2007 - The Year in Review

Posted by Luis de Sousa on December 31, 2007 - 12:01pm in The Oil Drum: Europe

The year started with low oil prices easing somewhat the fears of an energy crisis. With the dollar rallying, WTI would eventually sink below $50 per barrel. But world oil production wasn't growing and the performance of some producing regions were showing concerning signs. Mexico was clearly suffering from Cantarell's decline, the Caucasus kept raising question marks (a situation later updated here) and there was also Saudi Arabia.

There wasn't much doubt Mexico was in for the decline.

Energy was starting to have some grip on the political agenda, the European Commission presented A New Energy Policy for Europe that proposed some interesting measures but still left the feeling that at least part of the picture was being missed. In the United States the State of the Union address by the President to Congress showed to have a higher energy content than usual. The focus on agro-ethanol as an alternative to gasoline seems to be growing in the US, despite all the uncertainties about this strategy.

Europe at the Crossroads.

By the end of the month the Soil Association Conference was dedicated to Agriculture in a post-peak oil world, were some of the modern Hubbertian luminaries were present. The concept of Peak Oil is starting to concern people working in important sectors of our society.

In January, Chris issued a post trying to connect the dots between Peak Oil and Climate Change. The first of such articles on TOD. In February the first part of the IPCC report was published portraying fossil fuels forecasts that probably made some people blush at TOD's nemesis, CERA. Of all the fossil fuel forecasts issued worldwide, the one made for the IPCC report is the one that gets more media attention and is read by more people. Unfortunately this forecast is probably the least sound of them all.

Meanwhile Euan added some cold water to Mexico's boiler, the region is in decline but not in free fall. Even so, some months later, the country was showing concerning signs of social unrest in face of this decline.

February witnessed also the introduction of TOD into the unexplored seas of Anthropology and Neuroscience. Nate tried to explain why humans have a hard time preparing for the future and acknowledging the importance of problems like Peak Oil over daily routine worries. This effort would grant Nate an invitation to speak at the ASPO International Conference In Cork.

How steep are your discount rates?

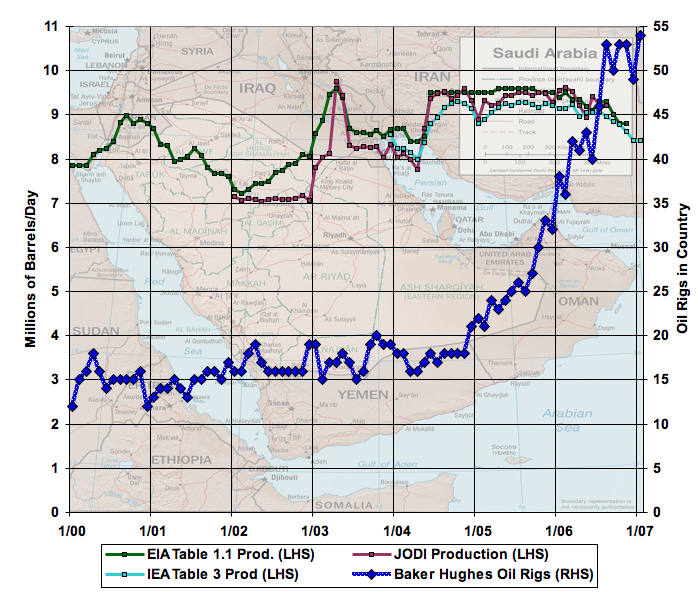

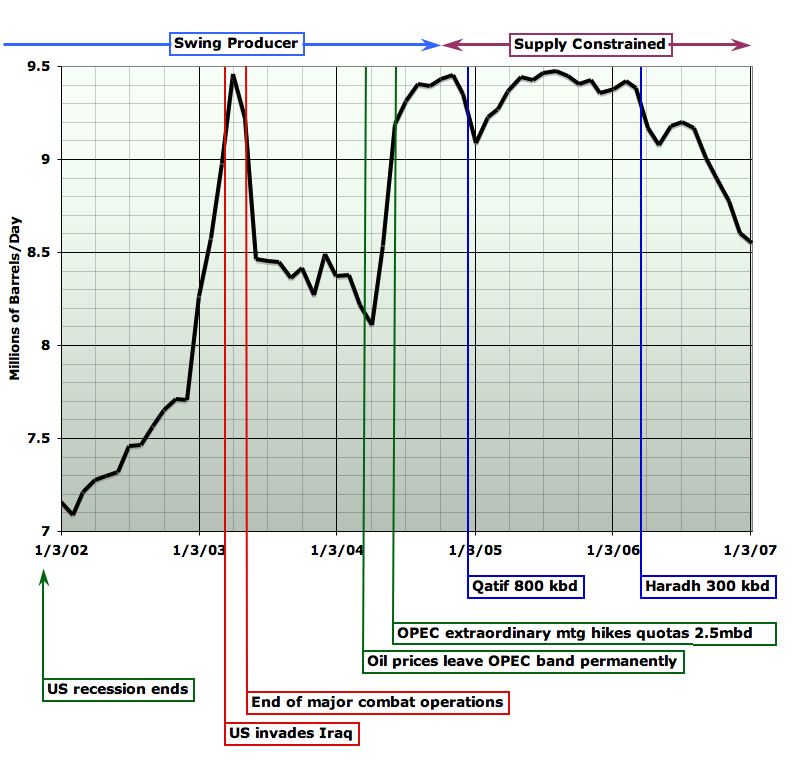

In the beginning of March Stuart had a post on Suadi showing a 8% decline during 2006. The article swept the Peak Oil community and broke all visit records at TOD. It seemed that geologic constraints were seriously impairing the Saudi production capacity possibly due a to production crash in Ghawar. Stuart offered a 1000$ bet that Saudi production would never cross north of 10.7 Mb/d.

