The Finance Round-Up: October 5th 2007

Posted by Stoneleigh on October 5, 2007 - 9:52am in The Oil Drum: Canada

This is a Finance Round-Up by ilargi.

We have a 'luxury' problem today. Not only was Thursday Stoneleigh’s birthday, at least 4 articles deserve our top spot. And there’s much more.

Highly regarded finance writer Mike ‘Mish’ Shedlock has a list that looks like “Peak oil survival guide Part 1”:

Drowning in Debt - How do we protect ourselves?

• Don't Buy Stuff You Cannot Afford (classic SNL video)

• Have a Years' Worth of Living Expenses in Cash

• Buy Food On Sale

• Consider Wants vs. Needs vs. Affordability

• Reduce Leverage

• Consider Retirement Plans

• Challenge Traditional Thinking

And this House testimony by Robert Kuttner is a must read:

The Alarming Parallels Between 1929 and 2007

Your predecessors on the Senate Banking Committee, in the celebrated Pecora Hearings of 1933 and 1934, laid the groundwork for the modern edifice of financial regulation. I suspect that they would be appalled at the parallels between the systemic risks of the 1920s and many of the modern practices that have been permitted to seep back in to our financial markets.

Tighter credit regulations? It’s only gotten worse!:

Subprime Delinquencies Accelerating

Subprime mortgage bonds created in the first half of 2007 contain loans that are going delinquent at the fastest rate ever.

“It’s shocking what you see,'' said Kyle Bass of Hayman Advisors LP. “Anything securitized in 2007 has got to have the worst collateral performance of any trust I've seen in my life.''

And the icing on the cake:

The Death Of Investment

THE GREATEST STOCK MARKET MANIA OF ALL TIMEBy comparing how swiftly money passes through stocks in relation to both gross domestic product (GDP) and total stock market capitalization, we can see how the relative importance of the stock market rises and falls over the course of the last 80 years.

Quite obviously, in 1929, nothing was more important than stocks and when the corresponding mania peaked, trading was 133% of gross domestic product stock market and 228% of total stock market capitalization. In 2000, trading was 328% of gross domestic product and 203% of total stock market capitalization, a mania fully equivalent to the madness of the "Roaring Twenties."

Today, trading is 326% of gross domestic product and 237% of total stock market capitalization. For all intents and purposes, the current environment represents the greatest velocity of trading ever seen. However, by the end of the year, we expect that the current stats will be far more extreme, a bizarre circumstance that lends itself to only one description - a continuing stock market mania, the greatest mania of all time.From July to August, in the span of just one month, the New York Stock Exchange reported that the monthly total for dollar trading volume had risen 21.7%. Share volume surged 29.7%. The number of trades soared 39.6%. The sheer speed at which our capital markets are evolving and metamorphosing is frightening.

The theme of investment is for all intents and purposes, dead.

Mish: Drowning in Debt - How do we protect ourselves?

Before thinking about vacations, new cars, or even investing, I would recommend for people to have 12 months of living expenses in cash, short term CDs, or short term treasuries. Those who say "cash is trash" have never lost a job for an extended period of time.

I have and I know what it's like.

Consider a decision to have "emergency cash on hand" as sound financial planning and as an additional means test on purchases as well. Can you really afford an expensive vacation, a boat, or a new car if such purchases would deplete your savings leaving nothing for emergencies like the loss of a job?

Is the credit crisis over? Not so fast

Already, the housing slowdown has subtracted about 1 percentage point from growth in inflation-adjusted gross domestic product so far this year.

"I don't think the worst is over," said Robert Arnott, chairman of Research Affiliates LLC, a Pasadena, California-based investment management firm.

"We are coming off the greatest lending bubble -- not housing bubble! -- in U.S. history. We will feel its impact for a very long time."

Falling home prices are leaving subprime borrowers who took out adjustable-rate mortgages with a major dilemma. Millions with subprime mortgages, which go to borrowers with checkered credit histories, are faced with negative equity in their homes that could make it increasingly unlikely they will qualify for new mortgages in an environment of tighter lending standards.

At current home prices, about $693 billion in ARMs are "already under water," according to Stephanie Pomboy, financial economist at MacroMavens in New York.

The Alarming Parallels Between 1929 and 2007

Testimony of Robert Kuttner

Before the Committee on Financial Services

Rep. Barney Frank, Chairman

U.S. House of Representatives

Washington, D.C.

October 2, 2007Mr. Chairman and members of the Committee:

Thank you for this opportunity. My name is Robert Kuttner. I am an economics and financial journalist, author of several books about the economy, co-editor of The American Prospect, and former investigator for the Senate Banking Committee. I have a book appearing in a few weeks that addresses the systemic risks of financial innovation coupled with deregulation and the moral hazard of periodic bailouts.

In researching the book, I devoted a lot of effort to reviewing the abuses of the 1920s, the effort in the 1930s to create a financial system that would prevent repetition of those abuses, and the steady dismantling of the safeguards over the last three decades in the name of free markets and financial innovation.

Your predecessors on the Senate Banking Committee, in the celebrated Pecora Hearings of 1933 and 1934, laid the groundwork for the modern edifice of financial regulation. I suspect that they would be appalled at the parallels between the systemic risks of the 1920s and many of the modern practices that have been permitted to seep back in to our financial markets.

Although the particulars are different, my reading of financial history suggests that the abuses and risks are all too similar and enduring. When you strip them down to their essence, they are variations on a few hardy perennials -- excessive leveraging, misrepresentation, insider conflicts of interest, non-transparency, and the triumph of engineered euphoria over evidence.

