Declining Net Oil Exports Versus “Near Record High” Crude Oil Inventories: What is going on?

Posted by Prof. Goose on September 14, 2007 - 10:18am

This is a guest post by Friend of TOD Jeffrey J. Brown, an independent petroleum geologist in the Dallas, Texas area. His e-mail address is westexas@aol.com.

You can also check out Jason Bradford's recent interview with Jeff for The Reality Report over at Global Public Media here.

Building on prior work by Matt Simmons and Kenneth Deffeyes, I have written a number of articles on Net Oil Exports, often with my frequent co-author, “Khebab,” most recently, “Net Oil Exports and the Iron Triangle.” We are going to present a quantitative assessment of future net exports by the top net exporters at the ASPO-USA (Association for the Study of Peak Oil & Gas) conference in October, in Houston, Texas, and we will be doing a preview of the paper in late September.

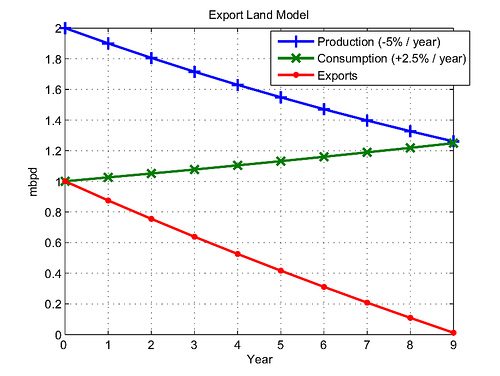

Above the fold was a graph of the Export Land Model (ELM), for a hypothetical net exporter, showed peak exports to net importer status in nine years. (For a better explanation of the meaning of that chart, check out this post.)

It’s interesting that the UK and Indonesia showed even sharper net export declines, going from peak recent net exports to net importer status in seven years and eight years respectively. The ELM and the UK and Indonesia case histories showed that net export declines tend to accelerate with time.

Note that the early data for Saudi Arabia are showing a similar pattern. The 2005 to 2006 numbers for Saudi Arabia are as follows (exponential increase/decrease per year, EIA, Total Liquids):

Production: -3.7%/year

Consumption: +5.7%/year

Net Exports: -5.5%/year

Extrapolating from year to date numbers, my estimates for 2006 to 2007 Saudi numbers are as follows (I am adding in some increased liquids consumption, because of their ongoing natural gas shortfall):

Production: -5.6%/year

Consumption: +10%/year

Net Exports: -9.5%/year

In addition, EIA data show an overall decline in net world exports from 2005 to 2006 that appears to be continuing into 2007.

Given this decline in net exports, It’s interesting that we have “near record high” crude oil inventories in the US, based on the five year range of crude oil inventories. In my opinion, the five year range for US crude oil inventories, as an indication of what is going on in oil markets, is highly misleading.

First, the industry has clearly gone to a Just In Time inventory system. In the Eighties, the industry maintained much higher crude oil inventories, especially in terms of Days of Supply, which have fallen to about 21 Days of Supply currently, from about 29 Days of Supply in September, 1982.

Second, we need to evaluate crude oil inventories based on Days of Supply in excess of Minimum Operating Level (MOL). In the US, the MOL for crude oil is probably about 270 million barrels (mb). At about 322 mb, US crude oil inventories are probably best characterized by Hours of Supply in excess of MOL (about 80 hours). In my opinion, recent fluctuations in US crude oil inventories merely reflect minor changes in a thin margin of supply in excess of MOL.

Refiners are unlikely to let their inventories drop below certain critical levels, and given the expectation of declining world oil exports, refiners will have two choices: (1) Bid the price up enough to keep their inventories up and/or (2) Reduce their crude oil input, thus reducing product output.

My contention is that instead of focusing on crude oil inventories, we need to focus on world net exports, crude oil prices, refinery utilization, product prices and product inventories.

I expect to see crude oil exports trending down, crude oil prices trending up, refinery utilization trending down, product prices trending up, and product inventories trending down.

I'm begining to hear the rumblings of distant thunder and it's making me nervous...

awaiting your quantitative ELM model with bated breath...

Regards, Nick.

There is also a question of quality maths that should be considered. Regard my response below.

Check out the Russan crude oil export number at the bottom of the thread.

http://science.reddit.com/info/2pgcf/comments

if you are so inclined...

Is it a good idea to spell out Jeffrey's email the way you did? Does he like spam that much?

That's what Jeff has done in every post to this point--his words, his choice.

You mean all those women don't want to have sex with me and I am not going to receive $100 million from my friend in Nigeria?

My spam filter seems to work fine.

When I go there, Prof. G., there is no vote buttton as for normal articles. Is this part of the discrimination you were talking about with these sources?

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

The reddit link looks fine to me - I can vote without any problems...

USA will be one of the last to see oil scarcity. As noted in the last drum beat post, where India faces depletion, the storm will hit first those who cannot buy the oil. And USA is the country with the most money.

Not only will USA foster a little bit longer than the majority of Import Land, but perhaps, perhaps it will trhive even longer than most export land countries. This is speculation on my part, but there seems to be an implicit truth in westexas export land model that may not render exactly as the real "truth". It is considered that export countries will firstly give their consumers their oil and just only afterwards they'll export the rest. I wonder if that will be the case. If USA can spend 150$ per barrel, how on earth will average saudi, russian, venezuelan, angolan, etc, etc be able to compete with that? Will the state oil companies just ignore the incredible amount of fortune that is being denied because of their own inhabitants? And a good example of this, yes you have guessed, is Iran.

So your triangle is a good uncomplicated graph, but reality may well be a different story. I can see perfectly well a country that exports oil but hasn't sufficient oil for their own. Perhaps not Russia, and KSA might have not the guts to do it, but others, why not? It might require more police control on the subsequent riots, but it can happen.

What about the political situation in the exporting country? Both the UK and Indonesia are relatively free and democratic.

Iran has implemented fuel rationing in a bid to cut domestic consumption. I can see many less democratic counties like Russia and SA using draconian measures to curb domestic consumption of oil in favour of selling it the open market at $150 a barrel.

I guess that we can divide the debate into pre-$100 oil and post-$100 oil, but I am struck by the similarities between the UK and Indonesian net export crashes, versus the vast differences between the two regions.

UK: High per capita income; high energy taxes; minimal increase in consumption.

Indonesia: Low per capita income; energy subsidies; rapid increase in consumption (up to net importer status).

A key point to keep in mind is that I expect many exporters to show rising cash flow from declining exports, at least initially.

In any case, one of the things I want to do with the preview paper, to be posted first at ASPO-USA, then presumably later on TOD, is to ask for feedback regarding the expanded ELM, as applied to top net exporters.

Also, I am not very optimistic about our ability, without the implied or actual use of force, to outbid other consumers. Ultimately, we have to offer something of value to trade for the oil, although I suppose that the US may be offering value in the same sense that a mugger offers "value," i.e., if you give me your money, I won't kill you.

Not only that. USA has a lot of political power in the world, perhaps enough to bend many countries' will in these matters. USA government will be very aggressive in the meetings with these countries, and they will pressure the most these countries to supply the oil they need, even if that implies gas cuts in those countrieslike in Iran, to prevent gas cuts inside US. Remember Dick Cheney motto: American way of life is not negotiable.

Yes, but will the USA just eat that cartel lookalike phenomenon without saying a word? Or will USA be one of the most aggressive buyers in the market? I mean, it is no tabu, USA is the bully of the world alredy, I'm not implying a change of attitude in any way. They are already with this attitude.

luisdias, I think you should consider that not only will most producing countries try their best to follow Westexas model but will be encouraged in that, as far as the US is concerned, by the decreasing value of the US dollar.

Personally I would not purchase US dollars right now and I do not see exporting countries trading their goods, as readily as previously, for those dollars.

