More on the Systematics of Hubbert Linearisation

Posted by Euan Mearns on September 12, 2007 - 10:00am in The Oil Drum: Europe

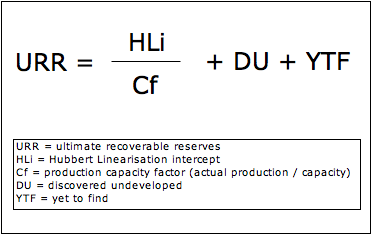

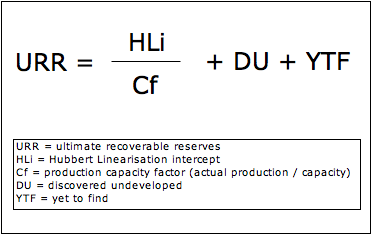

An empirical study of the impact producing at below capacity has on the Qt intercept of a Hubbert Linearisation (HL) shows exact proportionality. If a country produces at 90% of capacity, the Qt intercept is 90% of actual URR (ultimate recoverable reserves) and so forth.

On this basis the following methodology for applying HL is proposed.

Background

This post is aimed at bridging the gap between a face value interpretation of reserves based on the Qt intercept of a well-defined linear decline trend on Hubbert Linearisation and a more progressive interpretation that takes into account political and wider economic interference with resource exploitation.

Empirical approach

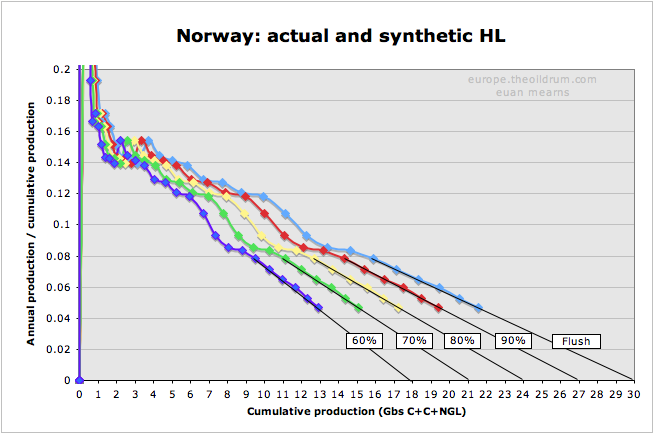

The actual crude + condensate + natural gas liquid (C+C+NGL) data for Norway as published in the BP statistical review of world energy are used to model the effect of producing at below capacity upon the HL Qt (URR) intercept.

The Norwegian data have been modelled at 100% (flush production), 90%, 80%, 70% and 60% of capacity and the results are shown below.

In advance of doing this exercise I was pretty sure that Qt would be reduced with below capacity production, but I was not sure about the nature of the relationship.

The experiment shows exact linear proportionality. If a country is producing at 90% of the built oil production capacity the Qt intercept gives a false low result for URR that is exactly 90% of actual URR and so forth.

Methodology

HL provides information on the developed resources in any given country. It says nothing about discovered undeveloped (DU) and yet to find reserves (YTF). In many countries, the size of the discovered undeveloped and yet to find resources are relatively small if the petroleum industry is mature. The majority of discoveries will be on production and most areas will be thoroughly explored. The HL for a mature country producing at capacity may provide an indication of that country's URR.

However, in countries where political interference has guided the resource development strategy, oil fields may not have produced at capacity and the full resource base may not have been produced following a single, commercial development cycle. In these instances the following methodology is proposed.

A correction should be applied for producing at below capacity. And allowance should be made for discovered undeveloped and yet to find reserves. I suggest this approach should always be followed but as already noted, in mature areas Cf will equal 1 and the size of DU and YTF are likely to be small. Hence the first order approach and this modified methodology will yield similar results in mature countries.

In countries that carry large volumes of DU reserves and which have produced for long periods below "capacity" it is very difficult to accurately estimate Cf and the size of DU reserves.

The variables of Cf, DU and YTF should always be taken into account when applying Hubbert Linearisation - be it to oil, gas or coal reserves.

Euan,

Excellent post I'm glad your working to improve the methodoogy of Hubbert Linearisation. I will certain use this type of equation in the future. I think it is a logical addtion to the existing knowledge base.

Best Regards,

David J.

"There is no silver bullet...to solve our energy crisis we will need, Solar, Wind, Nuclear, and Algae to Biodiesel."

It's an interesting approach. One suggestion, you might want to run a HL plot of total North Sea C+C production. My HL plot showed a rock solid pre-peak HL plot, with the production peaking right around 50%.

In regard to Texas, as we previously discussed, the only reasonable estimate of URR, using the pre-peak HL data, came from discounting the "dogleg up" just prior to the peak.

If memory serves, if we discount the dogleg up, it showed a URR estimate of 50 Gb or so. IMO, 66 Gb is the most accurate estimate of URR for Texas. If we used all of the "dogleg up" data, up to 1972, it produced a wildly inaccurate number, something like 110 Gb.

So, based on the Texas model, one could argue that the most accurate estimate of Saudi Arabia's URR comes from discounting the "dogleg up," but with an assumption that the resulting URR estimate will probably be on the low side, which may support your point.

One other interesting point about Saudi Arabia is that, dogleg aside, it showed a very stable linear pattern on the HL plot from about 1983 to 2001 or so.

This was the point of the Texas/Lower 48 article. I argued that the totality of the Texas HL data gave us a good idea of when Texas peaked--somewhere around 55% depleted--and the more stable Saudi data base allowed us to conclude that Saudi Arabia was at a similar stage of depletion, in the vicinity of 55%, in 2005:

Texas and the Lower 48 as a Model for Saudi Arabia and the World (May, 2006)

http://www.energybulletin.net/16459.html

In any case, regions with stable pre-peak HL plots seem to predict post-peak cumulative production quite well, e.g., the Lower 48 and Russia;

In Defense of the Hubbert Linearization Method (June, 2007)

http://graphoilogy.blogspot.com/2007/06/in-defense-of-hubbert-linearizat...

The charts produced below are for C+C+NGL from BP data. The UK data contains some production from west of Shetland, the Irish Sea and south England and the Norwegian data contains some production from the mid-Norway, Haltenbanken province. It is a lot of work to back out individual fields from the full data set. The data I plot is dominated by North Sea production and by C+C - but it does contain NGL and data from these peripheral areas.

The first plot is for 5 years prior to the known peak year. Personally I'd be very, very reluctant to use ths data to forecast URR or peak production year.

This second plot brings us up to 2006. The peak year as documented by production data was 2000 when 6.38 mmbpd of C+C+NGL were produced. I'm fairly comfortable using this data now to say that the discovered developed (DD) resources may ultimately produce around 64 Gbs. With 47.8 Gbs already produced that leaves 16.2 Gbs of DD reserves remaining.

I'm also fairly comfortable with the notion that the N Sea has undergone flush production for much of its history. The UK had a spell in the mid-late 80s where some production was suspended and Norway withheld a little production during the late 1990s. But in the grander scheme of things, the North Sea has operated at capacity (Cf = 1).

In the interest of being cautious, I do know that there are a large number of small discoveries waiting to be developed in the UK and Norway (but I have not yet determined how much oil they contain) but will want to add these discovered undeveloped reserves (DU) to the 16.2 GBs. Furthermore, I know for sure there will be future discoveries. Maybe some large ones in Norway. And these too (unknown size) need to be added to any concept of URR for these countries.

The cumulative production to 2000 was 35.5 Gbs. That works out at about 55% of the indicated Qt of 64 Gbs for the DD reserves. This fits well with our notion that peak productin will occur post 50% of Qt owing to modern field developement practices.

Yeah, yeah — Hubbert math — Whoopee!

Did anybody notice that OPEC will raise their production 0.5 million barrels per day by November 1st? I guess that would apparently obviate any "peak now" nonsense, wouldn't it?

