It's CERA Week -- Houston, we have a problem

Posted by Dave Cohen on February 16, 2007 - 1:15pm

My remarks are in reaction to Running out of oil may not be the issue at all by Kristen Hays, reporting in the Houston Chronicle on February 14th on statements by John Watson, head of international exploration and production for Chevron, at the CERA conference.

All the talk of when the world will run out of oil could be rendered irrelevant because of geopolitical issues that block access to untapped reserves, the head of international exploration and production for Chevron Corp. said Wednesday.

John Watson told energy executives and analysts that the so-called peak oil debate focuses on the level of resources below the ground. He joined the prevailing view of speakers at the Cambridge Energy Research Associates' annual conference in Houston that the planet won't run out of oil anytime soon despite opposing theories that a peak and subsequent drop-off in production is imminent or even ongoing.Let's examine this point of view."Every time we say we're about to be tapped out, we find new ways to squeeze more out of reservoirs," he said.

Or, companies find new wells in hard-to-reach places, like Chevron's huge [ultra] deep-water Jack discovery last year about 270 miles southwest of New Orleans in the Gulf of Mexico.

But worldwide oil production could still lag behind demand if politics get in the way of access, Watson said....

"Above-ground peak oil will trump below-ground peak oil every time," Watson said.

Despite much searching on my part, it is hard to find good evidence that the global recovery factor (URR/OIP) has increased much. But, assuming a higher recovery factor, and regarding "squeezing more [oil] out of reservoirs", Watson's statement says nothing about the rate at which this putative extra recoverable oil is lifted out the ground. Framing this mathematically, no statement has been made about dQ/dt, where Q is the cumulative production and t is time. If you can "squeeze out" more oil, but you can only do so at a very small rate measured in barrels per day, then the recovery factor over a very long time period (measured in decades) is irrelevant to the issue of "peak oil". Concomitantly, if you apply enhanced oil recovery (EOR, eg. gas injection) or improved oil recovery (IOR, eg. horizontal drilling) — techniques meant to maintain previously achieved production rates or boost production after it has peaked in a field or basin — then it is important to remember that such techniques have a limited warranty attached to them. In other words, they are guaranteed to work for a relatively short period of time, measured in some small number of years. Witness what is happening at Cantarell after the use of Nitrogen injection.

However, even if one grants a higher recovery factor, it still seems to be the case that most increased world production since the year 1996 —to pick a date— has come from either 1) new fields discovered sometime in the last 20 years or 2) additions to fields discovered further back in time — this is called reserves growth. Remember, world oil discoveries peaked in the 1960's. In the first case, older basins like the Caspian have been re-explored, which has led to new fields like the Azeri-Chirag-Gunashli. In other cases, technology has enabled development of deepwater fields like Dalia (offshore Angola). Given the historical discoveries curve, there appears to be a limited horizon under which such production can replace, let alone surpass, current declines in existing production, which most estimates place at 4 to 5% per year.

Deepwater and Some OGJ Data

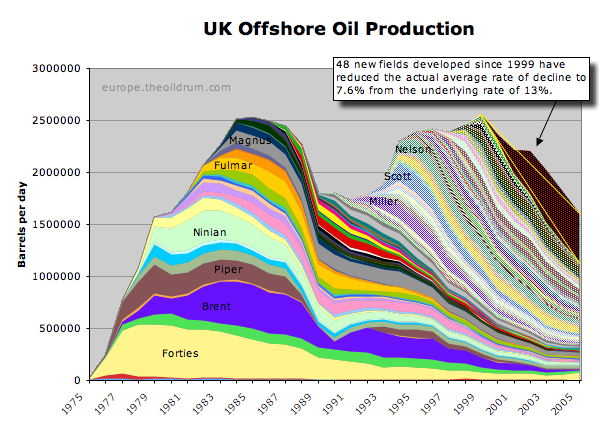

While ultra-deepwater holds some promise, it is still the case that all deepwater fields ramp up quickly, peak and then fall off rapidly, and the shape of this curve further depends on the field size. Look at this graphic compiled by my European colleague Euan Mearns in The architecture of UK offshore oil production in relation to future production models.

UK Offshore Production — new field additions

have reduced the overall decline rate from 13% to 7.6%

Click to enlarge

As usual, the larger fields were produced first. After an interruption — which I shall discuss below — a large number of smaller fields were put on stream. All these offshore fields show the same production profile, but the smaller fields produce less oil, just as they peak and decline more quickly. You can expect to see this historical trend in the future in the other prolific deepwater basins — the Gulf of Mexico, Brazil (Campos & Santos basins) and West Africa (Gulf of Guinea, Nigeria, Angola). Therefore, future ultra-deepwater fields will likely provide only replacement barrels for declining deepwater production at best, hype about Jack #2 aside. In any case, new fields will have to be constantly found and completed to maintain production rates. This trend is obviously unsustainable.

As for this —

CERA released a report last November that took aim at theories that the world has hit or passed the peak of oil production. CERA argues that information from the U.S. Geological Survey shows the world has 3.7 trillion barrels of oil, both tapped and untapped, rather than the 1.7 trillion barrels estimated by some peak-oil theorists.— it is sufficient to note that discoveries have not kept pace with USGS predictions and that oil from shale, various sands (including Canada) and coal-to-liquids conversions will not make major contributions in any time frame we care about.CERA's outlook includes conventional oil, or that extracted from the ground or in shallow waters offshore, as well as unconventional oil, or that derived from oil-soaked sands, natural gas liquids and coal turned to liquid and shale.

Some recent data: according to the Oil & Gas Journal (February 5th), the worlds natural gas liquids supply in 2006 (10 month average) was up over 2005 (same period) by 83.0 kbd, a rise of 1.04%. Outside the Middle East, the world was down 34.0 kbd. According to the OGJ (February 12th), the world oil (crude + condensate) supply in 2006 (11 month average) was up 479 kbd, a rise of 0.66%. If it weren't for the former Soviet Union (FSU), the world would have been substantially down. These numbers amount to no significant change, given margins of error in the data. The data indicate failure, an inability to grow the world oil supply. Is this being discussed at CERA Week in Houston?

Lovell: Houston, we've had a problem.

We've had a main B bus undervolt.

The Oil Drum team studies the glitch.

Source.

Stochastic Factors

Now, as you can see, the UK offshore production shows a "double hump" in the historical profile. Why? The short answer is that shit happens. The longer answer was provided to me by Euan.The first peak is built on the back of giant fields — Forties, Brent, Piper and Ninian. The oil price crash of 1986 led to a slowing in investment, the postponement of several new field developments and a hiatus in exploration, which in turn led to a bi-modal discovery history.So, considering what happened in the North Sea, and getting back to Watson's remarks, the important thing to understand is that there is a stochastic component to oil production. In the modern geopolitical world, it just happens to be the case that most of the world's remaining reserves are currently in unfriendly or dangerous places. The geographical distribution of the world's largest oil-bearing basins is an artifact of events (for example, plate tectonics) that occurred in geological time, as well as the inherent randomness in human history that drew those country boundaries and the populations that live within them. That's just the way it is. This observation must be qualified by a more recent historical fact — the West has already used up most of its easy oil. See the last section.The Piper Alpha oil rig explosion of 1988 that led to lost production from this hub for 4 years, and reduced production from a number of fields while sub-sea control valves were fitted to production wells in the wake of this disaster.

The rise from the valley between the peaks was caused by postponed projects being re-instated, large new fields being developed — Nelson Miller, Scott — and the end of forced maintenance retrofitting safety valves.

