Tech Talk - Insecurity in the Middle East

Posted by Heading Out on June 23, 2013 - 10:03am

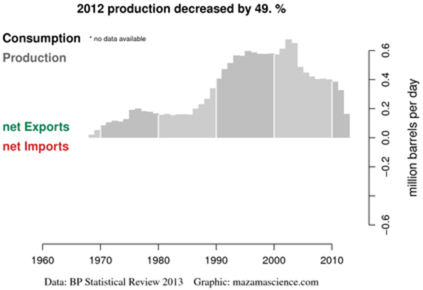

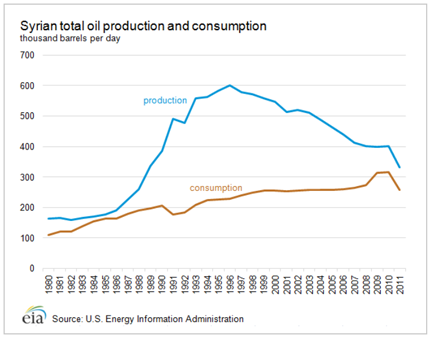

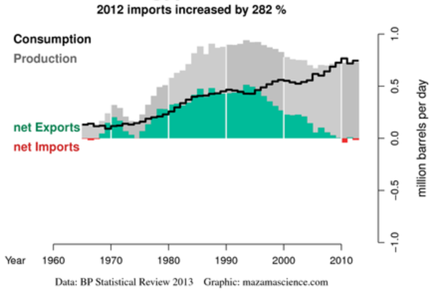

The continuing conflict in Syria, and the slow spread of violence in the region around it continue to make it difficult to accurately predict the future of oil exports from the region. Within Syria itself, production had fallen into decline about ten years ago, before the current struggle began. The precipitate drop over the last two years has, however, been much more dramatic. As Energy Export Databrowser noted from the BP statistic review, production fell by 49% last year.

As with most oil-producing nations, oil consumption had, on the other hand, been steadily rising with net exports (some is exported as crude and re-imported as refined product) falling to around 100 kbd. The conflict has, however, also reduced internal consumption at similar rates earlier in the conflict.

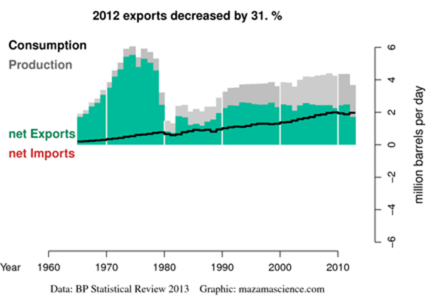

At the same time that Syrian exports have sensibly disappeared, the exports from Iran have continued to fall. Data through the end of last year shows that sanctions continued to bite, with exports falling 31% last year.

Much of the oil from Iran goes to China, India and Turkey. In May 2013, the total exports are reported to have fallen to 700 kbd although individual monthly numbers fluctuate given the complexity of now getting oil into the hands of customers. (H/t Gail - that report may only cover Chinese imports, since Bloomberg reports a different set of numbers, and an IEA estimate that Iran is averaging 1 mbd of exports this year.) India is hoping that the change in the Iranian Presidency will lead to an easing of sanctions. In the interim, the exemptions that China, India and Turkey are receiving to some of the sanctions have just been extended another six months. Part of this comes from the cuts those countries have already made. India, for example is now down to around 117 kbd around half that of a year ago.

Oil imports into China are reported to have increased, perhaps because the Iranians have just agreed to buy a number of Chinese drilling rigs. Total exports are projected to fall to 1.3 mbd over the current Iranian fiscal year (which started in March). If Iran is having to store more of its oil in off-shore tankers, this may explain the fall in regional tanker availability over the past month.

