Tech Talk - A Cautionary Tale Evolves over Shale Gas

Posted by Heading Out on August 11, 2013 - 8:17am

The development of the shale gas deposits in the United States, led by the drilling and fracking of horizontal wells into the Barnett Shale of Texas at the turn of the century, has opened up a resource that continues to draw visions of American energy independence from a number of commentators. The success of the development in exposing a potential resource that has been found in a number of states around the country continues to underwrite optimism for the short-term energy future of the country. In turn, it has led to projected dreams of enhanced domestic supply in some countries of Europe and the rest of the world.

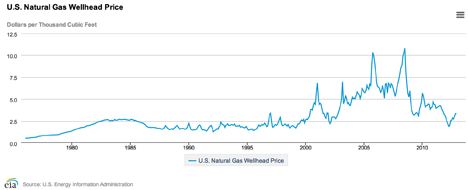

However, from that highly promising beginning things have not gone that well (depending on your viewpoint). In part, this is because of the overwhelming success of the industry in finding productive formations. As production spread through the Haynesville to the Marcellus, increasing volumes of natural gas fed into the market, it had, at the beginning, only a certain limited capacity to absorb the increased flow rates. As a result, natural gas prices, which had been bringing a comfortable profit to companies, rapidly fell.

The collapse in price from the high of $10.79/kcf was related to the developing recession, but while the price of oil rebounded, the domestic price of natural gas has not.

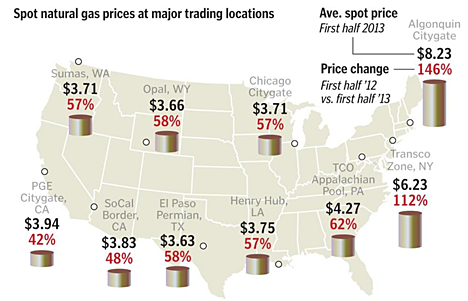

Because of the current cooler weather in parts of the country, gas prices for September are down to $3.35/kcf.

This was one of two contributing factors to the problems that the domestic industry is undergoing, both foreseen by Art Berman, an accurate, albeit in some quarters very unpopular prophet to the industry. Clearly, the first problem is the low price that natural gas continues to sell at in most of the country. (The high prices in the Northeast are because of the perception that the fuel is abundant, set against the current limited capacity of pipelines to carry sufficient gas into the region.) The second problem, which Art has also clearly identified, lies in the very rapid decline rates that are seen in the natural gas wells that have been drilled and fracked in these shales.

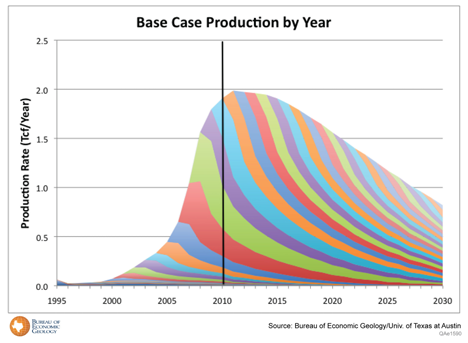

The Barnett shale has now been sufficiently well developed that production has now peaked and is recognized to now be in slow decline, though that rate is projected to accelerate.

There is also sufficient information such that, for example, such industrial stalwarts as the Oil and Gas Journal are confirming some of Art’s earlier predictions. A current article examines the economics of the Barnett shale development under DFW airport, first undertaken in 2009 following a lease agreement in 2006. The article examines the economics of the operation in which the airport has made over $300 million. Chesapeake, who drilled 110 wells on the property out of an anticipated 330 originally projected, has recovered some 104 bcf, but the undiscounted all-in cost is calculated at $7.21/kcf. While that was viable in 2008, when gas prices were north of $9.00/kcf it becomes quite a burden when they are down around $3.35/kcf. The loss to the operator is reported to be more than $300 million.