Watson said other above-ground risks include gaining access when national oil companies control about 80 percent of reserves.Watson can complain all day long that Hugo Chavez has a bad attitude or that Kuwait is lazy, but the simple fact remains that concerns about peak oil are not limited to geological constraints, which themselves were subject to the vagaries of deep time. Our concerns also encompass random, non-deterministic "above-ground" elements. Ask Vladimir Putin what it means to get lucky. Actually, perhaps it would better to ask the EU or the Ukraine. We also need to acknowledge the injurious effects of random geopolitical events — the Iraqi civil war, Iranian leadership & policies, western leadership (W) and policies toward Iran, Venezuelan politics, Nigerian rebels — and then move on. If Al-Qaeda hadn't bombed the World Trade Center, we wouldn't have invaded Iraq, which wouldn't be falling apart.... There is always this stochastic element in human history, just as human nature never changes. It is a form of unreality for Watson & others to bemoan the lack of a perfect world for oil production where there are no wars, national politics, catastrophic equipment failures, economic recessions, price volatiliy, conflicts between social groups, etc. Get used to it.

The oil price provides special cause for concern as another stochastic "above-ground" factor. There is apparently no guarantee that the oil price will provide a reliable signal of supply & demand fundamentals over short time periods (up to several months, perhaps longer). All sorts of irrational market "perceptions" and random events influence the oil price. Unless there are guarantees that the price will remain high, the oil companies will not even bother to produce ultra-deepwater fields or other difficult-to-produce resources. Even price depressions lasting short periods of time can do lasting damage to the world oil supply — this is the destructive effect of volatility.

Really, what Watson should be addressing is why the oil industry is such a mess. Inflation is eating up new E&P investment, there are equipment and skilled labor shortages. The infrastructure supporting existing production is aging and not being maintained (see Prudhoe Bay or use of rigs that should have been retired).

Keeping Our Eye on the Ball

Returning again to geology, we get this statement —Joseph Bryant, CEO of Houston-based exploration and production company Cobalt International Energy, said at Wednesday's peak oil panel that the industry continues to develop new resources — just not "super giant" fields.It's good to know Bryant finds it difficult to conclude that the world is runnning out of oil. We've reached the same conclusion at The Oil Drum. It's also heartening that Bryant does not think there is an endless supply of super-giant fields, because this indicates some connection with reality. And, if we define "super-giant" as being in the same size range as Burgan, Ghawar, Samotlor, Daqing or Cantarell, then we can most likely conclude that there are no fields of this type left on Earth. We know that "super-giant" is not as big as it used to be. As to the idea that we may no longer need such fields if we "tackle more fields more efficiently", I am not comforted by the conjecture that an envisioned increase in the global recovery factor in many smaller fields will provide enough oil in a timely manner, and do so indefinitely until unknown substitutes come onstream, thus rendering the peak & subsequent decline of world oil production a non-event.Bryant said that until technology shows there is nothing new to find, it's difficult to conclude that the planet is running out of oil.

"I do not think there's an endless supply of super-giant fields," he said, but they may not be needed if producers tackle more fields more efficiently.

Another thing not spoken, which is little understood by the public, is that we already ran through most of our oil here in the West, and what a shame it is that those uncooperative people in the rest of the world won't play by our rules — and give us what we want. This dilemma is compounded by the fact that some uppity countries in Asia are being quite assertive of their rights to a significant share of what oil remains. This "argument", if you can dignify it with that term, presumes that it is only a matter of allowing the international oil companies to produce huge untapped resources in the large producing countries. Blame is assigned — the exporting nations are culpable for withholding their oil, either from greed, hostility or incompetence. Thus, the presuppositions — that 1) there are vast, untapped resources ripe for the picking and 2) these riches could be easily brought on stream in a timely way to satisfy ever-growing world demand — are not questioned.

Until Chevron's Watson or Cobalt's Bryant or organizations like CERA start dealing with reality — and leveling with the public — instead of engaging in wishful thinking or complaining about things they have no control over, we will have to listen endlessly to this empty discourse while doing nothing to mitigate the effects on world economies of a peak & decline of available oil supply, regardless of its causes. Let's keep our eye on the ball.

Dave Cohen

Senior Contributor

The Oil Drum

davec @ linkvoyager.com

Release the hounds!

Al Qaeda Publication Calls on Jihadists to Attack Oil Facilities That Supply U.S.

http://www.foxnews.com/story/0,2933,251942,00.html

Bah, a previously US backed group may or may not, as a group decided to attact "us providers". Or is asking for others to kill themselves attacking oil infrastructure.

How about the 'dump the dollar' movement - far MORE of a threat than 'evil terrorists'

http://counterpunch.org/roberts02122007.html

If the world opts to stop accepting US Dollars for trade, what is the US Gonna do? Shoot the merchant class like 'the terrorists' have been shot (at)?

Other concerens for Americans is the people who will suffer in a deep recession/depression, the life changes from that and end up thinking and acting like Samuel Byck.

http://www.google.com/search?hl=en&q=Samuel+Byck&btnG=Search

People who feel they have 'done everything right' and are shocked when things in their life end up 'wrong' - how many will lash out in societally-destructive ways?

I guess that Samuel Byck, being Jewish, cannot be called a terrorist!

Release the hounds!

No no, Q-Tips! Fetch my cotton swabs!

See, there's oil on the bearings of this pumpjack! We're saved, the world hasn't run out of oil after all!

What's all this about a peak?

The Lower 48 and North Sea Case Histories

Based on the HL method (crude + condensate):

The Lower 48 peaked in 1970, between 50% and 52% of Qt and has shown a net decline rate of about 2% per year since peaking.

The North Sea peaked in 1999, between 48% and 52% of Qt and has shown a net decline rate of about 5% per year since peaking.

Both regions were developed by private companies, with no restriction on production, other than the Maximum Efficient Rate and regulatory limits.

Two, regions, 29 years apart, developed by private companies, same result--pretty much all out drilling efforts have simply slowed the post-peak decline rate.

The simple hard cold reality is that we find the big fields first, and the smaller fields that we subsequently find post-peak cannot offset the declines from the old, larger fields.

This does not mean that we stop finding oil. It just means that can only hope to slow the rate of decline.

Lets not forget that Texas, which at one point provided nearly 35-40% of the oil for the US, was considered a Cartel until its peak in 1972. Clearly there were SOME restrictions in at least one of those regions :P

As I have outlined several times, IMO, Saudi Arabia is to the world as Texas was to the Lower 48.

Based on EIA crude + condensate and the HL models, Saudi Arabia and the world are now declining at the same stages of depletion at which Texas and the Lower 48 respectively started declining.

BTW, the Kashagan startup has been once again pushed back--this time to the 2012 time frame, which suggests that the earliest that we will see peak (one mbpd plus) production from Kashagan probably won't be until after 2022. This is the only new one mbpd and larger field on the horizon.

At a 5% underlying decline rate, we need about 3.5 mbpd of new C+C production every single year--just for production to stay flat.

Well WT things seem to be going basically as you have predicted so far. We will know I think later this summer of the world has peaked on oil passes 70. Barring of course enough of a economic slow down to cause significant demand destruction. I think at least in the first half of 2007 the economy will stay strong enough that demand issues will not hide peak oil. The key is to get KSA in a situation where that either have to open up the spigot or admit they can't.

My prediction of a peak in prices between Feb 15 and March 15 seems to surprisingly be on course. Time will tell.

The model I used was pretty simple I considered the price of oil to behave like a rock dropped into the center of a round pool. The trick is guess the size of the pool. Once the initial wave reaches the edges it returns causing a spike.

Peak oil or supply is modeled as a shrinking pool.

So far so good. The trick is of course the size of the pool is decreasing so the spikes should both come more often and go higher over time.

My assumption was that oil price in this model was moving on a 8 month scale. If the pool is shrinking on average by half between the peeks that means the next peak would be in 4 months after the top of the comming peak. Then 2 months then I think it repeats. I'm not sure the model is good enough to handle all the issues but we will see. I think its a pretty good simple model for the price of oil at peak and it has a simple prediction that the time between peak prices will shorten until in a sense the market is exhausted resulting in a long period then the cycle repeats. The exhausted market represents either the boundary moving back or the scale reducing

as a significant number of players leave the market.