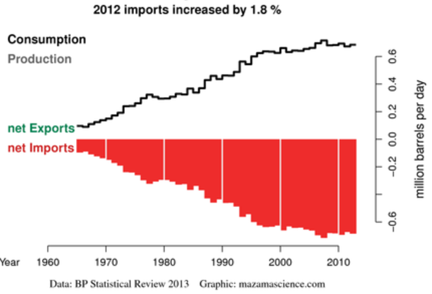

In a recent post, I discussed my concern over the likelihood of Iraq being able to achieve the increased volumes of production within the time frame that their Central Government has suggested. However, as Leanan caught recently, Kurdish Iraq is moving more and more toward independent action in regards to their oil. From the Turkish side a pipeline will be allowed that can go to the border, but not cross it. Mysteriously, it will likely then fill over time with a flow of 1 mbd. Turkey is working with BP to develop the resources of Kurdish Iraq. In the interim, Turkish demand has stabilized to a greater degree than it has in its southern neighbors.

To a degree the instability is feeding off itself. Egypt continues to have problems in ensuring an adequate supply of fuel, and while Iraq and Libya have agreed to help, they prefer cash up front for the delivery, and that is proving to be a bone of contention. The country has reached the point where domestic production can no longer keep up with consumer demand, and these imports are going to become more critical to the budget, and, as a follow-on, national stability.

The hope is that a pipeline can be built from Iraq through Jordan, but that requires that a mutually acceptable line of credit be established, and that appears to be a problem. Egypt has the same soft-credit deal with Libya for a supply of a million barrels a month. The price, however, will be at that of the world market.

Unfortunately, as the level of violence continues to grow, one starts to get into an almost inevitable snowball effect and there is a consequent negative impact on much industry, likely including oil production. The most likely consequence will be a further fall in the regional export of oil, which has a follow-on consequence in that the customers who have lost this supply (Japan has given up all Iranian oil for example) must then go onto the world market to find an alternate source of supply.

As those sources become even scarcer than they are already, marginal amounts of oil become more critical to maintaining a global balance. But such supplies don’t become available at the drop of a hat.

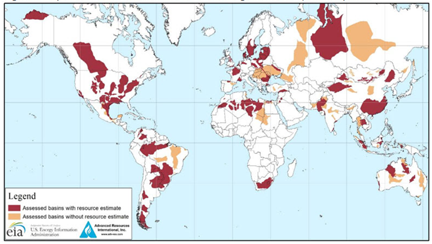

It seems to be a drum that I beat perhaps a bit often, but it is a message that bears repeating. Without significant and ongoing investment in the more difficult regions of the world, funds to identify the necessary availability of resource, and then to drill in a timely manner, to prove the resource and start the process of turning it into a reserve, the oil balance cannot be sustained at a viable and acceptable price. It does not matter how glowing a set of reports are put out about how we can all relax because the world has plenty of oil in shale.

The largest of those resource sites is in Russia, where there may be as much as 75 billion barrels. But two things should be remembered. The first is that peak oil is reached, not when we run out of oil, but when we start producing less each year than in the previous. And the second is that getting much of the oil in the shale into the proven reserve category is going to take a fair amount of time, after which production rates, going from the results seen, for example, in the Bakken will decline at such a rate that a continued and expansive program of expensive drilling will be required to sustain production. And all this time the flow of oil from existing reservoirs will continue to fall.

Editorial Note: Because of one of those delightful family events that occur from time to time, this series will be on hiatus for a couple of weeks, since we will be traveling when I would otherwise be writing.

Jeffrey Brown explains this issue very clearly with his Export Land Model. Basically it is a very clear manifestation of the impossibility of the current global economic model based on exponential growth. Limits are real, and the Club of Rome scenarios along with the much maligned Thomas Malthus' points continue to be valid.

You can listen again to Dr. Albert Bartlett's talk on Energy, Population and Arithmetic and his point about humans not being able to grasp the implications of the exponential function.

I recently watched Tom Murphy's talk titled Growth has an Expiration Date:

http://fora.tv/2011/10/26/Growth_Has_an_Expiration_Date

Tom is an Astro Physicist who writes the blog Do The Math. This particular talk also underscores this issue from a math based and basic physics perspective.