Yes the US military may momentarily trump Westexas's model but judging by how things have gone in Iraq I would not expect something in that order to be very effectual in the long range in solving US oil needs. Bullying only succeeds up to a certain point. I think the action in Iraq has, as well, diminished US political power greatly, one has only to look to south America , half a world away from Iraq yet next right door to the US, to see how that power has been reduced.

I think we are in for interesting times as to who gets what and how.

Of course they will try! nobody likes being robbed. Remember Carter's doctrine though. USA will not negotiate American's way of life!

Well, I'm a believer of Yoda's preachings, so I fully agree with you: in long term, it will be bad. Something in the order of Violence generates Hate, Hate generates Fear, Fear to the dark side will lead you, hmmmm!

But it may just be enough for the USA plummet after the others. Now, this is speculation. I am not really predicting. I predict USA's reaction and this is what they will try to do. And I see a closing gap for them to do it, but it still exists. Remember that the oil market depends on the US army to be secure. Remember that!

Personal opinion: The US will lose its access to oil in the back half of the total of nations. I wouldn't venture to guess where in that back half though. It might be at the 51% mark or clear back at the end as the 100th% of the loss. But if I had to guess, I'd put the US losing its access to exported oil after roughly 2/3rds of the rest of the world has lost their access to the same. This is all seat of the pants guessing, of course, since none of us know what the future actually holds. We can only look at trends and try to extrapolate.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

"Yes the US military may momentarily trump Westexas's model but judging by how things have gone in Iraq I would not expect something in that order to be very effectual in the long range in solving US oil needs."

Considering that the DOD is the largest consumer of oil in the world, it seems to me that no matter how much oil we attain through such military action, most of it would have to go to the government/military just to keep the military operational. How well this would go over with the American public when they realized these wars were not getting them any more energy to keep their cars running and their homes warm, I can only imagine - unless, of course, we're under martial law and we have no say in the matter.

Linda

The U.S. Department of Defense uses about 200,000 barrels of oil a day, less than 1% of the overall U.S. usage.

On the serious topic of the U.S. or some other country using military force to take oil - it seems unlikely that the U.S. would do this. Does anyone on this board think we ought to? I can't recall talking to anybody who does. The current Iraq conflict is not an example of seizing oil, since Iraqi oil is being sold to all kinds of players, many unfriendly to the U.S., and the Iraqi oil the U.S. gets is paid for at near record prices.

The Iraqi war, combined with mindboggling incompetence on the part of the Bush Administration, has just about demolished the US's ability to dictate to the world. Our economy is crumbling, etc. etc., so it is a fantasy that oil exporters (like Iran) will fear the US government more than their own people.

Quite the reverse. From Iran's model, we can see that cutting subsidies is a great way of losing legitimacy. and if it is in teh name of being able to sell it to American imperialists, that is even worse.

Yes, we have money (compared to India), but that will only go so far.

A quick check on Google, and I didn't see any recent estimates of US Military oil consumption that were below 320,000 bbls/day. I think you're off by about 50% (not that that invalidates your point...it is still not a large percentage of overall US consumption).

Arkansawyer

The DoD is the biggest user of oil in the world.

"On the serious topic of the U.S. or some other country using military force to take oil - it seems unlikely that the U.S. would do this"

You aren't serious about this?

Even with the Greenspan announcement, you still think US didn't go to Iraq for oil?

We all know that oil price is balanced on supply/demand (mostly).

If US is able to flood China, Japan, EU, etc with cheaper Iraqi oil, they can buy cheaper oil from elsewhere themselves (closer to home).

It's still stealing, even if you give it away to others to use.

Let's see what US does now that Iraqi government refuses to push the oil bill forward.

If it truly wasn't about stealing oil, as you suggest, US would let the people of Iraq do what they want. In good and bad.

However, I see it very unlikely it'll come to that.

As for people who advocate stealing oil, there are plenty of those on this board (if you read the backlog) and many other boards (go to peakoil.com for a large sampling).

It's not stealing when WE do it!

Luis, you live in 1975. Wait, that's Vietnam, bad example. In a comment above you say the US has the most money. Where have you been the past 5 years?

The US government aggressive in meetings? Not those with China and Russia, I can guarantee you that. The notion that the present government and Fed are trying to keep the economy roilling as is, and hence try to get as much oil as possible, ignores the fact that what they've really been doing the past 7 years, and have succeeded in doing, is try and bankrupt that same economy.

Does anyone really still believe these people are in the business of making sure Americans are comfortable?

One, China is Import Land. So all US has to do is to secure oil before China. Of course, this is increasingly difficult, because China plays that friendly character instead of the bully.

Two, Russia is being met with a lot of agressiveness in the placement of missiles near its own territory. Putin stated clearly this is not a tolerable behaviour and USA didn't retracted. How is this not being agressive?

One, that fact is not a fact, it is your own opinion, based on ... on other's opinions. Yes, you may say I'm blind and blah blah blah, just don't tell me its facts, 'cause they aren't.

Two, I've seen USA being "bankrupt" many times before, and they still recovered pretty easily as the most powerful economy. Yeah, this is a big bump, I know, but it also may not be. No one knows for sure. Fact is, USA is still the richest country in the world. Come on! Face it. Those are facts. If USA will be unable to pay back its debts, its the other countries which will pay the most, not USA itself (in the short run, at least). Also, you behave as if you are unaware that all the world economy plummets if the USA tanks. That simple.

So to say that USA will plummet before the others, is a big wishful thinking. They deserve it, but I think it won't happen.

Who cares what I believe? I just listen to the rethorics and the actions, and they fully coincide to the most dumb and stupid effort to maintain an unsustainable condition.

America has less cement, steel, coal, production than China today. Our only net exports are high technology products, and out entire net export base goes home every day at 5PM.

The devastation in real estate is almost too vast to comprehend. The mortgage bubble is roughly $5.5 trillion, and yet, prices have just begun to fall. It�s a long way to the bottom and there�s bound to be plenty of bloodshed ahead. Two million homeowners will lose their homes. 151 mortgage lenders have already gone belly up. Many of the hedge funds, which are loaded with billions of dollars in �mortgage-backed� securities, are struggling to stay alive. Perhaps the most shocking projection was made by Yale University Professor, Robert Schiller, who believes that home prices could decline as much as 50 percent in some of the �hotter markets."

Mike Whitney-Soup Kitchen USA

I posted this on the Drumbeat thread, but I have always thought that this essay was profound in its implications.

IMO, a key problem the Neocons are facing is that more and more members of the military--and their families--are beginning to realize that they are fighting and dying to keep the oil flowing a little longer to the US.

http://www.time.com/time/magazine/article/0,9171,1181629,00.html

Why Iraq Was a Mistake

Sunday, Apr. 09, 2006 By LIEUT. GENERAL GREG NEWBOLD (RET.)

Two senior military officers are known to have challenged Defense Secretary Donald Rumsfeld on the planning of the Iraq war. Army General Eric Shinseki publicly dissented and found himself marginalized. Marine Lieut. General Greg Newbold, the Pentagon's top operations officer, voiced his objections internally and then retired, in part out of opposition to the war. Here, for the first time, Newbold goes public with a full-throated critique:

Excerpt by Lt. General Newbold (Ret.):

Wait until the shortages begin, and then tell me that the majority of US people won't vote for a full scale war to anyone who is keeping "your" own oil in their backyard.

Carter's doctrine anyone?

I mean, when everything's fine, its good to be in John Lennon's side and all, but WTSHTF, the military option will have 99% popularity.

Full-scale war? Doubt it.

The US military is beyond stretched thin. They should and will revolt. As a draft would need to be re-instated, the majority of the US, realizing they might have to sacrifice not someone else's child, but their own, would openly revolt.

Otherwise, expect a radical change in US immigration policy, and some new, eh, requirements for citizenship.

luisdias,

the non-negotiable way of life is GHW Bush's doctrune, King George the Elder's. Jimmy Carter was the guy who put solar panels on the White House roof and the 55 mph speed limit andwore a sweater indoors instead of turning up the heat.

