Peak Oil Update - Final Thoughts

Posted by Sam Foucher on August 19, 2013 - 3:20am

Since 2006, I've been tracking a set of oil production forecasts

and trying to see how they performed over time. Comparing oil supply forecasts

is not an easy task

because of the many different assumptions, baselines, and fuel categories

included. Also, most of them deal with production capacity which is

almost impossible to track as we can only observe delivered supply. Since the 80s, oil

production has pretty much followed population growth;

using a ratio value of 4 barrels/person/year, one can accurately predict

supply level for crude oil plus NGL (C+C+NGL) with an accuracy of +/- 2

Mbpd. This naive model will constitute my Null hypothesis (or model M0)

that

supply is not being constrained. Consequently, what could constitute a

kind of "peak oil signal" would be a statistically

significant deviation (I would be happy with only 2 sigmas) from the

population based

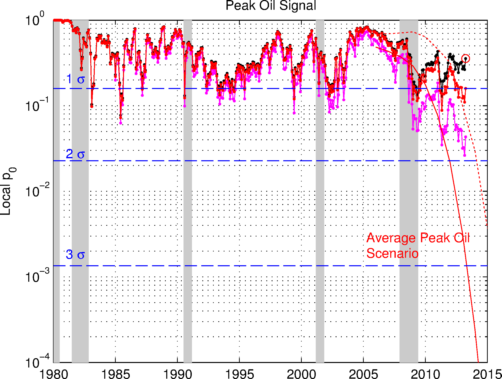

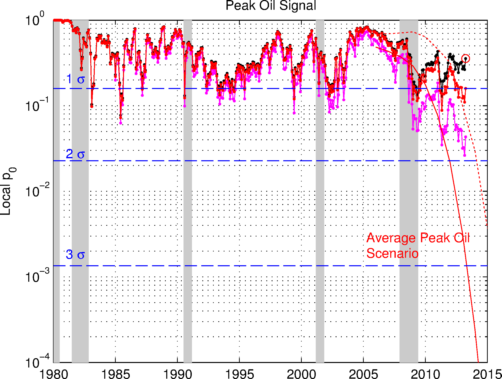

model M0. As we can see on the figure below, crude oil and NGL has not

deviated significantly from M0. However, if we remove the contribution

from Canadian tar sands and tight oil (shale oil), we can see that the

deviation

starts to be statistically significant.

Hypothetical peak oil signal for C+C+NGL. Light gray bands indicate recessions. The dotted black curve is for C+C+NGL, the dotted red curve excludes tight oil and the magenta curve excludes Canadian tar sands. The continuous red line is the statistical significance corresponding to the average peak oil scenario.

Notations:

- mbpd= Million of barrels per day

- Gb= Billion of barrels (109)

- Tb= Trillion of barrels (1012)

- NGPL= Natural Gas Plant Liquids

- CO=C+C= Crude Oil + Lease Condensate

- NGL= Natural Gas Liquids (lease condensate + NGPL)

- URR= Ultimate Recoverable Resource

EIA Last Update (April)

Data sources for the production numbers:

- Production data from BP Statistical Review of World Energy (Crude oil + NGL).

- EIA data (monthly and annual productions up to March 2009) for crude oil and lease condensate (noted CO) on which I added the NGPL production (noted CO+NGL).

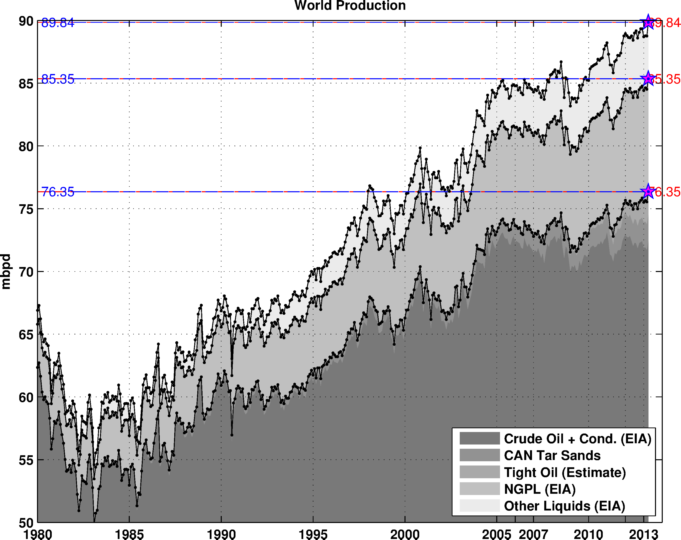

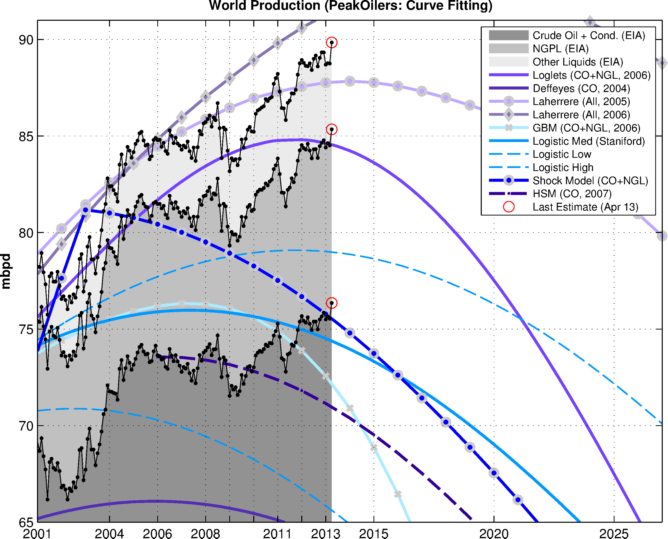

For the last two years, production has grown significantly and production records have been broken on a monthly basis, however, one can see that "conventional" crude oil is on a slightly downward plateau since 2005.

Fig 1.- World production (EIA data). Blue lines and pentagrams are indicating monthly maximum. Monthly data for CO from the EIA. Annual data for NGPL and Other Liquids from 1980 to 2001 have been upsampled to get monthly estimates.

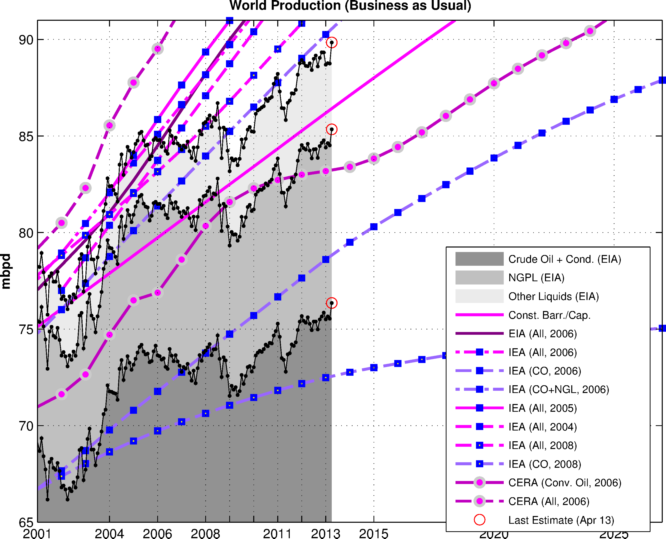

Business as Usual

- EIA's International Energy Outlook 2006, reference case (Table E4, World Oil Production by Region and Country, Reference Case).

- IEA total liquid demand forecast for 2006 and 2007 (Table1.xls).

- IEA World Energy Outlook 2008, see post here for details.

- IEA World Energy Outlook 2006: forecasts for All liquids, CO+NGL and Crude Oil (Table 3.2, p. 94).

- IEA World Energy Outlook 2005: forecast for All liquids (Table 3.5).

- IEA World Energy Outlook 2004: forecast for All liquids (Table 2.4).

- A simple demographic model based on the observation that the oil produced per capita has been roughly constant for the last 26 years around 4.45 barrels/capita/year (Crude Oil + NGL). The world population forecast employed is the UN 2004 Revision Population Database (medium variant).

- CERA forecasts for conventional oil (Crude Oil + Condensate?) and all liquids, believed to be productive capacities (i.e. actual production + spare capacity). The numbers have been derived from Figure 1 in Dave's response to CERA.

Fig 2.- Production forecasts assuming no visible peak.

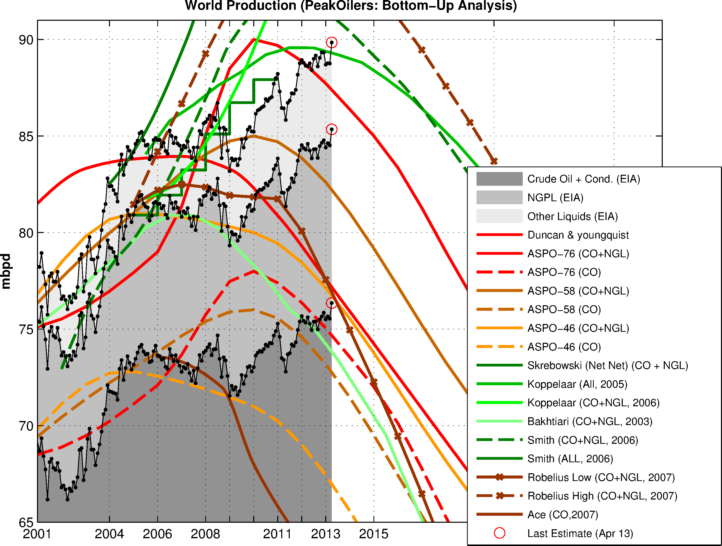

PeakOilers: Bottom-Up Analysis

- Chris Skrebowski's megaprojects database (see discussion here).

