Saudi Arabia - production forecasts and reserves estimates

Posted by Euan Mearns on August 30, 2007 - 10:27am in The Oil Drum: Europe

In his recent post, Ace assumes ultimate recoverable reserves (URR) in Saudi Arabia to be 175 Gb (billion barrels). With 112 Gb already produced, that leaves only 63 Gb remaining. Colin Campbell (the founder of ASPO) has estimated total reserves for Saudi Arabia of 275 Gb (news letter 66), believed to be C+C+NGL (crude oil + condensate + natural gas liquids). There is an enormous discrepancy between this and Ace's analysis that ought to be explained.

This post is a brief summary of my views on Saudi reserves and production. My conclusion is that Saudi Arabia likely has at least 120 Gbs of remaining reserves (C+C+NGL) for a URR in excess of 240 Gbs (C+C+NGL). The remaining reserves according to this analysis are almost double those reported by Ace.

The importance of reserves and production forecasting

The point I have reached in my analysis of peak oil and energy decline is that reserves and production forecasting are of paramount importance. It seems increasingly likely to me that Planet Earth has ample supplies of alternative energy that may be gathered (nuclear and renewable solar sources) and which may replace declining fossil solar fuels when that happens. The major challenge that confronts us is not a lack of energy or engineering solutions but one of political, institutional, corporate and personal behaviour. The human race seems intent upon running for the edge of an energy cliff. Persuading politicians and OECD institutions now that energy decline is a very serious threat to the future of industrial civilisation is the single most important task that confronts us. Reliable and credible energy forecasts lie at the heart of that task.

Forecasting oil, gas, coal, uranium reserves and production is a highly complex process, not to be taken lightly. It is therefore with some reservations that I present this view on Saudi Arabian reserves and production as I simply do not have all the information required to do this job reliably. This seems an appropriate time to quote Colin Campbell's 10th commandment:

ALL NUMBERS ARE WRONG – THE QUESTION IS : BY HOW MUCH ?

I will follow a combined bottom up and top down approach, drawing on the work Stuart Staniford and I have done on Ghawar, Aramco reserves estimates (pre-nationalisation based on BP data), Aramco forecasts for new projects (pdf) and Hubbert linearisation.

Why C+C+NGL

All the figures presented here are for C+C+NGL making direct comparison with Ace who has used C+C only, problematic. My apologies for that, but I have good reasons for doing so.

The first is laziness. I find the BP statistical review of world energy to be a very readily accessible source of data which I use all the time - and BP quote C+C+NGL.

The second is the fact that NGL is a vital constituent of any petroleum system. In simple terms, the kerogen rich petroleum source rocks produce progressively lighter hydrocarbons with increasing pressure and temperature during burial. Starting with crude oil, the kerogen will then produce light oil, condensate, wet gas and once it is near completely cooked it will produce dry methane. So NGL, which condenses out of wet gas is a vital constituent of any petroleum system and should not be ignored in my opinion.

And third, gas production in the Middle East has been relatively low to date owing to remoteness from European and North American markets that historically have been served by local sources of gas. With increasing amounts of liquefied natural gas (LNG - not to be confused with NGL) now being produced, NGLs are tending to make up a significant amount of new production that is coming on stream. Ignoring NGLs at this stage, therefore, may present an unduly pessimistic picture.

However, it must also be pointed out that the energy content of Saudi NGL is about 70% of Saudi crude oil. So 1 barrel of NGL is not equivalent to 1 barrel of crude oil in energy terms. No adjustment has been made for the differing energy contents.

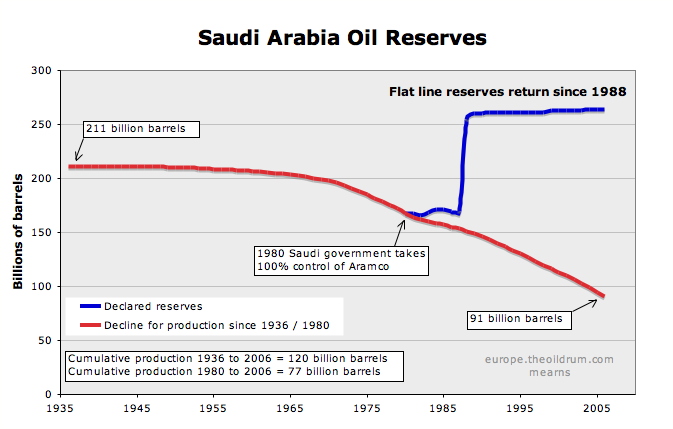

Saudi official reserves and their decline

The starting point for this analysis is to look at the official Saudi reserves estimates for 1980 as stated in the BP Statistical Review. A figure of 168 Gbs is quoted. This is the figure carried by Aramco when it was run by American companies, pre-nationalisation. As far as we know, this was an objective assessment of recoverable reserves at that time. Since 1980, Saudi Arabia has produced 77 billion barrels and declining the 168 figure for this production leaves 91 billion still to be produced, an observation made by Robert Rapier in an earlier post.

However, since 1980 there have been significant improvements in production technology, in particular the advent and widespread use of horizontal wells and 3D and 4D seismic that enable more accurate targeting of by-passed oil. This has lead to an improvement in recovery factors since 1980, and the figure of 91 Gbs remaining may justifiably be adjusted upwards to account for this.

Using the API Facts and Figures Centennial edition (1959) production data from 1936 to 1966 and BP production data from 1966 to 2006 shows that Saudi Arabia has produced 120 Gbs to date. Anchoring the production decline profile (the red line) on 1980 points to initial recoverable reserves of 211 Gbs with 91 Gbs remaining. But as already stated, these numbers should perhaps be adjusted upwards to account for improved recovery factors.

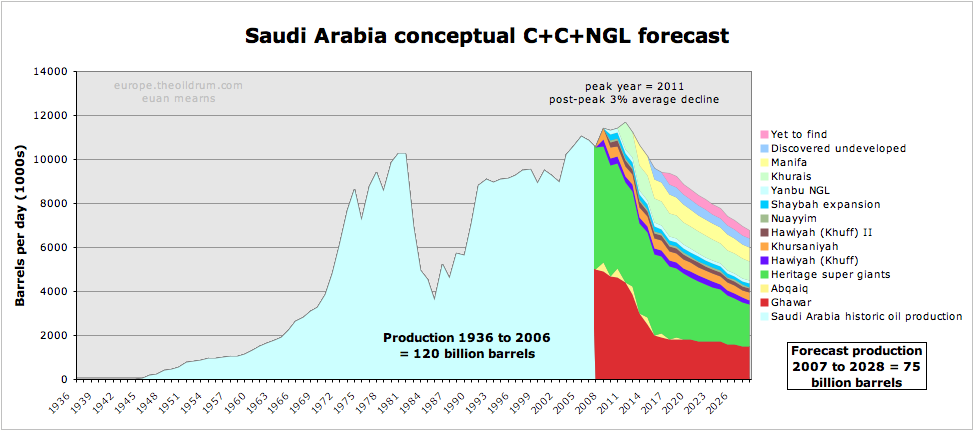

Conceptual production forecast

Forecast numbers are production capacity. Actual production may be lower depending upon demand. Click all charts to enlarge

The conceptual production forecast for Saudi Arabia has the following assumptions:

Ghawar

The Ghawar forecast is based on the base case revision 1 model I presented here. This is truly a bottom up analysis based on combining the reservoir volume determined from published maps and reservoir data combined with estimates made of the depletion state of the field estimated from published 3D models. The step down in production in the interval between now and 2017 represents the gradual death of northern Ghawar and transferral of production to the south which is much less depleted and may sustain a reduced plateau for many years.

Between now and 2028, 21 Gb of production is shown of an estimated 40 Gb remaining reserves. Some time beyond 2028, Ghawar production will go into rapid decline as the south end of the field becomes exhausted.

Abqaiq

Abqaiq is the most mature of the Saudi supergiants. The status of Abqaiq is rather obscure. The Linux map discussed here and subsequent posts shows oil remaining only in the crest and ridges of the structure. Jaffe and Elass (pdf) show zero production for 2004, although this may be clouded by periodic inclusion of Abqaiq production together with Ghawar. Multi-phase pumps (pdf) have been deployed to help produce the remaining oil.