These relatively poor returns on investment might not be so disproportionate in Europe where there have been potentially similar shale deposits found in countries such as the UK and Poland. Art has however already reviewed the British Bowland shale projections, suggesting that only 3% of the natural gas estimated to be in place may be recovered. While this is still a respectable number it falls short of the more optimistic numbers that, among others, Bishop Hill has collated. And while Bjorn Lomborg has estimated that this could bring as much as $10 billion a year into the British economy by 2020, this is all at a point where Egdon hopes to sink its first well into the formation at the end of next year. Cuadrilla Resources drilled their first well last year and now plans a six-well exploration program, but it has been suggested that it will be at least a decade before any significant gas production is available.

In this regard it is well to remember the case of Poland, where the presence of gas-bearing shales led to predictions that the industry would “transform Europe.” But then the results of the well tests came in, and the volumes of natural gas available were reduced by up to 90%. Although 40 wells have been drilled, to date none are reported to have produced commercial quantities of natural gas, although in only four cases was there fracking of the horizontal well section. Three major oil companies have backed away from committing to the program, and that initial enthusiasm is now considered to have been a “bubble,” while Chevron is seeing more protests over their planned fracking tests.

This collapse of hope for a potential resource has led the Polish Government (responsible for ensuring that the country has enough fuel at a viable price) to move back toward the greater use of lignite as a power source. Coal is the fuel for the power stations that produce 90% of the country's electricity, and lignite is readily and cheaply available. Prices for lignite (a brown coal that is softer and not yet fully geologically morphed into the harder black coal most envisage when coal is discussed) are quoted as giving a price of $2.00 per gigajoule, roughly a fifth of the cost for black coal. The country has large deposits of lignite, much of which is available for surface mining, at relatively low financial cost.

The government decision underscores a point that I have made a number of times, namely that as other fuel costs increase, more and more countries will move to the use of coal where it is domestically available and relatively inexpensive in financial cost to produce.

Link to some data on the DFW Airport case history, in the Barnett:

http://www.theoildrum.com/node/10102#comment-972165

Note that the first wells on the airport lease were completed in 2007. Chesapeake claimed that they would produce for at least 50 years. 10 of 21 wells completed in 2007 have already been plugged and abandoned.

Regarding total US gas production, a recent Citi Research report (estimating a 24%/year decline rate in US natural gas production from existing wells), implies that the industry has to replace virtually 100% of current US gas production in four years, just to maintain a dry natural gas production rate of 66 BCF/day. Or, at a 24%/year decline rate, we would need the productive equivalent of the peak production rate of 30 Barnett Shale Plays over the next 10 years, just to maintain current production.

HO, thanks!

There we again have this "affordability" thing again.

Coal's portion of global primary energy consumption has grown steadily in recent years, and could overtake oil's position as the worlds most used energy source in the near future.

Could it be that coal becomes the "energy bridge" to the future?

It's cheap energy. I've long thought that our future involves burning everything that can be burnt. Industrial civilisation is just a massive heat engine that converts nature into pollution.

The green revolution with electric cars are most likely to be driven by the cheapest avaialable energy source. I guess it is lignite or brown coal.

I have a norwegian dilbert strip with a environmently friendly car in form of a very large SUV using owls as fuel. Then the buyer ask how to get enough owls the seller anser translated to english "They are knocked out by the sound of the engine. You just pick them from the ground." It is all a matter of how you define environmentally friendly, it run from fuel grown naturally in the nature.

I have seen that strip as well, it is good.

What is the status of the "hydrogen economy"?

It is not an energy source so it is less important but a better and cheaper option to store energy is always welcome.

I guess the hydrogen economy is similar to the oil from algae. There is progress in Solazyme and it looks promising except that the algaes is grown on sugar in darkness. They fail the energy test but are able to produce oil from biomass. It actually seems engineered by the marketing department.

"Could it be that coal becomes the "energy bridge" to the future?"

... such as that future is. I posited in one of the earlier climate discussions that coal won't be supplanted by 'cleaner' sources of energy. I started to suggest that economies would revert back to coal as other energy sources disappoint, economically and in terms of availability, but, collectively, humans' reliance on coal hasn't waned. The 'boom' in the Bakken is meerly a diversion from the fact that North Dakota's most accessable, abundant resource (excepting wind, perhaps) is coal. EIA:

EIA also reports that coal is, by far, North Dakota's #1 energy source at nearly 400 trillion BTUs/year (2011 estimate), eclipsing (#2) distillate fuel oil by ~400%. I have friends in ND who still heat with coal because it is so much cheaper; no plans to change. Countries such as Poland (and many others) will, indeed, default to domestic and imported coal, as economic considerations trump environmental concerns. As we've seen, countries who are attempting to reduce their carbon/climate impacts often do so by exporting industry (and dirty fossil fuels) to countries that haven't. From the Austalia Coal Association:

While Australia has made some progress promoting renewables and reducing consumption, it means little, globally, environmentally.

