A Nosedive Toward the Desert

Posted by Stuart Staniford on March 8, 2007 - 10:15am

...Or, Why the Decline in Saudi Oil Production is Not Voluntary

Summary

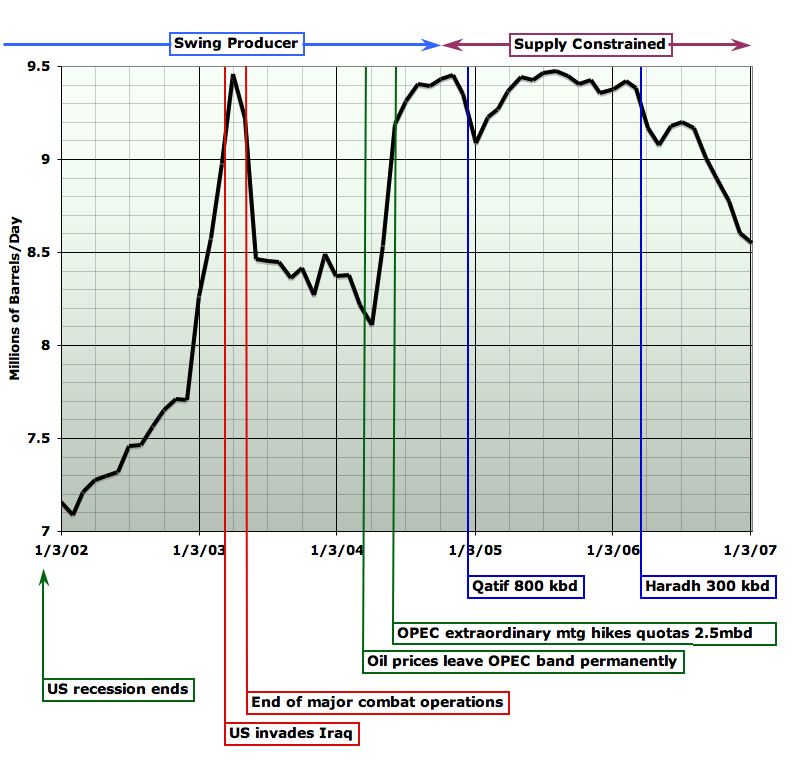

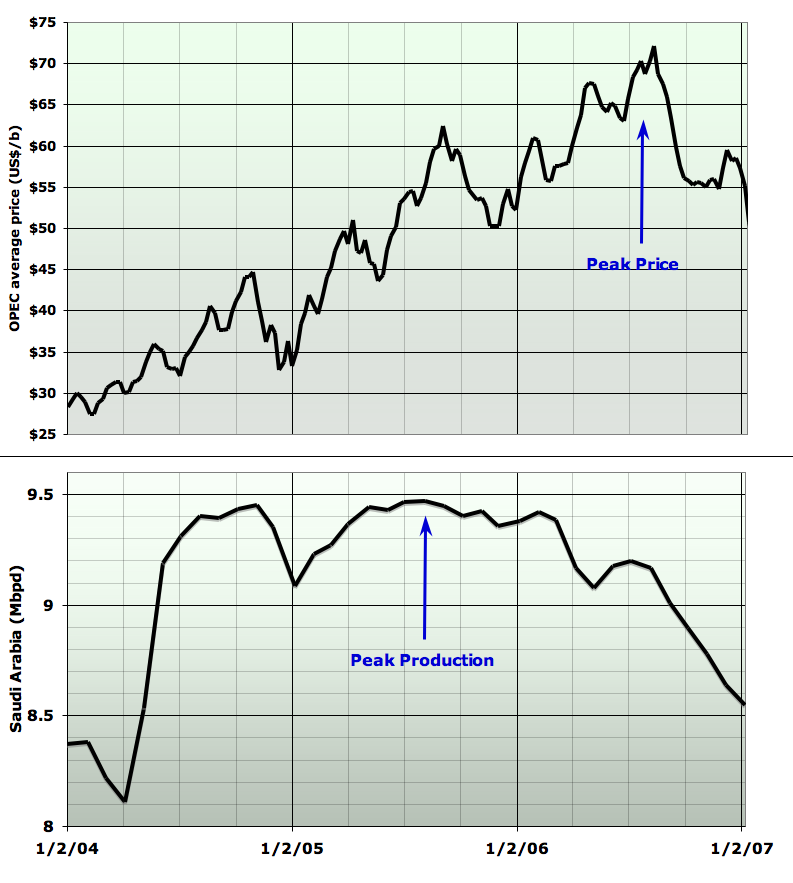

In this post, I extend my analysis of Saudi Arabian production backwards four years earlier than my post of last week. I explain in detail how the evidence strongly suggests that since late 2004, the Kingdom of Saudi Arabia (KSA) has entered rapid decline of their oil production, at least for the time being.The headline graph summarizes my conclusions, which are as follows.

- Saudi production can be divided into two eras. In the first, prior to the third quarter of 2004, KSA had spare capacity and acted as the swing producer, making large voluntary changes in their production to stabilize the market. During this era, all major features of the production graph can be well understood based on demand side needs.

- Since late 2004, KSA have entered a new era where they cannot raise production in response to demand side needs, and instead the major features of the production curve correspond to supply side events.

- During 2002, KSA was increasing production to accomodate increasing demand as the world recovered from the recession of 2001.

- In 2003, there was a major spike in oil production immediately preceding and during the US invasion of Iraq: this was a voluntary action to stabilize oil prices in the face of the loss of Iraqi production. As combat wound down, and Iraqi oil production resumed, Saudi production declined back to levels slightly higher than before the war.

- Oil prices increased due to increasing US, Chinese, etc demand in the strong economy of 2003 and early 2004. Once it became clear that oil prices had risen pronouncedly above OPECs desired $22-$28 price band, KSA initiated a large voluntary increase in production in the spring of 2004 in an attempt to bring prices back into the band. They were not able to raise production by more than 1 million barrels per day (mbpd), however, and this was not sufficient to stabilize prices, which have never returned to the price band. The band was abandoned a year later.

- After continuing to increase production very slightly for several more months, Saudi production began to decline in late 2004. This was only arrested by the arrival of the first KSA oil "megaproject", the 800 thousand barrel/day (kbpd) output from the combined Qatif/Abu Sa'fah fields (690kbpd of new crude and condensate production). This 690kbpd arrested declines during early 2005, but never sufficed to raise production above the peak achieved in 2004. There was no sign of Saudi increases in production in response to the high prices of 2005 and since, nor to the loss of production from the Gulf of Mexico hurricanes in 2005.

- Production began to decline again in 2005, and at greater rates through 2006. This was only arrested briefly by the arrival of oil from the 300kbpd Haradh III development in late spring of 2006.

- If these trends were to continue, Saudi oil production would halve over the next five years. However, it seems more likely that KSA will find ways to bring smaller fields on line and start to mitigate the decline within this time period.

The Production Data

Saudi Aramco has not historically published detailed data on its oil production, and so data is inferred by third parties from a variety of indirect methods (eg counting tankers - but see below on JODI data). Here, I consider four data series that are published by various agencies, and none of which agree perfectly. The series are:- EIA International Petroleum Monthly Table 1.1

- The US Energy Information Agency, in their monthly publication International Petroleum Monthly give a variety of data tables conveniently available in spreadsheet form. Table 1.1a provides monthly oil production estimates for OPEC countries, including Saudi Arabia. The EIA generally produces estimates about two months after the end of the month in question and revises them relatively little later. The data series includes crude oil, together with lease condensate, but not natural gas plant liquids (NGPLs). About half of neutral zone production is included. The EIA lists its sources as "Dow Jones, Middle East Economic Survey, Petroleum Intelligence Weekly, Monthly Oil Data Service from the International Energy Agency (IEA), Monthly Oil Market Report from OPEC, Oil & Gas Journal, Platts, and Reuters." It's unclear what algorithm the EIA uses to compute their final estimate from these sources.

- IEA Oil Market Report Table 3

- The OECD International Energy Agency produces a monthly Oil Market Report, available for free only as individual PDF files. Table 3 (Table 4 in older reports) contains a summary of oil production for a variety of countries, including Saudi Arabia. The IEA generally produces a preliminary estimate quite quickly after the end of a month, but then revises it multiple times in subsequent versions of the OMR, sometimes quites significantly. For Saudi Arabia, the production estimate excludes condensates and other NGLs. The exclusion of condensates probably makes the IEA's numbers systematically lower than the EIA's. The IEA does not document its sources or methods for its estimates of Saudi production, to my knowledge.

- JODI

- The Joint Oil Data Initiative is a global collaborative attempt to reconcile data from various agencies and improve transparency in the oil markets. They tabulate monthly oil production data, for many countries, including Saudi Arabia. Generally the data are a couple of months behind and do not get revised, but what is particularly interesting about JODI data is that it is based on self-reports by the countries. Thus since January 2002, when the JODI series begins, the Saudis have been making an assertion about their own production via the JODI process. This is of interest since the Saudis are in much the best position to know what their own oil production is. On the other hand, there is considerable reason to question the integrity of Saudi reports on their oil industry (discussed later), and they have incentives to distort their production data at times. JODI definitions of oil production includes condensates, but excludes other NGLs. In theory, the JODI data should thus be comparable to the EIA data. JODI data is available in convenient CSV or spreadsheet form.

- OPEC Monthly Oil Market Report

- The Organization of Oil Exporting Countries publishes a Monthly Oil Market Report (as individual PDFs) which includes data on OPEC member country production. This is in a table in the section on "World Oil Supply", but the table number varies from issue to issue. The sources of the data are listed only as "based on secondary sources", and OPEC does not document whether or not condensates are included, but apparently separately accounts for NGLs. OPEC data are generally produced within a couple of weeks of the end of the month, but then are significantly revised.

