Peak Oil Update - June 2007: Production Forecasts and EIA Oil Production Numbers

Posted by Sam Foucher on June 14, 2007 - 11:53am

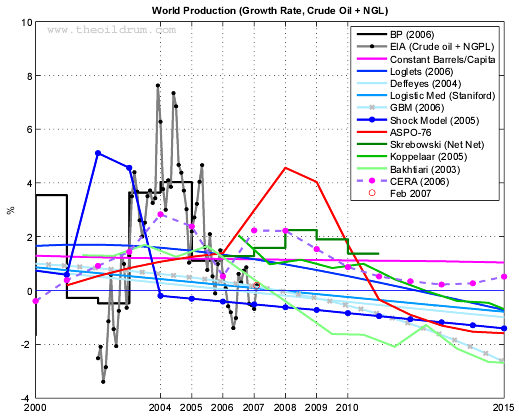

An update on the latest production numbers from the EIA along with graphs/charts of different oil production forecasts.

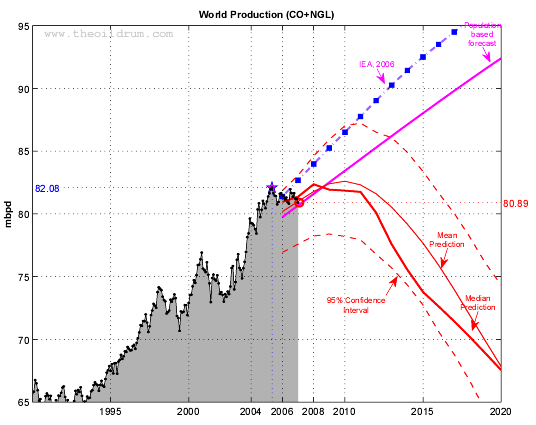

World oil production (EIA Monthly) for crude oil + NGL. The median forecast is calculated from 12 models that are predicting a peak before 2020 (Bakhiarti, Smith, Staniford, Loglets, Shock model, GBM, ASPO-[70,58,45], Robelius Low/High, HSM). 95% of the predictions sees a production peak between 2009 and 2011 at 78.23 - 87.12 mbpd (The 95% confidence interval is computed using a bootstrap technique). Click to Enlarge.

Executive Summary:

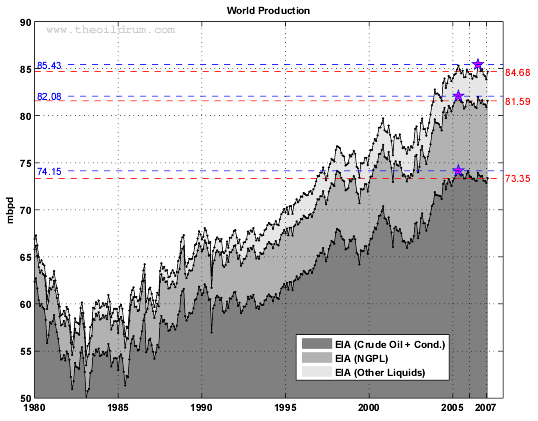

- Monthly production records are unchanged except for NGPL:

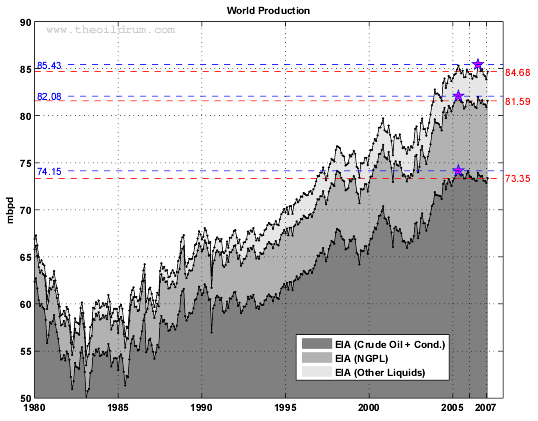

- All Liquids: the peak is still July 2006 at 85.43 mbpd, the year to date average production in 2007 (2 months) is 84.26 mbpd, up 0.2 mbpd from 2006.

- Crude Oil + NGL: the peak date remains May 2005 at 82.08 mbpd, the year to date average production for 2007 (2 months) is 81.24 mbpd, down 0.06 mbpd from 2006.

- Crude Oil + Condensate: the peak date remains May 2005 at 74.15 mbpd, the year to date average production for 2007 (2 months) is 73.09 mbpd, down 0.25 mbpd from 2006.

- NGPL: the peak date is now February 2007 at 8.24 mbpd, the year to date average production for 2007 (2 months) is 8.15 mbpd, up 0.19 mbpd from 2006.

- Decline in crude oil + condensate continues: February 2007 estimate for crude oil + condensate is 73.35 mbpd compared to 73.47 mbpd one year ago.

- New forecasts added: Projections from Frederik Robelius and the Hybrid Shock Model.

- Average forecast: the average forecast for crude oil + NGL based on 12 different projections is showing a kind of production plateau around 83 +/- 4 mbpd with a decline after 2010 +/- 1 year.

Notations:

Fig 1.- World production (EIA data). Blue lines and pentagrams are indicating monthly maximum. Monthly data for CO from the EIA. Annual data for NGPL and Other Liquids from 1980 to 2001 have been upsampled to get monthly estimates. Click to Enlarge.

Table I - Production

estimate

(in millions of barrels per day (mbpd)) for February 2007 taken from

the EIA website (International

Petroleum Monthly). 1Moving Average

on the last 12 months.

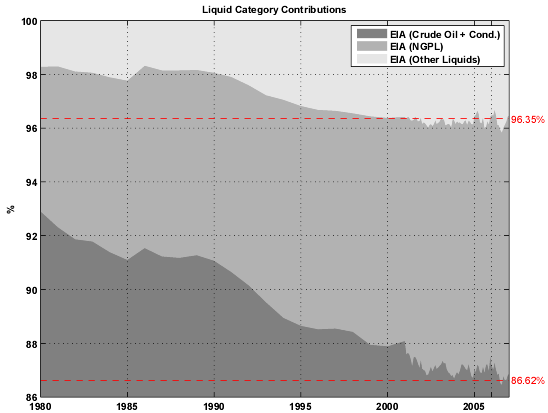

The share of CO is now only 86.6% of the total liquid production.

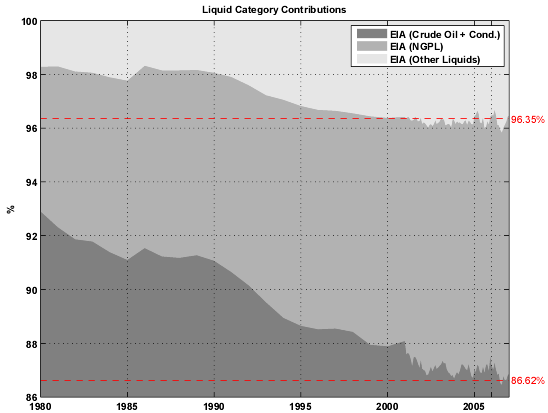

Fig 3.- Share of each liquid category to the total liquid production. Click to Enlarge.

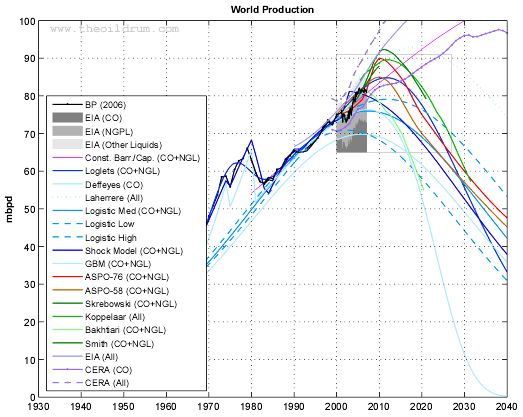

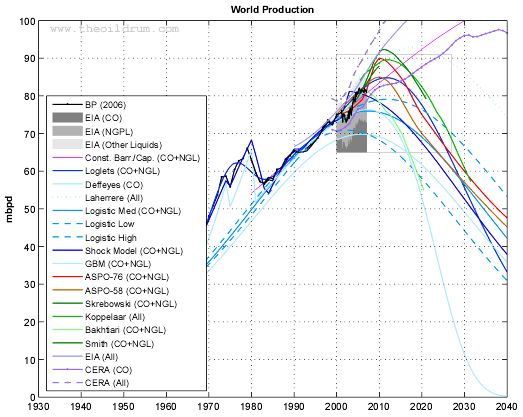

The figure below is giving the general context where all the forecasts are situated, in the following we will focus on the 2000-2025 period shown as a gray box.

Fig 4.- World oil production (Crude oil + NGL) and various forecasts (1940-2050). The light gray box gives the particular area where the Figures below are zooming in. Click to Enlarge.

