The Amazing Power of King Hubbert(...?)

Posted by Euan Mearns on September 12, 2007 - 10:30am in The Oil Drum: Europe

This post examines the impact of delaying oil field developments and producing at below capacity upon reserves estimates made using Hubbert Linearisation. Robert Rapier had a similar post some months back using synthetic data. This post uses real data from Norway and three different story lines are described and analysed.

- Norway

- Fjordland – same as Norway but with 4 fields allowed to lie fallow and 20% of production withheld from 1981 to the present day

- Fjelland – same as Fjordland but with the 4 fallow fields developed in 2001-2004 and full production reinstated from 2002.

The significance for predicting national and global oil reserves and peak oil are discussed.

Introduction

How do we know when oil production is going to peak? This question may be asked of individual oil fields, countries and the world as a whole. Once peak is past in countries such as the USA, UK and Norway, it is relatively straight forward to recognise this after the fact. But how is it possible to forecast this in advance?

One approach that has received much attention on The Oil Drum is called Hubbert Linearisation, following methodology first used by M. King Hubbert in 1956 to successfully predict a peak in US oil production around 1970.

Hubbert - a controversial figure

There have been many posts on The Oil Drum exploring the merits and weaknesses of this approach. For example:

By Stuart Stanniford

Linearize this...

Well, could we linearize this, then?

By Khebab

The Loglet Analysis

By Robert Rapier

Does the Hubbert Linearization Ever Work?

By Jeffrey Brown (Westexas)

In Defense of the Hubbert Linearization Method

It is not my intention here to review this methodology. The uninitiated reader will find an overview here and the mathematics described by Luis de Sousa here.

The objective of this post is to examine the influence that political interference has on reserves estimated using HL. In particular the impact of producing at below built oil production capacity and of allowing fields to lie fallow are explored. The issue of below capacity production is explored further in the accompanying post.

Story line 1: Norway

Norway is one of three Scandinavian countries of Northern Europe (Norway, Sweden and Denmark), famous for its mountains and Fjords. In the post WWII years, Norway thrived on a rural economy of fishing, farming and forestry but all that was to change during the 1960s with the first discoveries of gas and oil in the North Sea with first oil produced from the Ekofisk Field in 1971.

Norway was set on a course to become a major oil and gas producer and the number 3 oil exporting country in the world. The Norwegian government set out with the intention to control the rate of oil field development so that resources would be kept for future generations. But they were also keen to develop indigenous engineering and fabrication skills and this turned out to be incompatible with the aforementioned intent.

The seas around Norway’s coast were the deepest and roughest offshore area to be developed at that time and the Norwegians rose to the challenge by building truly massive gravity base concrete platforms, utilising the deep sheltered waters of the fjords. Two engineering companies competed for this lucrative work – Aker and Kvaerner. These companies provided highly paid jobs in the coastal rural areas but the Norwegians soon found that once one platform had been completed, these yards were hungry for more work. And the only way that work could be provided was by the government consenting new field developments. Thus, commercial interests drove Norway’s offshore oil industry and any good intention to slow the process was over-ridden by the need to provide work to the fabrication yards.

Troll - one of the biggest oil and gas platforms ever built

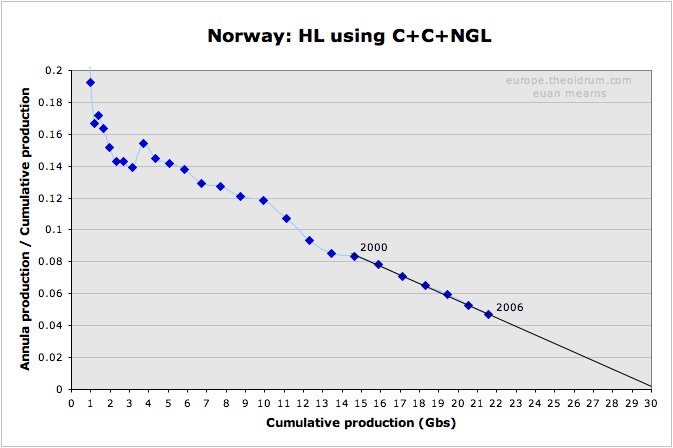

Norway’s oil production began in the Ekofisk field in 1971 and climbed steadily to 3.4 mmbpd in 2001, which was the year of peak production. Since then production has fallen at the considerable rate of 2 to 7% per annum. To the end of 2006, 22 Gbs of oil had been produced. The HL plot is rather unstable until it settles down in the year 2000. It is really only in the post-peak era that a good linear decline trend develops that now points at a URR of 30 Gbs. It is thus inferred that Norway has another 8Gbs of oil to be produced from the existing developed fields using the current range of technology that is deployed.

HL for Norway. The 2000 to 2006 data define a good linear trend pointing to a URR of around 30 Gbs (C+C+NGL). This figure does not include discovered undeveloped and yet to find reserves.

If Norway were to discover large new reserves in the deep-water areas of the Norwegian and Barents Seas this would modify the picture when they were developed and would add to Norway’s resource base. Furthermore, if new technology was developed that significantly increased the recovery factor this too would add to reserves and modify the decline trajectory of the HL.

Whilst Norway has done a poor job of preserving oil resources for future generations the government started an oil investment fund where some of the tax revenues from oil production are invested for future generations. The fund currently stands at US$317 billion, equivalent to $69,000 per person, safely invested in global equities and government bonds.

Storyline 2: Fjordland

The Fjordland storyline is the same as Norway with just two differences.

First, the Fjordland government wrote a clause in all exploration licenses stating that the Fjordland state owned oil company (Fjordoil) had the right to purchase at fair market value a 100% share of any new discoveries that were made. This proved to be an unpopular condition and the Fjordland government exercised this right on only four occasions. The first occasion was during the 1970s when Fjordoil purchased the whole of the Valhall Field. The Fjordland government decided to not develop this field and to keep it for future generations. This exercise was repeated for the Ula, Gullfaks and Snorre Fields. These four fields lie fallow to the present day.

Fjordland - a tranquil land reflecting on peak oil

In Norway these fields were developed as shown in the table below and combined they had peak production of 847 mmbpd in 1994.

| Field | Max production bpd | First oil Norway | First Oil Fjordland | First Oil Fjelland |

|---|---|---|---|---|

| Valhall | 91,000 | 1982 | Fallow | 2001 |

| Ula | 126,000 | 1986 | Fallow | 2003 |

| Gullfaks | 529,000 | 1986 | Fallow | 2002 |

| Snorre | 234,000 | 1992 | Fallow | 2004 |

In addition to the fallow field policy, the Fjordland government was concerned about the impact that Fjordland oil was having on the global oil market. It appeared to the Fjordland government that since their oil production had started that oil prices had fallen and they were concerned about producing all of this valuable resource at low market prices.

