The Cost of Gasoline around the World

Posted by Luis de Sousa on June 15, 2007 - 11:30am in The Oil Drum: Europe

These last weeks the MSM has been reporting news that, wouldn’t it be for the seriousness of the Hubbert Peak, would belong in the section of bizarre news of your local newspaper. First it was the report by PFC Energy that imposed a responsibility on oil exporting countries to supply oil importing countries. Jérôme showed his indignation on this kind of pressure on oil exporters to bring crude on the market, no matter what.

And then another pearl, the US Democratic Congress and Senate proposed a bill to amend anti-trust laws in order to make possible suing foreign countries that do not supply the market with desired quantities of oil. Luckily there seems to be some sane people at the Republican White House.

No, this is not a bundle of people going mad at the same time; these are just modern (although awkward) manifestations of the Carter Doctrine. As explained by Professor Michael T. Klare, the Carter Doctrine is a legacy of the 1970s oil crisis that basically transforms resources in foreign regions into indigenous assets that will be protected and controlled, no matter what.

And Europe is not the good guy of this play. As a hole it deployed troops in Afghanistan, and its Christian Democrat and Liberal states played along with the Iraq commission (after trying “politely” to secure Iraqi oil through the UN).

The problem is that those elected don’t seem to have any other way to deal with the common man on the street, demanding, complaining, raging, about gasoline prices. This is how electors get in touch with the Hubbert Peak, and being sadly clueless about it, they just cry like a baby that’s losing its candy. And instead of saying “grow up, it’s time to forget about the candy” those elected simply reply “daddy’s gonna fetch you more candy”.

But how high are gasoline prices?

Searching the web it is possible to find the price of a short gallon of regular gasoline for a number of countries around the World. In April the USAToday published a good number of prices provided by the AA Motoring Trust. And the Wikipedia gathers prices reported on the media during the last months. Compiling these numbers one gets Figure 1.

Figure 1 – Prices of a short gallon of gasoline in US$ around the World. Source: AA Motoring Trust via USAToday and Wikipedia. Click to enlarge.

These prices report mainly to April and May of 2007 with a small number of them being from last summer, when oil prices were above 70 $ per barrel like today. Some variations would occur if these prices where all from the same epoch, but they are good enough to get the overall picture. It is important to note though, that South America with two countries and Africa with one are poorly represented.

Looking at Figure 1 three big groups of countries can be identified:

- below 3 $ / gallon – mainly composed by oil exporting countries and some developing Asian countries that facilitate the access to fuel;

- from circa 4 $ / gallon to 6 $ / gallon – starting in Brasil and ending up in Poland this is a set of mostly developed (or close to) countries that perform mild tax policies on gasoline;

- above 6 $ / gallon – mostly wealthy countries that apply heavy tax policies on gasoline (Turkey being an obvious exception).

The United States is to be fond in no-man’s land with 3.1 $ / gallon, closer to the countries that subsidize consumption than those that do not.

But this is just half of the picture because in different countries a gallon of gasoline has different weights on the individual’s budget. One way to assess this difference would be to ponder the gasoline price against the average wage of each country. This approach was not taken for two reasons: first the average wage is not as available as other statistics and second it is biased by the tax policies followed in each country (e.g. the average wage in Norway is considerably lower than in the US, while both countries have similar numbers for GDP per capita).

Since the IMF publishes GDP per capita numbers in its World Economic Outlook for most of the countries in the World, this statistic was alternatively used (a quick compilataion can be found at Wikipedia). GDP (Gross Domestic Product) is a measure of the wealth generated in a country during a reference period (usually one year). GDP per capita is not affected by tax policies (which broadly speaking determines which part of the GDP is managed directly by the state) and is probably a best measure of individual wealth than average wages.

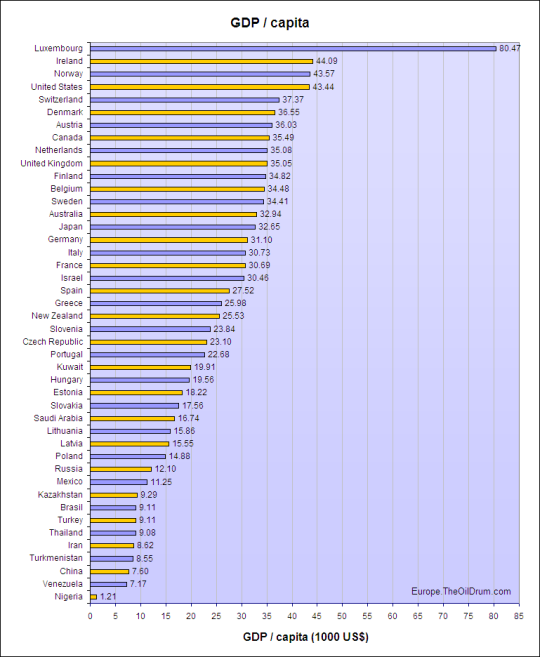

For the above countries, of which gasoline prices are known, the GDP per capita figures are the following:

Figure 2 – GDP per capita for the countries featured in Figure 1. Source: IMF World Economic Outlook. Click to enlarge

Besides Luxembourg, there are no big surprises in this graph. It is interesting to note that most major oil exporters are yet to achieve the levels of wealth in Europe, where almost every country is above 20000 US$ / cap. Of special note is Nigeria, one of the world’s largest oil exporters. This situation will likely change in consequence of the Hubbert Peak.

Luxembourg seems to be in a different level, but there are explanations for that. The country is a tax safe heaven situated right in the heart of Europe (at the cross point of the axis Paris – Frankfurt and Amsterdam – Strasbourg) making it favourable territory for financial/banking institutions. Also the majority of the workforce labouring in Luxembourg lives in the surrounding countries.