I'm down in Brazil right now and witnessing the protests in the streets by Brazilian citizens who also were promised impossible things by stupid ignorant greedy and unscrupulous politicians, economists, bankers and corporations.

Unfortunately they too swallowed, hook line and sinker, the impossible dream of the path of growth to riches.

Well guess what folks, the chickens are coming home to roost everywhere.

And if that weren't enough the sky is literally falling and that too is connected to all of the above.

Canada Calgary Aerial View + Bob Sanford speaks Floods June 22, 2013

http://www.youtube.com/watch?v=NoqfstqxqoU

And people still want to keep clinging to the old BAU paradigm?! The times sure look like they will be a changin...

Well, clearly we need to kick the oil habit.

We can replace oil, and the faster we kick the habit, the better.

"We can replace oil..."

With 90+ MMBD (EQ) of what? At what cost?$$$

Wind and solar will do. Nuclear will get used as well, though at this point I think wind and solar are cheaper and faster (and safer) in OECD countries.

Electricity will be used for HVAC, and almost all passenger and freight transportation. Synthetic fuel (from seawater and renewable electricity) and biofuel would supply relative small niches: aviation, some long distance land and water transportation/shipping, seasonal agricultural work, petrochemical feedstock. Greater efficiency will be important (PassivHaus, etc).

All in all, this is likely to be about the same cost as our current system, and much cheaper when you add in external costs like pollution and supply security.

----------------------------------------------------------------------

EVs are about the same cost as ICE's over their full lifecycle:

"EPRI: lifetime cost of ownership of plug-ins is roughly comparable with conventional vehicles

11 June 2013

Consumers who purchase an electric vehicle will find that lifetime costs to own the vehicle are competitive with conventional and hybrid vehicles, according to an analysis conducted by the Electric Power Research Institute (EPRI). The study is based on pricing for the automotive products for the 2013 model year.

The baseline analysis relies on a cost-of-ownership model that examines only current vehicles; current fuel prices; and a relatively conservative set of customer values. In particular, the report analyzes the Chevrolet Volt and Nissan LEAF in comparison with a limited set of current conventional and hybrid vehicles. The EPRI analysis focused on the LEAF and Volt because the plug-in vehicles have been on the market the longest, have generated the greatest sales volume and provide data on real-world performance."

http://www.greencarcongress.com/2013/06/epri-20130611.html

All of this in an environment of declining real resources (virtually all of them), increasing population/consumption, degrading ecological systems, corrupted financial systems, impotent political processes, and populations bent on substituting delusion for situational awareness. I admire your optimism.

declining real resources (virtually all of them)

Food, energy, metals - none of these are declining.

For the rest, the only thing that's new is climate change. I agree that's very big, but we certainly have time to fairly quickly eliminate CO2 emissions if we choose...

..." none of these are declining."

Not yet quantitatively, perhaps, but certainly qualitatively. Metal mining requires increasing inputs of energy (oil mostly), water, etc. per unit of output. Lots of evidence that the quality of our food sources is declining, even as inputs increase in price as soil and water systems suffer.... and we know the story of falling EROEI of oil. These processes are also being subsidized with excess debt creation and unaccounted for waste streams. Not sure how you can expect all of these interdependent systems to continue.

certainly qualitatively.

I'm not sure what that means. The purity and quality of aluminium, for instance, is as good as ever. It's price is as low as it's ever been.

Metal mining requires increasing inputs of energy (oil mostly), water, etc. per unit of output.

Well, ore concentrations are declining, but that doesn't mean much. New techniques have reduced cost, and as you step down in concentration the resource base grows geometrically.

There are a few elements which are difficult to find, like copper, but there are good substitutes. Ultimately, recycling will work.

we know the story of falling EROEI of oil.

Well, no. Wind and solar have very good EROEI. Tar sands EROEI is rising, according to the TOD article a few days ago. I'm not excited about tar sands, but...they're not going away due to resource limits.

These processes are also being subsidized with excess debt creation

You can't subsidize a physical process with a symbolic currency. It just doesn't make any sense.

