Science 1101 Part 1: The Science of Oil and Peak Oil

Posted by Gail the Actuary on February 5, 2008 - 5:24pm

In this article, I provide Peak Oil science curriculum suitable for introductory college science classes, advanced high school classes, and adult seminars. The material requires a little background in high school chemistry, but otherwise does not have any pre-requisites. There is sufficient material for a two to four session unit on peak oil.

The written material is divided into Part 1: The Science of Oil and Peak Oil (in this article) and Part 2: Oil as a Liquid Fuel and Expected Peak Oil Impacts (found at this link). There are also discussion questions at the end of Parts 1 and 2, and numerous links to other references. A PDF version which contains both Part 1 and Part 2 can be found at this link.

Last week, I posted an earlier version of proposed peak oil curriculum. Many of the comments related to things I had left out or hadn't explained adequately. After considering the comments, I decided that folks were right, and added some more material. Since the post was already fairly long, I broke it into two parts. I also reorganized sections to make a more logical flow. The earlier version can be found at this link.

The current version incorporates changes based both on comments to this post, and on comments to the previous post. On a rapidly changing topic such as peak oil, there is no real consensus on some issues. I have tried to pick a reasonable interpretation. If readers have questions or comments, I can be reached at gailtverberg (at) comcast (dot) net.

1. What is petroleum?

Petroleum (also called oil) is a viscous liquid that is found beneath the earth’s surface that is refined to make fuels, plastics and other goods. Oil is not found in large pools. Instead, it is generally trapped in the pores of sandstone or other porous rocks. It is often found with natural gas, which is formed under similar conditions.

Petroleum is not a single compound. Instead, it consists of a mixture of hydrocarbon chains of different lengths, ranging from about C5H12 to C42H86. It also contains some associated hydrocarbon gasses, with 1 to 4 carbon molecules. When petroleum is burned, the hydrocarbon chains plus oxygen are transformed into CO2 (carbon dioxide) and H2O (water), and energy is released. Carbon dioxide is one of the major gasses implicated in global warming.

2. How was petroleum formed?

Petroleum was formed millions of years ago from the remains of small plants and animals that lived in seas or lakes. These plants and animals died and fell to the bottom of the sea. Gradually, layers of silt and sediment covered their remains, causing great heat and pressure to build up.

Under this heat and pressure, a chemical reaction took place, transforming the hydrogen and carbon from the decaying plants and animals into the mixture of hydrocarbons that we know as petroleum. This petroleum is found in only a relatively small number of places in the world, where conditions were precisely right for its formation.

3. Is new petroleum now being formed?

Not in any measurable quantity. Once we use up the petroleum that was formed millions of years ago, it will be gone for good.

4. Aren’t we continuing to discover more and more oil every year?

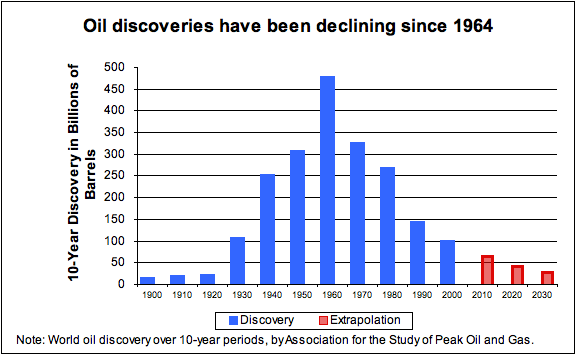

No. Once we started looking for oil, we found more and more oil for a while, but then new discoveries started to drop off, as more and more of the world was explored. This is shown in Figure 1, below. We are continuing to discover oil, but the quantity discovered now is much smaller than it was years ago, and much smaller than we are now using. (In all of these charts, the amount of oil is measured in barrels. A barrel is equal to 42 gallons or 158.984 liters. The total quantity is huge!)

We often read in the news about finding new fields, but these fields tend to be smaller and harder to reach than those discovered in the past. We are now so concerned about finding oil that even small discoveries are reported as news.

Figure 1 does not include oils that are not liquids, like the Canadian oil sands. There are large quantities of these, but extraction is extremely slow. It is doubtful that they will ever become a significant share of world oil production.

5. How is petroleum extracted from the ground?

Petroleum is generally extracted by drilling oil wells in areas where there is some reason to believe oil might be located. When oil is first found, it often comes from the ground very quickly, under great pressure. Gradually, the oil comes out more and more slowly. This happens partly because the oil pressure drops, and partly because the oil that is extracted from the ground tends to be mixed with more and more water, as more oil is removed from the ground. Many US oil wells produce more than 99% water.

In some places, such as the Canadian oil sands, a very viscous form of oil is found. This is mined, rather than extracted using oil wells. Production of such oil tends to be very slow and expensive.

6. Is all of the oil in a given area removed by the use of oil wells?

No. As noted in Item 1, oil is generally found trapped in the pores of porous rock such as sandstone or limestone. The rock is somewhat like a hard sponge, with a goey liquid trapped inside. This oil is very difficult to get out of the rock. If wells are used to collect the oil that seeps out of its own accord, typically only 10% to 30% of the oil originally in the rock can be removed.

Various methods of enhanced oil recovery have been developed to increase the percentage of oil that can be removed. One approach uses water injection to increase the pressure in the well. In another approach, carbon dioxide or some other gas is injected, to force some of the trapped oil out. In one newer process, microbes are used to break up the oil droplets into smaller pieces, so that they can more easily be removed. One method under development uses an underground fire to heat the oil, so that it will become more liquid and drain out of the rock (Microbial Method: http://www.titanoilrecovery.com/ Water injection: http://en.wikipedia.org/wiki/Water_injection_(oil_production) Underground fire: http://www.theoildrum.com/node/2907 )

Usually, even with enhanced oil recovery, not more than 50% of the oil originally in place can be removed. Often the percentage is quite a bit less than 50%. Some of the newer enhanced oil recovery methods offer the possibility that this percentage may be raised in the years ahead.

7. Can an oil company produce a constant amount of oil in a given location?

No, it generally doesn’t happen this way. When a single oil well is drilled, production very often quickly reaches a peak, and then tapers off over a several-year period, as oil pressure drops and the amount of water produced increases.