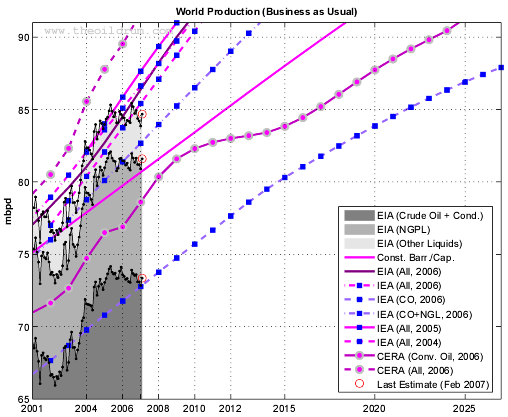

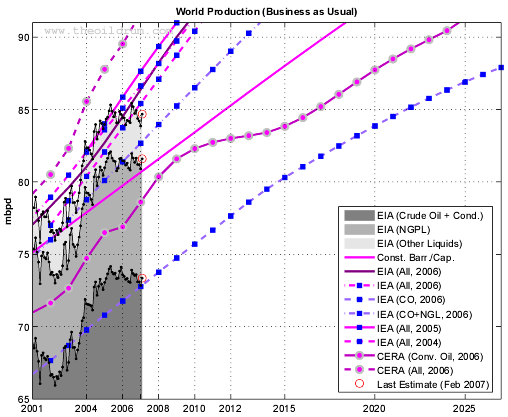

Fig 5.- Production forecasts assuming no visible peak. Click to Enlarge.

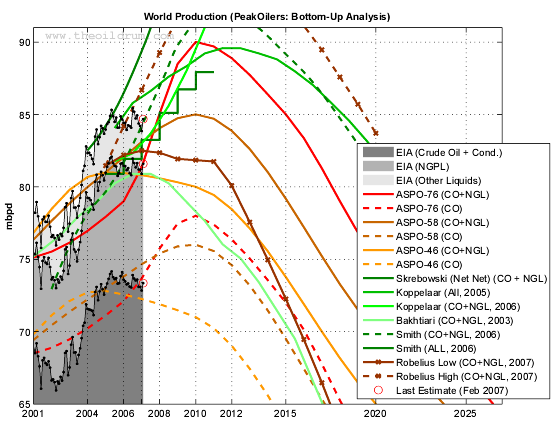

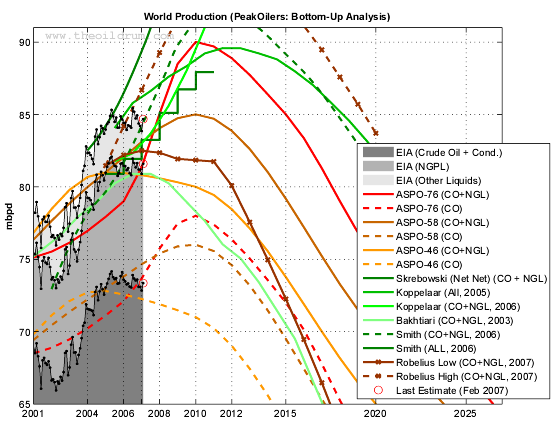

Fig 6.- Forecasts by PeakOilers based on bottom-up methodologies. Click to Enlarge.

Fig 7.- Forecasts by PeakOilers using curve fitting methodologies. Click to Enlarge.

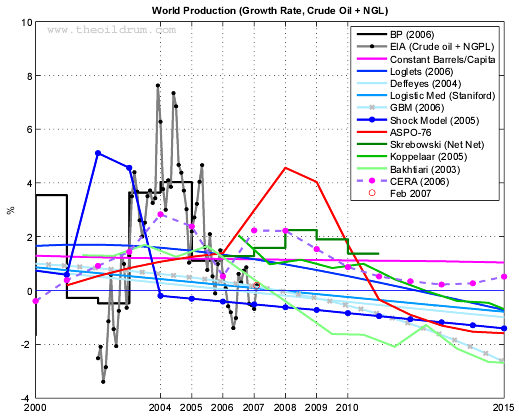

Fig 8.- Year-on-Year production growth. Click to Enlarge.

Table II. Summary of

all the

forecasts (figures are in mbpd) as well as the last EIA estimates.1Productive

capacities. 2Difference

between the observed production for 2007 and the predicted value (in

mbpd), the value in bold indicates the best forecast (i.e. the oldest

with the lowest difference.

January 2007

December 2006

November 2006

October 2006

September 2006

- mbpd= Million of barrels per day

- Gb= Billion of barrels (109)

- Tb= Trillion of barrels (1012)

- NGPL= Natural Gas Plant Liquids

- CO= Crude Oil + lease condensate

- NGL= Natural Gas Liquids (lease condensate + NGPL)

- URR= Ultimate Recoverable Resource

EIA Last Update (February)

Data sources for the production numbers:

- Production data from BP Statistical Review of World Energy 2006 (Crude oil + NGL).

- EIA data (monthly and annual productions up to February 2007) for crude oil and lease condensate (noted CO) on which I added the NGPL production (noted CO+NGL).

The All liquids peak is still July 2006 at 85.47 mbpd, the year to date average production value in 2007 (2 months) is down from 2005 for all the categories except for NGPL. The peak date for Crude Oil + Cond. is May 2005 at 74.15 mbpd (see Table I below).

Fig 1.- World production (EIA data). Blue lines and pentagrams are indicating monthly maximum. Monthly data for CO from the EIA. Annual data for NGPL and Other Liquids from 1980 to 2001 have been upsampled to get monthly estimates. Click to Enlarge.

| Category | Feb 2007 | Feb 2006 | 12 MA1 | 2007 (2 Months) | 2006 (2 Months) | Share | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|---|

| All Liquids | 84.68 | 84.41 | 84.48 | 84.26 | 84.46 | 100.00% | 2006-07 | 85.43 |

| Crude Oil + NGL | 81.59 | 81.43 | 81.30 | 81.24 | 81.30 | 96.35% | 2005-05 | 82.08 |

| Other Liquids | 3.09 | 2.98 | 3.18 | 3.02 | 3.16 | 3.65% | 2006-08 | 3.54 |

| NGPL | 8.24 | 7.97 | 7.99 | 8.15 | 7.96 | 9.73% | 2007-02 | 8.24 |

| Crude Oil + Condensate | 73.35 | 73.47 | 73.31 | 73.09 | 73.34 | 86.62% | 2005-05 | 74.15 |

The share of CO is now only 86.6% of the total liquid production.

Fig 3.- Share of each liquid category to the total liquid production. Click to Enlarge.

The figure below is giving the general context where all the forecasts are situated, in the following we will focus on the 2000-2025 period shown as a gray box.

Fig 4.- World oil production (Crude oil + NGL) and various forecasts (1940-2050). The light gray box gives the particular area where the Figures below are zooming in. Click to Enlarge.

Business as Usual

- EIA's International Energy Outlook 2006, reference case (Table E4, World Oil Production by Region and Country, Reference Case).

- IEA total liquid demand forecast for 2006 and 2007 (Table1.xls).

- IEA World Energy Outlook 2006 : forecasts for All liquids, CO+NGL and Crude Oil (Table 3.2, p. 94).

- IEA World Energy Outlook 2005 : forecast for All liquids (Table 3.5).

- IEA World Energy Outlook 2004 : forecast for All liquids (Table 2.4).

- A simple demographic model based on the observation that the oil produced per capita has been roughly constant for the last 26 years around 4.4496 barrels/capita/year (Crude Oil + NGL). The world population forecast employed is the UN 2004 Revision Population Database (medium variant).

- CERA forecasts for conventional oil (Crude Oil + Condensate?) and all liquids, believed to be productive capacities (i.e. actual production + spare capacity). The numbers have been derived from Figure 1 in Dave's response to CERA.

Fig 5.- Production forecasts assuming no visible peak. Click to Enlarge.

PeakOilers: Bottom-Up Analysis

- Chris Skrebowski's megaprojects database (see discussion here).

- The ASPO forecast from April newsletter (#76): I took the production numbers for 2000, 2005, 2010, 2015 and 2050 and then interpolated the data (spline) for the missing years. I added the previous forecast issued one year and two years ago (newsletter #58 and #46 respectively). There was no revision since August 2006.

- Rembrandt H. E. M. Koppelaar (Oil Supply Analysis 2006 - 2007): "Between 2006 and 2010 nearly 25 mbpd of new production is expected to come on-stream leading to a production (all liquids) level of 93-94 mbpd (91 mbpd for CO+NGL) in 2010 with the incorporation of a decline rate of 4% over present day production".

- Koppelaar Oil Production Outlook 2005-2040 - Foundation Peak Oil Netherlands (November 2005 Edition).

- The WOCAP model from Samsam Bakhtiari (2003). The forecast is for crude oil plus NGL.

- Forecast by Michael Smith (Energy Institute) for CO+NGL, the data have been taken from this chart in this presentation (pdf).

- PhD thesis of Frederik Robelius (2007): Giant Oil Fields - The Highway to Oil: Giant Oil Fields and their Importance for Future Oil Production. The forecasts (low and high) are derived from this chart.

Fig 6.- Forecasts by PeakOilers based on bottom-up methodologies. Click to Enlarge.

PeakOilers: Curve Fitting

The following results are based on a linear or non-linear fit of a parametric curve (most often a Logistic curve) directly on the observed production profile:- Professor Kenneth S. Deffeyes forecast (Beyond Oil: The View From Hubbert's Peak): Logistic curve fit applied on crude oil only (plus condensate) with URR= 2013 Gb and peak date around November 24th, 2005.

- Jean Lahèrrere (2005): Peak oil and other peaks, presentation to the CERN meeting, 2005.

- Jean Lahèrrere (2006): When will oil production decline significantly? European Geosciences Union, Vienna, 2006.

- Logistic curves derived from the application of Hubbert Linearization technique by Stuart Staniford (see this post for details).

- Results of the Loglet analysis.

- The Generalized Bass Model (GBM) proposed by Prof. Renato Guseo, I used his most recent paper (GUSEO, R. et al. (2006). World Oil Depletion Models: Price Effects Compared with Strategic or Technological Interventions ; Technological Forecasting and Social Change, (in press).). The GBM is a beautiful model that has been applied in finance and marketing science (see here for some background). The estimation in Guseo's article was based on BP data from 2004 (CO+NGL).

