Further Saudi Arabia Discussions

Posted by Stuart Staniford on April 6, 2007 - 9:05am

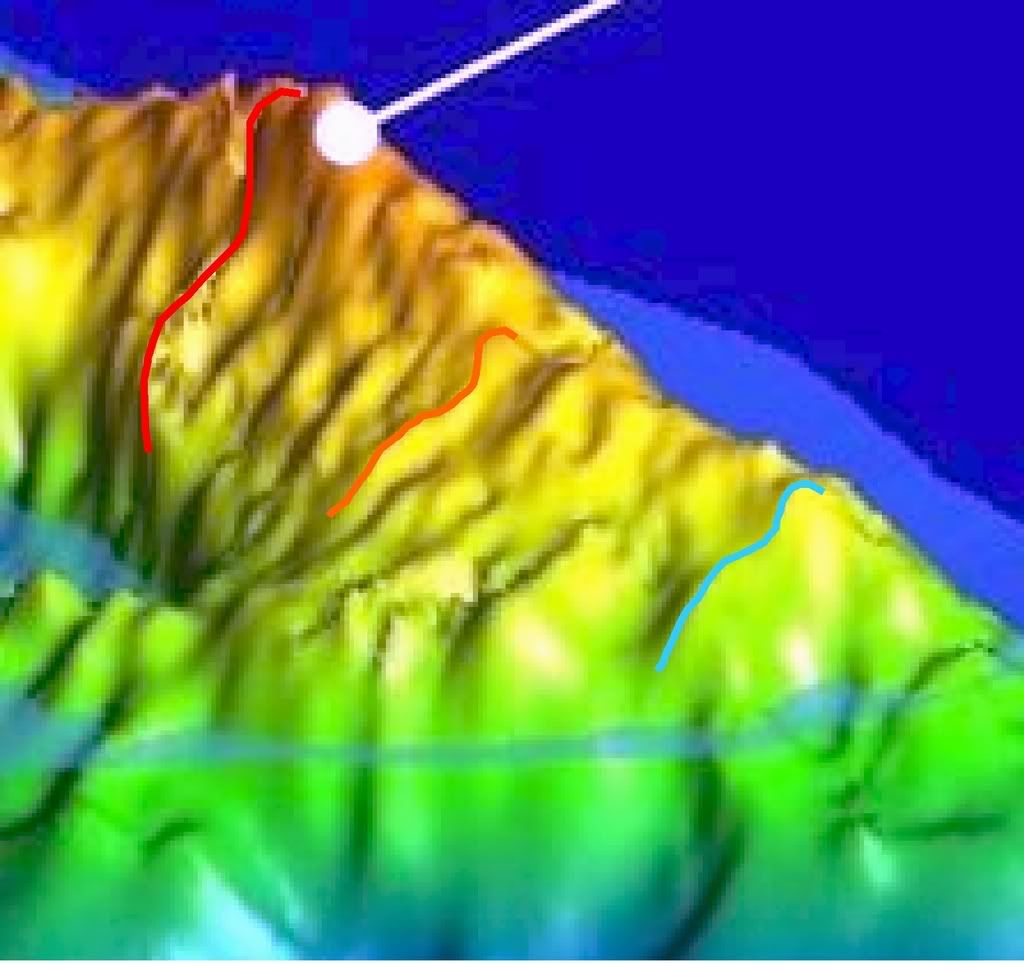

And the rest of North Ghawar might not be too far behind... Bob Shaw found this picture here:

The temptation to publish all this gorgeous reservoir simulation porn has just been overwhelming to Aramco's engineers I guess...

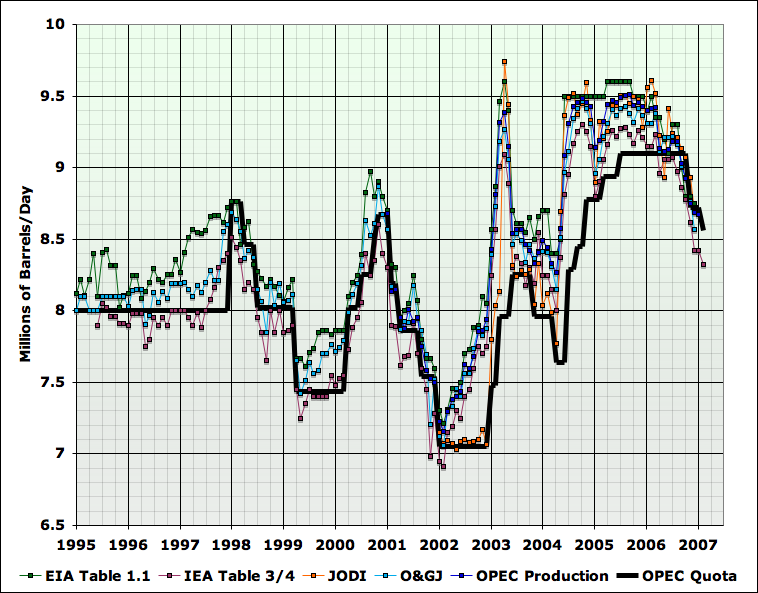

This post is a place to continue the Saudi Arabia discussion. To keep the ball rolling, I've extended a couple of my graphs. The above graph is the production data, with all series extended back to January 1995, or as far back as they are available online. I've also added a fifth series from the Oil and Gas Journal. Plotted on the picture is Saudi Arabia's OPEC oil quota.

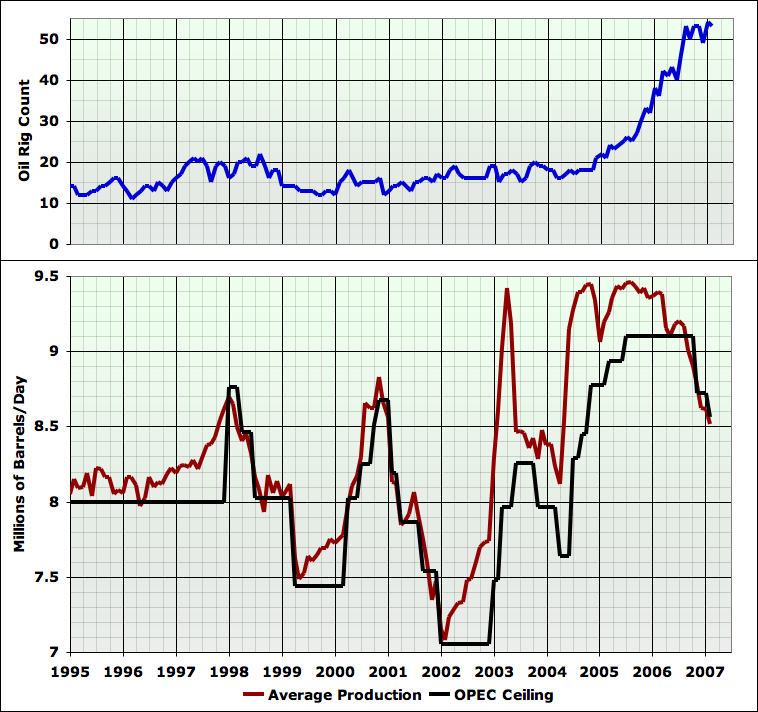

I showed production against the quota since some folks have been suggesting that perhaps the recent declines represent Saudi Arabia's attempt to return to quota. Here's a production index constructed from the five series, together with quota (and rig count at top).

I don't find the "return to quota" explanation very appealing, since the decline begins over a year before quota starts to drop, when prices were rising, and the index has now gone below quota despite continued fairly high prices. But another few months of data should say a lot more.

"I don't find the "return to quota" explanation very appealing"

Looks more like a "return to below quota" at a glance.

"I don't find the "return to quota" explanation very appealing"

Just 'glancing' at the first chart - without the average production, I see that Saudi production tends to lead the quotas (especially for IEA data). That is what it is doing now. I fail to see an anomoly based on the chart..

----

My grandfather pumped oil with an engine-house,

my father pumped oil with a 20 lb. electric motor,

can't I just pump it online?

But I'd say that they're historically quick to lead on the upside and reluctant to lead on the downside. You'll also notice that when prices were going up, or were staying high, they were far exceeding the quota (most likely to take advantage of the high prices). So that last bit of the trend, being quick to lead on towards the downside, and at or below quota during times of high prices, represents a departure from history (over the span of that graph) to me.

Re: So that last bit of the trend... represents a departure from history (over the span of that graph) to me.

Yes but oil inventories are still at record level for OCDE countries and OPEC has historically always used inventory levels as a way to assess the demand and supply equilibrium.

ROFLMAO Great tag line. Keep that.

Actually to me it looks like quotas are reactive to what production is already doing.

