UK Energy Descent Continues

Posted by Chris Vernon on February 22, 2007 - 10:06pm in The Oil Drum: Europe

Regular readers will not be surprised by the core data, in summary:

Main points

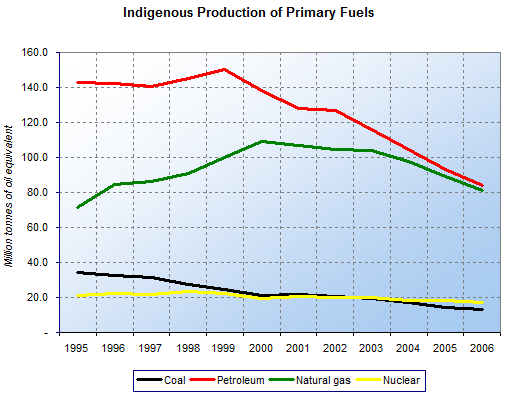

In 2006 total production was 196.1 million tonnes of oil equivalent, 9.0 per cent lower than in 2005. Within this, production of petroleum fell by 9.3 per cent, production of Natural Gas fell by 9.1 per cent and production of coal fell by 8.3 per cent.Latest three months

Total production of indigenous primary fuels in the three months to December 2006 stood at 48.0 million tonnes of oil equivalent, 11.7 per cent lower than the corresponding period a year ago.For the three months October to December 2006 compared to the same period a year earlier:

- production of petroleum fell by 6.2 per cent;

- production of natural gas fell by 13.5 per cent;

- production of coal and other solid fuels fell by 20.7 per cent;

- electricity produced from nuclear sources fell by 24.1 per cent;

- electricity produced from wind and natural flow hydro rose by 25.7 per cent.

Source: DTI Digest of UK Energy Statistics

Consumption data below the fold.

This is due to the extended closure of several power stations due to defects in boiler pipes and aggressive cracking of the graphite cores. The reactors are approaching end of life, these problems were anticipated to a certain degree and are resulting in reduced availability. These problems do make it increasingly unlikely that life time extensions will be granted.

- electricity produced from nuclear sources fell by 24.1 per cent;

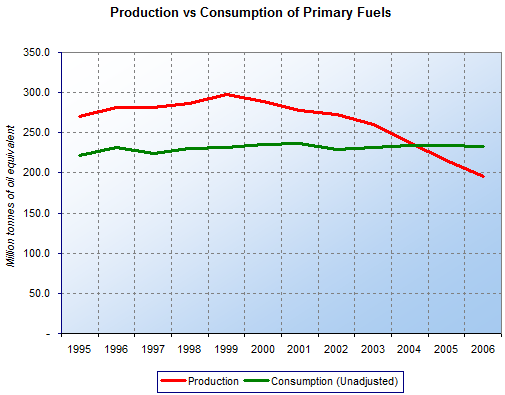

Production is of course only half the story. To complete the picture we must also consider the consumption data also published today:

Main pointsThis brings us to the familiar picture with its rapidly growing gap representing an increasing balance of payments deficit:

In 2006 total consumption was 232.9 million tonnes of oil equivalent, 0.6 per cent lower than in 2005. Within this, consumption of oil had risen by 0.8 per cent, consumption of Coal and other Solids had risen by 9.6 per cent whereas consumption of natural gas had fallen by 5.0 per cent.Latest three months

Total inland consumption of primary fuels, which includes deliveries into consumption, was 62.2 million tonnes of oil equivalent during the three months to December 2006, 2.4 per cent lower than recorded for the same period a year ago.On a temperature corrected basis, total inland consumption of primary fuels was 0.6 per cent higher during the three months to December 2006 than that recorded for the same period a year ago.

For October to December 2006 annualised temperature corrected and seasonally adjusted figures, compared to the same period a year earlier show that:

- consumption of oil had risen by 7.8 per cent;

- consumption of coal and other solid fuels had fallen by 1.3 per cent;

- consumption of natural gas remained broadly unchanged.

Source: DTI Digest of UK Energy Statistics

Previously on The Oil Drum

Fuel duty and the effect of oil prices on the UK economyThe architecture of UK offshore oil production in relation to future production models

Lies, Damned Lies and Government Oil Production Forecasts?

Folks, also consider this a reminder to positively rate these articles (using the icons under the tags in the story title) at reddit, digg, and del.icio.us if you are so inclined. Also, don't forget to submit them to your favorite link farms, such as metafilter, stumbleupon, slashdot, fark, boingboing, furl, or any of the others.

These posts are a lot of work, and the authors appreciate your helping them get more readers for their work however you can.

This is just damned scary. The critical point in my mind is that the government apparently doesn't care to admit to the problem and is still engaging in fantasy projections. Thanks for the post.

Hello Chris Vernon,

Thxs for the keypost--doesn't look like good news. Somehow, somewhere Peakoil Outreach needs to fully permeate your society to prevent the Zimbabwe Syndrome. Be very wary of any politician who promises good times ahead-- you need a modern day Churchill to rally the forces for Biosolar Powerup. I hope that Prince Charles, who doesn't have to worry about re-election, can help lead the charge to full societal awareness and change.

Has the UK govt identified a safe place and strategy for storing the dangerous waste from the future deconstruction of those nuclear plants?

On the other hand, if Zimbabwe's Dieoff occurs real fast, so as not to totally decimate the native ecology, some Brits could migrate there later and change the name back to South Rhodesia.

Wild Speculation: Does North Rhodesia appear to be proceeding nicely to British plans? According to the CIA Factbook life expectancy is about the same as Zimbabwe.

http://www.speroforum.com/site/article.asp?id=8096

Does this obviously speculative and hypothetical conjecture ever come up for discussion in the UK press? I could see where postPeak Biosolar Habitats could be very beneficial to a country that plans ahead.

Obviously Chris--this is not directed at you personally--just food for thought if the UK is looking for an outlet for their Overshoot.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Bob,

I disagree that the UK is manifestly in population overshoot. Bear in mind that it has a temperate climate, and huge areas of fertile farmland that have been exploited largely sustainably for hundreds/thousands of years. Obviously the future is not energy-rich, probably not economically rich, but probably one of the better places on earth to survive in.

... Unless the icecaps melt of course!

Peak oil is not scary; global warming is, especially given the prospects for another Atlantis. All these decreases in energy production yet another good reason to get radical about cutting energy consumption.

Cough, splutter...