Jimmy Carter was or best president on environmental issues and energy, and is a very decent and kind man who is informed on how to behave by his old-fashoined liberal Christianity, the best of what it means to be a Christian.

But that didn't mix very well with the real life responsibilities of being president of an aggressive empire, plus, he was just plain unlucky besides naive. Read about the Iran-Contra affair for a real expose of just how the thugs in the CIA and the Military operate. Bob Ebersole

Bob, Carter armed the Mujahideen.

55 mph was a gift from Tricky Dick Nixon, two presidents before Jimmy Carter.

Mr Robert, I have nothing against Carter himself. He is no longer the american president, so I couldn't care less if he is some kind of mother theresa.

I am referring to the Carter's doctrine, which is a document that refers:

Let our position be absolutely clear: An attempt by any outside force to gain control of the Persian Gulf region will be regarded as an assault on the vital interests of the United States of America, and such an assault will be repelled by any means necessary, including military force.

...which can be perceived as a clear reinvindication of the whole Middle East territory.

Arkansawyer

;}

Thanks WT. These comments need continuing exposure, because the story remains the same.

You should hear what Fallon thinks of Petraeus. :-)

Arkansawyer

Were War Critic Soldiers Killed To Send Message?

Two soldiers who wrote op-ed that contradicted Patraeus report die in strange accident, while another is shot in the head in case that bears chilling resemblance to Pat Tillman story

Paul Joseph Watson

Prison Planet

Friday, September 14, 2007

The mother of a soldier who died in an apparent vehicle accident shortly after writing a New York Times op-ed critical of the war in Iraq is demanding to know the truth about what happened to her son, while another author of the piece was also shot in the head in a case that bears a sinister resemblance to the murder of Pat Tillman.

Interesting website, also found there:

The Creeping Fascism of Global Warming Hysteria

We should keep in mind that China could buy OUR oil and have it shipped to them for their use. As they are our banker now, and we believe in the the law of supply and demand, it is more than a little possible. They are already making deals in Canada for tar sand development. We would certainly be on a quick oil efficiency diet if that were to happen.

Well, if China bought ANYTHING from us, that would at least start us on the path to solving the imbalance of trade. We are selling them our culture, but that turns out to be too copyable, so it doesn't actually send any funds our (or hollywood's) way.

Boeing aircraft are our biggest export to China. We sell some other capital goods as well. American fast food chains do well in China.

And they would be willing buyers of MANY of our slightly used or new military hardware.

And they wanted to buy one of our oil companies !

Alan

USA will be one of the last to see oil scarcity.

I think you might be wrong. Firstly, a good deal of our imported oil comes from Mexico and Venezuela. Mexico is struggling with Cantarell. Venezuela appears to have undertaken a program of "conservation" production. And they are also looking to do deals with China. Secondly, the GOM is not a very secure place. We've been lucky but we're one hurricane away from being caught short. Thirdly, tar sand production from Canada is limited. They haven't hit the NG limit factor yet, but I suspect they're approaching the water limit.

This means that our "in-hemisphere" import supplies are going to remain very tight.

It's also not clear that M.E. supplies are reliable or even robust. The Iraqi adventure is going poorly. OPEC is playing rope-a-dope with production. Simmons says OPEC members may be going into conservation production as well.

Two thirds of our petroleum supply is predicated on the exchange paper, or worse, sums of electrons. We are not exchanging commodities, our Current (trade) Account is highly negative. Without sufficient petroleum, our economy, and consequently our money's value will suffer. If the oil tipping point happens we may be in a situation, like the money center banks today, of having so-called "financial" assets that nobody wants.

Okay. That's a thought. But consider this: you haven't disagreed with me in the entire repply you've made. In fact, I agree with all you said.

But, you still have to name me one country in the Import Land which will thrive better than USA in this crisis. China? Don't think so. They are already having shortages. India? Don't make me laugh! Europe? Like Stalin once said, "how many divisions they've got?". Africa? LOL. South America? Only on Chavez wildest dreams.

So, name me one country.

Luis: 1. China 2. India 3. Germany 4. France 5. Canada- actually it is a pretty long list.

Oh boy. China? India?!? (wtf?) Germ...?

Okay. I can't go on. Are you going to simply list the import land countries on me?

Bejesus.

You live in the USA and you don't even have a clue on how more important the US is to the world than every other single nation within it.

Mind not the economy bubble. Even with that long correction, US will still be the largest economy.

Germany seems like a good example.

It produces a nominal GDP of $2.9T from oil consumption of 2.63Mb/d, or $1.1M/bbl, as compared to $0.64M/bbl in the US. Germany - along with most European countries - can afford to pay substantially more for a barrel of oil than the US can.

Of course, most of the reason for that is the bloated oil usage in the US. Once higher prices push that down a little, they're likely to equalize in efficiency somewhat.

Successfully equalizing efficiency assumes that the infrastructure can be rebuilt in the first place, both in monetary and energy cost terms, to allow for such efficiency. That is the first big problem we face - getting from where we are to somewhere more efficient, ideally closer to Germany and other such nations.

But we are not there yet and that won't happen with a wave of the hand. That is, in a nutshell, the "cost" that Hirsch tried to point out that we would pay. We could either pay it 20 years out and avoid serious pain or we could pay it closer in with increasing pain. And no one knows how much pain either.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Plus it's a moving target - in a limited-supply world, Germany's likely to implement efficiency measures of its own.

In general, I don't think countries are going to "lose access to oil", at least so long as economies stay reasonably sensible; it'll be just a matter of degree as price puts the squeeze on demand. All (importer) countries will lose access to some oil, and the poor ones moreso than the rich.

That squeeze is going to bring pain to even developed economies - it has already - but I'd argue it'd take an enormous amount of pain before western economies are brought to their knees. If it gets that bad, I expect to see broad swathes of society sleeping in their cars rather than commuting every day, or sharing rented rooms with 10 other workers, or similar kinds of conservation measures well before any kind of actual societal collapse.

And, since the amount of conservation available via such tried-and-tested measures represents an enormous amount of current levels of oil consumption, I don't expect there to be a societal collapse. In a truly serious situation, almost all oil consumption can be dispensed with (most airplanes are grounded, most people live in shared one-room apartments close to work or sleep in their cars, food is simple and shipped by rail or bought locally, a pickup truck is used for weekly shopping for 10 families, etc.), meaning society can adapt to quite a lot with substantial - but non-fatal - pain. If things get that serious, oil consumption will be low enough that supplies from stable sources such as the US and Canada will be able to cover most or all of the consumption.

Sure, society could collapse, but I still don't see why people would prefer that to sleeping in packed flophouses, so I don't see why declining oil supplies would be a particularly bigger risk than a severe depression.

Hey Pitt,

I didn't experience the 20's before the depression, but if there is anyone lurking about that did, I sure wish they would tell it like it was.

From what I have seen on film and in books it looks like it was a pretty good time. There they were with a full tank of petroleum in the ground, all the rest of the countries resources practically untouched, science bringing on new goodies daily and off they go and have a depression, go figure eh?

BTW could you define what you mean by societal collapse? By my light we are experiencing that now, people are sleeping in the bushes, crack houses are packing em in, it is getting kinda messy in spots out there right now. We have what amount to as soup kitchens even in small towns, the cracks are there!

That's not societal collapse; that's society - it's always been like that, or (usually) worse.

I use "collapse" to mean widespread starvation and lawlessness with a substantial fraction of the populace displaced or dying due to lack of basic necessities, particularly food and clean water. It's a situation that would be more-or-less necessary for what doomers refer to as "dieoff" - 70% of humanity dying over a relatively short period. Zimbabwe's probably the closest current example.