Request

I'll put up a new thread after I get home tonight (Pacific time) -- as this one is getting full -- but in the meantime, if anyone isn't busy and wants to help the project, see if you can dig out any information that bears on the thickness of the Arab D reservoir throughout Ghawar, and particularly in North 'Ain Dar. We have the Greg Croft average numbers for each area, but if someone can find a map or picture that shows in detail how the reservoir thickness varies throughout the topography, I think that would be a big help.

Don't know if this is what you are looking for but here is a title: Geostatistical Model for the Arab-D Reservoir, North 'Ain Dar Pilot, Ghawar Field, Saudi Arabia: An Improved Reservoir Simulation Model.

Behind firewall at:

http://www.gulfpetrolink.net/publication/vol1.php

This one has lots of pretty pictures.

http://www.searchanddiscovery.com/documents/2004/afifi01/index.htm

Deleted

Sorry, I just posted the Greg Croft URL before realizing you already had it.

Hello SS,

Jean Laherrere has an excellent, next generation 3D rendering of Ghawar looking from the SW --> NE [opposite direction of garyp's post]:

http://lpsc.in2p3.fr/gpr/Dautreppe/Laherrere/Image78.jpg

This might come in handy later, maybe Jean has original software.

F_F & Euan: I am fascinated with Uthmaniyah's far eastern ridgeline. If you look at GaryP's cross-sections and compare with Ghawar Oil Sat graphic--hasn't the waterfront rolled over the crest? How is the fractional flow skewed, watercut ratio best managed, and reservoir sweep best accomplished with pressurized water going downhill? I have no idea, hope you can help SS out.

Where do garyp's slices go on the Laherrere 3D and on this Uthmaniyah Graph [scroll down inside website please]:

http://home.entouch.net/dmd/ghawar.htm

Notice this above graphic from Alexander was in 1996-- has Uthmaniyah had a lot worse waterfront problems since then? We can't see the Western side of the Eastern Crest

My guess is the thick green rollover about halfway down Uthmaniyah Eastern ridge, but on the unseen western side in the Ghawar Oil Sat is where those slices best match up--but you guys might have better ideas!

From Greg Croft website:

--------------------------------

The fact that the Ghawar oil-water contact is substantially higher on the west flank than on the east indicates a hydrodynamic gradient to the east, which may explain the much larger volume of oil in Ghawar than in Khurais.

The oil-water contact at Ghawar dips to the northeast, dipping more than 660 feet between the southwest end of Haradh and the Fazran area.

-------------------------------------

This suggests to me that Aramco should have put Uthmaniyah's water injection more heavily on the west side to drive the oil east and upcrest--they did the opposite [eastside injection wells watered over the crest in a western direction instead]. Could you explain?

Another thing from Ghawar Oil Sat graphic: why is the Southern lower half of Abqaiq orange instead of yellow--what is the significance? Major reservoir sweep problems compared to Northern lower half, which is solid yellow?

One last thing:

When I blow up the PDF of the Ghawar Oil Sat graphic with the magnifying tool to 1600%--you get much more detail--for example the Shedgum to Uthmaniyah thin connection looks all blue at normal resolution but shows green breakthrough at high magnification. Farzan is only 3 miles wide at its max [approx. 3 cells wide at 1600%]--can this be a tool to generate our own cells for our own Ghawar graphics?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Bob, your doing an amazing job here digging up all this stuff - heres the picture you posted. Does Lahererere indicate what the coluours mean here? I'll respond to your questions in a separate post

http://lpsc.in2p3.fr/gpr/Dautreppe/Laherrere/Image78.jpg

Any idea on the data source(s) for this impressive graphic ? Date of data ?

My guess is that this is an educated guess for today based on available information.

It may be worth noting that the most important thing I have learned so far from this extended discussion is NOT when Ghawar production will drop

A) Now

B) Very Soon

C) Soon

although that it is critically important.

The most important lesson is that it will be a very sudden and rapid collapse for each affected section, and the "at risk" sections (see multiple choice above) total an irreplacable ~4 million b/day !

Best Hopes,

Alan

Hello Euan,

Sorry, can't help with any more details on the graphic--I don't know French.

The TopToders have got to carry the ball forward. I have practically turned into a zombie trying to stay up with you guys. I have even been googling, then reading sponge coring links after F_F mentioned it---is that sick? =)

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

OK Bob, doing the same as yesterday (and wasting even more time).

First off the modeling grid from the "When 4D seismic is not available: Alternative Monitoring Scenarios..." and "Reservoir Monitoring with Permanent Bore Hole sensors", both by Shiv Dasgupta are the same. You can have great fun lining the things up and finding that there are more bore holes on one than there are on the other. That means we have the top down data from one and the cross section data from the other to compare.

Doing the now normal and arranging each on top of the 3D view leads to the two resultant image below. Its harder to decide exactly where these lie this time, but I think this is about right. I've highlighted the area I think is oil from the cross section in the overlay.

Thus in 2004 there was a good 120feet of oil across a reasonable area of Uthmaniyah.

Everyone can now commence saying I've got it all wrong !

Has anyone "picked up the phone" so to speak and called/wrote greg croft, Laherrere and asked to signon and take a look at the discussions here? Matt Simmons talked about this series of posts(financialsense.com), etc.

These two as an example have put alot of work into these pictures and graphs, would they be interested in the discussions here?

How about sending out emails to Heinberg, Croft, Laherrere, Simmons and asking them to take a look and maybe comment?

Worth a try.

If you refer to yesterday's discussion about how North Ghawar will or has played out would you rather

1. Accept the fact that North Ghawar is watered out and it is reflected in that 1 MMBOPD production drop and deal with it.

2. Know that if that drop hasn't occurred it is bound to happen, it is in process right now and who knows where we will end up. Some other problem has or is occurring.

Next stop Uthmaniyah.

Hi Stuart

Euan Mearns argued here that the average oil production per well did not show any sign of decline until 2005. are you arguing that it dropped actually since this date.? what's the difference between number of rigs and number of wells, is it the same?

Gilles,

The post you reference is a post where the comments are tremendously important. Euan's post had a few pretty big and important holes shot in it in the comments section...visit these links for the greatest hits...

Ace's original post proposing the effects of MRC/Hori wells on well productivity: http://europe.theoildrum.com/node/2372#comment-170432

Well productivity with cumulative horizontal wells on same graph: http://europe.theoildrum.com/node/2372#comment-171280

Well productivity revised for 3 to 1, vertical to horizontal equivalent: http://europe.theoildrum.com/node/2372#comment-170649

I addressed the issues I saw with Euan's post toward the end of Water in the Gas Tank

What Substrate said. Read the comments. IMO, the meat grinder of TOD pretty much blew Euan's post right out of the water.

Which doesn't mean he's wrong, but if he's right, that post doesn't provide any support.

Leanan, since you are an editor of The Oil Drum, I think you really need to back this comment up with some pretty meaty details.

As far as I was aware I was merely reporting a data set and making what I still consider to be reasonable interpretations. The main weakness was the fact the data series stop in 2005 - and I did not feel inclined to simply make up data to plug the gap.

So a detailed response please of all the errors and weaknesses in what I presented. I think you also need to add some details on how you would interpret the OPEC data - or would you simply choose to ignore them?

I'm just the news editor. I have no say in the content of the other articles.

It's all laid out in the comments to your post. Substrate and Darwinian have already posted in this thread the most salient points.

Don't get upset. This is how it's supposed to work. This is TOD at its best.

I agree. That's TOD at its best.

All the contrubtors take their knocks. I just wish I had as much to offer the board as you.

Euan keep posting, without great contributers such as you TOD suffers.

I'm not upset I'm just sober and waiting for a response. WRT to the opinon you expressed I would have thought you should have at least 2 to 3 good arguments at your fingertips and could at least have the courtesy to jot these down for everyone's benefit.

Hi guys

I didn't intend to cause any trouble between all TOD contributors ;-). I really find you're all doing a fantastic job, and I understand quite well that there may be some divergence and/or dispute to establish the truth, considering the complexity of the problem.

I DO believe that Euan's approach is potentially interesting - but may be a little bit more argumented : for instance, do we see, or not, a clear variation of the average oil production per well in the historic cases of peak production? (Texas, US, North Sea?) Is there a linear trend similar to HL, or an abrupt phase transition? and of course, what is the situation of KSA since 2005 ? looking at Stuart's plots, it seems obvious that nothing very special happened before 2005 - just chaotic production caused by the "swing state" status of KSA, but that something actually changed after 2005. It confirms the study I made on EIA's forecasts vs real production, showing a sudden plateau after June 2005, which was not planned at all. So is there a clear indicator that we can construct, clearly showing something has changed (and may be rotten) in the Kingdom of Arabia?

