Low energy return on investment (EROI) need not limit oil sands extraction

Posted by Rembrandt on June 10, 2013 - 4:27am

This is a guest post by Adam Brandt, Assistant Professor from Stanford University, Department of Energy Resources Engineering.

1. Introduction

Low energetic returns (e.g., EROI, NER) from oil sands extraction and upgrading have been noted as a potential limit to the development of the oil sands as a substitute for depleting conventional oil resources (e.g., Herweyer and Gupta, 2008). In this article we will examine this claim from a variety of perspectives. Specifically, we will examine the following questions:

- Are the energetic returns from oil sands extraction lower than conventional oil?

- How have the energy returns from oil sands extraction varied over time?

- What energy sources are used in oil sands extraction, and what are the implications of this sourcing for net energy availability from the oil sands?

- Will low energy returns limit the net output of energy from the oil sands industry?

This article is based on the peer-reviewed journal article: Brandt A.R., J. Englander and S. Bharadwaj (2013). The energy efficiency of oil sands extraction: Energy return ratios from 1970 to 2010. Energy.

2. Are energy returns from oil sands extraction lower than conventional oil?

Previous works have calculated the energy returns from oil sands production using a variety of methods (Peter 2010; Herweyer and Gupta 2008; Rapier 2008; Peter 2012; DOE 2006). These studies estimate EROI from the oil sands at values ranging from 2.5 GJ/GJ to 7 GJ/GJ. Most of these estimates were generated quite simply, relying on a limited amount of data. Because of the different system boundaries used in each study, as well as other methodological differences, determining the exact reasons for variation in these estimates is challenging.

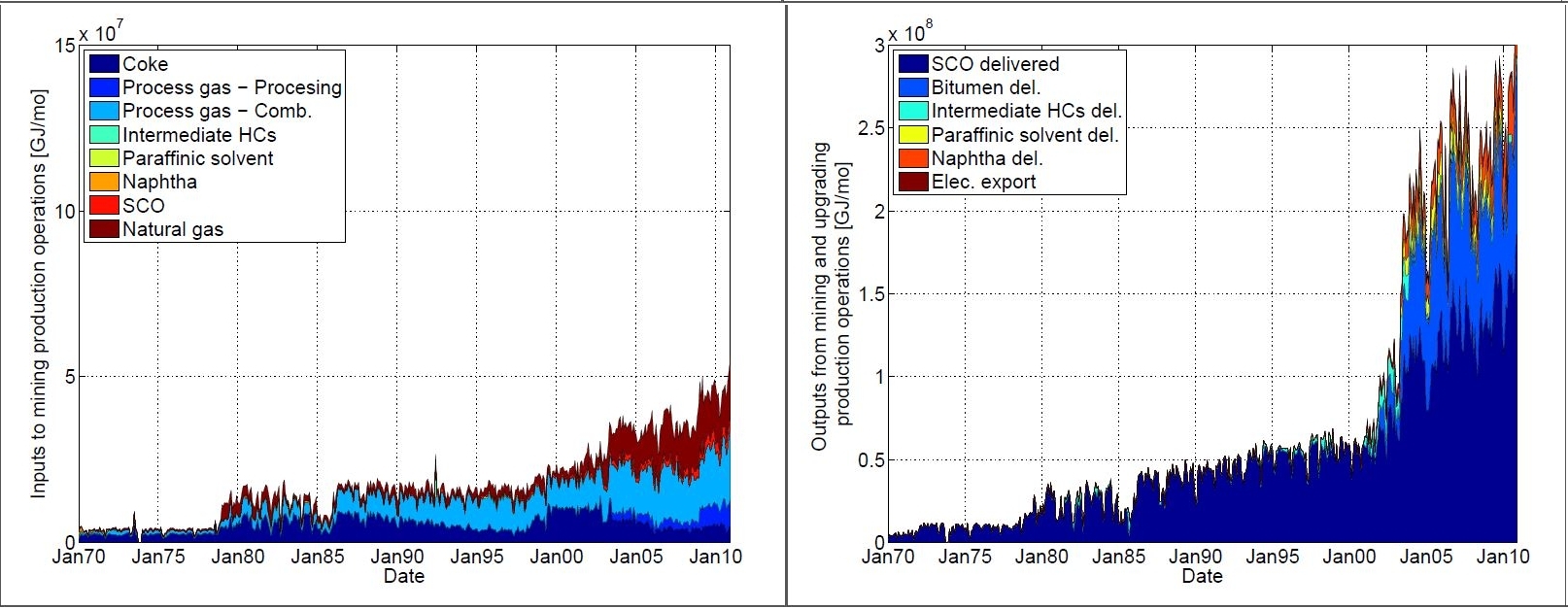

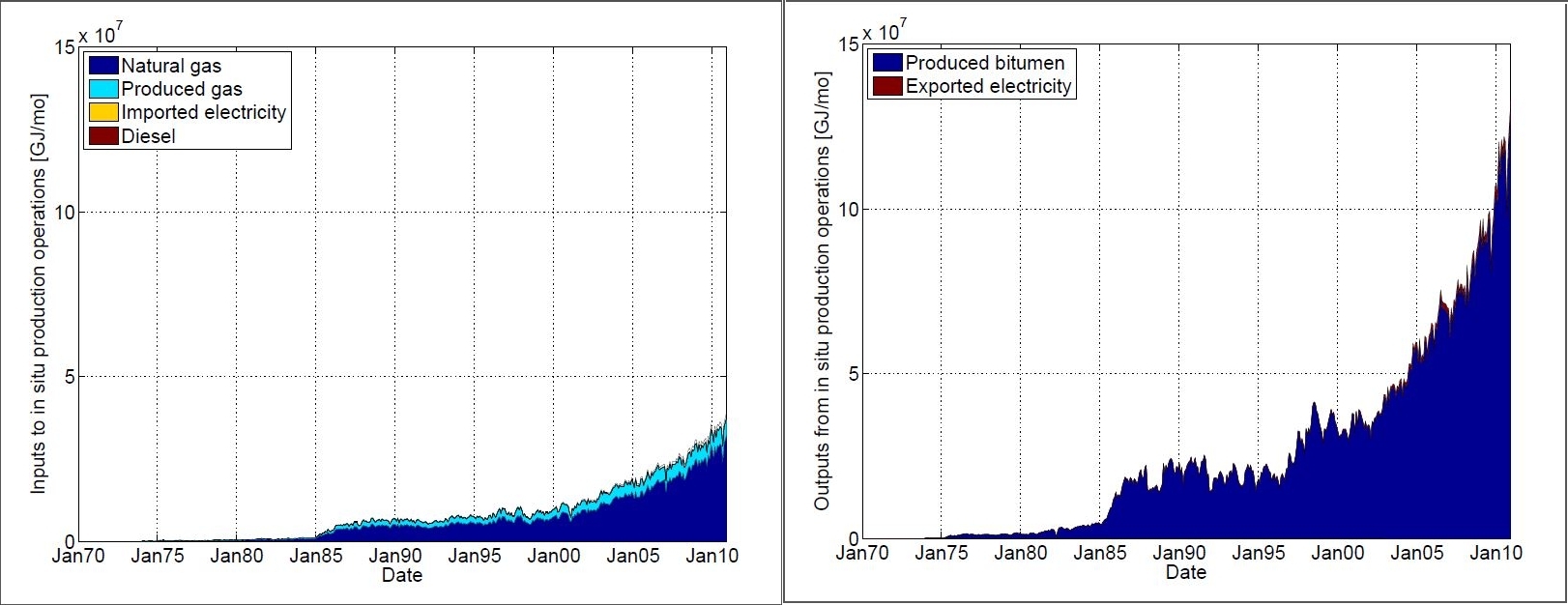

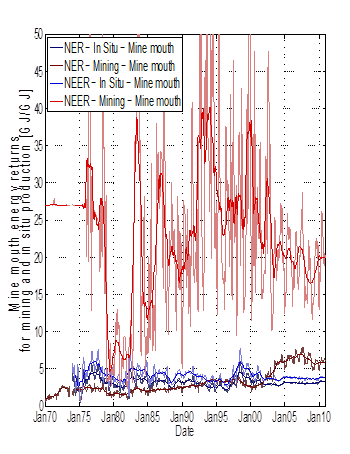

Our recent work (Brandt et al. 2013) utilized detailed energy production and consumption data reported by oil sands producers from 1970 to 2010 to examine trends in historical energy returns from oil sands extraction. The system diagram and flows considered are shown in Figures 1 and 2. Data are available on a monthly basis for most flows, with limited interpolation required in mining datasets, and some back-extrapolation required for in-situ energy intensities (see Brandt et al. (2013) for methodological details). The resulting energy inputs and outputs from mining and in situ production are shown in Figures 3 and 4. Mine mouth (e.g., extraction only, excluding refining) net energy returns (NER) for the entire industry were found to be 5.23 GJ/GJ in 2010. In situ NERs were approximately 3.5 to 4 GJ/GJ in 2010 while mining NERs were approximately 5.5 to 6 GJ/GJ.

