Peak Oil Update - February 2007: Production Forecasts and EIA Oil Production Numbers

Posted by Sam Foucher on February 26, 2007 - 11:30am

An update on the latest production numbers from the EIA along with graphs/charts of different oil production forecasts.

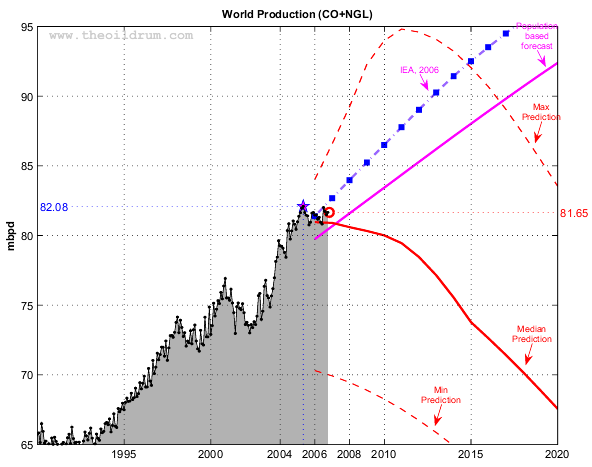

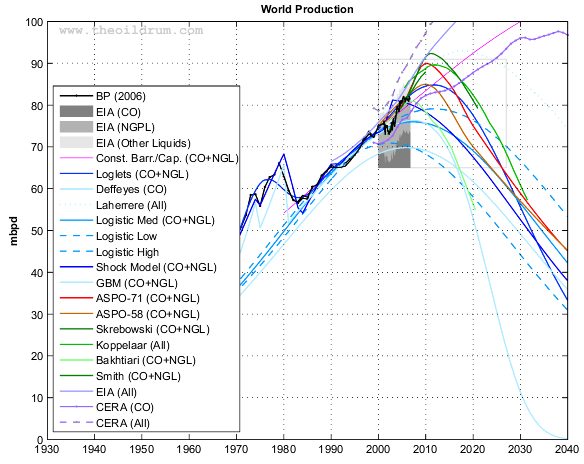

World oil production (EIA Monthly) for crude oil + NGL. The median forecast is calculated from 9 models that are predicting a peak before 2020 (Bakhiarti, Smith, Staniford, Loglets, Shock model, GBM, ASPO-[70,58,45]). Click to Enlarge.

Executive Summary:

- Monthly production records are unchanged:

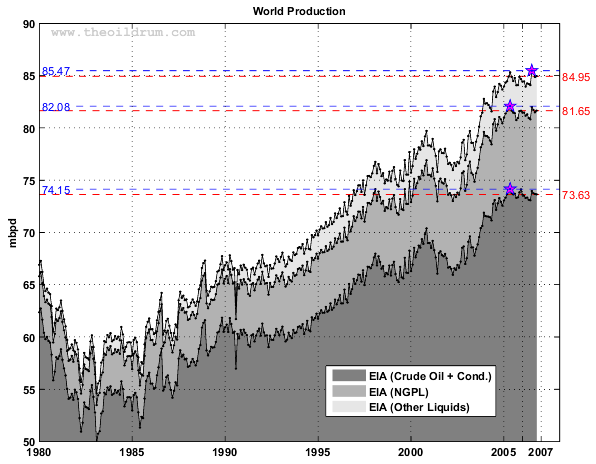

- All Liquids: the peak is still July 2006 at 85.47 mbpd, the year to date average production in 2006 (11 months) is 84.59 mbpd, up 0.01 mbpd from 2005.

- Crude Oil + NGL: the peak date remains May 2005 at 82.08 mbpd, the year to date average production for 2006 (11 months) is 81.40 mbpd, down 0.03 mbpd from 2005 (11 months).

- Crude Oil + Condensate: the peak date remains May 2005 at 74.15 mbpd, the year to date average production for 2006 (11 months) is 73.48 mbpd, down 0.09 mbpd from 2005 (11 months).

- NGPL: the peak date remains February 2005 at 8.05 mbpd, the year to date average production for 2006 (11 months) is 7.92 mbpd, up 0.06 mbpd from 2005 (11 months).

- No major revisions on the previous monthly estimates in this month release.

- Weak growth continues: November 2006 estimate for crude oil + condensate is 73.41 mbpd compared to 74.11 mbpd one year ago.

A French version is also available on TOD:Canada here

Notations:

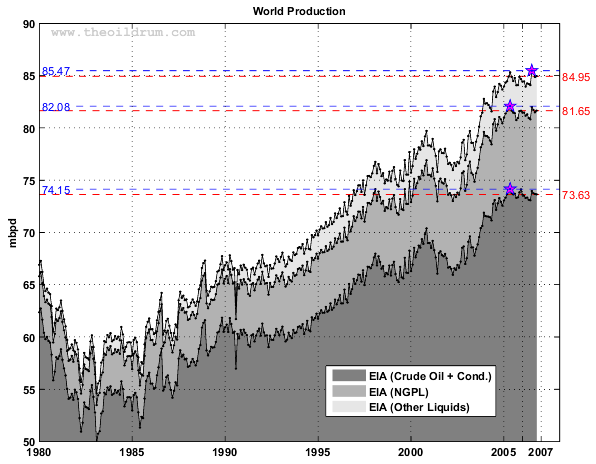

Fig 1.- World production (EIA data). Blue lines and pentagrams are indicating monthly maximum. Monthly data for CO from the EIA. Annual data for NGPL and Other Liquids from 1980 to 2001 have been upsampled to get monthly estimates. Click to Enlarge.

Table I - Production estimate

(in millions of barrels per day (mbpd)) for November 2006 taken from

the EIA website (International

Petroleum Monthly). 1Moving Average

on the last 12 months.

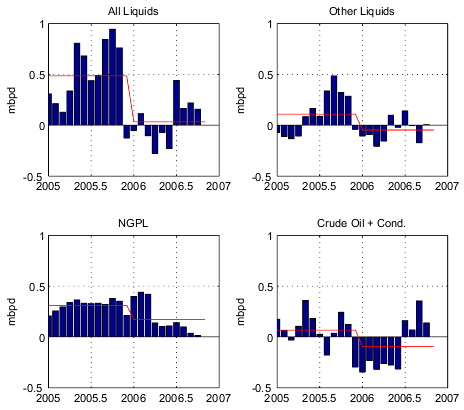

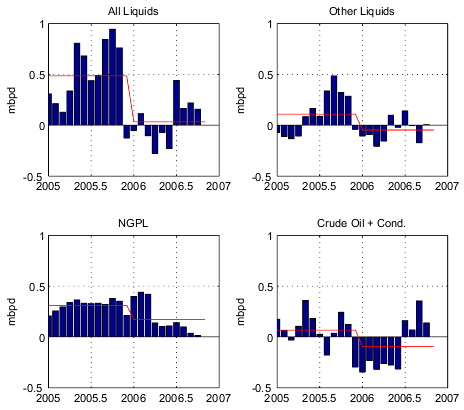

Fig 2.- Cumulative changes in production numbers since first estimates are issued for each month. The red line indicates the average revision for the entire year. Click to Enlarge.

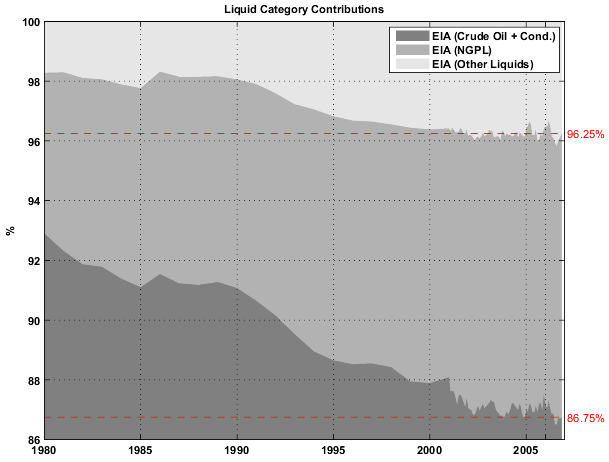

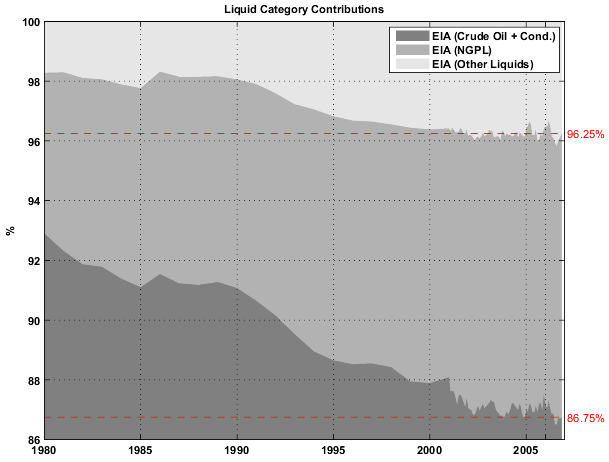

The share of CO is now only 86.75% of the total liquid production.

Fig 3.- Share of each liquid category to the total liquid production. Click to Enlarge.

