UK Energy Security

Posted by Euan Mearns on October 25, 2007 - 10:00am in The Oil Drum: Europe

In 2006, 92% of the primary energy consumed in the UK was derived from fossil solar fuels - oil, natural gas and coal.

Not so long ago the UK was self sufficient in these energy resources but now we are importing increasing amounts of all three.

Dependency upon imported energy undermines UK national security and will have potentially dire consequences for the balance of trade.

UK Primary Energy Consumption - basic statistics

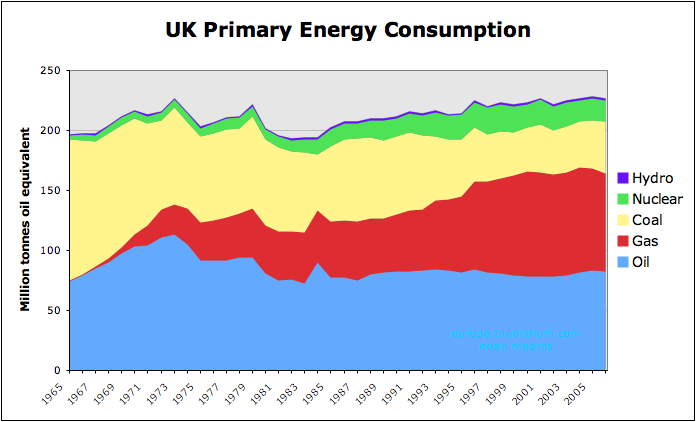

A beneficial attribute of the BP annual statistical review of world energy (used throughout this report) is that it shows primary energy consumption for the 5 principal energy sources normalised to millions of tonnes of oil equivalent. This eases comparison of energy consumption from oil, natural gas, coal, nuclear and hydroelectric power as shown for the UK (click all charts to enlarge).

In 1965 (when BP records begin) 98% of UK primary energy was derived from burning fossil solar fuels for transporation and power generation purposes. By 2006, the proportion of fossil solar in the energy mix had fallen marginally to 92% - largely due to an increase in nuclear energy.

In this period, the energy mix has changed significantly. In 1965, no natural gas was used. But with the discovery and development of offshore natural gas in the North Sea, the proportion of natural gas in the UK energy mix has increased steadily since 1968 largely at the expense of burning coal.

In 1965, the UK population was 54,350,000 and this had grown to 60,245,000 by 2005

This equates to 3.6 tonnes oil equivalent per person per annum in 1965 and 3.8 tonnes oil equivalent per person per annum in 2005. UK per capita energy consumption has been essentially flat in the period. Energy efficiency gains in transportation, building standards and in more energy efficient appliances have been lost to an overall rise in living standards and more prolific use of energy in transportation, single occupancy dwellings, foreign travel etc.

Each person in the UK uses on average 10 kgs of oil equivalent energy every day. The main message of this post is that it is in the vital national interest that this profligate level of energy consumption (and waste) is substantially reduced.

I will now look at the oil, natural gas and coal production and consumption records for the UK for the past 40 years and show how swings from deficit to surplus and back to deficit have affected our overall balance of trade. I will also examine oil and gas production forecasts for the period to 2012 and project how this will affect the trade balance and energy security.

Oil and gas prices

Historic average annual oil and gas prices are lifted from the BP statistical review. Inflation adjusted prices based on 2005 $US have been used.

Future oil and gas prices are of course impossible to predict with certainty. However, as a central aim of this post is to illustrate the potential impact of energy imports upon UK trade balance it is essential to make assumptions about future energy costs.

Future oil prices are based upon the oil price model presented here. This translates to an average 16% increase per annum to 2012.

| Year | $US / barrel |

|---|---|

| 2007 | 70 |

| 2008 | 80 |

| 2009 | 90 |

| 2010 | 110 |

| 2011 | 130 |

| 2012 | 160 |

Future gas prices are based on a 5% annual increase as shown below. BP quote gas production figures in BCM (billions of cubic meters) whilst prices are quoted in millions of BTUs (British thermal units). To convert, from BCM to BTU millions the former is multiplied by 36 million (see sheet on conversion factors in the BP review).

| Year | $US / million BTU |

|---|---|

| 2007 | 7.4 |

| 2008 | 7.7 |

| 2009 | 8.1 |

| 2010 | 8.5 |

| 2011 | 9.0 |

| 2012 | 9.4 |

Future price estimates do not include adjustment for monetary inflation or changes in exchange rates.

It is taken for granted that some may view the future oil and gas price estimates as too high whilst others may take the view they are too low. Future price estimates are presented for illustrative purposes only.

Oil

The historic oil production and consumption data shows large UK oil imports pre 1976. Once North Sea oil production got underway, imports were gradually reduced until in 1981, the UK became a net oil exporter. The UK remained an oil exporter until 2005. But in 2006, with falling production the UK once again resumed importing oil.

1.74 million barrels per day is a key figure for the UK as this represents the approximate level of daily oil consumption. If we produce more than this amount we can sit back and relax in the sure knowledge that our oil needs can be met from domestic supplies. Less than 1.74 million barrels per day means that the UK must compete for oil imports in the increasingly competitive world oil export market.

What will happen next? Three oil production forecasts are shown:

The first is by Alex Kemp who is Schlumberger Professor of Petroleum Economics at the University of Aberdeen. Professor Kemp has recently been appointed as energy economics advisor to the Scottish Parliament. The details of the Kemp forecast can be found here.

The second is by myself (Mearns2) the details of which can be found here and here.

The third is by the UK Department of Trade and Industry (DTI) who have responsibility for compiling UK oil and gas production forecasts and reporting those to the UK government. The DTI produce a forecast range. The upper range boundary is more or less coincident with Kemp whilst the lower range boundary is more or less coincident with Mearns2. Given this coincidence, the discussion will only consider the Kemp and Mearns2 forecasts.

The key difference between the Kemp and Mearns2 forecasts is that Kemp sees production rising this year and next and this mainatins the UK oil exporter status for a few years yet. The Mearns2 forecast sees the UK as a permanent oil importer with annual production declining at a rate of around 8% per annum.

The impact these different forecasts have upon the UK trade balance is quite profound. At times of high oil prices, oil exporters are handsomly rewarded whilst importers are penalised. The falling production and rising oil price implicit in the Mearns2 model shows the UK oil trade balance plunging from a surplus of over £5 billion in 2000 to a deficit of over £20 billion by 2012.

Which forecast is more likely to be correct? Only time will tell. Near term, the biggest impact upon UK oil production is the giant Buzzard Field that came on stream in January 2007. Production from Buzzard has pushed the UK into oil surplus for the first 4 months of the year according to the DTI Table et3_10 (XL spread sheet). However, oil and NGL production was 3.8% lower for Jan-April compared with the same period last year and I calculate an average daily production rate of 1.74 million bpd which is bang on UK average consumption levels and slightly higher than my forecast of 1.67 million bpd for the full year. Offshore maintenance programs combined with the relentless impact of decline means that production during the first half of the year is normally higher than during the second half and I would judge that my forecast for the full year is looking good.

Natural gas

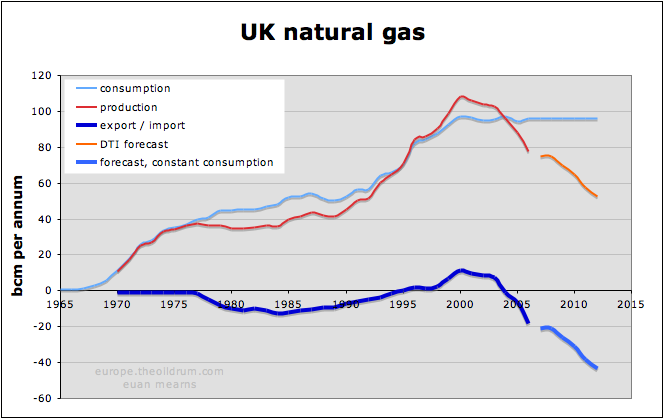

Offshore natural gas production in the UK got underway in earnest around 1968. Production grew steadily for over 30 years and peaked in 2000 and since then gas production has fallen, gradually at first, and then accelerated decline since 2003.

