DrumBeat: August 2, 2007

Posted by Leanan on August 2, 2007 - 9:04am

West pressures OPEC to increase oil production

Western countries are turning up the heat on OPEC to ramp up oil production, analysts said Thursday, a day after crude prices soared to record heights.Analysts said OPEC, which has not commented on the record price, was now obliged to consider increasing production after consistently resisting calls from the International Energy Agency, the consumer country watchdog

Philippe Chalmin, a specialist in raw materials, said pressure was intensifying on OPEC, which has "no interest in having such high market prices."

OPEC "must ask itself the question. We see small cracks" in its position, said Francis Perrin, the editorial director of the magazine Arab Gas and Oil.

Paying the Peak Oil Power Bill

The real issue is not whether "our oil is under their sand," but the fact supplies of oil and gas worldwide are nearly at the point where they will no longer be able to easily meet demand. The shorthand term for this reality is "peak oil," or "peak fossil fuels."

Democrats discard fuel mileage change

House Democrats decided Wednesday not to try to raise fuel mileage standards for cars and trucks as part of the energy package lawmakers will vote on this week.

Pakistan: Uncontrolled Population Blamed for Climate Change

When it comes to climate change population matters, particularly for countries in South Asia, Africa and some Arab countries, says Prof. Khalid Rashid. A mathematician and physicist in Pakistan, he has long been studying the phenomenon of global warming and views the uncontrolled population explosion with much trepidation.

The high cost of going nuclear

...The largest remaining obstacle to such plans? Cost. Consider a typical scenario in which a utility with a $9 billion market cap wants to build a nuke plant with a $5 billion price tag. "You put that on your balance sheet," as one former utility executive explained to me, "and you know what Wall Street would do with your bond ratings."The cost factor is the background to the generous set of nuclear subsidies contained in the Energy Policy Act of 2005. Among them: a tax credit of 1.8 cents per kilowatt hour for early movers, capped at $6 billion; regulatory risk insurance to cover licensing delays, potentially worth $2 billion; and federal loan guarantees that could pay up to 80 percent in the event of default. (Only the risk insurance applies specifically to nukes; the others cover wind, solar and biofuels as well.)

Steven Spielberg may soon resign as artistic director of the Beijing Olympics. The world is up in arms over China’s involvement in Sudan’s Darfur genocide. Why doesn’t China care? Energy is the answer, and the problem.China says it’s trying to curb its energy consumption and intensity (how much energy is used per unit of GDP). What it says and what it does are two different things, though, especially as regards the targets that Beijing has set for national economic progress.

Warming of glaciers threatens millions in China

More than 3 miles above sea level in these jagged, wind-scoured mountains, there's little doubt that global warming is endangering China's future.The glaciers that ripple off the peaks of Anyemaqen, a mountain range in the western China province of Qinghai, are shrinking rapidly, endangering hundreds of millions of people who depend on the waters flowing eastward through the Yellow River.

New Nepal - A Country Out of Whack

Electricity too has become a rare commodity. While half of the population still lives without electricity, the other half is getting used to the darkness too. As vast swathes of land lie inundated due to the monsoon rains, the Nepal electricity authority (NEA) still claims that there is inadequate supply of water for electricity generation. So with hours of load-shedding, electricity is intermittent and utterly unreliable.Another inadequacy is fuel shortage. Acute fuel shortages have also been a common phenomenon. Queues for fuel have been a frequent sight around Kathmandu. Laden with an unbearable debt, the Mecca of corruption and mismanagement - the Nepal Oil Corporation (NOC), is coming to a grinding halt. With losses of over 180 million dollars over the past five years and 250 million dollars of debt to Indian oil corporation (IOC) and other financial institutions, IOC may cut off supply if NOC doesn't cough up soon. Given the heavily indebted status of NOC, the future of fuel supply looks inexorably bleak.

South Africa: BP strike affecting fuel supplies

The department of minerals and energy expressed concern over fuel supply problems on Thursday after BP warned customers of supply problems due to a strike."This is exactly the concern we had all the time and we were hoping it would not come to this," said spokesperson Sputnik Ratau.

'Green' teams go for auto race

Thirty-one teams say they’ll line up to compete for at least $10 million by developing a marketable 100-mpg automobile … if the Automotive X Prize program can come up with the cash, that is. The X Prize Foundation says it’s hoping to do that by the end of the year, in time for the big auto shows.

Reviewing Linda McQuaig's "It's the Crude, Dude"

McQuaig cited a US Department of Energy National Energy Laboratory report saying: "The world has never faced a problem like this....Previous transitions (like 'wood to coal and coal to oil') were gradual and evolutionary; oil peaking will be abrupt and revolutionary," and may already have occurred. Further, with America waging two costly oil-related wars for much of what's left, gaining control has become violent with no letup in sight and more oil-rich nations in Washington's target queue. More on that below as well and the fact that oil consumption keeps increasing, two huge emerging nations (China and India) need growing amounts of it, just at a time production peaked and is declining. That's a combustible mixture now playing out in Iraq, Afghanistan, and Somalia. It also affects Iran, Venezuela, Sudan (for its Darfur oil riches) and other strategically important oil-rich nations that dare defy America by wanting control of their own resources along with the major share of revenue from them.

National Hurricane Center: Tropical Depression may form in Caribbean

All weather models predict the system will remain south of Cuba and Haiti over the next week before slamming into Honduras, Guatemala, Belize or the Yucatan Peninsula in Mexico.Two of the weather models show the storm crossing the Yucatan and the Bay of Campeche in the southern Gulf of Mexico before striking central Mexico. The Cantarell Complex of Mexican oil fields lies beneath the Bay of Campeche. It is one of the most productive oil fields in the world, supplying about two thirds of Mexico's crude oil output.

Can ecological economists stop the mainstreamers before it's too late?

Mainstream economists are trying to kill us. They don't think of it that way, but they should. The standard policies promoting endless economic growth of the conventional sort are destroying the ecosystem. Converging and interacting with other threats such as population growth, peak oil, and excessive per capita consumption, such policies and the economic growth they promote are hastening a looming global ecological collapse. And when influential economists push ecocidal policies when they could instead play a central role in protecting the ecosystem, how is that not homicide?

J.D. Power and Associates Reports: Hybrid Vehicle Sales on Pace to Reach Record Sales in 2007

Hybrid vehicles are on course to achieve record sales in 2007, increasing by 35 percent compared with 2006, according to the J.D. Power and Associates 2007 U.S. Hybrid Vehicle Forecast Second Quarter Update.According to the report, an estimated 187,000 hybrid vehicles were sold in the U.S. market through the first half of 2007, accounting for 2.3 percent of the total U.S. new light-vehicle market through June. While sales of hybrid vehicles are projected to decline slightly in the second half of the year, the market is still on track to sell 345,000 hybrids in 2007 -- a 35 percent increase from the 256,000 hybrids sold in 2006.

The Irish government has opened up swathes of the Atlantic Ocean to energy giants searching for undiscovered oil and gas fields.But multi-national companies hoping to take advantage of relatively low taxes previously afforded to the industry may be disappointed with an overhaul of the regime.

Natural Resources minister Eamon Ryan said new exploration licences will see hiked taxes of up to 40% on profits from newly-discovered oil and gas reserves off the west coast.

Sinopec Group will delay the startup of a $1.2 billion refinery in east China by at least nine months, adding uncertainties to a joint-venture and oil supply deal with Saudi Arabia, industry sources told Reuters.

Iran, Nicaragua deepen links despite U.S. concerns

Iranian government officials met leftist President Daniel Ortega on Wednesday for the third time this year as Nicaragua seeks help for its energy crisis in a deepening of ties with Tehran that worries the United States.

Schools demand fuel as Zimbabwe’s economic crisis worsens

An acute shortage of fuel in Zimbabwe is beginning to affect the country’s education sector, with some schools now demanding petrol and diesel from desperate parents, APA learnt here Thursday.One of the leading private schools in the capital Harare, has told parents that their children’s education risked being affected unless they donated fuel to enable teachers to come to school.

Report: No end to New England reliance on natural gas

New England's electricity market will continue to heavily rely on natural gas as a fuel source over the next two decades, even if the region invests more in alternative sources, the operator of the region's power grid says.