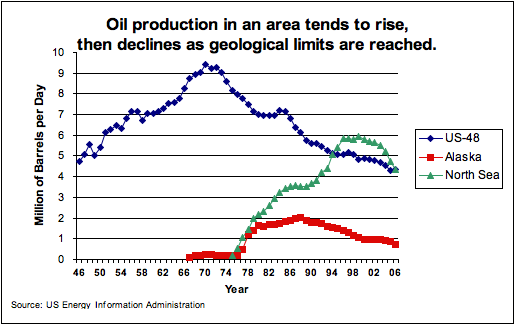

When we look at production from all of the wells in a given geographic area, production generally increases for several years, as more and more oil wells are drilled. One by one, wells begin to decline, and new wells are drilled. Eventually, there are not enough new places to drill additional wells, and overall production starts to decline. (See Figure 2, below.)

US oil production for the 48 states excluding Alaska and Hawaii reached its peak in 1970. Once energy companies realized that production was declining in the US 48 states, they looked for new locations where oil might be extracted. Alaska had oil, but it was difficult to transport oil out of Alaska without a pipeline. The necessary pipeline was completed in 1977. Production reached its peak in 19888, and has been declining since then.

Oil production was also begun in the North Sea, near Norway and Great Britain, but this too soon reached a peak. North Sea oil production has been declining since 1999. All of these declines have taken place in spite of new technology and improvements in oil recovery methods.

Oil is also produced in many other parts of the world, but oil recoveries are starting to decline in many of these areas as well. At this point, much of the world’s “easy to produce” oil has been removed. New oil production tends to be in difficult areas, like deep-sea locations.

8. Will world oil production reach a peak and begin to decline? If so, when?

Since oil is a finite resource, we know that production must eventually decline. There is considerable disagreement as to when this decline in production will occur.

The US General Accountability Office (GAO) released a report in March 2007 titled, “Uncertainty about Future Oil Supply Makes It Important to Develop a Strategy for Addressing a Peak and Decline in Oil Production.” This report indicates that decline is likely to begin sometime between now and 2040. The United States Association for the Study of Peak Oil indicates that the peak and decline is expected to occur prior to 2015.

Even oil companies are beginning to talk about the possibility of future production falling short of demand. This wouldn’t necessarily be a decline; it might be a plateau or slight increase. Shell Oil says, “After 2015, easily accessible supplies of oil and gas probably will no longer keep up with demand.”

(GAO Report: http://www.gao.gov/new.items/d07283.pdf Shell Oil statement: http://www.shell.com/home/content/aboutshell-en/our_strategy/shell_globa... National Petroleum Council 2007 report “Facing the Hard Truths about Energy” http://www.npchardtruthsreport.org/

Canadian Business article: http://www.canadianbusiness.com/columnists/jeff_sanford/article.jsp?cont... )

9. How are estimates of the date of peak production made?

There are a variety of methods. In 1956, M. King Hubbert correctly forecast that oil production for the United States was likely to reach a peak and decline about 1970. Estimates from that time period put the peak in world production at about 2000. Because of efficiency increases and energy conservation efforts that were put in place during our previous energy crises, growth in oil usage slowed and the date of the peak was pushed back. http://www.hubbertpeak.com/hubbert/1956/1956.pdf

Besides using techniques similar to Hubbert’s, estimates now consider additional types of information, including new projects being planned and decline rates on existing fields. Another consideration is the fact that it been very difficult to increase oil production in the past few years. Oil production since 2005 has been flat, in spite of increasing prices. Oil companies are having difficulty finding more oil reserves to replace those used by extraction of oil during the year.

The organizations with the highest estimates tend to put greatest reliance on published reserve estimates of the major oil exporting nations. These amounts are not audited. There is increasing evidence, including Google satellite information, that these amounts are inflated. Exporting nations look more powerful if they report high numbers, so there is a temptation to report optimistic amounts. http://www.theoildrum.com/node/3574#more

10. Can outside factors make a difference in future production?

If every country had infinite resources, and chose to put them all into oil production, it is likely that oil production would be higher than it is. In the real world, that is not the way it is, though.

One limitation is the supply of trained geologists and engineers. The energy field has been stagnant for many years. Many people trained for the oil and gas have left the field, because of frequent boom and bust cycles. Of those remaining, a disproportionate number are near retirement age.

There are also limitations on physical infrastructure. There is a limited number of drilling rigs, especially those needed for the very deep-sea locations now being explored. The forces of supply and demand drive up costs for these rigs, making projects more expensive. Other infrastructure items are in similarly short supply. Companies do not have infinite budgets, and can’t use equipment that is not available, so projects get pushed back.

Another factor is the influence of foreign governments and of government sponsored oil companies around the world. One estimate is that only 7% of the world’s oil reserves are in countries that allow “International Oil Companies” (companies like ExxonMobil, Chevron, and Total) free reign.

Wars and civil disorder can affect production. The production of Iraq and Nigeria have clearly been affected by fighting of various types.

One factor that has the potential to help future supply, or at least soften the down slope, is technological advances. For example, some of the newer enhanced oil recovery methods may have promise. Putting them to work on old fields could be done, but it would not necessarily easy. In many cases, oil rights would need to be obtained from current owners, and new wells drilled. This would be expensive.

11. How certain are future petroleum imports?

Not very. Oil imports comprise about two-thirds of US petroleum use. The amount of future world production is uncertain, and the portion available for import is even more uncertain. Oil exporting countries want to keep their own populations happy. This often means increasing use of oil within the country, at the expense of exports. Also, if it becomes clear that there will be a shortfall in world production, exporting countries may decide to hoard the oil they have, saving it for the future when it is likely to sell for an even higher price.

Another concern is a possible drop in the value of the dollar, because of difficulties within the US financial system, or because of balance of payment problems. If the value of the dollar should decline, oil will be much more expensive, so it will be difficult to buy as much.

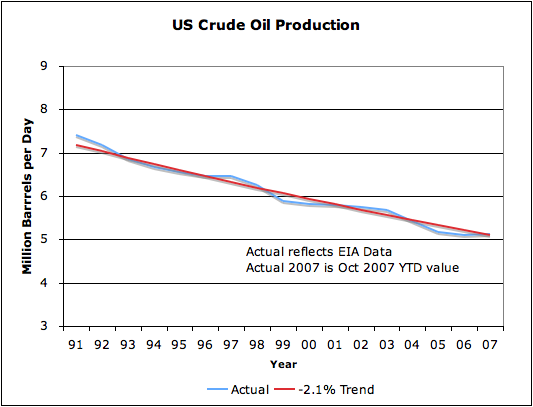

Figure 3 below shows US crude oil production. It has been decreasing at about 2.1% peer year.