Up until around 1995, most domestic gas production was consumed within the UK. Domestic gas production was allowed to substitue for coal in home heating and in power generation resulting in cleaner air in our cities and helping to solve the acid rain problem associated with burning sulphur rich UK coal in power stations. Up until 1995 the UK also imported North Sea natural gas from Norway and Holland. But then in an extraordinary bout of bravado, the UK exported gas for a brief spell between 1996 and 2003.

The UK has become hooked on natural gas for home heating and power generation and with plummeting production faces serious issues in securing future supplies. The production forecast is the DTI median forecast and combining this with assumed constant consumption produces an import requirement of over 40 bcm per annum in 2012. It is by no means certain that consumption will stay constant as new gas fired power generation plants are still being sanctioned and built!

The UK has pinned future gas supplies on a two pronged strategy. The most important strand is the new Langeled pipeline to Norway. This is the world's longest sub-sea pipeline starting at the Ormen Lange gas field off Mid Norway and ending in Easington, Yorkshire in the UK. At its peak, Ormen Lange will produce around 22 bcm per annum or around one half of the projected UK import requirement in 2012. It has to be noted that the UK will compete with continental Europe for Ormen Lange gas.

The second strand is to import liquified natural gas (LNG), especially from the North Field in Qatar. The UK will have to compete with the whole of the natural gas importing world to secure these supplies. Three terminals have been built:

The Isle of Grain with import capacity of 4.4 bcm per annum

Milford Haven (Dragon) with import capacity of 3 bcm per annum

Milford Haven (South Hook) with initial import capacity of 10.5 bcm per annum

The combined LNG capacity of 17.9 bcm per annum plus Ormen Lange capacity of 22 bcm per annum provides the magic number of 39.9 bcm per annum compared with the projected import requirement of 40 bcm per annum by 2012. So long as no one else wants that Norwegian and Qatari gas the UK should be OK.

UK government sources report Isle of Grain at 5 to 15 bcm per annum and Milford Haven at 10 to 25 bcm per annum.

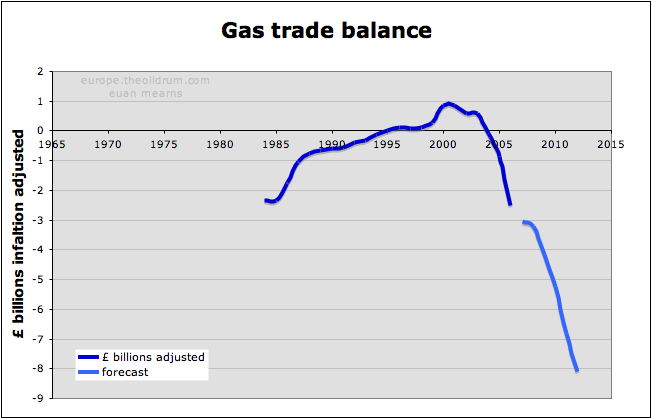

Whilst there may be doubts about the availability of gas for import to the UK, there seems to be unanimous agreement on the fact that the UK will have to import ever increasing amounts of gas for the foreseeable future and the imapct this will have upon the trade balance is shown below.

A surplus of £1 billion in 2000 is converted to a deficit of £8 billion by 2012. Note that this model assumes no growth in domestic gas consumption and a relatively modest increase in gas prices. There is also the possibility that the DTI forecast for domestic gas production proves over-optimistic.

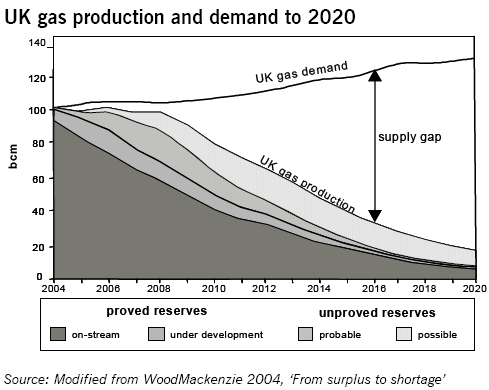

This chart taken from a UK government report shows gas demand increasing to 2020 and a gas import requirement of 100 bcm per anum.

How many LNG cargoes is that? LNG ships have current capacity of around 2.8 bcf. That translates to around 0.07 bcm, suggesting that the UK alone would require around 1400 LNG deliveries per annum to meet this import requirement.

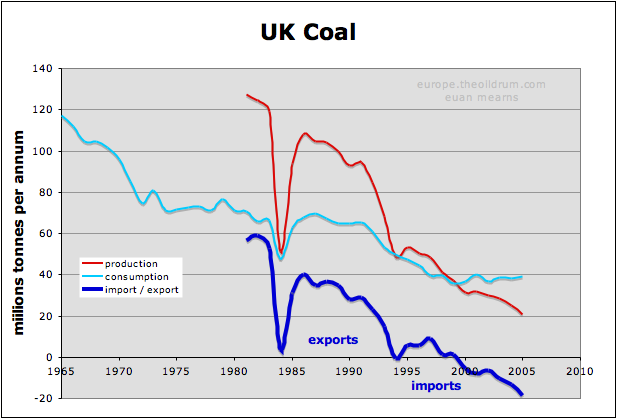

Coal

Back in 1965 (when BP records begin) coal accounted for around 60% of UK primary energy consumption and most of that was met by domestic supply. Both domestic production and consumption of coal fell steadily from 1965 to 1999 when coal accounted for only 16% of UK energy consumed. The spike down in 1984 represents the miners' strike. Since 1999 coal consumption as a percentage has once again begun to rise and in 2006 it represented 19% of the UK total.

So much for the UK government's feigned concern about global warming. Faced with the choice of switching off the lights, saving the planet and reaping the anger of the electorate, the UK government has made the pragmatic decision to keep the lights on, come what may, whilst voicing concerns for the welfare of polar bears.

In plotting these data I was somewhat surprised to see that the UK was once a significant exporter of coal and need to note that the production / consumption figures in tonnes do not agree with the BP data when transformed into BOE as shown in the next diagram. This shows the UK as a net coal importer since the 1980s. The trends, however, are the same, and show increasing dependence of the UK upon imported coal.

We have had much debate recently on The Oil Drum about the status of UK and Global coal reserves. See for example:

The Coal Question and Climate Change

Coal reserves and resources - a gentle cough

I tend to side with Heading Out on this debate and take the view that the UK has substantial deep coal resources that are uneconomic in the current economic and political climate. I think this climate is about to change and that a soaring energy trade deficit (see below) will result in a political decision to subsidise new deep UK coal mines in order to protect UK energy security and mitigate the plummeting trade deficit.

Energy and Trade Balance

Pulling all the data together for oil, gas and coal with nuclear and hydro provides the following picture of the overall UK energy balance. Note that following consultation with Jerome, I have shown nuclear as domestic supply due to the fact that the cost of importing uranium is a negligible part of the total cost of nuclear power (this is open to debate).

What we see is that during the 1960s and 1970s, the UK was a major importer of energy, mainly oil. At that time oil was cheap and the UK had a large manufacturing base, exporting goods all over the world. Trade back then was balanced (see below).

The advent of North Sea oil and gas resulted in a golden era of energy surplus from 1980 to 2004. However, with falling North Sea oil and gas production the energy balance is now plunging back into the red. So are we to return to the circumstances of the 1960s and 1970s? The answer is no! Back then energy was cheap and plentiful and the UK had a major manufacturing and export base. International energy supplies are now increasingly expensive, increasingly scarce, sourced from increasingly hostile geographic and political environments and our economy has lost much of its manufacturing export base that once enabled us to pay our way.

