Refinery Utilization Rates and Increase in Use of Heavy/Sour Crudes

Posted by Prof. Goose on June 30, 2007 - 9:30am

This is a guest post by Smokey. Smokey has a background in sustainability in transportation, and has conducted research on responding to fuel supply disruptions.

To what degree is the decline in quality crude affecting domestic refinery utilization rates and therefore gasoline stocks?

In recent years some analysis has suggested that light sweet crude oil may have peaked, with the world left to increasingly rely on lower quality crudes. See for example this story on The Oil Drum and this story on Energy Bulletin. Although the data on global peaking of light sweet crude may not yet be conclusive, data on the production of many regions that produce primarily light sweet crudes conclusive show that many of these regions are past peak.

Recently, gasoline inventories have been well below the normal range for this time of year, while crude oil stocks have been above the 5-year average. At the same time, refinery utilization rates have been well below normal for this time of year. Refiners and the EIA are well-aware that the crude oil mix has become increasingly sour and heavy.

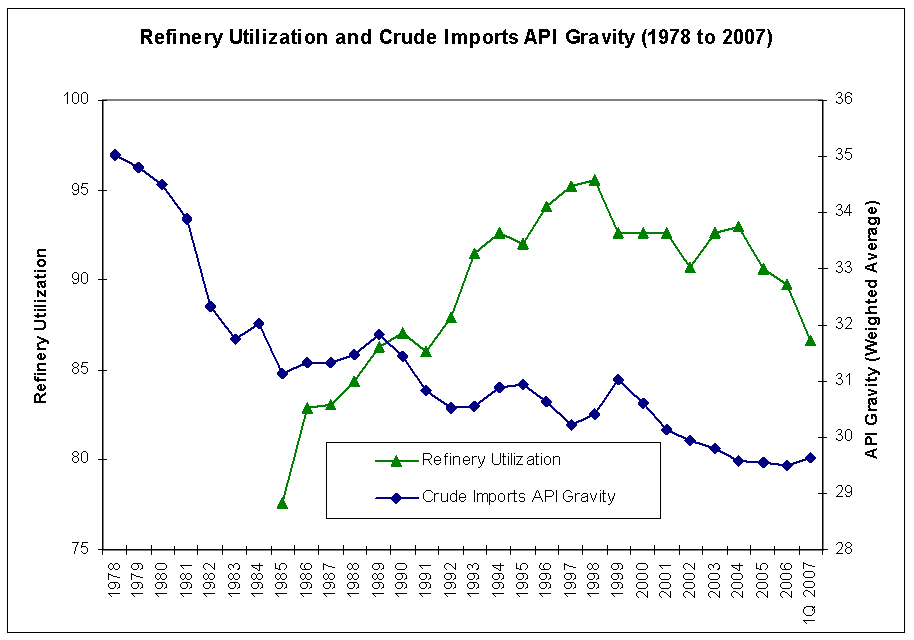

Figure 1 shows refinery utilization rates and the API gravity of crude imports from 1978 to 2007. Light crude oil is defined as having an API gravity higher than 31.1, medium oil has an API gravity between 22.3 and 31.1 and heavy oil is defined as having an API gravity below 22.3.

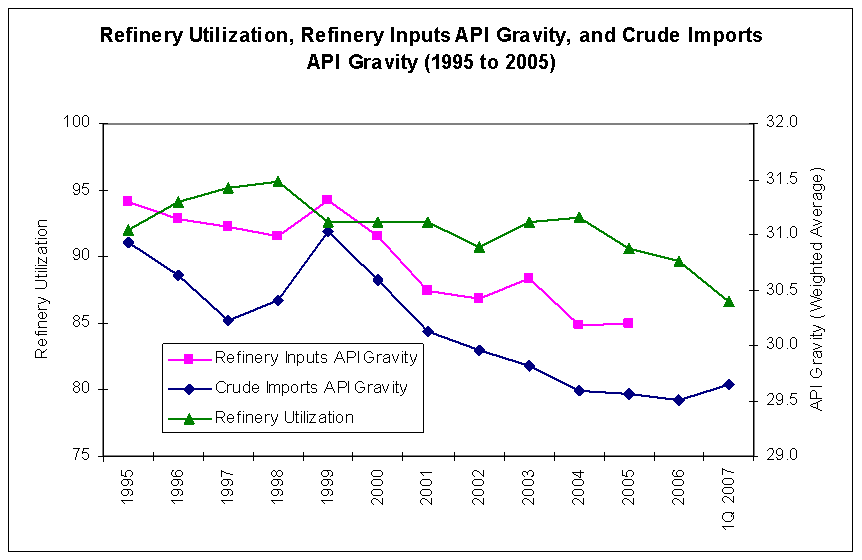

Figure 2 shows refinery utilization, the API gravity of refinery inputs, and the API gravity of crude imports from 1995 to 2005. As shown in Figure 2, API gravity of both imports and the crude used in refineries has been on the decline, while refinery utilization has also been on the decline.

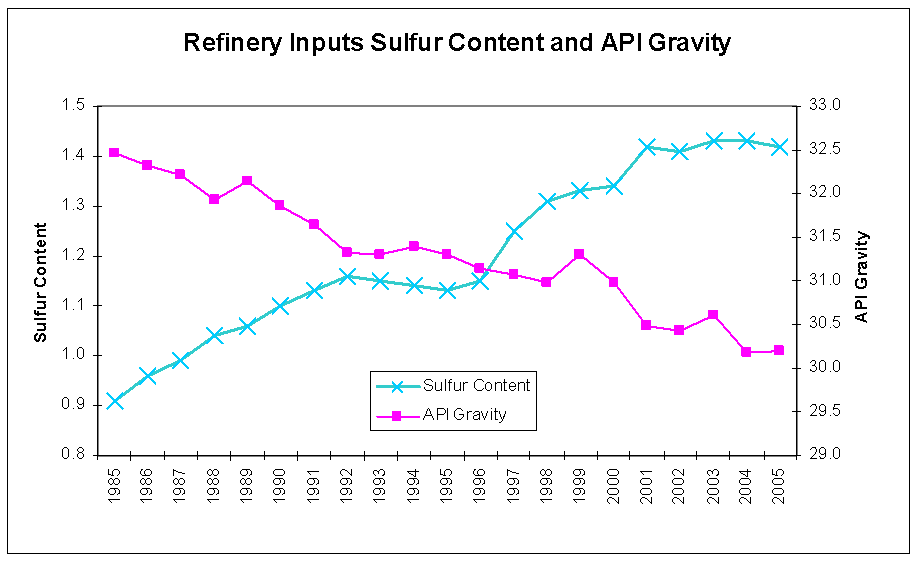

Figure 3 shows API gravity and sulfur content of US refinery inputs from 1985 to 2005. This figure shows that crudes used as feedstock to refineries are becoming increasingly heavy and sour.

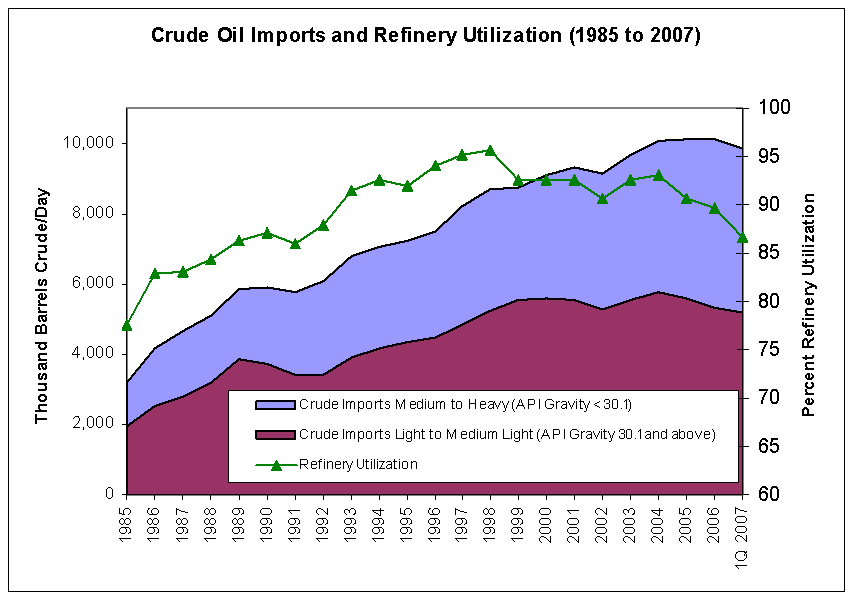

Figure 4 shows total crude oil imports by API Gravity and Refinery Utilization. Total imports declined in both 2006 and first quarter 2007, while imports with an API gravity of 30.1 or higher also declined in 2005.