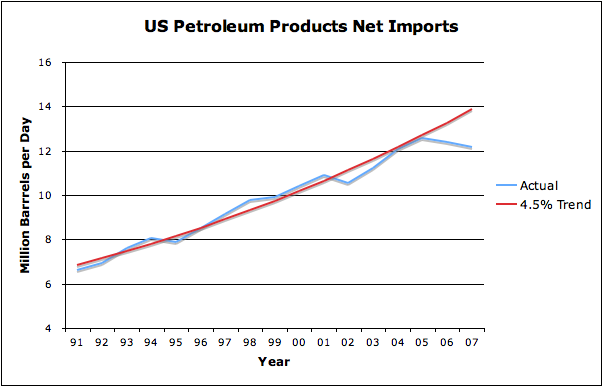

Figure 4 shows US imports of oil and finished products, like gasoline. These were rising at about 4.5% a year, but declined in 2006 and 2007. World oil production has been flat since 2005. (See Figure 5, below). With no increase in world production, it has been harder for the US to find oil to import, and the price of what we have been able to find has been higher.

12. Does the date of the peak matter?

We have already reached the point where oil is in short supply. Because of this, we need to find ways to conserve, and to find alternative energy sources. The actions we need to take are pretty much the same, whether the peak in the world’s oil production is now, or in 2040.

Also, any governmental action taken to change our oil usage, or to find alternatives, is likely to take many years to implement. For example, if manufacturers start making cars more fuel efficient, it will take many years before all of the old fuel-inefficient cars can be replaced. For this reason, we need to start taking action well before the peak.

(See “Peaking of World Oil Production: Impacts, Mitigation, and Risk Management” by Robert Hirsch, Roger Bezdek, and Robert Wendling for US Department of Energy (2005) http://www.netl.doe.gov/publications/others/pdf/Oil_Peaking_NETL.pdf )

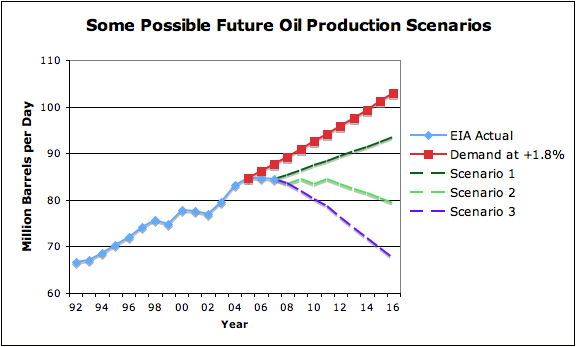

The blue line Figure 5 shows recent oil production trends. Oil production has been on a plateau for three years, since 2005. The line “Demand at +1.8%” gives an idea of how much oil the world would like to use, if it is actually available, at a reasonable (2005) price. It assumes 1.8% per year growth. Scenarios 1, 2, and 3, give three (of many) possible directions future oil production may follow. Even if a fairly optimistic scenario like Scenario 1 occurs, there is likely to be a significant gap between demand and supply.

13. What is petroleum used for?

The vast majority of oil is used as fuel, of one type or another. Figure 6, below, shows that largest share (46%) of US oil usage is for gasoline. The next biggest slice is “distillate”, with 20%. Distillate includes diesel fuel (used in trucks and many types of equipment) and home heating oil (used primarily in the Northeast). Petroleum is also used as jet fuel, and as fuel for boats, so it provides the vast majority of the transportation fuel used in the United States. It also provides asphalt for our roads, and lubricating oils for engines.

The “All Other” category is quite small on the graph, but includes most of the chemical uses for petroleum. Products made using petroleum as a feedstock include plastics, synthetic fabrics, dyes, pharmaceutical drugs, detergents, insecticides and herbicides, and many other products we use every day.

In some parts of the world, petroleum is used to produce electricity. In 2006, only about 2% of US power generation was from oil. http://www.theoildrum.com/files/Generation%20by%20State%20by%20Type.png

14. How is petroleum processed to obtain its major products?

Petroleum is sent to a refinery, where it is processed to remove impurities and to separate it into its component parts. As we noted earlier, petroleum is a mixture of different hydrocarbons ranging from about C5H12 to C42H86. These hydrocarbons have different properties, including different boiling points and different viscosities. Very short chains, containing 1 to 4 carbon molecules, are gasses at room temperature. Chains with 5 to 10 carbon molecules are thin liquids that boil at low temperatures. The longest chains are asphalt or bitumen. Asphalt is very viscous and has a very high boiling point.

During refining, a process called fractional distillation is used to separate out the mixture into components. Petroleum is heated to a vapor, and then allowed to condense in a tower containing trays at different levels. Because the shorter hydrocarbon chains boil at lower temperatures than longer chains, this process can be used to separate petroleum into its component parts. The lighter the fraction, (that is, the fewer carbon molecules in the chain), the higher up it condenses.

For further discussion see “How Oil Refining Works” on HowStuffWorks.com (http://science.howstuffworks.com/oil-refining.htm )

15. Is petroleum from different locations the same?

No. Some petroleum is “light” – that is, composed mostly of the shorter chain hydrocarbons. Other petroleum is “heavy” – that is composed mostly of longer chain hydrocarbons. Some is even “very heavy”. Oil also differs in the amount of impurities. The highest quality (and highest priced) crude oil is light oil, with few impurities. The lowest priced crude oil is heavy oil, with many impurities.

The reason that light oil is prized is because when fractional distillation is used, it yields a high proportion of gasoline and diesel fuel, and relatively little asphalt and other lower priced products. When fractional distillation is used on heavy oil, it tends to yield a high a proportion of asphalt and other low priced products. A process called “cracking” can be used to break very long molecules into shorter, more commercially valuable molecules, but this process is expensive, and requires specialized equipment.

The amount and types of impurities in crude oil is also important in determining the selling price of crude oil. Special processes, available only in certain refineries, may be needed to remove certain types of impurities. In some cases, it is necessary to build a refinery especially for oil from a particular location, so as to have the proper equipment to remove the impurities from the oil.

Some of the oil that has not yet been extracted is oil with difficult to remove impurities. This oil was bypassed in the past as too difficult to process. Saudi Arabia has some oil that it is not extracting because a refinery has not yet been built to handle the impurities.