Gilles - I think you are entirely right that the avearge well porductivity with time needs to be examined in other countries - I've been thinking about doing this and will now give this priority.

The key points to me were the ones you conceded (or at least, it seemed to me that you did - perhaps I am mistaken).

1) The data ends just before it gets interesting. Therefore, it doesn't prove your point. It doesn't prove Stuart's point. The data you presented is mute on the period we were discussing.

2) The horizontal vs. vertical wells. Your graph looks very different when that is taken into account (and you posted it yourself, to your credit).

Given those two issues, the rest really doesn't matter.

Leanan, thanks for repsonding. As I've said here on several occassions the only time your hear the word crash used in the oil industry is with reference to stock prices and hellicopters.

So if Saudi production was about to crash (as the current decline rate would suggest if this were natural decline) I'd expect to see some evidence of trouble ahead leading up to 2006 (though note my comment in response to Gilles). I still find evidence for trouble ahead lacking in the average well productivity data. I'm sorry the data series ends in 2005 and as noted I feel disinclined to make data up to plug the gap.

I've also indicated that I find the horizontal versus vertical well debate to be rather sterile. The fact is that the Saudis used to have vertical wells that did 50,000 + bpd, but as these have progresively watered out, the productivity of these wells has declined.

The Saudis are using horizontal wells in two main settings:

1. Short radius horizontals placed at the top of old vertical wells to provide a tool for balancing dry oil production with wet oil production to acieve a target water cut.

2. Single bore and multilateral horizontal wells to produce oil from low permeability reservoirs (which are the norm throughout this part of the Arabian Gulf). These reservoirs are very difficult to produce at high flow rate using vertical wells.

I'm afraid I just plain don't understand this statement.

To me, the essential argument of your post is that well productivity was not declining, and it should be, if Stuart is correct.

But given the two factors I listed previously - that we don't have data for the period Stuart thinks the decline began, and that horizontal vs. vertical wells could make a big difference - that argument doesn't doesn't hold. It doesn't mean you are wrong, but it doesn't provide any reason to believe you are right, either.

Given that, I just don't think the rest of it matters. It's like arguing about what color you want to paint the walls when the foundation has collapsed.

There may be solid arguments that prove you are right, but if so, they will be built on a different foundation than well productivity.

At least until we have more data...

Euan - have you read the discussion of the monthly interpolation I did in Water in the Gas Tank yet?

No - but I guess I better had.

TOD could be described as a "meat grinder" but does that mean we have to act like "meat heads"? We can surely have a discussion about very speculative areas without this continual degradation into veiled personal attacks on people we happen to disagree with?

Sure, there's a robust and confrontational atmosphere, but where does the bile get us? The current discussion about Saudi Arabia is a case in point. It's hard to know what's going on there. It's a difficult and complicated country, yet some people appear so sure of what's happening their, based on data which is highly problematic. The publically available data is only part of the story, the real numbers are a state secret. Twenty years ago my Saudi friends didn't trust their government's statistics, and nothing's change for the better since then.

Given the "difficult" nature of this whole subject, and the fact that there's a lot of gropping around in the dark going on, arrogance is not only irritating, it's also juvinile. I think arrogance is a kind of ignorance.

Two things: one is to avoid being provocative other than with ideas; two is to not take an occasional jab in the ribs too personally.

"Don't get upset. This is how it's supposed to work. This is TOD at its best."

It's called peer review.

Writerman, DaveBG and Cid, I'm not sure who your comments here are aimed at and I do appreciate what is being said. I certainly take this as part of the TOD rough and tumble. I took exception to what Leanan said for a number of reasons. This is what she said:

This in my opinion is devoid of objective technical analysis and laced with subjective opinion - we've come to expect this from certain posters.....

This is an interesting concept. From the first weeks I contributed to this site I have asked PG where the truth lies. The real question here is how many posters contributing here are genuinely qualified to read and understand SPE papers published by Saudi Aramaco and the interpretations placed upon those by TOD contributors?

This is a serious issue, because we are increasingly rulled by the technically ignorant masses, who rule the media. IMO, on ceratin issues, technically sound minority views must prevail.

I have no gripe with Leanan's off the cuff remark - and I don't want to start a serious debate on Web - based peer review right here. But I think there are some serious media based issues at large here.

I'll mail this to PG, HO, Stuart et al and see if they want to join in - I want to concentrate on the technical content.

FWIW, I am totally in favor of involving as much expertise as is willing to comment. The more expert the better. I am willing to champion guest posts at TOD from anyone willing to put a decent effort into the subject regardless of their conclusion. But I think what we need is detailed technical forensics on the data that is in the public domain. What I don't think we need more of is CERA style PR blasts with no supporting detail, or vague assurances based only on the quality of Nansen Saleri's resume or a general sense that life usually works out ok.

And while it's true that other fora might have had more qualified people, I'm not aware of any public debate on this topic to go look at. It's happening here because it hasn't already happened somewhere else.

Sorry, I honestly thought it had been hashed to death already in the other threads. It wasn't my intent to do a drive-by trashing, just to avoid beating a dead horse.

Leanan, this is about the worst Troll comment I've seen on the site for months.

I got a lot better things to do with my time that sit here to be insulted by the likes of you.

Have the site to yourself and wallow in doom!

Huh? How is it an insult?

Leanan, my sincere applogies for the comment above which is clearly below the belt and unwarranted.

Its probably best to leave discussion about the quality of comments and "peer review" to another day.

Euan

Pax.

Way over reacting. She was apologizing to you.

There is also an unfortunate implication that non experts, and possibly even women as well, should keep their mouths shut.

Huh??? How do you get from what she said to this reaction?

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Wow! I can't get there with what she said. Somebody deserves an appology.

Calm down Euan. I've had a "don't know what you're talking about" comment to something I've written on TOD Europe, without sulking about it. Leanan is hardly Mr. Hutter!

Euan,

One of the implicit questions that continually arises, between the snipping, is, who are the "peers"?

TOD is full to the brim with lots of interesting posts and the replies are fascinating, but real peer rieview? I on't think so. What we have is vertual peer review, in a vertual school. Not only that, we've also dealing with a pretty obscure subject based on a great deal of rather defuse data. There's room for massive ammount of disagreement and controversy, given these wide and unclear parameters, and boy do people jump in!

That's alright, it's informative and fun, as long as we remain reasonably respectful of each others views and also retain a little bit of humility, which is an attractive quality especially in those who regard themselves as being strikingly brilliant. It's a secret, but a touch of modesty actually makes the brilliant appear even more brilliant.

righterman, the internet peer review committee reminds you 'virtual' is spelled with an 'i'...;P)

Yeah, I know, but then I don't know. I have two languages in my head all the time and I mix them up continually. Here, at home we speak two languages, and we also mix them up into almost thired one. It gets slightly confusing, and bits seem to drop off now and then.

Gilles, Euan Means argument is totally meaningless. Since the mid 90's many Saudi wells have been completely shut down, or their flow has been cut because of "Rigless Water Shut Off", or existing wells have been "Sidetracked" with horizontal drilling. Production in north Ain Dar dropped by about 20% beginning in about 1998 because of these changes. This is clearly visible in Figure 1 of SPE 93439:

http://freeoil.1111mb.com/spe/spe93439.pdf

So while the average production in many wells were dropping the average production in wells in Haradh and Shaybah, because of the type of wells, are several times that of older wells. The wells in Haradh III are supposed to produce 10,000 barrels per day. Just a little common reasoning will tell you that if the new wells are producing much more per day, then older wells much be producing much less per day. And, if new wells are being added with no increase in production, (or with the current decrease in production), then production from older wells must be dropping or, are being closed down completely.

And just one more not so minor point; Euan’s chart ended in 2005, the very year Saudi peaked! I would bet a pretty penny that “production per well” is currently dropping precipitously.

Ron Patterson

The Norwegians used horizontal wells to try to get max. production as the oil-water contacts rose. It worked for awhile, but the declines eventually happened. The drops in production from North Sea water driven fields were steep. Yibal was going well for a long time, then it started to slip, they have proped it up with tertiary CO2 driven recovery, it might collapse again as it will gas out like Cantarell in Mexico.

I cannot see the $300 barrel oil in the immediate future. Shell concluded some agreements with local governments and is supposed to bring some spare capacity in Nigeria online this summer. Nigeria is in the process of auctioning more onshore and offshore exploration blocks with a stated purpose of increasing reserves to 40 billion barrels and production to 4 mbod by 2010.

The Caspian Sea oil will be coming online in increments over the next decade. The Iranian Caspian is a potential growth area, yet undeveloped.