The most basic and alarming parallel is the creation of asset bubbles, in which the purveyors of securities use very high leverage; the securities are sold to the public or to specialized funds with underlying collateral of uncertain value; and financial middlemen extract exorbitant returns at the expense of the real economy. This was the essence of the abuse of public utilities stock pyramids in the 1920s, where multi-layered holding companies allowed securities to be watered down, to the point where the real collateral was worth just a few cents on the dollar, and returns were diverted from operating companies and ratepayers. This only became exposed when the bubble burst. As Warren Buffett famously put it, you never know who is swimming naked until the tide goes out.

The Death Of Investment

THE GREATEST STOCK MARKET MANIA OF ALL TIME

The period of "'normal' times" as labeled above extends from 1934 to 1982, a 49 year stretch in which Dollar Trading Volume did not exceed 25% of GDP. Both the Roaring Twenties and the 26 year period from 1982 would argue that we are wrong, that "normal" is a lot higher than we imply.

Using the entire time frame of 1926-2007 captured by our chart, DTV has been less than 50% of GDP, still far, far lower than today's 325%. If we suppose the entire 82 year average is "normal," then "normal" transactional velocity over the course of time has been roughly 15% of what it is today!

Then, when comparing dollar trading volume versus total market capitalization, we see an even more bizarre and pronounced focus.

We have finally achieved a brand new record, an outcome even we never believed would actually occur.

How about this scenario? Banks are taking the liquidity the Fed is forcing out there through the discount window and repos. After using it to shore up the declining value of their assets, they have excess to lend out. Finding no traditional borrowers that want to buy a house or build a factory, the new rules the Fed has set forth allows the banks to pass this liquidity onto their broker dealer subsidiaries in much greater quantities. These broker dealers are lending thus to hedge funds and margin buyers who are speculating in stocks.

Remember, the Fed is powerless unless it can find people to borrow the credit it wants them to spend. By definition, the last ones willing to take that credit are the most speculative.

Mortgage fraud on a massive scale

Bad guys never rest. And the latest, greatest example of fraud on a massive scale involves the subprime mortgage, or ABCP (asset-backed commercial-paper) mess.

A combination of fraudsters, the Mafia and a lot of financial intermediaries on Wall Street have pulled off something bigger than Enron, the savings-and-loan mess and Lenny Rosenberg's 1983 apartment flip all combined.

At its root is a U.S. investment-banking and mortgage-brokerage system that's broken, had little government oversight and was rife with crooks. Last, but not least, most will get away with this because the globalization of capital markets allowed them to export the crime to Canada, Britain, Europe and elsewhere.

Regulator blames DBRS for credit meltdown

The head of Canada's banking regulator suggested credit-rating agency DBRS Ltd. is largely to blame for the chaos in this country's commercial paper market, along with investors who relied on its ratings without doing their own homework.

As liquidity evaporated in August, asset-backed commercial paper (ABCP) markets around the globe got into trouble.

But it was only in Canada that a part of the market — the part that was not created by the big banks — was so damaged that it's been left frozen....

....Toronto-based DBRS was the only major credit-rating agency that agreed to rate the Canadian market for asset-backed commercial paper that was not sponsored by the big banks.

Others, such as Standard & Poor's, refused to rate it because of a loophole that made it riskier.

Canada's market, which was worth about $40-billion, was left high and dry in August when the backup loans it had arranged for emergency situations did not come through. Many of the banks that had agreed to provide emergency loans balked at the bailouts, citing the loophole in their deals that said they didn't have to pay up unless the entire ABCP market dissolved, that is, unless there was a "market disruption."

That "market disruption" loophole has come to be known as "Canadian-style liquidity," and fingers have pointed at the Office of the Superintendent of Financial Institutions for its role in sanctioning it.

Canada's financial system regulator: IT'S NOT OUR FAULT

The head of Canada's financial system regulator fired back at critics who blame it partly for the meltdown in Canada's nonbank asset-backed commercial paper [ABCP] market, saying the trouble happened outside of its jurisdiction.

"I think it's time to separate fact from fiction," Julie Dickson, superintendent of the Office of the Superintendent of Financial Institutions (OSFI), said in a speech here yesterday.

"We do not tell unregulated players how to go about their business. And we do not tell banks to provide liquidity to certain players and on what conditions."

Some observers have pointed fingers at OSFI for helping to create the crisis. The criticism dates to guidelines OSFI adopted in 1994 and renewed in 2004. The rules indicated what kinds of liquidity facilities regulated banks could offer when issuing ABCP, typically 30-to-90-day notes backed by credit card, car and mortgage payments, but also more complex assets.

The Bank of Canada has over the past 5 days silently injected $4.5 billion into the market. So all is wine and roses...

Liquidity storm subsiding, Bank of Canada insists

The Bank of Canada insisted Wednesday that money markets and liquidity are well on their way back to normal, even though it had to intervene in the overnight market for the fifth day in a row. “Market liquidity should be restored, over time, through the operation of normal market forces,” David Longworth, deputy governor of the Bank of Canada said.

“While it's true that many term money market spreads remain abnormally wide, the market is functioning. There have been increasing numbers of term money market transactions, and spreads are beginning to narrow,” he said in the text of a speech to be delivered in Toronto Wednesday night.

The central bank has had to repeatedly inject fresh funds into the overnight market over the past five business days, but only “in response to upward technical pressure,” Mr. Longworth said.

