The National Petroleum Council Report

Posted by Stuart Staniford on July 21, 2007 - 9:59pm

Update: Webcast of the presentation here, though it's badly edited. (E.g., one has to wait 15 minutes to hear Mr Raymond begin speaking). Executive summary here (very slow download right now) and the 422 page full report (BIG .pdf warning) here.

The National Petroleum Council (NPC), a federally chartered and privately funded advisory committee, was established by the Secretary of the Interior in 1946 at the request of President Harry S. Truman. In 1977, the U.S. Department of Energy was established and the NPC’s functions were transferred to the new Department. The purpose of the NPC is solely to represent the views of the oil and natural gas industries in advising, informing, and making recommendations to the Secretary of Energy with respect to any matter relating to oil and natural gas, or to the oil and gas industries submitted to it or approved by the Secretary.Ok, so we're asking the oil and gas industry, who make their living by selling us oil and gas, whether there might any problem with the supply of oil and gas. I don't know what Secretary Bodman was expecting, but in his place I would have expected to get a sales pitch for buying more oil and gas. Given that very low expectation, the report is better than one might have feared. However, it's still pretty biassed, and fails to address the Secretary's questions.

An aside to Secretary Bodman: next time try the National Academies.

Anyway, continuing, the NPC put together a crack team of industry executives and consultants to answer the question of whether they could continue to deliver us enough oil and gas or not. (I should note here that my comments are based on a June 29th draft of the Executive Summary. I was one of the hundreds of persons consulted by the NPC, though not one of the ones who they paid much attention too, it seems. I'm assuming the final version will be on their website by the time you read this).

Here's the folks who ran the study:

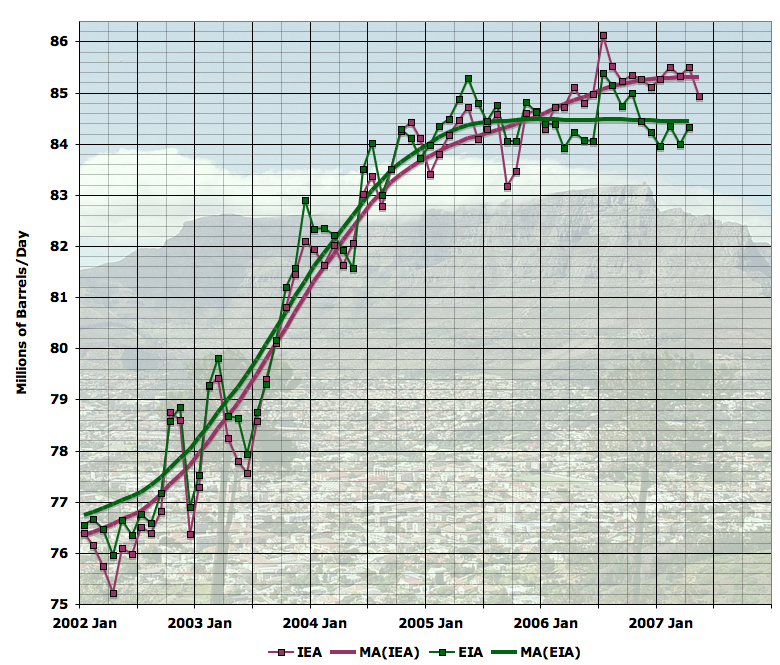

There will be a large, unprecedented buildup of oil supply in the next few years. Between 2004 and 2010, capacity to produce oil (not actual production) could grow by 16 million barrels a day -- from 85 million barrels per day to 101 million barrels a day -- a 20 percent increase. Such growth over the next few years would relieve the current pressure on supply and demand...Well, the "not speculative" forecast, made in July 2005, is not looking too good so far:While questions can be raised about specific countries, this forecast is not speculative. It is based on what is already unfolding. The oil industry is governed by a "law of long lead times." Much of the new capacity that will become available between now and 2010 is under development. Many of the projects that embody this new capacity were approved in the 2001-03 period, based on price expectations much lower than current prices....

But at least for the next several years, the growing production capacity will take the air out of the fear of imminent shortage. And that in turn will provide us the breathing space to address the investment needs and the full panoply of technologies and approaches -- from development to conservation -- that will be required to fuel a growing world economy, ensure energy security and meet the needs of what is becoming the global middle class.

Of the 16mbd of new capacity over five years, after two years we have seen somewhere between zero (EIA), or 1mbd (IEA) of new production. Not a good start, and it certainly hasn't been enough to "take the air out of the fear of imminent shortage" as Mr Yergin promised us.

So you get the idea: the NPC put together a team who have a track record of being relentlessly overoptimistic, and the absolute trailing edge of concern about oil supply issues. What did they have to say?

During the last quarter-century, world energy demand has increased about 60 percent, supported by a global infrastructure that has expanded to a massive scale. Now, most forecasts for the next quarter-century project a similar percentage increase in energy demand from a much larger base. Oil and natural gas have played a significant role in supporting economic activity in the past, and will likely continue to do so in combination with other energy types. Over the coming decades, the world will need better energy efficiency and all economic, environmentally responsible energy sources available to support and sustain future growth.So, we could summarize this as "Peak oil is nowhere in sight; we think we can continue to grow oil supply in coming decades as we have in recent decades, but it's getting trickier and you a) better be prepared to grant all our various requests for assistance in pulling it off, and b) should start trying to use less of our products in case we can't quite manage it".Fortunately, the world is not running out of energy resources. But many complex challenges could keep these diverse energy resources from becoming the sufficient, reliable, and economic energy supplies upon which people depend. These challenges are compounded by emerging uncertainties: geopolitical influences on energy development, trade, and security; and increasing constraints on carbon dioxide emissions that could impose changes in future energy use. While risks have always typified the energy business, they are now accumulating and converging in new ways.

The National Petroleum Council (NPC) examined a broad range of global energy supply, demand, and technology projections through 2030. The Council identified risks and challenges to a reliable and secure energy future, and developed strategies and recommendations aimed at balancing future economic, security, and environmental goals.

The United States and the world face hard truths about the global energy future over the next 25 years:

- Coal, oil, and natural gas will remain indispensable to meeting total projected energy demand growth.

- The world is not running out of energy resources, but there are accumulating risks to continuing expansion of oil and natural gas production from the conventional sources relied upon historically. These risks create significant challenges to meeting projected energy demand.

- To mitigate these risks, expansion of all economic energy sources will be required, including coal, nuclear, renewables, and unconventional oil and natural gas. Each of these sources faces significant challenges – including safety, environmental, political, or economic hurdles – and imposes infrastructure requirements for development and delivery.

- "Energy Independence" should not be confused with strengthening energy security. The concept of energy independence is not realistic in the foreseeable future, whereas U.S. energy security can be enhanced by moderating demand, expanding and diversifying domestic energy supplies, and strengthening global energy trade and investment. There can be no U.S. energy security without global energy security.

- A majority of the U.S. energy sector workforce, including skilled scientists and engineers, is eligible to retire within the next decade. The workforce must be replenished and trained.

- Policies aimed at curbing carbon dioxide emissions will alter the energy mix, increase energy-related costs, and require reductions in demand growth.

So this is undoubtedly some kind of progress. The fact that the trailing edge of the debate is now officially calling for efficiency and conservation measures is a big deal and good progress. But I still think these guys are a long way from making contact with reality. CEO's are supposed to set impossible goals and then exhort the troops to meet them, and that's what we have here, I think, from this group of oil company CEO's.

My bias is to look at the graphs and tables rather than the words. There aren't too many in this report, but the ones they do have are very revealing.