Clearly the data situation is scientifically quite unsatisfactory. We have four data series which are undocumented, of uncertain veracity, do not agree, and yet the differences cannot rightly be interpreted as statistically independent noise. They do not measure quite the same thing, but lack the auxiliary information to make them commensurable.

Nonetheless, for lack of any other way to make progress, in this essay I take it that trends that appear in all or most of the data series are veridicial. Having no a-priori reason to favor one series over another, I generally take the average of the four as the best overall estimate. I also assume that the spread of the series is some kind of estimate of the uncertainty in the values.

I now turn to justifying the narrative explanation of the data given in the summary.

Economic Growth

When economies grow well, people build more houses, take more vacations, and buy more goods and services. Businesses hire more workers, send staff on more business trips, and open new offices and factories. All these things increase the demand for oil to power cars, trucks, planes, heating systems, etc. Thus the usage of oil is highly sensitive to economic growth - indeed economic growth has a far stronger effect on oil demand than the price of oil (an economist would say that the income elasticity of oil demand is much larger than the price elasticity).As the swing producer, historically Saudi Arabian oil production has varied widely based on oil demand - they reduce production the most when demand drops, and they were best placed to make very large increases in production when there was a sudden need in the market for more oil.

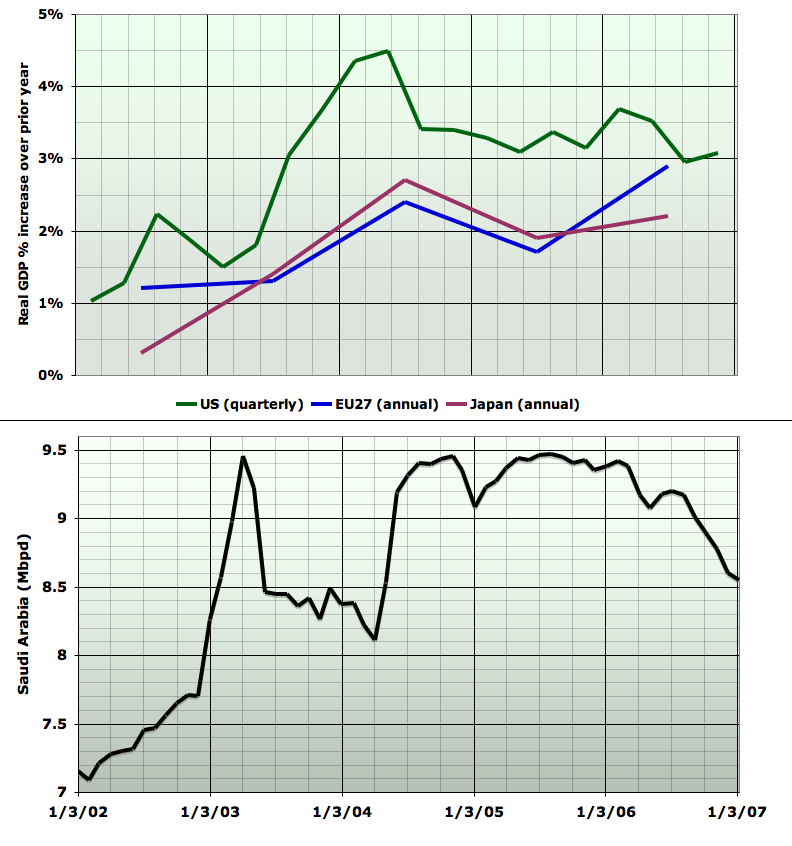

The next graph shows the history of real GDP growth in three key developed economies: the US (quarterly), the European Union (yearly), and Japan (also yearly), together with the Saudi production estimate for comparison.

In 2001, there was a recession in the US, and probably in the global economy, as a result of the bursting of the Internet stock bubble. The US recession officially ended in November 2001. So in 2002, economic growth resumed and gradually increased from a low base. Economic growth continued to increase until it reached a peak in mid 2004, after which it moderated, but remained overall healthy.

A-priori, in the face of steady economic growth like this, we would have expected world oil usage to increase several percent a year throughout the period of interest, and we might have expected Saudi production in particular to increase. The production increase in 2002 may well have this character, as may the increase from 2002 to 2004 and then to 2004 (though other factors enter the picture here as discussed in a moment). However it is striking that increases in production essentially ceased after a last step up in mid 2004, despite continued economic growth. This is surprising in the historical context. It is possible that the failure to increase oil supply (and resulting high prices) are the cause of economic growth being lower after mid 2004 - at any rate the two events coincide in onset. It is also likely, as discussed below, that the very strong economic growth of late 2003 and early 2004 led to the price increases which triggered the step-like Saudi production increase of mid 2004.

At any rate, it is important to note that there were no recessions during the study interval and no sizeable periods of low growth after 2002. Thus production declines in Saudi Arabia in the period of study cannot be due to weakness in global economic growth.

The Iraq War

The next graph is concerned with the large spike in KSA oil production in early 2003. It's fairly clear that this is due to the Saudi's increasing production to compensate the market for the loss of Iraqi production due to the US invasion, and to some extent the Venezuelan oil strike. Iraqi production is shown above Saudi production, and the spikes match up well.

All sources agree this spike began in January 2003 (the Venezuelan oil strike began in December 2002), peaked in April (the US invaded in March), and declined by June to a new, but higher level from which it sloped down through the remainder of 2003 (see the graph fragment to the right). Once the war was over and Iraqi production began to recover, the Saudis ramped down again - initially quickly, and then more gradually (OPEC was reducing quotas at the time). There does not seem too much to say about this interval. Clearly the Saudis were acting as swing producer and demonstrated an ability to raise production by 2mbpd in a fairly short interval to a total of somewhere around 9.5mbpd.

Breaking the OPEC Price Band

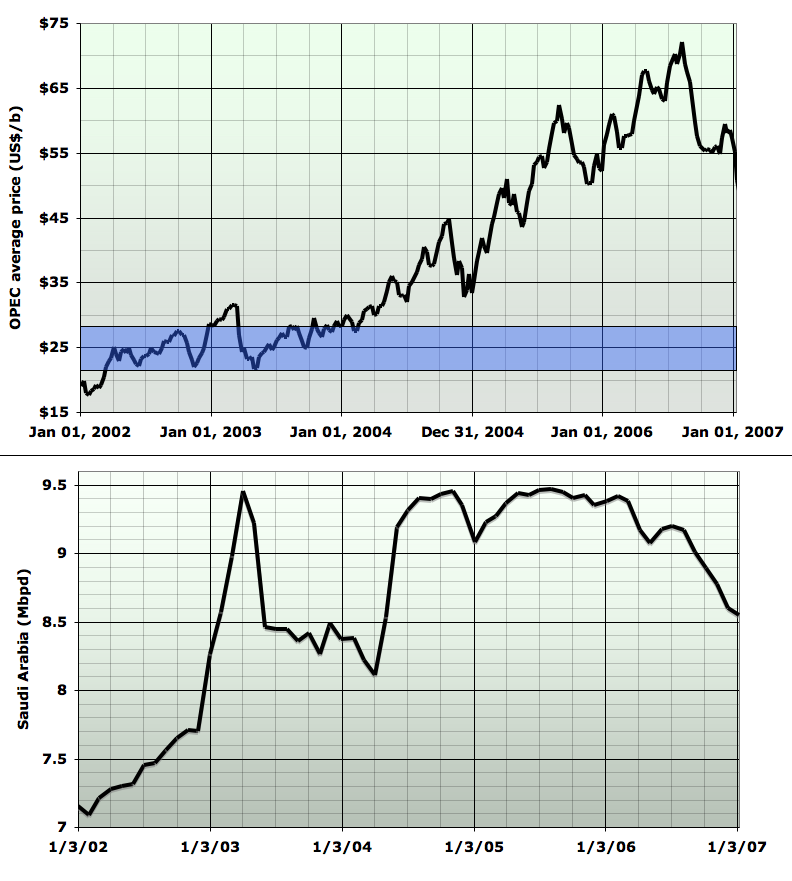

Now we come to what I think are the critical events in the story. With the very strong economic growth in late 2003 and early 2004, oil prices started to rise. The next graph shows oil price in the top panel - with OPEC's intended price band of $22-$28 shown in blue - and the Saudi production curve in the bottom panel. My price is the export weighted OPEC average from the EIA, not the official OPEC basket, but I don't think the difference matters too much.

We are going to focus now on explaining the large (roughly 1mbpd) rise in production in the May/June 2004 timeframe.