- The ASPO forecast from April newsletter (#76): I took the production numbers for 2000, 2005, 2010, 2015 and 2050 and then interpolated the data (spline) for the missing years. I added the previous forecast issued one year and two years ago (newsletter #58 and #46 respectively).

- Rembrandt H. E. M. Koppelaar (Oil Supply Analysis 2006 - 2007): "Between 2006 and 2010 nearly 25 mbpd of new production is expected to come on-stream leading to a production (all liquids) level of 93-94 mbpd (91 mbpd for CO+NGL) in 2010 with the incorporation of a decline rate of 4% over present day production".

- Koppelaar Oil Production Outlook 2005-2040 - Foundation Peak Oil Netherlands (November 2005 Edition).

- The WOCAP model from Samsam Bakhtiari (2003). The forecast is for crude oil plus NGL.

- Forecast by Michael Smith (was at the Energy Institute, now works for EnergyFiles) for CO+NGL, the data have been taken from this chart in this presentation (The Future for Global Oil Supply (1641Kb), November 2006.).

- PhD thesis of Frederik Robelius (2007): Giant Oil Fields - The Highway to Oil: Giant Oil Fields and their Importance for Future Oil Production. The forecasts (low and high) are derived from this chart.

- Forecast by TOD's contributor Ace, details can be found in this post.

- The forecast by Duncan and Youngquist made in 1999, see also this post by Euan Mearns.

Fig 3.- Forecasts by PeakOilers based on bottom-up methodologies.

PeakOilers: Curve Fitting

The following results are based on a linear or non-linear fit of a parametric curve (most often a Logistic curve) directly on the observed production profile:- Professor Kenneth S. Deffeyes forecast (Beyond Oil: The View From Hubbert's Peak): Logistic curve fit applied on crude oil only (plus condensate and probably excluding tar sand production) with URR= 2013 Gb and peak date around November 24th, 2005.

- Jean Lahèrrere (2005): Peak oil and other peaks, presentation to the CERN meeting, 2005.

- Jean Lahèrrere (2006): When will oil production decline significantly? European Geosciences Union, Vienna, 2006.

- Logistic curves derived from the application of Hubbert Linearization technique by Stuart Staniford (see this post for details).

- Results of the Loglet analysis.

- The Generalized Bass Model (GBM) proposed by Prof. Renato Guseo, I used his most recent paper (GUSEO, R. et al. (2006): World Oil Depletion Models: Price Effects Compared with Strategic or Technological Interventions; Technological Forecasting and Social Change, (in press).). The GBM is a beautiful model that has been applied in finance and marketing science (see here for some background). The estimation in Guseo's article was based on BP data from 2004 (CO+NGL).

- The so-called shock model proposed by TOD's poster WebHubbleTelescope . You can find a description of his approach on his blog here as well as a review on TOD. The current estimate was done in 2005 based on BP's data (CO+NGL).

- The Hybrid Shock Model is a variant of the shock model described here. The forecast is based on EIA data (up to 2006) for crude oil + condensate, the ASPO backdated disovery curve and assumes no reserve growth and declining new discoveries.

Fig 4.- Forecasts by PeakOilers using curve fitting methodologies.

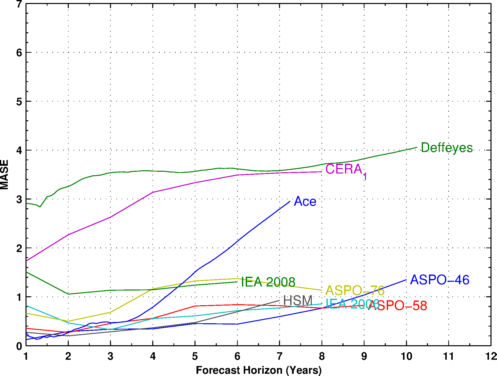

Forecast Performance

The forecast performances were evaluated using the Mean Absolute Scaled Error (MASE) proposed by Hyndman and Koehler [1]. A good forecast will have a MASE value less than 1 (i.e. better performance than a simple naive forecast). We can notice that few MASE curves are decreasing with time indicating that their predicted values are getting less accurate further in time. To be fair, forecasts should be evaluated on production levels excluding tight oil as most of them were not considering this marginal source of supply.

Fig. 5. - MASE values as a function of the forecast horizon. Year 1 is the baseline year when the forecast was issued.

| Forecast | Date | 2006 | 2008 | 2010 | 2013 | 2015 | MASE2 | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|---|---|

| All Liquids | |||||||||

| Observed (All Liquids) | 84.66 | 85.49 | 86.71 | 89.02 | NA | 2013-04 | 89.84 | ||

| IEA (WEO) | 2004 | 83.74 | 87.08 | 90.40 | 95.38 | 98.69 | 1.64 | 2030 | 121.30 |

| IEA (WEO) | 2005 | 85.85 | 89.35 | 92.50 | 96.62 | 99.11 | 2.33 | 2030 | 115.40 |

| Koppelaar | 2005 | 85.78 | 87.60 | 89.21 | 89.21 | 87.98 | 0.87 | 2011 | 89.58 |

| Lahèrrere | 2005 | 84.47 | 85.87 | 86.96 | 87.76 | 87.77 | 0.41 | 2014 | 87.84 |

| EIA (IEO) | 2006 | 84.50 | 88.23 | 91.60 | 95.76 | 98.30 | 2.09 | 2030 | 118.00 |

| IEA (WEO) | 2006 | 85.10 | 88.17 | 91.30 | 96.25 | 99.30 | 2.11 | 2030 | 116.30 |

| CERA_1 | 2006 | 89.52 | 93.75 | 97.24 | 101.54 | 104.54 | 4.87 | 2035 | 130.00 |

| Lahèrrere | 2006 | 84.82 | 87.02 | 88.93 | 91.29 | 92.27 | 0.97 | 2018 | 92.99 |

| Smith | 2006 | 87.77 | 94.38 | 98.94 | 99.74 | 98.56 | 4.80 | 2012-05 | 99.83 |

| IEA (WEO) | 2008 | 83.15 | 85.51 | 88.15 | 92.13 | 94.40 | 0.94 | 2030 | 106.40 |

| Crude Oil + NGL | |||||||||

| Observed (EIA) | 81.32 | 81.63 | 82.43 | 84.73 | NA | 2013-04 | 85.35 | ||

| Ducan & Youngquist | 1999 | 83.93 | 83.55 | 81.65 | 76.82 | 73.47 | 2.23 | 2007-01 | 83.95 |

| Population based | 2004 | 79.73 | 81.58 | 83.42 | 86.19 | 88.01 | 0.68 | 2050 | 110.64 |

| GBM | 2003 | 76.27 | 76.20 | 75.30 | 71.84 | 67.79 | 2.96 | 2007-05 | 76.34 |

| Bakhtiari | 2005 | 80.89 | 80.24 | 77.64 | 73.41 | 69.51 | 2.04 | 2006 | 80.89 |

| ASPO-46 | 2004 | 80.95 | 80.59 | 80.00 | 77.13 | 73.77 | 1.11 | 2005 | 81.00 |

| ASPO-58 | 2005 | 82.03 | 84.05 | 85.00 | 82.60 | 79.18 | 0.95 | 2010 | 85.00 |

| Staniford (High) | 2005 | 77.92 | 78.63 | 79.01 | 78.96 | 78.51 | 1.73 | 2011-10 | 79.08 |

| Staniford (Med) | 2005 | 75.94 | 75.91 | 75.52 | 74.27 | 73.00 | 3.23 | 2007-05 | 75.98 |

| Staniford (Low) | 2005 | 70.13 | 69.20 | 67.92 | 65.42 | 63.40 | 6.72 | 2002-07 | 70.88 |

| IEA (WEO) | 2006 | 81.38 | 83.96 | 86.50 | 90.26 | 92.50 | 1.76 | 2030 | 104.90 |

| Smith | 2006 | 82.81 | 88.27 | 91.95 | 90.97 | 88.60 | 3.50 | 2011-02 | 92.31 |

| Loglets | 2006 | 82.14 | 83.74 | 84.65 | 84.47 | 83.26 | 0.93 | 2012-01 | 84.80 |

| ASPO-76 | 2006 | 79.00 | 85.06 | 90.00 | 87.72 | 85.00 | 2.26 | 2010 | 90.00 |

| Robelius Low | 2006 | 82.19 | 82.35 | 81.84 | 77.55 | 72.26 | 1.11 | 2007 | 82.50 |

| Robelius High | 2006 | 84.19 | 89.27 | 93.40 | 94.39 | 92.40 | 4.36 | 2012 | 94.54 |

| Shock Model | 2006 | 80.43 | 79.51 | 78.27 | 75.78 | 73.74 | 1.97 | 2003 | 81.17 |

| EWG | 2007 | 81.00 | 79.66 | 78.06 | 73.47 | 69.21 | 2.48 | 2005 | 81.76 |

| IEA (WEO) | 2008 | 79.80 | 81.59 | 83.40 | 85.97 | 87.40 | 0.56 | 2030 | 95.00 |

| Crude Oil + Lease Condensate | |||||||||

| Observed (EIA) | 73.43 | 73.65 | 74.04 | 75.76 | NA | 2013-04 | 76.35 | ||

| ASPO-46 | 2004 | 72.56 | 71.89 | 71.00 | 67.44 | 63.55 | 1.35 | 2005 | 72.80 |

| Deffeyes | 2004 | 66.07 | 65.83 | 65.30 | 63.96 | 62.73 | 4.06 | 2005-12 | 66.08 |