- The so-called shock model proposed by TOD's poster WebHubbleTelescope . You can find a description of his approach on his blog here as well as a review on TOD. The current estimate was done in 2005 based on BP's data (CO+NGL).

- The Hybrid Shock Model is a variant of the shock model described here. The forecast is based on EIA data (up to 2006) for crude oil + condensate, the ASPO backdated disovery curve and assumes no reserve growth and declining new discoveries.

Fig 7.- Forecasts by PeakOilers using curve fitting methodologies. Click to Enlarge.

Production Growth

The chart below gives the year-on-year production growth (or decline) for each month. Growth has been weak (below 1%) since 2005..

Fig 8.- Year-on-Year production growth. Click to Enlarge.

| Forecast | 2005 | 2006 | 2007 | 2010 | 2015 | Diff2 | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|---|

| All Liquids | ||||||||

| Observed (All Liquids) | 84.56 | 84.51 | 84.26 | NA | NA | 2006-07 | 85.43 | |

| IEA (WEO, 2004) | 82.06 | 83.74 | 85.41 | 90.40 | 98.69 | -1.16 | 2030 | 121.30 |

| IEA (WEO, 2005) | 84.00 | 85.85 | 87.64 | 92.50 | 99.11 | -3.38 | 2030 | 115.40 |

| Koppelaar (2005) | 84.06 | 85.78 | 86.61 | 89.21 | 87.98 | -2.36 | 2011 | 89.58 |

| Lahèrrere (2005) | 83.59 | 84.47 | 85.23 | 86.96 | 87.77 | -0.97 | 2014 | 87.84 |

| EIA (IEO, 2006) | 82.70 | 84.50 | 86.37 | 91.60 | 98.30 | -2.11 | 2030 | 118.00 |

| IEA (WEO, 2006) | 83.60 | 85.10 | 86.62 | 91.30 | 99.30 | -2.36 | 2030 | 116.30 |

| CERA1 (2006) | 87.77 | 89.52 | 91.62 | 97.24 | 104.54 | -7.36 | 2035 | 130.00 |

| Lahèrrere (2006) | 83.59 | 84.82 | 85.96 | 88.93 | 92.27 | -1.70 | 2018 | 92.99 |

| Smith (2006) | 85.19 | 87.77 | 90.88 | 98.94 | 98.56 | -6.62 | 2012-05 | 99.83 |

| Crude Oil + NGL | ||||||||

| Observed (EIA) | 81.45 | 81.33 | 81.24 | NA | NA | 2005-05 | 82.08 | |

| GBM (2003) | 76.06 | 76.27 | 76.33 | 75.30 | 67.79 | 4.91 | 2007-05 | 76.34 |

| Bakhtiari (2003) | 80.24 | 80.89 | 80.89 | 77.64 | 69.51 | 0.34 | 2006 | 80.89 |

| ASPO-46 | 81.00 | 80.95 | 80.80 | 80.00 | 73.77 | 0.43 | 2005 | 81.00 |

| ASPO-58 | 81.00 | 82.03 | 83.10 | 85.00 | 79.18 | -1.86 | 2010 | 85.00 |

| Staniford (High) | 77.45 | 77.92 | 78.31 | 79.01 | 78.51 | 2.92 | 2011-10 | 79.08 |

| Staniford (Med) | 75.81 | 75.94 | 75.97 | 75.52 | 73.00 | 5.27 | 2007-05 | 75.98 |

| Staniford (Low) | 70.46 | 70.13 | 69.71 | 67.92 | 63.40 | 11.53 | 2002-07 | 70.88 |

| IEA (WEO, 2006) | 80.10 | 81.38 | 82.67 | 86.50 | 92.50 | -1.43 | 2030 | 104.90 |

| Koppelaar (2006) | 81.76 | 82.31 | 83.68 | 91.00 | NA | -2.44 | 2010 | 91.00 |

| Skrebowski (2006) | 80.90 | 81.42 | 82.59 | 87.32 | NA | -1.35 | 2010 | 87.92 |

| Smith (2006) | 80.53 | 82.81 | 85.45 | 91.95 | 88.60 | -4.21 | 2011-02 | 92.31 |

| Loglets | 81.12 | 82.14 | 83.02 | 84.65 | 83.26 | -1.78 | 2012-01 | 84.80 |

| ASPO-76 | 77.92 | 79.00 | 81.35 | 90.00 | 85.00 | -0.11 | 2010 | 90.00 |

| Robelius Low (2006) | 81.45 | 82.19 | 82.50 | 81.84 | 72.26 | -1.26 | 2007 | 82.50 |

| Robelius High (2006) | 81.45 | 84.19 | 86.67 | 93.40 | 92.40 | -5.44 | 2012 | 94.54 |

| Shock Model (2006) | 80.76 | 80.43 | 80.01 | 78.27 | 73.74 | 1.23 | 2003 | 81.17 |

| Crude Oil + Lease Condensate | ||||||||

| Observed (EIA) | 73.65 | 73.39 | 73.09 | NA | NA | 2005-05 | 74.15 | |

| ASPO-46 | 72.80 | 72.56 | 72.25 | 71.00 | 63.55 | 0.84 | 2005 | 72.80 |

| Deffeyes (2004) | 69.81 | 69.81 | 69.71 | 68.90 | 65.88 | 3.38 | 2005-12 | 69.82 |

| ASPO-58 | 73.00 | 73.80 | 74.65 | 76.00 | 69.50 | -1.56 | 2010 | 76.00 |

| IEA (WEO, 2006) | 70.80 | 71.78 | 72.77 | 75.70 | 80.30 | 0.32 | 2030 | 89.10 |

| CERA1 (2006) | 76.49 | 76.89 | 78.60 | 82.29 | 83.83 | -5.51 | 2038 | 97.58 |

| ASPO-76 | 71.11 | 72.10 | 73.66 | 78.00 | 72.00 | -0.57 | 2010 | 78.00 |

| HSM (2007) | NA | 73.56 | 73.53 | 72.82 | 69.53 | -0.44 | 2006 | 73.56 |

Next update probably in September.

Previous Update:

Februray 2007January 2007

December 2006

November 2006

October 2006

September 2006

OilWatch last issue:

Khebab: Great article. The way you lay it out with the summary drilling down to more and more detail is absolutely perfect.

An absolutely state of the art summary, thank you very much. What a pity the usual media (even sites such as The Nation or Die Tageszeitung) do not pay more attention to this.

ciao,

Bruce

Actually, Die Tageszeitung ran a longer piece on Deffeyes and the Thangsgiving Peak Prediction in November 2005 (which had the benefit of alerting me to the subject) but after that, they pretty much went back to ignoring the subject altogether. They have joined the Global Warming bandwagon in a large way, though, but most of their readers are greenish yuppies now, not Green radicals like 20 years ago, so they prefer to run stories about the Solar Future and our cars running on hydrogen instead of confronting depletion angst...

Well, the "bad" thing about PO is that the advocacy "cause" aspect of it always ends up shooting itself in the foot. The story never seems to get any traction because of cry wolf syndrome...

It is much easier for liberals and liberal publications to ride the GW train (so to speak) because the weather takes so damn long to change, and plus, it is a lot more excusable for some reason in the MSM to have all these wildly varying models for GW... but when it comes to PO it seems as if the interest wanes a lot more. I don't know why this is...

*But*, I do know that Democrats and liberals everywhere do not want to talk about PO... It is a political loser...

The propaganda mission for liberals seems to be use GW as an excuse to reduce fossil fuels use that way we don't even need to discuss PO!

I think the problem with trying to talk to the masses in the US about oil depletion is that most of them would either tell you the problem is "gouging" (the more suburban liberal bent), if not that then it is "they aren't allowed to drill" (the dyed-in-the-wool right-wing corporate apologist).

Then you have people like BenjaminCole, who agree PO is coming eventually, but modulate down into a no-brainer--ie, cow shit is gonna power our fleets of Boeings for the next 5 decades, etc etc...

Well, the cry wolf syndrome is a problem for more than just PO -- this is also true for the whole environmental movement. A lot of the stuff predicted back in the 70s was premature (but not otherwise wrong). I agree with you that GW and even the environmental movement are "safer" than PO. PO takes an axe to our whole way of life sooner than does GW. All you have to do about GW or the environment is send in a check to your favorite group. What does one do about PO? It's a statement that our whole way of life is becoming impossible in the next few decades.

One side note. I'm also one of those tinfoil hat guys on 9-11 (as is Colin Campbell along with some other PO people). The interesting part is that a lot of 9-11 people don't buy PO at all -- it's just a conspiracy by the oil companies to jack up prices. So while these people are able to adjust to the horrible implications of the 9-11 story, the idea that our whole way of life is not sustainable is somehow just too much to bear.

More, PO doesn't really seem to be a movement yet -- it's a research project. There's no simple set of answers to the problem. Even those who agree on PO do not agree on what it will mean and what's possible to do about it. The only thing PO does right now is say: do you see the freight train coming down the tracks?

This is mostly true except for the part that it was "premature", especially with respect to climate change.

The underlying cause for concern always was and still is that of run-away Climate Change. GW concerns really started in the 1980's. Twenty years later we are undergoing an anthropogenically enhanced abrupt and non-linear (unpredictable) climate change -- one that for all practical intents and purposes will likely be very soon humanly irreversible.

Was it really "premature" to warn of this then?