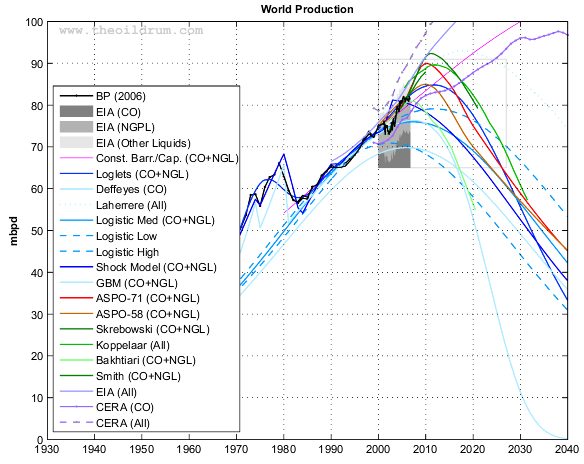

Fig 4.- World oil production (Crude oil + NGL) and various forecasts (1940-2050). The light gray box gives the particular area where the Figures below are zooming in. Click to Enlarge.

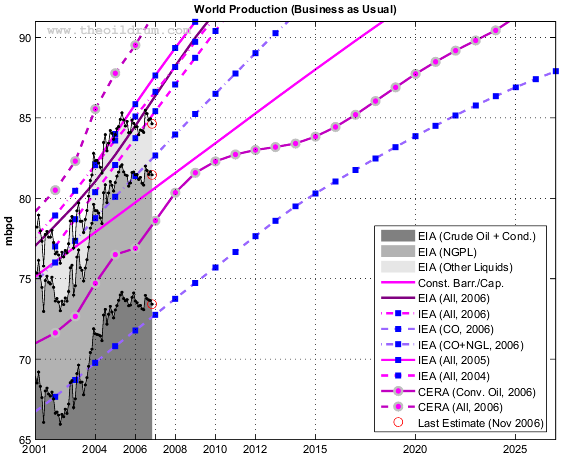

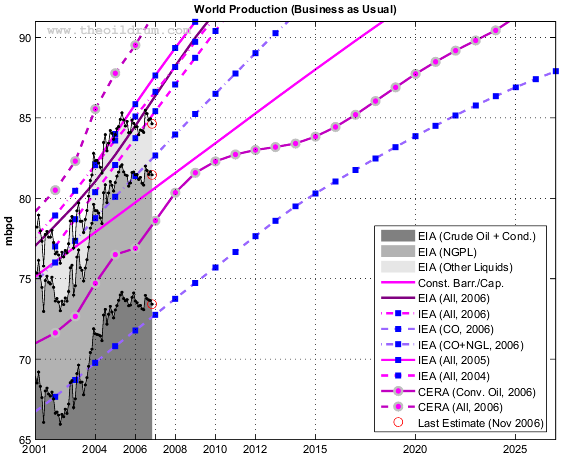

Fig 5.- Production forecasts assuming no visible peak. Click to Enlarge.

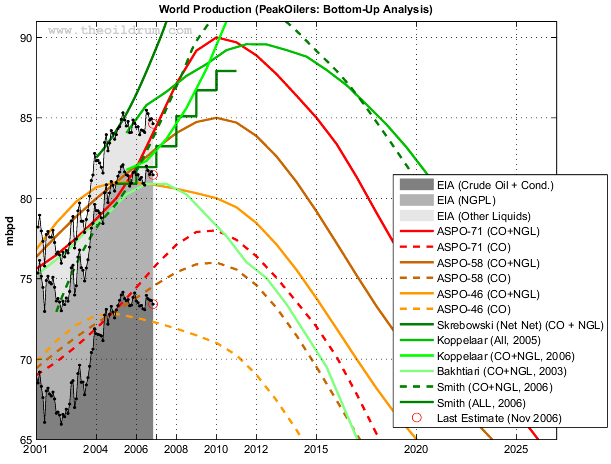

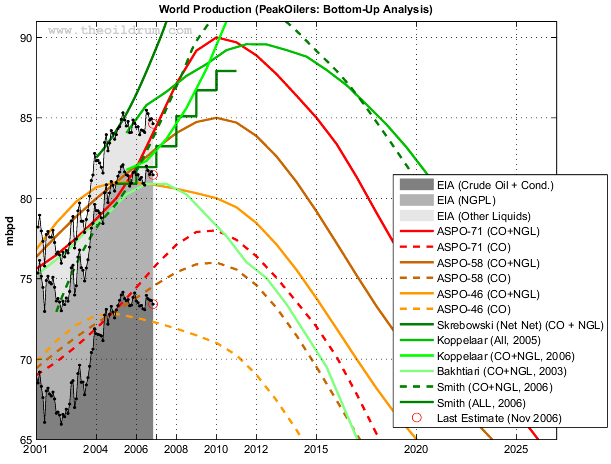

Fig 6.- Forecasts by PeakOilers based on bottom-up methodologies. Click to Enlarge.

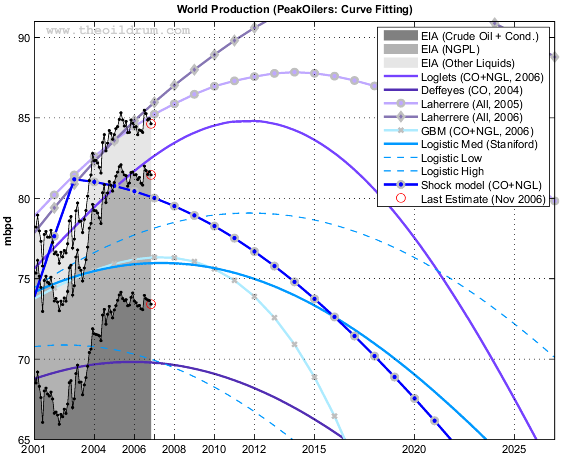

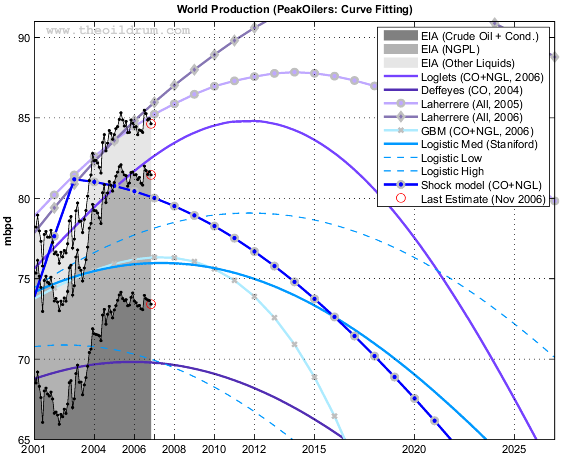

Fig 7.- Forecasts by PeakOilers using curve fitting methodologies. Click to Enlarge.

Fig 8.- Year-on-Year production growth. Click to Enlarge.

Table II. Summary of all the

forecasts (figures are in mbpd) as well as the last EIA estimates.1Productive

capacities.

December 2006

November 2006

October 2006

September 2006

- mbpd= Millions of barrels per day

- Gb= Billions of barrels (109)

- Tb= Trillions of barrels (1012)

- NGPL= Natural Gas Plant Liquids

- CO= Crude Oil + lease condensate

- NGL= Natural Gas Liquids (lease condensate + NGPL)

- URR= Ultimate Recoverable Resource

EIA Last Update (November)

Data sources for the production numbers:

- Production data from BP Statistical Review of World Energy 2006 (Crude oil + NGL).

- EIA data (monthly and annual productions up to November 2006) for crude oil and lease condensate (noted CO) on which I added the NGPL production (noted CO+NGL).

The All liquids peak is still July 2006 at 85.47 mbpd, the year to date average production value in 2006 (11 months) is down from 2005 for all the categories except for the total liquids which now equals 2005 production. The peak date for Crude Oil + Cond. is May 2005 at 74.15 mbpd (see Table I below).

Fig 1.- World production (EIA data). Blue lines and pentagrams are indicating monthly maximum. Monthly data for CO from the EIA. Annual data for NGPL and Other Liquids from 1980 to 2001 have been upsampled to get monthly estimates. Click to Enlarge.

| Category | Nov 2006 | Nov 2005 | 12 MA1 | 2006 (11 Months) | 2005 (11 Months) | Share | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|---|

| All Liquids | 84.62 | 84.66 | 84.60 | 84.59 | 84.58 | 100.00% | 2006-07 | 85.47 |

| Crude Oil + NGL | 81.45 | 81.63 | 81.42 | 81.40 | 81.43 | 96.25% | 2005-05 | 82.08 |

| Other Liquids | 3.17 | 3.02 | 3.18 | 3.19 | 3.15 | 3.75% | 2006-08 | 3.54 |

| NGPL | 8.04 | 7.52 | 7.88 | 7.92 | 7.86 | 9.50% | 2005-02 | 8.05 |

| Crude Oil + Condensate | 73.41 | 74.11 | 73.54 | 73.48 | 73.57 | 86.75% | 2005-05 | 74.15 |

Revision Pattern

The cumulative changes in production estimates are shown on Figure 2. The 2005 annual production for all liquids has been revised up by 0.5 mbpd since the first estimate has been issued. NGPL estimates increased by 0.25 mbpd in average. CO production has been revised down for the two first quarters of 2006.

Fig 2.- Cumulative changes in production numbers since first estimates are issued for each month. The red line indicates the average revision for the entire year. Click to Enlarge.

The share of CO is now only 86.75% of the total liquid production.

Fig 3.- Share of each liquid category to the total liquid production. Click to Enlarge.