| ASPO-58 | 2005 | 73.80 | 75.39 | 76.00 | 73.18 | 69.50 | 0.83 | 2010 | 76.00 |

| IEA (WEO) | 2006 | 71.78 | 73.76 | 75.70 | 78.60 | 80.30 | 0.85 | 2030 | 89.10 |

| CERA_1 | 2006 | 76.89 | 80.35 | 82.29 | 83.18 | 83.83 | 3.56 | 2038 | 97.58 |

| ASPO-76 | 2006 | 72.10 | 75.74 | 78.00 | 75.05 | 72.00 | 1.13 | 2010 | 78.00 |

| HSM | 2007 | 73.56 | 73.40 | 72.82 | 71.15 | 69.53 | 0.93 | 2006 | 73.56 |

| Ace | 2007 | 73.48 | 72.18 | 66.96 | 61.58 | 58.47 | 2.96 | 2006-01 | 73.55 |

| IEA (WEO) | 2008 | 69.73 | 70.64 | 71.46 | 72.49 | 73.00 | 1.31 | 2030 | 75.20 |

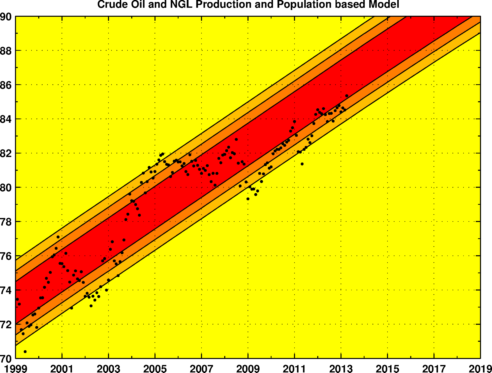

Note the good performance of the population based model for crude

oil and NGL (line in bold).

No peak oil?

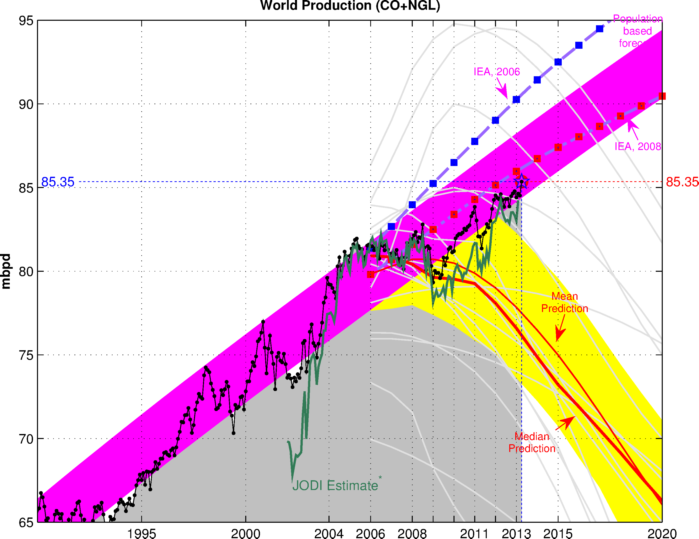

Looking at crude oil + NGL

production, we can consider two competitive models:- M0: The oil production will continue to grow with the world population at a constant rate of 4.3 barrels per capita per year (Figure 6).

- M1: The production will fall according to the average peak oil forecast (Figure 7).

Fig 6.- Population based model (M0) for crude oil and NGL (C+C+NGL), the colored bands are 1-sigma, 1.5-sigma and 2-sigmas intervals (sigma= 1.25 million barrels per year).

Fig 7.- Average peak oil forecast (M1) for C+C+NGL calculated from 15 models that are predicting a peak before 2020 (Bakhtiari, Smith, Staniford, Loglets, Shock model, GBM, ASPO-[70,58,45], Robelius Low/High, HSM,Duncan&Youngquist). 95% of the predictions sees a production peak between 2008 and 2010 at 77.5 - 85.0 mbpd (The 95% forecast variability area in yellow is computed using a bootstrap technique). The magenta area is the 95% confidence interval for the population-based model. Click to Enlarge.

Regardless of economic parameters and the various peak oil scenarios, the M0 model has been an excellent predictor of the current supply levels within a 1-sigma interval. We can then look at the probability that the observed production deviations are occuring by chance alone (which we note Prob(Deviation|M0)=p0). It is clear that without the addition of unconventional supply such as tar sands and tight oil we would have been much closer to the average peak oil scenario and close to a 2-sigmas deviation as illustrated on Figure 8 below.

Fig. 8 - Hypothetical peak oil signal for C+C+NGL. Light gray bands indicate recessions. The dotted black curve is for C+C+NGL, the dotted red curve excludes tight oil and the magenta curve excludes Canadian tar sands. The continuous red line is the statistical significance corresponding to the average peak oil scenario (see Figure 7)

A way to further stretch this analysis is to inject the knowledge of our average peak oil scenario M1 (Figure 7). Assuming that the "no peak oil" and "peak oil" events are equiprobable (uniform prior), we can then derive posterior probabilities from the Bayes rule:

Prob(M1 | Deviation) = Prob(Deviation | M1) / (Prob(Deviation | M0) + Prob(Deviation | M1))

Assuming our average peak oil scenario as M1, the probablity of this scenario

is now around 1%, excluding unconventional sources we get to 15% (no

tight oil) and

70% (no Canadian Tar Sands).

Fig 9.- Posterior probability values for a peak oil event for C+C+NGL.

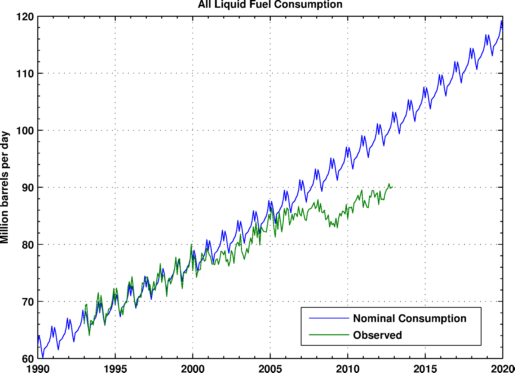

Supply and Demand Equilibrium

Supply is just one part of the equation. Demand is even harder to

predict and highly volatile. Since 2005, global fuel consumption has

strongly deviated from nominal levels by almost 10 million barrels per

day due to the persistent high price environment and lower economic

output.

Fig 11.- Observed total liquid fuel consumption (EIA data) and nominal consumption level based on 1993-2001 period.

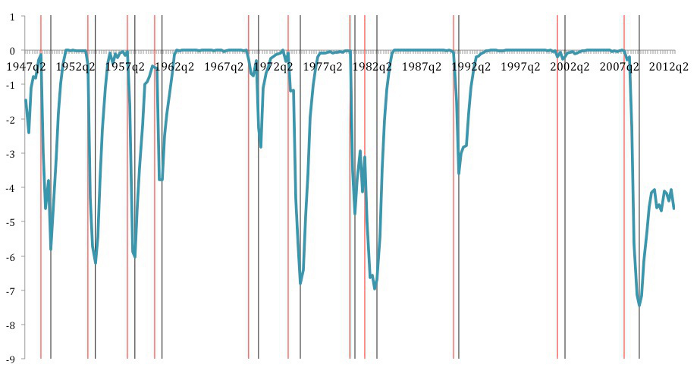

Since the 2009 financial crisis, growth in advanced economies has been weak. Recovery from the great recession is still ongoing and has been exceptionally long:

Fig 11.- US GDP cyclical component (src).

In their last economic outlook update, the IMF is forecasting just 3% growth for the world GDP.

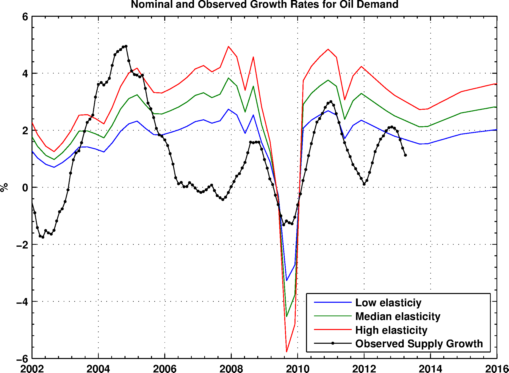

In chapter 3 of the April 2011 IMF World Economic

Outlook, the IMF economists derived short term income elasticity of

energy demand values between 0.47 and 0.83 (high price environment)

which means that a 1% rise in income (global GDP) can lead to an

increase in oil demand between 0.5 and 1.0%. Therefore, given the

current global growth forecast, oil supply growth (all liquids) should

be above 2% a year and we are struggling to maintain a 1% growth.

Fig 12.- Expected oil demand growth rates based on the IMF data. The observed supply growth rate (all liquids) is a year-on-year growth rate after a 12 months moving average.

Final Thoughts

- Econ 101 works. High oil prices reduce consumption and increase marginal supply, however, with vastly different short term and long term price elasticity values.

- Most peak oil forecasts can be dismissed but none of them could have factored in contributions from marginal unconventional sources such as shale oil.

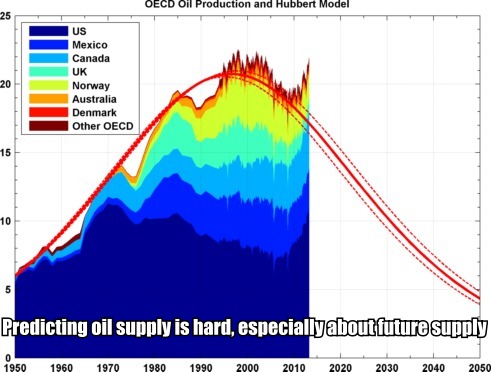

- We will see a second production peak for OECD countries of unknown duration (see chart above).

- Unconventional marginal oil supply sources have saved the day for now, however, double digit growth in tight oil production could also mean double digit decline.