16. How is oil transported from place to place?

When crude oil is found in a location, it must be transported to a refinery for processing. There are two major ways this is done. One is by “oil tanker” (type of ship). The other is by pipeline. When oil is discovered in a remote location, new pipelines often must be built before production can begin so as to have a way of transporting the oil once it is extracted. This is costly, and may take several years.

Once the oil is refined, the refined products are again shipped by pipeline to a location near where they will be used. Trucks are generally used for transportation to the final customer.

It might be noted that each pipeline has both a maximum and a minimum flow rate. If production or use drops too much in an area, its pipeline may no longer be usable.

One exception to the use of pipelines for transport occurs for gasoline with ethanol. The gasoline base is shipped by pipeline, but ethanol cannot be shipped by pipeline, because it tends to absorb water. Ethanol must therefore be shipped by other means (railroad, barge, and /or truck) to a location near where the gasoline will be sold. There, ethanol is blended with the appropriate gasoline base to make gasoline. After it has been blended with the base, it is shipped by truck to the retail location where it is sold. This whole process is expensive and difficult to co-ordinate.

Part 1 - Discussion Questions

1. In 1957. Rear Admiral Hyman Rickover gave a speech in which he talked about the expected peak of oil and gas production in the first part of the 21st century, and the likely decline of coal toward the middle of the 21st century. He also talked about the need to tell young people, and to start planning for the difficult transition that likely lay ahead. http://www.theoildrum.com/node/2724

Why didn’t people take his advice?

2. In 2007, there was considerable publicity about the Tupi field in Brazil. According to newspaper articles, Tupi may transform Brazil into a major oil exporter. When you read further, you find that the oil field is nearly 200 miles off shore, and is at record depths. Furthermore, the oil is found beneath layers of rock and salt.

The salt is unstable to drill through. A problem with thermal shock is expected when oil is extracted because the temperature of the oil in the reservoir is expected to be nearly 100 degrees Celsius, while the water above the rock is expected to be 4 degrees Celsius. In order to extract the oil, new technology will need to be developed to drill this deep and to overcome the problems of the unstable salt layer and of thermal shock.

Also, some means of transporting the material extracted will be needed. Because natural gas will be included, the usual method would be a pipeline, but the distance will be a challenge. Therefore, the company is considering building a floating liquefied natural gas to liquid plant, so that tankers can transport both the oil and liquefied natural gas.

The expected oil production from Tupi is large relative to recent discoveries, but not large relative to the amount of oil we need to discover each year. At full development, Tupi is expected to produce 500,000 to 1 million barrels a day. This is equivalent to 2.4% to 4.8% of the United States' current daily oil usage, or 0.6% to 1.2% of world usage. Just to offset declines in existing fields, we need to discover 5 to 9 fields the size of Tupi each year.

a. What probability would you assign to this project actually succeeding?

b. The company hopes to have initial production by 2013. Given the technology and infrastructure issues, how likely does this seem? Would you be surprised by setbacks?

c. If this is the major discovery of the year, what does this tell you about other discoveries?

To read about Tupi (not needed for exercise)

http://www.theoildrum.com/node/3269

http://www.iht.com/articles/2008/01/11/business/oil.php

http://www.afxnews.com/about488/index.php?lg=en&c=00.00&story=2305842

Figure 1 shows a year-2000 discovery rate of 10 billion barrels per year. If the production curve is just the discovery curve shifted 40 years forward in time, that implies 27 MB/d production in 2040.

A few years ago production was 1 MB/d; whatever it has risen to now probably isn't a significant fraction of present world production. I'll guess 2 MB/d.

Now, what does "extremely slow" mean? Does it mean the rate of change of production is very slow, 1 percent per year, maybe? That would bring it only to 2.7 MB/d by 2040, ten percent of expected world production.

What is the minimum year-2040 percentage it would have to attain to be significant?

How shall the car gain nuclear cachet?

Things aren't going all that well in the Canadian oil sands, according to an article in today's Wall Street Journal. Current production is 1.1 million barrels a day. The forecast by the CAPP for 2020 has recently been scaled back from 4.3 million barrels a day to 3.8 million barrels a day. Some of the smaller companies are leaving, because costs are too high.

If production hits 3.8 million barrels a day, it will be about 4% of our current production - not great. Current production techniques are very water and natural gas intensive.

If something like the Toe to Heel Air Injection method can be made to work, it is possible that production could be expanded. The Canadian oil sands is one place where technology could make a difference. It is possible that production could be 20% or 30% of a lower world production base in 2040, if technology works out right. I don't see it scaling up quickly, though.

Gail, nice job.

One small suggestion for your consideration: You might also want to incorporate the concept of the oil window and what it means in terms of the question "Can't we just drill deeper?" -- the answer of course is that we are pretty much at the end of line in term of depth. You could then point out that both Tupi and the much touted Jack II in addition to whatever issues there are with being sub salt, are at the extreme lower limit of the oil window [Jack II at least is a little below what is considered to be the lower limit --- it is only an oil prospect due to a lower than normal local geothermal gradiant.]

Thanks for the suggestion.

I was hoping the Tupi question would get the idea across that we are reaching the limits of where we can drill.

Regarding the oil window, I know oil isn't generally found below 15,000 feet because below that depth the pressure is too great, and the kerogen is turned to natural gas, rather than oil. For a more advanced class, that might be something to include.

"I was hoping the Tupi question would get the idea across that we are reaching the limits of where we can drill."

It does. A line from the Wizard of Oz seems most appropriate in thinking about just how hostile and chanllenging some of these deepwater projects are: "You're not in Kansas anymore" ... or for that matter Oklahoma or onshore Texas.

:<)

The first point needs some editing. Petroleum does not begin with pentane (C5) : most petroleums will contain all lighter paraffinic molecules ; this is confirmed by the sketch in item 13, where you do see the C1-C4 cut. Part of this gas is separated at the wellsite, being called "associated gas" ; but another part stays in the liquid. This gas is hardly stable with the liquid, and all installations (tanks, ships) allow for degassing.

I was wondering about this. There are clearly gasses mixed in the oil. Even on Figure 6, there is propane and other gasses listed as oil products. I'll see if I can figure out a way to say this.

Congratulations on writing what to me seems to be THE reference article on the concept of Peak Oil.