South wants to be biofuel breadbasket

The brightly painted vehicles lined up outside the Southeastern Bioenergy Conference seemed like they were built to run off of a suburban grocery list.There was the newspaper delivery car that runs on corn. The sedans that run on peach and watermelon juice. And the gleaming tractors fueled by peanuts, poultry fat, soy and cotton.

Amory B. Lovins talks big. He proposes to wean America off oil by the 2040s, touts ultralight cars and tells some of the most powerful corporate executives in the world, like those at Wal-Mart and Texas Instruments, how to behave more efficiently. But perhaps a former Oxford don—one who built a nuclear magnetic resonance spectrometer in his basement during high school, anticipated global warming in 1976 and lives in a house that can run on the same amount of energy as a conventional light bulb—is allowed to be bold. In the first of a series of conversations with thinkers and executives about the future of energy, NEWSWEEK's Fareed Zakaria spoke to the Rocky Mountain Institute's cofounder and chairman to see how this optimist makes sense of the world's energy woes.

'Nothing' Prods Oil to Record $78 a Barrel

Oil prices shattered another record on Tuesday, settling at $78.21 per barrel, driven by the familiar drumbeat of energy demand outpacing supply.No hurricanes appeared poised to ravage Gulf of Mexico oil production on Tuesday, geopolitical hot spots were relatively quiet, and economists weren't predicting big changes in the economic growth pushing China's thirst for energy.

So what caused the price to hit the latest milestone on Tuesday in particular?

"Nothing," said Philip Verleger, an oil economist who heads PK Verleger in Aspen, Colo.

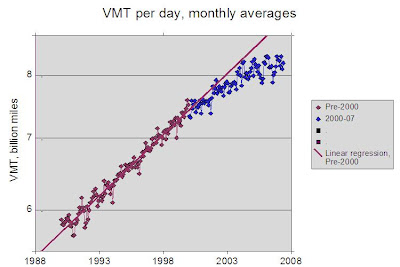

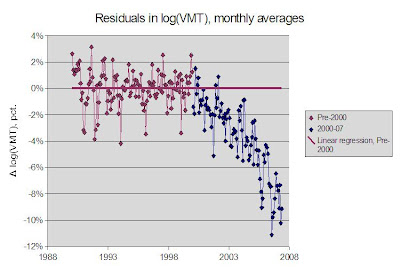

Dave Cohen: What About the Poor?

Today's front month oil contract stands at about $77/barrel. Such prices have not dampened demand in China, where demand growth is running at 11%, or in the United States, where finished motor gasoline consumption reached 9.71 million barrels per day in the week ending July 13, 2007. The volatile but rising oil price since 1999 is the primary signal of a growing supply and demand imbalance in a market with little spare capacity. This indication of scarcity now only inconveniences the wealthy, whose past income growth still allows mostly pain-free purchases. But what about the poor?

Energy is the hot topic on Capitol Hill this summer. Separate bills are emerging that include increasing mileage standards and encouraging the use of alternative fuels.

CNOOC to exploit oil with US firm despite new tax policy on oil exports

China National Offshore Oil Corp. (CNOOC), the country's largest offshore oil producer, is in talks with a U.S. firm for a possible product-sharing contract on an oilfield in the South China Sea.The contract, likely to be inked in a few weeks, will make Texas-based Newfield Exploration Co. the first to be affected by a new policy, which will levy a five-percent tax from Aug. 1 on offshore oil exports by foreign firms that co-develop Chinese oilfields with domestic firms.

No dealing with unions, says Iraq's oil ministry

Iraq's oil ministry has directed all its agencies and departments not to deal with the country's oil unions.The unions and Iraq's government, especially the prime minister and oil minister, have been at odds for months now over working conditions and the draft oil law.

Nigerian Oil Worker Employed By Total Seized

A Nigerian oil worker was seized outside his church in the country's restive south, the latest in a wave of hostage takings to hit the volatile region, a colleague said Wednesday.Gunmen seized the employee of Elf, a subsidiary of French firm Total SA (TOT), Tuesday evening in the oil city of Port Harcourt, said the colleague.

Compressed gas hits the metals markets

...I conducted a thought experiment, imagining what the implications would be if the world converted all its vehicles to natural gas.To convert and re-fit every car, bus and truck on our planet, the sheer volume of metal required would drive base metal prices to never-before-seen levels. In 2004, there were 880 million motor vehicles worldwide; this included passenger vehicles, heavy trucks and buses. To convert all of these vehicles, the world would need tanks fabricated from high-strength steel, aluminum or wound fiberglass to contain compressed natural gas, base plates for the tanks, stainless steel hoses, brass couplers, aluminum or steel brackets to hold the tank in place, all of the metal screws, nuts and bolts for the complete assembly of each unit, fuel control valves, oxygen sensors, vacuum hoses, vacuum fittings, fuses, tee fittings, high- and low-pressure regulators and particulate filters, plus solder and welding rods to hold it all together.

Russian Firm May Cut Gas Supply to Belarus

Gazprom, Russia's state-controlled natural gas monopoly, said Wednesday it will cut off nearly half of its shipments to Belarus within two days, raising fears that the gas supply to many European countries could be disrupted.The Russian company said that Belarus owes it $456 million but that it will keep the gas flowing if Belarus offers an acceptable settlement by Friday morning.

Oil Hits All-Time High Amid Peaking Supplies, Soaring Demand

Perhaps most worrisome for oil markets are growing indications that Saudi Arabia, the world's top oil exporter, may have peaked. Crude output has fallen 10% over last year and many observers say the desert kingdom -- and by extension OPEC -- may be unable to boost flows to cool prices."A new meta-concern is beginning to take hold," says Richard Katz with SF Informatics, an energy-education organization based in San Francisco. "Everywhere you look, crude production has either hit a plateau or is declining." If the trend continues, he says, world oil production as a whole may tip into permanent decline, if it hasn't done so already. "Welcome to peak oil," says Katz.

Where are oil prices headed from here?

When the price of a commodity rises, economists tell us, demand eventually goes down. But with oil prices setting new records, there’s apparently no let-up in demand from gas-guzzling drivers, businesses posting strong growth around the world and investors betting that crude prices are headed even higher.

THE world's biggest oil producers have boosted their search for oil and gas to one of the highest levels in two decades as prices yesterday neared record highs of more than $US78 a barrel.The Organisation of the Petroleum Exporting Countries, the cartel that controls three-quarters of global oil reserves, said its members operated 336 oil rigs last year, an increase of 11.5 per cent since 2005, in response to strong demand from developing countries.

Oil Field Costs Crimp Supply Search

Fierce cost escalation in the oil patch is complicating the industry's ability to respond to higher prices with new supplies, setting the stage for still-higher prices in the months and years to come.During past surges, higher oil prices pinched consumers and the economy but also made a greater amount of untapped oil economical to pump. As a result, new supplies eventually came online, putting downward pressure on prices. That dynamic helped tame the high oil prices of the early 1980s.

But during the current four-year rise in oil prices, inflation for equipment, labor and other crucial oil-field needs has largely kept up with the rise in oil prices. In recent quarters, this has crimped results at the world's oil producers, including Western majors such as Exxon Mobil Corp. as well as the world's biggest state-run oil companies, and has also led to delays and cancellations of major projects. While plenty of activity remains in place, the high prices are nibbling away at other projects that were expected to bring significant new supplies of oil and natural gas to the world.

Russia plants its flag on North Pole seabed

Russia planted its tri-colour national flag on the seabed more than 4km beneath the North Pole on Thursday, staking a symbolic claim to a vast swathe of Arctic territory believed to be rich in oil and minerals.

Gazprom says it hopes for major Arctic hydrocarbon discoveries

A Gazprom spokesman said Wednesday that the Russian energy giant expected "major new discoveries" of oil and gas reserves under the Arctic Ocean, and had large-scale prospecting plans for the region.

Gas and Glory Fuel Race for the North Pole

The race for the North Pole is on again, and this time there’s more at stake than pride at seeing a national flag fluttering on the icecap: There’s oil and gas too.Russia is one of a handful of nations vying to lay claim to the vast untapped resources of the Arctic, and the competition — like the region itself — is likely to heat up as global warming and new technology make previously undreamed-of exploration feasible.