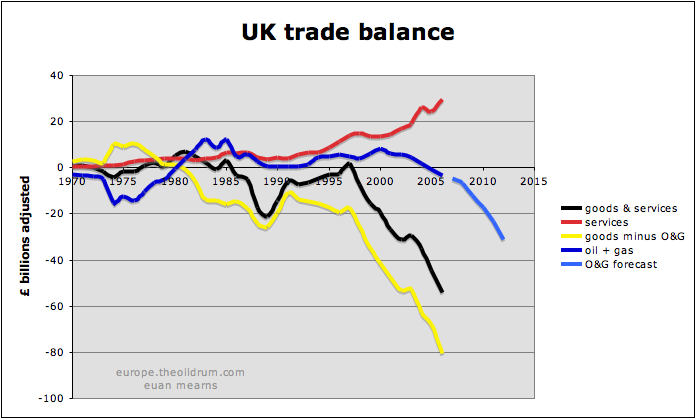

The UK trade balance has 3 main components: 1) goods, 2) oil and gas, and 3) services. The latter is made up mainly of financial services channelled through the major finance centres of London and Edinburgh. The chart is compiled from official government statistics using table 300570782. I have deducted oil and gas receipts from the goods column (IKBJ) to provide a separate picture for goods (less oil gas) and for Oil & Gas receipts.

From 1980 to 2004, the rapidly deteriorating trade deficit in goods was partly offset by surpluses in services and Oil & Gas. The Oil & Gas surplus, however, has now disappeared and the deficit looks set to get much worse as shown. The trade deficit of £54 billion recorded in 2006 looks set to hit £100 billion per annum by 2012.

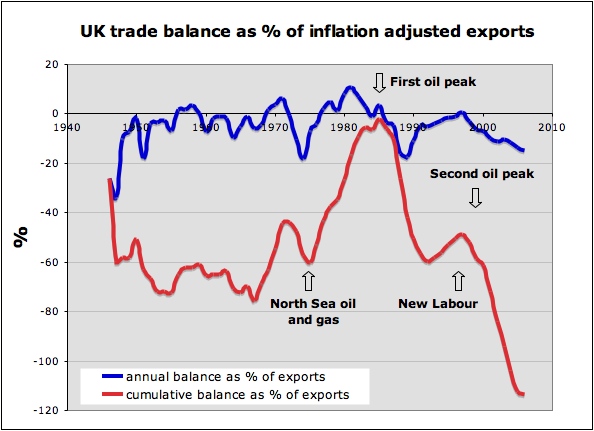

The government and main stream media (MSM) appear to be extremely sanguine about these eye popping numbers and one reason is that the deficit normalised to the size of the growing economy is much less significant.

In percentage terms, the annual deficit is no worse now than on occasions in the past. The absence of a period of surplus for the last 20 years, however, is resulting in the cumulative deficit expanding. Can the cumulative deficit be allowed to expand forever and how will it be repaid?

One of the main points of this post is to point out that rising North Sea oil and gas production rescued the UK trade balance during the 1980s and 1990s. The solution then is the problem now. Ballooning energy imports are set to make deterioration in the trade balance a whole lot worse.

Government response

The UK government is fully committed to private companies running our energy production and energy distribution industries and to a large extent our transportation infrastructure. These companies have one motive and that is to maximise turnover and profits via the eternal growth paradigm. The government tends only to interfere at the margin via regulation, taxation and occasionally setting strategy.

In recent years the government has:

1. Supported a massive expansion of UK airports

2. Supported on-going expansion of the road network

3. Shied away from increasing taxation on energy consumption

4. Introduced and then doubled windfall taxation on the profits of North Sea operating comapnies

5. Prevaricated about climate change, conservation and renewable energy without taking any decisive action.

The whole energy debate is shrouded in a carbon dioxide mist whilst the main thrust of policy has been to encourage the expansion of fossil fuel based transportation and to penalise the energy producers. The measures supported by the government are in my opinion the exact opposite of what are required to provide greater energy security for the UK.

What needs to be done?

The answer here is very simple. Domestic energy production should be maximised whilst energy consumption should be minimised. The strategy needs to be set within the context of national interest and energy security instead of being obscured by the fog of climate change.

1. The primary energy policy goal should be for the UK to remain in balance with respect to primary energy production and consumption.

2. To achieve this, domestic energy production should be expanded and in the near term this will inevitably mean expanding domestic coal production, nuclear energy and renewables with proven high ERoEI which for the UK means hydro electric and wind power.

2b. Construct a network of combined heat and power generators running on combustible domestic, industrial and agricultural waste.

Expanding these energy sources will unlikely replace the decline in domestic oil and gas supplies and the other side of the equation is conservation.

3. Meaningful energy conservation measures requires a clear and detailed understanding of where most energy is consumed by our society and a first step to conservation should be to audit our energy consumption patterns. Where is most energy being wasted and where can the easiest and least painful conservation measures be made? I suspect that government buildings (schools, hospitals, government housing and offices) and industry are profligate wasters of energy.

4. Set staged targets for per capita energy use reduction and identify stategies to achieve them. This must be linked to the primary objective of achieving energy balance which will likely require large incisions to be made in energy consumption.

5. Cars / automobiles are an obvious target and I would advocate aggressive legislation on motor efficiency that will inevitably mean reduced engine size, power and weight.

6. The strategy for cars should combine with a strategy for phased electrification of the automobile fleet and a proper evaluation / feasibility study of implementing V2G (vehicle to grid) technology combined with expansion of renewable energy sources.

7. Electrified mass transit systems should be built where possible.

8. Encourage pan-European taxation of jet fuel.

9. Legislate to discourage single occupancy dwellings and to encourage multi-occupancy. This has the added benefit of solving the apparent shortage of housing and will save the enormous energy cost of building millions of new homes.

10. Legislate to upgrade building standards for homes, industry and public buildings including the incorporation of micro renewables. Enable the upgarding of the existing building stock to improve energy efficiency - ensuring all the while that measures introduced do actually result in significant energy savings.

11. Audit our food production and distribution systems. Legislate in favour of energy efficiency which will inevitably limit choice. Ensure the energy infrastructure exists to guarantee our future food supplies.

12. Mount a public awareness exercise aimed at informing the public about decisions about energy use that are to be made on their behalf and their best interests.

These may seem draconian measures but they are in fact intended to provide a "business as usual model" for the UK based on using significantly less energy. There will inevitably be certain business casualties. But many new business opportunities will also be created.

The alternative may be to face real energy shortages in 2 to 8 years time when the anticipated supplies of imported natural gas and oil do not appear. Energy shortages combined with spiralling energy costs and energy import bills may paralyse our economy.

"...a soaring energy trade deficit (see below) will result in a political decision to subsidise new deep UK coal mines in order to protect UK energy security and mitigate the plummeting trade deficit."

I believe you meant to say the rising, or growing, trade deficit. In any case, I would be greatly interested in an explanation of how subsidising coal production will mitigate the growing trade deficit. Your point 9 seems to indicate a familiarity with Stalinism, so perhaps you can find some economics literature from Party conferences in Poland or Bulgaria, circa 1970, that aids your reasoning.

toilforoil,

I think your exactly right, subsidising sunset industries has never been a great idea, and with more money flooding out of the UK for oil and gas one would ask, subsidise it with what?

The U.K. has often struck me as the canery in the mine on this particular round of crisis, in that they will get there first, and if they hope to survive as a major player, will have to find a solution first. We could learn much (either about how to act or how not to) in how their situation develops. Sad to say, but it may be true.

One other thing: I have never been able to figure out why Alan Drake's (he famous among of due to many U.S. Oil Drum posts) of electrified rail would not work even more perfectly in the U.K. and my fondness for Plug or gridable hybrids would not be a perfect matching companion. As far as electtric production, let's admit it (even if your a renewable fan like me) that it will be wind and wave with baseline nuclear.