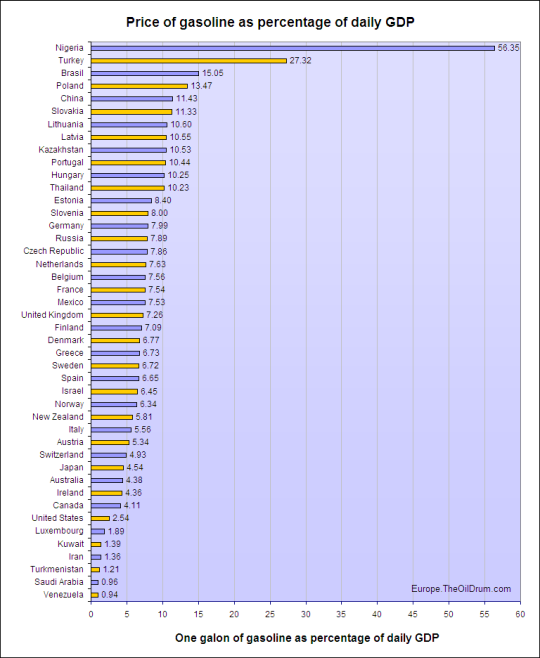

With this two sets of data (GDP and gasoline prices) it is possible to compute the weight of gasoline on an individual’s available wealth. Figure 3 shows the cost of a short gallon of gasoline as percentage of the wealth available daily per individual.

Figure 3 – Cost of a short gallon of gasoline as percentage of daily GDP. Click to enlarge.

Again three main groups can be roughly devised:

- below 1.5% - less wealthy countries that export oil;

- from 4% to circa 8% - wealthier countries;

- above 10% - less wealthy countries that import oil.

The cost of a short gallon of gasoline in Nigeria is a scorching 56% of daily available wealth per capita. And this is an oil exporting country, in other African countries the costs of fuel is probably too high to have real meaning, and most people live without it.

Once more the US is in no-man’s land, this time accompanied by Luxembourg. In both of these countries a gallon of gasoline, as a fraction of available wealth, costs close to what it costs in oil exporting countries.

Table 1 tries to give further insight on the cost of gasoline in the US and Luxembourg. The prices shown are those that equal the wealth costs of a short gallon in Japan, Germany and Brasil.

Table 1 – Prices for the US and Luxembourg that equal the wealth costs of a short gallon of gasoline in Japan, Germany and Brasil (US$)

| Japan | Germany | Brasil | |

| United States | 5.50 | 9.75 | 18.40 |

| Luxembourg | 10.25 | 18.00 | 34.00 |

The average cost of gasoline in Europe is 7.53% of daily GDP per short gallon. This is very close to the figure for France. In light of that, Table 2 presents what the gasoline prices would have to be in France to match the wealth costs in the US, China and Brasil.

Table 2 – Prices for France that equal the wealth costs of gasoline in the US, China and Brasil

| United States | China | Brasil | |

| US$/gal | 2.20 | 9.85 | 13.00 |

| €/litre | 0.45 | 1.95 | 2.55 |

Of note is also the disparity found among member states of the EU. Even with the half-harmonization imposed by the VAT, different states have completely different tax policies on fossil fuel consumption. Even discounting Luxembourg, gasoline in Estonia costs the double of what it costs in Ireland, and in Portugal almost the triple. Among the member states with lower gasoline costs, are some with visible commercial deficits, like Spain or Italy. This is probably an issue yet to be address in the framework of the European Construction.

Looking at these numbers it doesn’t seem to be the right time for the Carter Doctrine to set in. Gasoline prices are only cheaper than in the EU or the US in the countries that currently posses the base resource and that are yet to get to the western standards of wealth.

Countries like Venezuela or Turkmenistan have a significantly lower population and per capita consumption than the EU or the US. Gasoline prices in these less wealthy oil producing countries can’t have a visible impact on prices in the wealthy countries. Taking direct control of these countries’ resources is very likely a vain strategy.

Luís de Sousa

The Oil Drum : Europe

Luxembourg is at the top of GPD, with low gasoline prices. That might change soon since the EU ponders about it.

Everyone that ever visited the city of Martelange, which is a Belgian city on the border of Luxembourg is surprised that one side of it's main road is really plastered with gas stations. A dozen or more or so, it is a surreal sight.

That side of the road actually lies in Luxembourg, and the prices are considerable lower then in the surrounding countries. Martelange is a comfortable and small detour from one of the main highways of continental Europe, A2/E25, and is a known truckerstop for this reason.

moths to a flame

This thing has been going on for a while: Luxembourg always had lower gasoline taxes then Belgium or Germany. What adds most to the sureallity of the scene is that the environment around it is rather nice: large woods on hills, small rivers run through it. Therefore it is a tourist attraction.

Now there is something which will disappear: Mass tourism

Very small countries are an anomaly, specially in Europe. They are usually tax havens, trying to attract commerce and business from the neighbours. Andorra, Monaco, Liechtenstein, Gibraltar...

You could see them as parasitic economies, sucking money through their borders. They can be that way because they are not big, so the drain in the resources of the neighboring countries is acceptable, while they give some specialized services mostly to the higher classes: hush-hush banking, casinos, cheap electronics, luxury vacations.

Luxembourg is bigger and has more of a real economy than say Monaco, but still it has these kinds of tendencies.

Do you believe that privacy for banking should not be allowed? Because your post reads as such? Switzerland is an excellent example of a country which is highly stable (past 500 years) near zero interest rates. Highly trained and armed populace (14 soldiers per square km versus the USA <1) They maintained neutrality during ww1 and ww2 and have continued.

Banking privacy is very important, why should anyone know how much money I have after I declare my income for a given year and pay taxes?

and there's the rub. The main reason people love bank secrecy is it allows them to hide income.

Why not?

And the lead article in this morning's Salt Lake Tribune asks if "the exorbitant" price of gasoline is causing Utah drivers to change their habits. WTs iron triangle clearly rules.

I myself am being impacted by the Gasoline in a different way, it is not that I cannot afford the Gasoline it is I will not when there is alternatives. I have built myself a Motorized Bicycle and I consider this to be a thing that is going to be a wave of the future as it was in the past. When there was lack of capability in WW2 in Germany they did motorized bicycles and as people progressed they changed their habits and got various vehicles. However I am able to pull 150-180mpg in my motorized bicycle. I cut my costs and am loving it leaves me more when I would be having less.