Natural Gas Cartel Still A Long Way Off

A cartel of natural gas-producing nations similar to OPEC (Organization of Petroleum Exporting Countries), an idea floated by countries like Iran, Russia and Venezuela, remains a distant possibility due to the nature of the market."It's not at all feasible this decade or the next; perhaps in the distant future, but even then only for liquefied natural gas (LNG)," Luis Giusti, former head of the state oil company Petrcleos de Venezuela (PDVSA), told IPS. LNG is natural gas that has been condensed, usually by cooling to low temperatures.

OPEC oil output climbs in July - Reuters survey

OPEC, excluding Iraq and Angola, pumped more crude oil in July than in June, led by a rebound in supply from Nigeria after a spate of outages, a Reuters survey showed on Wednesday.

Why oil prices are at a record high

Real and threatened disruptions to crude oil supplies, constraints at refineries in consuming countries, resilient global fuel demand and a flow of investor money into oil and other commodities have pushed prices higher.

Focus on carbon 'missing the point'

The focus on reducing carbon emissions has blinded us to the real problem - unsustainable lifestyles, says Eamon O'Hara. In this week's Green Room, he argues that bigger problems await us unless we shift our efforts.

Marathon to pay $1M oil price manipulation fine

Marathon Oil Corp. agreed to pay a $1 million fine to settle charges that its Marathon Petroleum Company subsidiary attempted to manipulate crude oil prices in 2003, the Commodity Futures Trading Commission announced Wednesday.

Venezuela Oil Rig Count Stable But New Wells Fall in 2006

Petroleos de Venezuela managed to keep stable the number of oil rigs operating last year, but total new wells drilled fell and the company relied more on old ones to keep up production.

'Siberian forest fires due to climate change'

Devastating forest fires in Siberia that send a pall of smoke worldwide are happening more frequently because of climate change and in turn accelerating the pace of global warming, scientists claim.

"Asian Brown Cloud" is speeding melt of Himalaya glaciers: study

The haze of pollution that blankets southern Asia is accelerating the loss of Himalayan glaciers, bequeathing an incalculable bill to China, India and other countries whose rivers flow from this source, scientists warned on Wednesday.

U.N. climate chief skeptical about global carbon tax

A top U.N. climate change official voiced doubt on Wednesday about a global tax on carbon, but said national taxes were possible and laws to cap global warming emissions were better for business."I personally am skeptical on the notion of global carbon taxes," said Yvo de Boer, who heads the U.N. Framework Convention on Climate Change.

The TVA is getting some traction with nuclear power plant expansion.

http://www.guardian.co.uk/worldlatest/story/0,,-6820888,00.html

http://www.iht.com/articles/ap/2007/08/01/america/NA-GEN-US-Nuclear-Reac...

Best hopes for a rational discussion , free of regional stereotyping and slurs

Watt's Bar is the example of what the US says it does not want in the rest of the world nuclear world...a dual use reactor.

All reactors have the potential to make tritium, its just less likely with a LWR and in smaller quantities than one would get from a HWR. With the shutdown of the K-reactor at the SRS site and the scrapping of the NPR project there, tritium, with a half-life of 12.53 years slowly decays away at ~7% year. Not a good thing if you thermonuclear weapon yield is dependent upon tritium as a source of extra neutrons and an "easily" fusionable source.

But the article also points to a fundamental problem...demand growth is now reaching explosive proportions, even at a nominal 2.0-2.5% per year rate. The additional load required to supply that demand requires huge investments not only inthe generating source, but in the T&D system as well (which is also a huge bottleneck). As Duke Power has discovered and said "...someone has to say no" in reference to ever growing demand.

It cannot be a knee-jerk reaction to nuclear power (or any other power for that matter), but we also cannot assume that we can go one growing at the rate that we are and have been for the past decades.

Here is a scary thought that might go to political/military leaders that have thermal nucular weapons.

Use it or loose it.

MAD is still in effect. Anyone deploying nukes will lose, along with everyone else.

nukes merely guarantee that open warfare becomes impossible.

Hope was the last evil thing out of Pandora's box.

Venezuela has agreed to loan Belarus the money to pay it's gas bill. "Of course, we are draining our resources, but our good friends, in particular (Venezuelan President) Hugo Chavez, said they are ready to extend a loan at advantageous terms,"

http://english.pravda.ru/news/business/02-08-2007/95596-gazprom-0

Well, Chavez is either really ignorant or flying a false flag.

'Ignorant president'? Musashi, I would not be throwing rocks at other countries for electing ignorant presidents!

Thin Film's Time in the Sun

First Solar's thin-film technology is now challenging silicon panels at large-scale solar-power facilities

First Solar is the real deal walt. As conventional energy get s more expenisve getting first solar thin films for your roof will be a no brainer. Really exciting this company is, good to see them in full production.

Actually, antidoomer, I don't see this as doing much of anything for me. I live in Western MA and currently, my electric bill runs about $35/mo. My propane bill, on the other hand, is currently running about $2,000+ per year with about 3/4ths of that being burned in the months of Dec, Jan and Feb.

Sure, I could dump the propane burner and switch to solar-electric but we all know how notoriously inefficient resistance heating is.

At this point, shelling out $25 grand to save myself $35 a month seems foolish. Less, of course, you're buying... Then it would be a no-brainer.

So at current electricity rates you're spending 425$ a year for non heating electricty, and 2000$ a year on Heating. First Solar Panels are designed to last a minimum of 25 years. So let's go with your number that you can cover your home in panels for 25grand. you're energy needs are about $2500 a year, and I agree that energy will become more expensive, but hey lets' go with the cheap 2500 a year. Even in this conservative estimate you'll be in the black in 10 years. Now let's say your energy cost double to $5000 a year and the mass production of solar panels allows you to cover your home for $15000. That's where my "no brainer" statement in the future is based on. Three years to pay it off.

Theantidoomer, your math leaves a lot out. Are you saying he could heat his home, in Eastern Massachusetts, all night long, in the dead of winter with solar power? What kind of battery bank would he need to run all night, not to mention sometimes for weeks at a time when the sun does not shing?

Really, no one in Massachusetts heats with solar power, for very obvious reasons.

Ron Patterson, The Doomer ;-)

Ah Batteries you ask. This is where the NaS batteries added to the electric grid will come in:

http://en.wikipedia.org/wiki/Sodium-sulfur_battery

http://blogs.spectrum.ieee.org/tech_talk/2007/07/sodiumsulfur_batteries_...

Hey! Wild and crazy idea...he could - BUY INSULATION! Caulk, weatherstripping, etc. I'm sure $5,000 worth would put a huge dent in that bill and pay for itself lickety split. Anyway, it's always said that you should spend your money on efficiency before you spend it on alternative energy because you get a bigger bang for your buck and then it's a lot easier (need a smaller system) to go alternative afterward.

Insulation and air sealing are the key my friends.

2005-2006 average July KWH electrical usage for my home (890 kwh), this July after adding insulation and weatherization and replacing the AC with a 17 SEER (517 kwh), and the summer has been warm in the Twin Cities.

Yeah; they live in too big houses with inadequate insulation.

Cheaper to build a tiny winter house in the back yard than try to heat the stupid behemoth all winter. Or dig a hole and have a winter 'cave' with a greenhouse on top of it.

As for zoning, better to ask forgiveness than to ask permission, I think. The government will be broke, too, you know.

You can do a lot of shoveling and rock picking for 25 grand. Heat it with a catalytic pellet stove if that suits you, and grow some food and save money (or make money) with the greenhouse on top. We live in stupid houses. I've got one, and I'm planning to live the way the original farm builders did: close all the doors and only heat the kitchen.

Or build a cold fusion box. (www.infinite-energy.com)

I've got room for windmills, though, so that's also on the agenda.

Why the need the heat the home all night long?