According to James Hanson, from an adaptation of a talk delivered in February, and printed in The Nation (May 7.2007 issue):

"There's a huge gap between what is understood about global warming by the relevant scientific community and what is known about global warming by those who need to know: the public and policy-makers. We've had, in the past thirty years, one degree Fahrenheit of global warming. But there's another one degree Fahrenheit in the pipeline due to gases that are already in the atmosphere. And there's another one degree Fahrenheit in the pipeline because of the energy infrastructure now in place--for example, power plants and vehicles that we're not going to take off the road even if we decide that we're going to address this problem.

"The Energy Department says that we're going to continue to put more and more CO2 in the atmosphere each year -- not just additional CO2 but more than we put in the year before. If we do follow that path, even for another ten years, it guarantees that we will have dramatic climate changes that produce what I would call a different planet -- one without sea ice in the Arctic; with worldwide, repeated coastal tragedies associated with storms and a continuously rising sea level; and with regional disruptions due to freshwater shortages and shifting climatic zones."

Had we thought to address this as a serious concern, worthy of the precautionary principle, even 15 years ago we wouldn't be faced with the dire problem we are today as Hanson (among many, many other scientists) now sees coming no matter what we do. For civilization as we know it it will likely prove to be an unstoppable disaster.

Once set in motion climate change is a beast and will not readily relent to our late and still haphazard efforts to mitigate it. The lesson is a tragic one, in that those who were accused of "crying wolf" back were not at all premature with such an intractable threat.

Instead of learning our lesson, today's PO promoters are in the same boat that CC theorists were in 20 years ago. There is another "freight train coming down the tracks", which according to the Hirsch Report (along with many, many other thinking people, like ourselves):

"The peaking of world oil production presents the U.S. and the world with an unprecedented risk management problem. As peaking is approached, liquid fuel prices and price volatility will increase dramatically, and, without timely mitigation, the economic, social, and political costs will be unprecedented. Viable mitigation options exist on both the supply and demand sides, but to have substantial impact, they must be initiated more than a decade in advance of peaking." {my emphases}

Among their quoted conclusions:

• World oil peaking is going to happen, and will likely be abrupt.

• Oil peaking will adversely affect global economies, particularly those most dependent on oil.

• Oil peaking presents a unique challenge (“it will be abrupt and revolutionary”).

• The problem is liquid fuels (growth in demand mainly from transportation sector).

• Mitigation efforts will require substantial time.

• 20 years is required to transition without substantial impacts

• A 10 year rush transition with moderate impacts is possible with extraordinary efforts from governments, industry, and consumers

• Late initiation of mitigation may result in severe consequences.

Gee, this all sounds awfully familiar.

By the time we do wake up to recognizing PO for what it is, like CC, it will be too late to do much to mitigate the worst of its effects upon civilization as we know it.

By my way of reckoning, this new crying wolf "research project" is only interesting in the same way that any of us cares to give studied witness to the progression of our ultimate demise. For myself and civilization as I know it, I've grown weary of this new yet same old drama.

Of course it ain't over til its over, but the plot is essentially the same and I see no reason to believe the outcome won't be any different than the CC one already set in motion.

It really is a once in a long historical lifetime we are stuck in, and all I can do is sit back comfortably while preparing as best I can to enjoy the show while it lasts. Tragically, so it goes...

Why do some of you seem to have this interminable need to refer everything back to climate change or, amazingly enough, 9/11 theories?

For goodness sake, show some respect!

Khebab has spent a hell of a lot of time putting together a really good, professional post on peak oil and you precious ponies what to hijack the thread to talk about your pet subjects.

If you want to spout about those sorts of things, there are plenty of other forums to do it in (including the daily drum).

Please, stop polluting the research and analysis threads with this sort of stuff.

I absolutely agree concerning the 9/11 stuff, but you must know the climate change story started in scientific circles and has always been run by professionals. Any indication to the otherwise has always been, and still is, industry disinformation.

Want to _really_ know about climate change? Read the scientific literature. There is no substitute.

ciao,

Bruce

Critical_Mind, I hope you weren't referring to me. I was simply offering my opinion, not trying to be disrespectful of Khebab (who's work I not only respect, but thoroughly appreciate.)

I was just responding to a comment... I thought that's what the comment section was for. Comments and discussion. I hate to be smug, but I think I'm right (like most people).

Sometimes when someone responds to a comment I've posted I feel the need to engage the person's comment further so as to expound my analysis and/or position. And I think I have done so, now let my text speak for itself.

There is a disconcerting tendency for people that accept peak oil being a reality to concurrently hold unfounded conspiratorial beliefs about 9/11.

This is a problem for the TOD community, and the "movement" as a whole as it discredits much of the hard work that you are imploring us to respect. I humbly believe it is important for anyone who takes peak oil seriously to vocally distance themselves from the the so-called "theories" of the 9/11 truth meme. It needs to be stated that 9/11 may have been taken advantage of (to invade Iraq) on dubious premises, but that does not in any way somehow implicate Dick Cheney in giving Mr. Atta the "go" command (and don't ask my opinion of Cheney...) It needs to be stated in somewhat arguably-important venues that this is uncalled for, and damages not only the Left, but peak oil awareness as well. A quick google of "peakoil" and "9/11" will come up with some pretty discrediting stuff and is a superficial and easy (yet effective) way for propagandists to filter and diminish *critical* thought when it comes to "energy and our future", as the TOD masthead says.

I do preemptively apologize for adding yet even more clutter, but this is the goddamn internet--give me a break!

In my opinion, 9/11 is not an appropriate topic for this blog but climate change is because climate change is intimately tied to fossil fuels.

Additionally, I didn't see where Professor Goose made you a moderator of TOD. Oh he didn't? Then why are you worrying your head about it? The editors and contributors of TOD will police it (or not) as they see fit.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Grey: Neither topic is appropriate here IMO but most 9/11 bloggers do specifically relate the events to fossil fuel depletion (necessitating Iraq oil grab).

I believe that you are flatly incorrect about climate change as there have been many main articles on TOD itself in the past on that very topic but none, ever, about 9/11 conspiracy theories. If Professor Goose has allowed articles about climate change here and if those articles have been posted (both of which are true) then discussion of climate change is part of this blog.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I've also noticed the stark absurdity of the 9/11 "truth" demographic when it comes to acknowledging elementary geology. Obviously an interesting psychological phenomenon--or, more realistically, *problem*. I don't know if this is the appropriate place to ask, but when you say tin-foil-hat-wearing do you mean the the government had prior knowledge of 9/11? I always tended to think that our government is way to inept to organize such a murderous conundrum, but I know history has a lot to say in opposition.

Regarding the cry wolf syndrome being indicative of the problems of environmentalism, you are certainly right that the massively incorrect predictions emanating from the late '60s and early '70s gave ample firepower to propagandists in the opposing camps (Hoover, Heritage, Hudson et al). But in reality, there is no big conspiracy. Just a government that Madison set up to keep the wealthy business classes--now morphed into corporate descendants--in power over the economy. In the early 20th century this just became an industrialized version of Madison's experiment, and along with industrialism came an explosion of media, almost entirely corporate owned. So, to sum up, our society's psychological fabric consists of private interests and propaganda--the two pillars standing in the way of, for lack of a better term, the "awareness train". Entertainment is the best propaganda you can buy. These pillars have been in place since slavery, and they still impede consciousness raising to this very day... However, in addition to private interests and propaganda, we can also throw in the sheer imaginative ability of the Homo Sapien. We may be sick little monkeys but we're also quite stunning in our abilities of invention (think religion, for a good sprawling anthropological example) and intelligence (think math, science).

Point is...

I'm sure that even if the horrendous predictions made by prominent academics in the 70s were never made--that "environmentalism" still would be probably right where it is today... Which is to say, nowhere.

davebygolly, you succinctly wrote:

"The only thing PO does right now is say: do you see the freight train coming down the tracks?"

And the amazing thing is that many people do not--or they claim it's moving at .001mph and won't hit us for at least 30 years, and by then we won't even be standing on the tracks anymore... (We'll be living in our "sustainable" [subsidized] corn stalk homes!)

I don't know if this is the appropriate place to ask, but when you say tin-foil-hat-wearing do you mean the the government had prior knowledge of 9/11?

It's not the right place to ask or answer, so I will only say: I mean a lot worse than that.

This is one of those issues that is impossible to speak about in person to anyone, including liberals. I've seen the videos and I must say that at the very least, the government has to answer some major questions. I believe "Popular Mechanics" ran a rebuttal to many of the points, but even that left me unsatisfied. Where was NORAD? Why was Building 7 in particular the third steel-structured building in world history to fall due to fire (the first two being the ones that airplanes hit). I know there are many questions I'd like my government to answer, and put me at (somewhat more) ease.

It seems quite apparent to me by now, however, that the main reason for going into Iraq (which 9/11 enabled) was an oil-grab. I would just like some of these questions to be taken seriously instead of dismissed offhand. Funny how the only people who dare ask important questions are seen as traitors. To me, as teachers have told me before, "there is no stupid question".

davebygolly wrote,

"One side note. I'm also one of those tinfoil hat guys on 9-11 (as is Colin Campbell along with some other PO people). The interesting part is that a lot of 9-11 people don't buy PO at all -- it's just a conspiracy by the oil companies to jack up prices. So while these people are able to adjust to the horrible implications of the 9-11 story, the idea that our whole way of life is not sustainable is somehow just too much to bear."

