Will OPEC increase supply in the 2nd half of 2007? Or has Ghawar peaked?

Posted by Rembrandt on June 21, 2007 - 11:00am in The Oil Drum: Europe

Concerns about a gap in crude oil demand/supply in the 2nd half of 2007 increased in the past months. The International Energy Agency (IEA) and it’s sister organisation, the Energy Information Administration (EIA), have both told the OPEC cartel that OPEC must increase supply to avert rising oil prices. Presently the agencies expect a crude oil demand/supply shortfall of 1 million barrels per day towards the end of the year. However the OPEC cartel is of the opinion that oil markets are well supplied and therefore there is no need to increase supply at the moment.

This discussion, as shown below, boils down to the expectation for non-OPEC supply and world demand in the 2nd half. If the IEA and EIA projections are correct, we will soon find out what is going on in Saudi Arabia with the production of the supergiant oilfield Ghawar.

The Statements by the EIA and OPEC

Since March the Energy Information Administration has given warnings to OPEC that it must increase supply:

“OPEC must increase oil production by more than a million barrels per day if a rise in prices is to be avoided in the coming months, the Energy Information Administration said.”

Analysis from the International Energy Agency leads to a similar conclusion:

“OPEC needs to raise its crude oil output in the coming months to ensure an adequate supply, the head of the International Energy Agency said Monday.”

OPEC does not agree and released a press statement on June 14 stating that:

“OPEC notes oil markets remain well supplied and market fundamentals do not require any additional supply from the Organization at this time ... A combination of current high inventory levels and increasing OPEC spare capacity, which is expected to reach around 15% in the second half of this year, means there are adequate supplies available to cope with any upward revisions to oil demand forecasts.”

Demand and Supply expectations

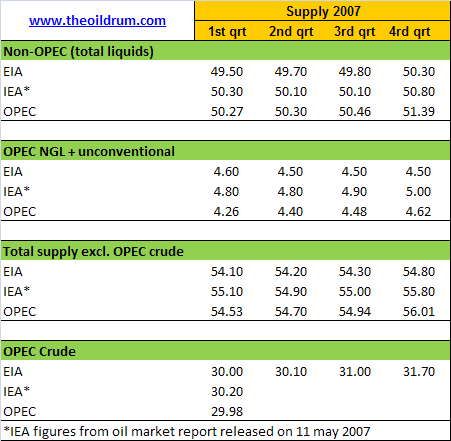

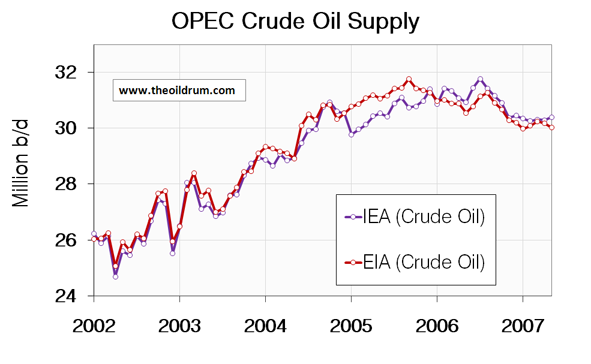

The difference in the OPEC vs. IEA/EIA discussion can be seen in both supply and demand. OPEC expects non-OPEC supply to increase with 1 million b/d from the 1st to the 4th quarter of this year. The EIA expects an increase of 800.000 b/d and the IEA an increase of 500.000 b/d.

World demand expectations differ by 400.000 to 500.000 b/d in the IEA/EIA forecasts from the OPEC forecast for the 4th quarter.

Based on the figures above, OPEC thinks that there is no need to increase production based on their expectations for supply and demand. The IEA thinks that OPEC should increase production with 1.50 million b/d from present levels of 30 million b/d. The EIA figures are even more drastic, requiring OPEC to increase production with 2.60 million b/d from present levels. In their forecast they already have incorporated the rosy expectation that the cartel increases production with 1.7 million b/d!

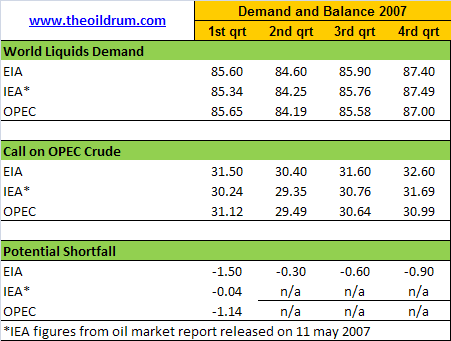

Current inventory levels

Regarding high inventory levels the OPEC cartel is correct. Total OECD crude oil stocks reside at a level of 960 million barrels. Quite near the highest level in the past five years of 996 million barrels reached in march 2006 and far above the lowest level in the past five years of 842 million barrels reached in September 2002. Currently crude oil demand and supply are in balance, which makes the IEA demand/supply projections for the 1st quarter the most likely. But, this does not imply that a similar situation can be expected for the 2nd half of the year.

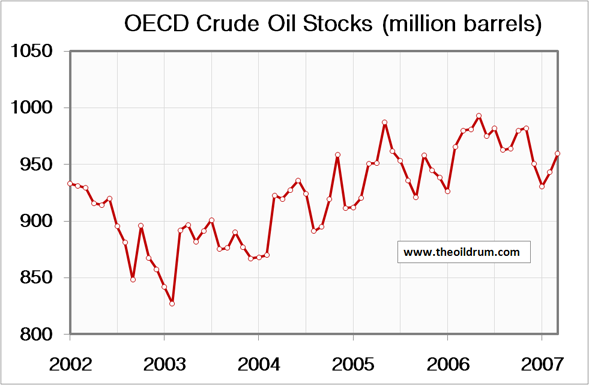

Can OPEC increase production?

The suggestion that OPEC can pump up 15% extra is dubious at best. This would amount to an increase of 4.5 million barrels per day from current crude production of 30.1 million barrels per day. All countries within OPEC except Saudi Arabia are pumping crude near maximum. Maybe, with the best of efforts, these countries could increase production with a total of 500,000 b/d. This means that most of the needed increase in crude oil production from OPEC must come from Saudi Arabia.

Whether Saudi Arabia is able to increase production significantly remains speculation. Crude oil production in the country dropped from 9.52 million b/d in march 2006 to 8.61 million b/d in may 2007. The cause of this drop could either be an artificial lowering by the national oil company of Saudi Arabia, or due to the peak in the supergiant oilfield Ghawar. This discussion has already been taking place on the oildrum for several months, of which the culmination came from Stuart Staniford and Euan Mearns with their articles on the status of Ghawar.

While we currently do not know the exact cause, it looks like we are about to find out in the 2nd half of this year, if the IEA & EIA projections for demand and non-OPEC are correct.

Sauda Arabia has peaked, so fasten your seatbelts and get ready for a real rollercoaster ride.

I am only one.

I cannot do everything.

But still I can do something

World Crude Oil & Lease Condensate Production Rate Changes

Mar 2007 world production of crude oil & lease condensate (C&C) has declined since Mar 2006 and also since Feb 2007. Saudi Arabia, the North Sea and Mexico are showing large production falls. New Buzzard oil has not prevented the North Sea from continuing to decline. Mexico will continue declining as Cantarell declines.

Many countries are showing good increases in production. However, only some will be sustainable. Canada’s increase is due mostly to oil sands and will increase further only if there are sufficient inputs of water and inexpensive natural gas, as well as easy environmental constraints. Production rates from USA, Russia, and Iraq are likely to stay constant to 2009. Azerbaijan, Angola, Brazil and Kazakhstan production rates should increase.

On balance, total production falls are just greater than total production increases. As Saudi Arabia has peaked, this situation will continue which will cause world C&C production to continue declining very slowly.

Click to enlarge - This chart will be updated when EIA Apr 2007 data is released, before mid July 2007.

In the likely event that IEA/EIA has to backtrack on their projections for possible supply growth, what happens?