Wouldn't superinsulation be more than adequate to keep the temperature from dropping below "dangerously cold"? Personally I would much prefer to have the heating off at night - I sleep much better when it's cold, but the wife has a fit at that suggestion. Admittedly I live in a much milder climate than MA, but we also have lousy insulation: even so, on the coldest nights of the year (where it might hit 0C = 32F briefly) the indoor temperature would never drop below 10C with the heating off.

wizofaus, we keep the thermostats (5 zones) set at 55 F. On sunny days, when the outside air temperature is in the twenties, the house heats up nicely and with a bit of help from the woodstove, inside temps stay above 60. It's when the sun doesn't shine -- which, as Darwinian says, can be days at a time -- or when the outside temps are down in the single digits or even below 0 F, that the house really gets tough to heat. We are well-insulated but even so, inside temps will go well down into the fifties at night (and then, of course, the furnace kicks on). The other thing that I've learned is that once the house really cools off, it's pretty tough to warm back up.

55F (~12.5C) is definitely quite low to set a thermostat...I assume you have it somewhat higher during the day?

Still, I remember watching something about houses in Sweden, which presumably gets just as cold as MA, that required no extra-energy inputs for heating. A combination of superinsulation and some sort of passive heat exchange system was enough to keep the temperature very comfortable all year around.

BTW, our natural gas bill is about $300 a year - which includes hot water heating and stovetop cooking. At that rate, extra insulation would take quite some time to pay itself off...but I'm still keen to have it done, if nothing else to allow the house to maintain a more consistent temperature.

It's called net metering, as long as you're connected to the grid. Check it and all incentives for any state or Fed at http://www.dsireusa.org/

Off-grid, you are correct and batteries will be required.

Wrong.

Passive solar, well-insulated buildings work just fine. No batteries required.

antidoomer, this is why I became a doomer: I can afford neither one of these.

This week I interviewed for a job that pays about 2/3 of what I'm making today (which isn't a lot, mind you but is above the median). Why am I considering this? Because, currently I am driving 50 miles to and from work every day by myself and taking this job would allow me to carpool to work with my wife.

Now, as of today, the "economics" of the job change don't work out. It probably costs me about $5,000 per year to drive that 50 mile/day round trip, when I factor in insurance, wear and tear, etc. But what happens when gas goes to $5 per gallon or more? What if I can't buy gas because of rationing or outages?

Now -- Yes -- being a forward thinking guy, I could go today and probably get a $25,000 adjustable-rate home-equity loan and go buy solar panels for my roof. But I already owe $10k on such a loan + I have a tractor payment + a car payment. Then, there are the other expenses -- mortgage, food, propane, car repairs, medical, $200 per mo. to help my disabled mother make ends meet... you get the picture.

I'm not telling you this to try and get sympathy. I'm just telling you that I'm already in "collapse" mode. I see my expenses spiraling ever higher, my pay stagnating (and likely declining) and the last thing I need is another $25,000 loan to be payed back at 10% interest.

My prediction: The only way I will ever have PV on my roof is if Hugo Chavez takes pity on me and decides that I should have it.

Yes, and how about those who don't own a house to put the solar panels on and couldn't get a loan even if they did? Most of the green energy strategies I've seen focus on people who own a house and can afford the initial cash layout to switch to energy-saving or off-the-grid technologies. It's not impossible to do this if you rent, but it's harder.

Plenty of people don't own property, have no assets (except a car) and little disposable income. They won't have the technical knowledge or the money to convert their car to biofuels or buy a hybrid. They can't insulate their apartment or replace the windows or buy lower-energy appliances. They are dependent on their fossil-fuel burning cars to get to their low-paying jobs because public transit is virtually nonexistent and there are no jobs closer to home. Food and health care (if they are lucky enough to have health care), consume nearly their entire budget. The long-term picture for these people is not pretty.

Thoughts like these make me a doomer, too.

Hi Conchita,

I'm glad you brought this up - tough subject.

re: "Food and health care (if they are lucky enough to have health care), consume nearly their entire budget."

I was just inspired by hearing a group of (young) people share how they felt empowered for the first time to take action in regard to the environment.

The problems are serious - but perhaps not intractable. There is still the "social capital" (people working together) - and that can be developed. (Also, btw, there are state and other grants available for starting CSAs.) It's work - but doable. The food part may be easier to tackle than the health care.

http://www.communitygarden.org/

If you get the food part down, you'll have the health care down. Ninety percent of health problems are due to the foods people eat.

that 10% 'll get ya--

When no-one around you understands

start your own revolution

and cut out the middle man

There are a few solar projects that renters could try. I've seen designs for homemade passive solar thermosiphon panels that will fit in a south-facing double-hung window. They could also buy or build a solar cooker. One can also buy those "solar shower" bags at any camping supply store; fill them up, put them out in a sunny spot every morning, and you've got a hot (well, warmish anyway) shower when you get home. They should also be able to at least prop up one or more PV panels on the south side of the house, these could be riged up to provide power to recharge batteries and cordless equipment if nothing else.

There are also things that renters can do to improve energy efficiency. All the years I rented, we made and used draft dogs at the base of all exterior doors. I installed plastic over all windows each winter. We used thick insulating curtains; another possibility is to make insulating shutters or shades to really insulate those windows every night. Of course, renters can always change out the incandescents with CFLs. Most landlords would probably let a renter change out a standard thermostat for a programable one. Of course, renters can always just set the temps down and bundle up in the winter, use fans and dress cool in the summer.

If the renter is pretty sure that they is going to be staying in that unit for a while, then they could talk with the owner and see if they couldn't negotiate something a little more substantial. If the renter is willing to contribute the sweat equity and materials, maybe the landlord would be willing to knock a little off of the monthly rent in exchange for installing a more substantial conservation or solar retrofit. Or, if the renter isn't that handy, maybe they could negotiate an increase in rent in exchange for the landlord doing things that will decrease the renter's energy bill.

FWIW: I don't dispute anything you said above. but I do have a comment about your future job. Will it be around during a major recession? All things equal if existing job with the 50 mile commute is more likely to remain during a recession, your better off keeping it, even if oil prices continue to rise. I believe there is a high probablity that we will roll into a recession within the next 6 to 8 months. When it happens it should cool off energy prices for a period, during which time you can re-asess your situation. Trees don't grow to the sky and neither did the stock market or real estate. Energy is unlike to travel there either.

Another thought is to have your mom move in with you. If she has her own place, she would probably save a significant amount of money, which means that you probably won't need to send her cash, and perhaps she might be able to contribute to your own household expenses (groceries, utilities, etc). I would look any other options available to lower your costs without sacraficing your salary first. Another low cost solution is to increase the number of heating zones (ie it doesn't make sense to heat a room when no one is using it).

Since I really don't know you, perhaps none of these suggestions are useful to you. However, I am sure if you consider your options you can think of several methods to cut your expenses. Best of luck to you.

Thanks, TechGuy. I've wrestled quite a lot with the job question and I don't have a clear answer as to which job would be more likely to disappear in an economic downturn. And there are additional considerations -- one being that I'm seeing evidence that someone in the organization may have thoughts of off-shoring my position. Suffice it to say that I don't feel like I have a lot of control over my employment situation.

We did, in fact, try to move my mother in with us, but that didn't work. She is severely disabled and needs someone within shouting distance at all hours of the day. My wife and I both work so living with us wasn't an option.

The heating zones we have are pretty well placed. Basically, any room with a door has it's own zone (exc the bathroom and one small bedroom). So, I don't think that would help us.

I'll ponder your job advice. Thanks for good wishes.

I hear ya... a lot of the solutions people discuss on here require a large amount of money that many of us (I assume - maybe it's just me) don't have

--

When no-one around you understands

start your own revolution

and cut out the middle man

I trust you are refering to the inefficiency in making the electricity, because resistance heating is 100% efficient at converting the electricity into heat.

In any case, there are better ways of capturing solar radiation for heating purposes, including evacuated tubes and passive approaches.

Yes, JB, my neighbor just installed an evacuated tube set up. And, yes, I'm envious.

I'm hoping that at some point in the future, I will be able to consider something like this. But until (a) I make more $$$ or (b) I get some bills paid, it isn't an option.

Thanks, btw, for setting me straight as to why electric space heating is considered inefficient. I misunderstood the problem.

Actually, resistance heating is 100% efficient-- maybe you meant expensive.

