whether it makes sense to develop these resources, one has to factor in the cost of roads and pipelines to the remote locations. If there is only a small amount of oil, it may not make sense to build a pipeline or roads. Even if it does make sense, the roads and pipelines add huge costs and delay.

I think I'm starting get an idea why it's so hard to convince people of peak oil. My wife has her Masters degree, belonged to Mensa and has a high IQ, yet I can't convince her of the gravity of the situaion, i.e. that prices will continue to rise. She says things like, they'll find more, or other technologies will replace the need for oil. Yesterday she said it was investors manipulating the market. I tried to explain it to her, but to no avail. The reason why is because she has a certain view of the world that is entractable. For her the assurance that the past equals the future is set, without much deviation. Any increases in price will be followed later by decreases and things will be rosey once again.

So here I am not understanding why the World as a whole can't catch up to the idea of Peak Oil, when I'm actually living with a well educated person that refuses to believe it. It's very disconcerting to me that it takes so much to breach the density of people's perception. I guess that's why situations must become dire before anyone acts.

For some, the glass is half empty. For others, half full. And for some, when it's half empty, it starts refilling itself..

I have tried to gently introduce this issue to family and friends, so far no one "understands" what I'm talking about. Better technology will save us, always. I think people are fobic of peak oil and its consequences.

It's very difficult to convince people, especially the educated ones. Nate Hagens has a few posts about the psychology behind peak oil. Most still think that oil is being produced and not extracted. King Hubbert could not even convince his peers in the 50s about the US peak production and it has not changed today.

Cs: I am not sure that the premise "the World can't catch up to the idea of Peak Oil" is valid. CEOs, stock analysts, energy analysts, politicians, MSM mouthpieces, etc. etc. are notorious for dishonesty so at this point it is very difficult to quantify what % of the world "gets" Peak Oil-IMO it is dramatically understated. IMO the Saudis will be trumpeting endless reserves the day after they are safely ensconsed in Geneva or Monaco or some other haven and the well has almost literally run dry.

My wife and I had some raging fights about it.

Three things helped greatly:

1) I have a Peak-Oil aware coworker. We went and visited him and his wife. While Paul and I disagree on the final outcome, we both agree on the technical whys.

2) My plans for mitigation all involve keeping one foot in both worlds and slowly shifting weight just a little bit ahead of the rest of humanity. I bought a farm so we could produce our own food and be out of the cities when the chaos erupts.... but for now, we raise natural produce and food for the hoighty-toighty Boulderites. So if oil really is replaced by magic fairy elves and sunshine, well... I've got a nice farm that I enjoy anyway. If chaos erupts, I've got a safe haven.

3) My wife likes the chickens, sheep, and vegetable garden.

My wife and I had some raging fights about it.

Four things helped greatly:

1) I have a Peak-Oil aware coworker. We went and visited him and his wife. While Paul and I disagree on the final outcome, we both agree on the technical whys.

2) My plans for mitigation all involve keeping one foot in both worlds and slowly shifting weight just a little bit ahead of the rest of humanity. I bought a farm so we could produce our own food and be out of the cities when the chaos erupts.... but for now, we raise natural produce and food for the hoighty-toighty Boulderites. So if oil really is replaced by magic fairy elves and sunshine, well... I've got a nice farm that I enjoy anyway. If chaos erupts, I've got a safe haven.

3) My wife likes the chickens, sheep, and vegetable garden.

4) Current trend are proving me a lot more correct than her friends who were all afraid she married a lunatic. So far I haven't killed her and buried her in the back yard, but gas prices are going through the roof and we are still in Iraq.... both things I promised would happen. She is a little bitter that her IRA was moved to Gold and it has been holding steady but my point is always "look at Alcoa and tell me you wanted it there!"

Men In Black

"Oil Will Never run out."

I believe this is a true statement.

However, as time goes on, production goes to zero (but never reaches zero)....at least in a mathematical model.

Flow rate will certainly decrease...