Has anybody done detailed analysis, what would be estimated optimistic scenarios for increases in Iraq and African countries on the short-term, IF the security/political situation didn't hamper production?

I do not expect the security situation to improve miraculously.

This is a mere thought-game to think if there is still any significant short-term spare capacity outside KSA?

I understand the importance of KSA and super-giants in particular, but it'd be interesting to see a summary of possible capacity increases from USA's major oil importing region, which I believe is now Africa.

@Samum

Your optimistic Iraq case if there were no violence, plenty of cooperation and large foreign inflows would be an increase from 2 mb/d now to 3 mb/d in 2010 and 6 mb/d in 2020.

In Africa there is about 600.000 b/d - 800.000 b/d offline in Nigeria, which can be added on a short term basis if violence seases.

Both scenario's are very unlikely.

Why do we listen to anything that has "Information" and "Administration" in the title?

We have an agency that is going to 'wish' more production into existence, but we don't have an agency to demand less consumption.

If we bury our heads in the numbers, we can easily justify driving to work to analyze more numbers, since that is the paradigm. Maybe the OPEC countries are right, maybe they don't go far enough. Sometime, the monkey on our back is going to bite our head off. That head is the economy based on perceptions of perpetual growth.

OPEC saying that "there's no need to increase production" is some severe spin where they should be saying that they _can't_ raise production. Get ready for oil prices to go into outer space! The SUV drivers are going to get MAD AS HELL at the gas pump.

Wait as road projects incur massive cost overruns as asphalt at the bottom of the fractionating towers gets cat-cracked into "crude" to be recycled with the real crude. Buy your blacktop patch before it gets to $5/gallon! I had to use 2 pallets of the stuff to try to patch craters in a parking lot that looks like the lunar surface. I told my boss that they had better repave that lot now before it gets MUCH more expensive later, explaining how refineries are starting to cat-crack the asphalt. The 2 skids didn't even come close to filling the two largest craters, one so huge I could park my car within the confines of the largest with ease.

A comparatively smaller example of sheer waste are those grocery bags that cashiers use like they are in a competition to waste them. You know, 2 items per double-bagged bag. America uses 33,000 barrels of oil per day just to wastefully bag groceries! And they _all_ end up in the landfills. 100 million years, when intelligent cockroaches evolve, our landfills will contain all the ingredients of high-tech civilisation. Just separate it all.

Petrol prices high enough yet? Just wait!

Mad Max,

What is 'cat-cracking' asphalt, and how does it advantage refineries to do it? I've never heard this term before.

Thanks,

Jonathan

Winnipeg, Canada

P.S. Did your boss listen?

Remember, its possible the answers to both the title questions.....

(Will OPEC increase supply in the 2nd half of 2007? Or has Ghawar peaked?)

...could be "no".

======and===============

sure, Saudi could be on some sort of bumpy plateau or near peak. Also, alot of what I read assumes..i spose as we all do..that the current governments-of-the-day will continue to hold. But somewhere along the line, the Saudi monarchy/gov't may (will?) fail and then who knows what will happen, i.e. the "above ground factors" that folks are talking about in Nigeria oil situation these days

YES! :-)

But unlikely, as you say the political situation in KSA is dangerous, so to withhold oil at the risk of destabilizing the WORLD economies and which could reduce the prices of oil is a very RISKY play...unless you can't raise production and know it won't reduce the prices(ie. supply shortage).

Equally well the answer could be YES.

I, like quite a few others, believe SA locked in surge production capacity to produce maybe 2-3Mbpd of extra production, but only for a short period. Averaged over reasonable periods the trend can still be down, but with the occasional political induced 'spike'.

Its worth SA's while to create a short term constricted supply (say over $100 a barrel) to induce efficiency activities and reduce ongoing demand - then to ride to the news rescue with a surge of production. Not only do they get to be the good guys, they get to push the world demand economy towards behaviours they might have more chance meeting.

In fact, such a scenario is more likely than turning on the taps ahead of time, if we are close to a peak date.

It's worth remembering that (spare) pumping capacity reflects the amount that can be brought online within 30 days and that can be sustained for at least 90 days.

It's easy to prove the peak has not happened yet (either in KSA or the World) by having at least six consecutive months at or above levels previously established (and simultaneously proving you have the capacity to be the swing player in the oil market). For the KSA, that's 9.6 MMBPD. Globally, that's 74.2 MMBPD (C+C) from May 2005.

The "markets," quite frankly don't believe the situation will improve, as they have been in an extended contango. That may give partial explanation as to why crude oil stocks have continued to increase in the OECD.

But in terms of "days supplied in stock " the difference between the 5-year "low" (and the contemporaneous usage rate) and the current value is less than 14 hours (13.15 currently days versus 12.58 days at the "low" using C+C as the basis).

uh..... by who's definition does "spare" capacity equal production that can be brought on line within 30 days and that can be sustained for 90 days ?

I'll dig for the link but it was EIA that defined this.

http://www.eia.doe.gov/emeu/steo/pub/3atab.html

In the footnotes its defined in several places.

So KSA may not be lying about spare capacity its just not what a lot of people think it is.

Is their anyway to adjust the oil supply numbers for growth.

You would expect stocks to increase in the OECD countries because of simple demand growth. I'm not sure if this is a big factor or not.

Next I'd have to side with OPEC on this issue at least for now

given the high levels of stocks its tough to call for a increase now and they would have plenty of time to increase supply if stock draw downs become obvious. Or at least I assume they would. This leads to my next question how long does it take for us to go from well supplied to under supplied. One month two three given our current import rates.

I'd have to guess it takes several months for this to happen.

From your graph I'm guessing 3-4 months to go from over to under supplied so I would have to side with OPEC and say do nothing for several more months. I believe they said the would re-evaluate the situation in September which sounds about right.

Now the point that if nothing is done we will get price increases I think OPEC is shooting for a new firm floor price of 70+ before they release any oil if they can. So I don't think you will see them do a thing until the price is well above 70 and then we might be able to see what KSA can do but on the same hand they may do a short token increase based more on straining the fields and drawing down storage then come back and say they are comfortable at the new price. Overall I'd have to side with OPEC on this one.

Can't the situation be seen this way as well?

$70/barrel do create a lot of demand destruction outside OECD. The food truck that did not get to were it was going in Africa do not get MSM attention. OECD stocks are high because we have demand destruction in OECD as well. People buy less gasoline than expected due to high price = higher inventories.

Even at §100/barrel I would expect OECD to keep up the inventories (what is the alternative?). Reduced availability of crude and higher prise will not affect inventories in OECD at all. It will only create demand destruction, especially outside of the OECD.

If we have a HUGE physical lack of crude and prises close to $200/barrel, than maybe OECD inventories would be affected, but I can not see one good argument on why there should be a link right now between inventories in OECD and world wide use. If there is such link I would rather see it being the other way around. High price = high inventories in the OECD due to less use (because of high prise).

Except gasoline demand is up.

Yes, but not up enough to create a problem. Why do OECD build more stocks?

1. Because they belive Crude is cheep now?

2. Because they believed demand would be even greater than it became?

3. Unknown factor?

4. Unknown unknowns? (Thanks Donald)

For me it is abvious that OECD can handle §70/Barrel, but the price increase must have led to demand destruction somewere. That demand destruction might mean that the increase in crude sales is less than it had been at say $30/barrel. It does not have to be a decrease in use for us to have demand destruction.

Do the poorest people on earth really buy as much oil know as they would have at $30/barrel?

For me it is obvious that OECD can handle $150 oil. Or $250 oil. But not the rest of the world. That is, as long as you can *get* the oil you want at those prices.

Cheers, Dom

Munich

Exactly!

And that is why OECD inventories have very little to do with how well the world market is fed with oil from OPEC.

OPEC is putting up a smokescreen here, or do any TODers have any good arguments to counter that?

There is no way to know with ironclad 100% metaphysical certainty what OPEC is up to. We should instead look at various scenarios as more or less likely. For example, anybody who claims to have full knowledge of Saudi Arabia's reserves and production capacity has no credibility IMHO. We have to live with the fact that there are many things we would like very much to know--but which cannot be part of our knowledge but rather only opinion, more or less supported by facts.