- No one knows how long the tight oil boom will last or how it will spread to the rest of the world, so we are still in the dark. Forecasting future production capacity is more uncertain and difficult than ever as we cannot just track a set of Tier one giant fields. Unconventional and marginal sources of supply are now making a difference and are more scattered and difficult to track.

- Despite large investments, exceptional exploration efforts and widespread application of enhanced oil recovery techniques (EOR), supply from conventional oil has been flat since 2005 and has probably peaked (so Kenneth Deffeyes was not completely wrong).

- Peak demand? maybe, but what about peak GDP growth? there is still and output gap between actual GDP and potential GDP.

- Prices are likely to stay elevated and volatile as demand periodically hits its head on a tight supply ceiling and will continue to depress demand (others would say destroy) and constrain growth rates. On the flip side, it will help spur efficiency gains, innovation, production from marginal source of supply, alternative transportation modes, etc.

Ref:

[1] Rob J. Hyndman, Anne B. Koehler, Another look at measures of forecast accuracy, International Journal of Forecasting, Volume 22, Issue 4, October-December 2006, Pages 679-688. pdf available here.[1] Helbling, T., Kang, J.S., Kumhof, M., Muir, D., Pescatori, A. and Roache, S. (2011), “Oil Scarcity, Growth, and Global Imbalances”, World Economic Outlook, April 2011, Chapter 3, International Monetary Fund.

Thank You!

Ok, enough with the psychedelic charting, I would like to express my gratitude to the founders of this one of a kind website (Prof. Goose and HO) as well as all the staff, contributors and all the TODers. They did a tremendous service to society by raising energy awareness, all of that as volunteers on their free time. I joined this site back in 2004 at the time peak oil was a fringe topic struggling to keep its spot between big foot and UFOs. At that time, I was completely energy illiterate and this forum opened my eyes on one of the most complex issue facing our modern world. Ultimately, it completely changed my views on our future on this planet. After eight years, I can appreciate the ground covered since as peak oil is now routinely debated in mainstream media. TOD was never about being right or wrong on the exact timing or shape of peak oil. TOD is a wakeup call on our energy predicament. Modern civilization was built upon cheap fossil fuel and it may cause its downfall. Finally, I urge decision makers not to turn their back on energy issues. TOD is going away but not resource depletion. If I learned one thing during this journey is that we cannot be reactive on these kinds of complex issues, we must be proactive. Our dependence on fossil fuels is as strong as ever and humanity faces tremendous challenges this century especially when considering potential impacts from climate change.

Thank you and good luck to all, I'll try to post periodically on my personal blog if you want to keep in touch with me.

Thanks for the informative post

And a double digit decline without an alternative infrastructure in place will be a disaster, yes?

How much better it would have been had we saved back unconventional oil for the future.

How much better it would be if we would now decide to save back all unconventional oil for the next generation to use as needed.

I do not wish my children to live in a world with double digit oil decline. If we can change that problem, we should.

How bad to you think that downfall will be, and what can we do about it?

There seems to be, at least it passed peer review, a way to out of the entire energy problem.

Cheap enough power can turn CO2 and hydrogen into liquid fuels. How cheap? There is about 40 kWh of energy in a gallon of gasoline, so penny a kWh would allow the production of synthetic fuel for less than a dollar a gallon.

I don't see any way to get energy that cheap on earth, even in the best places, solar takes a five to one hit because of night and the cosine effect. Most places it is more like ten to one or more. Out in space (i.e., solar power satellites) the same solar collector surface is illuminated 99% of the time. If both can be built for about the same cost, then space based solar is between 2.5 and 5 times less expensive (because you take a 50% loss on the microwave power link).

The location specifics matter as does the transmission cost. I was wondering why Germany didn't build solar power in places with more sunlight, but it the cost of power transmission is such that it's less expensive to put the cells in cloudy Germany than it is to put them in the south of France and build transmission lines.

Since power satellites can land power anywhere, they can bring it down close to big loads and avoid most of the cost of transmission (other than the hit they take from using microwaves to get the energy down.

If we (or more likely the Chinese) go this way, the number of power satellites can grow fast enough to take the whole world off fossil fuels in slightly more than two decades from the start. Big project, $60 B in start up, but the ten year ROI came out at 500%

Any takers for dollar a gallon synthetic gasoline?

Thanks Sam. A week ago, on Monday August 12, an editorial was published in one of the local newspapers in my neck of the woods:

EDITORIAL - Fingers crossed for Mr Paulwell

Someone calling them self "Peak Oiler", in a comment to the editorial on the newspaper's web site wrote

from your work, it's nice to know that "Peak Oiler"s assessment is not totally incorrect in that, as a rule, the forecasts of ASPO et al (the peakists) have been less wrong than those of the optimists, certainly if one excludes Tar Sands ans Shale Oil.

My basic take away from all this is that, in the future, we will only observe increased production if the price of oil remains high or more likely, continues to increase.

Alan from the islands

Is our economic model based on cheap energy?

Not really.

First, both the US and other developed countries got that way with "moderately expensive" energy, not cheap energy. Oil and electricity have been cheap in the US in the post-WWII period, but energy was rather higher in years before that: coal and electricity cost much more, adjusted for inflation. The US, and other countries, succeeded quite well in growing strongly even when energy was much more expensive, whether it was coal or oil.

Wind power is quite affordable (if perhaps not quite as dirt cheap as US post-WWII oil and electricity prices), scalable, high-E-ROI, etc, etc. So are nuclear, and solar even if they aren't quite as cheap at the moment (coal is also plentiful and cheap, unfortunately), so I see no reason to expect energy to ever be more than "moderately expensive".

The fact that energy pre-WWII was a much higher portion of GDP means that it was a much heavier burden on the economy. If wind and solar are a little more expensive, that means that the wind/solar sector has to be a little larger than otherwise to power the rest of the economy. This analysis suggests that this is not a big deal: that sector would still be a much smaller portion of the economy than pre-WWII.

Second, fossil fuels aren't nearly as cheap as they seem. Pollution is an unrecognized, external cost. So are the military costs we're seeing currently of roughly $500B per year. Those pollution costs aren't sustainable (especially CO2), but unfortunately the military costs probably are (in fact, many corporate interests are quite comfortable with them...). Moving away from oil and other fossil fuels will actually be much cheaper in the long-run than BAU.

Finally, let's assume that Business As Usual involved spending about 5% of our economic activity (perhaps measured by GDP) acquiring energy. If the cost of acquiring energy doubles, then we have to dedicate another 5% to that activity. GDP might go down by 5% quickly, in case we'd have a deep recession. Or, it might happen over time - if it took 10 years, then we'd see a reduction in economic growth of .5% per year, for 10 years. After that transition was complete, economic growth would continue. So, a reduction in "net energy" has a significant impact, but it's not TEOTWAWKI.

Does unusually strong growth since 1945 show the value of cheap energy in that period?

No, US growth was faster before 1945, using moderately expensive, non-oil energy:

1800-1900: 4.13%

1900-1945: 3.53%

1945-2000: 3.17%

(source in next comment, to avoid moderation problem)

It could also mean that today's GDP metric contains much more nonsensical and/or completely virtual activities and costs which did not exist back then, and which are meaningless in the long run anyway.

I don't suppose that growth was occurring from a much smaller base had anything to do with it, or that it was an altogether different economy. Apples and oranges.

Sure. Still, it's tough to argue that the new kid on the block, oil, "goosed" the economy.

Sure, oil is a bit more convenient - for instance, Churchill converted the British navy from coal to oil because they could "steam" just a little faster than the competition - but civilization would have been just fine without it. Rail would have kept it's central role for freight and passenger traffic, cars and planes would have been less numerous and shorter range, and used batteries and ethanol, etc.

Nick, as usual you shrug off and misunderemphasize critical factors, that seem to permit you to come to unrealistic conclusions.

Having your battleship go 'just a little' faster than your opponents is not gaining 'just a little' advantage. It's fundamentally different.

Moreover, the fact that oil is so potent and portable is entirely what allowed us to get Aviation going, outrunning ALL the fleets ultimately, and shaping the entire century up into space travel in ways unimaginable with any other power source. Even if rockets use other propellants now, it would be useless to argue that we would have gotten there and to the ICBM without the Carrier Group, the Messerschmidt 109, or the Interstate Highway System.

As ever, I join you in being thrilled about the potentials of Solar and other abundant energy sources.. but have to insist that the energy it will take to move from 'here to there' in time to avert troubles that should not be shrugged at is a transition that will still require the oil that runs the machines we already have.

I think your analysis needs to take that factor more seriously, as well as appreciating the amount of resistance to change comes with Human Society. You've stated that it's surprising that here on TOD, you don't see more flexibility to take in your ideas.. and this includes many of us who are already ardent supporters of many of the tools you champion. You might take THAT as information to add to your own review of the facts on the ground.

I would side with Nick more than you JoeCool. I tend to be more objective about the data and less drawn into creating doom-like scenarios.

Nick also acts as a devil's advocate, which is quite common to see in engineering circles and especially during program reviews. The best of the lot are tenacious and almost arrogant.

Having seen professional DA's in action, he doesn't seem to bother me as much as he seems to get under the skin of other TOD commenters. I wonder why?

Yeah, Eric, I've sat through quite a few reviews and confabs when the DAs, as you call them, imposed their will on the process. Learned two things quickly: Cover my ass; and don't bother to say "I told you so". In one instance, I survived the layoffs as the 'deciders' spent a couple of years in court. In another instance, I got an apology from a vice president as he handed me a glowing reference for me to give to his competitors (just after his company was sold off in a fire sale). I'm not generally conservative, but try to think systemically when other folks' lives and incomes are involved. Erring on the side of caution involves setting one's hubris aside.