It always annoys me when people familiar with economics use this little idiom..

Yes the quantity of oil on earth will never reach 0 barrels. It will just become so expensive, no one can use it anymore.

Relying on economics to solve all problems is just bad reasoning, because many people are led to believe a free market is perfect. It is fact due to the principle of what runs it, rational self-interest. If a free market ran under the assumption that all people had perfect instantaneous information then perhaps a free-market would efficiently and effectively allocate resources. However, this is not the case and so crisis's are inevitable in such a real world system, in the form of the weakness's of the free-market. The free market does not account for negative externalities and never will unless the fundamentals of it change or another factor makes it. The free market also suffers from short-sightedness stemming from it's lack of perfect information and it's basis in rational self-interest. The free-market also suffers from the lack of any sort of unified currency that has a basis in reality, therefore you get economic practices that seem viable but are in fact not, for instance, the pursuing negative or low eroi sources of energy. The hierarchy of society and structure of the free-market also inherently dictates that growth rationally will be pursued, which if one has any ecological, mathematical or common sense, would show you a serious flaw in the sustainability of this system. The people who state that the market place will solve all the problems typically also believe in magical sunshine cupcake faeries, and have a limited understanding of economics. This limited and fallacious understanding of economics by many, is another case of humanity putting faith above reason. So let's get to burning those witches and werewolves, while Rome falls.

-Crews

I believe Samsara was implying that

Is a false statement that people believe to be true. Soon they will discover that they were mistaken, like they discovered that the Earth was round and not the center of the Universe.

Unfortunately high IQ doesn't correlate well with wisdom. The mental faculties are as much influenced by how consistently and analytically you can think, your sense of proportions and scales, deriving cause and effect maps with weighted influences and feedbacks to the mix, and finally organizing all this into relevant and irrelevant strains. And being able to relate to different roles, taking different points of view, thinking laterally, ...

Most importantly though, thinking is not a calculation but a process. The conclusion is not as relevant as the path that lead up to it. Wisdom comes from the experience of thinking. Having learned how to think, you are free to explore and compare various methods and models to your perception over time. And you learn by failing - just like in most scientific experiments, you learn more when you fail or when something unexpected happens. Making convenient hypothesis and then finding ways to affirm those with the right experimental setup is a recipe for a fallacy. You have to go out of your way to prove yourself wrong, to play the devils advocate. All this is something people don't do so well, however high their IQ.

I used to annoy my math teacher by finding new ways to solve his problems that he actually had to think through when checking. Later I went to the mensa thing and scored high enough but didn't bother to join. I didn't relate to those people. Although I enjoy my work at the physics lab here, I don't have deep discussions with my colleagues. Somehow they can't think straight, make analysis of problems, or they have no attention span for it. Mostly though they resort to the same techniques as your wife - presumptions fed to them by our media, education and culture about the way things are, the ways they have always been. Arguing against such assumptions isn't about IQ, more about emotions, gut feelings, almost a religious state of mind.

But I have been able to convince a few of my closest friends through sheer persistence - Albert Bartlett's lecture 'Arithmetic, Population and Energy' helps. After you get them interested in the concept, you might get them to read Tainter's 'Collapse of Complex Societies' - ones they internalize the ideas of declining marginal return of complexity, and the fallacy of infinite substitutability, they should have a firm grounding into the analysis of our current day situation.

Pointing to some statistics and saying 'see'! works on people for a while but it isn't very effective in the long run if they don't understand the underlying mechanisms (if they haven't done the calculus themselves as Bartless would say). Try to get her to at least read some of the basics of how oil reservoirs and oil exploration actually functions (can be found here on TOD) - she might get worried/interested after that...

best of luck - Miikka

Right on ! Dealing correctly with peak oil is going to require a lot of out of the box thinking and I mean seriously out of the box. For example most of the people esp cornicopians that run around solving the problem ignore the real problem. Its a lifestyle issue. Who cares if you have corn ethanol powered SUV's if your country has deteriorated to a Zimbabwe or worse existence level with the elite in control of everything. You have to develop a new lifestyle that has as its most important element real freedom to be innovative to continue to change.