Therefore, following extensive debate in the Fjordland Parliament production restrictions were introduced which stated that companies could only produce oil at 80% of a field’s capacity. Every year, each field was allowed to produce at capacity for one week. The Fjordland Oil Executive closely monitored this and the production quota for the remainder of the year was set at 80% of the capacity thus determined.

This law was introduced in 1980 and enacted in 1981. The operating companies were furious at this development and threatened to pull out of Fjordland. Fjordoil by this time had developed significant expertise in developing oil fields and companies not happy with the new arrangement were invited to leave. None left but the grumbling went on for many years, despite a healthy rise in the oil price.

The people of Fjordland were initially happy with the arrangements made on their behalf by their government – they were after all still becoming filthy rich with this bounty from beneath the waves. However, some time around 1998 a group of patriotic Fjordlanders got together to voice concern at the rate of depletion of the Fjordland oil resources. They began to question the Government policy.

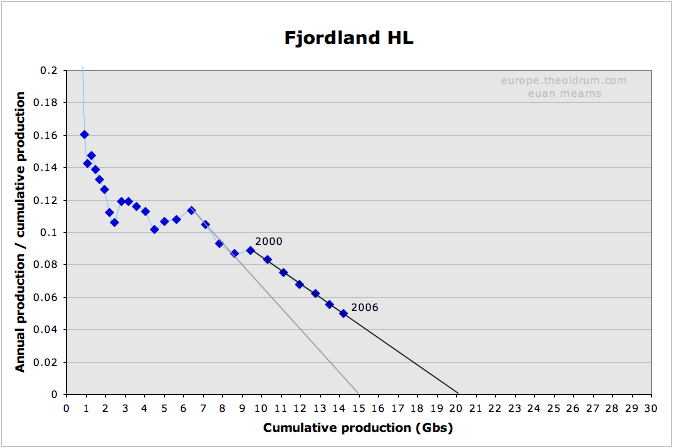

This group, known as Maxoil, were using the established and highly respected technique known as Hubbert linearization (HL) and pointed out that the HL for Fjordland was pointing towards a 15 Gb total and that the oil was being over-produced. These early warnings were ignored for a number of years. By the year 2000 the trend pointing at 15 Gbs was broken by what would become known as a dogleg up feature. Maxoil continued to grumble about overproduction of Fjordland oil resources. By 2004 production had been falling for 3 years and a new linear trend pointing towards a URR of 20 Gbs was apparent on the HL plot.

Synthetic HL for Fjordland. Since 1981, Fjordland has been producing at 80% of built capacity and four fields have been allowed to lie fallow. The synthetic HL points to an apparent URR of around 20 Gbs (C+C+NGL) whilst the actual figure is known to be around 30Gbs - the same as for Norway.

By this time the mainstream media was beginning to take interest in Fjordland oil production since it had been falling now for 3 years and despite government assurances the people were beginning to become restless. Big Foot, the leader of Maxoil was interviewed by the media. She showed her HL plots pointing to a URR of 20Gbs and whilst the media and the people were confused by the charts they were now even more concerned that Fjordland might be running out of oil.

The Fjordland state authorities joined the debate and tried to allay concerns. They pointed out that while they saw great merit in the HL technique that this had to be used with care. They explained that Fjordland still had 4 fields that lay undeveloped and that constrained production did not give a true picture of the potential of the producing fields. The Fjordland Oil Executive estimated that Fjordland would one day produce a total of 30 Gbs, and since only 12.8 Gbs had been produced to 2004 a fantastic future lay ahead for the current and for future generations.

Maxoil were enraged at this claim and pointed to the perfect line of dots pointing towards 20 Gbs. Some fine mathematicians joined the Maxoil ranks and performed elegant transformations of the data, and no matter what they did the answer was always 20 Gbs. Could the Fjordland Oil Executive not see the peril that lay ahead?

This debate raged for another 2 years with Maxoil accusing the Fjordland Government of intransigence. They even began to ask for proof that Gullfaks, Snorre, Ula and Valhall could produce oil and had the government not squandered funds buying these duff assets? If they could produce then why did the government not prove it by developing these fields? The Fjordland Government pointed out that this was counter to government policy and that such profligate expansion would actually hasten the collapse in Fjordland production and was this not counter to the objectives of Maxoil?

Books were written and the population instead of being happy with the wealth being created began to doubt the intentions of the government. Then in 2006, when the Government issued their annual update everyone was in for a shock. The Government argued that new technology would mean that Fjordland would in fact discover and recover more oil than previously thought to be the case and the official estimate was raised to 35 Gbs.

This ploy that was designed to allay concerns backfired badly. The population, instead of being pacified by the thought of more oil began to doubt the government’s intentions even more and this was all the proof required by Maxoil to show that the government had been lying all along. However, despite being vilified by the press, The Fjordland Government showed enormous discipline. Gullfaks, Snorre, Ula and Valhall remain undeveloped to the present day and the 80% capacity ceiling has stayed in place.

Storyline 3: Fjelland

The Fjelland storyline is the same as the Fjordland storyline up until the late 1990s. At this time the Fjelland Oil Directorate recognised that the oil production of Fjelland would peak and then go into decline and concerns were raised that the people, who had by now become accustomed to growing production and wealth may become fretful about the future. Maxoil was warning that the oil was running out. The government may become deeply unpopular if health and education services had to be cut owing to falling oil revenues.

Fjelland - reaching peak

At this time oil prices were low, but the countries buying Fjelland oil were beginning to fret about the security of future oil supplies and the oil price had just begun to strengthen. Under severe pressure from their American friends, the Fjelland government decided it was time to give consent to develop Gullfaks, Snorre, Ula and Valhall. These fields were duly consented and came on stream in 2002, 2004, 2003 and 2001, respectively.

In addition to this, by the year 2000, the oil price had strengthened considerably and international conflict over oil was threatened. The American news channels pointed out how Fjelland with all its oil wealth was betraying its friends and allies by withholding production. Under immense pressure, the Fjelland government relented in 2001 and gave consent to companies to produce at capacity and this was enacted in 2002.

The combined result of developing 4 fallow fields and starting to produce at capacity was a surge in Fjelland production of about 1 million bpd between 1999 and 2005. The money poured in and was wisely invested in US treasury bonds.