Middle East Reserves

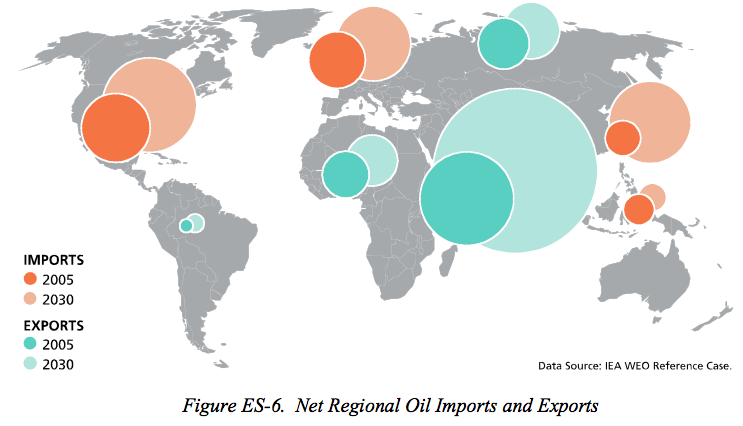

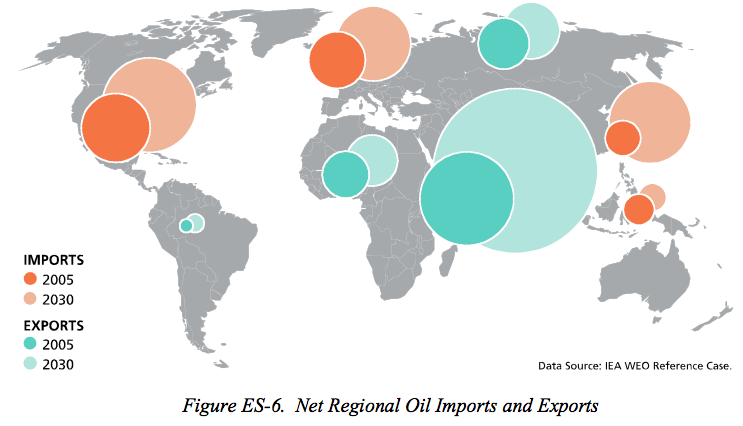

A major concern with the NPC report is its failure to take seriously the potential concerns with Middle Eastern oil reserves. As figure ES-6 of the Executive Summary makes clear, almost all the growth in oil export capacity that the report assumes by 2030 is anticipated to come from the Middle East:

Note that Asia, North America, and Europe all grow their imports significantly, while Latin America, Africa, and Russia increase exports only slightly. The Middle East is required to increase exports massively to balance the books. This is no doubt predicated on the claims that two-thirds of the world’s oil reserves are in that region (eg see the BP Statistical Review of World Energy 2007). However, it needs to be realized that there are serious long-standing concerns about whether these reserves exist in the amounts claimed. For example, in the 2005 World Energy Outlook, the International Energy Agency writes on pages 125-128:

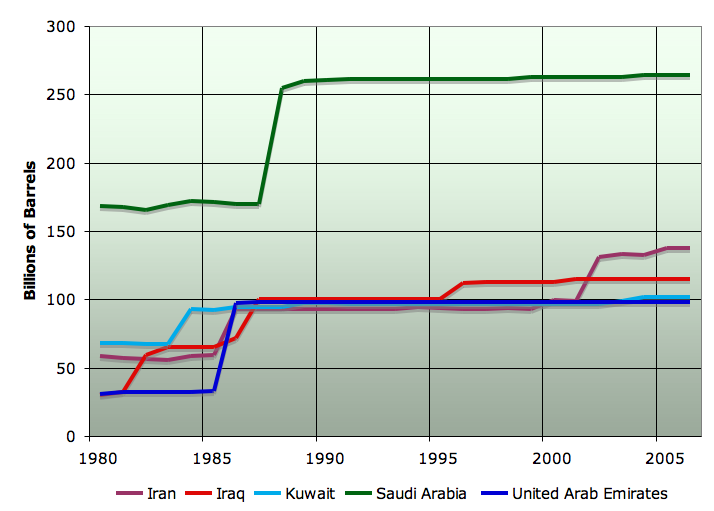

There are doubts about the reliability of official MENA reserves estimates, which have not been audited by independent auditors…The reserves data for the five main Middle Eastern oil producing countries are shown in this next graph:MENA proven oil reserves increased sharply in the 1980s and, after a period during which they hardly increased, rose further around the turn of the century. From around 400 billion barrels at the start of the 1980s, reserves ballooned to almost 700 billion barrels by 1989 and reached nearly 800 billion barrels at the end of 2004... Most of these increases occurred in the Middle East. In the second half of the 1980s, Saudi Arabia and Kuwait revised their reserves upwards by about one-half. The United Arab Emirates and Iraq also recorded large upward revisions at that time. Total Middle East reserves jumped from 398 billion barrels in 1985 to 663 billion barrels in 1990. As a result, world oil reserves increased by more than 40%.

This dramatic and sudden revision in MENA reserves has been much debated. It reflected partly the shift in ownership of reserves away from international oil companies, some of which were obliged to report reserves under strict US Securities and Exchange Commission rules. The revision was also prompted by discussions among OPEC countries over setting production quotas based, at least partly, on reserves. What is clear is that the revisions in official data had little to do with the actual discovery of new reserves. Total reserves in many MENA countries hardly changed in the 1990s. Official reserves in Kuwait, for example, were unchanged at 96.5 billion barrels (including its share of the Neutral Zone) from 1991 to 2002, even though the country produced more than 8 billion barrels and did not make any important new discoveries during that period. The case of Saudi Arabia is even more striking, with proven reserves estimated at between 258 and 262 billion barrels in the past 15 years, a variation of less than 2%.

This clearly shows the very strange pattern of reserve updates, which is quite unlike reserve histories in western countries that wander up and down year-by-year as oil is consumed and new discoveries are made and additional recovery projects are implemented.

Recently, data is starting to come to light that suggests that not all these reserves additions were appropriate. For example, in 2006, Petroleum Intelligence Weekly obtained a 2001 document from the Kuwait Oil Company which suggested that remaining proven plus probable oil reserves there were only about half of the official number for proven reserves. This has now been somewhat confirmed by the Kuwaiti Oil Minister, with the Kuwait Times reporting earlier this year: “Sheikh Ali also confirmed to Al-Wasat newspaper that the state's proven oil reserves have fallen to 48 billion barrels, as reported last year by Petroleum Intelligence Weekly, down from an announced 100 billion barrels.”

In the case of Saudi Arabia, concern that future production would be limited has existed since at least 1979, when a Senate Subcommittee Staff report on the subject stated, after extensive interviews with the American oil company executives managing the country’s fields at that time:

Saudi Arabia’s decision to cut back its producing target to 12 mmbd was significantly influenced by the conclusion that higher production rates would require costly investments and might not be maintained for a period of time acceptable to Saudi Arabia. The oil production level that can be maintained until it begins to decline to lower levels is known as the “production plateau.” The plateau that the Arabian American Oil Company (Aramco) now uses as a basis for its planning indicates that a rate of 12 mmbd may last 15-20 years before irreversibly declining, a period Saudi Arabia now finds uncomfortably short. Higher rates, such as 16 mmbd, could only be maintained for a shorter period of time before declining. Moreover, the prospect of future discoveries in Saudi Arabia is highly uncertain. In addition, technical problems have complicated the management of the oil fields since the early 1970’s. Taking into account all these factors, it would be imprudent for the United States to plan on a change in Saudi Arabian oil development plans to increase long-term production above 12mmbd. The current plan of a target capacity of 12 mmbd achieved no earlier than 1987 is a considerable change from an earlier one which envisioned a capacity of 16mmbd in 1983.In fact, due to a combination of lower production (via the demand collapse of the 1980s), and technology that allows oil operators to both increase recovery and maintain plateau until a field is more deeply depleted, Saudi Arabia has still been able to produce over 9mbpd in recent years, more than 25 years after the words above were written. However, is it at all prudent to assume that now, at this late stage, production can be increased significantly more than was thought feasible in 1979, and continue for decades more? That is what the NPC report would have you believe.

More recently, Matt Simmons, in his book Twilight in the Desert has documented in great detail that extensive exploration efforts have only found modest amounts of new oil discoveries, just as Aramco executives predicted in the late 1970s. Thus Saudi production still comes from the same handful of giant fields it was coming from in 1979, most of which are now quite mature. In particular, recent research here at The Oil Drum has shown that the northern half of Ghawar, which historically accounted for 4mbd of Saudi production, is significantly more depleted than Saudi Aramco has revealed, and production from this part of the field cannot be maintained much longer at recent levels. This raises the question of whether the development of other fields that Saudi Arabia is now undertaking will be sufficient to increase overall capacity, or only offset declines in north Ghawar. This may be in part why Saudi Arabia has not been able to increase production since 2004, which has had a great deal to do with the fact that global oil production has not increased appreciably in the last two years.

It seems to me that this issue is of central importance to global oil reserves and production capacity. Given the fact that most of the relevant data are closely held state secrets of the countries in question, I can see that reasonable people might hold a different view than me about the amount of oil remaining in the Middle East, and the potential for production increases. However, the fact that the issue is not even flagged to the reader of the executive summary of the NPC report suggests the degree of bias that pervades that document.