Prince Charles is one of the most prolifigate, wasteful and hypocritical subjects of Queen Elizabeth II. He has a household staff of around 80 - just to keep him comfortable. I mean, not even Lee F. Raymond, ExxonMobil's fabulously wealthy ex-CEO can match that.

Yes, I know that one of his houses, sorry palaces, is heated by wood-chips. However, there are few forests left in England and he happens to have one.

Please do not use Prince Charles, or Anthony Blair, as examples of what we should be striving for.

Perhaps the only coherent arguement for the British pound joining the Euro is that as the balance of payments goes into freefall as a result of the changes you highlight the currency will come under immense downward pressure (requiring raised interest rates to defend it). At least as part of the Euroblock the UK economies dire balanceof payments future would be shielded

Be very careful with comments like this.

Recently there was a programme on BBC2 detailing facts about the UK economy.

The total cost of ALL energy (including elec, gas, nuclear, and all oil extraction) only came to a grand total of less than 2% of GDP.

Yup, thats right, as a nation we spend more on widgets from china than ALL forms of power.

To suggest that we couldn't send between 2 - 5% of GDP overseas indefinitely would be quite naive.

Even if we had no North sea oil and gas, and the raw cost of energy doubled, we'd still be fine.

Incidentally, our BIG earner, is the finance industry. Primarily based in the city of London. Who'd have thought it. The City of London more valuable than the North sea oil & gas industry.

Andy

It doesn't matter if energy is 2%, 5%, 10% or 20% of GDP. Without energy you got no economy.

The finance industry, don't make me laugh. The UK once had a real economy, these days it got an imaginary economy based on people selling houses to each other and rich russians. One day not so far into the future the music will stop and you will be all out of chairs.

And it is you who are naive if you imagine those of us on continental Europe in the future will share our food and energy with you in return for paper with numbers printed on it.

Got gold? No that's right you don't. You sold it for half of what you could have gotten for it today.

And how viable do you think the earnings of the City of London will be in the new economy of post-Peak Oil? A huge proportion of the City's earnings come via the trade in derivatives and currencies. In a post peak world these are 2 'commodities' I don't think I fancy greatly. In the coming years which countries will be better placed, those who produce substantial amounts of their own hydrocarbons or those who's manufacturing base has collapsed below 20% and who's primary means of raising cash involves pushing near fictional amounts of money between various trading desks in the City of London?

Incidentally a very good point from Hurin regarding Brown's sale of a substantial amount of the UKs gold at almost the bottom of the gold cycle, and one that is not commented upon enough. Clueless, but then Prudence has mortgaged UK plc - just look at the Public spending deficit.

Well, AndyT, you'd better hope the UK can make it on its own.

I agree with AndyH that the UK would be well-advised to join the eurozone. But with Brown, no chance of that (best hope, a Conservative government?) I predict that by the time the UK government gets around to begging to join the Euro, they will be turned down flat. They don't have a strong case for EC solidarity, given that ever since they joined, all governments have systematically worked to weaken and undermine European efforts at integration and solidarity.

Here comes the BNP.

Banque National de Paris?

... Oh I suppose you mean British National Party. But I don't grasp your point?

Are you saying that no government will join the Euro because of thick-headed reactionary nationalism? Exactly, which is why I think they won't try till it's too late?.

I think what cynus means is that they are waiting for the alternative political parties to be thoroughly discredited so that power falls into their laps - a bit like the Weimar Republic and Hitler.

Thanks for the update Chris.

Just to add that UK’s trade deficit in 2006 went over 110 bn €. That’s the worst record for any state of the union last year and about four times that of France or Greece.

Things really don’t look good for Britain.

We need new nuclear power stations.

And we needed them 10 years ago.

I have an interesting chart from 2003 that shows total electricity provision from all sources and one of the most interesting things is that nuclear provide(ed) about 23% of all consumption despite not even being close to 23% installed capacity.

Nuclear is by far and away the best technology for base load provision.

If wind turbines can benefit from ROC's then a similar system could easily be put in place to encourage baseload power purchasing from nuclear utilities by the electricity distributing companies.

I'm also unconvinced with the govenments "hands off" no subsidies approach.

The job of govenment is to provide stategic guidance, and if necessary, funding to enable projects that are in the public interest but not necessarily the private sectors interest.

Requiring that nuclear power competes with cheap gas is all very well right up to the point that gas is no longer cheap.

Then we need something to bridge the gap between gas and new nuclear.

Some fiscal pain is required now to get new build underway so that we (like the french) will be in a much better position in 20 years time.

Andy

Nuclear is unsustainable and so is a bad option (since it merely increases dependence on unsustainable fuels), unless nuclear is used only as a stepping stone to sustainable energy production.

Tony

By your definition of sustainable, even solar power isn't sustainable cos one day the sun will implode and kill us all.

Only it will occur in a very very long time.

Likewise, nuclear power has hundreds of years worth of extractable reserves of uranium and beyond that Molten Salt thorium breeder reactors have thousands of years worth of fuel in the ground.

Thats good enough for me.

Anyone that truely believes that there is only 80 years worth of Uranium reserves left is guilt of some fairly wooly thinking (that and unquestioning belief in the report that claimed this)

Andy

Would you like to give verifiable calculations on extraction rates of uranium, over the next 80 years? Or should we build up nuclear on an assumption?

You're right that the timescales are important, in the definition of sustainable, but I think we need to be very clear that the timescales projected are real, before plunging into a course of action. I don't think any fuel with a lifetime of less than 150 years warrants consideration, considering how we've used another wonder fuel over the last 150 years.

I haven't heard of molten salt thorium breeder reactors before; how many are operating, at present?

No I wouldn't. Don't be lazy go, and look the extraction rates up for yourself.

What nonsense is this? Look around you. The entire world has been built on cheap oil. Are you suggesting that we should never have bothered with oil because it was "only" going to last 150-200 years.

And in case you hadn't noticed nuclear power stations are only good for approx 50 years of operation anyway. So if the fuel will last longer than the projected life of the power station then it would be entirely sensible to construct it.

Sheesh, I sometimes wonder why I bother commenting here.

As someone once said. "sounds like this bloke started with a conclusion and studiously avoided any facts that might have contradicted his position"

Andy

If, as Chris indicates, the current reactors are on their last legs, then a crash program to build new nuclear capacity is needed.

Probably makes more sense than massively importing electricity from France, which is the only obvious alternative. But since the new plants are likely to be owned and operated by EDF, the profits will be going back to France anyway...