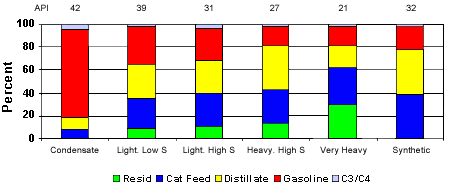

More gasoline can be derived from a barrel of light sweet than heavy sour crude, as shown in this figure from Natural Resources Canada.

From NRCAN: “Refinery yields by crude type: Figure 3 illustrates the product yield for six typical types of crude oil processed in Canada. It includes both light and heavy as well as sweet and sour crude oils. A very light condensate (62 API) and a synthetic crude oil are also included. The chart compares the different output when each crude type is processed in a simple distillation refinery. The output is broken down into five main product groups: gasoline, propane and butane (C3/C4), Cat feed (a partially processed material that requires further refining to make usable products), distillate (which includes diesel oil and furnace oil) and residual fuel (the heaviest and lowest-valued part of the product output, used to make heavy fuel oil and asphalt).”

Regarding differentials, an EIA presentation from March 2005 2004: Sign of the Future for Refiners? for the NPRA annual meeting suggested a couple of theories on light/heavy crude differentials.

“Theories on How Capacity Constraints Drove Light-Heavy Differentials:

1. Overall world refining capacity limit

2. Constraints on conversion capacity”

See the EIA presentation for a full analysis, which include potential indicators of one or the other theory above, such as:

- Light product stocks drop sharply

- Price for light products rise sharply

- Product price pulls crude prices up and pulls light crude up more than heavy

- Additional heavy crude oil won't be used

- Demand for light crude oil increases

- Added heavy crude oil run without benefit of conversion

- Residual fuel oil yield increases

- Over-supply of residual fuel oil

In the end, their analysis concluded that crude oil price was primary factor in 2004 differential increase, and that refiners made an economic choice to use more heavy crude oil as product values shifted.

Questions

A few questions that come to mind that readers of the Oil Drum may be able to offer thoughts on:

1. To what degree might low refinery utilization rates be a function of the inability of some refineries to process the heavier/sour crudes? Likewise, to what degree might refinery outages/unplanned maintenance be a function of the increasing use of heavy sour grades of crude? Finally, to what degree might low gasoline production rates also be a function of increasingly sour/heavy crude oil used as refinery inputs due to lower gasoline yields for the lower quality crudes?

2. Do trends in the quality of oil imports provide any evidence to support the theory that light sweet crude may have already peaked?

3. How long does it take to upgrade or expand a refinery to handle these lower quality crudes, and what kind of progress on this front has been made over the last several years?

I’m hoping there may be some insiders in the refining industry who could help answer these questions.

I am still on vacation, and probably won't be near a computer when this article posts. So, my apologies for commenting before it goes live. However, since I have commented on this several times, I want to make a note.

In the past, I have said that gravity has been relatively consistent for several years, which indicates to me that refinery utilization issues are not due to a sudden influx of heavy oil. Yes, over the longer term, crudes have heavied up as refiners have installed cokers and hydrocrackers. Due to the economics of processing heavy versus light oil, which I previously discussed here, if a refiner has a coker they are going to prefer heavy oil.

But if you look at the EIA numbers:

http://tonto.eia.doe.gov/dnav/pet/hist/mcrapus2m.htm

You will see that gravity in 2007 is almost the same as gravity in 2001. In fact, just eye-balling it I would say that the average in 2001 is a carbon copy of the average for 2007.

Sulfur tells a similar story - 1.4% in 2001 and 1.4% in 2007:

http://tonto.eia.doe.gov/dnav/pet/hist/mcrs1us2m.htm

I do believe that the lightest, sweetest crude has peaked, but refiners have been installing equipment to process heavy sour crudes. Overall, the product yields will be negatively impacted as this happens, but it didn't suddenly happen in the past 2 or 3 years (according to EIA data, which is data that refiners have reported).

Back to fishing with my boys. I will be back online some time next week, as we fly back to Scotland on June 30th. I won't be commenting a lot after that, but I will comment some.

I look forward to seeing you back, Robert!

BTW...I hope a few individuals take note of the refinery utilization for the past 22 years...

*wink*

>You will see that gravity in 2007 is almost the same as gravity in 2001. In fact, just eye-balling it I would say that the average in 2001 is a carbon copy of the average for 2007.

The EIA chart has to be wrong. The price spreads between Light and Heavy are tiny compared to the spreads back in 2004. I don't see how the demand for heavy has risen, while refineries statistic have remained unchanged. Valero was minting money before the spread collapsed. I suppose perhaps the figures may be escewed because of pre-refining upgrades. For instance, Oil produced from tar sands are upgraded before they are sent to refineries for production of consumer fuels.

Perhaps an insider from a refinery can set forward and provide some clarity.

The most recent price data (late May, EIA) show a spread of about $12 between Brent and Maya heavy crude, versus about $6 in late May, 2004.

>The most recent price data (late May, EIA) show a spread of about $12 between Brent and Maya heavy crude, versus about $6 in late May, 2004.

Thanks, I thought I had read somewhere that the spreads declined on increased demand, but I guess I was mistaken.

The light sweet stuff may have well peaked, but you can be sure that the refineries will install cat crackers to re-use the asphalt/bitumen. As we all know, when the crude goes into the fractionating distilling device, the bottom gets the asphalt. The asphalt can be broken down into smaller molecules in a cat converter or as we will call it a cat cracker. This however takes some amount of natural gas to supply the hydrogen for the cracking process.

The process to make the asphalt from Fort McMurray into "syncrude" does take a bunch of nat-gas. But nonetheless, the process of making heavy sour crude into something that can be refined is in progress. That does mean that asphalt will get expensive enough that fixing roads will eventually get too expensive. The asphalt from Fort McMurray is the mother of all heavy crudes. They dig it up as like strip mining. Then, it's made into "syncrude" to be pumped through pipelines to refineries. Then, after that journey, it's made into the gasoline, of course.

Petrol prices high enough yet? Just wait!

Smokey, thanks for your hard work! Those are great graphs.

since I'm in the upstream oil patch rather than refining, I can't add anything to this discussion.

I would add a fourth question:

4. What percentage of US (and OECD) commercial crude oil inventories consists of light sweet crude, and how many Days of Supply does that represent?

Note that on a Days of Supply basis, total US commercial crude oil inventories (light sweet + heavy sour) have fallen from around 30 days in the early Eighties, to the low 20 day range now.

Question.

The thesis is that even as crude has become heavier that refiners accepted this and produced a larger amount of side or low value products.

The spread has gotten large enough that is increasingly economic to switch to complex refining combined the low sulfur rules are having a negative impact on refinery utilization although gasoline per barrel may be higher. I think that the low sulfur requirements may be a big part of the current refinery problems.

So do we have the product mix per barrel ? Has it changed over time as refiners upgraded and became more efficient at handling the heavier crudes ? US refiners today seem to have a lot of control over the product mix they can produce has this always been the case ?

Next the US as one of the wealthier importers probably can control the grades of oil it chooses to import so one would expect them to move to heavier grades only as the profit margin increases. Now this may well be because of peak light sweet but thats secondary.

In general I agree with Roberts take on the situation except that I think the effects of the recent low sulfur rules coupled with the Ethanol requirements has caused serious refining supply issues.

So overall is their any evidence that the US is buying lower quality oil because it has no choice i.e the lighter oil are not economic or is it simply because we have complex refineries that can handle and are more profitable using lower quality oils.

In general however the depressed price of gasoline is causing problems attracting imports which is a whole different and probably more serious issue.

The thesis is flawed. Refiners could not accept larger production of low valued products. Simply no where to put them unless you price all the way down to replacing coal in thermal power stations (ugly!). Also with margins already poor, refiners couldn't afford to do this.

once you own a coker/resid hydrocracker + desulph capacity to make on spec products they run full. Even with shitty lith heavy differentials these units run full such that if their is over capacity, it's the simpler refiners that have to cry uncle and cut runs first.

ugh == "there" not "their"

It's a lost cause, dude.