“This pressure does not appear to be linked to changes in the rest of the money market.”

Sources: Feds probing American Home collapse

Federal prosecutors and the FBI have opened an investigation into whether criminal misconduct was involved in the collapse of Melville-based American Home Mortgage, according to several sources familiar with the situation.

The investigation, which is described as in its preliminary stages and has been going on for several weeks, is looking into whether various federal criminal statutes have been violated that resulted in the company's bankruptcy, the sources said. Among the statutes are conspiracy, securities, mail and wire fraud, and money laundering, the sources said.

American Home Mortgage, once one of the nation's 10 largest mortgage lenders, collapsed at the beginning of August, filing for bankruptcy on Aug. 6, and laying off most of its 7,000 employees, including 1,400 on Long Island.

While a number of civil regulatory agencies have said they are looking into the company's demise, the investigation by the FBI and prosecutors from the Eastern District in Brooklyn is the first that could lead to jail sentences if any illegal conduct is found.

Mortgage brokers' sleight of hand

In the past five years, if you called a mortgage broker when you were about to buy or refinance a house you may have been told, "We can check with lots of lenders so you'll get the best price." Because you are a careful shopper, this sounds good - one-stop comparative shopping. The broker most likely didn't add, "I'll take a bribe to steer you to the loan that is more expensive for you and more profitable for the lender."

A mortgage broker can offer wise advice to guide a buyer through a dangerous thicket of complex mortgage deals, but you are just as likely to encounter a broker who is working only for himself. There are brokers who take what amounts to a bribe from a mortgage company to steer a client into a higher-priced mortgage than it could qualify for, all the while assuring the client that this is the best possible deal.

The practice is sufficiently widespread that the bribe has a technical name, a "yield spread premium." The yield spread premium is a payment the mortgage company makes to the broker to persuade the broker to sell the homeowner a higher-priced loan.

For example, a family that might qualify for a 6.5 percent fixed-rate, 30-year mortgage could easily end up with a 9.5 percent variable mortgage because the broker can pocket a bigger fee. The ultimate blow is that often the buyer who has been defrauded will end up paying the bribe as additional "points" added to the closing costs.

A vice president of Fannie Mae has described the premiums as "lender kickbacks," but the practice remains legal. The additional costs for the bribe are slipped into the closing document as part of the closing costs. Under pressure from the mortgage-broker industry, Congress and the regulatory agencies have generally approved of yield spread premiums. In fact, mortgage brokers face few regulatory restrictions.

Mortgage lenders in subprime 'traffic jam'

US mortgage companies are being overwhelmed by the large numbers of homebuyers who need to renegotiate their loans to avoid default, creating a "subprime traffic jam" that could frustrate efforts by regulators to prevent foreclosures, experts say.

Mortgage servicers, the operations that collect loans, say they are having trouble making profits because of record levels of late payments and delinquencies. Litton Loan Servicing estimates that costs have increased 20 per cent in the last year for mortgage servicers, who even in good times depend on razor-thin profit margins.

The result is that few subprime mortgages are being renegotiated. Moody's, the ratings agency, found that lenders had eased terms on just 1 per cent of subprime loans resetting at higher interest rates in January, April and July this year.

"Servicers have failed because there's a huge resourcing issue," said Barefoot Bankhead, managing director at Navigant Consulting. "As lenders have gone out of business, the servicing arms have been in transition without the resources to handle the enormous number of requests for loan modifications and restructuring."

The problem could grow more severe as more than $350bn in adjustable-rate mortgages reset at higher rates in the next 18 months.

"Servicer inactivity could turn the subprime traffic jam into a monumental pile-up, because the longer people wait to make decisions, the worse the situation gets," said Don Brownstein, chief executive of Structured Portfolio Management, a hedge fund.

Two bank giants braced for $10bn hit from world turmoil

Two of the world's biggest banks announced a $10 billion (£4.8 billion) reversal in their fortunes yesterday as they gave warning of massive hits to their third-quarter results.

Analysts and bankers said that further pain would be inflicted on the sector before the credit squeeze had run its course. Attention will next focus on Deutsche Bank, which will report on its third quarter on October 31.

Brad Hintz, an analyst at Sanford C Bernstein, said: "The storm has hit everybody and we certainly haven't seen the last of it. There'll be plenty more banks giving profit warnings and making writedowns as their earnings days approach."

Deutsche Bank Writes Down $3.1 Billion

Deutsche Bank finally put a number on its losses from the home-lending crisis, saying today that it expected to write down $3.1 billion in loans and mortgage-backed assets.

Its disclosure — after two very public warnings from the bank about the effects of the market upheaval, and heavy write-downs by its peers, Citigroup and UBS — was not as dire as some analysts expected.

Deutsche takes hit from ABCP fallout

Ronald Weichert, a spokesman for Deutsche, said the bank has not given a regional breakdown of the losses, which have to do with structured credit products and mortgage-backed securities. However, it is well known that Germany's biggest bank is a major player in Canada's securitization sector, especially in third-party asset-backed commercial paper, or ABCP.

Around the world the securitization business has been dealt a body blow by the ongoing credit crunch but the troubles are especially severe in Canada, where the entire $40-billion market for third-party ABCP has been seized up since early last month.

Key to the problem was the failure of legal agreements requiring financial institutions to come forward with emergency funding for ABCP issuers in the event that liquidity in the market dried up. Because those agreements didn't work the way they were supposed to, investors ranging from individuals to big pension funds were left holding commercial paper that may be worth less than they paid for it, despite top ratings from credit agencies.