Canada is expected to increase oil production over the next ten years. Venezuela talked about developing the Orinoco heavy oil region, but cut back production there when worldwide oil prices started to fall.

Eventually Iraq should calm and reject killing people as an alternative. They might almost double production to about 4 million barrels a day.

Yet as time goes on and giant oilfields continue to fall, as more nations pass their peaks or secondary peaks, then oil supplies might diminish. Many little fields that were being brought in to create new production might see most of their expected lifetime production to occur within ten years. There were yet multi-billion barrel fields being found, thus suburbia is not over yet.

Continued economic growth in China, India, US, Russia, and OPEC nations might take up slack oil production. OPEC price controls have manipulated prices higher than might be the case if Saudi Arabia did a crash program to develop 80 undeveloped fields. Two new fields have been discovered in KSA during the past 12 months. Kuwait and Iran also announced major oil field discoveries in the past year.

There were yet multi-billion barrel fields being found, thus suburbia is not over yet.

Continued economic growth in China, India, US, Russia, and OPEC...

If I am not mistaken (and this is the forum to correct me), it has been over 25 years since a super-giant oil field (not oil equilavent in NG) has been found outside Kazakhstan. Mere "giant" oil fields have been found, but the trend is down for finding these as well.

And supporting US (as opposed to Moscow) suburban oil demands without the exports to pay for the oil imports is a game that is winding down quickly.

Best Hopes for Reality Based Planning,

Alan

Rainsong,

Too little, too late and a lot of wishful thinking. Let me correct that, Outright Fantasy. World financial markets are about to get real screwed up real fast. The cork is out of the bottle and the Genie is coming out. Everyone won't understand, but enough will and the rest will find out soon enough to their own detriment. CYA is now the rule of the day. If we invade Iran in the next few hours, God help us all. I got out of the markets before they closed.

well, you point to a lot of "potential" sources of new oil but some or all of these could and probably will be delayed some may not materialize at all.

if nigeria is auctioning exploration blocks, isnt a 3 yr timeframe a little short for these to be brough into production ? it is possible, but is it likely ?

you refer to multi-billion barrel fields being found, can you give specific examples ?

and finally do you have some details on saudi's 80 undeveloped and 2 new recent discoveries ?

Fractional_Flow,

I've been out of the loop for a while but may join in this discussion today. Could you perhaps start by remininding everyone what evidence exists to support this statement:

EM

Euan, try SPE 93439:

http://freeoil.1111mb.com/spe/spe93439.pdf

I think the evidence is absolutely overwhelming.

Ron Patterson

Ron, the main reason I was out of the loop was x country skiing in Norway. I just happened to take a copy of SPE 93439 with me - I read it several times together with my friend who is a senior production geology advisor. As you know I am a geologist with just a little bit of reservoir engineering expertise.

So its strange - you see the evidence for the watering out of North Ghawar as overwhelming and I don't.

Maybe you can go first and list the key points from this paper to support your position, then I'll respond.

Looks like I'm in for a busy afternoon.

It's good that your technically strong and have studied the paper in detail... it won't take me long then.

The paper explicitly states in several ways that the displacement feature here is gravity dominated.

Construction of a synthetic fractional flow curve using the Honapour correlation for a 600 md intermediate wettability carbonate with a 15% connate water saturation and 21% residual oil saturation results in the construction of a fractional flow curve which exhibits a 65% average water saturation behind the flood front at breakthrough. The endpoint Saturations exactly match the reserve figures in Saleri's May 2005 reserve pie chart. The 65% average water saturation behind the flood front matches quite well with the water saturation cross sections. The water cut at breakthrough via tangent construction is 93%, but the curve is steep here and the value could be as low as 85% -I think.

Now since this is a gravity dominated displacement we seek the vertical rise in water throughout the structure. Aramco gave us the 4.6 ft/day front velocity which I'm sure you noticed, and at an average 3 degree dip (stewart graciously analyzed the Greg Croft structure map for a 4.4 and 2.3 yesterday), the vertical rise in the water level is 0.24 ft/day on average, or about 2.88 inches per day.

Now, it has been about 3 years, 3 months and 5 days since 1/1/04 so that is about 1190 days. The horizontal movement of that front is 1190*4.6 = 5474'. So the total vertical rise up that structure is 5474 * sin 3= 286.5'.

Now, it depends very much on where we started. Here is where looking at those cross sections gets tricky. I posted over 2 weeks ago that some advanced image analysis was needed. Bunyonhead is to be commended for going through the process with me yesterday.

Now, I think there would be gravity equilibrium between Ain Dar and Shedgum, Stewart questions this. Please note that injection wells are widely spaced and the rise in water level is less than 3" per day. There is not much convection here. In my mind gravity dominates... and I believe the 4.6' day frontal velocity from the stream tube simulation must include the effects of the connected reservoir and injection activities at South Ain Dar and Shedgum. Reasonable men of good conscience can differ, I understand.

However, in the end, we must understand that breakthrough or not breakthough is the ballgame. As you know, the large mobile oil saturation and the tangent construction horizontally on such a large Sw span with the low oil viscosity must result in a high water cut at breakthrough. This is supported by the production logs.

I was alarmed with the height of the water rise from the frontal velocity over 1200 days. I think you should be too.

Cordially

FF

FF - lets take this in bite sized pieces to make sure we reach mutual understanding on some key points:

And so please correct me if I'm wrong. Original oil stauration is 85%. Final residual oil saturation is 35%. Suggesting that about 59% of the oil is recovered? That does seem pretty high to me - but there again this is a world class reservoir.

I'm not sure what you mean by this? Do you mean they had the same original OWC? I have read that the contacts on Ghawar are staggered, almost certainly suggesting a degree of reservoir compartmentalisation ± a dynamic aquifer.

I'm not sure what you mean by this either. I thought that first water breakthrough in Ain Dar occurred around 1976 and that water cut has been rising in stages ever since.

What I see as the key issue is whether or not Ain Dar (north or otherwise) still has a dry oil column that can be produced to compensate for wet oil being produced from old vertical wells.

Finally, I think it is very important to be aware of a couple of key geographic / structural features in SPE 93439:

1. The paper describes North 'Ain Dar which is the most mature part of Ghawar. North 'Ain Dar represents about 50% of the whole of 'Ain Dar.

2. The water saturation simulations (Figure 9 in SPE 93439) are from the flanks of the structure and tell us nothing / very little about oil saturation at the crest.

I think these are details that should not be overlooked.

I hope the skiing was good.

Goodbye.

FF

For the benefit of the non-experts among us, could you possibly explain why Euan's take on the paper in question is beside the point?

I for one, am lost, but it is not clear to me whether and why Euan is.

I'm just trying to learn what's going on here. And I have to say that I find the recent discussions on SA to be very valuable - an impressive tour-de-force of a free-for-all approach to things leading to helpful and well-argued results.

The skiing was great - 6 days of blue sky, no cloud, no wind and 3 m of snow on the ground.

If I have time I'll call back with some maps to set this in context, some comments on fractional flow and production in 'Ain Dar and Shedgum and water saturation profiles in Shedgum.

I was hoping you would continue to comment because as I said my understanding of reservoir engineering is a bit limited.

Hi Euan,

If you go back over the posts of the last 2 weeks, specifically Stuart's posts and a few of the drumbeats (search on F_F), you will find it all laid out in detail.

Now we are getting somewhere- the link between North Ain Dar, (and just what that is), South Ain Dar (and just what that is) and Shedgum needs to be worked hard. If you wonder why I wonder exactly what those boundaries are look at Figures 3 and 4 of the paper closely in comparison to the gregcroft.com. What and where is that hole??

But I will be hardpressed to believe you can buildup a 300' wall of water on the North Ain Dar structure independently.

And I am glad the skiing was good.

Well here's my interpretation of where the hole (more conventionally called a saddle) actually is, the basis for saying that N 'Ain Dar represents about 50% of all 'Ain Dar. This is based on matching the map outlines, the fact that it is called North 'Ain Dar and the fact that IPTC 10395 shows a small saddle in the exact location at the SE end of N 'Ain Dar.

The large saddle feature at the join between 'Ain Dar, Shedgum and Uthmaniya is way to the south.

The original map was nicked from Stuart's gas in the water tank post.

So we are talking about water saturations on the flanks of the most mature part of the most northerly extension of Ghawar - right?

Thanks very much for that I agree.

And yes we are talking about North Ain Dar... but we are not just talking about the flank. Are we not to assume that the area encompasses the entire -5750 closure... if not then it is hard to see a dry oil area if not (which existed on 1/1/04).

