Further Evidence of Saudi Arabia's Oil Production Decline

Posted by Sam Foucher on April 10, 2007 - 11:30am

This a guest post by ace.

Summary

My post is related to Stuart's and Euan's stories as my post discusses the declining Saudi Arabia's future production rates. The discussion about Euan's and Stuart's stories further validates Saudi Arabia's forecast decline.

My forecast decline for Saudi Arabia is in disagreement with Euan's previous statement: "According to my view, Saudi Arabia, together with other OPEC countries will raise production to meet this demand challenge". This demand challenge is stated by Euan to be that "The IEA are forecasting demand to rise strongly by around 3 million bpd between the second and fourth quarters." My assumption in my forecast in that Saudi Arabia does not have any long term ability to raise their production. This assumption is confirmed by Riyadh Bank's recent forecast of 8.44 mb/d average production for Saudi Arabia in 2007.

Stuart stated in his story "Saudi Arabian oil declines 8% in 2006". that "I'll bet $1000 with the first person who cares to take me up on it that the international oil agencies will never report sustained Saudi production of crude+condensate of 10.7 million barrels or more." My analysis gives further support to Stuart's prognosis that Saudi oil production is in decline, while showing a temporary increase back to 9 mb/d in 2011. However, the 900 kb/d total increase in capacity from Manifais the last of Saudi's known megaprojects. Consequently, Saudi oil production will begin steady irreversible decline, starting at the end of 2011.

Further evidence is presented from Hans Jud's article which uses field by field HL to forecast a decline in Saudi Arabia production. A hypothesis of URR=205 Gb is tested and proven to be false using a two cycle HL chart. Consequently, Saudi Arabia URR is showing a strong trend towards 165 Gb, of which about 110 Gb has already been produced. It's also worth noting that in BP's statistical review, Saudi Arabia reported reserves of 169.6 Gb in 1987, which is close to the URR of 165 Gb, and 255 Gb in 1988. How could this be when the last giant Saudi field of Lawnah (1.17 Gb) was discovered in 1975.

Finally, the future decline of Saudi production implies that peak total liquids is forecast to occur in mid 2009. This means that coordinated conservation plans need to start now.

Further evidence supporting Saudi Arabia's production decline continues to emerge. The evidence is not only technical and economic, but also behavioural. The analysis of the further evidence, described below, shows that Saudi Arabia is highly unlikely to produce over 8.5 million barrels/day of crude oil and lease condensate, on an annualised basis.

Saudi Arabia is in decline now. This means that the world's production is in decline now. Future supply will be unable to meet forecast demands. Governments, corporations and individuals need to start making coordinated plans to prepare for the decline in world production.

Recent Statements

Two recent statements provide further evidence of decreased Saudi oil production and the continuing struggle to convert resources to production.

Riyadh Bank predicts that Saudi oil production is expected to fall to 8.44 million bpd in 2007.

Andrew Gould, Schlumberger chief executive says "The age of easy oil is over" and "rapid decline in existing fields were slowing the growth of energy capacity worldwide".

Saudi Arabia Production Forecast to December 2011

My current forecast shows Saudi oil production to be 8.43 million bpd in 2007. This is similar to the 2007 production forecast by the Riyadh Bank.

Fig 1. Saudi Arabia Production Forecast. Click to enlarge.

Saudi Arabia's Failed Attempt to Bring Forward Production from AFK

As it is becoming more likely that Saudi has no surplus capacity, the importance of the near term big projects of Shaybah and AFK (Khursaniyah) becomes critical.

This Nov 2006 CSIS presentation by Obaid makes the following statements:

Khursaniyah (AFK) was ”originally scheduled for December 2007” but in Nov 2006, Obaid says that it will be earlier: ”by June 2007 to reach 500,000 b/d”.Shaybah expansion was ”originally scheduled for January 2009” but again Obaid states an earlier date: ”by April/May 2008: 250,000 b/d will come on stream”.

On Mar 4, 2007, Phil

Hart said that ”Khursaniyah group of

fields..is not expected on stream until the end of 2007.”

In

Figure 1, I’ve assumed Khursaniyah (AFK) first oil is Feb

2008.

The desperation to deliver first oil earlier from AFK and Shaybah together with Riyadh Bank's downgraded oil forecast shows that Saudi Aramco is struggling to increase production rates. The forecast in Figure 1 from 2008 to 2011 may be too optimistic.

Saudi Arabia field-by-field analysis by Hans G. Jud: "We are in decline NOW"

Figures 2 to 6 are from the presentation by Hans Jud.

Fig 2. Small Saudi Fields show “Great Future”?. Click to enlarge.

The figure above is partly based on information also from Obaid’s CSIS presentation. The figure shows that there is justified scepticism over Aramco’s promise to suddenly produce huge amounts of oil from old small fields. Look at Manifa and Khurais – huge production rate jumps!!

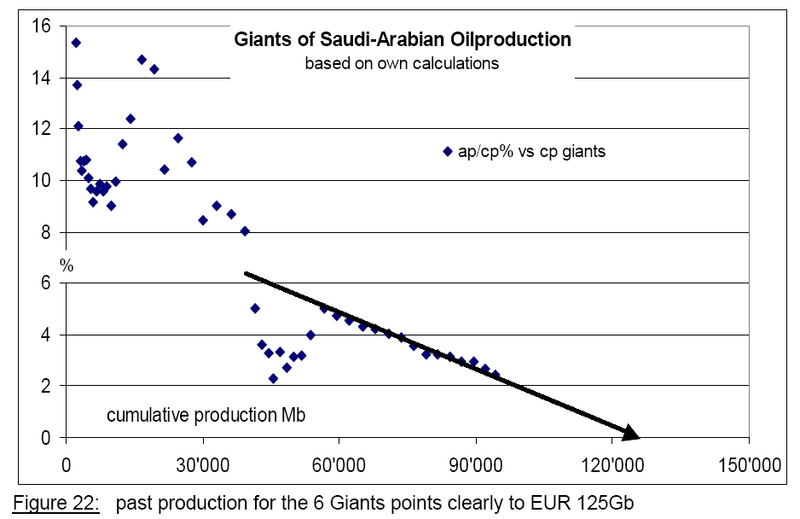

Fig 3. HL for Saudi Giant Fields. Click to enlarge.

Figure 3 shows a cumulative HL plot for the giant fields of Ghawar, Abqaiq, Berri, Safinaya, Zuluf and Marjan. The URR is 125 Gb. Jud also does HLs for each of these giant fields in his presentation. His analysis of Ghawar is further broken down into its subfields.

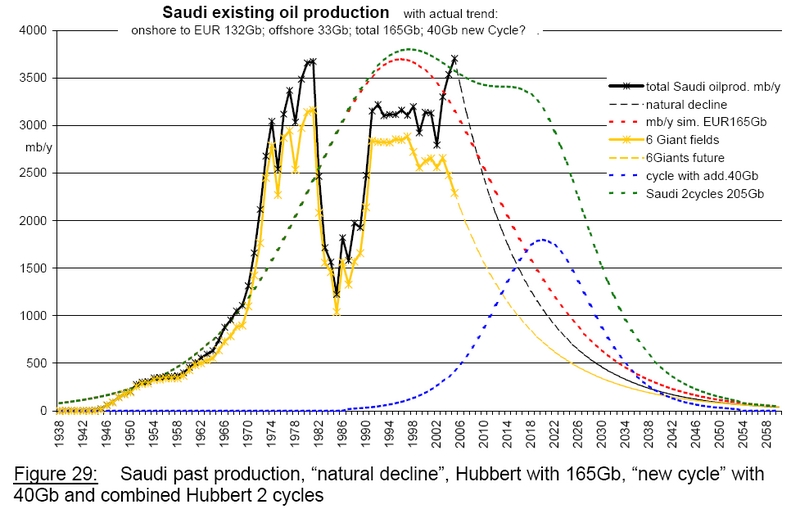

Fig 4. HL for Saudi Arabia – all fields. Click to enlarge.

Figure 4 above shows a URR of about 165 Gb.

Fig 5. Two cycle HL. Click to enlarge.

For this chart, Jud optimistically assumes that Saudi Arabia has an additional 40 Gb of secret oil to produce. This gives the dashed blue line. This is added to the dashed red line (URR 165 Gb) to give the dashed green line as a forecast for Saudi production.