Facts NEVER speak for themselves. Facts must be interpreted in terms of theory or models, such as Hubbert's Peak. Where we differ on TOD is not so much as to "facts" but rather as to the interpretation of these facts (e.g. Westexas's vs. Robert Rapier's interpretation).

Agree, but I still do not get why OPEC says:

"We do not need to increase the supply, since the OECD stocks are in good shape". I do not understand the logics here. I can not see the link.

It does not have to be a smokescreen of cource, it could be just good ol' stupidity, or can any of you explain this argument from OPEC for me, i.e. it might be my own stupidity that comes in to play here...

My hunch is that OPEC wants to keep crude in the sixty to eighty dollar range; in other words, they do not want to increase output. Whether they could increase output if they wanted to does not matter in the short run if the case is such that they do not want to drive prices down by allowing output to increase.

Agree again, BUT DO YOU UNDERSTAND THE OPEC ARGUMENT regarding OECD stocks? I do not! Does anybody?

No it makes no sense. As long as the oil markets are in Contango the natural move is to buy and store. Effectively hoarding oil. You have to look at the price. OPEC is not happy with the what they now consider a bargain price for oil and they want it higher. I've posted a few times that the last thing we will see before TSHTF is low oil inventories in OECD countries and it will be at far higher prices than today.

What I think is happening is OPEC is testing to see of non OPEC sources can deliver or if OECD stocks will go down. The reason is very sinister they want to repeat the 1970's embargo and get rid of Israel once and for all. At the moment they are a bit peeved because its not clear that a embargo would be devastating.

I'd suggest you give it a year or so and the political goals of OPEC will become clear in any case I fully expect another Arab embargo in the next few years.

I think they're well aware of PO and they're keeping us supplied until TSHTF. The battle between Islam and everyone else is a chess game...a marathon, not a single move game or a term-by-term race. While Iran openly admits they'll play their oil weapon when they see fit, OPEC has kept their overall strategy under the radar.

____________________

MySpace.com/ziontherapy

I think they're well aware of PO and they're keeping us supplied until TSHTF. The battle between Islam and everyone else is a chess game...a marathon, not a single move game or a term-by-term race. While Iran openly admits they'll play their oil weapon when they see fit, OPEC has kept their overall strategy under the radar.

____________________

MySpace.com/ziontherapy

What battle between Islam and everyone else? There is certainly an attack on Islam by everyone else, especially Western zealots and fundamentalists. Don't confuse the mugger with the victim. Islam is the victim not the aggressor.

Let's get things the right way round. During the European crusades against Islam in the middle ages, Islam was also portrayed as the aggressor, whereas in reality it was the victim of the barbarous crusades.

I think you will find the real enemy and therefore the "real battle" is much closer to home.

Triumvirate of collapse - Economy, Ecosystem, Energy

I try to stay out of political debates but this crap is so far out in left field I must comment. The three thousand people who died on September 11, 2001 were not muggers. How dare you suggest such a thing!

What happened one thousand years ago is not pertinent to this discussion. You may as well agree with those who say we owe money to the ancestors of slaves because our ancestors held slaves. At any rate the crusades were driven by religious fanatics, just as all Islamic terrorism today is driven by religious fanatics.

I agree that the Jews should have stayed out of Palestine, but that is now water over the dam. Neither you nor I had any say in that decision and we should not have to suffer the consequences. Bombing inniocent people becase of past errors is no way to settle differences.

Islam is a religion that believes that the infidel, (anyone not a Moslem), should be killed. The Koran divides the world up into two worlds. The world of Islam and the world of war. All the world is to be converted to Islam or be killed.

Now I know moderate Moslems do not agree with that position. But deep in their hearts most of them do. It is holy writ if you are a Moslem.

Follow the news out of Britain today. They are marching in the streets. They wish to make the law of the Koran the law of Britain. And they don't care who they have to kill to accomplish that goal.

Ron Patterson

"Nobody can just write what he thinks without proof. But we have real proof that that the story of Adam as the first man is true"

"What Proof?"

He looked at me with disbelief: "It is written in the Koran."

Science and Islam, Discover Magazine

The whole "does Islam preach killing of infidels" thing has been done to death all other the internet. Here's one link:

http://qa.sunnipath.com/issue_view.asp?HD=7&ID=9801&CATE=3000

It's not particularly difficult to "prove" that Judaism preaches the same thing by pulling particular passages out of the OT. Christians tend to let themselves off the hook by claiming that the NT showed a "new way" of love and tolerance etc. etc.

All mono-theistic religions are essentially "supremist" and destructive. In this current day and age, it may be that Islam has more than its fair share of followers that take this to an extreme, but that hasn't been true in the past, and there's no real proof that Islam is inherently worse than Judaism or Christianity in this regard.

I'm sorry, but I'm afraid the West are the muggers, and there is nothing historical in this statement. We are the ones who have been putting Islam on the spot by continually pushing our ideals, our economics and our values upon them (not to mention dictators, regimes, etc.).

Nothing political or religious, just an observation. I see no occupation of the West by Islam, no military bases or armies on our land, no fleets off our shoreline. In terms of scale the agression is practically all one way. The West is the aggressor, whether by military force, economic force or simply by pushing its culture upon a people who do not want it. Just look at which way the military convoys are going.

And don't put 911 on me as though it has some special meaning, it was just another atrocity amongst many, committed by people whose motives are mostly unknown.

I have no connection with Islam, but cannot abide the propagandist nonsense that there is a clash of civilisations or other such rubbish.

Triumvirate of collapse - Economy, Ecosystem, Energy

No particular disagreement here, I was merely looking at the issue from a comparative-religion standpoint.

Much as I have no time for religion, it's pretty hard to demonstrate that the U.S.'s military incursion into the M.E. has much to do with any sort of Christian superiority complex (though I'm sure it exists).

I am, on the other hand, prepared to defend the military imposition of democracy in extreme cases, providing it's done with that intent and done properly (as was quite obviously not the case in Iraq).

There are some 1 billion Muslims.

Undoubtedly any generalizations about beliefs about such a large group embedded across such a wide range of cultures and soceities is likely to be fraught with error.

Are Muslim countries more likely to support genocide? In the most recent incidents of geneocide the perpetrators were Christian (Rwanda and Bosnia), Marxist from a predominately Buddhist culture (Cambodia), and Darfur - where Muslim Arabs are persecuting Afrcian Arabs.

The largest scale genocides of the 20th century were carried out by Christian nations (Germany), Marxist nations with predominately Christian backgrounds (USSR) and Marxist nations with Confucian/Taoist cultures (China).

I think it is much simpler than all this stuff about religious zealotry. First they fought to force the Russians out of the Afghanistan (with our help) and now they are trying to do the same thing to us. It’s a good old fashion anti-colonial struggle. We should take their word for why they oppose us.

We have a very heavy footprint in their part of the world because we need their oil and gas. (You should know. You were part of it.) That effect is not surprising. But it is also not surprising that many people do not like us being there. We have brought about wrenching dislocation of their society and culture. Just imagine how people in the US would react if people from the Islamic world moved into the US in comparable force to our presence there and brought about similar changes here to our society and culture. Why do you think we have a second amendment? We would try to throw them out too, as we have in the past to much more familiar people.

Except people are moving into the US all the time and changing its society and culture, and have been for thousands of years.

Yeah, because they are relatively few compared to what is happening in the Middle East and most of them share much of our cultural heritage, they are not totally changing the nature of our society and violating our culture. They are successfully assimilating. It would be better for Saudi if that were happening there, too. But it's not. Its not a question of what should be happening to them. It is what is happening to them.

Thousands of years? What was 1776?

Accepted, technically before 1776 it wasn't the "U.S." - let's say the Americas.

Of course I realise there's a significant difference between the general pattern of "intrusion" into the Americas and the recent pattern of Americans into the M.E. Some Native American tribes might beg to differ, of course.