Then we are talking about the Northern Anticline which shares a crestal -5750' contour with the Southern Anticline and Shedgum.

Then the discussion should rapidly move to whether the Northern Anticline can fill without equilibrating to the other anticlines. And whether this is a wise reservoir management practice that Aramco would endorse.

And you are to be commended for leading this discussion here.

The cross sections (9a and 9b) clearly include the crest right? We can debate how far North or South they are, but you aren't trying to say that the cross-sections don't go all the way to the crest are you?

No Stuart, I'm not trying to say that because I don't know where the sections are located (but I gave you a guess on the map down the thread).

However, Saudi Aramco say this:

"Fig 9 shows simulation results on water evolution at the eastern and western flanks" (page 2 SPE 93439).

So its Aramco that says the sections are on the flanks - what ever gave you the idea that they go all the way to the crest?

I'll say this, however, if these sections did depict water saturation at the crest then N 'Ain Dar would be history. The oil production from horizontal wells not yet drilled would go out like a light.

But this of course raises the question why they are planning to drill some bilateral wells if all the oil has gone? But there again - they say these sections are on the flanks.

Here again is the west side (a) one:

Note that the two simulation cells on the right of the image both slope down (very slightly) to the east, whereas the rest of the cells slope down to the west. So the highest point in this piece of reservoir is two simulation cells over from the east side. I claim that must be the crest of the reservoir (in an East West sense). For it not to be, there would have to be a horizontal shelf on the west side of the structure. There is no sign of that in the contour map. Furthermore, it would make the overall scale not work. We know that the original oil layer thickness was about 200' (from Greg Croft). If we measure off the 1940 picture, I make the overall vertical scale as follows:

Here, I've shown my interpretation of the original 200' oil layer in the 1940 9a cross on the left, and based on that, the green boxes represent 250' intervals. So the whole structure is ballpark 850' high (probably plus or minus 100' given uncertainty as to exactly where the OOWC is in the picture). On the right is the Greg Croft map, and that shows the whole structure running 750-1000' high - around the same height as the cross section is. So I just don't think there is room for any interpretation other than that the cross section goes all the way to the top of the ridge.

The situation is even clearer with the eastern cross section, where it quite obviously folds over the top of the ridge:

I'll address the North/South issue below where you showed your hypothesized placements for the cross sections.

On this good Friday all I can say is "Praise the Lord"

From Mar 22 Drumbeat

http://www.theoildrum.com/node/2395#comment-171688

The ability to position that was way beyond my ability... it might be beyond anyone's.

It is in very much more capable hands now.

To any I have offended over the course of this discussion, I sincerely apologize.

Hope you all learned something, I know I did.

FF

Stuart:

I don't wish to detract from a very interesting dialog but could we for a minute think about turkey in reference to cross sectional images and the suppositions being made in reference to a "crest?"

Slice a turkey breast along the flank of the breast and you end up with a cross section which appears to capture the crest. But this is only the crest of that lateral slice, it is not a true transverse cross section of the bird. The true cross section of the bird would be presented by a cut through the bird perpendicular to the backbone.

I am acting as devil's advocate here, but if these images are in fact a lateral cross-section (which is what I understand Aramco to be claiming) then it makes the intent to drill further wells on this structure somewhat more understandable.

Cheers!

"I'll say this, however, if these sections did depict water saturation at the crest then N 'Ain Dar would be history."

I'm glad we now agree on that point, and it's just a matter of debating placement/timing.

"But this of course raises the question why they are planning to drill some bilateral wells if all the oil has gone?"

Well, my contention it's unlikely the demise of the oil layer is perfectly uniform, and so there's places where it makes sense to go in with a few extra wells to clean up the remaining patches of oil layer. That's what IPTC-10395 is about in my view. It's also why the anticipated life of the wells studied in IPTC-10395 is so short (see the pictures in Water in the Gas Tank).

it seems to me that we also have to keep in mind that we are dealing with a computer model that is history matched, in the final analysis, to production data (and possibly to some well log and/or 4d seimic data). if that is so, as i have pointed out previously, the history match is "probably not" a unique solution. the supposed "wall of oil" could be nothing more than the model's resolution* of production data and oil in place estimates.

* it would seem that saudi aramco would have "top notched" reservoir modelling experts. i would like to point out that i have seen some "top notched" reservoir modelling experts present some really bogus forecasts.

Great!

Surely you jest! If there were no watering would there be a need to shut down some wells as they did? If there were no watering would there be any need to plug some wells above the water line as they did? If there were no watering would there be any need vertical short radius horizontal drilling that limited the input to the well to the top ten feet of the reservoir?

The whole point of the SPE paper was to report on how they were attempting to control water intrusion into the field. If there were no watering out then there would be no need to do anything.

And the text clearly says that of these “Rigless Water Shutoff” operations, 77% of the time, by shutting off the wells above the high water line, they were successful in getting the water cut below 50%. In 19% of the cases they were successful in getting the water cut below 75%. And in 4% of the cases the water cut remained above 75%.

We saw in Figure 1 that production was decreased when these measures were initiated.

Euan, they are milking the oil from the top ten feet of the reservoir because below that point the reservoir is completely watered out. My God man, what further evidence do you need?

And Saudi admitted on 1/1/2004, 3.3 years ago, that Ain Dar and Shedgum were 60% depleted. Page 21:

http://www.saudiaramco.com/sa/webServer/general/Presentation_Fifty_Year_...

Knowing Saudi’s predilection for exaggeration, I would bet that on January 1st, 2004, Ain Dar and Shedgum were more than 60% depleted. But at any rate, even taking them at their word, that would put the area between 65% and 70% depleted today.

Let me repeat, what more evidence do you need?

Ron Patterson

Ron, SPE 93439 is for North 'Ain Dar and the water saturation sections (Fig. 9)are from the flank and not the crest of this small but important part of the North Ghawar area. The 10 ft oil column of which you speak is on the flank and tells us nothing of the size of potential dry oil columns up dip in crestal positions.

So how do you manage to extrapolate statements from the flank of North 'Ain Dar to include the whole of North Ghawar - which includes all 'Ain Dar and Shedgum?

Sounds to me we are in real good shape for a few years at least - even if they are 75% depleted - still 25% to go in this most mature part of the Greater Ghawar structure.

If I'm not mistaken, reading the charts in SPE 93439, Ghawar produces either water or dry oil (mixtures of the the two in vertical wells) and this gravity driven system performs like a piston. So if there is 25% left, this can probably be produced at high rates as dry oil from horizonatl wells.

Euan, this statement by you says it all. You think that if they are (northern Ghawar) is 75% depleted they are still in real good shape because after all they still have 25% left. Euan, though we are certainly concerned by how much oil is left in the reservoir, that is not our immediate concern. Our immediate concern is the decline rate. And in the past northern Ghawar has been the most productive area of all Saudi’s fields. The area has produced the bulk of Ghawar’s 5 million barrels per day for about 50 years.

Saudi says their existing fields are declining by from 5 to 12 percent per year. And if any field is 75% depleted then you can be assured that it is one of those near the 12% mark. If North Ghawar is declining by anywhere close to 12% then Saudi Arabia should in an absolute panic. And from all indications they most certainly are.

Ron Patterson

Euan - you need to indicate exactly where you think those cross-sections might be on a map or picture of Ghawar such that there is somewhere left for a significant amount of dry oil in reasonable rock to be hiding.

I would not normally be so speculative, but since you asked, here would be my very, very rough guess for the laocations of sections (a) and (b) from SPE 93439, Figure 9.

(a) is roughly in the same location as your prognosis. (b) is radically different.

Where I have drawn (b) is on the flank of the structure, rolling over the N-S orientated anticline in an area of exceptional reservoir quality. This seems to tie in with the shape of section (b) and the fact it is extensively water flooded. You drew section (b) in a crestal position with poor reservoir quality which does not to my mind match the data or the fact that the paper says the sections are from the flanks.

The yellow area indicates the crest of S 'Ain Dar which based on the data we have could still contain much dry oil. The reservoir quality here is less good - so if I were the Saudis I'd feel inclined to develop this using horizontal wells - someone should write and suggest this to them.

The map is from Greg Croft:

http://www.gregcroft.com/ghawar.ivnu

Would not the toes of the pay zone be getting wet in 1940 on a. -6250 -204 = -6444'

Thanks

FF

I'm afarid you're about 10 years out - the toes of the pay zone will have started to get wet around 1950 - so what?

I'm really intrigued to know what mental image you have of the Ghawar reservoir in 2D - any chance you can run up a sketch? I got lots of other stuff I want to post this evening which I hope you will comment upon - but if I find the time I'll run up a sketch of how I see the reservoir.