Well, in this particular case (again, it changes form if you shift to another part of the political spectrum) it is an ability to over fantasize. There is no direct link, to the extent that PO is related to 9/11... In my view the status quo explanation is correct. Government incompetency coupled with the blow back of a determined fundamentalist suicidal death cult. National security, to the extent that it works, is *supposed* to protect us. The 9/11 truth people seem to go the hot air route of BenjaminCole (just to continue upon my assault on him throughout this thread!) They say something is true--but do so without the backup of sensible argument coupled with hard evidence. They hem and haw for their "beliefs" in the the presence of devastating arguments against holding them (much like heavily religious, personal-god type people).

To the extent that there are questions about collapse, I don't believe they hold up. When the buildings began construction in the mid-60s they were a totally original design, no building of that stature had ever been constructed where essentially the exterior of the building would be holding together the structure. They used an entirely new system of building a skyscraper to... By the time they were finished, in the 70s the buildings were relics of an bygone era of building--but they obviously stood intact perfectly fine (that is until jetliners were flown into them at high speeds). That they collapsed, to me, is unsurprising and I don't believe one needs to imagine thermite in the staircases, etc etc, to conclude that they collapsed as a result the complicated physics of massive jet-liners slamming into very experimentally gargantuan buildings. Given how, and when the they were built, in addition to recognizing the immensity of them, it doesn't surprise me.

It is just inconceivable that my own government would "plan" the attacks--and that type of thinking gives the far left (of which I would count myself) a very bad name and makes me ashamed to be a liberal (as do very many other things purported "liberals" say and do.) I might also note here that there is probably some cognitive dissonance amongst those that can't believe that they came down as a consequence of the physics resulting purely from the impacts. I remember on that day, during the "event", while the two towers were will still standing--I don't think anyone imagined (or wanted to) that they would fall... Maybe this is part of it? I'm unsure, but I think there is some type of relation between the "truthers" and an inability to grasp, perhaps, American descent, failure, collapse (ironically enough), etc--ie, "it is all just the big corporations controlling us! But, everything will keep on going fine, we just hate them controlling us!" Of course strikingly, there are people on the otherside, who are evangelical about corporate benevolence and sacredness... Two sides of the same hysterical coin?

However, given all this (you started it, tin-foil-wearer! :-] ) I still wholeheartedly agree that our government did and has exploited 9/11 to the fullest extent allowable by human consciousness and has inexcusably whitewashed it--but that is just realpolitik. Iraq is clearly the manifestation of Hawkish tendencies in AEI and it's swarm of bees. And yes, that hive is essentially a strategic planning unit for US Imperialism and control of the world's economy, and energy reserves (not surprisingly--we've gotta use our half a trillion dollar military budget doing something!)

And when do we start to lose our grasp? Iraq is a harbinger of our inability to control a world that we have become dependent on.

It is very dismaying to me that people involved in the peak oil issue would traffic in the absurdities of 9/11 conspiracy theory. I suppose it shows that the delusional thinking endemic to highly-stressed societies is not limited to evangelicals, CNBC-cheerleaders, Nascar morons, and White House policy aides.

Jim Kunstler

Saratoga Springs, NY

I agree completely. Absolutely amazed that the 9/11 conspiracy movement has any traction among otherwise reasonable people (in my institute there are at least two true believers... these guys are scientists but it is impossible to shake them... the underlying reason is perhaps that physicists don't know anything about the physics of buildings... the only way to learn the relevant stuff is to read what building engineers have to say about the subject and then the silly nature of the 9/11 "theories" becomes clear).

ciao,

Bruce

Bruce: Personally, I am amazed that you guys are so convinced that you know exactly what happened on 9/11. I have no idea what exactly happened, but I would say that the probability is that the official conspiracy theory as relayed by the MSM is inaccurate (it almost always is).

Logic problem also relevant to Peak Oil (the only reason I respond): of course I don't know _exactly_ what happened. But preposterous claims made by the conspiracy crowd are not an appropriate response. It is like the believers in endless oil, who try to force the rest of us to predict, _exactly_ when the oil peak (or population crash, or other problem) will take place. If we cannot (of course we cannot), then they claim their position is justified. It is what I mentioned earlier about false premise. The fact that no human has been to the far side of the moon does not make it likely aliens have built buildings there now does it.

If we incorrectly claim oil will peak on 21 July 2007, and we are found to be wrong, then there will always be oil, right?

ciao,

Bruce

The reason the scientists (physicists?) are "unshakable" is because it is absolutely impossible to simultaneously believe both in Newton's laws and the gov't story. The gov't story also defies the laws of probability. Once again a choice is forced. I'm a math and physics guy. No one will survive a debate with me on the issue if they restrict themselves to logic and the known facts -- and foreswear ad hominens. But it can't be here -- I agree -- even though there is a very definite connection to PO. That's why Colin Campbell devotes a whole chapter in the middle of his book OIL CRISIS to the topic. But this topic, unlike GW, generates enormous amounts of heat in comparison to the amount of generated light, which is a distraction from the main issue of this site.

Wow, I always thought you were just a tiny bit on the nutty side (not that you care, I know, and I applaud that), but you are 100% correct (IMO) on this 9/11 issue. Peak oil is a logical intuitive resource constraint issue. But 9/11 conspiracies are almost entirely fantasy.

Unbelievable! Mr. Doom himself. Mr. The suburbs are the greatest waste of America, Mr. I live in upper state New York and will survive, thinks that conspiracy theories are hokum. Wow! Did you wake up one day and see how close you are to the edge and say "I better distance myself or no one will buy my books or book anymore talks"? Oh well. I guess the kooks have to draw a line somewhere. Or are you a kook?

What gives? You think WTC7 fell because of a little fire? You think that Bush lying us into Iraq was a simple mistake? You think that the nose of a plane would have made it through the second twin tower intact? Three towers fell on 9/11. How many people even know that?

By the way, I am half the time a great fan of your monday blog. But you seem to have a blind spot. Why is that? Do you close your eyes at videos like "loose change"?

I can read about 9/11 theories and climate change disasters in any number of other places.

However, I can only read about Khebab's analysis of oil production history and future scenarios here - on this thread.

You get a daily drum every day where you can discuss this other stuff.

On "specialist" threads, I'm more interested in reading about how others view the specialists' analyses.

I don't want you to stop discussing these other issues, however I do find it distracting when threads such as this one end up with large chunks of totally off-topic comments.

The EIA's May International Petroleum Monthly is just out. Late but it finally arrived. It has the March production data.

http://www.eia.doe.gov/ipm/

Ron Patterson

thanks, I was expecting it earlier.

The updated version of the IPM only changes your numbers slightly (they are still playing with the 2005 data to get it into final form, I expect similar revisions in the monthly energy review next month as they had finally gotten the numbers to "match" for 2005).

A slightly higher value for May 2005 (C+C) and a lower value for NGL's (7.9 MMBPD) for Feb 2007 but it's still the maximum.

Maximum liquids reduced a little (to 85.38 MMBPD) in July 2006 and the crude plus NGLs creeps up to 82.20 MMBPD in May 2005.

Of course they would release it just after you've completed you work!

Good job!

Update of Bottom Up Forecast for EIA March 2007 data

First, as usual, excellent work, Khebab! Every key post should have an executive summary like yours.

The updated world total liquids supply forecast shows a peak plateau from 2006 to 2009 with production between 85 and 86 mbd. This plateau is the result of decreased production of crude oil and lease condensate (C&C) being offset by increasing production from natural gas liquids and biofuels (mainly ethanol). The fall in total liquids production from 2009 to 2012 is similar, in magnitude, to the rise in production from 2002 to 2006. As supply falls short of demand, prices will continue increasing.

Fig 1 – Peak Oil Plateau – click to enlarge

The figure below shows crude oil and lease condensate (C&C) production declining at a rate of 1%/yr until end of 2008. Afterwards, the decline rate is 4%/yr from 2009 to 2012.

World C&C for Feb 2007 was 73.49 mbd. In Mar 2007, it was 73.36 mbd, a small drop of 0.13 mbd. Significant falls over the same time period include Nigeria down 0.21 mbd, due to militant attacks and the North Sea (primarily UK, Norway, Denmark), down 0.13 mbd. The North Sea produced 4.30 mbd in Mar 2007. Unfortunately, as this decline rate continues, the North Sea will be probably be producing less than 4 mbd by late 2007. Other significant sources of decline include China, down 0.05 mbd; Australia, 0.07 mbd; and Canada, 0.05 mbd.

Offsetting significant production increases include 0.06 mbd from Venezuela; USA, 0.08 mbd; Angola, 0.04 mbd; Azerbaijan, 0.06 mbd; Iraq, 0.05 mbd; Kazakhstan, 0.04 mbd; and UAE, 0.04 mbd.

Fig 2 – Crude Oil & Lease Condensate to 2012 – click to enlarge

One of the key drivers of the above forecasts is Saudi Arabia’s production forecast. It is assumed that Saudi Arabia has total ultimate recoverable C&C of 175 Gb and that the C&C production rate does not cause the depletion rate of remaining reserves to exceed 5.3%/yr. The blue line in the figure below shows Saudi Arabia’s C&C production decline curve.

Fig 3 – Saudi Arabia to 2020 – click to enlarge

The figure below shows Saudi Arabia’s C&C production since the late 1930s forecast to 2080. Saudi Arabia has probably passed peak production as the production from the scheduled megaprojects and infill drilling will probably be insufficient to create a new production peak.

Fig 4 – Has Saudi Arabia passed Peak C&C? – click to enlarge

Ace, is it my imagination or is your peak liquids date creeping forward a bit at a time? I seem to recall early 2009 previously as being your peak liquids date but now it looks like mid-2008.

And thank you for the update! You compress a massive amount of information into your graphs!