Funny, maybe TOD stands for "The Over-the-top Doomers".

Still, that does not remove us from a very likely peak by 2015 but probably 3 or 4 years sooner.

Have a good one, Euan.

Dave

Dave, please note that in response to the OPEC news, commodities traders raised the price of oil to within fifty cents of the all-time record of $78.77.

They are betting their careers against OPEC's word. My take on this is that a major disruption in petroleum distribution is expected in the next few months, rendering this quota increase moot.

I have a friend who works in a lumber yard. He regularly threatens to "start eating sawdust and crapping 2x4's" but I don't plan on building a house from his "output"

SW

Dave, I respect your posts greatly and value your wisdom, but I don't see how 500,000 barrels, if it is produced, changes anything yet. Most think SA has some spare capacity even if they are post-maximum peak, and the increase still won't break through the plateau we have had the last 1 to 2 years (depending on what liquids you are using and which data set). You are sounding like Hutter. I'm not saying you aren't right about 2012 or so, but this certainly doesn't tell us much one way or the other as far as I can see.

Eric

If you read his articles closely, Stuart Staniford does not believe that Saudi Arabia has any spare capacity.

Do you understand what I just said?

Stuart's view has become the mainstream view on TOD. Nobody else's view really counts. I see that PG believes Stuart's conjectures. HO, who I respect, does not. Look, if you want to deal with reality, read my columns over at ASPO-USA. If you want the doomer "end of the world" view, keep reading The Oil Drum.

Why do you think I resigned?

What makes you think they will actually be able to meet their production goals?

Um, to the best of my knowledge, they are raising the quota, not 'production' - OPEC's members have an extremely long track record of never producing within the set quota, it is at least possible to see this new quota as merely attempting to reconciling the numbers on paper with what is actually being produced. In Great Britain, the process is currently running in reverse - the numbers in such things as revenue for the government budget are being revised downwards - but the same trend can be seen. Reality is starting to overtake all the projections.

Of course, a lot of people here are over the top, and the looming American economic train wreck certainly plays its role in OPEC planning - except strangely, isn't this the sort of situation where traditionally OPEC would be cutting production, to ensure a stable price?

And yet, the price keeps rising, even as 'production' keeps rising.

A real puzzle - though some pieces are missing, it does seem as if a certain pattern can be seen - higher prices, no increase in real production from a number of former exporters (like the UK), and no noticeable increase in export production from countries like KSA or Russia (Russia remaining a puzzle wrapped in an enigma).

Of course, maybe Angola is the new Saudi Arabia, but I'm not holding my breath.

This is how peak looks - we will know if it is in a couple of more years, regardless of anyone's opinions.

The news made it quite clear that they are raising the quota by 1.4 million, and raising production by 500,000 to meet the new quota. So no, they are not just raising the quota and keeping production flat. I sense that they don't intend to raise production by this amount, however.

I haven't the interest to wade through the thickets, but does the statement's details include Angola being brought into the system (or how Angola's expected ramp up in production is to be accounted)? How about Iraq's declining production, which is not subject to quota? Or Saudi Aramco's now confirmed reduced output?

There is a lot of very imprecise data, and much of it is not readily accessible anyways - the call for transparency is actually just the start of beginning to actually figure out what is going on, and then how to deal with it.

However, rising price in the face of flat production does seem to indicate certain shifts in the oil market, ones best explained by geology, in my opinion.

I have little attachment to any particular model or method - to me, peak oil is measured by what is coming out of the pipeline, and these days, it is less than a year ago, and not significantly higher, even as the price seems to have undergone an approximate doubling, since the amount of oil being produced flattened 2005.

In Iraq the oil pipeline meters have been shut off since the invasion, so nobody can say how much oil has left Iraq or where it went. But I bet America had a hand in deciding how much and where.

So far, the data support a peak last year. Until production exceeds that peak, it's impossible to know that peak will happen a few years down the line.

OPEC agreed an increase but that doesn't mean they will produce an increase.

The latest IEA report shows a near 500,000 bpd drop in production last month.

Incredibly, the IEA are forecasting average consumption, this year, of 85.9 mbpd. From memory, I don't think production has ever reached this figure this year (and last month's production was way below that) and yet the report also shows a slight increase in stocks. I don't have all of the data with me but unless last month's figure is an abberation, stocks cannot increase when consumption exceeds production. Can it?

I think OPEC has consistently demonstrated that its production quota announcements are meaningless.

James Hamilton documents this at Econbrowser, and says: "I see the primary role of OPEC today as one of orchestrating political theater."

Khursaniyah was expected online in December of 2007--I expect it will be online in November instead. It is expected to produce 500,000 barrels per day. I expect we'll see a temporary increase of fewer barrels per day than that in overall Saudi production.

Moe - the role of OPEC is a price fixing cartell. For much of its history it existed in a world with over-supply of oil. Quotas were set and members cheated and the oil price bumbed along bottom for decades.

Now the rules have changed - but only recently - and I think OPEC are still playing catch up. I presume they are in favour of as high a price as the world economy can sustain without causing a crash that would reduce demand. They are trying to second guess what demand is in a rapidly changing world (BRIC etc). Some of their members import oil, others are pumping flat out, others want to mess with guest OECD companies (Venezuela) others are being messed up by invading armies (Iraq) and civil / tribal unrest (Nigeria). This is a complex tapestry.

Khursaniyah is indeed due onstream - and yes I'd bet that Saudi production may rise by around 250,000 bpd. Their heritage supergiants are tired and will benefit from rest. But remmeber that Khursaniyah is just the first in a line of new developments.

Didn't the discussions over Ghawar, earlier in the year, point to other new developments that came on stream previously? Stuart's analysis showed that these new developments just caused a blip in a generally declining trend. So Khursaniyah is certainly not the first, and won't be the last, but the question is how much will it affect the overall decline?

What decline? According to the IEA, Saudi oil production has been within 0.08mb/d - 1% - of 8.35 since the beginning of the year.

As much as we may not trust them, Aramco's production has been perfectly in line with their claims all year, and has totally failed to match any of the decline-based predictions made while Saudi production was falling. Like it or not, the available evidence suggests that Saudi production declines were voluntary.

Mmm, perhaps you didn't read Stuart's analysis; it showed that the decline during last year was on an 8% curve and didn't show the mathematical signature of voluntary declines. A quick check of the IEA figures shows 2007 production currently running at an average of about 8.35 mbpd, as you say. This is 6.5% below the average production for 2006. Their levels in the first seven months of the year were 8.42, 8.32, 8.27, 8.33, 8.43, 8.35, 8.35. This seems to indicate that they've halted the decline for now after continuing declines for the first three months. If you'd rather see no decline, that's up to you, but I don't think one can categorically point to an end to the trend. Let's see if they can raise production later this year, and what the final end of year average is.

I read it; he was just wrong.

There's nothing wrong with that - it was a speculative hypothesis, and I believe he said as much. But there is no indication of decline in the last 7 months of production (the slope of the linear regression is positive, meaning the best-fit line is a tiny but statistically-insignificant increase over time) and every indication of production being held in compliance with a quota.

It's just wishful thinking to say anything else at this point. You can speculate about all kinds of reasons why Saudi production is not declining right now, but the fact is that it is not.

Not really wishful thinking, just looking at the data. Wishful thinking would be that SA are not in decline. Of course, that thinking may be correct but, so far, 2006 shows a year on year decline over 2005 and 2007 shows a year on year decline over 2006. The data are not clear but I guess it all depends on how one is hoping that the production trends are going. Until the Saudis can increase production and keep it there (or further improve on it), they would appear to be in decline and struggling to hold production level in a period when oil prices are very high.

No, that would be statistics.