Note also that most M.E. countries have social structures and laws that make it virtually impossible for outsiders to 'assimilate'. We have a U.S. presence (civil and military) in Australia - it also exists in the U.K., Japan, and various other nations, all of whom (for the most part) are happy to have it there.

Especially in 1492.

I think they were testing the world production by 2005/2006, and are acting now. That could explain KSA dropping production.

I also think that it is about money, not Israel. Altough, Israel is about the US controll, so it may be involved.

Anyway, above ground factors (caused by the proximity of the geological peak) are a very nice explanation for what we have now. That would explain OPEC working into increase its market-share (with more countries), if it was a geological peak, OPEC would have no reason to grow. But above or below ground doesn't really matter, it's peak both ways.

Israel is the political whipping boy used to keep a restive populace inline attacking Israel is the easiest way to ensure that you have a lot of popular support. Thus when two conditions get closer one the world is obviously dependent on OPEC for any growth in oil supplies and the populations are restive you will see another Arab Oil Embargo ostensibly to force the destruction of Israel. In reality it will cause prices to increase dramatically and also rally the population.

Kill one dove with two stones :)

So yes its about money but its also popular politics and it probably will be a partial embargo you still need to make that money.

In general your right most of the Arab world probably does not really care about Israel outside of their usefulness as the best whipping boy on the block.

Historically, OPEC has used stocks levels in order to assess the equilibrium between supply and demand.

Check this article:

Low Inventories Or Stable Prices? You Can’t Have Both

BTW, there is also an interesting interview of William R. Edwards:

http://www.opec.org/home/Multimedia/videos/2006/142%20Meeting/Mr%20Willi...

But US oil inventories are a measure of nothing except expectation that prices might be lower in the future if they are low. We import gasoline and other finished products so we don't meet internal demand with our oil imports. So the US is going to have zero finished product imports long before its will have low inventory as long as the market is in contango.

I can't see US oil imports as an effective measure of anything except a contango market. The fact we continue to not fill the SPR is telling.

So this statement effectively means OPEC has no plans to ever increase production such that it will offset world decline.

They may increase production sometime in the future who knows but it won't be enough to make of for non OPEC declines. So ready or not it seems the decision has been made that peak oil is here now all OPEC might be able to do is effect the decline rate.

I think it makes good sense if the following are true:

1) They really don't care that much about small 3rd world countries and their people (at least not enough to sacrifice their own benefit - like the rest of us).

2) Only OECD countries have the power to put economic, military and political pressures on OPEC leaders, and they want to keep them happy.

3) To keep prices high, they can't cater to the "little guy" who by definition can't afford the high prices. They have to stick with the wealthier, big customers.

So in the end they are only really invested in keeping OECD happy, not everyone else, and their statements reiforce this.

Don, full knowledge and preponderance of evidence are two entirely difference things. Absolutely no one here claims to have full knowledge of anything. We do however claim to have examined the evidence and come to a conclusion as to what the preponderance of evidence supports.

The folks at the Oil Drum have gone over Saudi production, especially Ghawar, from top to bottom over the past six months or so. And I do believe they have a tremendous amount of credibility.

You have been gone for some time and apparently have not followed this debate or read any of the threads that dealt with Saudi production. You should review some of the data posted here before making such brash comments.

Ron Patterson

I did read the debates on Saudi oil that you refer to: They were excellent, outstanding pieces of research and reasoning.

However, I think Saudi oil is a puzzle inside a mystery inside an enigma. In other words, my reading of the data is that it is not sufficient to come to more than highly tentative conclusions.

For all we know, CERA is right. (Not likely, but possible.)

Don, you are making Saudi oil far more mysterious than it actually is. I spent five years in Saudi working for Aramco, (1980 to early 1985). Peak oil wasn't even on the radar screen back then and neither was Saudi reserves. But I did learn a lot about how the Arabs work and think.

There is not a snowballs chance in hell that Saudi has 264 billion barrels of reserves. The SPE papers reveal far more than than a tenative conclusion as to the condition of Saudi's ageing giant fields.

Of course one could come to the conclusion that all those engineers who wrote all those papers were just lying, in an attempt to deepen the mystery. You can believe that is a serious possibility if you wish but I must disregard that possibility.

For God's sake man, the data is right there before your eyes. Simmons saw it, the SPE authors saw it, and most important of all, the data and Saudi actions support the concept that future Saudi oil production is in deep doo-doo.

Wake up and smell the coffee.

Ron Patterson

In your opinion, CERA has no credibility. I make no claim to knowledge, though I am very suspicious of Yergin and Co.

Speaking as one outside the oil industry but as one who is sophisticated at analyzing quantitative data, my inclination is to believe that your interpretations of the data are correct. But this belief of mine is highly tentative and subject to revision.

If you want a subjective probability, I'll say that I think there is more than an eighty percent probability that your position is essentially correct. But I'll have to give CERA that ten percent probability--because those folks are neither idiots nor ignoramuses.

Ron:

I agree with you (and have heard the same thing from people I know that worked for Aramco. There are far too many miracles that have to take place to believe that Saudi Arabia has the capacity to be the swing player in all this for much longer, if it all.

Sometime back on TOD, I observed that the Hubbert Linearization curve for the KSA and Ghawar had the "dog-leg right" look to it, and from the standpoint of every other major oil basin that has gone through it's peak, that's a really bad sign because many of them show this same characteristic for 3-8 (annual) cycles before going over the falls.

In fact, the EIA (and I suspect the IEA projections) are all about creating and sustaining this "dog-leg" condition for the next 30 or so years. I think it's a fair question to ask if past performance does not support the assumptions, what "change" occurs and where to change the performance curve?

Starship, the Saudi dog-leg up was for the years 2003, 2004 and 2005. Saudi, and OPEC did reduce production in 2001 and 2002 but began to ramp up to full production in 2003.

A new Saudi linearization which includs 2006 data will show the dog-leg turning sharply downward. And when the 2007 data is eventually added the dog-leg downward will be even more pronounced.

There is no way that the EIA or IEA can fudge the data enough to keep the dog-leg from turning sharply downward.

Ron Patterson

"There is no way that the EIA or IEA can fudge the data enough to keep the dog-leg from turning sharply downward."

I know that and you know that. And yes, my linearization shows the same downturn (over the falls) as production was declining well before OPEC reducing export production quotas (as has been well documented here) in 2006. Might there be a little life left in that leg? Maybe, but history tells us it won't be for very long.

But besides a number of us whom follow such things (we are the persistent whine of the wind in the wires that is getting louder and bit more noticed) it will take sucha shock to get people to notice, and then only in disbelief . We've raised the hurricane warning flags and taken the first steps into the "new" future. But that future is pretty empty right now as the various parties hide stuff in plain sight. As the CNN series states "We were warned."

"Above ground factors" affect production, but to what degree will the big producers use production to affect "above ground factors".

It wouldn't be a stretch for KSA to use production to make their voice heard if for example they want the US to take some specific actions in Iraq.

Never mind Russia when it comes to possible action in Iran.

This was posted by Dave Cohen over on EB and may shed a little light on this topic:

A paradigm shift

by Dave Cohen

Mr. McGuire: I want to say one word to you [about your future]. Just one word.

Benjamin: Yes, sir.

Mr. McGuire: Are you listening?

Benjamin: Yes, I am.

Mr. McGuire: Plastics.

— from the movie The Graduate

In a recent personal communication sent to ASPO-USA, former Saudi Arabian exploration and production head Sadad Al-Husseini made the following statement.

Saudi Arabia's production declined 8% in 2006. This is a fact which requires interpretation, and there are two opposed views: they can't or they won't raise exports. Matt Simmons has doubts about current Saudi capacity, most prominently raised in his book Twilight in the Desert. At The Oil Drum, Stuart Staniford's analysis appears to buttress Simmons' position, but is hampered by a lack of current production data from Ghawar, which the Kingdom will not reveal. The "won't" position has gotten scant attention in the peak oil community. Al-Husseini's statement points to a fundamental reorganization of the world's future oil supply. Downstream investments in the Persian Gulf states lends support to his view that these producers will exert greater and greater control over their fossil fuel resources in the future.