Thanks! We need to have something available that isn't too difficult, but still gets the idea across regarding the peak oil story.

Item 6

You might spell the words "enhanced oil recovery", which will allow interested readers to look for more info. There is nothing in common between water injection, renown technology which has been around for decades, currently producing millions bbl/d, and the flame front which is hardly an idea, issued two decades ago and never produced a barrel. Many other EOR technologies are currently in use.

I did use the phrase "enhanced oil recovery", although people might not notice it.

There is a new version of the flame front "Toe to Heel Air injection" which is in testing stages, and seems to have some promise. Petrobank in Canada is working on this, and claims some success.

9. How are estimates of the date of peak production made?

You forgot to mention the price of oil, which was instrumental in the first three oil shocks.

The state of economy will be still another strong point, which will be made quite obvious during the 2008 recession.

The fact that the demography is not taken into account at all is quite strange to any economist.

10. Can outside factors make a difference in future production?

I am surprised you do not mention "geopolitics" and "peace" : one ME country, still with 2nd world reserves, has been in total disarray since 2003 and contributed to the price increase. Any other war in this area would cause more price and production transeant.

Once again, the quality of economics is a factor : AFK has been postponed by the Saudis for this particular reason.

I added something on wars.

11. How certain are future petroleum imports?

The US dollar already fell against most currencies ; it already caused some concern within oil producing countries which are pegged to the dollar. It was one of the major reasons for the oil price increase (20 %). This particular point shows how important the economy is in the future of oil.

In terms of imports safety, peace is the major factor. It might be useful to note that the first two US providers have peaked.

11. Does the date of the peak matter?

It sure does, especially since noone knows how to forecast it, as proved the Hirsch report.

One should remember what happened in 1971, when the USL48 peaked, and the industry actually realized it on the spot, with zero notice time, immediately followed by the 1973 shock, which could not have happened before the USL48 peak.

Absent early warning indicators of an incoming peak, the same is about to happen, but on a much wider scale. While the Hirsch report makes wishful thinking about making decisions 20 years in advance, many serious (industry) people publicly say we passed this line already.

The point is that we need to start doing something now, even if it isn't peak.

Absent a trustworthy early warning indicator, no decision maker will decide anything. Start by building one.

On the other hand, you might also delineate the efforts made in other parts of the world, which might be some day applied in the US : absolutely no peakist is aware that Europe passed its consumption peak back in 1976.

We are now! Can you provide some "then and now" consumption data?

Maybe that's why BP's chairman said yesterday that demand, not supply, will determine when Peak Oil occurs. Or maybe he's just a classical economist.

Aberhonddu

BTW. I'm not one of those peakists. I'm in the artists' regiment of the Hispano-Anglo-Japanese Front for Peak Oil. Guess that makes me a Peak Ah So.

This is quite common knowledge : all 2007 BP report values, this is not even a per capita graph.

Hi Gail,

Thanks again - and just a quick note, since I'm short of time to re-read.

I really appreciate this point - and I can see it's the main point you want to make (because you say it is).

At the same time, the way it's phrased here, with

re: "The actions we need to take are pretty much the same, whether the peak in the world’s oil production is now, or in 2040."

somehow seems to lose the point.

I wish I had a "quick fix" - perhaps I can try again tomorrow.

Thanks again, Gail.

re:

"11. Does the date of the peak matter?

We have already reached the point where oil is in short supply. Because of this, we need to find ways to conserve, and to find alternative energy sources. The actions we need to take are pretty much the same, whether the peak in the world’s oil production is now, or in 2040."

How about something like this:

11. Does the date of peak matter?

We have already reached the point where oil is in short supply. Based on observations of regions which have already passed peak, we find that the exact "peak date" can only be determined several years after it occurs. We assume the same will be true for the world supply picture.

For this reason, we need to find ways to conserve now - and to plan for how to live with less oil (and, one day, no oil). Finding alternative energy sources is one essential part of a plan.

The actions we need to take are most likely the same, regardless of the exact date of peak. At the same time, the scope and urgency of the actions we take in preparation increase as we weigh the probability of a near-term peak date.

As I get into this more and more, I am not sure peak date makes as much difference as people think. I think gasoline and food price run ups can/will/have begun well before a decline in oil production. They depend on a shortfall of oil supply relative to demand plus the impact of ethanol on grain supply. With food and gasoline run ups, you quickly get to debt problems, and huge problems with the financial system. And this is all without actually hitting peak oil. I think you also have downward pressure on GDP growth, both from the financial system problems, and the less-rapid growth in oil supply.

Once we hit peak oil, things get a lot worse, in some sense. But I think we may already have huge economic disruption, without even hitting peak oil. And any actions to mitigate should have started long before.

When I wrote Peak Oil and the Financial Markets: A Forecast for 2008, I was thinking about peak oil causing the problems I described. When talking about this later with some non-peak oil believers, it became clear to me that the effects we are seeing and can expect in the next year require only "peak lite" (supply less than demand), not true peak oil.

Hi Gail,

Thanks for responding.

re: "But I think we may already have huge economic disruption, without even hitting peak oil."

Yes.

re: "And any actions to mitigate should have started long before."

Well, of course, there is nothing to disagree with here.

The thing is...what I was trying to say...to say to people the same things need to be done whether peak is today or 40 years from now - well, it just gives an odd impression. (I don't know how else to say it.)

The beginning of decline causes problems - we don't know how severe, but could be really bad (as we all well know). As you say,

"Once we hit peak oil, things get a lot worse, in some sense."

Yes, they could.

Yes, we already have problems. (and then again, some of us think peak is already here.)

I tried to say in my re-phrasing of your paragraph that the "exact" date does not matter. At the same time - the difference between yesterday (or 2005, as my personal view) and forty years from now...that's 32 years or whatever.

It just seems to me the way you phrased it makes it sound like there's no urgency.

When I believe you mean to convey the opposite.

Hi again, Gail,

I had an opportunity to talk to some "peak oil aware" people, and tried out on them - the question "Does the date of peak matter?"

Though I may have said it awkwardly above, it seems to me there's a confusion conveyed with the sentence:

"The actions we need to take are pretty much the same, whether the peak in the world’s oil production is now, or in 2040."

This is not the same as saying we need to plan in advance. These are two different thoughts.

The sentence above sounds like you're saying literally - 2008 or 2040, the actions are the same.