Click to enlarge

Source: Nuclear Britain

However, given the problems experienced in 2006 I think this is now optimistic. For sure availability will be less than is has been and it is in my opinion likely that decommission dates for some reactors will be brought forward.

There is another alternative that is overlooked. Importing renewable power from Iceland via a HV DC line. Replace most NG fired power for the warmer half of the year and smaller amounts in the colder half.

Icelandic domestic demand is largely base load (aluminum smelting) with "other demand" winter peaking. OTOH, there are numerous summer only hydroelectric sites in Iceland (no one has done a proper survey since they are not needed) plus several GW of geothermal power. The untapped wind resource of Iceland is immense.

Landsvirkjun asked a decade ago and there was no interest in the UK for such a link. I have contacts in Iceland, any suggestions on the Scot/Brit end ?

In casual conversations with Arni Benediktsson, Head of Mechanical & Electrical Engineering, I have mentioned links to the Faroe Islands, Scotland & Ireland with favorable response. A series of different size transmission lines could be built over time.

Best Hopes,

Alan

Great idea in theory. However in practice there is already a problem in utilising the available wind capacity in Scotland. There is already insufficent transmission north-south capacity which is inhibiting wind developments.

What would make sense is a HV cable running down the west coast of the UK / east coast of Ireland. Wind and tidal potential probably exceeds 70 GW down that line. The UK does not lack in renewable power potential and could in theory be a net exporter. It does lack a framework to allow for the rapid development of this potential. The Government talks but does not act, subsidies are poorly structured and targeted, red tape makes planning and permitting hugely time-consuming and significantly erodes returns for the financiers. Lastly, tidal will probably never happen because the UK seems to be incapable of delivering large scale construction and engineering projects anywhere close to projected timelines and budgets and private finance is not going to take that risk on a multi-billion project. The Channel Tunnel is the best example, and the 2015 (!) Olympics will be another.

Government needs to mandate and fund tidal development, but it won't.

That encapsulates pretty nicely the fundamental reasons the UK is in such a severe energy fix. Ideological mindset. The market knows best... Works fine in times of plenty. Hurts when times are tough, because the market forgot to plan for tough times...

True, the UK is geographically in a good position for renewables. Poor in hydro and solar, but rich in wind and wave.

Is Brown the man with a plan?

Iceland could play the hydro/Norway role with Scotland playing the wind/Danish role. In the future, power could flow north during high winds and Iceland conserves water and geosteam.

I see tidal as being a very small player in UK energy. It generates on a an almost 25 hour cycle which makes it hard to match up with load and the economics are site specific & questionable (at best).

Best Hopes,

Alan

I disagree on tidal. Around the UK there is potential for between 10 and 15 GW of installed capacity, which would generate (approximately ) twice per day on the ebb tide - there are two tides per day. Each generation cycle would last approximately 6 hours, so 12 hours per day.

Sites range from North West (Morecambe Bay, Mersey Estuary, North Wales coast (which would have to be a dike-based barrage), the Severn Estuary in the west, Guernsey/Jersey archipelago in the south, and the Thames Estuary in the south east. High tides strike at different times from west to east which would spread the generation over a slightly longer period than 6 hours.

Tide times are predictable for decades in advance and it would therefore be simple to pre-plan for load-matching. If the UK does not build new nuclear, it will need a significant baseload replacement, tidal can go part of the way to filling that gap. Icelanddic hydro could be scheduled to fill in the missing parts of the cycle under your plan.

Economics are questionable if one considers only barrage-style schemes with (maximum) 20 year private finance. However, if one considers public funding, 50 year life-span and the huge incremental value of flood risk mitigation for a number of cities (London, Liverpool, Bristol, Cardiff) the economics begin to stack up. I can imagine insurancve companies would be very keen investors when viewed in that light.

What is the bill to-date for damage in NOLA from hurricane Katrina? Consider the bill for London being flooded and then compare that to the cost of installing all of the above schemes for a total cost in the region of £20 billion - to me that is entering "no-brainer" territory.

Anyhow, it's moot, because no politician in the UK has the balls or the vision to centrally-mandate such development.

Tidal may produce SOME power for 12 hours/24 hour 50 minute cycle (NOT day).

The Louisiana Hydroelectric Power Plant is the closest analogy to the proposed tidal basin projects. It harnesses 1/3rd of the of the Mississippi River as it is spillied into the Atchafalaya Basin. Heads vary from (memory) 2.5 m to .9 m and the eight 9+ m Kvaerner bulb turbines generate 192 MW at max head and 60 MW at minimum. The "shoulder" hours of those 12 hours will generate 1/3rd or so of peak. Geographic diversity will help some (with adequate transmission), but value will be in energy (turning off NG turbines on a predictable schedule) and not in capacity (in part due to the ~25 hour cycle). Coupled with large pumped storage projects and the economic value of these projects will increase significantly.

Beat Hopes,

Alan

Some more colour on transmissions issues in Scotland - http://www.hbp.org.uk/bn6.htm

Sorry about late posting. Did some back of the envelope calculations regarding Alan's scheme for HVDC link between Iceland and Britain.

The numbers quoted in your link point to fixed costs of around £200k/MW plus £500/(MW*km) for HVDC sea cables. Now, as far as I can determine, the distance between Iceland and Britain is about 800 km for shortest path Iceland-Scotland and 1200 km for Iceland-England. (Icelandair gives distance of 1500 km for Glasgow-Reykjavik so perhaps I should have tried harder to find good maps).

For a 1000MW link we have thus a cost-estimate of £600m for Iceland-Scotland, £800m for Iceland-England and £950m for a 1500 km cable.

If we assume obtainable interest rates of 7% and amortization period of 25 years, wikipedia's Amortization calculator yields annual payments of: £51.5m for Iceland-Scotland, £68.65m for Iceland-England and £81.6m for 1500 km cable.

Since I have no idea what the operating costs for such a cable might be, lets just assume they are negligible and move on to the income side of the equation...

For the NorNed cable project (700MW HVDC link between Norway and the Netherlands) the technical uptime is expected to be 97.4%, with planned downtime expected to be 0.9%. For the same cable, transmission loss is 4%.

For this project lets assume a loss of 5%. This means that maximum transmission capacity is reduced from 1000MW to 950MW. A capacity factor of 90% for the cable, means annually transmitted energy is about 7.5TWh. A capacity factor of 50% means 4.16TWh/a. You also have to pay for the power you lose, which means added costs (assuming avg. purchase power price: £21/MWh) of £8.28m for 90% capacity factor and £4.6m for 50% capacity factor.