And most important this means recognizing that what you have just written is the real enemy. It is us and our inability to be creative and with it more open minded in a social sense thats the root of the problem. Fantastic post.

Thanks Miikka for your post in reply to my questions regarding my wife's denial of PO. There are many gems in your post - very enlightening. "The conclusion is not as relevant as the path that lead up to it." That says it in a nutshell, as each one of us takes a unique path to achieve our conclusions.

My wife is a psychologist and she doesn't get it! That is the case even though I have discussed the psychology of PO with her and she has expressed broad agreement with the conclusions presented in a couple of excellent posts right here on TOD some time ago.

We live in Australia and last weekend our Prime Minister had a 2020 summit where 1000 of Australia's "best and brightest" gathered to consider the big picture in 2020. All Australians were asked to contribute. This was mine (http://anz.theoildrum.com/node/3872#more), it was one of 1000 contributions "accepted" for consideration out of 8000 in total. Peak Oil wasn't mentioned or even discussed. I sent her a link to this article (http://www.energybulletin.net/43115.html) that was very negative on the 2020 summit, after which we had a rather uncomfortable fight. Deep down she may understand the issues, however her response can be summed up as: "That is your opinion", "You have become obsessive about it"; and "Other people have valid opinions too."

In other words she has not understood, or does not accept that we as a species have an absolute dependency on oil, and that any plannning for 2020 that does not include oil supply is pointless, including the 2020 summit.

I think her objections lie in the Question "What does one do next". If, intellectually, both partners in a couple accept PO the family MUST respond. She is too fond of our urban life with the kids settled in good schools and getting good grades (even a scholarship - yesterday!) to turn our lives upside down. If only one partner understands PO and they cannot convince the other, the family will do nothing beyond tinker at the edges.

In 2007 Leonid Fedun, an oil executive of Lukoil, indicated that Russian oil production was peaking.

More recently:

http://www.google.com/search?hl=en&q=Leonid+Fedun%2C+the+52-year-old+vic...

What many people do not realize is that while oil companies earn billions, billions must be invested in new production or else there will be no new oil when the older wells are pumped dry. New oil production projects cost billions. Refinery upgrades cost billions. When governments start to add more tax burdens, the oil companies have less money to invest in new oil or natural gas production, refineries etc. The Russians saw foreign operators having the potential to earn billions and needed more tax income to pay for public services. Russian oil production cannot rapidly expand under such policies.

United States oil production is down this year compared to last and growth in natural gas liquids production was slowing. With the government complaining about the oil companies having money and raising royalties and so forth; the development of U.S. resources might slow also.

Indian oil production dipped in 2005 and then rose in 2006 & 2007. With Russia, once does not see any schedule that will allow for production to increase again in the near future.

It always annoys me when people familiar with economics use this little idiom..

Yes the quantity of oil on earth will never reach 0 barrels. It will just become so expensive, no one can use it anymore.

Relying on economics to solve all problems is just bad reasoning, because many people are led to believe a free market is perfect. It is fact due to the principle of what runs it, rational self-interest. If a free market ran under the assumption that all people had perfect instantaneous information then perhaps a free-market would efficiently and effectively allocate resources. However, this is not the case and so crisis's are inevitable in such a real world system, in the form of the weakness's of the free-market. The free market does not account for negative externalities and never will unless the fundamentals of it change or another factor makes it. The free market also suffers from short-sightedness stemming from it's lack of perfect information and it's basis in rational self-interest. The free-market also suffers from the lack of any sort of unified currency that has a basis in reality, therefore you get economic practices that seem viable but are in fact not, for instance, the pursuing negative or low eroi sources of energy. The hierarchy of society and structure of the free-market also inherently dictates that growth rationally will be pursued, which if one has any ecological, mathematical or common sense, would show you a serious flaw in the sustainability of this system. The people who state that the market place will solve all the problems typically also believe in magical sunshine cupcake faeries, and have a limited understanding of economics. This limited and fallacious understanding of economics by many, is another case of humanity putting faith above reason. So let's get to burning those witches and werewolves, while Rome falls.

