Daddy, will the lights be on at Christmas?

Posted by Euan Mearns on December 20, 2007 - 11:30am in The Oil Drum: Europe

... or is Europe running low on natural gas?

OECD Europe gas imports may grow by 295 BCM per annum by 2020. In the same time period, global LNG production is set to grow by 350 BCM per annum. So we Europeans should be OK, so long as the USA, Japan, China, South Korea, India and Taiwan are not planning to expand their LNG imports as well.

Edinburgh, the capital of Scotland, at Christmas. A wondrous site. And none of our politicians or the general public ever wonder where the energy comes from and how we will pay for it. Cutting CO2 emissions is a priority for all parties. Eliminating nuclear power is also high on the agenda. Confused? Our politicians certainly are. Visit Edinburgh while you can, it's one of Europe's finest cities.

This is a follow up to the post I had on European Gas last week. In the comments nrgyman2000 posted his forecast for Norwegian gas production that was somewhat more pessimistic than the assumptions I had made. The UK department of BERR also sent me some more reports with interesting data on Global LNG liquefaction and regasification capacity. SamuM posted a lengthy comment on Russian gas with 10 charts that is recommended reading. This post aims to pull this new information together and concludes that European gas and energy security is in a perilous situation.

Norwegian gas supplies

nrgyman2000 posted this forecast for Norwegian gas production to 2020. This forecast looks realistic and is based on official reserves estimates for Norwegian gas fields and estimated decline rates. In essence the giant Troll (in red) and Ormen Lange Fields (in white) show no decline in the forecast period since they are producing well within capacity and are facilities constrained. Other gas fields and associated gas from oil fields decline as reserves become exhausted.

I sent this to the Norwegian Petroleum Directorate (NPD) and invited comment. As always the NPD were very obliging and sent me this link to this figure saying that this was the only official gas forecast from Norway for the last five years.

I need to point out that Norway does hold large gas reserves and could produce higher volumes but this is a political issue. The Norwegian government recently refused an application to expand gas production in the Troll Field by 20 BCM per annum - in the interest of maximising oil recovery from that field. A future expansion of Troll may well take place and new field discoveries and developments may further boost Norwegian production beyond the volumes forecast by nrgyman2000.

But in the absence of any firm commitments on behalf of Norway in this regard, Europe should be planning for reduced gas imports from Norway from 2010. Given the energy predicament that Europe finds itself in, it would be helpful if the Norwegian government provided some clearer guidance as to their future gas export potential and intention. It would be a sensible strategy for Norway to impose energy rationing upon Europe and in so doing instill best practice in energy consumption, lay the ground work for sustainable energy use and lower the vast amounts of CO2 that Norway exports to the rest of the world every year.

Russian gas exports

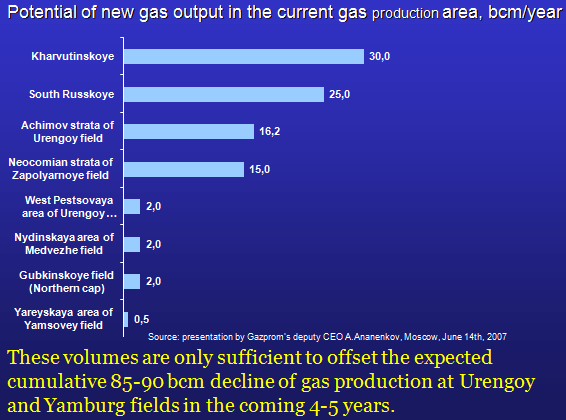

In an excellent comment, SamuM posted this chart attributed to Aleksandr Ananenkov, Deputy CEO of Gazprom. The chart seems to come from this presentation by Vladimir Milov in Budapest in September 2007, on the Nabucco pipeline proposal. I've uploaded this presentation on the TOD server and it can be downloaded here.

This chart tends to confirm the contention I made in my European Gas post, which was that new field development in Russia would be sufficient to offset declines in the years ahead, but no more.

A revised view of OECD Europe's gas import growth

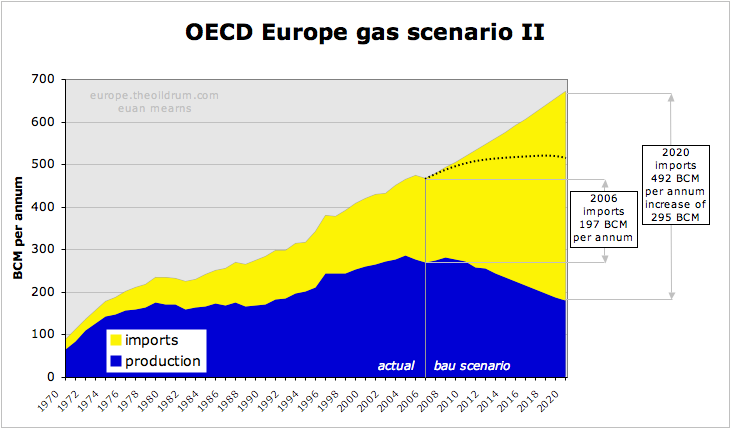

Taking into account the information posted by SamuM reinforces my view that Russia will maintain but will struggle to increase gas exports to OECD Europe in the years ahead. And taking into account the Norwegian gas forecast of nrgyman2000 suggests that Europe's indigenous production may be lower than I previously assumed. The revised forecast shows an increase in OECD gas imports of 295 BCM per annum to 2020 if consumption follows historic trends. Where will this gas come from?

For good measure I have made a similar chart for OECD Europe oil imports. Anyone wondering why world oil prices have gone up and are still rising need look no further than this chart. Where next for the oil price?

Liquefied natural gas - LNG

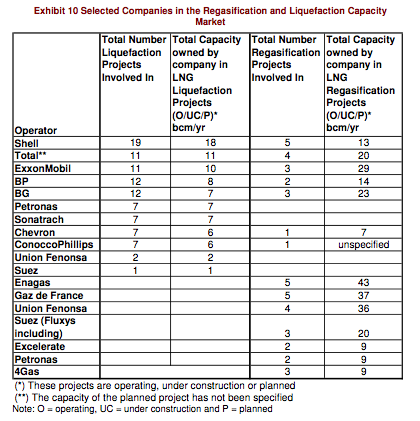

The UK government department for Business Enterprise and Regulatory Reform (BERR) have sent me reports on gas amounting to thousands of pages in recent weeks. More on that when I post on UK gas early in 2008. However, two tables from this report (large pdf) by Global Insight caught my eye. I have often heard that global LNG import capacity far exceeds export capacity and these tables seem to verify this contention.