Nick's insistence that oil isn't essential to, or wasn't a (the) major contributor to, the phenomenal growth of the 20th century ignores a mountain of data that indicates otherwise. His insistence that transitioning away from oil, likely in an uncontrolled manner, isn't going to be enormously disruptive, ignores the realities on the ground, as many countries have seen their production peak, and have 'transitioned' to being net importers, losing the petroleum subsidies that their entire society has invested in and adapted to.

The world's reserve currency is underwritten by two primary things - oil and trust. Egypt didn't run out of oil, yet trust evaporated virtually overnight as its ability to sell oil and subsidize its population's other needs ended. It exposes their overshoot in virtually everything else (food, water, infrastructure...). To insist that the US and other OECD nations are somehow immune to this effect ignores much.

Saying we'll adapt ignores that the majority of humans are living on a fine line that doesn't provide much capacity for adaptation. They are utterly reliant upon things as they are, not on someone else's concept of what could be. As we've seen, they generally don't react well when the inevitable reset comes.

Far too many claims on too few critical resources in too many parts of the world. Not enough chairs; not enough lifeboats. Last count, I've traveled to 42 countries, and have seen it for myself. I've also seen societies' remarkable ability to cope, and in virtually every case, oil, the master resource, was somehow essential to coping.

Erring on the side of caution involves setting one's hubris aside.

I'd say sticking with oil is very, very risky.

insistence that oil isn't essential to, or wasn't a (the) major contributor to, the phenomenal growth of the 20th century ignores a mountain of data that indicates otherwise.

I'd be curious to see that data. I haven't seen it in 7 years and 52 weeks on TOD...

Again, the US grew much more quickly on coal, right?

insistence that transitioning away from oil, likely in an uncontrolled manner, isn't going to be enormously disruptive, ignores the realities on the ground, as many countries have seen their production peak, and have 'transitioned' to being net importers, losing the petroleum subsidies that their entire society has invested in and adapted to.

Well, of course oil exporters are going to be hurt by losing that industry. Russia, KSA, Mexico, all will be hurt. On the other hand, oil importers will be helped (which is why Germany is working on it so hard). Eventually, of course, countries like Egypt would be much better off with wind and sun.

The world's reserve currency is underwritten by...oil.

No, it's really not. I think that urban myth came from the US's insistence that oil be priced in dollars, and that KSA recycle their surplus into US banks. Now, of course, dollar pricing is unimportant: dollars can be converted instantly into other currencies, and KSA no longer feels any need to put it's savings in any particular country. And, KSA no longer has a surplus: it spends oil revenues as fast as they come in.

Egypt didn't run out of oil, yet trust evaporated virtually overnight as its ability to sell oil and subsidize its population's other needs ended.

That greatly exaggerates the importance of ELM to Egypt. Of course, falling exports hurt, but that was far from the most important thing.

Now, Egypt's long-standing fuel and food subsidies hurt it enormously - they sooner they end them (and replace them with targeted aid to the poor, as they're planning), the better.

Saying we'll adapt ignores that the majority of humans are living on a fine line that doesn't provide much capacity for adaptation.

That's a bit too general. Certainly, most people in OECD countries, oil importing countries, and very poor countries in Africa, would be much better off.

If the developing countries take the lead in making wind, sun and EV-type countries even cheaper, it will be better for all.

In my opinion, the fact that the US dollar is the world's reserve currency, doesn't mean that much. It gives the USA a very slight advantage. Lots of countries have industrialized very rapidly (like Japan after WW2) when their currency was not the reserve currency.

-Tom P

The humans living on a fine line, such as those in sub-saharan Africa, consume almost no oil per capita.

-Tom P

That answer however gives short shrift to the many across America and much of the developed world who live paycheck to paycheck or far worse, and are completely mired in the oil-driven system that produces, delivers and currently assures basically all of their necessities, including their jobs.

The wealth divide is still, as far as I'm aware, growing wider, while I watch many professionals in my own life see their prospects bump sloppily down to lower quality and paid work opportunities.

For most people, their direct dependence on oil consists of needing it to drive.

Almost anyone in the US can trade in their vehicle for a used hybrid. The original Honda Insight is still available very cheaply, and it gets 60-70 MPG. For the large majority who can get financing, a Prius C is 2/3 the average price of a new car, and gets 50MPG pretty easily.

Now, if everyone saw the light at the same moment (let's say Fox News was bought by the Nature Conservancy), then there would be a "rush for the exits". Then, people might have to carpool for several years, until used hybrids/PHEV/EVs became more widely available. Given that the majority of phones sold in the US are smart phones, which would give access to scheduling apps, and that carpooling is still larger than mass transit in the US (IIRC, 11% of commuters, vs 9% for mass transit), that would work for most people.

For most people, their direct dependence on oil consists of needing it to drive

For most OECD people their direct dependence on oil consists of their needing to eat. And don't throw back that transport and farming only use such and such small percentage of total oil pool. Neither would have achieved their current capacities without the huge infrastructure and economy of oil production and delivery scale that have been put in place that make oil cheaply available almost everywhere in the OECD--that massive infrastructure and incredible economy of scale that would not exist if we had not found it easy to use so much oil for personal transport. You just can't go pulling threads out the fabric willy-nilly and still have a fabric.

Pull oil out of the last hundred year picture and you have sci-fi.

But you can be all about sci-fi when it suits you. A while back you argued that we did not need to burn fossil fuel at all to reach our current level of technology. But we did burn it and our population did mushroom worldwide as we burned it and we found use for and pressured more resources as we did--all the while a much larger and more interconnected pool of minds working on how to create that pressure by directing more and more resources for human consumption.

That process really picked up speed when we started burning fossil fuels on a large scale--you've seen the chart. Hard to prove what sort of population critical mass is needed for all that tech movement. All we have is the set of facts that do show the big explosion happened after coal became the main source of thermal energy for industrial processes. Far more difficult for you to prove we would have moved much beyond 17th century tech by now without burning massive amounts of fossil fuel. Of course many pieces for a tech explosion were in place before much coal was used--cheap printed books and reliable oversea transport to mention just a couple big items. Again, hard to pull many threads out and still have a fabric.

Oil came on top of coal and never supplanted it entirely, it just shunted it to where it could compete best at the moment. Our fossil fuel use is all interwoven, but pull that entire thread out of the fabric and I will lay odds humans would not yet have been able to engage in the discussion you and I are now involved right now.

Using fire goes way back for us, very likely, however you reset our development scenario on this planet, some population somewhere was bound to find an advantage over its neighbor once it started using dirtier more energy dense coal it had laying around especially once the sticks in the neighborhood were getting too few and far between. The tech transfer there is a lateral slide (sorta like the slide from oil, to coal, to gas power plants) not a vertical climb.

Carpooling--no doubt it is the biggest instant fuel saver out there for the US but there is that last mile is an issue especially when carrying groceries in bad weather. Income stressed workers who have to add an hour or more a day to their to and from work travel time (pretty much what using public transit did to my commute time as teen) should be a bit trimmer though. But I just can't imagine crime an fear being an issue with smart phone carpooling, can you??? I hitch hiked extensively as a fit young man---and had a few dicey encounters that might have went south if I had been smaller and weaker looking, Riding in a strangers car makes one very vulnerable. Not a show stopper, but look for security issues here to create profit and monopoly opportunities rather than an egalitarian point to point transport web.

Having your battleship go 'just a little' faster than your opponents is not gaining 'just a little' advantage. It's fundamentally different.

Sure....for the military. Churchill gained a 20% speed advantage with oil. That was enormous in wartime, where "gettin there fustest with the mostest" is essential.

But, not all that important for shipping freight. If the world never had oil, some things would have been a bit different (aviation, obviously, though I'm not so sure about rocketry), but would it have made much difference to our daily lives and industry? Not really.

And, if we eliminate oil now, it will have much less impact then it would have had then. We have hybrids, PHEVs, EVs, synthetic liquid fuel, wind and solar.

Oil was never essential, and now it's a real liability. It's time to eliminate it, ASAP.

the energy it will take to move from 'here to there' in time to avert troubles that should not be shrugged at

Hybrids, PHEVs and EVs take little more energy than ICEs, and most of it isn't oil. Wind has a very high EROEI, and again, it's manufacturing inputs are mostly not oil.

appreciating the amount of resistance to change comes with Human Society.

I agree: here's my comment about that from just a couple of days ago:

People take a long time to adopt new ideas.

Reminds me of a company that spent billions in the US a few years ago to offer online food shopping and delivery - Webvan. It was a great idea, but people took too long to get used to such a novel idea, and they went bankrupt before they could generate enough cash to pay for the expensive automated warehouses.

That's just the way it is - it takes time to absorb new things...

OTOH....TOD is supposed to combine analysis with new ideas: Aren't you just a little surprised that TOD couldn't think outside the "Fossil Fuel box" a little better?

Sure. For starters, there would be no plastics, but that's no big deal, right? /s

Plastic consumption can be made more efficient by reducing packaging and redesigning structures to reduce density while maintaining strength (human bones are a good example: they're hollow, and even the tubular structures are mostly empty space internally); other materials (glass, metal) can substitute; and it can be recycled to reduce virgin material needs by 99%.

One can produce very simple hydrocarbons from any source of hydrocarbons, and build them into any compound your heart might desire. Various kinds of feedstocks would work. Some are more convenient or slightly cheaper than others. Whatever fossil fuel is convenient will work; biomass will work just fine, or hydrocarbons can be synthesized from seawater, atmospheric CO2 and renewable electricity (air, fire and water!).

A huge fraction of plastics are used for things like disposable beverage containers and food packaging. Those could easily be made out of aluminum, glass, and cardboard.

Plastic is also used for toys, car interiors, and so on. The reason is because plastic can be squirted into a mold (which means cheap manufacturing) and it isn't brittle. But those functions could be also performed by silicone at only slightly higher prices. I know people don't prefer the rubbery textures which silicones usually have, but they'll deal with it.