Conventional oil EROI metrics commonly show energy returns of order 10-20 GJ/GJ (Gagnon 2009 et al.; Guilford et al., 2011; Dale et al. 2011). Therefore, oil sands projects exhibit demonstrably lower energy returns than conventional oil operations.

3. How have energy returns from oil sands extraction changed over time?

Net energy returns from mining and in situ operations (again, measured at a mine-mouth system boundary) have increased steadily over time, growing from 1.0 GJ/GJ in 1970 (entirely from the Suncor mining operation) to 2.95 GJ/GJ in 1990 and then to 5.23 GJ/GJ in 2010. As shown in Figure 5, significant improvements in mining energy returns have been realized.

4. What are the implications of oil sands energy sourcing for limitations due to low energy returns?

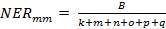

The net energy returns reported above are just one metric to assess the energy returns from oil sands operations. Using the key provided in Figure 1 for mining operations (top), a mine-mouth NER compares the net output from the mining and upgrading operation to the total energy inputs into the mining and upgrading stage. Symbolically, this can be written as:

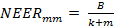

where B, k…q are defined for the mining pathway shown in Figure 1. However, this might not be the main point of interest from a societal net energy perspective. If one is concerned about the ability of the oil sands to provide net energy to society relative to the energy that they consume from other sectors, then one may actually more concerned with a ratio that we define as the net external energy return (NEER). Symbolically, we can state that:

That is, if we are concerned about the ability of the oil sands to provide energy to society, what we are concerned about is parasitic consumption of natural gas (flow k) and electricity (flow m) by the operations, relative to how much unrefined energy they provide to society (flow B). Energy consumed on site that is produced as by-products from the production process (e.g., coke or still gas) may not be a concern from the perspective of energetic availability (although may be a major concern from an environmental perspective).

Measured in this way, the NEER from mining operations was approximately 20 GJ/GJ in 2010, significantly higher than the corresponding NER (see Figure 5).

5. Will low energy returns limit the output of net energy from the oil sands?

These data suggest that oil sands processes exist that have reasonably high energetic returns relative to external energy provided by other energy sectors. That is, relative to the amount of energy that they consumed from the rest of society (e.g., natural gas, imported diesel, and electricity), these processes produce a significant amount of net energy output. This is partly a result of historical development and geographic considerations: the oil sands mining operations developed in a remote and poorly-integrated part of Alberta, and therefore were designed to be largely energy self-sufficient. Importantly, these conclusions are not just limited to mining operations. In situ operations such as the Nexen Long Lake project produce steam using upgrader by-products (asphaltene residues).

Our results suggest that it is not realistic to expect oil sands extraction to be limited by their calls on natural gas and other resources. If natural gas becomes expensive, processes can be adopted to use byproducts of the processing of bitumen to fuel extraction (e.g., integrated operations). However, these integrated processes have implications for the amount of oil sands resource available (e.g., not all barrels able to be produced will be available as “net” barrels of output) and can have important climate implications (e.g., using coke for fueling bitumen separation or steam production is more GHG intensive than using natural gas).

6. Works cited

Peter CJ. Enbridge northern gateway pipeline project energy return on investment. In the matter of NEB file: OF-Fac-Oil-N304- 2010-01 01 Northern Gateway Pipelines Inc. Application for Enbridge northern gateway project, certificate of public convenience and necessity 2011. http://www.ceaa-acee.gc.ca/050/documents/54603/54603E.pdf.

Herweyer M, Gupta A. Unconventional oil: tar sands and shale oil e EROI on the web, part 3 of 6. Technical Report. The Oil Drum, http://www.theoildrum.com/node/3839; 2008.

Rapier R. The energy return of tar sands. 2008. http://robertrapier.wordpress.com/2008/11/14/the-energy-return-of-tar-sa....

Peter C, Jacob N. Alberta to China: what’s the energy return? C.J. Peter Associates Engineering; 2012. http://www.bcsea.org/sites/default/files/webinars/20120522-Peter-Jacob-G...

DOE. Fact sheet: energy efficiency of strategic unconventional resources. DOE Office of Petroleum Reserves e Strategic Unconventional Fuels; 2006. http://fossil.energy.gov/programs/reserves/npr/Energy_Efficiency_Fact_Sh....

Brandt A.R., J. Englander and S. Bharadwaj. The energy efficiency of oil sands extraction: Energy return ratios from 1970 to 2010. Energy. 2013. DOI: 10.1016/j.energy.2013.03.080

Gagnon N, Hall CA, Brinker L. A Preliminary Investigation of Energy Return on Energy Investment for Global Oil and Gas Production. Energies 2009; 2: 490-503.

Guilford MC, Hall CA, O’Connor P, Cleveland CJ. A New Long Term Assessment of Energy Return on Investment (EROI) for U.S. Oil and Gas Discovery and Production.Sustainability 2011;3: 1866-87.

Dale M, Krumdieck S. Bodger P. Net energy yield from production of conventional oil Energy Policy 2011; 39: 7095-7102.

On an earlier post I suggested that barrels of each type liquid fuel be discounted to a 'useful fraction' by multiplying by (e-1)/e where e is EROEI. An EROEI of 4 for example gives a multiplier of 3/4 or 75%. Thus if tar sands got to 4 mbpd with an average EROEI of 4 then 4 X 3/4 = 3 mpbd the useful fraction. Note this metric is abysmal for corn ethanol of EROEI 1.25 the mulitplier being .25/1.25 or 20%.

The energy cliff theory espoused by Euan Mearns and others suggest that major energy sources should have EROEI > 8. That seems plausible to me since primitive hunter gather societies barely generated enough calories to survive. They may have been somewhat contented but they died young; a minor cut for example could be fatal since they lacked broad spectrum antibiotics. EROEI increased with the age of steam and not long after the world economy exploded when conventional oil had an EROEI of 30 or more. My guess is that the kind of world people want with a high protein diet, personal mobility, thermal comfort, affordable medical care and push button entertainment still needs an EROEI of at least 8.

I believe that the implications of such metrics are going to differ significantly depending on whether the energy used in producing an energy source is "internal" or "external".

For example, let's take an offshore rig with no economic means to get gas to market. This happens in offshore Nigeria for example. In these cases, associated gas is generally flared, as any means of getting it to market is so expensive that economic loss would occur. If this associated gas is instead used to power lifting, separations, compression, etc. (which it often is in practice) then what effect does using this "internal" energy have on the net output to society? I would argue that this self consumption of otherwise low value produced product is not consequential to the net energy returns to society.

In contrast: a field that is tied in with the electricity and natural gas grids -- and uses these products to fuel production operations -- can be seen as consuming energy that otherwise would have been able to be used elsewhere in society. This is a more clear case of low EROI having a "parasitic" impact on net availability to society.

With respect to the oil sands, the same thing occurs with mining and upgrading operations. A lot of the energy is provided by coke and still gas, which are otherwise very low value products that never make it to market (stockpiled or flared). Therefore, the energy return ratio if you count all energy inputs (NER) is ~ 6-7, while the ratio if you only count "external" inputs (NEER) is more like ~20-25.

Feel free to send me an email (abrandt "at" stanford "dot" edu) if you would like a copy of the full paper.

In a casual conversation this morning the idea of regretted investment came up which could be another metric. If major river valleys were to be dammed for hydro now deep greens would be hysterical. However we're now grateful for the low carbon power and long plant lifetimes that were instigated by mid 20th century hydro. That investment was 'low regret' compared to say buying the latest military equipment.

On the EROEI 'cliff' there is nothing special about the value 8 as it is not a turning point, just an empirical value. (the usual graph is y = (x-1)/x for 50>x>1, 0.98>y>0) However some aliens from another galaxy might turn up one day and tell us 8 is the lowest value to aim for as the other galaxies didn't make it.

Re gas flaring/onsite powering so long as it is carbon taxed at the CO2 rate if burned, the CH4 rate if vented. Now if carbon tax got really serious it might work out cheaper to inject it back underground which will demolish the previous EROEI.

Alberta heavy industry, including the oil sands, are subject to CO2 regulation which imposes an (effective) carbon tax of 15 $/tonne CO2. They do have to pay such a tax on the fuel gas consumed, as well as any imported natural gas. If they had to reinject the gas, the work required would go up and they would need to get the energy for processing from somwhere else. Not sure that this would make sense.

