Economic Impact of Peak Oil Part 1: A Flashback

Posted by Gail the Actuary on September 23, 2007 - 11:00am

This is the first part of a three-part series providing my ideas on the economic impact of peak oil.

What happens when peak oil collides with our economic system? It seems to me that there is a high probability of a major discontinuity of some type. What exactly happens after the discontinuity is likely to vary from country to country. It seems to me that the United States is especially vulnerable to a drastic drop in the amount of oil available for import because of the large amount of oil we import and the relatively small amount of goods we export.

Many people when analyzing the world oil situation focus on the relatively small drop in overall world supply in the first few years. From this, they conclude that peak oil will primarily raise the price of oil and some related goods, but not have a huge effect otherwise. If the decrease in oil products is severe, some rationing may be required. I think this analysis misses the big part of the problem – the impact of peak oil on the overall economic system, particularly in the United States.

The world is very different now than it was before the industrial revolution, which began about 1800 when fossil fuels were first used extensively. It seems to me that there is a significant chance that over the long term there will be just as big a change as we leave the age of fossil fuels. To start the discussion, let's start with where we are, and then take a look back.

1. What is our current economic system like?

We all recognize our current economic system. Goods are made in factories around the world. Food is grown on large farms, then processed and packaged before we buy it in grocery stores or restaurants. There is a huge amount of international and local trade that brings all of our goods and services to us.

Most of us have jobs and work for money to purchase the things we need or want. We expect to buy various types of insurance, such as life insurance, auto insurance, and long term care insurance. After we have worked for a number of years, we expect to retire and collect funds from various sources - social security, a pension, or perhaps a 401(k).

To finance all of this, there is a huge financial industry. This industry includes many players:

• Banks and savings and loans

• Insurance companies

• Hedge funds

• Markets that sell stocks, bonds, and a wide variety of derivatives and repackaged debt

• Large numbers of accountants, actuaries, economists, financial advisors, financial planners, quantitative analysts, and others associated with the financial services industry.

We know that this system includes a very large amount of debt. Almost any new factory is “financed”. Businesses use debt to buy other business. Individuals use debt to finance college educations and to purchase homes or cars. In recent years it has become fashionable to refinance home loans as soon as some equity has built up, and use the funds withdrawn to pay down credit card debt.

Governments use debt to just as great an extent as individuals. State and local governments issue bonds to finance a wide range of projects. The federal government has both the debt that it reports, and unfunded programs such as Social Security and Medicare. USA Today reports that when corporate style accounting is used, federal liabilities amount to $59.1 trillion, or $516,348 for each US household. This compares to an average of $112,043 per household in personal debt such as mortgage loans, auto loans, and credit cards.

2. Have economies always been similar to ours today?

We all know that the answer is “No”. Prior to the industrial revolution, most people were farmers, and businesses tended to be quite small. Governments funded big undertakings like roads or water systems (or pyramids). Farmers grew or made most of what they needed. What was left over was sold and traded for other goods. Cities tended to be quite small, because the amount farmers produced over and above what they needed for themselves was not sufficient to support very many additional people. While there was international trade, the volume was much smaller than today.

In businesses and governments, debt seems to have played a lesser role than today. When Lloyd’s of London was formed in 1688 to pool insurance risk, it was formed by a group of wealthy individuals, each pledging a share of their personal wealth as backing for the venture. Thus, the emphasis was on assets rather than debt. The US government did not have significant debt until the Civil War. Its next increase in debt came with World War I.

The use of debt, particularly by individuals, seems to have been viewed quite negatively. The Catholic Church forbad debt until 1822, and Islam to this day forbids paying interest on debt. The Jewish Torah says debts should be erased every seven years and every 50 years. Those who could not repay loans were sometimes sent to debtors’ prisons or became indentured servants or slaves.

Homes and barns were quite simple, and were often built with the help of friends or neighbors, so little debt was needed. Farms and other property tended to stay in families, and were transferred through inheritance. Many of the skills needed to run a farm or small business were learned through apprenticeship, often with the boy’s own father. Retirement was unknown. People would work as long as their heath permitted, and lived with their children when they got older.

Since retirement was unknown, when people saved for the future, it was primarily savings for a “rainy day”-–crop failure or ill health or burial. The stock market and even banks were viewed as risky. Panics, crashes and bubbles happened frequently, making it difficult to predict how markets would behave in the future.

3. How did this huge change in the economic system take place?

One of the big factors in the change was the greater use of fossil fuels, starting about 1800, when coal began to be used to power factories and the steam engine. This allowed for the production of many more goods, and resulted in greatly expanded trade.

Petroleum came into widespread use in the late 19th and early 20th century. Farmers were able to farm larger tracts of land with the use of tractors and other equipment. The green revolution between 1940 and 1960 further increased farm productivity through the greater use of fertilizers (natural gas), pesticides (oil), and pumped irrigation (oil).

4. Wasn't technology important in the change in the economy?

Energy and technology go hand-in-hand. Without energy, it is hard to have much technology improvement. Energy also goes hand in hand with productivity growth, since energy is what permits a machine to do the work a person previously would have done.

5. Have economists studied the relationship between energy and economic growth?

The standard model by which economists explain growth is the Solow-Swan neoclassical growth model, which is described in Robert Solow's 1956 paper A Contribution to the Theory of Economic Growth. This paper looks at the contribution of labor and capital to the growth of the US economy, using a model that assumes that the contributions of labor and capital are proportional to their respective costs. The paper finds that labor and capital in fact explain less than 25% of the actual growth of the US economy. The assumption is then made that "technology" must explain the huge residual.

With a model that explains so little (less than 25% of actual growth), it is not clear that the model is very helpful. The residual comprising over 75% of growth could just as well be energy as technology.

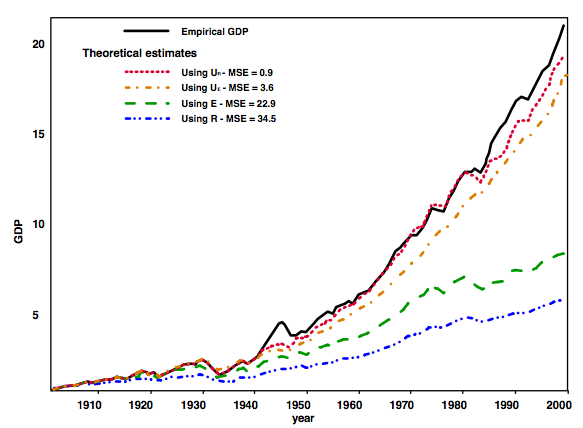

One economic growth model that explains growth quite well is Accounting for Growth, the Role of Physical Work by Robert U. Ayres and Benjamin Warr, Structural Change and Economic Dynamics, February, 2004). This model looks at the amount of work (in a physics sense) that is done by energy. Thus, it considers both the amount of energy used and how productive that energy is. For example, power stations in 1900 converted only 4% of the potential energy in coal to electricity, but by 2000, the conversion efficiency was raised to 35%. This model explains the vast majority of US real economic growth between 1900 and 2000, except for a residual of about 12% after 1975.

Figure 1: Results of model by Ayres and Warr. The selected model is the dotted red line, which includes biomass and animal labor, as well as other types of fuels (fossil and nuclear).