Most states in the USA or Countries in Europe allow for these to be run without insurance or license that makes it even more affordable.

Currently most people are running the two-stroke engines as they are cheaper than 4stroke however due to EPA ban they will be going the way of the dodo. This will usher in the 4stroke that is cleaner and will truly run longer. By doing so it will help cut down on pollution and dependence on foreign oil given the high gas savings.

I have plans to use a 4cycle Tecumseh engine built in the USA or brazil or wherever its built. and run around the same mpg maybe a little less but no matter its still leaps above what a car can do. I use 1/16th of the gas I would use going to the grocery store to grab things. When you translate that to actual usage its substantial.

There is a group of people that are all for the motorized bicycles and if you are interested you can look at http://www.motoredbikes.com and get some info for yourself. Its a great idea, it may not be the best idea that can be done but its a hell of alot better than any other ideas I have seen. Myself I would love to get diesel and run homegrown bio-diesel but that is a entirely different topic all together.

Thanks for a very nice piece of work.

It is said that one of the causes of WWI was the German push to obtain oil in the Middle East -- since the British had changed their naval fleet to oil-burning ships, the Germans would need to do the same.

It would seem from these data that the Carter Doctrine is alive and well; the U.S. and its satellites having won the oil wars if the previous century, currently have the lowest resource cost-- and development of the resources is limited to that planetary system as much as possible. Venezuela, and to a lesser extent, Brazil, seems to be trying to break the model. Could work, or could be war.

Excellent article!

Just received an email from my online broker's 'energy expert' on the 'wild ride in gasoline prices' which explained that although there is a $15 'geo-political premimum' in the crude prices, the real problem with gasoline prices in all the refinery maintenance problems of late and that as soon as they were all back up and running we could go on with our 'happy motoring' at a much cheaper price. Unfortunately they don't take feedback from these little advice missives.

I think the one piece of information missing is miles/GDP in other words how many miles are driven to generate the GDP of the various countries. This would include moving goods and personal transport.

If you added in miles driven then I suspect the Achilles heel of the US will show up. So although the cost is a much lower percentage of our GDP we drive probably 2-3 times the number of miles that the other nations do to generate our GDP. So rising gasoline prices rapidly drop the US GDP.

The US can certainly afford to pay more for Gas as can be seen with these simple calculations but it will be and is in a economy that is experiencing stagflation and asset deprecation. Since each penny increase has a 2 too even 5 fold effect on the GDP of the US and since its barely growing we almost immediately go into recession.

If you can get a miles/GDP then it will I think put this data in better perspective since I think your missing the big issue.

Here is Stuarts post on the subject.

http://www.theoildrum.com/story/2005/10/22/235239/89

I've got no idea how to find this for the various countries.

The simple calculation is the US is 5% of the population and uses 25% of the worlds oil so we use 5 times the worlds average usage to generate our GDP this is why I said higher energy prices have a 5 fold effect on the US GDP.

Stuart would have to do a better analysis but the magic number is per capita GDP/per capita miles driven. This tells you how the economy can handle higher prices. I contend the US is uniquely venerable since its high per capita GDP is effectively directly equal to the price difference in gasoline vs other western nations.

I think you are saying that it is the US’s tax policy on gasoline that has resulted in a higher GDP for them. Besides that going against basic Economics, you may want to recheck the numbers for Norway, Switzerland or Denmark.

I think he's saying that historically US per capita income (there's no such thing as per capita GDP) is/was higher than in other countries because more gasoline per capita is/was used to obtain it.. And I think he's right.

There is no necessary link to taxation, even though it can be implied.

I don't quite understand what your saying. Cheap gasoline is a major economic stimulant or better intoxicant. Subsidized gasoline combined with higher worldwide prices is one of the major factors in WestTexas export land model. The US is something of a hybrid since it is both a large producer and importer so it or at least parts of the US benefit from high prices. In some ways its better to think of Texas and Louisiana and Alaska as an exporter country to the rest of the US. But since "exporter" wealth tends to simply concentrate its not a strong driver of overall GDP in the US unlike a true exporting country with a National Oil company.

So either I don't agree with your statement or better don't understand it. Cheaper gasoline esp imports tends to increase GDP IMHO. In general the cheaper commodities are the higher the GDP since most of the GDP is in value add not bringing commodities to market.

Norway is unique since its a net exporter with high gasoline taxes. In effect the taxes vs income from exports probably leads to a low effective cost for Norway I don't think you have treated Norway correctly since they make quite a bit off their oil exports.

Denmark I simply don't know.

And the Swiss are well ... Swiss :)

True.

Not quite. Isn't the real comparison the US's consumption versus the average for the rest of the world? (Not "world including the US".)

Let's use the corresponding real numbers:

US: 20.8 million barrels/day divided by 300 million people -> 0.06933 barrels per person per day

Rest of world: 62.4 million barrels/day divided by 5700 million people -> 0.01095 barrels per person per day

(assumed total to make US 5%,25% figures: 83.2 million barrels/day, 6000 million people)

Ratio of US to rest of world: 6.33

The United states uses 6 1/3 times the rest-of-the-world average. So higher energy prices have a "6 1/3-fold" effect, given the 5% and 25% figures.

Okay :)

The point is the US economy is far more sensitive to oil prices then most of the rest of the world. And alternative transportation is a black/white or yes/no type of solution either you have it and can mitigate higher gasoline costs or you do not. The EU and many places in the world do have reasonable alternatives to driving so they can preserve their disposable income at effectively a fixed cost i.e. extra time taken to reach work. Although calling this a cost can be debated you can work on the train etc.

The US cannot. So the twin effects of a 6.33 multiplier and lack of alternatives makes the US uniquely venerable to higher gasoline prices even though the relative price per gallon between the US and the EU is about half. The economic impact as you can see is well over half as oil prices increase. This multiplier effect coupled with lack of mitigation strategies is the problem.