Reading through OPEC publications from the early 2004 timeframe is quite enlightening. In February 2004, the OPEC Oil Market Report gave the recent history of price, which was above the price band:

The OPEC Reference Basket started 2004 on a firm footing, with an average of $30.33/b in January. The Basket gained 89¢/b over the previous month but dropped 1¢/b lower compared to the same month for 2003. On a weekly count, the Basket put in a strong performance early in the month gaining 55¢/b or 1.9% during the first week, followed by another rise of 67¢/b or 2.2% in the second. Then the Basket made a downturn losing 8¢/b to average $30.67/b in the third week, followed by a hefty loss of 85¢/b at the end of January for an average of $29.82/b. The fall extended to the first half of February when the Basket shed a substantial 3.9% of its value, averaging $28.67/b in the second week of the month, yet remained comfortably above the upper limit of the OPEC price band.However, although technically above their policy, this is not a high enough price to alarm OPEC, and concerns are mainly about the risk of making stocks too large and causing prices to collapse:

Therefore, despite the uncertainties inherent in any forecast of the supply/demand balance, the range of opinion among regularly published oil market reports points to the inevitability of a higher-than-normal build in stocks in the 2Q of this year to minimum 2.7 mb/d with a mean of 3.6 mb/d, close to OPEC’s February figure of 3.4 mb/d. Moreover, no reasonable further upward revision in demand or a drop in non-OPEC supply is likely to change the consensus on the balance for 2Q 2004. If this surplus is not handled in a timely and effective manner, there is likely to be excessive downward pressure on prices. Such a development cannot be left unattended, as it would lead to a protracted spell of volatility in the market, something that is in no one’s interest.and, responding to these concerns, OPEC quotas were lowered and Saudi production in March and April fell slightly. However, this proved to be the wrong direction to move in: by May, prices had continued to rise, and we read,

The $32.35/b April’s OPEC Reference Basket price is second only to the all-time high monthly average of $34.32/b registered in October 1990. The constant strength of the Basket since the beginning of 2004, combined with the pronounced drop seen in March and April of last year, considerably widened the 2004 year’s year-to-date average with respect to 2003. The Basket averaged $31.13/b to 30 April of this year versus $29.02/b during the same period in 2003. Early in May, following a surge in crude prices, the Basket added another 5% or $1.66/b to average $34.91/b in the week ended 6 May and rose by another $1.25/b to $36.16/b in the following week. As of 17 May, the Basket’s daily average had risen to $37.72/b, or about $1.20 below the all-time high, driven primarily by geopolitics, security concerns, the gasoline situation in the USA, high demand for petroleum products and rampant speculation.and OPEC is now worried - sneaking a few bucks above the price band was apparently viewed as a harmless good time for the membership, but $35 oil is worrying them. They are going to do something about the situation:

OPEC crude oil production in April, based on secondary sources, is estimated at 28.05 mb/d, 0.26 mb/d lower than the revised March figure. However, May nominations and tanker movements indicate much higher volumes, and OPEC Member Countries are considering further production increases as part of their commitment to respond to market realities.This is the lead in to the large Saudi increase - it goes up 1mbpd by June. By June 3rd, OPEC is having an extraordinary meeting to officially sanction what is being done, and consider what more to do. The meeting summary reports:

Having reviewed market developments since its 130th Meeting, held on March 31, 2004, as well as the supply/demand outlook, the Conference noted with concern that, as a result of several factors, prices have continued to escalate, despite the efforts by OPEC Member Countries to meet market requirements. These factors are mainly the robust growth in demand in the USA and China, which had not been fully anticipated; geopolitical tensions; and refining and distribution industry bottlenecks in some major consuming regions, coupled with more stringent product specifications. Combined, these factors have led to unwarranted fear of a possible future supply shortage of crude oil, which has, in turn, resulted in increased speculation in the futures markets with substantial upward pressure on crude oil prices.Given current high and volatile prices and prevailing concerns regarding supply security, and in order to ensure continued, robust, global economic growth, especially in the economies of fellow Developing Countries, the Conference decided to increase the OPEC production ceiling (excluding Iraq) to 25.5 mb/d, with effect from July 1, 2004, and to 26 mb/d, with effect from August 1, 2004, in order to ensure adequate supply and give a clear signal of OPEC’s commitment to market stability and to maintaining prices at acceptable levels to both producers and consumers. The Conference also decided to convene an Extraordinary Meeting in Vienna, Austria, on July 21, 2004 to review market developments.

Ok. So as of June 2004, OPEC and Saudi Arabia are doing all the right swing-producer things - flooding the market with extra oil to damp down prices and bring them back within reasonable range of the price band. However, as the price fragment to the right shows, it didn't work. Prices dropped a bit in May and June, and then shot up again. What went wrong?

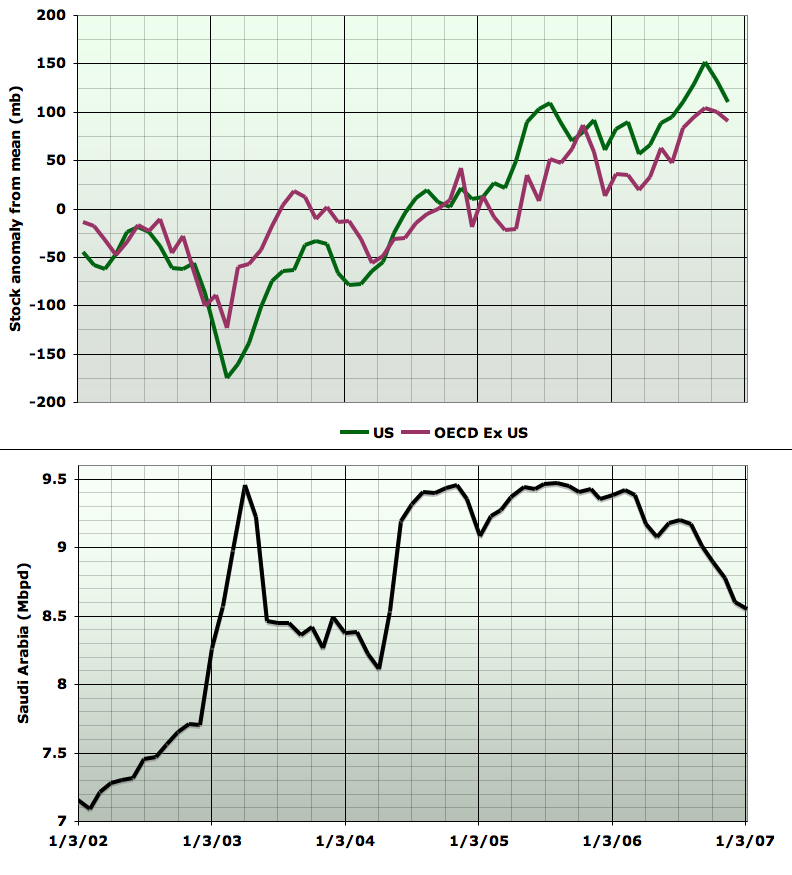

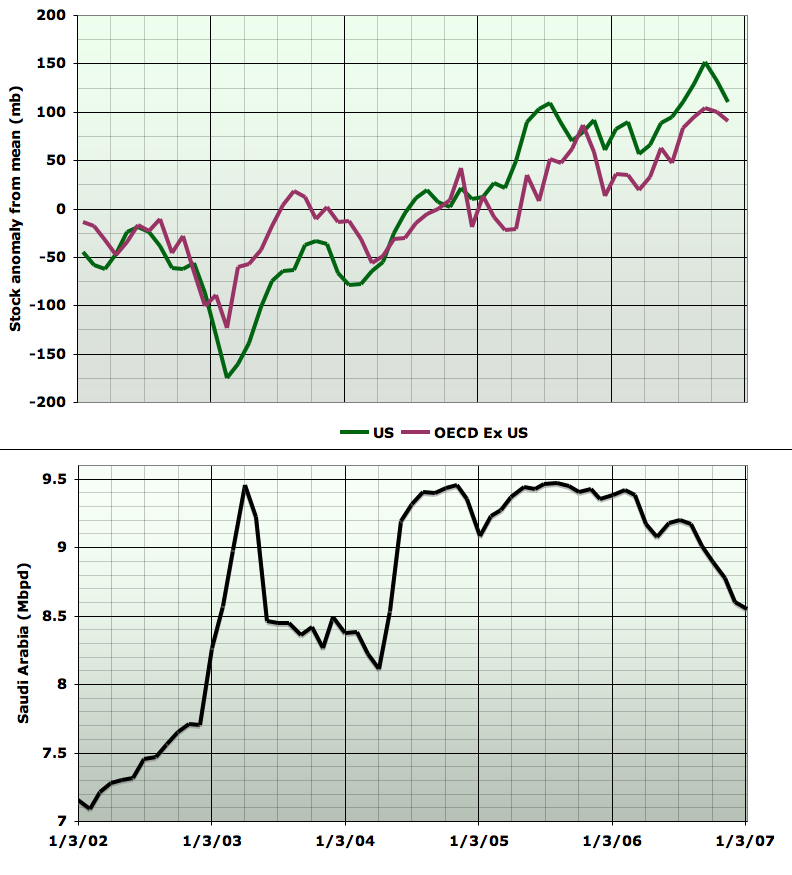

Ok. So as of June 2004, OPEC and Saudi Arabia are doing all the right swing-producer things - flooding the market with extra oil to damp down prices and bring them back within reasonable range of the price band. However, as the price fragment to the right shows, it didn't work. Prices dropped a bit in May and June, and then shot up again. What went wrong?I think the basic dynamic here is that futures market traders were essentially saying to Saudi Arabia: "show us what you got". This is six months after Matt Simmons gave his first presentation on his concerns about the future robustness of Saudi production, China and the US were both growing very fast, and prices were being bid up challenging the Saudis to show they could put enough oil on the market to rein prices in. Let's look at what happened. Here is oil stocks in the US, and the rest of the OECD, expressed as an anomaly relative to the average over the period.

As you can see, in spring 2004, stocks increase a little, but then, critically, they stop increasing in the third quarter of 2004. This coincides with the Saudis stopping increasing production. The Saudis cannot pump any more, and it's not enough to drive stocks up further. The point is even clearer in this EIA picture Euan found:

No matter in which time-frame is considered — monthly, weekly, daily — the OPEC Reference Basket in July and early August broke records all across the board. On a monthly basis, the rise of $1.68/b in July brought the monthly average to an unprecedented level of $36.29/b. Besides the previous monthly high of $36.27/b reached in May this year, the Basket has never been above $34/b since October 1990. On a weekly basis, the $37.40/b average for the week ending 29 July constitutes an all-time weekly high, while the daily average of $40.08/b on 11 August now holds the Basket’s daily record.but the bulletin was, unusually, silent on what anyone should do. There was nothing to be done. OPEC had lost control of the price of oil.

They would effectively acknowledge this in Janauary 2005 when they suspended the price band. I think it's important to stress that OPEC had every reason in late 2004 to think that these prices would hurt the world economy. Their literature at the time says they thought so, and as recently as 2000, $35 oil had caused massive civil unrest and an economic crisis in Europe. This seems endearing looking back from the era of $60+ oil, but there's little doubt that people at the time believed oil prices above $35 were going to cause serious problems, and that's why Saudi Arabia made a real effort to contain them.