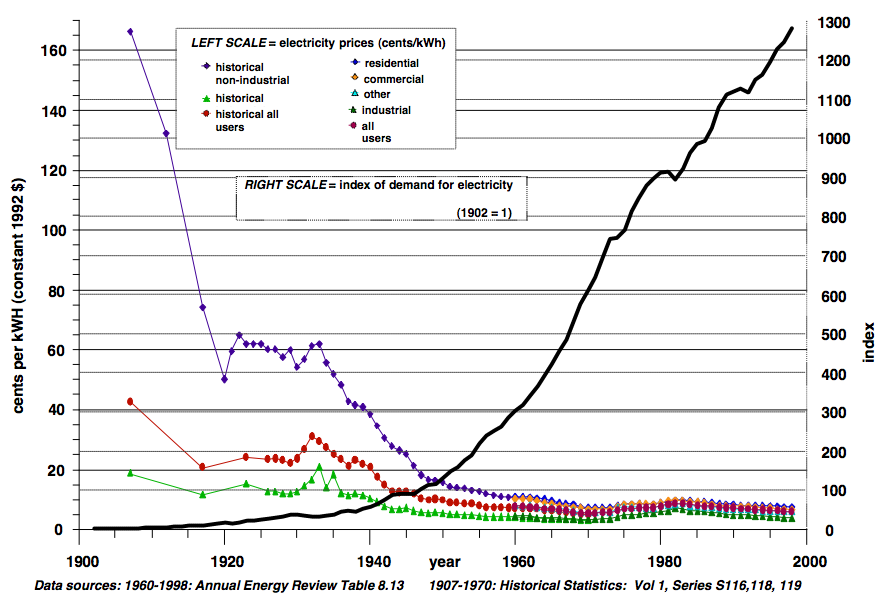

A closely related result from the Ayres and Warr paper is that declining real cost of energy, particularly electricity, and the rising use of the much cheaper electricity, fed economic growth in the 1900 to 1998 period.

Figure 2: Electricity prices and electrical demand, USA 1900 - 1998

6. Has the real price of electricity and other energy products continued to drop in recent years?

Any of us, looking at our electric bills, our natural gas bills, and the cost of fuel for our cars know the answer to this one. Rather than talking about peak oil, perhaps we should be talking about passing the "trough in energy prices".

The Department of Labor shows this graph of changes in the Consumer Price Index for Energy.

Figure 3: Changes in Consumer Price Index for Energy, from the US Department of Labor

The cost of electricity has also been rising since 1999.

Productivity is growing, but not nearly as rapidly as energy costs. The International Energy Association says that energy efficiency is growing at less than 1% per year in its 26 member countries. The US Energy Information Administration forecasts energy efficiency gains ranging from 2.2% to 2.4% per year between 2004 and 2030 in its various forecast scenarios.

One way of confirming the higher real cost of energy is to look at the trend in energy costs as a percentage of GDP. According to the U. S. Energy Information Agency, energy costs rose from 6.0% to 7.4% of US GDP between 1999 and 2004. We all know that since 2004, energy costs have likely risen further.

7. Were there any other factors besides the increased use of fossil fuels that caused a change in the economic system between early days and now?

Yes, there certainly have been many.

One that is important for our analysis is the fact that there was a real change in the way the markets and financing were viewed. Debt was viewed more positively. The stock market came to be viewed as a safe investment. The whole system came to be viewed as sufficiently stable that quantitative analysts could develop sophisticated models of the system and use these to price financial products.

We will look at how this change came about in Part 2. In Part 2, we will also look a little more at where the economy is now.

My car was in the shop yesterday for some much needed repairs (new brakes) so my day was confined to working from home. I drive just as little as possible these days and try to take care of multiple errands in one trip but the thought of being without a car or having no fuel for said auto is going to take some adjusting on my part. I do run my business from home so I have a number of days per year where I put on no miles, but currently I could not continue to conduct my business as usual without an auto.

In my case:

1) A partnership business with a friend who has a car is an asset! We actually both worked at home - but he made the trip into the city about once or twice a week to pick and drop off things.

2) It's nice being able to cycle to work. Alas it's hard to get others interested in the idea - esp. if they need to dress up for work or are dashing around to get here and then get over there to pickup the kids ....

One thing that limits me in our co-housing project is that I want to continue to ride my bike to work - not spend $4k+/year having to get another car and commute (again the costs are purchase, insurance, parking and maintance - gasoline is very low on the list).

A co-housing project in BC called WindSong is interesting in that when they built it it was built in the boondocks and didn't quite meet the vision of the founders; but over the past decade the city swalled it and so public transit is now nearby and people changed their jobs so that cars are not needed ....

A friend (to counter my reduction in pollution and consumption) has a sprawling house all to himself and because it's so hard to walk the 2 blocks to work got himself an e-scooter; but is now finding out that it must be licensed and insured. I'm itching to see what the insurance costs him as the lions share is liability and that's why insurance isn't much less on a motorcycle than a car.

Having talked with a friend - I think that post peak will be a slow ratcheting down and down and down; denial that goes on for years and years. I'm just too cynical about human nature some times. After all - it was amazing how much of a fight there was against a ban against cod fishing; even when everyone (in their gut or research papers) on the east coast knew that they were pretty well fished to extinction. Years later no recovery yet ....

praetzel,

There is so much we could do with conservation and not in any way limit quality of life. For example, we could retrofit homes to be more energy efficient and much more comfortable and all of this with a positive return on investment. Why are we not doing this?, I can tell smart people are investing now in energy conservation measures, it just has not hit the mainstream.

We are. Are you?

I think you are right-on here. I am a CPA and have completed several energy conservation projects around my house over the years. Most recently sealing and insulating the ducting under the floor in the craw space. This is hard and painful work to say the least. At this point in cycle of higher energy costs, only the highly motivated folks take on this kind of self abuse.

I'm driven by the fact that more dificult times (higher energy costs) are just over the horizon. The populous is just to busy to care at this point.

I am also riding my bike to work and have made it part of my routine.

For now, only the driven are leading the way. The rest of the folks will need to evaluate their own tradeoff's before they make changes on the personal energy consumption.

I have been undergoing a conservation effort on my home for about 2 years now, reducing gas usage for heating by 1/2 and reducing electrical use by about 40%. Yes, some of the air-sealing in the attic was not fun but seeing the reduced heating and cooling bills are rewarding. We use less than 1/2 the electricity of our neighbors and far less than 1/2 the natural gas for heating.

Moto insurance is very polar. Insurance on scooters is practically nothing. Usually less than $100/yr. The factors they look at are: where you live and if the scoot will be licked in a garage at night. Second, they look at your experience. Third, they look at what category your bike falls into. If you're n00b rider, expect to pay a lot the first year. Make it through the first year claim free and rates will drop dramatically. Even back when I only had 15 years riding experience, I paid only $70 for a year's worth of full coverage on a Kawasaki 250. I've seen teenagers, buying the fastest sportbike they can afford, and pay $3000/yr to insure a $9000 bike. That's because the insurance companies know that 40% of them are totaled in their first year.

Actually the liability part cost is very low both for cars and bikes. The highest cost by far is uninsured and underinsured motorist coverage, even more then comprehensive.

It is also something no one can afford to be without in view of all the illegals without insurance as well as the very low mandatory liability coverage.

so real growth net of inflation and so is just more energy use and the more productivity we have means just leveraging machinery which of course needs more energy. SO we think out ways to use the energy we found by making bigger, smarter machines so we have growth and productivity. In the end no energy so the machines are useless and the people too.

http://politics.reddit.com/info/2r7od/comments

if you are so inclined...

Thank you Gail. The point that just jumps out is that this article offers so much to those who don't take such an intense interest in oil. So http://newenergyandfuel.com has reviewed and linked this page with a recommendation for its visitiors. We look forward to the coming additions. Keep those comments coming! The knowledge and skill level of the readership here is astonishing. Thanks to all of you

Fostering economic growth based on the consumption of absolutely exhaustible resources like fossil fuels was (and is) most unwise. And even tragic when such growth brings society into a state of ever greater dependency on those resources for its basic functioning, as is the case with suburban development.

Gail,

Excellent article and great perspective. It is important to understand that our challenges do not exist in isolation, but are interconnected.

I am not an economist, just a casual observer, but it seems that during the first phase of industrial age, our economy grew with an increasing volume of debt creating the capital to finance the growth. Projects have continued to escalate until we now have mammoth mega-projects costing billions of dollars. As a casual observer, I think it is likely that as we slide down the backside, the gamble on continued growth will be less prudent. Costs of expensive projects with increased possibility of non-success (Jack 2?) will see a contraction of available financing. Many think that there will be the oil out there, it is just not at an economic price to recover. While this is true, we may find that although the cost increases, the risk in these projects may also rise and the result is that they will be much harder to fund. If we have a major economic hit, with decreasing liquidity and collapsing dollars, we may reach a point where these projects can no longer be funded at all. At that point we will not have the ability to recover the economic strength to grow back into a position for fund mega projects. This will be the end of the industrial age.