In the last few years, note also in the figure above the production drop in the 6 giant fields while total production is increasing. Are the MRC wells in the giant fields starting to show accelerated decline rates due to increased water cut?

Fig 6. Where are the missing fields?. Click to enlarge.

This last figure shows that Jud’s optimistic assumption of an additional 40 Gb is most likely false. This means that Saudi’s URR is about 165Gb. Figure 5 shows the dashed red line for the URR 165 Gb which might be the best HL fit for Saudi. This could imply a sudden decline in Saudi production as shown by the natural decline as the dashed black line in Figure 5.

Saudi Arabia's Decline means that the World's Production will not supply the Forecast Demand

The forecast in Figure 1 assumes that old small fields such as Khursaniyah (AFK), Khurais and Manifa can deliver huge increases in production. Figure 5 shows these forecasts to be overoptimistic (Matt Simmons would probably agree).

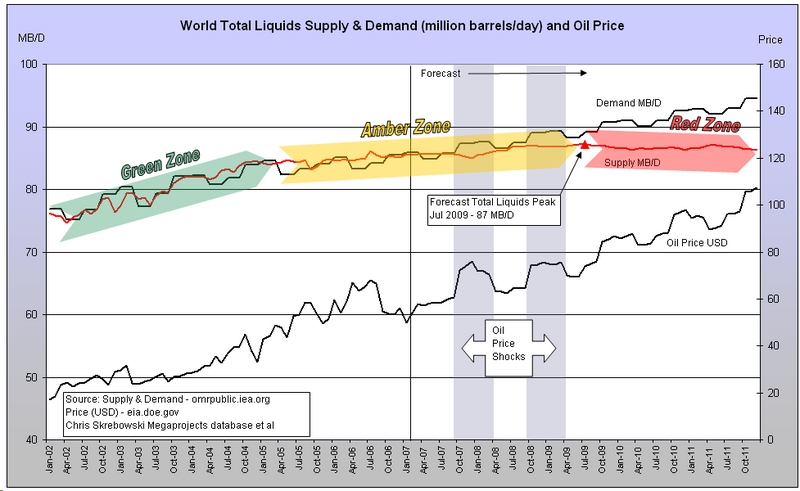

It is highly unlikely that Saudi Arabia will ever produce more than 8.5 million bpd (Crude Oil and Lease Condensate). This means that if any supply disruption or sudden demand increase occurs, do not assume that Saudi Arabia can be “called” upon to supply extra oil. Assume that oil price shocks are likely to occur starting the middle of this year as shown below.

Fig 7. We are in the Amber Zone and approaching the Red Zone!. Click to enlarge.

Green Zone:

Supply was able to meet demand. Sufficient surplus capacity existed. Prices showed only moderate volatility. This zone ended on about May 2005 which coincidentally is the peak for crude oil & lease condensate production.

Amber Zone:

Saudi Arabia has become supply constrained. Prices show more volatility. Price shocks occur in 2007Q4 and 2008Q4. Surplus capacity is going to zero. Supply is struggling to meet demand. Increased production from natural gas liquids and ethanol delays the total liquids peak to July 2009, which is the end of this zone. The desperate attempt to use subsidised ethanol has doubled corn prices and is now indirectly increasing other food prices. Nationalisation of hydrocarbon reserves continues. Refineries need to be modified to accept the heavier and increasingly sour crude stream. Horizontal MRC wells have become common practice but have steeper decline rates. Old infrastructure needs replacing. A shortage of skilled people exists. CONSERVATION PLANS NEED TO START NOW.

Red Zone:

Starts just after the total liquids peak in mid 2009. There is no more surplus capacity. Supply falls far short of demand leading to drastic demand destruction. The name of the last basin is called “conservation” – world must use less oil. Saudi Arabia announces further “voluntary cuts” in production. Oil prices increase at a faster rate than during the amber zone. World economic growth rates become lower. The IEA emergency sharing system may be invoked and rationing occurs......

Further Reading on Saudi Arabia:

by Stuart Staniford

Water in the Gas TankSaudi Aramco's Astrologers

A Nosedive Toward the Desert

Saudi Arabian oil declines 8% in 2006

by Euan Mearns

Saudi production laid bareSaudi Arabia and that $1000 bet

Ace - How did you calculate the price forecast shown in Fig 7?

Great post. Thanks

Oops...posted in the wrong thread.

The price is forecast using estimates of short and long term demand elasticities. The price is a weighted average price which includes heavy and light crudes. The price should be used as a rough guide and the trend is more important than the absolute price.

Here is also a long term forecast for Saudi Arabia

There are no known scheduled megaprojects after 2014

Hello TODers,

I realize this thread is getting age-dated, but I wanted to post this link near the top in the hopes that SS, F_F, and Euan will see it & comment:

http://www.spe.org/spe/jpt/jsp/jptmonthlysection/0,2440,1104_11038_58066...

-----------------------------------------------

Technology Update: Haradh III: A Milestone for Smart Fields

----------------------------------------------

Now to me, but I am not an expert, this mostly reads like a 'rah-rah' press release rather than a detailed analysis of Haradh III. Feel free to disagree TODers. Please see the pictures in the link.

---------------------------------------------------

Even more importantly, the northwest portion of Haradh III was diagnosed to provide a superhighway of communication because of the presence of faults/fractures—an eminent risk to offset crestal wells (because of accelerated water encroachment). Note the rapid rise and fall in pressures at observation Well HRDH 1500 in response to the injection from HRDH 1711.

Fig. 5—Isobaric map showing pressure distribution 3 months after startup of preinjection. The top plot shows the pressure response in an observation well resulting from injection at the offset injector.

The quick diagnosis and subsequent response (i.e., cutback in injection) most certainly averted premature water breakthrough and loss of oil production in the northwest segment of Haradh III.

-------------------------------------------

IMO, cutting back in injection does not change the hidden geo-structure of this area: KSA merely prevented the problem from getting worse [preventing water breakthrough into the centered high flux area topcrest]. My guess is, even with extensive seismic mapping before drilling, that unseen discrete fracture networks [DFNs] and/or pressurization-caused fractures suddenly started causing runaway waterfront flooding, so they then shut the injectors down. Aramco probably has no choice but to produce this area at much less than desired extraction/time levels plus additional drilling for bypassed pockets, or else accept much higher watercuts in the northwest segment of Haradh III.

It would be interesting to know how the other wells are performing to plan too. To my eyeballs: it looks like the same problem may be happening in the Fig. 5 Northeast sector too [red encroachment].

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Thanks for that and I've read the rah rah before.

I wonder how they're making the planned 300,000 BOPD if the had to curtail injection in area(s) from planned???

What is the major difference between having a pressure sensor in the ground that tells you bad news is on the way and the bad news showing up on your doorstep in the form of injected water.... what's going on in the reservoir didn't change... can you kiss recovery and volumetric sweep of that area of the reservoir goodbye??

Just some questions with no easy answers I know.... but spin goes both ways.

FF

Bob - you're obviously working overtime on this problem and the last 2 week debate for me has brought out one of the real strengths of TOD - data mining by committed posters.

This article I had in fact seen before - and would you be surprised to hear that my take on this is a bit different to FF.

They know in this area from the distribution of possibilities that there is going to be some bad news but don't know where its comming from. So the observation wells provide insight to bad news months / years before it arrives. This allows them to adjust their water injection strategy accordingly, and they will be expecting water to arrive prematurly at some arms of producers - which can be shut off in these so called intelligent wells.

One thing though, now that I've gotten very accustomed to looking at 3D images of Ghawar from every angle apart from below - I note that the Haradh 1 zone seems to include about half of the area formerly known as Hawiyah - now that is big, big news. Perhaps, you, FF and Stuart woud like to look at the images - I'm looking at jpg called Image 78 that you dug up - and would care to comment - combined with Greg Croft's map.

I (and others) are working on reserves estimates for Ghawar - and this one observation may just wipe a few billion off the slate.

The plot thickens.

Euan;-)

Are humans smarter than wells?

What about Zuluf? I've read forecasts that say it could be increased to 800,000 b/day. Is that field currently being used?

Correction - current production from zuluf is 500,000b/day. They are working on increasing production with 3 well heads according to Platts to reduce decline rates from 8% to 2%.