The cost of electric heating isn't that much out of wack with the cost of propane heating. From the DOE site, with a 90% efficient propane furnace, it costs about $24 per million BTU. Electric resistance heat costs about $31 per MBTU. Electric air source heat pump would cost about $20 per MBTU.

So if those panels ever come down to the equivalent of 10c per kwh, or if peak-propane (I hope not) begins to stare us in the face, solar PV might be just the thing afterall.

just an fyi but using a ground source heat pump should reduce that heating bill by a great deal.

more importantly, improving the insulation on your house will pay off much quicker.

Never use resistance heating when you can use a heat pump and get COP(coefficient of performance) greater than 5. What that means is for every 1 unit of energy in, you recieve 5 of heat! If the compressor is located in the house, you get 6 units worth of heat dumped into the house!

The best use of solar for heat is passive solar...put low E glass on south facing walls. Free heat and no losses transforming it to electricity and storage.

Hang drying clothes has to be worth a few nuclear plants by itself. We are totally stupid about the obvious.

You could possibly build what I refer to as a "Solar Wall." It's a type of solar air heater that's like a window on the outside of your house...but it's not.

http://store.altenergystore.com/Solar-Air-Heating/c469/

You don't need to buy something fancy like that. I'm sure one could be constructed out of simple materials.

Also, consider some sort of insulating draperies or "insulating storm shutters" that you can close at night and in rooms that aren't being used during the day.

Is this scalable? How long will the known reserves of cadmium (600,000 tons) and tellurium (21,000 tons) last?

Yes, but what's the estimated ultimately recoverable resource? Tellurium is especially uneconomic to extract currently due to the very low concentrations it occurs at. Tellurium may well have to become considerably more expensive for the reserves to increase much, but the amounts needed for thin-film solar are presumably not that great. Still, there is currently a global supply shortfall.

http://www.agiweb.org/geotimes/aug06/resources.html

(The first article on this page, actually more directly related to PO than the tellurium article, is a new one for me).

How to Profit from Peak Oil

Blame it on the opposing political party:

source: 'Nothing' Prods Oil to Record $78 a Barrel

Let me see ... Foley is fiddling kiddies, Haggard is humping hookers, Limbaugh is lusting after Dominicans, and O'Reilly makes me throw up a little in my throat when I read his recent sexual harassment lawsuit.

GOP must stand for Gang of Perverts. Boehner is an asshat and I am now going to ActBlue.org to donate to his opponent in the next election.

I stopped watching O'Reilley many regurgitations ago.

Has he been chasing after Ann Coulter's skirt?

Sometime ago on Tod someone asked what sort of prime minister Gordon Brown will be. I believe I responded that he was a colonialist, in favour of colonialism, and would probably involve the UK in military adventures to expand the UK's carrying capacity. Well we are now getting the first signs of exactly that.

After his chat with Bush, Brown quickly scurried over to the UN to push for friendly military forces to move into Darfur under a UN mandate. And Darfur is of course all about oil and nothing about humanitarian intervention. Poor old Bangladesh, 50% under water with millions without shelter, food or water, didn't even get a mention (they don't have oil of course).

Interestingly, in the following article, the author believes the US was responsible for starting the genocide in Darfur. Talk about hypocrisy.

Darfur: Forget genocide, there's oil

Dhttp://www.atimes.com/atimes/China_Business/IE25Cb04.html

Triumvirate of collapse - Economy, Ecosystem, Energy

Burgundy, I found your post rather simplistic, misleading and silly. Your analysis creates a false dichotomy. That is, you imply that there are two different opinions, one Darfur is about genocide and another opinion that it is about oil. That is simply wrong, the genocide is about oil! There are several hundred news stories on the web explaining this connection. Here is one of them:

War of the Future: Oil Drives the Genocide in Darfur

Yes it is about oil and yes it is about genocide. It is about the genocide by the Sudanese government because of the oil! But your conclusion that Brown is a hypocrite because he is concerned with the genocide in Darfur and not about the plight of those in Bangladesh is totally unfounded. Yes, people are starving in Bangladesh, and they are starving in Zimbabwe, and in Botswana, and virtually all of Sub-Sahara Africa and half of Asia.

That is not the point Burgundy, there is no genocide in Bangladesh. The people of Bangladesh are not being slaughtered, or herded into the desert without food and water in order to starve them to death, in order to possess the land they formerly lived on.

And the suggestion that Brown is doing this because he favors colonialism is absurd. You are insinuating that Brown would like to make Sudan a British colony. Really! Where do you guys get this kind of crap?

Ron Patterson

The conflict in Darfur has nothing to do with either genocide or oil, and owes all its ill-deserved media fame to the same gang of liars and criminals that gave us "Saddam's WMDs".

As for Spielberg, good riddance to bad rubbish. The show will be better without him.

Smekhovo, it really pisses me off when people talk in riddles. You seem to be saying "Guess what I am talking about?" Bottom line, when you say it is not about genocide or oil, then it behooves you to tell us it is about.

Okay, let me try to guess, let me try to put your little puzzle together. You cannot be saying that there is no oil in Sudan. By last count they were producing just under half a million barrels a day. And you could not possibly be saying there is no genocide in Darfur. After all we have seen the giant refugee camps and you can see several hundred of the pictures here. Click on the last one, “Victims of Genocide (graphic)”. There are 100 photos in this file alone. Or check out the 223 photos under "IDP Camps".

So since you say that it has nothing to do with genocide or oil, what you must be saying is that the whole damn thing has engineered by Bush and Company? Now why in the hell would they do that? Are you saying that they are helping the Arabic government of Sudan kill off all the blacks? Again, why the hell would they do that?

And if that is not what you are saying then tell us what the hell you are saying. That brief statement of yours is really just a pretension that you have some really profound knowledge that you could, if you wished, enlighten us with. But you choose instead to leave us lesser mortals guessing as to what profound knowledge you possess.

Ron Patterson

Darfur is just one province in Sudan, not where its oil deposits are.

Refugee camps are not a proof of genocide.

All parties to the conflict are both black and Muslim.

No-one is trying to "kill off all the blacks".

- The reason Darfur is about oil is that Sudan's oil exports make it immune to economic sanctions, and therefore the Darfur genocide has to be halted by other means.

- Refugee camps are mighty strong evidence of genocide. Witness accounts from the people who live in said camps provide more than enough proof of same.

- All parties to the conflict are black and Muslim, but some are less black, and therefore more Muslim, than others, and this dynamic is a source for justifying the violence in the view of the perpetrators.

- No one is trying to "kill off all the slaves" because in the end, someone will still have to do the slave labor in the region. BTW, the Sudanese Arabic word for a black person is 'abeed, which is derived from the word for a slave. The general definition of genocide also encompasses efforts to reduce the size of an ethnic group. And that is what is going on in Darfur.

Hi Apuleius,

Thanks for the summary. I had the opportunity to talk with someone who went to school with the current persons in power in Sudan, knows the actors fairly well and did not judge them kindly at all. According to my "source", they are simply corrupt (ie.., not very nice) people who happen to be in the "right place at the right time" to take advantage of the situation. Oh yes, and that religious motives were also excuses - the object being money and power.

Yes, Sudan's oil exports make it immune to economic sanctions. Also, the US invasion of Iraq effectively erases any credibility at all the US might have, thus effectively rendering the US helpless to take any positive action.

Smekhovo, please don't try to give me a geography lesson, especially when you haven't a clue as to what the hell you are talking about. I know where the hell Darfur is. And it IS where the oil deposits are.

Did you not even bother to read the link I posted?

Did you bother to look at the damn pictures? Dead bodies and babies looking like skeletons is pretty heavy proof. Have you read any of the bulletins coming out of Darfur? The nomads will ride in and slaughter hundreds.

Yes, that's the damn point isn't it.

Of course not. They are only trying to kill the ones in Darfur.

Ron Patterson

Africa is in a terrible situation...

because of Malaria, HIV, Poverty, Government Corruption, WAR, and Famines every few years. What were those four horsemen named again? All these things are synergistic and when they intersect we have tragedies like Darfur. This has been going on for decades.

matt

Thanks Ron!

Ron, I think it is fairly clear what I was saying. There has been no change in the relationship between Britain and the US with the change of prime minister. Brown's agenda is basically the same as Bush's, and as you may have noticed, bush likes to occupy other peoples countries - aka colonialism.