This misunderstnading often repeats itself.

The average age of hunter gatherers may have been low, but this is mostly due to infant mortality. Hunter gatherers who lived till their 20s had a life expectancy similar to a modern human, and probably died after a short illness rather than a prolonged period of deterioration moderns experience in our hospitals and old people's homes.

How very true. But that's not the only inaccuracy.

Not just primitive hunter gather societies. My grandfather died in 1954 at the age of 96, having reached adulthood when medicine had reached the stage where doctors could make a good estimate of how long a disease or injury would take to kill a patient, but had not yet developed much to cure him, and was well on in his seventies when the first broad spectrum antibiotics were developed.

Also, consider the following quote:

It seems that primitive societies had little difficulty generating calories most of the time.

That last point is reassuring. My nearest supermarket is 40 km away. If there is no black gold to power the car to get store bought calories I'll starve. Then again the shelves may be empty if farmers can't use tractors to grow food and delivery trucks can't get it to the store.

I think it depends on where you are lucky (or unlucky) enough to live. Here in New Zealand some pre contact Maori had a a range of health issues stemming from a restricted diet. Nutrition was mostly adequate but sometimes lacking in protein (New Zealand has no native mammals. Protein would have been entirely from fish, birds, and introduced domestic pigs and dogs). Their teeth were also not in very good shape due to fibrous and gritty staples such as taro, kumaru and fern roots which could lead to malnutrition and exposure to disease. Also note:

"Distilling his careful review of research evidence, historical demographer Ian Pool concluded that, at the time of contact 'birth rates might have been around 38-40 per 1000, death rates 30-35, and life expectation at birth of the order of 28-30 years', with gradual long-term population growth. Although very low by today's standards, this figure matches life expectancies in many European cities and countries at that time"

PDF http://www.waitangi-tribunal.govt.nz/scripts/reports/reports/692/FB92C82...

After a quick search I came upon this paper from Johns Hopkins circa 1990. The dubious sources (like burial counts) are sorted from the fairly sparse better data, but there are still some fairly large assumptions and a wide range for the calculated numbers. However, it is clear that infant and child mortality is a key parameter in life-expectancy.

The Decline of Childhood Mortality

Kenneth Hill

I do not know enough about demographics but model life tables seem a useful tool.

British aristocracy (reasonably documented) provide a case study over several centuries, and the unfavourable effects (a dip in child survival rates) during early urbanisation are discussed. The other largest variable, which appears not to have been discussed adequately in this paper, is Fertility Rate for women. This rate was very high for example in Britain during the 19thC but started its significant drop well before the advent of modern barrier or chemical contraception. Similar falls are noted worldwide today. If we want a more complete picture, I guess some attention is probably needed to be given to the data for survival of women in childbirth.

All the big changes affecting mortality across the age range in the urbanised West and elsewhere followed public health measures and pre-dated the use of effective antibiotics.

FYI, there is demographic information on this here (pdf).

Figure 3 in particular is informative. Modern Western people at age 20 can expect to live about 60 more years, vs. 40-45 years for modern hunter-gatherers, and vs. 20 years for prehistoric hunter-gatherers. (The authors of this paper argue, however, that 20 years is not an appropriate estimate for prehistoric populations, and the figure should be closer to that of modern hunter-gatherers.)

Actually, civilization is a long series of transitions to lower EROEI.

Hunter-gatherers only needed to work for a couple of hours per day - agriculture was much lower EREOEI.

Coal was a big step down from local wood.

Fortunately, wind and solar are much higher EROEI than "newer" oil.

Your observation raises an important point: that EROEI is only comparable within societies of similar population density.

Local wood, hunting, and gathering may have had high EROEI in a world with a population of a few million, but if 7 billion of us try to do it the EROEI will plummet.

Similarly, a thousand years from now we may say "fossil fuels may have had high EROEI for a world with a few billion people, but if all trillion of us try to do it today it won't work."

Yes.

I'm not sure it's useful to think in terms of EROEI falling dramatically when the resource runs out. At a certain point, no amount of work will find additional fruit, or wood.

Probably more helpful to simply introduce a separate metric - scalability. Or, possibly, "maximum net energy".

The evidence that I have encountered does not support this idea. For sources, you might try Vaclav Smil's books, which discuss energetics of historical energy transitions.

The transition from wood to coal in the UK was hugely net energy positive. Early oilfields had EROIs in the 100s to 1000s. For example, the Lakeview Gusher had an EROI of at least 35,000 (calculation I did with Charlie Hall for the Discovery Channel but did not publish yet).

Adam... great work. That is amazing that the Lakeview Gusher had an EROI of 35,000. Here is a question. I just read a new paper from Hall et al about a new EROI study of US Oil.

Looks like the EROI of early exploration was 1,200/1 in the 1920's but has moved down to 5/1 currently. My question is this. Shale Oil in the Bakken was calculated at approximately 5/1 EROI...but that was early on.

With all the new increased drilling, lower production and higher declines in newer wells, has the EROI fallen or has it increased similar to your study here on Tar Sands?

thanks...

The transition from wood to coal in the UK was hugely net energy positive.

Yes, but volume made up for lower returns.

The EROEI of local wood is very high. Coal was necessary because wood was limited. Coal was hard work to dig and transport, and was lethally dirty.

Agriculture was a big step down, but it was scalable where hunting/gathering was not.

I agree that early oil had very high returns - that was an exception to the rule, and I didn't include it.

Local wood perhaps (have not done the math myself). At the point of the coal transition, England's forests were pushed back such that wood became expensive and difficult to transport (over muddy and often impassable roads). Perlin talks about this transition and wood depletion in detail in "A Forest Journey".

Coal was accessible at scale (especially after development of Newcomen Engine to dewater mines) and was transported over water. Therefore it was much cheaper and easier to access (which caused the strange name of "sea coal" to develop). Of course, it also made London an unlivable smelly hell for a few centuries!

Yeah, at the time of the coal transition England had badly depleted their forests centuries before, and were working on depleting the forests of the new world. Wood had a scarcity premium built into the price, and was transported over long distances.

The only sustainable wood is local - many pre-industrial empires were Ponzi schemes that took wood (and food) from a rim that expanded until they collapsed: Athens, Rome, etc. England was saved from that fate by coal - of course, energy dynamics aren't everything: coal couldn't ultimately save the empire...

IIRC, the name "sea coal" predated mining, and came from coal that washed up on the beaches.

many pre-industrial empires were Ponzi schemes that took wood (and food) from a rim that expanded until they collapsed: Athens, Rome, etc

Got a peer-reviewed source for this? It's an attractive idea, I'd like to see the evidence.

As you know, the collapse of the Roman Empire was complex, and is controversial. The "depleting wood and food" theory is a strong competitor, and one I like (though I wouldn't suggest that it was the only element - for instance, one has to explain how the Eastern Empire was able to dial back it's exploitation, and survive another 9 centures).

Off the cuff, I don't remember seeing the collapse of Athens framed quite that way. But, Athens depleted it's wood, began drawing on distant sources, and the need to (and failure to) protect those imports was an important element in it's wars with Sparta.

This has been discussed in a qualitative sense in most of the energy history books, as well as "Collapse of complex societies" by Tainter, "A forest journey" by Perlin, and numerous other places. I don't know how much actual hard empirical data there is on it, but it is reasonably well accepted as a common story with early societies.

I have yet to see the math worked out in a peer-reviewed place, but it would be easy to do with basic calculus and idealized shapes (e.g., expanding circles). Add this to the near-infinite list of papers that I would write if I had the time!

Agreed. That could be the source of the "sea coal" name. I recall that london was fueled with coal from ships (from newcastle south then up the thames) for a long time (centuries?)

Agreed that energy dynamics are not everything.

"The only sustainable wood is local"

That doesn't pass a simple logic test.

The sustainability of wood must be judged by whether the removal of biomass from a forest area is greater or lesser than the growth rate of that forest each year. If the forest is growing (adding more biomass) at a higher rate each year than is being extracted, it can keep going indefinitely and it is sustainable (at least as a resource) no matter where in the world it is located.

However if removals are greater than the growth rate, it doesn't matter if the forest is in your back garden - it is NOT sustainable.

Of course if the wood is harvested then transported it will have a reduced EROI (or IRER!) and if the EROI falls below 1 (or the IRER falls negative), then it would also be fair and logical to deem it unsustainable. It really depends on the mode of transport. Ocean transport is by far the most efficient - in the time you are talking about ships may have been wind powered in which case it wouldn't matter. These days with very large efficient bulk carriers you would have to ship the wood several times around the world to consume as much as energy as you are carrying. At the other end of the scale is road transport where the break-even distance is much smaller (but still well over 1,000 miles if using a large articulated truck).