Thanks Ace, great work.

I have been playing with the megaprojects data a lot lately, and have said that, IMHO, the bottom up analysis should scare us silly.

Dugg it.

CNN says cheaper gas in 2007 ?????????????

http://money.cnn.com/2007/04/10/news/economy/eia_fuels/index.htm?postver...

How do they figure gas will be cheaper???????

Nowhere is Now Here!

I notice everything BUT PO is mentioned as a reason for the overall high gas prices in the last couple of years... but then the piece seems to be looking at short term trends (i.e. above ground factors weigh in heavily) rather than the long term trend of increasing supply problems...

"You can never solve a problem on the level on which it was created."

Albert Einstein

Ace, Khebab,

I've never quite understood how you get the fig 1 graph. Not only do the full size of the addition fields never seem to be reflected in the figures, but the 06-07 decline rate seems to disappear, never to return.

Can you say something of how you come by these figures? Although I end up somewhere near the same final total figure, I get a very different shape.

Remark that each project has a lead time before attaining full capacity.

The Khurais Exp, for example, is not reflected has a sudden 1.1 Mb/d jump, but has a ramp-up that seems reasonable (at least to me - I must have used a similar ramp-up rate, because I get a chart extremely close to Fig.1).

Hi Garyp,

Some assumptions for Fig 1 graph:

No surplus capacity

EIA and IEA state there is about 2 mb/d surplus capacity but then EIA and IEA state it takes 30 days to deliver this capacity and would last for a minimum of 90 days. Also I think that this spare capacity, if it really exists, might be mostly heavy crude that refineries don't want to process. One piece of evidence for the spare capacity being heavier crude is the decreasing price differential between Saudi Heavy and Saudi Light. This implies that Saudi is cutting supplies of heavy crude.

http://tonto.eia.doe.gov/dnav/pet/xls/pet_pri_wco_k_w.xls

Mar 30, 2007 Saudi Heavy was $57.06/b; Saudi Light $60.26/b. Diff of $3.20.

Oct 13, 2006: Saudi Heavy $49.12; Saudi Light $54.07; Diff$4.95

Ghawar, excluding Haradh

Ghawar is assumed to be producing at 4.35 mb/d for Jan 07 declining at an annual rate of 8%.

Existing fields

Existing old fields such as Berri, Safiniya and Zuluf are assumed to have annual decline rates of 6%.

New projects

Only Haradh(ghawar) and Nuayyim have the lowest decline rates of 4%/yr.

New projects which are workovers of old fields

Projects such as AFK, Khurais exp, Manifa, Shaybah(difficult field) are assumed to have decline rates of 6%/yr.

Project ramp up and plateaus

Future projects have a ramp up period to the peak plateau. Ramp up periods are about one to two years. In the case of Khurais - it might take three years. Peak production stays on plateaus ranging from one to five years.

Production versus reserves

I've just posted (see above) a long range forecast of Saudi Arabia to Dec 2020 to reconcile forecast production to Dec 2020 to Saudi reserves.

I assume that reserves are 2P reserves=URR. I assume that URR for Saudi is 165 Gb. I assume that URR produced to year ending 2006 for Saudi is 110 Gb. I calculate using the Dec 2020 forecast that additional URR produced from 2007 to 2020 is 40 Gb. URR produced at Dec 2020=110=40=150Gb. This leaves 165-150=15Gb which appears reasonable.

This is the seventh post now on sauidi and the pieces of the puzzle slowly but surely are slotting home. I've drunk so much coffee reading these articles and ditched a few books recently!! The missing bits of the puzzle?

Now it is time for Roger Conner to spill the beans. Come on Roger what do you know? What are you not telling us? Why are you not wading in with empirical data to support the contrarian viewpoint and restore balance to the force?

I'm running out of coffee brands here waiting!!!

Marco.

I also had to restock on coffee last night :)

Maybe we need to do a quick check on world coffee supplies :)

. shaking hands

Peak Coffee...

Think about that, and tremble in fear...

According to this link (http://www.unicamp.br/fea/ortega/energy/Oscar.pdf), conventional coffee production (only growing the beans!) requires ca. 14 kg of various pesticides and 2000 kg of fertilizer/ha/year and 50l of petrol fuel/ha/year, among many other things.

The burning, packaging and transport requires more, of course. Peak coffee, however, doesn't seem to come in sight yet, as the low price of coffee has prompted attempts to use it as, indeed, an energy source (http://www.teaandcoffee.net/0801/world.htm)(scroll down).

whew :)

Thanks.

I'm trying to grow my own coffee plants in Southern CA and they are not doing well. They seem pretty picky.

Gotta have the Bean Juice

Everyone calm down. You can make a coffee sub by roasting the roots of chickory or dandylion and grinding. Tastes like shit but any port in a storm? No? Well then stock up I know I will.

I'm going to get those coffee plants growing.

I think I know my calling if TSHTF local greenhouse coffee and tea barista. You can drink your dandelion crap.

Even roving bands of mutants need coffee.

No one would dare attack me :)

Moonshine might be a better bet, unless you are near the tropics. There's a lot more than temperature involved in growing coffee. Daylight length, soil type, drainage, etc.

I heard of this Filipino man who smuggled thousands of macadamia nut trees into the Philippines, planning to start a mac nut farm. No one told him the latitude was wrong for mac nuts. The trees grew, but they never bore nuts. Daylight length is what triggers flowering in mac trees, so they never flowered.

This is why I'm not sanguine about keeping food production up despite climate change. Just moving crops north is not going to be a solution.

Speaking of food production. I picked up a copy of Capital Press( Ag news weekly). Front cover $112,480 in fines for spraying illegal chemicals to control thrips on onions( no other control is known).

back page of second section. Monsanto and dairymen upset by other dairy companies touting that thier milk is rBST

(artificial hormone) free, which is illegal, because the hormone was tested and found to be safe, and advertizing non-rBST is deceptive advertizing. rBST makes cows produce up to an extra 10 lbs of milk a day.

This is only 1 week - makes you want to grow your own food PO or not.

"which is illegal, because the hormone was tested and found to be safe"

That's pure bullshit, though of course any milk, organic or hormone-laced, is full to the brim with disease and disease-causing crap. Monsanto and the "dairymen" are amoral, poison-pushers...hope no one confuses these greedy fucks with regular the regular small farms which they have done such a good job destroying...

"TSHTF Coffee Co." It has potential IMHO.

There's also the Kentucky Coffee Tree which grows easily in much of the U.S.

A few words of caution, however:

The common name "coffeetree" derives from the use of the roasted seeds as a substitute for coffee in times of poverty. They are a very inferior substitute for real coffee, and caution should be used in trying them as they are poisonous in large quantities

I doubt that the bean contains any caffeine, but I don't know this for sure.

Independent Lens on PBS just had a documentary on how the collapse in the coffee price has impacted Ethiopian farmers. It left me wishing I could pay MORE for coffee.

http://www.pbs.org/independentlens/blackgold/?campaign=pbshomefeatures_3...

But you can! Don't you have trade-aid coffee available where you are? I have drunk nothing else for the last ten years. Generally small growers are under contract and paid a fair price. Often organic too. Even without the conscience money, I find the quality justifies the price differential.

I think it's large-scale planting in Vietnam which has driven world prices down.

Thanks for the tip, the show did mention a Minnesota roaster that used Ethiopian beans.

Probably not. "Fair trade" products seem to be a European thing. It's almost unheard of in the U.S.

It started off as a boutique thing, but even the supermarkets carry fair-trade coffee now.

Here's a link to a list of certified fair-trade coffee suppliers in the US

Coffee is an easy vector because people are so passionate about it, it's a lot harder to extend the principle to other consumer goods.

Still looks like a boutique thing to me. Not many places on that list, and most of them seem to be concentrated in big cities or tony resort areas.

Fair trade coffee is available in Whole Foods and Wild Oats markets. It can also be ordered online.

Starbucks is the largest purchaser of Fair Trade coffee in North America. They don't serve it in brewed form but they sell it in bags. So if you're lucky enough to have a Starbucks in town :) then you should be able to find Fair Trade coffee.

The 'spice' is found only on Arrakis! :-)

The coffeeberry that grows on the west coast (Rhamnus sp.)is good mainly as a laxative.