I'd maintain this is not the case. (For best outcome.)

The nearer the date, the more limited the options - the more urgent the action. The limited options are the crucial issue with a near-term peak. We've talked about this here in some detail (yes?)

Instead of the "fuel efficiency", etc. you talk about - we would talk about more radical measures. I just don't think you can make the case that this much of a time frame literally doesn't matter.

This is quite a different point than to say that we need to take immediate action.

Yes, we do need to take immediate action.

Or, if you believe the actions are literally the same, then perhaps spell them out?

Also, it seems to me "peak lite" as you define it - actually is a subset of "true peak". "Supply less than demand"...if there was no underlying constraint, this would not occur.

Or...if what you're really trying to say is what you describe about the economic effects, then my suggestion is just to go ahead and say it.

I think it's a critical point.

If you expect the readers of this to refer to your other writings on this point, then my suggestion is to be sure to reference those in this specific paragraph.

One of the issues here is that we are talking to 18 to 23 year olds. What they personally can do is pretty limited. I could tell them to go start a sustainable farm somewhere, but I think that that is beyond the skill level of 18 to 23 year olds, and way too controversial for what I am doing here. If I were writing for government decision makers, or business people, I would have a fairly different view.

Part 1 - Discussion Questions

You seem to have worries about the Tupi field : several large producing fields are currently producing in different parts or the world, in similar, or more difficult, conditions

http://www.gomr.mms.gov/homepg/offshore/canyon/index.html

What you should say about Tupi is :

- it has been discovered by the best world deep-sea specialist, using a large amount of high level techniques, including satellite enhanced oil recognition

- it took already 1 bn dollars to only prove and delineate it

- it has been discovered where the industry said there was no oil.

If you want an example of what a really difficult field is, take Kashagan.

Gail: great work and I suspect the topic will be in near constant update mode. As someone who works in DoD, I use this site and its content to lead policy makers in their journeys of discovery about the petroleum industry and global oil supply awareness. To say that PO has huge implications for our military, our allies and adversaries is the geopolitical understatement of the last 75 years. Keep your work up!

JQP

Thanks!

I wish you would turn your attention to energy costs, Gail.

The DOE projects a levelised cost of windpower of 3.5 cents kwh.

Since in this report:

http://www1.eere.energy.gov/windandhydro/pdfs/41435.pdf

they give the costs of new installation on page 15 as $1.8 million MW, and if you use a figure of 30% for capacity utilisation, then you come out with $6million MW for actual power.

I can't for the life of my figure how that can work out at 3.5 cents kwh.

I've been struggling trying to estimate costs for the proposed wind-power build of 33GW in the UK, and the figures theere are in close agreement with the $1.8 million for the US, as they are £0.9 millions MW for on-shore:

http://energy-futures.blogspot.com/2008/02/cost-of-wind-power-in-uk.html

That sounds fantastically expensive to me, and does not even include costs for connection and back-up.

UK off-shore wind comes out to around twice the price of nuclear as far a I can see, allowing generous figures for the cost of nuclear build.

Even given that that is for off-shore, I can't see how you end up with 3.5cents for wind, and, I am told, 6.5cents levelised for nuclear.

But then I am not an accountant, or an actuary, so perhaps you can help sort out what costings are, and unravel some of the assumptions in the levelised costs for us mere mortals?

Perhaps I can look into that. Jerome a Paris has a pretty high opinion of wind, but I always remain skeptical until convinced. On your figures, I wonder if they are assuming that the wind turbines will last forever, with virtually no maintenance.

It seems like there are a lot of issues involved with wind. Wind operates at far less than full capacity, and that needs to be considered. Since the capacity is often quite far away from where the real electricity needs are, I would expect the line losses getting to where it is used are quite high. And some of the costs of the wires from the wind plants should theoretically be charged back, if they really only serve the wind plant.

Thanks for the idea.

I've amended my post since Gail - it turns out the 3.5 cents levelised costs were just someone's projections.

Well, you can project anything.

The UK figures I use on my blog are all Government figures and don't include back-up and so on.

The figures I get for solar in northern areas are even worse, mainly because the sun don't shine much in the winter months, in fact they are so bad that I feel that with anything like current or projected technology it's a nonsense.

Figures here:

http://energy-futures.blogspot.com/2008/02/solar-energy-for-uk-and-north...

As I said though, I have done my best to give a fair picture, but am no accountant and it really needs someone such as yourself on the case.

Gail and DaveMart,

The $6M/MW is $.035/kWh x 20 years, no?

The question is what discount rate to apply to a sustainable investment. This came up in the B.C. forest industry. If a tree takes 80 years to grow, and it costs $10 to grow and transplant the new seedling, and you apply a 9% discount rate (not unreasonable in the early '80s) then the replanting cost represented a $9,860 investment at time of harvest, which was more than the log was worth. Everyone involved really wanted to cut down those old-growth trees, so the Province justified it by treating the forest as a "pipeline". They assumed zero discount rate for the replanting "investment" and just mandated that the forest companies replant everything they cut.

I think a similar mindset is required for renewables, except we start with an empty pipeline. Once a wind or solar farm is built, it will be there for centuries, given some maintenance cost. So assume the government (not the banks!) issues 100 yr / 0% funding for the initial capital costs, and just consider ongoing maintenance and replacement in the production cost.

If I haven't dropped a decimal place or two somewhere, which is always possible, then the figures are both better and worse than you say. That is why I have made my calculations public and open to scutiny, the costs look awful to me, and I would be glad to be proven mistaken. More important, I see little evidence that the wind industry will do much to reduce CO2.

Essentially, the financing you are proposing is an accounting trick, which in no way alters real costs - you can fiddle it for a relatively small part of the total economy, but if you try doing it for something as large and basic as the energy industry, you go bankrupt.

I think you have dropped some decimals in your calculation though, and you are making it worse than it is.

Let's call the cost $6,000 kw , to make things easier.

We'll depreciate the asset over 6 years but won't worry about interest, as you could get the interest back by assuming that you actually charged that rate for the next couple of years.

$6,000 divided by 6 = $600

Each year has around 10,000 hours in it.

You have already taken care of the fact that the wind doesn't blow all the time by multiplying the $1.8 million install.

That works out to 6cents a watt.

Now lets look at what you haven't included.

Any charge for maintenance, connection to the grid, or back up to make up for the wind's intermittency.