The first of these tables (Exhibit 3) details how the global LNG trade is expected to develop in the period to 2025. Focus on Case A which is an optimistic scenario. At present there is 250 BCM liquefaction capacity (400-150) and 510 BCM regasification capacity (800-290). Note that liquefaction capacity equates to export capacity and regasification equates to import capacity. So, globally there is double the import capacity than export capacity for LNG.

By 2020, the timeframe for most forecasts, liquefaction capacity is forecast to grow to 600 BCM per annum and regasification capacity will grow to 1000 BCM per annum. The imbalance is redressed slightly but import capacity will still exceed export capacity by a factor of 1.7. It seems like there will be many disappointed importers and in a competitive LNG market the stage looks set for gas prices to escalate.

The other highly significant feature of these data is that they give an indication of how the international gas market will grow in the years ahead. Global Insight appear to forecast growth of 350 BCM per annum. Comparing this with the forecast growth in OECD Europe imports of 295 BCM per annum shows that Europe alone will likely have the appetite to consume most of the new global LNG supply in the period to 2020. What about the USA, Japan, China, India, South Korea, and Taiwan?

This discrepancy is so large I wrote to BERR inviting comment but have not received a satisfactory response as to how 350 BCM new global LNG export capacity is to be shared around the OECD and India and China?

Looking at the strategies of the International Oil Companies (IOC's) there is a similar picture (Exhibit 10). At present they have built 83 BCM of liquefaction capacity and 269 BCM of regasification capacity. I find this quite extraordinary that companies will happily invest in import infrastructure for non-existent product. The UK gas strategy will rely heavily upon LNG imports and there is a headlong rush to build import facilities.

Is it just me, or does anyone else sense the presence of an elephant?

Conclusion

Daddy, will the lights be on at Christmas? Most probably yes in the UK, though it is worth noting that with cold weather across continental Europe, UK gas spot prices have been running about double this year compared to last. With governments intent on pursuing market regulation of the energy sector we must wait for prices to get so high that this kills demand (the elderly freezing to death) and inflation kills our debt laden economy.

Next year I'd quite like to see the UK government commission studies on foreign gas supplies that goes beyond building import facilities and assuming the gas will be there to fill them. I'd also like to see the Norwegian government publish a clear statement of intent on their future gas production potential and strategy. It is no longer satisfactory to have national governments cite IEA reports that are built upon the incredible efforts of the United States Geological Survey.

On LNG, I recommend to regularly check BG Group's website, which always has highly informative presentations.

Presentations page

I recommend this one in particular: Natural gas – a globalising industry (September 2007, pdf)

On Russia, I would suggest that Milov is not a wholly impartial source, as he has been pushing (unsuccessfully) a hard deregulation and liberalisation agenda and has always been highly critical of Gazprom. Like Kasparov on the political side, he's a darling of the Western business press.

Jerome - thanks for the links - the world according to BG Group. There's a great quote in slide 22:

Euan,

How does the 33 GW of offshore wind planned for 2020 affect projected demand for gas in the UK? I would think that demand should be projected to decrease if this occurs.

Some new stories and TOD discussion are linked here.

Thanks,

Chris

7000 turbines in 12 years, or so we are told. Thats 11 offshore turbines brought online every week from now until 2020?

is that possible? I mean given a command economy type of deal I imagine it is.

It seems a bit of an ask. Or is it not really an issue given the right incentives?

Boris

London

That will almost offset the UK's Nuclear Cliff.

And let us not forget about the Wind's intermittency.

Actually, it more than offsets that at a 40% or greater capacity factor that might be expected for offshore wind. The UK has wisely avoided pushing refuling cycles for nuclear plants beyond reasonable limits so that their system works at about 70% capacity allowing careful attention to maintenance. In the US, pushing up the capacity factor for nuclear power has led to reliability issues owing to unscheduled outages as poorly maintained equipment fails.

As to intermitancy, it is turning out that geographically dispersed wind does a good job at providing power reliably so that, for the UK, is seems like an optimal choice.

Chris

Chris that's true, but the problem is load balancing the demand peaks at early morning and early evenning. The chances of wind following that demand profile are really slim. Storage will be needed even if only to acomadate daily demand variations.

So long as you are above the demand profile, there is no real problem, you just sell your excess. It is worth remembering that nuclear does a very poor job of tracking demand, coal a little better, gas even better and hydro the best of all. The UK has some pumped hydro storage now. I mention below that chemical storage in the form of methane might be a good fit with the UK's energy infrastructure.

Chris

To whom?

Chris, I'm a fan of wind owing to its reported high eroei, but feel there are some significant engineering and market regulatory steps need to be taken to make this truly viable. This would include pump storage and balancing against gas fired plant. I also kind of like the idea of building a parallel HVDC grid for renewables that sits along side our existing HVAC grid.

Euan

Do you think these engineering and market regulatory steps can be accomplished within the 2020 time frame as announced?

Boris

london

Euan,

Sorry to leave this unanswered. I know of at least one electrical connection between the UK and France through the Chunnel. By 2040, France may be interested in excess wind power since their renewable development is somewhat hindered by their present reliance on nuclear power. You'll likely be seeing excess at about that time that you won't want to put towards industry all the time. So, the timing may work out pretty well. There are other places where you might want to build an 8 or so GW line for export. The lines on the Risk board look like a rough draft of what might be useful.

Chris

Do you have statistics for wind farms operating at 40% or more? Real world operation, not theoretical.

I can confirm that the existing offshore windfarms in Europe operate in the vicinity of 40% or better (from real data I had access to during due diligence processes).

Let us remember that the length of the initial operating license for a nuclear power plant is not its expected life. Nearly all nuclear power plants that are approaching the end of their initial license are requesting 20 year extensions which will almost certainly be granted. After those 20 years, they will most likely get another 20 years.

That's interesting information, but if you check the comments on previous posts on Nuclear you'll see that some people claim exactly the contrary - some plants are closing due to aging and nothing else.

I think that faced with the prospect of electricity shortages those plants will either have to be refurbished or their operation will be continued despite aging.

Which makes building their replacement even higher priority that it already is.

Its interesting that when confronted with energy shortages, corporate and government attitudes to safety get deprioritised. You see the same thing happening in the oil industry, aging platforms chugging on for many years beyond initial design life. I suspect we shall start to see many more rig fires and disasters in the years ahead.

There are all kinds of claims about nuclear from the anti nuclear camp that are directly contradictory to those from the pro camp. The one we most frequently encounter here is the idea that we are running out of Uranium. This is not a split the difference situation. One side is clearly just wrong.

In the US at least, almost all of the early plants that are now coming up to the end of their initial operating licenses are filing for 20 extra years. There is no reason those plants cannot run 60-80 years. After that, they will just rebuild the reactors as they are doing right now at a major site in Canada. They might close down a few of the poorly sited early plants or ones that were really early designs that might not have worked out that well. Most sites will continue to operate as power plant indefinately.