The U.K.'s situation is not unresolvable, at least in the near term (this century plus) and as for their population density, it is still lower than several places in the world (Manhatten for one) but it wil be expensive and require iron will to avoid major discomfort....(hey, they do sound more like us on this side of the pond everyday) Good look on both sides of the Atlantic, and let's agree to share our best ideas....:-)

RC

At a guess about 10% of our cities have some form of electric underground trains. Some large cities are retrofitting trams in streets. The UK is a very crowded island, and with a very uneven distribution of wealth and investment. If you think of London like Singapore/Hong Kong and think of other entire regions as Chernobyl [economically].

Although Oildrummers think a lot of transport energy, the UK issue will be a heating/electricity problem and ultimately just a heating problem. We can come up with any sort of readjustments to our lifestyles but for 90% of the UK, a warm house either need big watts or knocking down and re-building to a standard that is never mass produced in UK houses.

Energy demand could be managed by planning 100 years ahead in the following way. For a 60 year period the UK planned state of the art new towns - see this:

http://en.wikipedia.org/wiki/Garden_city_movement

We gave up on centralised planning about 20 years ago [and 'bold thinking' planning about 80 years ago] with all this 'market forces' crap that gets us where we are now.

The UK needs new urban planning from the highest level. I would happily do it for them.

New cities need to start in unused areas such as the Pennine hills. The energy cost of making it will be astronomic. These are unpleasant climate areas and buildings will need to be state of the art designs - not art statements. We certainly don't have the land space for eco croft farming for everyone in the UK.

Retrofitting existing UK towns with any improvements eg for heat loss [or transport - until the cars are gone] is very limited.

Of the 27 countries in the European Union (EU), with regards to fossil fuels, the UK is actually one of the best placed at present - for instance we do actually, more or less, meet our needs for oil.

Other EU states with large economies such as France, Germany, Spain and Italy import about 100% of their oil.

If the Westexas' Export Land Model (ELM) is anything like correct (and so far it has been correct!) then, for importing countries, Peak Oil does not mean the end of cheap oil it actually means the end of any oil very shortly after peak. (Shortly probably means 10 years or less if we take into account escalating above ground events?)

If the 'peak' was indeed in 2005 (and there seems more evidence for this than against) that means very soon ...

any country currently importing a high percentage of their oil will not be able to source ANY oil.

There are many (25?) such countries in the EU and they are the UK's main export market! :-(

Xeroid.

I think this is overley dramatic. There will still be a significant global export market for many many years after peak and there is no reason why France, Germany etc. won’t be able to bid for a share of this market. I don’t believe the ELM can be taken to its final conclusion of exports drying up in economies where oil exports form a significant portion of GDP, far from it.

Where the UK is in a weaker position than say France or Germany is the rate+magnitude of change. The UK is experiancing a two variable problem, a £tens of billion pa swing from oil exporter to importer whereas traditional importer nations are only exposed to one variable, the price hike.

OPEC's Oil Output May Rise 1.6% This Month, PetroLogistics Says

By Grant Smith

Oct. 24 (Bloomberg) -- OPEC crude-oil supply will probably increase 1.6 percent this month in advance of the group's pledge to raise supplies from November, according to estimates by PetroLogistics Ltd.

The 12 members of the Organization of Petroleum Exporting Countries will probably supply 31.4 million barrels a day in October, compared with 30.9 million barrels a day estimated for September, Conrad Gerber, the president of the Geneva-based consulting firm, said today by telephone.

OPEC agreed on Sept. 11 to raise production by 500,000 barrels a day from Nov. 1 in a bid to cool record oil prices. Oil traded in New York touched a record $90.07 a barrel on Oct. 19 as investors piled into oil to hedge against the declining dollar, and as Turkey's plans for an assault in Iraq sparked supply concerns.

``We are implementing a decision we took in September, to increase our production by 500,000 barrels a day in November,'' OPEC Secretary General Abdalla Salem El-Badri told reporters in Beijing today.

Saudi Arabia, the group's largest member, will provide the majority of this month's output increase, raising supplies to 8.95 million barrels a day from 8.88 million barrels a day in September, Gerber said. The 10 OPEC states subject to output quotas will raise supplies to 27.5 million barrels a day this month from 27.2 million a day last month, he said.

Chris,

I agree my conclusion has very serious consequences, but I need to understand why my analysis is wrong and hopefully that you are correct.

Your beliefs that ELM is wrong by any meaningful amount are based on what logical reasoning?

I would like to be sure you aren't just at the first stage of Denial, Anger, Bargaining, Depression, and Acceptance.

If the net exports don't go to zero, what level do they go to? ( bearing in mind Return on Investment, Mercantilism, ELM, Nationalism, Privateering etc.)

The UK is an economy with a large element of GDP(10%?) based on oil, and the net exports have gone to zero in around six years ... so that, as one example pertinent to this current discussion, refutes your belief.

Xeroid.

It is an exponential problem, and the motivation of the sellers must be considered. If the OPEC cuts outputs below demand, then price will rise exponentially. The determinant of how much they then sell would be how much money they want, and how well they cooperate with each other. So far, they tend to cut each others' throats at the drop of a barrel and lie about their reserve numbers in order to ship more oil for more money. If they figure out that cooperation and limiting supplies can produce more money for a longer time than they ever dreamed before, then perhaps they will figure out some fixed quotas which keep just enough oil flowing to maintain the price/volume points. This is the rub, since if they go too far, they invite military action (shown to fail already, but still could be used as punishment incentive), if they cut too little, they risk running out of a future.

In past years, OPEC has been cognizant of the risk of alternative fuel incentives, but now that we see how futile that option is (in terms of volume), we also see that the oil production is going to decline much faster than alternatives can come on line. This means that the consuming countries will go into recession, and be unable to pay the prices which they could have in the past, which makes military action more probable.

Stress makes people collectively suicidal. Not a good situation. Anyone got another planet we can move to?

Didn't think so.

Unlike the UK and some others, many of the big exporters - Saudi Arabia especially comes to mind - have essentially no economy beyond oil and oil processing. As the rationing in Iran already suggests, one way or another they will do what they must to sustain some exports as they have nothing else to fall back upon. So it will be a while before Jeffrey Brown's curves actually cross over globally and the worldwide export market disappears.

But as to predicting the exact quantity of net exports, and the role of long term contracts vs. the spot market, there is simply no telling. Such things will follow from political decisions, which are capricious, arbitrary, and often irrational. Which is why are discussing it at all: it is a concern, just maybe less of a concern than the Mad Max Doomers would have us believe.

In any case, one reasonable side bet is that when forgoing coal becomes a matter of freezing in winter - rather than, as now, a matter of spitefully sticking it to evil wicked Big Business and sentimentally whining over useless, dangerous, brutish polar bears, it is unlikely that coal will continue to be forgone.

Difference between SA and UK : the Saudis have actually, starting fairly recently, been industrializing at a fast rate, concentrating on added value to their hydrocarbon products.

The UK, by contrast, has been rapidly deindustrializing, while pissing away their oil windfall.

The ELM focuses on the portion of oil that is exported - that's the interesting bit because it's what we in oil importing countries care about. Saudi production that's burnt in Saudi cars is of little consequence to the world. The ELM evaluates the impact of indigenous production (typically decline) and consumption (typically increase) to determine the remaining net exports.

Where I think the model breaks down, is to assume that there is no relationship between net exports and indigenous consumption - in countries where oil is a major part of the economy. How will a country earning much of their foreign exchange from oil exports be able to grow their economy (and indigenous consumption) whilst losing their main source of income? The UK is not a good example as oil is small part of our economy (~$50bn in a ~$2,000bn economy). The ELM, taken to its logical conclusion might see OPEC nations still producing some 20mbpd+ in several decades time yet exporting none of it as their internal consumption will have grown to use it all. In that scenario a country like France may well not be able to import any oil. However I think this scenario is nonsense since without the foreign exchange generating oil exports the OPEC countries will be in ruin, not able to feed themselves let alone import BMWs to burn all that oil. They will curtail their consumption in order to export oil.