Of course this is just my humble observations and opinions,

ej

In Part 2, I talk about my take on the current debt situation, and in Part 3, my take on what's ahead.

I agree, there are a lot of economic issues involved with our ability to continue business as usual, in more and more risky environments.

Estamos Jodidos

I'm not an economist either, but rather a little tiny independent contractor in the oil and gas business that occasionally has a fairly accurate flash of insight. I'm pretty well Texocentric, because Texas is where I was raised and make my living. And as westexas has repeatedly pointed out, Texas is big enough to draw conclusions about multiple basin oil trends, but started its main production enough earlier than the rest of the world that we can make some pretty good inferences about world trends by looking at Texas drilling and production history.

Lately I've been cogitating on the concept of Energy Returned On Energy Invested, or EROEI as we call it here. The concept isn't nearly as complex as the name, its how many feet of drilling does an operator have to do to find the reserves. At the beginning of the oil industry of the Gulf Coast the returns were pretty fantastic. Although the EROEI at Spindletop is quoted at 70:1 this is actually way too low. The Kucas Gusher was the third well to attempt to drill at Spindletop, and the discovery was at 1100 ft in depth. Although the field at Spindletop has produced around 160 million barrels from both the cap and sides, the cap rock reservoir has produced about 55 million barrels. That means that if the total footage drilled was about 2500 ft. in these three wells, the amount of oil found was 22,000 barrels per foot and the total cash expended on all three wells was less than $10,000.00. Technology has changed so much that is hard to make a comparison, but an equivalent depth well can be drilled and completed for around $200.00 a foot ($220K for an 1100 ft. well). At $80.00 per bbl for the oil discovered, the Spindletop well would have discovered $4.4 Billion dollars worth of oil for a Return on Investment of 88,000,000 to 1 and an EROEI of 1,760,000 to 1.

However, I wouldn't hold my breath waiting for the discovery of any new salt dome cap rock fields. The last one discovered onshore in Texas was the Humble Field in 1905.

The real return on investment was nowhere near that high, either, as there were no tanks, no shipping, no refineries so oil prices were all over the place in a thinly traded market. But, the return on investment was so high that Texaco, Gulf and the guys who started the Humble Company can all trace their roots to the 200 acres at Spindletop and it was the beginning of the modern oil industry. Other early fields were very profitable too, and the oil industry expanded very rapidly.

The peak of Texas exploration was in 1930, while the peak of US exploration in 1950. Production for both peaked in 1973. After Texas exploration peaked, the big oil companies began to explore in other parts of the world, and after about 1950 in offshore waters. The cost of finding oil went up exponentially as they adopted much more expensive methods of geophysical exploration and went to frontier areas that were further afield. Meanwhile, the major oil companies had no real setback since the Great Depression.

In the middle 1970's the rest of the world began to catch on to how good a deal they had, the immense profits that the majors were making from the addiction of modern society to crude oil. In the Middle East, the government of KSA (The Kingdom of Saudi Arabia) renegotiated the original leases that gave the KSA 12.5% of the gross sales price of the oil to the formation of Aramco, with the KSA owning 50% of the Saudi fields and western oil companies 50%. Soon the result was that the majors were forced out of Aramco. The Iranians threw out the Shah, and the western oil companles with them and the wave of National Oil Company (NOC) production began in earnest. Escalating prices even resulted in an oil price freeze by Nixon in the US, and then the Windfall Profits Tax.

But the market was growing so fast and the costs were still so low that the Majors continued to make money as fast as they could rake it in. But, the Majors became merely the big oil companies. The NOC's now owned 82% of the world production, the independents in the US about another 6%-8% and the majors were pushed off their fat, full teat to sucking away at rapidly depleting ones.

In the meantime their overhead has kept swelling. They can't make any money off fields that have less than 25 million barrels, and they've drilled up all the acreage thats possible for giant fields in US onshore or offshore waters. Thats why they like the Alberta Bitumen. Its the only place they can see a big prize in a halfway politicially safe area. And, they act like dinosaurs on a short grass prairie. Because some of their tactics worked in the past, they think they will work today. Political donations worked wonderfully with the Democrats and Lyndon Johnson, so they have kept putting more and more money in politics. This was OK with Lyndon Johnson and John Nance Garner, because they were good men and true patriots. But they've put their money behind more and more cheap theives who are greedy for power, and now we have the Bush Dynasty, Cheney and James Baker, whom I consider to be traitors because they could care less except where their pockets are concerned.

The big oil companies are just about finished. They can't survive as giants, and aren't smart enough to get smaller to get nimble, just as the car companies can't see that they need to ditch the internal combustion engine for hybrids and electric cars. And what scares me is they may decide to take down the world rather than change while they have time and money to change.

` Bob Ebersole

" the car companies can't see that they need to ditch the internal combustion engine for hybrids and electric cars"

I think important parts of the leadership at GM are getting it - GM seems to be really be putting their full resources behind the Volt. Toyota gets it, though they don't want to admit publicly that PHEV's are the next big thing, as they don't have their PHEV ready yet. Honda wants to expand their hybrids, but they've had a hard time getting it right: the Insight was too small, the Accord was tooo big (I'm thinking about the 3 Bears...).

The rest of the industry is following, albeit very reluctantly. They don't really like hybrids, but most are planning to come out with a fair number of them. Ford and Mercedes are among the worst. The case of Ford is kind of sad, as they had a good beginning under Bill Ford with the Escape.

I'm a bit pessimistic about the fate of Ford & Chrysler longterm, but I think GM has a decent chance.

The only way G.M. survives is by shafting each and every one of their pensioners. They're far more heavily loaded than the other two U.S. makers and the financial news always prognosticates their doom well in advance of Ford and the Chrysler contraption.

I think all three of the big three are doomed and the only way we'll see an auto maker here will be a post bankruptcy consolidation of the big three, picking over what capacity they've got to build 2.0L and smaller vehicles.

"The only way G.M. survives is by shafting each and every one of their pensioners. "

That would certainly take care of the problem - just eliminating pensions would put all 3 automakers solidly in the black, and on an even footing with Asian manufacturers. Other things might help, like national health insurance, or allocating a portion of an increased gas tax to subsidize new, domestic, car sales.

allocating a portion of an increased gas tax to subsidize new, domestic, car sales

WHAT A WASTE OF TAX $ !

Alan

Amen!

Yes, but politically acceptable, right? If no one has credit its an empty gesture, yes?

Trying to think sneaky like a politician is hard work ...

[just eliminating pensions would put all 3 automakers solidly in the black]

Maybe they could knock over a few liquor stores too--that would help their bottom line.

Well, there are several points here. One is that if Detroit goes bankrupt, that doesn't necessarily mean the end of the industry. If they shed pension obligations, they could emerge from bankruptcy as very viable & competitive operations. I'm not suggesting that's not a morally good thing, but it's useful to keep in mind.

2nd, if Detroit sheds it's pension obligations, that doesn't necessarily mean killing the pensions. Another options is to federalize them, which would happen partially in any case with the Pension Benefit Guaranty Corporation (PBGC). That's a choice for us as a society to make.

3rd, we're the only major country in the world that makes it's corporations responsible for health care, especially for retirees. That's an enormous competitive disadvantage for Detroit. Add in other subsidies like the military shield, and currency differentials, and there’s a pretty good case for helping Detroit.

Let the investors and banks help Detroit. No tax money for corporations like US auto companies that have made bad choices due to mismanagement of assets and employees.

US government will be hard pressed to fund projects that will help its citizens adapt to less available imported oil. We need more money put in the energy efficient rail mode, not conitinued funding of the energy wasteful auto/ highway mode through taxpayer bailouts. We need fewer cars, over the road trucks and highway lanes in the post peak oil world. Bancruptcy and subsequent consolidation of the US auto industry will help in this regard.

US did not bail out the RR's except for the meager passenger train business called Amtrak. It helped some banctrupt RR's through loans which were paid back or grants recouped through later sales of assets (Conrail in late 1990's).