We have thus:

*For 90% capacity factor:

Iceland-Scotland: Power transmitted; 7.5TWh/a, Costs: £59.78m/a, Unit cost: £7.97/MWh.

Iceland-England: Power transmitted; 7.5TWh/a, Costs: £76.93m/a, Unit cost: £10.26/MWh.

1500 km cable: Power transmitted; 7.5TWh/a, Costs: £89.88m/a, Unit cost: £12.0/MWh.

*For 50% capacity factor:

Iceland-Scotland: Power transmitted; 4.16TWh/a, Costs: £56.1m/a, Unit cost: £13.49/MWh.

Iceland-England: Power transmitted; 4.16TWh/a, Costs: £73,25m/a, Unit cost: £17.61/MWh.

1500 km cable: Power transmitted; 4.16TWh/a, Costs: £86.2m/a, Unit cost: £20.72/MWh.

Conclusion:

The transmission costs for power between Iceland and Britain lie between: £8-12/MWh for a high (90%) utilization link, £13.5-21/MWh for a link that has only 50% utilization.

So the transmission costs alone are some 50-100% of the current price of electricity. Either Icelandic electricity generation costs would have to be 0-50% the cost of UK indigenous or the price of indigenous electricity would have to rise to make it viable. I suspect the price will rise in the UK and I also suspect the cost of generation in Iceland is considerably cheaper than the UK. I wonder how far from financial viability we are and how the economics compares to something like the Severn tidal barrage/lagoons?

In the average summer, Landsvirkjun spills (lets water through the dam without bothering to generate power) 150 MW. Generating cost for this lost power is very close to zero. The industrial price of electricity is linked to the price of aluminum (this is guaranteed 24/7 power 365 days/year), but 2 pence/kWh is a reasonable price equilavent. Summer only power would be cheaper.

Karahnjukar was originally looked at for 2 GW of peak power to Scotland, but no interest in the UK. It is being built for a steady 550-570 MW to run an Alcoa smelter instead .

I can recheck distance from East Iceland to Scottish coast (on land transmission is much cheaper if one can get the clearances). I have floated the idea of several links of different sizes, supplying the Faoroe Islands and continuing onward to Ireland from Scotland, not to England. (Use existing weak HV AC links to northern England).

In the future there can be a link between Scottish & Irish windpower on one end and Icelandic hydro, geothermal and windpower on the other.

Best Hopes,

Alan

Alan, thanks for your response. What I feel about all of this is that a HVDC link that is used to balance wind with hydropower would not be economic. The reason is that the capacity factor for the cable would just be to low.

I think my calculation above shows that high capacity factor is essential to achieving good economy in the project.

IMO the only way to achieve high capacity factor is to use the cable to exchange baseload. If you think about using the cable for windbalancing, then you realize that quite often the wind will be blowing moderately. If the wind is blowing moderately, the cable will be "idling", ready to deliver hydropower should wind decrease or receive windpower if the wind should increase.

If you're exchanging baseload on the other hand, you only have to change direction two times a day (or not at all). (For the NorNed cable there is a ramping limit of 30MW/minute, don't know if this applies to all such cables).

The problem with baseload is that Britain probably has little to spare, and with their cheap hydroelectric power, it remains uncertain if Iceland is interested in coal power. In such a situation, the power would flow southwards only, and the Icelanders would have to ask themselves whether they want to export the power itself or try to add value to it by refining it to aluminum. (As far as I can determine, the investment cost for a 1000MW aluminum plant is 2-3 times the cheapest cost estimate of my cable. So it's not necessarily a better idea)

You also mention the possibility of laying the link via the Faroe Islands. These islands rely heavily on oil and diesel for power generation, but they don't use that much power. I tried out my understanding of the Faroese language at the website of their power company and derived these figures:

Energy:

thermic (oil/diesel): 147,029 MWh/a

hydro: 94,387 MWh/a

wind: 7,509 MWh/a

total: 248,926 MWh/a

capacity:

thermic (oil/diesel): 68.5584 MW

hydro: 31.6 MW

wind: 2.13 MW

total: 98.92 MW

In other words less than 100 MW is required...

Best hopes for sustainable project economics,

Mriswith in Trondheim, Norway

Is the Olduvai Theory plausible? Sure looks like it.

IT'S COMING RIGHT AT US!

Chris thanks for this update.

There are two aspects to this balooning energy defecit that need to be considered:

1. Where will our energy come from? (gas from Norway, U from Canada, coal from Australia, oil from Azerbaijan?)

2. Impact of balooning energy imports on trade balance.

I see reading Luis' and Andytk's comments that there may be some different perspectives on the economic impact, so I'll refrain from commenting, but worth posting this chart that points to a $25 billion defecit per year from oil alone by 2012. Your second chart looks worrying to me and my feeling is that we (i.e. you) should do some sums on the economic impact of this trend - I'm not sure I trust the spin doctors in HM Treasury.

The $ value of UK oil exports had declined to near zero in 2005. Future oil imports will weigh on the UK trade balance. Click to enlarge.

http://www.theoildrum.com/story/2006/9/17/135527/399

Prudence: UK Chacelor Gordon Brown has increased taxation on UK oil producers even when faced with plumetting North Sea oil production

Michael Meacher, Labour left winger with an outspoken record on environmental and energy matters, is set to challenge Gordon Brown for the top job in the UK

http://www.epolitix.com/EN/MPWebsites/Michael+Meacher/a8268361-ba48-4cb5...

Michael Meacher announced yesterday that he would challenge Gordon Brown for the Leaders job when Tony Blair stands down, most likely in May. It may be of interest to overseas readers that in the UK system, whoever wins the contest to lead the Labour Party will automatically become Prime Minister - taking over from Tony Blair.

Just for those who don't know, Mr Meacher is peak oil literate, on record. (Google him)I can't do links. I imagine that while he is in the news there may be some discussion of peak leak into the MSM. As of now, he's extremely unlikely to win.

Here is a piece by him in the Guardian. He mentions that oil 'wont last long'.

He is that rare thing, a politition who talks some sense. Unfortunately,

he is old, ugly, and has been in politics long enough to have a few skeletons

in the closet. His chance of election is zero, as evidenced by the feedback.

He is seen variously has a hypicritical capitalist, a crank, an old Labour

socialist or a complete non-entity. Shame, really.

http://commentisfree.guardian.co.uk/michael_meacher/2007/02/why_i_want_t...

I can't disagree with that. However I do see this as a very positive move as Meacher does fully understand peak oil. His 'campaign' should at a minimum provide him with a media platform to raise the profile of energy and environment issues and perhaps go some way to keeping Brown honest with respect to energy.