I agree entirely with your main points, I just wanted to point out that it's even worse than 5x!

Fear not, I’m not missing anything. It is the US (and Luxemburg) that is missing a proper tax policy.

With the right tax policy the US’ millage/GDP would never have gotten to were it is today.

I'm just saying that the US and I guess Luxemburg are uniquely venerable to high gasoline prices your paper is leading to this but the coffin nails are my opinion is the millage/GDP part of the equation.

For a good laugh here is the American viewpoint.

http://www.ti.org/vaupdate41.html

Under the covers of course is the suburbia driven economy.

Another Stuart post on the subject.

http://www.theoildrum.com/node/949/0

Finally found some numbers

http://www.narprail.org/cms/index.php/narpblog/europe_vs_usa_vmt_vs_gdp_...

They claim the US is consuming over 100% more gasoline than Germany a comparable economy. So my 2 times multiplier for the lower bounds on the price effect of gasoline for the US seems justified. I happen to think its higher.

If you just use this 2x multiplier you will see that the current prices put the US in effect equal to Europe without the tax benefit Europeans receive if thats included and you consider I think 2x is too low the US economy is already quite a bit weaker than the European economy on a gasoline cost basis. 4+ dollars a gallon would I feel put the US in the position of paying 12 dollars or so a gallon on a EU weighted economic scale since I feel 3x is a better metric.

This include the positive tax effect for the EU.

Its all a matter of how you do the numbers and how you discount the positive effects the EU gets from taxes.

But I think you would agree that 12 a gallon gasoline would have a negative effect on Europe and this is effectively what the US feels in my opinion at 4 dollars a gallon on a weighted scale. The US economy is already effectively negative at 3 dollars a gallon and .... we are in a recession or close to zero GDP even with number fudging.

I see your point, but I don’t exactly agree with it. The thing is: can the wealth output be the same driving less? Probably yes, in both places. Although as everyone knows the options for driving less are wider in Europe, just because of that tax policy. I don’t have numbers to say if 4 $/gal in US the equals 12 $/gal in Europe.

There’s also another point to be made about the tax policy. During 2005 gas prices rose 100% in the US, in the same period in Portugal (where the tax is considerably heavy) they rose merely 30%. A higher tax has this effect of shielding gas prices from rising crude prices. With a light tax policy, consumers in the US feel much more sharply the increase in crude prices, without that being affecting exactly more than in Europe their monthly budgets.

This is the whole point. As Europeans, we have already done are demand destruction. The tax policy was introduced in the 70s to deliberately reduce dependence on oil, especially after the UK horrors of the 3 day week - where our economy was literally reduced to 3 days a week working through lack of oil.

Petrol is expensive in the UK, so we have small cars, shorter commutes, more use of public transport, etc.

Petrol is already a large part of our budget. If it goes up from $7/gallon to $12/ gallon, it will be annoying, but will have relatively minor effects on my wallet, and on the economy as a whole.

So far the US has been in a demand destruction competition with the third world, and you have won that round.

Your next demand destruction competition is with Europe, and the odds are heavily stacked in our favour.

It was raining today, so I took the car to work. If the weather picks up, on Monday I will probably cycle. Because I can.

some sane people at the republican white house ? would you care to name names ?

Kagiso: Yes, the odds are heavily stacked in your favour in the next round vs the USA, but you are dreaming if you think Europe is outbidding China for crude oil on the world market.

There's another economic issue I haven't seen in this thread. The higher prices paid in most importing countries is not leaving the country. It is being cycled into government expenditures and I assume into the general fund, therefore paying for health care, defense, etc. The money thus used in Europe is available in the US for both other expenses and for investment. The investment part alone may be a part of the reason for greater GDP in the US. ...and for more pocket money to buy gas to drive around more in the Hummer.

There are various hints of the like in the comments. This goes against basic Economics. Google Trygve Haavelmo.

I think thats a bit garbled. The taxes part of the higher priced paid in the EU is recycled US gasoline taxes are so low they don't even cover road building expenses so they are effectively irrelevant since we use a lot of other tax sources just to subsidize oil based transport forget about using gasoline taxes for other uses.

I think thats what your saying. Its important and I was concerned that this would dwindle in the EU as gasoline got more expensive then decided that no the EU will keep the tax no matter what the cost. Finally technically the EU should have taxes high enough that gasoline is 2 -2.5 euros per liter if you wish to be impervious to peak oil. This does give a hedge that can be used short term to beef up public transport and longer term the tax can be slowly decreased as oil increases keeping the overall price constant.

So technically gasoline is still too cheap in the EU :)

That´s right i personally would have no problems with a gasoline price doubled from now. The price of food is more important.

Double post

Great work Luis.

We need more graphics like this to show people that gasoline is NOT expensive in real terms, only in the relative perception to where its been for last decade.

US needs to raise gas taxes or put floor on crude/refined products. Look at all the european countries who have very high GDP levels and gas that is double what it is in US. The key is to start that policy early, so that it doesnt shock the system. Europe has been smart to tax petroleum - they now have a built in cushion that the US does not.

Amazing that the average person in US really does believe that politicians and oil companies set the oil prices, and that its their god-given right to have cheap gasoline. I was at a drinking establishment last night (getting change) and overheard a loud argument from some farmers saying that once Bush and his oil cronies are out of the white house gasoline will go back to $1 because the 'inside help' wont be there for the oil companies anymore. I started to open my mouth but there were 6 of them and the smell of manure was strong.

Well Nate, next time you just show them a graph like these and then run away.

Hi Nate,

Next time ask them what they think of the Carter Doctrine, maybe they will buy you a beer and hoist you on their shoulders? Seems like you would be buddy for life talking that up. Seems also that some governments and oil companies think it is their god given right to the worlds oil, so can't really blame the people for thinking as they do, can one?

The smell of manure would have been strong even if they had been corporate lawyers & tax accountants. Maybe even stronger.

Yeah, how about 1960?

it's kind of misleading to suggest, even here, that such a policy in 2007 would make one iota of difference.