Whatever it is, humans will keep burning it.

For the US the only thing holding back Nat Gas is the size of the market. Because of low prices wind, solar and nuke face strong head winds. This includes rising exports to Mexico. The collapsed Nat Gas price is still heading down. At the moment coal market share is growing in exports globally but shrinking in the US. All this is happening with Nat Gas drilling close to an 18 year low as far as rig count is concerned.

In the US Nat Gas seems to be the bridge to the future. We will see when demand catches up, the price of nat gas goes up and the drilling rigs go back to exploring in earnest.

The post-2008 low monthly US spot natgas price was $1.95 in April, 2012, versus about $3.30 now.

Considering the number of Nat Gas drilling rigs has dropped by around 2/3 since the glut hit and prices dropped. Can anyone explain why the glut still exists. Natgas is still very cheap compared historically and even more so compared to most of the rest of the world. Are fracked Nat gas wells much more resilient and have much longer depletion rates as compared to fracked oil wells?

http://www.eia.gov/dnav/ng/hist/n9102us3m.htm

Nuclear is basically DOA at this point, the nuke supporters just haven't realized it yet. It's simply not cost competitive, even ignoring its serious shortcomings, such as waste storage and the serious potential risks involved. With current pricing, and post-Fukushima, nuclear is no longer viable. Of course the people who are all starry-eyed over nukes will never admit it.

Solar and wind, however, have been coming down in price. They are probably the ultimate future, but NG does look like it will serve as the bridge. Either way, in twenty years nuclear will be nothing but a distant memory in most of the world.

Either way, in twenty years nuclear will be nothing but a distant memory in most of the world.

Except in the areas surrounding the moldering, decaying, semi-shutdown non-operating plants. Those areas will be rather aware of the hazards left behind.

Nuclear is not dead, IMHO, it is just in a coma. Doing nuclear right is really expensive and people are scared of it. And for now, it is much easier to do wind, natural gas, and solar. However, nuclear will probably have a renaissance eventually, just not now. When natural gas prices eventually start to rise back up and it becomes difficult to run a grid on solar and wind alone, people will return to looking at nuclear. But for now . . . it can slumber in a coma for a while.

If coal is the bridge to the future there is no future to build a bridge to.

Are you kidding? Bridges are going to be the next boom industry! Bridges are going to be needed everywhere!

We've already got them going to nowhere!

Recent spot prices for wholesale piped gas in south eastern Australia have been about $4.30 to $5.30 a gigajoule. That is expected to increase to $9 or so after LNG exports begin from the Australian east coast late 2014, the declared aim being to overtake Qatar as the leading LNG exporter. Ship traffic along and through the Great Barrier Reef will include both bulk coal carriers and LNG bubble boats. Carbon that was sequestered millions of years ago in one part of the world will now be re-released to the atmosphere somewhere else.

Some conventional gas basins appear to be amenable to fracking but there will be no price reductions. A recent Drumbeat pointed out Germany is starting 5 new coal fired power stations this year as they represent cheaper backup for renewables than gas. It's hard to say if Australia will follow that lead. The likely incoming federal government has promised to remove explicit CO2 penalties such as carbon tax or cap and trade. The other major form of unconventional gas is coal seam but drilling restrictions threaten supply to the point the most populous state of New South Wales is expected to run short by 2015. Since nuclear power is prohibited in Australia despite massive uranium reserves it looks almost certain that coal both black and brown (lignite) will remain the dominant form of domestic electricity generation for many years. Meanwhile both the US and Australia shamelessly exploit Asia's insatiable demand for coal. Basically the climate change debate has achieved nothing.