I'm shocked at the illiteracy I see here at times.

Get a statistic wrong, and people will eviscerate you on TOD.

But confuse there/their/they're, its/it's, or be too g****** lazy to use the SHIFT key to properly capitalize, and no one cares.

Because it is trivial to determine the correct meaning, spelling and punctuation rarely matter. OTOH, it is hard to spot an error in a number, so accuracy here is important.

And what about those illiterate cretins who think it cool to mix case and put digits in place of letters, sheesh!

I agree with you. Right now reading to much into the US's supply of oil is probably a mistake. I think if any issues or strains exist in the system it will show up first in gasoline imports. However I think I came to the same conclusion once you have a complex refinery might as well use the lower grade oil and make money on the price spread.

Now you mention that its the simpler refiners that have to cut runs first but you would think that its the complex refiners that would fail more often so if we are having serious problems at or complex refineries we should see stronger imports of light sweet crude and the simpler refiners doing better now. This does not seem to be happening which is strange.

as long as the rest of the world is diesel driven, there will be plenty of surplus gasoline to export toward US markets especially if we continue to pay whatever it takes to attraat the oil. There are many many refineries that were built specifically to export toward us. Few examples -- Hess(no PDVSA) St. Croix. Venezuela's 4 biggies, Statoil Mongstat, . West coast UK refiners + several in the Mid East. Of course if another buyer pays more, we do without.

Refineries aren't usually single train systems such that when one element fails, the rest has to be shut. You work around the problem using intermediate feedstocks, storing offspec stuff, running the remainder differently etc. So the idea that complex refineries "fail more often" is too simplistic. They have more units to fail, but that doesn't mean they lose a larger percentage of their throughput due to failures.

Also simple refiners NEVER have better econs that complex ones. Even with a light heavy differential of zero(which never happens), the complex refiner can make more transportation fuels and less byproduct fuel oil than a topping/reforming refiner or a topping/reforming/cracking refiner. Once the investment is made for the cokers/resid upgraders etc, the cost is sunk. The units get run to the maximum extent possible as long as there is any extra margin to capture. Resid is still worth $20+/bbl less than gasoline so these units are staying full. So your expectation that imports of Lt. sweet should be up is off base IMO.

Sorry meant imports of light sweet into second third world refiners that tend to be of the simple variety in the poorer countries. You have to look at where the economic growth has been in the last few years and the bulk of the increasing demand is outside the western nations. Lists of refineries by country are readily available and the concentration of simple in the poorer countries seems pretty clear. Now this does not consider gasoline/diesel imports so its not a complete picture I'm sure they also import significant quantities of finished products but you can see they are probably paying more than their fair share for the recent price spikes.

I just don't think looking at US numbers without understanding the world situation better is not a good idea. I've never liked the focus on the US. I've always felt that by the time real problems start happening here we will be well and obviously past peak. Assuming we peak in 2005 this would mean late 2008-2009 before we should begin to see supply issues here. In the interim reading to much into data from the US is probably a mistake.

I've got no idea why we let our gasoline prices slide so we are not attracting the imports we need this summer this just seems to be simple stupidity but I'd have to guess that the first place we will get hit will be with gasoline imports at some point in the future people are simply not going to cause shortages at home to keep the US market supplied or we are going to fail to compete with closer customers who pay less of a premium. Note the Koreans ship to the Asian markets and the US the US has to cover the additional shipping costs beyond simple price competition. And if things get tight I suspect the jocking for export gasoline will not just be done on pure economics and its not clear th e US will win every round.

So all I'm saying is that when the US eventually has problems it will in my opinion show up in problems securing gasoline imports not oil. And I think the earliest this could occur would be summer 2008. Also if you think about it the oil market itself could be changing fairly rapidly right now so what was true three or six months ago may not hold right now in general we are looking at data thats inexact and often wrong so its fair to consider that we may not really know whats happening for some time. Right now the problems are probably generally in areas we don't have good data which I don't like but the gasoline import/export situation could easily get difficult fast so its something to watch.

Why don't you tell us how you think peak oil will first effect the US besides the obvious of increasing prices.

You will stay confused as long as you keep putting the cart before the horse. We don't "let our gasoline prices slide so we are not attracting the imports we need this summer"

First, we are getting plenty of imports. Imports are well above the typical levels of years before Katrina (ie, have to ignore fall 2005 to summer 2006). See

http://tonto.eia.doe.gov/dnav/pet/hist/wgtimus24.htm

Second, who is the overarching "we" that decides to lower prices? Prices slid because production is coming back restoring inventories to a safer level. Speculators liquidated their length when it became apparent there would be no shortfall. The market isn't prescient but it does reflect the common wisdom of the moment. There are more sellers than there were so prices have move back to just too high from obscene.

I don't think peak oil will effect the US beyond increasing prices. There is still a lot of wasteful demand out there that can be trimmed. Ditto countries that import that cannot compete with us for the marginal bbl. They may suffer, but we'll get all the mogas we wish to pay up for.. the only caveat is if Venz, with their enormous export capacity mostly aimed at us, decides to supply other nations for less money instead.

Its not like suddenly one day the world will be short 10% of demand (barring some political upheaval). The tightening will be slow strangulation like a boa constrictor. We'll have a flat supply curve for years and years. And as prices rise, we'll shift demand to other energy sources -- electric cars etc. Kunstler's collapse is bollocks IMO.

The cart may well be before the horse as you say but US gasoline inventories have slid to dangerous levels. A hurricane anywhere in the gulf that causes refineries to shutdown simply as a safety precaution could well lead to shortages. Letting our gasoline inventories get close to critical levels is a national problem not a industry issue.

I'm not happy with the current situation and it has nothing to do with prices if we have a hurricane this summer I suspect I'll not be alone in this sentiment.

This is the problem.

http://tonto.eia.doe.gov/oog/info/twip/gtstusm.gif

The west coast is the only place we seem to have decent gasoline stocks so we should be importing gasoline like mad.

Considering a 1%+ demand increase each year and the refinery problems we are having we should have already seen record breaking imports of gasoline. Instead we seem to have embarked on a grand experiment to discover exactly what our minimum operating levels are before we see widespread shortages. But hey I live on the west coast and we get our gasoline from Korea so its not my problem. We at least are not playing the same game.

And finally I am in agreement at least initially for the US I don't see sudden shortages. Later on I disagree mainly since I can't see us going forever without upheaval a world of ever increasing energy costs will not be a nice one.

As far as Kunstler a simple observation once living hours from work and commuting is not perceived as efficient then the value of the far flung suburbs will decrease all thats needed is a trend downwards to stall and reverse suburban expansion people will not buy a deprecating asset. I know for a fact that at least in my field Americans will no longer move too silicon valley to work if they have families and a lot of the senior programmers are leaving and working remotely like a lot of the American employees that work for silicon valley companies. The only people left are either rich executives or H1B's/immigrants living in crappy apartments and condo's with illegal migrant workers. At each economic downturn the immigrants scatter and the H1B's go home.

This goes into the general problem that prices are set at the margin slow squeeze concepts although nice tend to ignore this at some point the situation changes. Silicon Valley has changed into a overpriced slum unless your rich.

you seem to approach this perceived problem (gasoline shortfall) from a command and control economy viewpoint. Just who is the "we" in the system that would import gasoline as a buffer and take the price hit if it isn't needed?

We are NOT at some scary level of stocks. We're on the low end of normal and I suspect just like NAIRU, the predicted level at which the shit is supposed to hit the fan is higher e than the reality. When push comes to shove, the system will get by on a bit less. 200 million bbls is a hell of a lot of oil. It's roughly a tank and a half for every person in the country.

Your West Coast gas is not coming from Korea to any great extent. I'm going to guess 90%+ is made in the PAD V refineries. Just 20 years ago, I was exporting US mogas to Japan and Korea. Korea overbuilt refinery capacity not long after so now at time they may well have a tad of surplus for export. California gas is pain to make. We used to find it in odd spots like Finland for example. You need refineries that can make octane without aromatics and with low RVP. Not any easy equation.

Hello OcE,

Thanks for your comments. I've asked previously and still wonder:

1) re: "There is still a lot of wasteful demand out there that can be trimmed."

- Where do you see this? Could you explain a little further?