The automotive companies are a good example of how the need for growth gets wired into an organizations structure.

Everyone here knows that Detroit needs to be building and selling high efficiency cars for it to survive and the US to transition, but instead Detroit clings to huge SUVs (and the profit margins) and fights the CAFE standards. They have no choice. It is high profit margins or be crushed on the burden of past promises.

How many other systems are going to choose to break, rather than transition, because of a past assumption of infinite growth? How many ways is Infinite Growth woven into our corporate and financial systems?

Pensions are a good example. A pension is a bet that future growth will allow the company pay all prior employees on top of paying wages for current employees. And it is the bet that the pension obligation would be less burdening than just paying a higher wage now (and letting the employee worry about retirement planning).

Both the management and the union bought into the infinite growth idea. And both will lose that bet. They must in a declining world energy situation. The only solution is that everyone loses. How to contract the economy in an orderly fashion with the least amount of outright poverty, starvation and death?

Jon Freise

Analyze Not Fantasize -D. Meadows

I don't understand why conservatives want to default on corporate pensions while liberals want to default on corporate bonds.

What's the difference?

Pensions are much more important to the less wealthy, bonds more important to the more wealthy...

Seems too easy - did I mist the trick question?

What has hurt the Big 3 the most is mainly past mismanagement. They gave up the bottom end of the market 3 decades ago thinking they would concentrate on a more upscale market segment reaping a higher profit ratio. Instead they watched as the Japanese figured out how to make a profit in the lower end of the market and then use the toe hold to start expanding their product offerings.

GM has lost market share almost every year since about 1977. Ditto Chrysler. Ford has had a few years of upwards market share, but mainly at the expense of, yup you guessed it, GM.

They have simply refused to battle the Japanese in the trenchs. Now they get to live with their mistakes. And all the while market shares eroded, execs at the big 3 take home lordly salaries and bonuses.

And they have the gall to blame it all on the unions, OMG give me a break.

It isn't hard to see that yes pension obligations that were made when they enjoyed higher market share and unit sales are going to be a problem in a lower throughput situation. But not hardly the average workers fault. Mainly the total lack of vision, planning and asset allocation.

The big three have a pension obligation of about $750 for vehicle while the Japanese companies are all less than $200. The big three have been constrained by organized labor in some cases and unable to change or close factories. There are a lot of other factors, but we were talking pension liabilities.

Would the vision required to steer through what is coming have worked for a company required to report to its investors every ninety days? Nope ... the slate gets wiped clean and we find out what they have that is salvageable.

Part of my father's pension which still feeds my mom was due to some time spent at Fisher Body, the coachwork builder for General Motors. I don't have anything against union workers or investors ... just trying to figure out what happens next.

Yes, I agree. But the one thing that gets often ignored is that the unit pension cost would be MUCH lower if they had not frittered away market share, closing plant after plant after plant in the process.

They trumpet about their labor, pension and medical costs even as unit sales drop further. It has been a HUGE failure of management most especially at the steering and product planning levels.

They steadfastly refuse to publicly face the very root of their problem, product offerings. And for the most part they have been aided and abetted by the investment community. Only a very few analysts mention this issue.

Simply amazing to me, a retail business MUST offer product that the consumer wants. They have for the large part failed on this front.

That's like saying someone's brain cancer would be much smaller as a portion of their body weight if they gained 100 pounds.

It is accurate to say that the fixed costs of union workers are getting larger proportionately as the company gets smaller. However, "grow your way out of it" is not an achievable solution for a lumbering giant in a mature business. There was never any guarantee that GM could just bulk up and maintain a stable or growing market share.

Theft is always a good solution, is it not?

Some men rob the passerby

For a bit of cash to spend

Some men rob whole countries dry

And still get called their friend

And under the feeding frenzy

There's a wound that will not mend

From the song "The Mines of Mozambique" from the album "the charity of Night"

You can steal the pensions of the elderly, you can extend the Indian Wars to last indefinitely, you can globalize the genocide of "Injun Country" and you can pretend to rule the planet with raw brutality for God and Democracy, but ultimately you are left with whatever love you have managed to give.

The so-called "Free Market" is a tiny invention into which we have tried to imprison all of the genius of humanity, and with which we have destroyed ourselves and our planet.

The best thing for GM and Ford to do is to repent. The corporations have long outlived any good they do. Laborers should be paid their pensions, stockholders payed if any money is left, and the corporations dissolved.

Sometimes you have to break a few eggs to make an omelette. Creative destruction in the capitalist world, eh?

Now that Chrysler is under private ownership, I think the money men will right the ship and either take it public again and get out, or sell off the whole thing in chunks.

Ford, on the other hand, has some winning aces, but is unwilling to play them. It already builds small, efficient (even diesel!) vehicles. However, they well them everywhere else in the world. Why they'd rather flirt with bankruptcy than bring those vehicles here, just boggles the mind.

damac,

I suspect the Hedge Funds plan to loot whatever's left in th pension funds, sell the real estate and scuttle. They only paid the Germans 5 cents on the dollar for what they paid for the company. But combine Caiman Islands bank secrecy with the Bushites non-disclosure for Hedge Funds and theres a perfect opportunity for piracyBob Ebersole

It's tougher than you think to bring European vehicles here.

First, European vehicles use interior components that require a different voltage than U.S. does.

That makes mixing and matching parts an impossibility.(hence GM's struggles to go "global")

Second, European vehicles don't meet U.S. Federal Motor Vehicle Safety Standards.

Third, a lot of those high efficiency diesels are dirty! Unless they can meet future EPA emission standards, car co.s won't consider bringing them here.

Fourth, and probably most significantly, there hasn't been a big enough demand for diesel cars stateside. That makes it difficult for marketing departments to identify a "reason for being".

Last, diesel is not as widely available as is gasoline. not every fuel station sells it. Ironically E85 is VERY difficult to find but many new cars are E85 capable.

Spaceman said

This seems to be a common American misconception. All passenger car diesels currently sold in the EU conform to the Euro4 standard. I currently drive a Citroen C3 diesel - a small 4 seater, 5 door hatchback with a high efficiency engine and a particulate filter on the exhaust. Does about 50mpg in town. (I'm not an aggressive driver!) If I stand behind it when it's idling I don't see or smell anything.

http://en.wikipedia.org/wiki/European_emission_standards

This is of course just a subjective comment - Ive no idea what the emmission standards for diesels are in the US. I imagine NOx is more of a problem in California than it is in most of the EU.

ps

thats 50mpg Imperial not US!

At Jay Hanson's Killer_Ape list-serve we were talking about What-is-money?

I was surprised at how many people (including myself) had not taken a deep introspective look into the many meanings of the word "money".

Money is created out of thin air (it is not mined, harvested or other wise extracted from nature) when people make promises to each other (e.g. I promise to return to you in one year from now 5% more money than the amount you give me now --in other words I will manage to create 5% more than exists right now).

The definition of money has changed as we "evolved" from an economy based on tangible assets to one based on intangible ones.

Congress asked to lift debt ceiling

WASHINGTON - Treasury Secretary Henry Paulson told Congress on Wednesday that the federal government will hit the current debt ceiling on Oct. 1 ........

http://news.yahoo.com/s/ap/20070919/ap_on_bi_ge/debt_limit;_ylt=AmvWQ0Qq...

I see the major fallacy of our man-made economic theories as being unable to assign a "value" to nature. The majority of plant and animal species have no valuation assigned to them, and as they go extinct unnoticed everyday, we only hasten our demise as complex ecosystems simplify and collapse in an increasing move towards monocultures which are assigned some value. Economy and Nature are invariably at odds with each other when mankind has had the upper hand recently in terms of his machines and sheer numbers. With a global population that has quadrupled in the last 100 years (Al Gore) I see no solution other than an abrupt decrease in the population of mankind. The Earth has survived 4.5 billion years, nature will survive the coming 6th extinction which we will have wrought, albeit with species that seem as alien to us now as those abundant in the Paleozoic era.