For that reason I think that as long as oil is extracted from the ground somewhere in the world, there will be an export market and the French, for sake of argument, will be able to secure as much as their relative economic standing in the world allows them.

I agree that many OPEC countries will be in ruin without oil exports if that is all they have to offer for their essential imports.

Actually, they may starve or die of thirst without the oil. So, logically I would expect them act in their own best interests and make the oil last as long as possible by exporting only what they have to, and to diversify into other products as soon as possible.

Assuming that the OPEC leaders are sensible, then I think that neans not building up a huge pile of rapidly depreciating IOUs that may never pay out (or almost certainly won't, since it will be our grandchildren paying for our current consumption?)

The converse is also true that oil importing countries economies will be in ruin without the energy imports.

Which fails first, a country importing all it's oil or a country exporting a small part of it's oil?

IMO the amount of net exports may not be zero soon after peak but may very well be close to zero and that oil will be very expensive ... not to be burned!

Xeroid.

As the UK model showed, once production starts falling the overall net export decline rate (-56%/year) is more rapid than the production decline rate (about -7.8%year) and the net export decline rate accelerates over the net export decline period.

The top five net exporters in 2005 had a lower percentage of consumption relative to production than did the UK in 1999, so our middle case for the top five hitting zero net exports is 2031--peak top five exports to zero in 26 years.

Of course, the problems arise as soon as the decline kicks in, versus the expected increase in imports. IMO, October 1st was an inflection point of sorts as the bidding war for declining oil exports began to kick into high gear. Of course, here in the US I think that we are very poorly positioned to compete with Western Europe, Japan and China.

Westexas,

However, in 26 years many of the other countries that are currently exporting will have long since gone into import mode won't they ... they will be able to afford to do it and outbid all others with funds accumulated during the export phase?

Wouldn't you expect the Opec countries to look after each other, rather than the 'infidels', as they all roll over into net import mode?

Xeroid.

I think that various exporting countries will all react differently to the ELM. It is interesting that two vastly different regions, the UK and Indonesia, basically crashed to zero net exports in the same time frame.

In any case, what will be interesting is when the exporters begin to realize that oil exports are rapidly contracting. Do they continue to try to keep American SUV's on the road a little longer, or to they minimize their exports and try to use their oil to transition to a less oil dependent future? Note that the US went from a significant oil exporter in the Thirties and early Forties to a net importer around 1945, 25 years before we peaked.

At the start of WWII, Texas produced 60% of the oil in the world market. That's why Hitler sent U Boats to the Gulf of Mexico and sunk 72 tankers in the Gulf and the North Atlantic during 1942. So, as a comparison, the entire world was using less oil than Texas could produce at the end of the Great Depression.

I think the ELM model will describe the shortages for the next 30 years or so. Any farther in the future requires a crystal ball instead of mathematics skills, though. The Saudi's own the Texaco refining capacity which they bought about 1980. Saudi Rfining is in a joint venture with Shell, Motiva, and has a huge refinery in Deer Park. Since Chevron purchased Texaco's remaining 50% interest in the refining capacity, Saudi Refining may also be in joint ventures with Chevron. I'd guess they will continue to supply their US refining ventures. Likewise, PDVSA purchased Cities Service about 15 years ago, and I'd suspect that Venezuela will continue to supply its refineries in the US.

Likewise, we've used the first trillion barrels, but their is another trillion barrels left to be produced. Lots of it is in areas in which no one in their right minds would construct a refinery. And the country's lack the finances to construct their own. The oil strikes in the Great Lakes region of Africa are like that. Tullow oil has found a billion barrels in Tanzania, and the Chinese are planning to purchase the oil in the Darfur region. Who would construct another onshore refinery in Nigeria? And, when I was reading about Senegal I read that Hunt had discovered a billion barrel heavy oil offshore field in Senegal, but had let the concession go back because it wasn't economic to drill and produce in the 1990s. I'm sure someone is taking a second look at fields like that now

Bob Ebersole

The latest figures from the DTI oh alright DBERR have been updated to show 2.769 million tonne net import of oil and oil products this year up to August this year the peak of the summer maintenance shut downs. This is about 5.5% to total production this year. There may be some of this clawed back in the remaining four months but there seems to be little hope of the UK being a net exporter in 2007.

Buzzard the only large project coming on line in the near future has not even managed to compensate for the decline in other oil fields. This was the hope that gave the curves of Kemp and the DTI upper predictions the upward hump into net export shown in Euan's second graph.

Roger - right now in Aberdeen we are planning to build a new $1 billion high way around the city and expand our local airport - to boost tourism. Donald Trump is planning to build a massive new golfing resort just up the coast - but has said he won't go ahead if the off shore wind farm gets built.

The trains that run form Aberdeen down the east coast all the way to London still run on diesel, though the west coast line is electrified.

The majority of our politicians are quite simply clueless.

Do you think the UK will get by OK if we have to import more than 80% of our energy? And have you any suggestions where we might import all this oil and gas and coal from in 2020? And how will we pay for it? Ah ah - all those rich Arabs coming to play golf?

Sorry for the sarcasm here, but currently 7 of our 16 neuks are out of action and in the future I think we may face the choice of mining our deep coal or freezing to death in winter.

More than anywhere else in the World, the UK needs first a crash program in reality followed by a crash program of expanding our alternative sources of energy combined with a crash program of conservation - IMHO.

The "Great Debate" in the city of Dallas right now is where--not whether--to build a multi-hundred million dollar new road, within a floodplain or along the levees of the Trinity River.

Soon, we won't even be able to fully maintain our existing road network.

So go ahead and build that wind farm! Sounds like a win-win situation to me.

(Never knew there was a shortage of golf courses in Scotland.)

Clearly the UK's continued economic prosperity is highly exposed to the continued health of the "Services" particularly Financial Services, sector. If that should crash and burn...

Euan,

We may get our crash program in reality. This winter or next.

The current UK energy strategy is to pray for warm winters.

The UK population still thinks that we have the luxury of time. Hence the levels of stupidity in the debates, especially regarding realistic options such as coal, carbon capture and nuclear.

Whitehall and UKGov cannot act against the 'wishes' of the people. I am hoping that a sufficient number of Whitehall Mandarins know this and are sufficiently Machiavellian to realise that a couple of cold weeks with blackouts and consequent horrors such as dead pensioners, mass layoffs, food riots etc, may just provide a wake up call to get the people behind Nukes and Coal. And they will not care where we get it from, just that we get it.

Because if we keep skidding through mild winters by the skin of our teeth, then nothing will save us when the coal fired generation is not replaced, and the ageing nuke fleet is decomissioned and we depend upon the kindness of strangers for gas.

As it is, nothing will stop the dithering at present and enable the continued bleating and the nonsense sprouted regarding wind power and solar panels as a means to keep 60 + million energised (even at 1960 levels) - which would be an essential pre-condition to retaining any level of civilisation. A civilisation that would then need to seriously look at how it operates.

And the free market has no place in this debate. Energy is a strategic and sovereign issue. No nukes will get built without Government guarantees of contracts. No coal mines will open without Government guarantees of a market for product. So 'letting the free market decide' as Zach Goldsmith put it, is a disingenuous way of guaranteeing nothing will be done regarding Coal or Nukes. But then the Tory Party's favourite 'Green' is probably just a sleeper agent for Friends of the Earth.

And to all you Wind fans out there: Guess what: The UK gets sub-zero cold snaps when stable air masses from the arctic, or continental air masses push south and west over the UK. Wind turbines don't work when these stable air masses cover the UK. They can last up to 2-3 weeks. That is 2-3 weeks depending upon coal, gas and nuke base load generators, all of which are already stretched to operational limits.