The paradigm shift reflects the historical trend toward resource nationalism. IHS Energy's Pete Stark summarizes the change.

Considering that governments and NOCs control more than 80% of the world’s remaining oil reserves, are expanding and upgrading refineries and infrastructure, and are developing gas resources, the effect [of the shift] is considerable. But that has not always been the case. In the past, when oil prices were low, investments in exploration dropped, and governments were eager to create incentives to attract investments—including reducing tax rates and state participation, or providing royalty relief.

All that changed in 2003 when oil prices began to soar....

The core issue for the large consumer nations is how quickly resource holders will produce oil & gas to meet their burgeoning demand. The IEA and other OEDC representatives constantly call on OPEC — with ever greater acrimony and desperation — to increase production (graphic below, left). The key question, as energy economist Ferdinand Banks notes at EnergyPulse, is why should they?

On this topic I think it best to pay attention to something that Matthew Simmons of Simmons & Company – a Houston-based investment firm specializing in oil – once said: "Too many people are looking at OPEC through the rear-view mirror. There’s a resolve in their eyes never to go back to the days of cheap oil." Not just in OPEC’s eyes but in their investment policies, which make it clear that they feel that it is in their best interests to refrain from bringing too much additional oil to market. This is a good place to ask one of my favorite questions: would you if you were in their place? Accordingly, the optimal development strategy for a country like Saudi Arabia is to pay more attention to the refining of oil, and the production of petrochemicals.

A paradigm shift means that OPEC nations are determined to never see the low prices of the late 1990's ever again. The Call on OPEC? (published here, May 2, 2007) calls attention to the obvious fact that the OPEC nations will always act in their best economic interests. This conclusion would seem self-evident, except that the IEA apparently has not absorbed the lesson, as Al-Husseini says. Further to the point, there is no OPEC desired price band at the moment. It was also argued, based on some reasonable assumptions, that at the current OPEC Basket Price — $67.90 on June 18th — Kuwait, Saudi Arabia and other OPEC states are making as much money leaving some of their oil in the ground as they would if they were producing it, which would only lower the price.

This conclusion runs counter to James Hamilton's reasonable assertion, made in June, 2006, that Saudi production did not fit "the classic story of a monopolist cutting back production in order to raise the price." However, Hamilton also says "while I believe the Saudis are quite capable of letting output drift down in order to try to defend a price floor, wherever such a floor might be, it's not $70 a barrel." A year later, on June 15, 2007, the Brent price is $71.84, and has hovered around the $70/barrel mark for the past month, rising from low $50s since the beginning of the year. There is little evidence that current price level has stifled world oil demand, although that demand has been redistributed from the poor to the wealthy. (See Africa and Central America.) The desired price today is whatever OPEC thinks the market will bear, not the fair price of $60/barrel back in 2006. This is a dangerous game because the downward demand pressures on consumer economies created by even higher prices (about $80/barrel) could be severe.

Oil consumers expect Middle Eastern nations to invest heavily in upstream activities to keep the oil flowing. In fact, major investments are being made, in the downstream refining and petrochemical sectors. The numbers are staggering, as compared with upstream investments, according to Ali Al-Naimi.

Based on the outlook of growing demand for their oil and gas, by 2011 the countries of the Middle East will invest some $94 billion in their oil and gas upstream sectors, more than half of which will go to expand oil production capacity. This is in addition to more than $240 billion of investment in the mid and downstream oil and gas chains and petrochemicals...

Of the $70 billion Saudi Arabia is investing by 2012, only $18 billion is for upstream expansions. Nancy Yamaguchi's Middle East petroleum sector: growing in all directions (Petromin, March 2007) provides an overview of refinery expansions in the Middle East (graphic, left). Saudi Arabia has ambitious plans to create more refining capacity, including the Jubail and Yanpu export facilities.

The Middle East push into petrochemicals rivals the refining investments. Saudi Aramco has a joint venture with Japan’s Sumitomo Chemical to build a complex at Rabigh. The Gulf Cooperation Council (GCC) nations spent almost $70 billion in 2006, with Saudi Arabia leading the way at $44 billion (Gulf News).

The Persian Gulf states are expanding downstream capacity to meet rising internal consumption of refined products (see Yamaguchi), but that's only a small part of the story. Due to their substantial comparative advantage, refining and petrochemicals is where the money is. Oil and condensate can be provided for refining at below market costs. Saudi Arabia can refine its own heavy, sour (sulfur-laden) crude. Cheaply produced naphtha or natural gas or gas liquids can be used as a petrochemical feedstock for olefins (e.g. ethylene). From the Gulf News (link above) --

Investment in petrochemical facilities is driven by availability of cheap feedstock and the region's proximity to large markets of Asia such as China and India.

More than 30 million tonnes per year of ethylene capacity will be added in the Middle East by 2012-13, according to London-based Chemical Week.

The new capacity is also likely to put pressure on global petrochemical markets. Steam crackers coming onstream from 2008 in Kuwait, Qatar and Saudi Arabia will cause an imbalance in worldwide supply and demand, lowering petrochemical plant operating rates and leading to a softening in prices, it quoted industry analysts as saying....

General Electric has already capitulated, selling its petrochemicals division to Saudi Basic Industries for $11.6 billion. The Kingdom's future is plastics.

Saudi Arabia is expanding their refining nameplate capacity to 3.6 million barrels per day. It is hard to reconcile such large capital expenditures in a context where the Saudis have diminished expectations about their future oil production. They will not want that expensive capacity sitting idle, nor the petrochemical industry upon which it depends. The Persian Gulf countries are planning for a future where global oil spare capacity stays tight and refining margins remain high. They will increasingly export gasoline and ethylene, not crude oil.

Ferdinand Banks argues2 that "OPEC is in the driver's seat." The paradigm shift strategy optimizes production rates over time, protecting the longevity of the resources while keeping prices high. Banks believes OPEC's best position is one in which non-OPEC supply price elasticities are falling just as OPEC controls a greater and greater market share. This seems to be what is happening. Angola, one of most successful non-OPEC producers, joined the cartel this year, a move which raised their market share about 2.5% all at once. Meanwhile, non-OPEC production is struggling to rise above declines. Lower downstream product costs allow sales at global market prices, a market in which OPEC can expect to exert more and more control over those prices. It looks like a license to print money. Those assets will be used to diversify the economies of the Persian Gulf oil producers.

If non-OPEC oil is on the verge of peaking, and OPEC output is going to be limited for macroeconomic reasons (Saudi Arabia, Kuwait), political reasons (Venezuela), lack of investment (Iran, Venezuela) or disruption (Iraq, Nigeria), then the near term peak of world production is all but assured. If Saudi Arabia can't manage natural declines at Ghawar at this time, and must wait a few years for additional capacity, declines there will merely speed up a liquids peak that appears inevitable in any case. Many in the peak oil community have not paid enough attention to so-called "aboveground" factors. The "paradigm shift" Al-Husseini speaks of is likely to forever change the world oil supply balance.

1. The U.S. Congress provides an amusing sideshow to the argument. They saw fit to pass a bill making it illegal for OPEC to withhold "our" oil & natural gas from the world market (NOPEC). A well-informed colleague voiced his eminently reasonable opinion that Congress is currently living in La La Land. This is not good news.

2. Bank's paper Economic Theory and OPEC is unpublished. Contact the author to arrange to see a copy.

ASPO-USA is a nonpartisan, proactive effort to encourage prudent energy management, constructive community transformation, and cooperative initiatives during an era of depleting petroleum resources.

A brilliant analysis, and it makes perfect sense to me.

I agree, a very useful contribution.

The very idea that a peak could occur in the near future can be expected to change the behaviour of the major players. Self-fulfilling prophecy. You realise that you are sitting on something finite and very valuable, that hoarding is the smartest strategy.