Fig 4.- World oil production (Crude oil + NGL) and various forecasts (1940-2050). The light gray box gives the particular area where the Figures below are zooming in. Click to Enlarge.

Business as Usual

- EIA's International Energy Outlook 2006, reference case (Table E4, World Oil Production by Region and Country, Reference Case).

- IEA total liquid demand forecast for 2006 and 2007 (Table1.xls).

- IEA World Energy Outlook 2006 : forecasts for All liquids, CO+NGL and Crude Oil (Table 3.2, p. 94).

- IEA World Energy Outlook 2005 : forecast for All liquids (Table 3.5).

- IEA World Energy Outlook 2004 : forecast for All liquids (Table 2.4).

- A simple demographic model based on the observation that the oil produced per capita has been roughly constant for the last 26 years around 4.4496 barrels/capita/year (Crude Oil + NGL). The world population forecast employed is the UN 2004 Revision Population Database (medium variant).

- CERA forecasts for conventional oil (Crude Oil + Condensate?) and all liquids, believed to be productive capacities (i.e. actual production + spare capacity). The numbers have been derived from Figure 1 in Dave's response to CERA.

Fig 5.- Production forecasts assuming no visible peak. Click to Enlarge.

PeakOilers: Bottom-Up Analysis

- Chris Skrebowski's megaprojects database (see discussion here).

- The ASPO forecast from the last newsletter (#71): I took the production numbers for 2000, 2005, 2010, 2015 and 2050 and then interpolated the data (spline) for the missing years. I added the previous forecast issued one year and two years ago (newsletter #58 and #46 respectively). There was no revision since August 2006.

- Rembrandt H. E. M. Koppelaar (Oil Supply Analysis 2006 - 2007): "Between 2006 and 2010 nearly 25 mbpd of new production is expected to come on-stream leading to a production (all liquids) level of 93-94 mbpd (91 mbpd for CO+NGL) in 2010 with the incorporation of a decline rate of 4% over present day production".

- Koppelaar Oil Production Outlook 2005-2040 - Foundation Peak Oil Netherlands (November 2005 Edition).

- The WOCAP model from Samsam Bakhtiari (2003). The forecast is for crude oil plus NGL.

- Forecast by Michael Smith (Energy Institute) for CO+NGL, the data have been taken from this chart in this presentation (pdf).

Fig 6.- Forecasts by PeakOilers based on bottom-up methodologies. Click to Enlarge.

PeakOilers: Curve Fitting

The following results are based on a linear or non-linear fit of a parametric curve (most often a Logistic curve) directly on the observed production profile:- Professor Kenneth S. Deffeyes forecast (Beyond Oil: The View From Hubbert's Peak): Logistic curve fit applied on crude oil only (plus condensate) with URR= 2013 Gb and peak date around November 24th, 2005.

- Jean Lahèrrere (2005): Peak oil and other peaks, presentation to the CERN meeting, 2005.

- Jean Lahèrrere (2006): When will oil production decline significantly? European Geosciences Union, Vienna, 2006.

- Logistic curves derived from the application of Hubbert Linearization technique by Stuart Staniford (see this post for details).

- Results of the Loglet analysis.

- The Generalized Bass Model (GBM) proposed by Prof. Renato Guseo, I used his most recent paper (GUSEO, R. et al. (2006). World Oil Depletion Models: Price Effects Compared with Strategic or Technological Interventions ; Technological Forecasting and Social Change, (in press).). The GBM is a beautiful model that has been applied in finance and marketing science (see here for some background). The estimation in Guseo's article was based on BP data from 2004 (CO+NGL).

- The so-called shock model proposed by TOD's poster WebHubbleTelescope . You can find a description of his approach on his blog here. The current estimate was done in 2005 based on BP's data.

Fig 7.- Forecasts by PeakOilers using curve fitting methodologies. Click to Enlarge.

Production Growth

The chart below gives the year-on-year production growth (or decline) for each month. Growth has been weak (below 1%) most of the year but went back in positive territory since last July.

Fig 8.- Year-on-Year production growth. Click to Enlarge.

| Forecast | 2005 | 2006 | 2007 | 2010 | 2015 | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|

| All Liquids | |||||||

| Observed (EIA) | 84.56 | 84.59 | NA | NA | NA | 2006-07 | 85.47 |

| Koppelaar (2005) | 84.06 | 85.78 | 86.61 | 89.21 | 87.98 | >2011 | >89.58 |

| EIA (IEO, 2006) | 82.70 | 84.50 | 86.37 | 91.60 | 98.30 | >2030 | >118.00 |

| IEA (WEO, 2006) | 83.60 | 85.10 | 86.62 | 91.30 | 99.30 | >2030 | >116.30 |

| IEA (WEO, 2005) | 84.00 | 85.85 | 87.64 | 92.50 | 99.11 | >2030 | >115.40 |

| IEA (WEO, 2004) | 82.06 | 83.74 | 85.41 | 90.40 | 98.69 | >2030 | >121.30 |

| CERA1 (2006) | 87.77 | 89.52 | 91.62 | 97.24 | 104.54 | >2035 | >130.00 |

| Lahèrrere (2006) | 83.59 | 84.82 | 85.96 | 88.93 | 92.27 | 2018 | 92.99 |

| Lahèrrere (2005) | 83.59 | 84.47 | 85.23 | 86.96 | 87.77 | 2014 | 87.84 |

| Smith (2006) | 85.19 | 87.77 | 90.88 | 98.94 | 98.56 | 2012-05 | 99.83 |

| Crude Oil + NGL | |||||||

| Observed (EIA) | 81.45 | 81.40 | NA | NA | NA | 2005-05 | 82.08 |

| IEA (WEO, 2006) | 80.10 | 81.38 | 82.67 | 86.50 | 92.50 | >2030 | >104.90 |

| ASPO-71 | 80.00 | 81.90 | 84.48 | 90.00 | 85.00 | 2010 | 90.00 |

| ASPO-58 | 81.00 | 82.03 | 83.10 | 85.00 | 79.18 | 2010 | 85.00 |

| ASPO-45 | 81.00 | 80.95 | 80.80 | 80.00 | 73.77 | 2005 | 81.00 |

| Koppelaar (2006) | 81.76 | 82.31 | 83.68 | 91.00 | NA | >2010 | >91.00 |

| Bakhtiari (2003) | 80.24 | 80.89 | 80.89 | 77.64 | 69.51 | 2006 | 80.89 |

| Skrebowski (2006) | 80.90 | 81.42 | 82.59 | 87.32 | NA | >2010 | >87.92 |

| Smith (2006) | 80.53 | 82.81 | 85.45 | 91.95 | 88.60 | 2011-02 | 92.31 |

| Staniford (High) | 77.45 | 77.92 | 78.31 | 79.01 | 78.51 | 2011-10 | 79.08 |

| Staniford (Med) | 75.81 | 75.94 | 75.97 | 75.52 | 73.00 | 2007-05 | 75.98 |

| Staniford (Low) | 70.46 | 70.13 | 69.71 | 67.92 | 63.40 | 2002-07 | 70.88 |

| Loglets | 81.12 | 82.14 | 83.02 | 84.65 | 83.26 | 2012-01 | 84.80 |

| GBM (2003) | 76.06 | 76.27 | 76.33 | 75.30 | 67.79 | 2007-05 | 76.34 |

| Shock Model (2006) | 80.76 | 80.43 | 80.01 | 78.27 | 73.74 | 2003 | 81.17 |

| Constant barrels/capita | 78.81 | 79.73 | 80.66 | 83.42 | 88.01 | 2050 | 110.64 |

| Crude Oil + Lease Condensate | |||||||

| Observed (EIA) | 73.65 | 73.48 | NA | NA | NA | 2005-05 | 74.15 |

| IEA (WEO, 2006) | 70.80 | 71.78 | 72.77 | 75.70 | 80.30 | >2030 | >89.10 |

| CERA1 (2006) | 76.49 | 76.89 | 78.60 | 82.29 | 83.83 | 2038 | 97.58 |

| ASPO-71 | 73.10 | 74.45 | 75.87 | 78.00 | 72.00 | 2010 | 78.00 |

| ASPO-58 | 73.00 | 73.80 | 74.65 | 76.00 | 69.50 | 2010 | 76.00 |

| ASPO-58 | 72.80 | 72.56 | 72.25 | 71.00 | 63.55 | 2005 | 72.80 |

| Deffeyes (2004) | 69.81 | 69.81 | 69.71 | 68.90 | 65.88 | 2005-12 | 69.82 |

Next update in March.

Previous Update:

January 2007December 2006

November 2006

October 2006

September 2006

Khebab@theoildrum.com

Folks, also consider this a reminder to positively rate these articles (using the icons under the tags in the story title) at reddit, digg, and del.icio.us if you are so inclined. Also, don't forget to submit them to your favorite link farms, such as metafilter, stumbleupon, slashdot, fark, boingboing, furl, or any of the others.

These posts are a lot of work, and the authors appreciate your helping them get more readers for their work however you can.

Khebab has some of the best charts of this stuff on the internet, let's make sure people see them.

Placing 13 different curves on one chart makes it as incomprehensible as a plate of spaghetti. I can't tell which lines are from those who support peak oil theory and those who deny peak oil.

Well, I think the title of the different sections are quite explicit: "Business as usual" and "PeakOilers:...".