Entering the Supply Constraint Era

This third quarter of 2004 was the point when Saudi Arabia, and by extension OPEC, crossed from being a swing producer, to being supply constrained. And, as is typical of oil production in some region, once production cannot go up any more, it starts to go down. In the fourth quarter of 2004, Saudi production drops sharply: my hypothesis is that after nearly six months of running flat out, parts of the oil fields really needed to be rested to prevent water breakthroughs (producing a field too fast can allow water to find channels to the wells and then flow straight into them, instead of pushing the oil ahead of it). This is in the absence of any suggestion in the September OPEC OMR, or the press release from the 132nd OPEC meeting on September 15th 2004, that anyone should do anything but keep increasing production.In fact, the meeting decided on yet another quota hike:

In light of the foregoing, the Conference decided to raise the OPEC production ceiling (excluding Iraq) by 1.0 mb/d, to 27.0 mb/d, with effect from November 1, 2004, in order to bring prices down further to a more sustainable level, whilst, at the same time, vigilantly monitoring market developments. In taking this decision, the Organization reiterated its commitment to take action to stabilize the market at prices reasonable to both producers and consumers.Saudi Arabia appears to have been obliged to do the opposite, dropping production by around 400,000 barrels per day between October 2004 and January 2005.

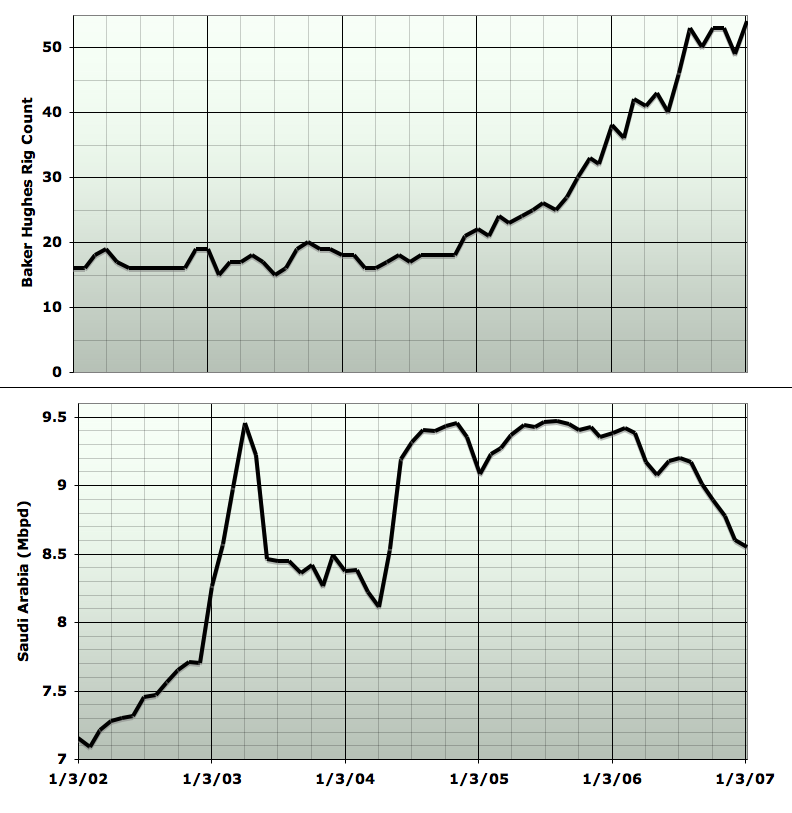

As the next graph shows, it was this quarter - the fourth quarter of 2004 - when the rig count began its rise above the long term very modest number of rigs that the Saudis had needed to maintain their production (given the extraordinary permeability of some of their large reservoirs - a point Euan helpfully reminds us of).

It is at this point that megaprojects come into the story. After the initial development of the Shaybah field, which came on stream in 1998, the next major development the Saudis took on was the redevelopment of the Qatif and Abu Sa'fah fields. Qatif had been produced from 1951 to 1982, but was in serious decline at the end of that time and was mothballed during the low production years of the 1980s. It was then redeveloped using all the latest technology (horizontal drilling, multilateral completions) from 2002 to 2004, with official inaguaration in December 2004. A similar project rehabilitated the nearby offshore Abu Sa'fah field. Together, these were intended to produce 800,000 barrels per day of crude, plus 40kbpd of condensate, which was 690kbpd of new production, since Abu Sa'fah was already producing 150kbpd.

My suggestion is that the production bump that started in early 2005 should be interpreted as the new flows from Qatif/Abu Sa'fah being used to offset declines elsewhere. However, they did not allow Saudi production to rise above the almost 9.5mbpd attained in October 2004 - instead that level was just matched for a few months in the summer of 2005. This suggests that the rest of the production base was being produced 690kbpd lower than it had been 10 months earlier. That's about an 8% decline rate in the underlying base production, compensated for by the new field to give an overall roughly flat production profile.

My suggestion is that the production bump that started in early 2005 should be interpreted as the new flows from Qatif/Abu Sa'fah being used to offset declines elsewhere. However, they did not allow Saudi production to rise above the almost 9.5mbpd attained in October 2004 - instead that level was just matched for a few months in the summer of 2005. This suggests that the rest of the production base was being produced 690kbpd lower than it had been 10 months earlier. That's about an 8% decline rate in the underlying base production, compensated for by the new field to give an overall roughly flat production profile.

By the end of 2005, beginning of 2006, the new projects were presumably fully in production and there was nothing to offset declines, which therefore show through into the top line production again. As I discussed at length last week, during 2006 we saw declines in the base production accelerate to 14%, offset to 8% as a net decline rate after addition of the smaller Haradh III megaproject.

Alternative Explanations

Next, I'd like to look at alternative explanations that have been proposed for what is happening, most of which stem from the Saudi's and OPEC's own explanation for what is occuring (with Euan and Robert Rapier adding wrinkles to this). It will be impossible to look at all variants, so let me try to string together the strongest possible narrative along these lines, and then point out why I don't believe it's plausible. That narrative would go something like the following:

Due to long-standing under-investment in production capacity, Saudi Arabia did indeed temporarily fail to increase production as much as oil markets might have liked in the fall of 2004. This caused prices to rise very high, driven primarily by speculators in the futures market. However, KSA has now rebuilt significant spare capacity by utilizing more of their ample reserves. In the interim, it became clear that the world economy could in fact continue to grow with oil prices in the $60+ range, and so they realized that there was no point in increasing their production again to lower prices. In fact, as western oil stocks have been increasing since then, the market is overall well supplied, and in recognition of this fact, the Saudis have been lowering production voluntarily. If the onset of new megaprojects shows up in the production statistics, that is just because they waited to be sure that the new production was working before resting existing production. Nonetheless, they could increase production further if they really wanted to, eg. if oil prices became high enough to cause serious distress to the world economy.Let me start with the idea that the visibility of the Qatif and Haradh megaprojects in the data is not significant. As Robert Rapier at one point put it:

That (Haradh III) probably is what it was. They probably brought that production on line. But, you want to prove your production rate before you take other production offline. You don't take the other production offline as you are bringing the new production on, because you don't know for sure if things are going to work out like you think they will.I found this completely implausible from a theoretical perspective. Aramco, a very sophisticated high-tech company, has several decades of experience running the oil infrastructure for a swing producer that participates in political arrangments dependent on changing their oil output regularly. We have to assume that they would have made it easy to centrally control the amount of oil output. Indeed we see many occasions in the past when they've changed production by 1mpbd up or down from one month to another. So it has to be, from a technical standpoint, easy for them to adjust the level of their base production, assuming they are not operating at capacity. This means they can mask the effects of new production in the curve.You can see this same pattern on their prior production declines. There will be a decline, and then a little step up, and then more declines.

Furthermore, according to Robert's hypothesis, these declines (in 2006 for example) are voluntary. The declines occur every month according to the production statistics. Therefore, the level of production must be being adjusted at least every month under normal circumstance to implement the decline schedule. So again, if they are being adjusted every month, how can it be so difficult to change the adjustment to do a little extra ramping down on existing production when new production is coming on line?

And the failure to match the intended production has real consequences: extra tankers must be ordered and paid for to take the extra oil away, and that extra oil will affect prices in the marketplace. It's hard for me to believe that it's easier to face these consequences than just turn the base production down a little at the outset of turning on the new megaproject, and then turn it back up again if there's a problem with the new field.

However, in my modus operandi, empirical evidence trumps theoretical prejudice every time. So I went back and looked at the inauguration of the Shaybah field. This was a megaproject to bring on a brand new field, 500 kbpd, during the swing producer era. Specifically, first oil was in July 1998 and the official inauguration of the completed facility was in March 1999. Presumably the new oil came on to varying degrees between those dates, or perhaps a little after, but we don't know exactly how much when. I made a graph of the 1998-1999 period, and I plotted two things: the official OPEC allocations for Saudi Arabia, which is the schedule that production is supposed to be following. I also plotted the average of IEA and EIA production estimates (JODI didn't exist back then and I don't have the OPEC production series done back that far yet and it's particularly time consuming to compile).

As you can see, at the time Saudi Arabia was tracking its quota pretty well. OPEC was ramping down production in response to the Asian financial crisis, and the Saudis were behaving as well-disciplined members of the cartel. The new megaproject has no apparent impact on their ability to follow the schedule - they are never more than a couple of hundred kbpd off, usually less, and they are particularly close to the line during the interval whan Shaybah came on stream. (Note that it is just a coincidence that both first oil and inauguration of Shaybah are in the same month as OPEC production cuts).