A graph that left a lot of people wondering.

The scepticism towards Stuart's conclusions came from inside TOD itself. “High stakes and long odds!" Euan called Stuart's bet. Stuart reaffirmed that Saudi's decline wasn't voluntary, but Euan retorted that the Saudis know better than anyone how to manage their fields.

Maybe the sky isn't falling after all.

A fabulous duel evolved between Stuart and Euan that would endure for two months. It all came down to Ghawar and both men dived in to assess the field's depletion state.

Or is it?

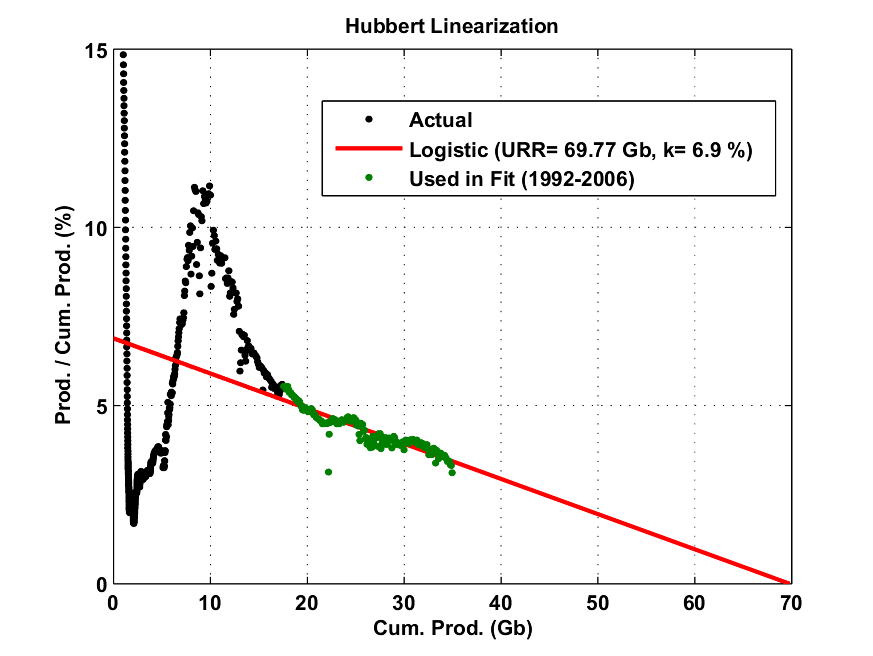

On another field there was more rattling. Robert had a post criticizing HL that caused some stir, given TOD's role in popularizing the method. Robert came on the attack again casting more doubts on the blind application of the method. Later in the year, friend of TOD Jeffrey Brown took the defender role with a guest post. This subject was revisited several times during the remainder of the year and the debate still goes on, especially around the conceptual assumption that oil production should follow a logistic cycle.

By the Ides of March came out the GAO Report on Peak Oil. The main conclusion made by the authors was that the US government lacked a proper plan to deal with the problem. The report made some lines in the US mainstream press and suddenly Peak Oil seemed an unavoidable issue.

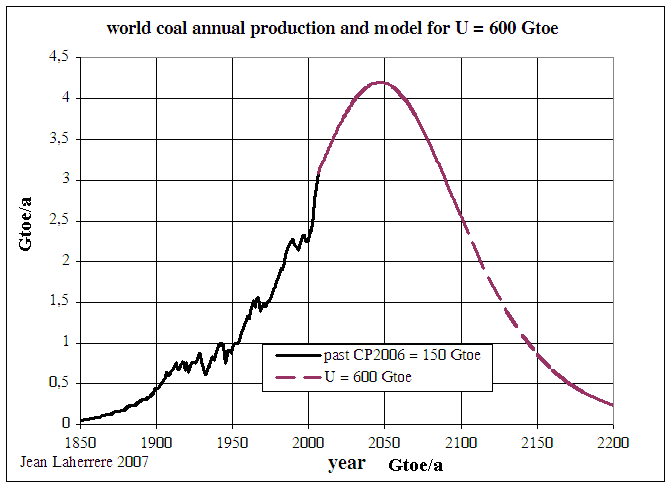

April was a time of revelations. The first one came by the hand of Shaun Chamberlin: we should expect a Coal Peak in less than 20 years. This post was based on the assessment undertaken by the Energy Watch Group and caught a lot of people by surprise. Some other people weren't really caught and this would develop into a very interesting debate throughout the year.