One of the headlines regarding Mr Meacher and his decision to stand was that he "Wished to re-nationalise the British Railways".

Having read TOD for a year or so now, I can see where Mr Meacher might be heading with this, from a PO perspective.

Nationalising the railways would give the chance for a massive investment (maybe even a Government 'Rail-Bond') towards the electrification, dualling of single track, signal improvements, freight infrastructure and all the other projects which would be required for a country like the UK to approach mass transit of people and cargo as PO bites.

But I can imagine that the electorate in general might dismiss it as an old-fashioned left wing agenda, enabling the unions and embracing all the bad bits of British Rail..

Lets hope that Mr Meacher gets the point across. IMO There will likely only be a small window of opportunity, before Mr Brown's coronation!

I am certain that David Miliband is also peak oil literate. He is not old or ugly and looks to me like a survivor and possible future leader.

Having heard him talking about energy crises on the radio and reading material on the web. He puts very heavy emphasis on mitigating energy crises.

Maybe we'll see a strong energy faction / internal lobby develop in the labour party.

Carbon

If David Miliband is Peak Oil literate he did a good job of debunking Organic farming a month ago which we know is what we have to take seriously. The problem with Miliband, New Labour and most UK politicians is that they are servants of the market system. Recent examples are the foot and mouth crisis and just recently the H5N1 outbreak in Suffolk. They will do anything to protect the likes of the food industry irrespective of how much suffering and environmental damage they inflict. Lip service is all that is paid. I have not too date heard anything worthwhile been uttered by Miliban.

The sad fact is that in the UK the BNP are the only party that are really switched on to this issue and yes we should worry.

I wouldn't be suprised if this site is a regular read of the BNP.

I think we would need more cartoons and fewer words ...

Let's not kid ourselves!

Both the Guardian Newspaper and Jeremy Leggett have flagged this. The latter in his book 'half Empty'-- the number of BNP members at talks about Peak Oil and Global Warming.

The Guardian infiltrated the party and became a London organiser.

Nick Griffin is a smart dude-- read history at Cambridge. He has studied history, and what brought the rise to power of the likes of Hitler, Franco, Peron etc.

The BNP strategy is to wait for the chaos surrounding PO and GW. It will be each country for itself, Europe will break up, there will be mass immigration and a backlash against it, unemployment will soar.

These are precisely the conditions of 1930s Europe. In Britain and France they led to fighting in the streets. In Germany, Bulgaria, Austria, Romania etc. they led to the rise of fascism.

Can we say, on the eve of the US bombing Iran, with scientists screaming that there may be massive global climate disruption, with the potential for serious oil supply disruptions in a Middle East torn in a Sunni v. Shia war, with Russia 'punishing' uncooperative governments by turning off their gas,

that Griffin is wrong?

That we are doing enough to prevent that situation from occurring?

This is the government that runs out of householder grants for alternative energy and energy savings in the 2nd day of each month.

This is the government that raises £1bn in new airline taxes, but does nothing to improve household energy efficiency.

Look how popular anti-immigrant stances are with the man on the street. Let alone anti-muslim ones.

If we believe in Peak Oil, then Griffin's political strategy must sound a very sensible one, and his party a real threat

http://www.guardian.co.uk/farright/story/0,,1977519,00.html

Remember, they thought Hitler was a funny little Austrian corporal with a thick accent and a stupid mustache.

Good comment. I spoke with Leggett about this recently - it is his greatest peak oil fear, more so than the direct energy/economic implications, I’m inclined to agree.

One major difficulty we have is even articulating a productive debate on this subject. I don’t think ignoring it is the best course of action.

Very interesting news. Let's hope he can at least bring energy to the debate.

I have to agree, I don't think Meacher has any real chance. However, if he actually gets into the contest - I think he needs 40 MP signatures - there might be some awareness-raising of energy issues via the TV time he'll get.

Two questions Chris or others might be able to answer:

1) Can the shocking drop in nuclear output be reversed for 2007, can the radiation-induced damage be repaired on a long term basis?

2) Will the Buzzard field halt the fall in UK oil output for 2007 (i.e. is it on schedule and will it produce enough to offset declines from other fields)? I think someone on this forum (?Euan) put up a graph some months ago showing production staying level across 2006-7 before resuming its decline thereafter. If so, it would give a breathing space, though it might only give politicians opportunity to ignore the problem for another year.

1. No. Not really. As Nick explained, the cracks are as a result of age. The Advanced Gas Reactor series is winding down its operating life (the earlier Magnox reactors are almost all decomissioned, I believe).

Nuclear output might go up a bit, but not for long. It's on a permanent downward trend-- after 2020, only Sizewell B (Pressurised Water Reactor) will be running, I think.

If nothing is done, the UK's electric power supply will be 70% gas fired by c. 2018 (from about 35% now).

2. Not sure, but I doubt it. Buzzard is 200,000 bl/day I think.

Thought I'd include a production graph from the DTI quarterly data.

Despite almost doubling over the last five years or so, wind and hydro power still accounts for well under 1% of primary energy production, and doesn't really show up on the graph.

Based on HL, the North Sea is about 70% depleted (crude + condensate), while Saudi Arabia is 60% depleted.

Both producing regions show declining crude oil production.

Remind me again as to why the North Sea decline is involuntary, but the Saudi decline is voluntary?

We know the north sea decline is involuntary because of the copious data provided by Norway and GB. We know the saudi decline is voluntary because they say so.

Chris;

The Hess corps Triton FPSO has been down for a year being retrofitted with new technology upgrades, it produces oil and gas from the Bittern and West and North West Guillemot fields through an array of subsea infrastructure.

I believe I read somewhere it produces 60k/day flow.

regards

Marvin

Thanks Chris for your informative update.

I put the recent DTI numbers (as of Dec 2006) for NATURAL GAS into a spreadsheet (Excel) that also generates diagrams tracking the developments in UK indigenous supplies, imports and exports (really NET imports and exports), storage injections and withdrawals etc..

Graphics may tell more than a thousand words (which I think many are aware of).

I made the following observations that I hope some on this thread could assist in shedding some more light on;

1) An accelerating decline in UK indigenous natural gas supplies (2006 versus 2005, a decline above 9 %).

2) A steep increase in UK (net) natural gas imports of 47 Mcm/d, (using a conversion of 11,11 kWh = 1 Scm) in Dec 2006 versus Dec 2005 translating into an increase of close to 70 % in imports.