Marco asks,

"Now it is time for Roger Conner to spill the beans. Come on Roger what do you know?"

I know enough not to take Stuart and Khebab on in a statistical fight...I have never pretented to be a match for that kind of firepower! :-)

Once more we are back to my pet three: Khurais (referred to here as “an old small field”, it is the second largest oil bearing structure in KSA [per Simmons], the Saudi’s seem to believe in it enough to spend billions, would they just throw that kind of money in the garbage on a bluff?), the empty quarter (Shaybah for now, more later? Who knows?), and offshore (the assumption here seems to be there is nothing there to speak of, but if that’s true, KSA is wasting a lot of money bringing in those offshore jackups)

But, as I have long said, we are running in the blind. We are having to place our bets somewhere between our mouth and Saudi money....and I feel a bit uncomfortable betting against the latter.

Who knows. We may be there, we know that “peak time” has to come for KSA sometime, now is as good as any I guess. If so, one prediction of mine is holding strong: The price will be no warning. As I looked just a few moments ago, crude prices were just over $61 a barrel. That would be insanely, INSANELY cheap if we are within months of Saudi peak. But, that was the case when U.S. peaked in '70, oil was dirt cheap. It came virtually without warning.

What do I know? I know I am paying down debts. I just made a spare $300 plus spare place per month in my budget, so if Diesel goes to $6 to $7 per gallon, I can still get around! Next step may be apartent shopping closer to work....we are so overbuilt on apartments, townhouses and condos in our area it should take a while to fill them all up....now as to the condition of my employer :-(........who knows. Either way, we will know by end of summer, let's all meet up here after Labor Day and see how it went!

Roger Conner Jr.

Remember we are only one cubic mile from freedom

(but aparently, reserves are disappearing on paper even faster than we are burning them! How does that work....? I have heard of "reserve growth", now we are getting massive "reserve shrink"!) :-)

These are mighty strong and confident words. How many of the TOD senior staff and contributors agree with this conclusion?

Hello Dragonfly41,

As a regular TODer, I agree with ACE. Consider that billionaires Richard Rainwater and T. Boone Pickens, and multi-millionaire Matthew Simmons have clearly staked out their Peakoil positions already.

Absent fresh KSA data that provides proof positive of greater extraction: I think the Law of Diminishing Returns predominates going forward.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Bob...I didn't say I disagreed. I just want some official statement from SS, F_F, Euan, et al. saying that they all back up this statement. I am not trying to put them up against the wall. I've just heard it come from different articles and comments and wondered if it is time to say it with one TOD voice..."PO IS HERE!!!"

Bob,

Of the 3 you mention, I would propose that only Rainwater has 'staked out' his PeakOil position - the others are financially involved but perhaps not 'dug in' to the extent of the former.

Remember, there are three major parts to the Peak Oil debate (at least):

1) What is the definition of Peak oil (crude oil, all liquids, net liquids available to non-energy society, etc.) ?

2) What is the date of 1) ?

3) What happens to the global system and society, etc after 2) ?

People who agree on 1) may not agree on 2). People that agree on 1) and 2) may not agree on 3), etc. The people that have spent a good deal of time reading and learning sociobiology (Jay Hanson, Ron Patterson, Matt Savinar, Grey Zone, yourself, etc) are probably considerably more 'entrenched' than the typical financial folks who understand 1) and 2) clearly.

Hello Nate,

Good points. We don't know if Pickens has an Eco-Tech bunker/farm, but clearly he has the means to set one up very quickly with hired expert help. He may be figuring that he is too old to want to do this, and instead, that he is better off maximizing his wealth so that his last days are as comfortable as possible. If his offspring is even listening to their father's warning: it would be interesting to know what his kids or grandkids are doing/planning. Probably in denial like most people.

Simmons will probably be seen as the 'goto guy' postPeak; politically protected for a long time for being such a successful public prophet. If he is careful, he probably has sufficient funds/connections to stay one step ahead of the mob; good chance he will not die an unnatural death.

Obviously, the rich and powerful, who are not in denial, still have a 'shrinking window' for personal mitigation options that most of us on the lower levels of the human food chain do not, or will not have access to; our best chance is to develop needed postPeak skills/knowledge.

Once we are past a certain level of societal breakdown, it will be too unpredictable for either rich or poor.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Although I'm sure to be taken as a doomer :)

The issue here for everyone is pretty simple. We are 100% certain that doing nothing about the issues facing us including peak oil is possible. The only question is it viable ? Can we successfully do nothing and react late and poorly to obvious problems and still succeed ?

In my opinion the chances of success if we execute the do nothing strategy are slim. Arguing over exactly what will cause the biggest problem or when to act is not relevant.

If doing nothing is not a viable solution we know that meaningful mitigation will take a lot of money and politics so the chance to mitigate could well be past us but the chance to try is not.

Notice the spin from the biggest advocate of do nothing.

And of course the current situation in the US housing market

is a direct result of the successful do nothing approach.

http://www.bloomberg.com/apps/news?pid=20601087&sid=a8RkrYHR5ObA&refer=home

I found a really nice risk analysis that counters the IMF.

http://www.oftwominds.com/blog.html

Of course it does not include commodity price issues esp oil or global warming.

But this gives a detailed explanation of the risk situation we are entering.

And one final thing. Assuming even some of this comes true the chances of being able to successfully execute mitigation strategies that involve taxes and infrastructure investment are practically nil.

Regardless of your feelings about peak oil if we don't begin aggressive mitigation now we proabably simply cannot afford it later.

At some point people simply need to take the argument we have today and fight to get action like it or not. Waiting till your certain or the do nothing approach is not viable.

But we're in such a weak state to do anything. Governments, corporations, cities, institutions, schools, family's, even political parties are all so deep in debt they're unable to do anything. Society is so constrained and weakened by debt that the effort to mitigate GW and PO is probably impossible (possibly why Bush holds his contrarian stand against what most believe to be sensible regarding GW & PO). Even if we don't factor in a looming economic collapse.

Society is in no fit state to make the necessary changes. It's up to individuals to act in their own interests and manage the fall-out best they can. As it stands, there is no way society can meet this head-on and come out the other side intact IMO (meaning institutions will also fail, such as government, democracy, social welfare, etc.).

The combined effects of economic failure, Peak Oil and Climate Change will simply overwhelm any societal response to the crises. And that's without adding the fact that political and economic machinations have produced a class of child-like citizens incapable of understanding anything that doesn't meet their (ie. advertising induced) wants.

Those that can, do, those that can't, don't. C'est la vie!

I'd also proffer that it would be better to be stuck in a socialist state (if any still truly exist) rather than a capitalist state. The end result probably being stuck in a totalitarian socialist state or a fascist capitalist state.

Please tell me I'm wrong.

The stark reality is that the Oil based economy needs to declare bankruptcy and start over. The debt is a figment of peoples imaginations it does not exist its a few bits of iron oxide. The fiat currencies don't work in a collapsing economy anyway. Better to replace them with something that represents real wealth like a energy based currency or resource based currency system.

I'm pretty sure this is where we will end up. On the financial side peak oil makes default almost certain in the short term and global warming does the same longer term.

As far as I'm concerned the first thing we need to do is restart our financial systems. Only then with a firm stable currency not subject to inflation can we make the long term infrastructure commitments we need to make to solve all the problems we face you cannot invest in 100 year projects with inflation yet this is the way we need to start thinking.

If people go back to building buildings that last 100 plus years then cost is not and issue and ownership is exposed as what it really is a lifetime transferable lease plus taxes.

Personally one of the best things I ever did was walk out of my PhD program as I was writing my thesis after four years of grad school. My professor was shocked and said you cannot do this. I just said watch me. Sometimes you just have to walk away.

Hi memmel,

Thanks for your posts here. Okay - action now.

Re: " The stark reality is that the Oil based economy needs to declare bankruptcy and start over."

Could you please expand upon this? Do you mean for the world? The US? Is this a case where unilateral action can be done?

Is it necessary or desirable to undo the legal basis of the existence/creation of large corporations?

Or, another version of this, allowing municipalities and states to enact laws in violation of WTO/NAFTA,(and other) entities, so that governments can mandate or encourage the necessary (assumption) re-localization?

