Tech Talk - Future Oil Production from Iraq: An Optimistic View

Posted by Heading Out on June 2, 2013 - 4:54am

There is often quite a debate in the Peak Oil community over the difference between a reserve and a resource. Simplistically a resource is, for the sake of discussion, the amount of oil that is in the ground in a certain country, while the reserve is the amount of oil that can be both technically and economically recovered from that resource. The numbers can differ quite markedly, and the judgment as to whether a certain body is a reserve is finally made when a well is drilled down, and production (or not) begins.

Just having the reserve available is not, however, within the global discussion of Peak Oil, an adequate sufficiency. Because oil well flow declines over time, it is important that the rate of oil production from that reservoir, and the timeliness of its arrival within the supply chain, be considered. This is particularly true in discussions about the help that the reserve will provide in ensuring that there is an adequate supply available when the global demand needs it. Normally, as noted, the decisions about production are made on geologic and economic grounds, but it would be foolish not to recognize that there are other factors. Consider the case of Iraq. It is a common the assumption that Iraqi oil production will rise considerably, with some suggesting it will reach the levels currently only achieved by Russia and Saudi Arabia, although there are some who project it might even rise to as much as 13 mbd, given that there are contracts in place, which if fulfilled on time, would raise Iraqi production four-fold to 12 mbd by 2017.

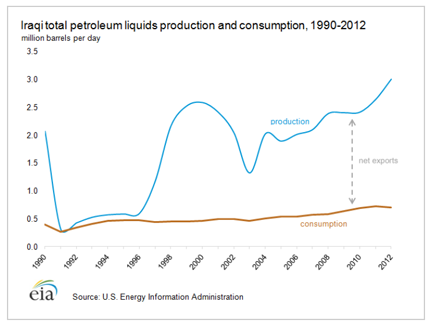

In their Special Report on Iraq last year, the IEA noted that the country is already the world’s third-largest oil exporter, with the potential and intent to increase production much further. And, as the EIA notes, Iraq became the second largest oil producer in OPEC when it passed Iran at the end of last year.

Iraq is currently producing around 3.1 mbd of crude and thus the potential production levels, and their contribution to reserves and to the daily global need for supply, still has a way to go. With so much oil potentially available, and yet with considerable question over the rate at which it will arrive, it is worth examining the conclusions that the IEA came to, before the current increase in violence occurred. This new spate of attacks comes after an interval when violence was decreasing in the country, and may prove a further impediment to significant growth in production.

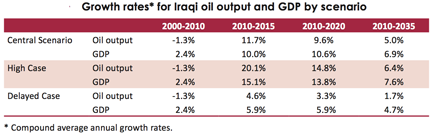

The IEA built three different scenarios in their report, for which there was extensive consultation in the country. The main or Central Scenario they project anticipates that GDP in the country will continue to rise, though tapering off as stability is achieved in the out years.

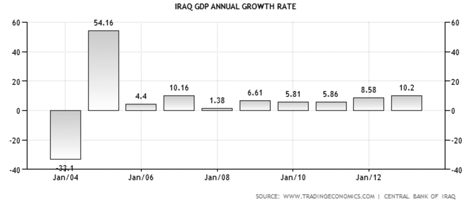

The Iraqi GDP grew 10.2% last year, and has been growing at an increasing rate over the past few years.

The oil fields in the country are largely concentrated in two separate regions, down around Basra in the south of the country, and in the region around Kirkuk and Mosul in the North.

This division is somewhat unfortunate from a politically stable point of view since the region in the south is predominantly Shiite, while the reserves in the north lie in the Kurdish region of the country. There is significantly less within the Sunni communities which are largely found in the central region of the country.

In recent times Euan Mearns has written of the potential for oil production in the Kurdish region in the north. In total this is estimated to hold around 4 billion barrels of oil, or around 17% of the national reserve. However, as exploration of the potential fields in Kurdistan continues, this estimate has been increased by the local government to a possible 45 billion barrels. Euan, for example, wrote about the development of the Shaikan oil field and the potential size of between 8 and 13.4 billion barrels that it showed in January 2012. Current plans are for production to reach 40,000 bpd “soon”, with production ramping up to 400,000 bpd. The Kurdistan Regional Government (KRG) see it playing a considerable role in achieving their target of 400 kbd this year, 1 mbd by 2015, and 2 mbd by 2019. The field is being developed by Gulf Keystone Petroleum.

In the south, current production is centered around the Rumaila oil fields. BP has committed $2.85 billion toward improvements in Rumaila this year, with the intent of raising production from the current 1.4 mbd, through 1.45 mbd at the end of this year, up to 6 mbd by 2017. Three hundred new wells will be drilled in the field over the next five years, to meet the goal, with 150 of these being drilled in the second half of this year. BP operates the field in partnership with CNPC.