Five families sharing a house the size of what one family has now, people sleeping in cars or under their desks during the weeknights, food choices constrained to local produce, and rail or ship as the only affordable long-distance transportation isn't "collapse", not in the way people say Easter Island "collapsed". It's inconvenient, and a lower standard of living, but it doesn't have millions of people in the West starving to death while cities burn.

That is collapse. Anything less is just a change of lifestyle.

Hey hey Pitt,

You are assuming that they have jobs to goto. With 70% of the US economy based on consumption that is not a forgone conclusion.

Tim

No, but neither is it a foregone conclusion that they won't.

Moreover, massive unemployment would certainly help curtail oil consumption; someone without a job doesn't need much gas for commuting. A large-scale disruption of the economy would certainly increase the misery involved, though.

erm, Stalin was talking about the pope when he said 'How many divisions has he got', and incidently, the pope was a big part of the final push that collapsed his once mighty empire.

In answer to your question, Europe spends $300 billion a year on armed forces - so we have plenty of divisions.

No erm. I am fully aware of history of my own continent, thank you very much.

So you say. I'd say it had more to do with the allocation of Russia's resources, oil price in the eighties and afghanistan war, but hey, the pope speeches rules!

Hmmm, who's the primary seller? How much more money does USA spend in its own defense? How many countries are you considering? Right. Preach me another day.

The closest European military bases are 20 miles from the Arabs. The closest American military bases are 1,000 miles from the Arabs.

Unless you think that the Europeans will let the US continue using bases in their countries to conquer Arabia? Or unless you think that we can maintain and supply, let alone act out of our bases actually inside Iraq, by air from America?

Wtf are you talking about? Do you think 1000 miles is some kind of a "big" figure? It's not! Its two three hours range. And the closest to what? To Iraq? To afghanistan? To Kuwait? Or are you talking about the aircraft carriers of the persian golf? Do you not realise the states are there?

wtf are you talking about?

you haven't disagreed with me in the entire repply you've made...

Luis... you said...

I said...

meaning: running short of oil would queer the value of our money (our capital assets require oil to be productive). We've seen an identical situation with Triple A rated mortgage securities.

What I think you are forgetting is the fact that this crisis is not insolated to the rest of the world. European banks are at risk too. Chinese are chewing their fingernails. If the dollar tanks too much, all the economy tanks as well, and so I am still right when I say that the US will still have more money than all the others. The world will simply be poorer in its entirety.

Report: U.S. Less Important to Global Growth Than Thought

It does not matter. As long as the perception that US is the engine of world economic growth stays the party will keep going on.

And we have nukes to persuade anyone that dares the stupidity not have this perception.

That perception appears to be already going or gone.

Nonsense. The US isn't going to use nuclear weapons to improve its economic position, and everybody knows it.

Aside from how unconscionable that would be, it'd simply be stupid - it'd massively disrupt the world economy, which would do more harm to the US economy than simply accepting a lesser role would.

I admit my answer was a little provocation :)

Personally I think the US is holding the rest of the world in Zung-Zwang position. The perception you are talking about is of course largely gone, but none of the major players is interested in changing the status quo. Any attempt to create a new world arrangement in which the USA does not have the status of "debtor of last resort" are and will be crashed to the ground by US with all instruments it has on its disposal - economical, political and even military if necessary.

And here comes the nuke comment, which was only half-serious. Common sense dictates that US will not use its nuclear or even conventional military might to protect its status, but it can not be argued that it is positioned to do it. And also recently it showed it is ready to use its position if things get rough enough... This is enough to prop that "perception" we are both talking about. Nobody pays tribute to the neighborhood bully because it breaks his/her house every week; they agree to pay just because they know he can.

I'll pray to that. But:

this is a study made for a single percentage point drop. If dollar tanks like 50%, will the percentages maintain? Or will it cascade like a domino? I think that past a certain threshold, plummeting the states will plummet the entire world.

from: http://www.safehaven.com/article-8405.htm

American Consumers are Losing their Crown

by Peter Schiff

Assuming a 50% decline in the value of the dollar and a 20% fall in U.S. GDP, the above chart would look something like this:

Luxembourg 183,853.25

Norway 152,895.56

Ireland 114,326.14

Switzerland 108,933.54

Iceland 107,064.94

Sweden 88,908.73

Netherlands 85,525.93

United Kingdom 83,919.70

Canada 82,695.74

Australia 75,963.04

France 74,833.10

Germany 73,558.27

United Arab Emirates 72,361.73

Japan 72,042.44

Singapore 64,164.05

Spain 63,453.11

New Zealand 49,023.91

Greece 48,060.83

Israel 41,021.10

Portugal 38,575.02

United States 36,868.12

Saudi Arabia 33,224.32

Chile 16,671.40

Russia 16,366.03

Mexico 15,511.38

Argentina 13,097.61

Venezuela 12,787.97

Brazil 11,036.41

Peru 6,657.09

The above projection by 2010 gives 20 countries with per capita GDP above the US.

In three years if the world price is $120/bbl in todays dollars, the US price in 2010 dollars will be $240.

Cuba

Can I just agree with and expand on your 'I think you may be wrong' post?

Specific factors that suggest the US maybe earlier on in feeling the pinch:

1) The dollar isn't doing to well on the world markets, compared to other major currencies. Even if oil is still priced in dollars into the future that means that the price rises to keep income to oil producing nations at a level. Other country don't feel it as the dollar declines, but the US feels the full force. Make that double if the US loses its petrodollar linkage.

2) Its not a question of absolute costs, its a question of disposable income. If your income is all allocated paying for a house which is dropping in value while interest rates rise then you feel the effect of oil prices rise before someone with less allocated income. Factor into that too the wide disparity between low and high income households in the US.

3) The low tax regime in the US means in percentage terms the US feels rises much more than high tax countries (eg UK). What might double costs in the US would only increase them in high tax countries by say 30%. Add in here the extreme usage again and the pain of sudden rises on the US is magnified.

4) The general calculation is the wrong way round. Prices have to rise to squeeze demand out of the system. Given the disproportionate consumption by the US that means prices will rise UNTIL THEY HIT THE US. Sure certain low income countries will be hit first, but they don't actually use much anyway. To match demand and supply the US has to be an early casualty.

5) Oil will become a weapon of politics, and the US isn't loved.

In part these reasons are why I think there is a step change in oil prices due, to a level that starts really hurting the US and curtailing demand there. Prices will then stagnate at roughly that level, eating through the US overconsumption.

Good points, garyp.

Still, I'll play devil's advocate on you. Remember, I only posted what I speculated, its not a full prediction.

1. The dollar is going down, but the gas price is way higher in europe. The oil's price will rise much faster than the dollar will plummet, as it has been. This means the difference between the eurozone and the dollarzone won't be that much. Remember, if the dollar tanks, all the world tanks: the euro isn't still a clear alternative.

2. I live in an european country where gas enters in family budget like 10%. USA is still 3%. Who's gonna plummet first? That's right, I am. And so will many countries.

3. Yeah, sure you feel. But when it enters in your family budget in like 10%, in my country perhaps it only has elevated to 15%. I'm still going to plummet first.

4. There are a lot of countries in the developed world. Remember, USA only accounts for smth like 25% of oil usage. There are 75% under you. Doesn't that count? Remember too that oil will skyrocket when in two, three, four mbd gap between demand and production. Many developed countries will feel the hard pain much before the US. The Shit Will Hit The Fan before it gets too hard on Americans.

Now, this is speculation. Ponder that it will also depend on the intelligence in the oil secure dealings, luck in the sources you chose to buy oil, etc. etc. What I mean, it is not as simple as I've put it. I know. But abstracting that, USA seems just fine.

OK:

1) So far the oil price rise and the dollar decline have been pretty matched. Even if they aren't its the dollar buyers that suffer doubly. Plus in some ways the dollar tanking is good for the world economy since there is that much more oil for available for those outside the US - they don't get an oil shock.