A graph that stunned the world. And would generate a lot of controversy.

The work on Ghawar was also bringing some revelations: the northern sections of the field were in an advanced stage of depletion and there were official estimates of Ghawar at 50% depletion levels. In the discussion threads there were emerging very helpful comments and info (especially some charts that TOD commentators dug out) that improved considerably the final work made by Stuart and Euan.

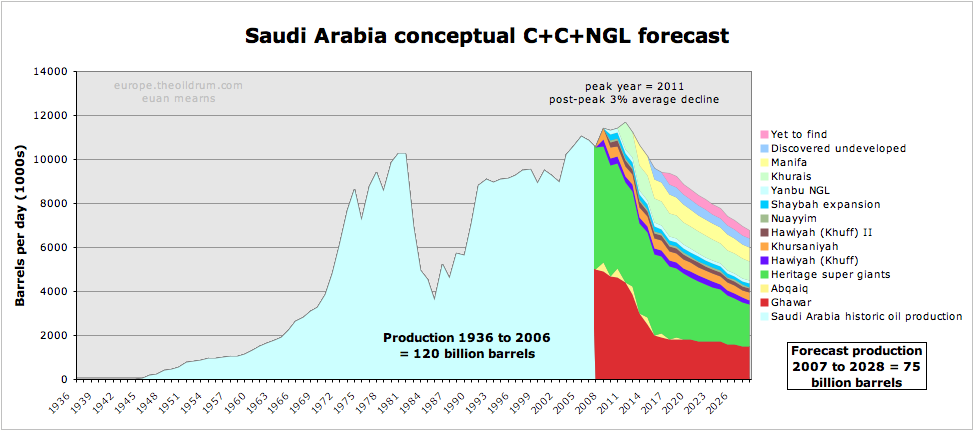

The Ghawar Omnibus was finally drawing to an end. Euan was the first to publish his results, commencing by addressing his methodology and finally presenting his results. Stuart's assessment came already in May in another thorough post. Using two different methodologies they both got to a ballpark number of 60% for Ghawar's depletion state, with most of the field' southern oil still in place. The largest oil field in the world is clearly on its latter life but not facing imminent decline. Still, Ghawar should loose its statute has Saudi's largest producing asset in the not too distant future. If the remaining country's fields can cover that gap or not was a question left unanswered.

Euan's and Stuart's work ended up agreeing quite closely.

Also in April we finally had the Shock Model presented at TOD, the mathematical method developed by WebHubbleTelescope, a long time TOD commentator and the individual behind the Mobjectivist weblog. Khebab went further and improved the model producing a series of different forecasts. The collaboration with WebHubbleTelescope continued with two more posts published later in the year, one with a new discovery model and a following improvement that firmed the name of Dispersive Discovery Model. If you felt bewildered by all this mathematical wizardry, just consider that no matter how complex these models may look, they all turn up in a short term Oil peak.

"Heavy duty" math reflects a short term peak.

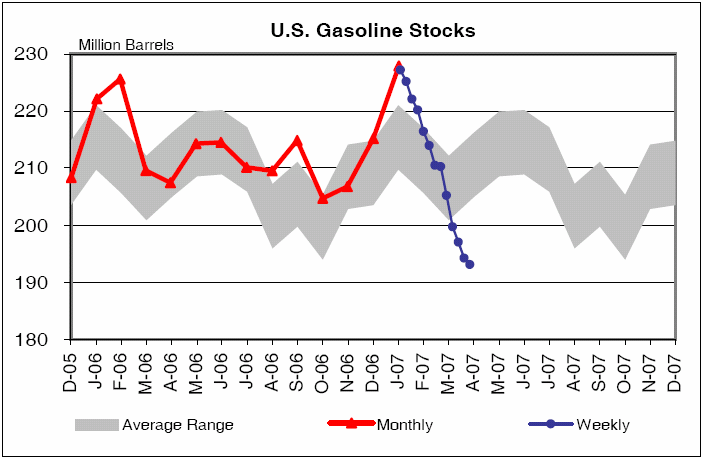

During May a gasoline price shock was developing in the US. After being at record levels in the beginning of the year, US finished products stocks were now below average range levels. TOD started following This Week In Petroleum a weekly release by the US Department of Energy, assessing among other things the current stock status. Record demand and lower refinery output conjured to create the sharpest recorded decline in US gasoline stocks.

Running on empty?

Finished products imports would eventually pick up and from June onwards gasoline prices eased up, although making them climb elsewhere. Several similar articles appeared in the international press blaming oil producing countries for the current price spike, due to their gasoline subsidy policy. This logic failed to acknowledge that an unfavourable environment for the refining business had been developing in the US and that gasoline prices in this country are closer to those practised in subsidizing countries than in those that tax gasoline.

In May Rembrandt started the Oil Watch Monthly series, a thorough portrait of oil production from a global and regional perspective, made by ASPO-Netherlands and published by TOD:E.