-----------------------

I sympathize with your concerns: I'd like to see ecoystems and habitat protected and restored, and CO2 emissions eliminated. But, it's not realistic to say that resource limits will stop the course of "BAU" any time soon.

it's highly unrealistic to say that a comfortable, familiar lifestyle is impossible with renewable energy and recycled basic commodities. It's wishful thinking to think that resource limits will stop resource extraction anytime soon, or prevent ecological destruction and climate change.

Worse, that's a prescription for denial, and "drill, baby drill". It's giving comfort to the Koch brothers and ExxonMobil. What a convenient message for them: stay with fossil fuels, or face poverty.

Good points Nick -

Sometimes I think of the amount of pristine metal ore bodies on the continental shelves - there has been no economic justification for going after them. Likewise 40 years ago there was no economic justification for extensive mining of sub sea oil resources - and indeed, for the most part the technology did not exist for all but the most shallow areas. And here we are today extracting oil in water miles deep - after a few decades of reliable economic incentive to do so.

The continental shelves I am sure have ore bodies as rich as had been mined in antiquity. I believe some of the oil industry technology available now could be used to mine such deposits. What is missing currently is sufficient economic incentive. There is still enough resources coming from on shore mines (but sand, gravel, black sands and IIRC phosphates are already sub sea mined).

There are huge sub sea excavating and pipe laying machines already in use capable of operating in extremely deep water that, it seems to me, could be adapted for placer metal mining (in a sense placer is the wrong term sub sea - however ocean currents and other processes do concentrate ores underwater eg phosphates, monzanite thorium sands etc). I think, that after a few years of shortages and increasing efficiency brought about in part by efficient recycling, the economy will be able to support higher prices for metals, and mining when necessary will begin to move off shore (there are already some noises being made re sub sea goldmines - there is or was a group proposing a gold mine in shallow water off Australia - it is supposed to be an extremely rich ore body).

And if civilization fully utilizes the con shelves, unlike oil, there will be plentiful ore bodies in the mid ocean ridges etc - eg all the sulfide systems discovered to date. After talking with commercial diver buddies who have worked on some truly mind boggling offshore deep water oil infrastructure (huge excavating sledges capable of operating many thousands of feet underwater etc), I am not sure at all that I am being cornucopian here -

Of course many will argue economic collapse will prevent such mining - but there are no sure arguments that collapse will be total. Partial collapse is more likely and appears to be what is beginning.

The concept of Jevons Paradox supports that we will get the metals we need - the more we recycle and conserve, the more society will be able to pay per pound of material that must be mined.

Think about it a minute - it is ironic isn't it?

Yeah, there's a lot out there, and we're likely to need less of it as time goes by. For example, US steel production is not far from historic levels, but it's almost all recycled.

A quibble - the history of mankind is boom and bust, and we seem hel-bent on serious climate change. But...there aren't really any theoretical tech or resource obstacles to continuous improvement in the human condition.

All of our booms and busts are in the holocene - there is no requirement at all that Nature allow us to survive the full effect of climate change - there's not even a requirement that Nature survive it. In the short term, however - the next few decades - tech ability will continue to increase, efforts will be made to conserve and recycle, and although more will be left out of the economy through unemployment, poverty etc, those who continue to work, and those corporations that survive coming changes, will continue to push for more technology, more ability, more profit, more resource extraction.

What I find ironic is that resource conservation allows more effort at resource extraction to be economic.

eg if all our vehicles got no better than 4 miles/gallon, our economy as it is now structured could afford to pay very little per gallon, and it would not be profitable to drill in ultra deep water - it just would not happen - the Gulf of Mexico would be considered depleted, what was left in the deep water would not matter.

If all our vehicles averaged 80 miles per gallon, our economy as it is now structured could pay quite a lot per gallon, and vast effort would go into CTL, GTL, Canadian and Venezuelan tar sands, methane clathrates, the Green River oil shales etc., as there is no governing body that will prevent it (indeed, they will encourage it).

If we conserve sufficiently, I find that there really is quite little in the way of geologic limits to stop us.