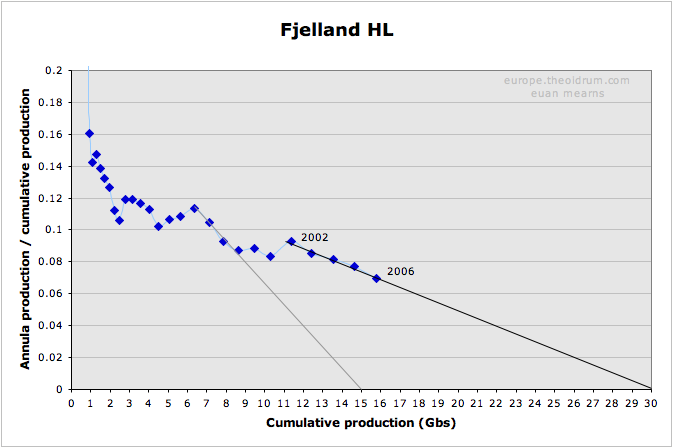

The main point of the Fjelland storyline is to show the impact on HL. From 2001, there is a well-defined trend pointing to 30Gbs – the known true reserves figure for Fjelland. Isn’t that amazing! The Hubbert technique is truly powerful when applied to the full resource base of a country operating at capacity.

Synthetic HL for Fjelland. From 1981 to 2002, Fjelland produced at 80% of built capacity and four discovered fields were allowed to lie fallow. The four fallow fields were developed in the period 2001 to 2004 and in 2002, flush production was reinstated. The HL from 2002 to 2006 defines a good linear trend pointing towards 30 Gbs - the known URR figure for Norway. This suggests that an HL influenced by under production may recover to provide a meaningful result once full and flush production is reinstated.

Lessons to learn from these simple parables:

The reserve base of Norway, Fjordland and Fjelland are all the same, i.e. 30 Gbs.If a country has not developed all its discovered (or undiscovered) resources and / or is producing at bellow capacity, HL will provide a false result that is biased towards a low URR.

If a country has been under-producing, once full production is instated the HL may find a new trend pointing towards a more reliable reserves estimate.

Disclaimer

Fjordland and Fjelland are hypothetical countries. Fjordoil and Fjelloil are hypothetical companies. The Fjordland Oil Executive, the Fjelland Oil Directorate and Maxoil are hypothetical organisations and Big Foot is a hypothetical being. Any similarity between these entities and real entities, past or present, living or dead, is entirely coincidental.

You can sum up this post in the following way:

Appart from this specific tweaking of HL to accommodate restricted production like in the Saudi case, Web pointed out in the previous post that HL is simply a heuristic – there’s no certainty that production will follow a symmetric curve.

In fact most oil producing regions do not yield symmetric curves. But the logistic analysis, due to its simplicity and soundness, is IMO a valid tool to have a sense of when a peak might occur.

And notwithstanding an erroneous observation that we may have peaked in 2000, Deffeyes' prediction, based on HL, never varied, to-wit, a world crude oil peak between 2004 and 2008, most likely in 2005.

Based on EIA data, world crude oil production (C+C) is down about one mbpd or so from its May, 2005 peak.

Question please. I have no qualification to comment.

If the U.S. Government and its allies succeed in eliminating all opposition to their policies in Iraq, and at the same time, succeed in transforming, co-opting or eliminating opposition in Iran, thereby allowing "efficient" market forces to develop the Persian Gulf region -- then what will be the effect on the total world production of petroleum and gas? Does it change the total URR? How long could present production and consumption proceed in the absence of meaningful opposition by the Arab and Persian worlds? Would a total U.S./European/Corporate victory really be meaningful to the folks who are promoting the war, or would it be a Pyrrhic victory at best?

Another way of asking the question is, if I want to keep driving my SUV and heating my McMansion, am I better off paying foreign powers whatever they ask for their oil, or am I better off paying my taxes to the American Government to go get it for me? Does anything we do make any difference, and is there enough oil in the Middle East to justify all the killing and destruction?

For some time, I have been expecting Bush/Cheney to come out of the "Peak Oil Closet" and admit that they want the US keep a large US ground force in the Middle East, in order to "protect" Middle East oil fields from takeovers by Iran and/or the terrorists. As they tiptoe out of the Peak Oil Closet, I actually expect Bush's domestic approval ratings to slightly increase.

If the US is disliked now, just wait until the US starts using the implied threat of military force to ensure that crude oil keeps flowing to the US (which has twice the per capita energy consumption as the EU).

In regard to the supply question, the big problem is the Export Land Model, where the combination of declining production and rapidly increasing domestic consumption in exporting countries, will cause a crash in exported liquids.

So, I recommend the following:

ELP Plan (April, 2007)

http://graphoilogy.blogspot.com/2007/04/elp-plan-economize-localize-prod...

Electrification of Transportation

http://www.energybulletin.net/14492.html

Streetcars 100 Years Ago

(if we did it in 1908, why can't we do it in 2008?)

http://www.familyoldphotos.com/tx/2c/chadbourne_street_trolley_san_an.htm

Like you I can see Bush/Cheney tiptoe out of the "oil closet" but not the "peak oil closet." Denial of peak oil is required to send the message that sacrifices in the Middle East will be followed by another period of prosperity identical to today. This message is required to rally consumers behind a long-term military presence in the Middle East.

I would take the view that no amount of oil can justify the killing of 600,000 or more Iraqis, plus the propping up of ruthless dictators in the Middle East and Central Asia, to the great cost to the peoples of those countries.

Is driving an SUV to Wal-Mart that important? Three Days of the Condor indeed.

Of course, as this post demonstrates, all players would have to have been producing at capacity for the last 15 years for Mr. Deffeyes HL to be accurate. Since we know that several major players were not, we can safely assume that his figures will eventually prove to come up short.

Your theory is directly contradicted by the Texas/Lower 48 case history. Texas was gradually increasing production in the 10 years prior to its peak in 1972, when the RRC went to a 100% allowable, which corresponded to the final peak in production from the East Texas Field.

The Texas/Lower 48 case history was our basis for predicting an imminent decline in Saudi and world production.

In any case, it appears a near certainty that every oil field that has ever produced one mbpd or more of crude oil is now in decline, with only one definite one mbpd plus field on the horizon (peak production some time after 2020), Kashagan.

Peak Oil is basically the rise and fall of the big fields.

Texas developed, and in many cases, over developed every available major field. The same is not true for KSA or the world. Your analogy is lacking in this case.