Reliance on Undiscovered Oil

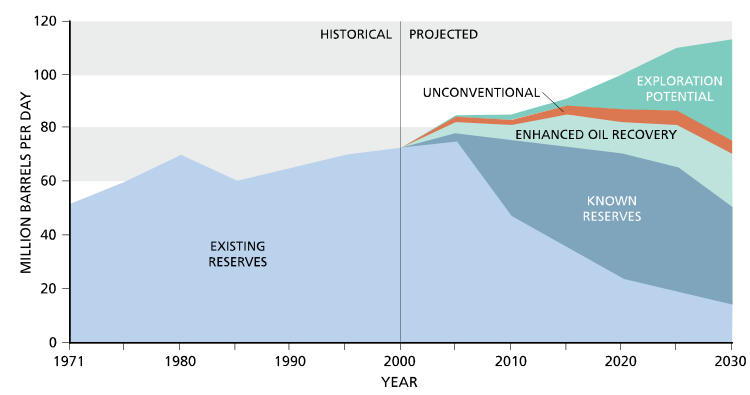

Not only is much of the growth in oil anticipated to come from the Middle East, where it is unclear whether the oil exists, and whether the region will be stable enough to produce it, but it is also mainly not yet discovered:

As you can see, the growth in total liquids supply comes by and large from about 40mbd of "Exploration Potential". Now, to put this in context OPEC liquids production at the moment, according to Table 16 of the OPEC Monthly Oil Market Report (PDF)) is just around 30mbd. So the NPC wants us to believe that there is a whole other OPEC plus a third waiting to be discovered.

If that doesn't sound too likely to you, you're not alone. The ASPO curve for the trend in oil discoveries shows a peak back in the 1960s, with gradual downtrend ever since:

So in summary, the NPC report is saying that production will increase by around 25% over the next twenty five years, but this increase is entirely reliant on finding large amounts of new oil, mainly in the Middle East. Unfortunately, it is rather unlikely that the existing claims of oil reserves in the Middle East are true, and even less likely that massive amounts more oil can be found there. Even if it could, the Middle East is the least politically stable region of the world, and relying ever more heavily on it for critical inputs to our economy is likely to be fairly painful at regular intervals.

However, their number one recommendation on the demand side is:

Based on a detailed review of technological potential, a doubling of fuel economy of new cars and light-trucks by 2030 is possible through the use of existing and anticipated technologies, assuming vehicle performance and other attributes remain the same as today. The 4 percent annual gain in CAFE standards starting in 2010 that President George W. Bush suggested in his 2007 State of the Union speech is not inconsistent with a potential doubling of fuel economy for new light duty vehicles by 2030. Depending upon how quickly new vehicle improvements become incorporated in the full fleet average, it should be possible to lower U.S. oil demand by about 3-5 million barrels per day by 2030. Additional fuel economy improvements would be possible by reducing vehicle weight, horsepower, and amenities, or by developing more expensive, step-out technologies.That's something I can heartily agree with, and it's great to hear the oil industry calling for a doubling of fuel economy.

Any mention in the report of the recent rapid increases in domestic consumption in oil exporting countries?

Interesting news item:

VLCC Tanker Rates to Japan Fall About 50% From Last Summer

No collapse forecast as tanker rates fall near year lows

Reuters

Published: July 04, 2007, 00:00

Note that Mexico's cash flow from oil export sales is increasing faster (for now, in their "Phase One" Net Export Decline) than their oil exports are declining:

http://www.bloomberg.com/apps/news?pid=20601086&sid=asL_Fmzu80R4&refer=news

Mexico's Peso Rises to Highest in Almost a Month on Oil Prices

By Valerie Rota

WT,

I wonder if maybe some of the VLCC rate drop isn't because there is a glut of tankers - not only from reduced deliveries - but also from excess new tankers.

Many new tankers have been planned for years, based on growing demand and Yerginism. Some new tankers must have been delivered this year, but only to find that there is less deliveries of oil taking place even for last years fleet.

So the problem is amplified...hence the 50% rate drop.

Plausible. That means that 2008 may be interesting for shipbuilding as well...defaults on delivery, cancelled contracts...etc.

2008 really shaping up to be turning point in many ways.

I've read a few times that we are in the middle of phasing out single hull tankers for all double hull not sure what the status is of this. But in the interim you would have a tanker glut.

But those would have been scheduled replacements, and then there is NEW capacity.

If they accelerate the replacement/retire of older fleet with NEW capacity, still leaves deliveries of tankers on the books that are not needed...so will still lead to a crunch in shipbuilding in the near future.

Well, its good to get all these groups on record. Otherwise, if Yergin wasn't on record, for example, what would we do for a Daniel Yergin Day ?

Yerganism - now there's a whole new concept. A Yergin day is a brilliant idea, that's if there any days left after love your dog day, hug a stranger day etc.

Talking of Yergin, CERA's 16mbpd, and the NPC's 1.33 new OPEC's we should add Schlumbergers prediction of 24mbpd declines from existing fields by 2010 (from 2006). That will bring CERA up to a nice round total of 40mbpd new production by 2010 and the NPC is in effect looking for more than 2 new OPECs! Or maybe its just 5 new Saudi Arabias. Heck, it's only nearly half global total liquids production by 2010!

We know these new reserves must be there, somewhere, because the NPC are the guys that know these things. Everybody else believes them, so it must be true. Maybe Yergin day can be the day we find them.

We need to add a bubble out on the edge of that map for Titan -- that's where all those extra hydrocarbons are!

Great EROEI, that!

Rename it KSA II and everything comes out right!

The NPC report isn't on their website yet.

I was hoping that we could come to some sort of agreement with the cornucopians so that we could come up with some realistic plans to mitigate the production declines. Your analysis, Stuart, makes it pretty clear that thats not possible. Did they address the issue of production costs?

This is not "some type of progress"--it is merely more of the same, the usual AEI cipher apologetics for the usual TEOTWAWKI-inducing agenda. Not that I blame them, it's pretty late in the game and they're clearly privy to this. The proof is in the pudding, the cliché goes.

Hey, Big Time Dick, bust out those nukes and lets enforce some more global energy security ...

I haven't read the full report yet, but it sounds like it might be progress of a sort. Considering it is the National Petroleum Council and all.

This story, for example:

I suspect we will deal with peak oil obliquely - via global warming, and petro-politics. Peak oil is too scary. Much more comfortable to phrase the problem in terms of climate change and recalcitrant national oil companies.

Fair enough. Just throwing my two cents in--when you've got really flimsy propaganda (meaning that it's easily detectable to critical thought), one occasionally needs to update it to something resembling reality, or at least a reticulation of something resembling reality. Let us remember, that up until I think only a few months ago Mr. Raymond's former corporation did not publicly accept the scientific consensus on CC. This is the tip of the iceberg, no pun intended.

No worries though. Window dressing on more or less absurd scenarios of CERA et al is to be expected. It makes them seem less absurd as it becomes increasingly obvious as time passes forward what the real situation is. It also paves the wave for excuse making ("WMD" is the prime, cynical example at the top of a nauseatingly long list.)

The triple D's of saying nothing: distract, distort and defend. (Maybe that can be applied to this comment. God, I love being a self-hating liberal.)

Gee wilikers what have they been putting in the bath water being drunk here?

Golobal warming scares the bejesus out of me and the only hope I can see is that engendered by Peak Oil. To me it comes down to whether there is a bang or a whimper to end the age of human controlled energy excess. With a bang there may be some pieces to pick up with mitigation there might be nothing except a rather nasty heat death.

Yes, Leanan, I realize that you were talking about how differently the main stream punters would view PO and GW in degrees of fear and you are likely right in that. I am trying to make the point that the NPC,Cera and all the rest of orthodoxy might be right in their actions, even if for very wrong reasons.

Maybe this point has been discussed to death on TOD, if so, I wouldn't mind seeing any articles about it. Or even any threads if there are no articles.

Global warming does not raise the specter of the end of growth. GW, to most of the population, seems like a problem that can be solved with some technical changes but no fundamental change to the infinite growth paradigm.

But you cannot go near peak oil without running smack into that question. Thus, peak oil is far more dangerous than global warming in the attitudes and expectations that it seems to foster.