The idea came from looking at prices at peak and realizing they matched up to 1D slices over time in the above 2D model.

In any case the next two years should show if I'm right.

As I have pointed out on numerous occasions, there have been 7 different instances since 1980 in which oil production reached a plateau or declined. In two such instances, oil production declined by more then 1 million bpd, AND it took almost 3 years for production to surpass the previous high. We will know in another 18-24 months if we truly are at peak oil or not. Until then, rampant speculation does nothing but irk proponents on either side.

Let the data do the talking. And that doesn't mean how you chose to fit the data WT.

Actually the pool/rock model works for these cases also.

In this case the pool is getting larger faster than the price/demand ripples are moving. And return wave is muted and basically undetectable. Like dropping a rock in a large lake or the ocean. Only at peak do the size of the pool i.e. supply start having a big effect on prices causing a semi-periodic forcing.

In the past price dropped until oil was so cheap it was not worth expanding the pool. The key difference today is years of high prices have not resulted in any significant expansion of the pool.

If we are not at peak then plenty of oil projects should be profitable at 30 a barrel and we should have seen prices drop into this range by now. At the minimum a lot of project that are profitable at 30 should be coming online rapidly by now. Most people mention a higher floor price of 40-45 with confidence.

With almost 7 years of oil trending upwards production should have continued to increase at a steady clip. Yet we have had 2 years of stalled production without prices dropping to the 30 barrel level or even 45 for that matter.

http://www.wtrg.com/oil_graphs/oilprice1947.gif

So far I've not seen anything that rebuts WT model.

And if things continue as they are we have a chance to find stronger support for WT within the next 6 months.

Also I might add that the fact will speak for themselves

WT has made a great case given the information we have.

I don't understand the constant need to needle him.

He has made a prediction its testable and so far its passing all test that have been offered. The strongest test is of course when oil crosses 70 a barrel and KSA does not increase production.

If they do then WT is wrong so far he has not been wrong.

I'm sure we will know this summer.

And all this BS about 60 a barrel being comfortable is just that 45 a barrel is fantastic for KSA they should be pumping like mad. China is booming India is booming the world economy is growing faster than ever before the chances of them actually causing a price crash below 45 is slim to none. US producers have far higher costs and I don't see them slowing production.

So far at least revenue lost from lower production basically matches any gain from higher prices. KSA would probably have to drop production by at least 2 mbpd to get significant price increases that over revenue loss from lost production.

I guess I don't buy into these relatively small "cuts" that OPEC has made. If they want the price higher cut production by 2-3 mpd eliminate the glut then raise it slowly to a comfortable level.

Anyway.

memmel...good commentary. I have asked Robert (where is he lately btw?) many times this simple question...if things are just dandy and oversupplied in the oil industry, why is crude still $60 a barrel....I don't think I've heard a simple answer yet.

I think I asked him that question a few months ago and his response was, "if we are past peak, why is crude not at $100?" or something to that effect.

But the price of oil is only an imaginary number created by human psychology. Even if for some insane reason the price drops as we peak (super demand destruction), it won't change the underlying geology, or the fact that the human population is still growing, while energy resources are dwindling.

This leads to the argument that $60 oil has not appreciably hurt the economy. Which in turn leads to a possible conjecture that $60 oil is not 'expensive' oil given all other economic metrics involved such as growth in GDP, inflation, etc. Which in turn gives credence to RR's answer on the price likely being 'painfully' higher if we really are/were at/past peak. As has been said, $60 (or $50) is the new $40 (or $30) price that we accept as... acceptable.

60 is hurting our economies and so did 70+. I believe that last summers oil prices was the pin that pricked Americas housing bubble. The additional expense of gasoline caused enough people to pause in the migration to ever distant suburbia that the housing bubble collapsed. At that point in the bubble the last people buying houses could not afford the additional cost of gasoline and a crazy loan package. Things got that out of control. Thus people in the 25-35K a year income bracket did not buy 300K houses. The few hundred a month extra for gas stopped the ponzi scheme at the bottom.

The current price of oil is relentlessly sapping the real economy i.e. production of real goods and services. The only thing keeping the economy afloat now is the sloshing of all those petrodollars and china dollars back into the US as investments generally buying up US debt.

In our current whacked economy China/Japan/OPEC gets dollars that we print like crazy going into debt buying their goods then the nuts invest it back into the US. Allowing us to borrow more money. Sooner or later this game will end.

Core economic indicators housing manufacturing all started down when oil hit 70+. Most American companies are in reality Chinese /American with as many or more employees in China as in the US.

The current record profits simply reflect that these companies are playing both sides of the game.

Look at the P/E's of the stock market its been a speculative bubble for some time.

Whats amazing is how long the jugglers have managed to keep all the balls in the air not that the world economy has long since lost touch with reality.

If you look under the covers just a little bit you will see that the US economy is in the worst shape it has ever been in since the Great Depression. Now its just a matter of when it collapses and what the trigger will be.

Look at the trade deficits

Negative savings rate

Housing bubble crashing

The American consumer recklessly spending on credit.

Neither China nor Japan working to balance trade.

In short we are in for a long hard depression. The chance for a recession is gone.

My only question is what is the trigger.

Hedge Fund blow up

Yen carry trade unraveling

Oil hits 80+ a barrel

petrodollar collapse

Massive wave of BK's from the Housing bubble.

Thats the tough part. I'm just hopping to see if we last long enough to call KSA's bluff.

Dont be surprised if the catalyst is GMAC finance. I read an article this morning (can't find it now) that basically laid bare several facts about their "investment" portfolio. By investment I mean loans for homes. They are really out of whack in terms of risk management and their sub prime portfolio is blowing up in their face. Combine that with the purchase by Cerbrus....damn I need to find the article.....oh Mish had it.

http://globaleconomicanalysis.blogspot.com/

http://wallstreetexaminer.com/blogs/winter/?p=436#more-436

Guess how these banks are going to find the reserves to pay for the losses? Pull money out of their equity accounts of course.....

tate, interesting idea but wont the taxpayers ultimately "cover the losses" ?

as a side note gmac is offering online money market accounts paying in the range of 5% for basically a saving account. gmac states that the money market account if fdic insured ?????

"60 is hurting our economies and so did 70+. "

I agree that the high(er) oil price may be a 'stealth' drag on the economy. Along with all the other such drags, such as increasingly unservicable debt, spells hard times. Whether tomorrow or in 5 or 10 years who knows. I would bet on a within 2 years time frame. Hopefully in time for GW to get more of the blame he so richly deserves, even if his policies are not directly related to the long term problems.

A few quick points to make.

"In short we are in for a long hard depression. The chance for a recession is gone." There are far too many variables in play at present to make such a conclusion. Notably the FED has a few arrows left in its quiver. Until the quiver is empty, count on the FED continuing to act so as to squish market volatility in every direction.

Don't bank on a hedge fund blow up causing a 1929-like event. LTCM didn't thanks largely to the FED organizing an orderly fire sale of positions. Amarath didn't, thanks to Citadel and JPM. Hedge funds are SWIMMING in cash at present. Any mess-up will likely be resolved just the way Amaranth was: large-scale buying of the portfolio by other hedge funds/banks at discounted prices. Some hedge fund investors lose, others win, and the market moves on.

The runup in oil pices the last few years was from demand growth via growing economies, not from a large drop in supply. Thus, when some talking head predicts a recession when oil hits $X, ignore them -- how we get to $X matters. A supply shock can easily cause a recession (like the Arab oil embargo of the 1970's), but not a rise in oil prices due to strong economic growth against roughly level oil production. The rise in oil in such a case simply reduces growth.

The aggregate American consumer still has several months left on the "credit card". The slowdown in housing should result in a drop in the home-as-an-ATM-machine (cash-out refis, etc.) driven spending. The best case scenario is for income gains to make-up for the drop in home-equity "bonus cash". Will income gains be this large? I doubt it, but the US economy is still chugging forward. The US economy may get a little lucky this time around.