I guess that's why Saudi and world crude oil production are both down from 2005.

So again, what's your recommendation? That we all buy Hummers and McMansions and party on, based on the assumption of an infinite rate of increase in the consumption of a finite energy resource base?

And yet, despite the 'voluntary decline', they are increasing their production by a few 100k bpd. Interesting...

158k bpd, hallelujah! Peak averted! Hummers for everyone!

Get back to us when they are producing over 9.6 mbd again.

Actually the production in the majority of cases has been maximized. You can verify this for yourself by comparing original URR estimates to the 507 giant/supergiant fields in the world (1% of all fields total) which produce 60% of all oil in the world. There is no need to even look at the smaller fields to see that the dominant factor is the giant/supergiant fields and that most of them have been maximized in production.

So as Euan has noted elsewhere, the URR is going to be low but not by as much as you try to insinuate.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Ghawar could have produced over 15 million bpd, according to several people here at TOD. Did it ever produce 15 million bpd?

Clearly not.

Clearly you are incorrect.

Whoa, in rides the jackass! I said majority, not all. When you understand that difference, get back to me, little troll boy.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Your case isn't helped by name calling, nor by ignoring the worlds largest oil field and basin...

In reality the "worlds largest oil field and basin" is just a statistical outlier in any decent model of global oil discovery and production.

You do realize that if Mr. Deffeyes is correct, this 'statistical outlier' represents almost 10% of all the oil we will ever produce. Clearly it shouldn't be considered at all! Typical TOD rhetoric though. WT can rant on all day about the lower 48, but a region of equal size such as KSA is an 'outlier'.

Big ones are rare. They fall in the tail of the distribution; evidently you have never seen a probability density function,

PartyGuy,

The changing political climate advances in technology and economics of the Texas Oil and Gas Industry over the last 105 years has had much lot to do with Texas development as political decisions have had with the development in the Kingdom of Saudi Arabia. Much of it is field size distribution.

In the KSA 70% of the production came from the Ghawar complex, while Texas's largest field, East Texas had about 7% of the total Texas production. Ghwar has always been managed for maximum production by the major oil companies and their successor Aramco, and its discovery was after petroleum engineering had discovered basic principles of reservoir management like well spacing and chokeing back wells so they didn't cause reservoir damage. The first years of the East Texas field drilling and production was totally uncontrolled so huge amounts of economic waste occurred. The well density is 1 well for every 6 acres and oil prices fell to 10 cents a barrel in 1932.

The governor, Ross Sterling was a former president of the Humble Company (which became ExxonMobil eventually) and ended up sending in the Texas Rangers and the National Guard to shut in wells and enforce new state rules to limit production and raise prices. In essence the State of Texas acted like the OPEC cartel to limit production so that the producers made more money and the State collected more severance taxes for the same volume of oil.There's a great history of all this in a book called "The Last Boom" by Michael Halbouty and James Clark. For a shorter summary I'd also reccommend the "oil and gas industry" article in the Handbook of Texas Online.

The end result of the wild price gyrations was that many oilfields discovered before the East Texas field were abandoned too early, especially ones with heavy and sour oil. And, after the Texas peak Nixon put price controls on "old oil", or fields discovered before the tripling of prices after the first Arab embargo. All fields except the very best were sold by the big oil companies and they moved to offshore and foreign production because of the price distortions. Virtually no wells were worked because it took three times as much oil to reach pay-out as it did on new reservoirs. The 1990's crash in oil prices finished off most of the smaller independents, yet few people have much of an idea about the old, shallow fields and that's where the best chance of commercial production exists in the United States.I'm currently working on a couple of these prospects on old fields near Houston, but they exist all over the United States for tertiary development.

I think the conclusion I've come to is that Hubbert would be right in a universe withoutgeopolitical considerations or great technologica changes. The curves are elegant, and the thinking irrefutable. But, thats not our universe, so Stuart Staniford may be closer to the truth with his bottom up analysis.

Just think, if we all live another 94 years the answer wil be clear and obvious! Bob Ebersole

I disagree there Bob. We reckon that if Ghawar lay within the OECD that is would have peaked at over 15 mmbpd. Large segments lay undeveloped for decades (Haradh) and the developed segments have seen progressive drilling from flanks to crest over a period of decades. I's say that the ME supergiants have been developed to maximise recovery.

Which means that the reserves 'demonstrated' by the HL for Ghawar, if not KSA are greatly understated, seeing how over half their production comes from that one field. Its an interesting pickle. In one case, no one has suggested that Ghawar peaked when it achieved its highest production rate several decades ago of 5.6 million bpd. On the other hand, no one wants to admit the implications this has for our HL for their country...

The stories are interesting, I am in favour of its concept, that HL doesn't predict future big discoveries, artificial lowering of production, etc.

But, there are assumptions in these stories that are hard to swallow, if one is to gather a "lesson" from them in global terms (and not local terms), that is, if some how peak oil is artificially produced by these political constraints, or if there is some big discovery yet to be made...

The first one is that such artificial constraint could gather a figure close to 20% of total production. If one is to consider arctic and antarctic oil basins as a yet-to-produce area, well, hats off, but if not, I don't see any country being able to do this stunt. Notice that you picked up Norway, a country seen as very rational and wealthy. But the rest of the world is quite the opposite.

In truth, I see those political constraints, the so-called "above-ground" factors, and because they can only subtract oil production, that's what inevitabily they'll do, to artificially reduce oil's production below what would have been possible geologically. Thus, all global production acts like a "swing producer" in its own, but without much human control. This may have something to do with the recurring HL error in retrieving total URR, which seems to be always increasing. The artificial constraints are simply putting HL URR always below the real URR.

But I don't see 20% coming up. And even if that would have been the case, it wouldn't matter much in what concerns of time - in your example, peak would be reached in few years time anyway.

Good story though. Very simple and elegant, explains one of the issues I have with HL very well. Congrats.

Euan's recent posts have sneaked an important economics idea in through the back door:

Producers of a depleting resource (that is perceived as such) have substantial incentives to underproduce.That single fact will change the shape of the world's production curve. If May 2005 turns out to have been the 'peak' and then, going forward, we have more or less stable production for several decades, that peak has little real significance.

Previous regional peaks occurred in times of perceived abundance. Not so with future regional peaks.

We now have difficulty interpreting all future declines in production. Are they forced or are they planned declines either by rigid production control or by simply (and wisely) neglecting to invest in production and erecting barriers to development?Little real significance?