Ghawar Is Dying as we slide Into the Grey Zone

"The greatest shortcoming of the human race is our inability to understand the exponential function.

Hi Greyzone,

I agree, like you tell some guy, "hey man you know Peak Oil is on the way and your job as car jockey in the local Suds and Slop car wash is soon to be a thing of the past" and guess what? He will get that picture pronto, but you say "hey man there is going to be climate change with crazy weather, hail, mudslides,dust, dirt, , tornadoes and even an all invasive shitstorm" and all that means to him is one hell of a lot of overtime at that Suds and Slop car wash.

My big fear is that PO will not live up to expectations and cause a soon enough or large enough blow to the belly of the beast to cause an economic collapse deep enough to 'mitigate' the effects the human race is having on the planet.

Global warming does not raise the specter of the end of growth.

Alas, NPC report is in accord with you. Interestingly, note how CC is used in this report not as a major problem to be dealt with, but something which will "lessen demand", and will diversify "alternative energy sources". They know the latter is bs, from a fiscal perspective--which is certainly Mr. Raymond's overriding concern, albeit the only meaningful perspective to take. They in essence say so much, under their breath, by not investing all that much in "alternatives" if you compare to hydrocarbon investments. "Lessen demand" is code for, if things do get hairy--we warned you may be driving too much! (Wow, talk about the pot calling the kettle black...) Mommy tells you "eat all the cookies you want" and then she leaves the room for a minute and comes back to find you sick and bloated from too many cookies she slaps you over the head and says "now if you want a cookie, it's gonna cost you--you know you want some more right? There are no shortages of cookies it's just now all your friends down the street want cookies, and there are evil-doers trying to blow up your cookies" etc etc... You get my drift.

I agree with Leanan* that they would sooner bring out the relatively minor boogeyman of global warming, than the stink bomb of peak oil (and these are all Big Oil guys!) Clearly, because CC is an ancillary issue. We "don't know what causes it" or "even if it is happening at all." Either way, it would cost too much money to fix, right? So fuck it all, BAU.

CC cannot be directly tied to "war" and "terrorism" (PO can). This maintains the facade, the disconnect, between war terrorism and oil. This is a critical distinction, the elephant in the room which our culture has somehow built up immunity too. "National Security", I believe the secret handshake goes...

Why would that be? The reason is pretty clear... CC and other "above ground security and political issues" will be the bellwether front for peak oil. It is far more comforting for businessmen and average Joe to think "well, these here economic problems are at root caused by 'terrorists' and the other ancillary affects of 'combating CC'" (a futile effort if I've ever seen one, one reason among a myriad that conservatives are so uber-cynical... anyone for throwing beach sand at waves? I'll take profits, thank you very much.) This is probably due to the fact that the markets need to be comforted, and even coming close to endorsing worst case scenarios for oil depletion would be tantamount to burning money (surely not something Mr. Raymond would want--can you sense my seething jealousy? ;] )

But you cannot go near peak oil without running smack into that question. Thus, peak oil is far more dangerous than global warming in the attitudes and expectations that it seems to foster.

This is why it is so easy to see how things are going to turn nasty quick, because when you can't even acknowledge a problem, then there is little chance of "fixing" it (particularly problems that seriously border on the insurmountable.) By definition, even if this so-called "progress" continues, actually addressing the root issue is an anathema to everything our society is and wants to be. Predictions are worth the price of storing them on a hard drive (hint: close to nothing) but I believe one can say fairly confidently that you will not hear these birds tweet 'uncle', ever. Why would you when you own everything and you can harp on about above ground issues?

A growing economy based on burning fossil fuels will self-destruct in possibly as little as 30 years.

Leanan

Thats why we need to come to some points of common agreement with the cornucopians and stop focusing on the exact minute of the peak or getting into doomer scenarios. If we have to blame above ground stuff, O.K.. The important thing is to start on mitigation right now.

A couple of days ago we discussed how people change their minds. If they get their ego's involved in the process it really slows the change-look at how the NPC report is still in the global warming denial column, Lee Raymond's contribution. Lee Raymond sees himself as a hero, making giant money for his stockholders and providing the world with prosperity with cheap energy. He and his cohorts are threatened that they have part of the blame for global warming. So we've got to find some agreement so we can enlist them in a common cause. National Security is my best guess as to an opening, but I'm not an expert on conservative, type A psychology.

Bob Ebersole

One can't negotiate with a malignant psychology by trying to make it a friend... Just doesn't work. I'm young and have figured that out, and I believe you're older than me so you should know this doubly. You negotiate with malignant psychology by trying to remove it or reform it, unfortunately neither are really an option as these "things" are deeply entrenched and not going away short of a revolution (which would essentially mean the end of the civilization anyway, since we would be in fact toppling the very psychology that gave us all the wonders of "modern American life"). Perhaps you'll say I'm entering Doomer psychology, tweeting chicken little in my sleep... Although, I respect your attempt at some type of hopeful outcome, it is very unlikely that simply by "saying nice things" about these people that they'll somehow all of a sudden say "Gosh, you know what, you're right, we're just so wasteful, and this profit motive thing--what's that all about anyway?"

I do agree with you though that one must forge on and keep tootin' the horn, no matter what happens. It's just, honestly, trying to wrangle the "higher-ups" is really a lost cause, like pissin' in the wind (or up a rope, take your pick).

From the bottom-up people will do what they find neccessary to prepare for whatever our future holds.

The top-down leadership of our country will do whatever they deem in the "interest" of the "country"--it matters little what you and I say--it's a large world out there (for now) and the people that "run it" are tasked with keeping themselves and their cronies happy. Lets see how long they can keep the jig up.

Ain't dat da troot, eh?

If there are a hundred people in a room, and only one person knows the right solution to a problem, any compromise will yield something less than solving the problem.

That's what we have now. The one solution is Demand Destruction, yet almost everyone in the room is trying to figure out how to compromise on that.

I read an interview with a Conservative once who said, "If you want to change a conservative's mind, you only have to show them how to make more money doing it your way. The only way to change an intellectuals mind is to take it out and put in a different one."

This scenario doesn't work for either now, because 99% of the solutions require Conservatives to stop thinking in Perpetual Growth terms, and they require intellectuals to stop expecting to get grant money from the perpetual growth System.

The Peak Oil scenario will hopefully be mitigated by demand destruction due to economic impact, but if global warming hits hard and fast "With Speed and Violence" (nod to Fred Pearce), then the resource demand may simply increase even more.

Oh... that is so perfect. U.W., Madison just went whore's-ville for some ethanol money. Your words express exactly how I feel.

Speaking of which, did you hear about the dumb sailor that was at sea for six months and then spent 3 days hanging around a warehouse?

Ahhh. As we refer to it from the farm; "The People's Republic of Madison". I'm all for progressive ideas and education, but the first time I drove through Madison, I told my wife I could never work there. "Why is that?"

"No smokestacks." It's like a mini-Washington D.C. All government buildings and Jaguar dealers. (Service Economy, my a.... Farmers get poorer while government contractors get pools.)Cheap food and expensive cars: that's the plan. Well, the price of milk is going up again..At least until people can't afford Pizza deliveries anymore. Time to get some cows, I guess.

"If you want Change, keep it in your pocket."

Now you get to hear my more paranoid theory. The NPC issued a 440 page report in order to bury peak oil where nobody will read about it because its too long and written in beaurocrat double speak. That way, if we're right they can say "we warned you" while making sure nobody but geeks reads the report. Certainly not Congress or the Media, who can be counted on to be lazy.

I understand they have now pulled the graph up at the top that shows how crazy their projections are. The NPC expects EOR to go up about 2,000%, the Saudi's and Iraqis to give us their all, the "alternative fuels" to scale up 1,000% and the crude oil fairy to reveal a couple of new Ghawar fields, all with no consideration for above ground factors, global warming or economic costs. As Matt Simmons has noted, the chances for all of that happening are zero.

Bob Ebersole

The NY Times also sees progress:

Note that this article was written by Jad Mouawad, author of the infamous Oil Innovations Pump New Life Into Old Wells in which he wrote "There is still a minority view, held largely by a small band of retired petroleum geologists and some members of Congress, that oil production has peaked, but the theory has been fading."

In today's article, he also refers to peak oil:

So, he refers to peak oil with the pejorative "so-called" adjective, and he also gets the peak oil definition wrong.