Khebab, I love your first graph; thank you. Also your graph with 3 bands showing C+C, NGL and other. But any chart with more than 5 lines on it does my head in, so I skipped over all the other graphs. I consider myself a numerate mechanical engineer but I cannot cope with data overload. Maybe it's a function of my age? (48)

I always enjoy these updates, even though I doubt the monthly numbers are that meaningful (and they'll probably be revised, anyway).

But I suspect the "spaghetti" graphs are of interest to peak oil geeks only. Ordinary peakists won't understand them, and ordinary people - forget it. They aren't going to know the difference between curve-fitting and bottom-up, let alone care about Bakhtiari vs. ASPO vs. Deffeyes.

I greatly appreciate having all the different estimates on the same axes.

Thanks Khebab for yet another fine post :-)

Posts like this is why I browse TOD everyday.

I dont mind the detailed graphs.

They give a nice "at a glance image" of the situation. The graphs can always be simplified to suit communication outside TOD.

Regards/ And1

Thomas, it seems to me that this is one of the points of Khebab's charts that gets lost sometimes: just how much uncertainty/variation there is out there with regard to the credible predictions of the future petroleum/liquids supply. It indicates a lack of scientific knowledge and predictive power, something you really would think we would have a lot more of regarding our energy future...that's what always strikes me anyway.

Yes, that has always struck me too. However there is a fundamental disconnect between "professionals" ie UGS and CERA and "amateurs" essentially Peak Oilers.

I'm normally much more likely to take professionals advice over an amateur, but the maths of resource depletion are relatively simple and the fact is that world oil production in 2006 has not been greater than 2005 despite a massive increase in price.

In any case dealing with global warming will be much easier if we really can't increase the rate of oil and gas without a massive price increase.

I think world governments should plan on making kebahb's loglets prediction come true with price signals even if resources are plentiful.

Finally, thanks Khebab! I love these updates with all the preductions.

I have one feature request. Could you include past predictions from 2004 and 2005 somehow? Especially for CERA and EIA.

Unfortunately as gas and oil production decline we will have coal burning on a massive scale. So we are not going to get out of the CO2 crisis so easily. A good thing that will come out of the liquid fuel constriction is that current fossil fuel guzzling cars and SUVs will disappear (ethanol will not save them). People will be forced to use electric vehicles that are powered from the grid. Aside from that they will have to use public transit.

Actually it is not necessary to increase coal burning on a massive scale to solve transportation if people move to electic. The electric route is 5 - 10 times more efficient than ICE's. Replacing the US's fleet of auto's with electric, increases electricity demand by about 20%.

That said, it is quite possible to replace current coal fired power stations with Nuclear Plants as well. Other people have other opinions about Nuclear, but it works now and is likely to be significantly cheaper in the future.

My biggest problem with nuclear energy is not nuclear but powe r companies that engineer nuclear power plants.

I've seen a number of reasonable designs for power plants with the pebble bed based reactors seeming the most promising.

Next I think its possible to handle radioactive waste in a responsible manner. I'd think "burning" it makes sense

http://arxiv.org/pdf/physics/0401010

Basically you use the neutron flux to further degrade the isotopes to ones with short half lives. This seems possible and I don't like the fact that what seems to be a reasonable disposal route has not been aggressively perused.

Maybe forming a international consortium to create standard safe reactor designs and disposal methods is the right answer.

On the same hand and aggressive well funded program on fusion is a must. We should be spending a significant amount of the worlds GNP or is it GWP ? On fusion and cleaner fission and radioactive waste processing.

I'm not saying that the nuclear industry has not done better lately but they need to go into overdrive and show people that clean safe nuclear power is possible and the operation and design of the reactors is open and well understood.

I think that nuclear fission and later fusion reactors for base load and industrial use are a must. I wish we could get by without them but we need them.

On the same hand conservation and solar/wind renewable that don't have a massive negative impact on the land should be perused to lessen the need for nuclear power of any kind.

Other solutions like run-of-river hydro also look like that have a reasonable minimal impact while traditional dams have problems.

I wonder whether these words were spoken about oil about 120 years ago. If so, they would've been true, of course.

But why should we use the event of the end of a non-renewable source at the basis of the global economy to restructure that economy to be based on another non-renewable resource? Only to be faced with the exact same problem again one or two centuries later? Aren't we smarter than that? Aren't we supposed to learn from our mistakes?

--

Sven Geier, Ph. D.

Yes, I speak for the White House, the CIA, the Pentagon, the Bilderberg Group and the Illuminati; Nasa, MI-5, and the Trilateral Commission. Really. Trust me.

The Nuclear fuel supply is huge and will almost certainly last for many centuries.

http://www.theoildrum.com/story/2006/8/7/195721/3132#more

From the link:

there are doubts this diffuse fuel can be constrained and delivered at a cost in energy less than the final product contained. Though this mental externality may be considered mundane (by some), it is a necessary consideration when considering such a primary fuel.

How can we run a complex society on a fuel that does not leak itself out for mom and the kid's shopping Excursion (tm)?

Pete

That is a nice and informative link there - it doesn't seem to support your claim, though.

According to the material at the other side of that link, using his own most optimistic numbers, the author states "Thus, the provable uranium resources amount to approximately 85 years supply at the current level of consumption with current technology, with another 500 years of additional reserves."

Nuclear currently supplies about 16% of the world electricity production, 0% of the worlds non-electric heating and 0% of the world transportation fuels, so if I were to increase the world consumption level of Uranium by, say, a factor of 10 or so to cover for the current use of oil, I get the most optimistic estimate by a proponent of nuclear power reduced to about 50 years of "estimated" reserves (and less than a decade of actually proven supply).

And that's the optimistic reading where I'm simply granting the numbers given by the author, i.e. without even examining the assumptions those were based on.

I can only see one way to read that article and conclude that the worlds nuclear fuel supply will "almost certainly last for many centuries": if I were to assume that current consumption levels will not increase, i.e. that nuclear power will NOT replace oil.

--

Sven Geier, Ph. D.

Yes, I speak for the White House, the CIA, the Pentagon, the Bilderberg Group and the Illuminati; Nasa, MI-5, and the Trilateral Commission. Really. Trust me.

There is also a lot of "noise" and variability in historical oil production.

I'd be interested in thoughts on why oil production declined for a year or so around 1998, then again why it declined in the year 2000 or so for a couple of years (recession? 9/11? Iraq war?).

I'm convinced that we have serious problems with oil, after looking at the data, inaccurate government forecasts, continuing dependency on exports, etc. But it's been mentioned already by others -- shouldn't we expect similar declines (based on recession, etc.) that may appear to be due to peak oil but actually not? That is, might not it go up and down for a while based on geopolitical conditions? I understand the long-term trend of course will be down at some point, but these graphs (especially historical) point to the confusion that we may experience as things unfold over the years.

Hi Smokey.

Yes, there is a lot of noise.

I got actively interested in "Peak oil" almost exactly after the Iraq War II. What I noticed was that prices were rising/stable AND production was increasing, EVEN THOUGH the political situation was "stable". This led me (being so market lead that I am) to look for what was going on. "Peaking" oil led me to the conclusion that we will never see $20 oil again.

So far (ok, forget the light corrections since the summer 2006 highs) the markets have proved my analysis correct.

So...

If you want to know if Peak is behind us or not, look at:

Production numbers, price dynamic AND the HL graphs being presented here. As a market follower, it has all come together incredibly well, n'est-ce pas?

And, of course, the number of rigs out there trying to scrape out the dregs...

And, that the world's giant fields are starting to blow steam.

And the fact that even if I went back to Pappy's Oil Patch to try my luck, even $60 oil is not enough to cover my costs. Well, ok, the patch is in Ohio..

Should I go on?

Cheers, Dom

Khebab's work doubles as beautiful art.

Note: I have deleted the update on Saudi Production because this post was getting a little bit too long. I'm working on another post that will track specifically production from a few important countries (Saudi Arabia, Russia, Mexico, etc.).

It's one thing to say that a given curve is a good fit to exsisting data, and another to say that it has predicitve power. It's been my experiance that this is very much the case when fitting to a noisy data set and looking to predict an inflection point in the near future.

What would be really interesting (at least to me) would be to take the various models that are shown here, feed them the data from time "0" (i.e. start of the data set) up to 1985, then project them forward to see what they "predict" for the period from 1985 to 2005. A metric could be calculated comparing "predicted" to "actual" production.

This it seems to me is a first step in determining the extent, if any, to which any of these models can tell us much about what might happen in the period say from 2005 to 2025 which seems to be the period of interest.

I assume that these models are implemented as spreadsheets somewhere? but I have not found a post here providing a link to them i.e. to the raw data set and calculations, just the graphs that they output.

Would it be possible to actually gain access to the models and dataset? or are they considered "propritary" or something?

It's possible only on some of them which are parametric models (essentially the curve fitting approach) but I don't see how you can apply this approach on Bottom-Up forecasts.

Some of them are available on EditGrid:

http://www.editgrid.com/user/graphoilogy/Oil_Production

The spreadsheet is not completely up to date.

What I find there is the output of a few models, which is o.k. as far as it goes, but not the equations used to generate it i.e. all the cells in the sheet seem to contain numeric constants, not the equations/macros used generate the fit (unless I'm looking in the wrong place).

If you could explain the methodology used to produce the "Bottom-Up forecasts" based curves I'll try to be more clear about those.