The situation is becoming extremely dire for the UK, and it could start this winter with 7 nukes currently offline.

BTW: The Bewick Swans arrived in Norfolk from Siberia last Friday. 8 days earlier than the previous record. Maybe they know something about the coming winter weather that we dont.

Or maybe we will just get lucky like we did in the winter of 2005-2006.

But we are running out of time. It may already be too late.

Mudlogger - I agree. We likely need AN EVENT to change public attitude. Problem is, freezing conditions will get blamed on Global Warming;)

So we have our first Bewick Swan event!

I'm off to buy a chain saw and a wood burning stove.

Euan while I agree with your concerns with the energy problems the UK are going to be facing... can I just quietly point out the East Coast Main Line from Edinburgh to Kings X has been electrified for what must be getting on for 20 years now.

Wibble - thanks - I must try it some time.

Comrade Toil, It sounds like you are not familiar with the local taxation system in the UK and how this was changed under Thatcher and subsequently modified by Blair (I think). Many decades ago we paid a local tax called "rates". This was based on property value and a single property / household paid a flat rate. So four working adults sharing a house could share this burden between them.

Under Thatcher we moved to a system called Poll Tax - where every individual paid a local tax irrespective of their means and ability to pay - a good old right wing tax. Under new Labour (or it may have been under John Major) we moved to a tax called Council tax that is half way between Rates and Poll Tax. Everyone now pays a local tax that is based on property value.

Under the old Rating system there was incentive for adults to share property - not quite Stalinist I hope you would agree. Now there is no incentive to share - everyone wants to live alone in a 2 bed flat - with lousy insulation - watching their own TV, with their own half empty fridge - not to mention the energy cost of building all those flats. There is no property shortage in the UK - it is just that many now want to live alone - and enjoy all that wealth that is created by values rising under this system.

NOT SUSTAINABLE IN MY OPINION.

And as for coal - one reason our high sulphur coal mines were closed during the 80s was to protect the welfare of Norwegian trout that had a particular liking for water with high pH - i.e. somewhat higher that 7. The other reason was that coal could be surface mined in South africa and Australia and could be more cheaply imported from those areas. The impact of importing coal on our trade balance back then didn't matter because rising oil and gas production was about to transform our economy. But now we are importing oil, gas and coal. How long will the export nations continue to accept our IOUs? So I do expect to see a revival in UK deep mining - quite simply for reasons of strategic national interest. Are we to become 80% dependent on imported energy? I don't think that is a viable option. Remember the US imports oil and gas but not coal as well.

On behalf of generations of Norwegian trout I sincerely thank the British and Germans for dismantling their heavy industry. Now that it appears that the old ways are coming back, I, this time on the behalf of yet to be born generations of Norwegian trout, hope the sulphur emissions will be lower this time :) It's been years since there was any talk about acid rain here. 10-15 years ago acid rain, global warming and the ozone hole got about equal attention.

I agree that it seems inevitable that much more coal will be mined in Britain. It just depends on the availability of cheap labor to man the mines, and that cheap labor will surely be available when the house of cards that is the global economy comes crashing down.

edit: forgot to add link to animation showing the impact of acid rain in southern norway.

The trend to single person occupancy of dwellings is not unique to the UK. It has occurred in a number of countries, most without anything akin to a poll tax.

There is no economic case for subsidising coal production. As for 'national security', which is a euphemism in the United States for state intervention, who do you expect to interupt the flow from lower cost coal producers? The US? A rebuilt Spanish armada?

Hey Euan

How you doing? I see you been quiet busy last few day.

What happened to my article?

Dear Euan,

A sober assessment of very complicated subject. Personally I believe the UK's economy has been grossly missmanaged, only this was obscured by the windfall of revenues from the North Sea, the property boom, massive debt accumulation, and a historic redistribution of wealth from the bottom to the top. Despite the superficial gloss covering the economic policies of the last thirty years, I was always sceptical about the longterm viability of abandoning Britain's industrial base. In fact I always believed it would eventually be viewed with incredulity by coming generations, once the consequences of these policies fully understood. That the UK's economy is far more fragile that it appears to be on the surface. Still, that's all water-under-the-bridge now; we are, where we are. Though I don't feel any sense of gratification that the facade is beginning to crack and crumble to reveal substantial, structural weaknesses.

I often listen to Radio Five Live in the mornings when I preparing breakfast for the family, especially a programme called 'Wake-up to Money'. Normally there is a fairly blatant bias towards optimism when dealing with economic issues and the market. The vast majority of the experts they interview are optimists and incredibly positive about the nature and workings of the free-market. It's almost like they are members of a religious cult. If anyone exhibits even a modicum of 'scepticism' or is 'critical' they are immediately dubbed 'pessimists' or 'gloom merchants'. Very, very, rarely do they ever invite a any 'expert' onto the programme who doesn't support the prevailing economic dogma. It's almost like this is the best of all possible worlds.

Recently though I've detected a kind of friction or disconect between the finacial journalists and the experts from the City who they've invited into the studio.

It's as if 'reality' is pushing its way into the endless party atmosphere of 'casino captilaism'. The Credit Crunch and the bursting of the American housing bubble, Northern Rock and the problems of the energy sector, are undermining the usual frothy and jolly atmosphere in the studio. Something is going wrong and we don't what it is.

This morning they were chatting about the North Sea and had an expert from the oil and gas industry in. The interviewer didn't understand why BP was in trouble and cutting jobs in Aberdeen, when oil prices were so high and company profits in the industry were so huge. Why didn't BP just increase production from the North Sea when prices were so high?! The idea that one couldn't just increase production if the oil wasn't there, seemed beyond him! The expert from the oil industry didn't talk about falling reserves or longterm production decline, he neatly sidestepped the central issue and instead talked about the four-fold increase in production costs and lack of infrastructure investment as an explanation for why North Sea production isn't increasing when we need more oil and gas!

Later on they were talking about the lastest warning from the Bank of England about the possible consequences of the Cridit Crunch in the US. Again they asked an expert from the City, isn't the Bank being overly pessimistic here, once again the bias towards optimism, massaging reality. The expert replied that he thought the Bank was being realistic, though they were only indicating the possibility of future problems relating to the Credit Crunch. The fact that there are massive structural problems in the US economy based on the biggest speculative bubble in history, which unless we're very lucky may well lead to the mother of all finacial meltdowns, potentially dwarfing the Great Depression, wasn't touched on, which isn't surprising.

At the end of the programme the journalists were speculating about how they were supposed to get to grips with what was happening in the finacial markets when the banks seemed to be so confused about the scale of the US mortgage black hole. Their finally words to the markets and thier listeners were 'cheer up' which is comforting.

The reason I've mentioned all this is because I believe it's indicative and typical of the way the mainstream media deals with many issues, not just energy and the markets. There is a built-in and substantial bias towards 'establishment' views and forms of analysis. The experts employed come from a very small and narrow group. Alternative or critical views are almost totally excluded. The status quo is always supported. One is not allowed to question the fundamental premisses of our socio/economic model, even in realm of theory. If one has concrete points of criticism, one is ignored almost totally in the mainstream, establishment media, with a few notable exceptions. Real debate is strangled at birth. The parameters for open, democratic debate are extrodinarily narrow and constrained, by a form of censorship which is likely to get worse as the evident problems and contradictions in our economic system become more and more obvious, and impossible to hide.

I think you're right. The main stream media do gradually seem to be adopting a more realistic tone, although they're still a long way from reality. I only hope that this revelation isn't obscured by a major source of news, such as a new war or 'terrorist attack'.

Just out of interest, to what extent do people think immigration and lack of supply will prevent the housing bubble from collapsing? I tend to imagine a 30-40% reduction over the next couple of years, weighted towards the first time buyer market.

There's a feedback loop in there, a reinforcing one.