The dumb-dumbs in the media babble on and on about the trade deficit, but they almost never discuss "cash flows": America earns as much on its foreign investments as foreignors do on their US dollar holdings. Prior to 2005, America was cash flow positive in spite of the "face value" of foreign investments in the US far exceeding the "face value" of US investments abroad. (Borrowing from the Asians at 4% to make equity investments abroad that return much more than 4% is not such a bad thing. Risky? Yes, but not necessarily stupid.) The US is roughly cash-flow neutral at present. Worry when America gets cash flow negative. Since the cash-flow situtation has been steadily deteriorating the last several years, it's almost time to start worrying. I strongly recommend immediately reducing, if not completely eliminating, the debt side of your personal balance sheet. No need to panic, but now is NOT time to lever up. Just my $0.02.

I'm off to Mexico for a holiday. Have a great weekend.

From what I read in the WSJ, JPM was directly involved with and facilitiated the Amaranth failure. They would not release Amaranth's margin funds and they were the clearing house of record. They made the most money (of all players) salvaging and reselling the remnant positions. It was an incredible conflict of interest.

Very interesting thoughts...would like to hear more when you return.

You are doing great Memmmel, this goes along my lines (way to answer, thoughts and clarity). Nice.

Thanks ..

A drum could also be used as the model but this is already the Oil Drum :)

I wonder how many complex 1D systems can be modeled as a 2D wave with reflection and a time scale. The model is empirical but on the same hand it seems to make price changes clearer.

The trick of course is that the pond or drum thats bounding the 2D wave is itself changing in size. I did not do the numerical analysis on the system but I think it can be chaotic for certain parameters.

Also note that the model predicts that record highs must be followed by crashes. Since the pond cannot shrink any more and must expand. Permanently high plateau's are impossible.

A few other things it predicts. Unexpected or external events to the market cause a new stone to be dropped in the pond if its a negative event or the pond to get larger if its positive. Smaller negative events are modeled as a slight contraction of the sides of the pond. Really big negative events are both a contraction of the pond and a new stone.

So event like and embargo basically reset the whole system.

This model predicts this and its exactly what happened in the 70's the whole oil industry reset after the Arab oil embargo.

Sure texas had peaked but the important factor was actually political. The peaking of texas prevented the US from expanding the pond. Not till the North Sea came online did we go back to the expanding pond situation. So we had a full market reset.

It is a qualitative model but if you get the parameters right it has some empirical predictive powers.

I've been reading all the voodoo Elliot wave and technical analysis cruft and of course pricing at peak and I think my model is far simpler more intuitive and predictive than anything else I've seen. I've never seen another model that forces a crash to happen after large peaks. The fact mine goes to infinity as the size of the pond approaches zero or the size of the rocks splash approaches the size of the pond is not modeled by other approaches as far as I know.

Note it does predict a price crisis happening at some point with a depleting resource. You are going to get into a situation where the parameters are sensitive to the creation of a really big splash or wave. So according to my model we will see a price spike to hundreds of dollars a barrel causing basically a system reset to new parameters.

So if I'm right a 70's style shortage embargo situation is coming but its not for political reasons but because of depletion.

It will pass but after its over the market will reset.

From WT export land model this is when the pressure of internal consumption plus the need to export plus the wealth of consumers meets at a crisis point.

If I had to guess today when this would occur I'd say Mexico will initiate the next crisis with the populace of most oil producing regions responding unfavorably to the realization that the oil export money won't last forever.

WT export land model actually predicts internal crisis in each of the oil producing countries as they are forced to either give up exporting or radically change their subsidy strategy for internal consumption.

Also Bush could bomb Iran.

So basically we are going to go from crisis to crisis over the next 4-5 years with the mother of all oil crisis happening when parameters reach the right values. So according to my model we are due for the big one. After that the market resets.

In reality the pond model is not a pond but the tightening noose of a hangman's rope.

Excellent thread and Kudo's to all involved.

Dave, well reasoned critique of CERA and its statements. An ability to increase daily supply is not the same as running out of oil no matter how many times they try to make the two equal.

Westexas, I agree your assessment of the geology and impact of supply have been the best predictor for close to 2 years now. Keep hammering your basic message so that new readers come across it. You have the patience of Job to put up with Hothgar. Ignore him as I do now.

Memmel, A really excellent and creative way to show how markets interact with supply/demand and prices. Good way to track and predict price swings based on true supply versus artificial supply based on someones profit motive to increase or decrease the commodity. I now have a pictorial model for economics rather than mathematical formula. Very handy. Thanks for sharing this concept, wether you invented it or not.

All in all the very best of what TOD provides in content for understanding oil supply and when that pesky peak might become evident. Thanks to all, keep it up your message does get through all the irrelevant posts.

Do the rocks dropping in the pond get larger over time, also causing larger spikes? Perhaps as more people begin to appreciate that perhaps CERA ain't telling it like it is?

Thats why the model is qualitative not quantiative you have to many knobs to turn :)

The only two fixed quantities is it takes X amount of time for a super tanker to sail from the producer to consumer. And the edge of the pond represents the total amount of oil. The two conditions give a natural cycle of 3-4 months with 3 big peaks each year.

External events like and attack on Iran or collapse of Mexico are big rocks that overwhelm the natural cycle your free to toggle the model as you wish. Change the size of the rocks the timing change the rate that the total pond size changes etc etc. The model would generate any waveform you desire. The only new factor is the reflected wave coming back to create secondary peaks. This concept of a echo peak caused by resource depletion is I think novel.

This reflected peak is caused by high prices demand destruction price reduction and increased demand. Thus once supply is constrained every price peak spawns the next one.

If supply where too increase you would not get the reflected wave but it would dampen out as the bounds or pool size increased.

Thuis pre-peak we would never see this reflected wave. And also the natural cycle demand driven is for two peaks in prices once in winter and once in summer. The prediction of a third and basically final peak in fall is new. Along with the prediction that attempts for the market to move to 4 peaks results in a reset. The argument is that the sailing times of tankers places a intrinsic restriction on how much oil we can move and how fast. Of course at some point post peak these tankers simply won't have any oil to deliver this leads to the 4 peak crash.

Anything more than this would entail doing a really good job of tuning the model to sync it with reality.

One more time :)

If the model is right and we are post peak we will move to 3 peak pricing seasons followed by a aborted attempt to move to 4.

We will never again see low prices in the fall and inventories should be at all time lows in early fall along with major SPR draws in the summer. Eventually of course we will have summer walking season not driving season as people move to use buses and trains and other public transport for summer vacations.

Obviously the vacation industry will be the first to die.

Or at least one based on car/air travel. Local vacation spots should fare quite well.

It of course makes sense that the most frivolous industry on the planet is the first to go.

your model makes a lot of sense, and the pond may be infinite acting (as the cornucopians assume). ..............and now a disclaimer:past performance is no guarantee of future returns.

The price of oil in the near term might behave differently than a Peaknick might think.

We are headed into the shoulder period - the time between peak heating and peak driving demand. Though we are not there yet, the crude futures market is in a condition of significant "contango", in which the spot price is lower than the futures price, indicating, at least temporarily, oversupply.

If the futures market market exhibited the opposite, "backwardation", that would indicate a shortage. Prices would move accordingly.

I like your analogy/model of the rock in a pond, and will happily consider it in my trading.

In the end demand may no longer drive supply as it did in the past, but demand will drive prices. If the economy were to experience any type of contraction, demand would be decreased and it would be my expectation that the price would fall, all else being equal That leaves us back with a "chicken or the egg" scenario:

Did diminished oil supply cause demand destruction and a recession, or did a recession cause demand to fall. Even with the benefit of hindsight, I am not sure if i would be able to determine the difference.

"...the crude futures market is in a condition of significant "contango", in which the spot price is lower than the futures price, indicating, at least temporarily, oversupply..."