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Greyzone, peak total liquids is creeping forward slightly due to downward forecast revisions to the North Sea, Mexico and Saudi Arabia. As more years pass from the 1999 North Sea peak, production decline rates could increase for the mature North Sea region.

In addition, NGL production showed a big drop: Feb 2007 NGL production was 8.24 mbd in the EIA Feb 2007 data and Mar 2007 NGL production was 7.88 mbd. This is a drop of 0.36 mbd! My forecast for NGL is shown below.

Natural Gas Plant Liquids to 2012 – click to enlarge

The forecast for Ethanol and XTL is below. (XTL means BTL, CTL and GTL.)

Ethanol/XTL to 2012 – click to enlarge

Both of the above forecasts contribute to total liquids forecast being on a plateau until 2009. If these NGL and ethanol/XTL forecasts are too optimistic, then total liquids production could come off the plateau earlier.

As more awareness of peak oil occurs, some countries may decide to voluntarily cut production to conserve their valuable hydrocarbon resources for the benefit of future generations or for economic reasons. Brunei currently has an oil conservation policy as described by the EIA:

Equatorial Guinea also has a production limiting policy:

Brunei and Equatorial Guinea are small producers but world total liquids production would come off plateau tomorrow if a big producer such as Russia decides to adopt a production limiting policy. Douglas Low makes some important observations in his article titled Is Russia about to cap its oil production?

The next six months may hold many surprises in the oil market as the supply demand balance is very tight. There are many factors which could reduce supply this year. There are very few factors which could increase the supply.

I think your slightly optimistic if you factor in EROI issues especially with ethanol and also the age factor ( 20 years no investment) in the oil industry. If you add in these two factor you get the beginning of real peak effects in 2008 for sure i.e you should be post peak enough to have real pricing pressure. This means I think we get the first peak oil price shock Sep 08 not in 09 like you have it. A saving factor may be a slowing economy which will reduce demand. But I'd say from basically summer of next year on we could easily see a bidding war start between the wealthier countries and this is the major short term problem. A few externals such as hurricanes ME conflict which cannot be predicted but can be assumed to be 100% probable over a three year period will ensure that we will probably enter into post peak conditions sooner than a bottom up analysis would indicate. Finally a lot of our recent production is from fairly small offshore projects these have very steep decline rates in general and "swarms" of offshore production should deplete rapidly of the next few years. This additional effect that I don't think anyone has really modeled should also be considered.

Overall since most of the factors your not considering are negative we should expect your forecast or more correctly the monetary effects we expect once we get the demand/peak oil wedge to happen sooner than later. The only positive is a slowing economy.

memmel, I am trying to be optimistic. I don't include projects that produce under 40,000 barrels/day in my forecast. However, IMHO, the potential forces pushing total liquids supply lower are currently much greater than the forces which could push supply higher. I sincerely hope that the total liquids plateau extends to 2009.

Please consider looking at what I call the swarm effect from the large number of small offshore projects that will begin declining about the same time. Most of the offshore fields where discovered about the same time exploited and then will begin decline about the same time. Its more diffuse but small fields are a big contributor and overall as far as I can tell by looking at the status of the large number of small offshore wells we should see them collectively act as another giant or two going into decline of the next few years.

The problem is these fields are about the same size and where discovered and exploited about the same time thus the "swarm". The giant fields are the backbone and in many ways they allow other discoveries to increase or stabilize world production. Since it seems they are all in decline the actual world wide decline rate becomes sensitive to the decline rate of the other smaller fields which in aggregate are obviously important. And since so much is offshore from the last twenty years expect steep declines from this type of production that will not be made up.

What got me thinking about this was realizing the North Sea and GOM represented the leaders for these types of fields and with these two in decline we must be having aggregate steep declines from effectively all the offshore wells.

This is important.

Excellent work. The first chart reads as if CERA's prediction is excluded from the average. Is this the case? Also, are Freddy Hutter's numbers banned as well as his comments? Seems like he used to be part of theses summaries.

Re: The first chart reads as if CERA's prediction is excluded from the average

Well, it's hard to take an global average on a bunch of forecasts based on totally different assumptions (i.e. straight lines versus bell curves), the result would be meaningless. Consequently, I chose to consider only forecasts who are predicting a peak before 2025. Of course, you can call this result biased :).

Re: Also, are Freddy Hutter's numbers banned as well as his comments? Seems like he used to be part of theses summaries.

To my knowledge, Freddy compiled also a least of forecasts but he's focusing more on the URR estimation which does not necessarily relate to the actual maximum production rate. I don't think Freddy published a forecast of his own.

You might call the results biased. A poster comments are "banned?" That is not good. I thought this was a forum, not propaganda venue. I noticed one of my posts was erased, which also mentioned the shrinking increases in world demand for fossil crude. From 3.4 % in 2004, to 1.4% in 2005, to 0.7 percent in 2006. See a pattern?

By the way, a Peak Oiler, Chris Skrebowski, issued what he thought was a gloomy forecast. In fact, it didn't make sense much, except to say not much to worry about. Skrebowski says world supply will grow to 92-94 mbd by 2011-12. We now are consuming at 83.7 mbd. He is forecasting a 12 percent increase in fossil oil output. In just five years. Then, a peak.

Meanwhile, at $60 a barrel and above, we see oil demand slowly growing, perhaps moving to negative growth. World demand up in 2006 by only 0.7 percent. This year could be a flatline. Check out BP stats, just released.

It looks like we are setting up for a glut — capacity will be far in excess of demand, even using Skrebowski’s numbers, at current prices.

Prices will have to come down, maybe way down, to sop up that level of supply by 2011-12.

Maybe we hit a peak in 2011. If so, and if prices hold, we will have Peak Deman perhaps four years before that.

BenjaminCole, please explain how you can tell a peak in demand from a geologic peak in supply.

We all await some useful discussion on this instead of your endless assertions without basis.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Greyzone: Right now, I can see why both sides think they are right. We had a rapid run-up in oil prices, followed by shrinking increases in demand.

Obviously, to really know who is "right' we may have to wait a few years. I suspect a glut will come, unless OPEC cuts and cuts and cuts. So the argument may, in fact, continue for years.

I don't think there is a practical "geological" peak in fossil crude supply. At what price? What about tar sands? Venezuela heavy oil? Huge supplies in kook-nations, such as Iraq, Iran, Libya, Nigeria, not being exploited now? Mexico's chronic buffoonery? At $60 a barrel incentives are pretty good to go after the oil (I understand certain light oil deposits crater, no matter what).

My point is that there may be a Peak Demand, and, even more importantly, there may be serious bottlenecks amplified by the fact that unstable, hostile nations control so much of the oil.

We are wise to quickly ramp-up alternative liquid fuels, PHEVs, and conservation measures of every stripe. Solar, wind, everything.

The good news is that we know what price will cut off the growing demand for fossil crude – it appears to be more than $60 a barrel – and that said price need not necessarily lead to global recession.

I still say the future is better than it has been in a long time. The new technologies and alternative fuels coming online are wonderful. Solar power making progress. Rapier now says he is workng on terrific ethanol process. Big wind farms going up. Huge jatropha plantations in Indonesia. The progress being made is just starting.

Most of my assertions rest on data from EIA, BP, EIA. They are generally accepted figures pertaining to consumption. I think I am fairly factual, when not extolling the merits of pig oil.

I hope differences of opinion are welcomed, not resented. Every forum is richer for openess, not censorship.

You have twice now made statements about Robert Rapier with which I do not believe he would agree. He is not working on ethanol. He was critiquing someone else's work. He has not claimed it will make a significant dent in fuel supplies but rather that it will be an efficient process for producing the ethanol we use for things like additives.

I strongly suggest that you reconsider the statements you are making about Robert Rapier as he may not find your statements correct. In fact, if your statements are sufficiently wrong, they could be actionable in a court of law, seeing how Robert works for a large oil company and false information being fed to his superiors could cause him significant problems.

Also, thank you for admitting that unlike peak oil proponents who have a huge body of theory and data from which to work, that you instead have nothing but your opinion. I think that difference speaks for itself.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

BenjaminCole

If you go to RR's website, r-squared, you will see he talks very positively about the new process....I don't think it is a secret....since he says he is planning to help the company involved, I gather he is impressed. I have actually downtoned how positive he was in his latest posts....he says it is the best process yet for ethanol....he started a whole furor on TOD by saying it might provide up to 50 percent of US liquid fuel supplies....

...but Peak Oilers have only opinions, as do I. No one has "the facts" when it comes to future output. Why do you think rational, intelligent people disagree?

I happen to fall a little north of Peak Oilers and south of CERA.

Are you trying to shut down any commentary you do not like?

A little north of Peak Oilers and a little south of CERA is as wide as the Pacific Ocean. Can you, perhaps, be a little more precise.

No, I am trying to make sure that other readers realize that you have nothing but hot air for your positions whereas others have extensive research for theirs.

Further, I do not believe that Robert Rapier ever claimed that this new ethanol process would provide 50% of the US liquid fuel needs. That is very unlike Robert. I demand a reference and I have searched both this site and his blog (which I regularly read) and not found this statement that you claim he made.

My understanding after reading Robert's blog is that he is very positive about this new process but on a small scale to replace that subset of ethanol used as additives in gasoline and a small amount more for some small percentage of fuel but nowhere do I recall him claiming 50%. So I demand either a citation that shows this quote or if he did not make that claim, then I think you owe him an apology.