Abqaiq is an ageing queen that no doubt would benefit from periodic rest and I have therefore conceptually shown sporadic annual production of up to 400,000 bpd that is turned on when needs require. A total of 657 million barrels of Abqaiq production is in the model.

Heritage super-giants

The heritage supergiants are those mature fields that together with Ghawar and Abqaiq have made up Saudi production for the last 50 years. These include Safaniyah, Berri, Shaybah, Qatif, Marjan, Zuluf, Abu Safah and the Hawtah trend fields. These fields are much less mature than Ghawar and it is difficult to estimate their future performance. The oil in Safaniyah, Zuluf and Marjan is very sour (contains high sulphur content) which creates refining and hence marketability problems. I consider it likely that these fields are not producing flat out but are production constrained owing to poor marketability of their oil. The Saudis are taking steps to increase their own refining capacity to deal with this problem.

It is difficult to know what decline rate to apply to this group of fields. Some, like Safaniyah and Shaybah may not decline at all in the foreseeable future. Whilst others like Berri and the smaller Hawtah trend fields may experience more rapid decline in the years ahead. Jaffe and Elass report natural decline rates of 7 to 8% that is stemmed to 2% by intervention. In the interest of being conservative, I have declined the heritage assets at a rate of 5% per annum. This may prove to be too high. They contribute 27.5 Gbs to 2028.

New Fields

New Fields are based on the Saudi Aramco projects time line, posted by Ace. Project delays have been a common feature of the recent commodities bull run and delays have therefore been built into the model.

Hawiyah (Khuff), Khursaniyah, Hawiyah (Khuff) II, Nuayyim, Shaybah expansion and Yanbu NGL have all been delayed by one year. Khurais and Manifa have been delayed by 2 years.

Two projects - 2007, Khursaniyah ethane+NGL, 290,000 bpd and 2008 Yanbu ethane + NGL, 195,000 bpd - are not included because it is not clear that these are genuine liquids projects. Ethane is a gas.

The new projects are all included at their nameplate capacity but are declined at a rate of 2% per annum thereafter.

Discovered undeveloped

A 500,000 bpd allowance is made for discovered undeveloped fields from 2015 that are declined at 2% per annum thereafter.

Yet to find

A further 500,000 bpd allowance is made for fields as yet undiscovered from 2017 (10 years from now) that too are declined at 2% per annum.

All this is speculative and conceptual. It seems unlikely in an oil rich country like Saudi Arabia that oil developments will grind to a halt after Manifa - thus it seems prudent to include some allowance for these future but as yet undetermined projects.

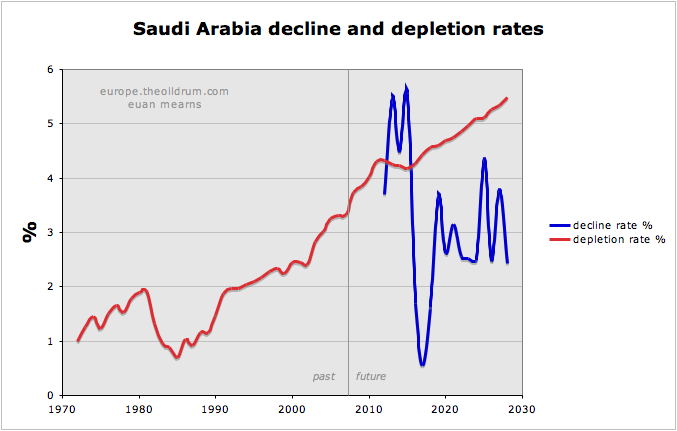

Putting all this together provides the conceptual production forecast model shown above. The peak in liquids production is 2011 and the average post-peak decline is 3%. The modelled decline and depletion rates are shown below. Depletion is based on a URR of 240 Gbs (see the following section). The reserves depletion rate cannot go on rising forever, and at some point in the future, the death of S Ghawar (and other supergiants) will lead to periods of accelerated decline that will lower the reserve depletion rate.

Decline rate = year on year change as % of production that year.

Depletion rate = annual production as % of remaining reserves based on an assumption of 240 Gbs URR (see following section)

| Asset | Production allocation 2007-2028 Gbs | Hydrocarbon |

|---|---|---|

| Ghawar | 20.9 | Arab light |

| Abqaiq | 0.66 | Arab light |

| Heritage assets | 27.5 | mixed, biased sour |

| Hawiyah (Khuff) | 2 | NGL |

| Khursaniyah | 3.2 | Arab light |

| Hawiyah (Khuff) II | 1.6 | NGL |

| Nuayyim | 0.61 | Super light |

| Shaybah expansion | 1.5 | Extra light |

| Yanbu NGL | 1.2 | NGL |

| Khurais | 6.7 | Arab light |

| Manifa | 4.5 | Arabian heavy |

| Discovered undeveloped | 2.2 | |

| Yet to find | 2.0 | |

| Total 2007 to 2028 | 75 |

Hubbert Linearisation

Regular readers of The Oil Drum will recognise this Hubbert Linearisation (HL) chart that I have posted many times on various threads. When it was first posted it received cries of derision from certain posters because my favoured trend is the "stretch HL" drawn between 1991 and 2005 (the red line). How could anyone have the audacity to draw a trend between two points pointing to 240 Gbs whilst there was a well-defined linear trend pointing to around 180 Gbs (the blue line)?

Saudi oil minister Ali I. Al-Naimi holds Saudi Oil production and the future of industrial civilisation in his hands

The logic is this:

We know for sure that in the period 1991 to 2002, Saudi Arabia was not pumping at capacity. The southern third of Ghawar (Haradh) was'nt even developed and numerous discoveries were standing idle, we saw $10 oil in 1998 and Saudi Arabia probably had over 2 million bpd spare capacity. The linear trend from 1991 to 2002 therefore does not see all the reserves and it seems highly likely that this will underestimate the Saudi resource.

1991 (GW I) and 2005 were two years that Saudi Arabia was likely pumping at or near capacity. It is hypothesised that had they pumped at capacity for the interim period then the HL would have declined along the red line and would be pointing towards 240 Gbs.

The red symbols represent the production forecast detailed above and needless to say I was fairly satisfied to see these lining up along my stretch HL trend. This doesn't make it right, but it certainly adds a degree of internal consistency. 2006 production is the last blue symbol.

There has been much debate about HL on TOD over the past year ranging from those such as Westexas who have blind faith in the method to Robert Rapier who has expressed doubts that HL has predictive qualities. I have always adopted a moderate view acknowledging usefulness so long as the limitations are recognised and understood. On this basis for the time being my view on Saudi reserves of C+C+NGL is that these will be at least 240 Gbs.

Downside risk

Staurt has recently circulated an internet chart of Ghawar production that shows 4 million barrels per day (mmbpd) for 2007. This is about 1 mmbpd lower than shown in my production model. The provenance of this data is unknown, as is its reliablity. 4 mmbpd, however, matches anecdotal evidence from other sources considered to be reliable.

The reduction in Ghawar of 1 mmbpd over 2 years as indicated on this chart matches the decline in Saudi production over the same period. This brings us back to the question of why Ghawar production may have fallen at a rate of 10% per annum for two years?

One possibility is that the depletion state of Ghawar is more advanced than was concluded in my analysis and that Ghawar is now on the slide indicated in my forecast to begin in 2011. It is therefore within the realms of possibility that the Saudis have been caught unprepared for a collapse in N Ghawar production, and the scramble for rigs and new projects that is now underway has come too late to forestall a drop in their productive capacity. The altenative explanation is that mature parts of N Ghawar are being rested to allow new wells to be drilled and reservoir pressure to rise etc.

Bringing N Ghawar decline forward by 4 years produces a modified forecast in the near term. Saudi watchers will note that 2005 becomes the peak year in a 30 year undulating plateau spanning 1990 to 2020. 5 billion barrels production are lost in the period to 2028 relative to the base case forecast presented above.