For the simplest curve-fitting models (e.g. logistic models), the numerical results were produced using Matlab and then copy-paste in a spreadsheet.

I wish I could explain it! I have simply used the forecast profiles as published by the authors (see various html links). Most bottom-up forecasts cannot be replicated because they require large databases and includes a lot of different variables that are most often not in the public domain (e.g. IHS database).

I have simply used the forecast profiles as published by the authors (see various html links). Most bottom-up forecasts cannot be replicated because they require large databases and includes a lot of different variables that are most often not in the public domain (e.g. IHS database).

O.K., first let me say that I don't want this to be read as negative against you Khebab; It's interesting up to a point to look at these charts you post. But it would be wonderful if at some point this site could become a place where this info. was presented closer to the standards found in scientific research. I.E. to a level of detail that would allow readers who were so inclined to replicate the results starting from the raw data, and by extension to work on incremental improvements to the models.

If the constraints on this include lack of disk space on your server to hold raw data let me know, I probably have some spare megabytes of on-line room for such a task... There are also now free and open cross platform tools, like openoffice "calc" and "math" which could form a good basis for coding the routines I think.

Absent this it's really difficult for me to see how the question of who's squggle to "belive" is much more than a matter of how it conforms with my prehaps mis-informed predjudices on the question.

I don't think the issue is server space. As Khebab said, many of the "bottom up" estimates use private databases. The kind you pay thousands of dollars to access. We couldn't just put that data up for anyone to download, even if we had access to it. It would be illegal, and we'd get our butts sued.

John,

Khebab has left the references, if you want the scientific articles go there. The TODmade Logistic and Loglets models are well documented in their respective posts.

TOD is not intended to be a scientific research forum, although articles in that format are also welcome. Still the information you find here at TOD is enough for you to replicate the results presented, especially those concerning the curve fitting techniques.

I'm afraid this may be one of those questions that likely waste time and energy, but...

Would there be any way, or point, to converting these 'oil' production numbers into terms of energy in graph form?

In the graph,

Fig 3.- Share of each liquid category to the total liquid production,

I see that the share of natural gas increases and the crude oil drops but I don't know how this relates to the energy produced as a whole.

My thinking is pretty crude and is at the level of considering the economy as a whole undifferentiated machine and looking at 'oil', in total, as a single fuel to run that machine and looking for Peak Energy (these different components of that fuel having differing energy values?)

Thanks for all the work/energy you and the rest are putting into this site.

Black Bald

re: Would there be any way, or point, to converting these 'oil' production numbers into terms of energy in graph form?

It's possible using various conversion factors. Volumetric quantities can be misleading as one barrel of NGPL or ethanol contains only 64% of the BTU content of one barrel of crude.

It would be interesting (and probably a lot of work) to add a new line to the graph showing total BTU levels in addition to C+C, NGPL, and other.

While this is of course correct, it strikes me as somewhat misleading itself - ethanol is much higher up in the energy food chain: it can be used directly to generate, say, electricity. Crude Oil is close to worthless until it has been separated/refined/processed and all those steps consume energy (i.e. some of these BTU).

By the time you have turned 1 barrel of crude oil into (?? some smaller volume that I do not know) of, say, gasoline that can replace the ethanol, you've already consumed (?? another number that I don't know) percent of its total energy content. Which is itself again a misleading statement as you'd only need ~diesel-class fuel oil to generate electricity. If you want to run an internal combustion engine, you have to process it somewhat further, losing some more of that theoretical energy content.

Meanwhile, all that processing generates all kinds of petrochamical byproducts, some of which are valuable in a non-energy sense (industrial chemicals, plastics etc) and some others require costly cleanup (costly both in dollars and in energy again).

By the time you've really accounted for the actual number of BTU that makes into your gas tank, the barrel of ethanol may seel like a good deal. Or like a lousy deal. I find it hard to discern this kind of thing.

(Meanwhile even a perfectly liquid international market will impose (energy-)costs on the barrel of oil that has to be carted around the world vs. the barrel of ethanol that can be produced at home. The whole thing is really a big, messy hairball of mutually restricting statements...)

For the case of Hubbert linearization, you aren't trying to curve fit to an inflection. You are using historical production data (plotting production rates vs total cumulative production) and fit this data to a straight line.

Once you have the slope and intercept for the curve, you can then convert into a more familiar production-vs-time graph which will show the inflection.

Someone actually did that here some months ago...

http://static.flickr.com/43/108482206_8769d44c1c_o.png

In the captioned graph, Khebab took the Lower 48 C+C data through 1970 and generated a predicted production profile (in red). He specifically used the data points in green (1942 to 1970) to construct the model.

The post-1970 cumulative Lower 48 production (which is the post-50% of Qt production), through 2004, was 99% of what the HL model predicted it would be.

Based on Deffeyes' plot, the world is now where the Lower 48 was at in the early Seventies. The post-peak accuracy of the Lower 48 HL model has obvious implications for the world.

Edit: The same exercise for Russia showed that the post-50% cumulative production, through 2004, was 95% of what the HL model predicted.

Edit#2: Deffeyes puts the remaining recoverable conventional C+C reserves at about 970 Gb. A key question is what percentage of this will be exported.

I think using different regions and times instead of just different times would be a good validation method.

Algoritm for validation of prediction:

1. Use an error metric for a example sum of squared errors and divide it by length of data - one.

2. Take a region that is known to had peaked and early data.

3. Do a prediction.

4. Calculate the error of early data.

5. Calculate the error of all available data.

4. Compare the two different error for example by dividing them.

5. Do this for as many regions as possible and calculate the varians of the comparison.

If the varians is small we have good model! and we also know a little bit of how good the prediction is!!! Go ahead and use it for the world.

I'm working on it!

Fascinating though these monthly updates are (and a considerable and

valued effort by all involved), the data is inevitably too noisy to pick out short term trends leading to the geological peak. It will inevitably be masked by seasonal demand variation, geopolitical interventions, and supply logistics. However, as every month passes of essentially static output, the assertion that we have hit the 'bumpy plateau' must become stronger. As each new delay is announced in a major oil development, Skrebowski's latest

analysis looks increasingly over optimistic. We will not see a single data

point on these graphs that says 'this is it!'. However, if Westtexas is right, by

late summer we may see flat or falling production, and sky high prices once more, perhaps pushing the US economy over the edge into undisputed recession. That will be a signal hard to refute.

Alternatively, geopolitics may trump the play with an attack on Iran...

"by late summer we may see flat or falling production, and sky high prices once more, perhaps pushing the US economy over the edge into undisputed recession. That will be a signal hard to refute."

Yes, and to take it one step further:

If the US and world are into undisputed recession and yet oil prices fail to fall as they typically do in a recession, that will be a convincing argument that we are at peak. This would suggest the economy is contracting in lock-step with a decline in oil production.

"by late summer we may see flat or falling production, and sky high prices once more, perhaps pushing the US economy over the edge into undisputed recession. That will be a signal hard to refute."

I would only issue my normal caution: Remember 1979.

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

Merci, Khebab.

We've seen it before, but it always strikes me as interesting that the only projections which forecast a somewhat constant barrels of liquid fuel per capita into the future are from the usual suspects, and these evidently are anticipating a great deal of ethanol, bio-diesel, CTL and whatever. It seems like a great deal of wishful thinking.

Thanks once again Khebab.

Some thoughts:

. Right now the Bottom-Up models closer to the real thing are Bakhtiari’s and Campbell’s 2004;

. Chris Skebrowski’s “mega projects” is starting to look optimistic (and so Rembrandt’s);

. Of the curve fitting models the Oil Shock and the Loglets are the closest to the real thing, and they seem to be delimiting the space where the data has been evolving;

. Growth in Liquids production seems to come solely from NGPL, which is subject to the Natural Gas cycle (peak circa 2030).

This is starting to look a lot like a Bumpy Plateau. If we go into recession this year we can definitely call it that, and forget about the prominent peak in 2012.

P.S.: Khebab check Fig.2.

Luis,

As you know, flat production almost certainly equals declining net oil exports, because of rising domestic consumption in the exporting countries, but the problem is that the top exporters are much more depleted than the world is overall.

Even some regions such as Russia, which reported a year over year increase in production from 2005 to 2006, reported about a 2.4% decline in oil exports.

That’s right. Where you and I live it will feel just like a Peak … probably in 2005.

Google Search for: Net Oil Exports

Luis,

As of this afternoon, our two net oil export articles have bumped the EIA out of the #1 and #2 spots.

Our two articles are #1 and #2, out of about two million listings.

Oh, my....

Someone is paying attention. . .

amen...that's awesome guys.

I Googled it and got Jeffrey in spots 1 and 2 (Energy Bulletin) and my TOD UK oil export import model in slot 10 - no sign of Luis.

Luis is #2--(Assessment of . . )

It's offset to the right. I suppose because it's the second listing for the EB.

Jeffrey - I think you'll find that Google gives different results depending where you Google from - they're too clever by half.

Too bad none of this matters.

Hi b,

Could you expand on this?