The EU should do better but I think whats important for the World and the EU which is a big trading partner with the US is that the US is in pretty bad shape as gasoline prices increase. Our bad decisions will have a effect on Europe. Probably the best answer for Europe is to aggressively increase the amount of internal trade in the EU at all costs.

And secondly seek other markets Latin America Africa etc.

Being in better shape then the 500 pound fat lady that buys most of your food does not mean your in a good position.

The EU needs to push gasoline up to 12 USD/gallon or about 2.5 Euros a liter right now your low. And make sure its economy runs at those levels and it needs to eliminate its NG dependencies on Russia.

memmel - thats quite a wish list but I think you are right - unfortunately I think all industrial countries will sink or swim with the fat lady - the world has become too interdependent. Countries that implement import substitution policies for basic goods and use international trade for non-essential luxury items only will have big advantage in years ahead. I wrote about that here

Nate, your link doesn't work...

thank you. Its fixed now.

Who would have thought when I was born that in 40 years Id be typing in html and growing squash....

Hi,

the figure for Italy is not accurate at all: as a matter of fact it is comparable to that of Germany, which is according to my calculation 6,70 [$/Gallon].

I live in Germany and I can see from my window the figures (unleaded gasoline 95 octane) of a gasoline station nearby: 1,35 [Euro/l]

Almost one month ago I bought italian gasoline for 1,21 [Euro/l] ( = 6,0 [$/Gallon] ) .

Cheers,

Geppetto

Thanks for that Geppetto.

I've checked the numbers from the Motoring Trust and it in facts states 4.8 $/gal in April. In light of that recent 6 $/gal this is probably wrong.

Thanks Luìs for your article

I don't remember how it was in April, but

right yesterday in north Italy, where I live,

the price was about €1,35/litre for gasoline

(benzina)

and about 1,15/litre for diesel (gasolio)

I saw €1,40/litre gasoline too.

OT: my first comment here :-)

Another Italian and another first post here (been a long time lurker).

I can confirm that actual price of gasoline in Italy is about $ 6.80/gal.

You can check Italian gasoline prices here: http://www.prezzibenzina.it

Folks welcome to TOD Europe!

Those prices are close to what we have here in Portugal. It's good to know that Italy has a sensible tax policy on fossil fuels consumption.

I again apologize for the erroneous number, but I couldn't know.

Why, in the oil drum: EUROPE, do you list prices as US$ per gallon? Why not Euros/l?

:) That's a funny remark.

The original data was all in $, and it reported to different points in time where the exchange rates would be different. So it was easier to have it this way. Anyway you just need the bars’ length in the graphs to get the idea.

You do mean £GB per pint.

Britain is not Europe... just ask the Irish :-)

ciao,

Bruce

Three things you could do if you would like to take this analysis in some interesting and useful directions.

1) Do the calculation as gasoline price as a percentage of take home pay. As you note GDP is a poor standin for this metric and it really does miss quite a bit. The Economist is a great source of such data.

2) Make the assumption that the prices fall into three groups, the subsidised, the market based, and the heavily taxed. The subsidised stay constant but place pressures on their governments, the market based rise with market prices, and the heavily taxed are mostly fixed rates, so rise only at a submultiple of the market price (pump price = fixed tax + fuel cost).

If you do this you can calculate to a first order the pump prices as oil goes from $70 to $80, $90, $100, $110.

You can then relate that back to take home pay to see which countries move up the table.

3) Making the assumption that take home pay is always fully allocated, compare typical costs (taking into account typical mileages) before and after certain oil price rises. Express this in percentage terms.

This is the interesting bit.

The countries with the highest numbers are the ones that will feel the pain first, and therefore the countries on which the greatest degree of demand destruction will fall.

If you do this calculation, then from my past calcs I think you will find an interesting and maybe surprising country towards the top of the list.

Demand destruction is NOT of uniform impact - and its not absolute costs that dominate.

I think your right on. The EU will be able to preserve take home pay even as gasoline prices rise since they have alternative transportation. The best metric is probably percentage of people that don't have alternative transport over cars. In either case the key is the EU will be able to preserve its take home pay far better than the US which preservers consumer spending and thus its economy.

I like this approach since it goes right to the heart of the matter. I was a bit concerned that the EU taxes are not as beneficial as we would think since they would have to cut taxes to lessen the impact but I don't think so since they have alternatives they will actually be able to keep the tax rate high and continue to enjoy the social benefits from the taxes. My concern was that this tax benefit would drop overtime but if you have alternatives this need not happen.

I still think EU taxes are too low but thats a different issue. The critical point is that they are high enough that alternatives are available preserving take home pay. Its really a black white situation either you can get to work in a reasonable amount of time without a car or you can't. In countries where the majority can't take home pay will drop with gasoline prices slowing the economy and starting a bit of a death spiral.

This of course leads to my analysis that in the US the result since we don't have any effective alternatives is to send a increasing percentage of Americans into abject poverty while in the EU you see a slightly lower general living standard that will actually rebound as public transport is optimized.

Any of you guys interested in one slightly obese American and family :)

The problem we have in the US is the huge welfare establishment and the plan to add another 20 million.

The image of the 300# welfare queen driving her SUV to collect her benefit check and then to the mall is realistic indeed. As soon as they are forced out of their SUV's you are going to have problems long before the people that work for a living are affected.

Our unproductive population is larger then a number of countries in Europe.

You are not going to be the only one, given half a chance.

Still believe in the myth of the American welfare queen I see. You also probably believe in the self made man myth and that you have never benefited from the taxpayer funded infrastructure like public roads.

Mushashi,

“The problem we have in the US is the huge welfare establishment and the plan to add another 20 million.”

That statement is so factually wrong that it indicates a severe irrationality.

Huge ?! Thats a laugh. It's a drop in the bucket compared to what can only be called corporate welfare.

I am a white 53 yo who has never been on welfare. But my life has been adversely affected because of corporate welfare.

I don't worship money. I live within my means. I am not an obsessive consumerist. And I guarantee you, that living within those guide lines is getting harder not easier. This board alone delivers enough empirical evidence to make that case.