In the beginning of June, meteorologists stunningly observed a cyclone forming in the Arabian Sea and heading west towards the Persian Gulf. TOD followed this event very closely and for some hours it seemed like most of the oil coming out of Gulf would be shut in. Gonu (the cyclone's name) would eventually make landfall in Oman with heavy material costs and unfortunately some lives lost, but oil shipments weren't visibly affected.

What was a cyclone doing in the Persian Gulf?

By this time the Coal debate was heating up. Previously Chris reported on a new paper by James Hansen implicitly acknowledging problems with the fossil fuels forecasts present in the IPCC report; then there was a report by the US National Research Council casting doubt on the country's reserves numbers. And in June TOD hosted a post by David Rutledge that in trying to get a clearer picture on Climate Change factoring in the Hubbert Peak, produced another forecast for Coal peaking before mid-century. As did the Energy Watch Group, Dave Rutledge undertook a thorough country-by-country analysis leading to a similar conclusion. Heading Out stepped on the brakes and highlighted that the picture can change if deeper seems are reached.

Dave Rutledge came to TOD to talk about Climate, but this chart with HL applied to UK Coal production would cause a stir on its own.

Later Doug and Chris would put together the various negative reports on Coal that came out during these months. Heading Out continued with a series of posts presenting counter arguments. British reserves were an especially hot topic in the comment threads and Technology showed to have a crucial role in this discussion, leaving the perspective of unlocking reserves inaccessible today. In August TOD heard Jean Laherrère on the subject, it became apparent that a considerable degree of uncertainty remains around Coal reserves estimates and hence his higher forecast (peak by mid-century), but all in all it is a finite resource subject to depletion.

Jean Laherrère's outlook for Coal wasn't as bad as the previous ones, but still reminded that it is a finite resource.

2007 can be left to History as the year Coal stopped being infinite. It is today much better perceived as a non-renewable resource about which centennial R/P rates are meaningless. During 2007 China became a net importer of Coal and closed down its Fisher-Tropsch program for lack of fuel; by the end of the year international Coal prices had doubled. Either peaking later or sooner, Coal has to be regarded henceforth as a limited resource, not because extraction will start declining in the near future but simply because it is failing to meet an overwhelming demand.

As the Coal discussion evolved there were growing concerns that the financial markets could be on the brink of a serious disruption. The credit bubble seemed set to burst and washing away entire economic sectors. TOD:C followed the development of this crisis very closely maintaining a watchful eye on these matters that would latter be baptised the Finance Round Up.

In June Jeff Vail dived into the Nigerian situation that was regularly making headlines. A previous report had observed the ethnic pressures gathered in country and a second looked into the general strike and the growing unrest among the Nigerian people. Nigeria would keep making headlines but reaching the end of the year relatively calm. The fact that International Oil Companies continue exploring for oil in such environments is by itself a revealing fact.

In July the Medium Term Oil Market Report was released by the IEA. A bombshell, an oil shock was clearly on the making and the international watchdog wasn't shying away from telling everybody about it. Days later, Claude Mandil, the IEA's headman, gave an interview to Le Monde that dismissed any doubts, even if peak oil was not in his perspectives for the short term, trouble was ahead in the following winter.

And then came August, and instead of vacations the Financial markets got headaches. The Credit Crunch was here, a series of bad news and suddenly no one was lending money to anyone. The Bubble was finally bursting promising to spread throughout the banking sector if not deeper. These events were leading to fears of an impending Deflationary Recession of which we were seeing the first stages of development.

The picture of a crunch.

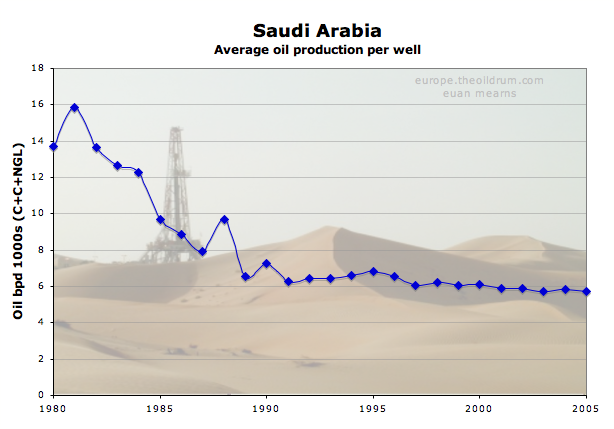

There was also a resurgence of the Ghawar debate during August, after some alternative assessments emerged that contrasted with Euan's and Stuart's. The former went on to produce a conceptual forecast for Saudi that presented a peak in 2011. This forecast would prove to be remarkably close to that made ten years earlier by Walter Youngquist and Richard Duncan, two influential modern Hubbertians in the US.

Euan's conceptual forecast for Saudi. Are the days of plenty reaching an end?

In September the ASPO International Conference took place at Cork in Ireland. Unlike previous meetings this edition had a high number of presentations from the Industry, still the audience didn't note that much of a difference in the forecasts. Peak Oil is a fact of Nature, there's no use avoiding it. Heading Out reported the conference: Introduction, First Morning, First Afternoon, Second Morning and Second Afternoon. On this last session the audience assisted to an inflamed declaration by Michael Meacher against corporate interest interfering with government action – a Disruption of Democracy he called it - that is avoiding the proper action in face of the current energy crisis.