Leanan,

I'll give you something to say "my" about. For the past three years petrol has been frozen at US$0.09 cents per litre in Iran and the word is rationing by the end of April

When oil prices are increasing faster than the rate of inflation, the size of the basket of goods that an exporting nation gives up when it chooses to increase consumption will go up, which could make increased consumption of oil an illogical choice. Projecting a linear increase in consumption by exporters may not make sense in a world where prices are wildly fluctuating. In Mexico, for example, your model would imply that the government will always choose reasonably priced gas over the subsidized tortillas financed by PEMEX profits.

westexas said,

"... flat production almost certainly equals declining net oil exports, because of rising domestic consumption in the exporting countries, but the problem is that the top exporters are much more depleted than the world is overall."

That is certainly the case in one of the world's biggest markets, Europe, i.e., with the North Sea decline. I think that few people realize the magnitude of the effect when you throw a whole continent and especially one of the worlds richest ones, back into the world competition for oil and more importantly, natural gas. Russia is now working between three major cliients....Europe, Asia, and it's own domestic consumption. For political reasons, one has to asume they will take care of the home front first....and see whom it is of most advantage to give good deals next....Europe or Asia? Do you notice any prominent names missing.....ahhh, that's right, the U.S., not exactly on Putin's fav' list right now anyway....

In the Persian Gulf, the situation seems to me to be much more muddled....the Saudi's and the U.S. are now married to a great extent whether we like it our not....but Saudi domestic consumption is still climbing (per Simmons and most others), and all the more so on natural gas....this posing an interesting problem indeed.....with Qatar right there on the doorstep, and building petrochemical facilities like mad to convert natural gas to finished product like plastics and fertilizer as well as GTL, plus with a set of close customers in the Gulf with them......explain to me again the advantage of chilling nat gas to be shipped halfway around the world to be thawed?

The natural gas issue is rapidly becoming the canary in the mine, and if we assume that your "export land" model is correct Westexas (which I essentially do) for crude oil, we have to assume it is even more so for the less fungible and harder to transport natural gas...

CERA may talk in glowing terms about "the internationalization of the gas market", but to me it looks like a trainwreck in the making.

(damm, I sounded almost doomerish for a second there.....:-?

Roger Conner Jr.

Remember we are only one cubic mile from freedom

Curiously, the last ASPO estimate seems to be over-optimistic (#70). I think that Rembrandt, Skebrowski and Smith are giving in fact production capacities (i.e. the maximum we can produce at a given time).

Also, I was surprised that the median of the 9 forecasts appears to be quite reasonable so far despite a large uncertainty interval.

Here is the link for Figure 2 (full resolution):

http://www.theoildrum.com/files/PU200702_Rev_0.png

Quick question, Khebab... Why didnt you include Laherere's prediction in the median? He has peak before 2020, yes?

You're right, I have included only his last forecasts for All Liquids. I'll try to include his forecasts for CO+NGL next time.

My first thought on seeing this was "we are on plateau, how long can we stay on it?". It's getting ever-more difficult to see where what has been called a "wall of oil" to boost total liquids close to 90 Mb/day, is going to come from. Looking at Luis's points above, I would definitely agree with the first two. I think the critical point will come when prices rise above $70-75 - then we will see if OPEC can raise production and if their current cuts are really voluntary. If not, I don't think any excuse from them or anyone else will wash for long, and there will shortly after be real panic.

On BBC radio 4 (UK; don't know mane of programme) this afternoon there were some share experts who suggested a considerable share and real estate "adjustment" was likely later this year. It could be a very big "adjustment"!

Re: I think the critical point will come when prices rise above $70-75 - then we will see if OPEC can raise production and if their current cuts are really voluntary.

I agree, for now the argument is that there is not enough demand at the current price. If demand increases, price should go up and OPEC production should go back up again.

that's how I am thinking about it..it's the next step in the roadmap to me as well...provided we don't see too much demand destruction over the rest of this year.

Prof. G, I am inclined to disagree here. It is my opinion that the $60+ range by itself is causing demand destruction that will be sufficient to allow the major importers to continue at about current levels of imports (slowly declining) for another few years.

I suspect that the initial upward shock to the $60 range immediately drove out the poorest nations from the world oil market. But the current $60 price is going to drive other poor nations out as well. I am guessing that these nations are cumulatively spending their current savings to obtain enough oil to keep operating in the vain hope that these prices are truly temporary. But what if prices simply remain around $60 per barrel for another few years? By that time this next tier of poor nations will have exhausted their savings and even gone into debt (watch for IMF interventions!!!) and thus leave more of the remaining oil available for the OECD nations plus China and India.

I have mentioned this before but I do not see a compelling reason yet for oil prices to spike upwards as long as we are in this "bumpy plateau". Instead the current price regime will slowly strangle out various players in the market by draining their remaining savings until it also begins to strangle one of the bigger players, at which point I would expect direct military intervention by another of the bigger players. And no, Iraq does not qualify here in my mind. Iraq appears to have been a preemptive strike aimed at securing oil supplies before things got worse.

Things I am watching for include:

The above cues come on top of watching oil exporters struggle to maintain their revenue streams (which are needed to maintain their welfare states) versus rising domestic consumption. Jeffrey posits that they will always try to satisfy domestic consumption first but I am not so sure. KSA, without its revenue stream, cannot keep the House of Saud in power without the use of extreme police state tactics. Some producers may split the declining production pool between exports, to maintain revenue, and domestic consumption. As another poster notes, Iran may be about to do the same thing if they go to rationing (at their locked $0.09 per gallon price). For some regimes it may be better to use a heavy hand at home and export remaining oil for revenue than to allow consumption at home but a collapsing welfare state due to reduced revenue.

Saudi Arabia is the only question. I don't think many question what other OPEC nations can do. They have cut so little that it would not make much difference if they ramp back up to pre November levels. The question, the only question, is Saudi Arabia.

Will they be able to ramp back up. I will wager that they will never produce 9 million barrels per day again.

Ron Patterson

Everyone has to remember that we are looking at demand here - that is an absolute. Only when demand exceeds capacity to produce at the price the world market on average will bear, will peak have been reached - and if that happens at $61 a barrel I for one will be very, very, very, very, very, very, very, very disappointed.

Khebab, can you remind me one more time what the other liquids are. Refinery gains and alcohol?

Other Liquids: Ethanol, liquids produced from coal and oil shale, non-oil inputs to methyl tertiary butyl ether (MTBE), Orimulsion, and other hydrocarbons.

And Orimulsion is 30% water so "All Liquids" contains quite a bit of water.

Ron Patterson

Averages can be decieving. We are surely seeing demand 'restraint'/destruction from areas of the world that represent only a blip on the economic radar screeen (at least in terms of western standards). $61 is relatively cheap for some and extraordinarily expensive for others. I'm not sure what my point is except maybe that demand is compressible if the Nigerias of the world are left to implode. When the pain hits soccer moms in Denver we will have a much better view of hard capacity constraints.

I should have said weighted average. You're right that what we're seeing is demand destruction among the poor amongst other things. My favoured long term trend is the population based - purple line - and we are still a bit above that. So I see us trackng side ways till we hit that line again in 2008 - then one final surge before the marathon runner hits the wall.

I have yet to see any evidence that more demand has been 'destroyed' in Africa than in the United States with a price move from $30 to $60. In Africa the 'demand destruction' shows up in maternity wards and gets the attention of the Wall Street Journal. In the United States the 'demand destruction' plays out in a decision by freight forwarders to shift container movement from truck to rail. And so on.

Maybe someone has more information.

toilforoil said,

" In the United States the 'demand destruction' plays out in a decision by freight forwarders to shift container movement from truck to rail. And so on."

First of all, that is no small thing. The logistical decisions made by shippers can have a huge impact. I don't have the numbers in front of me, but I recall recently that a logistics magazine (and I didn't even know there was such a thing until I accidently backed into it's website!) was advising subscribers (shippers and corporations) to begin making arrangements to have a back up plan to get off road hauling and look at rail/barge (I love the advice, by the way, it conforms to my idea as stated in prior posts of "case hardening" of the system for any fuel supply/price eventuality)

On demand destruction in the advanced technical nations...you asked,

"Maybe someone has more information."

I don't, but it is a can of worms well worth opening! I don't want to go long, but the subject of the myriad ways in which people can change demand and "fuel switch" has never been properly studied. A few examples:

--I have a friend who comes across the Rockies each year in an RV from the West to Kentucky to visit his sister....he has cut that down to every other year now, thus cutting the fuel for this trip in half with one decision.

--Another friend has an RV and goes to the racetrack. This year, he made a deal to park his RV at the race track for the summer, and go back and forth to it by car, and chose a racetrack close to home (about 70 miles) He says he enjoys it even more than driving all over the South.

--Another friend has a house with both propane heat and a woodstove....in a very large shed he has enough firewood to heat the place for three years....and it has sat there for about three years! He holds it in reserve so if propane prices climb too fast.

--It is very common in this area (U.S. South) to fire up some electric space heaters and an electric blanket if natural gas prices go too high....KY, TN, AL, MS, IN and more states are all provided electricity by coal fired plants.....while this decision may make the global warming crowd cringe, as an economic decision, much of the south can "fuel switch" right down at the household level.

The recent assertion by Walmart that they intend to move to advanced trucks which will cut Diesel consumption in half is one radical step that could have huge implications....as they will almost certainly pressure their suppliers to do the same as part of "cost cutting" across the supply chain. It also has the "green aura" which is now so desired. If Walmart pulls it off, what choice will their competitors have but to follow suit? This decision is brilliant, in that if Diesel costs go up, it gives Walmart a competitive advantage.