Where IS that 'Theory of Everything' ?

Here

it is !

No argument from me on that, the corporations get away with murder also, transfer pricing, subsidies, insider trading as national sport, etc.

What are you going to do? Can't beat them, can't join them, at least when you downsize everything down to nothing you become a spectator rather then a contributor.

garyp,

Do you have any links to the underlying data sources that you could share?

- per capita disposable income

- per capita mileage

Or, for that matter your results?

Thanks

I explained why I didn’t do it that way.

That method you describe to ascertain demand destruction looks interesting, but as I said liquid wage is a poor indicator, since it is impacted by the tax policy of the country. You could eventually learn in which countries demand destruction would impact more individual consumers, but would be clueless about state spending.

I'd say its the investment policy by the government not the tax policy. For example you have under estimated the amount of taxes the US collects to underwrite cheap gasoline and free roads. Although our subsidies are not direct like in oil exporting nations they are numerous. So the critical point is not taxes per se but if the tax money is invested in alternatives to oil. If its not its effectively of no use and in many cases it actually harms creating a economy that can handle high oil prices.

Yet again the EU stands out by reinvestment of the tax monies in alternatives while the US looks even worse with this metric. The tax structure is complex and simple gasoline taxes cannot cover all the ways that oil based transportation is funded I think that its much easier to track investment into alternatives.

And finally of course you have the petrodollar effect thats not been explored the fact that the importers print the currency used to buy oil and the oil producing nations primarily reinvest in the consumer nations has a big effect on oil prices and the relative cost of gasoline. I don't think we actually know what the price of oil would be if it was the standard or we had a gold standard. Just looking at the US now if it was any other country it would be considered to have a failed economy now. So the petrodollar effect is probably fairly large.

By almost any metric the EU comes out ok not great vs most of the other importing regions esp the US. Its almost amazing how bad the situation is in the US.

Memmel

I'd like to emphasize one of your points regarding the difficulty in linking simple gasoline taxes to transporation costs.

One of the most important variables in the life of pavement is the number of large axle/wheel loads it sees. The impact of cars on pavement deterioration is trivial in comparison with that of heavy trucks.

So, at least in this regard 'simple' fuel taxes probably don't provide a proportional funding source for our highway infrastructure.

Not much there on Central America, but here in Panama regular unleaded (91 oct) is running about $3.40, and I hear it's about a dollar more in neighboring Costa Rica. Premium diesel is quite a bit cheaper at around $2.70, and there's lots of smaller personal cars and trucks that run on it.

Like last August, I'm seeing fewer personal vehicles on the roads and less congestion in town. People can't afford the price: despite rapid economic progress/growth, and the large influx of wealthy retirees, this is still a poor country by any standard. Luckily there's lots of public transportation, but even that's starting to get crowded now.

At least we're not rationing yet -- as I hear they're doing in Nicaragua.

Brazil is a net exporter that puts a (relatively) heavy taxation at gasoline. That puts it at the middle, but not for the cited reasons.

Also, did you take out the price of ethanol that is bundled (as 25% of volume) at our gasoline?

According to the EIA, Brazil is a net importer on a Total Liquids basis:

http://www.eia.doe.gov/emeu/cabs/topworldtables1_2.html

I say kudos to Norway for having the stones to impose high taxes on petrol, when they could have opted for the easy, populist solution of providing cheap fuel to the people. (They may be post-peak, but they still produce far more than they consume).

It shows long term thinking on their part: by making petrol expensive, it discourages the trends we have seen in countries where fuel is cheap (most notably the US). I am referring in particular to people buying gas-guzzlers ("hey, gas is cheap!"), and even planning their lives around the notion that the personal car will always be present.

I know there are many in this forum who lean towards a laissez-faire stance on economics. I hope the Norwegian example will give them something to think about. It's an example of how strong government intervention (and that cursed word, taxation) can have a long term positive effect on the wealth of a nation.

I think that Norway has the second highest per capita income in the world.

I know there are many in this forum who lean towards a laissez-faire stance on economics. I hope the Norwegian example will give them something to think about. It's an example of how strong government intervention (and that cursed word, taxation) can have a long term positive effect on the wealth of a nation.

Thanks for your remarks cultural_sublimation, as a Norwegian, I'm almost blushing.

With regard to the Norwegian tax system, I find myself in favor of what I will call efficient taxation. The fact remains that there has to be taxes, the question is what kind of taxes and how much.

I will argue that taxes on consumption, like gasoline taxes, do less harm than taxes on work, like income taxes. But this is probably more true in a small country such as Norway, where BNP tend to be driven by exports (=production). In a larger economy such as the USA, BNP tend to be more driven by internal consumption. In such an economy, exports would be of lesser importance to BNP, which would be an excuse for politicians who focus on increased consumption to achieve a higher BNP.

Is the Norwegian tax system efficient?

-No it is not.

True, the Norwegian government has achieved a lot when it comes to diversifying the tax system away from pure income taxes. But this has resulted mainly in increased public consumption. Further, it has proved remarkably difficult to cull unnecessary benefits. Additionally, while income taxes has negative impact on people's willingness to work, they are generally easier to collect than alternative taxes.

The following summary details some of the income of the Norwegian state as projected for 2007:

All numbers in billion crowns

Total: 1137 \ 100%

Income and fortune tax : 153 \ 13%

Petroleum royalty taxes: 225 \ 20%

Value added tax: 171 \ 15%

alcohol tax: 10 \ 1%

tobacco tax: 7 \ 1%

vehicle value added tax: 19 \ 2%

vehicle registration fees: 10 \ 1%

gas/diesel taxes: 15 \ 1%

electricity consumption tax: 6 \ 1%

CO2-tax: 8 \ 1%

sugar and beverage taxes: 2 \ 0%

Document fee: 5 \ 0%

misc. environmental taxes: 3 \ 0%

Social security tax: 73 \ 6%

Employers' employee tax: 103 \ 9%

Other taxes and fees: 6 \ 1%

Dividends from companies: 26 \ 2%

Dividends from ownership

in oil & gas fields: 122 \ 11%

misc. other income: 173 \ 15%

Total from oil & gas: 385 \ 33%

Saved to meet future

pension and benefit

obligations: 308 \ 27%

Of note is the relatively small role played by income taxes. 13% for income and fortune taxes and 6% for social security tax. But in addition to this, Norwegian citizens must pay income and property tax to the county and municipality level.