It is widely reported that NG generates about half the CO2 of coal for the same energy output, but it occurs to me that the inefficiencies of LNG (the figure varies but I think about 20% of the energy content is lost compressing and expanding the gas ) means that the gap narrows sharply when we move from piped NG to shipped LNG. Add in the greenhouse contribution from methane releases and the future looks grim whichever fuel we use - we are going to see accelerated climate change for at least a couple of generations.

And at what oil price, do they then start converting coal to petrol/diesel ?

Here is some info on GTL:

http://www.sasol.com/sites/default/files/presentations/downloads/GTL_An_...

(warning, slow loading PDF)

Here is a number: 4 bucks/gallon for diesel with 3.60 NG

http://www.nytimes.com/2012/12/04/business/energy-environment/sasol-plan...

On input costs:

http://theenergycollective.com/geoffrey-styles/172516/could-diesel-fuel-...

On CTL:

http://www.kosid.org/wp-content/uploads/2012/09/SasolCtL.pdf

The numbers here a bit different, but that is for coal, not gas.

Keep in mind though that because these plants are highly capital intensive the cost is to a significant extend a function of expected life, depreciation schedules etc.

If the GTL plant owns an NG well, either physically or economically it becomes a matter of process efficiency and durability, all within thermodynamic limitations of course.

In other words, there is no one answer/number to the question at which price GTL becomes economically interesting.

Rgds

WP

Keep in mind though that because these plants are highly capital intensive the cost is to a significant extend a function of expected life, depreciation schedules etc.

Yes, my understanding is that the capital cost is about 3-4 times more than a "typical" refinery.

I suspect getting the necessary environmental approvals might be challenging as well.

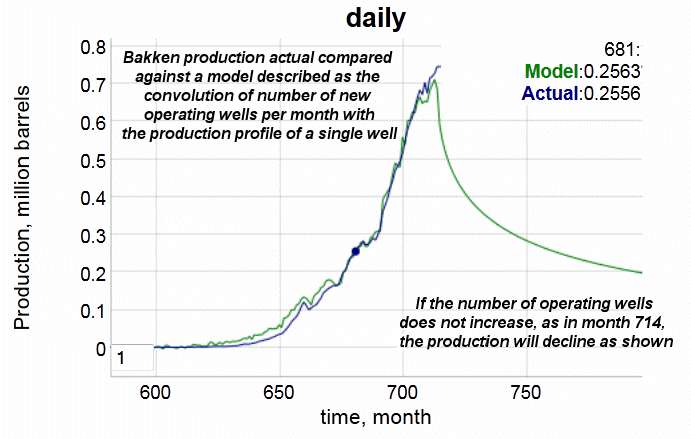

It is a bit tricky to make production projections from Bakken because the state of North Dakota only provides the number of operating wells at any time. As soon as it is out of commission they remove it from the "wells producing" column

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

If the out-of-commission wells were kept in the records, we can get a much better idea of the actual profile of a well, and when they get shut in.

However, doing the best that I can with the limited numbers, this is how well we can model the output

The math behind this is described in my blog post from last year

http://theoilconundrum.blogspot.com/2012/05/bakken-growth.html

Urge everyone to also check out DC's blog, where he does the same type of analysis http://oilpeakclimate.blogspot.com/

That is one of the things about these 'mancamps'. They need to build permanent housing because it is not like they just need to drill some wells and then leave with the wells producing lots of oil into the future. The only way the Bakken produces oil is through non-stop drilling and fracking. So they might as well build some more permanent housing . . . . unless they foresee the resource running drop in the not too distant future.

They call it "gold-rush dynamics".

They should learn from history not to overbuild at the risk of creating a ghost-town.

Yeah, that is my point. Their actions speak louder than the words. If this is some big permanent increase in production they'd be building lots more housing . . . but . . .

We should have some data on NoDak housing starts to overlay the Bakken oil stats.

Wolfcamp second only to Ghawar???

http://www.ogj.com/articles/2013/08/urtech-wolfcamp-play-dwarves-bakken-...

See Oil and Gas Journal 08/12/2013 “The Spraberry Wolfcamp could possibly become the largest oil and gas discovery in the world,” said Pioneer Natural Resources Co.