During the second day of conference, the US Federal Reserve cut interest rates by half percent sending the WTI to a record 84 $/barrel. The markets were in turmoil, perceiving that the credit crunch had deep ramifications and that there wasn't much the Fed could do about the dollar.

By the end of September TOD people started realizing that the May 2005 Crude Oil peak was then standing for more than two years. Was it time to start referring to Peak Oil in the past tense? Some thought so and with the help of a favourable price environment a “peak is here" hype set in.

By September the May 2005 Crude Peak was looking really far away.

The scene was set for an “interesting" October, as T. Boone Pickens called it. Oil prices went on a cavalcade - towards where, few ventured to forecast - WTI crossed 86 $/barrel, then demolished the 90 $/barrel barrier and continued to reach beyond 93 $/barrel. Some called it speculation, but there it was, the Oil Shock.

In October the ASPO-USA conference took palce, another international gathering that takes place in the other side of the Atlantic. The conference brought some dismay and some hope regarding a problem whose dimension “defeats most imaginations". Heading Out was once again the TOD reporter with the following notes: Workshop Day, Day 1 part 1, Day 1 part 2, Day 2 part 1 and Day 2 part 2.

Two other events occurred in October deserve attention. Libelle reported that Natural Gas had entered the decline phase in Canada, meaning that all three countries in North America (Canada, US and Mexico) are now declining. Most of the TOD followship/fellowship comes from North America and Europe, for them Natural Gas is posited to create larger personal problems than Oil.

Canada's Gas: the decline sets in.

And also in October the TOD community welcomed the launching of its first ship in the Southern Hemisphere, with TOD Australia/New Zealand coming afloat.

November would witness times of great anxiety with the WTI index getting ever closer to 100 $/barrel. The Tapis index would go through 100 $/barrel several times and Brent would cross above 96 $/barrel once or twice. Days after another rate cut by the Federal Reserve, the WTI would go above 99.5 $/barrel in spot trading, but still no cigar.

100 $/barrel is just a magic number without any physical meaning, even so when referring to an index that is today but a regional token like the WTI. But for the TOD community it meant front page headlines the following day, that might - just might - put some forces of change at work. Maybe next time. Another piece of the puzzle was the dollar weakness, that although couldn't explain entirely the oil cavalcade, put it in a completely different perspective. The US$ fell 13% in just ten months and got some oil exporting countries wondering what to do with all those green tickets they have accumulating in recent years. December would see the dollar rallying somewhat but without leaving a very uncomfortable situation.

WTI throughout 2007.

Even without getting to the psychological three digits, Oil was indeed hitting the news. Especially in the US media, articles poured that hinted at geological constraints being the cause behind high prices. Notably, the History Channel aired a documentary on Peak Oil, and when petrol crossed north of one sterling per litre in the UK, ITV had a short piece on the subject. There were direct addresses by some industry headmen and Fatih Birol, the IEA's chief economist, started to show some concern.

All this media attention would fade away when Petrobras announced it had found an 8 Gb oil and gas field off Brasil. Tupi was the name, and unlike Jack in 2006, this announcement had a bit more juice to it, it could be the first of a series of finds in a new, up to recently unknown, oil province. There's a 2000 metre salt layer to overcome that could prevent commercial exploration, but still a remarkable find. Even with Tupi and without media attention, 90$ oil was here to stay.

By the end of November TOD (led by Stuart, Khebab and Ace) embarked on a new project to build a Megaproject database. The project is being developed using Wikipedia with everyone invited to join in and fill the gaps. This collaborative project promises to be of great value, both for the TOD community as for other researchers performing what is usually called the bottom up analysis. Hopefully 2008 will see the fruits of this effort.

The Megaproject Megaproject.

December saw the first days of cold in Europe and North America after a mild early Fall. As energy consumption stepped up, so did the IEA's warnings of an impending energy crisis. Aad van Bohemen, the IEA's Director of Crisis Management, explicitly warned on a Dutch TV channel that supply wasn't keeping up with demand. And when presented the 2007 World Energy Outlook, Fatih Birol, even if avoiding sharp words, showed a clear sense of urgency.

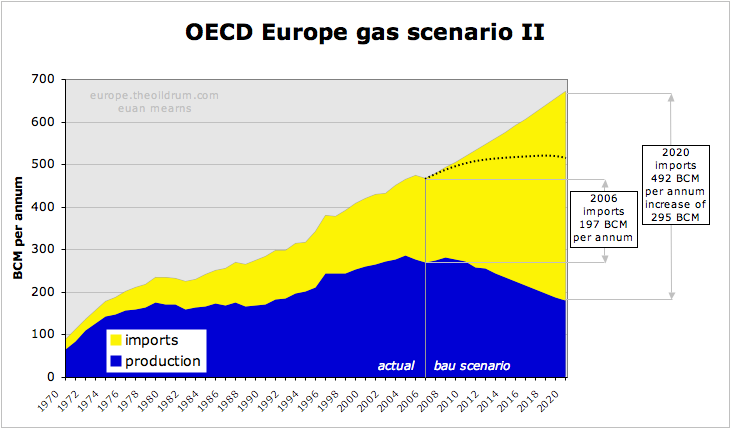

Natural Gas got some deserved attention by this time. On both sides of the Atlantic the access to this scarce resource is much more concerning than to oil. Awareness has to be built about this problem, if possible before it's too late. Euan, with the precious help of Jean Laherrère, finally finished an opus on the European Gas Market that showed a really bleak picture. The innocent question “Daddy will lights be on at Christmas?" might seem displaced today, but may make some sense one of these winters.