Another anology that was here reciently was short term interest rates were higher than long term ones(inversion) It doesn't make sense but it can and does happen.

I have often considered the same thing PO might be covered by economic factors and it might be that we will never recognize it.

DelusionaL:

I like your handle...

The "natural state" of futures markets is contango. After all, future(s) prices should be higher to reflect sorage, maintenance, and transportation costs. Inverted yield curves, while not unheard of, are far less commone then positive yield curves, and ussually indicate a recession if the inversion lasts for greater than a certain period of time.

Speaking of which, the currrent yield curve has been in this condition for longer than has been traditional to predict a recession - yet, as yet, one has not materialized. Clearly, this is not an exact science.

The fingerprint of fiat currency manipulation is all over our current economy. Nothing is natural right now. Give it time.

The only thing playing games with money causes is for the eventual downturn to be far harder than necessary.

We did succeed in creating a real global economy over the last ten years the problem is its out of control. Thanks mainly to Japan China and the US. EU economic expansion is the only real growth that has happened not that they are not playing games too.

Chinese economic growth is a myth. Its fueled by deficit US spending and Japan trying to maintain and export economy in competition with China. All three economies will implode taking South America out as collateral damage. Europe should survive as the strongest economy it will have a lot of problems but it will be better than the rest.

In Arkansas their is a saying.. Thank god for Mississippi.

This comes from Arkansas repeatedly beating Mississippi and ranking 49 instead of 50 in a lot of metrics. Yes their is a fight at the bottom :)

I think Europe will be the Arkansas economy of the future. The strongest of the weak.

Assuming the global economy does not implode for other reasons peak oil is certain to cause it.

"Chinese economic growth is a myth. Its fueled by deficit US spending..."

Agreed, and do they care if all the factories are on thier turf. I guess the factories could be bombed in a mutual game of screw you.

We traded alot of security for low Walmart prices.

Don't forget all the pollution we have let them have.

What use are the factories they only need a tenth of what they build for their internal economy. For a balanced real global economy maybe 30%.

Next the have no way to handle the waves of layoffs once the trade unravels.

Despite what people say about the US we are the real bastards in the world and we hoodwinked China into chasing the American dream.

No matter how bad it gets in the US no doubt in my mind it will be far worse in China.

If

is true, then how do you explain China trades more with the EU than the US? Let's be a bit more honest. China is not wholly dependany on any one nation any longer. Catch up on some current Chinese reading and you'll find bits a pieces of your point, but your blanket statement is not true.

http://www.chinadaily.com.cn/china/2007-01/28/content_794665.htm

I won't argue over Japan, they are indeed idiotic to say the least right now. Also on China, keep this in mind. They are in a desperate race to get farmers into the cities and transform the country. This is a delicate balancing act and they accomplish it by building anything, anywhere. They have hundreds of auto manufacturers, hundreds of ball bearing plants, etc etc. Resources are being wasted in such ways we may be put to shame. This will cause a glut of overcapacity and CHEAP assets but thats years away IMO. Yes it's interconnected, but it's not as dependent as we still think. This complex environment can do anything at this point!

I don't disagree its a complex subject and I am aware of the trade balance with the EU.

As far as I know the EU does not have a massively negative trade imbalance with its partners overall. Nor does the population have a negative savings rate. And China is not buying up EU debt to support deficit spending. And finally most of China's reserves are still in dollars. I mentioned a few times that Europe looks like the strongest of the weak western economies.

A wild guess is that China/EU trade might be 25% of what it is today for political reasons I think a lot less.

But your forgetting that we are a huge trading partner with the EU also so if we go down China/EU trade is certain to decrease Also I think their will be a strong backlash in the EU against Chinese imports if the US falters. Localization will happen.

Or put it this way the global economy is at a cross roads either the current trade imbalances are settled in a friendly manner or they will be settled via a big unwinding. I think France and Germany will force the EU to focus on internal trade or they will break up the EU.

The problem is we now have created this huge unbalanced global economy which cannot last.

Needless to say it is a complex topic maybe I should add a few caveats to my strong statments...

Naw :)

I don't disagree its a complex subject and I am aware of the trade balance with the EU.

As far as I know the EU does not have a massively negative trade imbalance with its partners overall. Nor does the population have a negative savings rate. And China is not buying up EU debt to support deficit spending. And finally most of China's reserves are still in dollars. I mentioned a few times that Europe looks like the strongest of the weak western economies.

A wild guess is that China/EU trade might be 25% of what it is today for political reasons I think a lot less.

But your forgetting that we are a huge trading partner with the EU also so if we go down China/EU trade is certain to decrease Also I think their will be a strong backlash in the EU against Chinese imports if the US falters. Localization will happen.

Or put it this way the global economy is at a cross roads either the current trade imbalances are settled in a friendly manner or they will be settled via a big unwinding. I think France and Germany will force the EU to focus on internal trade or they will break up the EU.

The problem is we now have created this huge unbalanced global economy which cannot last.

Needless to say it is a complex topic maybe I should add a few caveats to my strong statements...

Naw :)

I stress that the model is qualitative not quantitative. If you get lucky and plug in the right numbers you get a prediction that is accurate over basically any time scale. The smaller the time scale the more "rocks" or really pebbles are being thrown in. Note that at the smaller scale reflected waves from previous peaks are not relevant. Only theoretically does the model have predictive powers.

Notice I predicted a price peak between Feb 15 and March 15 a time that as you mention should not result in a peak. According to conventional wisdom we should not be having a price spike over the next few months. My model said we would get a reflected wave spike about now from this summers peak.

The natural oil price cycle seems to go from April to April with a peak in the summer and a peak in the winter.

My model is predicting a change to three peak price points not two.

1.) Late Winter peak ( timing controlled by global warming )

2.) Spring Early summer peak ( attempt at a driving season )

3.) A new fall peak ( Hurricane fear driven political responses peak oil)

More important the new fall peak is directly related to peak oil it only happens because the pond is getting smaller. Also notice that the warm winters are saving us to some extent by pushing the winter peak a bit later.

In my opinion this new peaking of prices in the fall should show up next year.

Once it goes to four peaks as you can see we are headed for trouble. We don't have room for four peak price points since a pricing/supply cycle takes about 4 months for logistic reasons

you just cannot contract and move oil beyond the rate a tanker fleet can sail.

This is why opec took 3/4 months to study the effects of their cuts you have that much slop if you will in the actual supply of oil.

Notice that the fall peak from Katrina in 2005 was and outlier

my prediction is that over the next two years it will become permanent. When the system tries to move to 4 peaks a year it fails. The intrinsic maximum number of peaks possible without a market reset is 3. Since at 4 we go to plateau and thats not allowed.

So if I'm right we will see a price spike or peak this fall.

This is a peak oil signal no matter how they spin it.

One more thing :)

The driving force for the fall peak is refilling of reserves esp the SPR in the US and chinas new SPR. Everyone will have one in the next few years. They will be drawn down in the summer and maybe some in the winter to soften the natural price spikes but refilling them in the fall will be the main cause a new spike.

So we should be seeing record low inventories in late summer from now on out if peak oil is upon us.

If we get hit by a hurricanes in the gulf ouch...

As much as I'd like to think we can be more certain by as early as this summer, reality has an unfortunate way of muddling things beyond belief. The long-predicted recession may pick up steam and the economy may sag in such a way that demand drops more-or-less in concert with oil supply. This could muddle the picture for several years into the future, especially given the big push to invest in new spare capacity which will likely smooth out the curve into more of a plateau.

My own fatalistic sense is that those eager for an obvious set of signs pointing to a geological peak are due for another case of 'peakitus-interruptus' thus forcing us to, once again, put off that after-the-fact satisfying smoke.

Yeah we need the economy to hang their for one more year.

I agree. If it tanks we might not know for years what happened.

Or if Bush bombs Iran.