Most recent immigrants from eastern europe (the Poles that the Daily Mail so loves) are here not to live, but to earn high wages so they can go home eventually to the good life. They are doing many types of job, but there are a high percentage of the labourer/builder type.

If there is a downturn in the housing market then there are less opportunities and less money - and they pack up and leave for home. The housing they vacate (much of it rented) becomes empty and needs to be sold, pushing even more stock and powering the downward spiral in prices.

Provided there is the required shock to the housing market the immigrant level produces a magnifying of the rate of decline, not a preventative for house price collapse

Excellent point! Hadn't thought of that... so it's going to be even worse than I was thinking. At least we haven't been building them at the rate the US has I suppose!

On the other hand, the fact that those Polish workers are remitting a large part of their wages back home, and will go home when the crunch comes, provides insulation from the crunch for the UK labour market... and shares the pain of the crunch with the Polish economy. Everything is connected to everything, and vice-versa...

Just now there was a good piece on BBC4 news on the crude awakening docu.. all the usual suspects interviewed; Matt , Campbell, Simmons et al.

It also mentioned that Peak oil was the most under-reported story out there in the MSM

Boris

London

writerman - thanks for a very good post. Your analysis is right on the button. I also believe that the majority of intelligent people in the UK would agree with almost everything you say. Sadly, the country appears to be run by an entirely disjoint set (i.e. non-thinking people).

This has been true for so long now, it is hard to see how anything less than an economic mega-shock will suffice to shake the rotten apples from the tree.

Writerman - thank you for this very thoughtful contribution. I agree with you on every point. It seems we are currently destined to topple over a cliff edge with the media and political system in dissarray. They have been selling us a lie now for so long that they now either believe it or those who don't, cannot confront the enormity of the lie they have told for so long.

"The economy is fundamentally sound" reverberates from Galbraith's telling of The Great Crash. We have a massive and balooning trade deficit, a mere stump of a manufacturing base, an enormous pensions crisis - that can only be solved by the pesnions funds bidding up worthless paper, an ageing population that requires massive immigration to pay for it, an agricutural system dependent increasingly on imported energy / fertilizer that is also stressed by disease and climate change, and an economy that has been driven by equity withdrawl from mortgaged property increasingly prone to flooding whose values have been bid up to ridiculous multiples of sallaries - never to be repaid. And oh yes - we just had a run on our 7th largest bank.

Yes, on the national news last night the question of why BP should be cutting costs amid $90 oil was never asked. In Aberdeen $90 a barrel is seen as great news.

Chris V circulated this pod cast from Platts today:

http://www.platts.com/Oil/Resources/Podcasts/americas/index.xml

They refer to the talks that Stuart and I gave in Houston.

Hello Writerman,

I thoroughly agree with you. The same applies right across the MSM spectrum. Here is a prime example in yesterday's FT. Rise in working age adults forecast

Note the optimistic title.

If you delve into the article, you will see quite a different picture. The UK's population is now forecast to increase from 61 million at present to 71 million in 2031 - a government forecast only three years ago had estimated 67 million.

At present, there are 11 million under-16's and 11 million over 65's - this will go to 13 and 15 million in 2031. This clearly means that the current proportion of those of working age people will decline from its present 60.5% to 55% over this period. This is clearly at variance from the title.

I suspect that things will turn out quite differently once reality strikes and smart productive foreigners leave for greener pastures while the others try to stave off mainstream policies that are currently only espoused by the BNP.

I came to the conclusion some 5 years ago that the UK (together with most of Europe) would be one of the least happy places to try and weather the peakoil storm. Whilst the UK will still be producing some oil in 10 years time, the problems that have built up in the past 20 years (declining industrial base, housing market on the verge of calamity, rocketing government and private sector debt, substantial overpopulation made worse by ballooning immigration in recent years) far outweigh such considerations. So I legged it to a place with a slightly bigger landmass and only 4 million inhabitants (where the weather is generally better too). Some similar problems here (the Anglo Saxon curse) with house prices and personal debt, but we are under-populated and well forested and get 60% of our electricity for renewables.

andyh

Would you be writing from New Zealand by any chance ?

Shhhh!

On the bright side, we probably won't starve. A 25-year study of farm yields in the US concluded that after an initial loss, organic farming (of grains - it was expected that fruit and so on would still be lower) had the same yields as chemical farming. Meanwhile Cuba demonstrates that a lower industrial element to farming is possible, although with a lot more people working the land. You can do a quick calculation based on the figures for farmland areas (I used 2001 figures - best I could find) and come to the conclusion that we should be able to feed the current population or indeed a couple of million more.

At the ASPO-USA conference, I was talking to a French investment banker, and I was advancing my Iran is to World War Three as Poland was to World War Two theory, i.e., triggering events that caused the world to organize against the aggressors, the US and Germany respectively.

He disagreed.

He said a more likely scenario is that Western Europe and the US are quietly working together to control the Persian Gulf oil fields and to shift oil to the US and Western Europe, and I suppose Japan, and to deny it to China.

As I am typing this, there is a press conference going on. The US Secretary of State and Secretary of the Treasury are talking about US sanctions of designated terrorist organizations in Iran. It will be interesting to see how Western European governments respond.

Who knows what the future holds?

It sounds like your French banker was just 'in denial' to me!

I think it's much more likely we just get recession (normal economics, for now) rather than war. But don't wars follow recession ... hmmm?

Xeroid.

Dear Westexas,

I've heard the argument over and over again that because the US only gets a small proportion of it oil from the Middle East, then the occupation of Iraq couldn't really just be about oil. I don't think it is only about oil, but I think the argument misses the point. The invasion and occupation aren't about gaining access, it's about control of the regions oil, who gets it and how much and at what cost. Having a large army on top of the world's largest oil reserve means Power. The power to switch the spigots on and off in one has to.

For example if China, India or Japan or some other Asian country came into some kind of conflict with the United States, having the ability to impose an oil embargo on them would be a good card to have up ones sleeve!

Dick Cheney has called the Middle East's oil 'the prize' he also seems convinced that their are vast, untapped reserves underneath the sand just waiting to be exploited, if only one can get in there with American knowhow and get up and go. The irony would be if these untapped reserves were nothing more than a desert mirage. Dan Simmons seems very sceptical about finding these vast, untapped reserves, he doesn't believe Iraq contains another Saudi Arabia somewhere in the Western desert.

It looks like the wars in Iraq and Afghanistan are probably going to cost somewhere between 3 and 4 trillion dollars. That is a lot of money. Most people can't even begin to imagine how much that really is. Then on top of all that treasure one piles up all the dead, and then the hatred of America that all has a price. Then one wonders, surely this is too high a price to pay, surely this is a criminal waste of blood and treasure, surely there must be another way?

Imagine investing trillions of dollars in alternatives to fossil fuels and greater efficiency in our use of fossil fuels, in better infrastructure; there's so much we could do with all these trillions of dollars.

Isn't one forced to the conclusion that the guys running the Whitehouse are not only criminals, but they are also insane?

As you implied, there is a big difference between be able seize, or control, the oil fields in the short term, versus maintaining long term control.

In regard to evaluating oil fields, I often cite the example of the Yibal Field, where Shell was expanding their surface production facilities to handle an expected increase in oil, when they got an unexpected increase in water instead, which partially accounted for a big reduction in Shell's proven reserves. If a major could be this wrong about their own oil field, how wrong could they be regarding other people's oil fields?

While I'm in the apocalyptic style, there's also the potential cost of a war with Iran. The Whitehouse wants regime change in Iran. This is understandable, as Iran is the last piece in the puzzle. With Iranian revolution out of the way, in theory, changing the entire Middle East should be far easier!

But attacking Iran seems crazy, because powerful forces in Iran actually want to come to a mutually beneficial 'arrangement' with the United States, their price is reasonable, the US promisses not to attack Iran and recognizes the Iranian regime. Once that happens we can be friends! Seems like a good deal, but not if one actually wants war with Iran, because an independent Iran outside of the American sphere or Empire, is unacceptable.