If Saudia Arabia was doing fine right now, really did have a few million barrels per day of spare capacity, but knew they were going to peak in 5 years time, wouldn't it be in their best interest (and ours too, actually) to hold back a bit and get people used to higher prices and limited supply?

Turn a geological peak into a managed plateau?

If we are to believe in things we cannot see or touch, how do we tell the true belief from the false belief?

misuse ..

He can't be talking about chemical basic materials from which medicaments, for instance, are made. Nor about plastic which to some extent is recyclable, even in the face of billions of thrown away plastic bags that decorate the landscape all around the Mediterranean.

He must be talking about .. yes: burning oil products in internal combustion engines. Burnt in a moment, gone forever, dissolved into billions of tons of carbondioxide.

"He must be talking about .. yes: burning oil products in internal combustion engines. Burnt in a moment, gone forever, dissolved into billions of tons of carbondioxide."

Not only that, but the bigger question begs to be asked: "Burnt to do WHAT, exactly?"

In other words, where is everyone going so fast and so inefficiently that they not only don't question how they get there, but they don't question what it costs or whether the result is worth the risks.

The Arab world has a long history of deep thought and distrust of Western philosophies. The fast buck has overridden that distrust for a time, but perhaps they are starting to question whether they shouldn't have fought harder to keep us out in the first place, if it is costing them a planet to live on, warring or not.

I don't know why they havn't started developing downstream industries before -they have the cheapest feedstocks and are hardly banana republics. If we are nearing PO outside OPEC then they get their money whether they pump more or the same anyway.

And they know that China, US, etc. will eat up as much as they can supply at whatever price.

We are now in for decades of steadily rising prices with the OPEC Nations increasingly climbing the food chain of what is provided. Goodbye SUV and suburbon MacMansion...

I have had my differences with Dave Cohen on one or two occasions, but the above is to me an absoutely correct reading of the situation, and text I intend to save. An elagant reading of the whole situation, the REAL broad scope of the "peak" issue. Great job Dave)

(see my "Fly On The Wall" satire on down this thread for my almost exact same take as an ironic "tale")

As things are now developing, it matters less and less whether we are at true "geological" peak or not. The shift is no moving away from growth in fossil fuel consumption ON EVERY FRONT. Geo-political, environmental, economic, social and philosophical. We are on the cutting edge of the greatest revolution since steam overtook sail, animal and water power (and that has not been that long ago, my grandfather's farm as late as the 1950's had both water wheel and working farm animals (mules), and my grandfather himself grew up handling ox in the timber woods)

The error is: this revolution is being portrayed as a BAD thing. Folks, IF, and that's it, IF we play this well, we are looking at the greatest leap forward in human history. But we have to BE WILLING TO ACCEPT AND GUIDE THE CHANGE. The A&M schools of the 1800's brought in the age of mechanics and engineering down at local level. The schools taught it, the shops built it, the customer read about it, learned it, bought it, used it. This is what we must do if we do not intend to be left behind by world competitors who will adapt to this new era and thrive on it. Our children's futures are at stake.

Oh, and one more thing: Forget the Ludditism. It didn't work then. It won't work now.

RC

Remember, we are only one cubic mile from freedom

Lud·dite(ldt)

n.

1. Any of a group of British workers who between 1811 and 1816 rioted and destroyed laborsaving textile machinery in the belief that such machinery would diminish employment.

2. One who opposes technical or technological change.

I think we will BE the machines!

Every solar panel you buy is equal in energy to one slave. Which would you rather have in your backyard...

If the slave were female, eighteen, built like a brick..... Well, you get the idea. I had damn well rather have the slave.

But alas, I am sixty-nine (today) and a radical prostatectomy five years ago has left me with nothing but memories of a sex life. However I would still rather have damn the slave. I am sure I could think of something to do with her. My age, 69, comes to mind. ;-)

Ron Patterson

Happy Birthday Ron.

Enjoy your posts.

Leanan,

Could you please edit Ron's prostatectomy post above? This is way too much information, even for TOD.

wHoOpS

RC, whereas I agree with a lot that you say, unfortunately the demise of the Luddites has brought us to our current predicament. A victory by the Luddites would have created a very different World than the one we've currently inherited. It would have produced an industrial revolution with a human face and contained the capitalist genie within Pandora's Box.

No system should take precedence over human needs. There is a place for industry, I would be the first to argue for it, but it must never be elevated above its fundamental requirement to service humans. Currently humans service an unsustainable industrial system which needs to end. Creating a different industrial system for humans to service is also not a good idea.

Humans must stand against inhuman systems, the Luddites were exemplary humans in this vane. If we are on the eve of a new revolution, lets make sure it serves humanity. Acknowledging the Luddites were right would seem to be a necessary step in getting it right this time around.

Triumvirate of collapse - Economy, Ecosystem, Energy

Hello, Burgundy.

I'd like to point out that anyone who claims that he knows what would have happened "if" the french revolution or smth like that never happened is not going to be listened at all.

Specially when one is defending a looting group that was simply protesting about the harsh future machines were going to send them, by rendering them jobless. Rethorics about inhumanity were mainly tools they used, not primary concern.

They were against free market as well. Are you implying that you are against free market and industrial breakthrough? If so, please elaborate. But I can sense a marxist leninist from miles away.

Greets.

We have spent the last 80 years replacing people on farms and in local factories with petroleum and electricity to 'relieve' them of the 'burden' of physical labors. In the meantime, they pay thousands of dollars to go to a health club to 'work out'.

And you think the Luddites were absurd?

"industrial breakthrough" is not the same as technological advancement. Modern organic farming is technological advancement, the Milwaukee Road electric trains were a technological advancement. Interstate highways, pesticides that only work for a few generations of weeds, GMO foods that only increase profits, not production, and Microsoft Windows are industrial applications of technology that hasn't been refined properly. "Productivity Increase" is the same as saying "replacing people with oil" in a factory. The only ones who profit are the ones already on top of the pile of dead bodies.

"free markets" don't exist except where deals are done in person through barter. Otherwise, the value of the work one person does is determined by external factors other than the things they or people they know need.

I'm so far Right, I'm now considered Left, and John Birch looks pink.

Ask any farmer who wants to sell fresh, raw milk whether there is a 'free' market in the United States. Maybe when vegetables are declared illegal, and we set up a Carrot Czar, then the real value of goods will be paid to the source of those goods.

I think the Arabs are starting to realize they should have made the IOC's put more refineries on their property so they could get something closer to retail price for the resources they are taking from their children's future. When they use the inventories to determine export levels, they are saying that they have decided to speculate the speculators. It may work, or it may simply create a horrendous feedback in the system which makes people reduce demand because of fear of control loss over supplies.

The question comes down to whether demand destruction will coincide with economic destruction, or precede it. Planned descent is always better than free fall from 'free' markets.

Maybe we could call it "Consumption Redeployment".

Interesting article, worth the read. I have two remarks.

Because they have an exploding population, a large part of which is unemployed, to keep satisfied. Imagine how that strains their budget. I read an article which proposed a connection between the instability of a country and low average age.

I actually think that policy could be a sign they prepare for a future without oil. And a smart policy that is. It has been said that natural gas is different from oil in that it can't be transported as easily. The Middle East has huge natural gas fields they never exploited. If KSA is smart they invest in fertilizer factories and produce the stuff from NG. Fertilizer is easily transportable, and the factory creates jobs and diversifies their dangerously monlithic economy. Many chemical manufactoring processes depend more on NG then on oil.

I agree with that statement, OPEC is testing the world to see how well our economy are coping with high prices.

Saudi Arabia got addicted to high oil prices for good reasons, their state budget balance is now positive for the first time in decades.

Why should they increase production if 3 mbpd at $60 is as profitable as 9 mbpd at 20$/barrel? They know they have squeezed the low hanging fruits (Ghawar), now they have to manage their assets and makes what's left as profitable as possible.

"...OPEC is testing the world to see how well our economy are coping with high prices."

The problem is, how do we measure how well the world is coping? If households borrow more to compensate for rising fuel prices (or dip into existing savings) any adverse effects on GDP may not be apparent for some time.