As a nation, we have not even began to scratch the surface of the ways in which fuel demand destruction can occur, or the ways in which we can move between alternatives (nat gas, electricity, coal, oil, Diesel, LPG, methane, bio-fuels {and remember, this is about much more than just ethanol} etc.)

We are in for some interesting times, and these are market force changes that have not been studied enough to give us any real guidence as to how the scenarios could play out.

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

So far, the peak C+C production (EIA) was 5/05. Cumulative shortfall between what we would have produced at the 5/05 rate and what we actually produced, through 11/06: over 300 million barrels.

Average Brent monthly crude spot price 20 months prior to 5/05: $38

Average Brent monthly crude spot price 20 months after 5/05: $62, within a range from $54 to $74. Note that the previous nominal peak was about $38 in 1980.

So, we had a decline in crude oil production, relative to 5/05, against about a two-thirds increase in oil prices, and we are getting pretty close to two years of lower crude oil production, as of 5/07.

We did see a two year decline in C+C in 2001 and 2002, relative to 2000, but this also corresponded to lower crude oil prices, not higher.

There are always the seasonal variations in demand, and my guess is that the first indications that we would have of demand exceeding supply would be that summer prices spike, and winter prices are more moderate. Which some would argue that we are already seeing.....

Ericy, This is not aimed particularly at you. But this seems like a good place to locate my comment.

It strikes me that there is widespread confusion about the meaning of the terms supply and demand.

Demand, when the term is used according to its meaning in economics, refers to a schedule of quantities that a buyer is willing and able to buy at different prices at a given time. Supply, likewise, refers to differing amounts at different prices. It does not mean the amount a seller puts on the market at a given price. An equilibrium price establishes an equality in the quantities demanded and the the quantities supplied. An equality of supply and demand, because these terms refer to the relationships between quantities and prices, would mean that prices are wholly indeterminant. The demand schedule and the supply schedule would lie one over the other. This is simply at odds with reality.

What does price tell us? The quantity of oil demanded at $5/bbl, we can reasonably surmise, is greater that the quantity that would, or could, be supplied at that price. So do we speak of peak oil? I doubt we'll ever know just how much oil might have been supplied at $200 per barrel, because I doubt we'll ever see $200 per bbl (that is, until oil becomes a minor part of the energy mix).

I would agree that price movements provide information. But I don't think price will be the first to tell us when world oil production has peaked. Production numbers will tell that tale.

It is to me reasonable to imagine a scenario where declining EROI leads to lower prices for oil - hence less offered-, simply because a shift of investment and and available energy to oil production reduces wealth, if not immediately, because efficiencies might be adopted, then overtime as EROI and supply both continue to drop and the available efficiencies are exhausted. Ultimately, if not immediately, a range of sectors and activities that enhance productivity (communications, education, water supply, public health, recreation, come to mind) will be affected by the effort to maintain oil production, eroding purchasing power in the economy. Stupidity and greed will be the friends of the recreational ATV industry for example, even as schools and colleges are impoverished.

I can see this trend to declining prices for oil being reinforced from the onset of declining production of the other crown joule, natural gas.

How do we factor in the rising break even point for mega projects.

That is, there have been several reports that the cost of exploration and production is rising dramatically.

Projects that were forcast to cost 10B are now coming in at 20B

The oil companies do an on going rolling analysis of the profitability and ROI of certain projects.

The majors have a backlog of potential projects based on previous exploration that were non-economic at $30, that become economic at $50.

Do we have any idea of how many, and which, projects become economic at $90? or $120?

Its the old joke that we have run out of $2 gas, but we have plenty of $5 gas

Does Chris Skrebowski's (sp) or Rembrandts bottom up analysis encompass this?

It's not just a question of money. IMO, timing is becoming increasingly important in order to maintain a global high production rate from many increasingly smaller and technically challenging oil fields.

I'd like to mention again the bridge builders problem of technical innovation. The problem is simple in 100 years we have at best increased the rate we can build large infrastructure projects by 3-5 times. Thus the rate we can accomplish large projects has been the slowest area of growth during the industrial revolution.

This is because large projects face delays from a number of factors and technology is just one of the factors. Worse new technology generally increases delays.

I think what we are seeing now in oil production are the effects of large projects delays and technical hiccups. No modeler too my knowledge has accounted for these although models exist for including these factors. The simplest model is to double or triple your best time estimates.

The end result is that technical innovation and large new projects probably are not going to save the day if peak oil has arrived. The would have had to start in earnest 10-15 years ago.

To see this is simple if we shifted the mega-projects time lines by 10 years we would not be at peak oil now but still increasing production. At least for a few more years.

Next high oil prices are leading to a deadlock situation for exports. Higher oil prices do allow more projects to go forward but generally the production rates from these are not large. On the other hand it leads to increased consumption in oil exporting countries leading to decreased exports. The net gain is zero or negative.

Thus without out the prospect of a number large new discoveries from higher prices we probably will never export any more oil than we do today because of the export land model.

Instead we simply have a flow of wealth from consumers to producers without export growth.

These two conditions lend support for WT export land model and are not based on HL. Thus if you do a bottom up analysis with realistic delay model and include the effect of wt export land hypotheses you get the result that the lack of large discoveries

coming online results in peak oil now. Once decline has set in for a number of years it is impossible to reverse.

One thing HL has showed is that for regions that have passed their peak production by at least 4 years they have never again produced more than they did at peak. The difficulty of extracting the last 50% and depletion ensure that production rates are always lower on the backside of the curve. HL is very accurate for regions that have peaked for over 4 years.

Thus focusing on these 3 simple factors the argument that peak oil is now seems pretty solid to me regardless of the projections.

A delaying factor which precedes those mentioned above is the difficulty of securing enough capital to undertake large projects when there is as much uncertainty/misinformation about future oil prices. A project might pencil out at today's oil price, but some pundits are predicting (or pleading for) $30/barrel oil. If that scenario sticks in the back of your head long enough, it gets harder to write that billion-dollar check. The other wild card is demand destruction: how high can the price of oil go before it drags down the economy and consumption with it, moderating the price? And then add in escalating labor and materials costs if everybody else gets religion at the same time. Maybe it's better to just bankroll the next YouTube instead.

Two phrases come to mind - "graceful degradation" and "plutonomy"

graceful degradation would imply that supply will decline in a predictable fashion (some say 4%, some 6%) and price will increase in the same way, so that advanced economists can predict precisely the point at which demand destruction equals price increase. not gonna happen. the ride down will be Volatile.

Plutonomy is a phrase goldman sachs came up with to explain the modern US economy. bascially they said only the 10% of the economy makes any difference, in terms of spending changes that effect change.

All the rest of the great unwashed, or lumpen proletariat, are living hand to mouth. They have no money to spend, have no money to save, dont buy much, and so dont count.

So if you put these two terms together, what you get is gas price increases that affect the 90%, which will increase their suffering quotient. they will reduce discretionary driving, and wear an extra sweater, and eat Kraft dinner more often. A doubling or tripling of gas prices will have no effect on the behavior of the top 10%.

This also extends to a global model. You will have increasing pain among those least able to afford it. "the rich get richer and the poor get children"

This plutonomy crap besides being way off on the numbers. Does not explain how this magical top 10% make their money. Generally selling to the 90%.

Somehow this concept tries to propose that the top of the pyramid can levitate in space without its support.

The finical version of free energy and thus not even worth discussion.

Blogger Mish doesn't like plutonomy either.

Money flow in society is an interesting study, but Wal-Mart didn't ring up $316B in sales ($11B income) in 2006 selling to the top 10%.

This is interesting:

How could this happen? The study suggests that rising volatility of income caused by job instability is partly responsible. While richer households have responded to the volatility by saving more of their income, middle- and low-income households have done the opposite. They have borrowed more to enable them to maintain their living standards during bad patches.

So what happens when the lesser-funded folks can't borrow any more?

I'd take a wild guess and say the pyramid or better ponzi scheme collapses.

Actually one of the biggest reasons that I believe that not only is peak oil now but ghawar is close to collapse is the timing of the global finical game that has been played. If you assume that the richest and the the most powerful people in the world have the real information on KSA then gaming for a collapse about now along with GW's moves in Iraq/Iran make perfect sense.

Its what I'd do if I was a rich bastard neo-con.

I think a lot of people assume that somehow the rich are in this together but thats not the case. The game is being played for bigger stakes that will not only take out the poor but many people with wealth also. Not only is their not enough resources for all the poor/normal folks post peak their is not even enough to support all the wealthy people in the world.

Right or wrong if your a really rich powerful bastard not just top 1% but in the top 500 and you had access to excellent info on KSA and better info than us on the rest of the world what would you do ?

I'd blow the world economy out for short term gains angle to control a big part of the worlds remaining oil supplies (Iraq).

And screw China/et al. So I get my "fair" share when the oil based economy and the middle class it supports crumbles.

Sounds to close to reality for me.

Hi memmel,

What you say here makes sense. I have some kind of theoretical (perhaps speculative) qs: (If you're up for discussion. I know it's a bit off main topic, still we are talking in general about implications...)

1) re: "If you assume that the richest and the the most powerful people in the world have the real information on KSA..."

--Who do you count in this group? Let's say Cheney "knows", which apparently he does (http://www.energybulletin.net/559.html). Is he acting as head honcho for a group of others?