Daddy doesn't exactly knows how to fill that gap.

The year ends with two other noteworthy events. First, wheat broke above the psychological barrier of 10 $/bushel, showing the implications of an energy scarce world for food production. And then the early oil production numbers for the third quarter were strongly hinting at new all time records for Crude and All Liquids in October and maybe November. Certainties about these numbers will come only in 2008, but for now, Peak Oil still seems to be a future event.

Perhaps the work at TOD has to endure a few more years.

2008 is presenting itself as a very uncertain year. Both energy scarcity and the credit crunch are menacing to spread to other sectors of the Economy, affecting it in opposite ways. Will 2008 be the year that Oil crossed sustainably above 100 $/barrel? Or the year oil prices dived due to a worldwide recession? That's the question to answer. Factoring in the dollar's secular downward trend, forecasting oil prices or price ranges seems more difficult than ever (as I write this lines, both Tapis and Lousiana Sweet have been intermitently crossing 100 $/barrel amidst another dollar dive) Besides all this, Natural Gas could have some bad surprises reserved for 2008.

TOD's audience grew visibly in 2007. The year started off with 230 K visits in January, but topped 400 K already in March in consequence of the Saudi roll. It took some time to repeat that number but monthly visits kept above 350 K from then on. Thanks to high oil prices and a steady stream of top quality articles and news reporting, TOD topped 500 K visits both in October and November. The satellite sites grew even faster during this period, also reflecting a growing and enhancing community.

Before the final good bye to 2007, it must be said that none of this would have been possible without TOD's Captain (now more like Commodore) - Prof. Goose - and First Mate - Super G. The TOD community is forever indebted to them.

May 2008 fulfil your hopes and expectations.

Luís de Sousa

TheOilDrum:Europe

Folks,

This post is not intended to be a “best of” of 2007, it just tries to put in perspective the major events of the year and how they were lived at TOD. There are excellent articles in various areas that weren't referred.

Why don't you take this holiday season and browse through the Archives for the stuff you may have missed.

If you do a Google Search for Net Oil Exports, the top two listings--at least here in the US--are Energy Bulletin articles by two people that you and I know well.

Thanks Luís for this excellent summary!

It's amazing the amount of work done on TOD in just one year! a lot of excellent articles got buried too fast.

What a busy year!

An excellent review!

For me in 2007 the biggest revelation was the large amount of data already in the public domain showing world 'net exports' of oil on a 3.5% decline even in 2006.

For us 'net importer' countries trying to grow our economies falling 'net exports' of oil, gas, coal, uranium, phosphorus, indium, food etc, (whether the cause is geologic (best case) or above ground), is much more important than Peak Oil itself - to say nothing of Anthropogenic Climate Change.

I think that the top five net exporters (about half of current world net exports) had about a -3.5%/year decline rate. Total net exports did decline in 2006 (EIA data), but by a lesser amount. In any case, the top five net export decline rate almost certainly accelerated in 2007.

Just too add my two cents. Although I've only got rough concepts in place I think we will see accelerated decline rates in regions that have made extensive use of the latest extraction technologies. This includes the North Sea and US and Canada. These increasing decline rates means that I think we will see domestic production or "safe" production drop faster than most people predict putting even more pressure on the world oil exporters. The more I've read about US production the more convinced I've become that continued technical advances and extensive investment have played a large role in its fairly slow decline rate to date.

Over have the oil wells in the world are in North America.

The problem is this as resulted in increasing depletion rates in the region and I think we have reached the point of diminishing returns where we simply don't have a lot of places to rework fields or exploit new fields.

Time will tell of course but if I'm right then the technical advancement factor which has influenced production will decline and the underlying high depletion rates will no longer be hidden by strong technical growth.

To a lesser extent the rest of the world faces these same problems if they have adopted aggressive extraction methods.

Regardless of the amount of new URR attributed to these methods they still exhibit higher depletion rates vs simpler technologies thus higher final decline rates once a region is throughly exploited.

Thanks for this post, Luís.

Another resource is the Best Of The Oil Drum Index I am maintaining here:

www.inspiringgreenleadership.com/blog/aangel/oil-drum-best-index

Would veteran TODers please take a moment to see if your favorite articles are included? I haven't gone through the whole archive yet and the riches are virtually endless, I'm finding.

Best,

Andre'

P.S. The Best Of The Oil Drum Index is open if others want to participate.