This (UK) heating season has been mild and thus suppressed natural gas demand from mainly domestic users.

I also notice that this resulted in prices this heating season have been depressed (presently around 18 p/therm, BNP?), which I assume has happened primarily from a combination of increased imports and mild weather.

I have for some time and on a regular detailed basis followed the development in UK natural gas supplies, and what has puzzled me a bit this heating season is the steep increase in natural gas imports, which were up by 47 Mcm/d in Dec 2006 relative to Dec 2005, or an increase of close to 70 %.

For 2005 based upon data from various sources like NPD, DTI, National Grid and BP I found that during the previous heating season (2005/2006) imports ran on an average just above 80 Mcm/d in Feb 2006 (up due to the fire at the main storage facilities at Rough). Of this approx. 45 Mcm/d I estimated (more guesstimated) came from Norway, 13 - 14 Mcm/d from LNG (Grain) and the balance through the bi-directional Interconnector.

This winter it looks like LNG imports through Grain are running pretty close to the previous heating season, imports through the Interconnector are running lower and gas started to flow through the new 36“ pipeline between Balgzand and Bacton late November 2006. This suggests (by looking on the DTI import figures for Nov and Dec 2006 that imports from Norway are way up if the supplies are to be balanced).

I have been expecting imports from Norway would be up this heating season by 10 Mcm/d to 55 Mcm/d, but the recent data from DTI suggests to me that Norwegian imports are presently (Nov - Dec 2006) running higher, may be above 70 Mcm/d.

Is there anyone (reading this) who could assist clarify?

Why I consider this important?

This fall the Ormen Lange field will start flowing and from what I know could reach a plateau of 55 - 60 Mcm/d by fall 2009. This suggests that a flow of 20 - 25 Mcm/d could be added to the Norwegian natural gas production by fall 2007. It could be that this flow from Ormen Lange will replace some of the natural gas presently being exported from Norway to UK, thus the imports from Norway for the coming heating season (2007/2008) could remain flat (relative to present levels) or even decline, and thus not help make up for the expected future declines in UK indigenous supplies.

This could make a recipe for a tighter natural gas supply situation for the next heating season (2007/2008)…….and beyond. The situation this heating season could thus give some false signals of the future fundamentals for the UK natural gas supplies situation, which of course has presently been assisted through the declining UK natural gas prices, which thus in retrospective could become a “false” price signal.

This……..just as the natural gas trolls seemed to have left the scene.

Rgds

NGM2 (in Norway)

Could you explain this a bit more please? Why should additional Norwegian gas make Norwegian gas imports to the UK remain flat?

I'd also be interested in a fuller explanation of why it appears that UK domestic gas prices will be coming down. What exactly has changed from last year? Is it simply more pipes for gas imports? The warmer weather (but that's only temporary and so shouldn't affect prices further in the year?)? Is there more gas from somewhere (obviously not the UK)?

Peter.

Hello to you all,

and thanks for your replies. I will try to detail some of my reasoning based upon my understandings.

First of all my understandings are based upon analyzing information obtained from open sources and some educated guesses.

My understanding is that present Norwegian UK nat gas deliveries are composed by both short and long term contracts. The short term contracts are normally supplied from otherwise spare capacities from existing nat gas fields on NCS, and might run for one maybe two years. One contractual nat gas year being from Oct. 01 to Sep. 30 the following year.

Oct. 01 2006, as bunnyhead points to, the southern leg of the Langeled pipeline, terminating in Easington, started to flow and as Ormen Lange will not start to flow before Oct. 01 2007 simultanoulsy with the start up of the northern leg of Langeled, the southern leg of Langeled is presently physically fed with nat gas from the Sleipner fields and fields in the Troll area (i.e. Troll, Kvitebjørn and Visund).

The Sleipner fields are now more than 70 % depleted (NPD data, and present R/P ratio below 4) and are expected to enter into steep declines in the near future, the declines of the Sleipner fields will gradually be physically substituted with nat gas from fields in the Troll area for contracts with continental buyers, thus gradually lowering the amount of spare capacities from these fields allocable for contracts for UK buyers through Langeled. There are some other smaller Norwegian natural gas fields that presently are sold on “root” (i.e. depletion contracts) to UK buyers that will soon start their declines.

Last contractual year (2005) a large portion of Norwegian nat gas supplies were landed through Zeepipe in Zeebrugge and then fed through the Interconnector to Bacton UK. This was mainly a 5 Bcm/a (or 15 - 16 Mcm/d) contract between Centrica and Statoil. Tracking the development in flows through the Interconnector, you will se that imports through this system to UK is considerable down this year as compared to 2005).

Some nat gas is delivered through Vesterled in St. Fergus to respectively National (Scottish?) Power and BP (approx. 2 Bcm/a each) in addition to some field depletion contracts estimated to approx. 1,5 Bcm/a and possibly some short term contracts that I estimated could max approx. 4 Bcm/a.

This should total 14 - 15 Bcm/a (or 42 - 45 Mcm/d) contracted from Norway to UK last year (2005).

This contractual year with the start up of the southern leg of Langeled the Centrica along with (to my best understanding) a bunch of new contracts (among these a new contract between Gazprom and Norsk Hydro of 0,5 Bcm/a) and existing short term contracts changed delivery points from Bacton/Zeebrugge and St. Fergus to the Langeled Easington terminal. My estimate is that the total amount of Norwegian gas could presently run as high as 40 Mcm/d being delivered to Easington (the 40 Mcm/d seems to be in line with the figure referred to by bunnyonhead). In addition (and to my best understanding) a total of 5,0 - 5,5 Bcm/a or 15 - 17 Mcm/d are presently delivered in St. Fergus.

Thus total Norwegian deliveries to UK for this contractual year could run as high as 55 Mcm/d.

As mentioned Ormen Lange will start to flow Oct. 01 2007, and I expect that some of the contractual delivery obligations now physically undertaken by other Norwegian fileds will be transferred to Ormen Lange. To my best knowledge Ormen Lange will reach the plateau of approx. 60 Mcm/d by fall 2009. This means Ormen Lange could be expected to physically deliver 20 - 25 Mcm/d next contractual year. Thus it does not automatically mean that Norwegian nat gas deliveries to the UK will increase with the same amounts as capacities on Ormen Lange builds.

Another reason is that Norwegian gas sales are now owner based, meaning that each owner is free to sell his nat gas into the market this owner finds most fit (being willing to pay the highest price). As the Norwegian nat gas pipelines system is highly integrated this means that some owners in Ormen Lange could sell and deliver their nat gas to customers in Zeebrugge and/or Emden/Dornum in Germany.