There are other complexities - for instance how do you set the boundaries of your "forest"? Too small and removals will not be fairly balanced with growth elsewhere, too big and you may be missing localised effects. Of course replanting/regeneration is also essential and in your appraisal you need to take account of your age class - a changing age class is a sign that the forest is changing - this may or may not be sustainable. One of the most interesting features of American commercial forests - especially in the South East states from LA up to VA - is that planting stock is genentically selected to be faster growing and this is a process of continuous improvement, therefore in theory the sustainable removals rate is actually slightly higher than annual growth - although you would never get away with that in practise.

I didn't mention nutrients. Actually, it really depends on the forest and the soil. In the beest cases nutrient removal is tiny if you only take out stem wood and leave behine leaves/needles, small wood and bark. Eventually it would be a constraint though (whether local or not).

Lastly of course I have only discussed resource sustainability here. The issue of sustainability of bio-diversity is incredibly important in relation to forests and is a major constraint for those looking to remain sustainable in a broader sense, but here is not the place to go into those issues.

I agree: being local was not a sufficient condition for sustainability, just a necessary one.

Not necessary, as wood can be transported on bulk ocean vessels at very low energy cost. For instance the fuel consumed in a 4,000 mile journey from the US South to the UK moving wood chips in panamax class wood chip carrier is about 2% of the energy in the wood being transported. The discussion was in refernce to a historical period in which sail ships could have been used - making it even more sustainable.

In modern day, even including some trucking of the wood at both ends, the rate of energy return (and greenhouse gas emissions) is far superior to PV, even for trans-Atlantic wood, but if the forest removals are not sustainable then there is no point (no matter how far it is transported).

Let me clarify - I'm not talking about the current dynamics of wood usage. I'm talking about the historical transition from wood to coal. My point: before the demand for wood exceeded supply, supplies came from local sources, and the E-ROI was very good.

Historically, imported wood was only used because local wood had been exhausted. That's kind of the definition of unsustainable.

A quibble: don't forget to include energy in the form of labor in the calculation of E-ROI for imported wood – sailing ships were *very* labor-intensive. As a practical matter, I believe the British imported wood (before the advent of coal) not primarily for fuel, but for applications where wood was essential: building warships (especially sailing masts, for which domestic logs just wouldn't suffice), charcoal for iron smelting, etc.

Another proof by example is ethanol production, which arguably has an EROI < 1.

The key point regarding tar sands and EROEI vs ROI (in $) is that the natural gas used for much of the process can be said to be "stranded" for other usage, no ?

For mining operations, much of the energy used in the process is in the form of upgrader byproducts, including still gas and coke. These products have little economic value, due to poor quality and remote location. Therefore, if they are not consumed in the upgraders, they are generally "wasted" by stockpiling (in the case of coke) or flaring (in the gas of gas). This will have a big impact on any ROI vs EROI comparison.

The natural gas used in the operations should likely be considered fungible with other gas in Alberta.

The natural gas in the oil sands area is not really "stranded", but it is expensive to transport to far-away markets in Eastern Canada and the US. With the current glut of domestically produced shale gas in the US and resulting low natural gas prices, gas from Northern Alberta and BC (particularly Canadian shale gas) is uneconomic to deliver to those Eastern and US markets. Selling it to the local oil sands plants is the gas producer's best option.

Under Alberta's strict flaring regulations, burning the process gas would not be an option, but it is a perfectly adequate fuel for the upgraders so almost all of it goes for fuel. Coke is burned for fuel as well.

If there was a local market for the coke - e.g. steel mills or power plants in Northern Alberta - it might be more salable, but there are no steel mills around and the power plants are mostly mine-mouth units sitting on top of big deposits of low-sulfur coal. They are not much interested in high-sulfur coke. If it was closer to China there would be a huge market for the coke.

Oil sands coke has found an interesting market recently. A big heavy oil refinery near Detroit has been processing bitumen and building up huge piles of coke on the water's edge. However, Nova Scotia Power has started buying it and burning it in a power plant in Nova Scotia. The power plant was built to burn Nova Scotia's local high-sulfur coal, but the coal mines have shut down as uneconomic, and the cheapest alternative is coke produced in Michigan from Alberta bitumen. Too bad they can't get the bitumen to Nova Scotia to reduce the oil costs.

http://www.desmogblog.com/2013/05/21/greenwashing-tar-sands-part-3-where...

This says that if EROEI is 20 for crude, tar sands has an EROEI of from 5 to 7.

Only rough congruence exists between GHGs and EROI. We are using this same dataset to build a time-varying GHG analysis. This is forthcoming (in review). Our detailed energy consumption dataset is a much more rigorous way of getting at EROI (or whatever metric you are interested in) than a GHG comparison (which can be stymied by shifts in fuel shares from coke to still gas, etc.)

Agreed. There is certainly interest in coke if the price is right. Power generation is what will happen if raw bitumen is sent to a less remote market (as dilbit or synbit) and coking occurs in an accessible area. The Detroit case is of interest, and has made the papers. If refining occurs on the gulf coast, there will be ready markets for the coke.

I believe that what most people who are concerned about EROI are actually concerned about is something more like the NEER. It has little impact on energy availability if some fraction of the bbl is consumed as coke or still gas, except possible reductions in net resource availability from a truly enormous resources base.

Tanks a lot for the info, RMG and arbrandt

Hi, Adam.

I am wondering about one of your result. From a simple back of the envelop EIO-LCA analysis, and EROI of 20 in the Oil industry, should translate in a exploitation cost around 30-50 $/bbl. However, there is indication that the exploitation cost are more around 70-80$ $/bbl. This would mean that the NEER is closer to 10. Nevertheless, I have used rough societal average. It might be possible that in a remoter region la northern Alberta higher EROI are needed to be sustainable, like for an off shore platform.

Adam Brandt here. The translation between dollars and energy is challenging, and will depend on the nature of the operation. For example, some operations are more capital intensive (e.g., mines and upgrading) while others are more energy intensive (e.g., in situ projects). These data are direct energy use, as reported to regulators, and so should be more accurate than an EIO-based number.

An interesting thing with the oil sands is that a significant amount of the energy consumed is not "commercial" energy that otherwise has much market value. For example, the integrated mining and upgrading operations use a lot of by-product coke and still gas (upgrader gas) that has little other economic value due to location and quality.

Adam, actually people in Calgary have done all those calculation, they had a supporting grant for the oil industry. However, once the oilers found that the results were not moving in the right direction, they just cut off the funding ;) I tried to find out for over a year before giving up.

The operating costs of the existing oil sands plants actually is around $30-$50/bbl. It is the costs of NEW oil sands production which is more like $70-$80/bbl. The difference is the cost of labor and capital to build the plants which are the biggest factors in new oil sands development.

The primary factors of production in traditional economic theory are Land, Labor, and Capital, while Energy is only a secondary factor of production. This is true of oil sands development today. The big constraints in Northern Alberta are the shortages of Labor and Capital. Availability of Energy is not a significant constraint in Northern Alberta - there is as much Energy available there as is needed.

This perfectly illustrates the difference between the marginal cost of production and the average cost of production.

While it might not make sense to add more oil sands capacity if the price drops below 70-80 $/bbl, producers will keep operating well below that price. On the margin, they can make money at quite low prices (especially if the gas prices is low at the same time).

The existing oil sands plants can get their marginal cost of production very low if they have to. During the low point in world oil prices around 2000, they managed to reduce their avoidable costs to around $12/bbl. They did this by cutting staff, putting new development on hold, and generally operating with very sharp pencils. The cost of fuel gas was also very low because gas prices tend to follow oil prices.

The owners of these plants have very deep pockets and are not going to shut them down even if they are losing money. The reason is, if they shut down the operation, they would have to surrender their leases to the government, the government would re-lease them to someone else, and when prices went back up they wouldn't be able to get back in the business because all the good land was leased by someone else.

They know the conventional oil is running out and the oil sands are the last big reserves left they have access to, so smart players don't want to give them up. Dumb players? Well I won't name names, but I know of one giant multinational which sold its leases back when oil prices were low, and then ended up buying back the same leases for billion$$$ more than they sold them for after prices went up in recent years.