Yes, Darfur is about oil, that's what I was saying and the attempt to involve the UN has nothing to do with humanitarian concerns. The hypocrisy I was referring to was the hypocrisy of the people who instigated the genocide (namely the US), then wrapping themselves in humanitarian sheep's clothing to get control of the oil.

Triumvirate of collapse - Economy, Ecosystem, Energy

The US instigated the genocide? Let's see, you are saying that The US pursuaded the Sudanese military and the camel-herding Janjaweed nomads (all Arabs) to drive the farming tribes of the Fur, Zaghawa, and Massaleit, (all blacks), off their land and to rape and kill them in the desert. The US said to let them starve, to raid their camps and slaughter as many as possible?

The US did all this in order to steal their oil? Or perhaps you think we had another reason for doing this?

You know what I think Burgundy? I think you are just making this crap up. If the US instigated this genocide then please explain exactly how they did this. Explain how they pursuaded the nomatic Janjaweed tribes to rape and kill the black tribes. Please explain how they pursuaded, or tricked, the Sudanese military into slauhtering so many people.

Burgandy, this crap really pisses me off and here's why. It is bad enough that Bush and company got us into Iraq and made the US the mosted hated nation in the world. I cringe at the thought. But Bush is a bungling fool who has caused every US citizen great grief. But they are the gang that could not shoot straight. They, Bush, Cheney and the rest of those idiot right wing Christian fundamentalists, thought they were making the world safe for democracy and all they were doing is creating more misery and chaos.

But they do not have the intelligence, nor the motive, to start a civil war in Sudan between the Blacks and the Arabs. No, hell no Burgundy, the US had absolutely nothing to do with the genocide in Darfur.

In fact, as the article points out, Bush could help stop the genocide, but he did not start it. He is NOT doing what he should if he wanted to help US oil companies or get control of any oil.

And the idea that we are trying to get control of their oil is just down in the dirt dumb. There is not enough oil there anyway. The US is not involved in Sudan and we did not start that damn conflict no more than we started the civil conflict in Nigeria. Oh, but I suppose you will now say we started that one too.

But if you have proof??????

Ron Patterson

> The US is not involved in Sudan and we did not start that damn conflict no more than we started the civil conflict in Nigeria. Oh, but I suppose you will now say we started that one too.

Geez Ron!

Of course the US started those African civil conflicts! Its all just a big conspiracy for big US Oil companies to rake in big profits! I have proof! Just look at the prices at the pump! Ha!

I just love circular reasoning! Of course people trying to conveince those that follow circular reasoning the flaws in their logic, are themselves sucked into never ending circular disputes. Its often best to simply avoid getting sucked into the vortex of circular reasoning.

Best of Luck to you!

USS Cole. No, the US is not involved in Sudan.

The degree to which the 4 or 5 major coffee handling corporations have destroyed the African economy is enormous. Oil is much bigger. Our empire/technology/society depend on our extracting everything possible from the periphery. WTO, IMF, "free trade", alignment and liberalization. I would not be so quick to dismiss the impact of the Empire on black africans and I'd guess many historians might agree.

Of course, if the Nigerians stood up to the Empire - sort of like Chavez - then they might be better off. Or dead.

cfm in Gray, ME

Ron

There's enough oil for the Chinese.

But, much as I dispise the NeoCons, this situation isn't their fault, or their machinations. People were doing evil stuff in the world long before the US was founded or Dick Cheney and George W Bush were born .

Bob Ebersole

Your Common Dreams link is ok, but fails to adequately address the proxy war being waged by China and the US over the oil, nor the history of Chevron and prior oil development.

http://www.atimes.com/atimes/China_Business/IE25Cb04.html

Ron, you seem to be acting wilfully ignorant, presumably so you can spout the kind of nonsense above. Try reading the article I provided the link to, in which was said:

The US wants regime change in Sudan, the genocide is a result of US activity in pursuit of that regime change (which is for oil). And, in case you haven't noticed, the US is attempting similar regime change in countries all over the frigging planet.

Triumvirate of collapse - Economy, Ecosystem, Energy

Bangladesh Energy resources:

http://www.eia.doe.gov/emeu/cabs/Bangladesh/Background.html

General Background

With its large potential natural gas reserves, Bangladesh is becoming increasingly important to world energy markets. In 2005, Bangladesh’s real gross domestic product (GDP) grew at 5.4 percent, down somewhat from the 2004 growth rate of 6.3 percent. Economic forecasts are at 5.8 percent for 2006. Economic performance has been steady since 1990, with annual GDP growth averaging 5 percent. However, Bangladesh remains one of the world’s poorest and most densely populated countries, and faces a number of obstacles to further growth and development.

Despite recent growth, Bangladesh faces numerous challenges. According to the International Monetary Fund (IMF), the country is hampered by weak institutions and inadequate infrastructure. Bangladesh remains dependent on foreign aid and worker remittances for a large percent of its economic activity. In 2004, the government of Bangladesh estimated that remittances from expatriates totaled $3.3 billion, or 6 percent of nominal GDP. The country also remains vulnerable to natural disasters such as cyclones, floods, and droughts. This is especially true in the agriculture sector, which employs about two-thirds of the labor force and accounts

Natural Gas

Natural gas production in Bangladesh has more than doubled from a decade earlier. Natural gas reserve estimates vary widely for Bangladesh. Oil & Gas Journal (OGJ) reported that Bangladesh had 5 trillion cubic feet (Tcf) of proven natural gas reserves as of January 2006, down significantly from OGJ ’s January 2005 estimate of 10.6 Tcf. It is not clear why the large downgrade of Bangladesh’s natural gas reserves occurred. In mid-2004, estimates from state-owned Petrobangla put net proven reserves at 15.3 Tcf. Bangladesh’s Ministry of Finance estimated in 2004 that the country holds 28.4 Tcf of total gas reserves, of which 20.5 Tcf is recoverable. In June 2001, the U.S. Geological Survey estimated that Bangladesh contains 32.1 Tcf of additional “undiscovered reserves.”

While estima tes of the country’s reserves vary, natural gas is Bangladesh ’s only significant source of commercial energy. The government of Bangladesh estimates that natural gas accounts for 80 percent of the country’s commercial energy consumption. In 2004, Bangaldesh produced 463 billion cubic feet (Bcf) of natural gas, up from 429 Bcf in 2003 and more than doubling the 1994 level. Despite increasing production levels, Bangladesh has never been a net exporter of natural gas. Given the uncertain size of the country’s natural gas reserves, the government has been reluctant to export natural gas and has instead focused on meeting current and future domestic energy needs.

Exploration and Production

Natural gas exploration and production is dominated by three state-owned companies, all of which are subsidiaries of Petrobangla. Bangladesh ’s largest gas production company, Bangladesh Gas Fields Company Ltd. (BGFCL), operates the Sylhet, Kailashtila MSTE, Kailashtia, Rashidpur, and Beanibazar gas fields. From these five fields, BGFCL produces 810 million cubic feet per day (Mmcf/d), or roughly half of the country’s total natural gas production. The Sylhet Gas Field Company Ltd. (SGFCL) is Bangladesh ’s second largest production company, producing 162 Mmcf/d of natural gas . SGFCL operates the Sylhet, Kailashtila MSTE, Kailashtia, Rashidpur, and Beanibazar gas fields. The third state-owned company involved in natural gas production and exploration is BAPEX, which produces about 58 Mmcf/d of natural gas from the Salda and Fenchuganj fields .

They don't have oil? chech Block 6: http://www.afrol.com/articles/21316

An update:

Cairn’s Crisis: Gas Production at Sangu Drying Up

RE: Oil Field Costs Crimp Supply Search

Massive investments needed for continued conventional and unconventional FF development. Massive investments needed for renewable energy resources development (and for nukes, maybe). Massive investments needed for CCS schemes. Massive investments needed for electrified rail transport and other energy efficiency measures. Massive investments needed to keep our civic infrastructure from literally crumbling to pieces and killing people (see Mpls/StP bridge).

I keep repeating this question: WHERE WILL THE MONEY COME FROM?