2) Its not about %age or absolute numbers, its about how well you can deal with it in your household budget, about the rise. If you are leveraged to the hilt it will hurt since there's no slack. The US has no slack in two dimensions.

3) When you line up the economies and their consumption, you might be surprised how things size up. I postulate that the developing countries are already being hit, but developed countries such as, say, Switzerland, are not going to suffer much from rising prices. Its the US with its high per capita consumption AND low margin for pain that will feel it first. Do some rough numbers if you don't agree - $4-5 at the US forecourts will cause reduced demand when you do 20,000+ miles a year.

5a) Oil is a weapon of politics, and the US isn't loved. Supply or withholding of oil is a political weapon; that's why BigOil is part of government, whether openly or covertly. There are no "private" oil co.s. [except short-lived or insignificant].

Making sure that exports are favored over domestic consumption is the essence of US foreign policy. All the other importing countries have the same goal, but some are using different tools.

Europe has joined with the US approach, but is trying to make it less obvious - and they're nervous about NG supplies from Russia. China and India are trying to do it by spending money - much of it rapidly devaluing US dollars. In some places the local population will be able to maintain control over their own supplies, but in many they will not.

The conflicts will become more intense as the supplies become scarcer, and the Western and Eastern factions compete for the same oil. The biggest worry for the Western powers is a militarily powerful exporter - witness the agitation over Iran and Russia.

In the end, it will be messy and hard to model

Indeed. Sadly, most things worth looking at are exactly so.

Human behavior is so inherently stochastic at the individual level--hell, when I am doing models of human attitudes or such, I am ecstatic to explain 5% of the variation.

Of course, when you start predicting the behavior of aggregates, such as states or nation-states, it's only a little easier. :(

But we still gotta try.

The three key factors which determine how fast a given net export decline/crash occurs are: consumption as a percentage of production at peak production; the production decline rate and the rate of change in consumption.

What is striking is how similar the UK/Indonesian net export crashes are to the ELM: Same time frame 7/8 years versus 9 years and in both cases the net export decline rates accelerated with time, just like the ELM.

Note that the ELM indicated that only 10% of post-peak production from Export Land would be exported. Again, the percentage of future production that will be exported by a given exporter is a function of the three variables outlined above.

I think the model is working fairly well, especially as it seems to be confirmed by the UK/Indonesian examples. The question is whether the behavior of exporting countries/societies will change when the pressure from the outside increases down the line. But then, by that time the decline may be much more advanced, and it may not matter so much.

Added on top of that, it seems to me that as outside pressure and conflict increase, it cannot help but increase the "noise" in the system ("above ground factors"), with the effect of decreasing overall throughput. So it may be that even if the West is successful in applying pressure to favor exports over domestic consumption, this would be offset by an overall reduction in export capacity caused by applying that pressure.

There are at least 4.

HOARDING and saving in ANTICIPATION of NO MORE OIL.

I agree. Concerning the question of how hard the US will be hit and when, consider these cumbersome and conflicting factoids.

If the US dollar tanks then US exports become much more competitive.

The US is the wealthiest nation on the planet, but the average savings rate is negative.

The US uses more oil per capita and per unit of economic output than the EU, thus the US has a greater ability to conserve than the EU. Similarly, the average US consumer spends 3% of their income on energy vs. 10% EU ( 3% vs 10%, I am quoting from up thread, I don't know if this is fact) giving the US more room to weather the storm. But, the US consumer is stretched thinner and the economy is far more dependent on consumption which will be reduced to pay higher energy costs.

One could go on but I think you get the point.

I think a simpler analysis is in order. The US is less efficient and less sustainable than the EU. Therefore the US will be hurt more than the EU. Be it recession, depression or collapse.

Tim

luis,

You have a valid comment but you may want to consider the value of the US $. To a certain extent, the wealth of the US is only perceived and the credit bubble seems to have leveraged this perception to the max. At some point, the Export countries will no longer be interested in accepting dollars that are still hot off the press. If/when the dollar looses hegemony, the only thing going for the US will be it's military force, but even that may be to costly to maintain with fake money. Worst possible case would then be that the US sees using it's military toys while it still can. I have a very bad feeling about all of this...

ej

To add to a thoughtful discussion:

I believe the US has one other wildcard to play besides the Military. What about agricultural production? Couldn't the US trade a fair amount of food for oil? Perhaps it wouldn't be enough to prevent a "big pinch" and change in the American Way of Life, but it could be enough to encourage some exporting coutries to keep the precious juice flowing--maybe enough to cover certain essentials.

-best,

Especially as the price of food, namely wheat and corn, goes through the roof because it is being turned into an energy sink...

Oy, the increasing variance and number of deflationary and inflationary pressures once you start thinking about this are amazing...makes it a lot harder to walk along the knife edge.

The Fed is in the same spot. Do you cut rates, make money cheaper and feed the inflation fire, or do you keep rates stable and hope that the wind doesn't blow while you're on the high wire?

Indeed--it is the sheer, mind-bending, complexity that keeps me interested in energy and the future (aside from the all-to-real impacts on my life). Maybe this is the era of "Peak Uncertainty"? Interesting times and all that...

-best

We have an export land crisis in wheat as former exporters turn importers. Australia, Argentina and Ukraine no longer export wheat. Looks like Russia will soon follow their footsteps. India - one of the biggest producers of wheat in the world - is an interesting case. Last year they imported 3 million tonnes of wheat for the first time in decades. This year are going to import 5 million tonnes - a 66% increase in just one year!

As less and less food is available for import in the face of rising demand and declining exports, US & Canada will make a lot of money. The question is: will the US earn enough money to pay for crude oil imports by exporting food? Will it make more money by exporting food compared to turning it into bio-fuels at home?

The US became a net importer of food last year or the year before. I'd have to go look up the specifics. While we could still export some food, to do so in order to get oil means we would have to do without in some other part of the economy. So you rob Peter to pay Paul or you rob Paul to pay Peter. Take your choice.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

That would be interesting, since the USDA reports that the US is running a large surplus in agricultural trade.

That's on a value-basis, though, so on a calorie-basis might be different. I'd expect that to favour the US even more, though, since my impression was that the US exports a great deal of (low-cost) grains and imports (high-cost) processed goods. I would be quite interested to see what data on this you've found, though, since I've had trouble finding agricultural trade balance figures in other than cost terms.

I believe the difference was in dollar value. We export lots of grains at relatively low (at least until recently) cost and import lots of expensive and exotic foods. Thus my point was that yes, we could export food, probably at the loss of the more exotic foods or some other high dollar value market.

Ok, found the references. First one was that we were expected to become a net food importer in 2005 since the 2004 food trade surplus (in dollar terms) was zero. This did not quite occur but it has remained very low, due precisely to the exotic foods we import. The second reference is the USDA asking whether we will see a resurgence in US exports or not and noting that the trade surplus in 2006 was less than $5 billion.

http://www.yesmagazine.org/article.asp?ID=1238

http://www.ers.usda.gov/AmberWaves/September07/Features/USTrade.htm

So I stand corrected. The US is not yet a food importer (in dollar value) though it was and remains very close to that level currently.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Bing! We have a winner! I find Maslow's hierarchy of needs usefull to think about the problem. In a collapse situation those that can fufill the bottom the pyramid (food, water, etc.) will be in the drivers seat (or having to fend off those who can't). I wonder how long it would take to calculate a subsistence ratio (food grown over food needed to support current population at subsistence levels) for various regions of the world.

Fufilling ones self-esteem with the latest Hummer wil be history.

We don't BUY oil, we trade for it. That's why it's called a trade balance. It doesn't matter what the dollar price of oil is if the Saudi's want Yuan. Why would the Saudi's want dollars. In fact, the head of opec said this last week but nobody listened.

Can you elaborate as to what the OPEC head said in this regard? Maybe provide a quote and cite?