Summary

| URR Gb | Remaining Gb | Recovery % | Notes | |

|---|---|---|---|---|

| Ace | 175 | 63 | 25 | C+C only |

| Pre-nationalisation | 211 | 91 | 30 | minimum |

| Mearns | 240 | 120 | 34 | minimum |

| Campbell | 275 | 155 | 39 | |

| Saudi official | 384 | 264 | 55 | BP+produced |

The recovery factors are based on an ussumed 700 Gbs of original oil in place. This is the figure reported by Baqi and Saleri and by Colin Campbell.

The projected recovery factor for the official Saudi reserves is unrealistically high for the whole country. 55% may be achieved in the N Ghawar production sweet spots but most certainly not in poorer quality reservoirs that make up much of the countries resource base.

In his analysis, Ace concluded:

it is now almost a certainty that Saudi Arabia passed peak C&C production of 9.6 mmbd in 2005

In reaching this conclusion, Ace assumed that Saudi Arabia had no market for most of its sour crude oil and allocated only 20 billion barrels to sour crude reserves whilst acknowledging that the actual figure may be much higher. 85 Gbs recoverable reserves were booked for Ghawar, whilst Stuart's analysis suggested 96 Gbs and my base case analysis suggested 97 Gbs. Not all new projects were included at nameplate capacity and NGL is not included in this analysis of C+C only. It seems that worst possible case assumptions have been made at each stage which not surprisingly then leads to a low estimate of reserves and a picture of imminent production collapse. The indicated country-wide recovery factor of 25% is very low.

Campbell's analysis of Saudi reserves is rather superficial. He recognises official Saudi estimates of original oil in place to be 716 Gb but prefers a figure of 600 Gb based on anecdotal evidence from reliable sources. A generous 45% recovery factor is applied to the 600 Gbs to get a figure of around 270 Gbs. This figure matches Saudi official reserves estimates and it is suggested that the Saudis report URR and not remaining reserves. This certainly fits the practice of showing no decline in the annual reserves return.

Time to recall Colin Campbell's 10th commandment:

ALL NUMBERS ARE WRONG – THE QUESTION IS : BY HOW MUCH ?

It is up to individual readers to decide where the truth lies.

Acknowledgement

Professor Goose, Stuart Staniford, Khebab, Luis de Sousa and Ace reviewed the text and provided helpful comments. This does not mean they necessarily agree with the content.

Further articles on The Oil Drum about Saudi Arabia:

by Stuart Staniford

- Saudi Arabia and Gas Prices

- Depletion Levels in Ghawar

- The Status of North Ghawar

- Further Saudi Arabia Discussions

- Water in the Gas Tank

- A Nosedive Toward the Desert

- Saudi Arabian oil declines 8% in 2006

by Euan Mearns

- Ghawar reserves update and revisions (1)

- GHAWAR: an estimate of remaining oil reserves and production decline (Part 2 - results)

- GHAWAR: an estimate of remaining oil reserves and production decline (Part 1 - background and methodology)

- Saudi production laid bare

- Saudi Arabia and that $1000 bet

by Heading Out

- Simple mathematics - The Saudi reserves, GOSPs and water injection

- Of Oil Supply trains and a thought on Ain Dar

by Ace

http://science.reddit.com/info/2k75q/comments

theoildrum authors thank you for helping them get more readers... :)

One observation: If you plug in the 2006 and 2007 year to date production numbers, the HL plot is reverting back to the 1991 to 2001 P/Q intercept line. This is consistent with the Texas model, where a careful analysis of the pre-peak data show that the most accurate pre-peak estimate of URR came from discounting the "dogleg up."

It's nice to see TOD contributers using objective terms such as "blind faith" for yours truly, especially when the available 2006 and 2007 data show the HL plot reverting back to the 1991 to 2001 P/Q intercept, which you have somehow failed to show.

Of course, one would think that an objective writer would at least acknowledge that my HL based warnings of an imminent Saudi production decline have--based on the production data--been correct. Could I still be wrong? Sure, if and when Saudi production exceeds its 2005 average annual production in a given calendar year. But until then, the production data are supporting a 2005 final production peak for Saudi Arabia.

WT I think the problem people are having and why they are slamming HL is that KSA puts being a swing producer above production rate. So they may not be maximizing production but trying to maintain a capacity buffer for emergency use even as they decline. If you add this concept esp if they are trying to maintain a 1mbpd plus buffer it skews the data.

The people that claim that KSA can produce more are assuming that they have a large buffer and some day will pump at capacity. While I think they generally don't have a lot of spare capacity and will only use it for short periods of time during major emergencies. So I think your right for "day to day" production but I also think KSA is not producing at maximum. Next of course the amount of spare capacity they have is unknown. What will be interesting going forward is if the bring large fields online and we see no change in production rates then we know that are working like mad to rebuild spare capacity. Over time we will eventually ferret out how much spare capacity KSA has and its nature at the moment I don't think we have enough information. However because of political reasons I don't think its all that relevant to daily production and your estimate are probably closer to the truth.

Finally my opinion is if you assume they want to maintain a spare capacity buffer even as they decline all the data seems to fit so I think this paper is making in correct assumptions.

One more thing KSA has adopted and in fact been a leader in developing technology to enhance production rates this is not

included. The dogleg for the US occurred because of a massive drilling campaign. KSA has a different profile but newer technology probably has resulted in inflated reserve estimates. KSA itself uses enhanced extraction rates to justify their highly inflated reserve estimates so you have to assume that they have seen some significant improvements in extraction rates from technical advancements. We have reason however to doubt this translates into higher final recoveries at high production rates.

So KSA production is not a black and white issue and its sad that its treated as such.

Everything Saudi Arabia has done in developing their oil resources has been aimed at maximising recovery at the expense of high production in the short term.

Ghawar alone could have produced at over 15 million barrels per day but has never done much over 5. The Saudis have also left huge fields lying fallow. None of this would ever have happened within the OECD.

There principal use of horizontal wells has been to maximise recovery from poorer quality reservoirs and to control water cuts in the vicinity of mobile oil water contacts.

The advent of new technology - mainly horizontal drilling and 3D and 4D seismic has led to a justifiable expectation of higher recovery factors over the years. The one-off reserves inflation in the 1980s and in particular the fact that they have not been declined for production since remains a seroius problem.

Why Euan, you almost sound like...

nevermind :P

I'm curious as to why these technologies have not turned around the Texas and North Sea declines.

BTW, a question I have been meaning to ask you. Were there ever any material restrictions on drilling in the North Sea?

Because these fields have been grossly mismanaged in such a way that most of the OOIP is now locked in no matter what kind of technology you bring into it. KSA has done a great service by slowly producing their oil to maximize long term profit. We at the USofA are concerned with this quarters shareholder earnings...

I nominate this comment for the top 10 list of most nonsensical comments ever posted on The Oil Drum.

We're not talking about turning around decline here but estimating URR.

The biggest hydrocrabon resource as far as I'm aware in NW Europe is not Statfjord, Troll, Brent or Forties but the Claire field west of Shetland. A huge accumulation of relatively heavy oil (20 api) in poor quality Devonian sandstone reservoir. This field lay fallow for decades as the oil was not producible using vertical wells - but much diligant work by BP (which I was involved in in a small way) has led to development of the best reservoir segments using horizontal wells. This has added to the URR of the UK.

In Norway, the giant Troll west field is gas with a thin oil rim. Norsk Hydro spent many years modelling the producibility of this oil using horizontal wells (I was also involved in a small way in that modleling work) - as it turns out Troll W became Norway's largest oil producer, I believe, for a few years. Again, this oil was not recoverable using vertical wells and producing this oil using horizontals has added to the URR of Norway.

If I could second what I take to be the thrust of this post. What I think I can see SA doing is shutting in premium quality production capacity such that X Mbpd can be turned on quickly. This capacity is the last bits of production from key fields (such as Abqaiq) and could be used to increase SA production for short periods of time (lets say up to 100-200 days).

Now there is a world of difference between a short term peak rate and long term base capacity. Its the former that SA is talking to the world about - but the later that people are assuming.