The linear trend of monthly 2007 production values from KSA is positive, but is statistically indistinguishable from zero (F = 0.009, P > 0.97). KSA is showing - statistically speaking - neither a growth nor a decline trend in its 2007 production levels.

Declines happened - for whatever reason - in 2006, but they are no longer happening.

It is wishful thinking because declines have only apparently been halted in the last few months. Last year's decline continued into this year but the production curve has now flattened. It is wishful thinking to say that this means the declines are over. As I've pointed out, year-on-year average production figures continue to show a decline. You may choose to believe that the plateau will continue indefinitely (or for the rest of this year) but if the figures start down again soon (say within the next 6 months), the recent plateau will almost be unnoticed when looking back at the production curve in a few years.

The last 7 months of production data show a statistically verifiable lack of relationship between time and production level; i.e., no decline. You can dispute this all you want, but you are verifiably incorrect. Run the stats yourself if you don't believe me.

KSA's production did decline in the past, but has not been declining recently, and that is the more salient data for predicting production in the immediate future.

You're reading in something I haven't written.

What I have said is that KSA's production this year has not been in decline, and that that lack of decline is statistically verifiable.

I have not said what their production will do in the future, other than to note that since they appear to be in voluntary control of production levels now, it seems reasonable to assume they will have some level of voluntary control over production levels in the near future.

Based on that, my guess is that they'll fulfill their increased production quota starting in November. If they couldn't, I don't see why they would have allowed the quota to be increased; news reports suggested that KSA was the main voice in favour of a quota increase, strongly suggesting they could have nixed it if they'd wanted to.

"I read it; he was just wrong." Wrong in that it wasn't declining at 8% at the time? It certainly was. Or wrong in projecting it to continue indefinitely? I made no such claim and specifically pointed out that Saudi production was unlikely to continue to decline at that rate indefinitely. Would you care to point to a specific statement I actually made that you think is wrong?

"didn't show the mathematical signature of voluntary declines" is the claim I'm saying appears to have been wrong.

I don't recall whether you explicitly made that claim, much less a claim about continuing declines, although both I and the previous poster got that sense from your articles. If you didn't make either claim, then my apologies for suggesting you had.

Both claims do seem to be widely-believed and incorrect, though, regardless of who bears responsibility for making them.

EDIT: ahh, found the speculative hypothesis I was referring to. From Saudi Arabian oil declines 8% in 2006:

You made the speculative hypothesis that KSA production is in decline - from the phrasing, you appeared to be saying permanent decline - and appear to imply that it will decline at a rapid rate. You reinforced that hypothesis at the beginning of A Nosedive Toward the Desert:

i.e., KSA is currently undergoing rapid decline. As in, that is a present and continuing situation as of March 2007.

Obviously, I disagree with that hypothesis: KSA was not in the middle of a decline - rapid or otherwise - in March of this year, as the 2007 production numbers show. Moreover, I disagree with your other hypothesis:

2006-2007 production has been a sharp decline until reaching the quota level, and then no decline at all thereafter. That is just what one would expect from a voluntary decline, but it seems unlikely that an involuntary decline would conveniently stop at a chosen quota level.

"Declines are rather unlikely to be arrested, and may well accelerate." was clearly wrong and an overhasty extrapolation. By the next piece, I was more careful, saying "has entered rapid decline of their oil production, at least for the time being". I also in that piece pointed out that "However, it's very hard to believe that declines would continue at that rate. Eg, if they continued all the way to zero after ten years, that would only be another 16 billion barrels of oil production. No-one is that sceptical of Saudi oil reserves. Eg Hubbert linearization suggests there's about another 80gb or so of oil there. ASPO estimates 170gb still to produce (though based on a fairly generous recovery factor)."

There was no good evidence of stabilization in March. The data available at that time would only go through Jan-Feb, and all series were still dropping. I continue to believe the declines in 2005-2006 were largely or entirely involuntary and likely reflected at least in part depletion in North Ghawar. However, I also continue to believe that there is a sizeable fraction of reserves remaining in Saudi Arabia, and the declines probably reflect a failure to anticipate the depletion of Ghawar (and maybe other fields), and not a complete lack of anything else to develop.

Yes, of course. I'm not saying you did anything wrong - as I said, you made a speculative hypothesis, and it turned out to be incorrect, and there's nothing wrong with that. Happens all the time when people are trying to figure out something tricky. All I'm saying is that current evidence suggests that hypothesis was not correct. No biggie.

It's not yet clear, though, what the nature of last year's decline was. I'd argue that 2007 production gives strong evidence that at least some of it was voluntary, but we don't know whether all of it was. There's probably a good chance you're right that some of it was involuntary - your analysis of North Ghawar was very solid, although it's somewhat speculative how heavily KSA was relying on the region - but there's also a good chance we'll never know.

Wikipedia on Signal to Noise Ratio.

I like HL but I think it only makes sense to apply it to resource where there are Geological reasons for thinking we're close to using a large fraction of the resources, say above 0.2 minimum.

HL derives it's power from it's simplicity:

dQ/dt = Q(1-Q)

Where Q is the fraction of the total resource consumed. The equation above describes the growth of bacteria in a petri dish. At small Q, the growth is exponential. As Q becomes reaches 0.5, diminishing returns set in and the growth rate becomes negative. Of course in the real world, many effects can interfere with this but it's hard to beat the fundamental first order effect you get from the equation.

If you apply it to many minerals you get no predictive power from the extrapolations because we're so far away from exhausting supply. ie Q << 0.2. For this reason I don't think it works for coal production.

Sorry for the low quality graphs. I haven't put time into prettying them up. The data are for the period 1900 - 2004 from the the United States Geological Survey.

The hard part was obtaining the production prior to 1900, for which I pent a fair bit of time web surfing. I'm pretty confident of gold, copper and silver. But for tin I just scaled the copper production prior to 1900 by the production rate post 1900.

HL is more applicable to oil IMHO because oil is:

1) liquid. the easy stuff was under pressure on land, even.

2) sold in its natural state.

3) the source of energy for its own exploitation, and the exploitation of all other resources, including all metals

The limiting factor - the bottleneck of oil production - is geology. Copper, Tin, Silver and Gold however must be mined and smelted. Even when geology is good, metal production is limited by the availability of energy sources required for mining, smelting, and transportation. Energy sources such as oil.

Metal production in the ancient world rose and fell on the availability of cheap wood, and in today's world it rises and falls on cheap oil.

If you'd like to explore the efficacy of HL I invite you to apply it to primary energy sources and not metals, or PlayStations, or pork bellies, all of which are made of cheap oil.

Wood and coal should be good targets, but you'd need to look back at when they served as primary energy sources - before the age of oil.

I think you have hit the nail on the head BMCNETT.

Given a limitless amount of free Energy Q would tend to zero for most extracted commodities...

This would explain the long term commodity downtrend even as demand has risen.

There are metals that should be more highly correlated to underlying energy costs: Aluminium and Lithium come to mind.

Regards, Nick

Prices and Production over a complete Hubbert Cycle: the Case of the American Whale Fisheries in 19th Century

http://www.energybulletin.net/3338.html

What's your reasoning to apply HL to metals?

Try to apply it to whale oil, that would be interesting.

A few reasons. Firstly to demonstrate the limits of the HL method. You can can't use HL to predict URR and the peak production time if a large fraction of the resource has not been produced.

Secondly there is a second order theme on this site that we're close to peak production of various other resources.

The data above suggest we're nowhere near close to this.

Thirdly because a lot of economists confuse Oil with other mineral commodities. The four metals I showed have been mined for over 5000 years. Some economists appear to confuse metals with Oil and think that if we just keep trying harder we'll find more Oil, like we have for copper, gold, silver and tin for the past 5000 years.

So I'm also trying to demonstrate that there is a fundamental difference between fossil Oil and minerals.