Bear in mind, that when our civilization started using plastics extensively, we could have chosen other options. Plastics were selected by economic decision-makers, among various alternatives. The alternative wasn't just nothing. If plastics had never been invented, then something else would have been used. In many cases, plastics had only extremely minor advantages over other materials.

-Tom P

By what I understand, most plastic is made out of natural gas these days not oil. And we have plenty of natural for a while as long as you don't mind the fracking. Plus, there are plenty of bio-based plastic-like substitutes. So plastics is not something I'd worry about for a while.

"Aren't you just a little surprised that TOD couldn't think outside the "Fossil Fuel box" a little better?"

What surprises me is that you can't seem to notice that those among the TOD regulars who have done the MOST to get outside of the FF box find your conclusions and characterization of our lot to be unrealistic.

Your detractors here are absolutely NOT trying to argue that we 'need to stay on oil'. You know we are pro solar and alternatives, but we are also facing denial and misinformation, the scale of the job to do against what look to be economies that have already begun staggering.. I don't predict doom, but neither do I predict an 'obvious success' as you do.. you're overassured confidence in how you expect this to be able to play out only works when you lightly toss off the many types of inertia and resistance that must be overcome to get there.. while I find it bewildering that you would conflate THEIR obstinate resistance to making ANY kind of transition, with this critique from those of us who simply don't buy into your particular narrative, coming back with it as if we're opposed to this transition. We're onboard, we just refuse to go into it starry eyed, I have to say.

Well, if you feel that we have all of the technology we need to replace oil but that we face ferocious political opposition to installing it, then we agree!

But that's not the issue here. The question is whether industrial civilization could have grown without oil. That's not affected by one country's battleships going slightly faster than the other's.

Oil was really only important for battleships and submarines. All other ships could easily have used other fuels. In fact, most ships until about 1975 had steam turbine engines (not internal combustion engines) which could easily have been designed to use anything that burns, as fuel. Obviously there are disadvantages to using solid fuels (like, conveyor belts for fuel and ash, 10% lower efficiency of steam turbines, more smoke, etc). None of those factors are deal-breakers.

Most new ships these days are being delivered with dual-fuel engines capable of burning either bunker fuel OR natural gas. In other words, the shipbuilding industry is already phasing out oil. That's not surprising. The shipbuilding industry has made fundamental changes before, with regard to fuel and engine technology (transitioning from reciprocating steam engines, to steam turbines, to internal combustion engines; from wood to coal to oil), and this time is no different.

I'll bet you didn't even notice that the goods you bought in the department store (and delivered from Asia) were being delivered using a different fuel.

Bear in mind that intercontinental shipping is far more important as a driver of economic growth than space rockets. I'm in favor of the space program, as much as anyone, but it wasn't necessary to get us here. In fact, we've never exploited anything in space commercially. The space program had beneficial effects because it funneled money to R&D, but that could have been done without oil.

I don't think it's useless to argue that. Bear in mind that we wouldn't have just stopped developing without the Interstate Highway System. We wouldn't have just stayed in 1945. Instead, we would have developed along different lines. Economic growth only requires net energy, not oil.

Now that you mention it, I'm not even sure that we needed oil for cars. Back in the 1920s, lots of cars were battery-electric. If we had no oil, maybe battery-electric cars would have become more popular instead.

In the 1920s, battery-electric car manufacturers went out of business because oil-powered cars had better range. If oil had never existed, however, the battery-electric car manufacturers would have prevailed. Which would mean that all of the massive R&D money funneled into the ICE, over decades, would have gone to batteries instead. Perhaps we would have seen rapid price decreases in battery-electric cars back then, similar to the rapid price decreases we saw for oil-powered cars, and similar to the rapid price decreases we're seeing for battery-electric cars now that they're finally being mass-manufactured.

Obviously, things would be different today if battery-electric cars had prevailed. Range would probably be much less. Long-distance road trips probably couldn't be done as easily. Some countries would be richer, and others poorer. However, it wouldn't have prevented the development of industrial civilization.

Even if fossil fuels were essential for industrial civilization to develop in the first place, that doesn't mean they're still essential for industrial civilization now. We've developed alternatives in the mean time, like nuclear power, photovoltaics, concentrating solar thermal power, and many others. Fossil fuels aren't necessary now, any more than reciprocating steam engines are necessary now, even though they were important once.

-Tom P

I think you're making the same mistake as Nick. It's almost a 'pound of flesh' argument. You can't just take oil out of that history and pop in something else. Any of the conceivable alternatives at the time, or even today, would in all likelihood not have had anything like the impact that oil, with both it's abundance and energy density, has done.

I don't say this to revere it, but to at least acknowledge that it has been central to a very unique set of historical actions. If we had not had the Space Race or the Rocket Programs in that century, for example.. it's not at all certain we would have developed microprocessor tech to the degree or in the direction that we have.. you can't just toss in a substitute and try to erase all the unique effects that have derived from Petroleum, and shrug and say it's really not all that key to the last century.

Now, can we work away from it? I think so, but we still need to appreciate what effect it has on the current scene, and considering that up to 70- whatever million barrels of the stuff has been flowing around our economy daily for years and years.. it's simply not credible to say it's not that important.

You're soaking in it.

Any of the conceivable alternatives at the time, or even today, would in all likelihood not have had anything like the impact that oil, with both it's abundance and energy density, has done.

Again, economic growth was *slower* in the age of oil.

If we had not had the Space Race or the Rocket Programs in that century, for example.. it's not at all certain we would have developed microprocessor tech to the degree

The Space Race didn't rely on oil, particularly - rocket fuels didn't need it. More importantly, the IC was developed by Bell Labs before the Space Race, and the development of chips had very little to do with space.

Now, would things have developed differently in unpredictable ways? Sure. But that's very, very different from the idea that industrial civilization is dependent on oil.

I don't think energy prices matter too much for economic growth unless they're extremely high. Economic growth is driven by capital investment and progress in technical knowledge. Economic growth slowed in the late 1970s because prior fundamental inventions (gas turbines, steam turbines, electricity generation, steel making, and so on) had reached maturity and no other fundamental inventions were forthcoming. Furthermore, manufacturing is a smaller fraction of our economy now anyway, and most of the economy is devoted to services, which haven't had the a corresponding improvement in productivity. (For example, accountants probably reached the pinnacle of productivity in the early 1980s when they first got computers. They probably are no more productive now on average).

Right now, we spend an extremely small fraction of our energy on manufacturing capital goods. We could increase the amount of energy devoted to capital goods by a lot even in the face of significant declines in energy production.

-Tom P

The vast majority of oil has been used for things which aren't very important. The oil is blown on trivial stuff that had obvious substitutes. Until 1980, we burned a lot of oil to generate electricity, something which we could have done using any number of alternatives. These days, we use oil to manufacture soda bottles because they look slightly prettier and weigh 1% less than beverages in aluminum cans. Oil has allowed us to move way out into suburbia or exurbia rather than live in denser settlements (this particular usage is responsible for about 70% of all oil usage, not just for cars but also for delivery trucks traveling longer distances).

I think the biggest impact of massive oil usage has been on our living patterns (suburbia). Obviously that has been a profound effect on the countryside. However I don't think that's really crucial to civilization.

I'm not denying that oil has had a big impact. I'm saying it was not crucial for civilization to develop. Civilization would have developed along slightly different lines. There were other options (such as battery-electric cars, electrified transport, and denser settlement) which were all available at the time oil was chosen as the best alternative.

Oil was the best alternative. That's why oil was chosen. Other options were all slightly worse. For example, battery-electric cars would have had range limitations. Materials other than plastics are brittle or slightly more expensive. Beverage containers would be opaque.

However there are not massive differences to civilization implied by having chosen the second-best alternative in those cases.

-Tom P

Good thoughts.

A quibble: oil *appeared* to be the best alternative. If the costs of security and pollution (direct and CO2) were included, I think the calculus would have been very different.

Europe uses 18% as much fuel for personal transportation, per capita. That has a lot to do with $7/gallon fuel. If the US built in $2T oil wars, as well as all the other costs, fuel in the US would be around $7 as well.

The cost of military intervention almost always exceeds any financial benefit derived from it. We should never have tried to stabilize the market for oil by military means.

-Tom P

I agree, very strongly.

Still, we continue to spend roughly $500B more per year on military, post-9/11, due to oil related "terrorism". Oil has cost us dearly.

Another way to look at it: clearly, the US feels that "energy security" has a very large value. We should price oil's insecurity into each gallon.

TomP: "The question is whether industrial civilization could have grown without oil."

The point is, it didn't; not for the last century. Dis-investing in our oil-based economy and infrastructure isn't nearly as simple as claiming it can be done. It's like saying all of our cars can be converted from liquid fuels to electric. It's more efficient to scrap what we have and start over, hard to do when you still need to drive/maintain/pay for the car you already have, especially for those who are barely affording (or not) what they've already invested in. Easy to ignore that any transition is simply not an option for many. There is no "we" when it comes to the sort of adaptations you posit.

I ask the cornucopians here, are you going to buy an electric car for someone who needs one, but can't afford it? Are you going to donate solar panels and heat pumps? Are you going to feed their children while they transition away from their current fossil-fuel-reliant source of income? What about the vast number of folks who see no need for change because everything is going pretty well in their lives? How do you convince them that the way they've been living, and what they've invested in, has been wrong when it's been working quite well for them?

As I've said, there are those who can afford and promote change but have little incentive to do so (quite the opposite), and there are those who have little or no capacity for change, as much as they need it. There's a lot of socio-apathy inherent in both points of view. Ignoring this reality is pure bargaining.