- Can it "be trimmed" without altering (presumably in a negative fashion) the economy that relies upon it?

2) re: "... beyond increasing prices."

How do you expect the price increase to effect the economy?

3) re: "Ditto countries that import that cannot compete with us for the marginal bbl."

So, those countries (as entire countries) can "be trimmed"?

What does this look like?

And...what about say, China, deciding to simply purchase contracts, rather than bid for or "pay for" barrels?

And...how does the "we wish to pay up for..." come into it? does this rely on a "healthy dollar"? Or what?

What about US debt?

4) "...suddenly one day"

What about Memmsl's idea concerning the probability of shortages?

5) "As prices rise..."

What about Deffeys' (and others') argument that we will see, not a gradual rise, nor a "slow strangulation", rather increasing volatility in price?

6) And then, of course, the "finale" of a question:

re: "...we'll shift demand to other energy sources..."

And use those energy sources to...

--devour the last fish in the sea?

--in other words, introduce other non-energy resources, which are nonetheless critical in the spot they occupy?

Example, water supply.

7) And may as well ask you about Venezeuala:

re: "...with their enormous export capacity mostly aimed at us, decides to supply other nations for less money instead."

What do you see as the deciding factors on the part of Venz. - either way?

What do you see as "pre-emptive" actions US can take, if any?

Do we have numbers like this for some other country thats reasonably wealthy but not the US and imports oil?

For example does the Philippine's post this information or New Zealand for example ? Its hard to understand the US numbers without some frames of reference. What about Israel Korea ?

I found this news article that indicates that heavy sour seems to be a issue world wide.

http://www.iht.com/articles/2005/11/22/bloomberg/sxrefiners.php

http://www.iht.com/articles/2005/06/20/bloomberg/sxrefine.php

I think if you had world wide data you might see a stronger move to heavy sour oil then just looking at the US.

So a bit of googling seems to show the move to handle heavier sour is not just a US economic move but a worldwide move. Real numbers would be cool.

The change in gravity is there but does not look that dramatic yet. But the change in sulfur is nothing short of amazing - an approximately 50% increase in sulfur content from 1985 to 2000! Since we know that sulfur causes maintenance issues, this would seem to be a fruitful area to explore as to one reason why refinery utilization rates are down. (There's never any single reason but this one may be a large part of it.)

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Do you have a take on the effect of the new low sulfur rules on top of this dramatic increase in sulfur content ?

I agree with you that at the moment sulfur looks like the biggest problem.

A link from the past but it seems the problems we have today where foreseen in 2003. Four years seems to be able time to meet demand with refinery upgrades so it makes you wonder a bit.

http://www.npra.org/news/testimony/20030610Testimony.cfm

My understanding is that sulfur is a real problem in refineries, being highly corrosive. This might explain both lowered utilization rates and the apparent increase in unexpected downtimes.

As Robert has noted, the gravity of the oil, whether taking the EIA data or Smokey's data, does not show what I would consider a really dramatic decline. There is change there but not so swift as other issues. But the increase in sulfur is far more recent (2000) and it may have just taken this long for the maintenance issues to start popping loose.

Unfortunately, I am not an expert on refinery operations so this is just a hunch, given that the sulfur increase is the clearest change in what we are refining.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Is high sulphur content the reason that many earlier descovered resevoirs were not produced and are only now being brought back on stream? I can't think of a specific, but reading Matt Simmons book a few months ago I seem to remember this being the case.

Marco.

Marco,

In years past many different reasons could lead an operator to abandon a hole as dry, even with good shows. Sulfur is one, but mostly it was a flow rate issue. The first major reservoir produced on the Texas Gulf Coast was Spindletop at Beaumont in 1901. The Lucas Gusher blew in at 100,000 bbls a day, and the oil from the caprock is sour and 18 gravity, and had hydrogen sulfide in the produced gas, as well as 25% CO2 content. But it was prolific. Spindletop salt dome was a sulfur mine later.

In contrast, everyone knew that the Buda Lime would produce a sulferous crude from at least the 1950's, but it wasn't completed as a reservoir rock until the late 1970's in the Giddings field area. It had to wait for modern geophysics to know how to complete the wells.

Sources: Bulletin of the AAPG on Spindletop, volume number 1, personal recollection of Giddings field development

If the refinery is making gasoline and using a catalytic reformer then sulfur can poison the metallic catalyst, which would be a big headache. Most of the refinery is anhydrous, so generalized corrosion wouldn't be a major problem. Of course, when fuel with sulfur is burned water and SO2 is formed so anything corrodes big time.

virtually all refineries have a cat reformer. But the first stage is a feed desulfurizer which removes sulfur to the necessary levels to protect the platinum/palladium catalsyt si the reformer proper. with poorer feeds, you just add feed desulph capacity.

just a matter of money. Refiners spent billions to make the new gasoline/diesel sulfur specs.

Hmm very low levels of sulfur poison catalytic converters so I'm not clear how they got by with the higher sulfur levels to begin with unless the sulfur was only removed when going to the catalytic converter or it was cheaper to redo the catalyst then to drop the sulfur content. The old sulfur levels would have I would have poisoned the converters fairly quickly in my opinion. Maybe the regenerated periodically in situ ?

You might want to invest some time in reading up on how refineries work. Your fingerpainting is wasting you a lot of thinking time. I wish I knew a good text to point you to but I don't.

IIRC (and I'm no reformer expert by far) cat reformer feed needs to be desulfurized down to about 10 ppm ish. And they do regen insitu fairly often but that is to remove coke building up on the catalyst.

But all of the gasoline pool doesn't come from the reformer. there is straight run gasoline (if your crude has decent mogas octane ), FCC gasoline, hydrocracker gasoline, coker gasoline, alkylate, polymerization plant streams, petchem byproduct streams, etc depending on the specific design of your refinery. In the old days, you blended via linear program to hit all the specs with 500 ppm sulfur as a constraint. Gasoline components with shitty sulfur levels (like FCC gasoline) could go in without further treating. Current, lower sulfur specs require more of these streams to pass through desufurizers or to deeper desulph levels.

LOL!

Memmel works on a little knowledge and a lot of typing. It's a bit like the million monkeys principle. ;)

the finger painting is assuming the old sulfur levels poisoned catalysts. That's just ignorance. The same level of feed desulfurization is needed now as then for cat reformer feed. The difference is in what is happening to rest of the pool.

I find you make an assumption, often pulled from thin air, and then fingerpaint about how that assumption affects the situation. GIGO.

Maybe you did not understand my point is its doubtful that they are running high sulfur into the cat converters.

This means the technology to remove sulfur down to low levels is common and well tested therefore I don't think the new low sulfur requirements are a huge burden to the industry and responsible for our problems. Sulfur content has risen lately but I don't see it as a major problem. The sulfur has to be removed early and now they are doing it across all feeds.

I assure you I understand catalysts very very well and much better than you. I've worked on gas phase catalytic systems in the past. I'm a chemist not a chemical engineer and industrial process and constraints are quite different from the small scale reaction oriented systems I work on and I've often seen assumptions you make in the lab not holding for industrial production. Sometimes the trade offs are surprising since cost is and overriding factor. So I do know enough to never assume the way I see it as a chemist applies to the chemical manufacturing reactions are just a small part of chemical engineering. I could not see them allowing the catalyst to poison but if poisoning is slow and they can regen in situ maybe its cheaper I don't know I did see how but its not all that uncommon for catalyst to be regenerated often in say plastic synthesis a lot of processes toggle between catalysis and regeneration.

"what i would consider a really dramatic decline"

huh? what sort of decline would you consider dramatic ?

The change in gravity was less than 10% change. The change in sulfur was about over 50% change. I don't mean to minimize the gravity change as much as point out the extreme change in sulfur content of the oil being processed.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

The ENI World Oil and Gas Review 2007 has a table that breaks down worldwide production by quality. It's located at:

http://www.eni.it/wogr_2007/oil_production_quality-world-18.htm

From the chart you can see that light sweet peaked in 1997 at 1.285 mbpd.

Thanks Cynus, I never saw that table before. To me, the peaking of light sweet crude is just another indication that peaking of the other grades is just a matter of time.

One thing I couldn't find though was domestic gravity/sulfur. With the exception of 2006, we have been importing more and more oil, and I assume the imported oil is lower in quality than domestic (in general). This means more lower quality oil to process, even if in recent years gravity/sulfur hasn't changed dramatically it still means processing more of it relative to the good stuff.