Sterling,

I've been doing a bit of research into nuclear as I intend to make an investment in it shortly (Uranium mining company).

The main arguments from the 'anti' camp is that when the full lifecycle costs of nuclear are taken into account it is not so attractive and that Uranium is also non-renewable (the Chernoble argument seems not to be so effective as generally nuclear has a pretty good record compared to the 10,000+ deaths a year of coal for example).

The cleanup costs include everything from returning the mining 'waste' back to normal (some methods include huge quantities of rather nasty acids), disposal of UHexaflouride (Flourine itself a very potent Greenhouse gas negating some of the 'nuclear emits no CO2 argument) to the actual dismantling and storage of all the radioctive materials generated.

Uranium is abundant in nature but is only concentrated in certain ores. Therefore it is possible to extract seemingly limitless quantities 'if the price is right'. This is where the two camps can be correct at the same time. So its a bit like oil -there's a ton of the stuff left out there and if the price is right we can get at it...

There's also the issues that initial reactor core requirements are large and the US/USSR agreement to dismantle warheads has resulted in an oversupply (this agreement is due to phase out around 2012/13.) It therefore looks likely that during the next decade Uranium will be in short supply and I expect there to be something of a supply crunch around the middle of the decade. The Uranium price has already gone up almost 10 fold over the last 5 years or so. Some estimates put the number of new reactors to 2030 at between 500-1000 (this will probably depend on many factors like if we have to shut down old ones, if Peak Gas bites, when PO hits, Uranium price, etc, etc, etc.)

All in all I expect nuclear to play an important role in the next couple of decades but agree we may be literally storing up a tsunami of trouble ahead if the cleanup issues are not addressed...

Nick.

Actual measurements of full life cycle nuclear power energy inputs give an EROEI of 93. That is a lot better than any other fuel. Initial costs have been driven up by requiring safety and cleanup that are far beyond the other sources. Once coal has to pay anything near its fair share of safety and cleanup costs, nuclear will kill it. There is good reason to think coal will peak worldwide in about 15 years anyway.

Nuclear fuel costs are 4% of fully loaded costs and Uranium is about 25% of fuel costs. This means Uranium is about 1% of costs. The cost of Uranium could go up one hundred fold and only double total costs. New generation reactors, within the next 50 years, will recover as much as 30 times the energy from the fuel as the current ones. This will make it possible to economically use ores with many orders of magnitude lower concentration than we use today.

I do not agree with you on that one. Since reactors only generate about three cubic meters of spent fuel a year each, there is no reason that many decades of it cannot be easily stored at each plant. It is also too valuable to bury of otherwise dispose of. We should take the time to develop the technology to reprocess it so that it can be run through again to recover more of the available energy. In doing this, we will also be able to burn up all the elements with long lived radiation so that the true waste will be that much smaller and will be safe in a few hundred years. There is no real urgency to do anything about the spent fuel issue, except the political concerns raised by the anti nukes.

With that reasoning, we should just go on extracting the seemingly limitless quantities of oil as the price allows and forget about the uranium.

The point that seems to be missed here is that there will be a peak and decline in uranium extraction (or production, pick your term). If we went all-out, obviously peak uranium leads to peak nuclear some time down the road.

Almost all of the nuclear plants will receive license extensions, except probably the smallest and oldest ones. The 33GW of wind is a pie in the sky. Some wind will be build, but there is no way UK grid can take this much, especially with strains on NG supply (NG is the only option to balance wind in UK).

This is the only feasible path for UK electricity supply, neither the UK government nor anyone else can afford the lights to go out.

In my opinion the wind option could work if it was in parallel with a huge build-out of pumped storage capacity. We have plenty of steep enough mountains, lakes and other topographical features to do this, if we could overcome the NIMBY and environmental objections. It is NOT necessary for the UK to build pumped storage in teh same way it did at Dinowic and Ffestiniog (ie hollow out a mountain), it is possible to bury the conduit pipes near the surface and re-lanscape over them. Turbine housing a separate issue, but needs must.....

This would require govenment funding since wind plus pumped storage capital costs would far exceed the payback the market could offer in the time window used for market finance.

I would also look at building a major HV DC interconnector from Iceland to UK to baseload geothermal and/or hydro power. Same applies to this re financing.

None of this will happen since no UK political party has the balls to either cut spending or raise taxes to fund this sort of thing.

"The market will provide" is the prevailing view, and it will, just not the way they expect it to.

Iceland to UK is more than 1000km... not an option IMO. In addition Iceland has 1/200th of the UK population and similar energy production. What is it to offer?

Much more necessary is additional interconnection to the continent - this is only 50km and would allow imports of surplus nuclear electricity from France (AFAIK they are building a plant specifically for this purpose).

You are forgetting that pumped storage requires much more than just steep mountains (you are talking Scotland I assume) - it requires a river and suitable area for the two reservoirs which will be unused for other purposes. It should also be relatively near huge demand centers. I guess in theory it could be done in some not so favorable places, but in practice it will be hugely capital intensive, will require massive subsidies and will face stiff local opposition - not going to happen.

Why is 1000 km not an option? The Chinese are building a 2000 km UHVDC line!

http://www.abb.com/cawp/gad02181/c0d40da9112e6856c12573b0004490f7.aspx

1000km under sea? To export power from a country of 300,000 to a country of 60mln?!?

Of course it is a option. Hiring 1 bln.chinese to pedal their bicycles and generate our electricity is also an option. Just these options don't look good, do they?

Why is the population of Iceland an issue? It is irrelevant. The fact is that Iceland has vast geothermal and hydro resources which they cannot possibly use domestically.

As to 1000 km subsea power cables, it is really not that big a deal.

There is a 700 MW 580 km link between Norway and Holland about to come into service (http://www.statnett.no/default.aspx?ChannelID=1408)

There have been detailed plans for a 1200 MW 750 km cable from Norway to England, which failed to go ahead for financial rather than technical reasons (http://www.statnett.no/default.aspx?ChannelID=1169&DocumentID=10916)

Lastly the distance fom Iceland to Scotland is 800 km, not 1000 km (http://www.travelnet.is/ABC/about/geography.asp)

There appears to be an assumption prevalent in this thread that Wind is the UK's major non-fossil energy resource.

This is not only untrue, it is also dangerously misleading.

There are for a start a range of potentially massive resources offering power-on-demand

(without notional energy-costly storage options),

including both Geothermal and Coppice-&-Standards Forestry.

There are also major "scheduled-power" options including Tidal Barrage and Sea-bed Turbine.

In addition there is perhaps the largest near-pristine option of Offshore Wave Energy which,

with the provision of international power cables and the relatively slow decline of wind-driven waves,

could meet the majority of EU demand rather easily.

And nothing remotely serious is done about these options, despite our looming predicament.