------------------------------------

Peak Oil, Climate Change and Business

Free, Bi-Weekly Executive Briefing

www.inspiringgreenleadership.com/peak-oil-climate-change-and-business

Let me modify my request: please look for articles in 2006 or earlier that I missed. I will update the index with the articles Luís has provided in this post.

-Andre

Luís,

the link to the archives isn't working (has an extra " at the end). Also, did you make a 2006 review by chance?

I've added the links from this post to the Best Of index, btw (http://www.inspiringgreenleadership.com/blog/aangel/oil-drum-best-index).

Last, for those who don't know this technique, add "site:theoildrum.com" to narrow your search to just The Oil Drum in Google, like this:

ghawar site:theoildrum.com

-Andre'

Hello,

Many thanks for the Year in Review. It is priceless, particularly for someone like me who is still struggling to catch up with you all.

My user history says I have been a user for 12 weeks, but I have spent so many hours reading and making very occasional comments that it seems much longer.

At any rate, it is a most interesting and informative. I have read so much from some of you that I feel we know each other.

So, many thanks and have an excellent 2008, whatever it may bring.

Ciao,

FB

Happy New Year

Great summary Luis!

Luis,

Thank you very much for not including the NPC report. I feel that the asterisk for that report is how the Yes Men's Vivoleum web site was driven off the web in 2007 rather than any faint hint that oil industry might have learned something.

Chris

Yes, the Yes Men's Vivoleum website was driven off the web, and meanwhile (as noted in the key post above) Michael Meacher gave the most succinct evaluation of why we do not see the necessary changes to address Peak Oil (or Global Heating):

"The other thing which I think is very important is vested interests. I mean who wants to keep the world the way it is?

The oil industry; the chemical industry; the food industry; the car industry; the airline industry; these are very powerful. Who rules Britain? Not parliament!

I’ll tell you who rules Britain. It is the Prime Minister with a small cabal around him of unelected advisors, not including members of the cabinet, meeting regularly with leaders of business, leaders of finance and I have to say with Mr Murdoch and leaders of the media, and taking the decisions over our heads which are then imposed upon us.

That’s the actual situation we face. It is a very serious breakdown of democracy. And until we deal with that, and until we regard that as an issue that is central to solving all our issues, including the environment and climate change, we’re not going to get very far."

This subversion of democracy -- including the perversion of media and the educational system to seduce and manipulate a dumbed-down population into obedient servants of The Permanent War Machine -- is the big story of the current response to Peak Oil.

It is worth repeating: the biggest energy story goes completely unreported in the media. That story is about the use of concentrated wealth and power to subvert democracy and to take resources through warfare.

http://europe.theoildrum.com/comment/reply/3440#form

Yes, For example I found it absurd that the young Bhutto said "Democracy is the best revenge" as he inherited like a king his mother's candidacy at the tender age of 19 without any apparent irony. Cognitive dissonance is so easy. I think similar is happening in America with Bush Jr. and Hillary and behind the scenes are the money men who pull the strings. It is really amazing but I guess it has always been so.

Democracy is best when forcibly dictated onto the people.

Was it GW Bush who said this or George Orwell's Ministry of Double Speak? (Dictatorship is Democracy. Falsehoods are Truths. Our enemies are our friends. Repeat often but never more than once. Apply directly to the head.)

beggar

Recently I've read a very good book, "Supercapitalism" by Robert Reich, the former Secretary of Labor under Clinton. In it, he describes how corporations and their money have undermined democracy in the US, with much the same result you describe in the UK.

He makes some interesting suggestions about reforming capitalism to save democracy, the principal one is to stop treating corporations as persons. He maintains that corporations are really contracts written on paper and that they deserve exactly the same rights as any other piece of paper.

I fear that his suggestions are way too late. Peak oil is upon us now.

They are amplified alter egos for the uninhibited greedy among us.

One can make analogy to the sci-fi movie, "Forbidden Planet" where the invisible hand monster turns out to be the good professor's uninhibited subconscious, amplified by the subterranean machinery of the extinct Krell. A corporation can similarly be an invisible hand monster whose powers are amplified by the liability limiting of laws of the state. Much more than a harmless piece of paper.

_____

May the force be with us rather than against us.

Thanks for the book recommendation, jubilado. It's on my list!

Wiki has a good intro article to the superb book and film "The Corporation" by a Canadian team.

Widely respected constitutional lawyer Joel Bakan wrote the book and movie.

No other movie includes powerful quotes from GWBush, Chomsky, Zinn, Naomi Klein, Reformed Plunderer (Corporate CEO) Ray Anderson, Michael Moore, Vandana Shiva, and many more.

Bakan traces the history of corporate law, and notes along the way the Corporatist attempt at a coup in the USA according to General Smedly Butler.

The core of the movie is this: an FBI profiler who specializes in dealing with psychopaths is invited to describe how psychopaths behave.

Bakan then details and gives many illustrations as to how corporations are set up not only as persons, but are legally obligated to behave as psychopaths.

This destructive corporate behaviour is ultimately self-destructive -- as we see in the economy today. Psychopaths charm, seduce, manipulate, intimidate, and devour their prey, but ultimately end up destroying themselves.

I recommend the article, but also the book and movie.