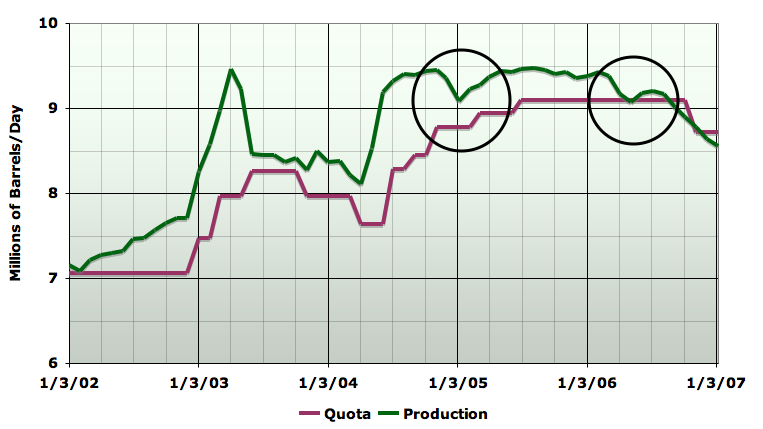

To me, this strongly demonstrates my contention: when KSA is not operating at capacity, they can control base production so that a new megaproject does not influence their total production level. Thus the fact that they did not achieve that control for the onset of Qatif and Haradh III continues to strike me as highly significant. For reference, here is the production profile and quota for the last five years (on the same vertical scale):

In general, KSA was not following its quota so closely during this era - in particular, they seem to have responded much more aggressively than OPEC required to the market need for more oil during the Gulf war, and also in response to the loss of control over prices in mid 2004. However, as the two circled regions show, there was nothing in the quota curve to explain these events.

Now, let's turn to the issue of rising OECD stocks:

It's certainly true that stocks have been rising from 2004 until last summer, both on an absolute and a days of supply basis - though the rise is not historically outrageous. OPEC is fond of claiming this mean that the market is well supplied and so nobody needs any more oil. Clearly, the average minimum wage worker forced to cut short on driving because they can't afford the gas would have a very different perspective. The problem is in the supply constraint era, inventories just do not mean what they used to mean. The price rises of the last few years have frequently come from the long end of the futures market - the market has often been in contango in which the right to have a barrel of oil in five years is more expensive than the right to have a barrel today. When the far future oil contracts are driving up like that, two things happen: one is that it makes it more profitable to store oil, so stocks rise. The other is that the current price of oil has to rise too (because otherwise even more oil would be stored, which tends to drive the far future price and the current price towards one another). So the historical role of inventories as the main signal OPEC used to balance the market has broken down. But I find it hard to believe that OPEC doesn't know how the futures markets work.

But obviously, none of this would happen if the futures markets thought that there was going to be ample oil in the future. $60 is high enough that demand has flattened out, despite decent economic growth. Thus there are certainly additional customers who would drive further and turn up the heating oil thermostat if only oil was a bit cheaper and they could afford it. The fact that there's no-one available to supply it to them is why prices have remained so high. If OPEC had the capacity and convincingly demonstrated their ability to flood the market with all the oil anyone anywhere would pay for, oil market bulls would have no choice but to run screaming for the hills - selling their long positions cheaper and cheaper lest they be faced with the prospect of tankers heading up Long Island Sound trying to deliver to their hedge fund offices.

Ok, but what about the idea that the Saudis, having recognized that the world can cope with $60+oil, are now deliberately holding production down in order to maintain prices at that level. At one level, I think it's incontrovertible that OPEC has gotten very fond of the high prices. There does seem to be some evidence that some countries did actually make very small cuts specifically in response to the recent OPEC cuts. Could the Saudis simply have decided that being the swing producer is a mugs game, and they're just going to take all the money they can?

Well, that hypothesis has some problems, I think. One is, why don't they cut even further, and make even more money? Knock another few mbpd off, and oil will be $150, which is even better for the treasury. Ok, they can't do that all at once, or they'd throw the world into recession. But after prices peaked at almost $80 last summer, why did the newly greedy Saudis let them come down again. Why not have managed them slowly higher to find the point of maximum profitability, which is almost certainly higher than $60? Or if they aren't that greedy, and $60ish is the new price band, the new balance between the interests of producers and consumers, why'd they let the price go almost to $80 over the summer? Why not ramp up to 10.5mbpd for a few months and scare the markets back down to $65?

In short, if the Saudis had spare capacity, we'd expect the production profile to show some intentionality around managing the price in some way that they perceive to benefit them. But that's not what we've got. If we focus on price and production over just the last three years:

I just can't see Euan's contention that the peak in Saudi production and price coincide. From my perspective, declines in Saudi production start a year earlier than the peak price, gradually at first, and then accelerating.

Instead of some rational looking approach to price management, we see a profile of drops interrupted by each new megaproject.

Thirdly, if the Saudi's were indeed sitting on 716gb of ultimately recoverable oil, there's some serious risks in running prices so high now, so early in the history of their production. In particular, they are triggering a huge boom in investment in trying to find alternative forms of energy (this is going gangbusters here in the SF Bay Area). That's pretty risky for them - who's to say that Silicon Valley won't solve the electric car battery problem and the cheap solar panel problem? It's not usually a good business strategy to price your product so high that your customers are driven to furiously trying to invent an alternative. In the past, they understood this which was why they created a moderate $22-$28 price band which balanced the needs of producers and consumers. They had the experience of the 1980s when the price spikes of the 1970s caused a huge shift away from oil and contraction in demand, which absolutely killed their revenues for years. Why would they repeat that experience?

So, at this point, I'm pretty strongly persuaded that this can't be the explanation.

The Future of Saudi Production

The very near term future is generally agreed to be continued declines. The most recent IEA Oil Market Report (from Feb 13th, 2007) says:The Saudi Arabian crude supply estimate for December was revised down by 100 kb/d to 8.7 mb/d in light of updated tanker data and reported production levels. January supply is assessed unchanged, although Aramco has signalled to Asian term buyers that exports will be curbed by between 10-13% in February compared with 8-9% in January. Moreover, steep price increases for March exports suggest supply remaining constrained next month.For the medium term, if you just project the underlying linear decline rate in 2006 out for the next five years and add in the known megaprojects, you get the red line in the following graph:

If that were true, production would have halved by 2012. However, it's very hard to believe that declines would continue at that rate. Eg, if they continued all the way to zero after ten years, that would only be another 16 billion barrels of oil production. No-one is that sceptical of Saudi oil reserves. Eg Hubbert linearization suggests there's about another 80gb or so of oil there. ASPO estimates 170gb still to produce (though based on a fairly generous recovery factor).

So rather than declines continuing at the present rate all the way into the ground, more likely, I think, is that there are a large number of small fields, and pockets in big fields, which carry the remaining reserves. Hitherto, these have been beneath the attention of Saudi Aramco, which prefers to engage in massive heroic engineering projects - they haven't gone below about a 5gb field in recent publicly announced projects. Just as in other regions, the addition of increasingly large numbers of increasingly small fields to the backside of the production peak should serve to moderate the decline rate. How quickly Saudi Arabia will move to exploit the remaining smaller fields is anyone's guess, but the green line on the chart above is intended to suggest that the present decline rates should moderate at some point.

Parting Thoughts

No-one has taken me up on my bet, but since I feel even more confident of my conclusions, I'm raising the offered stakes to $2000. I need to go find some cornucopians to take the other side of it.Which reminds me. For those of you doomers keen to see this as the end of civilization as we know it, it's going to take more than this for me to join you. While it's certainly worrying, we need to keep some perspective: 8% of Saudi production is 1% of global production, and as long as global declines are less than a few percent a year they are well within society's proven capacity to adapt. Probably the biggest potential issue is the political stability of the Kingdom of Saudi Arabia once this news becomes clear to everyone.

Prof. Goose reminds us:

Outstanding work! It's a shame it's getting so little digg count:

On the front page of digg at 90 odd.

Getting noticed on digg is majorly a matter of the rate at which the story is 'dugg'. People need to hit ~40-50 within a short period of time to maximise the probability of receiving attention.

Unfortunate, but that's the way these sites work. Getting the story noticed by those that matter, that's another story.

Darn - just 288!

Khebab - I've often said that I like your loglets analysis with global peak in 2012. If Stuart is right here, then your analysis is most likely wrong. Care to comment - maybe further down the thread. I'm off to nose dive into bed!

For me it all comes down to the 1988 reserve increase:

If we correct for the increase, we get 180Gb left, the HL would then look like that:

A global HL without a priori knowledge is saying 90 Gb left:

Stuart's hypothesis is clearly very pessimistic (dotted red line) but would be consistent with a rapid crash of Ghawar probably followed by a small rebound or a least a flattening in production coming from smaller fields.

more comments later.

If i look at the maps http://maps.google.com/ i could see that the concentration of oil in middle east must be a lot higher than for example in us or the north sea. Is there any gelogical reason to believe that middle east has a lot more oil per area than any other area of the world. Then i check these http://www.searchanddiscovery.net/documents/2004/horn/images/13.htm and http://www.searchanddiscovery.net/documents/2004/horn/images/14.htm i could see that middle east are dominated by carbonate. Is it possible that this could create a skewness towards large easy to tap reservoirs that gives the perception that they have lot more oil than they have.

It's possible. Saudi Arabia has (had?) the most productive wells in the world because of the exceptional quality of their reservoirs. That's explains also why they have drilled so little compared to the US for instance.

I first saw that chart about the 1988 reserve increase in a 2000 issue of Outstanding Investments. They had all the other OPEC countries graphed too, and it was the beginning of my interest in peak oil. I still remember the sudden knot in my stomach when I saw the charts and "grokked" their meaning. Suddenly, the year 2000 doomers did not seem quite as whacky as they did before.