The ABCP business is complex and has a lot of players, and Deutsche was prominent in several areas. Analysts said it was one of the liquidity providers that did not supply funding to issuers in the run-up to the meltdown. It also acted as a counter-party on derivatives known as credit-default swaps entered into by many stricken ABCP issuers, essentially bets around interest rates. The swaps have now become a major focus for a committee of investors that is seeking to rescue the stricken ABCP market.

Canada is a small market in global terms but because of lax regulations in the securitization industry, it was highly profitable for many players and, as a result, attracted more than its fair share of the worldwide market.

Bank of Canada adds another $855-million to the markets

The Bank of Canada intervened in financial markets again on Tuesday, buying $855 million of securities to defend its target overnight interest rate.

Since Thursday, Canada's central bank has intervened four times for a total of $3.815 billion.

In such purchase and resale transactions, the Bank of Canada buys government bonds from major financial institutions with an agreement to sell them back at a predetermined price the next business day.

The bank made the transactions to maintain its overnight loan target rate, which is 4.5 per cent.

BoC knows its role in credit crisis

David Longworth, deputy governor of the Bank of Canada, said it is not the job of the central bank to support individual markets - like the asset backed commercial paper market that was swept into turmoil by the meltdown in the U.S. subprime mortgage market this summer - but rather to provide overall liquidity to institutions that need to borrow.

Mr. Longworth made the comment in Toronto after a speech in response to a question over why the bank had not accepted ABCP as collateral as global credit markets seized up this summer....

....The governor added the bank's target rate for overnight lending between banks - currently at 4.50% - has drifted up again in recent days largely due to technical month-end financial flows. Asked why the bank had to intervene again on Wednesday to bring the rate down after the month-end was over, he said the bank itself did not always understand what was going on in the markets.

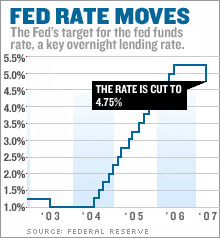

The Fed got what it wanted. Or did it? The markets' reaction may actually complicate matters for Fed Chairman Ben Bernanke and his fellow policy makers at their next scheduled meeting on Oct. 30-31, and create a new conundrum - to use a word made popular by Bernanke's predecessor, Alan Greenspan - for the Fed........"What the Fed did had more to do with psychology than fundamentals. It showed the markets it would provide liquidity and not cause the housing markets to cause more havoc," said Jeff Cummer, president and chief portfolio manager, with SMH Capital Advisors, a Fort Worth, Texas-based money management firm.

But by moving so quickly to soothe the worries of investors, the Fed may also have raised the expectation that it will keep cutting rates. And it may be this expectation of further rate cuts, and not the actual rate cuts themselves, that are fueling the market's recent rally.

According to federal funds futures listed on the Chicago Board of Trade, investors are pricing in a strong likelihood of a quarter-point rate cut at the Fed's next meeting.

Bank of England Keeps Interest Rate at Six-Year High

The Bank of England kept its benchmark interest rate unchanged at a six-year high as policy makers assessed the effect on the economy of higher credit costs and a run on Northern Rock Plc.

The Monetary Policy Committee, led by Governor Mervyn King, left the bank rate at 5.75 percent, matching the forecast of all except one of the 60 economists surveyed by Bloomberg News.

The decision follows panic among depositors at Northern Rock after money-market rates jumped, leaving the bank unable to fund its business. The run on the lender, the first in more than a century, has clouded the outlook for economic growth and inflation, and sparked criticism of the way the central bank handled the seizing-up of credit over the past two months.

Calls grow for ECB intervention to stem rise of euro

The recent rise of the euro has sparked a chorus of disapproval from the region's exporters and politicians, but analysts say it may now be approaching levels that could even push central banks into action.

The euro has hit a fresh high against the dollar for the last nine trading sessions, touching $1.4281 on Monday. This took the euro's gains against the dollar so far this year to 7.8 per cent.

The single currency has been boosted by the continued hawkish interest rate stance from the European Central Bank, which has repeatedly indicated that it has no intention of cutting eurozone interest rates. In contrast, US interest rates are expected to continue on their downward path, putting further pressure on the dollar.

Eurozone politicians have been quick to voice concern over the euro's rise. Joaquin Almunia, the EU's commissioner for economic and monetary affairs, said Europe could not stand by passively if the dollar continued to weaken.

British banks gorge on ECB's cheap credit

British lenders are shunning the Bank of England and turning instead to the European Central Bank on a massive scale, taking advantage of much lower interest rates and guaranteed anonymity to weather the credit crunch.EU sources say Britain's banks have been clamouring for money in Frankfurt, accounting for a substantial chunk of the €190bn (£132bn) lent last week in the ECB's variable tender operation. "It is fair to say they have been borrowing from the ECB on a very large scale. It's cheap, so why not," said one official.

The UK banks were also major subscribers at the €50bn issue of three-month loans on September 27 at 4.63pc, and the earlier tender of €75bn on September 13.

Hans Redeker, currency chief at BNP Paribas, said British reliance on ECB funds has become to big that it is leaving a clear footprint in the currency markets, forcing up sterling on the days following ECB tenders as the banks switch euros into pounds – typically Thursdays, Fridays, and Mondays.