-Crews

With what do you plan to replace the free market?

Well, I was mainly trying to point across that the free market is far from perfect and faith cannot be kept in it. We today do not have a purely free market mainly because of the things stated above the free market does not account for. We developed governments to try to account for these things, and in doing so initiated a constant struggle for power between the market and the government, because those entities are acting in their own self interest it follows they will try to grow. In a environment of limitations a struggle will ensue, just like in nature there is a struggle for survival. The markets and governments entity's of the world can actually be thought of like different species competing for survival, filling niches, and constantly evolving. In nature the most successful species are often the simplest and smallest. One could argue that microbes, bacteria and algae are the true rulers over this world.

I would advocate a marketplace that is almost completely decentralized, i.e. instead of a single giant power plant powering millions of homes, you have millions of small power plants powering one home each. Each home or in reality the smallest unit of governance or market would not be a single home but perhaps the size of a small town, or a city-state. These states would all act like organisms in an environment and compete for survival. With modern communications they can do a much better job of coordinating themselves into a better position in the world. I think the state most suited for survival would be emulated by the others, therefore ensuring all entity's, city-states, or w/e would be suited for survival to their particular area. Sustainability would eventually be ubiquitous because the most sustainable states would survive best obviously. Other areas dependent upon non-sustainable practices would collapse and or be forced to emulate the sustainable practices of the others.

here in the US I am advocating states regaining more of their sovereignty and the federal government losing a lot of its. I am also saying we might move towards emulating more successful countries, such as the Scandinavian countries, Switzerland, Germany and Japan. Not everything about them, just the stuff that works. It's kind of interesting to notice that some of the most successful and sustainable countries have stable or declining populations. That is a fundamental key to making the world a better place. Anyway these are just some idea's, feel free to point out any flaws, I learn more from arguing than from anything.

Sorry for any mis-spellings or grammar mistakes, I'm in a bit of a hurry.

It's extremely annoying when you see a good analysis being attacked with such a shallow strawman.

Swords was not suggesting to "replace" the free market with anything, he was criticizing the irrational belief that free markets fix everything. I think the difference is pretty obvious.

LevinK,

I appreciate it, straw men are flying everywhere nowadays. I wish people would learn to argue with reason, facts and logic as oppose to the kind of circular reasoning fallacy ridden straw man approaches.

Others responded vis-a-vis the free market, but may I make a very laymanesque observation? There is nothing wrong with the free market. The problem is we do not now have, and have never had, free markets. "Free" markets are either regulated in such a way as to benefit those with the greatest resources to hand or by governments... to the same ends. Yes, one can argue things are better than in, say the Middle Ages, but in a relative sense, not really. We went from the king in the cold, dank castle and the peasant in the mud hut to the billionaire with a Lear and the worker/peasant with a McMansion, or far worse, and a load of debt he's choking on. Debt that made the billionaire a billionaire.

So, what is needed is... free markets. But this is an ideal. There are reasons that we see cycles in everything people do, and it is because we are as much a part of nature as the lion pride that goes through boom and bust periods depending on the amount of rain that falls on the Serengeti. Were markets truly free and all opportunities open to all, we'd be moving in the right direction.

Were the peasants not in debt to the lords of the manors, we would be yet another step closer. This requires there not to be debt. That requires there not to be a fractional banking system; let us buy only what we can afford. The economy moved much more slowly when this was the case. We would not now be in overshoot of the planet were there no fractional banking system. With no fractional banking system, there is no *need* for growth simply to cover the interest owed. Growth can then be left to more natural forces, such as weather, population, competition, etc.