We can choose one of the below listed paths here.

If oil is a primary driver in population growth, then flat oil production will reduce population growth (or eliminate it entirely). Or, if oil has nothing to do with population growth, then a steadily growing population (to the UN's 9 billion or beyond) means that per capita oil must inevitably go down (since production is flat) with the economic impacts associated with reduced oil consumption. Or another energy source must grow to fill the gap.

Every single one of these alternatives would appear to me to be of serious significance (whether positively serious or negatively serious). Even if everything works out right and we have zero doom or gloom, we're going to get a radically different civilization grow out of flat oil production coupled with increasing population.

In fact, the only way that you can have no serious significance is IF production remains steady for decades and IF population remains steady at the same time and IF no further political repercussions arise due to the currently badly out of balance distribution of current oil usage. And if you believe in that fairy tale then you need to stop criticizing Jeff Vail and look in the mirror.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

A plateau a current levels would obviously have great significance. But the 'peak' in May 2005, would have little.

peak vs. plateau

I see a plateau as more likely than a peak. And without a peak, doomer scenarios are much less likely.

Once peakists get up to speed on their economics, I suspect they will gradually tweak their HL models until it more or less produces a plateau (perhaps downward sloping).

Without an attempt to seriously model the behaviour of economic actors in response to price and scarcity, HL is garbage.

First, claiming the HL is "garbage" and more specifically your "hope" for what the HL curve might look like shows that you do not understand the HL method.

It plots ratio of the current year's production (P) to the sum of the total production (Q). That ratio is the y-value or the abcissa. It is plotted as a function of the total production (Q). The value Q is the x-value or the ordinate.

So, if the production level is "flat" or a plateau, then year after year, even with a constant value of "P", the value of Q keeps increasing. Therefore, flat production means that year after year P/Q declines against the plotting of the value Q (Q cannot remain the same unless P=0. That's the math and no view about "economics" will change that).

To flatten an HL curve requires growth, which by definition is not a plateau. And the longer that flattening persists, the faster you burn through the resources (a consequence of exponential growth). The HL line cannot be a "plateau" at the levels we are using because a slope of zero or near zero implies an infinite supply of oil and we know what the maximum amount of oil cannot exceed.

Besides, a plateau of 10 years at current levels versus a 2% pa decline makes little difference to the URR (less than 4% of the total amount and only about 3 years extra oil at "current usage rates." (Since we have a reasonable computation of the total amount of oil already consumed.)

You misunderstand me and, yes, I do think I've a decent grasp of HL.

The "flattening" refers to the production curve, not the HL plot. In fact, if we plateau, the HL plot aint even gonna be linear.

To put it simply, a logistic curve doesn't fit world production up to this point and fails to fit many important regions. Why the heck would people assume it tells the future?

There are cases where the logistic curve works. It does so because certain assumptions about price and perceived scarcity held in the past. They no longer do.

Economics tells us that where you have different expectations about price and scarcity, you get different behaviour.

The production curve (P/Q vs Q) is never linear either. However, the linearization is the least-squares fit of the tail portion of a production system curve. And by definition, it's the curve with the least residual error from the actual data.

So, in one sense, arguing that nothing fits the logistics surve is a bit futile simply because the actual data in the HL plot is that...actual data.

Hypothesizing a plateau (say, for 10 years) does not significantly alter the curve (it does in the near term, but in the long-term it does not unless you assume that the plateau is infinitely long. And as EOR technology has demonstrated in newer fields, the technology drains the fields faster and results in much steeper declines than have been typically encountered).

As for economic considerations, they are artificial considerations applied to a physical system. But as long as we play the game of "economics" they may have marginal influences on the tail of production. If oil were suddenly "worth" 80 quadrillion €/barrel, every last frop of oil might seem worth retrieiving (except that most people could only afford a few molecules of the stuff meaning that it becomes "worthless"). The low hanging fruit is already gone.

I think it was Hubbert that said something like: "The only group that has a worse prediction track-record than petroleum geologists and engineers searching for oil is economists."

It would be easy to convince me that the peak has not occurred...six continuous months of global oil (C+C) at greater than 74.3 million barresl per day.

As for economic considerations, they are artificial considerations applied to a physical system.

This I would see as the central HUGE fallacy, something that would make a neuro-scientist giggle uncontrollably.

You see, the things that occur in people's heads -- among other things, expectations and perceptions that economics attempts to model -- are as real as rocks and trees and oil in the ground. They are physical.

The enormous physical complexity that exists between our ears is completely ignored in Hubbert's calculations. You could say that Hubbert's math left out something very important: Hubbert himself.

And without that, you might as well be on a different planet , Starship.

Economic models of our economic thinking may be too simple, but at least they take up the challenge. Hubbertians are completely clueless on this aspect of the physical world.

While neuro-scientists might giggle (and thereby argue that the chemical reactions that "caused them to "giggle" are real and measurable), they would also tell you that it is nothing more than "learned behavior" and that the giggle is nothing more than a stimulus-response reaction that is given by some combination or hard-wired and programming. And given that, neuro-scientists would (from their programming) recognize that we are (specifically stimulus-response reactivation machines).

Just because we perceive something as "real" (and even act upon that perception) does not mean that it is real. It's nothing more than a "feeling" and in a moment we'll have another, and then another, until we don't have feelings any more. Just because we set up something called "an economy" does not mean that the "economy" or "economics" is real. We might agree to operate as if economy and economics exists, but its a story that we tell ourselves. Just as we (in the US) have a story about the mostly green pieces of paper with portraits of dead people emblazened upon them.

And neuro-scientists are programmed to recognize that as well.

For about nine years following the Texas peak, oil prices increased significantly, up about 25% per year from 1972 to 1981, which caused the biggest drilling boom in in state history.

Oil prices were relatively low from 1962 to 1972, as production went from 2.5 mbpd to 3.5 mbpd, followed by the decline from 3.5 mbpd in 1972 to 2.5 mbpd in 1982 (an initial decline rate of 3.3% per year), concurrent with an oil price explosion.

We have seen a similar pattern in the North Sea, which has shown a 4.5% decline rate since 1999 (C+C), while Brent crude oil prices have increased at about 18% per year.

It's really very simple. We find most of the big fields first. Peak production pretty closely correlates with the peak production from the big fields. The smaller fields that we find post-peak can't offset the declines from the big fields. Within limits, empirically price has very little to do with conventional production volumes.

However, higher prices do make a lot of nonconventional production economic.