I don't believe in conspiracies but dang the timing is just to good. America is in the perfect position to trash the world economy by tanking the dollar or increasing interest rates or both forcing Japan and China to unpeg. And if you don't think Japan has the yen pegged to the dollar ...

My theory is that the US will either tank the world economy or bomb Iran to maintain the illusion of plenty of peak oil if the powers that be really fear peak oil as much as they seem too.

They are already pushing hard that their is plenty of oil just those pesky governments won't let us pump it.

If we are lucky we will get a glimpse of 80+ bbl and no increase in KSA output before the waters are muddied.

By lucky I mean a chance to confirm peak not lucky in the traditional sense :)

You don't believe in conspiracies? Do you mean you don't believe that people say one thing and do another? Really? Sociology is amazing! Step back from the culture and examine basic human behavior. Read the 48 laws of power. #3 - conceal your intentions. Why should we know what's going on, we're stupid remember? It happens all the time and to honestly whitewash all ideas as conspiracies only seeks to undermine the facts by using a highly connotative word.

Test: How many "Rules of Acquisition" are there?

sa failed this test last summer when oil passed thru 70 and their production declined. Over the past year sa has steadily reduced production, regardless of whether oil was above 60, 70, or at a record (broken continuously thru aug 8), or whether oil was falling. Price, up or down, has not had any significant effect on their production, now down twice their agreed cuts.

Hothgor,

1980 was 27 years ago - 27 years to suck alot of oil out of the ground. To use this as a reference flys in the face of this comment by the CEO of Chevron David J. O'Reilly - "the era of easy oil is over".

http://www.postcarbon.org/node/402/view

I know just how smart you think you are, and, how you will never be used as "fodder" because of your greater intelligence. I just wonder how anyone so vastly intelligent can look backward at "a full 27 years" of "easy oil" and use that as a refernce for future results.

Maybe you should be the one running Chevron because Mr. O'Reilly seems to think it isn't going to be as easy as it was in the past. Chevron desperately needs you as thier leader.

"My prediction of a peak in prices between Feb 15 and March 15 seems to surprisingly be on course. "

I don't know how you can say that. Today, on Feb 16, oil is at $58/barrel. For your prediction to come true it has to exceed $78/barrel in 4 weeks. Barring at attack on Iran or some such catastrophic event, I don't see oil going up by $20 in just 4 weeks.

Can you elaborate?

Not a absolute price peak but a peak in prices. The low was back in what Dec, Jan. Our highest prices will always I think be in summer.

The model I have is not quantitative but qualitative. I was lucky to even be able to predict a peak about now.

Also not according to my model the actual peak should occur within the next 30 days. So we should see a trough in april/may with the big summer peak starting to go full steam then.

Next a new fall peak will start occurring as SPR releases are made over the summer then refilled in the fall and early winter.

Just predicting the timing of the peaks is a hard thing for my model forget about the magnitudes its not that good.

But even saying that the movement to 3 peaks a year followed by a attempt to go to four resulting in a market reset is a non trivial result.

To repeat if my model is correct and we are actually post peak in oil we will have summer SPR draws followed by a fall peak as these are refilled. Once this runs into 4 peaks we plateau and the market resets. Rinse and repeat at a higher base price.

The natural market post peak seems to be three periods of peak prices with the highest in the summer. Global warming is helping push the winter peak later coupled with a peak oil induced reflected price upswing from summer highs.

Understand that a hurricane in the gulf will now be potentially devastating if the SPR is drawn down in the summer. Basically the strategic part of the SPR will no longer work.

Also note if I'm right then this is one big factor that Bush would have to consider before going to war with Iran. We will be lucky to make it though next year without the SPR becoming a oil bank for smoothing prices. My prediction is we will see significant draws to calm the market. From now on out we are basically one hurricane away from real shortages in the US.

So time will tell I've laid my cards on the table.

Memmel,

I like your logical approach and the guts to put your hypothesis in public so that it can be tested. (Also denigrated, torn apart, laughed at, etc. if you are the tiniest bit off on your model.

I have the same kind of 3 period swing in my head that I have been monitoring over the last few years. You seem to have a much clearer picture than me. I have been predicting an oscillation of prices on a gradual upward trend until "a bad thing happens" to change that trend.

As you say, we'll see this summer. Excellent posts and follow up.

Why do you hate our freedoms?

Right on time--after WT

EDIT. This was supposed to be a reply to Hothgor's 7:25 posting. Somehow it ended up way downthread.

WT, I think that your analysis which compares these two regions is compelling.

It also seems that comparison of SA to these regions remains compelling.

SA -- and the multinational oil companies -- all seem to use smoke and mirrors to hide their actual proven reserves, and to create PR hype about potential reserves or new finds, a la "Jack 2." So that makes it hard, as so many have noted, to talk with more certainty about what's going on.

Even so, knowing what we do about the behaviour of past fields and the behaviour of nations and corporations today, we can say that remaining resources are diminishing and thus recognised to be of incalculable value.

Why enter into such costly and terrible Resource War if petroleum resources are abundant and easily accessible?

Great analysis, Dave!

In your second last paragraph you say "what a shame it is that those uncooperative people in the rest of the world won't play by our rules — and give us what we want."

This is exactly what Sam Bodman, US Energy Secretary, said at CERA week.

http://www.reuters.com/article/bondsNews/idUSN1434739120070214

Regarding increasing oil nationalisation, he said "Changing oil deal terms and wresting control away from international oil majors will harm producer nations in the long-run by dampening foreign investment". This will certainly harm the oil international oil majors!!

He also said "Moves to restrict foreign investment and increase the reach of state-run energy industries limit access to capital and to the expertise needed to unlock new resources,". Really, Saudi Aramco doesn't seem to have a problem with capital and expertise. Once again, the increased reach of state run energy industries will harm international oil majors.

For clarity, I think an event name change is required.

Change "CERAWEEK 2007" to

"CERAWEEK 2007 - INTERNATIONAL OIL MAJORS VS STATE OWNED OIL"

Current reserves score:

International Oil Majors 20%

State Owned Oil 80% (Watson's number)

Wonder what the score will be for CERAWEEK 2008

Angola has joined OPEC, Sudan will probably follow

Ecuador might decide to also join OPEC

http://www.latimes.com/business/la-fi-ecuador12feb12,1,7269880.story?col...

Maybe other countries will join OPEC.

These new members of OPEC may decide to increase state control of their hydrocarbon reserves.

Projected reserves score:

International Oil Majors 15%

State Owned Oil 85%

I wonder how Sam Bodman, Rex Tillerson and John Watson will respond?

If enough countries join OPEC so that OPEC controls not only most of world's reserves but also most of the world's production, OPEC could decide which customers should get oil supply increases and which customers should get decreases based on OPEC's own criteria.

The competition for oil reserves between the oil majors and state owned oil will increase. As oil production decreases, the competition for oil supply between countries will also increase.

By blaming state owned oil for reducing reserve access for the oil majors, CERAWEEK 2007 might be acting as a catalyst which increases the motivation of state owned oil to increase their rate of reserves and production ownership.

I agree that Dave did a terrific job with this post.

I also find that the CERA Show seems to be a very obvious propaganda ploy. In a complex world where too many people are competing for too few resources, various elites will develop narratives to push nations into war for access to those resources.

CERA seems to be a propaganda agency masquerading as business consulting on petroleum resources. CERA is participating in the development of a view of that all those who have any kind of energy resources must roll over and let the multinationals extract the resources at terms favorable to the multinationals. Any nation or leaders who resist this approach are increasingly demonized.

By framing the resource debate in terms of "Good Corporatists vs. Evil Nationalisis" rather than in terms of "too many people competing for too few remaining resources" CERA promotes the agenda of Resource War and encourages continued waste of resources on devastaing overconsumption.

Our species in this way continues to act as one with: "Stone Age emotions, Medieval self image, and godlike technology" -- three characteristics which combine to cause us to self destruct rather than to plan for a sustainable future. (Quote and interpretation of E. O. Wilson, "The Creation.")