Used hybrids are just as cheap as used ICE's. The average used car turns over every 3 years, so there's lots of opportunity for switching.

New hybrids are cheap: a Prius C is 2/3 the price (about $20k) of the average new car.

Almost anyone can afford to greatly reduce what they spend on fuel.

The planet I live on has over 3 billion people living on less than $2.50 per day, almost half. I'll have to visit whatever planet you're on sometimes. Sounds like a great place where wealth is distributed more equitably, and the majority have a global sense of community, sacrifice and sharing, and "where all the women are strong, all the men are good-looking, and all the children are above average."

People living on less than $2.50 per day aren't driving cars! They may be on a bike, in which case an E-bike will work better than a push-bike, and cheaper than a gas bike - 25M sold in China annually.

Solar lighting is far cheaper and more convenient (no walking to the nearest village for refills!) than kerosene - the conversion away from oil is a big step up for the very poorest in Africa.

The planet I live on has over 3 billion people living on less than $2.50 per day, almost half. I'll have to visit whatever planet you're on sometimes.

Give it up! Nick isn't going to ever acknowledge the existence of those people if he won't even acknowledge that there are people just down the street from him posting on Craigslist like this:

or

or

These were taken from my local listings and Nick doesn't understand that these people wouldn't be making these postings if they could just pop down to their local dealer and pick up a new or used one. These people want a car that costs under $1000. They don't have a wonderful credit rating, the dealer tells them to take a hike. These ads are always present. Yes, the Prius C is a great car (I have one) but it's not something that everybody in the US can even begin to afford, unlike Nick thinks. He's not just from a different planet, but from a different universe with different physical laws.

First, there are very cheap used hybrids around. And, there are very cheap Toyota Echos and Corollas - they're just as cheap as the pickups and SUVs that many low income people unfortunately choose.

2nd, the poorest 1/5 of people in the US have much lower rates of car ownership. Many live in big cities and use mass transit. Car ownership is, overall, a middle class thing, especially so in developing countries.

3rd, this is a whole different conversation.

We started with: "is oil necessary for industrial civilization?", and this is "are there some people so poor that they have trouble scraping up $1,000 to buy a used car?". Of course. And, they need help (remember Cash for Clunkers?). But, what does that have to do with whether civilization will crumble without oil??

I know such people perfectly well: I had a Corolla for 20 years that had some brake problems that were a little expensive. I sold it to a homeless guy on my street for $5, he fixed it himself, and now he's off the street because he can deliver food for a living.

Very soon very old Priuses will be that cheap. Fairly soon after that so will EVs.

Almost everyone who has had a used car for a while has to replace the battery eventually--$100 or so for a cheap one. To replace the batteries in an EV will be many thousand dollars.

Starter batteries are designed to be very cheap, and not last very long. "Traction" batteries (designed to turn the wheels) are very different - much longer lasting chemistries, with sophisticated temperature and charge/discharge management systems.

That's true, but almost everyone who has owned old gasoline-powered cars has needed to replace a transmission or some other expensive mechanical part at some point.

I expect that the cost of maintenance for EVs will eventually be similar to, or less than, the cost of maintenance for gasoline-powered cars. Gasoline-powered cars are actually mechanically far more complicated and have all kinds of expensive wearable parts. Not to mention, they require oil changes and fluids which add up to $2000 over the life of the car.

-Tom P

Where did the homeless guy get the tools Nick, or the place to work on the car? My BS meter is ringing big time.

Good question - I don't know. That's what he told me. Despite being on the street (he was living in his car, because the transmission went out and he couldn't do his delivery thing), he seemed to be pretty smart and creative.

You just contradicted yourself Nick, Very old Priuses, will not happen soon, unless you can get a time machine and get some from the future. This is one of your biggest shortcomings of analysis, time. Your act as if we either can do this quickly, or we have all the time in the world to act. Tell me how much time do we have to act, Five years? Ten? Twenty? Each year your solution does not happen makes it more difficult to enact, as resources dwindle and desperation sets in.

For some reason, you're concentrating on details instead of the big picture. Are you worried about the overall situation, in which case the small percentage of car owners who can't afford to pay more than $1,000 aren't that important? Or are you worried about helping the working poor, in which case there are plenty of good public policy solutions (Cars for Clunkers, microcredit, improved transit and carpooling, etc, etc)? Are you worried about individual strategies, or public policy??

FWIW, The Honda Insight (70 MPG, highway) has been available since 1999, so there are 14 year olds out there. That's fairly old. The Prius has been sold worldwide since 2000. So, there are used-car options available for individuals, right now.

On the other hand, from the point of view of public policy - I agree, we need to pursue massive change. We need to slap a stiff carbon/fuel tax on oil and FF (rebated to the working poor), and sharply raise CAFE MPG requirements. That would produce a lot of change, mighty quickly, and on balance help the working poor enormously.

I get the same feeling from all your posts. Everything you write here is tightly focused on the USA, and not even the whole country, but just tiny rich segments within it. Add to that a very distorted view of Europe (I suspect you get that mostly from reading various blogs) and zero concern for the rest of the world. Do you realize that you can't take all those USA examples and simply extend them to all the other 6.7 billion people around the world? The US has been an empire for the last 60 years, heavily subsidized with resources and wealth from around the world. That's the basis of its economic power, that's what all those prices and costs that you are quoting are based on, and it's foolish to take this exceptional situation (which is about to end soon) as a basis for any future predictions.

tightly focused on the USA

hmmm. Yes, I know the US better. But, no, renewables, rail and EVs are better for most countries (not FF exporters, quite as much). Certainly Europeans agree, especially Germany.

not even the whole country, but just tiny rich segments

That's very unrealistic. When people focus on the very poor, they're not seeing the big picture. The average new car in the US is $30k. I suspect Europe isn't very different. So, a $20k Prius is extremely affordable for *most* car buyers. There are plenty of high MPG (low liters per km) used cars. That's just the reality.

That's the basis of its economic power

I'd be curious to hear a detailed explanation of that. Certainly, the US would be far better off if it had priced fuel the way Europe has, by slapping a stiff fuel tax on oil in the 1960's, when imports started to balloon. The US has been badly harmed by it's oil imports, not helped.

similarly, mid-income and developing countries like Egypt, Argentina and India would be far, far better off with proper fuel pricing and development of renewables, rail and alt vehicles.

The point is, that ultimately, the economic power of a country is based on its ability to create things that are necessary, useful and exportable. All the financial blahblah does not matter, because in the end, it all comes down to the simple "we have something that you need, you have something that we need". That's why Germany is so successful today. Germany is focused on products and technologies that are actually needed, and which they will always be able to exchange on the world markets.

Of course, there is an alternative to this, and that's extortion through military power, economic bullying and so on. And that's what the US is doing. I'm not saying the US has nothing to export, the truth is you have a lot... but definitely not enough to support your imports and consumption. For example, look at Spain or Greece. The real problem with those countries is that they sucked money of the EU and spent it all on consumption. Instead of building factories to produce stuff, they built millions of apartments. And now they are in a situation when they need stuff, but there is nothing they can offer anyone in exchange. The UK is exactly the same, what do they produce that anyone could want? Nothing. So they cling to their lying and thieving "financial industry" which steals wealth and resources from other countries instead of a proper exchange.

This is what it all comes down to in the end. Countries that produce vs. countries that only consume. And the US is one of the countries that mainly consume (and please, don't reply with your GDP numbers... a huge portion of your GDP has no relevance to real, necessary and useful export, especially in relation to your consumption). That's the problem with your argument of "cheap" EVs and PV and all the rest. Is only cheap for the americans now, because you are holding the rest of the world at gunpoint. Those millions of americans simply don't produce enough real value to exchange for the import of those "cheap" technologies. You ARE Spain, the difference is you don't have to pay the real price for your imports. Not yet, anyway.

I'm not saying the US has nothing to export, the truth is you have a lot... but definitely not enough to support your imports and consumption.

Have you looked at the actual import and export numbers?? US net imports are only about 4% of consumption, and about half of that is oil imports.

look at Spain or Greece. The real problem with those countries is that they sucked money of the EU and spent it all on consumption.

Whoa! That's a very Germanic viewpoint. The fact is, German banks financed a large part of that real estate bubble, and it's paying back those loans that's at the heart of much of the current disputes.

the problem with your argument of "cheap" EVs and PV

The US can, and is, building cheap EVs and PV. Of course, Chinese subsidies are making it hard to compete with "dirt cheap" Chinese PV...

US net imports are only about 4% of consumption, and about half of that is oil imports.

That's nice. Right now, the top three places of the current account balance table on wikipedia look like this:

1. USA -784.775

2. UK -162.973

3. India -154.401

When the US moves to a lower place in that table, or maybe even to the other table, the one with the positive numbers, then I'm going to agree with your views of the US economy.

The fact is, German banks financed a large part of that real estate bubble

Yes, unfortunately. Although, this tends to be overstated a lot... those banks that participated in the bubble are not the "real" german banks. The real German banking sector is based on local savings banks. The banks that are most exposed to the Spanish and Greek debt are the investment banks, parasites that were inspired by the british financial industry. Germany can (and will) nationalize or dissolve those banks without any trouble if necessary and nothing much will happen.

The US can, and is, building cheap EVs and PV

As I said, they are only cheap because the whole value added chain leading up to them is skewed in your favor. You keep mentioning the poor as some kind of anomaly. The poor people of america, the people of Detroit are not an anomaly, but you are. Their consumption has been adjusted to the value added that they really produce, as it should be. Meaning very very low. Yours, and your fancy neighbours wasn't (yet). When your neighbour buys a Tesla S, did he actually produce equal value added, as went into the production of that car? I doubt it. And this is what the people of Spain, Greece and Detroit are experiencing. An adjustment of consumption based on the real value added of their production. You are not experiencing that yet, due to your status as a privileged citizen of the empire. Cherish it while it lasts.