Trying to shut you down? No, this is a website that focuses on reality, not wishful thinking. If you are going to bring numbers to the table do as Dezakin or other proponents of alternatives have done and demonstrate that you have a credible position. We can then argue the details of that position but at least we will know you are not blowing smoke.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Actually, he didn't say that. He said it would not provide 50 percent. He pointed that out fairly forcefully in the comments to that article when people began to take him to task for their (mis)understanding of what he really wrote.

My reading of his article and comments is that he thinks this process will make a big difference, but only in the form of a larger silver BB than most.

BenjaminCole, you wrote ,

"kook-nations, such as Iraq, Iran, Libya, Nigeria, not being exploited now? Mexico's chronic buffoonery?"

What? "Kook-nations"? "Mexico's chronic buffoonery"?

Then you write, "Are you trying to shut down any commentary you do not like?"

I don't want to "shut [you] down" but I do want to state for the record that I think you are balmy, and *sound* like a racist to boot (even though I'm sure you're not one). Give it a break and go back to the WSJ comment pages, please for the love of a non existent god!

Just so we're all clear:

"I think this technology could be used to realistically displace a fair fraction of our gasoline usage. But we are still talking about less than 50% in all probability (20% was my back of the envelope calculation"

To quote RR:

"a promising cellulosic ethanol technology...they have asked for my assistance in developing a business plan and helping work through technical hurdles."

Helping with developing the business plan and tech? One could be forgiven for calling that "working on".

Quoting RR again:

"I think this technology could be used to realistically displace a fair fraction of our gasoline usage....20% was my back of the envelope calculation"

So somebody has made two incorrect statements about RR here, but evidence suggests you're looking a little too far afield for the culprit.

And I strongly suggest you take the time to check your facts before you start ranting.

Unless you wanted to look like a fool.

Spare us your pathetic attempts at internet bullying. Nobody's impressed.

I would turn that around and say there is certainly a very *practical* geological peak - meaning that extraction becomes increasingly dificult, making it very imPRACTICAL to extract. Whether this happens on a global scale in the same year as the "theoretical" peak will be interesting.

Ohio, the home of Standard Oil, peaked in 1893.

Was that practical or theoretical; geological or economic??

The USA lower 48 peaked in 1970/1.

Was that practical or theoretical; geological or economic?

I would contend that geology PREDETERMINED the limits to extraction rates. Or would you claim that a theoretical peak date was greatly different than the practical one?

Just concerned about comparing apples and oranges here..

There are many people that believe that the '70 lower-48 US peak was economic (mostly hardcore conservatives, fiscal and social)... I dunno about finding someone that would argue Ohio '93 in the prior century though! ;]

For instance, I and others argue with some of them here:

http://www.econbrowser.com/archives/2007/06/post_mortem_on.html

http://www.econbrowser.com/archives/2007/05/peak_oil_in_ame.html

I'm commenter "Hsapien", and then when I realized I didn't want to be mistaken for hits on google that weren't me, I changed my econbrowser handle to "executive_hsapien" (just in case you wanted to know, not that you did!)

Anyway, amazingly enough BenjaminCole isn't the only delusional economic-commentator! As you can see, there is ample evidence that there is a wide spectrum of delusion, of varying types of intensities...

(Hamilton of econbrowser, however, is relatively upstanding, bright, responsible economist--which is saying a lot!)

If there is less of the stuff even though the demand is still rising, then prices will rise.

If there is less demand for the stuff even it is there to be had, then prices will fall.

Actual demand will always be the same as actual production (with the reserves as a buffer). Price is the variable to look for.

Guess what has been happening in these last 5 years.

It may surprise you to learn that the terms "supply" and "demand" have been used by these folks called "economists" for a while now.

According to these "economist" guys, a situation with too little demand should involve low prices, and a situation with too little supply should involve high prices.

So telling the difference between peak demand and peak supply should be pretty easy. I have no idea why you keep insisting it'll be hard. Perhaps you could, y'know, offer us a little evidence to back up your claim?

A matter on which you are a known expert.

Can you precise what comment you are talking about? I have no idea.

Fair enough but demand growth is still positive, I see also the following pattern for crude oil + condensate: +4.3% in 2004, +2% in 2005, -0.4% in 2006 and -0.4% so far in 2007.

Many are predicting an oil glut in the near future (even the ASPO). It's possible that the observed plateau is due to a lower demand rather that a supply problem however prices have averaged 65$ in 2006 despite a lower demand and record inventory levels. Notice that I'm not drawing any conclusions (yet) from this analysis, I personally think that it is too early to say whether or not the current production peak in 2005 for C+C is a global peak or a temporary fluctuation. The big test will be probably this year with the international pressure on OPEC to increase its production.

Khebab-

Judging from an above post, evidently there was someone named Freddy Hutter, who had his posts banned. I know one of my posts was deleted, and, on another occasion, I was asked to reconsider posting until I read the archives. I have never posted anything obscene or offensive, or even insulting.

Just my usual commentary that I think things are somewhat better than most TOD'ers, somewhat less happy than CERA.

But then, we do not have transparency on how TOD is funded, or what its agenda is. There is no disclosure about financial resources, or possible conflicts of interest editors may have. I am deeply skeptical about the motives and agenda of TOD, but find it a good source of information. I think the CFTC should take a long hard look at PO websites, to see if any may have ties to hedge funds which have gone long on oil. There is $15-20 of fear in every barrel of oil, and billions riding on keeping that fear intact. I am making no accusations, but the plain facts are that there is no transparency.

Those are fascinating figures you provide on crude oil and condensate. If the figures are cirrect, we are already seeing declining consumption of crude oil and condensate, in this price regime.

Are we seeing Peak Demand? I think so. That is the big story: We have Peak Demand at more than $60 a barrel, and the trend is our friend. It is only going down from here.

Thank you for not insulting me.

Ben: After reading a few of your posts, I start to miss Freddy Hutter. I don't remember why he got banned, but unlike yourself he would sometimes write posts that were worth reading, IMO.

Mr. "Cole,"

I wanted to give you an advance warning. We have begun monitoring your comments due to many reader complaints about the tone and content of your posts to The Oil Drum that have come in to our editors' box.

If you persist in this course of action, your account will be deleted without further notice.

Cheers,

The Staff of The Oil Drum

--

The Oil Drum

See the above. Maybe it is a joke, or maybe TOD believes in censorship. It came to my e-mail box.

To TOD'ers: Maybe you disagree with me. That's great. But do you really want to read a censored forum?

You don't have any "rights" here, only privileges.

You contribute absolutely nothing here except frivolous banter that belongs in a first year undergraduate economics course (or maybe worse).

If TOD does decide to axe your privileges, good riddance.

I'd happily read this forum with your comments censored--go get your own blog you crank! Although I'm sure you think we're all the cranks, right? The irony of it all...

BeenJammin Coal.

That's his agenda evidently.

You provide what you claim to this board is an email from TOD staff.

You think maybe it was a joke. But ... YOU DON”T KNOW ???

This is incredulous to me. Do I understand this correctly ?

Where IS that 'Theory of Everything' ?

Here

it is !

BenjaminCole

This will be the last time I respond to you thus, as you obviously have ignored my previous remarks.

Ive been contributing here for two years and am actively involved in discussions with the editors of TOD. This website has ZERO funding (though in my opinion it sorely needs it, in order to make more of an impact and reduce the burden on its core volunteers time). The revenue we get from the ads on the side is a pittance and goes right back in to pay for servers/bandwidth. This is a volunteer community and at least 2 of the editors have put more time into this site, 'for free' than most people put into full time jobs.

Regarding transparency, the editors hold academic positions, and it is much safer for their careers to do this, at least for now anonymously - they receive NO funding from any outside source and if the ad revs come up short one month, they pay for the bandwidth out of their own pockets.

I cant speak for other editors and contributors, other than to laud them as a group for the contributions of their time, since the ONLY compensation they get is out of possible recognition that their research is correct and making meaningful impacts on policy. But since you ask about 'our motives and agenda', I can offer you mine:

I write here because it COULD matter. I am a Phd student in ecological economics. Economics has dictated the direction of our country and world for two hundred years. But I believe it is based on faulty premises - that in a planet filling up with people who have insatiable demand drives, the supply curve of finite resources will eventually become inelastic. The demand curves are not based on rational consumers but on biological drivers. In effect, I believe the current system is fatally flawed and economics needs to be rewritten. This cannot be done using conventional methods because they are too embedded in the 'no limits' culture. I contribute time here to share my knowledge and viewpoints, and to learn from this community, which for the most part is a wonderful thing, and has itself grown organically since we started, with very few problems. I think TOD is special, and possibly revolutionary, both in its ideas and in its structure, and Im proud to be a part of the volunteer team. My views on the planet or humanity may be proved wrong, but not my views of TOD. Ive met most of the people involved and talked with all of them. This place is run by high quality people with no 'secret motives' other than doing the right thing because they see a need for such a venue. And I used to work for a hedge fund so I feel qualified to comment on who I think is selfish and who is selfless.

Similarly, your viewpoints are your own, though they have been empirically lacking. But your suggestion that the CFTC should look at PO websites, is ignorant at the least and actually quite insulting. For the record I DO trade oil futures, and right now I happen to be short, though I change pretty frequently. Boy do I wish the large hedge funds would read and understand what we discuss here, and verify it with their own research. The best thing to happen on all fronts would be higher oil prices. Reduces consumption and accelerates paradigm shift.

Please recognize that unless you engage people here with insights backed by credible research, you are not advancing anyones agenda but your own. Long term readers know the above commentary to be true. It is MUCH more likely that you are diverting attention from the possibility that YOU are the one working for a hedge fund who is short oil, though I put the odds of that under 10%.