The overall scale of Chinese involvement is of concern to some, since as oil supplies tighten in the years to come, it is expected that up to 80% of future Iraqi production will head towards Asia, and particularly to China.

With the growing development of the Majnoon field, with an estimated reserve of 38 billion barrels, it might thus appear that the country is well on its way to meeting the projections that the contracts might suggest. However, there are many constraints on future production, including infrastructure and water availability, and I will discuss these and why they limit the IEA to an optimistic assessment that the country will produce 6 mbd by 2020, and only reach 8.3 mbd by 2035 in the next post.

One of the main problems which could limit the growth in production from Iraq is the perpetual conflict between Sunnis and Shiites. The NYT has a commentary article today discussing the possible impact of the civil war in Syria on regional stability.

As Syrians Fight, Sectarian Strife Infects Mideast

Your graph of incidents of violence appears to end in early 2012. Those pesky "above ground factors" would impact the expansion plans in Iraq and may even lead to a reduction in output, if the sectarian violence returns. Maybe the Chinese will be the next empire to step into the quagmire, much as the US followed Russia into Afghanistan...

E. Swanson

And do not forget the Kurds, who gave Xenophon and company some grief a few years ago (Anabasis being a fascinating read), and likely have not much changed their ways, especially after recent kind treatment of their kind.

South Rumaila has been tapped by the Kuwaitis for quite some time.

This was said to be a casus belli of the Iraqi invasion of Kuwait in 1990, and the resulting First Gulf War. Later analysis suggested that Saddam Hussein was probably correct in his accusations about Kuwaiti poaching of Iraqi oil, by means of Kuwait's calculated use of cross-border slant drilling techniques.

There's a fair deal of backpedaling going on lately: RIGZONE - Iraq Oil Minister Agreed with Eni to Cut Zubair Output Target

XOM, Chevron, Total, and Gazprom have all cut deals with the KGR. Seems the majors are owing up to reality a bit here, that the bottlenecks to massive production expansion are such that their best bet is to reduce targets and broker deals in the north, irrespective of the consequences this may have with the central government.

"...up to 6 mbd by 2017"

A doubling in 3.5 years? Yeah thats a bit optimistic. If they should reach such an output by lets say 2020, its probably gonna be a plateau for some years. I'd say theres not gonna be many countries that can continue to increase after Iraq increases. Canadian oil sands and US shale is probably gonna peak around the same time as Iraq between 2020-2030 and unless the Green Vally formation is ripped open and every inch of the oceans including north and south pole is opened up, where else to look for further increased output?

the arctic?

Oil peaking around 2020 are you sure that seems optimistic? Where are you getting your assumptions from? You might be right if they are all counted together and if we fall into a deep depression; but if that happens then difficult oil will be off the market and the Arab countries will fall into civil war...so I think any projections beyond 3 years is futile...the world is a much more volatile place. I am making a special tinfoil hat for that occasion, as everyone I talk to about this thinks I am nuts...

8.3 mbd in 2035? That's optimistic? I for one do not view any future world in which we get to the year 2035 and still have not transitioned to mostly renewables as optimistic. Surely we can do better with improving technology and knowledge of what CO2 is doing to our climate than simply pursue the greatest extraction possible.

Yes but what would a worldwide depression due...which is where we are heading..

Question is: what would the Saudis do if Iraqi oil production were really increased to levels suggested by optimistic assumptions?

4.5Mbpd extra, from one set of fields in 4-5 years?

5% extra production, or 1+% extra per year.

The saudis would expect Iraq to be good OPEC members and limit that significantly to keep prices up around $100. If they didn't, then I assume someone would fund some of the many discontented groups in the region to impose production cuts by proxy.

Mind, 4.5Mbpd out of ~300 wells = 15,000 bpd per well. Not sure if that rate is actually practical in the area?

We should have a good clue if it's possible by the end of this year, they are supposed to drill 150 of those 300 in 2013. It's interesting to note they are only building a 300,000 bpd production facility, starting next year.

4.5Mbpd <> 0.3Mbpd - either there is a lot of production capacity lying idle, they are planning to build an order of magnitude more production facilities the year after, or that 4.5Mbpd figure is .... questionable.

we have had this prediction kicking around since the invasion

back then IIRC we should be at 6mbpd already...with 12mbpd a final destination.

Frankly I think that is very unlikely.

My personal gut feeling is that we are about to see a regional war kick off... I do not want to be alarmist but etc...

I have to agree with you about the regional wars kicking off...if the price of oil falls for any length of time the arab nations will not be able to hold back the tide...My guess is that they need 100 oil to keep heads above water