One of the most glaring inefficiencies, is the 103 bn crowns paid by employers as a fee to employ people. I think everybody would agree that taxing businesses for employing people does not exactly encourage value creation.

To illustrate my points, I offer the story of my uncle, who works as an engineer at a private research foundation. Some years ago he spent much of his non-working hours doing home improvement. From a social economic perspective, he should probably have taken overtime work at his day job instead. But what he did probably made a lot of sense from a personal economic perspective.

Consider the following:

*House ownership is taxed favorably in Norway (socialist policy)

*Value added tax and employer fee means that services from craftsmen are very expensive

*A progressive income tax means that the marginal tax for working overtime is a lot higher than the capital gains tax for an appreciating asset like a house.

The history of the tax system is of course socialist policy (with an interesting twist). Socialist policy - tax the rich etc. - means a progressive income tax. But if you tax the really rich (the investors), they will leave the country. In the post WW2 world, where hard currency was lacking and we had a socialist government in Norway, the result was predictable: Low capital gains tax, high progressive income tax.

This means that the dentist who makes $100k-200k and wonders whether or not to do more overtime, knows that he must pay well over 50% income tax on any overtime. But the investor who receives $200k in dividends every year, only has to pay a 28% flat tax on this income.

It occurs to me that Europeans have no way of imagining how big the United States is. All of Germany is 138,000sq.mi. Oregon, where I live, is 96,000, with a population of only around 3.5 million humans, and it is by no means the largest in area of 50 states, ngor the least populous.

Add to that the near absence of human population after the Indian Clearances, and the existence of huge amounts of oil -- early in the development cycle of oil as a resource-- and it is easy to imagine how the automobile/suburbia culture got started. Europe, by contrast, was late to the car scene, with a pre-existing, highly developed rail system already in place, and an entrenched, not-very-mobile, stable population, used to living near where they were born. And cars didn't even really get started in Europe until after the devastating wars, by which time much technological advance in auto engineering had occurred.

The result has been that since 1950 or so, Europe has developed rationally and USA has developed hedonistically. Americans right now are incapable of thinking small. At the center of this earth-friendly universe is the Ashland CoOp food store. Here the ever-so-conscious long-hairs drink Perrier bottled water because it is so cool and eat asparagus flown in from Chile in the winter. Notwithstanding all the carbon credits required to bottle and transport from Europe and South America, and notwithstanding there is no better water in the world than that which comes out of the tap from Ashland water works high in the Siskiyu mountains.

There is going to have to be some major collapse in USA before attitudes change!

At the dawn of the auto age the United States had a "a pre-existing, highly developed rail system already in place" as well.

Perhaps major collapse is required for Americans to change their ways. Prior to WWII, there was a large peace movement which wanted nothing to do with wars in Europe and Asia. Japan had invaded Manchuria in 1931. Roosevelt shipped arms to Britain to stave off defeat by Germany. It took the bombing of Pearl Harbor to arouse and unite this country to defeat fascism. Perhaps the American people can be roused from their sleep once more to defeat fascism here.

I think you're right here NeverLNG. The US infrastructure of suburbs, interstate highways and an integrated continental economy was built on American oil. The US was by far the biggest oil producer prior to the 1970s Saudi ramp up. There was no real concept of limits on oil before 1973 and, even then, it was put down to OPEC. The general view was more drilling produced more oil.

As a Brit/European I can't claim that Europe had more foresight. The higher gas taxes are simply that - higher taxes from socialist politicians. The taxes reduced demand for oil but the smaller cars are as much a product of the smaller roads and infrastructure. When I lived in London I found even a VW Golf (US = Rabbit) was too big to squeeze between the parked cars. Smaller cars just drive better on smaller roads.

The small town I live in England now is about the size of a cloverleaf junction on an interstate. That's because the roads were built for horse and cart. No foresight there.

I would love to think it was due to rationally but I'm not sure. At the end of the day, stuff happens. Europe was laid out on horseback.

We have the same problem here in Australia. In a discussion at work recently i was advocating higher petrol taxation (a heresy in this country, of course), and was informed quite strongly that we cannot have high petrol taxes like in Europe as it is too far between places in Australia. The idea that petrol should be anything but a near free commodity is heretical, a term i happily use, as the oil based culture we inhabit is nothing short of a religion.

True as the reality of distance may be, that doesn't change the reality that there should probably be higher taxes on petrol. We have simply reached a point where virtually everyone who is alive has only lived in an oil driven culture, and for those who can, it was so long ago, that it is more of a hazy recollection than a firm memory. As such it is impossible for the people of a country used to building big to imagine that we should have a need to build a society that is localised. Unfortunately, there appears to be very little forcing people to think otherwise, and it appears that before it all falls apart, the last of the farmland on Sydney's suburban fringe will be lost to suburbs, a situation being repeated all across the country. Future generations will wonder how we could have got it so wrong, but in the here-and-now, most people don't see how it could be any other way.

Both Australia and America started off with a great abundance of land and resources. Smallpox and other diseases cleared the way for America and the lack of food grains and isolation limited the native population in Oz. Similar events produced similar attitudes. I find Australians much closer to Americans than Europeans in their thinking about resources. European attitudes are driven by a deep down belief that there isn't enough to go around. Hell, we were having famines before your countries existed!

By what you say it sounds like attitudes will take time to change even though Australia is short of oil and water. Most politicians are lawyers and want proof which can only come post peak.

This could potentially be worked around by having differentiated gasoline taxes -high in urban areas, low in rural areas. Another alternative would be to go for congestion charging. The revenue would have to go to road improvement/maintainance or public transportation.