My list (offered for additions, corrections and comment):

For the US:

1) re: Internationally: An announcement of recognition of the problem; that the world needs to work together (don't know how to say this, perhaps you can fill in the details),

- the "Energy Summit" Matt Simmons talked about.

Specific offers, consisting of (please fill in the blank) -

alternative/renewable tech sharing, (blank)(etc.) (As you mentioned one time a while back - something even as simple as distribution of solar ovens.)

What else? Nuclear non-proliferation, legitimization of plans for world social forum, etc. (not that I'm familiar w. these).

2) Nationally

a) immediate conservation measures, as discussed on drumbeat a few days ago - Enforce 65 mph speed limit, "drive easy"

b) Specific steps and plans for each area of energy use:

transportation, housing, industry.

Breaking those down -

One of my first list items is for distributed energy using only wind/solar (I said I'm just putting these out there!) in order to secure - (let me use the word, I know security is not possible, really)- water purification and transport.

Next up, agriculture.

I have other ideas. The point is to suggest a list, suggest perhaps discussion such as the one we had the other day, (even though someone called it "resistance" to the idea of a speed limit), I actually thought it was an interesting and fruitful discussion, which took place in a short amount of time, and resulted in what looked to me like areas of agreement and one concrete suggestion (reached by consensus, in the sense that it was the one that fit all comments, namely enforcement of the 65 mph speed limit, perhaps along w. a campaign for "drive easy".)

My question to Matt Simmons is:

If OCs (or let's use the generic "we") drill off the CA coast, (as an example), find and extract oil, without a policy in place that addresses the urgency of "peak", will we not be in an even worse position? I.e., Is it not the case that we need a plan that ties any new oil/NG extraction activity to actions that make sense in context of "peak"?

Here is a basic example of how our grand global economy works today.

I go to a bank and borrow 100% or more of the value of a home from a bank using a exotic bank loan. The only real cash in the transaction is bank fees. Remember this since throughout the only real money is bank fees.

The bank then sells the loan as a MBS mortgage backed security. We are told that the investment money for these are generally coming from Asian savers. But guess what this is not true. What everyone is doing is borrowing yen at a very low interest rate from banks ( for a fee ) to buy these bonds. This is the yen carry trade. Basically at the end of the day from a global perspective the banks are allowed to loan infinite amounts of money to buy assets and to buy the loans. This is not stable so to bring at some semblance of stability they sell CDO's collateral's debt obligations.

This supposedly work like insurance and protect the holder against default based on the collateral that underlies the CDO. And guess what they use for collateral ?

Why MBS's of course.

Today it would probably take our world GDP for 200-500 years to pay off all the existing debt which has a maximum generally of 30 years. Basically we need the world economy to grow at between 5-15% to make it. The idea is you simply take all the debt and then take the worlds gdp

and divide its not trivial and my best guess is its 10-100 times the world gdp. I don't exactly know how to do this but its pretty obvious we have borrowed more money then we will make in my lifetime and my children's if peak oil happens stopping global economic growth.

The gross world product is about 46 trillion dollars.

http://en.wikipedia.org/wiki/World_economy.

Understand a lot of this is the base economy i.e basics like food clothing and shelter not discretionary spending.

Here is a link to world debt.

http://en.wikipedia.org/wiki/Global_debt

Global debt is estimated at 100trillion but this is debatable and probably low. Its difficult to account.

But lets assume 100 trillion.

And lets assume we can use 5% of our gwp for paying down debt. This gives a 2.3 trillion a year in pay down but this debt carries interest lets assume 5% and you can see we owe a compounded 105 trillion at the end of year one and have only paid 2.3 trillion leaving us about 2.5 trillion in the hole every year. Consider what happens if the GWP slows or goes negative its obvious that this situation will blow up.

Right now its not clear the world can service the interest on its collective debt much less pay it off.

The underlying problem is the central banks simply left interest rates too low for too long and now have lost control of the money supply and worse the ability to raise rates. Given a robust economy we probably could unwind slowly and eventually get the economy back on track. But peak oil is the nasty surprise that will slow then stop economic growth at a point we can least afford it. Not to mention causing asset deflation as assets that are not viable post peak lose all value further undermining any attempt to sell assets to cover debt.

By declaring bankruptcy I simply mean stepping off this runway train and stopping the game.

My suggestion is to stop it on purpose and let all this debt unwind and default in a sense declare bankruptcy. Or you can take the do nothing approach and it will unwind on its own with unpredictable consequences. Chances are that they will do it inadvertently by simply changing one of the parameters in this vast unstable web of debt. I'm advocating recognizing the problem and at least attempting to bring it to a close in a orderly fashion to limit the carnage.

Once you actually know how much real money exists you can do a number of things to make investment in renewable energy desirable. A simple thing is to give a big tax break for homes that have PV panels installed and communities that install windmills. On the global warming side you can use punishing tariffs against countries such as China and the US that refuse to implement a carbon tax. The US can tax china until it at least conforms to the US levels of pollution controls and Europe can tax the US. Simply forcing a level playing field at the pollution level would be enough to balance the world economy. You don't need to do anything specific simply force people to pay the true cost of using fossil fuels. To spur electric railroad development you can simply remove the federal highway subsidy and charge a carbon tax for non electric rail. To get rid of suburbia remove all the tax breaks for single family homes.

The only place your adding money is to support PV/Wind power since these have a high up front costs that can be payed down over many years and favoring electric rail simply because it has lower carbon usage than individual diesel trains. The rest simply consists of removing the artificial props that allow our current oil economy to work and allowing the market to pick the right direction. Their is no reason for the government to try and do a detailed intervention and in fact its counter productive the economy needs to change as naturally as possible. Attempts by governments to meddle will simply distort the situation. The only meddling they need to do is some basic support for covering infrastructure costs so alternative can compete with the entrenched infrastructure and to me this is more a issue of ensuring a level playing field.

Surely the most probably response to the coming debt crisis is for national governments (read: central banks) to print more money to cover debt obligations, causing global hyperinflation.

The US government appears convinced, by the events and duration of the Great Depression, that a deflationary depression is to be avoided at all costs. They believe they can inflate their way out of anything, hence the Fed Reserve Chairman's nickname - Ben "Helicopter" Bernanke, from when he suggested that in a worst case the US government could use helicopters to drop money on neighborhoods to spur more spending. This is the man in charge of the dollar.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Hi m,

Thanks. I appreciate this. And I'd very much like to hear more. After all, the economic implications of "peak" are the problem.

So, could you possibly take this a little further for the sake of discussion (and proposed action).

For example,

re: "By declaring bankruptcy I simply mean stepping off this runway train and stopping the game.

My suggestion is to stop it on purpose and let all this debt unwind and default in a sense declare bankruptcy."

Could you please sketch out for me:

1) Who stops the train? Who, exactly does what?

The US gov't does X, Y, Z?

Corpos do X, Y, Z?

2) "...debt unwind" What does his mean? Can you draw me a picture of what this looks like in the real world?

3) Okay, it seems two responses (to your reply) below say this will not happen, or is not most likely.

Granted. This gets us into the generalizations about "human"

behavior.

My question is: Could you please respond in some way to this idea?

In other words, I'd like to see this - (I know it's work!) - laid out in such a way that someone without extensive knowledge of economics, (or even w. some knowledge) could read it and grasp it.

This is so important (IMHO). It's the basis of what we're talking about, when we talking about the scenarios, collapse, etc.

4) re: "...removing the artificial props"

Who does what here? What are the props? Who removes them and how?

5) What is the role of multinational corporations in all of this? Actors? Acted upon? By whom? What about "offshore" and "out of reach" corporations?

6) And what about (if you can) my question to Matt Simmons, when he advocates more extraction. Without tying exploration and drilling (eg. Calif. coast) to an energy policy based on the reality of "peak", would this not merely be a set up for a worse situation?

7) Gail, if you're around, could you possibly add to this discussion?

I don't know to be honest I just know from reading that our current monetary system is not surprisingly geared to supporting the status quo. And we have recently stressed the system to the breaking point. And finally its designed around controlled monetary inflation to drive investment and growth.

I don't see it is a system that can survive peak oil for long nor the correct one to use after peak oil.

With the chance of major monetary problems other issues that needed to addressed to handle peak oil global warming etc etc become difficult or impossible to address.