Or just unable to assign anything but "monetary value" to nature. Monetary value is what the system is designed around. Hence why corporations and other legal entities have no hesitation breaking the law or entering morally questionable ground so long as they see the monetary outcome as statistically favourable - i.e. if they think they can get away with it, or if caught the fines are not likely to outweigh their gains. And companies that do make a show of "caring" about nature and the environment are usually doing it more as a PR technique (i.e. to gain consumer confidence - hence $) and/or to comply with Acts (i.e. not be fined and lose too much money). It all comes back to $$$...

"You can never solve a problem on the level on which it was created."

Albert Einstein

Our economy is as based on tangible assets and services as it ever was. Our perception of money has changed from being an energy-carrier to an energy-source, much like electricity.

Electricity must be generated by an energy source, coal, gas, oil, uranium, etc. Money, similarly must be generated by an energy source: people. Human activity, which has always produced goods and services, which has always needed a given amount of good and services to produce more.

Raised in a culture of consumption and money, we believe that money is what's necessary to make the world go round. Not true, never has been true. Human activity is what makes the human world go round. People using tools and skills to provide other things and services to other people.

Money, as most people consider it, is actually an illusion and neither necessary nor sufficient for a stable human society.

Goods and Services

Well there you go again, probably without any awareness of it, being a parrot for the priests of "Economics".

Did you ever consider that the economy generates Un-Goods (aka Bads)?

Did you ever consider that the economy generates Un-Services (aka Disservices)? ... war, famine, hurts, injustices, etc.

Did you ever consider that the economy generates many a nothingness (something that is neither good not bad, neither a service or disservice)?

The language of economics is filled with false choice frame-ups. "Goods and Services" is one of them.

(Query: Two humans hurting each other. Why is that a "Good" or a "Service"?)

I said "always", not "only".

Sport is a service. They are getting paid for that. A bar fight, in and of itself, is not economic activity. Participants are rewarded with survival for their efforts. The bar keep is rewarded with damage, which he may then use as a reason to charge higher prices in the future. The repair contractor is rewarded with more immediate economic activity.

A good example of that is the criminal justice system, which needs to criminalize something, anything, in order to generate demand for itself.

710

I like the way you put that!

All of our financial services industry has lead us to believe that money has value in and of itself, and that it can be counted on to earn investment income in years ahead. Part 2 will talk more about related issues.

When actuaries think about something like Social Security, they often think about what the total goods and services available to society will be at a particular point in time - say 2020, and what share of those goods the retirees will get. It is pretty clear that if the total amount of goods and services goes down, the amount retirees will get needs to go down - and probably not just proportionately. Retirement ages are likely to be raised, and benefits made less generous.

Glad you like it. Feel free to use the analogy. :)

Still not sure why actuaries haven't exposed SS for the ponzi scheme it is ...

I think it's perfectly clear that retirement ages will have to rise whether or not the economy does well. As people live longer the benefits promised by pensions balloon beyond all rationality. People are healthier & living longer - retirement before age 70 made sense when people were effectively disabled at 60 or 65, but that makes no sense at all now, when people are "able" well into their 80's.

Seems to me that really we need to talk about two levels of economics.

The primary level is the production and exchange of goods and services. The range of possibilities shifts with the availability of raw materials, with primary productivity of field and forest and sea, with technology and the availability of expertise.

The secondary level has to do with how people decide, individually and in groups - how they choose among the possibilities.

Money is basically a decision-making tool. More fundamental than money is the idea of property or ownership. Ownership is also just an abstract idea, a social construct. If the land is mine, then I can decide what to plant, when to harvest, etc. Ownership grants decision-making authority.

Money is really just a way to shift property around in time and space. I can sell some goods in one market, then go buy goods in a different market. All I have to do is carry my piece of paper in between. Or I can sell at one time and buy at another. Money is something that is easy to accumulate and store or transport.

Of course by now we have become lost in abstractions, i.e. money. The big shifts coming at the primary level will redirect our attention! What I think will be very useful for the next decades will be to develop lots of models and analysis and optimization back on the primary level. When the primary level is stable, the secondary level can grow quite elaborate and still things can hang together. But when the ground is shaking, all that secondary stuff is going to coming falling down. We need to look again at the basics of producing food and shelter and providing health care and education. These are the pillars of human culture. I guess some kind of police/military seems unavoidable too. New constraints will be shifting the range of possibilities at this fundamental level. Then we do need to figure out some decision making mechanisms that can help us choose in a way that at least avoids the most miserable of these possibilities.

Interesting ideas!

Fine business Gail.

I am imagining our economy as a modern bells and whistles auto. We have a diminishing amount of energy but have been countering this with increased efficiencies. Efficiency attempts to reach 100% and energy attempts to reach 0%. IMO we have less in the way of tech induced efficiencies to look forward to but lots in the way of energy deficiencies (eroei). So, my guess is (and it seems apparent) that we will start to gradually remove from our vehicle all those bells and whistles. There are countries we look on much like those little extras -- power seats, power windows, power power -- that we are discarding as unnecessary energy drains. To keep this a short analogy, as it deserves to be, we end up clinging to a striped down beast consisting of engine drive shaft and wheels. After that is when things get difficult.

In my own attempt to deal with energy more usefully, in a perverse variety of bell and whistle reduction, we have become a multi vehicle family. We have a motorcycle, a van, a small trailer for hauling dung etc. and a tandem bike. With a little bit of planning and by living in a small town this worked quite well and we are spending less on fuel than we did a whole lot of time ago (decades). We would like to get rid of the van and replace it with a small enclosed engine and drive shaft but we can't sell our van which has been referred to, by some young punk kid, as '...that beat up rustbucket old hippie van'. And besides it doesn't want to die so we are stuck there. We could kill it but feel that would result in greater energy losses so are waiting for it to die of natural causes, and then life will be beautiful ... for a while:)

Your take on debt doesn't seem to present a picture that I would be happy with. Debts from the Revolutionary war were huge in comparison to the economy at the time. What about 'not worth a Continental' and the paper printed by Paterson, the initiator of the paper bank note? Debts at the end of the second world war - tens of billions!!! - were supposed to reduce the sons of the victors to eternal penury.

Maybe we aren't reading the same economic history books. Try The Age of Uncertainty by J K Galbraith, or Freedom and Organization by Bertrand Russell. Your take that we have recently invented a new economic wheel based on increased debt isn't convincing. One of the main reasons people came to America was to escape debts or to acquire land without taking on unpayable debts. That didn't last long.

The above mentioned books are not only informative, but both authors have a dry wit and sense of lovable human frailty that I find fulfilling.

I'm also noticing a tendency to blame the US housing bubble for European banking problems, but they have had a bubble too. A huge bubble. I'm not even going to mention China, oops. Wise heads have pronounced concern over the international scale of the situation, which the typically inward looking American financial establishment isn't paying much attention to.

It isn't the debt, it's the debt serviceability. If PO reduces economic flow - which it doesn't have to - then debt serviceablity is a problem. If new debt flows to alternate sources, it isn't. Just because United Buggy Whip was in Chapter 11 didn't mean the end was near in 1907.

Petro: I don't totally buy the whole oil is everything, but you are stretching it way too far to use the example of post WW2. If you can realistically conjure up a scenario whereby North America totally dominates world industrial output (e.g. 1950) and global oil supply increases 400% (1950-1980) then maybe the current debt levels are quite manageable. IMO, current debt levels are not sustainable without the added burden of oil depletion.

Electricity is the major candidate for replacement of oil (and eventually fossil fuels), so an important question is: how is the price of electricity changing?

The EIA table (http://www.eia.doe.gov/cneaf/electricity/epa/epat7p4.html ) shows the price per KWH going from 6.91 in 1994 to 8.14 in 2005, for an 18% increase, and a 1.5% annual increase. This is less than inflation. So, the price of electricity, adjusted for inflation, has dropped over this period.

Now, prices hit a bottom in 1999 at 6.64. Since then they rose at an annual rate of 3.45%, and inflation has been 2.55%, so they've risen at a real rate of .9% per year: that's not a lot.