And, I think that price has a big part to play in the Export Land Model--probably causing increasing cash flows from export sales, even as export volumes decline.

Don't forget that a plateau on oil production with a growing population means a decrease in per capita consumption. Set that against growing expectations in places like India, China, Russia.....oh hell everywhere.

You also need to mention the financial system's need for "growth". Even a plateau is enough to destroy it.

If that's the case, then how has Japan survived?

During the 90s, it more or less stagnated.

I know people who lived there during that period. Believe me, the average Japanese experienced very little hardship.

Perhaps in Japan, but right now even with the US economy still growing a little, people are suffering. Employment is going down and median salaries are trending down.

It probably has to do with the distribution of resources and saving. Japan saves a lot and has a strong culture of helping out its citizens. In the US there is no savings and a culture of greed. If employment falls a little below full employment, the employers take advantage and slash wages even lower.

Perhaps because US isn't growing, but shrinking in real economic terms since 2001. You're illuding yourself.

Nice post GreyZone.

Monetary experiments aside, I totally agree. The rest is for the recorded choir to wax and hear.

Firstly, I present this simple remark: Me thinks we spend too much time looking in 9' mirrors already (presumptions of faked vanity trying to be delivered backwards with shined-up fiat shoes and all that cal) Thee broken record of monetary guided nonsense is being played over and over- Never mind the big upcoming void where it skips and trashes the actual hearing device in the bought off process....oh how thee baton of easy street C-bankerism's infiltrate even the most honest compliances of socialized communed citizenery to pass that lie along. Check stubs from growing shrubs, watered with green pixels and negative positives based on ever increasing infinite oil wardumbery.

Personally, I think it rather beyond pathetic that we have to engineer more political Clintonix to replace a double exposure of Bush. Three hundred million citizens and this is all the elite string pullers offer up to our petty

minds? We are even more stupid than I give us fiat credit for.

FAKEASS monetary prescripted cohorts with handpicked FAKEASS puppets to carry on that FAKEASS resolve.

Good luck FAKEASS America pushing the lies when the energy costs more and more while our FAKEASS UNCONSTITUTIONAL private money launderers eventually look the other way, and promote anything done anywhere but here. Sorry, rot remains unto those who destroy honest weights and measures.

They aint bailing out the poor jackasses who bought more home than they could afford with money they never earned or could afford.

They be bailing out a window of "timeframed" bullshitted unbacked, unaccountable banking derivatized actions (giving them an opportunity of one more step of advanced distance before shaggin' ass)

Oh boy, not like their chances of celebrating their

hundred year anniversary are all that great. (FEDheds)

A hundred years is a cough in the historied timeline of things that did not work, and, I suspect that at thee eventual closure of this charade, then almost anything is permissably possible and being mediated quite quickly as a passible worded truth.

The varnished/oiled up veneer is going to make everything all better...It must be so, for any thought beyond this is quite uncomprehendable.

Euan:

Your graphs don't project your scenarios out very far, and maybe I am just mistaken in my understanding, but wouldn't a policy of holding back resources to constrain production now imply that the rate of decline of production in the future might also be less drastic?

I'm a lot less concerned about when exactly we peak and how high we go than I am about that plunge on the other side.

Of course, this is all just academic - UNLESS a few governments actually have been holding back, overtly or covertly. I'm hoping that they have.

Don't forget that the 'holding back' can take many forms:

eg. constantly delaying and renegotiating contracts with foreign oil companies, erecting environmental barriers, Chavez-style actions that result in needed foreign expertise packing it in.

An oil producer like Iran may even make different calculations regarding war knowing that should productive capacity be knocked offline or destroyed, there will be a voracious market with high prices to assist bringing production back.

If oil is believed to be scarce in the future then greed, laziness, tolerance for inefficiency, brinksmanship, even war can work on the side of holding back production and positively changing the shape of the production graph post peak.

The idea that only virtuous conservation will keep oil in the ground is nonsense.

Wait until you meet your first oil miser!!!

I'm thinking, when you mention Iran, of the snarky mention in the NPC report that world statigic reserves could replace iranian supply for some period of time that sounded like the duration of a war. Is it Iran or others making the calculations you are considering? All parties perhaps?

Chris

I think that's exactly the case. However, the number of countries that may have withheld production are relatively small so their impact on the overall world picture will not be too substantial.

There are also the countries with involuntary withheld production - Iraq, Nigeria etc. And it is rightly questioanble if some of that oil ever makes it to market.

Euan,

Great post! Thanks.

I take issue with your assumption that the number of countries that have withheld production is relatively small.

I'm familiar with the Western hemisphere, so i'll confine my remarks to those countries.

In the US, out of a world of roughly 600 billion barrels originally in place, drilling has been limited by environmental considerations in all of offshore West Coast since 1978? at any rate, the Santa Barbara blow-out.

Offshore in the Gulf east of the Missisippi delta.

Most of the Atlantic seaboard

ANWAR in Alaska, plus most of the Artic Ocean.

Plus the hostility towards the oil business in California means that although most of its basins have great redevelopment prospects and step-out prospects, its very underdeveloped compared with the Permian basin, Gulf Coast of Texas and Louisiana or the East Texas embayment.

In Mexico, there has been no exploration in depths of water greater than 100 meters. Pemex has a very high overhead through "taxes", so has not explored for or developed much of their potential basins onshore or their possible basins offshore of Baja California or the Gulf of California.

Skipping southward, the close to anarchy in Columbia has lead to much less development than the production has justified. The remoteness of much of the continent has notallowed the exploration of much of areas such as Bolivia and eastern Ecuador and Peru with huge potential. And also a lot of Venezuela has not been drilled up. Bob Ebersole

Bob - you are of course entirely correct, especially with regard to the USA. The USA has conserved via environmental conseravtion rather than directly as reserves conservation.

This raises some interesting points. With oil through $80 and heading N, how long will the environmental lobby hold sway in the USA? High price is a prelude to shortage, and when shortages hit the USA, and if society begins to crack as many believe it will , how long before the stuff the environemt lobby wins?

However, the enviro-types will have new allies. eg. Those who aren't really that green but who want to conserve in order that their children and grand-children have some to burn.

Save it for the children!

The real war will be between those with different time horizons.

This is one of the problems going down the backside of Hubbert's Peak. Your comments make sense in politically stable regions where exploration and/or production can continue and geology is the only consideration.

But what happens when human behavior enters the picture? For a sample, look at Iraq, where production has remained below the pre-war production on average and looks to stay that way. Or look at Angola. Or now, today, look at Mexico. The latest pipeline bombings in Mexico are bringing up estimates of 25% reduction in natural gas exported by Mexico (to the US).