Actually, the USA is the country with the most debt .

Debt is a lack of money ... and it has to be borrowed and paid back with interest.

Usually, a sensible person will only lend money to a rich person, ie: one without a large debt to equity ratio and also having the long term ability to pay back the loan. Bearing in mind imminent peaking of fossil fuel production, the ressulting declining exports of same and Climate Change, does it seem like the USA is going to be a good place to lend money to if you want your money back?

Xeroid.

This is to repply to all of the posters that repplied me with that same reasoning of yours.

There's a saying. If you borrow a thousand dollars from the bank, it owns you. If you borrow ten trillion dollars from the bank, you own the bank.

I rest my case.

I believe the saying actually goes: if you owe the bank $1000, you have a problem. If you owe the bank $1,000,000 THEY have a problem. Not that that conflicts with what you said, but perhaps it retains some important subtlety.

Relevant points to consider in this discussion:

1) The US has the means to obliterate any nation on earth with military impunity if it chooses to - excepting, perhaps, Russia and China.

2) Even in the case of Russia and China, it can be seriously argued that the US has this trump card (see March/April 2006 article by Lieber and Press in FOREIGN AFFAIRS, where this argument was made).

Don't you think that, as oil gets scarcer and scarcer, US "diplomacy" will impress these power realities upon oil producing nations with ever-increasing menace? In fact, this type of "Godfather"-type intimidation has probably been going on behind the scenes already for a long time.

And maybe, to drive the point home, the US WILL at some point obliterate an entire country with impunity - North Korea, say.

This would rather resemble the shocking scene in "The Untouchables" where the Al Capone character murders someone with a baseball bat at a meeting of his underlings for the miniscule offense of being just a little too obviously sycophantic.

"The US has the means to obliterate any nation on earth with military impunity if it chooses to - excepting, perhaps, Russia and China."

Except for any country with mountains, jungle, or nuclear arms, or without roads. And only once.

PhilRelig

R: the US ability to obliterate any country with impugnity

Although it was never stated, I've always considered this as a prime motive in the attempted conquest of Iraq by the neocons, that it was meant as a demonstration to rest of the world as the real life example of how American technology and tactics could destroy anyone who defied the imperial will of the US and gain us by conquest what we couldn't gain by intimidation. That's the reason that Rumsfeld and Cheney were willing to invade Iraq with less than a third as many available troops as were present when the US andits allies had in the first Iraq war when they basicially stopped at the border. They considered it old thought that we needed enough troops to control the populace.

Seymore Hersch wrote a series of articles published in the New Yorker about three years ago about the changes in tactics by the pentagon, and its adoption by Rumsfeld et al. Somehow they seemed to have neglected to see that one soldier can't control 1,000 people, no matter how well equiped. He can certainly kill them but he can't make them do what he wants. That takes their willing cooperation.

I doubt the US has actually lost any engagement with the enemy in Iraq. They can call in reenforcements immediately, and so are always left in physical possession of the ground. The US weapons and body armor are so superior that the US causes a huge multiple of casulties in Iraqi dead for every soldier killed in combat. Yet, we have lost the war. There's no possibility of getting what the US wants, even the puppet government feels free to defy the US-look at the "oil law".

It still hasn't changed US rhetoric-Cheney is demanding regieme change in Iran as part of the sabre rattling. And the US is stuck in Iraq. We absolutely must maintain bases there, for if the troops all ever get east of the Straights of Hormuz, we'll never get another ship on the Persian Gulf side. Its only about 20 miles wide, and easily closed with shore batteries of rockets, mines and small boats full of plastic explosive.

So much for intimidation. Bob Ebersole

Jeffrey,

You are right that you should take domestic use growth in consideration when you want to determine the export quantity.

However, something does not add up.

Countries like KSA, Iran, Kuweit, Venezuela, Russia etc are very poor. If they don't export, they will break down. It's not like the UK, which is very rich. Imagine Hugo Chavez without the money: How long will he last?

This has already happened in Iran. They have cut back their domestic use with about 25% by rationing, basically because they could not afford it anymore.

This would invalidate your ELM theory.

Richard,

I would not describe KSA and Kuwait as "poor."

Also, cash flows to exporting countries have gone up dramatically, for example resulting in foreign car sales in Russia increasing at 50% per year. I expect their cash flows to increase, even as their export volumes decline.

Furthermore, as noted up the thread, you have to explain the virtually identical UK/Indonesian net export crashes, versus their wildly different per capita incomes.

IMO, what the ELM means is the death of the consumer driven economy, which is a point I have been relentlessly, and repetitively, emphasizing for going on two years now: "Cut thy spending, and get thee to the non-discretionary side of the economy."

To be very blunt, IMO it is a high probability that if you are not a producer of essential goods and/or services, you are going to be roadkill in the Net Export Crash. You have a choice. Stand still and be run over by a 18 wheeler, or get the hell out of the way.

I agree with you about Kuwait, but think again about KSA. It is burdened with a substantial non-productive class, and has to support a "welfare state" for both the rich and the poor. Its men are educated primarily in theology, while its women are barely educated at all. No one moves to Saudi Arabia because of their human capital. If you had to rank the value added from Saudi human capital against other countries, I do not think that it would fare very well. So, in that sense, KSA is "poor." Had they used their money to build schools, and then used their educational advantages to build a service or a manufacturing sector, I would be with you. But outside of oil, they are poor, and they have to export to support their poverty.

The Middle East countries are mostly desert (KSA is also incredibly hot!)... little rain! ... but with rapidly growing populations ... they need growing amounts of water or they die! ... which requires energy for the desalination ... the West won't let them have nuclear ... so, IMO, they have no option but to use the only low cost fuel they have ... the fossil fuel ... it is theirs not ours.

Better not to export and only have a low standard of living than be dead? ... I think so. Back to camels as well I think.

Xeroid.

Jeff,

An important part of the internal consumption of oil in Export Land is vehicles for internal security and military. This consumption is ABSOLUTELY ESSENTIAL to the continued export of oil. Your description of ELM in terms of generic internal consumption softens the image of the real danger, IMO: How can one continue to run a reliable police state without oil?

And if we decide to invade (liberate) where will our military get the oil it needs?

"How can one continue to run a reliable police state without oil?"

What Chess! What an end-game! If Saudis ANTICIPATED global oil starvation, might they HOARD theirs and buy $30 Billion of...police-state weapons?

Golly. Running out of oil could be very disruptive to WorldOrder and ThePowersThatBe.

Jeffrey - whilst your ELM is basically a sound and interesting concept, I would like to see some kind of "middle of the road" appraisal of what might actually happen come out of this work.

For example. What evidence is there that Saudi Arabia's oil consumption might rise by 10% this year? And whilst the production figure for this year may be bordering accurate, I'd like to see the possibility of higher production in Saudi during 2008 built into your model. It is entirely plausible to me that Saudi consumption might be flat or even fall in 2008 and their production might rise.

If you simply choose worst possible case input parameters at every turn then I for one will ignore your results - and that would be a pity becuase I think getting an accuarte handle on global export capacity and an importers hierarchy is an important piece of work to do.

Its worth noting Kuwait's oil consumption dropped 10% in 2006 (BP data). Norway's consumption was up 3% - but was actually the same as in 1999. Mexican oil consumption was down 0.8%. Indonesian oil consumption was down 12% - all according to BP.

Given that oil exports are the primary source of income for many OPEC countries, do you think it is possible that they may take steps to minimise domestic consumption in order to maximise exports and revenues?

PS. I see oil just hit $80.25 - according to 321energy

This is exactly the question that sent me looking into Oil's price elasticity. Inelastic goods maximize revenue by taking supply OFF the market. Essentially, the price goes up faster than supply goes down. You can see it in the real world, supply is about 1.5 mbpd off peak (3% or so), but prices are 100 to 200% higher.

Wikipedia has a good article on "price elasticity of demand".