I've finally decided that I don't think their are any answers to our current situation. Or more correctly we need to make so many changes that its impossible for us to come together to make a smooth transition.

Every time I think we might be able to work this out when I try and put the big picture together it all falls apart.

Unfortunately most of the people that do think we can succeed focus on individual issues and the solutions that don't seem to put together the required overall interacting transitions needed to move off of oil.

I wish I could answer your questions but I'm out of even possible solutions. Your right for example about the multinationals they have way to much power and are not going to change. Artificial props are subsidies primarily and using taxes to subsidies oil consumption i.e highway funds removing these would be a huge political battle.

But on further thought this is just the tip of the iceberg

we need to fundamentally change the way we do business to support sustainable living I cannot see this happening.

Hi m,

Thanks for responding, and I appreciate your honesty.

Also, I'd encourage you to share your thinking, if you feel like it - how you think, what exactly happens when the big picture then doesn't make sense. It seemed like you were on to something there (for a while, anyway).

re: "Your right for example about the multinationals they have way to much power and are not going to change."

I've heard of individual municipalities enacting laws to challenge the superseding dominance (legally) of the multi-national. I was trying to find links earlier, and couldn't. It has to do with the way NAFTA and other similar agreements are written - so as to circumvent local pollution laws, for example. Still, it seems people have done it.

I was also trying to find POCLAD on the web, and couldn't. I think they've been working on this a long time.

Also, there's a county - (again I'll look) - that gives tax breaks to organic farmers, to encourage local, organic ag.

These seem to be in line w. what you're thinking.

If you can still ponder the "big picture" ideas...to me, this is worth thinking about...how to change or limit the debt structure. I'd like to encourage and support you in this.

Another way to perhaps get at is...

When you say "...we need to fundamentally change the way we do business..."

Can you describe the end point? (If not how to get there.) ie., What are some of the features of the ideal way?

this is the opposite of pimco's position.

Not sure what you mean by position you mean for pimco they publish a number of reports I'd have to read the report.

Send a link.

If enough defaults occur in the bond market it will crash. The bond market unlike banks has no protection against runs. And the rating services are deeply involved the products they are supposed to rate.

Once enough bonds default and faith is lost in the bond rating services like moodys you will have the equivalent of a bank run on bonds crashing the market.

Jacking interest rates sky high will be the only way to stabilize it. Same with the stock market. Most people think we cant have a depression since banks are protected but almost all the money in the world is invested in stocks and bonds and their is not protection for this money. Bank deposits are a tiny part of the modern money supply.

The only thing protecting the bond market right now is the dubious models of the bond rating services for pricing risk.

Once the systematic risk they have allowed for their own profit is exposed I think many people will realize they have become the equivalent of the fox guarding the hen house.

The bond market doesn't have any form of protection agaionst a run because it doesn't need any.

Very few bonds are "callable" and those that are usually have tight conditions (ie preset times). If China, for example, wants to get rid of a 20 year US treasury, they can not ask for immediate payment. They have to find a buyer on secondary markets. No matter what happens, the US doesn't have to pay that bond back for 20 years after issuance.

In theory, there could be enough bond defaults to undermine crebility to the point where bonds are sharply devalued, but it would take quite a lot and there would be worse upstream impacts on equities.

When bond defaults increase, yields on similar bonds go up, which means borrowing costs increase. If a large percentage of bonds defaulted, the price that similar bonds would get in the market would go down (since yield = coupon/cost, yield then goes up).

If by interest rates you meaning the central bank policy rate, there is no reason it would need to change. Interest rates on bonds (the yield I mention above) would increase until their credit risk was compensated for. The main impact would be that risky borrowers would get priced out of the market.

The problem and why I call it a run is if the market destabilizes it cannot correctly asses risk and thus set interest rates. Right now they are way low compared to the risk this will change and change fast. The base of our money supply is actually bonds so a flight from the bond market is exactly the same as a bank failure and even less protected than banks where in the 1920's. And since most companies and state and local governments have low credit ratings themselves pricing them out of the bond market will lead to them failing which leads to existing bonds defaulting which leads to higher interest rates ...

I call that a run on the market.

I disagree with your categorization of this as a run on the market. It seems like your basic crash to me. However, that is not important.

It does seem likely that interest rates on bonds are reflecting a lower level of risk than they should be. However, these things are very hard to measure and, in fact, can only be right or wrong in hindsight.

You argument seems to be that an economic crash could lead to a credit tightening that could further fuel the crash. I can't dispute that, but don't see why it is probable. Neither do I see why an inability of some marginal borrowers to borrow more would lead them to default in a significant quantity.

Are there really that many cities that are so perilously close to default that debt interest rate increases would entirely shut down borrowing? And do these cities need new borrowing to pay back existing debt? If so, what percentage of the bond market does this represent?

I think the case is even weaker for corporate bonds. I agreed above that the credit spread for risky instruments seems lower than it should be. That means that investors are accepting a lower level of compensation for taking on the risk beyond what is in a "risk free" bond (treasury). But this doesn't mean that there is huge default risk.

I expect that the vast majority of debt is to companies with pretty good credit ratings and significant equity. In most cases all of this equity would have to be wiped out before the debt is even touched. Even when this happens, in the vast majority of cases, the bond holder does receive a portion of their investment back. I haven't seen any evidence that US (or global) corporate debt is at anything but an acceptable level.

So, if there is an economic downturn, investors who consciously took on risky investments (presumably as a small part of portfolios that are fairly diversified) lose some money on the debt portion of their investments.

But that's the way it works. Equity holders take on a lot of risk in hopes of a big payoff. Bondholder often take on smaller amounts of risk in hope of a more predictable, but still risky payout.

If those investors that decided to make wagers on risky debt lose some, or all, of their substantial gains from th last decade, so be it. Again, for the most part these are sophisticated, diversified investors.

Would this mean that no one will ever invest in bonds again? No, credit spreads would go up a bit until complacency sets in again.

If your argument is that peak oil is going to create a short-term crash and that many, many things including the bond market will be destroyed along the way, OK. But you could apply this same argument to sidewalks, schools, libraries, and probably even blogs. I don’t see that bonds have a unique exposure to an economic downturn that should make it a special focus of our already abundant fears.

I'm using the term run to represent irrational fear. Crashes are in my opinion the result of over valuation. And I'm calling it a run to emphasize that the bond market has replaced banks as the key store of the worlds value.

To me the bond market is one of our best modern financial instruments done correctly it is both low risk and a promoter of growth and a market that is not easily used for speculation.

This was destroyed recently by games in the MBS market and I'm sure with other types of bonds and securities to present high risk debt as low risk.

Bonds are unique since I feel like they are the corner stone of the fiat currency world generally the bond market cannot be easily manipulated and its what keeps our world chugging a long. Its considers the safe haven etc etc. In short our economy is underpinned by the bond market. If the bond markets crumble people literally have no place to put their money.

As far as debt goes I suggest you read about the debt levels of our companies and the worlds state local and national governments. First in general taxes have been kept low resulting in the issuing of bonds as a proxy for taxes. Next the low interest rates has lead to a orgy of borrowing. Few companies or governments have AAA ratings any more. In general everyone has been spending way beyond their means using borrowed money.

And finally in thinking about how we would live in a post peak world the bond market seemed to be one of the institutions worth keeping if left uncorrupted. And it does

not need inflation to operate in fact it works best with zero inflation.

A functional fair bond market is required to finance infrastructure development. What I'm think is that by combing the role of the central bank with the bond markets and getting rid of fractional banking in a sense but replace it with CB loans to fund some bonds or a percentage of every bond we would have a very stable economy system backed by the assets of the world. This would limit the amount of money possible to say twice the amount of assets which have no debt associated. Money would then simply be bearer bonds which are now frowned upon but should have been our currency. Money is created by having the new Bond based CB buy up bonds by issuing bearer bonds. So I'm think the role of the central bank is filled by introducing liquidity via this process. Money supply is contracted by converting these bearer bonds back into longer term fixed debt. So in general all the CB can do is change how much money is in circulation

or in reality how much risk exists.

To sum it up.

1.) Bearer bonds replace money they can be used to purchase goods and services and ultimately recycled by converting other bonds to bearer bonds.