Calorie,

The problem is with Jay Mouawad, not with the NPC report. If you'll skip down to Gail the Actuary's report downthread on the API conference call today you will be pleasantly suprised to see that they reference peak oil and use ASPO graphs as one of their production scenarios in the report.

I really think we are doing the cause of peak oil a real disservice constantly disparaging oil company executives and industry writers. It makes us look crazy. I've been around oil industry people all my life, and they are generally decent, honorable men who have spent their working lives ensuring that gasoline sells for less than bottled water in a gas station. They're not cheats or members of a cartel. They are wrong-headed in their politics, but I have no doubt they love their countries and want whats best for the world.

Even Daniel Yergin, while he's a lousy price predictor, is a fine author and a good historian. He deserved the Pulitzer prize, and I'd happily buy him lunch to meet him.

We need to give respect if we expect respect, and try to find common ground so we can work towards real solutions.

Bob Ebersole

My take on this issue is that the two biggest threats facing US oil & gas independents are ExxonMobil and Daniel Yergin.

When the trillions of barrels of oil that ExxonMobil and Yergin promised us fail to show up as actual production, it is going to give credence to the people who claim that high oil prices are a result of oil companies deliberately withholding oil off the market.

I also listened to much of the meeting today, and I also tend to agree that most are trying to do a good job, trying to be forthright. But I also believe that they are largely accountable to stockholders, etc. and are likely not being entirely forthcoming. And what's good for business may not be what's best for the rest of us.

http://www.energybulletin.net/18111.html

Published on 13 Jul 2006 by Energy Bulletin. Archived on 13 Jul 2006.

Daniel Yergin Day, July 13, 2006

by Jeffrey J. Brown

My concluding comments:

WT,

I know you're right that Exxon-Mobil's and Daniel Yergin's attitude of total denial is the great enemy of all of us who are afraid of punative taxation. The question is have they learned anything from the XOM reversal on climate change?

We've now seen three giant cracks in the cornucopian dam-the IEA report, and now the respect given the peak oil position in the NPC report, and the conservation recomendation. Events are going to make the water leak through soon enough, probably this winter or spring as exports to the US decline and prices continue to escalate. Daniel Yergin is already getting the "above ground factors" line prepared.

The question is: Are we going to be gracious and allow them to revise their position, or are we going to be assholes and rub their noses in it? Remember, it took about 8 years to stop XOM funding the global warming deniers and the Neocons, at least in part because the environmentalists threatened them and demonized them. The world can't afford the fight or the time.

I guess its a landman's perspective-always leave the other guy a face saving out in a negotiation. Its not a good deal unless everybody walks away with something, and nobody should get everything they want.

We really are on the same side. Everyone wants the country and the world to be prosperous and secure. We'd love to see plentiful energy delivered at a fair price, and we all want a clean world for our children. And, our positions aren't that different. This report shows that they acknowledge that there will be a peak, and that we're going to have to change. The difference is about 30 or 40 years on the timing-not very much when you consider the 70,000 year history of mankind, or the 4,000 year history of civilization.

Bob Ebersole

it took about 8 years to stop XOM funding the global warming deniers and the Neocons

That is completely unsubstantiated. There is no evidence that XOM will or has stopped in its mission of disinformation, support of ridiculous front organizations, funding of irresponsible corporate think tanks, the propping up of individuals of dubious scientific credentials and efforts at viral astroturfing. In all likelihood it will continue the familiar tactics we have all seen before, this time with a bigger grin and better talking points. As prices get higher, I'm sure it will become no-holds-barred. Anyway, that "funding" is a trifle compared to the surreal political power XOM and the other big oil players wield behind closed doors, to the detriment of society IMHO. There is a enough blame to go around to society as well, I should note here. I'll also be the first to state that Big Oil is not "price gouging". They are just performing a business function, just like any other business. It happens to damage the environment, fuel CC etc etc, but it does run the economy, help make my cheap plastic gilette razors I like to buy etc etc, and generally make everything about modern life nice. Their function happens to support the life blood of the economy, and they certainly know it. They also don't have "control" to the extent that OPEC and various others now are singing to their own tunes. Perhaps that's why they're updating their propaganda, sign of the times. Bracing for higher prices--need something to point to substantial... I do not personally think, and have never said, that the people that work within the US oil and gas industry are money grubbing zealots and just state this because I am unsure if my earlier remarks sparked you to write the above--and another comment somewhere else in this thread where you lament the poor treatment given to the poor 'ole oil companies... The individuals that work in the hydrocarbon industry, like many Americans in various other industries, are hard-working and surely want the best for the country, and all that jazz, etc. The leadership in big oil and the think-tanks and ideologues that flank her is an entirely different matter. Avarice is the life blood of Wall Street and it is still overriding all systems--as the warning lights flash red, beeping. The status quo seems to be full speed ahead! I'm not sure this decision is wise, but perhaps realpolitik dictates it, I'm no apparatchik or fellow at the CFR, and wasn't educated at Harvard or Yale, so I wouldn't know.

As for "revising their position", I hardly see how that qualifies as a truism in the present context. This is illustrated by your last point (of, again, a questionable efficacy) of time lines...

*blink* .... *blink*

I honestly don't know how to respond to that. First off, you're an oil man (hence the name :]), right? Then, why don't we use Titusville (or better yet the early 20th century) as a reference point. I mean, Jesus, you use civilization and then the origin of language as reference points to the age of oil? That scaling does indeed denigrate a meager 30 to 40 years--which seems your intention, although it is an odd one since we don't have close to that much time... I hardly understand what would motivate you to pooh-pooh that (disingenuous) time frame.

When one actually considers the relevant time line one quickly sees that 30-40 years (gasp) is indeed a long time. Not to mention, that it is a complete and utter pipe dream. Much like the earlier statement that XOM has finally seen the light and been delivered to accept Christ died for all its sins..... Repentance can certainly be rare in some people, yes--but you will be hard pressed to find it in the eternal soul of XOM.

Which is to say, that the only point you really make--admittedly in a cryptically surreptitious manner, is that this is old hat with new window dressing. Plus, we should smile and be nice because our corporate overlords may well be listening, and besides, deep down inside they're really nice fellas if one just gives them a chance and is gracious enough...

Maybe I misunderstood you... If so, my apologies, I just thought I would "clarify" so as neither of us are misconstrued.

WT,

I've reconsidered, and posted my reasoning above. If Nate's right about the discount rate of future events-and I think he is- then 440 pages of Beaurocrat speak is just a soporific. Bury the truth where no one will find it, and count on boredom to conceal the truth.

To be frank, I really don't know the best course to pursue. The thinking person's quandry-GWB and Osama Ben Laden aren't plagued by any doubts. They have the mystical light of true believers in their eyes.

But I'd still like to be cautious about attacking them, the Doomers have already got us tagged with being nuts. And, we needn't forget that Cassandra was right about all the shit that was going to happen, but look what she got for being vocal.

Bob Ebersole

Here we go again with the semantics...

"Pollyanna", "cassandra", "chicken little", "doomer", "cornucopian"--all diversionary, but also delineating the minefield of this debate quite well... Maybe if they're put to use enough they will lose potency? With that in mind, I will now attempt to weave in all of those into this comment.

Look, seeing how this is an open forum I don't understand your desire to be uniformly accommodating, to universally "stay on a positive message"--seems to me that is the problem to begin with... There will be dissent. As long as it isn't childish, I say bring it. Being nice is not a foolproof plan, and sure, neither is screaming the sky is falling. As for your self-conscious point of being "tagged with being nuts"--this is another non-sequitur. We are nuts, didn't you get the memo? *grin*. It matters little if we "attack them" or instead send "them" flowers and chocolates--they are going to do whatever is dictated by their business models, they are after all just businesses, in fact major transnational corporations that literally fuel the global economy. The last thing they'll do is read a blog for advice on how to run their industry which has been around for a hundred years turning a profit, without any help before from the blogosphere... They know how to do that much better than any of us. Can TOD influence public policy? Perhaps. But I doubt these here comments (that I'm sure only real TOD cultists read all the way through--people like you and I) really get all that much attention payed to them. Perhaps I'm wrong and Exxon Mobil has a crack team of people hired by Steven Milloy to go through the TOD comment section and document just how "nuts" most of us are... but again, I seriously doubt that. Entirely more likely is that the comment section at TOD is a way for people to bat around ideas, discuss things and generally converse with fellow concern citizens in a social and educational manner. It is much more grassroots here than power corridor...