In this way SA can offset limited duration issues (say someone attacking Iran), but it doesn't deal with the base load of world demand.

So, in short - close down the scraps of the high quality fields against short term needs. Drill new fields to make up for the loss of base production in mature fields and keep long term total capacity stable. No increases in capacity over the 9Mbpd we are seeing, except for short emergencies.

Seems very sensible to me.

Correct but this introduces errors in estimating their true reserves and you must include the technology effect which offsets to some extent this spare capacity. Considering that this capacity is anywhere from 500k to 1mbpd or more and its been a systematic part of KSA production ( swing producer ) we have a fairly large margin of error in reserve estimate. However since HL is based on real production data not the probably offsetting effects of advanced technology and shut in capacity its probably closer to the right answer. So in general KSA has been shutting in capacity and using advanced technology to deplete the fields they do produce at a higher rate. The net result is they probably end up close to HL but its not simple. HL in effect hides this complexity its "builtin" people who disprove HL pull out one of the variables of their choice but don't acknowledge at the variables. Its pretty clear that KSA has been fairly aggressive in producing fields when they do produce them for example and its rumored that they produce to the point of field damage during crisis conditions.

I guess I don't see the point in discrediting HL its a tool and it seems to provide valuable information along with all our other information sources. And as far as the way people discredit it they simply don't understand how it works. But claiming that you can fit a lot of curves to a data set and thus one fit is wrong is .... I won't even go there.

One problem I have with HL based on KSA production history is that it implies some sort of predestination with regards to how fast they can pump oil and what the eventual yield will be. In reality, decisions that they make can obviously affect the near-term rate and the URR. Develop Haradh using MRC wells? Develop Khurais? Squeeze more oil out of Abqaiq with new technology? Will they get what they expect? Who knows, but in any case, there is no information whatsoever on these prospects embedded in past KSA production rates.

While it is very possible that they will never match the 2005 peak again, it doesn't logically follow that the decline rate and the URR are magically determined by a line drawn through a set of data points.

Both the US Lower 48 and Russia have made more oil than Saudi Arabia. If we construct HL models based on production through 1970 and 1984 respectively for the Lower 48 and Russia, the post-1970 and post-1984 cumulative production for the Lower 48 and Russia have basically been what the HL models predicted it would be.

My confidence in the HL method is based on an evaluation of the method as applied to several large producing regions, not "blind faith." I think that the method works because we tend to find the big fields first, and "Peak Oil" is basically the story of the rise and fall of large oil fields.

In my opinion, the HL method is controversial because people don't like the answers it is providing.

I'm not going to question your eyesight, but I will question the ability of the HL method to "see" how much oil is in Haradh (or Khurais, etc.).

Similarly, most reservoirs in the lower 48 (the East Texas field being an exception) have rather low recovery rates, mostly because they were produced early. If you and oilmanbob and thousands of others decide to go after a lot of that oil using EOR wo whatnot, won't that give a different production decline profile and a higher URR than predicted by the current HL plot? Now, there's no way Texas or the lower 48 are going to come close to re-peaking, but that is not the only consideration.

I don't disagree with your message. I just question one of your sales pitches.

In defense of WT and Hubbert linearsation-King Hubbert made his prdictions on crude plus condensate produced with primary and secondary production. What I'm talking about, and other companies too is the 390 billion barrels left behind in the lower 48 states as a tertiary development target has a huge absolute volume. To get the oil to an average 60% recovery, we're talking another 156 million barrels to be produced.

But lets get realistic about the situation I have a hard time believing that most fields can be produced at even 1/2 of the original production rate, and probably more like a quarter of the original rate seems a likely scenario. The whole reason the pressures were wasted was because the operators pulled the wells too hard. The THAI method seems to be great for making bitumen produce at very high rates, yet these are virgin reservoirs and still have solution gas, and the process isn't going to be suitable for rocks with a high proportion of limestone, like the entire Permian Basin. Think about it-the 700 degree temperature is going to turn that limestone into cement, which doesnt produce very easily. And, the process may not work at all on medium to light oil in great sandstone reservoirs. The best, most productive reservoirs like the East Texas field have already had 50% of the original oil in place produced by primary and secondary methods. It had a natural water drive in that field

We currently produce about 3.8 mbopd, and at the highest the US produced around 10 mbopd. If the tertiary guys could get that up to 5 mbopd I'd consider it heroic work. But we are consuming 21 million barrels of oil per day. That leaves a gap of 15 or 16 mbopd. The Canadian Bitumen might provide as much as 5 million barrels, so we are still looking at a shortfall of perhaps 10 million barrels of oil to be produced. Alan Drake's Electrification of Rail will save us another 2 to 3 million barrels, so we are still looking at a shortfall of 7 or 8 million barrels of oil that has to come from somewhere- and its obviously hybrids and increased cafe standards,bicycles, electric vehicles, natural gas to diesel from stranded natural gas. I'm not a doomer, but I sure think its going to take everone in the country and the world working together to keep reasonable prosperity . Look at the tail end of King Hubbert'curve-it trails off a long ways. Bob Ebersole

I take it you meant another 156 billion barrels.

But that's my point. The lower 48 production data to date has no information about the heroic efforts which could be employed to get that extra oil, and so an HL analysis would not account for it. If a massive effort could even slow down the decline in production, that would also represent a deviation from the HL prediction. Certainly not "Happy Motoring", but it will be needed for any kind of transition.

As for the East Texas field, sometimes it's better to be lucky than good. The recovery after secondary production will be around 75%, which is amazing given the haphazard way it was produced (30,000 wells etc.).

This in my opinion is correct. But was you fall back to the case that the future is similar to the past you get back on HL. This means that you should be careful about the validity of data points shortly after peak production.

Next HL probably stays optimistic post peak. Its implicitly assuming that the amount of work put into production is basically a constant with production dropping only from depletion effects. For oil its implicitly assuming that the number of new wells drilled is a simple function of the size of the field probably effectively constant. Its measuring the life/death cycle of the wells and I've not set around and figured out the actual well drilling pattern that gives this sort of Gaussian production curve. I think the key feature is actually the rate that wells are closed in not the details of the drilling campaign. The fact that the "death" of wells is directly related to URR is what gives HL its utility the drilling campaign itself just determines the height and slope of the curve but the death rate is the critical factor. The sweet spot for the HL method is the data between when the rate or production growth start decreasing and the peak. This is the cleanest data given HL's assumptions. The drilling campaign is in a steady state for the most part and changes in production are pretty much only from the death of wells. WT has in my opinion correctly applied HL thus I believe his results.

I guess if people are willing to take the data range from the first inflection point to the beginning of the peak plateau's and argue about HL I'd be more willing to listen.

Trying to prove HL wrong outside of its "sweet" spot is not interesting. Notice that given this analysis its pretty obvious that massive drilling campaigns post peak are probably simply extracting the resources faster and not increasing URR. Since so much of oil is in the long tail it will be a long time if ever before we find out what the real URR is. In any case the constraints on a good HL analysis are pretty obvious its surprising that people seem hell bent to disprove it. HL is not rocket science its a good simple model.

75 % recovery after secondary for east texas? isn't current recovery in the 50% range with a 99% water cut ? i dont see how east texas is going to get to 75%.

Actually, 75% is on the low end. I have several sources for this. A report prepared by U. Texas in 2003 said that as of 2003 5.3 billion barrels had been produce out of 7 billion OOIP (76%). The book Nontechnical Guide to Petroleum Geology, Exploration, Drilling, and Production by Norman J. Hyne says 82% will be produced, and Jean Leherrere estimates 85%. All secondary production.

u of texas and jean leherrere notwithstanding, i doubt the figure. but i cant say that i have read either or your references. i have never, ever heard of a secondary recovery project with anywhere near that recovery. gravity drainage, maybe, but that is not a secondary recovery method. my guess is that the ooip is understated. and of course the water injection may be completely incidental to the recovery by gravity drainage.

but i am always open minded and willing to learn something new. i will take a look at the references you have cited. and fwiw, oilmanbob quotes 50% a few posts up.

The following is from this abstract of a SPE paper.