2.) The role of the central bank is replaced by simply converting the highest grade bonds with the best security directly into bearer bonds. This high grade debt is whats really used to pay interest. So interest can be seen as simply borrowing from the future by converting safe bonds into bearer bonds to use as money.

The amount of money is tied directly to what we value. Assets the perceived ability to create assets etc. New money is created by creating a new highly valued asset thats directly convertible to bearer bonds and is destroyed if you let a asset's value decrease.

Stocks would not exist I think since the value of companies is needed to create bonds forcing a real risk pricing and forcing companies to focus on value add.

Good comment. I think much of what you are saying is logical and my disagreements are only with certain elements. These mainly concern some of your conclusions, rather than the basic analysis.

It is taken as a given in many circles, and especially here, that debt is terrible, that we have much too much of it, and it is going to lead to ruin.

I think the debt market is more robust and that, while there are pockets of excess, it is not clear that the world is only held together by an interlocking web of debt that will inevitably collapse, Ponzi-like.

It is as easy to contrive a scenario in which it will all work out as one in which it will all collapse. I am not saying one is more likely than the other, only that it is easier to focus on one extreme potential outcome - either doom or boom - than to pick the whole thing apart and come up with a forecast that you have to live with.

I am a financial analysts, so this is not new to me. When your living depends on analysing situations, advising people to invest on that basis, then have to face them afterwards, you being to view forecasting in a colder and more pragmatic fashion.

I have already done the reading you suggest. I repeat my claim that there doesn't seem to be evidence that corporate debt, in the US or elsewhere is at high levels or otherwise presents a large systematic risk. If this is a point on which your argument rests, I think it is reasonable to ask you for evidence. Please provide a link, or at least some data on this point.

I don't know about municipalities and so am willing to accept your point here.

For most companies, debt rating is a strategic decision. Any corporate finance textbook will have a chapter on capital structure which explains this. Companies balance their investment opportunities, risk, cost of capital in arriving at the optimimal amount of debt to put in their capital structure, and hence what rating is right for them.

For a company in a sunset industry with few growth opportunities, cost of debt is extremely important so they will pursue a high rating. For growth companies, the rating is less important. If they have abundant investment opportunities they will want to gear up, even if it means a slightly higher cost of debt. The difference between an AAA rating and an A or even BBB rating is nothing compared to the ability to access capital for companies with ample investment opportunities above their hurdle rate.

Criteria for debt rating agencies is fairly clear and it is not hard for companiers to select and achieve the rating that they determine is optimal.

So, while I think your overall point is interesting and valid, I think you are taking an overly pessimtic approach to viewing levels of debt accross the board and the ability of the system tio adjust to problems.

Hello Jack,

Thanks for your response.

Is there any chance you could take a look at memmel's basic argument, and respond?

(If not here - then, in a future article or drumbeat? Perhaps here is not the best place, though I'd very much like to have this discussion.)

Q: What economic consequences do you foresee re: "peak" in general, and an early "peak" (like...now) in particular?

Q: Do you see any mitigation measures possible?

Q: What do you think about the idea of the monetary system no longer working?

And what do you think about what memmel is saying wrt a way to "let debt undwind", etc.?

Here's a quick reply, I'll try more later.

Q1: I don't know the answer to this one. To the degree that I can contribute to the discussion, I would only say that the future is extremely hard to predict. I tend to look at it in terms of three main scenarios, and then try to put probabilities to each. The scenarios would be something like:

1. Things work out better than we think (decline is slower, economies adjust to declining oil more easily than we think, alternatives come on stream, etc) - no major economic displacement

2. Peak oil leads to major disruption, but no crash. We get hurt, we adjust. World goes on with population and economic system in place, but potentially huge damage to human life

3. Crash - pretty well described here already.

My current probability weighting is around 34%, 51% and 10% respectively. In other words, I see it as probably that there will be significant disruption, death and change, but that we will adjust. As I note below, anyone with a 100% probability in one future scenario is an ideologue.

Q2: Yes. I think the world could operate on half to two thirds of current energy use with very little economic or social impact in a perfect transition. Currently we waste huge amounts of energy and food. I bet that if the world went vegetarian tomorrow, the problem would be pushed back ten years. Over time I also see a transition to electricity fueled vehicles as being a potential solution. I do think conservation has to be driven by price. I do think that eventually population will over run the world. But that was no less accurate 500 years ago. I don't see compelling evidence that the over run point is 1, 3 or 5 years away. It could be, but it could also be hundreds.

Q3: I don't have a lot of sympathy for the various arguments that say that the current monetary system is fatally flawed. I think these basically take old arguments and recast them in terms of peak oil. Broadly, I think they start by underestimating the value of a market system in allocating risk and resources. Then, since the have taken the most important element of the current system out of the equation, don't see things adding up.

I see this debate as political more than economic, ideological rather than pragmatic. If you start with the assumption that rich countries got rich ONLY by stealing from others and exploiting cheap energy, then, yes, it appears to be a pyramid scheme.

If, however, you see much of the market system, as ways to put values on resources and to apportion risk so that better decisions are reached and resources are used more efficiently, then there is no fundamental problem. This is the answer to why people think the world can grow exponentially with finite resources. Yes, a given resource may be finite, but we can change and adjust. I don't think anyone can really argue that it is theoretically possible to move beyond oil, only that the barriers are so high we may fail to do it.

Basically, I see these two arguments as theoretical bookends that frame the discussion. Almost all of us lie somewhere between. Those at either end, and those who think they know the future, are ideologues.

Hi Jack,

http://www.amnestyusa.org/Our_Issues/Business_and_Human_Rights/page.do?i...

Since I've lost my post once already, this will be short.

I'm putting this link at the top, since I lost my entire post trying to find it to insert later...

I really appreciate your response and I'd like to encourage your thinking and sharing (if you like) - because these seem like such crucial topics, and we've barely touched on them. (Or, at least not nearly in the depth of other topics.) I mean, the entire issue of the economy, under the conditions of "post-peak" - this is what will effect people's lives.

So, I hope you think and write more (when you can).

This is really interesting, what you say about the ability of the market to allocate resources.

Here's a question for clarification (and I so wish we had a process that could work more easily over days at a time! As I'd like to continue this discussion...)

re: "...rich countries got rich ONLY by stealing from others and exploiting cheap energy"

Are you saying that there's a combination of "steal" and "not steal" involved?

Or, that it is only "not steal"?

A couple of things that strike me:

1) It seems one way to make the distinction would be to ask "When does the use of violence and force come into play? And how?"

Thus, I'd consider it a "steal" if coercion, force, violence, whether by state or non-state actors. Perhaps Jeff Vail speaks to these points.

My guess is - there can be a particular "supply chain" where there is violence on one end, unbeknownst to those who participate in (and profit by) a different "point in time" and/or "location" of the chain. For example, take above link, wrt, say...oil or just about anything else. I suppose "blood diamonds" (though haven't seen the movie and am only superficially aware of the topic) might be an example, though I'm sure there are others. (Perhaps some would make the case this is generally true.)

In other words, some people using violence, and yet, your friendly neighborhood jeweler wouldn't dream of such a thing and would probably be upset to learn about it.

What do you think of what I've said so far?

re: "I don't think anyone can really argue that it is theoretically possible to move beyond oil, only that the barriers are so high we may fail to do it."

Can you elaborate?

1) Can you draw for me the picture of what the "beyond oil" world might look like?

2) And what the barriers (specifically) are?

To me, there are some obvious things to do...taking every dime now put into expanding roads, etc. and instead put it into solar. To me, there would be a priority list...water first (to link to renewable energy sources).

(Just to try to chime in w. what might be my reply to my own question.)

I'm very interested in your views (and those of others as well), because of your education (I assume) and experience in looking at what we call the financial system.

Aniya,

Take a look at "We," if you haven't already. This my offer some deep insight into a few of your questions, and, perhaps, offer new avenues to explore. Especially when taken in the context of the cold realities of Peak Oil, "We" is an eye-opener.

-best,

Wolf

First, I have sympathies to all side of this argument. Obviously there is violence and exploitation implicit in our economic system. However, there would be violence and exploitation in any possible economic system. It is very hard to come up with absolutes in this type of discussion.

I think efforts to improve the system, or find a better one are admirable. However, I think those that just want to view it as evil and try to destroy it without any evidence that there are prospects for anything better to emerge in its place are misguided.