It should be noted that price of grid connection is usually high, as wind farms are by definition in the middle of a field somewhere, where there are no existing connections, and often in remote areas.

All that added would make the wind option very expensive indeed by comparison with the alternatives.

But the real crux of things is that, given a shortage of gas, you would have to run coal fired plant day and night ready to take over at a moment's notice, obviously on reduced power, but up and ready to go.

You have to have peak load facilities for nuclear, but outages are overwhelmingly predictable and you don't need to have them running continuously.

You have not achieved your objective of eliminating greenhouse gasses, but have built them into the system, albeit at somewhat reduced rates compared to pure coal burn.

The cost per ton of greenhouse gasses avoided is massive.

You can imagine solutions, you could extend the grid, evening out fluctuations, you could back-up with batteries, there are a number of different solutions.

They have one thing in common, they all cost enormous amounts of money, and most of them we really don't know how to do at the moment.

In wind power, you can have a quiet week at a time. The cost of back-up would be awesome, and the storage/and or grid extensions required vast.

That is not to say that in some favoured locations, particularly in the States, it is not worth building windmills where the penetration rates are low.

It is to argue that we simply don't have the technology at the moment to make wind a major part of the grid at any reasonable cost.

We may develop that in the future, but it is not sensible to place all your bets on it.

One of my problems with wind is that I have a hard time envisioning it lasting for long, if it cannot be embedded in an economy using quite a bit of oil.

The blades are moving parts. It seems like there will need to be servicing of the mechanism on a fairly frequent basis. The wind turbines are huge. I don't see someone riding on a horse being able to do much. Besides the big equipment to service the equipment, it will be necessary to maintain the roads on which the equipment travels.

In order for the wind generated electricity to be very useful, we are also going to have to keep the grid up, including the long wires from the remote locations where the wind farms are operated. This isn't happening as well as we would like now, when we do have oil. There is a need for upgrading the grid, as the intermittency of wind is added to the load. I am not sure the upgrading is going to happen.

There is also the need to keep up the mining the coal, and transporting it to the utility stations. Perhaps this can be done without a lot of oil, but I am skeptical. Liebig's law of the minimum is likely to take over.

When you put it all together, I have a hard time seeing that wind has a very long life expectancy. It seems to me to be a temporary appendage to the oil economy, that will disappear as rapidly as the oil economy does.

Gail, a horizontal wind turbine in its most basic form uses as few as two moving parts [assuming that the rotor is one part -- the blades can be separated from / coupled to the generator's rotor by a transmission, but don't necessary have to be --- the mechanism for getting the rotor oriented into the wind is the another] and accordingly as few as four bearings. Big parts, but a small number. Also no reason not to over engineer the fixed bearing surfaces ... they don't move ... ergo no loss other than initial cost in making these puppies very stout.

As an old [if half *ssed] mechanic, I like the prospects for keeping a small number of very large moving parts adequately lubed and mechanically balanced at ambient air temperatures plus a wee bit for friction and other mechanical losses.

Compare that with the comparative nightmare of an six cylinder car powered by an internal combustion engine with a crankshaft, a camshaft, twelve to twenty four intake and exhaust valves, six injectors, six pistons / six connecting rods, two fuel pumps, a water pump, an alternator rotor and lord knows how many parts in the transmission / transaxle, and the air delivery system and elsewhere. Add to that the thermal effects of going from ambient temperature to well over the boiling point in the block / head / water jacket and several hundred degrees at the exhaust valves. Now recognize that this nighmare mostly continues to function for years in spite of an owner who is clueless, Jiffy Lube service at sporadic intervals and an operational cycle that is not likely to result in an optimal life cycle.

For a horizontal wind turbine, cut the number of moving parts at a minimum to just one!

I realize that wind energy in practice isn't this simple, but it is something that I believe that at its most basic, late 19th century technology could maintain. The rest of a grid ... well maybe or maybe not, but there are some pretty basic ways to transmit power and regulate voltage.

Thanks. I appreciate your perspective.

11: If the auto companies made a decision to build/market fuel efficient cars how long would the changeover take:

(1) Preproduction engineering studies 5 years.

(2) Production ramp up, 5 years.

(3) Replacement/retirement of the existing gas hogs 10-15 years.

The sum of 1+2+3 is 20-25years!

That is assuming that we are working with known technology. If we have to develop new technology first, the lead time gets even longer. Also, if there are problems with manufacturing because of energy shortages, or if people cannot afford the new cars, the changeover will take longer.

I think we would do better than that, although your figures are fair for usual industry practise.

We are postulating a nearly unprecedented emergency situation.

I would guess that any company who took that long to respond would be out of business.

They would get an imperfect response out of the door fast, initially by just cutting the bigger models in the range so the emphasis was switched.

Preproduction engineering would then have to get done in maybe two years, not as well as at present, just a rush job.

Ramp times would also be cut back, as are postulating greatly reduced demand, and they would not have to wait for a space in the production line, they could move right in and start modifying.

The need for light cars might also lead to a change in production techniques anyway, to much more use of composites instead of steel.

I'm guessing just a year to ramp up, as a lot of the changes could happen simultaneously with preproduction engineering in those circumstances.

The first thing then is that in tight circumstances not all the cars would get replaced - multi-car families would cut back.

The biggest gas-guzzlers would simply be scrapped.

The same thing happened in the 70's - a lot of cars became worthless overnight.

I'm guessing 7years for effectively none of the previous fleet to remain, save for the ones which were very small, bottom of the range models.

10years total for change, under extreme pressure.

They won't be very good cars, as they will be rush jobs, and it will be in a much reduced fleet, but they would be changed.

That is for the states, Europe has much smaller cars anyway, some of which are quite economic, and it is much more practical there to cut back on mileage, so the whole fleet would probably not be changed and the rate would be much slower

It depends on what you call emergency : situation is quite different in the US, and in ROW.

ROW currently buys cars that give twice more MPG than US new cars. Hence to save money on gas, US consumers only have to buy cars similar to ROW - no research, no development, no delay : these cars are available now. And that gets a 50% savings on gasoline, which is 60 % of the US oil dependency. Ford, GM already manufacture such cars - only Americans do not buy them.

ROW, which is already using such cars, will have to find other sources of savings - and that means research, development, new techniques, etc. But this research already is under way : you do not suppose the common rail engine has been developed by chance. So the industry is in no way taken by surprise : only some US citizens may not be aware of what is in store. I do not see many motor-related articles on TOD, even though it is the first US problem.