Banks Demand Leeway for Raising LBO Loan Charges, Law Firm Says

Banks are demanding greater leeway to charge more for underwriting buyout debt after global credit market turmoil led to a backlog of unsold deals, according to law firm Paul, Hastings, Janofsky & Walker LLP.

Banks are asking borrowers to agree to pay between 1 and 3 percentage points more for buyout debt in the event of a sharp increase in risk aversion among investors, said Brett King, a partner at the Los Angeles-based firm. The so-called ``flex provision'' in underwriting contracts is up from 0.25 percentage point in the first half of the year.

Stricter lending conditions following the collapse of the U.S. subprime mortgage market marks a reversal of fortune for buyout firms, who benefited in the first half of this year as banks cut charges to compete for underwriting debt, King said.

``Banks have now learned the lesson,'' he said today in a briefing in Hong Kong. ``Market flex provisions are now being heavily negotiated, while before the market crisis the provisions had been significantly pared down.''

Banks were lining up to sell more than $370 billion of non- investment-grade debt pledged to finance takeovers as of Sept. 21, according to analysts at Bank of America Corp. Citigroup Inc. and JPMorgan Chase & Co. are among those who may be forced to write off as much as $25 billion of leveraged buyout debt after market prices tumbled, Citigroup analysts estimate.

Will Subprime Save the Last Dance for Banks?

On October 1, the headline-grabbing news event known as "The Citigroup Shock" sent shudders down the spine of the entire financial world.

In short: Citigroup Inc., the largest U.S. investment bank, revealed a 60% drop in earnings from a year ago after taking a $3.3 Billion (and counting) loss on subprime mortgages gone bad. The even "bigger casualty" came from Citigroup's European counterpart UBS AG, where a third-quarter profit loss of $690 million, a pummeled stock price, and job cuts of 7% of the bank's entire work staff were added to the list of setbacks.

Until recently, the damage from the subprime turmoil has been limited to non-bank lenders; that is no longer the case. The trauma has clearly "bled out" as the nation's top tier financial firms take their position in the growing "red-flag parade." (CNN Money)

See: Countrywide Financial, JP Morgan Chase & Co, Bank of America Corp, Merrill Lynch, and the official shutdown of NetBank, "the largest thrift to fail in 14 years."

But while the mainstream media dubs the banking bombshell a "Shock" and Citigroup's own CEO admits, "We obviously cannot predict market movements or other unforeseeable events that may affect our business" – the reality is quite different.

For example, back in July 2006, Citi's chief executive was one of many industry leaders who saw no threat to the near-term credit environment. In his own words: "When the music stops, in terms of liquidity, things will become complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing."

Credit Suisse Says Mortgages to Remain `Problematic'

Credit Suisse Group Chief Executive Officer Brady Dougan, the former derivatives trader who took over in May, predicts the market for mortgage credit will be ``problematic'' for as long as 18 months.

``U.S. mortgage credit will remain problematic through this year and perhaps through 2008,'' Dougan told investors at a conference organized by Merrill Lynch & Co. in London. The Zurich-based bank doesn't see a return to stability ``any time soon'' after a surge in subprime mortgage defaults sparked a seize-up in credit markets in the third quarter, Dougan said.

Credit Suisse said Oct. 1 that profit from continuing operations will be between 1.04 billion Swiss francs ($890 million) and 1.56 billion francs, compared with 1.47 billion francs a year earlier. While the bank has sufficient access to cash, mortgage markets have suffered ``severe investor pull-back'' and ``origination has all but dried up,'' Dougan said today.

U.S. Economy: Pending Home Sales Slide to Record

The number of Americans signing contracts to buy previously owned homes dropped to the lowest level on record in August as the housing recession deepened.

``The existing homes market is now in freefall,'' said Ian Shepherdson, chief U.S. economist at High Frequency Economics Ltd., in Valhalla, New York. ``The downside from here is still substantial.''

The National Association of Realtors' index of signed purchase agreements fell 6.5 percent from the previous month, the group said today in Washington. The decline was more than economists anticipated and pushed the measure to the lowest level since the organization began tracking purchases in 2001. The gauge plunged 11 percent in July.

Higher credit costs and lending restrictions after the collapse in subprime mortgages may push the industry downturn well into 2008. Market futures contracts show the Federal Reserve will probably cut rates later this month to avert spillover from the credit squeeze and keep the broader economy expanding.

A Look Inside Citigroup's Writedowns

While I will readily accept that Citigroup and others in the industry have come clean on the earnings impacts of August's credit market "thunderstorm", I firmly believe that the deterioration in consumer credit is just beginning. And when you combine that with the heightened leverage and "hot money" funding that most of the major financial institutions have come to rely on, I find it difficult, based on Citigroup's own words, to believe that the whole storm has passed.

Too bad Citigroup got rid of the umbrella logo a few months ago. It's going to need it.

Mortgage Monsters: Party's Over

Correction is in train, and if you're thinking that's all good ask yourself why the Great Depression was called a "depression." Banks, consumers, investors, loan officers, speculators, Wall Street… an entire nation is now being force-fed responsibility. With regard to the subprime mortgage crisis, many are relearning basic economic principles: "There is no free lunch." "Caveat emptor." "If it looks to good to be true..." and so on.

The heyday of irresponsible mortgage lending is over, much to the chagrin of predatory lenders nationwide. The house of one-eyed jacks is crashing down and even political conservatives are taking cover from the fallout.