Clearly large portions of wealth in the world came from theft. Colonizers did steal wealth from colonies, slaveholders stole from slaves and third world elites through corruption and misrule steal from citizens of their countries. This has happened under every regime and economic system we have ever had and will continue under any that humans can design.

I do think activities like those of Amnesty Int'l in your link can do a lot to improve conditions at local and system levels.

My point, however, was that modern market capitalism does enable value creation beyond a mere harvesting of people and resources. I say this in rebuttal to those who frequently claim that the entire collection of value in the world is just what mankind has "taken" rather than created.

I think this approaches the heart of the money discussion we frequently have here. If one thinks that the only value is that which is taken from the earth or wrought through labor, then it is easy to believe that only mining and manufacturing matter and that services and financing are elements of a "pyramid scheme". This viewpoint sees debt as exclusively bad.

However, debt, services and financing can create huge amounts of value and improve life for people. Take someone provides a service, say in advertising, and borrows money to start their own business. I see this person as providing a useful service that supports other businesses. I also see the borrowing and investment in the business as taking a risk and using financial tools to create value. The advertising firm will help more businesses and may hire people to work there. Now if the company advertises for a software company that has also created a product with very little material input, lives can be improved and the economy strengthened, with no "exploitation".

I would agree that much of the advertising goes for things people don't "need" and that it boosts consumerism, with its problems. However, I like having things beyond my basic needs, and think there are good aspects to consumers. I also see the above scenario as a piece of a sustainable long term economic system in developed countries. The debt enables the business owner to do something they otherwise couldn't and if their risk pays off, they made a good decision.

So my point here is that value can be created and lives improved without a direct linkage to energy/resource use, or exploitation.

Now in developing countries the picture is somewhat different. I have lived in Thailand for close to ten years and started out working in rural development. I have worked in the NGO or development assistance field in Southeast Asia for over six years, so I have some direct experience.

We, in the West, see people working in factories under poor conditions and think that they are victims. People often advocate for a "living wage" or other attempts to bring their pay near Western standards. While some of these efforts are admirable, in many cases they are selfish attempts to preserve Western jobs.

The last thing a poor worker in Cambodia wants in a minimum wage anywhere near Western levels. If you made a global minimum wage of $20/per day, companies would shut down Cambodian factories, where productivity is low and move to, say Malaysia factories, where the wage is already $20 per day.

To me the problem here is not the abuses by Western business, but the poverty people suffer separately. We tend to imagine that a poor worker in a Nike factory has been lured by a desire for consumer goods to surrender a good rural life for one suffering in a factory.

But this really requires assuming that the individual involved is stupid. The reality is quite different. What is the individual is a single mother in a poor part of the country who can not afford to feed or educate her children. If the presence of the factory give her a choice, how can it be bad?

I certainly agree that abuses go on in many, many factories and that not all choices are good ones. However, someone who wants to shut the factory and take away the opportunity of this woman to choose whether to work there or not is naive at best. As i discussed above, the global minimum wage type discussion is really a version of this.

Workers are in the factory because their lives are bad and their opportunities limited. It is not the other way around.

This is all a very long way of saying that it is easy to just sit back and deride the way the world works, but there is no easy way to keep six billion people going. The way we do things has good aspects and bad, but it exists for a reason and is not all going to fall apart without a giant blow. And if it does, there is no assurance that what replaces it will be any better.

There are other cases in which the choice is not so clear. Diamonds certainly do seem to be created through slavery and exploitation. But there are other places where people are starving and dying, but not producing anything. Would they trade places with a diamond miner? I don't know.

What about North Korea? Should we buy products made there? It seems clear that the North Korean people are abused and exploited. The regime also takes most of the money and keeps people poor. But if we buy products, do worker at least do better? Would it be better to just send them food supplies? Again, I don't know.

This already too long. I had hoped to comment a bit on post peak adjustments, but will try to get to it later. I’ll be interested in any feedback you have. This is fairly rough off the top of my head. I wanted to get it out, rather than work on the details. I apologize for any sloppiness.

"So my point here is that value can be created and lives improved without a direct linkage to energy/resource use, or exploitation."

This doesn't make sense to me. Simply to live requires energy. All human activity, be it economic, arguing on TOD, improving lives, or lying in bed daydreaming, requires energy. When you eat, a necessary energy input for daily life, resources are being used. There is always a direct link to energy. Without it nothing would happen.

There is no escaping themodynamics--in other words, cold, hard, and uncompromising reality.

If I missed something from your post--sorry!

-best,

Wolf

It is true that nothing can be done with no energy and that the law of thermodynamics is in escapable. However, this does not imply a direct one-to-one relationship between energy and value.

Some activities that we do require very little external energy, some a lot (think reading a book versus drag racing - or - eating vegetarian versus McDonalds).

There is no law that says that if humanity (or any individual) used half as much energy, they would be half as happy, or half as productive. There is no law that says that economic growth requires increased energy consumption (although some seem to claim that there is).

As I mentioned above, it seems to me that we waste enormous amounts of energy because it has been cheap and abundant. As this changes we will use less energy, more efficienctly and may achieve similar results.

HI Jack,

True enough. Now, how do we get from here to there? Being as how "we" are either starting from here, or will be affected by those who are even more immersed.

Hi Jack,

I appreciate (a lot) your responding...I would very much like to continue this discussion, and to expand it. I'm not sure exactly how to do this, since, for eg., here I am only getting a chance to come back two days later to see what you've written. (and not sure you'll see it, either.)

If you can (at some point) talk about both "post-peak adjustments", as you mention, and - perhaps most important "pre-peak" planning, I'm very interested. To me, this is the conversation we need to have, (including taking the advice of Jeffrey, Samsen Bakhtiari, and everyone - "okay time to act!")

I'd also like to hear about your firsthand experience, esp. as it relates to the subjects we discuss here. Perhaps others would also. (Are you still in Thailand?)

re: "While some of these efforts are admirable, in many cases they are selfish attempts to preserve Western jobs."

Kind of the kernel of at least one topic, i.e., is it selfish? What if "we" (US) exported neither jobs nor food? Would this be better or worse? Not wanting to pose a deliberately callous question (at all). Perhaps this question is most accurately framed in the past tense (since it's all already happened.)

I guess I'm wondering to what extent, say, locating a factory somewhere and/or having say, agricultural exports resulted in influencing local development in a negative v. positive direction. Fostering a situation where food aid is required, because the dependency (lack of local production) was created in the first place.

re: "Workers are in the factory because their lives are bad and their opportunities limited. It is not the other way around."

Actually, I can see it being either way round - a chicken-egg type of thing, depending on the particular example. In other words, had the same "outside" contact occurred in a different form, would this have been better? ie., the factories are not really arranged with the goal of making worker's lives better, are they? (See what I mean?)

In other words, I believe you. (Or, I should say, I can see how you would say this.) At the same time, it seems like it depends upon a look at the history of any particular example, (in the sense of "Why are these lives bad?")

I am also enjoying this conversation and don't disagree with any of the points you make. I don't think factories, workers, developed, countries, developing countries, you, me, etc. as either pure good or pure evil.

Many of these issues are subtle and sophisticated. It is great to be able to discuss them in an open and non-confrontational way. I don't think I am right and others wrong, so the adversarial point scoring type back-and-forths that often charactorize controversial discussions here are off putting.

I'd like to continue this and related discussions. Maybe we can just jump from one Drumbeat to the next. I'll send you my email soon, so you can alter me if you have a comment that I could reply to. I think having these discussions in the Drumbeat is good because others can join in.

Yes, I am in Thailand, where we are vigorously celebrating the New Year Water Festival.

Jack,

Really outstanding post (I come to all of this from a financial/investing, not ideological, perspective, and so tend to react badly to much of the anti-western, anti-market talk that pervades certain peak oil circles).

I think the probabilistic, rather than deterministic, nature of trend projections can never be overemphasized.

Personally, I would be inclined to add a fourth scenario, between 1 and 2, (1.5):

1.5 Serious economic disruption leading to significant structural adjustments, but damage to human life comparable to severe recession at best, depression at worst, not global war.

I'd put the probabilities at:

1. 33%

1.5 33%

2. 28%

3. 5%

It could be amusing to firm up time parameters and category definition and get a pool going.

All the best,

E

Hello Hans,