As to why this is so, ask yourself whether, if even a couple of them were now under serious large-scale development, there would be any further discussion at all of the black farce of nuclear power ?

Walter Marshall, nuclear engineer and then head of CEGB, had the largest wind turbine yet built put on the Shetlands in the early '80s, and flew a planeload of compliant jouno.s up there for a liquid lunch at the opening.

And for decades data flowed to Whithall about the advantages of Wind power, and no other option got a look in.

And the Green movement ? That was not only neatly split between those for and against plastering the countryside with massive industrial artifacts, it was also prevented from gaining the rural landowners vote against nuclear power.

Notably the recent shift into rhetoric about Offshore Wind neatly continues the covert embargo on the serious non-fossil options.

Walter Marshall is discredited, dead & buried, but his nuclear-fossil-energy legacy still haunts the energy debate.

Until we succeed in viewing the options dispassionately, it seems likely that our position will only deteriorate.

Regards,

Backstop

I explained my population point in my answer to Chris downthread.

The whole electricity production of Iceland is 8.5 billion kwth. If they can spare to export 10% of it to UK, 850mln.kwth would cover the pathetic 0.25% of UK demand.

Now consider the costs of this equilibristics - the 580km.link to Norway costs 500mln.euro. Let's say your link costs the same (despite being twice longer). At 0.05euro/kwth times 850mln.kwth the value of the electricity transported would be euro 42.5 mln.year.

It will take 12 years for the link just to transfer as much electricity as it costed to build that power line only!! What about the cost of producing that electricity, the cost of maintaining that line (in the harsh North sea conditions), the cost of power losses etc.etc.

All these calculations would have been unnecessary if you just considered how small of a country Iceland is and how large is UK. Let's apply some common sense before starting to link any place on Earth.

See my reply below. The potential economies of scale are obvious.

Let's say the line would cost three times the Norned cost, or approximately GBP 1 billion. Let's also say it is "only" 1000 MW capacity, and runs at 95% annual capacity factor, leaving 18 days/year for maintenance.

That would equate to 8,322,000 MWh per year, creating revenues of approximately GBP 250 million per annum, using a ridiculously low price of only £30 per MWh. We are already down to a four year payback, and that discounts the fact that goeothermal energy would qualify for higher prices due to its renewable nature.

In practice, at present UK prices, each MWh would be paid at over GBP 80 over the average of the year - that's £700 million per annum - are the pieces of this particular puzzle beginning to fit yet?

Are you reading my posts?

"Let's say the line is 1000MW capacity" is nonsense.

1000MW x 365 x 24 = 8.7 billion kwth

The whole electricity production of Iceland is 8.5 bln. kwth. so you are suggesting Iceland will more than double its electricity production just to serve the UK market. Do you have the blueprints of all those extra power plants? Did you factor in their price and time frame? Did you factor in the infrastructure to interconnect them? Why not just build new plants in UK and reuse the infrastructure there?!?

What exactly is your point? Do you have one?

Last post on this

As I posted on another reply to you, Iceland has an estimated goethermal resource of 5,800 MW, of which they have developed about 1000 MW. That leaves 4,800 MW available - I am merely suggesting using just over 20% of the available remaining resource base.

That resource is available, it just hasn't been developed. Your assumption that they have developed all of what they have available is simply wrong - five minutes on Google proved that.

I have not factored in all the points you have asked (time frames, price, etc) because I have focused simply on rebutting your original claims that a 1000 MW subsea link would not be feasible and that Iceland did not have the available resource. I have proved conclusively that you are wrong on both counts.

So, in summary, yes, I am suggesting that Iceland could more than double (or triple, quadruple, etc) its electricity production just to serve the UK market. At current prices for renewable electricity in the UK, the revenue stream from 1000 MW of geothermal power exports would increase Icelandic GDP by 10%.

However, just because they could does not mean they will.....

Do you get the point now?

However, just because they could does not mean they will.....

Finally some bit of sanity here. It is so much easier to fantasize what we "could" do. We "could" build a giant solar array in space and power the Earth with it but we won't. We "could" build a bridge between London and New York and many other things.

And no, Iceland will not do what you suggest it will do. It is so much cheaper to generate and consume electricity locally or from much closer locations. It will be even cheaper for UK to export its energy intensive industries to Iceland than building new plants and so much more additional infrastructure around them.

It will be much cheaper to build wind farms in North Sea than geothermal in far away Iceland. A new nuke on the other side of the channel will beat your idea manifold and will provide much more electricity than what you suggest Iceland could ever provide. New coal power plants locally in UK will be even cheaper, despite carbon costs.

It is essential to distinguish what we 'could' from what is economical or in other words what we 'will'.

Why is population important? Just how many people do you think it takes to operate a few GW of geothermal or hydro power?

Norway manages to export lots of energy despite a small population. They manages around 2.5mbpd, at 6.1GJ per barrel that’s a steady rate of 177GW from a population of just 4.8 million. (To be fair we should divide that 177GW by three to give us 59GW of electrical equivalent energy).

It is important because it gives an idea of the energy production of the country.

I'm sorry that I was too lazy to look up the numbers before:

https://www.cia.gov/library/publications/the-world-factbook/geos/ic.html

Iceland electricity production: 8.5 bln.kwth

https://www.cia.gov/library/publications/the-world-factbook/geos/uk.html

UK electricity consumption: 348.7 bln.kwth

If we divert all electricity produced in Iceland to UK it will cover just 2.5% of UK demand. But obviously Icelanders may object the idea. As for the potential to ramp up production in Iceland, AFAIK they have already pretty much done it and are using excess electricity for energy intensive industries like aluminum smelting.

OK, I understand where your error comes from now.

The potential for geothermal development in Iceland is still enormous, they have only developed what they have demand for, for obvious reasons. This article (http://www.emagazine.com/view/?3975) estimates the total resource available at 5800 MW, of which less than 1000 MW has been developed.

Thus, in theory, Iceland has exportable availability of 42 billion KWh per year, or 12% of UK demand.

Aha. Now, you foresee still unexisting power plants and boosting Iceland electricity production more than 5 times.

You know Northern Canada has undeveloped hydro - why not connect to there?

Iceland has developed its most favorable sites for 50 years now. If you are counting on this small country to start developing all other sites and investing billions in transmission lines just to serve the UK market I think you are looking in entirely wrong direction. It's not going to happen.

Just compare your pie-in the sky project to a new 50km interconnection with France. I would suggest it is a hundred to one higher benefits/cost ratio.

Whether the increase is twice, 5 times or 10 times the existing capacity is irrelevant, as it the population of Iceland. Iceland's current electricity generation is based on the local needs of population and industry, without consideration of exports.