Well said. This is precisely my problem with HL--it doesn't take into account things that we know for a fact can influence production volumes.

As one more example, consider the talk recently about how there has been a paradigm shift in OPEC's view of the market, and how they are apparently much more willing to restrain production and drive up prices. Whether this was caused by their seeing proof that $70 oil would not instantly wreck the US economy or their desire to maximize revenues as they approach the peak is, in one sense, irrelevant. The point is there seems to be at least one major factor influencing their production volume aside from geology.

Note my question up the thread--Why hasn't better technology reversed the Texas and North Sea production declines?

IMO, regardless of whether we are Capitalists, Communists or Britney Spears Worshipers and regardless of whether it is Texas, the North Sea or Saudi Arabia, we generally find the biggest fields first. A production peak does not mean that we stop finding fields and it does not mean that we stop trying to extract the last barrel of recoverable oil out of the reservoir.

It does mean that we can't offset the declines from the old, larger oil fields.

That is my point about using the wildly different post-peak Lower 48 and Russian production profiles. The post-1970 and post-1984 cumulative production numbers were basically what the HL models predicted they would be.

The thing about HL is it tends to give you a URR not surprisingly based on how the fields are developed. Its insensitive to the exact nature of the development except that the growth should reasonably follow the assumed population like pattern. It need not be maximum growth etc etc. It also probably underestimates the amount of oil extracted in the tail end of a fields life when more aggressive methods are used. But since its primary utility is near peak and post peak its faults probably don't effect its "predictive" power.

Its very much a sledgehammer and a simple tool but considering the uncertainties involved its seems to be a pretty good tool. If HL is pointing to peak you need in my opinion some strong evidence that the region is not close to peaking. Its simplicity is both its strength and in a sense its weakness. In general people that object seem to not understand it. Its a simple model of the exploitation of a resource that makes the assumption that future exploitation of the resource will follow previous methodology. I.e the future is like the past and any slowing in the growth rate of production is caused by depletion of the underlying resource.

Thus its a fairly sensible simple model and useful in the case of incomplete data. So far none of the arguments against HL are that strong in general its the bias of the people that dislike the model that reject it.

And finally the URR calculated but HL and by other measures is probably not the same number. This is easy to see for example since people that dismiss HL are assuming a massive investment will be made as a field declines to increase URR and also enhance production rates while HL does not make this assumption. This is why it does not capture the flat peak we find in practice or the so called dogleg. The assumption that the future is the same as the past fail at peak but it becomes strong afterwards.

Anyway I'm not going to debate HL the facts will become clear soon enough and with issues such as Export Land and the potential for the oil industry itself to crumble etc etc

I don't see the projected production rates as relevant now.

So I think HL's and all the other depletion based models are either irrelevant are close to irrelevant now. Politics, war, weather and economics will determine how much oil is produced from now on out and I expect the real amounts will be far less than predicted by depletion modeling. We are going to kill the golden goose.

I don't think there has been much investigation of this and I believe it may have significant explanatory power.

OPEC went through an early post-nationalization phase which was the equivalent of the kids finally getting the keys to the bank vault. There was little or no market discipline and the attempt was made to maximize immediate returns.

OPEC now appears to have significant market discipline and I suspect this is due to increasing financial sophistication and their own recognition that they have a finite resource and need to manage that finite resource to maximize value extraction. They see themselves as pumping dollars, not oil, and will act as necessary to maintain the value of the income stream.

I suspect that within 6 months we will see OPEC taking more oil off the market in anticipation of a US/UK recession.

"I suspect that within 6 months we will see OPEC taking more oil off the market in anticipation of a US/UK recession."

Interesting.

Finance markets seem to say (futures market) there'll be no recession.

Also, IEA seems to say that sub-prime (et-al) fiasco will not make a dent into oil demand.

But still OPEC will cut?

It'll be an interesting coming 6 months, whatever happens, that's for sure.

A year or two ago the Wall Street Journal looked at the predictive power of oil futures and concluded that they were utterly worthless more than about 6 months out. This differs from certain other commodities so they sought to explain this and their best guess was that the market lacked complete information (or transparency) thus making futures "bets" problematic.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Yes, but that was only for Oil futures market.

And I am now talking about the whole economy AND the next 6 months.

Apples and oranges?

Could the "dog leg up" in '03 not be a case of mild overproduction by KSA in their role as swing producer in response to the Gulf War? I'm not sure picking just two data points,'91 and '03, and assuming a steady state, sustainable rate happening at just those two points is good HL. But because they seemed to always be under or over producing, it makes their true producible reserves a mystery. Their reponse to any kind of supply problem in the past has typically been overproduction. The point that newer recovery methods should rightly add a lot of the bypassed oil from past bouts of overproduction to the older reserve numbers seems valid. But is this going to change the KSA peak time much?

The assumption that production needs to be maximized to do a valid HL prediction is just that and assumption with no supporting evidence. In fact the concept of maximizing production makes little sense. The modern practice seems to be to drill all the wells in the beginning. Thus production is 100% controlled by the depletion rate and their are a number of approaches in between. I think HL requires a number of years of a steady development program but I see no reason for this concept that the field development has to be maximized and its not clear what this even means. Better for HL is that the number of wells drilled each year is relatively constant.

But considering HL seems to work under a number of different types of drilling programs the exact nature of the program does not seem to be that important as long as its consistent.

Please explain how HL - or any method - is supposed to correctly divine the amount of oil in the ground if the rate of production - the only data it's given - is determined by economics rather than geology.

HL isn't magic; it follows the same "garbage in/garbage out" rule that every other algorithm does, and production data that is determined by fiat rather than geology is - when looking for geological limits - garbage.

Moreover, RR's theoretical examination of HL pointed out quite clearly that intentionally-constrained production will cause HL to give too-low results. It's pretty easy to see for yourself, though. Suppose a field comes online producing 1 unit of oil per day, and is developed in one of two ways:

If you graph that, the first approach will show a nice peak shape, and using data from years 6 through 16 gives a nicely-fitting HL that predicts an URR of 32 (vs. a true URR for that series of 36; not too bad when predicted from a currently-produced value of 24).

By contrast, using data from years 6 through 16 of the intentionally-constrained production gives a nicely-fitting HL (R^2 of 0.95) that predicts an URR of 22...which the other well management scheme has already exceeded.

And it's not like this second well development approach is somehow unreasonably unrealistic - the first approach is producing in excess of 1.5 units/day for the entire data period, so there's no difficulty in achieving 1.0 units/day with the constrained well. Moreover, the unconstrained well has a production shape (rise-peak-fall) that looks very similar to the "theoretical ideal" from Hubbert's 1956 paper, so this seems like input data that HL should be able to handle.

But constrained production makes it fail utterly.

The Saudis have tended to always under-produce their fields. Ramping to capacity does not necessarily represent over-production.

For several months I have been mulling how to interpret the dog leg up in the HL trend and settled on the "stretch HL" pointing towards 240Gbs some months ago as one likely scenario. You are right to say that using only 2 points is not good practice, but this was presented as a possible outcome / interpretation.

What I have done now is to look at the various components of Saudi production completely indpendently of HL. The Ghawar model is based on the work done and reported on earlier this year. The new projects are based on the Saudi projects timeline. Both these components can be viewed as "bottom up" analyses. The third element is the heritage super giants which I have simply declined at 5% per annum from past production levels - this is a top down approach.

These components are then summed and fed into the HL model to see how they fit. I was naturally pleasantly surprised to see them lining up along my stretch HL trend. The data match the model and are not used to constrain it.

Those who want to refute this model need to provide arguments for how each of the input components should be modelled differently. GaryP has said he thinks I'm over-optimistic on Ghawar. I simply disagree with that and the only way to resolve such differences is to wait and see what happens.

First how HL works has been a bit of a mystery. Or better why it would work. WebHubbleTelescope (WHT) has made some great comments on it. Its a birth death models what the heck does it have to do with oil ?

So I've proposed this is how it works.

Its measuring the life/death cycle of wells. They are born when they are drilled and die when they water out. So this pins the logistic equation to something that follows a life death cycle. Production rates are a good proxy for the life and death of the average well.