This is not proof that Exporter consumption will rise and production will fall, it just says that the market favors that response.

Looking at the 2005 to 2006 data for the top 16 exporters (42 out of 47mbpd), it looked like production was flat but domestic consumption was up 3%, leading to an export drop. (typing from memory, I will post the table later tonight).

Jon Freise

Analyze Not Fantasize -D. Meadows

Jon - I look forward to seeing your table. These are good points. What I'd be inclined to say is that exporters may be inclined to withold production whilst doing what they can to supress domestic consumption.

It really depends on the size of the consumer. If your a tidler like Qatar - then what the Hell, buy Porsches or Landcruisers and have a blast. If you're Russia - then maybe you increase gasoline taxes, after the election?

Euan

It came out a little mashed. These are the 2005 values from the EIA subtracted from the 2006 values. The bottom line has the totals in thousands of bpd. It is showing the essence of ELM, production flat, consumption up, exports falling. 2007 looks worse (from Rembrandt's August oil outlook).

Source EIA

I think Russia might be the opposite example, and discourage exports (the taxes against exports seem structured that way from what I understand). HT Odum discusses this at length in "A Prosperous Way Down". The short story is that converting an energy source to denser higher value products always pays back (you get to keep the energy profit at multiple steps). So for this reason you want to keep the oil local. That does not apply if your just going to blow it on luxury goods. But any manufacture or services are higher profit than export of raw energy.

Jon Freise

Analyze Not Fantasize -D. Meadows

There ya go, in a table. And boy, did that take far too long :-)

Jon and Rethin - thanks for this. I'm struggling with the units - maybe a mental block.

A couple of observations:

The total drop in exports can be accounted for by Saudi alone. Which brings us back to why Saudi production and hence exports are down. It seems that without that one anomaly, that any trend might dissappear.

The ELM describes export countries with falling production and rising consumption.

Of the 16 top exporters listed only 6 have falling production (Saudi, Norway, Iran, Venezuela, Mexico). And of those only 2 have rising consumption (Saudi and Iran), the others I'd judge to be flat.

There is a discrepenecy between these data and the BP data for Kuwait - which shows a sharp fall in Kuwaiti consumption in 2006.

As I said at the start of this exchange, I do think exports, future export capacities etc are important to look at but I think it is important to analyse this in terms of what is actually happening.

which shows a sharp fall in Kuwaiti consumption in 2006

The impact of supporting the invasion of Iraq (and supplying the Iraqi market via US buys & transport which may not have been reflected as exports) make Kuwaiti numbers uncertain.

My impression is that US operations in Kuwait are less welcome than before.

A further drop when the US withdraws seems likely.

But secular demand in Kuwait will continue to grow.

Alan

A couple of notes, based on the latest EIA data:

Based on those, it seems far too early to call a trend. However, despite there being 4 declines in the last 8 years, there's been only 5 in the last 20, suggesting exports are indeed tighter than they have been.

It's also worth noting that the number of net exporters is very slowly creeping up (43 now), which helps mitigate the declines of the bigger exporters, although to a somewhat limited extent (total net exports declined by 1.2% last year, as compared to 1.3% for the top exporters).

I agree, but it is worth noting that we are at the top of the bell curve. Conventional oil "peaked" only in 2005 and all liquids (the data here) in 2006. The top of the bell is flat, we might get a new peak. But we are seeing what ELM predicts for this part of the curve: Production is flat, exporter economies are growing and consuming more oil which is cutting into exports. I think the principal is sound, and must be taken into account in trying to predict the future oil supply.

We can think of refining the prediction in these layers, with each layer refining the prediction accuracy:

1. World Geology (Hubbert Curve)

2. Exporter Specific Geology (subset not the same as world)

3. Exporter economies (ELM)

4. Importer purchasing power (OECD vs China who wins?)

Once we have a solid handle on all four layers, I think we will have a pretty good prediction (assuming no wars etc).

Jon Freise

Analyze Not Fantasize -D. Meadows

Why this fixation with who "wins" an oil bidding war?

It seems fairly obvious that all countries have more-valuable and less-valuable uses to which they put oil, and rising prices are going to squeeze out the less-valuable uses of every country before they prevent the more-valuable uses of any major country. Use of oil as a feedstock in manufacturing, for example, takes only 7% of US oil consumption, meaning a great many other uses will fall by the wayside before manufacturing has to go without materials, and the same is almost certainly true for China.

In general, I think a "who wins?" kind of adversarial mindset is not the best way to look at the situation. Declining oil supply would force all countries to change, some more than others.

The goal is not to be adversarial, the goal is to be able to predict when the oil won't be available. Oil exports dropped a few percent this year. In the US gasoline usage went up. In Nepal it suffered a massive decline.

What future should my local city council plan for? A massive decline? A medium decline with time to adapt? A very slow decline where the market will handle it?

I personally support the Oil Depletion Protocol and feel the pain of decline should be spread widely and predictably.

Your right about all countries having more and less valuable uses that will get squeezed. I have a few ideas on how to model that concept, but will save that for another thread.

Part of the domestic consumption will be the energy required to pump the current oil and to develop reserves, so that part of domestic consumption is irreducable, and as the EROEI lowers it will increase. I think another major point of the ELM is that during the first phase rising oil prices mean increased profits even on dropping exports, so there is very little incentive to lower domestic consumption because this would create political instability.

In response to Euan, in creating models, you don't really want to aim for either optimistic or pessimistic scenarios. You want to base your model on what has actually been observed, and test what's been observed for its predictive power.

So, it doesn't matter that you can find a country or two that violates your model. No model will ever predict every single case 100% of the time.

Also, some of Euan's examples of "exceptions" don't make any sense as exceptions. For example, Indonesia's consumption may be down, but its exports have stopped completely. So it doesn't violate westexas's model.

And I personally don't believe Saudi Arabia will be producing an extra 500k come November. (Why would they allocate part of that extra 500k of production to Venezuela and Iran, who are already maxed out, as NASAguy points out, if they were going to produce the full amount themselves? And how about the OPEC allocation to Indonesia, which far exceeds Indonesia's capability?!) But even if Saudi Arabia did increase its production that much, that would not necessarily invalidate westexas's model. I would expect the trend he's identified to remain and operate roughly according to expectation.

Even the IEA models predict Middle Eastern demand to rise next year. Regarding Kuwait, I don't know the details surrounding their domestic consumption in 2006, but I do know the Kuwait Oil & Gas Report from BMI forecasts that the country's consumption will rise sharply by 2010. Also, I don't feel like taking the time to write a paper about this and dig up all the data, but I have seen plenty of evidence to support westexas's idea that Saudi consumption is likely to go up a significant amount in 2008. There is a building boom in the Middle East, car sales are way up, etc.

What westexas is doing is pointing out that there is a trend for oil exporters to make more money as supply tightens, and that this tends to lead to more prosperity and consumption at home, which tends to lead to lower exports. It's happened in Indonesia, the UK, Venezuela, the U.S., and many other countries. That is a very valuable model, in my opinion, for real-world planning and investment when you're actually putting your own dollars on the line.

Iran is often used as an example of a country striving to limit consumption at home, but in my opinion it's a pretty weak example, because it's in an atypical political situation where the U.S. and its allies have been trying to isolate the country economically and cut it off from things like gasoline imports.

So, in making my own investment plans, I'd be far more inclined to rely on westexas's model than Euan's insistence on a more optimistic scenario. Of course, Euan should base his investments on whatever scenario he thinks most likely.

One quibble: I would say that there has to be some kind of limit to the model before you get to zero exports, given a world situation where zero exports would mean no oil available to non-producers. Saudi Arabia is never likely to be able to produce all the food it needs, for example, and presumably would trade oil for food. But models often get iffy when you get out to extremes.

I agree entirely, and that's why I said:

"I would like to see some kind of "middle of the road" appraisal of what might actually happen"

Of course I cherry picked a few examples of exporters exhibiting behavior counter to the ELM - but I quoted real data for these examples.