Recycling is a significant part of metal usage. A large fraction of the iron used now is recycled. I think you need to adjust if you can metal production for the recycling effect.

In general most oil products are not recycled.

But is not recycling like a birth/death model? For instance, the materials die and then come back to life as they get recycled. If what I am reading here is that Hubbert Linearizing is a form of birthing and dying, then it seems like it should work even better for recycled materials.

Yes but the number presented above are only for new mining.

My understanding is mining of iron ore has dropped off substantially since the 1960's. So I think the problem is metals are semi-renewable and HL at least as we do it don't work for metals. I'm sure their is a similar equation but HL is probably not right. I don't think it works for wheat either for example. And it has a similar birth-death model if you will.

That does not appear to be true:

World production of iron ore was at an all time high in 2004.

What's the impact of price on those wild inflection points? Do the sharp dips and peaks correspond to price swings? Can you tell the direction that causality runs?

If OPEC is able to sustain higher production for more than a few weeks it could be a non-logistic surge done for show. Think of a jet fighter in vertical climb which soon has to tilt forward to maintain lift.

I believe the flaw in the logistic models is that they are only supply side. Consumers have to learn to demand more which is not factored in ie we 'learned' to want gas guzzlers and oilcos responded.

I've never known what to make of HL. Initially it seems pretty damned predictive as the slope crashes steeply toward the X-intercept. However, suppose conditions should stabilize or improve, for whatever reason (someone discovers abiotic oil); then the slope can become asymptotic (well, not completely asymptotic, since even with abiotic oil we do live in a finite world). To the extent that unexpected good news causes the slope to approach the horizontal, the smallest perturbation then vastly changes the ultimate x-intercept. HL seems like a very seductive tool, but isn't it finally empty of predictive power? Or are we expected to just rule out abiotic oil and everything else that disagrees with our preconceptions?

By the way, what would does HL look like in theory for a sustainable resource? An asymptote, I assume. It still looks like a big crash at the beginning but since we're talking about a no-growth system, the consuming society continues to do just fine under a progressively infinitesimal y-value as the line slopes off to the right.

BTW, I'm no cornucopian. I do believe that TWAWKI is on its last legs. Just not sure how much useful light HL actually sheds.

Hi Helot,

HL only works where a large fraction of a finite resource has been consumed. Crude Oil from fossilized plants is clearly finite and depending on who you believe, we've consumed 0.3 - 0.5 of it. HL works reasonably well for crude oil I think.

Look at the examples I posted above for situations where I don't think it has predictive power. (Almost all other mining activities.)

I respectfully disagree. HL works best where exploitation of the resource is so cheap that it is limited by factors that can be modeled with simple math, such as geology in the case of oil.

All primary energy sources are cheap to exploit by definition, because they provide the net energy for exploitation of all resources, including themselves.

Hubbert predicted global peak oil in 1956 not because we'd consumed a large fraction by then, but because oil exploitation was so cheap as to be limited by geology alone. Geology is big enough and old enough to be describable by relatively simple math.

I respectfully disagree. HL works best where exploitation of the resource is so cheap that it is limited by factors that can be modeled with simple math, such as geology in the case of oil.

Conflating "simple math" with "geology" makes my head spin. Exactly what does the logistic, which is an overly simplistic biological model and forms the basis of HL, have to do with geology? Last I heard, geological materials are not known to reproduce.

That is a different perspective to mine. I'll have to think about whether I agree with you.

Hubbert certainly did not use "Hubbert Linearization" to predict the peak in US Oil production.

Producing below capacity does not work if you except technical advances. So your spot on without technical advances but they subvert the underproduction concept.

Next EROI comes into play for the left overs.

And you have export land esp for swing producers.

The net result is that you can push forward in time any delayed production with confidence that its a over estimate of overall exports. Thus a physical smoothing of KSA's production is and over estimate of URR.

Scissors work.

What do you mean by Scissors work?

Sorry KSA production rate changes a lot over time as they play swing producer. You can smooth the graph by combining the total production for a number of years to be effectively the production for on year. Its just accounting work.

Using this approach they should have peaked in the 1990 early 2000 but the delayed production seems to have delayed their peak by a few years. A better example is Russia they suffered a similar but smoother delay in production and are now back on curve.

The second part of the argument is that non of the production numbers show a clear technology effect even though we have had major advances in technology. So using the simple vertical well no water drive as the standard then technology have given us a boost which causes HL to over estimate the remaining URR. The increased ability to maintain extraction rates over time reduces the amount of real spare capacity even if you try and limit production.

Finally since the 1980's most of the new production has been offshore which has a different production profile and cost ratio vs onshore. We treat offshore production the same in HL. In general recoveries are lower for offshore production.

In fact we are also facing the collapse of what is collectively our other giant field which is all the shallow offshore fields that where developed since the 1980's. Collectively this group is going into a steep decline and represents a sort of giant field. I call it the swarm effect.

Put everything together and attempting to adjust HL for the concept of producing below capacity is probably not the right approach. It makes sense to smooth the graph yes but only to the point of balancing already produced oil. The assumption that future production is available from previous periods of below capacity production for more then say 4-5 years is probably not true. Look at Russia for example.

KSA did delay peak by several years but this is past.

I would tread very cautiously on this route. First of all, the logistic model on which HL is based is purely a heuristic with no first-principles derivation. The only process that matches logistic behavior is birth-death population dynamics, and we know that oil molecules don't mate and give birth. Secondly, based on the previous assumption that no physical model matches HL, then in no way is it possible to ascribe further meaning to any of the parameters apart from some asymptotic meaning with respect to the URR. In other words, the scaling parameters have no meaning in the logistic model, so why do you expect them to have meaning in the boxed equation you show?

If we want to go with something simple, then go with something simple. For instance, why the heck don't we just plot the first derivative of yearly production with respect to time and then plot that? Around the peak, this will turn into a straight line with negative slope and you should be able to discern the peak by where it goes through zero (i.e. the slope flips sign around the peak).

This is based purely on calculus and the Taylor series approximation that every quasi-symmetrically peaked curve has major terms like A-B*(t-t0)2 around the peak. Take the derivative of that curve and you get 2B*(t0-t) which you and I and everyone else can easily understand as a negatively sloped straight line which crosses the axis at peak.

I know that this completely obscures the subject of URR, but URR is not even important here, based on the same assumption of a quasi-symmetric peak. As much of the production will appear on one side of the peak as the other for a more-or-less symmetric curve, so just ignore the URR.

So I see it that we have two routes to take:

1) Go for the trivial analysis as above (therefore undermining HL, which has proven to be a perfect example of a concocted and contrived analysis)

2) Go for a real model of oil discovery and depletion

I'm all for (2) but if we really want to do (1) then let's really agree to finding the faults with HL. It's really embarrassing that's all we have with all the excessive brainpower in the world.

When I first sent this round the contributing crew at TOD I said is was "mind dumbingly simple". Not everyone liked it. I've spent the greater part of 18 months trying to get to grips with what HL is really telling us, always feeling that there was much latent value - but trying to distill the truth from a morass of uncertainties.

What I have come up with is somthing I hope the majority of readers can understand. Rather than looking for faults - I 'd prefer to find areas of agreement. The main conclusion I have reached is that HL will provide a fair estimate of the ultimate size of Discovered Developed (DD) reserves in a maturing setting - if these are being produced "flat out". That I think is quite important. It takes us in the direction then of asking what is the size of the Discovered Undeveloped and Yet to Find resources? In some countries such as the UK and Norway it is actually possible to get a handle on the size of DU. In the Middle East and Russia this is more tricky and requires vast resources to acquire the knowledge - this is the game that IHS and CERA play.