In other words some of the capacities from Oremen Lange will be used to substitute declining nat gas production from fields presently delivering to UK. The other thing is what market the respective owners in the Ormen Lange fields chooses to deliver to (which I honestly does not presently know).

The fields delivering on depletion contracts will gradually decline.

This fall there will be opened a new link, Tampen Link, connecting Statfjord with the british NGLP system. For contractual year 2007 this Statfjord could deliver 5 – 6 Mcm/d towards UK (again some owners in Statfjord could decide to sell their nat gas to continental buyers).

The flow rates that bunnyonhead refers to from the BBL pipeline (fluctuating between 17 - 38 Mcm/d) is within the estimating range I made myself, partly based on the latest DTI data. My guess is that this nat gas flow is composed by a portfolio of sellers (I noted that E.On Ruhrgas and Gasunie are among the owners in this pipeline) which could mean that some of the gas presently sold through this system originates from Russia, as I suspect that German and Dutch indigenous nat gas supplies are still in decline.

What is important to understand about future nat gas supplies to UK from Norway is the net build in nat gas production capacities. Nat gas fields as oil fields declines……..but faster.

Did this clarify some of your questions Blue Peter?

Rgds

NGM2 (in Norway)

The incremental gas is coming through the new Langeled pipeline into the Easington terminal near Hull - deliveries started in Spetember 2006. This is the same pipeline which will deliver gas from Ormen Lange, but to date the gas has been coming from the Sleipner field (if I am not mistaken) and has been flowing at avergaer rates arounf 40 MCM/day. When Ormen Lange comes online in autumn, import capacity through Langeled will increase to 70 MCM. So an additional supply of about 30 MCM/day for 2007/08 winter over 2006/07 winter.

Furthermore, the BBL import pipe from Holland started operation in December last year, flow rates have fluctuated from 17 to 38 MCM/day.

In addition to Langeled and BBL, thre will be two new LNG import facilities operating at Milford Haven, Excelerate's Teeside LNG facility, upgraded capacity at Isle of Grain LNG and greater import capacity through the Zeebrugge/Bacton interconnector all within the the next year or so.

I do not foresee any capacity shortages in the UK for the next 5 years - however we will be increasingly reliant on LNG and our demand for LNG will set the winter NG price from 2008/09 forward.

All the above numbers and dates are from memory, so please excuse any errors.

So there are now more connections. Is there more gas? Or where was this gas that's now coming to the UK going previously?

Peter.

More pipelines, more LNG import facilties, greater capacity through existing facilities.

Ormen Lange is a huge Norwegian gas field in the North Sea, with approx 315 billion cubic metres (BCM) of reserves. It is a new development, scheduled to start flowing gas in autumn 2007. At maximum production rate, it can produce 70 million cubic metres (MCM) per day for 12 years. 70 MCM is about 15% of total UK demand on a very cold winter day, and about 33% of average demand on a summer day. http://www.offshore-technology.com/projects/ormen/

There are three new LNG import facilities:

1. Excelerate's offshore facility at Teeside (circa 10 MCM day, operating now, geting gas wherever they can source it from. Algeria may be a potetnial supplier as the Belgian company Distrigas has switched supplier from Algeria to Qatar on a new long term LNG deal for their Facility at Zeebrugge)

2. Dragon LNG in Milford Haven (http://www.dragonlng.co.uk/index.cfm), owned by BG, Petronas andf the Carlyle Group. Will have initial capacity of 16.8 MCM/day. gas will probably come from BG's Egyptian or Trinidadian operations

3. South Hook LNG (http://www.southhooklng.co.uk/) ExxonMobil/Qatar Petroleum, will be two stage development each with capacity of 28 MCM/day. gas will come from Qatar

BBL Pipeline (http://www.bblcompany.com/). 38 MCM/day. Gasunie, Gazprom, Eon, Fluxys. gas could come from Dutch Groningen field but could equally come all the way from Russia

Isle Of Grain LNG (http://www.nationalgrid.com/uk/GrainLNG/background/) National Grid transco/BP/Sonatrach, 12 MCM/day increasing to 36 MCM/day by 2009. Gas comes from Algeria and from any of BP's operations (mainly Trinidad)

Off topic, but in reply to an email from Mr B. Head:

It would co-mingle with the gas (but also push some gas towards producers). Most gas fields produce by pressure decline - think of gas cylinder venting to air. Once it is "empty" it is in fact still full of gas - but at atmospheric pressure.

Oil fields produce by pressure decline at the start but later in field life switch to displacement - oil sweep by natural aquifer, water injection, gas cap expansion, gas injection and last but not least CO2 miscible gas flood.

It's clear there is no lack of import capacity. The question in my mind is whether there is going to be the gas to fill that import capacity. Considering LNG isn't there something like 3 times as much LNG import capacity being built around the world as there is reciprocal export capacity?

I don't know the exact number, but there is a clear surplus of shipping and regasification capacity in the LNG world (or a deficit of liquefaction, if you like!)

There will be enough gas to fill the UK import capacity - but only if we outbid the competition in the Atlantic Basin (ie USA, Spain, Italy, Belgium, France, Holland [in the future]).

Look at who owns the regas here: Exxon - they have the best gas from a geographical perspective in Qatar, and can move product to the highest paying of the Atlantic and Pacific Basins. They have already stated that South Hook will not operate in baseload import fashion, as have BG/Petronas/Carlyle at Dragon LNG. BG has regas capacity all over the place in the Atlantic Basin and are well positioned to swing their Trinidad and Egyptian production to the highest paying market. Excelerate also has a facility in the Gulf of Mexico and can play the Atlantic arb - their problem is going to be sourcing product.

UK looks pretty well supplied for the next winter or two, but after that will have to outbid the competition to secure supply during winter peaks. UK also has a huge deficit in seasonal storage facilities - I estimate that the UK needs about 400 billion cubic feet (BCF) of storage capacity (11.3 BCM) but currently only has only about 170 BCF. Once again, it is the planning and permitting process that is holding everything up. There is no shortage of sites, whether depleted fields or salt, but plenty of short-minded, ill-informed NIMBYism delaying things.

I think it unlikely that the UK will add more than about 30 BCF of storage in the next three years, which will add about 35 MCM/day to peak day supply.

The planning regime is a disaster.