THANKS !

Bookmarked.

Hmm but it has not actually declined that much 1.218 in 2006 for example interesting. But you can see that almost all the new production since 1995 has been source and heavy sour oil with a healthy increase in Medium Sweet. So in a sense oil available for growth has been heavier and sour. If your growing your economy light sweet is not and option.

This trend has been going on for a looong time why are we suddenly having problems now its been 10 years at least since light sweet was readily available if you think about the spread between light sweet and heavy sour. Knowing this and knowing our demand curves our current situation did not sneak up on us. So I'm back to being puzzled why we are having refinery problems and even bottle necks now. The 2003 paper laid out the issue and this shows they should have been obvious at least as far back as 2000.

For some reason I got the impression that the problems this year where a bit sudden but the more you look the more it seems to have obvious whats going on to the industry players. This would point towards maybe some issues with regulations between industry and the government ?

I'd have to think the refining industry would have issued warning regularly for the last several years. Note the date

2001. Somebody messed up and its not just the industry.

http://www.whitehouse.gov/news/releases/2001/05/20010511-3.html

This is a good example of Republican ideology at work. No matter what the problem is cutting taxes on the rich will solve it. A great many working families are just as poor as I am and essentially pay zero federal income tax. Poor retired folks like me do not pay Social Security tax so cutting those taxes won't give me any benefit.

for the hundredth time, refiners did make huge investments in the 90's just to make the low sulphur/low aromatics products required for new cleaner fuels. Margins were poor most of that time so these investments were very painful expenditures of capital just to stay in business rather than based on an expected return. Therefore refiners invested as little as they could. There was some capacity creep as designers always throw in a little fat both to cover their asses but also when it makes little difference in cost, you tend to round up on sizes.

You keep assuming that this refining capacity squeeze was obvious and refiners should have built capacity to meet it. That might have happend in a PUC type environment where you are guaranteed a rate of return on new investment. But refiners had been badly burned by investments that were dogs in the 80's and were not eager to rush pell mell into new capacity projects. What if 9/11/2001 had led to a major world recession for 3 years? We'd have excess capacity and shitty margins. What if China has a revolution and destroys their economy for a decade? Demand collapses.

It's apparent you believe cheap gasoline is some right that should be protected by govt intervention. Not so. Moreove, with rights come responsibilities. Do you want the govt setting capacity targets for industry? And guaranteeing their margins?

I believe nothing if gasoline production is not profitable enough in the private sector to ensure supply then we have a problem thats all. Certainly everyone seems to have been aware for a very long time that refinery capacity was tight. Now whats interesting is it seems to have been tight well before the run up in oil prices yet tight refining capacity is blamed for our current situation so...

And repeatedly we get claims and even facts that the US seems to have no problems importing gasoline for a price.

All I know is that nothing coming from official sources passes the sniff test.

1.)Refining capacity is tight in the US. This has been known for a long time well before the price spikes.

2.) The Saudi's blame lack of refining capacity as the big problem today but yet the US has no problems with imports so it seems world refining capacity is not a problem which makes me wonder why the Saudis claim it is.

3.) Oil and gasoline are both substantially higher in price but the various parts of the oil industry are simply pointing fingers at each other as the cause.

4.) One thing we know pretty well is oil production has not increased substantially in a long time.

Number 4 seems to be the only thing thats true the rest is a blame game.

please provide some evidence for this statement. I believe the contrary to be true. As late as the mid 90's the refining industry was still moaning about over capacity and hence the supposed collusion pointed to by Sen. Wyden's badly flawed report.

Unless "a very long time" is 3-4 years.......

Agreed, OilcoEx. What happened was not collusion nor lack of capacity. What happened was excess capacity then coupled with planning for lower growth rates while real consumption growth skyrocketed. So the industry got caught flatfooted (and are trying today to catch up with refinery expansions).

Pretty simply, the IOCs appear to have had excess capacity because of the extremely slow growth of the 1980s and they began planning longer term based on that outlook. It appears that they only kept up in the 1990s because they had excess capacity but then continued to plan as though real growth would move back towards 1980s levels which caused them to under-plan expansions leading to the current tight situation.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I don't know you can finger paint or you can read.

http://www.eia.doe.gov/emeu/finance/usi&to/downstream/ch4.html

This 1996 report seems very accurate so.

You can follow the paper trail from this link.

http://www.eia.doe.gov/emeu/finance/

As far as I'm concerned your statements don't ring true.

I see a industry that has anticipated future needs and expanded capacity to meet those needs. As far as why we are tight now a lot of things may be causing problems but its short term issues not long term trends or industry direction.

Found a older paper 1994.

http://findarticles.com/p/articles/mi_m3617/is_1994_Annual/ai_14698430/pg_1

The gist of the issue was demand was in general increasing

but that new regulations where the driving for for closures and consolidation. So even then demand was not a major factor

despite the claims your making.

Anyway I've got some finger painting to finish later.

I don't know what point you are trying to make, memmel, but this table from the DOE backs my contention exactly as it explicitly tracks refinery utilization. You can look at that table and see the drop in utilization from 1979 forward then the slow increase in utilization up to the mid-90% range by the late 1990s, exactly as I stated. The simplest explanation to me and that is supported by the evidence is that the IOCs did expand capacity over the last decade but at a rate that was less than the rate of growth in consumption.

Further, from that table you can see that from 1993, the date on which we hit above 90% utilization for the first time since 1974, to the present, that total capacity has actually grown by 2.2 mbpd! The problem is that consumption over the same period grew by even more.

Note that the price collapse in the mid-1980s also reduced capacity from its peak level ever and towards which we are still slowly climbing again. But in the early 1980s we had 18 mbpd capacity but only about 12 mbpd usage or about 60% utilization. This is what caused many of the closures that Robert Rapier has previously discussed. The industry had too much capacity at that time. This is also why they are afraid to overbuild especially with all the political talk about alternatives. Who wants to build 3 mbpd of capacity and never see it used because we switched out to alternatives that do not need refining?

I am not sure what point you are trying to make but the picture to me appears pretty clear that the industry was guided by 20 years of utilization and that is what controlled investment from 1995 to now. The only problem is those assumptions proved too conservative and consumption outpaced refinery capacity growth.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I'd have to dig for earlier data. But a lot of the capacity reduction around this time period was related to the new EPA rules your not including the effect of these in the early 90's. Beyond that I see no indication that the industry was not expecting demand to continue to grow and later reports were fairly accurate in reporting stronger demand. In short I don't see anything but a decision to close marginal refineries that could not meet EPA rules as early as 1993 and beyond that a industry experiencing and growing to meet strong demand.

http://www.eia.doe.gov/kids/history/timelines/petroleum.html

Tying lack of investment and expanding capacity to some sort of reluctance on the part of refiners seems to have zero evidence in anything I've read. Nothing indicates that this argument was made. I do see concern about domestic refiners being able to compete with overseas refineries that don't have the same rules and regulations.

So by at least 1993 if not earlier refiners face growing demand and seemed to be willing and able to expand.

Going back farther in my finger painting.

This is in stark contrast to your assertions of a collapse.

http://www.eia.doe.gov/pub/oil_gas/petroleum/analysis_publications/chron...

http://www.eia.doe.gov/pub/oil_gas/petroleum/analysis_publications/chron...

So even back then the culprit was government meddling not a industry scared of investing but one that had been propped up by previous price controls.

Certainly the refining industry like and industry has its ups and downs but I don't see any single event standing out to indicate a massive change instead as you read through you have a series of events happening and good and bad spans.

http://www.eia.doe.gov/emeu/finance/usi&to/downstream/dfig01.html

What I see is about a 4-5 year time period when the refining

industry had serious problems out of a thirty year span.

The golden years of 30% profit margins where related to heavy government regulation not any intrinsic ability of the market as well as the profit margin collapse once the industry was deregulated.

I'm sorry but 30% profit margins are not normal. I don't have pre 1977 data but I'd suspect that the profit margin varied at 5-10% before this.

http://www-geology.ucdavis.edu/~cowen/~GEL115/115CH13oil.html

I can't see taking two events a unusual level of profitability followed by collapse once free market conditions returned and focus on it as the defining moment in the oil industry since on each side of this event spanning decades we see oil profitability range right around 10%. Your taking and unusual and fairly short lived event 6-7 years from run up to crash and claiming its the standard. Instead I see a industry that had 3 years of massive profits and 3 following years of lean profits. Averaged together they actually made above average.