Conventional oil involves a lot of risk, and the risk offsets the nominally better rates of return. There is no geological risk in the oil sands, only the economic risk of prices being too low. Example: Shell's recent Arctic offshore drilling fiasco, which discovered nothing and ended with them running the drilling rig onto the rocks and damaging it, with full press coverage. Meanwhile, Shell's oil sands plant kept humming away generating money - not as much money as a big Arctic offshore discovery would make, but certainly much better than having an Arctic offshore disaster.

Am I right that there is no time element in EROI calculations? I have never been able to understand this, why should EROI be any different from financial IRR in its fundamental methodology? I'm sure I must be missing something, because this seems so obvious. Please don't feel patronised by this point, I'm sure it is down to my ignorance, but I would appreciate it if someone could comment as I've so often wondered about it.

Take the following two examples, the first is an oversimplified oil sands operation and the second is an oversimplified solar PV plant, both have an EROI (as I understand it) of 2 GJ/GJ.

Example 1: Oil sands:

On day 1 the oil sands producer is forced to expend 100 units of energy (which he has "borrowed" from society), the process is not at all capital intensive (negligibly so in this case) but requires 100 units of diesel fuel to dig up, wash and refine the sands back into diesel (in this theoretical example). At the end of the day he makes 200 units of energy. On day 2, he has to start all over again and invest his 100 units of energy, again he gets back 200 units at the end of the day. And so on. The process has an EROI of 2 GJ/GJ. However at the end of the 1st day, the oil sands producer is a able to completely pay back his "loan" of energy from society and still have enough left over to operate again the next day. At this point, as far as society is concerned they are even and from then on he produces a surplus energy amount of 100 units every day. So even though the EROI is very low, as far as society is concerned the INITIAL energy investment was paid back in a single day and from then on it receives 100 units every day without any further investment.

Example 2: Solar PV:

A solar PV developer invests 1 thousand energy units in the form of electricity (which again it "borrows" from society) to make the high grade crystalline silicon, turn it into photovoltaic cells and install them for electricity production. The operating life of the PV plant is 50 years and it takes very little energy to maintain the plant (negligible in this case). It produces 40 units of energy per year for 50 years, overall producing 2 thousand units of energy, an EROI of 2 GJ/GJ, the same as the oil sands operation. In this case however, society has had to wait 25 years before it gets paid back the energy it invested! After that, as with the oil sands case it gets surplus energy every day.

Both cases have an EROI of 2 GJ/GJ but the difference in impact on society of the 2 options is huge. In the first case society gets surplus energy almost straight away - after 1 day, in the second case it takes 25 years to make any surplus energy during which time that energy debt could have been spent on something else. This difference between upfront capital investment and on-going operational expenditure, and the different results in terms of payback time and return on investment is obvious to anyone who has ever done a day's corporate level work in their lives. It is crucial in making financial investment decisions, again for completely obvious reasons, and in the two examples above, the time difference would be just as meaningful to an energy constrained society. But as far as I can understand there is no time component whatsoever in EROI, so how can it be a useful measure of net energy production?

Can this possibly be right? Is my understanding of EROI wrong? If not - I am sure this must have been debated and discussed before, what is the rational for it? I can see no possible justification, what am I missing?

The 2:1 return from oil sands presumably is over the lifetime production, so just as with PV you don't get it back the first day. And it does not consider that the return from the oil sands depletes the reserve while the return from the PV uses renewable fuel.

The difference is made possible by the indiscriminate use of the term EROEI. Replace the oil sands by a fuel tank with a spigot. No matter how efficient the pump, the EROEI from a fuel tank is always less than 1 if you consider the potential energy in the tank as one of the energy inputs. But the PV case generates additional energy that would not have been available otherwise, so it can truly have a positive EROEI.

However if you simply regard the oil sands net output as energy that would not otherwise be available to society, it wins if you can extract it more rapidly than using PV.

The numbers for cash flow are not all that different; the oil sands tie up capital during the build up of infrastructure, but the PV can return a positive cash flow in the first month of operation. Apply your own discount rate before investing!

This is an interesting problem. Michael Dale at Stanford University has started to look at returns as a function of time, rather than integrated over the whole project life. He has a recent publication that looks at rates of energy return over different times of project life.

Also, energy returns of 2 GJ/GJ are too low for both oil sands and solar. Given what we have seen for oil sands operations, the industry as a whole is closer to 5-7 GJ/GJ. Most recent solar analyses are closer to 5-10 GJ/GJ, rather than 2 GJ/GJ.

Yes, I agree. Energy payback time is more important that EROI for long lifetime project due to the non stationary of the system boundaries. I have a paper waiting for an internal review before submission, that as an extensive discussion on this topic. This aspect is very important in sustainable building practices.

Sustainable building would have huge effects. Lots of embodied energy and time effects.

You are right Adam. The problem is that promoter of sustainable building have a tendency to support the most extreme measure to save a kWh even if this makes no sense.

Perhaps energy has a Net Present Value curve which is sloped in the opposite direction from an NPV curve for money. A dollar now is more valuable than a dollar 5 years from now, but with respect to energy, as efficiency increases one can argue that the "True Value Curve" (just made that up) is actually upsloping. A gallon of gas would have allowed you to travel 15 miles 10 years ago, now that same gallon allows you to travel 25 miles (not actual numbers of course). Although the quantity of energy is the same now and 10 years ago the utility derived from that gallon has increased.

So in a way applying anything resembling a (financial) NPV type of analysis to physical energy, not the dollars associated with lead you to make the opposite decisions of what ought to be done.

abrandt: thanks for sending me the paper. It seems quite well researched and within the boundaries of energy efficiency analysis of bitumen production a welcome and needed contribution.

Rgds

WP

An interesting concept. I think that Mik Dale at Stanford might have looked at these sorts of issues, so you might contact him.

I would wonder if such a curve would slope differently than a financial NPV curve. NPV and discounting arises because of human "impatience". A trip to Hawaii is more desirable this summer than next summer (weather in terms of monetary or energetic costs and benefits) because I may be unable to travel next summer. I wonder if this same impatience applies, and acts to offset the increased efficiency effect that you are discussing.

There is indeed some depreciation due to energy basket change, efficiency improvement. In building, climate change has also to be factored as the unknown lifetime of a building.

This article is useful in that it brings out the fact that the energy return on oil sands is a lot higher than the 2:1 or 3:1 ratio that is commonly bandied around. Those are based on old data. There has been a lot of research and development done to bring the efficiency of the oil sands plants up, and the ratio is over 5:1 today and still rising. This renders a lot of the skepticism obsolete - these plants really do work to generate more energy.

The distinction between internal and external energy consumption is also useful, because if energy cannot be used, it doesn't matter how much of it there is. If it is used to produce more energy, then it is the external consumption and production that matters, not the internal processes.

One point not brought out is that the oil sands plants are burning a low-cost form of energy which is available in excess supply (natural gas) and in effect converting it into a higher-cost form of energy which is much less readily available (oil). If you did this with a gas-to-liquids plant, you would have an EROEI of about 0.6:1, but it still might be cost-effective. If you do it with an oil sands plant, you achieve an EROEI of 5+:1, which is much better.

The economics of it are better than the energy balance. If you take 1 GJ of gas, which costs about $3 at an oil sands plant, and use it to produce 1 barrel of syncrude, which is worth $100, you have achieved a ROI of about 33:1. Of course it's not nearly that simple because it ignores the very important costs of labor and capital, but it does illustrate that you are making a significant gain in value.

One way to view internal consumption is by changing the system boundaries. If you draw your boundaries to envelop the internal consumption, you can assess the net inputs and outputs to society (e.g., you "black box" the process and disregard internal flows). This, to my mind, gives a better sense of the scarcity implications of energy returns. However, total energy consumption (e.g., NER) will be more proportional to environmental impact.

We discuss these mathematical aspects in a few recent papers:

Brandt, A.R., M. Dale, C. Barnhart. (2013) Systems-scale energy efficiency with multiple energy pathways and non-energy processes: a bottom-up matrix-based approach. In review, Energy.

Brandt, A.R., M. Dale. A general mathematical framework for systems-scale efficiency of energy extraction and conversion: Energy return on investment (EROI) and other energy return ratios. Energies 2011(4): 1211-1245. DOI:10.3390/en408121

Thanks, RMG, for a very clear summary of this whole discussion, but I worry about what is being done ...

I wonder if a case can be made that any resource that is now in excess supply may some day become more in demand. For example, as global warming progresses, human population will likely migrate toward polar regions, and these future generations of Canadians may rue their forefathers decision to strip the region of its once abundant energy resources.

Thomas Jefferson once opined that the Earth and its wealth belongs to the living, unfettered by concerns of past or future generations. When I first read it, I was impressed at his wisdom, but now not so much. There is. also, a Psalm about being good stewards of the Earth, which is hardly what is happening in the case of so called 'stranded' resources.