Next how the heck does this relate to reservoir size or URR.

The key insight here is that the changes in production become dominated by the rate of death of wells in a mature field and if the rate new wells are created is consistent then you have a heuristic to guess the point at which all well would be dead. The critical factor is that the change in production is now primarily because of the death of wells and new wells are being consistently added even though the rate production is increasing is beginning the slow. This means the field is well developed. You don't have to maximize production just be consistent.

The critical factor is that changes in production from births is now linear and non-linear effects are caused by the death of wells. This is related directly to the size of the reservoir. And easy way to think about it is drilling holes in a damn dead holes occur when the water level drops below the hole. Once you drill enough holes and watch the flow rates its fairly obvious that you can estimate how much water is in the reservoir. Or you could consider drilling holes in a bucket. This is actually close to classic calculus problems. And you can see that the critical factor is that the rate of change is governed by "dry" holes and I need to be consistent with how fast I drill new holes. So I can discount the effect of new drilling.

Now when do these conditions hold ?

1.) Once the rate of increase in production begins to slow.

2.) As long as the drilling campaign is consistent.

3.) When well deaths contribute a significant amount to the change in production.

And when does it not hold ?

1.) Early in the life of the field before its fully developed and well deaths are not important since this is what we are really measuring.

2.) During periods with the drilling campaign changes drastically. This is common near the peak in production and leads to changes in the field development in attempts to maintain and increase production.

3.) Slightly post peak you probably still have a extensive campaign going.

So this means you have two places to apply HL. On the upslope before the peak and on the down slope after the peak. The caveat is the downslope URR may be overstated if advanced technology has increased extraction rates but eventually it will snap back to the original HL plot as wells die faster.

And finally what is this URR ?

Its the reasonably recoverable URR it does not include the long tail 2bpd type production. Since well life/death is under economic control. This is a lot of oil thats not in the HL URR estimate and I'm sure its the cause of a lot of trouble. The HL URR should be considered the URR of semi-easy oil not total URR. The total is at least 10-30% higher but the last 10-30% will be recovered at low production rates with minimal economic gain. The reason its not in HL is that the rate of well death and the nature of the wells changes dramatically when you go to stripper wells. HL is measuring effectively low water cut production during primary/secondary production. Consider how much of the US production came from stripper wells and you will see why you have a disconnect between HL URR and other ways to measure URR. They are not the same variable !!!!

Now the key point is West Texas correctly did the HL analysis. From reading his posts I think he basically followed the same line of reasoning. He knew to correctly reject the dogleg and did the right thing and focused on steady production. Kudos.

If you don't believe in HL then use the following guidelines for your HL plots and lets look at where it fails and why.

I think we have enough data to prove/disprove this physical explanation for HL.

I think it's a most salient point made by memmel about the URR predicted by HL being more a real world than theoretically producible thing (at least out to a production peak). Hubbert's model is at it's best when projecting peaks for something with stable, slowly changing inputs as, for example, in conventional crude in big bodies of land with fairly constant well operation strategies. The model is at it's worst when dealing with sudden new modes of extraction as, for example, in the recent rapid addition of deep water oil. For the case of KSA, the well operation strategy at first may seem controlled totally by chaotic geopolitics, the price of oil, etc. But, according to Simmons anyway in his book Twilight, KSA's well management was all along controlled more by geophysical (and thus HL friendly) factors than we may think. Off and on bouts of overproduction followed by long periods of resting the reservoirs was pretty much the well operation strategy for decades! First, there was a lot of overproduction. To quote Simmons:

And in discussing the production cutbacks of the '80s and '90s, Simmons had this to say:

Simmons based his conclusions not on public perceptions or speculation, but on the mountain of little studied technical papers filed by KSA's technicians. The public perception is, of course, that they cut back to manipulate the price of oil.

As for the '90s period, where a lot of underproduction is assumed in the higher HL fit through the "dog leg" away from the more normal straightline data points, you had yet another production ramp-up from the first Gulf War followed supposedly by more cuts to prop up the price of oil. But Simmons had this to say on that:

Could it be that the straight line HL fit through the "underproduction" '90s is actually a fit through the decades long well strategy of KSA in dealing with bouts of overproduction and is based mostly on geophysical, not economic or other factors and, amazingly enough, winds up going straight through the data points for '06 and '07 where we know for a fact there is no underproduction? I'm sure there was some excess capacity in the '90s, but the HL fit suggests that then as now, there may not have been much in terms of light sweet crude. The spare capacity now is mostly heavy sour with limited marketability. I don't think picking two Gulf War years, '91 and '03, and drawing a straight line between them detouring decades of data points that paint a very different picture is trustworthy HL.

What's the closing hymn?

C'mon. Twilight in the Desert not a sacred text that you can quote as gospel truth. The "little studied technical papers" are not hidden in Dick Cheney's closet--you can read them online (OK, for the price of a movie). I've read (and re-read) the book, the rebuttal from "the Dark Side", and many of the papers involved, and came to the conclusion that the truth is somewhere in between. Simmons has some hits, some near misses, and some wild pitches. All in all, he makes a good story that will keep you up at night. He's more connected to reality than the "KSA can keep it up for 70 years at current rates" crowd, but don't get too enamored with the details.

This is a little late to be replying to this thread but I must.

Your "Dog Leg Up" is all out of whack. Look at the data. Saudi C+C in 2006 was about 400 kb/d below 2005. Assuming no dramatic increase in the remainder of 2007, then production in 2007 will be 550 kb/d below 2006. I don't think you are showing that kind of a decline in your chart. But in 2008 you are really optimistic. In orcer for your chart to be correct, Saudi production in 2008 would have to be back up around 9.5 mb/d, and continue at close to that level for several years. Perhaps that is your opinion but it is not mine.

At any rate it is just an opinion. If production in 2008 is around 8.5 mb/d then the dog leg will turn down and remain on the trajectory it has been on since the early 90s. The data from 2008, I believe, will cause the HL to predict Saudi has between 60 and 80 billion barrels of reserves.

But if we are just guessing at 2008 production, as you clearly are, then we can make them anything we wish.

Ron Patterson

"Blind faith" is pretty accurate because you avoid at all costs any serious consideration of the possibility that KSA reduced production (at least in part) to support the market. In hind sight, of course, those Arabs made a pretty good call! The market got soft even with Saudi reductions. I don't recall you making any prediction that oil would get soft last fall.

The problem WT has is they are discounting his analysis.

Also I might add KSA makes claims that prices are inflated because of speculation yet they have not done the obvious and up production to kill the speculation. The one thing they have not done is increase production. Finally attempts by KSA to maintain a capacity buffer certainly muddy the analysis but we can be sure that they will use it sparingly so WT's HL is probably a better prediction of daily future production.

In any case this is yet another attack on HL and a fairly poor post since it does not even consider how KSA will manage declining production increased internal consumption and their desire to maintain swing producer status. I'm amazed that people use the swing producer or spare capacity argument to discount HL yet somehow assume that KSA is going to open the taps and produce flat out ANY DAY NOW.

Yeah right.

He is showing a forecast for the Saudi HL plot that is directly contradicted by the 2006 and 2007 year to date data.

WT its a absolute myth that HL only works when you maximize production. I have no idea how that got started it has no basis. I outlined why I believe your numbers you did it right.

I suspect you may have not understood why your right it took me a while to figure out what HL is measuring. But I'll repeat HL gives URR under the following conditions.

1.) Production has begun to slow because individual wells have reached the end of their productive life.

2.) The drilling campaign is effectively in a steady state i.e well are "born" under a set of constant conditions. This need not be to obtain the maximum production rate. The critical factor is production is dominated by the rate wells are closed in.

HL is a life death model of the drilling campaign and gives URR if the campaign is fairly steady and changes in production are from closing in wells and thus pretty much directly caused buy the underlying URR. If you break production into four periods initial, mature, post peak, and mature decline. HL should be used in the mature phase or mature decline ( new steady drilling state). It is not a good estimator of URR during the initial phase and peak periods. So I think Euans basic assumptions of maximum production as a prerequisite for HL are false and unsubstantiated.