This can (not will, but can) produce positive feedback loops that might ensure that little to none of that oil yet to be discovered ever gets produced. This is another reason why the Bush policies are so insane - they destroy political stability which is the essential component of exploration and production of natural resources. In other words, Bush is actually lowering the chances that much of this undiscovered future oil will ever get produced.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Exactly. The global oil market is the result of 150 years of building knowledge, technology and infrastructure. This resource base has enabled us to continue discovering, developing and exploiting ever more difficult oil reserves. If we start to lose that 150 year base, there is zero chance that we will develop and utilize the remaining oil reserve.

We have built and climbed a very high ladder to reach the fruit at the top of the tree. If the ladder breaks now, we can never build another one.

IMO, the impact of off limit areas in the US is overestimated.

In Texas, we certainly had no material restrictions on drilling, and I am not aware of any material restrictions on drilling in the North Sea. Their respective post-peak decline rates have been 4% and 4.5% respectively (C+C).

IMO, Peak Oil is the story of the rise and fall of the big oil fields. While we will find smaller fields post-peak, we generally can't offset the declines of the old, large fields.

In any case, as Hubbert noted in 1956, a one-third increase in estimated Lower 48 URR only postponed the predicted peak by five years.

I agree wholeheartedly.

By the way, I really like Euan's articles on the limitations of the HL model.

The Santa Barbara blowout was 1969.

RobertInSantaBarbara

I haven`t escaped from reality. I have a daypass.

Hubbert's theory was never limited to below-ground factors. It is a generalization about the interaction between geology and human behavior around resource extraction. That behavior being more or less determined by our genetically-embedded urge for "more and faster".

It is no accident that despite the claim that "This post uses real data" it actually makes up a hypothetical scenario that did not happen. Not even in Norway, a country that probably is most likely to "husband" its resources.

Of course not all oil regions were/are developed as fast as possible. If you think about it, what does "as fast as possible" mean, anyway? There are always above-ground complications, some "boring" (efforts to secure a loan take time) and some more "exciting" (rebels blow up the pipelines). If you add it up over a large enough region and a long enough time period, the "law of large numbers" boils it down to the bell curve. For any given region at a given point in time the Hubbert Linearization may or may not reliably predict the peak and Ultimately Recoverable Reserve, but once it settles onto a trendline it seems to be right more often than not. Is there a method with a better track record?

now if we just had an analysis of "witheld comsumption"

Euan - great post. I have long been in your camp re HL, to the point that I believe your article in effect 'states the obvious' (which in no way detracts from its worth).

Euan

Thanks for throwing three retrospective scenarios at Norway. As an Anglo-Norwegian who has followed these issues for three decades I welcome the attention.

I have to say that I find the first of your three conclusions ("The reserve base of Norway, Fjordland and Fjelland are all the same, i.e. 30 Gbs.") unproven - and unprovable - by your methodology or any other methodology based on past data. Far too little data is available for the Norwegian and Barents Seas to lump them statistically with the North Sea.

Even the Norwegian sector of the North Sea, arguably the statistically most tranparent oil domain on the planet, is not obviously predictable. What proves to be ultimately recoverable there is dependent on many difficult-to-predict factors that are independent of geology or technology. Politics, economics, climate and many other strong variables will play a role.

There's clearly a lot of potential tail-end production in the Norwegian sector of the North Sea, but it's not obvious how much of this will be realised. Differing domestic and international political scenarios could lead to radically different outcomes.

It's enough to do a couple of Albert Einstein/Donald Duck "thought experiments':

1. A future/present Norwegian government goes for Chavez-style nationalism and issues anti-oil-investment messages to all individuals and companies unfortunate enough not to be Norwegian. Many Norwegian companies reflag and run for cover. Everybody else moves Norway a long way down the list. Meanwhile the North sea infrastructure rusts, deteriorates and sinks into the mud. The opportunity to tap tail-end resources at some kind of profit disappears. Or does it? Who knows what may make economic sense 10 or 20 years post-peak?

2. A future/present Norwegian government goes for "burn, baby, burn" - get as much North Sea oil and gas out as quickly as possible. Is this better or worse in terms of the amount of hydrocarbons that are ultimately recovered?

I don't think that we know.

My conclusion: humility (especially for policy-makers). We need models that cope with more than physics. We don't have them. They won't arrive in time. Learn to make decisions under extreme and outrageous uncertainty.

My hunch (i.e not backed by rigourous proof, which is unlikely to be available in time): formulate policies that make the best possible use of existing oil and gas production, processing and distribution infrastructure in areas of the world where there is some semblance of the rule of law.

Coromo - the 30Gb estimate is for discovered developed fields. And I agree that sigificant quantities of oil and gas may lie undiscovered in Norway that will in time get added to this figure. Discovered undeveloped reserves need also to be added.

Has anyone got an example of a non-fossil limited natural resource which market players actively chose or choose to withhold supply over meaningful time frames (say >3yrs) for economic reasons?

I'm pretty sure it didn't happen for whale oil or gold, but prepared to be advised otherwise.

--

Jaymax (cornucomer-doomopian)

diamonds by the deBeers bunch

I think if you look into salt you'll find cartel-like behavior in a number of places and times. Colonial north america, much of chinese history and various contols on trade routes in the old world.

Chris

Hello Jaymax,

Germany withholding potash exports to the US just before the outbreak of WWI. Recall my posting whereby potash rose to $500/ton in 1914 dollars, or $10,500/ton in 2007 dollars.

As I understand the situation: the two cartels that currently control world potash production [Canpotex & Belaruskali] are still witholding maximal production. But resource depletion is inevitable eventually.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Has anyone got an example of a non-fossil limited natural resource which market players actively chose or choose to withhold supply over meaningful time frames (say >3yrs) for economic reasons?

I'm pretty sure it didn't happen for whale oil or gold, but prepared to be advised otherwise.

--

Jaymax (cornucomer-doomopian)

Land.

It is regularly hoarded by governments and by individuals. For instance, in my province of Ontario, there are more than a few completely undeveloped lakes within a couple of hours drive from Toronto, Canada's biggest city. This is in addition to the many dozens that exist in national parks. So, even though lake-side cottages are very expensive, those lakes remain off limits, and have been so for decades. Land use is heavily regulated. The government a few years back passed laws to outlaw the conversion into housing of a large belt of prime farmland that circles Toronto. (Greenbelt Laws)

In any urban center in North America, prime commercial lots can sit vacant for many years as the owner waits.