There are some countries that exhibit ELM behavior - Russia, Saudi, UAE and some that do not - Mexico, Kuwait and Norway. The thing these three countries have in common is falling production (or reserves)!

I'm left wondering if there is any general evidence that exporting countries with falling production actually have rising consumption - that is what the ELM says is it not?

This is easy to test - it just takes a bit of time.

Re: Real Data

As noted elsewhere, the UK and Indonesian net export crashes (with strikingly different consumption profiles) were very similar to the ELM, actually in both cases hitting zero before the ELM.

Euan,

In regard to Saudi Arabia, I actually assumed a fourth quarter increase in production for Saudi Arabia. I assumed that average 2007 production was 8.7 mbpd (C+C), which suggests a fourth quarter production rate of 9.0 mbpd, versus 8.6 for year to date (and I assumed that total liquids was proportional).

In regard to Saudi consumption, my 10% number was based on a recent conversation I had with a person in a diplomatic service in Saudi Arabia who described a recent report that predicted a shift of 500,000 bpd in liquids production to domestic power plants and desalination plants over the next two years, because of the shortfall in natural gas production (in the interest of full disclosure, he also thought that most of the recent decline in Saudi production was voluntary). I think that I only added 100,000 bpd in consumption beyond the 5.7% increase.

He also noted that the shortfall in natural gas production was the reason that Saudi Arabia is considering importing coal.

In any case, if we back out my 10% consumption number, and use the same consumption number as 2005 to 2006, the results are as follows for 2006 to 2007:

Production: -5.6%/year

Consumption: +5.7%/year

Net Exports: -8.5%/year

In regard to Kuwait, note that the top 10, in aggregate, have shown a significant increase in consumption from 2000 to 2006, just shy of 5%/year, if memory serves.

Mexico's decline in consumption correlates closely to the decline in transfer payments back home from workers in the US.

In regard to Indonesia, they didn't start showing any sustained decline in consumption until they became a net importer.

In any case, the UK had a minimal increase in consumption, and their net export crash occurred in seven years.

As noted elsewhere, I expect that many exporters, at least in the short term. will show increasing cash flows from export sales, even as their export volumes decline.

Excerpt from post down the thread:

Jeff - I appreciate what you are saying here. I think the general concept of the energy exporting nations assuming a new mantle of importance is spot on (more on that later). But...

You say here that:

and

So that's great. but then:

You seem to agree now that Saudi production may rise fourth quarter and that recent production cuts are voluntary - so we're eye to eye here - but yet you want to stick to a production fall in Saudi next year - why?

In general terms I agree that countries with surplus energy will play an ever more important role. One pattern that is emerging is that the huge trade imbalances will be redressed by the export lands buying assets in the import lands that have strong legal entitlement. The UAE and Kuwait are always sniffing around UK airline companies - this is a great business model, airlines with jet fuel!

There are a very small number of oil exporting coutries that may act as magnets for imigrant workers and prosperity. Norway is top of the list - probably where I'll end up since I already stayed there for8 years and speak the language. The other is UAE - an oil exporting oasis that allows beer and wine to be sold and consumed.

So I'll get tanned in the Norwegian summer and ski and drink in the UAE:

SAT - WRU - millions wait for your oil price forecast!

Hold on there cowboy.

My prediction, for what it's worth, is that Saudi Arabia will never again exceed 9.6 mbpd (C+C), average annual production in a calendar year.

Rather than assuming 8.6 mbpd for 2007, which would have been about a 6.7%/year decline rate, I simply assumed the possibility of some fourth quarter increase, putting the average 2007 number at 8.7 versus 9.2 for 2006. As I have noted many times, if we round off to the nearest 0.1 mbpd, Texas averaged 3.4 mbpd for the first two years of its decline, after peaking at 3.5 mbpd, within the context of a long term production decline rate of about 4% per year.

In regard to my "source," in Saudi Arabia, who is well placed, I felt obligated to pass on all of his material comments, which doesn't mean that I agree with him about most of the production decline being voluntary. As we have discussed, Shell thought that the Yibal production was about to increase, when a flood of new water hit.

The "coal to Saudi Arabia" story has been widely reported, so the possibility of a shift of 500,000 bpd of liquids production to domestic use over a two year period sounds plausible.

In regard to the forthcoming top exporters model, our plan is to use the HL to predict future production, and probably just assume a 5% rate of increase in consumption, at least until they hit zero net exports.

Copy of post down the thread (again, the net export decline rate for a given region is a function of three variables):

I'd be very surprised if you can use HL to forecast production and would be wary of assuming 5% consumption increases everywhere. Look for example at Mexico. From GTrouts table it looks like 3% may be a better average.

You touch on some good points about energy substitution. I don't know how all the oil gets used in the ME - but I'd bet they try and substitute wherever they can in order to conserve their oil.

Its also worth considering non-oil energy exports. I've heard that there has been huge growth in ammonia production in Saudi.

Of the countries that were net exporters in 2006, the 5-year and 10-year consumption growth rates are 2.7% and 2.3% respectively, with 2.9% in 2005-2006. (Weighted averages, of course.)

Based on the 10-year linear trend, consumption growth rate is increasing by about 0.2% per year - making 3-4% a reasonable assumption for the next 5-15 years - but it's a pretty weak fit (R^2 is about 0.38).

What evidence is there that Saudi Arabia's oil consumption might rise by 10% this year?

Imports by Arab countries of U.S. merchandise has risen by about ten percent so far this year. Between 2006-2007, Saudi imports of U.S. goods rose almost fifty percent, from USD 7.88 billion, to USD 11.54 billion. This link is to U.S.-Arab Tradeline's 2007 Outlook:

http://www.nusacc.org/tl07outlook/tl0307p03.html

Of those Saudi imports of U.S. goods, 21 percent is passenger cars (see pie chart on p. 5 of this report)

Although a realistic middle of the road assessment would be best it is also the most difficult to accomplish. I think I have a handle on an upper bound/worst case scenario based on the guest post I wrote (Found Here).

Basically, using IEA data and splitting all countries into one "Country" of all exporters and one of all importers and assuming Import land will continue to import as much oil as is available no matter the price, one gets the following:

Assuming a world decline in oil production of 2% and export land consumption increases at 3% ( as it did based on IEA data for the last several years ) then the oil consumption of Import land must decline at ~4%. If a 0% increase in export land consumption is assumed, import land consumption must decline at ~3%.

So a rough upper bound on the ELM effect on importers, based on IEA data, would be that the conglomerate of import countries would have the pool of oil over which they compete with one another decline at a rate of approximately 1.5-2 times the rate at which world oil production was declining, assuming the peak was in 2007 ( This will be roughly correct if the world decline rate does not vary much from 2% and consumption and production #s at the time of the peak are not too different from 2007 values. ).

MarkB - hahahahahhahahahahah

I'ts late here in Aberdeen, I head for Cork tomorrow - and I'm now half through my second bottle of red, so I'll try to be as kind as I can be...

really?

Well I think you need to present some concrete data to support this. The best data I have available to me right now is that decline from Discovered Developed (DD) will be 4.5% per annum. And new capacity coming on according to Skrebowski is as follows:

2007: 4.6 mmbpd

2008: 4.4 mmbpd

2009: 5.1 mmbpd

If you work out 4.5% of 84 mmbpd you get 3.8 mmbod - so if Skrebowski’s mega projects work out as planned production will grow in the years ahead. Note also that non-mega projects will account for a further 20% of new capacity - not included in the figures above.

Yes in every land with money consumption has been increasing - but your focus really needs to be on export lands with falling production - cos that is the focus of the ELP - how have they faired?

Well, I'll be as kind as possible then. Read what someone writes before commenting. Your response is inane. I'd suggest responding once half way through your second bottle is not wise.