On the one hand one could argue that measuring from the low point of 1999 is cherry-picking data, OTOH you could reply that we know that conditions have changed since then, with FF inputs rising in price. Finally, I think you have to observe that only oil & gas, at 21% of electricity supply, have actually risen in cost and had limits to supply, while coal and nuclear, at 70% of supply, have not.

So, I think you have to conclude that electricity costs are not rising significantly, and don't show the same problems as oil & gas.

While using 1999 may be cherry-picking the data, we know that electricity uses coal and natural gas, and these tend to be going up because of the price pressure on all forms of energy. Because these are likely to continue to rise in the future, and we don't seem to be getting big efficiency gains, we are likely to continue to see a continued rise in the future.

I agree that electricity is not experiencing a very steep rise yet, but we have lost the real price decline that contributed to growth.

"we know that electricity uses coal and natural gas, and these tend to be going up because of the price pressure on all forms of energy."

Natural gas is only 18% of electricity supply.

There is an important distinction here between prices and costs. Coal and nuclear are the major players at 70% of supply, and the costs of supply from existing plants aren't going up. Their prices are going up, but that's a windfall which simply shifts income between parts of the economy, rather than increasing costs to the economy or lowering energy availability to the economy.

"we don't seem to be getting big efficiency gains,"

Your data is very broad and imprecise. If you look at specific industries (e.g., domestic electric appliances, computer cpu's, or new light vehicles in the last 2 years) you see very significant increases. More importantly, it's clear that very large increases are broadly available, and simply haven't been important until very recently because FF's were so cheap. For example, a 50% increase in fuel efficiency in light vehicles is available even without hybridization, and a 100% increase with hybridization.

"we have lost the real price decline that contributed to growth."

The price decline is certainly nice, but it's not the major contributor to growth. There is an enormous value surplus to energy above and beyond it's price, and that's what delivered the vast majority of its contribution to growth. For instance, some of the research you discuss estimates the value of oil to growth at $300/bbl, so even when prices rise to their current levels roughly 3/4 of the value contribution is still there (of course, costs are still much lower, so most of the effect of the recent price increase is simply a transfer of wealth from consumers to producers).

An important point here is that all of these models are analyzing correlation, not causation - there's no reason to assume that the correlation between btu inputs and economic outputs can't change. You've addressed that when discussing efficiency, but still, it needs emphasis.

A final point: oil is now sharply limited, and gas & coal will get there sooner or later, but renewables aren't. Coal and nuclear can easily continue to supply their existing levels for several decades as well as provide some additional growth if needed, while wind, solar & others transition to replace fossil fuels. The cost of renewables provides a ceiling to the cost of electricity. Wind is cheaper than natural gas, and only slightly more expensive than coal, andthere will be some additional costs to deal with the variability of renewables, but those costs aren’t enormous. Therefore that price ceiling is not very far above current prices.

This is a chart showing the fossil fuel component of electricity costs. Natural gas is far and away the largest dollar component. It is hard to get an analysis of nuclear in the same way, since the huge front end and back end costs are the overwhelming issue.

This chart also shows how the cost (per 10^6 BTU) for all fossil fuels used in electricity production has been increasing recently. The weighted average cost for all fuels combined is shown below. The chart which I linked to shows the figures separately for coal, petroleum, and natural gas.

1999 144

2000 174

2001 173

2002 152

2003 228

2004 248

2005 326

"Natural gas is far and away the largest dollar component."

Sure. NG has gotten relatively very expensive: 5.3x as expensive as coal per BTU, per the EIA table (http://www.eia.doe.gov/cneaf/electricity/epa/epat4p5.html). But, coal provides 3x as many BTU's as does NG. Nuclear provides more BTU's than NG. And, only 2.6T CF (about 45%, from the data for FERC Form 423 for electric utilities) in 2005 were for pure electrical production by major utilities, the rest being from CHP plants and smaller independents.

"This chart also shows how the cost (per 10^6 BTU) for all fossil fuels used in electricity production has been increasing recently."

No question. But, only 18% of the KWH's are from natural gas, making them relatively easy to replace (with some time for the transition, of course) - look at the NG contribution in 1999 through 2001: as NG prices rose, NG useage dropped sharply, by almost a 1/3. A look at comparable data from 2005 shows that NG useage has only recovered to 2.6T CF, the 2000 level, and 15% below it's peak in 1995, despite significant industry growth. We should also note that 1) coal prices increased only from 122 to 154, 2) we still have the cherry picking problem of choosing the low point in 1999 - it's partially valid, in that it highlights the increase due to the spike in oil prices, but it obscures the longterm trend, and 3) it's striking that FF input prices rose by 126%, and yet kwh prices rose only 23% - this partially reflects price controls, of course, but it also reflects a nuclear contribution, and increasing efficiencies, including more efficient NG turbines.

Finally, let me say it again: price is not cost. Coal prices began to spike in 2005, due to fuel switching from NG to coal and the lag time required to expand production & transportation, but mining & transportation costs didn't go up (though the railroads did manage to increase their prices somewhat, though, again, their costs didn't increase either). Instead, coal producer (and railroad) profits rose, transferring income from utility customers to coal company shareholders, leaving net social income unchanged.

Price increases due to temporary shortages, as in coal, purified silicon, wind turbines, etc, are not cost increases. What you, Gail, are concerned about are fundamental cost increases which put a strain on societal resources, impoverishing society. This is not what we are seeing here.

You are suggesting that there is a longterm problem with electricity cost and supply, and there simply is no evidence for that. Instead, we are seeing a modest temporary spike due to NG, which will subside as NG is replaced by utilities.

But, only 18% of the KWH's are from natural gas, making them relatively easy to replace

I think that is like saying Energy only accounts to x% of GDP....

The thing about NG generated Electricity is that it's instant power. On days where the demand leaps, you can't take 8 hours to crank up another type of generator.

Natural Gas is the only thing that will keep a brown out from becoming a black out in most instances.

A MOST important 18% contribution.

Not all sources have the same characteristics.

Hydro and Pumped storage are even better than NG for several reasons.

Response time is 90 seconds to a few minutes depending on details of the headrace, etc.

The massive inertia of the hydroelectric turbine, multi-pole generator (10 to 24 poles vs 2 for NG) and coupled water column (incompressible fluid makes it mechanically part of the machine) is great for grid stability and absorbing transients.

The multi-pole generator does a great job of creating a perfect sine wave and cleaning up distortions (off-sine wave, voltage, etc.)

Alan

Thanks, Alan, for being such a strong and persistent supporter of pumped hydro storage. I have a hard time understanding why it isn't the run-away (npi) favorite of people here, since it has so many proven virtues. I also wish I had not lost that reference on how to make cheap holes in the ground to replace that convenient local mountain reservoir. Maybe somebody could search "cheap holes in ground for hydro storage" and post the results.

I am having fun as usual making my own biomass gasifier-stirling- pump- turbine-alternator- hilltop store system for my house. I am not wasting anybody's money and time but my own so I am not feeling all that guilty about this little frivolity. Better, I think, than golf or drink.

And thanks to Gail for this interesting and important bit of education in econ. I have given it to my wife as an essential read, since she is much smarter than I am in such stuff (and in what else is she? hahaha.).

I think pumped-electron storage:

http://electricitystorage.org/tech/technologies_technologies_nas.htm

http://en.wikipedia.org/wiki/Category:Rechargeable_batteries

... has a bright future as well. Works on a neighborhood level where it isn't convenient to pump fluids around.

1st, Alan has a good point: Natural Gas is far from the only way to provide quick response to load variation. Other ways include demand management, long distance transmission, even V2G, eventually.

2nd, the fact is that NG is used for baseload in a lot of places, while others get away without it. Chicago uses essentially zero NG, while IIRC California and FLA use around 50%.

3rd, wind and NG have a nice transitional synergy, as the wind can reduce NG useage, while the NG can compensate for wind variation. Growing wind production tends to reduce NG useage 1st.

4th, if you have to use less dispatchable sources like coal, nuclear or wind instead of NG, you may just waste a little electricity during short periods of lower demand. That can be compensated for with demand management, but if not, the cost of a small % of wasted electricity is much smaller than the NG useage that has been avoided.