WRT a comment you made higher up the thread. Would it not be the case that once the saddle between the crests of N and S 'Ain Dar waters out that the crests behave as two independent GIANT FIELDS?

My guess would be that the saddle is already water, and sure we are talking about the beginning of the end game of northern, northern Ghawar. The difference here between the different positions being discussed is that I see this as the beginning of the end, while others see it as end in 2005.

The relationship of the structural crest/ pay thickness to the position of the water oil contact in 1940 is the only semi-reliable (although speculative as hell- I wish we had better data believe me) method I can see to position these cross sections.

Now we should be arguing about the ss of the original oil water contact on that west side. It is not readily apparent to me.

With regard to your post about being the beginning of the end or ending in 2005.. you redacted my original post to read "The Northern End of Ghawar is watered out" when basically it gave the choice of two options the Northern End being watered out or the watering out of the Northern End still looms ahead- I'm not certain which is worse.

In an effort to understand the too and fro here, I've been doing a little searching. I came across this paper "Ghawar: The Anatomy of the World's Largest Oil Field", which I'm sure is old hat to you guys, but makes things a bit clearer for us morals. PDF of the presentation is here.

In that presentation was a slide of a 3D view of the field, I grabbed the image of the northern part of the field, below.

The view is from the north east, looking south west.

At a rough guess I's suggest that shape of the eastern flank features could place the cross section at a number of points along the north-south line towards the northern 'peak'. See what you think.

You rock!!!! It is blindingly obvious where 9b) has to go on this from it's shape. Hold on....

Ok - here we go. There is only possible place for the 9b cross section on this picture. And it is within a mile or two of the very top of the crest:

Click to enlarge if need be.

There is nowhere left for oil to hide in North 'Ain Dar.

I consider that this removes all conceivable doubt on the location of the 9b) cross section. Anyone disagree?

I have to say that it is far from "blindingly obvious" that this removes "all conceivable doubt"! It is one possible location, but the general features you highlight of "sharp crest", "steep", "shallower" and "steep again" would apply to many points along that ridge as we sweep north and south from your chosen location. Keep in mind that the vertical and horizontal scales are probably not the same in the two diagrams. A cross section quite a ways north of the ridge peak would also go steep-shallow-steep along the east flank, and if the relief looks "gentler" than the cross section diagram, that could be accounted for by varying the vertical scale.

Again, I'm not saying your location is wrong, just that the degree of certainty you have expressed is far from appropriate given the quality of the data.

Take a look at my positioning of the cross-section, further down the thread.

The cross section location can be moved, but getting ALL the features to match limits the possible locations to points close to the peak of that field. I've put Euan's suggestion on my image and pointed out why I don't think it fits.

I spent quite a while this morning trying out locations, scaling factors, etc. There aren't as many possible places as you might think.

Go ahead and propose an alternative hypothesis Halfin.

Holy Heisenberg.

And for those who say the Saudis wouldn't release this info if it revealed this much...I disagree. A lot of intelligence work is not the cloak and dagger stuff you see on TV, but just putting together publically available information - research papers, newspaper stories, etc. - in ways not imagined by those approving the releases bit by bit.

Hello Leanan,

Good Morning! Please see the discussion between Garyp and I far downthread! Will you post a visual [possibly topthread?] of my recently discoverd Ghawar 3D oil saturation chart--I don't know how. Thxs!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Here you go:

It's from here.

Holy crap Look at Uthmaniyah

Thanks for this

FF,

Take a look at the modeled change in Sw for Uthmaniyah 2003-2004 that I reference below. To me it looks like a lot of oil in the big white patch downslope of the peak, but I'd be interested in your view of this and the rest of the PDF.

Gary-

Send stuart an e-mail.

He knows how to reach me.

There is a lot here to talk about but I'm weary of the public domain.

FF

I can understand you guys talking in private about all this, but please, please come back with some statement afterwards...

If nothing else say whether we're "dead men walking already" or "I'd get my affairs in order within the next 18 months"

Or something...

Thank you all for your hard work and everything you have done for the public on this one.

The talent and knowledge here is incredible.

Thanks

JOhn

Hello F_F,

Full credit to you, SS, and the other TopTODers-- you guys set me off on big google Easter Egg Hunt! Hopefully you and the other TODers can make good use of this if it was indeed an accurate chart circa 2004. Can you and SS somehow match this up with the other slices and data? Have at it--give it your best shot.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Note the text references "over 4,000 wells" in the simulation.

I wonder how many are injectors and producers to make the 5.6 MMBOPD claimed for the field in yesterday's WSJ wood mckenzie table??

According to ths rather excellent post here:

http://europe.theoildrum.com/node/2372#more

Saudi Arabia had around 1900 producing wells in total in 2005. So the 4000 wells on Ghawar will include the historic data set used to tie seisimic to stratigraphy and to record water saturations.

Aramco drill a fairly large number of observation wells (used to observe pressure, temperature and saturations).

So the 4000 will probably include watered out wells, injector wells, producing wells, old exploration and appraisal wells and of course suspended wells waiting to come back on when global oil demand once again picks up.

Help! How about a clickable enlargement? I can't see the right half of the picture and don't know what I am looking at directionally.

use firefox, and drag & drop the picture in a new tab.

Great find!!! We don't know the exact date, or exactly the color scale (though I can guess :-) but what I think it does do is let us make a fairly plausible extrapolation from the North 'Ain Dar data to the whole of North Ghawar, and I would say it tends to support the following points:

Those are my quick reactions (I have to shoot off and do some paying work) - we can tear it to bits further in coming days... In particular, we can start trying to correlate the Uthmaniyah cross-sections with this picture.

The picture very much begs the question of what rate they can (or will) produce the oil from Haradh and Hawiyah.

I'm interested to hear Euan weigh in on the last 12 hours of developments...

You would not believe how many people are waiting for Euan to weigh in on this. If you, FF and Euan come to an agreement...I think you can propose an "official" announcement from TOD about the state of affairs in KSA.

Stuart Staniford wrote:

See, the guy needs funding.

Matt Simmons and Boone Pickens and other peak oil money-bags take note.

http://www.theoildrum.com/node/2420#comment-174937

Bob Shaw - a fantastic, find. I'll make a few comments here and suggest that Stuart re-posts this on a fresh thread tomorrow as this one has gotten pretty unwieldy.

What can I say - look at all that oil in N 'Ain Dar!

One think that intrigues me is what different folks see when they look at this. Yesterday I suggested F_F should post a sketch showing his view of Ghwar in x section and now I'd like to ask Stuart to do the same. I will prepare a sketch to show tomorrow. What I wonder is if a significant amount of missunderstanding stems from a poor mental image of the reservoir. There is I believe vast vertical exaggeration in this depiction - and so in the real world you need to visualise this without that exaggeration. The Arab D reservoir is about 200 ft thick and that northern part of Ghawar is about 79,000 ft across. The structure amplitude is about 1300 ft - maybe some drafting whizz kids to run up a true vertical scale x section using Greg Crofts contour map:

http://www.gregcroft.com/ghawar.ivnu

1. What does the blue show? In SPE 93439 a "dry area" means an area with a full (200ft) oil column - no water ingress at the sole. If that is what the blue is showing here then N Ghawar actually looks in relatively good shape. Imagine that 200ft thick slab of limestone full of oil covering all that area.

2. Yesterday I said that I imagined the saddle between N 'Ain Dar and S 'Ain Dar was probably water - this in fact shows there is still oil in the saddle (probably gone by now).

3. We seem to have extensive oil in the crests of N and S 'Ain Dar and Shedgum. Abquiaq is near history - but Aramaco seem to have done a great job ensuring efficient sweep.

4. The real shocker here is N Uthmaniya - but this needs to be kept in perspective. That tongue of oil is still 2 to 4 miles across, 20 miles long and 200 ft thick. It is interesting to note the less efficient sweep in this area that may be attributed to the poorer reservoir quality.

Are wolves smarter than humans:)

EM

Hello Euan,

Thxs for your analysis--I think you and fellow TopToder SS do a great job of taking turns holding each other's feet to the debating fire. Both of you need to stay calm and composed, but keep the facts and analysis coming for the normal TODers trying to keep up [like me!].

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

For what it's worth, I am an image analyst and my quick assessment puts the east flank profile here:

Without knowing a good deal more about the various scalings in these data sets, we are way out in SWAG land. Probably just WAG actually.

That area ends up being too far south in my estimation since the cross-section can't trail away correctly. Also peak width to 'saddle' width need to be comparible.

I agree with you that there are areas up and down that ridge that could be made to fit the profile data. Here are 3 versions of the profile laid over the basin model that look plausible, just depends on how you scale the axis'.