Anyway I'm gone on vacation.

As early as 2001 it had reached the level of the President.

I'd have to think he was not the first one to be concerned about refining capacity. You mention the mid 90's so the industry probably should have been questioning the rate of expansion in the late 90's. I can't see how it can reach the attention of the president by 2001 and not have been a issue before that.

Flawed or not

http://wyden.senate.gov/leg_issues/reports/wyden_oil_report.pdf

The issue of refining capacity was on the table at that point.

This link indicates that refining capacity wast tight by 1995.

http://www.eia.doe.gov/pub/pdf/feature/lidder3.pdf

Since its now 2007 I think its a safe bet that this issues been recognized for more than "3-4" years.

Assuming we have a refining crunch now which is questionable what is clear is that the refining needs and trends have been clear and obvious for some time. 1995 seems to be a key date so claiming no problems before then although true is irrelevant and I'm sure someone could have done a projection in 1993-1994 and seen that refining capacity would be tight by the end of the decade but 1995 is good enough.

And the conclusion. We are having a bit of bad luck it seems

with refinery utilization but in general I see no indication that the industry has not done a reasonable job of increasing refining capacity. I think the government on the other hand seems to have dropped the ball a bit. If any finger pointing needs to be done a close scrutiny of the Governments role in ensuring domestic refining capacity is in needed in my opinion.

The only thing that seems to be happening now is oil supplies are tight worldwide and if we ever get our act together probably tight in the US.

Thanks for the link.

There are no obvious trends.

However, there is a strong increase in Heavy and sour for the Americas:

So care to comment on whats really going on ?

This is confusing. Is it just increased demand for light sweet from growth but no growth in supply thats driving a price spread so sour heavy is "more cheaper" these days than in the past ? I can see because of the price spread a weighting towards countries that can afford and have the technology to process heavy sour crudes or in the case of America think they can :)

There are a couple of graphs showing where each grade is produced on page 3 of this paper.

http://www.worldenergy.org/wec-geis/congress/papers/marcellog0904.pdf

The graphs are taken from the same source as above previous year(ENI world oil and gas review 2003)

Check their site for other reviews later (their site is down right now) it may be possible to reconstruct the trends for various years.

The chart in the link shows all the growth in production since 1995 has basically been in heavy and or sour oils.

Strange it looks like it depends on the chart. Prices indicate that the market at least believes light sweet is harder to come by now. Hmmm Is the chart above for the US or world ?

And a chart from the same source shows basically no trend as far as I can tell on a percentage basis like your chart.

http://www.eni.it/wogr_2007/oil_production_quality-world-20.htm

Then one more that does ...

http://www.eni.it/wogr_2007/oil_production_quality-world-21.htm

Got me.

Something that is getting ignored in this discussion is ultra-light oil, produced from Shaybah in the Rub' Al-Khali for example. Its production has nearly doubled, making up for the decline of light sweet. It is likely to increase further as Saudi Aramco's planned expansions come online in the next few years.

ultra light ? is this condensate from the permian ?

and

do you have a link ?

There are numbers for ultralight in the link from cyrus's post

http://www.theoildrum.com/node/2707#comment-207690

Is it condensate from the permian?

I thought it might be condensate but didn't find any mention of condensate when I googled it. Just a couple of mentions of Shaybah. For example

http://findarticles.com/p/articles/mi_qn4182/is_19950609/ai_n10083914

Other articles called Shaybah extra-light or super-light.

OECD getting too refined

From Turkish Daily News

http://www.turkishdailynews.com.tr/article.php?enewsid=76939

These comments from Fatih Birol seem apt;

“The average crude we are producing is getting heavier and heavier,” he said. “But the average refinery in the United States is 80 years old.” OECD countries, Europe and Asia face similar problems.

“I would be surprised if current prices [70 dollars per barrel would go down significantly under normal conditions,” says Birol

that 80 year figure is such crap. There is virtually nothing 80 years old left in any refinery. Stuff gets replaced as it wears out and as times change. maybe the dirt under the units is old, but the equipment is much younger.

Yes, the oil companies do such a great job at maintenance. Witness Texas City. Witness the Alaskan pipeline. (Both were BP foulups as I recall but BP is not alone in this.)

The heavy wear necessitates changing out components regularly but that does not mean all components get changed out at the same schedule. And as history proves, if the oil companies think they can get away with it, they will skimp on maintenance. You cannot argue that away and it's purely a function of a corporation being a corporation - a sociopathic organism that is concerned solely with its own growth at the expense of all else.

Corporations should never have been given personhood status in the courts. We will rue that day eventually and hopefully that ruling will be reversed.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I won't defend BP's messes. But there are no 80 year old refineries unless you are dating them based on the year the gates opened as opposed to the age of the existing equipment.

80 years ago there were no reformers, FCCs, hydrocrackers, desulfurizers etc. About all they had were acid treaters, thermal crackers and a few other bits and bobs. Bit like comparing a Model T to a Ferrari.

Even well maintained refineries have accidents and deaths. Again, BP made a hash of things. It's a dangerous business with high pressure steam, 3000 PSI hydrogen rich streams 2500 F catalyst streams, super concentrated acid streams and just plain old flammable hydrocarbons all over the place. Doesn't take much of a screw up or material failure to make a big problem.

Refiners are like all businesses. Some are well run and make every effort to do the right thing. Then there are the other 95%.

I didn't say they were 80 years old OilcoEx. Maintenance issues can crop up in less than 6 months in some cases depending on the corrosiveness of the particular compounds in play. (In fact, that's been a selling point for a glassy metals vendor who makes refinery pipe inserts that decay at far slower rates than normal metals.) The problem is not 80 year old refineries but entities (corporations) that are recognized as persons under the law but behave in sociopathic ways.

And yeah, that is one dangerous business. I am from the Houston area and I've coached youth sports and I have known kids who were affected by the BP incident. Hopefully that was a massive wakeup call to the IOCs. If not, we can just regulate the hell out of them til they do wake up.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

From the Middle Eastern Times

http://www.metimes.com/storyview.php?StoryID=20070628-125342-6811r

Birol argued that some $487 billion was needed in refinery investments around the world between 2004 and 2030 to keep pace with global gasoline demand.

"Two-thirds of this sum will need to be invested in developing countries, over one half of this in the Middle East and China," Birol added.The world's refineries had a combined capacity of about 85.7 million barrels per day (bpd) in 2005, according to the French Petroleum Institute (FPI).

They will need to reach 93 million bpd by 2010, and 118 million bpd by 2030 to meet demand, the International Energy Agency (IEA) recently forecast.

How is this affecting diesel quality? Around Chicagoland, rarely does one see a Cetane Rating Sticker and if there is, Ive never seen one above 40. Arent these req'd by law? It certainly doesnt help biodiesel's cause to be mixed with low-grade petroD.

Newer diesels not only require UltraLowSulpherD (below 15ppm) but cetanes approaching or exceeding 50. This will go a long way toward clean diesel acceptance, ie little or no smoke, and reducing maintenance issues.

us Diesel spec was 40 for ages. Europe was 45 and some places demanded 48 IIRC. We put up with lower as we had so much FCC capacity producing crappy cycle oils (highly aromatic) that we couldn't blend to 45 in our pool.

Checked the Colonial Pipeline spec for ULSD -- still 40 cetane number....not sure where you are getting the 50 cetane figure.

There was a refinery problem in Indiana that shut down 420,000 barrels of capacity per day. That is a significant reduction in refinery utilization.

BP was planning to expand this refinery to 1.7 million barrels per day:

http://www.post-trib.com/business/444707,bp.article

Refinery outages around the country have reduced capacity utilization (6/25/07):

http://money.cnn.com/2007/06/25/markets/oil.reut/index.htm

Thus we have more of a problem with downed refineries. Sulphur modules were also rumored to be part of the refinery problems, some of these are in their break-in runs.

The spread from light to heavy was wide at first, then narrowed as cokers were installed.

The price of petroleum coke went up in 2005 and 2006. An article about petroleum coke:

http://www.roskill.com/report.html?id=79

Chevron has a good article about their efforts to get more gasoline and diesel from oil by installing more coking capacity at one of their refineries:

http://www.chevron.com/products/about/pascagoula/refiningprocess/proccru...