How do we respond to such well funded propaganda efforts?

My "Iron Triangle" Theory:

Interesting theory.

I have a few more.

If the government was up front with people, many would realize the "gig is up" with regards to the fantasy of infinite growth/expansion since cheap/abundant oil makes it so. If they realize the gig is up, they will be rushing to get out of the stock market and any US debt instruments that they know will not get paid....at least not with dollars worth anything.

Also, there would be those that would bail from the petrodollar in a heartbeat, and gold would likely skyrocket -- setting off alarm bells everywhere. In other words, the whole huge ponzi scheme collapses unless the populace, as a general whole, remains convinced that everything is fine and will continue to be business a usual. If the govt is up front, we likely will have chaos. So why bother telling the people? We will let it out in little bits and pieces, and if it gets really bad we just declare martial law and institute the totalitarian government we've been creating.

Whenever I try to discuss peak oil with folks, they are either in disbelief or they believe that technology will solve it so there is no reason to be concerned. They truly believe that if there is a problem, their government would tell them. None of them even begin to grasp the scope of it. They seem to think the only thing it will affect is driving, and that's easily solvable with electric cars. No big deal -- don't worry about our already broken grids.

As for me, I'm hunkering down for hard times. The way I figure it, even if times don't get hard, it's good to conserve energy/water, good to grow food, good to be out of debt, and good to save for a rainy day. Sounds a lot like our grandparents who are long gone...

Cheryl

"Also, there would be those that would bail from the petrodollar in a heartbeat"

China is doing this now - reducing its reserves of US dollars in exchange for strategic reserves of many commodities - gold, oil, bauxite, chromium, copper, manganese, tungsten and agricultural products.

http://www.findarticles.com/p/articles/mi_m3MKT/is_18-4_114/ai_n16462674

http://www.resourceinvestor.com/pebble.asp?relid=28619

There was a time when paper currency could be exchanged for gold now it's just worthless paper!

When I mention peak oil in a discussion, most people are unconcerned. People usually function in a reactive rather than proactive way. Global warming is becoming accepted as truth, thanks partly to Al Gore's sensationalist documentary.

A price shock has to occur first to get people's attention. The admission of decline of Cantarell by Pemex is a start. If Russia or Saudi Arabia starts to show clear evidence of an irreversible oil production decline and gasoline prices increase by 50% then people will react and become aware of peak oil.

Clear evidence from Russia or Saudi Arabia could emerge later this year if Iran's oil production is disrupted by Middle East conflicts, severe hurricanes occur in the Gulf of Mexico or next year's winter is very cold.

US Congress has just expanded Iran sanctions which will not help Iran's oil production. These sanctions further reduce the supply of capital to Iran's energy industry. In addition, capital is reduced not only to petroleum production but also now to petroleum byproducts and natural gas.

http://www.upstreamonline.com/live/article127848.ece

And then there's crap like this from the MSM to feed the president's arguement that Iran needs to be dealt with:

Iran’s stealth force: Accused of backing Iraqi militias, elite Quds corps deeply enmeshed in Iraq

http://www.msnbc.msn.com/id/17175714/

Yep. Russia is already bailing from the US dollar, right along with China. Add in many of the middle eastern countries, other Asian Countries, and European countries that are also bailing at this time. It doesn't get much press because they'd prefer you not know--and that goes for both sides. These countries hold huge amounts of the US$ and they don't want it to crash before they get out or at least protect a portion of their reserves. For several years the fed has been buying up our excess debt instruments (referred to as "monetization of debt) to keep the bubble pumped up.

The US govt really decided to attack Iraq when Saddam started selling oil in Euros. They not only wanted Iraq's oil, they wanted to put a stop to anything that might threaten the sovereignty of the petrodollar -- no matter how small the threat. When you understand that, you understand the string of lies about the "reasons" we invaded and occupy Iraq. Bush actually screwed up about six months ago and admitted that we can't leave "because we need the oil."

Iran has been "threatening" to open an oil bourse and trade oil in Euros, so we have a very parallel situation here. We want to control their resources and put a stop to any "nonsense" that might usurp the US$ in any way, form, or manner.

Politics is about lies. All politicians know that giving the populace bad news is the death knell for any chances at re-election. I don't believe anything that any politician says.

"...Whenever I try to discuss peak oil with folks, they are either in disbelief or they believe that technology will solve it ..."

While I tend to side with Hothgor and think that the jury is still out on how well the HL predicts the KSA's production profile (or actually the precision of the estimate), I do feel that PO and its consequences represent the most pressing issue of the day (or year).

But when I bring up the issue of exponential growth of a finite resource with folks, I get the same reaction that you do. Yesterday a guy that I was testing (I do medical work) said that he just likes having 6000 lbs of steel around him when he drives (and he was about 120 lbs). The folks around here just don't make the connection between the gas pedal and the geologic limits of oil production, the economic drain on the users, and the transfer of wealth (well, bits of paper) to countries that hate us.

Damn those pesky Canadians:)

Cheryl,

I agree with your assesment about "don't spook the herd". I think now is the time to get prepared before "peak awareness" hits the masses. Look at China and thier stockpiles nat rescources.

So do I--and I wanted to get ahead of the heard. That's why I packed up my husband and I and moved to HI. I didn't give him much choice, but then again, he wasn't likely to complain. We bought 2 acres of agricultural land and have been busting out butts. In less than a year, we've planted more than 50 fruit trees and have a huge, prolific vege garden. The climate here is great for growing food, and the papaya trees that my husband grew from starts were heavy with fruit in less than 9 months. I'm sure glad the old man has a green thumb.

I cashed in a bunch of investments and paid off all of our debts and am using my monthly retirement income to invest in items for self-sustainability. We put in solar hot water. Next up is solar pv and a small windmill. Since we live in a rain forest area and are on catchment, I'm trying to figure out a way (that isn't too ugly) to harness the hydro power of the catchment system. It often rains so hard that the catchment system can't keep up and it sounds like we are under a huge waterfall. There's got to be something we can do with that other that just let the catchment tank and gutters overflow. If nothing else, it should flow to another tank that is raised so that we have running water when the power is out. That way we could flush the toilet without carrying buckets of water---getting too old and beat up for that.

This is an interesting place...very 3rd world-like. The power goes out frequently when it gets windy, and we get a taste of what peak oil/peak gas/peak clean water might be like. Since we are on catchment, our pump quits and we have no running water. No running water-no indoor plumbing. Since we have to filter the water (it runs off the roof and picks up lots of debris -- like bird crap -- along the way), it's hard to function without a pump. There are no street lights here either, so when the house lights are out it is VERY, VERY dark unless there is a full moon and the skies are clear. When they are, it is a treat with the power out. The stars are incredibly brilliant and you feel closer than ever to the heavens. Also, when the power is out, there are no potential adjacent areas with any "glow" of light. It's just you and the night sky...you feel like you could touch the moon. But now I know why out ancestors went to bed when it was dark.

Electricity and gasoline are very expensive here -- the highest in the country. We have our gasoline use down to about 20-30 gallons per month and try to go to town (Hilo) only once every 2 weeks and to Kona once every 6 months. We have our electricity use down to about 400-500kwh per month and don't use any form of heating. It does get cool in the winter, but we just bundle up. In the summer, we just sweat.

I don't know when peak oil will hit. But I do know that it is inevitable that it will happen as it is a finite resource on a finite planet, and I suspect it will happen sooner rather than later. I was in a hurry to get established partly due to our age (both 58) and partly to do it before the panicked masses want the same equipment we want. The physical work has been killer, and I'm not sure we could have pulled this off if we waited even 3 more years. We are pretty exhausted, but it's all coming together nicely, and once it's all in place it will be mainly maintenance. This way it should all be in place before we are too old to do the physical labor. It would be cost prohibitive if we had to pay someone to do all of this work.