1. USA -784.775

I think it's about $420B, now. Google "us current account deficit" and choose the BEA entry.

The overall US economy is what, about $15T? $420B is less than 3%. If you subtract oil, it's what, around 1.5%? How can the rest of the world be the mainstay of the US economy, when net imports are so low?

the whole value added chain leading up to them is skewed in your favor

What do you have in mind, specifically?

You keep mentioning the poor as some kind of anomaly.

Well, when it comes to car buying, the person who can't afford to buy a used Prius for $4k certainly is a small minority. Of course, many of the poor simply don't own cars, which makes them irrelevant to a discussion of the difficulty of affording alt vehicles.

To the contrary . . . those ads show the need for electric vehicles even more! Those people are looking for a $1000 car that will cost them more than a $1000/year in fuel to power. And as any follower of this web site knows, the cost of that $1000/year is going to go up the future years. What good will a cheap car be if they can't afford the fuel for it?!?! We need cheaper EVs and that is why getting them into mass production where more cost savings can be achieved is important. Eventually, the used EVs will filter down and people can fuel them for $35/month in electricity.

But we will certainly need more than that. We need better public transportation, we need people to stop having 3 kids that they can't afford, and we need jobs closer to homes.

Yes.

One quibble - more than half of all kids are unplanned, courtesy of the religious right that makes contraception so difficult.

We don't have to force anyone to have fewer children - people are desperate to have fewer kids, if the larger society would just get out of their way.

I'm not saying that. I don't think anyone will scrap anything. I'm saying that we'll stop buying new gasoline-powered cars and start buying new EVs, at some point. Cars need to be replaced after awhile anyway. The car fleet turns over every 15 years or so. I'm saying we could buy new EVs instead of new gasoline-powered cars, and the entire fleet will gradually transition that way.

No. For that matter, I didn't buy them a gasoline-powered car either.

I'm not saying EVs would suddenly alleviate poverty. I expect they will have little effect on living standards one way or the other, since their cost (on a TCO basis) will be similar to gasoline-powered cars.

No. For that matter, I've never fed any children during the gazillions of other industry transitions we've already undergone. I didn't feed any children when manufacturing was outsourced in the 1980's and 1990's. I didn't feed any children when all those factory jobs were lost to robots. (Far more people had factory jobs than oil-industry jobs). This kind of churn is typical in capitalism, and has always been. At the beginning of the industrial revolution, 90% of people worked in agriculture, and now, almost nobody does.

Bear in mind that there are as many jobs surrounding EVs, as there are jobs related to oil. EVs need to be manufactured. We'll need greater electricity generation capacity, and so on. If EVs end up being much cheaper (and requiring fewer jobs) then consumers will have more income to spend on other things, creating jobs elsewhere. Even though 99% of all jobs have been eliminated during the past 200 years by industrialization, most of us are still employed. Of course there are periods of mass unemployment during recessions, as there have always been (financial panics and recessions were more frequent and more severe during the 19th century). However there has never been a net loss of jobs as industries have been replaced.

I'm saying that the transition to an electric infrastructure IS business-as-usual for capitalism. Capitalism has always been transitioning from one thing to another, is transitioning right now, and will probably continue transitioning far into the future. The history of ocean shipping is just one example. From sailing ships, to steam reciprocating engines powered by wood, to coal, to oil, to steam turbines, to diesel internal combustion engines, and now to natural gas-powered internal combustion engines. This latest transition certainly isn't the last one. I expect there are one or two more transitions before ships reach their final form. Jobs will be lost, and other jobs created. I'm not saying this will suddenly eliminate all poverty. Poverty will continue to decline gradually. This is all business as usual.

-Tom P

A good discussion. One detail:

The car fleet turns over every 15 years or so.

New cars are driven more. Cars less than 6 years old acount for 50% of VMT. New vehicles, therefore, have a fairly quick impact.

This doesn't sound right to me. They only ships that ever had natural gas powered engines were LNG tankers that were burning the boil off from the cargo. Looking around, you can find this:

"This led to dual fuel LNG ships with steam engines which could burn either the boil-off gas from the LNG cargo tanks, or its usual bunker fuel."

. . .

"The next innovation was an on-board re-liquefaction plant. This would take the boil-off gases, cool them back into a liquid, and then put the liquid back into the cargo tanks. These re-liquefaction plants can be found on the rear decks of some of the newer and largest LNG ships, the Q-Flex and the Q-Max vessels. Because the engines on these vessels no longer needed to burn two different fuels, conventional diesel engines could be used."

http://gcaptain.com/fire-safety-ships-terminals/

I should note that fossil fuels were what ended famines in Europe.

Wouldn't this mean that GDP growth during the period of cheap energy (after ww2) was even slower than Nick indicated?

-Tom P

I woudn't say so, I think that the post war period needs to be divided into two distinct periods: 1945 - 1971/79 and 1979 - present. During the first phase, cheap energy fueled real growth which is refleced in the real GDP numbers. After the late 70s, economy became virtualized, real growth slowed down drastically and GDP became meaningless.

Those two periods aren't very different with regard to energy prices generally. Electricity and coal dropped in price rapidly during the 1960s and 1970s and then stayed at that low level until about 10 years ago. Only oil increased in price during that period, so it's not cheap energy in general.

In fact, it's not oil price either. Japan, South Korea, Germany, and China grew their industrial output at more than 8% per year, after the oil shocks. China managed 10% year-over-year growth in industrial output over the last 10 years, despite very high energy prices in general--the highest they've been in many decades. I think the last 10 years had the highest worldwide growth in industrial output ever, much of it happening after conventional oil had already reached a plateau.

Energy prices appear to have little effect on industrial growth, as long as they're not outrageously high.

-Tom P

Price needs to be viewed in relation to marginal returns and that's what separates those two periods, not the price itself. Western society was getting very high marginal returns from each barrel of oil in the period 1945-1979 and therefore there was very high real growth. China is getting very high marginal returns now, and that's what behind their amazing growth. They can afford $150 or $200 a barrel, because they are still in the phase where each barrel gives them huge marginal returns.

Western society was getting very high marginal returns from each barrel of oil in the period 1945-1979 and therefore there was very high real growth.

Well, no, US growth was *lower* than before WWII.

As I have pointed out before from 1942-1945 the US elite decided to seriously curb Auto Addiction reducing car production to a few hundred cars and quadrupling intercity rail and bus transit as well as quadrupling intraurban public transit. It was not until the Interstate Highway system was launched in the 1950's that the US went whole hog into Auto Addiction and amazingly enough many passenger Rail Lines like the one 10 minutes from my house from Dover, New Jersey to Buffalo, New York with connections to Chicago survived until the 1970's. In this period car ownership and miles skyrocketed until Peak Cars for the US was reached about 2006. As Auto Addiction accounts for 70% of US oil usage this has a HUGE impact on energy efficiency.

So IF the US would get serious about promoting Green Transit ie Rail, buses, shuttles, walking and bikepaths we could cut our oil and energy usage by a huge amount and still

manage to sustain a reasonably mobile (probably MORE mobile actually for the 30% of the population that cannot drive!) way of life.

Of course the same goes for all other aspects of the Green Transition/ New Deal, cutting

wasted heat, air conditioning,etc etc.

But Auto addiction after the waste of 5% of our oil and $1 Trillion per year on endless Wars (ironically frequently fueled by attempts to control oil resources (lol!)) is the

most important and critical factor. It is why the US consumes about 2-3 times the energy per capita of Europe and Japan.

The big difference between 1945 and now is the huge proportion of the population living in suburban sprawl. Could someone explain how mass transit, walking work in spread-out suburbia?

Try googling, "Streetcar suburb".

From Wikipedia:

Southern California once had the largest interurban rail network in the world, but starting after WWII this was abandoned in favor of a monstrous freeway network that is working less and less well at greater and greater cost as years go by. Freeways are basically a dead-end technology in large urban areas.

Although streetcars have largely been abandoned in North America, they are making a big comeback. Only a few cities (notably Toronto) still have classic streetcars, but there are hundreds of new systems in cities worldwide, variously called "trams", "light rail", "light metro". They use the same basic concept (electric rail vehicles running at grade) but they are much faster, smoother, quieter, and user-friendly.

Rail is great - we need lot's more.

But...hybrids, PHEVs, and pure EVs will work just fine, where rail won't.

And as usual, my 2¢ worth, regarding oil prices, oil supplies and debt. Note that by definition, the post-2005 supply of Available Cumulative Net Exports (CNE), which is Global CNE available to importers other than China & India, is declining.

In my opinion, the estimated post-2005 Available CNE depletion rate has been catastrophic, but we can only deal with estimates. What we know is that the annual volume of Available Net Exports, which is GNE less CNI (as defined below), declined from 41 mbpd in 2005 to 35 mbpd in 2012.

GNE/CNI Ratio Vs. Annual Brent Crude Oil Prices, 2002-2011:

GNE/CNI ratio fell to 5.0 in 2012 (EIA), while Brent averaged $112 in 2012.

GNE/CNI Ratio Vs. Total Global Public Debt, 2002-2011:

GNE/CNI ratio fell to 5.0 in 2012 (EIA), while total global public debt increased to $48 trillion in 2012.

GNE = Combined net oil exports from from top 33 net exporters in 2005 (BP + EIA data on charts), total petroleum liquids

CNI = Chindia (China + India’s) Net Imports of oil

In my opinion, the 10 year increase in global annual crude oil prices, from $25 in 2002 to $112 in 2012, was largely a result of China and India consuming an increasing percentage of GNE, which presented problems for net oil importing OECD countries like the US.