Heavy oil is one of the last frontiers of oil exploration and production. Trillions of barrels of tar-heavy oil were rumored to exist. If the Hubbert Peak occurs when about half of producable oil is gone, when will 3 trillion barrels of tar-heavy oil production/refining peak? Will there yet be any remaining conventional oil and NGL's at that time?

******************************************************

"In war, truth is the first casualty." Aeschylus c. 500 B.C.

"There was never a good war or a bad peace." Benjamin Franklin

"Be as harmless as doves." Jesus

According to this web page:

http://www.stockhouse.ca/blogs.asp?page=viewpost&blogID=419&postID=21924

There are about 4.5 trillion barrels of bitumen in place in some of the major heavy oil belts of the world. Not much is known about the Mideast, but there might be more than a couple trillion barrels of heavy oil/tar in place there.

With mining of bitumen, recovery rates were 80-90 percent. In-situ recovery rates of greater than 30% are likely. Years ago recovery rates of bitumen insitu recovery approached 10 percent, today insitu recovery of 30% was not unheard of. Technology seems to be pushing ahead to greater gains. They will want to get this stuff out of the ground and sell it. It is too great a resource to be ignored.

Excellent news. Plenty of stuff for paved cycle lanes!

AT WHAT RATE?

AT WHAT COST?

Are you new here, or do you just enjoy pretending to not know what you're talking about?

I think I got a bit carried away with linking to this site about 4.5 trillion barrels of bitumen, as it seemed exagerrated, and thus I doubted what I was writing. Other people put Canada and Venezuela at 1.7 or 1.8 trillion barrels of oil in place a piece. A Suncor exec. indicated there were 2 trillion barrels of bitumen in Canada on a 60 Minutes documentary special. There were 240 billion barrels of bitumen in Russia OOIP reserves and 100's of billions of cumulative OOIP resources in other locations around the world. The 30% insitu SAGD recovery rate is much more productive than the 10% recovery rate was, especially with higher oil prices. These companies are not going out of business. The price of oil sands leases were increasing rapidly. Most of the major multi-nationals have some sort of project(s) in the oil sands. Basically there were profits to be made and the development might be exponential. If you can get on the order of a 20% greater recovery factor with almost 4 trillion barrels, you get 800 billion barrels more. If you could get 80% of the bitumen out, then what would happen?

It seemed unbelievable to me as I began to read more and more about developments with the heavy oil projects. It is now more believable that there might be another oil production spike from the oil sands not many decades in the future.

If you actually read your link, it says that only 12% of these 4.5 trillion "barrels" are commercially recoverable.

Basically this stuff is crud, it's not a great resource, and people aren't rushing to dig it up. It's only because of access to cheaper fuel (e.g. natural gas) that it becomes a commercial prospect. Heavy/tar may not peak for a while, but it's never going to substitute for light/medium in a significant quantity.

Be careful of your numbers, 420,000 bpd is roughly the total output of that refinery and the troubles it was experiencing did not shut it down, lol. It was reportedly down to about half output at one point.

In addition, the number you cite for expansion was quoted in the press release as 1.7 million GALLONS/day, or roughly 40,000 bpd. Wow, that boggled my mind for a sec, hehe. I had an office in that refinery for over 3 years, they would have had to buy out half the town of Whiting to get to 1.7 million bpd.

Interestingly, this appx. 10% increase in throughput, if implemented, is budgeted at $3 billion.

Whiting can already handle about any kind of crude you can throw at it in quantity, 4 cokers last I heard, de-sulferization units, relatively new cracker, the works.

Man that place is something around 120 years old now, but they've kept it up with the Joneses nicely. Certainly isn't an original bolt left. Well, over on the fuel oil rail rack maybe. Things just don't rust over there,lol.

need to re-read. that was gallons not bbls so just 40,00 bbls/day or sweet FA compared to US capacity of 16 million ish.

If you look towards the oil sands, operations like Syncrude have their own cokers and refine their heavy oil into a light sweet blend, and then it goes for sale as Syncrude Sweet Blend or something like that.

In US import statistics, that oil would appear as light sweet, although the source is heavy.

Or something like that.

How does that figure into the graphs above? It doesn't is my guess, and Syncrude isn't the only one, right?

We need to start looking at Alternatives, Oil in whatever form, will continue. Ireland will soon have the Worlds largest Tidal Turbines. This is a great initiative to develop sustainable energy. Technology buffs will be interested in how these turbines look like regular wind turbines. Peak Oil is nearly upon us its time we all start working to develop this technology.

http://giftofireland.com/Siteblog/2007/06/29/worlds-largest-tidal-turbin...

I wish you would stop spamming your site on every thread. Your site is crap anyway, it doesn't even display properly.

Bob, this seems a little harsh to me:

1) I spend a fair amount of time on this site and this is the first time I can remember seeing the link to Gift to Ireland

2)At quick glance the site has an attractive appearance amd displayed OK

3)The subject is energy-related and interesting (at least to me). In fact, Florida Power and Light is researching similar turbines off the E coast of FLA where the Gulfstream narrows.

Best wishes for ocean hydroelectricity,

Errol in Miami

Harsh, but fair.

1. The same post has been made 7 times to 6 threads in 30 hours since the guy joined (twice in 1 thread).

2. Good for you.

3. It was certainly off topic in 4 of the threads posted. It has nothing to do with refinery utilization. Off-topic, multiple posts: it's called spam.

Bob,

I agree with the spam characterization.

You, or someone, said the site didn't display right in FF 2.0.0.0 - I'll add to that it doesn't display right in

2.0.0.4 either - unless you use IE tab function. I also checked the site in IE 6.0.x.x and it looks fine so I'm guessing it's coded on the cheap.

Gift, if you are reading, the readers

at this site will cut you no slack for

poor coding, much less inappropriate content, IMVHO.

Where IS that 'Theory of Everything' ?

Here

it is !

Probably a good portion of Venezuela's crude would fall in that category.

There's no shortage of bitumen, but the stuff is very expensive. It takes 6 mcf of gas to upgrade a barrel of bitumen too, and Canadian NG has passed its peak. Also, the province of Alberta has been giving away its share of the production to encourage development-the royalty is at 1%, but will probably increase to at least 16.666666% (1/6th) as the process becomes more competative in costs. There is a current royalty review happening.

Its a misnomer to call bitumen deposits oil sands. Oil flows out of the ground, while this stuff is 15% asphalt in a mix with clay and sand. It can be made into oil at a cost of $100,000 per barrel per day of capital expenditures plus about $30-$40/bbl of operating costs and a huge environmental cost in fresh water, CO2, natural gas depletion and waste dumping. The EROEI is quite low, but the producers aren't breaking even yet on costs and won't for at least 20 years.

This is exactly why I keep harping on the fact that we cannot beat the cornucopians in a debate about the peak. They keep trying to change the definition of oil and claim we have virtually infinite reserves. We are past the peak on light sweet crude-the cheap, easy to refine stuff. Oil prices will have a floor at the production cost of synthetic crude, but the sky's the limit on the upside. We are all going to be a lot poorer, though.

As I understand it the $100,000/bbl was 80's investment costs. It's $150-200,000 now and rising.

I saw a link in yesterday's drumbeat that said the costs were $100K per barrel per day of level production, plus lifting costs at 1% royalty. But I 've seen the same figures for a couple of years, yours sound more realistic.

Even at $100K, its going to take at least 15 years at $60/bbl to break even, and thats with no repairs or maintainence. They seem to be counting on the increasing price of oil to make a profit.

Of course major oil company economics aren't the same as an independent oil operator in Texas. They have a huge investment in the refining-petrochemical equipment that must stay productive to profit, and this is a safe source of supply. They're making a $30-$40 bbl spread at the refinery. They also have the retail profit at their convenience stores/gas stations on cigarettes and beer.

But still, an independent must project a payout of two years or less to get a well drilled-so thats the real comparison-twenty years to pay-out vs. two years to pay out.

bob, this is brilliantly stated. Thank you.

Strangely enough, operations like Syncrude are profitable and apparently show a positive cash flow, as the biggest owner, Canadian Oil Sands Trust, right now has a yearly dividend of around 5%.

6 mcf/ barrel is about the same conversion from gas(mmbtu) to boe. gas is undervalued to crude at about $42/boe, but this would make the operating costs much greater than $ 40/bbl.