I agree with your new comment upthread stating that they have "revised" their position by winking at PO in a underhanded fashion by inserting the right implications into a massive report that otherwise is generally, in the spirit of the markets, cornucopian... This is in fact, I believe, the first comment I made (which was, yes, pessimistic). "Nuts" is all in the eye of the beholder, isn't it? You wrote:

I happen to 100% agree with your "paranoid theory". I stated this differently upthread, saying they have modified their propaganda so as to use your "we warned you" clause, plus to update their alma mater, so investors still have confident marching orders in the face of rising spot prices. Certainly, to at least the publicly pollyannaish oil companies you, I and much of rest of TOD would be considered chicken little doomers. Cassandra comparisons are unwarranted, because IMHO the people that tell the ideologues what to go do (I use "ideologues" here to mean people that actually believe what they say) probably have a very real sense of where things are going. Hence the ideologues are trotted out in front of the cameras and behind the op-ed pages to have their glowing eyes of faith communicate just how jolly well fine everything is. Meanwhile, the powerful corporate cynics are positioning to weather the "storm", whenever it may crop up. In other words, the Cassandra connection is non-existent, because I'm sure that the non-ideologue realpolitik business corporate strategists already do agree with the TOD consensus. People that argue this also love to argue that Iraq was totally not thought through... ie. that these people really are being honest and truthful about their "optimism". I call BS. The oil companies should know their futures better than anyone (which is why assuming not telling the absolute truth just has to be the default poise.) An analogy (and a not entirely unwarranted one) could be OIF. One may not agree with neocon war policies on a whole or at all, but it is quite easy for anyone familiar with realpolitik and not totally blinded by magical ideology to see what is at play here--and to also realize that our over half a trillion dollar DoD budget certainly spelled out the risk management and aftermath of an Iraq invasion. Obviously, since the first Gulf War, the intelligence community and the military establishment had more than enough time to figure out what would, would not, or may occur if Saddam was toppled and we went into to control the oil. The whole idea of Iraq being a "cake walk" was, again, only stated as such to allow the invasion to take place. It may seem like I've wandered off the beaten path, but I think the parallels of deception and disingenuousness of the PR that both the Bush admin and Big Oil put out are mighty similar. Hrmmm, I wonder if there is a connection in these tactics? Nah, couldn't be, I must be nuts...

WT, you are my man - on the other side of the pond !

Keep up your good reflections.

- from my neck of the woods, I see "a full and neck above head"-production all over the place, and also around here they celebrate small finds as they where really gonna make any difference, North Sea that is...

Those promoters (CERA, Exxon) of an undulating plateau have no references at all in claiming that such a plateau will occur - because such a claim would have been rooted in treaties and coordination from all/most oil-developers and exporters of this world, and full transparency on reserves – but that is not happening, or ?

The scope of an undulating plateau and the claims thereof – would include some prophetic understanding concerning;

-number of new vehicles hitting the roads during this period how far will these travel/day, the pace of declining productions from old wells – where/when new wells are put online for substitution – what is Wall-street doing in some years – this list goes on forever AND there is NO ONE from the homo-homo-sapiens branch able to assemble the full algorithm as to where this will go----

Actually I feel OPEC is a good thing for the planet these days because they give a “certain” reliability – and at medium term they will probably be able to stick to their words..

If we dont listen to these signals soon, we'll be in a several feet of rubbish before we know of it.. AND there is no free lunch from me to this Yergin-bloke.

I think you contradict yourself a bit here. If the problem is $50K suvs and $500K homes, then there shouldn't be a tax offset with tax on energy. There should just be some disincentive to consume overall, since all consumption at this point leads back to energy and wasted resources. The days of needing a patent system to convert "vast lands and resources" into a national quest of Destiny are over. A consumption tax across the board, eliminate the income tax (which encourages excess mortgages and discourages saving), set up a prize system for inventions which reduce waste and increase Net Creativity, set up mandatory mass transport systems, incentives for gardening, more vacation time, etc.

When you get down to the needs of human beings, most of our economic activity is useless and inane. It's time for a Descent Plan.

"If you want Change, keep it in your pocket."

Yes, I agree. Jay Mouawad seems to be disdainful of peak oil.

In my opinion, the discussion subtly knocks peak oil as an unsophisticated approach:

The key phrases are italicized and amount to cornucopian language suggesting that the peak oil forecasts are wrong because they use unsophisticated and "discredited" static analysis, while the economic models use modern, sophisticated, and therefore correct, dynamic analysis.

Dynamic analysis is the argument frequently used by tax cutting proponents to explain why cutting tax rates will increase tax revenue by spurring economic growth (static analysis, because it ignores the growth stimulus, suggests that cutting tax rates leads to lower tax revenues). What this argument misses with regard to forecasting oil production is that one of the chief peak oil forecasting techniques, Hubbert modeling, implicitly takes supply, demand, and price into account by virtue of its using the actual production history.

I think you are increasingly going to see the MSM no longer give Daniel Yergin a free pass, and hold him to account for his incorrect past predictions. People like Matt Simmons, T. Boone Pickens, and groups like ASPO will be given equal or more airtime than Mr. Yergin from here on out. He will repeatedly be asked about peak oil, the term will gain currency, and he will work harder and harder to make it go away. This is not rubbing his nose in it, but shining a light on his spotty track record.

I have to admit to some surprise to see that most MSM accounts of the NPC report, including the Jay Mouawad piece, are taking the position that "we have a problem" rather than "all is well." Casts some doubt on WT's Iron Triangle theory.

Note that the NPC report is talking about potential problems in about 25 years. I think 25 days is a better estimate.

I like your style, Bob.

By the time this is over we will be whistling while Rome burns since we can't afford a fiddle.

It´s a nice effort but I don't see anything new in this report. The same arguments are exposed here: 1) we have a lot of reserves so we will be able to increase flow rate 2) There are some above ground risks so we may be wrong. Looking at their production forecast (around 115 mbpd in 2030) they are assuming an URR of 3.3 Tb which is what the USGS has forecasted. I'll bet you they will blame a lack of private investments when it will be obvious than middle east reserves have been overstated.

What are big oil companies supposed to do ?

Look at homebuilders now in the US they continue to build homes despite the massive overhang of unsold homes. They have no choice builders build. Big Oil needs big discoveries just around the corner without big discoveries you don't need big oil. Post peak the world is probably better served by smaller more nimble oil companies willing to work with National companies to maximize reserves. KSA still employees a large number of contractors on a per project basis. These companies make great returns. I'm sure Venezuela and even Mexico will in time open up but it won't be to Big Oil.

If you consider this report a attempt by Big Oil to force the US government to embark on more gunboat diplomacy to meet their needs then its perfectly reasonable. About the only thing Big Oil can do thats difficult for smaller companies is ultra-deep offshore and the return on these projects cannot sustain Big Oil. They are probably marginal no matter what the price of oil is because of cost factors.

Look at another part of the old oil triangle Big Auto we are already seeing it broken up and pieces sold off. The same fate awaits Big Oil.

I think its obvious that Big Oil is scared about its survival and this report can be viewed as a call for help.

If you think about it the Texas Oil crash damaged Big Oil.

I think that the Oil companies actually understand that the Texas oil industry failed not because flows of cheap oil came online from other sources but because they spent a lot of money and did not find any oil. They know that they are in the exact same position now.

They can spend a LOT of money on marginal projects that are barely profitable or lose money, bankrupting them. Or they can pull back and break themselves up into units with less overhead. What they don't have outside of this hail mary report is a way to survive. Big Oil is dead and they know it.

Regarding oil investments, Matt Simmons says that he is personally invested in independent oil companies and service companies--no major oil companies.

But its no bed of roses for the small companies. One reason they work well in this sort of situation is that some overextend or make mistakes thus going bankrupt. The investors in these companies lose out but the assets are purchased cheap by another small company which can now afford to profitably operate the project. Its vicious but this constant write down ensures that a lot of projects become profitable and are brought into production even if a few investors are burned in the process.

Commercial real estate works in a similar fashion often the company that originally builds a project goes bankrupt and a second group of investors comes in and purchases the property for a song and then can operate it at a profit.

This churn is bad for investors but good for actual utilization of resources.

Westexas,

Do you know what companies he invests in? I had a look over at his website without joy.

Thanks.

I haven't heard any specific recommendations. I just know that he has concerns about large major oil companies being able to replace their reserves. The last time I heard Boone Pickens offer some recommendations, he liked US coal and Canadian tar sands companies.