What is relevant is whether there is the primary energy resource there and whether technology allows electricity to be generated and transported to the UK at competitive cost. It seems there is the primary energy resource to generate a GW or two for export. China are showing us that long distance HVDC lines are feasible and I'm sure we can all agree that with the UK's nuclear decommission and gas depletion there will be an import market for those 1 or 2 GW Iceland could export.

Will they do it? They will if it'll make money - imported Icelandic electricity may well be cheaper than imported LNG in 2020.

Chris -

I'd well agree with both the technical feasibility of a GW-scale supply of Geothermal power from Iceland to the UK - In fact I seem to remember it being urged back in the '80s with the expected super-conductor transmission lines.

While the latter tech has not materialized, HVDC does appear to be a practical option, and one that is affordable even to a developing country like China.

Thus it seems very likely that Icelandic GeoT power could undercut imported-LNG power in the UK by 2020.

Yet there remains the political "consent" problem that has blocked all and any serious challenge to Nuclear Power's advancement in the UK over the last 35 years.

Geothermal, Tidal, Offshore Wave, Coppice Forestry and other major options have been starved even of research funds, let alone of funding for pilot projects on a scale to make any base-load non-fossil power look feasible.

A second strand of evidence of this obstruction (though neither reaches proof standards to my mind) lies in the UK’s utter failure, over decades, to update its fleet of power plants to avoid the (now inevitable) cliff of ageing plants facing forced closures.

Unless and until we address the obstruction I doubt whether even the most careful analysis of our energy options for the coming decades could properly reflect the difficulties and opportunities we face,

since, were we to achieve effective political leadership in the UK without further delay,

the options for base-load non-fossil power development could quite rapidly be invested to transform a probability of collapse into one of mere privation.

Attempts at forecasting actual outcomes thus seem rather courageous, to say the least.

Regards,

Backstop

Providing UK with 2% of its electricity is quite a revenue stream from a country that produces goods a tiny iceland polulation needs.

Making a healthy Icelandic economy with well maintained electricity production more important for UK has positive long term political implications for Iceland.

If the HVDC cable can be built for a reasonable cost it is a good idea even if new nuclear plants is an even better idea for UK electricity consumer. UK will anyway probably need both and more.

Colin Powell: "Throughout history, people have had difficulty in distinguishing reality from illusion. Reality is what happens, whereas illusion is what we would like to happen. Wishful thinking is a well-worn expression. Momentum is still another element: we tend to assume that things keep moving in the same direction.

The world now faces a discontinuity of historic proportions, as nature shows her hand by imposing a new energy reality. There are vested interests on all sides hoping somehow to evade the iron grip of oil depletion, or at least to put it off until after the next election or until they can develop some strategy for their personal or corporate survival. As the moment of truth approaches, so does the heat, the deceptions, the half-truth and the flat out lies."

Chris Shaw: "In the (alas, too few) years to come, we will see great argument over the proper allocation of dwindling oil reserves. It will be realised that other sources of energy cannot deliver sufficient surpluses to replace the potent portable energy we know as gasoline and diesel. It is not generally understood that poorer quality energy sources can be critically dependent on oil for their extraction, processing and distribution. In other words, oil is the precursor for other sources of energy; gas, coal, nuclear, solar, hydro, because these require oil fuel to create and maintain infrastructure. It also gives them the illusion of being profitable."

http://www.onlineopinion.com.au/view.asp?article=3837

Wouldn't that be Colin J. Campbell, not Powell?

Ni - I've always felt that a top priority should be to use Scottish large hydro schemes to pump store wind energy. This requires a sea change in market attitude since large hydro is currently used to sell electricity at peak times and rates.

How do you regulate this so that it is used in a fundamentally different way that is of strategic national interest?

I'm suprised you feel 33 GW it a stretch. About 15 GW of capacity were added worldwide in just 2006. The anticipated cost for offshore wind in the UK in 2020 is 2 to 3 pence per kWh, rather less that the 3 to 4 pence per kWh anticipated for new nuclear power. I think the estimate for nuclear was made before it was realized that reusing coastal reactor sites would not be an option so the price spread is likely larger. So, if the UK needs new generation, it's cheapest option is likely to be wind. Check pages 111 and 95 of Monbiot's book.

As you'll see below, wind can be used to manufacture methane so there not a big issue about balancing I think.

Chris

I gave a presentation summer 2005 where I discussed the issues of costal nuclear sites and sea level rise. This does not mean it has been "realized" though. If new nukes are to be built in the UK it's a dead certainty it will be on the existing coastal sites.

Not doing so is opening a nasty can of worms that the Government won't touch. If the Government says we can't build new nukes on the coast due to sea level rise - what else can't we build on the coast? What do we do about stuff already on the coast? Major cities including London? The existing nuke sites that don't complete decommissioning for 120 years? The new houses at the Thames Gateway?

It's politically impossible for the Government to prevent new nuclear build on the coast due to sea level rise.

Chris,

I'm sure you are aware of the work Greenpeace UK has done on this issue. So, the can of worms is not just open but the stage is set for needing to address more rapid decommisioning. This is so because the London Dumping Convention prohibits nuclear waste being disposed of at sea.

I suspect that insurance companies will have something to say about other construction projects, but in the case of nuclear power, international treaties come into play. The cost of accelerated decommisioning together with the need to find inland sites which may lack adequate cooling capacity without the use of cooling towers likely boosts the 2020 cost of nuclear power in the UK by a couple pence to 5 to 6 pence per kWh.

Chris

What a pile of crap.

So, the latest hit is that the sea level will rise hundreds of meters in 2 hours and will leave all those power plants underwater along with the nuclear waste inside. People will run away from the coming Great Flood and the ocean will be forever contaminated with the nuclear waste.

Well the British certainly deserve to freeze in the dark, especially since they are still listening to such nutcases as Greenpeace. The only missing thing in the equation is who is going to take the blame when things get rough? My bet - it will be the Russians again. Goodness.

You demonstrate a severe lack of understanding of nuclear power. The timescale for decomissioning of a plant is intentionally long. Humboldt 3, which was not all that hot since the engineers who designed it were a bit clueless so it had to be shut down early, is only now getting its reactor packed away. Thirty years! With sea level rise, it's on-site storage will have to be moved further inland. More expense. No wonder California has outlawed new nuclear plants.

Try to get a clue.

Chris

This is getting ridiculous.

Why the hell would you need to move the whole interim storage site? You just load the waste in containers and send them to another site. This practice has been around for 50 years and surprise, surprise - it is happening with hundreds of spent fuel assemblies - the ones many people like to call waste - now as speak.

Are you getting in a holiday mood or something?

"Humboldt 3, which was not all that hot since the engineers who designed it were a bit clueless so it had to be shut down early."

WRONG!!! And hostile to boot.