The third needed change is an understanding of Dunbar's number. Complex systems collapse. This is a universal truism. Sure, the Mars rovers are still going, but they're not really systems, are they. Find a society or empire that hasn't suffered collapse of some form. England/Great Britain still exists, but the empire is gone. Same for Italy. China is relatively the same contiguous area it has been for quite a while, but the actual borders/economic systems/rulers have changed many times. The entire socio-political system changed just a few decades ago. And it is not an empire.

Dunbar's number suggests we can only live stably for long periods of time in small groups. This makes sense to me, a person with a background in psych and education. Cohesion requires connection. When connections fail, so do consideration, empathy and sympathy. Yes, we are able to redefine what our group is based on circumstances. E.g., in time of peace state may fight state, neighbor fight neighbor and even brother fight brother, but let a time of war come - a time of a threat from "the other(s)" - and those divides can dissolve. But they re-assert almost immediately after the threat passes.

Dunbar says we need simple systems with real connections. Small communities remove the need for usury as neighbors go all - gasp! - "socialist/commie" and share. Small communities allow simple solutions to complex problems. Barn burnt down! Time for a barn raising! Raise the barn. Milk some cows. VS. Barn burnt down. File the insurance claim. Battle the insurer for a fair settlement. Contact a builder and negotiate prices. Get the permits for building. Get it built. Take the builder to court for shoddy work. Fight five years of appeals. Get the barn repaired. Milk some cows. Sell the cows to pay the lawyer.

Relocalization is nothing more than saying let's live in smaller communities and share. If we add not seeking growth for it's own sake, i.e., greed, then we can maybe find ways to live with the earth and each other.

Cheers

I'm a bit confused. This article concludes Russian oil production probably won't peak until 2010. I'm confused bc just recently Russia has reported its at peak production. What I'm I missing?

With the first approach, peak is projected to be between 2010 and 2015 at 95% confidence.

If you look at figure 6 (Megaprojects + 3% decline rate), production in 2010 is seen at 9.44 +/- 0.15 mbpd so production in 2010 can be lower than 2007 level.

The conclusion is more than it is very unlikely that production growth will continue past 2010.

This analysis does not take into account recent news for Sakhalin-I declining at >20%.

One gets a far scarier picture using HL. In attempt to model post-Soviet production, we (my idea, Khebab did the heavy lifting) took only the data through 1984 and then predicted post-1984 cumulative production.

Russia only recently "caught up" to where it should have been, based on the HL model, and therefore it seemed likely that its production decline should resume. IMO, the HL model is a decent model for the mature Russian basins that were in production in the Eighties.

IMO, the decline in the mature basins will be so severe that new fields can't offset the decline.

Some graphs:

In Defense of the Hubbert Linearization Method (June, 2007)

http://graphoilogy.blogspot.com/2007/06/in-defense-of-hubbert-linearizat...

I don't know what to make of this 'announcement' that Russia has peaked. How long did it take the USA to confess to peaking? What about the UK? Doesn't it usually take years to begrudgingly confess to the fact? And now Russia are doing it after 3 months!? I have not seen anyone address this point yet...

There has been lots of "smoke" regarding Russian production, especially a report last year from Alpha Bank warning of rapidly rising water cuts.

My premise is that most of the recent rebound in production was making up for what was not produced following the collapse of the Soviet Union. In a nutshell, the problem is that Russia is highly dependent on some old oil fields that are watering out. I suspect that this has a lot to do with the recent announcements.

But this is the key point: Our middle case (using HL for production estimates) is that net oil exports from Russia, the #2 net oil exporter, will be approaching zero net oil exports in about 16 years, while net exports from Norway, the #3 net oil exporter in 2005, will be approaching zero net oil exports in the same time frame.

Has there been an editorial decision on TOD not to use HL anymore? I had thought that HL predicted the Russian peak with a lot of accuracy. I was surprised the Khebab did not mention it in this piece.

Anybody can use any mathematics they want. Basically, any math at all is useful.