Appears the party really is over. Will the age of 20% down, good collateral, and good credit will make a comeback? Perhaps Americans will change their minds about leveraging themselves to the hilt and begin living within their means. But in the words of the late John Kenneth Galbraith "In the choice between changing ones mind and proving there's no need to do so, most people get busy on the proof."

Job Cuts Worst Among Mortgage Companies

About 37 percent of September job cuts were connected to the housing industry as that sector continues to languish in a deep slump, consulting firm Challenger, Gray & Christmas Inc. said Wednesday.

Credit crunch ripples into U.S. mega-mansion market

There's an indoor lap pool, eight-car garage and four-storey elevator. But the 26,000-sq ft (2,415-sq meter), Tuscan-style home features something even more unusual in this ritzy suburb of gated estates and mansions -- a $3 million discount on its price.

As the credit crisis started to shake global financial markets in August, the owners of the 22-acre (9-hectare) estate at 309 Taconic Road in Greenwich, Connecticut, cut their price to $19 million, showing turbulence in the U.S. housing market penetrating the wealthiest strata of American society.

"People are looking instead of buying, maybe since the second week of August," said Julianne Ward, director of fine homes at broker Prudential in Greenwich, a coastal town of 61,000 about 30 miles from New York City.

Until recently, the nation's most extravagant homes had defied the two-year slide in prices and surge in foreclosures roiling the broader property market, where existing home sales are down more than 20 percent from a 2005 peak, according to industry data.

Jumbo Subprime Home Loans More Likely to Default, UBS Says

About 17 percent of subprime-mortgage balances in bonds are too large for borrowers to refinance into loans from Fannie Mae or Freddie Mac, making them more likely to default, UBS AG analysts said.

The loans exceed the $417,000 limit for what government- chartered Fannie Mae and Freddie Mac, the two largest U.S. mortgage-finance companies, can buy, the New York-based UBS analysts wrote in a report yesterday. That also makes the loans ineligible to be insured by the Federal Housing Administration.

Subprime borrowers with jumbo mortgages ``will probably have a more difficult time in the coming months than borrowers who can take advantage of'' refinancing opportunities through government- linked entities, the UBS analysts led by Laurie Goodman wrote.

Borrowers are having difficulty refinancing or selling their homes at favorable terms as lenders have tightened standards and U.S. home prices have dropped.

Selling Students into Credit-Card Debt

Citibank pitched an offer at Ohio State University that few college students would refuse: free food. A company hired by the bank plastered the Columbus campus with advertisements for free sandwiches at a local haunt, Potbelly, and free burritos from La Bamba restaurant. The only catch? Students had to submit a credit-card application before any free food crossed the counter.

The food-for-credit application scheme caught the attention of Ohio's attorney general, Marc Dann, who sued Citibank on Sept. 19, alleging that the campus advertisements violated the state's consumer-protection laws. Dann has partnered with students and professors at Ohio State's Moritz College of Law to prosecute the suit, which accuses Citibank of using bait-and-switch advertising, failing to clearly state conditions of the offer, and tempting students with a prize without disclosing all the conditions. The suit seeks more accountability in credit-card marketing practices. "Citibank is starting out the marketing deceptively and banking on the fact that these kids won't read the fine print," Dann says.

FDIC receives offers for mortgage lender

Federal regulators who took control of Market Street Mortgage on Friday in the collapse of NetBank hope to have a deal for the sale of the Clearwater mortgage company by the end of the week.

"We have a couple of motivated buyers," the FDIC's Dan Bell told Market Street employees in a Monday morning e-mail announcing that he is the company's new chief executive officer. Market Street is a subsidiary of NetBank, which makes it part of the receivership controlled by the Federal Deposit Insurance Corp....

....NetBank was shut down by the government's Office of Thrift Supervision on Friday because of bad loans and poor business practices. It was the largest savings and loan failure since the crisis more than 14 years ago.

ING Bank took over the insured deposits. Customers with $109-million in deposits above the FDIC insurance limits will be creditors of the receivership.

New bid rumours at Northern Rock

Shares in Northern Rock picked up again after falling to an all-time low earlier in the morning on new rumours of a possible 175p per share rescue package.

Earlier this morning, shares in the troubled mortgage lender slumped again, valuing the group at only £512.6m, more than 90% less than eight month ago. That steep fall followed a newspaper report by Spanish ABC saying that a potential suitor has pulled out, while all other bids so far have also failed to materialise.

Northern Rock Lures State Street, RAB as Shares Dip

Northern Rock Plc, the U.K. mortgage lender that has lost 73 percent of its value and was rescued last month by the Bank of England, has lured investors State Street Global Advisors, RAB Capital Plc and Artemis Investment Management Ltd.The three investors have a combined 9.6 percent stake worth 62 million pounds ($126 million) based on yesterday's closing price, regulatory filings and data compiled by Bloomberg show. Northern Rock hired Citigroup Inc. and Merrill Lynch & Co. to advise on acquisition talks.

``It's a speculative strategy,'' said Richard Hunter, head of equities at Hargreaves Lansdown Plc, a brokerage based in Bristol, England. ``Without a takeover, it would be very difficult for Northern Rock to run its own business. The brand has been irrevocably damaged.''

Sub-prime claims Spanish developer

The Valencia property developer Llanera has become the first high-profile victim of the credit crunch in Spain, declaring insolvency yesterday after failing to meet payments on €748m of debt.

The fashionable builder, known for its links to Charlton Athletic Football Club, was unable to reach agreement with Lehman Brothers and other banks on a refinancing deal, a sign that foreign creditors are no longer willing to underwrite Spain's property market.