I don't accuse you of advocating what some might see as vandalism. But your summary did clarify my thinking.

It's highly likely that fossil hydrocarbons will be used less and less for fuel. Even petrochemical feedstock will likely be phased out in favor of pulling carbon from air and water, and hydrogen from water.

Renewables will get cheaper and cheaper, and FF will eventually be seen as a very, very odd, very very dirty anachronism.

I can't really believe in your vision of the future. The laws of physics, energy conservation, etc. will still apply, IMHO.

Of course. Wind and solar power obey all of the laws of physics, energy conservation, etc. For instance, Conservation of Energy is obeyed: the Earth is an open system with 100,000 terawatts of continuous input (and not quite as much output, lately!).

Which laws were you worried about?

Well, if human beings ever decide to settle on Melville Island, in the Canadian Archipelago, they can exploit its oil sands, which rival the three oil sands in Alberta (Athabasca, Peace River, and Cold Lake). Few people even know about the Melville Island oil sands, even fewer care, and nobody lives there despite the fact it's slightly bigger than Switzerland. It also has huge reserves of stranded natural gas, and not inconsiderable reserves of conventional crude oil. There are also huge amounts of coal in the Arctic Islands. It's just all frozen in place.

I don't think future generations of Canadians will really remember the historical oil deposits of Southern Canada once they are gone, any more than they remember the huge white pine trees of Toronto and Southern Ontario or the once vast rain forests of Vancouver and the Lower Mainland of BC - or even the dense, dark, trackless oak forests of Southern England. They are gone now, and the people living there now don't remember they were there. Who even thinks about the ferocious wolves, lions, and bears that stalked the ancient English forests, now that they are seen only on heraldic crests?

Future generations will look at the hydroelectric dams and wind farms and think they always were there. In fact they will probably be nostalgic about them when they are replaced by quantum zero-point diffusers or some other Star-Trek-like energy source.

Nicely put.

I'm really amused by people being nostalgic about Dutch and Spanish windmills, while others are complaining about modern windmills...

"Am I right that there is no time element in EROI calculations?"

I have mentioned this before as a weakness of EROEI; that without a time element one can't really say that you can't run society on a low EROEI. If I returned 1.5 units for every 1 unit I put in -- but it returns that every day -- then that would be a fantastic process. The other weakness is the issue of unlike energy inputs. It may make perfect economic sense to turn 2 BTUs of coal into 1 BTU of liquid fuel -- even though the EROEI is less than 1. What the EROEI tells you in this case is that this process would accelerated depletion of fossil fuels.

Many thanks for your time and replies, especially Professor Brandt.

As I thought, I am hardly the first to have thought about the importance of timing in energy investment returns. It's also good to know that there are people doing formal work on the subject.

On the other hand, I was afraid of the answers that were given, and I find this very disturbing. For years I have read blogs and articles about EROI and been troubled by the thought that time effects were being ignored - rendering the value of the discussion (i.e. as a metric for the usefulness to society of an energy source) almost worthless - but I've always sort of assumed that I was missing something somewhere, since lots of obviously intelligent people don't usually sit around wasting their time. What I think I'm reading is that actually I'm not missing anything at all and that EROI is indeed oblivious to time.

The analogy with financial investing is quite obvious. We have been talking about unit margins while all the time acting like (or at least giving the impression to me, and therefore surely others) we have been talking about project level IRRs.

I've spent my career in UK power and more than half of it as a project developer, of course unit margins are interesting but the first and only metric of importance that an investor wants to know is IRR. Later he might look at unit margins in order to better understand the mechanics of the business but the investment decision is going to be taken based on IRR. That is also clearly what society needs to do when evaluating the net energy returns of an energy project, it needs to know at what rate (rate = amount / time) any energy that it has to invest will be returned to it (along with the additional energy profits) so that it can go on being used to human ends.

Please somebody help me. What is the reason for unit margin EROIs being the main metric of discussion and not Internal Rate of Return of Energy?

P.S. Final point: Sorry to those who thought I was saying that oil sands (and/or PV) EROI is 2. I was just trying to make a point about the timing of energy returns and used the number 2 for simplicity of arithmetic. It was supposed to be purely illustrative - sorry for the confusion.

Hoover, You have conveniently forgotten that the time constant involved in fossil fuel EROEI is several hundred thousand years. That is the amount of time it takes to transform ancient biota into a convenient energy store. How do you like them apples?

Very droll, but not very constructive.

Or have I forgotten some reason why EROI/IRER doesn't matter for renewable (or nuclear) energy?

In fact I seem to remember reading blogs on TOD about an energy "hump" (or was it bump?) referring to the difficulty of transitioning to renewable energy because of the sheer amount of upfront energy investment required. A bizarrely qualitative and inelegant approach to describing the issue of payback times and rates of return that is so much more easily captured and quantified by using an internal rate of energy return calculation - but at least one that recognises that the challenges for society of IRER are probably greatest of all for renewable energy.

The time scales for formation of fossil fuels from biomass material would not be material to any calculation of IRR, EROI, etc. Fossil fuels have essentially been "gifted" to us by geologic processes, and the time scales involved are so long as to be effectively infinite.

EROI can be whatever you want it to be.

Take your oil sands example, run it for 100 days.

Output is clearly 99 GJ higher than input, but there's 100 GJ that can either be ignored as an internal recycle, or counted as both output and input.

Counting it as internal recycle EROI = 100/1 = 100

Counting it as output and input EROI = 200/101 = 2

The analysis can be interesting, but the EROI result is useless once divorced from the analysis that led to it because it is completely dependent on hidden assumptions made in drawing the boundary. Is the process with the EROI of 100 fifty times better than the process with the EROI of 2, or is the boundary just drawn in a different place? Unless you see the detail of the analysis, you don't know.

a post on eroei boundary issues (a second one is coming)

http://connectrandomdots.blogspot.com/2012/07/test-post.html

Rgds

WeekendPeak

I'm utterly confused by that. You could apply exactly the same thinking to finance and investment - you could, but why on earth would you? And indeed no one does.

There are only really a discreet number of variables that are worth considering, the science and mathematics of this stuff was long ago created and refined to dreadful detail by accountants and economists. That's why I can't understand why people don't just apply the same thinking to energy.

Ultimately the one that matters the most is the one that must be considered before embarking on any investment (whether of finance or energy) which is the rate of return over the lifetime of the project.

Hi Hoover,

Very interesting discussion. It's pretty obvious that investments today in Solar, Wind farms or Oil rigs are done by investors who look at IRR. But is it the right measure to talk about society's future?

My take would be that EROI's avoidance of the time parameter is also a strength. It leaves out of the picture the messy details. In other words: EROI lets you take a birds eye view, and IRR gives you more details (together with many more dubious assumptions and errors). Take MIRR, with cost of capital included. It looks good on the books, doesn't it? Now forward to 2045, increase global temperature 2 degrees, reduce global oil production by 40%, assume a deep financial crisis with 20% interest rates, demand falling, war ... did you predict the cashflow in your IRR calculation? Probably not.

What I have seen in the industry are business as usual assumptions: growth, constant inflation, average interest rates, same demand, typical risk premiums (construction delay, contract problems, maintenance problems). But reality in 2033 might look a bit different. From that point of view, talking about 2040 in terms of IRR is probably pure fantasy. And EROI might be a more cautious measure to guide us.

There is another question, and it's the definition of "useful to society". Is it better to give society 100GJ/day to burn today? Or is it better to give a small stream of 2GJ/day and buy time to figure out a more sustainable future for Humanity? The question has been phrased in a different way by asking: ... if we suddenly had cheap unlimited fusion ... would it help us as a society ... or would it accelerate our destruction?

I think those two factors: 1. Defining useful, and 2. getting too detailed may have something to do with the use of EROI. If you're investing your money in a well defined 10 year project ... definitely IRR. If you're deciding Humanity's fate for the next 50 years ... then it's not so clear which metric is best to guide you.

Thanks for your reply Massagran.

I agree with you completely that there are a wide number of important factors that need to be taken into account when deciding whether or not an energy source is good for society. Clearly the impact on the environment, climate and long term resource depletion are all factors. BUT we should not try to confuse all those things into one metric; we should test them each independently. The energy return on investment metric helps us to decide if, in developing a primary energy source, we are actually producing enough energy for society’s use to justify the energy that will have to be invested. This is especially relevant when subsidies are involved (i.e. almost everything). It shouldn't be confused with resource depletion or social/climate/environment issues, rather it is a test that should stand alone and alongside those other tests.