"tar pit" is more appropriate.

but we americans are much smarter than this, we prefer to sacrifice food for our gasoline addiction.

Good point about the natural gas prices. I really can't fathom the economics of bitumen, any more than I can understand how folks can drill and produce gas wells in an urban area like Ft. Worth and expect to make a profit.

My thought is that this is just the latest oil exploration fad. Whenever a new exploration idea makes money, the vast herd of exploration companies runs in to purchase over-priced leases and rent over-priced rigs for second rate acreage-witness Chesapeake purchasing a $18,000 per acre lease on the DFW Airport, that's $180,000,000 smackers. They've done the same on the bitumen-they announced early this year a big Alberta "Tar Sands" block. In a year or two they'll be announcing their latest trend play, maybe the ultra-deep water Gulf of Mexico wells, or they'll get a picked-over lease block in Iraq

Maybe the peak in light, sweet crude will bail out the Canadian bitumen mines in a couple of years, or maybe the incipient depression because of the collapse of the hedge funds will so depress consumption to cause the undulating plateau to be extended. I suspect the hedge fund cowboys are the money behind this boom, too. We'll be able to look back with perfect 20/20 hindsight in ten years.

Why not check out the horse´s mouth, take a look at Canadian Oil Sands latest quartely report:

http://www.cos-trust.com/files/investor/pdf/2007/Q1_2007_Quarterly_Repor...

Operating costs 23.56, down from above 40. Royalties 9.58. Canadian dollars. Purchased energy cost (natural gas) per barrel of 2.72 CAD.

It's all there. Black and white. And this is economic reporting, meaning that the government will have their ass if they don't report correctly.

Great charts, good work. Thanks for the information.

I especially enjoyed the charts of distillate/gasoline/cat percentages of light vs. heavy. I thought this was the way it worked out in my gut feeling, but it's good to know I didn't waste my money on a diesel truck.

As for the government addressing supplies/prices: the best answer will always lie in conservation and reduction of consumption, IMHO. If people want to save money, they need to stay home and keep their spendthrift neighbors home.

If you think about it globally the real driving force is probably just that most of the growth over the last ten years as been in emerging economies. If they build refineries they probably build simple ones. Robert posts some links on the types of refineries around the world and unsurprisingly simple refineries where common in the second and third world. This is putting pressure on the lighter and sweeter crudes and driving up the prices and is probably the reason for the price spread.

This price spread makes it economic for countries with capitol and technology to process the heavier crudes thus a increase in complex refineries in the western nations.

Short term we are having refining problems with the number one issue probably sulfur maybe Robert can enlighten us on sulfur.

Underlying all of this is the fact that crude production of all types has not changed but since its not a homogeneous product its not surprising that the best crude increases in price faster. Using the housing bubble as an example the greatest price increases by percentage are in the best areas so during the first stages of supply not meeting demand a selective pricing pressure effect is not unusual.

I was talking to a retired refinery worker fishing a few weeks ago, he told me the reason the Exxon Refinery in Baytown was so profitable is because they bought "junk crude" and ran it through their cokers, they were one of the few refineries that could handle it. Its antedotal, but sounds right.

I also heard, I think on CNBC, that Valero had bought refineries that could handle heavy, sour crude about 10 years ago when the refining industry was depressed, and they had a better spread than other refiners. That also sounds right.

more fingerpainting. China is building complex refineries with resid upgrading. Ditto Korea, ditto Thailand, ditto India. The company I worked for was selling them that sort of technology from the 80's forward. My old colleagues continue to do so.

Real 3rd world countries aren't building refineries. They just import products and pay through the nose.

Me

You

If you would just post your infinite wisdom instead of only offering by attacking my attempts to honestly understand the situation then fine. I don't see my conclusions as all that different.

1.) Heavy/Light spreads are not a issue (More complex refining today)

2.) Sulfur is not and issue.

3.) The third world is getting the shaft.

4.) We better not have a hurricane or ME crisis this summer or the vaunted experts in the Oil industry will have a national crisis on their hands. This is the only point of contention but I've not got your finger painting response.

the trouble is what you are saying is caka de toro. The refining capacity growth is in India, China, Indo etc. Not Zimbabwe or other true 3rd world locations. So your contentions re L/H diffs is bogus. Sorry, but that's how I see it. Prove otherwise and I'll back off.

Again, India, China Indo etc are installing fairly complex cracking/coking refineries not simple topping/reforming. units.

I do agree the 3rd world will get the shaft. The poorest always do when the s==t hits the fan. Also agree that a hurricane this summer wiping out a chunk of the USGC refining capacity will be a disaster. But imports will flow from other locales as we have the cash to pay up.

the oil industry is not set up to provide for the USA come feast or fallow. They make individual decisions to maximize shareholder return not to have unneeded capacity up their sleeves to minimize the effects of a long shot disaster n the consumer. If you want govt to force them to do this, you have to accept guaranteed returns on spare capacity.

My semi educated answers

1) None. Refinery utilization rates are being hit by years of half assed maintenance (BP) and paying the piper for deferring maintenance after Katrina/Rita. At these margins, no US refiner is trimming runs. Brent is only $1 over WTI so there isn't that big a shortage of waterborne light sweet for European/US East Coast refiners.

2) Dunno. Doubt it though. Suspect this trend is just a reflection of the massive investment US refiners made in desulfurization tomeet new clean fuels regs. When you put in the equipment needed to do that, it's cheap to add a little extra conversion capacity in the hydrocrackers you are installing so you can heavy up your slate.

3) I'd guess about 4-5 years to do a major refit to go heavy sour in a big way. 18 months to do the process/mechanical design and maybe 3 years to get it built and running. When I joined a major oilco in 1980 they were in the middle of a $1 billion project of that sort. We were doing the process design and IIRC, the units began starting up in 1983 so my 4-5 years may be pessimistic.

I'm out of date so can't answer 2nd half.

Thank you for taking a crack at answering these questions.

The key question is as follows: Why is Brent currently more than 90% higher than the average monthly price ($38) in the 20 months preceding 5/05?

OK I'll be the one to bite: competition for the ever-tightening available bbls.

NYMEX made it to $70 this last week, how long till the old $78 high? Any guesses? A week, 2 weeks?

Man, I am still out to lunch on what it will take for a little real demand destruction here in the U.S. A lot of my acquaintances that have stupidly bought SUVs and pickups are now driving them less. But the slack must be being taken up by people higher up the food chain. Still seeing plenty of Escalades towing powerboats.

Interestingly the crack spread seems to be tightening again somewhat, but we should be back to $3.50/gal. gas soon. The huge gap ($.70 around here for a while) between Diesel and Gas has disappeared. Will $4 slow anyone down?

Coming soon to a theater near you...

Take a 5 mile walk to the grocery store some summer aftenoon. Buy 50 lbs of groceries and walk back. Gas is cheap compared to what it buys you.

But I agree. It amazes me how much extra people are willing to pay for vehicles that are far larger/heavier/more powerful than they need. Must have very small penises to compensate for.

straighforward answer

World demand finally hit world supply including all of the OPEC production (mainly Saudi) that was mothballed in the early 80's. Once OPEC saw that there was no one else able to ramp up production and steal their market share or that the world would not enter recession and lead to a price collapse, they've decided to go for max revenue. They've trimmed about 2 MMBD of production. Without those cuts, I believe we'd be down to more like $50/bbl where we were on Jan 10th or so.

To which I would add that the Saudis have "voluntarily" cut production in much the same way that Texas has "voluntarily" cut production for 35 years: http://static.flickr.com/55/145186318_27a012448e_o.png

I doubt that. They are well below where they were just 6 months ago. The cuts were debated by OPEC and put in place to to prop up prices that were sliding.

If we have a world shortfall (and we don't as stocks are staying high) and then the Saudis cannot re-open the taps then you may have something. I think this Saudis are post peak idea is 2 + 2 = 6.

Greetings OcE,

Okay, So,

1) What do you consider "world shortfall" to be, exactly?

2) "And then the Saudis cannot re-open the taps"

How long - over what time span - do you think we'd have to witness such a phenomenon before you'd declare "peak now"?

Does anyone have any figures on how much 'energy' it takes to remove sulfur from oil?

And does anyone know if the numbers for the image relating to output/api are available? (it would be more accurate than using a ruler to estimate the percentage)