I've been reading comments like this for some time now and have been wondering what the Hell they mean. I think you have lost site of what happens in the real world. Oil fields are discovered, they get developed, and then in the off-shore setting, they are decomissioned and abandoned. That maybe is a birth-death model. This is one reason that in the offshore setting decline rates are much faster, it is because fewer wells are drilled and a lesser number of ior interventions are possible. What is driving this is reservoir physics - a crucial combination of oil quality, reservoir quality, reservoir connectivity, reservor size and potential.

In super-giant oil fields of the ME the process is very, very different. Fields get discovered - and then for extraordinary reasons many of them get left on the shelf for decades. This completely decouples the production / depletion cycle from the discovery cycle. Similarly, the fields that are developed are not produced flat out. These will die over a protracted period - the death process may take decades.

I don't know for sure what % of global oil comes from offshore fields and what comes from ME supergiants - I'd guess 30% from each. The birth-life-death cycles for each are very, very different - and I'm not atall sure that we can come up with a single mathematical solution that explains both.

I presume by this you mean the Shock model - the details of which I have not followed, but Khebab has a new post in the Q about this - so I'm looking forward to seeing what it does.

http://www.peakoil.net/uhdsg/Default.htm

I gather the objective is to link oil discovery to oil depletion. In other words, linking discovered volumes to production, depletion and decline. I'm all for that - but how do we know how much recoverable oil has been discovered?

So the point I have reached in trying to work out how best to model future production is to use a top down decline / Hubbert model for DD reserves and to use a bottom up approach for the DU and YTF. Imperfect I know. I suspect this is what Campbell and Skrebowski does - so I'd be a bit cautious about calling this a "trivial analysis".

''and then in the off-shore setting, they are decomissioned and abandoned. That maybe is a birth-death model. This is one reason that in the offshore setting decline rates are much faster,''.

Remember the business case for offshore production , especially in demanding environments such as the North Sea.

The very high cost of installations demanded that production was ramped up as quickly as possible in order to recoup the very significant costs of investment. Ramping up production was also of course encouraged by UKGov in the 80's.

Hence the production profiles typically seen on Forties and all the other major fields.

Does an unrestrained profile for an offshore UK Field show a truer Hubbert curve? - Steep upward flank, brief plateau and gentle(r) downward flank with a residual and long tail.

I think so, because initial production was unrestrained by politics or economics, indeed both politics and economics encouraged a lack of restraint.

By and large, the porous and permeable clastic reservoirs offered no significant barrier to production.

The only significant intervention on the UKCS profile was around the time of Piper Alpha, causing the double peak.

Other than that, UKCS suggests an ideal and transparent example of unrestrained production profiles.

I've been reading comments like this for some time now and have been wondering what the Hell they mean. I think you have lost site of what happens in the real world. Oil fields are discovered, they get developed, and then in the off-shore setting, they are decomissioned and abandoned. That maybe is a birth-death model.

Okay, here is the only derivation for the logistic that has any kind of "real-world" physical basis (and questionable at that). The derivation starts with two assumptions, the birth and death rates:

B = B0 - B1*P

D = D0 + D1*P

We base the entire premise on the negative sign on the second term in the birth rate -- in the event of limited resources such as food, the birth rate can only decrease with size of population (and the death rate correspondingly increases).

The next step involves writing the equation for population dynamics as a function of time.

dP/dt = (B-D)*P

This provides the underpinnings for a form of exponential growth, however critically modulated by the individual birth and death functions. So if we expand the population growth rate, we get:

dP/dt = (B0-B1*P-D0-D1*P)*P = (B0-D0)*P - (B1+D1)*P2

which matches the classic Logistic equation formulation:

dP/dt = rP*(1-P/Pinfinity)

We need to look at the correspondence of this biological birth-death cycle to oil with a critical eye. First of all, P can only be linked to cumulative oil production for the equations to even start making sense -- so right there it raises a furrowed brow, as the carrying capacity for a bunch of dynamic biological entities (Pinfinity) is not the same as the ultimate recovery of a static resource like oil (URR). Secondly, discovery is not the same thing as birth, and, in any case, why would the rate of discoveries initially be proportional to the cumulative number of discoveries? Most realistically, I would think that it would be proportional to the instantaneous rate of discoveries (i.e. the law of exponential growth). But if you chose this, you wouldn't get the same easily solvable equation.

So the set of equations is a marriage of convenience. The basis of the logistic maps to a completely unrelated physical concept that we only use because the form of the result heuristically fits the empirical observations. But then again, we can clearly show that other models can also fit the general form. We can conclude therefore that the reason we use the logistic and therefore HL, is because of laziness.

If we don't want to be lazy, and be truthful to the real-world, we should use the basis equations I wrote above, and come up with values for B0, B1, D0, and D1 to fit to. I contend that we don't because it would get us stuck in a logical conundrum, having to rationalize values for these questionable physical parameters as it relates to oil production.

If we want to meet halfway, perhaps we should talk about HL only in terms of the discovery curve? And we leave the production curve out of it? The question I would state is how can the logistic map to production and not to discovery if you state that discovery is like birth? Try as you might, you cannot deconvolve a single logistic curve into two curves, one discovery and one logistic, that are separated by a temporal shift. By laws of group theory, we have a problem right there.

Web - thanks for your input here. I will admit to understanding less than half of what you are saying. Our backgrounds are clearly rather different.

As a geologist I have become accustomed to developing a simplistic view of systems that are too complex to describe. If it is possible to come up with equations that handle the unceratinties then great.

In terms of the birth and death analogy I'd add that life style and longevity may also need to be considered.

No doubt that any production model / forecast should contain the same amount of oil reserves as the discovery cycle. Does anyone know how much oil is in Campbell's discovery cycle? Linking the two is very tricky owing to very different behavioural traits of the oil producing blocks - OECD - unfettered greed, Soviet Union - power and control, OPEC - conservation and price fixing. To be fair on the USA, conservation has palyed a role here too, but in a different way, with conserved acreage in the Arctic refuge, Atlantic margin and Florida coast.

I dare say what you say about laziness is true. HL IMO provides a quick and easy way of getting a handle for the size of the Discovered Developed resource. Working out what will happen next requires a bit more work

There are two contexts for the use of a Hubbert/Logistic curve:

1. logistic demographic modeling as initially proposed by Pierre François Verhulst.

2. curve fitting as Hubbert did.

WHT's arguments are dealing with the first context whereas you are putting yourself in the second context. The power of (1) is that you are trying to physically model the observed phenomenon using a differential equation. In the case of a logistic curve, the differential equation is modeling a birth-death process as explained by WHT above:

where URR would then be the total population in equlibrium and K the birth rate.

Note that Hubbert could have chosen as well a Gaussian curve to fit the Lower-48. He did not used context (1) to justify his choice simply because the differential equation above is not appropriate to describe the reality of oil production (i.e. not a birth-death process). The limitation of (2) is that you cannot pretend to model production, you are just merely extrapolating future production from past production.

The shock model, on the contrary, is based on an attempt to truly model the oil production cycle (initial discovery, build time, reserve addition and decline, etc.).

Khebab nailed it by placing it in the 2 contexts. As I said before, you cannot ascribe any physical meaning to the parameters if it is simply a curve-fitting exercise. And in the other context, we just can't make any sense of the model in terms of oil production.

Let me present another perplexing situation. If we actually consider the full birth-death model:

dP/dt = (B0-B1*P-D0-D1*P)*P = (B0-D0)*P - (B1+D1)*P2

you notice that in terms of birth and death, this gives us asymptotic P as the current carrying capacity. The equivalence between carrying capacity and URR makes absolutely no sense if we keep the death terms in the equation. Remember that deaths essentially knock out entities from the current population and the number of entities that have actually existed over all time would be infinite! But we know that URR << infinity.

What this means for the oil analogy is that we would have to present the Birth/Death model as purely a Birth model. In other words, births don't give rise to deaths but they do add to the cumulative growth. Otherwise, we would significantly undercount the URR as deaths would invisibly remove "entities" from the cumulative count.