Australians now floating in a record sea of debt

Britain could be facing a major debt crisis, the country's top banker has warned.

If they're unable to increase production it's one thing; willingly withholding production to keep the price high is asking for trouble.

There seems to be a message emerging from both Saudi Arabia and Russia that they may "choose" not to raise their production.

If your goal is to extract maximum economic advantage from a depleting resource in a post-peak producing region, do you admit that you can't increase your production--thus vastly encouraging extreme conservation measures and alternative energy supplies--or do you claim that you are "voluntarily" cutting production, so that you can always offer the possibility of higher production, in order to discourage expensive conservation and alternative energy program?

The latter, of course.

And additionally, as a further precautionary step, you may start to talk about biofuels affecting your propensity to invest into exploration etc.

This assertion (production declines are "voluntary" and/or due to "above ground factors") is also not a bad strategy from the point of view of a major oil company--if your only goal is to maximize the economic benefit of a depleting resource.

The problem of course is that one has to talk politicians out of punitive taxation as the trillions and trillions of barrels of oil fail to appear as higher crude oil production.

Now, on the consuming side of the equation, home builders and auto manufacturers are solely focused on selling the next McMansion and SUV, and people in the MSM want to hold on to their jobs (by selling advertising).

So, for Joe Consumer in the middle of the "Iron Triangle," the prevailing message getting through is to continue to borrow and spend.

Edit: BTW, this makes you wonder about the motivation of the parade of cornucopians posting on TOD constantly attacking the Peak Oil concept. As I have said several times, if you follow my ELP advice, and I am wrong about Peak Oil and Peak Exports, what have you lost by downsizing and living more simply? Or, as I have said before, who among us now wishes that they had bought a 100% financed $500,000 McMansion and a 100% financed $50,000 SUV on January 1, 2006?

Everything, perhaps.

The construction plan of humans requires all that "more". It's the legacy of the stone age.

Less goods - less women - less progeny, to put it in simple words.

Jeeesh! What a butload of crap!

Everytime I downsize my lifestyle, I get happier. Less problems to be concerned about.

Now that explains a lot to me why the most poor have the more babies. What a mindless pseudo-darwinian say of you! It's cultural, not biological!

Everytime I downsize my lifestyle, I get happier. Less problems to be concerned about.

The same with me. I live a pretty simple life (no car, for example, and my personal needs are moderate). I totally agree that it's worth questioning a lot of all that stuff we are offered in the ads every day, and that a better life virtually requires owning less gadgets and geegaw.

But most people around me do not. From young age most of them dream of ever bigger cars, for example. More money, bigger houses, longer vacation trips etc.

It's cultural, not biological!

It's both.

This might be a false dichotomy. If the Saudis (and possibly all of OPEC) is moving away from oil as transportation fuel, and towards petrochemical industrial production, then motor fuel conservation is not a real impediment.

Westexas,

According to your export model, when do you anticapate a 10% decline from peak level of exports?

Flavius Aetius

In regard to my simple model, which assumes that consumption is 50% of production when production starts falling, we would see a net export annual decline rate of 16% per year for about 4.5 years and then a net export annual decline rate of 37% per year for about 4.5 years. If we average out the decline rate, it's in excess of 20% per year, but note that the export decline rate would accelerate with time.

For the top five (half of world net exports in 2006), in 2006 their consumption was 25% of production.

If the top five's production declines at 5% and if their consumption goes up at 5% (the 5%/5% assumption), their decline in net exports would be about 10% from 2006 to 2007. Note that several other smaller exporters, such as Mexico, are showing steep export declines.

But over a longer time period of about 7 years, using the 5%/5% assumptions, the net export decline rate by the top five would be in excess of 20% per year--again "slower" at first, faster later.

Okay WT I sent you my model of how this will effect the world.

A quick explanation. Maybe lest call it the movable famine model. The market is effectively unwilling to accept peak oil and thus under prices oil this leads to shortages these shortages either remove a customer effectively permanently or they drive the price upwards this shortages not the market is what will set the price. Only after a shortage will the new higher floor price cause traditional demand destruction.

Using this concept and WT model. Two things happen first you get ample warning in the wealthier nations by simply paying attention to shortages and the wealth of the losers. Next you even get more warning as the bidding war moves up the food chain and shortages and low stocks signal problems through out the world. But once this is over things escalate rapidly and you go from having warnings to major shortages overnight.

The idea is right now we have say 500,000bpd of demand greater than supply this is handle by high price caused demand destruction but outright shortages are the real driving force. A region goes into shortage reconfigures and buys oil less than before but enough to avert the shortage condition. Somewhere else in the world now goes into shortage rinse and repeat. The problem is the absolute usage of oil in the poorer countries is so low that it does not take long for this movable shortage to move up the economic ladder and effect wealthier and wealthier countries. Also of course even though the average per capita usage is low in the poor countries a good bit of the oil is used by people living in these countries that have the same economic levels as the US. The per capita measurement distorts the situation since you have a lot of subsistence farmers that effectively use no oil while others live a western lifestyle.

I'm just pointing out that the competition will get fierce fast. But back to the model everyone is a optimist and will try to make minimum bids until they get themselves into shortage conditions at this point the oil is marked to market as the group under shortage condition overbids.

The key is that this shortage/over bid condition is what will set the market prices not the traders on the open markets.

Now traditional demand destruction happens at the new higher price. Someone else in the world who did not bid enough goes into shortage rinse and repeat.

The party ends when the major economies have to reorganize to remove the dependency on oil and move to alternatives thus the price of oil no longer effects the economy and it simply does not need the oil. This is my observation that the only way to win at Jevon's paradox is to quit playing.

The good news if this model is correct is that we will have plenty of warning about what is happening if we watch the right indicators and PRICE is not a important one its misleading. But on the other hand when this situation finally gets to the point that the wealthiest consumers are effected you get essentially an immediate economic meltdown.

Since of course at some point everyone figures out whats happening and panic ensues not to mention the real shortages are crippling even with out the emotional political effects.

My continuing prediction: by the time of the ASPO-USA Conference in Houston this October, reports of declining world oil exports will be widespread.

Yes but the market will misinterpret this to mean more investment is needed. Or OPEC needs to open the taps.

I'm a bit fascinated by the fact that my model shows that this optimism is the cause of the shortages in the first place. Since if the market rationally prices oil going forward we would have a much higher price then today but demand destruction would follow traditional price driven models.

Its the unwarranted optimism itself that is the root of the catastrophic and destructive shortage and overreaction feedback loop.

If you look at events and psychology etc you find enumerable cases where optimists that ignored the facts ended in a tragic situation that could have been averted or far less severe if they simply recognized the truth.

I don't know what this model is called but I know its well known I'm not inventing anything here just recognizing that it is I believe the correct model to apply as exports decline.

Its impact on your bidding war model is the bidding will not initially be as strong as we think and price driven demand destruction will not have the effect we expect. We have already seen this in the US as prices increase. Only when outright shortages occur will the market wake up and reprice oil at a much higher price point than previously.

Thus my contention that shortages are the critical factor.

And back to my bunker fuel debate the reason its important is bunker fuel is a global market and is very close to a free market and complex refining methods are removing the lower grade components faster then overall oil production is declining while demand for goods is increasing causing a need for more shipping. So my bunker fuel model is a micro version of your export land model but with complex refining acting as internal demand.

The point is I think we will see this movable shortage occur in the bunker fuel market fairly easily and before we see it for larger volume higher value goods like gasoline.

If anyone else can think of a way to test this model using public info I'd be happy to hear it. The only other choice I can think of is to watch the news for shortages in wealthier and wealthier countries. Shortages regardless of what the media claims is the cause and even despite the real cause are the critical factor since they would not have happened if a market was well supplied. Since if it had enough reserves it could seek other imports to cover a above factor.

So I think we know what to look for as your export land model progresses and again I stress price and supplies in the wealthy nations are lagging indicators since it will be the bidding war after/during a shortage event that will drive the price.