Yes, if Stuart is right the loglet result is probably too optimistic. Growth is coming from the type II group as I have tried to explain here. The type II group is dominated by KSA and Russia. If KSA is going down or flat and Russia not as strong as it used to be in 2004, I don't see then how we can compensate for depletion coming from the type III group (countries that have passed their peak) as shown below. The only positive news is that tar sand production from Canada is growing nice and strong and will probably meet the most optimistic forecast.

We will probably loose an additional 0.5 mbpd of production every year due to depletion in the type III group (blue area above). If KSA enters that group, well... it means the world has peaked.

At around 7 PM CST, it was 12th on my RSS feed with 342 diggs. As I write this comment, it has 354 — apparently this article has reached 'critical mass' on digg.

If I can only understand about 50% of what someone says because he speaks over my head, then I don't dig it.

Stuart: Impressive article. Your ability to summarize a lot of info into an easy to read format is top-notch. Maybe you should get a book together and contact an agent/publisher.

Wow...amazing work Stuart.

This has to be one of, if not, the best article I have ever seen on TOD.

Excellent graphs and references.

=================

It's all about population!

Absolutely agree - superb article. The previous article by Stuart last week did not entirely convince me. After all, KSA's lower production had prevented oil falling below $50 and now brought it back up to $60 without causing much sign of further slowdown in USA, or any at all in the EU. However, Stuart's detailed dissection of oil price, OECD economic performance and KSA output over 5 years, to my mind leaves very little room for alternative explanation.

I think those of us who watch TOD should take this as warning that the peak oil storm will break upon us fairly soon. IMHO, this will occur when this reality begins to be recognized by the MSM and hits the money markets and business optimism. My guess on this has been for some time, the second half of next year, but that may be optimistic. So those of us here have maybe 15-20 months (max.?) to get our affairs in order and, if we are minded, help our local communities to prepare too.

Stuart's book

Stuart - one of the things that jumped out at me looking at this chart was the symetry - that is the point you make from the chart. It is also quiet clear that Iraqi production surged 600,000 bpd (settling back to 400,000 bpd) just before the fall in Saudi production began. And shortly after that the Baku-Tiblisi-Cayen pipeline was oppened with first oil on 6 May 2006. This was ramping to 1,000,000 bpd over the course of a year I believe. So here we have from these two areas alone somewhwere between 900,000 and 1,400,000 bpd new production coming to market and Saudi production has been reduced by around 800,000 bpd.

Do you think that the Saudi decision to reduce their production may be related to all this new oil flooding onto the market?

Euan,

If Saudi Arabia has been cutting the production of oil voluntarily for the last 17 months, it can only mean that they want to drive the price of oil higher. But that doesn't make any sense because they continued to cut production as the price surged to $78 last summer. And if they think the world can bear $78 oil without any problems, why did they not defend that price by cutting their production deeper as the price fell to $50 in January, 2007?

You can see that for the last 17 months, their production has declined consistently whereas the price of oil has been all over the place.

In my opinion, the evidence is overwhelming that Saudi Arabia has peaked and the decline in production is not voluntary.

Suyog, best to just address the issue raised in my edits to Stuart's chart. Do you think that an additional 1.4 million barrels per day coming to world market is significant and do you think there is a possibility that the Saudis actions may be influenced by such events?

WRT to Saudi actions and price, I imagine that they study supply and demand very closely and adjust their production accordingly. Getting ths balance right is of course difficult. Price fluctuations will flow from these actions and not the other way around.

Euan, I think what you are missing is that demand is a function of price. There is a lot of forced conservation going on in poor countries. Don't you think Bangladesh & African countries would love to buy a few more tankers of crude oil if price was $20/barrel? Even in the US, quite a few people will buy SUVs and pickup trucks instead of small cars if price were to fall that low.

Only a year before the Saudi production peaked, they were trying to keep the price of oil in the range of $22 - $28 and $35/barrel was viewed as a calamity. I find it hard to believe that they suddenly started cutting production because they were concerned about an additional 1.4 million barrels hitting the market; especially when the nominal price of crude oil was so high.

Saudi Arabia has stated several times that they are not going to flood the world with crude oil when refined product price margins expand. If you take those statements into consideration, you will find that they have no choice but to shut in production as refinery capacity is still limited.

But the Saudis were telling the Asian refiners a few months ago that they will be cutting their supply of crude. If refinery capacity was the issue, it would be the other way (refiners would be telling the Saudis to ship less crude), wouldn't it?

You are confusing Saudi compliance with OPEC cuts with Saudi reduced oil production.

Stuart is trying to argue that Saudi production has been in decline before they implement OPEC cuts, and those production decline are caused by field exhaustion rather than business reasons.

At least, that is how I am reading it. Feel free to correct me.

If that is Stuart's position, then I think there are many flaws with it coming from an analyst's perspective.

I perfectly understand Stuart's position. But you attributed Saudi production cuts to refinery capacity. My position is: if refinery capacity was the issue you would expect the crude oil consumers to tell Saudi Arabia to ship less oil; you wouldn't expect Saudi Arabia to unilaterally announce cuts in crude shipments to refineries.

Also, note that Saudi production cuts of 1 million barrels per day (so far) are twice as large as their share of OPEC cuts.

Then, the answer to your statement is that refineries are ordering less Saudi oil.

The only cuts that Saudi have done that are under contract are the ones for OPEC cuts. (These are contracts with pricing already predetermined based on market prices.) All other cuts are from open market pricing. If refineries lack oil, they will bid up these prices, which is not happening. On the contrary, prices have been dropping and oil shipments from other OPEC members and from Caspian region via Turkey have been shipped out without contracts during latter half of 2006. The oil market picture is very clear that refineries do not lack oil at all.

Suyog,

The time frame you discuss might not be long enough for Saudi organizational politics to come to a course of action. The price signals might mean exactly what you think, and then again they might not.

You will certainly get a better picture during the next demand surge - perhaps during this summer's drving season. Market reaction cannot be swept under the rug.

Further, all of the above charts are in US$. Now, I know that Crude is priced in US$ - for the most part. Oil, priced in Euro's to europeans is 9% (+ or-) less than Oil priced in US$ to Americans compared to the year ago period. The decling dollar has at least some impact.

Stuart's is a compelling narrative. The idea I got while reading was :

It looks to me that the Saudis increased production every time the price got out of control. In 2004 they chased it down at $45, then slackened off production; in 2005 they again chased down peaks at $50 and $60. In 2006, they failed to increase production to head off peaks at $65 and $70 : compelled to let demand destruction do the job...

Henceforth we have "plenty of oil". By the same token, there's no shortage of caviar either. For those who have the money.

I love your parallel...until they kill the last sturgeon...

Oil if you can afford it, until they stop exporting it.

=================

It's all about population!

Euan:

If you want to maintain that they are adjusting their production up and down voluntarily in pursuit of something, what is the something? If they have voluntary control of their prouduction level, then in order to have a falsifiable hypothesis, you have got to suppose that they are in rational pursuit of some goal with that production level. What are they in pursuit of, in your view? Constant price? Maximum profit? Target OECD stock level?

Stuart - I would suggest that they are striving to achieve a supply demand balance in the global market. This needs analysis and forecasts of supply and demand, both of which are difficult to achieve accurately. But when they see several hundred barrels of new oil coming down the pipe they may act accordingly.

I venture one flaw in the analysis that you lay forth and that is the notion that the Suadis watch the oil price and adjust their production accordingly. I imagine they are much more likely to monitor supply and demand, act accordingly and price will flow from those actions. I'd be interested to hear others' views on this.

One part of your yarn where you may be on the right track is the entering of a new era with OPEC. What has happened is that we have gone from an era where OPEC in concert were supposed to act as swing producer (that never worked because of cheating) to one where Saudi Arabia are all powerful within the OPEC block - being the only nation with significant reserve capacity. So we see an end of cheating (that actually caused GWI) and Saudi in the driving seat. Does $60 suit them - well Hell its still only 10 cents a cup.

I'm going to post a few more comments if that's OK, picking holes in your argument. As I said in my post earlier this week, you may be right, I'm just a bit sceptical about drawing such firm and potentially catastrophic conclusions on a stack of well researched but circumstantial bits of evidence. We will end the evening on a humerous note!

What about the United Arab Emirates? Do they have any spare capacity? They are significant producers, yet I hardly ever see them mentioned in any context whatsoever.

And what about Kuwait? Does the decline of Burgan establish all by itself that they no longer have spare capacity?

"supply demand balance in the global market. This needs analysis and forecasts of supply and demand, both of which are difficult to achieve accurately. But when they see several hundred barrels of new oil coming down the pipe they may act accordingly"

Ok, but supply and demand will always, in some sense, balance (absent major sudden disruptions). Prices will adjust one or the other until they do. So it doesn't really mean anything to say they want to specify supply and demand balance, since there are many possible balances. Should they pick the $20 balance? Or the $80 dollar balance? Or pick the balance that holds stocks at 80% of capacity? Or what? If their goal is either a particular price or a particular stock level they've sure done a lousy job over the last few years, as I discussed in more detail in the post.

What you seem to be groping towards in the comment here is the idea that they are trying to keep total global supply flat, so when somebody comes on with new production, they cut theirs to keep total global supply constant. But why would they target flat total production? It's almost like they decided to bring peak oil early for some reason.

But then in comments below, you're cherry-picking features out of the price graph and arguing that they explain certain features of the supply graph.

Overall, the impression is you're grabbing bits and pieces of different explanations for different pieces of the production curve, whatever will fit each piece, without having any coherent hypothesis of what the Saudis are trying to do, and then showing how that hypothesis explains all of the data. I can't really refute a hypothesis like that because it's not well specified enough to really know what its implications are.

Thanks, Stuart,

re:

"But why would they target flat total production? It's almost like they decided to bring peak oil early for some reason."

Interesting.

Just out of curiosity...do you have (or could you come up with)an idea about this?

And...does Advokat's idea make sense? (Or, are you saying his/her hypothesis isn't specified enough in the way it relates to the data?)