You missed to look at the graph I had just posted earlier on.

http://www.theoildrum.com/node/3626#comment-334363

When looking at the crude oil statistics (EIA), Russia has just peaked.

Just remembered the East Siberia pipeline and a number of large fields there undeveloped. It might smooth out declines in Western Siberia. If you have one person working in Western Siberia commenting about the Russian situation and another who worked primarily in the East, you might get two unique view points.

http://www.oilru.com/or/31/581/

That's about 2 million bbl/day by 2020 or 2.5 million bbl/day by 2030.

Although significant, will probably only offset Russia's decline...

Great analysis, as usual, Khebab!

Unless Russia has some secret oil fields, I’m convinced that Russia’s production is now in irreversible decline.

This is one of your charts, with my forecast shown by the blue line, below (crude oil, lease condensate and natural gas liquids).

click to enlarge

This chart below is from Colin Campbell for regular oil, assumed to be crude oil and lease condensate, URR 210 Gb.

click to enlarge

Source: http://www.energybulletin.net/3600.html

Russia has produced about 140 Gb C&C to end 2007. Using Colin Campbell’s 210 Gb URR, that leaves 70 Gb remaining. This produces your worst case scenario in your Fig 3 above, which I support.

For comparison, the Oil & Gas Journal remaining Russia proven reserves at year end 2007 is 60 Gb(excludes probable reserves).

You don't have to invoke secret oil fields. According to the statistics behind Dispersive Discovery theory, nothing more will be found than described by the (smoothed) discovery profile in the above curve. Of course, someone will invoke the Black Swan and perhaps find some statistical glitch, but the only way the overall trend can change is to experience some huge paradigm shift -- which I suppose can be the Black Swan that people are desperately hoping for.

I'm having a hard time believing in such a collapse, eyeballing Campbell chart, the post 2010 decline rate looks like around 5.8%/per year. It's pretty high but in the same time the average growth rate for the 1998-2007 period is around that value. Do we have info on the average decline rates for fields brought online after 1998?

Based on the HL models, Russia in 1984 was at about the same stage of depletion at which the Lower 48 was at in 1970.

You could take the post-1970 cumulative Lower 48 production numbers, and assume a catastrophic political decline in about 1975, followed by a rebound, with a secondary lower peak at about 1990, and then use HL to "solve" for the post-1990 Lower 48 decline rate.

This might be a way to model the post-2007 decline from mature Russian basins.

Then the question is how many "Alaskas" are out there.

I suppose that you could then take post-1975 Alaskan production and add it into the synthetic Lower 48 chart at some point, say about 1985 or so.

This November 2007 Uppsala 100 page thesis on Russian oil by Aram Makivierikko might be of interest.

http://www.peakoil.net/publications/russian-oil-a-depletion-rate-model-e...

http://www.tsl.uu.se/uhdsg/Publications/Aram_Thesis.pdf

On page 53 of the thesis, the decline rate is very steep at 5.53% if it is assumed that 70 Gb oil remains.

Now, both vice president of LUKOIL, Leonid Fedun, and Viktor Vekselberg, an owner of TNK-BP have stated that Russian oil production has peaked.

http://www.peakoil.net/headline-news/more-about-the-peak-in-russian-oil-...

For the old Samotlor field, there is this data from TNK-BP.

http://www.tnk-bp.com/operations/exploration-production/production/

http://www.tnk-bp.com/operations/exploration-production/production/tnk-b...

Assuming that Samotlor production is from Samotlorneftegaz, Yugraneft, and TNK-Nizhevartovsk, then Samotlor's production was 0.660 mbd in Jan 2007 and 0.628 mbd in Dec 2007. This represents an annual decline of 4.85%.

The chart below is a forecast assuming that remaining URR is 90 Gb (close to your low case in Fig 3 above) which is 30 Gb more than the Oil & Gas Journal's remaining proven oil of 60 Gb. It is assumed that the depletion rate is about 4%/yr which gives a production decline rate of 4%/yr.

click to enlarge