You did it right and correctly discounted the dogleg up phenomena. The dogleg is probably better termed the Ohh S&*t period.

Finally the URR from HL is probably best described is the amount of oil that can be reasonably extracted most advanced extraction method will work to move this forward in time but the total URR is probably correct for commercial extraction.

The bottom up methods tend to give the utopian extraction rates and thus are in my opinion less useful than HL. But the point is the URR from HL is not quite the same as URR from bottom up approaches its a slightly different and my opinion far more realistic URR. A lot of the excess oil that is part of the URR from other methods would be produced in a long tail at low production rates so it distorts the issues surrounding peak and the near term post peak world. We could care less how much oil is being produced 30 or 60 years from now since it will be a very different society at that point.

Let's see.

I warned of an imminent decline in Saudi production. Check.

I warned of a decline world oil exports. Check.

I warned anyone who would listen to implement ELP and "Cut thy spending and get thee to the non-discretionary side of the economy." Check.

I warned of an imminent decline in Russian production. Based on EIA data, production has basically been flat since October, 2006, and flat production = declining oil exports.

Did I warn of a short term decline in crude oil prices (down to about 400% above the 1999 low) in the fourth quarter of 2006? You've got me there.

You warned about a forced decline in Saudi production. There's decent evidence you were wrong.

Regarding ELP, I'm not sure all those folks who moved to the country and are now farming turnips on your advice will thank you. Just bought one for the same price as they were sold last year. They didn't go up.

Good call on net exports, though. ;-)

Not to get too far off tangent - but I grew turnips this year- they grew ok but they tasted lousy. I left them for the deer and even they didnt eat them. However, my 37 tomato plants have produced a cornucopia. And i mean it. And I am SO glad I grew them, not because the sky is falling, but because a)I enjoyed it b)I gave several hundred away to new neighbors, and c) they taste fantastic!

Congrats on the tomats. There are few things as nice as a fresh garden grown tomato. Similarly with sauces made from the freshly picked. Grow oregano and basil and heaven is at hand. RE turnips, I've occasionally bought one that looked perfectly decent but turned out to have a horrible taste and horrible texture. When they go wrong, they go very wrong.

Hello Lehmanite Nate,

My ADD kicked in with your comment. We grew everything imaginable on our farm this year... and it was a hoot. Quite a difference from working at Bear Stearns and living in NYC. We have chronicaled some of it at:

almostselfsufficient.blogspot.com

Still, not willing (yet) to give up trading for living and give farming a go.

You have to look at it as 'trading' but a different vehicle. In any case, the first step is trying to balance thew two. A foot in both worlds so to speak. At least thats what im telling myself.

Exactly! I keep telling people: you don't know happiness untill your first potato harvest. What great tasting abundance!

I must say I enjoy the time I spend in my garden much more than the time I spend in the office also. Of course, my children are often at my side in the garden which is very gratifying to me.

It is not productive to argue with those who worship at the altar of the Dollar. The US$ is simply a tool I use to increase the comfort and security of those I love. It is not an end unto itself.

...and you don't know misery until your first failed potato harvest.

(mine did OK).

I know :-\ I lost one third to the blight. Still, enough remained to get me through next month. Then it's back to buying.

There are three parts to ELP.

Economize, Try to live on half of less of your income.

Localize, Reduce the distance between home (preferably small energy efficient housing) and work to as close to zero as possible.

Produce, Try to work for, become (or invest in) a provider of essential goods and service.

The "P" part does not necessarily mean growing your own food. It does mean that huge numbers of people who survive in the discretionary side of the economy because of the efforts of the food and energy producers are in deep trouble.

As I said up the thread, I could be wrong about Saudi Arabia, but let me know when their average annual crude + condensate production exceeds 9.6 mbpd.

Texas and the Lower 48 as a Model for Saudi Arabia and the World (May, 2006)

http://www.energybulletin.net/16459.html

Get back to me when KSA returns to 9.6 mbpd, ok? What's amusing here is that WT and Ace have been consistently closer to the reality of the situation than any other forecasts yet people argue that the more optimistic forecasts must be true because... because... because... why? Because you say so? Like I said, get back to me when the data demonstrates your position but not before.

Decent evidence he is wrong? What evidence? There is none, as Euan himself has admitted in the past. There is simply a decline that people have tried to force fit to OPEC cuts totally ignoring that KSA was falling for months before any OPEC cuts were even announced!!! Ah, but we can ignore that inconvenient fact, can't we? We can ignore that KSA production began falling before prices fell, can't we? Because we want to, because it supports our theological position, because the alternative is unthinkable. Well think again, Asebius.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

On the nose GZ,

There is NO Evidence that WT and Ace are wrong...and also no evidence that the higher URRs for KSA are correct.

So...we wait.

My money is on Ace being closest at this point...not due to KSA but Net exports and world peak in general. KSA rolling over is just another painful aggravating factor.

Prepare for the worst (ie. ELP and imminent oil shock) still seems to be a good idea and shouldn't really hurt you...but not preparing (*subject to interpretation) will most likely result in PAIN.

But hey, to each their own.

BTW, we shouldn't have to wait too long to see if KSA will ramp up...but will that prove anything if they don't...doh.

And no evidence that they are right...

Go back to when Ace began posting his charts and then look at other forecasts for 2006 and 2007 production. Then compare those forecasts to Ace's forecasts and tell me who was closer to the reality so far. No evidence? That IS evidence. That is how science is done - a falsifiable theory is given and then tested with real world data, not religious faith. Ace has been wrong so far too - by being too optimistic consistently - but his numbers have been closer to the reality than anyone else I've seen from Skrebowski to Campbell, except perhaps for Bakhtiari.

Stick that in your bong and smoke it, PartyGuy.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Of course the realism in the forecasts is improved by bringing in the world data. Perhaps we see too much of an emphasis as SA being portrayed as any kind of savior.

I think the key with KSA is internal consumption and politics.

Both point to them becoming increasingly conservative with oil production as the world peaks. Put it this way even if they could increase production by say 4mbd its only going to have and effect for a few years at most before the world is again low on global supplies. Its getting to the point that even a rosy view from a single producer is not sufficient to really change the overall state of affairs. At best and aggressive production campaign by KSA might offset the declines in Mexico and Iran for a few years at the expense of lower production later. So considering geopolitical issues large increases in production from KSA will not be forthcoming regardless of how much oil they have. If this is not obvious by now then ...

I think the models are still useful as a upper bound to world production but real production is going to be controlled increasingly by above ground factors and in general this means it will be lower then predicted and probably a lot lower, especially crude exports and finished product exports. These two are at least on the same level as depletion if not dominate. And next of course how the world economy changes as it can no longer expand via using more oil.

The world has already changed and not for the better.

Ohh and WHT I tried to put my physical interpretation of HL together on this thread in various posts if you feel like demolishing it feel free I'd love to hear your opinion.

I read it and I can't help but want to see some math behind the argument. As it stands, these rationalizations of HL seem to fall in the same category of endless rhetorical arguments. Rhetorical arguments, by definition, are described by the spoken word, so that the only way to keep this up is by producing more rhetoric. So I for one suggest that we play on a field governed by math. Let me give you an example;; elsewhere you said

This is not right, because intrinsic to the birth-death model is proportionality to the amount of material that is there; the oil molecules must pair up and reproduce to "give birth". Just by saying that it looks like wells die does not make it equivalent to a birth-death model.

This is where I let out a sigh, because I can't deal with sloppy language that stands completely separate from the math that lies behind the correspondence.

Thats the problem with HL we don't exactly know what the math is. What is it measuring and why does a logistic equation fit ?

Left as and empirical formula you need not consider what the underlying process is. But its fascinating that it does fit.

And as far as math goes I'd need a complete set of well logs to do this. Given that information you could show that the logistic is coming from the way the well log data works out.

Hubbert actually had this data. He proposed the logistic fit using this data. Finally the death of a well is related directly to the amount of oil it is producing. So although I'm talking about wells since its the drilling campaign and the reservoir size that gives the total production. We are interested in the total reservoir size.