Euan's hypothesis is, in other words, is 'not even wrong.'

Stuart please expalin yourself. You know as well as I that global demand can go up as well as down?

For the sake of clarity:

Change in Global demand ± change in Global supply (ex OPEC/KSA) =(approx) Change in OPEC (KSA) production

So if Global demand goes down or Global supply goes up (e.g. the Azeri Field), then the swing producer (OPEC dominated by KSA) may adjust their supply accordingly. Can you please detail which part of this you don't understand.

In 2006, Global demand was flat, supply from other sources was rising so OPEC faced a choice. Cut supply and sustain price or continue to produce flat out and dump the price. You seem to think they should have done the latter?

You might understand Stuart's argument if you would learn the meaning of the terms, supply and demand. These terms refer to schedules of quantities that producers or consumers are willing and able to offer or buy at different prices at a given time. Supply, to choose one term for clarification, does not mean the amount a seller puts on the market at a given price. That is quantity offered. Supply means the differing amounts offered at different prices.

Sofistek, lower down this page, points to the inaccurate use of the term 'demand' in data reports, when consumption is what is being described. So your misuse of the language is understandable. But it appears that a misconception underlies your misuse and this misconception is blocking your ability to comprehend Stuart's explanations.

Your error is in believing that the economics-theory definition of "supply" applies strictly to the phrase "oil supply".

I second toilforoil's comment above. From an economics perspective there is no such thing as free-floating demand(independant of a specified price) that must somehow be 'balanced' with supply.

Don Sailorman could give us a nice lecture on the difference between consumption and demand.

Is Euan saying that the Saudis are targeting a certain level of world consumption?

Or do the Saudis have price targets? (for any of a variety of reasons)

Or are they maximizing revenue?

It appears that both toilforoil & asebius fail to understand the concepts of supply and call. It is also a reality that OPEC failed to address with its quota system.

During a typical year, demand can vary by 2 mb/d and I have mentioned that Q2 is usally the softest. The call on OPEC is down 1 mb/d at that time, but global demand expects an extra 1 mb/d from OPEC in Q4's.

The accomodation of this led to the original label of cheating. But it is an unfair label if that assistance goes *both* ways.

OPEC's position is that the supply should be level through the year and inventories will take care of the high curve season. This is what transpired in Q4 of 2006 and may be the scenario unfolding for 2007Q4.

Euan's comments reflect this practical flaw. OPEC regular confernces and special meetings often are unable to respond to the dynamic marketplace in real time. While some nations are pleased to surge when needed (to get extra revenue), they frown upon the reverse requests of low call on OPEC (because it hurts national revenues of NOC's).

Saudi Arabia affluence dictates that it does not have these

concerns and it yields indifferently to monthly changes in call. The risk of its actions has always been that other OPEC nations accuse SA of cheating and then rationalize doing it themselves. This has forced SA at times to be right on the money wrt quota (as one of Stuart's graphs demonstrates).

Insolent OPEC members must learn to be team players and mature in their comprehension of the seasonal and geopolitical factors affecting global demand and the subseqent call on OPEC as the swing partner.

Impatience on this issue has caused SA to go public with statements of concern wrt whether it alone should be the swing producer or if OPEC as a pool should attempt that role. This is magnified by the reality that its surplus capacity was significant one or two decades ago; and could easily manipulate supply and price. But at the 86 mb/d flow rates of today, their moves are but hiccups.

It's time you returned to the classroom, Freddy.

Last Viking, you got any links on this point. This is not something I'd previously thought about but which clearly just has to be true. OPEC / Saudi reserve capacity is shrinking whilst global production is rising giving rise to a very potent de-gearing of the effect of swing production.

Toilforoil and Asebius - thanks for the lecture in economics where I have no formal training.

IMO this bit of the thread has gone off at a tangent. The point I made at the outset was that about 1.4 million bpd new global production started to come on at about the time that Saudi production began to fall.

Armed with the knowledge that this was going to happen do either of you think that Saudi and / or OPEC may respond in some way by adjusting their production volumes (as swing producers) or is this something they would simply ignore?

Stuart,

The answer to your question is answered, in part, by the analysis of the Hotelling rule with regards to pricing a non-renewable resource such as oil. The methodology involves maximizing the present value of the stream of profits out to infinity. Now, the Hotelling scenario is far too simplistic to apply directly, but it gives us a very good intuition.

Before 2003-4, the world more or less seemed to perceive oil as being infinitely renewable, in the same way that coal is perceived today, even though technically, coal is not renewable. The Hotelling analysis is based on the "perception" of renewability within a generation or 2. Thus, timber, while renewable, may also be viewed as a non-renewable resource for the purposes of the analysis.

It could well be that Saudi Arabia got "religion", so to speak. Once the $22-28 price band broke, crude oil went up and up, economies didn't crash, and the "Peak Oil" meme gained some momentum, Saudi Arabia realized that this is the time to start behaving according the Hotelling rule. This is especially true, when they discovered that there were no other viable swing producers out there.

Your analysis also focuses on what I would call "near-term" capacity. Can KSA raise production 1.5m bpd? Probably not. Can they easily invest in up to 300 rigs (several times more than they currently have but a far lower number than other oil producers) and then increase production by up to 3m bpd? Probably.

As I mentioned in my last comment, the key variable for me is the ratio of total recoverable barrels remaining in the ground and current production. If we assume KSA has about 85Gb left, then at 8.5mbpd, that is an R/P ratio of 27.4. We've seen in the OECD that R/P ratios higher than 15 can easily raise production by 5-10%.

So 10 % is 1 mbpd. Why you are hypothezing/argumenting on 3?

The risk is we are never gonna see >10 mbpd from SA again...

Euan,

this chart is the only glimmer of hope that I now see for the future of SA oil production. As noted below, it is within the Kingdom's strategic interest to have some semblance of order in Iraq. I do not think it is a big stretch to now examine combined Saudi and Iraqi production for clues. I think that is now clear that SA cannot ramp up production above 9 mmb/d and they will be hard pressed to maintain it at that level. The unique partnership between the House of Saud and the US makes me believe that the US will insure that KSA is the last one standing by explicit coordination of the Iraqi and Saudi production. The US will go out of its way to enable the Saudi's to minimize their decline rate at the cost of Iraq. The decline is combination of voluntary and involuntary factors.

This is classic example where oil truly manifests itself as a strategic commodity.

For the record, I find Westexas's and Khebabs HL analysis of Saudi production compelling. The kingdom is clearly in a transition phase and is at the tipping point, it is only a question of how long "above ground" factors can obscure the truth. I don't recall the poster that reiterates that 3Q07 will likely be the moment of truth....we shall see.

PS Excellent article Stuart... I doff my cap.

Hello SS, Euan, and other TODers,

Thxs for this keypost SS, and contrapost by Euan--Great food for thought! I would refer you to my earlier 3/7 post that generated no replies, reposted again below for convenience:

+++++++++++++++++++++++++++++++++++++++++++++++++++++

Hello TODers,

If we take the word of Heinberg's inside source that Ghawar was under 3 million barrels/day, then add the now online 300,000 b/d of Haradh III: Can the other KSU oilfields make up the difference? Could this be a another method to help predict the possibility and error bars of KSU being postPeak?

http://energybulletin.net/18904.html

-----------------------------------------

[4 AUG '06] What happens next? It depends on the real condition of Ghawar. Perhaps a heroic drilling campaign could result in a temporary bloom in production, lasting perhaps three years, followed by a swift, terminal collapse. On the other hand, it is possible that the field has been so thoroughly exploited already that we are seeing the irreversible, rapid decline. At the ASPO conference a well-connected industry insider who wishes not to be directly quoted told me that his own sources inside Saudi Arabia insist that production from Ghawar is now down to less than three million barrels per day, and that the Saudis are maintaining total production at only slowly dwindling levels by producing other fields at maximum rates. This, if true, would be a bombshell: most estimates give production from Ghawar at 5.5 Mb/d.

-----------------------------------------

If one looks at SS's graph [green background with the two hand-drawn lines above]: this bombshell of info was right when Haradh III was turned on. So, is this a valid equation?--> 9.2 - 3.3 for Ghawar = 5.9 mmbpd for the other KSU oilfields. Is this even possible for the queens, princes, and barons: Berri, Abqaiq, Zuluf, Marjan,etc?

So if Ghawar is dying, but the other oilfields last Aug had the capability to be only temporarily ramped up to cover this decline-- does that help explain all the unsold heavy crude and the further decline since last Aug?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

+++++++++++++++++++++++++++++++++++++++++++++++++++++

Recall that ASPO's insider, called 'Nemesis', has been eerily correct in his/her prognostications as evidenced by earlier postings by TODer Down Under. I thank him for binging Nemesis to greater TODer attention. Additionally, has Heinberg's insider been accurate? Hard to tell without direct Aramco confirmation, but Deffeyes, WT, Darwinian, Ace, Simmons, Pickens, and others seem to be finding corroborating data with the passage of time.

Now our very much admired data-freak SS seem to be reaching the same conclusions as Nemesis, Heinberg's insider, and the experienced data analysis of the aforementioned Deffeyes Group. Let's not forget that Simmons and Pickens can easily afford to field impressive research staffs on their own as they have billions$$$ in market play.

As repeated again from my earlier posts when Heinberg first released this bombshell info in Aug06: He should have kept this confidential unless he could have found additional confirming evidence. I contend that Heinberg was 'played', and benefits accrued to some [I just don't know whom]. Nonetheless, it has been added to the mindset of astute observers along with the Nemesis reports, and other FF market data.