So unless and until our legal framework of our worldwide society changes, our conservation activity ultimately serves to further enable the resource extraction activity that will cause the climate change that may very well utterly destroy us.

Could anything be more ironic?

there is no requirement at all that Nature allow us to survive the full effect of climate change

Yeah, but there's no tech or resource reason we couldn't eliminate CO2/GHG emissions pretty quickly, and then start sequestering CO2. It doesn't look likely at the moment, but it can be done! That's worth saying and repeating!

---------

The idea that efficiency enables resource consumption growth is reversing things. Efficiency will reduce resource consumption compared to the inefficient baseline.

If all US vehicles averaged 80MPG, US fuel consumption would decline by 70%! Drivers wouldn't increase their driving significantly (ok, maybe the 2nd poorest quintile would drive 20% more (the poorest quintile can't afford cars)). Even Chinese drivers wouldn't triple their driving - they're primarily limited by the capital cost of new cars and secondarily by congestion - the cost of fuel is maybe 3rd.

Rising efficiency would reduce volumes even as it enabled higher prices - for instance, we pay a lot for gold and silver because we use so little of it.

And they don't even have to be tiny econoboxes or pure EVs. If we had nice renewable electricity generation and people drove PHEVs that got 20 to 40 miles on a charge before switching to gasoline, that would eliminate a HUGE amount of gasoline usage. Just plug in every night and get those first 20 to 40 miles on cheap green renewable energy. (Ford C-Max Energi, Ford Fusion Energi, Chevy Volt, Honda Accord PHEV, etc.)

Good points from both Nick and Spec.

There are many possible futures at this point - it is one of those times that the choices we collectively make have an inordinate impact.

Apparently not, but the price of most raw materials has increased dramatically since roughly 2008.

The 1st question is: what will Chinese demand do? As Japan will tell us, capex led booms tend to lead to bust.

The 2nd question: if the economy is being slowed down by resource limits, where's inflation? US inflation is 1.1% year over year (5/13, CPI-U).

We will need a transition period, we have built the oil and auto industry over 100 years, that does not change over night. This is why I favor synthetic fuels used in hybrids. Start with natural gas and coal and over time more biomass and renewable hydrogen.

If EVs become popular then we can accelerate the process. If fuel cells become affordable then we can do that. Fast breeder reactors and thorium will take time, but they have the most potential for the long haul.

We will get where we need to go, but not as fast as some would like. We will have to deal with some of the effects of global warming and climate change, this is just the way it is and the way it is going to be. Being practical and realistic is more likely to result in a favorable outcome. Begin absolutist is more likely to build resistance.

we have built the oil and auto industry over 100 years, that does not change over night.

It's a social choice. We can do it very fast, if we wish. It's been done many times before. The Meiji restoration, the German building of their war machine before WWII, the US building of it's war machine after Pearl Harbor, etc, etc, etc. More examples with hat tip to Bob W:

We sometimes forget how quickly a new technology can replace a well-established technology.

Few people drove cars when Henry introduced the T in 1908, most used horses. Looking through city street photographs from the 1930s one doesn't see horses except in parades.

Two years after the first scientific calculator was introduced the two major manufacturers of slide rules shut down production.

Computers replaced typewriters, ledger books and typesetters in about a decade.

Film was kicked to the corner by digital in about a decade.

In each of these cases the entry cost/purchase price of the new technology was higher than that of the replaced technology. Often much higher. But the operating cost, convenience, etc. brought about very rapid changes.

synthetic fuels used in hybrids. Start with natural gas and coal

Do you mean GTL and CTL? Those require very large ($20B) plants, and CTL is terrible CO2-wise. Batteries are faster, cheaper, more efficient, etc.

biomass and renewable hydrogen

Ethanol is fine, but not very scalable. Renewable hydrogen is a great idea for stationary plants for surpluse renewable electricity, but terrible for transportation.

If EVs become popular then we can accelerate the process.

Again, that's just a social choice. The automotive industry stalled them for decades. Now the oil industry is the big holdout.

Begin absolutist is more likely to build resistance.