The rating agency Moody's said default rates in Spain could jump from 0.37pc to 5.5pc if the economy suffers a hard landing, with an outside risk that values could fall by 20pc.

Trichet: Excess currency volatility very counterproductive

Excessive foreign exchange volatility is potentially damaging to the global economy, European Central Bank President Jean-Claude Trichet said on Thursday. “We consider excessive volatility very counterproductive from the standpoint of global growth,” Mr. Trichet told a news conference after the ECB left interest rates at 4 per cent.

Preparations are under way for a meeting of euro zone finance ministers next Monday, which Mr. Trichet will also attend, where they hope to forge a united message of concern about the dollar's weakness ahead of a mid-October meeting of the Group of Seven industrial powers in Washington.

GM Accord Moves Fourth of Workers to Lower-Pay Jobs

General Motors Corp. has the right to shift a fourth of its union labor force to lower-paying jobs by 2011 under a tentative contract reached last week with the United Auto Workers.

GM and the union agreed to label ``in excess of 16,766'' jobs as ``non-core'' positions that pay about half as much as the earnings of 73,500 current UAW members at the largest U.S. automaker, according to the agreement. The jobs won't provide a full UAW pension or retiree health care.

The contract addresses GM Chief Executive Officer Rick Wagoner's demand that the union help close a $25-to-$30 gap in hourly U.S. labor costs with Toyota Motor Corp. and Honda Motor Co. Hourly pay and benefits for non-core jobs will be about $28, compared with $51 for current UAW workers, people familiar with the plan have said.

“These rates get them very close to the Toyota labor costs,'' said Kristin Dziczek, an analyst at the Center for Automotive Research in Ann Arbor, Michigan. ``It really sets up a mash of the titans'' between GM and Toyota.

The “non-core'' ranks may swell, Dziczek said. The four- year contract identifies 3,126 jobs now done by outside suppliers that may be brought back to Detroit-based GM under the lower pay scale.

Secessionists meeting in Tennessee

In an unlikely marriage of desire to secede from the United States, two advocacy groups from opposite political traditions — New England and the South — are sitting down to talk.

Tired of foreign wars and what they consider right-wing courts, the Middlebury Institute wants liberal states like Vermont to be able to secede peacefully.

That sounds just fine to the League of the South, a conservative group that refuses to give up on Southern independence.

"We believe that an independent South, or Hawaii, Alaska, or Vermont would be better able to serve the interest of everybody, regardless of race or ethnicity," said Michael Hill of Killen, Ala., president of the League of the South.

Separated by hundreds of miles and divergent political philosophies, the Middlebury Institute and the League of the South are hosting a two-day Secessionist Convention starting Wednesday in Chattanooga.

They expect to attract supporters from California, Alaska and Hawaii, inviting anyone who wants to dissolve the Union so states can save themselves from an overbearing federal government.

Thanks Ilargi for all the news, but for now gotta run to pick up the son from University for Thanksgiving. Have a good one, you and all you other Canadians, sensibly eating their Thanksgiving turkey at a suitable distance from their Christmas one.

-------

Question here: I grabbed this from the Mish blog site about gold, I had assumed that gold was only good in response to inflation but?:

http://globaleconomicanalysis.blogspot.com/2007/10/minyan-mailbag-how-do...

That sounds pretty good but is there another side to that?

BTW Mish includes a not bad 'Saturday Night Live' skit about debt. They sound a lot like me asking questions on The Oil Drum.

CR, the SNL link is in the post:

• Don't Buy Stuff You Cannot Afford (classic SNL video).

As for gold, while I think everything that Mish says is in principle true, I am wary of gold, for three reasons;

Central banks all over are selling gold in mass quantities whenever they feel like it. Now the IMF joins in as well. A weird paradoxical tendency, if you think about it: if they would keep it in their vaults, prices would rise, because it would be scarcer. So what's the reasoning? Go to gata.org sometime.

There may be, I think, a bottom limit to how well gold performs in "extreme" times. First, you can't eat it. Second, as in the 1930's, possession may be banned, which hinders its use as currency. Mish' arguments should hold up well as long as there is a semblance of a remaining functioning economy. But how low will we go?

I'm not so sure I wish to support that. I know, the same is true of many commodities. Personally, I draw the same conclusion for all.

Happy Thanksgiving. It's 28 Celsius here in the east. Eating turkey poolside.

Thanks ilargi, please excuse the duplication of that link, found it in a bit of a rush while taking a quick look for numbers on job creation as well as trying to get out of the door. Have some time now though.

But what east do you speak of ? East Bermuda? Here in B.C. on the coast it was down to 3 degrees C this morning. Amazing, made us think we are not so different from the rest of Canada ... except, now, for that 28 C. of yours!

Kebek

Lovely there.

I must take a refresher in scanning... hope you had a fine birthday thursday Stoneleigh.

Hi CR,

I think there's a difference between saying gold is a hedge against deflation and gold is an insurance policy. I disagree that gold is a hedge against deflation - that is, a hedge against your net worth decreasing during a significant decline in the money supply. The reason being, that it is very likely to fall in value relative to cash (ie its price falls in nominal terms), along with almost everything else, as people sell whatever assets they can to raise the cash they need to pay their debts and living expenses. That would mean you should (in theory) be able to buy gold at a lower nominal price later, along with all manner of other things, with any cash you've managed to hold on to. Of course in the case of gold there may be other complicating factors, such as it being made illegal for individuals to buy or hold gold, and that might mean the theory doesn't work quite so well in practice.