IMO, we have not seen the energy "boom" yet. This is just a squall line in front of the big storm. We are going to see an absolutely desperate across the board push for more energy production.

I don't know what he has been investing in, and how it has done, but my only oil investment is Big Oil, and my average annual return over 5 years is close to 30%.

I agree that we are reaching the point where they won't be able to replace reserves. But are reserves going to shrink faster than prices increase? If he has correct that $200 oil is right around the corner, does he think Big Oil stocks won't follow that price rise?

So far, I have not invested in refineries, gas stations, pipelines, tankers and all the downstream operations.

I want crude producers with as little baggage as possible,

So far, with global production down less than 1%, the downstream operations have certainly held their own and refining has become a gold mine. But reduce global oil production by 5%, add a few refineries in Export Land, and refineries lose much of their value. The crack spread shrinks.

A dollar invested in an integrated oil company (and COP is the best managed IMHO) will likely increase in value several fold, but on the back of their oil production post-Peak Oil, The downstream operations are likely to loss value as volumes decline and we have a surplus (Note: this assumes retirements - planned new capacity will be less than declines in exported crude).

OTOH, a dollar invested in a crude only producer with long lived reserves will not have an anchor.

As always, diversify your risk.

Robert, I would be glad to send you my short list of investments.

Best Hopes for Smart Investments,

Alan

WestExas & Robert,

Thanks. I would have been interested in knowing what stocks he thought would do well in terms of Peak Oil.

Although I have some large positions in Shell & BP, I am now having some doubts as they are giving up in the North Sea.

Having listened to Jim Puplava's radio show last week it seems that due to geopolitics the big oil companies have only about 15% of the world left to explore. That doesn't look good for future earnings.

However, I have found some smaller fish that are operating in the North Sea (ie. safer investments) that have excellent production capacity. I think Simmons may be right about about smaller oil and service companies.

I'm pretty sure Boone Pickens has a big piece of XTO. He sold them the Mesa Hugoton royalties and production, and they are now a seperate royalty trust, the Hugoton Royalty trust, which is sold publicly.

XTO is the second or third most successful company in the huge gas field in the Fort Worth-Dallas area, the Barnett shale. The guys at XTO are very savvy operators.

Boone Pickens is also promoting LNG as a replacement for gasoline and has some outlets in the Dallas area. When TSHTF in gasoline, LNG is going to be the only replacement quickly available-it costs about $2,000 per car or light truck to convert the vehicle. Ferrell Gas is in that business too, and seems a good company.

Bob Ebersole

Memmel,

the major oil companies haven't invested much money in the US except offshore in the last 35 years. The reason is their overhead-they find it impossible to make money on anything less than giant (100 mmbbl) oil fields, and they are scarce as hen's teeth in the basins of the US. And, if you'll look at history, they've gotten their big reserve additions in the US as acquisitions.

The big exploration push was from independents in Texas. They found the Giddings field (500,000,000 bbls. so far) and the Bryan Woodbine field, the only significant onshore Texas finds in oil in the last 35 years.

The political climate didn't help. Nixon's price controls and the Windfall Profits Tax put a double-whammy on their efforts.

Bob Ebersole

Correct and I'll admit I may not have my facts perfectly correct around the transition. The point is that US productions levels have been in a large part maintained not by Big Oil but by smaller independents that are profitable and lower cost.

And yes politics are a factor but what I see in this report is Big Oil trying to actually get trillions out of the government to fund production from marginal resources or use gunboat diplomacy to force nations to open up. What the Yergin crowd is really trying to do is make a lot of promises so that the government underwrites all the risk and they get the reward.

What they are not saying is that their is no way in hell they can raise the money they claim they need for exploration and that even if they did the results will probably be far less than they promised.

Big Oil is in the difficult position of trying to get a massive government bailout while making outsize profits.

The truth is they simply don't have the money to do what they claim needs to happen even if the Nationals opened up.

Understand this is trillions of dollars.

So whats really happening is they are trying to convince the worlds governments to bet the farm on Big Oil and all will be well except if its not.

Big Oil is dead and they know it.

I don't agree with that at all. Here's the way I see it, and the way I have seen it for 5 years. Peak Oil, or its ugly step-sister Peak Lite, will keep prices very high. The major oil companies still have substantial oil reserves. Even if we peaked today, they are going to be pumping ever more expensive oil for years. Profits are going to be even higher than they are now. (There will of course be political pressure to intervene with higher taxes, but that won't help on the supply side).

Big Oil is going to be a cash machine for a long time - long after oil production peaks. Think OPEC. Their production is flat, yet they are making more than ever before. If production is down 10% next year, but prices are up 20%, they make more money. That's the situation I see with Big Oil. And they will have the funds to get into just about any business they want. Exxon could easily buy up most, if not all of the ethanol production right now if they wanted to. It's a drop in the bucket. That kind of money gives you lots of options. The idea that oil is going to peak and then the oil industry is going to die is not what I see unfolding.

This is exactly why, 5 years ago, I left the chemical industry and came to work for the oil industry. The scenario that has unfolded to this point is the scenario I envisioned. What I did not realize at that time was that the workforce in this industry is very old, and will be mostly retiring in the next 10 years. That means job security is incredibly high.

Robert,

You mentioned the possibility of resource nationalization before.

Don't you think that in a not so distant future, politics will limit big oil corporations profits? I mean, oil is just too much important to allow years and years of big profits while the rest of the economy has to pay tributes to those corporations.

Fernando

Instead of taxing producers, in order to subsidize consumption, I suggest that we tax consumption, via an energy consumption tax here in the US--offset by eliminating the highly regressive Payroll (Social Security + Medicare) Tax.

A consumption tax is a rational response and encourages savings, Jeffrey. It also interferes with the growth at any price mentality and with the credit bubbles that fuel them. It's far easier to maintain the illusion of easy credit and a constantly expanding economy if they nationalize or punitively tax the oil companies. Thus, while I certainly do not want to see that occur, I still think there is a reasonable risk of it occurring several years after peak as things unwind and the government is faced with oil as a clear and present national security risk.

Ghawar Is Dying as we slide Into the Grey Zone

"The greatest shortcoming of the human race is our inability to understand the exponential function.

Yes vote for the fair tax - and read the book and understand it completely before you discount it. It's a consumption tax with a rebate up to the federal poverty level. If you’re worried about Peak Oil, government spending, and consumption this should be much better than our current income tax system. A tax on just energy isn't politically possible, so this is the next best thing. Especially with the future black market; remember drug dealers or illegals don’t pay income tax; but they do buy things...

I think that we direct the focus on the individual who drives a gas guzzler, but what about the industry or the agriculture? That tax would be for everyone?

Taxes on gasoline are incredibly unpopular with the general public. With gasoline prices steadily rising without such taxes the public is even more opposed. Plus, the rising prices are already sending out the signals the public wants to hear.

When will gasoline hit $4 per gallon? When will it hit $5? Those points are going to be huge wake-up calls. We are reaching the end of the era when we needed to preach conservation. Pretty soon everyone is going to get that religion out of necessity.

You guys need to get accustomed to a majority of the public agreeing with you about both peak oil and conservation. It isn't going to happen tomorrow or next month. But it'll probably happen by 2010. You might want to give thought to what other messages you want to reach the public with at the moment where they start agreeing with you on peak oil in droves.

You said:

/We are reaching the end of the era when we needed to preach conservation/

Once the conservation concept has neared it's end, and the public finally understands it, the panic will begin. It'll be every man/woman for themselves. With a world population over 6 Billion and rising every minute as we speak, and getting hungrier by the minute, I can see how the term desperate times means desperate measures comes into play!. Oh, once the SHTF we will see gasoline much higher than $4, but only briefly for a few hours, and then as we watch, it climbs much higher as the have's and have nots battle it out!

I am hearing from many people (uninformed, as many more people are) that big oil is behind the high prices, but throw in a gasoline tax and the general public will see big oil and govt in cahoots to squeeze the little man. I smell a revolution if that happens!

This will not be popular, I hate to spew gloom and doom, but when you or anyone (gotta love those politicians) tells the general public that they HAVE to change thier lifestyle NOW! Things are gonna get pretty ugly! This is not a personal attack on you or anyone else here that thinks the same way!, but a mere observation, hope you understand!

Don't you think that in a not so distant future, politics will limit big oil corporations profits?