The view angle on the 3d model can also make you see things that aren't really there.

I guess my main point would be that we do not know enough about the resolution or binning of the profile data or the basin model to really match them up.

And what is that light blue horizon line running through the elevation model? Water level? If so when and what is the depth?

Too many ?s. Too many assumptions to make.

My assumption was the blue level was the original water level - see my posting for matching. Also the 'general' shape had to fit, not the specifics of particular bumps (which you are right, you can't really be sure if they are gridding or geology). Take that as a constraint and you see that options decrease.

As far as gridding is concerned, check Abqaiq.

To me, these don't pass the sniff test. The orange one has no way to get all the way down to the water without the grade shallowing out again - the actual cross has the grade steep as it goes into the water.

And both of them, but especially the blue one, suffer from a vertical scale issue. Again, my interpretation of the vertical scale (based on the Greg Croft numbers) is:

That blue one would make the pay and the reservoir really thin.

Actually I think the orange line would reach the presumed water line without flattening out, my graphic doesn't follow the ridge exactly. But that's not really the point. We're reading tea leaves here.

The vertical scale on elevation models is routinely exaggerated for display purposes and not always linearly.

We're also assuming that the profile is perpendicular to the ridge crest but there is no reason it has to be.

Perhaps I've missed this in the discussion,but on the 200' of oil, are you assuming that thickness along the entire ridge peak? Seems unlikely, but not my area.

"my graphic doesn't follow the ridge exactly. But that's not really the point."

No, that's exactly the point. If it doesn't fit all the parameters that's not it, Stuart's fits all the parameters. No one is reading tea leaves here. Everyone is being extremely careful.

There's a quite obvious large lump sticking out below your orange line that it would have to go over to get to the water (clearly visible by the shadow on top of it). That doesn't match anything on the profile.

"But that's not really the point. We're reading tea leaves here."

I agree that you are acting in that way, but I'm attempting to be as careful and precise as possible. You may feel free to make up random facts with no support (like assuming a non-linear scaling), but I'm attempting to find the best possible match given the facts we know.

There could easily be a valley behind that ridge, you only have one view angle here and it's a jpg of a 3d model created for a powerpoint presentation. Not a reliable data source. View angle, scaling and resolution have a huge effect with these models. It is very easy to be mislead by data like this and it happens far too often.

Given the undocumented data sources I think you may be working very hard for high precision but likely achieving low accuracy.

I haven't made up any facts, I'm merely pointing out that you know very few facts about this data set and are unlikely to come to a reliable conclusion.

You are the one assuming to much, I'm only mentioning some of the possible ways the data has been transformed.

Rugbman - thanks very much for this which at least shows differnt options. A few comments.

1. Stuart and others are right in saying that the tail end of the profile needs to dip below the pale blue plain depicting the original OWC.

2. Stuart I believe is wrong in placing this at the crest (your red line) because the paper says explicitily the profiles are on the flanks - I'm therefore drawn to your orange and blue lines (which are on the flanks) and which lie in the vicinity of my own prognosis (which I spent 2 minutes preparing).

3. How are you dealing with scaling? Both vertical and lateral scales.

4. A general comment - if the profile goes all the way from OWC to crest then it is about 4 miles long and 200 ft thick. There are about 17 grid cells (vertical and lateral) in the model so this would require cell dimmensions of around 12 ft thick and 1240 ft long. Cells in these models are always elongate but this seems extreme to me. So it would be interesting to play around for a match that allowed the profile to be much shorter.

Fabulous work!

What do you believe is the vertical extent of the 9a) and 9b) cross sections (top of simulated reservoir to toe of the watery region), and why?

(I agree completely that the vertical scale on all these models is exaggerated - we've got about O(1000') of height and O(10miles) width in 'Ain Dar). However, I don't see why it bears on the discussion at hand. The shape is the shape regardless of the scaling factors.

To be honest I haven't a clue and that's why I believe this debate of these cross sections could lead nowhere. Are they a half mile long? a mile long? or as you seem to favour cover the full structure from contact to crest - about 4 miles long?

You make them different lenghths then you can fit them in lots of different slots - as Rugbman I believe shows. So of course scale matters.

Hunt and Peck. Since it's all speculation, didn't see need for a systematic approach.

Do we know if this is profiling the entire 200'X4 mile structure or just a subset? 12'x1240' does seem like an odd bin size.

Photobucket will not allow registration without giving them a valid cell phone #.

I will NOT do this !

You should not use such hostile sites.

Alan

Didn't ask me for a valid cell #. shrug.

Site was suggest by TOD FAQ. I don't generally use such things.

And for what its worth, here's my guessimate of the location of the eastern flank cross section - with the image overlaid on the 3D view. A cross section somewhere close to the peak, probably somewhere very slightly to the north of the very peak (not south, sorry Stuart). This is the best match to the 'peakiness' of the peak, relative to the width of the 'saddle' area. Its difficult to be exactly precise given the bumpiness of the real data, but I've tried to match all features, including what I take to be the original water level.

Edit: For fairness I've a added my best guess at Euan's position as well. The problems as far as I see are the 'peakiness' is wrong in order to get the saddle right, and the water level is now off as well. Make up your own minds !

I disagree - I think the shape match is better a shade south of the peak. However, it doesn't matter to the conclusion.

Its the shape and steepness of the side as it comes off the peak that makes me shift it north. I've pawed over it in Photoshop at high magnification looking for the fit and the wall seems too steep at the peak to the south.

However, as you say it doesn't really make much difference north or south - either way it seems to have to be very close to the peak point.

For those reading up afterwards, Stuart and I came to our conclusions as to position independently, posting the original guesses within a minute or so.

I just don't think there's enough of a shelf where you've got it. However, I guess if these are the only two candidates, I'm not going to get into a massive statistical image processing exercise, since the difference between them doesn't change the conclusion. Here again is where I think it is - with and without:

With that, I'm going to bed!

Bed? I've just got up!

There is one further thing that comes to mind when I look at the overlay I made of the cross section and the geological data. That thin red band of dry oil in the simulation looks a lot like the same thinkness as the 'lumpiness' of the geology.

As you push the oil up and across with your water front, when you get to that thin shell, surely it begins to break up via the shape of your capping stone. Its difficult to tell if the artifacts are real geology or data sampling, but by comparing to Abqaiq I'd say real. Doesn't that mean you get more pockets of dry oil left behind unless you stick a well point into each and every local peak in the structure?

Something I hadn't thought about before.

Click to enlarge.

Agree with Nate.

Thanks Euan, F_F and Stuart for having the debate in public. I view all these posters as equally competent but having different experience and hypotheses. If they all believed the same thing there would be nothing to discuss.

Maybe it's not obvious to everyone but the debate (and data to support the debate) is what is important. No one is stating as fact that this how it is in SA. They are comparing notes with each other. My perception is they all learn new tidbits and concepts as they go and refine their arguments and hypotheses.

No one knows what the real state of affairs is but being privy to the discussion is educational for me. The overall impact is great concern but not dogmatism.

This is better than American Idol and Perry Mason combined!

No kidding! Thanks, both Euan and FF.

So I argue a better placement is like this:

This is about the required 250' or so below the very summit of the ridge, hits the crest in a fairly broad place (which matches the rather flat crest top that the simulation cross-section shows) and also, is about right for where I placed it on the permutation picture. Notice in the 9a cross that there is a notch downards four simulation cells over from the eastern side. I believe this matches the slight shadow that crosses my a) line 1/2 way along it in this picture:

So all of this works out fairly consistently. And as far as I can see, that area is of roughly average permeability (I agree with you it's implausible that these cross sections would be in regions of sub 100 millidarcy permeability, but think they could well be in averageish 500-1000 millidarcy territory).

Let me post this comment, and then turn to the 9b) eastern cross in a separate comment.

Ok. Let's do the same analysis for the 9b (eastern) cross section. Here is my analysis of the vertical scale, together with the original OOWC and Greg Croft contour map.

My analysis of vertical scale is this cross-section is taller - around 1100'. That means it pretty much has to go close to the summit of the ridge. Where you have it at the Northern end of the -6000 contour, there's only 750 feet of structure, which this cross section cannot be made to fit in. If I put it close to the summit, I have enough vertical space for it. Furthermore, the fairly distinctive shape of the reservoir here matches up on both the contour map and my reading of the shadows in the permeability visualization:

Your location does not look like the right shape to my eye.

My one problem is the OOWC looks somewhat high. However, there are two readings close together on the 1959 map that are very different, so maybe the original height of the OOWC is a bit variable in this area (the permeability is also changing fast around the bottom of the cross section too).