It was a demonstation plant of only 60 or so MWe, built to test out ideas for design and operations. It did its job and was shutdown because it was just not economic to staff and operate the plant. Plants under construction at the time of shutown were 1200 MWe and today reach 1600 MWe.

Most early plants of this size (60 MW) have been shutdown for the same reason. It would need a staff of five just to do the government forms and reports, at least five health physics techs, at least 12 licensed operators, a couple trainers, five or so managers, etc, etc, etc.

Besides, local natural gas production came on line as well. PURPA meant that the local lumber businesses went into the side business of burning their sawdust for electric production. Eureka is a very small electrical island with tenuous links to the larger grid.

I've crawled all around inside the Humboldt Bay 3 plant, BTW, and helped with some post-closure tasks there. Interesting design but it is intentionally sunk into the bay mud. The fuel will have to be removed in any case although the fuel pool is an independent structure that literally FLOATS in the mud. Slowly rising sea levels will just cause it to float higher!

You are correct that waiting to decommission and remove the structures is both economically advantaged and reduces the radiation exposures of those doing the work.

Now you invented this problem too.

You are worrying about nuclear power plants on the sea coast (say of 10-20bln.pounds total value) while each year properties of hundreds of billions pounds are being built on similar elevation and countless trillions have already been built.

Don't worry if in 100 years London is underwater the demand destruction would be good enough to render these nuclear plants obsolete.

BTW why is nobody considering sea level rise when planning for those gigantic offshore wind farms? After all every nuke around is considerably more above sea level than an offshore wind turbine. Who is going to be underwater first?

I need to revisit that post and redraw the charts in light of recent announcements. Two large Advanced Gas Reactors (AGR), Hinkley Point B and Hunterston B were both due to close in 2011 after 35 years operation but have just been awarded 5 year extensions, however according the British Energy site they have also been awarded the following caveat “Operating at its currently reduced level of 70% of full output...".

It seems every effort is being made to keep the old girls running. I have to wonder how feasible this is though as over the last decade their load factor has fallen from 80.1% in 1998 to 69.3% in 2006 due to poor reliability and with the numerous outages in 2007 I wouldn’t be surprised to see the load factor for the nuclear fleet down to ~60%. With this unreliability and by derating the extended power stations to 70% from the get-go we’re going to see significantly less output in the future years.

Chris, this obviously needs to be taken into account. My feeling is that the government needs to come clean and tell everyone that we need this in order to keep the lights on most of the time - then we may see some of the urgency that is required and resistance melting.

One problem is the cyclic nature of gas demand. If the wind doesn't blow in winter then you need a large supply of gas that can be readily ramped up / switched on.

The conclusion I've reached is that the UK needs to nationalise a part of the gas industry, retaining a handful of fields that are used exclusively to meet peak winter demand. This would be in strategic national interest. I believe Morecambe used to play this roll. It seems to make more sense to do that than convert depleted fields to storage. Where's the sense in transporting LNG half way round the world to pump it into an old depleted gas field?

"Where's the sense in transporting LNG half way round the world to pump it into an old depleted gas field?"

That's easy - security of supply. Whne the LNG is hafway round the world somewhere else, it's not yours. When it's stored in your depleted field, it is. In additon, it allows LNG pridcuers to monetise their resources. The alternatice would be for the UK to purchase NG resouces in their indiginous fields and hope that they don;t get nationalised or produced by soemone else.....

Some may have noticed yesterday that Petronas bought out UK gas storage operator Star Energy. Star themselves just increased their ownership on the offshore Esmond Gordon depleted fiwls storage project (150 BCF). Petronas' financial clout will make the development of this project far more easy and will enable Petrnoas to make fuller use of its Dragon LNG import facility in Milford Haven in summer months.

My point is that reducing indigenous base load gas supply will increase the year round demand for LNG which should be supplied and used as a continuous stream. Conserved offshore gas fields may be used to shave the winter peaks.

Of course, if the figures above are correct, there won't be enough LNG to meet that increased demand - so we must really start developing alternatives to gas with some urgency.

I gotta say that storing gas from LNG offshore sounds nuts. Your supply chain is this:

production - pipeline - liquefaction - transport - regasification - pipeline - injection - production - pipeline - use

The supply chain from conserved fields is:

production - pipeline - use

Euan, I agree 100% with your logic.

However, who is going to the producers to conserve their gas? If we are talking about a nearly depleted field, the producer will "swing" the gas anyway. However if the field has several years production left, the NPV difference (particularly at current cost of capital) between a molecule produced this summer or during winter many years hence is too big. From an economics point of view, the sensible thing is to produce that molecule today. Unless incentives (aka taxpayers' money) exist to refrain from producing that molecule, it will be produced, twas ever thus.

Thats why Euan mentioned Nationalisation. Let the baseload run at a profit [if you believe utilities should be private/deregulated] and let the government fill in the demand peaks/supply troughs. I think this is inevitable eventually.

Euan,

Thanks for this reply. I notice the chart is marked in MWh but I think that a good portion of the use must be for heat. George Monbiot suggests in his book "Heat" that home heating be converted to co-generation using small gas powered generators. While this would clearly increase the use of gas in the home, it should reduce the use of gas overall since less of the energy would be vented to the atmosphere unused. The seasonality would remain but the amplitude would reduce so that your current storage capacity would represent a larger fraction of the system.

It seems to me also that the build out needed to get 33 GW of offshore wind by 2020 will have a follow-on effect of providing an additional 30 GW before 2030 since the infrastructure to do the job will be available and the costs substantially reduced since I presume that you will used accelerated depreciation of the construction equipment as an inducement to invest.

By 2020, I'd expect small scale Sabatier reactors to be space qualified so that there would not be a big issue adding these to Monbiot's proposed home generators. The reaction is exothermic. Thus, you would have a choice of either generating electricity from gas, or, when wind is supplying more power than is being used, producing methane directly from the atmosphere and water mains feeding it back through the gas delivery system for storage. Water heating throughout the year might be put on the Sabatier process yielding more ability to absorb peaks in wind generation. I've put up a (clumsy) sketch of how this might work using existing heating oil delivery infrastructure in the US Northeast to produce jet fuel renewably using the more complex Fischer-Tropsch process. I suspect that the UK's stong commitment to wind will mitigate your gas supply worried, making you energy independent in fairly short order while allowing you to substantially reduce your cabon dioxide emissions. Your involvement in ESA should make transitioning the space technology fairly smooth.

Chris

Your sketch is interesting, but lacks the energy input to the fischer-tropsh process, so it is impossible to assess straightforwardly.

IMHO it looks realy dumb to use a scarce energy source like natural gas to perform electrolysis. Why not just use the stuff directly?