Natural gas is much cheaper per BTU than oil, yet they are using oil instead of natural gas in their vehicles. Coal is great. The Sierra Club would like to cut coal use because of mercury emissions. The average person gets 75% of his/her mercury poisoning from amalgam dental fillings and only 25% from fish, meats, and vegetables, etc. In 98% of Finland citizens with amalgam fillings, the mercury content of their saliva was higher than Finland allowed in their drinking water. Coal has alot of BTU's in it, so does sunlight striking the earth.

Electricity is not an energy source, it is an energy carrier. Electricity can't replace anything.

Aside from petroleum, the energy sources used for electricity include coal and gas, and also hydroelectric, solar, geothermal, uranium (nuclear), and wind. It is from these remaining sources that you can get electricity, and it is only from these sources that a replacement for declining oil production can be found. The cost of processing these sources using the currently FF-dependent infrastructure will determine future price increases of electricity.

I agree. Electricity can replace some other forms of power, but you have to get electricity from something else - fossil fuels, nuclear, wind, or some replacement.

"Electricity is not an energy source, it is an energy carrier. Electricity can't replace anything."

Sure, but 1st,that's not the only way to look at it: you can think of electricity from wind and solar as similar to refined products from oil - the wind turbine or the solar panel converts one form of energy into another, more useable form, as does a refinery.

2nd, even if we agree that this point is correct, let's agree that what I referred to as "electricity" is shorthand for the longer phrase "electricity generated from multiple sources, especially renewables".

As a practical matter, the difference isn't important, because the conversion and handling of electricity is very efficient, unlike hydrogen (or, arguably, liquid biofuels), for which this is an important point.

You didn't refute my point. Electricity is still an energy carrier and it still can't replace anything.

You actually want to replace natural gas, coal, oil and nuclear with wind, solar, hydro, and more nuclear using an infrastructure overwhelmingly dependent on natural gas, coal, oil, and existing nuclear. But this infrastructure doesn't just support your change initiatives, it supports the very existence of the bulk of humanity on this planet.

And you want to do this now that there are 6.6 billion people to support while methane is in decline in North America, the oil is starting to run short worldwide, and effects of the ELM will drastically pull oil (and other necessary commodities) off the world market.

We put all the energy and materials we generate today into something for tomorrow. So where do our energy and materials go?

Here:

Human Necessities – The basic food, water, shelter, and sanitation that all 6.6 billion humans require, expected to grow by (births minus deaths) another 200K tomorrow. Sanitation includes dealing with effects from our soiling our nest, such as deforestation, pollution, topsoil depletion, climate change.

Energy Production – Energy required to get more energy from existing infrastructure, eg., to pump methane, pressurize water or methane for oil extraction, distill ethanol.

Infrastructure – The maintenance and development of the physical systems needed for service and product delivery. This includes the development of technology. Examples are road maintenance, pipeline extensions, electrical grid buildout, and support for researchers and scientists who theorize, develop, and test technology.

Other/Lifestyle - Everything else we use energy for, our lifestyles. This includes the incremental energy needed for caviar vs. chicken eggs, or deep dish pizza vs. tortillas and raw tomatoes.

All of the energy and materials we produce ends up somewhere in this group, allocated between Necessities, Production, Infrastructure, and Lifestyle.

The problem is that there are so many of us already straining the overall planet's resources and oil production is about to decline.

Electricity is an energy carrier. Electricity can't replace anything. Only other primary energy sources can: coal, methane, oil, uranium, solar, geothermal, hydro, and wind.

Currently, all these primary energy sources are being used for something other than your change initiative, so to the extent that you want to develop wind, solar, nuclear, geothermal, or hydro, that development means increased energy investment in Infrastructure, taking energy away from Necessities, other Production, other Infrastructure and Lifestyle. In other words, increasingly not meeting basic human needs among a growing population, lower energy production elsewhere, declining infrastructure, and less quality of life across the board.

The system is already being strained as a whole. Adding more strain will not help, unless it is coupled with a tightly-managed voluntary or coerced massive reduction in consumption.

And we won't be seeing any voluntary reductions in consumption among the 6.6 billion blissfully unaware and unwashed masses.

And who has the influence to enforce a controlled world-wide reduction in consumption? So we won't be seeing that either. Nuclear war and pandemic would qualify as uncontrolled reductions.

And there is also a dependence time lag which must occur before any new development and infrastructure buildout gets up to speed, a time measured in decades.

There is plenty of evidence to suggest that we will have problems with electricity, not just in the long term, but in the intermediate term as well.

The 12% residual after 1975 is interesting. Could it be speculation in the stock market? Or perhaps printing of excessive amounts of paper money? When was the dollar freed from all backing?

I'd have to guess this is coming from the computer revolution.

And probably more important associated advances in design and modeling. I bet it would be safe to assume a good bit of this is better more efficient designs say at least 6%. This leaves 6% or less for advances in communication and information technology.

Considering how highly we think of of advanced technology a 6% real increase in GDP is surprisingly small for IT.

I take this as evidence that technology is probably not going to "save us".

1971 was the year the dollar was freed from the gold standard and also the year that US oil peaked. It was also the start of some pretty high inflation. I don't know how good the inflation adjustments were. These are the published annual CPI changes:

1971 .. 4.4%

1972 .. 3.2%

1973 .. 6.2%

1974 .. 11.0%

1975 .. 9.1%

1976 .. 5.8%

1977 .. 6.5%

1978 .. 7.6%

1979 .. 11.3%

1980 .. 13.3%

1981 .. 10.3%

1982 .. 6.2%

Gail, I'm looking forward to your 3rd installment the most as I will spend most time in the future! :o) Hoping you will consider the Inflation/Deflation theme that occasionally crops up here. Still havn't got my head around it!

Putting together a thought piece of my own and the basic conclusion I have come to is the current system is unsustainable and will become increasingly volatile in the years ahead with Energy and Food prises rising and the 'future growth premium' embedded into some assets completely wiped out -e.g. high PE values- that's assuming the market survives of course...

Nick.

"The Catholic Church forbad debt until 1822."

Debt was never forbidden. Interest was.

And the reason for lifting the prohibition is clear for anyone who understands the evolution of the monetary system. By 1822 fractional reserve banking was allowing M1 to grow faster than M0 (which was physically constrained by the amount of gold and silver mined). In other words, the nature of "money" was changing, becoming less "harder".

It might be useful to repost this contribution I made last year.

A key issue is the nature of the monetary system being used. Unlike in physics, where measurement units are simple and completely defined, in economics/finance, money - one of whose functions is *unit of account*: a measure used to set prices and make economic calculations - has very different properties depending on the monetary system in place.

Below I'll try to show that:

1. The existence of a WIDELY available, RISK-FREE, interest bearing investment requires a "soft" monetary system.

2. For that investment to also yield a REAL positive interest rate, the economic system must be on the way up to Hubbert's Peak.

By "soft" monetary system ("funny money" in gold bugs' jargon) I mean one which is not PURE precious metals-based. By that in turn I mean one in which circulation consists exclusively of bullion or at most of certificates thereof issued by "100% reserve" banks.

So, funny monetary systems comprise:

- the fractional gold standard, which was inherently unstable (because a fractional reserve banking system demands a lender of last resort and the gold standard prevents the existence of one), was suspended during any major upheaval (such as Napoleonic War, American Civil War, WWI) and was definitively abandoned during the Great Depression, and

- the fiat money system, both in its universally adopted fractional reserve banking flavor and in the theoretical-domain 100% reserve banking flavor (Simons 1934 and Fisher 1935).

Of note, the biblical prohibition of interest was issued when the monetary system in effect was pure precious metals-based. And it applies to that system. So it is legitimate to earn interest from the current funny money system.