Resistance comes primary from the threat of losing investments and careers. The more effective the change, the bigger the resistance. If we do nothing, then of course there will be no resistance...

Apologies for the totally off topic comment, just wanted to thank westexas for dropping by HCN (comments on Calculated Risk). Nice to have another 'voice in the wilderness'.

Mankind is addicted to living off of buried treasure and bad things happen when you run out of that buried treasure. Seems like a pattern.

Yemen's oil exports drop to zero . . . the place falls apart.

The UK's oil exports go negative . . . triple dip recession.

Egypt's energy exports go to zero . . . the country has a revolution.

Syria's exports drop to near zero . . . the country has a revolution.

Former oil exporter Indonesia cuts fuel subsidies . . . there are riots in the streets.

Now clearly there are many other things going on that also affect these situations. But the lack of money from energy certainly contributes heavily to these problem. You can paper over a lot of problems when there is money to spread around and placate the people.

I'd say it's the lack of available energy itself that is the real problem, granted, fictitious paper money doesn't help and it doesn't solve the underlying energy problem.

Some comments -

To be specific - lack of energy to expand as we are used to -

I believe there has been more energy produced worldwide than the year before every year of my life (I don't think even 2007 poses an exception to that if you include every source of energy)- the difference is there is less available per person in the OECD countries. Resource use in the East is expanding faster than the rate the resources in question are increasing worldwide.

Commodity prices would collapse for a very long while if eg the entire population of China were to return to its resource consumption pattern of eg 1965. Of coarse, the Chinese would rather we revert so they don't have to pay so much!

If only two things were to happen - we could buy a lot of time as a worldwide society - and that would be to heat and cool buildings with mostly insulation and little else, and transport people and goods without fossil fuels. Even better would be to reduce the amount of people who need to travel, the amount of days they need to travel, and the amount of goods we need to transport.

It would help a lot to banish the 40 hour work week in favor of the 36 (3 12 hour shifts) for all corporate entities worldwide. Less unemployment and less pointless commuting. Lower tax on primary homes also - so much CO2 is created by what is commonly known as the rat race - pay for gas to go to work to pay for gas to go to work to pay for property tax to pay for a place to keep the car to got to work to ... - just allow me my land to grow my garden so I can stay put!

Voluntary poverty of a sense in our current economy is a most helpful ingredient in carbon reduction, but is largely blocked by gov tax structure that forces you to keep working hard just to be left alone by eg the crazy rental level property tax levels in the US. If someone is willing to provide their own inputs for food etc and not draw from the system, we should have a gov system that leaves them alone in their own home. For their choice to reduce their carbon footprint will ultimately benefit us all.

So there you go - an important part of fighting climate change, until the economy becomes less carbon intensive, should include a hefty personal property tax exemption (as exists in some states - this is an important point for some people to include in their planning)) for your home and a number of acres with it too.

Taxes pay for overhead: roads, communication, regulatory standards, garbage pickup, military, etc, etc, etc.

Property taxes should be made progressive, but they shouldn't be reduced. In fact, I'm interested in the "single tax" idea - tax wealth...

Well, lots of places got a recession in 2008 / 2009 but did not fall apart, quite, even though they were and are net importers.

Here in Britland we did have riots in August 2011. Mostly illegal shopping and a bit of arson and lots of young people were imprisoned for a while.

(USA seems better placed and only Bernie Madof in prison if I remember correctly, even though US has been a net importer for long enough now?)

Hmmn ... our number on the British equivalent of food stamps seems to be going up. And we are importing wheat again because of a bad harvest last year. Not quite however the same edge they live on in Egypt, and our 'growth-hope' springs eternal: UK Financial Services Industry is joined at the hip with the big boys of New York! :) A pity of course about the civil wars ongoing in or engulfing these places HO mentions – geopolitics has not neglected them for best part of a century now?

The Middle east is a problem that has plagued the region for years.

joking aside I see no end in sight only further instability with demographics and resource constraints playing a big role. Some sort of regional furball spreading out of Syria is on the cards.