Bear with me as I am trying to understand the mathematics involved with this model. Let's say the hypothetical kingdom of Sandystan produces 100 million barrels of crude oil per day, and consumes 50 million barrels each day for its own population. So net, 50 million barrels of oil are "left-over" for export.

Some fateful day oil production peaks for Sandystan, so the production rate starts to fall while internal consumption continues to rise, thereby reducing available oil for export. Where did you get the 16% per year figure? Why does this rate remain constant for 4.5 years and then jump to 37%? Expondential growth curves start slowly at first, but steadily increase at an increasing rate. Or is a different ytpe of growth curve involved.

If I am reading you right, you are saying that for the present top 5 exporters, they are already off 10% from their previous maximium export rates?

Flavius Aetius

The math for exports is kind of interesting. We have a dependent variable, net exports, which is dependent on two independent variables, production and consumption: http://static.flickr.com/97/240076673_494160e1a0_o.png

If you look at this graph, and just use the Rule of 72, the decline rate in net exports over the first 4.5 years is 16% (down by 50% in 4.5 years, so 72/4.5 = 16%), or LN(0.5/1.0)/4.5 = 15.4%.

Let's jump forward to the 8.5 year mark, when net exports are down to 100,000 bpd. From the 4.5 year mark to the 8.5 year mark, the decline rate would be LN (0.1/0.5)/4 years = 40% per year.

In summary, net exports decline so fast in post peak regions because we are looking at the difference between exponentially declining production and (at least initially) exponentially increasing consumption.

I see now what you mean. The only way to even slow down the end result (no exportable oil) would be to drastically reduce internal consumption. But even that would only delay the inevitable since production will continue to decline: the oil doesn't care who consumes it.

Countries like Iran have huge domestic subsidies which are highly unlikely to be reduced because of the danger of popular unrest. And Saudi Arabia needs the revenue provided by oil exports to keep its country stable.

The only "smart" move open to them would be to move up the crude processing chain to extract more of the value-added profits. Instead of just selling crude oil as a commodity, use it as feedstock for higher value products like plastics, gasoline, diesel, chemicals, etc. This process will put even more pricing pressure on the importing countries.

This is a important addition to the peak oil theory, especially from the point of view from oil importing nations. With the US importing, what 60%?, of its crude requirements, it is extremely vulnerable to changes in available exports.

Flavius Aetius

You see why I remain stupefied, dumbfounded, etc. that net oil export capacity is not the #1 story in the world.

I think that we are literally seeing the very lifeblood of the world industrial economy draining away in front of our eyes.

Imagine the collision between the expectations of an infinite exponential increase in US petroleum imports and the reality of exponentially declining exports:

http://www.theoildrum.com/uploads/28/Data_4weeks.png

And this is why I believe the collapse will happen like I said with the markets initially not responding to the true situation and shortages moving rapidly around the globe.

The combination of the rate of decline and a lack of real understanding of the event will in my opinion work to cause the worst possible response which is paralyzing shortages.

The problem of course is even if the country wakes up late to the full extent of the problem under the conditions of constant persistent shortages or skyrocketing over price corrections its impossible to mount any sort of alternative strategy holding a economy together will be the first order of business since the system becomes effectively dysfunctional almost immediately.

And whats sad is most people are worried about the growth rate.

Yeah, but If I was the Sultan of Sandystan, I would begin reducing exports in excess of the amount available for export until I had developed another means of bringing home the bacon then stop the exports altogether(if that would not bring on an invasion). I would probably develop a refining capacity, cutting out the middle men and develop a vertical monopoly. No more oil exports, only finished products and only as much as I care to produce. Buy it or don't. As long as I am increasingly exporting finished products as I reduce oil exports I should be able to pull it off without an invasion.

I agree with your post but typically the chemical industry does not employ a lot of people even packed to the gills with government appointments. And I think we will use oil for a long time for all the products we can make for it and probably for a few fuel cases where subsitutes are hard to come by. Jet Fuel for example. But this use is at best a tenth of what we use today if not less. Once you eliminate the American middle class and similar groups around the world we have plenty of oil. This means basically eliminate the private car.

So back to Sandystan they will be competing against bio/coal based organic sources for finished products. And since these products have a lot of value add over the cost of raw materials other sources of reduced organic matter for plastic production make sense. Next you would have to think the consumers would do two thing heavily subsidize internal manufacture based on bio/coal and also become more frugal and recycle plastic items.

The end result is I don't see reduced organic base materials going much over 10 dollars a gallon in todays terms. And if you look you can buy all the food grade vegetable oil you want for 10 bucks a gallon and this is far better than whats needed as inputs to a chemical plant.

http://www.oregon.gov/ENERGY/RENEW/Biomass/Cost.shtml

You can see from here that soybean oil is about 2 dollars a gallon now.

So overall non-fuel uses for oil face stiff competition from other sources of reduced carbon and the political climate will favor not using oil in many countries. This coupled with a little bit of sanity in our use of plastics means that the market probably will be smaller than today. In effect we probably are at peak new plastic now or soon.

With that said it will be a good business for them since I doubt everyone will care where there plastic comes from but I don't see a glorious future. They still have a large population thats not been employed by this industry and they have no other resources to easily tap to create employment.

Finally as far as basic labor goes they are competing with the rest of Africa, India etc for labor so in that part of the world labor will remain cheap or get cheaper.

So this vertical approach is more a retirement plan for the wealthy then any sort of solution for the problems KSA faces. All of these oil producing nations are going to face a situation where they will have to cut support for their internal population if you follow WT export land model you see that they quickly hit the wall where internal consumption is higher than external profits this won't last long and the only way to go is down for a long time.

You don't want to be in a former oil exporting nation in five years.

There has been a tremendous amount of top level work on TOD concerning plotting actual crude oil production, both on a world wide basis and for individual countries, e.g.; Saudi Arabia. I would now go even so far as to say that determining global peak oil is but a useful and necessary preliminary for getting to the real heart of the matter: net exports.

Has anyone plotted/graphed out net world exports, as per your theory? I really don't care if Sandystan produced 10 million barrels per day IF they consumed 9 millions barrels.

Net, only one million barrels per day is available and that's what the importing countries are after.

It would be very useful to be able to see how net exports are faring y/o/y. I would bet there is a very good correlation between changes in export level and price changes. With the rapid growth in demand in China and elsewhere, the shrinking amount of exports will be priced ever higher.

Flavius Aetius

Thanks for assembling evidence to back this very plausible argument.

This seems like a prudent move especially if the Saudis have diminished expectations about their future oil production.

By exporting crude oil, the Saudis have left much of its value added profit on the table. If they anticipate a long slow decline in crude oil production, capturing as much of the profit of refined oil/petrochemicals as possible prior to export makes perfect sense. Long after their own production peak, the Saudis will be among the last oil exporters left on the planet. Why would they want to forego any of the value add to oil that they can capture in this position? And now's the time to make the investment, before the next major recession hits and the crude price crashes.

In addition we can expect a lot of this capacity to be used for internal consumption thus they may be forecasting continued increases in internal use. Most of the forecasts see overall production from KSA well above 4mbd for some time.

So you can expect a lot of this capacity to be directed towards the internal and probably local markets in the future.

Alsp even when oil becomes prohibitively expensive for producing general use fuel I expect us to continue to produce a wide range of value add products from oil. It will be sometime before production of specialty plastics, solvents jet fuel, etc from oil is not economical. With a few breakthroughs plastic solar cells could well be the primary export out of KSA in the future.

Exactly. I agree with you.

Saudi refining capacity is a small fraction today of their production. Even if production declined tomorrow to 6 mbpd, this 3.6 mbpd refining expansion would stay active as they refine something less than 2mbpd right now.

To conclude that this expansion of refining capacity can only be supported by an expansion of production assumes that KSA intends to still export as much crude as before. This is not a valid assumption and therefore the conclusion (that this expansion is intended to support higher production) is not at all as clear cut as Dave seems to suggest (though I may be misreading Dave).