--Do you think the richest and most powerful *really* "know"? That is, do you believe that *they* think there's "...not even enough to support all the wealthy people in the world."

Does my question make sense? Like... I've wondered, in general - sometimes (often? always?) people act in very pre-determined ways, (just a momentary feeling of wanting to "best" someone else, for example) without really thinking through the long-term gain.

So, do they, in fact, "know"? Or, rather, is it others around them who know?

2) Re: "...people assume that somehow the rich are in this together..."

So, do you think these top 500 *are* in it together?

3) The thing about "thinking" - (attempting to get a handle on the big picture)- is: It seems to me if someone is capable of actually seeing the situation in context and of seeing some of the logical outcomes (if we take your assumptions as true for purposes of argument), then it seems they are then led to see what you describe, namely,

"...when the oil based economy and the middle class it supports crumbles."

But then, the question becomes...how can one actually live in such a world?

In other words, do you suppose they imagine their futures as islands in a collapsed world?

Or, do you suppose they don't really understand what collapse means and might mean for them?

I guess this is another version of a thought I've had, namely, if you're watching out for "numero uno" by accumulating as much wealth as possible, at some point, you have to realize you might need a doctor. (A doctor who had to have had the benefits of an intact educational system of some sort, for example.)

4) Re: "Not only is their not enough resources for all the poor/normal folks post peak their is not even enough to support all the wealthy people in the world."

Is this the same as talking about "carrying capacity" or do you mean it in a different sense? In other words, are you saying that under the current arrangements of money, growth economies, etc. there cannot be enough? Or, under any conceivable arrangement? (Do you see my question here?)

If I may, I would like to repond to your question. There is no conspiracy of the rich. Those that do know are taking action to provide for the future. (Bush just purchased 98,000 acres in Paraguay and is using the US Military to displace the local residents in the name of "the war on terror".) I imagine others are in the process of setting up their own feudal estates to ensure their continuation, establish a power base and provide for the future of their progeny. Their world will not end. Would you not do the same if you had the means? Those that have the means to survive will. Those that don't won't. I imagine that small private armies will be essential to protect what they have and take what they need. The world changes, the world stays the same.

Hi Cid,

Thanks and do you by any chance have a reference for the Paraguay purchase? (You mean this is a private holding?)

I'd say that a lot of "rich" people *think* that they'll be part of the winning team. I think certain media are aggressively assuring people that they can be part of the winning team if they support the right interests. This assurance goes all the way down to working class Americans being urged to keep out immigrants.

But I would think that anyone who has ever been laid off would realize that those richer than you are going to cut you loose to save themselves. (During the great depression, a lot of firms went out of business trying to keep their staffs together and weather the storm, but that rarely happens anymore.) If RIFs and layoffs happen in an ordinary slow market, or a recession, can anyone really believe that they have a place in any lifeboat that they don't own?

Re: "What rich people 'know'": I'm thinking that it approximates what we all have been reading/writing about on this site...it's not a mystery, is it? I doubt that it varies much from the attempts of our people here to estimate the peak (and its effects). Another reason to tune in here, I suppose.

What did the crew of the Tianic do when they hit that 'berg? ...They stampeded to the lifeboats before the passengers even knew what happened. Same thing. Except the Titanic is world-sized now.

My tuppence worth.

Of the megaprojects listed by Skrebowski, I am familar with the forecasts of only one, the Horizon Oil Sands project by Canadian Natural Resources ("CNR").

The forecast by CNR for the Horizon project targets production of 110 mbbl/d in 2008 whereas Skrebowski has indicated 240 mbbl/d in 2008 in his megaprojects listing.

At least for this instance, I believe that Skrebowski is too optimistic.

Megaprojects will definitely need downward revisions.

Numerous offshore projects/ Oil Sands projects/ and Kashagan

Kashagan in particular will move all of its phases forward a couple of years each.

Khebab, Great work!

Have you and WT done an estimate on the "exportland model"? How short does it look like we will be here in the US? I realize demand destruction could (will) play a factor among other factors. It looks like you have done the leg work. I realize that this information might be very valuable to other folks who pay and I'm fine with that. I very much appreciate the work you do, and are willing to share.

Thanks,

D

We are going to work together on a Net Oil Exports article for the ASPO USA meeting in Houston. My tentative idea is to focus on the top 10 net oil exporters.

Jeff, if you have said it once you said it a million times about exports.

I'm wondering which dog will bite the US first, nat gas or imported oil. I hate to even think it but could we get twin hammers with both within say 3 years?

Am I the only one who thinks this gets a little more clear and alot more frightening at the same time?

D

Thank you Kebab, this update is perhaps the post I'm looking each month the most forward to.. It is too long to wait another month now... the suspense is unbearable now..

Khebab... thanks again for your efforts... I always enjoy perusing your latest.

Do you know when we might expect eia to produce dec and year end totals?

there are many corrections one might try to make on account of current barrels being of lower quality than, say, 1990 barrels, in an effort to try to guess the decline in the amount of gasoline/diesel/jet fue, that is the bits we want the most, we now get from the avg barrel. No doubt such an effort would be pretty difficult.

However, it is well know that ethanol has 1/3 less energy than gasoline, so it would be easy to correct the annual ethanol production to obtain a more accurate 'useful' total liquids production... if, for example, world ethanol production was 1.5Mb/d, then we could logically subtract 0.5Mb/d from published tot. BTW, does anybody know if ethanol produces more or less co2/unit energy than gasoline?

Second, it would be very interesting to plot total exports over the past 25 years to get a better idea of how this has changed in the recent past and how it might change in the future... I assume that exports are falling fairly rapidly, eg north sea, mexico, sa and russia declines probably not offset by nigeria, angola, brazil, stans.

Nice work Khebab - as always.

Great post as always Khebab! I enjoy the “spaghetti” graphs. What would help the more casual readers might be a “bio” on the different data sets. Who produces them and how the data set is unique, also what is the bias of the author.

Add my thanks, Khebab... and would Roger R's request here be possible for you (all) to do?

Thanks, Khebab. Always look forward to your posts.

In terms of energy instead of production is there a decline in BTU's over the time period discussed above? Might make an interesting addition to the graph.

Thanks for your superb effort!

It appears that the future growth in NGPLs should keep total liquids on a bumpy plateau for the short term.

I think that supply will start struggling to meet summer driving season demand and that supply will struggle even more to meet next winter's demand.

Interesting comment by Juan Cole in "Informed Comment" regarding Exxon/Mobil's connection to the Iraq War via its major funding of the American Enterprise Institute.

This is not news to most of us who are informed on the issues, however, it is always refreshing to see it spelled out in the way that Cole has done on his blog. He also mentions oil scarcity and our continued reliance on oil in relation to global warming and our own survival.

http://www.juancole.com/

Oops. This should have been posted in the Drumbeat. My apologies.

Gas Rationing Begins At Some Stations But How Far Will It Go?

Monday February 26, 2007

http://www.citynews.ca/news/news_8211.aspx

xom is simply trying to reduce persian gulf competition, which is so far quite successful and will usefully save a bit of oil for later... Next stop iran, which americans anyway love to hate... here is an opportunity to stop 4Mb/d (less 1.5Mb internal consumption) in its tracks... Resulting in much higher oil, stepped up profits for all the majors (and minors, too , I might add), more than compensating for very modest contributions to cera, aei, etc.

Now just imagine if all of this spreads to sa... and imagine the effect on xom's profits! Lee will justly deserve a retirement bonus that exceeds his predecessor.

I too really look forward to this post.

I recently skimmed the Hubbert 1956 report. I had not realized that he made a low and a high prediction, and that it was the high that was correct for US production.

With all of the predictions in this key post, I start wondering: Are the implied estimates of the URR beginning to converge? It is one thing if the estimates are tending to drift up as time passes. If they are declining, then it is time to buckle our seat belts for an E ticket ride.

On the third hand (need more arms), for some models (HL) there may be too much noise to draw conclusions based on demand side perturbations.

In effect, Hubbert made two "If, Then" statements.

As you said, the larger estimate appears to be more accurate, and the cumulative post peak Lower 48 production was 99% of what Khebab's HL model predicted, using only data through 1970 to generate the model.

The point I keep hammering about the world is that, relative to the Lower 48 peak, we have the same amount of data that Hubbert had in 1970--not 1956. And the post-1970 cumulative Lower 48 production was 99% of what the HL model predicted.

Re: Are the implied estimates of the URR beginning to converge?

Most of the models are assuming a symmetric profile (i.e. the post peak decline will match the pre-peak growth). Therefore, once you know the peak position, the URR is simply twice the cumulative production. All the models that are predicting a peak before 2020 have URR values between 2.1 and 2.4 Tb.

Thanks for all the good words from everybody.

I'll try to maintain and improve this thread on a monthly basis even if it may get a little boring (especially if 2012 is the peak date!). I was thinking adding other indicators such as the inventory levels.

If anybody have some new "spaghetti" that can be added to the list of forecasts, please send me a link or a reference.

I'm still looking for a more synthetic way to represent and evaluate the different forecasts.

Also, all the numbers used in this post will be put together in an excel spreadsheet in the next update.

RE: C+C, CO+NGL

The World Production is for CO+NGL which I take to mean Crude Oil plus Natural Gas Liquids (correct)? If so, why isn't World Production a measure of Crude+Condensates which is most narrowly focused on oil. Why add in NGL? Or am I confused in terminology?