Nate-

I am banned from posting anymore, but I skulked in under a fake name.

I appreciate you may be an honest netizen, hoping to help avert world disaster.

But look at from an outsider's perspective. You have editors operating under aliases. You say yourself you have futures positions in crude. Your bio says you are a former Lehman Bros. man. There are regular "scare stories' on this site, sometimes picked up by broader media (Storm Gonu anyone?).

There is zero financial disclosure. Would you even know if another editor had been hired by a PR firm, on a monthly retainer? And that PR shop worked for a hedge fund?

Are hedge funds stupid? They have billions riding on their long positions. There is $10-$20 of fear in every barrel of oil. What happens if that fear goes away?

Given these realities, if I were running the CFTC, I would place a gimlet eye on Peak Oil sites. They are a perfect venue for jiggling crude oil futures. If I were a hedge fund, I would try to "get to" a TOD editor. It is a perfect set-up, as the reading audience appears rabid for bad news. The Energy RoundUp, in the WSJ, seemed enchanted with TOD (perhaps not anymore).

Remember: If you want to be perceived as an honest journalist you have to not only be honest, but bend over backwards to show you are honest, and every day. Not only probity, but the appearance of probity.

That means complete financial disclosure, and transparency.

You cannot expect to have editors who post under aliases and not invite skepticism. The fact that you trade futures is another red flag. Jeez, I am a gullible guy, and even I don't like the smell of this.

Don't worry, I won't post anymore. If anyone is reading, see you later TOD'ers.

Elocne: The classic "fear" premium. Some MSM mouthpiece started this around Iraq I-its original meaning was fear of supply issues caused by military/political conflicts. Now it has morphed into: oil supply problems of any type that are reported on cause a $15-20 "fear" premium. BS. If the customer didn't want the stuff or have the money to buy the stuff the price goes down, fear or no fear, period.

BenjaminCole/ElocneB, this is just one man's opinion but, man, geez, you've got it all backwards.

"PR" firms? Guahaha, you are truly absurd. See, TOD is just a 'lil website forum--with crappy bandwidth (no offense to the admins/"personnel"). Just another website with people linking to a whole bunch of blogs, run by an intrepid crew of smart, well-research, dedicated people. As Nate already said, he is a volunteer--and if you were actually intellectually honest, which you aren't, you would know that by listening to various publicly available interviews on the internet and reading the archives. Instead, you *repeatedly* make unsubstantiated arguments and ignore good faith discussion.

"scare stories"? Peak oil is a scare story! Every story on here is a scary story... This is a peak oil website, deal with it. Go long oil! Come on SEC, come get me!

You write,

"Not only probity, but the appearance of probity."

Well, you know what Ben? First off, that doesn't even make sense. Not only that, it is redundant. Secondly, CERA not only has "probity" but guess what it also has? It also has the "appearance of probity"! You know what else has that too? That's right, the markets... The joy! You've found your mate, mate.

Adios, take care.

Is the world stupid? We have trillions riding on an interdependent oil economy. There is a $100-$1000+ reality discount in every barrel of oil. What happens if reality shows up?

So?

As I understand it, blogs are held to different standards than the press because (generally) blogs are not considered as reputable as accredited press.

Newspapers and television news have built up a reputation over time, and hence are often given the benefit of the doubt when they claim something to be true. Blogs, generally, have not and are not - unless they present solid and compelling evidence, the skepticism with which they are viewed prevents them from being believed by anyone who doesn't already agree with them.

(Which, incidentally, is probably part of why blogs tend to get so insular.)

So it matters less what the background and financial/political ties of bloggers are, since they tend to have a substantially lower ability to influence large numbers of people. I'm sure there are bloggers running fear-based sites for personal gain - indeed, a few peak oil websites have always struck me as being predatory that way - but that isn't against the law, as I understand it; convincing people they'll die without your books may be underhanded, but it's the buyer's free choice.

None of that applies to The Oil Drum, though - there's no pimping of merchandise here - and an insular-community website is hardly the optimal venue for pump-and-dump stock manipulations.

So in most cases - and certainly here - there's no reason for the people running the site to disclose personal or financial information. And there's very little call to suggest they have hidden agendas.

Sometimes.

Remember Amaranth going under due to a failed bet on natural gas last year? It's not like that's the first, either - I think it was a copper bet gone out of hand - and a single rogue trader - that sank one of the old British banking firms in the 90s. I'm sure you'd find more if you dug.

People can be wrong. Even people in control of lots of money.

Convincing people something is scarce and valuable when it's really abundant and less-valuable - on a long-term, societal level - doesn't appear to be illegal, even when it's done in bad faith. (deBeers is often accused of this, purportedly manufacturing a market for diamonds with their ad campaigns.)

So even if peak oil sites are wrong, know they're wrong, and are trying to mislead people, it's still not likely to be a legal matter.

(At any rate, TOD appears much more honest, open, and above-board than many other sites - PO and otherwise - so that's hardly a pressing concern for the staff here.)

Yes, Freddy Hutter used to comment on some of my past PO updates but he has never been part of my analysis simply because he never produced any original forecast. Freddy got banned simply because he has crossed the line many times with ad hominem attacks and insults.

Regarding your deleted comment, I'll try to find out why.

I have never posted anything obscene or offensive, or even insulting

I took umbrage to one of your posts.

I did not lodge a complaint, but I did post my displeasure.

Alan

Just imagine that Oil is a non-renewable resource/substance. What would the price of a bbl oil be if that were suddenly realized in society?

Cheers, Dom

In other words, we are trading at a $300-500/barrel 'reality discount', not a $15-$20 fear premium..;)

Well, that would explain a lot. Or, perhaps the Export Land Model is too scary for even some of the Peak Oil crowd.

We have apparently been disinvited to present a paper on Oil Exports for the ASPO-USA conference in Houston this fall, if I insist on using the HL method. Perhaps I am missing something, but if one uses a technique that accurately predicted the decline in net exports in 2006, why wouldn't one use it to predict future production and exports? I told them I wouldn't be doing a paper without using the HL method to predict future production. You might talk to Rembrandt about a joint paper if you are interested.

In any case, I would like to proceed with a HL based paper (for Graphoilogy/TOD/EB), focused at least the top five. Can you get historical Total Liquids production for the top five exporters? I'll delve into the EIA data set to get recent consumption numbers for the top five.

Export Land in action: Some recent monthly crude oil data, from Pemex, for the period from 1/06 to 4/07:

Nothing to worry about here, just one of the top 10 net oil exporters in the world, and the #2 source of imported crude oil for the US.

FYI--using the HL method, Khebab predicted the decline in Mexican production (and warned about falling exports).

A quick look at the top five net exporters (accounting for half of net exports in 2006, annual average numbers, Total Liquids, EIA), from 2005 to 2006:

WesTexas

"We have apparently been disinvited to present a paper on Oil Exports for the ASPO-USA conference in Houston this fall, if I insist on using the HL method."

this is the most surprising thing I have read.

Are you serious? HL can't be the reason.

Let's just say that I am exchanging some tense emails with them, and yes, HL is the reason. To be very precise, I said that I am not presenting the paper if I can't base it on HL.

The crux of the problem is that a HL based prediction of production and exports for the top exporters is going to be beyond scary. It's going to be off the scale. Unfortunately, I think that it is probably more or less correct.

IMO, we need an emergency crash wind/nuclear power program combined with Alan Drake's Electrification of Transportation proposal, if we are going to have some chance of having some semblance of a civilized society left.

Very likely that HL heuristically shows the actual trend, but that's the problem. If the ASPO conference has a scientific or academic bent to it, they might want something more than a set of heuristics empirically fit from data.

Could that be one of the fundamental issues? And not necessarily that the outlook is scary?

He could use the Hybrid Shock Model and that would scare the bejezus out of them because it appears to drop off faster than the HL curve. If they complain at that point, he could tell them that the HL method says things will be a wee bit better. ;)

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I find the response to the H-L method interesting, particularly since there is a relative wealth of data to work with and indications in the H-L method of the signs of systems of fields "dying."

I recently cranked the EIA predictions for the "Reference Case" from International Energy Outlook (2007) into the H-L curve and the ran the regression from 1982 to present, 1982 to 2035, and 2007 to 2035, through the model. Right now the H-L curve 1982 to present is "pointing" straight at 2200 GB +/- 35 GB and the little dog-leg right in the past couple of years is an ominous sign.

Plugging the Reference Case (for Crude + Condensate) into the model distinctly bends the curve from the last 25 years (wishful thinking?) and pushed the URR from the H-L to just over 3000 GB.

But if you look at JUST the EIA data for the Reference Case and see where it would point to, you get something around 4300 GB (notice for the last years of the Reference Case there is an even stronger dogleg right). If you really want an interesting comparison, take the 2006 version of the IEO, interpolate between the years for THAT reference case and compare it with the current one (2007).

Someone, has a strong wishful thinking viewpoint when they created that one and previous versions. Maybe a discussion of the departure from real data is in order.

Here is the point, the point where a man grows two large brass dangly things and struts up on stage after telling the people in Houston you have changed your mind and will not be using HL in your presentation, and that EIA data is sufficient!!!

THEN YOU GET UP ON STAGE AND GIVE YOUR ORIGINAL PRESENTATION. If you believe strongly in your paper/report, you LIE to get in a position to explain it, and you had better be able to VERY CLEARLY explain your position.

Start off with an analysis of how accurate a logistic modelling approach is. Give many examples, of many oil fields.

Then break out the simple concept of growing consumption, cite numbers for China, Russia, and India about the # of cars being purchased every month.