It might just be possible to come up with all this money, but not with BAU. A massive reallocation of GDP is necessary, and I see no signs of this even being talked about, let alone anything actually happening. There certainly is no plan in place to address this, nor does it appear that there is even anybody working on one.

Maybe we have already run out of money; we are certainly running out of time.

WNC Observer writes:

I'm not trying to be facetious about money being created out of thin air by us human creatures.

First, observe that Money (My) is not an element appearing in the Periodic Table of Stable Elements.

Second observe that anybody (you, me, your neighbor) with "apparent" wealth can create money out of thin air.

Say you come over to my house to do some plumbing repairs. When it comes time for me to reimburse you for your labors, I come out in my Hugh Hefner bathrobe and say, "Sorry old chum. It appears that our petty cash box is fresh out. Can I write you an IOU instead?".

You look around and see a nicely furnished house. And after all, I did represent to you that ALL this is "mine", my house, my furniture, etc. The fair market "value" of what your lying eyes see is well in excess of the IOU amount. So you say, OK.

I write out an IOU note that looks like this:

There.

I have just created "money" out of thin air based on "appearances" --based on the fact that you assessed my net worth as being far in excess of the amount on the note.

But suppose now, that I lied to you. The house and furnishings are no longer mine. They are in bankruptcy receivership and I own nothing. In fact, I'm terminally ill with some medical ailment and will drop dead in a day or two. The bankruptcy judge knew about my hidden state of "decline" and let me stay in the house a few more days because he has a kind heart.

Now let's change the story a bit and suppose that my "apparent wealth" is based on underground reserves of crude oil rather than an above-ground house. Same game. You take my word for it that the oil is there and I'm good for it in the future. In fact, all of it could be untrue. But for the moment, we're all swimming in "money".

increasing money does not increase wealth.

Heres my take: (slightly off-topic)

Money and energy are virtually interchangable. Money represents a store of labor or work performed ( an energy credit). A day labor, expends his energy doing manual labor in exchange for money that can be used to purchase goods or services that require energy to produce. Now the value of energy and money vary between the source of energy, how abundant it is, or how useful it is. Credit is can be considered a from or loaning surplus energy to another in return for a profit of energy at a later date. Money is also a flexible in the sense that you can use to purchase oil and gas, or manul labor. Where as most forms of energy (electricity, oil and gas, manual labor) each have a limited set of tasks they can perform. Money can usually be used for purchasing all forms of energy.

Yes gov'ts and banks can inflate money, or ecomonic contraints can cause deflation, but the basic principle is that Money represents a credit for energy performed. Inflation lowers the value of money in repect to the amount of energy you can purchase with it. Deflation is the opposite. However, without energy, money (or its value) ceases to exist. It doesn't matter if money is the the form of dollar bills, gold or coins. Without an source of energy, you can't use it.

In response to "step back":

An IOU is not money, no matter the author. It is a personal promise to pay money. Any person trying to use it as money is likely to be refused, as it is not generally transferable - while the potential recipient may believe that the author will honour it for the original recipient, what's to say he will honour it for a new recipient? No, this is simply the creation of an informal promissory note. The reason established banks can issue promissory notes, and everybody will accept them, is that the bank is formally on the hook for the money.

The best a recipient can do with an IOU is try to use it in a court case as proof of debt.

-

James Gervais

Hope was the last ill to escape Pandora's box.

i would argue current money is actually IOU's due to central banking tendancies to use fiat debt-based money.

IOUs are the same as money. If i say IOU 1 apple and the market rate of one apple is 1 dollar, repayment would be for 1 apple or whatever is exchangable for that apple, plus opportunity costs.

IOUs are often exchanged and are highly liquid, morgages, debts, loans these are all IOUs and are bought and sold on open markets.

Gilgamesh,

Good example --the apple one.

Let's take it one step into deeper thought though.

Say James Gervais came to my house and did some handyman work there.

Instead of giving him Uncle Sam Greenbacks in renumeration, I give him a coupon entitling the bearer to 100 fresh red apples at Joe's Fresh Apple Mart.

Of course, if James is not in the mood for apples at the moment, he can take the coupon to Frank's Fish Mart and exchange it for some Chilean Sea Bass.

However, let's say word gets out that Joe's Fresh Apple Mart is in "decline".

Word gets out that Joe's apples are kind of "sour" as of late. Some lunatic fringe group is out there with a theory of "Peak Apples". What happens then to the "money" I gave James in reciprocal payment for his good work? What happens to our "economy"? The next time I ask James to come and fix something in my house he may say, "I don't know. Those Apple Coupons you give me don't seem to go as far as they used to, you know, with that there Peak Apples theory floating around and all."

I beg to differ. Corporations and banks are legal "persons". They issue IOU's. A corporate bond is an IOU. They are traded as liquid assets on the bond markets. Liquid assets are money. The most liquid form of money is of course, green Uncle Sam cash.

I wanted to get beyond the mumbo jamba definition that your Economics teacher probably dumped on you about "Money is a medium of exchange".

The bigger point I was trying to make was that, no matter who the promisor is behind a promisory note (be it Uncle Sam, Bill Gates, Hugh Hefner or GM Corporation), the recipient of that note (the money) takes the "promise" to include one that we live in a cornucopian civilization and that it is that civilization as a whole (the market as a whole) which will deliver the "value" that the monetary token represents.

Part of the current "promise" of US money (in whatever form that "token" takes) is that our civilization has abundant, cheap energy available to power our airplanes, our cars, our factories to formulate the fertilizers that drive our farms; all so that the "promise" can be delivered on --the promise of money ($$$$$$$$$) includes the promise of cheap, abundant and never-ending energy.

Well, perhaps the U.S. will (is) printing more money to pay for all these investments. That cheapens the value of the dollar, making real wages worth less. As it is, the compensation for the average worker has been declining in real terms for many years. Then too, after the construction industry goes bust, there will be lots of extra building materials out there, such as concrete and rebar. Also, there will be lots of illegals that will work for even less than minimum wage, else they will go back to places like Mexico, which will also be in dire straits as the availability of oil for export declines.

Or, maybe we will have (another) coup and the Government will become the "employer", mandating which projects will be built and providing the cheap labor to make the transition. I expect Wall Street will still be making billions from whatever happens.

E. Swanson

Good points, Step Back & Black Dog. But when I ask "Where is the money", I am not referring to "funny money" -- What I mean is that real investments involving real resources need to be made. These require a real reallocation of the resources accounted for in the GDP from one set of uses to another. No amount of inflation and creative accounting can get around that fact, though they can obfuscate the issue for a while and thus hide the fact that it isn't really being done (which very much appears to be the case).

Good point.

There are three kinds of "real" resources:

1. Real Labor,

2. Real Goods/Raw Materials, and

3. Real Energy (in useful form)

As an example of real "labor", right now the US government has about 30 million slaves providing it with essentially free labor.

Where does the number come from? Assume 90 million workers being "taxed" at 33%. In other words, one third of the real labor generated by the 90 million workers is transferred to Uncle Sam with no renumeration in kind (except for those bozos who believe they are being "protected" from terror, hurricanes and bridge collapses). Of course that is a very high estimate of what might be "real" labor because a good portion of the laborers might be doing mindless paper pushing or robotic extermination of Iraqi's so we get 'em there before "they" get us here.

So that is a really good question. Exactly from where will our society pull the "real" labor, real goods, real energy to make conversion to alternative energy sources, "real"?

I know.

From "the market".

See? The easy answer is just an economist's stone throw away.

Did you mean to count labor as being time invested? Otherwise, it has to be lumped into the energy resource.

That being said, I agree that those are the resources that economists should really be talking about if they really want to claim to be scientists. Money is an abstract symbol for real resources. As such, it can be given any nominal value the creator wants. One dollar could mean 1 gallon of gasoline or 100 gallons; it's up to the creator.

- Scott

"Try sour grapes; you might like them."

That is pretty close to the truth except that in our society, the "creator" gets to externalize the promise that stands behind the note.

That allows the creator to parlay nothingness into somethingness. For example, if the creator hands out shares in Enron (before the collapse) and gets something of "real" value in return from the plumber, the creator is telling all of society, not just the plumber, hey these Enron shares are something of value and when this poor plumber comes knocking at YOUR door to pay with Enron shares, YOU will be the one who coughs up something real in exchange for something I created out of pure nothingness."