Finally there's Afghanistan. The war there is lost. We'd have to send more troops than the Russians had there if we were really serious, only we aren't going to send a couple of hundred thousand extra soldiers, all those extra men would make wonderful targets. The Afghans will never accept foreign occupation. Our strategy is deeply flawed.

The war in Afghanistan is also spilling over into Pakistan and destabilizing that country too. Are we going to send an army into Pakistan as well? If Pakistan slides or is pushed by us inot civil war, how will India react? We must be crazy, were acting like big, stupid, dumb, bull, in china shop, stomping the place to dust. It truly beggars belief that we allow these guys to lead us all into the Valley of Death!

We, too, think all of this is simply mad.

James Gosler and Gus Simmons mad.

http://www.prosefights.org/nmlegal/fbifoia/mueller/mueller.htm#psycho

We're trying to work our way our of this insanity.

Without too much luck so far.

http://www.prosefights.org/nmlegal/dcvoid/dcvoid.htm#gabreski

I love when I see charts with demand and supply diverging like a cornucopia. That's hilarious!

The common misconception is that demand is based upon what people want. It is not. It is based upon what their money can pay for. If their money becomes worthless because of a lack of energy to run their industries, then demand will follow the decline in supply. People won't demand what they cannot pay for. They will stop demanding at some point and find other ways of living.

It's called Recession.Economists never predict recession in their demand charts, even though it is inherently present.

Oh yeah, and Thanks for the Harrier picture. They always look so BRISTLEY with antennae and pods and that goofy canopy-smashing ejection system. Talk about the most inefficient way to launch an airplane!! ("Hey! I've got an idea! Let's base our air defense on an airplane that burns up half it's weight in fuel and water to go the first 50 feet of flight!) Who came up with that? Exxon?

"People won't demand what they cannot pay for."

This is the point I made yesterday. I asked if the US would still be refining the same amount of crude oil if gasoline were at the same level as many areas in Europe, about $8/gallon. Some people actually said yes. I disagree. IMO, the US is very poorly positioned to compete for declining petroleum exports, at least without the use of military force.

In any case, before too long I expect to see smaller and less efficient refineries in importing countries shutting down.

The USA has a great tradition of letting whole regions die economically, as their populations migrate to where the jobs are. $8 gas would surely initiate a major migratory wave : but presumably intra-regional this time, as people seek to migrate closer to their jobs.

Yeah, I know. It's a pretty sad situation. When you start looking at how many trucks wouldn't be on the road at $8 or $10 per gallon, and how many farms, suburban towns, and businesses are dependent upon UPS and FedEx being relatively inexpensive, and the fact that there aren't alternatives in place, well....

I mean, when you look at the 'feel' of the American economy's recent 'growth' (which, sorry guys, reflects the trend of the world economy, and isn't actually growing if you compare the price of wheat in stocks from 1929 to the price of wheat in stocks now), it is a System of converting the 'inefficiencies' of human beings into perceived wealth of petroleum-based systems. Every place that a human being used to be valuable as a producer has been replaced by some form of petroleum running a machine or running a truck to replace warehouse personnel or using a chemical to replace hands in the fields. NOBODY in government is even going to talk about reversing this trend. It will only happen by natural descent from the hallowed pyramids of Wall Street when the farcical bricks are pulled apart from the bottom and people decide that they are not worth less than oil.

"The American way of life is not negotiable." -GWBush

"After a point, Nature doesn't negotiate." -Richard Heinberg

http://science.reddit.com/info/5z3lz/comments/

thanks!

If we can't import fossil fuels then maybe we'll switch to renewables faster! Plus get serious about conservation/efficiency etc.

It does seem that private ownership of energy companies is not a good way to conserve fossil fuels - a certain conflict of interest? How do we get the energy companies to sell warmth and not kWh? Can you tell I've been reading Lovins? :)

The US is bankrupt.

Our tangible exports are not only smaller than our imports, they are dependent on our imports. No imported ammonium nitrate means no exported corn.

Our intangible exports are hostage to our overseas debts. A debt default means no sales of Pixar's Shrek 4 or Microsoft's Vista 2.

So when we stop importing 10,000,000 barrels of oil a year, oil prices will collapse and cause one last orgy of consumption.

Why should we care if a war in the Middle East will cause oil prices to go to 200$ per barrel?

Because we will reindustrialise in a few years, and it would be nice if there is some oil left in the Middle East to import.

I wouldn't bet on Georgie bluffing. He has nothing to lose from a political standpoint. He needs to establish Iranian WMD to justify the costs of the Middle East war. If the Iranians back down on nukes, he still has to attack to preserve the oil in place in the Middle East till we can afford to buy it.

US has a very neat way of defaulting on its debt without losing access to world's resources - just by inflating it away.

For example with the USD 40% down for the last 5 years US magically succeeded to reduce it's real term external debt by 40%. And it will continue to do so while foreigners are too much afraid from the fallout of US collapsing and will continue grudgingly to finance it. Which equals to duly paying its "inflation tax" to the empire.

I'm not sure for how long would they could get away with this, but it looks like the days are counted.

The movement away from the dollar seems to be carrying on apace, in Asia. Asia will hit a critical mass soon, that will allow it to carry on economically, however Europe and America are doing, could already be here, given that China grew 11 % in the last Qtr, as America stumbled with its housing slump.

Eric

Memorial gifts!

I can't really see Oil prices dropping to much war or no war, America will still import significant quantities of oil, even in a severe depression, and will have to contend with Voracious Asian demand.

Eric

Memorial gifts!

Price drops, no, I agree. We jumpstarted the Chinese into the middle class, so any lowering of oil demand by our 300 million people will simply be absorbed by their (and India's) 2 billion people.

As for the U.S. continuing to import, well that is up to the banks of the world. Sooner or later, they are going to figure out that they are never going to get paid when we go into Depression. We will have to do things locally, by hand, and without petroleum. Not such a real hardship as we might think. Most of the economic 'activity' which is propping up the stock market is useless drivel anyway. Nobody really needs computers, TVs, cars, motorcycles, snowmobiles, campers, fast food joints, etc. People really only need food and water and shelter. That is currently provided by about 2% of the population (1% is farming). Most people could just stay home if it wasn't for the artificial debt loads they have run up to acquire crap they don't need.

"We jumpstarted the Chinese into the middle class..."

Well, capital has been running hither and yon looking for disciplined and lowcost labour and minimal regulation regarding the environment, but I don't think this constitutes a basis for the claim that 'we' jumpstarted the Chinese...

I wrote about the impact of increased oil imports on the ever growing trade deficit in "Energy" about a year ago.

I probably need to revisit it because the impact is going to be much higher now.

Overall, I agree with you Euan. What is thoroughly depressing though is that the UK Govt doesn't seem to give a toss. Its view seems to be that as long as financial services keep growing then that's OK. They're wrong of course because the growth in financial services in the UK can be linked almost directly to the reduction in investment in everything else and particularly energy technologies.

Any solution that offers a business as usual model is destined to failure. Business as usual is continued economic growth and continued economic growth requires growing use of resources. This is so clearly unsustainable that I'm amazed anyone here would even consider that business as usual is a target to aim for. We need to aim for business as unusual. Anything else is headed for oblivion.

Let's get this clear, use of resources beyond their renewal rates is unsustainable. Use of resources that damage the environment is also unsustainable. Is that really so hard to understand?

Sofistek - reasonable comment. However, the fact that "business as usual model" is placed in quotes, denotes that this will not be business as usual.

In terms of achieving a significant reduction in resource usage, I think in the interim, the population and governments need to be offered some form of mechanism and hope that will allow them to adapt downwards in terms of energy and resource usage.

How do you suggest this problem shoud be managed?