I'm going to risk suggesting another example now, one that will probably be even more controversial than the oil sands, and it is corn ethanol. Corn ethanol is usually cited as having EROI in the range of 1.1 to 1.3, which is widely condemned by energy pundits as conclusive evidence that at best corn ethanol is a waste of time and money. However ON ENERGY RETURN GROUNDS (but not environmental or social) this needs to be challenged.

Firstly there is the fact that much of the energy input is natural gas and most of the output is transport fuel. Others have just pointed out the difficulties in assessing the relative "value" of different types of energy, this is clearly a difficult problem as not all energy carriers are equal (as a power station developer I have been involved in many energy projects, but never one with an EROI of more than 0.7!). But I want to deliberately ignore that for now and just purely focus on whether or not we are right to judge corn ethanol as useless by its low EROI.

Corn ethanol is an annual crop and the vast majority of the energy needed to produce it is spent in the same year as the ethanol is consumed. Let's assume an EROI of 1.2 for the sake of argument (PLEASE note, this figure is purely illustrative - I have no axe to grind on what the correct number is). The EROI does indeed look terrible, but because the returns are annual, in 5 years enough surplus energy produced by corn ethanol has been generated to offset the energy that will have to be spent the next year to make more. At this point "society" has already broken even, from then on every year the surplus 20% is effectively provided scot free to society. The Internal Rate of Energy Return is 20%. Resurrecting my earlier 50 year PV project with the EROI of 2 (far better than the corn ethanol) the IRER on that is only 3% because all of the investment is up front and takes a long time to pay back.

How is all of this relevant to your comments Massagran? Well firstly, corn ethanol is a great example of where those other social considerations should come into play. While I disagree that corn ethanol should be ruled out on energy grounds, I am still personally against subsidising it because I feel the environmental and social costs are too high, something I judge by applying tests that are completely independent to energy returns.

But now to answer your question about timing; is it better to produce energy now than later? For two reasons the answer is a conditional, but resounding yes! Conditional on other environmental and social factors. Energy is used to improve people's quality of life. Honestly, my quality of life is already so great that any marginal increase in my use of energy only has a small additional benefit to me. In fact I actively look for ways to consume less energy. However I am part of the lucky 10 or 20% or so of the global population for whom that might be somewhat true. For everybody else access to more (cheaper) energy would improve their lives quite meaningfully and I passionately see that as goal in itself.

How does the rate of energy production affect this? Well I think the easiest way to visualise the answer is to consider our ability to re-invest the energy "profits" to produce yet more energy for society in the future. Let's take another example:

Say "society" happens to have a spare 100 energy units that are not currently required for essential human needs. In this example it (society) already has an excellent and steady supply of energy for the next 50 years but that it is known that this source will dry up suddenly in 50 years’ time. The President comes to you and says this: "Please take these 100 energy units and invest them. Whatever energy you produce you must re-invest for the next 50 years, but on the 50th year, and every year from then on, you must produce as much NET energy for society as you possibly can, sustainably, for ever".

If we invest in the solar PV scheme with the EROI of 2, and each year use the electricity produced to keep expanding the array, then on the 50th year, when society's original energy source finally dries up, it works out that on a sustainable basis we are able to supply roughly 13.5 units per year of energy to society indefinitely (i.e. net of the energy that will have to be constantly re-invested to replace expiring cells - a different amount each year on a 50 year cycle meaning some will have to be stored through the cycle).

However If instead we had invested in corn ethanol with the pitiful EROI of 1.2, after 50 years we would be supplying a massive 151,674 units each year on a sustainable basis – 4 orders of magnitude more! Roughly 910k units would be produced each year and roughly 758k would have to be held over to invest in the next year’s production. Thus we can see that society was far better off by investing in the technology with the highest RATE of return even though it had a much lower UNIT return.

Finally, I beg my fellow commenters to understand and recognise the limitations of this model; it is for illustration purposes only. I fully realise that in the real world I would have had to consider whether there was enough agricultural land available for the corn crops; or if high food prices might have created appalling poverty; or if silicon for the PV or potash for corn fertiliser might have run out; or if terrible environmental damage caused by intensive agriculture might have been worse for society than a lack of energy. These factors MUST, of course, be taken into account, and in many/most/all cases over-ride the benefit of higher energy returns. But that does not mean energy returns should not also be properly tested and understood - they should! And the correct metric for proper evaluation is the internal RATE of energy return (IRER), NOT the marginal expenditure per unit of return (EROI).

Sorry for the long one, I feel strongly.

Sure, society gets more energy back at 1:1.2 per year compared to 1:2 over 10 years. And in your example the energy is extracted from the Sun by way of photosynthesis, so all other things being equal it is as sustainable as PV.

However the theoretical maximum efficiency of photosynthesis is 11% and in practice half that (sugar cane can do 8% in a good year). So the hectares used in energy production could be generating twice the amount if the crop were replaced by garden-variety 15% efficient PV. Production would ramp up more slowly as the area fills with panels but in the long term the highest EROEI process will extract the most energy from the sunlight. Lifecycle EROEI analysis is essential to make that decision; the initial rate of energy return is a consideration only during the ramping up phase.

Hi dak664, that is a very useful argument.

You have thrown an additional variable into the mix - that of land availability. Your conclusion is that, because land is constrained, PV is a better investment than corn ethanol, despite its much lower IRER, because in the end more energy will be extracted from the constrained resource (land in this case). You may very well be right, in fact I'm sure you are, but you are naughty because you are subverting my argument away from the pure comparison between RATE of energy return and UNIT energy return (IRER v EROI). I deliberately went out of my way to exclude additional variables such as resource constraints, demanding instead that they be tested and considered separately.

If we once more exclude land availability as a variable then the reason why corn ethanol is superior in terms of RATE of energy returns becomes clear. PV - although it overall requires less energy investment per unit of energy eventually produced - requires ALL of that energy to be invested UP FRONT - the production of crystalline silicon is a tremendously energy intensive thing, and so is the energy required to install the module relative to the electricity it produces. Once it's installed it sits there producing electricity all by itself (for 50 years in my illustration) without any further inputs. The planting of corn on the other hand is not as energy intensive as crystalline silicon production, but unlike PV it has to be re-invested every year. Yes, there is a lot of energy embedded in the nitrogen fertiliser, the harvesting, transport and distillation - however that energy is all paid back in the same year with profits.

As before I want to emphasise that real world constraints have to be properly considered when evaluating energy investments - environmental, social and resource scarcity constraints. In your case where land is the greatest constraint then yes, that would over-ride the IRER comparison (although I don't know if land for solar PV really is constrained). However, this does not mean that energy returns should not also be properly evaluated by considering the relative RATE of energy returns (not EROI).

Ethanol production from sugarcane is hoped to increase to 9,000l/ha, or somewhat under 1,000 gal/acre. Each gallon of ethanol has about 22kWh of energy, so each acre is expected to produce about 22,000 kWh/yr, or 5.75kWh/m^2/year.

By contrast, a square meter of solar PV will produce approximately 0.75 kWh/day, or nearly 50 times as much energy.

(For comparison, corn produces about 400 gallons per acre, or 40% as much as sugarcane, meaning it produces 0.8% as much energy per acre as solar PV.)

I appreciate that these numbers are chosen to illustrate your point, but it's worth noting that your input numbers are grossly unrealistic, so the example you discuss is unfortunately highly misleading.

The EROEI of solar PV is 6-12 (and increasing) for a 30-year lifespan. Using the minimum value of 6, we find that after 5 years, when ethanol has generated enough surplus energy to pay for one year's production, solar PV has generated enough energy to entirely pay back its construction cost up to twice over.

Sorry if I've come over negative about PV, that really isn't the case. I did my Master’s thesis on thin film PV (back contact effects of CdTe) and I wanted a career in PV at the time - there were simply no jobs in those days and I needed a reasonable income due to some hefty debts. I ended up going in a slightly different direction but still in power and mostly renewables.

I'm in awe of the progress made by PV recently, even if I suspect some of the cost reductions are not sustainable (i.e. from Chinese production subsidies). I'm sure they will be replaced by other more fundamental cost improvements, and it seems inevitable to me now that grid parity will happen, with or without Chinese dumping, and some places are probably there already.

For me, I just can't compute the lack of understanding about the importance of rates of return. PV does suffer relative to other renewables technologies when considering rates of returns instead of unit returns, albeit clearly nowhere near as much as in my simple example. It doesn't mean that PV cannot or should not be built out, but it is an important consideration because it means the faster we try to build it out, the more scarce energy for investment will become which will limit the rate of deployment relative to other technologies.