First, thanks very much to Euan for engaging and thought-provoking work on important topics. Much appreciated.

Second, HL is basically a procedure to transform a nonlinear function, in this case to linearize a single-humped curve without specifying an explicit algebraic function. There are lots of ways to do this. Many would be more satisfactory from a statistics point of view. Maybe not much more, but certainly an improvement. There is a lore and tradition in the use of HL that is part of its mystic and charm. It evidently works pretty well in the hand of an experienced engineer. One should not minimize that quality.

The procedure of eye-balling where the linear process settles down does what statisticians call "robustify" the function. This may be the most important feature of the method, and takes into consideration the knowledge and judgment of the user. It is a graphical way to downweight the unusual points without specifying an explicit functional form. As many have already commented, there are lots of way to accomplish that objective these days also.

HL is clever. Its also robust and practical. But because its ad hoc, it is most prudent to take it with a grain of salt and not reify it as somehow intrinsic to the problem of peak oil. Go back a couple of hundred years to Gauss himself

http://en.wikipedia.org/wiki/Carl_Friedrich_Gauss

who was trying to filter noise from signal while making astronomical predictions. This is an old statistics problem that is also timely today.

imho: it would be better to present production data as it is taken, untransformed, instead of linearized by calculating annual divided by cumulative production. The untransformed data show a peak if it exists. It also shows outliers and unusual phases of production, which brings home why some procedure for the treatment of influential data is important. Its surprising that there has been so little mention of robust statistics or estimator breakdown or influential data in nonlinear model fitting for this class of problems. Where to start?

http://www.math.siu.edu/olive/ol-bookp.htm

This is not intended to be a criticism of HL or its applicability in this context or any real disagreement with any of Euan's nifty analyses. Just a reminder that a model -- such as Hubbert linearization -- is a humble device to summarize data that are very complex. A dozen modern approaches could do better than HL in describing production data, describing the peak, estimating total capacity. Better. Although probably not by much.

Thanks Babicus - I'll give this some thought and pass you comment on to Khebab, Luis and Stuart who are more into maths and stats than I.

In Euan's previous TOD post on Systematics of HL there was some discussion of this point as well. I suggested using something akin to the painfully obvious "First Derivative Linearization" (FDL) instead of HL to aid in establishing a peak.

One of the insane aspects of HL is that we supposedly do it to get the vaunted "insight", yet the moment we get something odd like the infamous "dog leg up" crink in the HL, everyone freaks out. And the weird thing is that everyone freaks out because they can't figure out what the dog-leg up actually means. In fact this robustifying HL transformation that Babicus talks up serves to reduce or actually remove the intuition we would have if we just left the peak alone or applied a traditional signal processing function.

So I ask everyone: What does a dog-leg up mean?

(1) a plateauing of the peak

(2) a slow rise in the peak

(3) a sudden upshift in the peak

(4) other

My point is that unless we can look at a crease in the HL curve and immediately gain some insight it is not as useful to us, and especially to other people who we want to convince or who do not have the math background that we may have.

I'm not sure, but I think I may have Christened this infamous feature which Luis now wants to project "wee" from.

The curious thing is, that while I don't understand your math, as a geologist I feel I have intuitive understanding of what the Dog Leg feature is telling us. The danger lies in the fact that there may be different kinds of dog leg - dogs and bitches, so no universal explanation may exist. By way of example, the much discussed Yibal field produced a dog leg that then collapsed - this was a production boost not supported by underlying reserves.

Folks then want to take the horizontal well boost and apply it to Saudi when in fact the type of "horizontal disaster" that befell Yibal may only be applicable to a small number of the horizontal wells in Saudi. Horizontal wells in Saudi are being used to control water cuts and to produce oil from poor quality reservoirs - that could not be developed using verticals.

I was hoping that you math guys may look at the 3 production profiles along with the HLS for Norway, Fjordland and Fjelland and be inspired. If you are able to take the production data for Fjordland and transform that into 30Gbs - this exercise will have been a major triumph.

The way I would do this is to take 20 Gbs / 0.8 = 25 Gbs and then add the reserves for the 4 fallow fields - this will get me close to thirty. Of course I can only do this becuase I know the Cf and the DU numbers.

If you're able to explain why the the Fjelland HL quickly adjusts to 30 Gbs with full production - that would also be interesting to know. I can send you the data if you want.

In statistical terms, the bigger the aggregate of regions that we are dealing with, the more powerful the math analysis becomes. That's why I put less faith in trying to pin down the dynamics of a region like Norway.

I last wrote about Norway here:

http://mobjectivist.blogspot.com/2007/02/norway-drop.html

Clink on the older links for the back-story.

I kind of agree with you, the approach you are describing would probably be the one followed by most Statisticians. I personally use a robust fit technique most of the time especially when the distribution of residuals is departing significantly from a Gaussian distribution. One issue with the HL is that it does not distribute evenly noise because of the damping effect of the cumulative production. There are alternate ways to represent the data based on the logistic PDE:

http://www.theoildrum.com/story/2006/8/16/102942/337

Note that the HL does not exploit directly the logistic curve which has three parameters (t_half, URR, K) but instead the underlying differential equation that has only two parameters (URR and K). Therefore, one issue with a direct fit on the production profile is that t_half (peak date) needs to be determined which is sometimes a difficult problem (especially when the production profile does not actually follow a logistic curve :)). The HL does not deal with the peak date but only with the URR (and K).

This was the point of the "In Defense of HL" article, to-wit, the post-1970 Lower 48 and post-1984 Russian cumulative production numbers have basically been what the HL models predicted, using only production data through 1970 and 1984 to construct the models.

The thing that has scared the crap out of me since January, 2006 is when one looks at the HL plots for the top exporters and then we plug in the expectation of rapid increases in consumption in exporting countries.

Tiny mistakes in any beginings of pinpointed mathematical projections flowing outward usually provide for greatly surprised estimations once "time" has spoken and, thus is cobbling factored. (like that is possible) Also, those mistakes amplify rather quickly. Quibbling with exactness in the "here and now" between a 1 and a 1.1 is almost infinitely petty. I think you are 90% correct in the overall picture. Time may revise assumptions slightly while us oiled up brats point our fingered solialized solutions of blame anywhere but to our fiat unaccounted squanderings...March forward with our blind self destruction... Pretend the currency is the all providing Oz of liquid mobility payments...lower those bayonets and credit percentages and lets get this charaded show back on the road.... to where?....