In that case, the creator is a parasite rather than a contributor to society's "wealth".

As our society gets infested with more and more parasites (because it's a "profitable" game) the core of our well being is eaten out of us while we think we are still alive. Then finally the shell collapses catastrophically when there is no more core left to hold it together.

I like the analogy Step Back.

It is hard to know to what extent many of us are being parasites, though. Who here considers their work to be of great value to society? And what makes you think that it is? How would you reconcile that with the people who do not consider it to be of value?

"You can never solve a problem on the level on which it was created."

Albert Einstein

Interesting choice of words.

"Values" is exactly what our society is based on.

Each individual has to worry about whether society "values" him or her, and then to what extent.

You are told of your "value" based on how much "money" you are given by those around you.

CEO's are highly "valued". Janitors and teachers, not so much.

'Local foreclosure rates soar past national number

I was watching 'Squawk Box' this morning when one of the guest talking heads (didnt catch his name) made the comment that 'Michigan and Florida are now in recession.' Also in todays News Journal it was reported that Florida is 1.1$B short of revenue to cover the state budget. Florida just completed a round of cuts to save on budget expenditures and now must ready for a new round. Year on year forclosures in Volusia County are up 156%, Flagler County up 408%!...and we are not near the end of the great housing crash.

Daytona Beach News Journal

By BARRY FLYNN

Staff Writer

'In a sign that deterioration of the Volusia-Flagler area housing market may be accelerating, foreclosure activity on local homes soared in the first half of the year at rates far exceeding the troubling increases nationally and statewide.

The number of foreclosure-related filings -- including default notices, auction sale notices and repossessions -- shot up 156 percent in Volusia County from the first six months last year to 2,623 in the first half this year, according to Irvine, Calif.-based RealtyTrac, which compiles the figures.

In much less populous Flagler County, the total number of filings was smaller -- 600 in the first half this year -- but represented a staggering 408 percent increase over the year-earlier pace, the company said'...snip...

http://www.news-journalonline.com/NewsJournalOnline/Business/Headlines/b...

This makes me very happy. Houses being repossessed are a fine alternative to houses going up in flames due to civil disorder.

I fear this above all other things: a sudden implosion rather than a graceful deflation.

An interesting trend, to say the least. There seems to be no doubt that costs will keep on "spiraling". There should be questions, though, as to how much of this is included in the industry's profitability forecasts. Total crude oil production up 7.5%, while profits drop 25%. Something's wrong with this picture.

There always looms a profit just beyond a Receding Horizon. A pot of gold..

And against this background, Shell plans a $54 billion upgrader project?! With costs rising in double-digits each year, and construction taking 15-20 years, it will cost $100's of billions. The more I look at it, the less sense it makes.

I wouldn't be surprised if the entire oilsands industry collapses within 10 years. That's the only thing that does make sense.

Double digits for four years alone will mean a minimum of 50% higher costs in four years. (1.1^4)

HeIsSoFly,

I've got a theory about the Alberta Bitumen boom. The majors are all having real problems with declining reserves. By "investing" the hundreds of billions committed so far, the SEC lets them move oil sands to the proven reserves coloumn, and they are able to camoflage the actual situation with depletion and discovery rates. This keep sthe stock prices pumped, and the executives and board members who get options and bonuses make exhorbitant amounts of money. In the mean time, maybe the horse will learn to sing.

Bob Ebersole

That's about along the same lines as a bank being allowed to count as "reserves" the contents of a treasure ship sunk twenty thousand leagues under the sea. "We know it is down there, and we've got clear title to it!" Right. Just that little problem of recovery. . .

Look here Bob,

As I told you yesterday, you can't just steal my theory. See also June 25.

They are going to invest the 54 billion in a hedge fund in order to insure that its value will grow faster than the cost increases. After all, everyone knows what a great investment hedge funds are.

Yeah, you will be rewarded in the next life... sucker.

SARCONOL ALERT !!

http://www.nolevee.com/

My favorites:

New Orleans hookers withdraw support for Senator Vitter. "If he can't buy local, what good is he ?"

and

The last psychiatrist left in New Orleans warns about the trauma in moving out of a FEMA trailer into a regular house.

And, of course, the US Army's new levee plan

http://www.nolevee.com/?article=army_corps_completed_cat_5_levee_protect...

Humor can help post-Peak Oil as well !

Best Hopes for Humor & Sarconol,

Alan

Kashagan (7-9 Gb in recoverable reserves, according to the article) is the only confirmed new one mbpd or larger field on the horizon. Assuming that Ghawar is declining, it appears that every field that has ever produced one mbpd or more of crude oil is in decline.

From fossil fuel + nuclear sources, the world uses the energy equivalent of 9 Gb of oil every 45 days.

http://www.economist.com/agenda/displaystory.cfm?story_id=9573066

Kazakhstan turns the screw

Aug 1st 2007

I have been expecting to see a decline in Russian crude oil production. When Russian crude oil production does start declining, I expect the decline to be rapid. If their production declines at 10% per year, and if the consumption continues to increase at about 5% per year, their net oil exports will be down by about 50% in three years.

Jeffrey J. Brown

http://www.energyintel.com/DocumentDetail.asp?Try=Yes&document_id=208885...

Russia Cuts August Black Sea Crude Exports, Maintains Baltic

Tuesday, July 31, 2007

DON’T WORRY.

THEY WILL BE DIGGING SOON….(bit deep though, at 14k feet)

http://news.bbc.co.uk/1/hi/world/europe/6927395.stm

Russia plants flag under N Pole

The Mir-I is one of two Russian craft diving to the Arctic floor

Submarine footage

Russian explorers have planted their country's flag on the seabed 4,200m (14,000ft) below the North Pole to further Moscow's claims to the Arctic.

The rust-proof titanium metal flag was brought by explorers travelling in two mini-submarines, in what is believed to be the first expedition of its kind.

One of the two vessels has completed the difficult journey back to the surface, Itar-Tass news agency reports.

Melting polar ice has led to competing claims over access to Arctic resources.

Russia's claim to a vast swathe of territory in the Arctic, thought to contain oil, gas and mineral reserves, has been challenged by other powers, including the US.

See a detailed map of the region

>The rust-proof titanium metal flag was brought by explorers travelling in two mini-submarines, in what is believed to be the first expedition of its kind.

I guess they didn't read about the worldwide growth of metal theft. Just wait until next week when a Chinese Submarine swings by to swipe their flag. Titanium is in high demand in China. Silly Russians!

Of course, the US has a flag on the moon.

>Of course, the US has a flag on the moon.

Perhaps that' why the Chinese are working on a man mission to the moon. Besides the flag, there is several kilograms of plutonium.

Hi Jeffrey,

Thanks for your always-informative (scary) posts.

Do you know offhand what (percentage?) share this represents of US imports?

From Marketing Green:

Thank you, dear readers and to my colleagues.

(Though, I would also like to point out that TOD is #337 today at 13,849 visits/day. These stats vary a lot day-to-day.)

And 14540th most visited website according to Nercraft just ahead of chrysler.com nr.14555

Better to be right than popular...

Expect oil to hit $100 a barrel and beyond

OK, there's a very small piece of the investment needed. However, I suspect that once the offshore drilling capacity has been doubled, they are going to have to turn around and double it again, and keep on expanding it, all the way up to the point where the EROEI and ROI makes it non-worthwhile.

Does anyone else realize this?

Hello HeIsSoFly,

The Peakoil Explanation I find effective:

1. Mommy, Daddy's car ran out of gas. We had to walk home.

2. I keep flipping the switches, but nothing turns on, Mommy.

3. I am so cold and hungry, Mommy. Where are Daddy and those other angry men going with those machetes'?

Please see Battle of Kruger on YouTube for details.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Toto,

I'm staying in Kansas for now. You're scarier than Homer even. And besides, I'm with him on this one, we're kindred beer souls. Also, while he may run a nuclear plant, I wouldn't trust him with a machete.

NB: Did you see The War Game yet on Google Video?

There was an interesting op-ed in our local paper today (which, unfortunately, I cannot find openly available online), called "Time to get real about going green" by Patt Morrison.