So the next time someone talks about oil fields dying and trying to relate that to Logistic/HL modeling, point them here.

As Khebab said, no problem if you use HL as simply a curve fitting exercise, but you cannot ascribe any further meaning to it.

I would argue that this equation marries economics with geology and is the basis of the HL's power.

In the presence of economic growth the consumption of resource will rise exponentially, until such time as the fundamental limits of resource availability curtail further consumption.

The term proportional to Q models the the economic pressure, the term proportional to (1-Q) models resource availability.

The data I showed above on metals production show a exponentially increasing consumption rate. If there was no limits to oil availability, the HL of Oil would not show the observed decreasing trend but would be constant as a function of cumulative production.

Khebab, Web et al - thanks for your input again.

WRT the shock model as you describe it, I'd suggest that you may need to develope different sets of average parameters for different countries / field settings to account for different political / economic behaviour and field development practices.

The main break downs may be:

Onshore and offshore

OECD

OPEC

Russia

Others

Onshore fields tend to have a prolonged life cycle as they get traded down the company chain until you end up with stripper wells and negative eroei. Off shore fields tend to have a finite life as facilities eventually need to be decommissioned etc.

Between the economic groups, the discovery - development cycles are very different. I don't know if that makes any sense, but its my toupence worth.

The HL methodology is actually one used by reservoir engineers in analysing the performance of individual fields - they will look at this and try to work out ways of influencing the outcome by maximising / production and recovery. I still feel reasonably comfortable using this as a lazy way of getting an approximate handle on URR for Developed reserves. My own attention will avert to assessing DU - especially in the North Sea where I hope I may get hold of the DU data base from the government.

WRT to Greyzones comments below, it seems there is no substitute for bottom up analysis of discoveries - we need to get our hands on a public domain global data set. I had lunch with Kjell Aleklett some months back and he mentioned that his group had put wuch work into compiling this - and the intention was that this should be public domain. Will hopefully get a chance to ask him about this next week.

This a very interesting comment, as usual anyway.

I’d like to make two points:

Another process that does match a symmetrical curve is oil discovery. When smoothed with a moving average world oil discovery yields a quasi-symmetric curve. This is also true for individual regions (UK’s portion of the North Sea from memory). I think you’re narrowing the view when strictly concentrating in Population Dynamics.

Btw, don’t you work with spatial simulations? Toying around with models like SugarScape (were sugar doesn’t grow) often turns up with quasi-symmetrical curves for “sugar discovery”.

The other thing I’d like point out is that the base problem for Saudi (constrained production) that undermines HL also undermines other mathematical models. The example you gave with 2B*(t0-t) is one of those. If you have constant production like you had the last few years in Saudi you simple get a straight line at 0. What do you conclude from that? Can you be certain that’s the final peak? Can it go into the positive again?

This example is very simple and other models could be more helpful, like the shock model. But still, on a situation like Saudi’s it’ll need some guessing.

I've never seen an HL of the discovery curve. You'd think that being well well past peak oil discovery, the HL of those numbers would point pretty definitively to a reliable UDR (ultimately discoverable resources?) number. Of course, I'm not sure it's valid to do so, since discovery of oil is not the same physical process as sucking an oil field dry, but hell, people are making HL's of copper and silver extraction, so why not?

HL and the Logistic model, is closer in principle to the discovery curve than production simply because discovery is more analogous to birth than production is to birth. But then again, we have pretty miserable data for discoveries, as most of it is backdated or estimated.

I do have a separate discovery model posted to TOD:

http://www.theoildrum.com/node/2712

Of course this model has nothing to do with HL or Logistic, but it is more-or-less symmetric, apart from the fact that causality causes a real asymmetry because the initial tail starts from zero.

Hubbert did note that production mirrored discovery with a roughly 40 year lag time. While he never explicitly said so in that 1956 paper, maybe that was part of his underlying assumption? Too bad we will never know what he was actually thinking then.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

If you have constant production like you had the last few years in Saudi you simple get a straight line at 0. What do you conclude from that? Can you be certain that’s the final peak? Can it go into the positive again?

Very good point. At least you can make sense out of this with my "First Derivative Linearization" (FDL). Compare this to the nonsense of the "dog-leg up" -- no one knows what to make of the crink in this curve because it destroys all of our mathematical intuition, mainly because the entire HL is a contrived construct which holds very little intuitive power after the HL transformation occurs.

So I hold FDL in higher regard than HL.

Though its not completely testable, the principle of declining net energy - or rather the net difference between decline in net energy and increase in technology/recovery could be what underlies HL.

In Louisiana, on shore EROI has dropped to break even. The EROI peaked above 30 and followed something similar to a Gaussian curve - this is from Energy And Resource Quality - pg 186. We don't KNOW what this is for the US as a whole, other than it went from 100:1, to 30:1 to 10-17:1 7 years ago - where is it now? Charlie Halls data from BP and John Herold show a similar trend on world oil and gas.

King Hubbert didn't know this. But it may explain why unconstrained production of large contiguous regions declines over time - it just becomes uneconomical based on higher energy inputs to get the tuff stuff.

Nate - I think you are on the money here in more ways than one. I've been thinking about peak oil like climbing a mountain recently. The higher you get the harder it gets. I was up Kilimanjaro a few years ago. I climbed to around 18,000 ft until a combination of altitude, cold and terrain got the better of me. I couldn't take another step going up.

Back in 1971, global oil production was around 50 mmbpd. In 1986, it was 60 mmbpd. In 1996, 70 mmbpd and in 2004 it was 80 mmbpd.

Assuming annual agregate decline of 4.5%, that means new capacity of 2.25, 2.7, 3.15 and 3.6 mmbpd per annum for each increment. Simply put, the higher you get the more new capacity is required each year just to compensate for decline.

Whats more, as time passes, your ability to add new capacit is eroded - as all the best fields get used up. So every year you need to add more new capacity from a resource base of diminishing quality. At some point you just can't do it, either because you lose the will, can't afford it or lack human and engineering resources to do so.

The chart you show is astonishing. I've not seen this before. It presents the peril we are in in a new light. Whilst the scale is tricky to read it looks like the aggregate energy profit for Lousiana now stands at around 7. How do they measure these numbers? So the energy bounty / profit that once existed in being spewed away in spending a vast amount on recovering the tail end.

This is unlikley to happen in offshore areas where it becomes plain uneconomic to keep platforms running - they begin to fall to bits - and ar eventually decomissioned. This draws a line between what's sensible and what's not.

The graph is 20 years old and is from Cutler Clevelands doctoral thesis. From what I hear, the energy profit for onshore Louisiana oil and gas is now break even, just a conduit for increasing the notional amount of internal US production.

The world has gotten so far away from biophysical terms and so glued to money that Im not sure we have the data to accurately do things in BTU terms anymore. And we will only realize that we need to after the net energy card has been played.

The issue is even more complicated because of fixed vs marginal net energy. If Louisiana (or any other region) is producing Life cycle analysis energy break even oil now, it still might be ok because all the infrastructure is paid for - but if anywhere is producing MARGINAL sub unity EROI oil, the energy in that facility would be best used building renewable infrastructure. The problem will be that oil prices will go up dramatically so the gut reaction of businesspeople will be to keep these projects going to 'get the oil'. It will be called a treadmill.

I too climbed and failed Kilimanjaro - up at around 15,000 feet - thought it was from food poisoning from the pig our sherpa carried around in his backpack to eat off of, but in retrospect Im told it was altitude sickness - closest I came to dying. (Other than when Traci broke up with me).

Nate your right on. And this fits with what I've been saying that HL is modeling the creation and "death" of wells or the means of production. This happens to be related to the overall amount of oil in place.