Given I don't have well log data to figure this out from first principles the next step is to consider a simple model. The issue here is to agree that the simple model is accurate.

One example would be to take a cylinder of water and drill a line of holes down the side. Stand it on end and let the water drain out. These holes represent wells. Now this model is trivial since the moment one hole is exposed to air you know the total amount of water since you know the spacing. So at least with this sample problem the solution is trivial. But this simple problem highlights that its when in the case that a hole no longer produces water that you can estimate the total volume. So one of the key assertions stand. Next of course the flow itself is proportional to the pressure which depends on the height of the cylinder but I don't think the dynamics are the same so this is not a good model for the actual flow.

As far as what is constant for creating wells. For me that would be the surface area of the reservoir. So from the perspective of wells the finite quantity is the area that can be drilled. Back to my water example. Once you drill holes at a certain level drilling more holes once the water has passed that level does no good. If you drill multiple lines of holes i.e change your drilling campaign you see that this just changes the rates.

But correlating the finite area required for a well with the

"material" that a well is created from seems to make sense.

Anyway the math at least in this example trivial. You would need a more complex example to create a better model that requires something besides grade school geometry to solve.

But forget HL if you know the extent of your reservoir and you know how fast your wells are watering out as with this example you have a good idea how long the reservoir will last.

And why are you being so hostile ? How can I do math when I don't have constraints or the problem specified ?

And this is not about oil its about wells the oil is secondary it seems and actually not important the actual model would be that a person could say be born live and die over x square meters and once they die no one can be born.

Another way to look at it is its a checkerboard and you can put checkers on each square and each checker has a life time but the square is dead from that point on. I guess the addition is the more squares die the faster the remaining die ?

So does this look like a valid simple model ?

The point is given the assertion that HL is tied to the life cycle of wells and that I don't have well log data required to prove this for oil like Hubbert who suggested the equation in the first place. Notice the fact I need the exact data used to propose the equation to prove its true.

So we would need to come up with a simple model thats still valid. The checkerboard/go board concept looks interesting.

I'd be happy to do math if I knew what I was doing math on. And I see no sense is doing math on a simple model if the model is not acceptable as a model at least for some aspects of oil production. This does highlight that we don't seem to have any simple "virtual" reservoir models which is interesting. If we did then I could say that given the standard reservoir model its obvious that when you assume a steady rate for drilling new wells the URR is proportional to the rate at which wells water out governed by a overall logistic equation. But the first order of business is to agree what the heck this simple standard model is.

And this is getting long but the checkerboard looks interesting to me the water in cylinder is introducing to much complexity. But note that the checkerboard with interaction is simply a version of the game of life.

I.e its cellular automata. If you even find this barely credible its obvious that its related to cellular automata and its not surprising that logistic behavior arises.

http://www.gis.usu.edu/~sanduku/misc/interests.html

But you have to agree on a model to do math. If you don't agree on the model who cares about math ?

Memmel:

I think we just need to correct some of your language to arrive at a better conceptual model.

1) Discovery is a directed process based on a random result. [This may be less true today as we have much better geophysical tools but the early phases of discovery were largely random.]

2) The largest fields will be found first. Throw darts at a random array of targets and the probability of a larger target collecting more darts is higher than for a smaller target.

3) Once having made a strike then we will drill more in the same area and will experience a better discovery rate.

4) For any province the discovery rate will decline over time. We have found all that we are able to find.

5) Production profiles build to a near term peak and then are subject to a long term decline.

So you locate an oil province, you quickly locate all the fields in that province, and you bring them online. The result is an "eruption" of production which is heavily front loaded over the time domain.

The long tail of this production will eventually smooth out and display the characteristics we see in HL plots. It smoothes out as any subsequent finds are of much less significant size and display like noise around the primary signal.

Someone once presented a HL for "Peak Whale" and it showed many of the same characteristics as an oil province HL chart. I suspect you would find a similar profile for commercial airline accidents (a big bulge at the front end when commercial aviation begins, a reduction in accidents as better regulations and engineering practices are implemented and a very long tail in which individual airline accidents show up as noise in a long tail of improved performance.)

Sorry let me explain a bit more thats fine at a larger level and the explanation makes sense. The question thats asked is is their any physical basis for the logistic equation. At the moment its a empirical observation but the problem is its a bit arbitrary on how you perform the observation. A lot of HL curves can reasonable fit the data. For example some people claim HL only works if production is maximized. First this does not mean anything in and of itself second even if it was true why would it be true.

All I'm proposing is HL is probably related to well lifetimes.

It makes sense to me ( maybe only me ). I'm not sure if you can create some sort of simple equation that shows the relationship. My example of automata is not the sort of simple

model one would want but I suspect its the real model. I've got no idea how one develops some sort of simple equation to describe the behavior of automata.

Anyway back on track if you do come up with a plausible set of rules for performing HL thats all you need. The problem is how do you judge the validity of a given HL fit.

My "rule" is you should fit during a period after the rate of increase in production has begun to decline and when the drilling campaign is reasonably stable. Maximum production whatever that means is not required. Another period when you can again get a good fit is towards the tail of production.

The two periods which give invalid data with this criteria is early in production while production is steadily increasing and right around the peak where you probably have a accelerated drilling campaign as production flattens and falls.

Considering no one else has a reasonable set of criteria I don't see why we can't at least use these. They seem sensible.

A lot of HL plots actually use this criteria without exactly defining it. WT HL plots for example fit. The HL plots in this post don't. I'd like to see HL plots with this criteria that are obviously wrong. I'm not aware of one that fails under these restrictions and they seem sensible. I think its better than other proposals for how to pick points for HL.

Notice that this means your only using the first linear segment which most people claim underestimates URR. So it will be very interesting as the world passes peak if we can see if this is correct. The answers are a bit disturbing but I suspect outside of a short term boost we get from advanced methods correct. It implies that production today may be in a sense artificially higher because of advanced technologies and that decline rates will be worse later on if you believe HL plots using the conditions I've outlined the Yibal effect if you will. In short our current slow decline rate is unstable and probably won't last much longer.

And with all of this the data keeps coming in so time will tell and of course we have other factors export land/economy etc that are probably more important. So its a bit of a counting angels on the head of a pin problem. By the end of next summer at the latest our situation should be clear with regards to KSA and Russia. I'm of course of the opinion we are living on borrowed time for the most part now.

Another way to look at it is its a checkerboard and you can put checkers on each square and each checker has a life time but the square is dead from that point on. I guess the addition is the more squares die the faster the remaining die ?

So does this look like a valid simple model ?

No. Its not valid because it doesn't make any sense.

I'd be happy to do math if I knew what I was doing math on.

So how can you make assertions of why HL works? HL is a purely mathematical statement. It either stands alone as a cheap heuristic, which means it is immune to any kind of derivation. Or it actually follows from some actual physical and statistical mechanism, which means you should be able to mathematically derive it.

The actuality is the former, and you can't derive it even though it is tempting to do so, only because it happens to look similar to the actual statistical profiles that describe oil depletion.

But you have to agree on a model to do math. If you don't agree on the model who cares about math ?

You have the model in your head. Because that is all you have been talking about, namely how to justify what is happening in HL. I don't mean to be hostile in casting this in terms of rhetoric. Rhetorical arguments (or a rhetorical model) are a specific category of arguments. Once you put it down in terms of math, it ceases to be rhetorical. We can then look at it and follow the dynamics precisely. And the assumptions and results survive based on careful analysis, and not on more-or-less subjective opinions.

I'd say I have speculation about possible models or musings.

Although I get lambasted constantly its intriguing that a logistic heuristic fits. I've got pretty think skin so don't worry. At best I have a reasonable set of guidelines for using HL.

Now back to the checkerboard why do you say it makes no sense.

Once you drill a well in part of the reservoir and it waters out that part of the field is removed from the reservoir. You asserted that nothing was consumed in creating a well I suggest its the physical area for the well itself thats consumed. The actual amount of oil is simply a scale factor.

The actual relationships between the wells is complex since they are connected via the pressure in the field so valid or not its not a simple model.