At the heart of our dilemma with Peak Oil and Global Heating is the simple fact that we have placed a psychopathic paradigm at the core of our culture.

This is apparent in Corporatist behavior, but also in the kind of individual leaders who rise to the top of our culture.

In between bouts of depression, I try to move in the opposite direction. I find that I can take small steps when the depression lets up a bit. Sometimes it is all I can do to survive.

Here in the USA, "intentional ignorance" and "charming intimidation" and "friendly fascism" completely dominate public perception, discourse and policy.

Outstanding!

I couldn't help notice this mangled bit of sentence structure, though: "Still, Ghawar should loose its statute has Saudi's largest producing asset in the not too distant future."

Luis,

Excellent summary.

about the growth in readership. Are those all original clicks from separate IP addresses? Can we chek where they all come from geographically and make a graphic day by day and month by month for each of the TOD stieas and all together to see what sort of growth and how it spikes relative to say oil price spikes or big news stories. I think it would be interesting to see what sort of people are looking at TOD how long, not just "average". Maybe 1% hang around all day and 99% only 10 minutes and these people never come back. A thorough analysis would be like in marketing. Who are you reaching to what effect? This is as important as just hanging out in Drum beat and making self development and maintaining friendships. Additionally are we reaching important people, VIPs, press people,influential businessmen and women regularly?

The last data should be more difficult to get, except anecdotally as maybe some CEO of Exxon won't let on that in secret he is a doomer and surfs TOD from his teenage kids laptop or something. Of course altenately spooks from CIA, DOD, DOE probably scour the net daily and always check up on us to keep an eye on the base.

Perhaps with some heavy hitting stories in the new year and some adding sites (TOD california, TOD TEXAS, TOD NYC/NEW England?) or with daily polls or some other features for tecies and economists and average people readership could be expanded(like TOD canada has taken on a role for economics and TOD Local for local developments).

You can start with Alexa, but TOD editors will have better data from their web server logs:

http://www.alexa.com/data/details/traffic_details/theoildrum.com

Andre'

------------------------------------

Peak Oil, Climate Change and Business

Free, Bi-Weekly Executive Briefing

www.inspiringgreenleadership.com/peak-oil-climate-change-and-business

The statistics are publicly available. Click on the “Sitemeter” logo in the right-hand side bar.

Quick links for the front page here and TOD:Europe here.

Hi Luis,

Thanks for the summary, and particularly the great interview with Jean Laherrere.

Have a great New Year!

Dave

This morning on CNBC Squawking Chickens Box, the financial gurus were still at it, blaming the "above ground" factors for the unexpected high price of crude.

The more things change, the more they remain the same: denialism as usual.

Happy New Year to TODders all around the world.

Let's pray that we were wrong and that 2008 will bring a new peak instead of an in-the-rearview-mirror I told you so.

Us cats

Excellent summary, thanks!

I'd like to add one more thing:

Leanan kept us fed with a constant stream of mainstream and off-beat news sources, covering oil, natural gas, economy, farming, global warming and then some. Thanks, Leanan.

Many thanks also to the rest of the staff/contributors of TOD who continue without any reward other than an occasional thank you like this.

Thanks so much for this good summary. And Happy New Year to all.

I will send it around to a few scientific types who have their head in the sand - gritty sticky oil sands - or in the air - hydrogen and other airy fairy stuff. It will pique their interest if only because they will have an immediate critical attitude.

As a psych type, I shouldn’t be surprised that group-think, ideology, subservience or just plain old ‘I’m a regular guy with the mainstream’ stuff blinds people with top scientific training, and yet I am, each and every time. I find them hard to deal with.

The folowing from Energy Bulletin from PO review by ASPO:

Nothing ever changes or "The more things change the more they stay the same"

We might be nearing a time when the Invisible Hand of the Market Economy can not be counted upon to provide all of societies needs. Waiting for a reaction to conditions may not be an option much longer. Vision, prediction and action before problems arise may be our only way to avoid an uncertain future.

Top Story of 2007

Russia, Iran tighten the energy noose

By M K Bhadrakumar

Schroeder pointed out that energy rivalries lie at the core of the US policy of encirclement of Russia and behind Washington's persistent attempts to denigrate and isolate Moscow. He warned of dire consequences if Washington persisted with such a course, as Moscow is "certainly not happy about it".

Iran factor becomes important

In such an overall context, during the months ahead Moscow can be expected to make robust efforts to coordinate with Iran over its oil and gas output and exports. The rationale for such a coordinated strategy involving Iran is very obvious. First, Moscow is intensely conscious of the Western awareness of Iran's enormous untapped hydrocarbon reserves as an alternative to Russian supplies. Russia will strive to stay ahead of the European, and eventually American, overtures to Iran.

Second, the hydrocarbon sector in Iran is firmly under state control and Moscow and Tehran are in harmony in this regard. Third, the two countries will be coordinating their energy policies for wider geopolitical purposes within the broad framework of their strategic cooperation. Furthermore, market forces dictate the rationale of Russia-Iran cooperation.

http://www.atimes.com/atimes/Central_Asia/IL22Ag02.html