You'd use electrolysis as an input for making natural gas. It would not make sense to do that without a renewable source of electricity. However, in the UK, I think we can expect 63 GW or so of wind power by 2030 owing to momentum from the 33 GW to be installed by 2020. That would mean quite a lot of power to be put towards home heating and co-production of methane.

Fischer-Tropsch is exothermic which is why energy inputs are shown only for the feedstocks. This is also why it makes sense to do these kinds of processes in an environment where the heat from the process can be used, e.g. home heating. The chief thing though is that hydrocarbon fuels can be produced renewably without putting a strain on agricultural land, or, in this case, any land.

Chris

Chris - I gotta admire your optimism here. I'm a bit more cynical taking the view that our politicians are nothing more than a bunch of opportunistic idiots who will say absolutely anything at all in order to get through the week. Hence, I have virtually ignored the announcement of 33 GW offshore wind.

The reality is that the UK has one of the worst records of any country in installing alternative energy. According to the BWEA we have 2.3 GW of wind energy installed to date. To achieve 33 GW will require true leadership and a clear sense of purpose - and the UK is currently a leader and principal free zone.

http://www.bwea.com/ukwed/index.asp

We have one deep water off shore wind project developed by Tallisman with two 5 MW turbines on it. Some of our politicians have had wet dreams about this and are sublimely unaware that the principal reason for this development is to defer the decommissioning costs of the Beatrice oil production platform.

Sorry for being so cynical here but my mood is very black at present with since our "leaders" decided to throw billions at a bank that should be allowed to fail - and in so doing teach our financial institutions some rudimentary lessons in prudence.

Hi Euan,

I understand you cynical attitude. Here in the US we've managed to undercut the renewable energy industry substantially while planning to push inflation and food prices through the roof. There is a saving grace though. While it is possible to legislate physical law, it is not possible to do so successfully. Reality will intervene and physics is on the side of wind for the UK.

From your link, looking at the offshore projects, I get 0.33 GW operational, 0.28 GW under construction, 2.66 GW approved with 0.1 withdrawn after approval and 2.15 GW submitted for approval. From these numbers, it looks to me as though an approval process of slightly under a year, or a beefing up of a slower process to handle a larger volume of submissions should get you to 33 GW by 2020. I'm assuming that the approval process requires a demonstration that financing is sound and contractors are available to undertake construction. If this is not the case, then there could be bottlenecks on the construction side. But, because the operational and under construction numbers are similar, I'm guessing that the process of growing the capability to carry out construction is well underway.

Recently, George Monbiot has been writing about approval processes for new new coal open pit mining which seem to be too well greased. A bit of cognitive dissonace, and the resulting headache, may lead to a more rapid convergence to priciples of physics in your governmental practices. The key issue is that we have exceeded plants by a long way now in our ability to extract energy from renewable flows, including fossil plants, and we are also better than plants at chemical transformations related to energy (though not nutrition) so that renewable energy is actually the path of least resistance. The political machinations of extracted fuel industries will be amusing to follow, but they are now relics just as their fuels are. You can get a good chuckle elsewhere in the thread where an EROEI of 93 is cited (without attribution) for nuclear power from an intentionally deceptive source. Usually there is a delay until a TOD story is moved to page 2 before this chestnut is pulled out. There will be more bathos along the way, but you need to remember the physics so that you will not be depressed by it.

Chris

Euan,

if we average the blue (roughly) it doesn't look to me like the UK has much more than -what- 10 years of indigenous gas in any sort of quantity. If then we look at the Laherre North American gas discovery shifted 21 years -'The Cliff'- it would appear that there will be a huge bun fight for LPG -slugged out by rich economies. I can't see how the gas price won't skyrocket given this scenario. No-one will want to "freeze to death"...

Nick.

Nick - you're right. Even BERR agree that by 2020 most of our gas is gone. We'll have a post on N American gas by Luis and Laherrere early 2008.

A major event takes place when our indigenous supply no longer meets summer demand. At that point we become year round importer and lose our ability to cycle indigenous supplies all together. Hence winter peak demand must be met by imports - pipe and LNG - and from storage. I estimate that event is only 3 years away.

Yep - I think the gas price is set to go through the roof. They are already very spiky - down 10% yesterday and up 8% today.

Hello Euan,

Great post!

According to data from DTI UK became a year round net importer of nat gas as of 2007.

NGM2

-You ask how we will pay for 295/350ths of the total. Well here in the UK the answer is simple: we will use the proceeds of our vast and mighty financial service sector...

Erm, iceberg ahead captain...

Nick.

Nick, there is no problem. Just yesterday Gordon Brown was on TV saying that the UK economy was so strong that we will weather the global economy crashing around us. There is no need to panic! We are so rich we can afford to pay £60 billion for an asset which at its peak was worth only £7 billion. What the hell, we could even pay £100 billion for this worthless piece of junk. Its nothing - just a little more than the UK annual trade deficit. Its only £2000 for every man woman and child in the country.

Hmmm .... peak BS? ... lets hope so, or we are definitely doomed.

This is the same Government who will not allow contingency plans to be made in case the expected peaking of oil isn't actually 2030 (or maybe even later)... 'cos if the public got to hear that there were such plans they might panic!

It seems the words 'peak' and 'oil' are not to be allowed in the same sentence even!

The Welsh pipeline was hammered in. The speed of investing in import capacity is almost demonic in intent.

I just don't know what to make of UK energy policy anymore. On one hand we are going to reduce CO2 by 20% and on the other project growth in future fossil fuel consumption. they can't both be right?

I just don't understand what is going on in whitehall? confusion is the correct term.

Boris

London

The need to complete several offshore turbines a week, declining LNG supply , the nuclear cliff. This calls for the stoicism of Wilkins Micawber

I have no doubt I shall, please Heaven, begin to be more beforehand with the world, and to live in a perfectly new manner, if -if, in short, anything turns up.

Euan thanks for this short and clear overview. Those OECD outlooks for Oil & Gas graphs are immensely scary. My son is turning 5 today. My-o-my how life will be much different when he turns 18 in 2020.

http://science.reddit.com/info/63iv0/comments/

thanks for your support.

Indeed, very intriguing. Thank you for your timely post.

the elderly freezing to death

I don't think so. My 79 year old mother gets a £200 ($400) 'Winter Fuel Payment' tax free from the government. My total fuel costs for the entire year (also UK based) are less than £180 ($360) for heat, light, hot water etc. And I work from home.

JN2, this is the same blinkered 'BAU' type thinking that will cause the wave of panic when people actually realise what is hitting them.

Fast forward to 2017, Europe is struggling to import LNG and has to compete with the Yanks, Japan, etc. Russia is having supply problems of its own and the Euro-pipeline is up and down like a yoyo creating energy price spikes...

The UK goverment is shelling out tens of Billions for oil and gas imports and after PO hit 5 years ago the financial service sector took a dive. As a result many discretionary payments where frozen or slashed and gas bills are running at 5 times what they where a decade ago, as a result...