One important point you don't need to produce flat out thats a myth you need to consistently develop the resource until its no longer economic. I think your 100% right on except that constrained or unconstrained is not important its more important that the development/production program is consistent. Only if external factors cause a major change in production collapse of the Soviet Union for example will you need to adjust HL.

Western oil fields were developed and produced close to the maximum but thats not important the key is they where systematically exploited.

I'd wish there was less focus on EROI. While it holds great merit when dealing with the decline (and new deployment) of energy sources, it's not very helpful when we deal with Peak Oil.

Let me explain. While oil is a very important source of primary energy, the really important part is that it is the almost exclusive source of liquid fuel, and hence also the almost exlusive source for transportation fuel.

This is by the way the one thing Bob Hirsch constantly pounds into your head at his lectures. It's not an energy crisis, it's a liquid fuel crisis.

Even if the EROI of an oil well falls under 1 it might still make sense to keep pumping, just to get hold of the precious liquid fuel. This oil would then not be an energy source but an energy negative "manufactured" energy carrier, like hydrogen (except it would be about 100 times as convenient).

Consider that we produce vast amounts of useful things which are not energy sources, but which still create great utility for it's consumers and great profits for it's manufacturers.

Like computers, steel, toothbrushes and industrial chemicals.

This entire argument is built on the belief that oil as an energy source can be replaced by other energy sources (including in the extraction of the oil itself), something I fervently believe considering the experiences of for example France, Switzerland and Sweden.

I hope this argument is not completely unintelligble.

Its not unintelligible but misses a few key points:

1)the EROI of the things we will use to replace said liquid fuel is very low (ethanol, CTL). That lack of total energy gain has to come from somewhere.

2)this is the first energy transition when we will be moving DOWN the energy density ladder as opposed to up.

3)in order to obtain the same energy gain we've gotten (in BTUs) from oil, gas and coal will mean our non-energy inputs (land, soil, water, GHGs) etc will likely go way up.

Bob Hirsch has never once (to my knowledge) mentioned the environmental impact of some of the 'wedge' tactics

I completely agree - and this is already happening in places. But as net energy declines, we are going to need more and more coal plants, more and more nuclear plants, etc - and where will the water come from for that?

So, in effect, I agree that EROI itself is more of a blunt weapon than a surgical tool. But the energy gain (net energy) of society as a whole cannot precipitously drop if we expect to maintain a growth economy. Thats where net energy comes in.

I agree there - but we need to debate the significance of this point. May technology not help us make this reversal?

Wildebeest, gazzelles and caribou are all pretty successful.

I agree. But I argue finding and deployin other energy sources (wind, nuclear etc) will not prove more than a transient problem. That's a solvable problem.

True. A good argument to use when people say this I'll be just another transition. This time it's different (gack!). We might still make it through pretty well though. Or not.

I don't agree here. The only places where this is relevant today would tar sands, shale oil and coal mining. Going for wind and nukes should mean less use of land, water soil etc, compared to fossil fuels.

Haven't heard that either.

What water? For cooling? There are lakes and rivers all over the place, not to mention the sea. Remember that the largest US nuclear power plant (Palo Verde) is located in the middle of a desert. We have all our plants on the coast.

I'm not sure about this, as it ignores the role of efficiency.

Consider Sweden. In the last three decades our economy has doubled or tripled while energy use is constant and oil use is down 40-45 % (we still drive the most gas guzzling cars in Europe). This is while the energy consumption of our extremely energy intensive process industry has gone up (due to radically increased production) and a larger share of the population is working in industry than 30 years ago.

Lots of inefficient direct use of oil and coal has been switched to (nuclear) electricity, granting large savings of energy. Even if it seems the most low hanging fruit has already been picked, I'm sure there is still plenty to go after.

And barring that, we can always increase energy consumption by building more wind and nukes. Because this aint an energy crisis but a liquid fuel crisis.

water for biofuels was my main point

are you going to ASPO?

On Ireland?

I'd love to, but no.

There's plenty of freshwater here and biomass actually is something like 20-30 % of all our energy (not electricity), mainly in heating and industry.

But I very much doubt that biofuels will ever produce more than a few percent, 10-15 % at best, of global liquid fuels. There just isn't enough land.

well sweden has plenty of water, but in my recent paper, using UN stats for 2025, we show that 68% of worlds population will not be able to use ANY additional water for bioenergy. Which means of course that the countries with excess water will be exporting it, via energy and food.

Euan,

I expect that when Hubbert formulated his simple equation for the US Cf was closing in on 100% and as far as onshore conventional oil went DU/YTF where close to zero. We then see the US production 'dogleg up' as the latter two parameters jump on discovery/production of offshore.

I think it possible that given OPEC constraints the Cf parameter has NOT been 100% for all producers (otherwise why do we call KSA a swing producer? -You cannot swing if you are at 100%...)

[A note on capacity drivers: Companies would wish to maximise output in order to drive shareholder value, state companies to drive treasury income, we are always told the market is 'more efficient' -therefore I would expect the former to tend to have a higher Cf value.]

The IEA and CERA peak-date arguments are based on large values of the DU/YTF and increases in Cf (all aided by liberal doses of unknown 'future-tech'). It seems to me that any counter to their arguments must be based on discounting that these factors can or will grow significantly...

...I have a picture in mind of ancient mathematicians estimating the area of a circle. One group places a square inside it with four corners touching and proclaims it is simply X squared, the other group places a square outside it with sides touching and claims the same but with a much bigger X value. Both sides chip away at each others arguments. What it seems to me you have done here is start to fill out the void spaces between the inner square and the actuality of the circles area with unknowns that could -if expanded sufficiently- make your square as big as the external one. In other words I'm not sure it gains us anything...

Regards, Nick.

John Kenneth Galbraith

In this and the accompanying post I'm trying to lay down markers on what we know with some confidence and what we don't know. Knowing what we don't know should direct our future efforts.

The only way we can discount these factors is by having more or better knowledge than them.

It depends on who you mean by us. I've been struggling with this methodology for over a year now and only feel now I have a reasonable grasp of what it is telling us. But not everyone agrees on this. With respect to peak oil, I think YTF will come too late to make any difference to peak and immediate post-peak decline. Our focus therefore, should be on better understanding of DU. This takes us in the direction of Skrebowski and work that Rembrandt is doing.

I've read both of Deffeye's books, I heard him speak on two seperate occasions. I've spent a few Winter evenings playing with HL models. Personally, I think that the HL is probably the best approximating tool we have for the money.

However, I (meaning, me) would be a little cautious about making asumptions with below capacity production if URR isn't 'comfortably' known.

Where countries are producing at below built capacity it is very tricky indeed to estimate the Capacity factor (Cf). The message then is to be wary of interpreting HL data where below capacity production is suspected. The empirical data presented here would suggest the liklihood of a false low URR intercept. But without precise knowledge of what Cf is, then HL will be unworkable.

On the advice of the eds I scrapped part of the post that tried to apply this methodology to ME reserves.

I hope one of those eds wasn't Prof Goose. After all, we have reruns by an anarchist philosopher predicting the dissolution of the Mexican state and the end of nation states worldwide.

I guess if you figure out a way to juice it with some extra scare factor, their objections will disappear.

I think your making it too complex. You need to do some simple smoothing for obvious major drops in production. KSA/Russia but this is and accounting problem and it just causes a time shift to peak. In both cases buy a few years. HL just requires that a resource is consistently exploited. This whole concept of maximizing production is not important. Its based on the systematic exploitation of a resource this need not be at some maximum rate. In fact the whole concept of some maximum exploitation rate makes no sense. Its a EROI issue.

For HL you have three basic conditions.

1.) The resource has to be reasonably exploited and discovery in the past.

2.) The resource needs to be systematically developed.

3.) The EROI constraints need to be consistent.

Maximum is not important.