Overall, the permeability where I place the cross section looks to be around 400-800 millidarcies. I don't see that as low enough relative to the reservoir average to justify your concerns about the sweep efficiency at this location.

Finally, here's a summary of the state of the reservoir at the beginning of 2004:

Again, the green boxes are 250' in height (estimated).

Overall, I don't think there can be more than small patches of oil layer left behind. It's worth noticing that in the cross sections, the oil layer is of fairly uniform thickness but is not level. The OWC varies in height by two or three hundred feet and is hugging the top of the reservoir. So even if you think I'm wrong on the b) placement and think that cross section is a few hundred feet lower on the structure, still the most natural model of the three dimensional structure is it's like the two dimensional structure - a thin layer of oil hugging the top of the reservoir.

I have shown SPE #93439 to petroleum (reservoir) engineers from British Petroleum. I have talked to them. These people indicate that the SPE paper merely describes a mature reservoir. There is no evidence whatsoever in the paper to indicate that North 'Ain Dar has "watered out". To be more accurate, there is no way to "confirm or deny" anything regarding the field.

These discussions have also indicated that the Saudis would not disclose anything in SPE that might indicate trouble in any case. This is a thought I'd had myself. It is implausible, given Saudi Arabia's secretive policies. Therefore, it follows that there is little of substance in the paper, which was the conclusion of the BP reviewers.

The Oil Drum may be a "meat grinder", as Leanan said above, but it's not the kind she had in mind, I think.

I am tempted to just stay out of these discussions and let people give themselves enough rope to hang themselves with. There is such a thing as journalistic standards & practices, and that applies to those studying "peak oil" more than anyone else, because it is us who hold the controversial position. I also believe that a lot of naive people reading TOD get many wrong impressions. That's a shame.

My cynical view, moreover, is that people will believe whatever they need to believe, and will not let anything interfere with that agenda, disregarding evidence that contradicts their position or misinterpreting evidence that does not support their position.

More and more, this Saudi Arabia obsession takes a bizarre turn down a familiar road in human affairs. Apparently, fewer and fewer on this weblog give a damn about its reputation.

But, I guess I still care because here I am, writing this.

That reminded me of the "dry air" popcorn popper I had in college- man that thing sucked

You make many comments (like this one) that reinforce Dave's point. I am usually just a lurker, but I have to say, Dave voiced my thoughts extremely well.

Oh, Please. We have been presented with all the data Stuart, FF(and Bunyonhead yesterday) have been using. They have presented step by step analysis throughout. They have put there argument up for peer review on The Oil Drum. We have yet to see(other than cursorily by Euan) any arguments actually addressing the data and conjecture. Yet, the connucopian trolls start ringing in with "I know nothing but I think everyone is equal" and "I'm not going to comment on any of the data and cannot reveal my sources who tell me you are full of shit". Give me a break. Dave, go get your gun.

http://www.theoildrum.com/node/2330#comment-166160

Dave, if you have any dirt than spill it. If not shut the f* up.

Sorry to be blunt, but some of us have a lot riding on this.

Myself, I live in Japan. In response to peak oil I am in the process of relocating my wife and me to the US where my father is preparing a farm for PO.

Therefore I take this personally. You've twice now called Stuarts and FF's contrubutions BS without the slightest proof.

If North 'Ain Dar hasn't watered out then tell me why. Don't insinuate. For a lot of us its not academic. It sure as hell aint for me.

Maybe I've had too much beer tonight to post. You sure have posted good material in the past. But Dave, if you have the goods then spill them. I'd sure as hell love to see your evidence go toe to toe with FF's.

good night.

You think?

So you resent any information - even tentative information - that even suggests in the tiniest way that this drastic relocation could just conceivably, possibly, be an overreaction? If so, a site such as this, which specializes in analysis, really might not be the best place to be...

You have that completly 180 degrees backwards.

What I resent is the lack of information, unsubstantiated insinuations.

I would absolutely love any information that even in the tiniest way suggests my relocation is an overreaction.

You see I can't just casually move back home if the economy gets bad. I have to get a visa for my wife. This takes a huge investment in time and money. I'm talking several thousand dollars and a full year from start to finish. That's just for the visa, I'm not talking relocation costs.

I've been contemplating this action for a while now. I don't feel my employment position is secure here in Japan and I would have a much better chance of riding out any economic downturns in the States.

Based on what I've seen recently (Stuart's, Euan's, Fractional Flow's, Simmons, etc etc) evidence I've decided to begin that visa process. Once you start it you really can't stop it (or so says the immigration lawyer I consulted).

So yeah, if Dave has some good info from some BP engineers than I would really like to see it. This argument may be academic for most of the people on this board but it sure as hell aint for me.

Edit:

I have found Dave's work to be of the highest caliber in the past. That is why I am especially frustrated with his recent lack of transparancy (even if he stated he is working on getting the information out there.)

Let me also appologize to Dave. Dave I am sorry for my outburst. I didn't not mean to tell you to F off.

this is pretty much true for everything about Saudi Arabia! it's a black box and any discussion about Saudi Arabia will always be highly speculative based on sketchy evidence and crappy data. But webblogging is about being speculative, isnt'it!

If KSA were a black box, which is not quite true, then another approach to guessing at what the insiders there are seeing would be to analyze their geo-political actions. Why is that interesting? Because it just happens that KSA has only very recently begun a 180 degree shift from passive diplomatic observer to active participant. Why now? One reason could be that they see Ghawar starting to decline, they understand the implications of that better than anyone, and they see a need for a new political direction (toward a peaceful neighborhood) as a result.

Perhaps their thinking goes something like this:

1. Our asset base has always been valuable, but at scarcity-pricing for oil ($100?, $250?, $500 - you pick a number) it will be seen as vital to first-world prosperity.

2. Suddenly the number of potential take-over threats expands from just Osama/Al-Queda to who knows? - maybe even the US itself. Maybe a consortium of powers. In other words, if oil scarcity is recognized globally, a small weak country that controls the biggest supply of it is looking increasingly vulnerable - over time.

3. There are small fires breaking out in our neighborhood: Iraq, Lebanon. They threaten to spread. The more fire there is in the neighborhood, the more likely it is that some big power(s) will eventually use that as an excuse to bring in the First World Fire Department. They might use KSA as a landing strip and deployment point (otherwise known as an occupation). We don't want that, so let's start to turn down the heat in the neighborhood, put out these fires ourselves.

My point: one KSA action that's well documented is a huge buildup in recent years of new drill rigs. But a second one, just in the past few months (as KSA production has fallen dramatically): a 180 degree turn in KSA diplomacy. These two observable changes may not be unrelated.

if you look at stuart's 2nd graph (oil production vs quota) and focus on 2004, one might conclude that the saudis produced all out to the benifit of their useful idiot (that would be bush) and as a result are "resting".

a sprint followed by a nap.

With respect to your views, I really don't want to get into one of these tiresome, testosterone tumbles; I wonder if you're right about Saudi Arabia stepping forward as an active player in the Middle East, compared to the more passive role its had until recently.

Hasn't Saudi Arabia, in reality, played a key behind the scenes role for decades in the Middle East, only now its chosen to step forward into the limelight and go public?

I'm thinking about Afghanistan here, where Saudi Arabia was crucial to the war against the Russians, providing men, money and ideological backbone to the struggle. There's also their role in the Iraq-Iran war, which is too big to go into here.

I think you right about the main reason they are entering the stage so openly and actively. They are deeply concerned about the enormous destabilizing effect of american envolvement in the region. Specifically can the disasterous destruction of Iraq be confined to Iraq alone, or will it spill over to eventually engulf the whole region? Saudi Arabia's new, overt, policy shift, can be seen as a sign of deep frustration and profound fear that all the conflicts in the area could bleed into one another, into an unstopable and uncontrolable river of blood, or perhaps that should be tidal wave?

So, Saudi Arabia, above all wants stability in the Middle East, not more regime change, not a New Order, not more war. However, peace in the Middle East is easier said than done. Some kind of peace between the Palestinians and Israel is the key to reversing the slide towards chaos and extremism. Somehow the two warring peoples have to be forced to share the land and its resources. With their money the Saudis can probably, with luck, buy most of the Palestinians off. But only if the Israelis return to their old 1967 borders. But who will force the Israelis to do this? Only one country - the United States has the power to do this. How likely is this? Not very likely at the moment. But what of the future? Is Israel really, or objectively, all that important or of vital national interest to the United States? Will the United States one day decide its "had enough" of Israel? That Israel just isn't worth the cost? It's a very difficult question.

But how much time do we have? How long can we allow the festering sore to pollute the Middle East? I'm talking about the Israeli/Palestinian conflict here, not Israel. Saudi Arabia clearly thinks that time is running out.