You see it in new wind sites as well: Perthshire (I think) has a perfect record in rejecting new wind power facilities. And the Ramblers and other environmental bodies (see the 'Renewable Energy Foundation') cheer them on with papers 'proving' that wind power is a bad idea.

Local planning officers are not required to bear the national interest, and the national security interest, in mind when considering planning applications.

It would be different if we were building Trident missile bases or joining President Bush's (non functional) Anti Ballistic Missile system.

But if London wants to build the world's largest wind farm in the mouth of the Thames (The London Array), why then Deal Burrough Council can kill it, because it doesn't like the looks of the electricity substation).

bunnyonhead,

Thx for the links.

The link for Ormen Lange puts it nat gas capacities just below 50 Mcm/d.

Where is all this LNG going to come from?

NGM2 (in Norway)

Hello NGM2 - glad to hear from you - a genuine Troll!

Inspired by one of your charts, I made this - I'm still planning to do a post on UK gas supplies, but the lack of a crisis this year means I put that on the back burner...

I'm engaged in correspondence with the DTI on oil and gas suplies - and they do not foresee a supply problem till at least "the middle of the next decade". The UK has / is greatly expanding import capacity and the real question is where the imported gas will come from how secure and at what price?

With UK and Dutch gas production in decline, the western European gas market will get very competitive IMO.

Claire Durkin, Head, Energy Markets, Department of Trade and Industry at the Oil Depletion event in London last year didn't seem too calm about the UK gas situation.

However perhaps she is happier now, and can switch her focus to Peak Oil.

Yes, Claire was pretty rattled at that conference. IMO, winter 2005 / 6 was an anomaly, but a clear warning of what is comming. The difference between the weather last year and this is part of the story.

The bigger story lies in unravelling the growing international trade in gas. That is a major project. WRT DTI awareness of oil security, check this out:

http://ior.senergyltd.com/issue13/talking-point/

Euan,

why is it that when I make a comment on TOD, I seem to get an overwhelmingly response? It makes me feel so uninformed. :-)

Obviously I must be one of those trolls that have given you (Cry Wolf) some constructive (and perhaps artistic) inspiration. Nice diagram, mine have also been updated with the recent DTI data, and the declines in the UK should give a lot of food for thought. It could be interesting to know a little about the future supply scenarios DTI is presently placing their bets on.

Euan, I know we earlier discussed making a post on future UK nat gas supplies, but monitoring the devlopments from the databases I found the timing could be a little awkward. This is due to this years increased exports from Norway, the Netherlands (BBL import line) and so far (the global climate changes?) the mild weather. Obviously UK is presently awash in nat gas and I have noted prices has dropped from above 45 p/therm to presently below 18 p/therm. This price drop has impacted the bottom line to the Norwegian oil majors (Statoil and Norsk Hydro) for Q4 2006 and will even more for Q1 2007.

I am not fully convinced that the UK nat gas supply situation will not deterioate at earliest mid next decade. Building new receving facilites for LNG does not automatically mean that the ships with LNG will be there. The declining nat gas production in North America will have an impact on the global LNG market, and most LNG is, to my best knowledge, sold to southeast Asian buyers.

Building pipelines does not automatically mean that there is nat gas available to fill these. Nat gas production on continental Europe is declining, so it should be expected future declining exports from these countries to UK.

Then we have Russia, which I understand presently finds it challenging to meet their domestic demand while their indigenous supplies are declining. They have the reserves, but question is; Are enough investments being made to counter declines and build production capacities?

Euan, I think like you that the European gas market soon (very soon) will become very, very competitive.

Rgds

NGM2 (in Norway)

NGM2 - I think I understand and agree with the comments made further up the thread. The essence is that building import capacity does not guarantee supplies. Having greater clarity about long and short term gas contracts would help - I don't know if anyone has an overview as these are commercial contracts between companies - only when the short market got very tight last year did the UK government get involved - reportedly phoning round producers saying "we want more".

Hope this graphic helps clarify European pipeline supply from producers. Many small cross border trades are not shown, nor is the Mediterranean LNG trade. Based on BP 2005 Stat review.

Hope you keep calling by more regularly - we need Troll Gas!! I got one more climate post to finnish then I move back to global energy supply topic.

CW :)

CW,

Nice graphic. The cross border nat gas trades is a real challenge to make good estimates on.

I will try to call in more regurlarly.

NGM2 :)

The growth in Russian domestic consumption is striking to watch.

UES is due to float on London Stock Exchange at some point. Apparently the vast majority of their production is gas-fired, and there are serious power shortages threatened in St. Petersburg and Moscow, as a result of the economic boom.

Unless the Russians find more gas, there is going to be a real squeeze for their Western European customers.

In a spot market (for LNG) you can outbid someone else, and get the gas. But in a longterm contract market, you cannot. If the gas isn't available, it isn't available.

I think that I understand the situation a little better now. The problem which I have is that I see discussions like this, and Luis's discussion last December with the ASPO European gas prediction (which suggests peak right about now), and I think, "Oh dear!" But then on the media, all I hear about is utility prices coming down, and how this is going to bring CPI down considerably and so forth. So, the two views don't seem to add up (and it seems to be a similar picture in North America, with stories about cliffs, yet, in snippets I see producers scaling back due to low gas prices). Certainly further discussion of these issues would help me (and from a practical point of view, it would be very useful to know when would be the best time to fix one's utility prices :-)),

Peter.

Hello,

I think you are right that in these days of massive information flows, perceptions may be confused as various and conflicting facts may obfuscate the fundamentals.

There is no doubt that customers (households and industries) prefers low prices on utilities (electricity/nat gas). OTOH low prices accelerates the time for shutdowns of some of the marginal producing fields (which I am told on UK sector may produce with approximately threee months at a loss before they are allowed to shut down).

Low (nat gas) prices lowers the incentive for producers to build production as described here;

http://business.scotsman.com/index.cfm?id=297782007&format=print

This could in turn help acclerate the decline in nat gas production (which on UK sector is accelerating with year on year decline (Dec 2005 to Dec 2006) of 20 %, suggesting some 40 - 50 Mcm/d of new nat gas capacities/flows has to be added by Dec. 2007 just to remain flat.

The other thing is that though low nat gas prices are nice for the customers, the sellers that presently are pursuing short term contracts could turn to better paying customers/markets, thus the incentives to prolong short term contracts are softened by low prices.

In short, though low prices are nice, they could come with a cost later, and this is what I think Matt Simmons try to tell people; energy prices need to rise to enable a steady or increasing flow.

Rgds

NGM2 (in Norway)