In the past we had oil prices fall dramatically so 3 became a factor. And we have had a few political/wars happen.

We should have peaked back during the end of the 1990/2000

because a lot of global production was shutin a few times through the 1990's global peak was shifted out about 4-5 years. Without the interruptions peak would have been well in the past and technology has help keep rates higher then they should be the last 10 years. So we are well into borrowed time. This is why I'm convinced we will see and accelerated global decline in production starting about 2009/2010 as the technically enhanced extraction rates cause fields to decline faster than HL would predict.

Actually the adjustments presented in this paper probably have the wrong sign and overall its negative vs pure HL.

The scared cow of swing producer/myth of maximum production needs the be shot and eaten its irrelevant esp on the time scales we are looking at.

Euan's post here further validates what I said a while ago - that Hubbert used external URR estimates and did not use any "HL" type technique to derive URR.

It is my firm belief that while Hubbert's math is a good tool IF a region is produced at near maximum output, it is also my belief that the derivative of Hubbert's equation (from Professor Deffeyes) goes too far in assuming that HL can predict URR.

Finally, it is my opinion that the HL technique works best just as Hubbert's 1956 paper does - when there is an external URR estimate against which the prediction can be bracketed.

This means that regions produced at close to maximum will look pretty darned close to reality when done on an HL plot but regions not produced that way will not look close to reality. This is exactly why Dr. Hubbert used externally generated URR estimates himself!! HL proponents have never, ever answered me why Dr. Hubbert himself used externally generated URR estimates. Instead they are defending Professor Deffeyes, not Hubbert. It is my opinion that this technique ought to be renamed "DL" for Deffeyes Linearization to keep Hubbert's name off of what is not a reliable indicator.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

It's my impression that Deffeyes does work with a Global URR number (I think 2.13 trillion barrels). He mentions that in his books and also in his public lectures; and points out why finding as-close-to-accurate URR is important prior to using the HL method.

Deffeyes did work professionally with Hubbert for quite a few years at (I believe) Shell Oil, and does acknowledge M.K. Hubbert at the end of his lectures.

Deffeyes admits that it took him quite a few years to simplify Hubbert's work.

It'd probably be educational if someone can write a post on the methods that Hubbert and Deffeyes used in coming up with their URR numbers... which aren't that far apart.

That's the point though, isn't it? The HL URR prediction was validated by other URR estimates, not that he took the HL prediction in isolation at all.

Hubbert's math and Deffeye's simplification of that math both rely on external URR estimates as ways to gauge the validity of the estimate.

I take exception to anyone who claims that we can always predict URR solely by HL. But when used with other tools, and understanding the production profile of a producing region, we can know whether applying HL matters or not.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

I thank GreyZone for hammering this point home over the last year. Pinning URR thus turns HL it into a very constrained curve-fitting exercise. Not a lot of room for slop, so the lined up points will either go through the points plus the URR or it will be way off.

{deleted, due to being redundant. :) }

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Grey - it sounds like Hubbert may be turning in his grave. Thanks for the links and I will bookmark this comment.

So how did Hubbert (and Deffeyes) estimate URR independently?

The same way that geologists do today! Hubbert simply took the sum of those existing estimates made by geologists and which he apparently had access to during his time at Shell. Deffeyes got his estimated data from somewhere else (I forget where now as I'd have to re-read that book to find out). You folks go out to new fields and produce 5%, 50% and 95% estimates of reserves (and a few others as I recall) using geology and seismic data, core samples, etc. Those are the estimates that Hubbert added up, from regular geologists produced on a field by field basis for the US.

But note that Hubbert never, ever tries to do anything like HL and never ever tries to predict URR. Hubbert started with prior URR estimates and then fitted production (and consequently consumption) against discovery (as the original URR) as a simple curve fitting exercise. He even did two different estimates, as WT is fond of noting. Increasing the URR by 33% changed the peak date in the US by 5 years.

Note: He used the 150 GB and 200 GB estimates in the 1956 paper. We now have a pretty good picture that US URR is going to be in the 230 GB barrel range and even this stretching of the tail did not change the peak date.

This is the power of an exponential function (and hence my constant reference to Dr. Bartlett's quote) - humans just do not at all intuitively understand what the hell is happening when a system has gone exponential. Our brains have been trained by natural selection to recognize and understand linear changes but not exponential ones. That was another point that Deffeyes has made - if you grow URR by 1000 GB but consumption continues to grow at current rates you shove peak back by a whopping 15 or so years because in short order you are eating 120 mbpd (or more) or 43.8 GB per year (we use 30GB per year right now).

And that's the crux of every human problem right now - exponential growth on a finite planet. Exponential growth of human population, of human food consumption, of human waste excretion, of human damage to the environment, and on and on. Until we realize that we have to control all of these things, we are just shooting ourselves in the foot, over and over.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

I'm trying to remember here, so don't take my word on it, but I think Hubbert used some complex probability equations to determine what would be found based on what had been found. Deffeyes (I think) took existing estimates and used some other techniques (based on geological surveys) to come up with an estimate.

So far, they seem to fit today's estimates if you discount the 1980's "hyper-growth" in reported reserves.

I SERIOUSLY RECOMMEND THAT PEOPLE SHOULD READ AT LEAST ONE OF DEFFEYES' BOOKS. The reason he came up with the HL is so that the average guy on the street (who paid attention in high-school algebra class) could understand the threat of Peak-Oil. He's also got some good humor in there.

After reading the book - just for fun - go and listen to some of these speakers who try to "debunk" Deffeyes. I used to go to these lectures to hear the other side of the story, but I never got to hear anything that could be backed up with numbers the way Deffeyes backs up his arguement.

Actually, it's been linear for about 30 years.

False statement from your own cited stats. If we go back 30 years we have 1977 when the annual growth was 71,461,445 per year. This steadily increased until 1989 at 87,671,844 per year. Then we have a short decline and then we get about 10 years of linear growth (roughly the same annual value per year). Further, even this linear growth is going to add another billion people from 2007 to 2020 and another billion after that from 2020 to 2036 IF rates go as projected.

So no, it has not been linear for 30 years, Pitt. I'll take 10 though so we'll call you 33% right on this one.

Finally, you are staring at the trees and ignoring the forest. This article provides one of many graphs of human population over the most recent several centuries.

The growth curve has been exponential for centuries, Pitt. The fact that it is leveling off may not be due to humans getting suddenly brilliant about conception, but rather it might be the human population reaching the apex of the curve, before joining every other species that played this game throughout earth's history, having decimated their environment and created the necessary conditions for large scale die off.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

No, I'm just simplifying.

Population increase has been 80m +/- 10m for those 30 years, which is adequately fit by a line. There is some overall structure to the sequence (up, down, tiny up), but when the points of reference are "linear" or "exponential", it's very clearly linear.

You weren't talking about several centuries ago; you were talking about "the crux of every human problem right now....Exponential growth of human population", and how we have to control that (among other things) now.

So don't change the subject.

While possible, your theory is monumentally unlikely.

Fertility is lowest in the richest countries - those with most access to resources - meaning that a simplistic guess of "running out of environment" as the explanation does not fit the available data. What does fit the data is that fertility has dropped due to cultural shifts, something that is qualitatively different from all other species.

Of course, that's beside the point.

The point was that you claimed population was increasing exponentially right now, and you were demonstrably wrong. Is it that hard to say, "oops, my mistake"?

Hey, I can make it linear for the last century if I claim that it fits a pattern +/- 50 million each way. Maybe I should claim +/- 100 million each way, right and make it linear for the last 2 centuries? You have no basis for choosing such a wide range except to justify your own fallacious statement. The data itself shows the exponential rise if anyone cares to plot it. Further, there was a clear growth pattern from 1977 to 1989 and it was part of the earlier growth pattern that your own stats cited. The only real odd deviation in there was around 1963.