The figures for model replacement are more like 70% of a car generation replaced in 14 years : going faster will mean a lot of government incentives.

If there is real urgency, things can of course be sped up. That would probably require limits on manufacturer liability -from defective product. The US designed, and produced warplanes during WWII much faster. But then I don't think there were teams of lawyers making their living suing the manufacturers because the planes design was imperfect.

At least for Toyota, for hybrids they are most of the way along steps (1) and (2). And I have the impression that several manufactures; GM, Toyota, Volvo at least, are fairly far along step (1) for plugins.

Gail, fantastic work. As a result, my comments will be trivial and petty :-)

I felt right at the start in the second para of part 1 it would have been appropriate to touch on (one brief sentence) that petroleum is refined to make fuels, plastics and other goods. (perhaps with a 'more on this later' comment?).

The concept of 'millions of barrels per day' is referenced a couple of times, and I wonder if it might make sense to define a 'barrel' - poss in part 1 also - maybe briefly mention the total approx number of barrels per day currently used at the same time - again just for setting context.

There is one exclamation point in the whole item, it jars a bit. (99% water) - suggest more stated, less exclaimed :-)

I remain in awe of your ability to get to the point!

Thanks. I'll look at those.

Hello Gail,

Check out http://www.peakoilandhumanity.com/, if you're not already aware of it. The production values could use a little tidying up, but otherwise it is perhaps the best intro to Peak Oil I've run across. It's a little pessimistic in it's conclusions, but up to there is simple, direct and pretty accurate. I would absolutely add it to your list of resources, or even have it as required prep for the course. It would allow you to go further in-depth with your own work, extending the value of the course.

Great work by Beriault.

Cheers

Thanks for suggesting this!

I hadn't seen it before - i went through several of the presentations. Amazing graphics!

I can certainly add it to my list of additional materials.

I am not the one teaching actually teaching the course - I am just helping the university with materials. It would be a little easier to add to the materials if I were the one actually teaching the course. There will be a fairly large number of faculty, and I expect, many will not be at all peak oil aware. It would be good supplementary material, though.

One drawback is that the presentations are very definitely Canadian - talking about liters of gasoline and kilometers driven. Also, I think the university wants to taylor the course to what they are willing to say also. I am not sure they would endorse all of the suggested actions at the end of the series.

Perhaps the gentleman would allow some revision at a mirror site to address some of those issues?

Cheers

I think we may very well end up with a TOD version and a version for the university. I know that there are at least a few folks who want to use the TOD version for classes or seminars that they are teaching.

The university did not require that they have exclusive rights to the material. In fact, they would like others to be aware of what is happening.

Thank you much for sharing this with all of us.

I had a teacher once who could make the most boring of subjects interesting. The way he did it was he played dumb. He would guide the class by asking questions but he would only answer them once the class got so frustrated that they demanded he answer. We got frustrated because his response was never "that's right" or "that's wrong." He would just nod or ask for clarification and then go on to the next student. What this did was engender suspense and highened interest.

My suggestion is for you to consider a different method of presentation. What you have created so far is a document rich in information and well organized. Before exposing students to this rich storehouse you might start by asking questions like the following:

Anyone know what peak oil is?

How much oil do you think is produced each day and how much is used?

What it is used for?

What do you think would happen if we did not have enough oil?

ETC.

These questions and student answers should segway nicely into the data of your presentation. Personally, my voyage of discovery into this area of knowledge has been one of astonishment and disbelief. My frustration comes mostly from knowing that there are many who refused to accept the truth. By "playing dumb" the teacher avoids getting labeled as "for or against" and also allows the nay sayers permission to disagree. Eventually, the weight of the evidence should pursuade even the stanchest naysayer.

I think it was William James who said that every argument turns on a particular point. For me that point is - that oil cannot last forever. Like death and taxes it is inevitable. There is another saying, "out of sight out of mind" as well as "ignorance is bliss." Not everyone is going to be happy being made aware of this new inconvenient truth. You must hook them deep or it will become just another of those "bad" things that are everywhere and by being everywhere they end up nowhere.

Good luck and thanks again for sharing.

-Peter

This is intended as reading material for the students - and for the faculty, who may not be peak oil aware. Many Science 1101 sections are taught by adjunct faculty (part timers). Many of them may have had no exposure to peak oil.

I haven't put together PowerPoint slides yet. These could use the Q/A approach, at least at the beginning. Thanks for the idea!

c. If this is the major discovery of the year, what does this tell you about other discoveries?

FYI, the Tupi formation got upgraded from 8 Gbbl to 20 Gbbl, making it a true supergiant. While it was difficult to ascertain the production cost of Tupi if it were in the 1 Gbbl range, now in the 20 Gbbl there is no doubt Petrobras will find financing : at 80 USD/bbl, this means... 1600 bn USD, quite enough to seduce more than a banker.

You will notice I didn't say anything about the volume of Tupi. I figured the initial estimates, as were used in Luis's post, were too low.

In our current strange world of finances, I don't know where the $1.6 trillion will come from. The US banking system is hurting, as is European. I expect to see some fracture lines in the months ahead. I don't see it as being able to take on very much of this project.

This leaves folks like China and the various international wealth funds. I wonder what kind of strings they might attach to the financing. Would the oil really be available on the world market, or just to those financing the project, plus Brazil?

Strictly local use. As the development will take a few years, you might expect the announced recession to be over when Tupi starts producing.

In the section talking about different types of crude, you mention light crude and heavy crude, but I didn't see any mention of sour or sweet (sour being sulfur rich and sweet being sulfur lean). Historically, Texas and Louisiana crude was sweet, and many refineries were not initially equipped to deal with very sour crudes. The adjustment towards more sour Canadian and South American crudes is a very real problem for refineries who do not have the capacity to deal with so much extra sulfur.

Someone else mentioned this also in the previous round of edits. I talk about impurities, but I don't talk about sulphur per se. While the sulphur issue is important, this write-up is really intended for the someone learning about oil and peak oil the first-time. I am hoping just the idea of impurities will be enough to alert people to the issue, even though it doesn't spell our the sulphur problem. It is one of those things on the borderline in/out.

Where's the Link to Part 2 on this new version? I can only find it by going through the old version.

Good point. I will add one.