The geo-political and monetary aspects should not be underestimated vis-a-vis the strictly straight forward but data-obtuse geologic depletion. As Churchill said, "We are entering a period of consequences". I note the low prices mentioned by others at US election periods--Could Heinberg's source's revelation in Aug purposely have over-hyped the market early when combined with over-blown hurricane and ME expectations, then Goldman Sachs' index revision combined with other events to drive the gasoline price so low in Nov. 2006? Recall how TODer SelfAggrandizedTrader [SAT] had this so clearly pegged so early. Even RR, who I believe clearly watches inventories closely, was late in recognition.

As Euan, RR, and others point out downthread, it is entirely reasonable for KSA to see early forsee climbing Russian and Iraqi output, plus the addition of the Caspian pipeline, and other factors: then adjust their output accordingly. But the question remains: has Aramco adequately forseen and invested in a timely manner to offset their inherent oilfields depletion's decline rate to retain sufficent swing capacity to market demand?

If Heinberg's source [same as Nemesis? I don't know!] revealed 'Truth'--I strongly doubt if Ghawar alone can regain back the 2.5 million BPD of swing capacity [haradh-3 maybe the last gasp?], the Deffeyes Group's conclusions are sound, and SS's ugly, jagged future KSA downslope will be the result of heroic efforts on the remaining oilfield queens, princes, and barons. Ghawar, the king, will be riding astride untold thousands of flagging horseheads into the depletion twilight.

If Heinberg's source revealed 'False Info', then RR, Euan, and Dave Cohen's Sadad Al-Husseini conjecture maybe correct that KSA retains additional capacity, and the voluntary resting of Ghawar, along with further drilling and infrastructure enhancement will allow later, and greater kingsize flows combined with the other oilfields' production.

But then the earlier release of this 'False Info' [once proven false somehow] from Heinberg's source would strongly indicate that geo-political concerns override or will be used to direct geologic concerns going forward. Time will tell what conclusions we can draw from this.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

This reduction is not a decision, it is INVOLUNTARY. That is Stuart's point. Of course you know that. You're just trying to twist his words and give the impression he is saying something he isn't.

Also, All what Oil? Even an extra mb/d can't save them from this decline.

Stuart,

this was a VERY impressive analysis!

I think you and Euan lately have done some admirable pieces of analysis (well documented and supported by impressive graphics) that has shed some more lights on the oil supplies situation in KSA.

Thank you both for sharing.

NGM2

I'd suggest to TOD readers that they e-mail a link of this article, along with a few comments and some of the initial summary to news reporters and to influential people they know or have even slight contact with.

To link to the article, close out of the article and click on the permalink. Send a copy of the permalink address.

Gail,

It's far too late for that.

I suggest they figure out what, if anything, they can do to protect themselves and their families, then take that action.

Hi Chimp/AMPOD/Matt,

Given your premise, ("too late"), what is the action you suggest? (I'm being 100% sincere, BTW.)

SS - Thorough and impressive as always.

Here we differ:

If SA production is cut in half or even by 1/3 in the next 5 years, as your last graph suggests, that will be the smoking gun that will trigger a mainstream realization globally that 'holy crap our oil really IS finite, and soon!'. Instability, resource grab (local and global) and the geopolitcal game of RISK, will quickly ensue. Its never been about running out of oil, its been about the perception that oil will be readily supplied over near and intermediate future.

Irrespective if SA is only 8% of worlds production, it means that all the warnings are true, Peak Oil is here, and we're not going to Disneyland.

I would recommend that Senate staffers and aides print this out and show it to all policy people in DC and elsewhere. However, as valid as your points are, all it takes is one respected authority (CERA comes to mind) to poo-poo it and the warning is lost, except to those who can connect the dots.

Nate, I agree this is one of the best articles ever to appear on TOD, perhaps even the best. And I must agree with Nate on this second point. Once it becomes obvious that Saudi does not have vast reserves, not even close to the 262 billion barrels they claim to have, but more like 70 billion barrels instead, this will hit the financial world like a bombshell.

People will then realize that not only are Saudi reserves mythical, but so are the rest of those vast Middle East reserves. I shudder to think what effect this will have on the stock markets of the world.

Ron Patterson

Yes, it's great. And now compare it with what appears simultaneously elsewhere:

Huffington Post

I'm with Simmons: "The situation is desperate."

I'm with my geology professor, Craig Bond Hatfield: "It's too late."

NYT with a cheshire grin :)

I luv being right

Now, I know only Freddy writes like that.

Glad to have you aboard again. :)

If Saudi production is down by 1/3 people will realise “the party’s over”? Maybe not, not if the decrease can be explanined by above ground factors on the evening news.

For example what if there is millitaty acation againest Iran which somehow ends up a significant chunk of Saudi oil infrstructure being destroyed? Production will be down – people will blame the war and live in hope for brighter times to come.

Another example, reveloution in Saudi, the overthrow of the House of Saud with a period of civil unrest during which production falls. Again an above ground factor allowing people to hope to brighter times ahead.

I’d be very surprised if a permanent 1/3 decline in production would not be accoumpined by some above ground factor which could be blamed – the chicken and egg debate wouldn’t be mainstream.

Sigh...

Chris - you're right. Its quite possible Peak Oil might never be realized as geologically based, but will be rationalized as due to some 'above ground factor' in perpetuity. "There is plenty of oil - if only that real smart petroleum geologist hadnt died in the copter crash, we'd be able to get 100mbpd next year!" There will effectively never be 'proof' and people will be arguing about it 10 years after the fact.

Its like debating evolution with a religious apologist - 'well how do you explain that humans have tailbones'? "well- God works in mysterious ways"....

Hows this juicy rationalization - "well if those democrats hadnt removed the troops back in 2007 from basically the heart of oil central, we'd still have single digit gasoline! Duh!"

This is CERA's saving grace and probably true. As long as there is an "above ground" excuse for drops in production, no one can ever really declare a geologic peak. It is a sick little spin.

What does it matter to the world how peak oil is explained. Isn't the outcome the same?

Tom A-B

Not really. A recognition that the peak is real and permanent would elicit different reactions than a belief that next week [or month or year] things will get back to normal after the arabs, the big oil companies, the illuminati, and / or the environmentalists stop screwing with the gasoline supply.

Buying a used land yacht in 1974 wasn't necessarily a mistake on a micro level. Buying a bargain priced monster SUV in the crunch period after peak oil probably won't work out even on a micro level.

This isn't happening in a vaccuum. It doesn't matter what they believe. As, Deffeyes says, there's a snowballs chance in hell of a soft landing. Game Over is Game Over. It doesn't matter who they blame for it. Those with the power to grab everything they could in the last days of oil will still be in power.(Probabally running little fiefdoms around the world). Most others will die in some horrible fashion. No there won't be any great holding of hands and sharing of what is left. Those in enlightened Post-Oil communities will be knocked off for their resources or incorporated into the aforementioned fiefdoms and become serfs. Certainly the world will not continue as it has at a smaller scale. Those that think protest will accomplish anything; Yes it will. It will get your ass thrown into one of Haliburton's Concentration Camps.

Yes we're all going to die. But if you are expecting a quick peak oil induced population crash, [it may come at some point in time if our choices are stupid enough for long enough], my contention is that most of us now living will die from old age. Maybe with a sweater on ... but from old age.

American don't need to consume like we do to live very well. We don't need to buy as much stuff. We don't need to drive to work alone 5 days a week, go shopping 7 days a week [for stuff that we don't need], drive our kid across town to excercise by playing soccer, drive 3 ton SUVs every day [alone], continue to buy mostly incandesent lights, transport most of our long haul freight in trucks, eat apples flown in from Chile, under insulate our homes, heat / cool every room in our oversized dwellings, maintain our indoor climates at 74 in the winter and 68 in the summer and on and on and on.

Oil production won't stop. The tail to the right of the peak oil curve will be long and probably quite fat.

There is a lot of coal. Nasty stuff, lots of CO2 but it's there and we'll use it.

There is a lot of uranium. When push comes to shove, the supply of grades of uranium that can be mined & processed to yield a positive EROEI is vast. Breeder technology -- yeah probably.

Fusion --- well maybe.

In situ recovery of tar sands and oil shales -- another well maybe.

The sun shines, and solar cells will decrease in price over time.

The wind blows and wind power is economic now.

The sun shines and biomass [probably algea] will make economic sense and a reasonable multiple on energy invested.

I suspect that pricing will take care of most of the problem if people are not flim flammed into believing that more oil is going to be forth coming.

If the peak is now or even 10 years from now, CERA is the enemy. Politicians who believe in throttling energy production or push unsuitable "solutions" such as corn based ethanol, or price controls on energy are the enemy. Environmentalists who oppose construction of nuclear power plants or wind turbines because they are ugly or are threat to bird populations are the enemy.

I have rarely been noted for my optimism, but even if I am wrong and we are indeed doomed as a civilization, we lose little or nothing by trying.

RR: IMO, you are basically correct. America has a simple way of dealing with these supply issues, which is basically you take the bottom 25% of users of any product (in this case oil) and they are thrown to the curb (demand destruction as the mouthpieces call it). Bingo-problem delayed for a long long time (assuming you are not one of the bottom 25-30%). Remember, this is a country that will not even provide proper medical care for these people so IMO their oil usage is not a priority to TBTB.

RW & BT Both good posts. Believe together you have both outlined the dangers of ignorance and painted a most plausible outcome.

Agreed - plus the political ramifications are quite different. Blaming supply problems on Ay-rabs, Lib-ruls, Joos, and Tree-Huggers will be easier if above-ground excuses are what the media and political system concentrate on. Below ground causation would cut to the heart of the way we currently organize and run our society. Much easier to find internal enemies rather than focus on the entire society and, more importantly, its leadership elite.

I imagaine that in the degenerate, primitive English that will be spoken after the collapse of our current civilization, the word 'Lib-rul' will come to be associated more fully with demons and Satanism than it is currently in some of the darker parts of North America.

I "second" all of this:

#1) trigger-->holy crap-->resource grab

#2) staffers print-->CERA poo-->warning is lost