"the elderly freeze to death"

I have tried to warn my own mother of possible problems ahead and that she should get a solar water heater put on the roof. So far she says if gas prices go up she may get a solar heating panel, and anyway if they become more common prices will come down... Well perhaps... Or perhaps there will be such a demand that prices for panels and installers will go through the roof.

Imagine houses without electricity or gas -that's how they where in the 19th Century. But now we are quite happy to pay £300K for a house that is essentially a death trap once the FFs run out. Solar panels (thermal and PV), Ground source heat pumps, triple glazing, massively isulated -all these things will add the same small fraction that the 'plumbing' for electricy and gas does now and they will all be seen as essential items if we (humans) pull though the next half decade...

You know, when I get in my 'creepy zone' I can't help thinking that all this GW related stuff (HIPs, Windmills in the sea, etc.) is just a really big cover up for the real truth that the Government does know we are stuffed and is trying desperatly to prepare us for the moment when they have to announce to an unsuspecting population that 'Life As They Know It' is effectively over... Nah, they're not that clever... :o)

Nick.

Nick, thanks for replying:

Fast forward to 2017... gas bills are running at 5 times what they where a decade ago

Sure, if nat gas is 5 times more expensive AND the government can't afford £200 winter fuel payments AND you live in an uninsulated property AND you have zero disgressionary income then it won't be pretty...

That's pretty much the scenario I was thinking about. Society gets a windfall profit from very cheap energy that is used to subsidise the needy. Once that windfall evaporates then our ability to care for the elderly will be stretched to the limit - market forces kick in.

A couple of points:

1) Import capacity SHOULD exceed export capacity for LNG since demand is seasonal for most users. Few import terminals would find it economic to run flat out all year. Of course, that may change as pipeline-delivered supplies deplete.

2) I haven't heard of any decline in the capacity factor of US nukes due to lack of maintenance. There have been a few plant specific items that constrain 2 year refueling cycles or shorter outages. Those have been replaced where possible. Plant maintenance is carefully and responsibly managed since it is in the owner's long term interest to do so.

3) The British AGR had a rocky start and has never been considered a successful or competitive design. Still, you'll miss them when they're gone.

4) Please be aware that the economics of electric storage is levered towards the cheapest input power. That is the cost differentials of the input sources are magnified and made even greater for the released power. Wind's intermittency makes the storage cost even higher since becalmed windmills means a useless storage facility.

5) Yes, European and UK politicans make even American politicans look like wise sages when it comes to energy.

At least the EU and the UK have high energy consumption taxes, and per capita energy consumption in the US is about twice what it is in the EU.

Joseph, I'm glad you make this important point - one of the few on-topic comments in the thread. Cycling gas supply to meet seasonal demand is easy when you have over-capacity in indigenous supply - you simply cycle this up and down between winter and summer. Once you lose that ability, meeting winter demand becomes a real challenge. I think it is a mistake to try and use LNG for that purpose. Better to import LNG the year round - maximising utilisation of export and import facilities and to retain the ability to cycle your indigenous sources.

In very general terms, your comment suggests that importers may import 100% of their supply over a 6 month period - when they need the gas most in winter. If demand for LNG was split roughly 50:50 between northern and southern hemispheres this might work. But unfortunately that is not the case. All demand for LNG is in the N hemisphere, hence everyone wants to meet peak demand at the same time. In essence, liquefaction capacity may sit idle for 6 months and the actual capacity may only be 50% of the nameplate, since gas sales in N hemisphere summer will be low.

The argument still stands that in winter the whole N hemisphere will be competing for a finite amount of LNG that will be insufficient to meet peak winter demand. January's regas capacity will be double January's liquefaction capacity. So only half the market will get supply - I think?

Maybe Bunyonhead's proposal for long range "LNG" storage isn't so daft after all.

Experience in the US has been that only during the winter months have internal market prices been adequate to make importation of LNG economic. Why buy dear to sell cheap?

Of course, cheaper storage would help smooth price swings but LNG costs (not prices) are about $7.00/mmBTU delivered last I checked and this data set shows that it hasn't always been that high:

http://www.oilnergy.com/1gnymex.htm#year

Since demand varies with the season, some production capacity will have to sit idle some of the time. Adding lots of gas-fired electrical generation in systems with summer peaks would smooth out seasonal demands but is that worth it?

Further, is it cheaper to store domestic gaseous gas or imported LNG? I think the former but I don't have the numbers. Plus, how do the economics of storage at the liquefaction plant vs more LNG tankers vs end-user storage shake out?

One of the things holding up the LNG industry is the desire by producers for fixed price, take-or-pay contracts and the desire by end-users for a spot market.

Here's my analysis of LNG vs nuclear for base load electricity:

http://www.energypulse.net/centers/article/article_display.cfm?a_id=623

Note that I used the OLD heat rate for gas generation initially but corrected the numbers in the comments.

http://www.seapower-generation.co.uk/english/ormonde.htm

Do you think we will start to see more projects like this. Offshore wind and gas sharing a grid connection?

What about carrying out the haber process offshore, using gas from small wells and offshore wind.

Or maybe using the offshore wind power to liquify the natural gas straight out the fields into LNG tankers.

Offshore compresed air storage in all the soon to be empty gas wells?

I hope to be able to write about this project in the near future, as my bank has been mandated to finance it. This is what will keep me busy in the next few months...

On the subject of solar water heaters I installed a system this year. A DIY system using 20 vacuum tubes and a retro fit coil can be installed by a competent DIYer in less than 3 days for under £700. The particular system I have installed delivers approximately 1600kwh per annum which represents about 12% of my gas usage.

It seems this technology is quite practical, modular, and achievable by large sections of the DIYing public.

Solar water heaters are one use of solar power that I strongly advocate! Solar photon quality matches well with domestic hot water quality plus storage is cheap, easy, and economical.

However, I don't understand Nick's use of units. "KWhr" are electrical power consumption units while his solar hot water heater reduced his gas usage? 1600 kWhr converts into 1600 X 3412 = 5,459,426 BTU. Of course, it doesn't work backwards.

Do they sell natural gas in units of electricity in Europe?

IN UK, natural gas is metered and billed in pence per KWh by the utilities

Yes by KWH I mean 3600,000 joules equivalent of gas. This is what gas is priced by in the UK as gas by volume will vary in energy content and BTU's are an obsolete measure here.

Learn something new everyday (if I'm lucky!)

Here in California, gas is billed per "therm" of 100,000 BTUs, also per heat content as the BTU/cubic foot (I know, obsolete units!) varies somewhat due to sources.

Nick - you got a link to this?

No - link - I was just commenting on my own experience. I can post more details of my set up if people are interested.