I would agree that gold is an insurance policy - a hedge against gross disruption of the economy - and as such could be said to have a place in a reasonable strategy for the wealthy, even if its nominal price is high at the moment relative to what it might be later. However, gold ownership can be problematic in practical terms, as it's such a concentrated store of value. Making ownership illegal wouldn't prevent you from owning it, but it would make it dangerous to use it to exchange for anything you might need. (Using it could put you on the radar of the sort of people whose radar you would really rather not be on.) But if you have a lot of money, and you want to store it in a form that will hold it value in order to pass it on eventually to your nearest and dearest, then gold ownership is not such a bad idea. Gold will hold its real value indefinitely (for example, an ounce of gold would have bought you a really nice toga in Rome and would buy you a really nice suit now).

It really depends on how much money you have, and whether you can afford potentially to put a big chunk of it out of reach for a long time. If you don't have a lot of money, and therefore have to be selective about what preparations you make, then I would say there are far better things you could do with it than buy gold, even as a hedge against disruption. Getting out of debt is very important, and if you still have money after that then some land with self-sufficiency features (ie well and septic system, good soil, fuel-wood supply etc), some renewable energy equipment, hand tools, and an alternative means of transport would be very useful - far more useful than gold. Helping your nearest and dearest to reduce their vulnerability to disruption would be good as well, as no man is an island.

Talking debt

http://www.minyanville.com/articles/index.php?a=14385

Especially #4 Hahahahahahaaaaa !!!!

Hi Stoneleigh,

You put a good case for not putting ones trust in gold, I hope others will read your reply to that question.

There are better places to be putting any spare dinero one may have than in gold and the one thing I really would and am doin, is putting it into cash (saving) despite the immediate problem of inflation.

One thing that I would suggest is that the purchase of land be held off until such a time as there is a drop in that market . While I do have what I consider a minimum holding necessary to grow enough to get buy on (slightly over as quarter of an acre.) I would prefer to have enough for fallow or as you mention a wood lot. I am putting aside a few dollars for that but with the price of land here (Coastal B.C.) a little bit crazy, it will have to fall quite a bit before I will be able to afford anything extra other than a rock/stump farm on top of a mountain. Many of these decisions depend on circumstances, now and later, but as a generalization would you put land (including that very scarce item good quality farm land) in the same category as any other item you are thinking of in your statement above, to wit: That would mean you should (in theory) be able to buy gold at a lower nominal price later, along with all manner of other things, with any cash you've managed to hold on to.

I see you have posted a new Roundup so will end this here. Thanks.

PS. As we pass PO it would become increasingly difficult for individuals and corporations to farm large acreage, therefore I would expect there to be more willingness on both government and individuals part to allow these to be broken down to smaller holdings which would be manageable by individuals. As well government support might be given to groups to collectively run larger holdings... Vive la revolución!

I agree with you about buying land in coastal BC - the prices are so inflated right now that only someone with so much money that they needn't care how much anything costs should really consider buying there now. The same goes for quite a few other locations - the UK for instance.

Land prices should fall dramatically, and you should have far more to choose from later as well, so long as you've managed to preserve some liquidity. I agree that larege parcels may well be broken up, as farming a large amount may simply not be feasible.

In the meantime, there's quite a lot you can do with the patch you already have - think of it as practice :)

A little fresh compilation from this morning. The Fed rate cut may have propped up the banks, but nothing much trickles through, they use it all to save themselves. All major banks have announced $multi-billion write-downs in the past week, but there’s more to come, at least $100 billion worth. On top of that, there’s $370 billion in unfunded buyouts on the shelves.

Citi may have issued a positive report on home-builders, but don’t think it bought much of the shares. That leaves home-builders on their own, trying to survive in a market with 17.4 million unsold homes. In other words, US home prices for 2008 will be set by auctions, from builders and/or foreclosures. There is no doubt this will mark prices down rapidly. Don’t be surprised by a 25% drop within a year.

“They're selling homes at any price they can get.”

Belated birthday greetings.

Thanks :)

ilargi,

The article 'The Alarming Parallels Between 1929 and 2007' may have a partial link as the text is coming in blank.

fixed

and meanwhile global stock markets are melting up, including that of the u.s., despite an endless litany of bad news relating to housing and the economy. can anyone explain this phenomenon in logical terms, other than the weimar hyperinflationary analogy? i find it curious as well that price discovery in the credit markets is so episodic. perhaps the financial engineers can explain how a credit panic replete with bank runs can be so quickly transformed, at least perceptually.

fred,

Enormous amounts of credit are still floating out there, and looking for a place to invest. At least when put in stocks, it can all be pulled back fast. That keeps them high for now.

There is no panic, not yet. What we are trying to make clear that it will happen, though, and that this is inevitable.

The timing is impossible to predict, but there is so much pressure on the system already that it's hard to see it taking much longer. Still, the Fed could first cut rates all the way down to 1% again. That would tailspin the US dollar, but it'd make for a little more delay as well.

Simple advice: get out of debt, now, and don't have money in things that you can't take it out off on very short notice, like real estate. Banks may be risky, since they are deep in risky paper. Lots of that will be marked for its true value before Christmas.

When it starts moving for real, there is no telling how much will evaporate, but $500 trillion in paper with the potential to lose most of its purchasing price makes for some scary scenario's.

http://globaleconomicanalysis.blogspot.com/2007/10/ryder-blames-freight-...