We met a lot of neighbors that are into gardening and we share a lot of food. The joke is always the rounds the avocados make when in season. After moving from porch to porch, they are likely to end up back at the originators doorstep. There are just too many to eat. But even these people don't really believe peak oil...or they believe technology will just solve it -- not matter how gargantuan the scope and scale of the problem is. My biggest worry here is health care and getting medicines/treatment if peak oil gets really bad. I figure there won't be a lot of air shipment anymore, and items that come in will come via cargo vessels that are very slow. That means everything will have to be planned out in advance. Other than our screwed up joints and backs, we are fairly healthy, so here's knocking on wood. But the place has the added attraction of being beautiful with lots of hiking, snorkeling, fishing, etc. You could die in much worse places -- like Iraq.

Agreed. I have invested in the martkets for many years and have kept on in my office what was originally FNN and now its successor. I was thinking just this morning how FNN used to give a lot of coverage to the commodities markets and how its successor gives very little analysis of commodities since the bull run began. Oil and natural gas are covered some, but skewed in a negative way.

It is hard for the reporters to contain their glee when either natural gas or oil sells off. In short,objectivity is gone and what exists now is almost an infomercial for buy, buy, buy stocks.

I watch it closely and manage my own investments. The market is very scary right now -- it reminds me of 2000 when everything kept going up for no reason. Meanwhile, then as now, lots of really bad economic data come out and no one reacted. Then, all of a sudden, POP. But meanwhile, it's buy, buy, buy.

Agreed on the commodities stuff. Gold has gone up 50% in the past 3 years and it gets no notice. I too see that they respond with glee to drops in prices for oil/gas, but they pretty much ignore the increases.

The fed has been increasing the money supply at an ever increasing rate. There is no "global savings glut." What there is is a huge liquidity bubble as the fed creates new money at an ever increasing pace and all of the other central banks respond in kind. All that liquidity has to go somewhere. The ponzi scheme is doomed to fail when hyper-inflation gets out of control. But I don't think they care anymore. They know that peak oil will stop the infinite growth paradigm, so their only intent is to keep the pyramid going for as long as they can and for the rich to extract as much as possible while it lasts. Meanwhile, don't worry, be happy! Consume! Go shopping!!! Wheeee, what fun!!!

Look at who is advertising on the financial channels.

Mostly managed investment firms adverising people happily (richly) retired flying gliders and such with these s**t eating grins on their face. Discount stock brokerage firms make up most of the balance of the advertisers. Use to see the discount commodity brokers some but I don't recall any lately.

You are right about the liquidity going into the equity markets. Chart

growth has been eerily steady upward. I don't think we have had the blow-off rally yet though.

WT -- yes, the Iron Triangle seems to be working right along the lines you've discussed.

It seems to me that the lies will continue until things fall apart. As people become more desperate, violence will increase, with more lies to rationalise the violence on the part of the disintegrating elites.

Too many people competing for too few resources.

"Stone Age emotions, Medieval self image, godlike technology" leads us to self destruction.

I still say that we can only each do our bit to live as sustainably as we can, to help others become more aware, and then to recognise that the chips will fall where they may. Sounds a bit like a twelve-step program, eh?

Keep on keepin' on, fellow TODers!

Do you mind if I steal this quote and completely "forget" to give you credit?

Not at all, except that the real deal is from Edward O. Wilson, from his latest superb book "The Creation."

(page 10)

"Here is a chimera, a new and very odd species come shambling into our universe, a mix of Stone Age emotion, medieval self image, and godlike technology. The combination makes the species unresponsive to the forces that count most for its own long term survival."

Be sure and go to the CERAWeek webpage and get load of the list of "partners" as you scroll down.

Aren't the NOCs dependent on the IOCs for retailing their production?

Simply changing the name to CERAWEAK 2007 would probably get the message across.

This is a great article and dQ/dt hits the nail on the head (although most people associate dt with delerium tremens, especially those forced to take high school calculus). No where near enough attention is being paid to the rate of future production of any energy source even though the warning has been out there for a long time in the form of the wedge principle.

The SPE is holding a forum on enhanced recovery in Dubrovnik in September:

70% Recovery --- A Dream or Reality: From Smart Water to Microbes

They claim the average recovery factor globally is 32%. Considering the rewards, I'm sure some very astute minds have given this issue a lot of attention over the years, but has the recovery factor significantly increased? Doesn't seem like it.

Good point on flow rate with regard to recovery, although if I understood him correctly Freddy Hutter thinks such considerations are irrelevant:

Maybe I'm misinterpreting his post, but Freddy seems to be saying that it doesn't matter if you can only pull the stuff out globally at 20 mb/d. The price will simply adjust (and hence so will demand) and the oil will last a lot longer. It's how much you've got that counts, not how fast you can shift it.

Why can't I help thinking there's something wrong with that logic?

Because like so many others on this site, you have been brainwashed into believing that OIL is irreplaceable. I have tried on numerous occasions, backed up by linking dozens of articles from various reputable sites on the WWW to point out that simply electrifying our fleet would cut down globally about 2/3rds of our consumption or more. How strange that would be...only needing around 28 million bpd?

Ok Hothgor,

You state "Because like so many others on this site, you have been brainwashed into believing that OIL is irreplaceable."

"brainwashed"

First off all this is crass, insulting, and just plain wrong, like so many of your other comebacks. You imply stupidity and a lack of understanding of your valid but niave point that follows.

I guess the point that you either ignore or fail to comprehend is that TPTB(the powers that be) do not want EV's, electric rail, or all the other logical mitigation projects that could make 28 mbpd do-able. So go ask yourself why you think they would act in such selfserving, screw the masses, and the future too, and get back to me.

You are the most insulting poster here IMO, and why? Would you quit telling, implying, or infering stupidity and you might find that the people here "get it"? Your insults should be aimed way up the ladder to industry and polital leaders.

You should ask yourself why I as a business owner can get a 100% to $100,000 this year tax deduction for a VECHILE THAT MUST WEIGHT OVER 7800 lbs. and ask your self how in the fuck we are going to get oil use down to 28 mbpd. Huh? Is this my fucking fault? Come off it, you are pissing up a rope with your insulting comments. I must depreciate a more fuel efficient car or truck but can expense a gas hog - just who in the fuck are you calling brainwashed?

Take solar panels - you get to deduct up to $6,000 OVER 4 YEARS and you wonder why they aren't on every rooftop? You want to get to 28 mbpd then quit pissing off people here and get in the face of polital leaders.

Please respond in detail on stay on the topic's I mentioned or don't waste your time. Thanks,

D

Score 1 for Hothgor...every time you respond to him like this you have gotten his rocks off. He feeds off anger and now his belly is full. Anyone that still believes this poser is a recent graduate from college is about as naive as they come. Hothgor comes with the facts fast and furious. He is ready for any rebuttal and speaks like someone that would take his best friend out on a hunting trip and shoot him in the face.

Remember what I've said about XOM feeling out TOD's arguements in order to better frame their PR campaign. Keep that in mind ever time you read his posts.

Think about it everyone. How big of a stretch would this be?

Dragonfly said, "Anyone that still believes this poser is a recent graduate from college is about as naive as they come."

You may be onto something.

With 50 billion you think they could hire something a little better.

He responded to WT first comment here in 2 Minuets.

That's nothing, wait until he actually manages to "convinces" (slips a rufie) a woman to sleep with him... I bet he'll beat that record easily.

Hehehehehehehehehehehehe. If he's anything like he comes across in his posts, the woman will be glad it only lasted that long. Sorry, couldn't resist. Ban me if you must.

Cheryl

That was funny. Points for humour.No bans.

Hi Hothgar,

Fine analysis of the situation; however, I'm a little confused about the irregular use of the word 'simply' in this context. Is there a definition of the word that I am not aware of? Nothing I've found in my dictionary seems to precisely fit your statement.