In reality other constraints are more important than energy returns for all the technologies - load profile is the biggest one for PV, wind sites for wind (and grid flexibility), appropriate land for biomass etc etc. But anyway, while we're talking about energy returns, we may as well use the right metric, otherwise the conversation becomes irrelevant.

otherwise the conversation becomes irrelevant.

Really, this conversation has already become irrelevant. Both wind and solar have E-ROI and E-IRR which are "good enough". Those metrics don't really matter any more for those two sources. And, I think Liquid Fuel Return on Liquid Fuel Invested is more important for an analysis of ethanol.

Cost is more important - both out of pocket and total (which includes externalities like CO2, other pollution, and energy security). That still puts wind well ahead of solar.

Of course, other things matter too: solar is on the consumer side, it provides power that is peak or close-to-peak, etc.

If the E-IRR of PV really is already around 40% now (or even half of that) then, yes, I have to agree with you. Growth is exponential (although limits are not) so that becomes a huge number in no time.

Oil sands and corn ethanol, which have poor EROIs, have pretty reasonable E-IRRs.

Thanks for the conversation. The conclusion is that it has been a waste of time .... but of course it hasn't been.

I'll turn my thoughts now to limiting factors and real terms delivery. My instincts about intercontinental transmission lines are that there will be far more optimal solutions than that, unless superconductors jump out of the box. Hmm, interesting.

"EROI can be whatever you want it to be."

This is a major challenge with the term "EROI" or "EROEI". It is used in such widely varying ways as to be very difficult to compare. I have argued mathematically that this is the case in two papers. Feel free to write to ask for either paper:

Brandt, A.R., M. Dale, C. Barnhart. Systems-scale energy efficiency with multiple energy pathways and non-energy processes: a bottom-up matrix-based approach. In review, Energy.

Brandt, A.R., M. Dale. A general mathematical framework for systems-scale efficiency of energy extraction and conversion: Energy return on investment (EROI) and other energy return ratios. Energies 2011(4): 1211-1245. DOI:10.3390/en408121

For this reason, I don't compute "EROI" per se, and in this oil sands paper compute 8 metrics of interest, which have different boundaries. People have been looking at and comparing different metrics for computing energy returns since at least 1976. We go over the history in the earlier (2011) paper. Unfortunately, many people who do EROI analysis are not careful with defining boundaries or being clear about exactly which metric is being computed. This area is in dire need of rigor and standardization of terminology. Baring that, much more transparency is needed in system boundary definitions.

+1 for standardization of terminology, with the first distinction being that between the energy returned from a fixed reservoir which caps the total amount no matter how fast it is extracted, and the energy extracted from an entropy stream or renewing reservoir, with no upper limit to total but limited in rate (wind, hydropower, PV, Dyson sphere)

Reliance on the former would explain the Fermi paradox, but we can fondly hope that happy civilizations enclosed in Dyson spheres are just hard to detect.

+1 for referencing the Dyson sphere in a post about oil sands! ;)

Where can I find a description of the 8 metrics and their relative importance?

Briefly in this paper, but more thoroughly in my mathematical papers:

Brandt, A.R., M. Dale, C. Barnhart. (2013) Systems-scale energy efficiency with multiple energy pathways and non-energy processes: a bottom-up matrix-based approach. In review, Energy.

Brandt, A.R., M. Dale. A general mathematical framework for systems-scale efficiency of energy extraction and conversion: Energy return on investment (EROI) and other energy return ratios. Energies 2011(4): 1211-1245. DOI:10.3390/en408121

Feel free to write for any of them: abrandt "at" stanford "dot" edu

Hey hey Hoover,

There was a TOD post on this a few years ago: http://www.theoildrum.com/node/7147

I haven't read all the replies to your post. It's late and I have to work in the morning so I apologize if any of this has already been addressed.

There are at least three good reasons why we use time in financial IRR. 1) Interest rates, both charged and received, that represent the opportunity costs in an exponentially growing economy. 2) Discount rates from human psychology. We discount the future in a hyperbolic, not exponential, way and there are evolutionary reasons for this. 3) Entropy and or physical wear. There are stock flow issues that need to be addressed for any dynamic system with built infrastructure. Biomass of mammal populations (humans), leaves on trees, business equipment, roads and grids, etc.

I don't know how to segue into this but there was an economist named Pierro Sraffa who wrote a paper called 'the production of commodities by means of commodities' that sparked a big debate in economics called the Cambridge Capital Controversy (University of Cambridge in England vs MIT in Cambridge Massachusetts). The gist of it (for our time quandary) was that there is a trade off between capital and labor that should be governed by interest rates in one, and only one, direction. Sraffa didn't like this at all and he provided a counter example where the production of some good would switch from one capital to labor ratio/technology to another (which is supposed to happen) as interest rates increased and then switch back (which is not supposed to happen) as interest rates increased further.

The Cambridge Capital Controversy died a quiet death. It posed a challenge that neoclassical economics could not answer (which is a bad thing for the neoclassical school of thought) but it failed to advance the field (which is a bad thing for economics at large). Sraffa didn't know diddly about energetics. He was only concerned about economic theory and so he missed the stock/flow angle. The relationship between stocks and flows is time. The stock of fossil fuels that we have was a long time in the making and the flow from renewables could replenish those stocks over sufficient timescales.

As I said, it's late and I have to work in the morning, so I am stopping here. But, applying time to EROI or applying energetics to the financial IRR is going to offer insight.

Thanks,

Tim

Thanks for your reply Tim, and for that interesting info.

I didn't think for a minute I would have been the only one to wonder why time was not included as a variable in assessing energy returns from energy investment, but it does seem that for now most are happy to invest their effort (and in some cases their careers) in working on EROI as if the time factor was of no relevance at all.

I'm not saying EROI isn't a valuable metric in itself, but for the most part - especially when discussing the transition pathways as we gradually leave behind the old world of conventional fossil fuels and embrace the next phase of unconventional and renewable resources - internal rate of energy return should be the most important metric.

This has been a fascinating couple of days of discussion for me. I started off not being quite sure whether or not there was some time component to EROI. I've learned that there isn't, and I've developed my own thinking about rates of return considerably, as well as picking up several ideas from others. Maybe one or two other people have thought a bit more about it as well.

I'd like to thank Professor Brandt for his original article, even though it was only about EROI it was very good, and his participation in the discussion that followed was very constructive.

internal rate of energy return should be the most important metric.

Well, it's certainly useful. OTOH, like E-ROI, it's less important than the financial IRR/ROI, and is most important in the rare cases where it's very low (as seen in your examples).

Both wind and PV return energy sufficiently quickly that E-IRR isn't really that important.

Why?

The developed world is not particularly short on energy at the moment, so we're not constrained to use the system that can grow the fastest. I would argue that a better model -- all else being equal -- would be to choose the option that requires the lowest gross input, as that will roughly correspond to the smallest diversion of society's productive capacity to achieve the goal of providing enough energy. This corresponds to EROEI.

For example, providing 20 units of surplus energy via an EROEI 1.2 system will require society to do the work to provide 100 units of energy as input every year, or 3,000 units of energy provided as input over 30 years. By contrast, an EROEI 6 system with a lifespan of 30 years will require the input of only 100 units of energy, meaning it requires only around 3% as much of society's effort.

Even an EROEI 2 system will require just 600 units of energy to be input, or 80% less than the first system. Given that our society has enough of a productive surplus to choose either system right now, why would the system which requires 5-30x as much input effort be preferred?

A great thought, but I think energy has a negative discount rate. The economist's idea of net present value boils down to this: it's better to spend money in the future than today, because there will be more money in the future. Leaving aside the question of whether this is really true for money, it's certainly not true for fossil energy. Quite the opposite.

"Leaving aside the question of whether this is really true for money, it's certainly not true for fossil energy. Quite the opposite."

For as long as we have the ability to invest in energy production with a positive Internal Rate of Energy Return (which is still true for most renewable energy) that should fundamentally and inherently be untrue, and discount rates should remain positive - albeit one would expect them to fall to a considerably lower number as we transition from fossil to renewable energy, a trend which in both cases has already started.

It's not true that if we invest in energy production with an EROI > 1 (which is what I think you mean), we will always have more in the future than we do now, because we're not just "reinvesting" our energy profits, we're using them to run our society, whereupon they disappear.

Well if EROI > 1 then the internal rate of energy return would mathematically be expected to be positive, but IRER is the useful term here (not EROI) for several reasons but not least because discount rates are related to rates of return expectations – even if the nature of the relationship is somewhat controversial. The importance of using the internal RATE of energy return (IRER) rather than EROI is exactly what I have been going on about, possibly at too much length for you to bother with, which would be quite understandable.