To demonstrate the first point, let 's assume we have a pure gold system. How can some person or institution make a risk-free promise to anyone to pay them interest on the gold they initially lent (plus the principal at maturity)? By one of two ways:

a. The borrower has the power to exact ever increasing quantities of gold from subject/victim populations, i.e. to forever expand its share of the total bullion stock. Clearly that cannot last long.

b. If we assume the borrower's share of total bullion stocks to remain constant at most, which is plausible, then we need the total stock of monetary gold to grow exponentially at that rate or higher (which implies that the amount of gold mined each year must grow exponentially at the same rate too). Actually, the cumulative gold production did grow exponentially, only the rate was very low, as you can calculate from the data at page

http://www.gold-eagle.com/editorials_00/mbutler031900.html

Thus, the annual rate of growth of above-ground gold stocks was 0.11 % from 1200 BC to 600 BC and again from 300 BC to 500 AD (see the reason for the biblical prohibition of interest?), dropping to 0.05 % during the Middle Ages, to rise to 0.59 % during the XIX century and to 1.7 % on average during the XX century (actually it was 1.8 % 1900-1950, 1.6 % 1950-1975 and 1.5 % 1975-2000). Adding silver to the picture changed the above percentages very little.

As said, the above figures provide the ceiling for the interest that could be offered by a risk-free investment if a pure gold standard had been in place. BTW, 1.5 % leads to k = 1/67. Of course, the correlation of higher rates with higher energy use in the XIX and XX centuries is no coincidence, as modern mining is very energy intensive, which also means that, after Hubbert's Peak (for oil and for precious metals), the annual growth rate is bound to get lower and lower.

In a fiat money system, on the other hand, the monetary stock can (and certainly does!) grow exponentially at any rate that suits the keepers of the printing press, so the government can promise beyond any risk to anybody to return them any nominal interest rate below that.

Now comes the second point: how do you insure that the nominal interest earned (plus the returned principal) allows the lender to buy more REAL goods and services than the principal initially allowed them to, in a fashion of a certain annual real rate? By having the amount of available goods and services grow exponentially at a rate that fulfills:

(1 + yGR) = (1 + RIR) (1+MGR) / (1 + NIR)

where

yGR: real Net National Income Growth Rate (approx real GDP Growth Rate)

RIR: Real Interest Rate

MGR: Monetary stock Growth Rate

NIR: Nominal risk-free Interest Rate

*Since MGR >= NIR as said above (to make the investment yielding NIR risk-free), it follows that the real GDP growth rate must be >= the real interest rate.*

(BTW, the last condition holds for any monetary system, hard or soft, and it comes from the Fisher Equation of the Quantity Theory of Money, M V = P y, assuming constant V. See Appendix.)

The good news, then, is that after Hubbert's Peak, since real GDP Growth rates will become negative for a long time, so will real "risk-free" interest rates, and therefore there will be no financial incentive for clearcutting the forest.

Appendix:

At t=0, let be:

y0 the real Net National Income (can be subsituted by real GDP, since we will deal with its growth rate, which will not differ substantially)

M0 the monetary stock (M1 or M2 depending on country)

P0 the price level = M0 V / y0

Let's call Real Purchasing Power at t=0 what an initial amount A0 can buy:

RPP0 = A0 / P0 = A0 y0 / M0 V

Let that initial monetary amount A0 be invested in a risk-free vehicle that yields a nominal interest rate NIR.

At t=n, we have:

yn = y0 (1+yGR)exp(n)

Mn = M0 (1+MGR)exp(n)

Pn = Mn V / yn

An = A0 (1+NIR)exp(n)

where

yGR: real Net National Income Growth Rate (approx real GDP Growth Rate)

MGR: Monetary stock Growth Rate

How much can An buy at t=n?

RPPn = An / Pn = Ao (1+NIR)exp(n) y0 (1+yGR)exp(n) / [M0 (1+MGR)exp(n) V]

RPPn = RPP0 (1+NIR)exp(n) (1+yGR)exp(n) / (1+MGR)exp(n)

Now, you want RPP to grow at a certain annual Real Interest Rate, RIR, so:

RPPn = RPP0 (1+RIR)exp(n)

From the last two equations:

(1+RIR)exp(n) = (1+NIR)exp(n) (1+yGR)exp(n) / (1+MGR)exp(n)

Taking the nth root:

(1+RIR) = (1+yGR) (1+NIR) / (1+MGR)

As said above, for an investment vehicle that yields a nominal interest rate NIR to be risk-free, NIR has to be <= MGR (otherwise it needs to capture an ever greater share of the monetary stock).

That implies RIR <= yGR

"For that investment to also yield a REAL positive interest rate, the economic system must be on the way up to Hubbert's Peak... after Hubbert's Peak, since real GDP Growth rates will become negative for a long time"

This assumes that peak oil equals peak fossil fuel (which it doesn't), and that peak FF equals peak energy, which is also not the case.

Peak oil does not equal peak fossil fuels - coal will be with us for a long time, and it will be used if it's needed to prevent economic collapse. Peak FF does not equal peak BTU's - renewables and nuclear will do just fine. Peak BTU"s wouldn't equal peak useable energy - the US could easily function with 10% of our current BTU's. Heck, replacing heat engines (with renewables for electrical generation and electric motors for transportation) would reduce our BTU consumption by 2/3, with no loss of functionality.

Beach Boy,

Regarding the Catholic Church, I agree the issue is paying interest, not debt itself. Of course, if you can't collect interest, it does cause a problem. I understand sometimes ways were found around the problem - such as converting the payments to another form of income.

Tomorrow's post talks more about debt and peak oil. My conclusion is pretty similar to yours.

The Biblical prohibition against charging interest was bypassed by the lender becoming part owner of the borrower's business or farm i.e. a share. The concept of being a shareholder is therefore ancient and at times proved more profitable than collecting interest.

Gail, Thank you, I appreciate the historical perspective and I await the next two in the series.

Beach Boy, great analysis, thank you very much.

First, I would like to post a link about inflation. Neither of you mentioned it. Hubbert talked about the money supply, inflation, interest rates and industrial production in his testimony before a congressional committee. Posted on the Energy Bulletin here. And it is very much in line with Gail's analysis of growth on the upside of Hubbert and Beach Boy's economic reasoning. In short he said that:

F = I - P

Interest rates = I

Inflation = F

Growth in industrial production = P

And I think that is more or less accurate, although in any economist will tell you otherwise.

Second, I would like to mention another function of money not yet discussed. Money is a way of storing work (in the economics sense of the word). I work a job, I get paid, I can use that money to buy work from other people. It is worth noting that fossil fuels also store work (in the physics sense of the word). In physics work = energy. In economics work = money. In reality work = work; getting things done, by human labor or machine labor.

Lastly, I would like to ask a question of both of you. Given that we are approaching the down side of Hubbert and neither the energy sector nor the financial sector seems to be prepared we can thus expect the financial sector to flounder. So the question is: Are there any financial or economic systems that are suitable for the downside? I heard demurrage mentioned in a previous post here, but that is at best a single component of a viable economic arrangement. Any thoughts?

Thanks in advance,

Tim

Thanks team10tim

I'd surmise as well that we work to get money to buy food so we can labour some more.

When money is all but worthless we will trade work for food and water.

Consuming will really mean consuming food and food only.

We will trade implements to grow, hunt and forage for food.

Labour, food, shelter, clothing and energy, it will be basic and simple.

Before we even get to the trading stage though, black markets will be the harbinger of our destruction.

When you hear talk of them and you begin to use them, you will know then, it's all over.

Sarcasm starts

Now I need to hear............

Use charts, graphs and figures to enhance your arguement

Electricity cost and supply is not affected by a failing economy.

Talk of wind turbines in plentiful supply, able to be manufactured and erected with their own energy output. Alternative energy powered transport just in time.

Farmers in full production because they only need, ethanol, electricity and natural gas.

No need to worry about food because fertilizer is made from natural gas and fertilizer is the farmers major cost.

Pumped energy storage which will save the world.

Dozens of ten billion dollar nuclear power plants being constructed because any idiot would know uranium is cheap and clean to mine and refine, in plentiful supply and waste is not a worry and that you will get your money back in short order.

As soon as gasoline is too expensive or scarce, everyone will have access to energy efficient vehicles.

We will cover land the size of California with sugar cane to make ethanol, because ethanol made with sugar has an EROEI of 10-1.