Yes, and I have commented on this before. I think the pressure in all countries will be intense to nationalize the oil industry. In a peak oil world, it is obviously not going to relieve the supply crunch, but it would redirect the money flowing in to the government.

Like Jeffrey, I advocate much higher taxes to stem consumption. This will stretch out our remaining supplies, and it will start redirecting that money right now. But U.S. politicians don't have the courage to enact higher gas taxes.

I have to agree with Robert here, if you think about the classic Hubbert curve and consider the hypothetical case of a constant oil price over the curve then the amount of cash generated from the sale of the oil will be the integral of the curve -which will be an 'S' Curve.

The Maximum rate of increase of cash will be exactly at the peak in production of this model where it will be half the total amount generated and the rate of income will decline afterwards to zero income when all the oil is gone.

In the real world before peak the price has been low and after it is likely to be a lot higher -i.e. not a constant. This will have the effect that the 'S' curve will be flattened before peak and be less than half the total at peak.

What this implies to me is that those countries/companies with oil for sale after peak are likely to get a lot more than half the total cash EVER generated since the sale of oil began... Looking at that global bubble map I would expect a huge wealth transfer to Brazil, Russia some parts of Africa and the Middle East -and it's all going to come from America, Europe and Asia/China. Oh, and the oil companies are going to do really well too.

Regards, Nick.

This is the premise of "Phase One" of the Export Land Model (ELM). Starting from Peak Exports, I define the first 50% decline in net exports to be Phase One, and the second 50% decline (from peak) to be Phase Two.

I expect that most oil exporters will see rising cash flows from oil export sales in their Phase One decline, which will generally have the effect of accelerating the rate of increase in domestic consumption.

On my simplistic ELM, the net export decline rate in Phase One is 15% per year, and Phase Two is 45% per year. Note that the decline rates for specific countries will be a function of three principal variables: consumption as a percentage of production at peak exports, the production decline rate and the rate of increase in consumption.

In virtually all oil exporting countries, flat production = declining oil exports.

To answer everyone. I think the phase one condition is short lived and probably already fading in many exporting countries.

The reason is inflation of all sorts monetary assets etc. The economies of these countries cannot convert the cash flows into any sort of useful outcome so you get a huge amount of waste internally and massive inflation undermining any attempts to create a real economy. Also of course you have the importers who print the money inflating like mad to keep their economies growing as energy becomes more expensive.

Next after adjusting for inflation and the relative drop in the dollar against the rest of the worlds currencies we have yet to actually see a large real gain in oil prices despite flat production for several years.

I think we will see a real price spike in the next year no matter how you adjust it but it will be short lived and we will see a fairly major retraction of the economy followed by a big drop in oil prices and the end of a lot of projects.

The economics should follow the same boom bust style as the gold and silver strikes of the west. In fact we are seeing exactly this happening now in Canada with the tar sands region economy already stumbling despite the record flow of cash. Its like people paying a half million dollars for houses in Compton California they would have been better off just burning the money.

The Western Oil companies will of course be under continuous threat of nationalization especially once peak is clear. One reason I hope they break up voluntarily since I think punitive taxation or nationalization is not the right answer.

In general this dream of a pot of gold at the end of the rainbow held by oil companies national and private is I think just that a dream. Its pretty obvious that everyone inside the oil industry is blinded by visions of immense wealth that will be flowing into their coffers for many years to come.

I give it two years more at best before a wrecked world economy war and nationalization of resources to protect the god given rights of this or that country kill this dream.

This expectation of immense wealth is based on the false premise of business as usual and I assure you once the world understands that peak oil is in the past business will be anything but usual.

But with all thing time will tell I hope I'm wrong since for the oil companies to make the kind of money they think the will implies that peak will bring no real problems besides high prices no problem. I don't think so.

WT often mentions the Iron Triangle well on of the obvious things the will happen in my opinion well before export land goes to the end is that the Iron triangle will fall apart once the consumer economy is no longer effective at generating wealth. At this point former allies will be instead competing and fighting to take the lead position in a economy moving away from oil. Large industries and powerful groups have risen and fallen rapidly through out history so we can expect the same sort of struggle to ensue once its clear that suburbia and its consumption economy is dead.

In general once exports drop by about 5% all bets are off and the party is almost certainly over.

As always I hope to be wrong but no one seems to be able to give good reasons why everything will keep on working like it does today and in general most of the positive assumptions make business as usual a prerequisite.

It reminds me of the mark to model concept used for rating the housing bonds. Mark to market seems to give very different results. Very few seem to want to consider reasonable real situations.

I though of a simple way to express it. Can the world afford to have hundreds of billions of dollars flow into the oil exporting nations and into investors in the majors ?

If so for how long ?

Thats the question that needs to be answered.

I think the phase one condition is short lived and probably already fading in many exporting countries.

Some examples, maybe? Which countries do you expect for production to drop more in the next year than prices will increase?

The Western Oil companies will of course be under continuous threat of nationalization especially once peak is clear.

Agree.

Its pretty obvious that everyone inside the oil industry is blinded by visions of immense wealth that will be flowing into their coffers for many years to come.

That’s completely wrong. Speaking from within, everyone is convinced that the price will fall back down, and we will start back down the cycle. I have argued for several years that in a supply constrained world, there is no more cycle. These recent acknowledgements by the IEA and the NPC were a bit of fresh air, because every since I joined the oil industry all I have heard about is that we were in an up cycle, and hard times were just around the corner. Just like every other time.

This expectation of immense wealth is based on the false premise of business as usual…

No. Not at all. It is based on the realization that people are going to give up a lot of things and sacrifice a lot in order to keep buying oil. This will drive prices and profits through the roof. And I say that not with glee, but just as what I think will happen. And my actions in my personal life reflect that belief: It is why I came to work for Big Oil, it is why I am in the North Sea now, and it is why I am making the plans I am making (essential to use oil money to buy arable land).

Since the dollar as been devaluing at a pretty good clip

and production rates have been decreasing I'd say that we have already seen production declines greater than price increases. This is not however a good measure for the end of phase one for a country.

1.) Iran

2.) Venezuela

3.) Mexico (later)

In the case if Iran we can expect demonstrations and strikes at some point that will disrupt the oil sector. Its just a matter of time.

In the case of Venezuela I expect simple mismanagement of the fields to have a big effect but Venezuela will redirect more and more of its oil revenue into military spending and eventually have strikes. This is dependent on the rate that military spending increases. I expect Chavez to both gain more power and get more paranoid ( not without reason ) thus the massive growth in military spending.

Lets define the end of phase 1:

Phase one for oil exporting countries ends when oil revenues are no longer growing fast enough to meet social service/diversification needs and keep the oil industry going.

Iran seems well past this phase the oil price could double and the would need more money.

Considering the way our fiat currencies are manipulated and that countries such as KSA recycle a lot of its petrodollars the flow of true wealth is not just the flow of nominal dollars. Its the rate of conversion to goods and services and for oil exporting nations more important is the rate of conversion to the means of production for a diversified economy. Underlying the money flows is a transfer of wealth and power from one group to another.

As and obvious exception look at Norway and the way they have managed their oil wealth. They have created real wealth. Compare and contrast to Iran Mexico and Venezuela.

Expectations of immense profits:

This was generalized across all oil producers but OPEC concept of a fair price increases daily. The fear your speaking of is more caused by the fact that most of the project open to the major to increase oil production are very expensive and marginally profitable and I think they believe OPEC will increase production. Next you would be a fool to believe the world economy is on a permanently high growth trajectory it will go down. So I think for your slice of the oil industry fear exists which is preventing investment regardless of profits. But even with all this even reasonable projects show supply will be constrained and huge profits possible over the next several years. The oil industry has raked in record profits to date.

This is the key problem.

Lets say I work for blockbuster and gasoline and related inflation is putting a tight squeeze on my budget. So I give something up lets say its and expensive hair cut every week I go to say two weeks.

Over at the salon the hair stylists notices that he is making less money and gas is pinching his lifestyle. He decides to give up renting movies at blockbuster to pay for gas.

Blockbuster notices a drop and revenue and puts everyone on part time. The guy at blockbuster now decides to let his mom cut his hair....

High oil prices create nothing they are an absolute negative on the worlds economy at best they redirect consumption from importing countries to exporting countries. As you notice from this scenario no new money i.e growth was created from high oil prices instead just the opposite the total amount of wealth went down.