Differentiated gasoline taxes for road improvement, was recently discussed, but rejected in Norway. Congestion road tolls to fund public transportation is presently being considered.

In line with that, it should probably be mentioned that Norway is already the home of the Troll-, excuse me - Toll Road. The sad fact is that without tolls to fund new roads, the present 200 bn crown ($ 33 bn, $7400 per capita) underinvestment in roads would be even larger.

Freedom from road tolls, rather than high gasoline taxes, is probably the single factor that makes EVs economical for Norwegian commuters.

EVs in Norway also don't come with the high VAT of gas-guzzling vehicles. And they don't have to pay the high annual registration fees of regular vehicles. Further perks include free use of dedicated bus lanes and free parking. The problem now, is getting enough vehicles. Most distributors are operating with waiting lists.

Some illustrative pictures:

The Kewet Buddy, an electric vehicle recently seen in Norway:

Nordhorlandsbrua (The North-Hordaland Bridge), was paid off in 2005 after being financed mainly by user tolls

The 27 member EU is about 47% of the area of the USA

1.67 million square miles against 3.54 million square miles

Turkey, Croatia and Macedonia are candidates to join and if they do the area will go up to 1.98 million square miles which will bring us up to 56% of the USA or 69% of the lower 48 states.

Add in Norway Switzerland and Iceland which are European countries closely tied to EU but not in it and who have considered joining and we are up to 2.17 million square miles and if Greenland wanted to come back (it left the EU in 1985) we would be over the 3 million square miles mark and bigger than the lower 48.

Europe is not that small.

fascinating comments from everyone -- we all live in our own imaginations (me too, of course.)

Europe as a land mass is huge -- but several thousands of years of conquerors and wars have failed to unite it as an imaginative whole. Perhaps the EU will succeed. In any event, the size of the population, the density of the towns, the smallness of the roads and so much more makes the comparison between U.S.-- (which by the same reasoning could claim at least Canada and Mexico, and has, of course) with Central America on the fringe-- and the European land mass interesting, but not quite convincing.

Australia is similar to the US in size and in some ways history-- but so much of it is uninhabitable by conventional standards that its development has encouraged what seems to me an even more unrealistic notion of space and time (provided their is abundant energy to support the imagination) that the American Dream.

The Norwegian commentator points out the difficulty of trying to influence rational behavior by tax policy. I certainly agree. But perhaps it is not useless to keep trying. Laissez faire can only lead to cycles of collapse and repair.

I suspect that the difference lies not in area, but the fact that Europe rose to high population density before the time when technology made it possible for large numbers of people to usefully own large areas and travel long distances.

As long as the maximum area a man could cultivate was determined by how far he could trudge behind a horse drawn plow in one growing season and the maximum distance he could be from a reasonable number of other people was set by how far he could reasonably take his produce to market by bullock cart or hand cart along bad roads, then sprawl across large areas was not possible.

By the time technology developed that could overcome these barriers large parts of Europe was already a tight network of small fields and compact cities and towns.

In America and Australia the technology arrived when there was still large areas of land to grab and new cities could be built taking advantage of it.

There may not be many people yet that sing Ode to Joy bursting with European patriotism but I meet a growing number of people that feel themselves more culturally at home in other EU countries than their own than they do in America despite language difficulties. The EU is slowly growing to be a feeling of being "us", not some extraneous thing foisted on us by "them"

Notice Aussies are posting because there's not much on TV. I'm sure mileage (kilometrage?) is a major factor whereby people move to the exurbs or hobby farm belt because they can afford the commute. I don't think the graphs in the article enable a comparison of total fuel cost/household income which I'd guess could be more stable between countries of a similar stage of development.

Another complex issue is that of fuel taxes and revenue needs of State and Federal governments. I think our PHEVs will need some liquid fuel not made from corn ethanol but from gasification ie 2nd generation biofuels. From what I gather such fuels are barely competitive now even with zero tax. Can governments afford not to tax such fuels for say a decade?

Good post, interesting. But what, in fine, do these national averages show in our globalised world?

What of all the Chinese stuff in American homes, produced in China with - mostly - Chinese coal? What of the cost of ‘defending ME oil’ - a huge ‘defense’ budget and high taxes, wars, etc. ?

Tax policies, including gas tax, always are part of a complicated mosaic...it is low here, high there, in function of the price of for ex. health insurance (or tax if health is state run.)

-- And why does the US take a sort guilty pride in being a big consumer (of gasoline, oil..) when it is not, as compared to some EU countries, as well as some exporting countries?--

The only point, really, is how to reduce consumption: but very few, or no, policies in the US and the EU have that explicit aim, either thru tax, investment elsewhere, social change, concerted community policies that receive state support, etc. etc.

Of course one can come up with positive examples that aim in that direction, but the overall effect is negligible. Sounds good, is all.

Where's India???

Shell Australia provides a graph to break down the cost of petroleum and taxes by country (Note this is Australian Dollars AUD)

This diagram was found here

I can't believe how little tax you pay in the US!

The US simply has had no incentive to conserve and make more efficient which is surprising giving the endless drive for profitability and corporate expansion.

Rough calculation: A tripling of crude prices to say $180 (from $60) would double UK costs (~£1.80/litre) but triple US costs (~$8-9 gallon). Yes very sensitive.

I wonder if highly taxed countries could afford to scale back the fuel taxation in response to this?? (If the UK dropped the tax to zero in response to a crisis it could absorb the whole tripling of crude price. It's not going to happen though.)

Nick.

_________________________________________

Just got back from Tuscanny in NW Italy. Really nice, lot's of small cars, motorbikes and villages with lots of farmland growing wine crops for export. Hardly any solar PV visible but saw some electric cars and bikes charging in Florence. Even though Europe is dense we still have a lot of food growing potential and organic / local produce is gaining in popularity.

It would be nice to see a similar work done with diesel fuel prices.

It would be even nicer to be able to compare the price of diesel fuel with that of sunflower oil for each country. To get an idea of the current economic viability of biodiesel.

Just venting a dream in case someone would pick it up...